- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 24-02-2023

"Markets have taken on board probabilities around a changed fiscal stance as well as the more aggressive Fed and expect inflation to come under control in quarters and years ahead," St. Louis Federal Reserve President James Bullard said on Friday, per Reuters.

Additional takeaways

"Fed has considerable institutional credibility compared with its 1970s"

"The current US situation may fall under the rubric of credible disinflations, which do not have large output costs."

"Soft landing is feasible in the US if the post-pandemic regime shift is executed well."

Market reaction

These comments don't seem to be having a significant impact on the US Dollar's valuation. As of writing, the US Dollar Index was up 0.63% on the day at 105.24.

The EUR/USD is about to post the lowest weekly close in two months. According to analysts at MUFG Bank, the US Dollar has room to rise further versus the Euro, potentially toward the 200-day Moving Average, currently around 1.0330.

Room for USD rebound to extend further

“The pair has broken back below the 1.06000-level over the past week and we expect it to fall back towards support from the 200-day moving average that comes in at around 1.0330.”

“The recent move lower in EUR/USD has been mainly driven by the USD leg. Stronger US activity data combined with firmer inflation at the start of this year is encouraging market participants to price in a more hawkish outlook for Fed policy.”

“While euro-zone activity data it still surprising to the upside on balance, the scale of upside surprise is beginning to diminish. The EUR failed to strengthen on the back of the stronger PMI surveys over the past week, and there was a downward revision to German GDP in Q4 revealing a larger contraction.”

Data released on Friday in the United States showed an increase in Real Personal Spending and higher inflation numbers. Analysts at Wells Fargo point out that a clean read on January income is tough. They argue that while a jump in wages is supportive of spending, it's a challenge for the Federal Reserve if it keeps the heat on inflation.

Signs of resilience beneath volatility

“Real personal spending got a lift again to start the year, and in jumping 1.1% in January, growth more than offset weakness at year-end. A blow-out January retail sales report pointed to scope for a rebound to start the year at least in terms of goods outlays.”

“We anticipate durables strength is due more to monthly volatility than a renewed interest in goods outlays by consumers.”

“The sustained strength in real personal income is a mixed blessing. While it could provide a path to the elusive soft landing by supporting consumer spending more sustainably than reduced savings or reliance on more costly credit cards; it could also point to slower declines in services inflation which could compel the Fed to go higher for longer.”

“The core PCE deflator rose 0.6% and demonstrates the road to 2% inflation will be bumpy.”

- US Dollar extends gains during Friday’s American session.

- Economic data continues to support more rate hikes from the Fed.

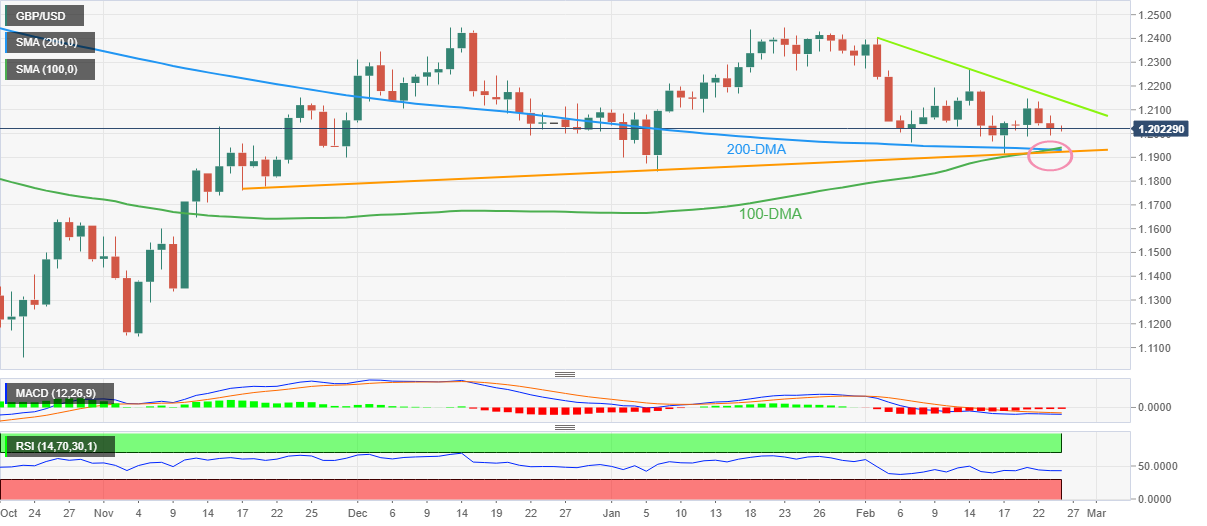

- GBP/USD tests levels under critical support area of 1.1940.

The GBP/USD dropped further on Friday following the release of US economic data and bottomed at 1.1927, the lowest level in a week, and slightly above the monthly low.

The pound is consolidating weekly losses amid a stronger US Dollar and higher US yields. US activity and inflation figures above consensus favoured expectations of higher for longer interest rates. As a consequence, the 2-year Treasury yield jumped to the highest since November at 4.79% and the 10-year moved toward 4%.

The dollar on Friday accelerated to the upside also boosted by a deterioration in market sentiment. The GBP/USD broke decisively below 1.2000. It is hovering around 1.1940/50, down almost a hundred pips for the level it had a week ago.

The weekly chart shows the price testing the 20-week moving average, after being unable to recover above the 20-day moving average at 1.2120. It is falling for the third consecutive day.

“Should the pair yield a daily closing below the critical support around the 1.1940 level, where the 100 and 200 DMAs (Daily Moving Averages) converge, a sharp sell-off toward the 1.1900 round figure will be in the offing. Further south, the 2023 low of 1.1841 will be next on sellers' radars”, writes Dhawni Mehta, Analyst at FXStreet. According to Mehta, the GBP/USD needs acceptance above the 1.2150 static resistance and the 50-day DMA to initiate a fresh recovery toward 1.2200.

Technical levels

- USD/JPY gathered bullish momentum and climbed above 136.00 on Friday.

- The data from the US showed that PCE inflation rose at a stronger pace than expected in January.

- USD/JPY remains on track to post its highest weekly close since early December.

After having spent the European trading hours near 135.00, USD/JPY gathered bullish momentum in the early American session on Friday and reached its highest level since December 20 at 136.46. As of writing, the pair was trading at 136.30, where it was up 1.2% on a daily basis.

PCE inflation data fuels USD rally

Earlier in the day, incoming Bank of Japan Governor Kazuo Ueda said that a weak Japanese Yen would support exports, inbound tourism and some service sectors. Ueda added that they would need to normalize the monetary policy if inflation makes headway toward 2%. Since the data from Japan revealed that the National Core CPI edged higher to 4.2% on a yearly basis in January from 4% in December, these comments failed to help the Yen gather strength.

In the second half of the day, the US Bureau of Economic Analysis reported that the annual Personal Consumption Expenditures (PCE) Price Index rose to 5.4% in January from 5.3% in December (revised from 5%). Additionally, the Core PCE Price Index, the Fed's preferred gauge of inflation, rose 0.6% on a monthly basis and lifted the annual rate to 4.7% from 4.6%.

Reflecting the positive impact of hot inflation data on the US Dollar, the US Dollar Index advanced above 105.00 for the first time since early January.

Meanwhile, the benchmark 10-year US Treasury bond yield climbed to 3.95% following Thursday's slide and pus additional weight on USD/JPY's shoulders.

Technical levels to watch for

Gold is facing headwinds from several sides at once. Prospects of higher rates are set to weigh on the yellow metal, economists at Commerzbank report.

Further Fed rate hikes

“Gold ETFs have been seeing increased outflows again of late, for one thing. Outflows in the last five days of trading have totalled 14.7 tons, which equates to just shy of three tons per day.”

“The world’s largest and most liquid Gold ETF has also registered outflows again recently. Previously, it had seen slight net inflows for several weeks, fuelling hopes that ETF investors were returning. It appears that the noticeable increase in rate hike expectations has quashed any such hopes for now.”

“According to the Fed Fund Futures, interest rates are expected to peak at around 5.35% in the summer. That’s approx. 50 bps higher than was anticipated in early February. The resulting marked rise in (real) bond yields and the simultaneous appreciation of the US Dollar are putting pressure on Gold.”

- New Home Sales in the US rose at a stronger pace than expected in January.

- US Dollar Index clings to strong daily gains above 105.00.

Sales of new single‐family houses rose by 7.2% in January to a seasonally adjusted annual rate of 670,000, the data published jointly by the US Census Bureau and the Department of Housing and Urban Development showed on Friday.

This reading followed December's increase of 7.2% (revised from 2.3%) and surpassed the market expectation of 2.5% by a wide margin.

Market reaction

The US Dollar Index clings to strong daily gains above 105.00 after this data.

Wage growth in the US is running too high to be consistent with a timely and sustainable return to the Federal Reserve's 2% inflation objective, Federal Reserve Governor Philip Jefferson said on Friday.

Additional takeaways

"Fed is addressing inflation promptly, forcefully to maintain its credibility, preserve inflation anchor."

"Outlook for non-housing core services inflation depends on whether labor demand moves into better balance with labor supply."

"Ongoing imbalance between supply and demand for labor suggests high inflation may come down only slowly."

"Fed's credibility is higher now than in 1960s and 1970s."

"Argument that policymakers should accept that disinflation will be costly is well-reasoned."

"Current situation is different from past inflation fights."

"Policymakers must complement findings from economic models with careful scrutiny of real-time data."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen rising 0.6% on the day at 105.19.

Economists at Nordea think central banks still have a lot of work to do, and risks remain tilted toward this hiking cycle continuing for considerably longer.

Fed will probably need to bring the Fed funds rate up close to 6%

“The resilient economy implies central banks will need to hike rates to ever higher levels.”

“We see the Fed’s benchmark approach 6% and the ECB’s 4% later this year.”

“Also longer US yields will continue to climb, and we target 4.5% for the 10-year Treasury yield.”

- US Dollar and yields rise further after US economic data.

- US Core PCE rises above expectations in January.

- Gold hits fresh weekly lows near $1,810.

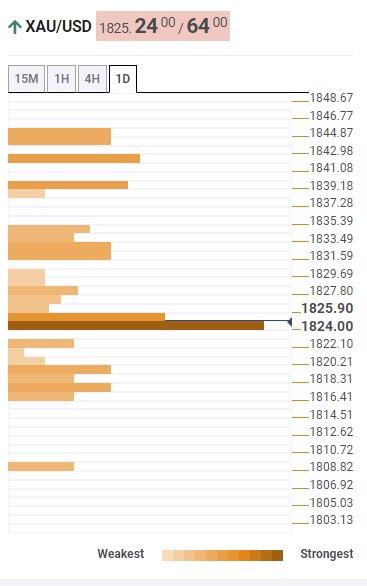

Gold prices dropped further after the beginning of the American session amid a stronger US Dollar and higher Treasury bond yields following data that showed the core PCE rose at the highest rate in six months, above expectations.

XAU/USD bottomed at $1,809/oz, the lowest level since December 29. It is hovering around the lows, looking at the $1,800 area. The 20-week Simple Moving Average awaits at $1,797. Bulls need to recover the $1,820 area in order to alleviate the bearish pressure.

The downside extended following the January Personal Income and Spending. The numbers came in above expectations. Market participants looked into inflation numbers. The Federal Reserve’s preferred inflation gauge, the core PCE rose by 0.6%, to an annual rate of 4.7%, up from the 4.6% of December and against expectations of a decline.

The Dollar gained momentum after the economic numbers, US yields soarrf and equity prices tumbled. The context added pressure to gold that is fighting to hold above $1,810. The 2-year Treasury yield is at 4.79%, the highest since November and the 10-year is at 3.93%.

Technical levels

The Bank of England (BoE) is signaling an end to the rate hike cycle soon. If inflation does turn out to be more persistent than the BoE expects, its rather dovish stance is likely to weigh further on the Pound, economists at Commerzbank report.

GBP weakness is likely to persist next year as well

“The BoE runs the risk of ending its fight against inflation too soon and inflation becoming a more persistent problem. This risk is likely to weigh on the Pound in the coming months, which is why we expect further moderate appreciation in EUR/GBP over the course of the year.”

“GBP weakness is likely to persist next year as well, as the BoE is likely to cut its key rate again in view of the weak economy and somewhat lower inflation.”

See – Source: Commerzbank Research

The Israeli Shekel has faced uncharacteristic depreciation pressure over the last few weeks. Looking ahead, economists at Wells Fargo expect ILS to enjoy considerable gains.

USD/ILS to move toward 3.40 by the end of Q1-2023

“Netanyahu defending BOI independence and the increasing likelihood of BOI FX intervention to support the Shekel reinforces our view that the Shekel is on the verge of a strong rebound back and can recover most of recent losses by the end of Q1-2023.”

“While the progress of Netanyahu's judicial reform proposal through parliament could potentially see some further depreciation in the very short-term, current USD/ILS levels are still attractive for investors to gain ILS exposure and for corporates to hedge ILS-denominated expenses.”

“We see merit in entering positions at current levels, and we believe a move toward 3.40 by the end of Q1-2023 is imminent.”

The Peso depreciated against the USD yesterday. Minutes confirm Banxico’s concerns about stubborn inflation, risks remain, Elisabeth Andreae, FX Analyst at Commerzbank, reports.

Political risks

“On the markets, the inflation data, which remained below consensus, is likely to confirm the rate expectations. The expectations correspond with the announcement in the statement and seem to point towards a continuation of the rate cycle with smaller steps. In line with the TIE rates the market expects rates to peak at just above 11.5%. So the MXN will not find support on this front.”

“The Mexican congress recently passed a controversial reform of the National Electoral Institute (INE) that had been initiated by the President. According to reports, the opposition sees this as a risk to the running of free elections and it wants to challenge the reform as it is considered to be unconstitutional. Protests are planned. MXN investors are likely to keep an eye on that.”

- EUR/USD rapidly loses the grip and trades in fresh lows near 1.0540.

- Next on the downside emerges the 2023 low at 1.0481.

The downside pressure picks up extra impulse and forces EUR/USD to print new monthly lows in the 1.0545/40 band at the end of the week.

If sellers push harder, spot could extend the retracement to the 2023 low at 1.0481 (January 6), an area reinforced by the proximity of the temporary 100-day SMA, today at 1.0449.

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0329.

EUR/USD daily chart

The US Dollar may enjoy a brief rally in the coming months, but in the bigger picture, EUR/USD will head higher, economists at Nordea report.

USD to enjoy a brief rally as financial conditions tighten

“We believe EUR/USD will periodically decline to 1.03 until the summer as the Fed and other central banks continue raising rates more than previously anticipated to tighten financial conditions – implying renewed periods of risk-off, an environment in which the USD should thrive.”

“Looking longer out, we still see a weaker USD. We expect USD vs other G10 rate differentials to move broadly sideways after the summer until year-end and diminish longer-out.”

“Overall, we believe global factors are in favour of a somewhat weaker USD in the long term and see EUR/USD at 1.15 by the end of next year. However, with higher rates than previously anticipated, recession risks increase. Thus, the USD could be a comeback kid sooner than we currently anticipate, after all.”

USD/CAD has regained the 1.36 handle. Economists at Scotiabank expect the pair to enjoy further gains.

Firm support on dips to the low/mid 1.35s

“CAD losses on the week through the mid-1.35s point to additional losses towards the 1.36/1.37 range.”

“Underlying trend dynamics are USD-bullish across short and medium-term oscillators, suggesting limited scope for counter-trend corrections (lower) in the USD at the moment.”

“Look for firm USD support on dips to the low/mid 1.35s.”

- EUR/USD drops further to the 1.0540 region on Friday.

- German Final GDP Growth Rate came in at 0.9% YoY.

- US PCE surprised to the upside in January.

EUR/USD sees its decline accelerate to new lows near 1.0540 in the wake of the release of US PCE on Friday.

EUR/USD remains offered well below 1.0600

The selling momentum in EUR/USD gathers extra traction on the back of the unabated advance in the greenback, which lifts the USD Index (DXY) to fresh highs past the 105.00 barrier after US inflation figures tracked by the PCE came on the strong side in January.

Indeed, the pair loses further ground after the US headline PCE rose 5.4% in the year to January (from 5.3%) and the Core PCE gained 4.7% from a year earlier, both prints surpassing initial estimates.

Further data saw Personal Income expand 0.6% MoM also in January and Persona Spending increase 1.8% vs. the previous month. Later in the session, New Home Sales and the final Michigan Consumer Sentiment print will close the weekly docket across the pond.

Also next on tap appears the speeches by FOMC Governor P.Jefferson (permanent voter, centrist) and Cleveland Fed L.Mester (2024 voter, hawk).

What to look for around EUR

Price action around EUR/USD remains subdued and forces the pair to clock fresh lows in the mid-1.0500s in response to the firmer note in the dollar.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the bank has already anticipated another 50 bps rate raise at the March event.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: Germany Final Q4 GDP Growth Rate/GfK Consumer Confidence (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is retreating 0.33% at 1.0559 and a drop below 1.0545 (monthly low February 24) would target 1.0481 (2023 low January 6) en route to 1.0329 (200-day SMA). On the other hand, the next up barrier emerges at 1.0714 (55-day SMA) followed by 1.0804 (weekly high February 14) and finally 1.1032 (2023 high February 2).

- USD/JPY rallies nearly 200 pips from the daily low and draws support from a combination of factors.

- BoJ Governor nominee Ueda's dovish remarks weigh on JPY and boost the pair amid a stronger USD.

- The stronger-than-expected US PCE Price index provides an additional lift to the buck and the major.

The USD/JPY pair is seen building on its strong intraday rally from the 134.00 mark and scaling higher through the early North American session. The momentum picks up pace in reaction to the stronger-than-expected US PCE Price Index and lifts spot prices to 136.00 neighbourhood, or the highest level since December 20.

In fact, the US Bureau of Economic Analysis reported this Friday inflation in the US, as measured by the Personal Consumption Expenditures (PCE) Price Index, rose 0.6% in January. Furthermore, the yearly rate edged up to 5.4% from the 5.3% previous, beating estimates for a fall to 4.9%. Additional detail of the report showed that Core PCE Price Index - the Fed's preferred inflation gauge - climbed 0.6% MoM and 4.7% over the past twelve months, again surpassing expectations.

The data indicate that inflation isn't coming down quite as fast as hoped and reaffirms expectations for further policy tightening by the Fed. Moreover, the recent upbeat US macro data pointed to an economy that remains resilient despite rising borrowing costs and should allow the Fed to stick to its hawkish stance. This, in turn, remains supportive of elevated US Treasury bond yields, which keeps the US Dollar near a multi-week high and acts as a tailwind for the USD/JPY.

The Japanese Yen (JPY), on the other hand, is weighed down by dovish remarks by the incoming Bank of Japan (BoJ) Governor Kazuo Ueda. In fact, Ueda said that the BoJ's current ultra-loose monetary policy stance is a necessary and appropriate means to steadily meet the 2% target. This is seen as another factor boosting the USD/JPY pair, though the prevalent risk-off mood could underpin the safe-haven JPY and keep a lid on any further gains, at least for the time being.

Technical levels to watch

- DXY accelerates the upside past the 105.00 mark on Friday.

- The next target of note comes at the 2023 high near 105.60.

DXY extends the upside momentum further north of the 105.00 barrier at the end of the week.

The ongoing price action favours the continuation of the uptrend for the time being. That said, the dollar could now challenge the 2023 top at 105.63 (January 6) in the near term ahead of the key 200-day SMA, today at 106.46.

In the longer run, the outlook for the index remains negative while below the 200-day SMA.

DXY daily chart

Alvin Liew, Senior Economist at UOB Group, comments on the recent inflation figures in Singapore.

Key Takeaways

“Headline and core CPI inflation further converged at the start of 2023. Headline CPI rose by 0.2% m/m NSA, 6.6% y/y in Jan, lower compared to market and our expectations, but edged higher from Dec’s 0.2% m/m, 6.5% y/y. In comparison, core inflation (which excludes accommodation and private road transport) continued to rise sequentially and at a faster pace of 0.8% m/m NSA in Jan (from +0.6% m/m in Dec), attributed partly to ‘the one-off effect of the 1%-point GST increase as well as seasonal effects associated with the Chinese New Year’. This resulted in core inflation rising further to 5.5% y/y in Jan (from 5.1% y/y in Dec), the highest y/y print since Nov 2008.”

“The sources of core inflationary pressures remained broad-based and two sources stood out: food and services inflation. The other notable components that added to core inflation were health care and education expenses while the retail & other goods also contributed. Electricity & gas inflation stayed positive but slowed further in Jan. As for the headline CPI inflation, other than upside to the core CPI, the accommodation costs increase stayed elevated, while private transport costs saw yet another further moderation, which explained why the headline CPI and core converged.”

“Inflation Outlook – Notwithstanding the one-off GST impact, the MAS maintained that core inflation ‘to stay elevated in the first half of this year before slowing more discernibly in H2 2023 as the current tightness in the domestic labour market eases and global inflation moderates’ and that the ‘MAS Core Inflation is expected to stay above 5% y-o-y in Q1 2023’. It also kept its 2023 forecasts unchanged from the Oct 2022 Monetary Policy Statement. We also maintain our current set of forecasts, for headline inflation to average 5.0% and core inflation to average 4.0% in 2023. Excluding the 2023 GST impact, we expect headline inflation to average 4.0% and core inflation to average 3.0%.”

Cleveland Fed President Loretta Mester told CNBC on Friday that the financial market alignment with the Fed's policy outlook is much closer now than it was before, as reported by Reuters.

"My funds rate was above the median in December and still think we need to be somewhat above 5%," Mester added and said that she doesn't think they need to have a tradeoff between labor and price stability. "There has been some good movement on inflation measures but it's still too high," she further noted.

Market reaction

The US Dollar Index preserves its bullish momentum following these comments and was last seen rising 0.33% on the day at 104.92.

- USD/CAD catches aggressive bids on Friday and hits a fresh high since January.

- Sustained USD buying turns out to be a key factor fueling the strong move up.

- Investors now await the US Core PCE Price Index for some meaningful impetus.

The USD/CAD pair regains positive traction on Friday and jumps to the 1.3600 mark, or a fresh high since January heading into the North American session. The strong intraday bullish move follows the previous day's good two-way price swings and is sponsored by sustained US Dollar buying.

In fact, the USD Index, which tracks the Greenback against a basket of currencies, climbs to a fresh multi-week high and continues to draw support from hawkish Fed expectations. In fact, the markets seem convinced that the US central bank will stick to its hawkish stance for longer. The bets were lifted by the FOMC minutes released on Wednesday, which revealed that officials were determined to raise interest rates further to fully gain control over inflation.

Moreover, the recent upbeat US economic data points to an economy that remains resilient despite rising borrowing costs and supports prospects for further policy tightening by the Fed. This remains supportive of elevated US Treasury bond yields, which, along with a weaker risk tone, seem to boost the safe-haven USD. Apart from this, an intraday pullback in Crude Oil prices undermines the commodity-linked Loonie and acts as a tailwind for the USD/CAD pair.

Worries that rapidly rising interest rates will dampen economic growth and dent fuel demand keep a lid on any meaningful gains for the black liquid. Furthermore, softer Canadian consumer inflation figures released earlier this week fueled speculations that the Bank of Canada will pause the policy-tightening cycle. This, along with the recent break through key technical hurdles, suggests that the path of least resistance for the USD/CAD pair is to the upside.

Next on tap is the release of the US Core PCE Price Index - the Fed's preferred inflation gauge. The data should influence market expectations about the Fed's future rate hike path. This, in turn, will play a key role in driving the USD demand in the near term. Apart from this, Oil price dynamics should provide some meaningful impetus to the USD/CAD pair. Nevertheless, spot prices remain on track to register strong gains for the second successive week.

Technical levels to watch

Comments from Kazuo Ueda who was speaking in the Lower House of Parliament have failed to provide hawkish trigger for fresh gains. Economists at MUFG Bank note that the Yen is vulnerable to further correction lower.

No clear hawkish signal to fuel a renewed pick-up in speculative demand for JPY

“The comments appear broadly in line with the BoJ’s current policy communication although at the margin they may disappoint those who are looking for a bigger/more imminent further shift in BoJ policy settings under his leadership.”

“There was no clear hawkish signal to fuel a renewed pick-up in speculative demand for the Yen in the near-term. It leaves the Yen vulnerable to further a correction lower while yields outside of Japan are rising again in anticipation that the Fed and other major central banks may have to deliver more rate hikes to bring inflation back down.”

“USD/JPY is currently testing resistance at the 135.00 level which if broken would open the door for the pair to rise back up towards the 200-Day Moving Average that comes in at just over the 137.00 level.”

The USD is rounding out the week on a firm note. PCE deflator data today may support a rise, economists at Scotiabank report.

Broader gains in the DXY may extend another 1-2% in the next few weeks

“Hawkish Fed perspectives and positive seasonal patterns are boosting the USD generally and further gains, which serve to correct some of the late 2022/early 2023 decline in the DXY, look likely to develop in the next few weeks.”

“Minor USD dips remain a buy, with technical signals suggesting a well-established bull trend is developing on the short-term charts at least. Broader gains in the DXY may extend another 1-2% in the next few weeks.”

“Only a modest deceleration in core PCE is expected in Jan (4.3% YoY, from 4.4%); elevated data may lift the USD.”

See – US Core PCE Preview: Forecasts from eight major banks, meaningful acceleration

- AUD/USD dives to fresh low since January amid sustained USD buying and risk-off mood.

- Weakness below the 200-day SMA and the 38.2% Fibo. pave the way for further losses.

- Attempted recovery back above the 0.6800 mark could be seen as a selling opportunity.

The AUD/USD pair comes under heavy selling pressure on the last day of the week and dives to the 0.6750 area, or a fresh low since January 6 during the mid-European session.

Firming expectations that the Federal Reserve will keep interest rates higher for longer in the wake of stubbornly high inflation continue to push the US Dollar higher. Apart from this, the prevalent risk-off mood - amid looming recession risks and geopolitical tensions - benefits the safe-haven buck and drives flows away from the risk-sensitive.

The aforementioned fundamental factors drag the AUD/USD pair below a technically significant 200-day Simple Moving Average (SMA). A subsequent slide below the 38.2% Fibonacci retracement level of the October 2022-February 2023 rally could be seen as a fresh trigger for bearish traders and might have already set the stage for deeper losses.

The negative outlook is reinforced by the fact that oscillators on the daily chart are holding deep in the bearish territory and are still far from being in the oversold zone. Hence, some follow-through weakness towards the 0.6700 round-figure mark, en route to the YTD low, around the 0.6685 zone set in January, looks like a distinct possibility.

On the flip side, the 0.6780 region, or the 38.2% Fibo. level, now seems to act as an immediate hurdle ahead of the 200-day SMA, near the 0.6800 mark. Any further recovery is more likely to attract fresh sellers near the 0.6855-0.6860 region. The latter should act as a pivotal point, which if cleared could prompt some short-covering around the AUD/USD pair.

AUD/USD daily chart

Key levels to watch

EUR’s leak lower continues. Economists at Scotiabank expect the EUR/USD pair to continue under downside pressure for the time being.

Scope for EUR gains is very limited

“ECB hawks are responding to this week’s data showing upward revisions to Jan CPI data and a record rate of core inflation. Hawkish comments may slow EUR losses against the USD in the near term but the USD’s overall yield advantage suggests – for now – that a lower EUR/USD remains the most likely outcome.”

“Technicals suggest firm resistance at 1.0610/15 intraday, with the EUR really needing to regain 1.07+ to stabilize.”

“Broader technical patterns still point to a drop in the EUR to 1.0461 (retracement support from the EUR’s recent 0.95/1.10 rally).”

Economists at OCBC Bank analyze how the release of the US Core PCE Price Index could impact the Dollar.

Potential rising wedge pattern forming

“Markets await the release of Core PCE. Expectations are now skewed towards a sequential rebound in January, judging from the pick-up in US CPI and PPI last week. An upside print could see USD momentum gather traction, but a downside surprise should see a pause in hawkish Fed repricing and recent USD gains can take a breather.”

“Bullish momentum on daily chart remains intact while RSI is rising towards near overbought conditions. Potential rising wedge pattern forming – this is typically associated with a bearish reversal. We won’t rule out near term pullback in DXY.”

“Support at 104.10 (23.6% fibo retracement Sep peak to Feb low), 103.30 (21, 50-DMAs).”

“Resistance at 104.90/105.20 levels before 105.60 (year’s high).

See – US Core PCE Preview: Forecasts from eight major banks, meaningful acceleration

- EUR/JPY reverses two consecutive daily pullbacks on Friday.

- Further gains seen above the 2023 high past 144.00.

EUR/JPY manages to rebound from earlier multi-session lows near 142.00 and returns to the positive territory at the end of the week.

While the cross looks somewhat side-lined for the time being, a convincing breakout of the 2023 high at 144.16 (February 21) could spark extra strength to, initially, the December 2022 peak at 146.72 (December 15).

In the meantime, while above the 200-day SMA, today at 141.41, the outlook for the cross is expected to remain positive.

EUR/JPY daily chart

All eyes are on US Core PCE today as the Dollar remains bid. Kit Juckes, Chief Global FX Strategist at Société Générale, expects the greenback to remain underpinned by strong figures.

Key US data releases

“This morning has thrown up a small downward revision to German Q4 GDP, soft but unsurprising French retail sales data but eyes are on US January personal income and spending data.”

“The consensus looks for a chunky 0.4% monthly rise in the core PCE deflator, which nevertheless can see the annual rate fall to 4.3%, and a 1.1% monthly gain in real personal spending, thanks to the weather. If that’s how it works out, the market may continue to wonder whether we’ll get more than three 25 bps hikes before the FOMC is done tightening, and Dollar’s bounce may have ground on a bit further.”

See – US Core PCE Preview: Forecasts from eight major banks, meaningful acceleration

Economist at UOB Group Ho Woei Chen assesses the latest interest rate decision by the Bank of Korea (BoK).

Key Takeaways

“Bank of Korea (BoK) kept its benchmark 7-day repo rate unchanged at 3.50%... pausing after it hiked consecutively for the past seven meetings and a cumulative 300bps increase since Aug 2021. The rate decision was in line with consensus expectation.”

“However, the rate decision was not unanimous with one policy board member (out of six, excluding Rhee) voting for the interest rate to be hiked by 25bps at today’s meeting.”

“The BoK slightly lowered its GDP growth to 1.6% (previously 1.7%) and inflation forecast to 3.5% (previously 3.6%) for 2023.”

“Despite keeping interest rate unchanged, the BoK continues to maintain a hawkish bias. Governor Rhee pointed out that the rate hold today does not imply that the interest rate has peaked for the current hiking cycle. Five board members see the terminal interest rate at 3.75% (vs. three in the Jan meeting), meaning possibility of a further 25bps hike has increased.”

“We continue to expect an extended pause at 3.50% unless the inflation trajectory turns higher from here. There will be more data until the next monetary policy meeting on 13 Apr that could affect our expectation including two more months of trade and CPI data (Feb and Mar) as well as any changes in the outlook for China’s economic recovery and US Fed’s monetary policy tightening trajectory. Particularly for domestic inflation, we expect the headline CPI to start to recede below 5% in Mar due to the high base effect. Movement of the KRW may also influence the BoK’s decision making.”

The USD/JPY pair is set to take cues from US Core PCE data and UST Yields, economists at OCBC Bank report.

Potential rising wedge in the making

“Bullish momentum on daily chart intact while RSI shows signs of falling from overbought conditions. Potential rising wedge in the making but apex still a distant away.”

“US Core PCE, UST yields will be bigger drivers of USD/JPY in the near term.”

“We are biased to sell rallies.”

“Resistance at 135.40, 136.80 (38.2% fibo retracement of October high to January low).”

“Support at 133.20 (23.6% fibo), 132.30 (21-DMA).”

See – US Core PCE Preview: Forecasts from eight major banks, meaningful acceleration

Gold price dipped briefly under $1,820 on Thursday to hit its lowest level since the end of December. In the short term, there is a risk of the yellow metal falling further, strategists at Commerzbank report.

Marked rise in bond yields putting pressure on Gold

“The disappointment over the more restrictive Fed policy that we are likely to see after all has left its biggest mark on the Gold market. This is because US real interest rates have climbed again as a result. In this sense, a ‘good’ PMI in the US threatens to weigh on prices.”

“We envisage further setback potential in the short term.”

USD/JPY has surpassed the 135 level. Economists at Société Générale analyze the pair's technical picture.

130/129.80 should be a crucial support

“Sellers stay sidelined after neutral comments by Ueda on policy and inflation.”

“Projection at 135.50 is next resistance. An initial pullback is not ruled out, however, recent pivot low at 130/129.80 should be a crucial support.”

“Cross above 135.50 can lead to an extended bounce toward the 200-DMA at 137.00/137.70.”

See: USD/JPY could hit the 136/137 area over the next couple of weeks – ING

The US Dollar managed to stay resilient on Thursday. February and March are seasonally strong months for the Dollar and 4.50% overnight deposit rates can keep the USD supported a little longer, according to economists at ING.

DXY looks like it can continue to press 105.00

“The Dollar is seasonally strong (February and March) and the bar to put money to work outside of 4.50% yielding overnight Dollar deposits is not particularly low.”

“Today should see the January core PCE deflator at a sticky 0.4% month-on-month. In other words, the US disinflation/bearish Dollar narrative will find little from today's data.”

“DXY looks like it can continue to press 105.00 and should USD/CNH trade back up to 7.00 on geopolitics, we could be looking at 105.60/106.00 on DXY.”

See – US Core PCE Preview: Forecasts from eight major banks, meaningful acceleration

- GBP/USD edges higher on Friday and snaps a two-day losing streak, though lacks follow-through.

- Bets for additional rate hikes by the BoE lend support to the British Pound and act as a tailwind.

- Sustained USD buying keeps a lid on any further gains ahead of the US Core PCE Price Index.

The GBP/USD pair attracts some buyers near the 1.2000 psychological mark on Friday and reverses a part of the previous day's slide back closer to the weekly low. The uptick, however, lacks follow-through and spot prices remain below the 1.2050 region through the first half of the European session amid the prevalent bullish sentiment surrounding the US Dollar.

In fact, the USD Index, which tracks the Greenback against a basket of currencies, stands tall near a multi-week high amid the prospects for further policy tightening by the Fed. The bets were reaffirmed by the FOMC minutes released on Wednesday, which showed that officials were determined to continue lifting interest rates to fully gain control over inflation. Moreover, the incoming upbeat US macro data pointed to an economy that remains resilient despite rising borrowing costs and should allow the US central bank to stick to its hawkish stance.

The expectations remain supportive of elevated US Treasury bond yields and continue to underpin the buck. Apart from this, a softer risk tone - amid looming recession risks and geopolitical tensions - is seen as another factor benefitting the safe-haven Greenback and caps the upside for the GBP/USD pair. That said, rising bets for additional rate hikes by the Bank of England (BoE) lend some support to the British Pound and act as a tailwind for the major.

Traders also seem reluctant and now seem to have moved to the sidelines ahead of the release of the US Core PCE Price Index - the Fed's preferred inflation gauge. The crucial data will influence market expectations about the Fed's future rate-hike path. This, in turn, should drive the USD demand and provide a fresh directional impetus to the GBP/USD pair, making it prudent to wait for strong follow-through selling before placing fresh bearish bets.

Technical levels to watch

Economists at Commerzbank forecast CNY to appreciate mildly this year. However, risks to growth and CNY remain significant.

Yuan still has room to gain

“Due to the Covid reopening and in anticipation of a weaker Dollar later this year, we forecast CNY will continue to appreciate this year. But the pace of appreciation will be mild as we remain cautious about the speed of the economic recovery, especially in H2.”

“However, risks to growth and CNY remain large. The strength of consumption recovery will hinge on a corresponding improvement in jobs and income prospects. The property slump will take time to turn around, while headwinds from global slowdown and US-China tensions will remain.”

Source: Commerzbank Research

Senior Economist at UOB Group Alvin Liew reviews the recently published FOMC Minutes of the February 21-22 gathering.

Key Notes

“The key takeaways from the US Federal Reserve’s (Fed) 31 Jan/01 Feb 2023 FOMC meeting minutes were 1) Even though significant progress has been made to lower inflation, inflation remains well above the 2% objective, 2) More hikes are necessary to curb inflation and the restrictive stance maintained until the Fedis confident inflation is on a downward path, 3) While the vote to dial down to a smaller 25-bps hike in Feb was unanimous among FOMC voters, a few participants (non-voters) wanted a bigger 50-bps hike but not the majority, and 4) the minutes clearly showed the Fed remains more concerned about inflation over the economic outlook.”

“Fed Outlook – Dialed Down But Not Done Yet. The latest FOMC minutes strongly suggest that we are not quite near the end [of the tightening cycle], despite the improving inflation trajectory. As the Fed had retained its pledge that “ongoing increases” remaining appropriate but the minutes also showed that the view of downshifting to 25-bps hike is the majority of the FOMC policy makers, we continue to expect the Fed to hike for the next two meetings in clips of 25-bps hikes at the Mar and May 2023 FOMC meetings, bringing our terminal FFTR level to 5.25% (unchanged from previous). We continue to expect this terminal rate of 5.25% to last through 2023.”

EUR/USD registered small losses on Thursday. Economists at ING believe that the world’s most popular currency pair could fall to the 1.05 level.

EUR/USD supported on a multi-quarter view

“A core view slowly permeating through the market is that the ECB has perhaps another 100 bps of tightening to do, but crucially will be leaving rates at those high levels throughout a large chunk of 2024. This should be a key factor in keeping EUR/USD supported on a multi-quarter view.”

“The Eurozone calendar is light today, but given the Dollar bid on the back of US data/geopolitics, the EUR/USD bias looks to a press of 1.0575 support and a potential move to 1.0500.”

- EUR/USD extends the bearish note below the 1.0600 mark.

- German Final GDP Growth Rate came in at 0.9% YoY.

- Markets’ attention will be on the US PCE, Fedspeak.

Sellers remain well in control of the mood around the European currency and keep EUR/USD depressed in the 1.0590 region at the end of the week.

EUR/USD weaker ahead of US PCE, Fedspeak

EUR/USD retreats uninterruptedly since Monday and navigates the area of multi-week lows in the 1.0590/80 band on Friday amidst a mild but constant bid bias in the greenback and generalized prudence ahead of the release of key US data later in the session.

The persevering decline in the pair remains propped up by the better tone in the dollar, which in turn appears bolstered by speculation of the Fed’s tighter-for-longer stance and higher US yields.

In the domestic calendar, final GDP Growth Rate in Germany showed the economy expanded 0.9% YoY in the October-December 2020 period, while Consumer Confidence tracked by GfK “improved” to -30.5 for the month of March. In France, Consumer Confidence eased to 82 in February (from 83).

Across the ocean, the release of the Fed’s preferred inflation gauge – the PCE and Core PCE – will be the salient event seconded by Personal Income/Spending, New Home Sales and the final Michigan Consumer Sentiment print.

Additionally, FOMC Governor P.Jefferson (permanent voter, centrist) and Cleveland Fed L.Mester (2024 voter, hawk) are also due to speak.

What to look for around EUR

Price action around EUR/USD remains subdued and forces the pair to keep business in the lower end of the recent 6-weeks trading range.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the bank has already anticipated another 50 bps rate raise at the March event.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: Germany Final Q4 GDP Growth Rate/GfK Consumer Confidence (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is retreating 0.08% at 1.0586 and a drop below 1.0577 (monthly low February 23) would target 1.0481 (2023 low January 6) en route to 1.0329 (200-day SMA). On the other hand, the next up barrier emerges at 1.0714 (55-day SMA) followed by 1.0804 (weekly high February 14) and finally 1.1032 (2023 high February 2).

- USD/JPY reverses an intraday slide to the 134.00 mark and rallies back closer to the YTD peak.

- BoJ Governor candidate Ueda's dovish remarks weigh on JPY and act as a tailwind for the pair.

- Bets for additional rate hikes by the Fed underpin the USD and remain supportive of the move.

- Traders now look forward to the US Core PCE Price Index before placing fresh directional bets.

The USD/JPY pair rallies around 120 pips from the 134.00 neighbourhood on Friday and climbs back closer to a two-month high touched the previous day. The pair currently trades above the 135.00 psychological mark and seems poised to build on the positive momentum.

The Japanese Yen (JPY) did get a minor boost on the last day of the week after data released earlier today showed that Japan's core consumer inflation hit a new 41-year high in January. The initial reaction, however, fades rather quickly in reaction to the incoming Bank of Japan (BoJ) Governor Kazuo Ueda's dovish remarks. Addressing the parliament for the first time since his nomination, Ueda that the recent rise in consumer inflation was driven mostly by surging import costs of raw materials, rather than strong domestic demand.

Ueda added that the BoJ's current ultra-loose monetary policy stance is a necessary and appropriate means to steadily meet the 2% target. In contrast, the Federal Reserve is expected to stick to its hawkish stance. In fact, the FOMC minutes released on Wednesday showed that officials were determined to raise interest rates further to fully gain control over inflation. This remains supportive of elevated US Treasury bond yields, which, in turn, keeps the US Dollar pinned near a multi-week high and further lends support to the USD/JPY pair.

The aforementioned fundamental backdrop supports prospects for a further near-term appreciating move. The USD bulls, however, might refrain from placing aggressive bets and wait for the release of the US Core PCE Price Index - the Fed's preferred inflation gauge. The data should influence expectations above the Fed's future rate-hike path and drive the USD demand, providing some impetus to the USD/JPY pair. Nevertheless, spot prices remain on track to register gains for the second straight week and the fourth week in the previous five.

Technical levels to watch

USD/JPY holds steady below 135.00. As a normalisation of monetary in Japan policy is set to take some time, economists at Commerzbank expect the Yen to struggle against the USD.

Fluent transition seems likely

“The future chair of the BoJ Kazuo Ueda pointed out that inflation was unlikely to remain at high levels for long and that the central bank should continue its expansionary course. Ueda signalled that the transition to a new governor was probably going to be smooth. A sudden change in monetary policy, therefore, does not seem that likely.”

“A renewed appreciation of the JPY against USD should remain difficult for now. The market is likely to remain nervous as speculation that under the current governor Kuroda another adjustment of monetary policy in connection with yield curve control might be made could continue, causing increased volatility in JPY.”

European Commission President Ursula von der Leyen on Friday, “sanctions are sharply eroding Russia's economic base.”

Additional comments

China shared principles, not a peace plan for Ukraine.

China has already taken side for Russia, we have to view their principles in that light.

Market reaction

EUR/USD was last seen trading at 1.0585, down 0.08% on the day.

- NZD/USD meets with a fresh supply on Friday and drifts back closer to the monthly low.

- Bets for more rate hikes by the Fed, recession fears benefit the USD and exert pressure.

- Investors now look to the US Core PCE Price Index before placing fresh directional bets.

The NZD/USD pair comes under some renewed selling pressure following an early uptick to the 0.6245 area on Friday and drops to a fresh daily low during the first half of the European session. The pair is currently placed just a few pips above the 0.6200 mark, well within the striking distance of the monthly low touched last week and a technically significant 200-day SMA.

The US Dollar remains pinned near a multi-week top and continues to draw support from a combination of factors, which, in turn, is seen exerting downward pressure on the NZD/USD pair. Growing acceptance that the Federal Reserve will stick to its hawkish stance for longer remains supportive of elevated US Treasury bond yields and underpins the buck. Apart from this, the cautious market mood benefits the safe-haven Greenback and weighs on the risk-sensitive Kiwi.

The FOMC meeting minutes released on Wednesday showed that officials were determined to raise interest rates further to fully gain control over inflation. Moreover, the incoming upbeat US macro data pointed to an economy that remains resilient despite rising borrowing costs. In fact, the US Initial Jobless Claims unexpectedly fell last week and indicated a still-tight labor market. This, in turn, supports prospects for further policy tightening by the US central bank.

The USD bulls, however, might refrain from placing aggressive bets and move to the sidelines ahead of the release of the Fed's preferred inflation gauge - the Core PCE Price Index. The crucial data should influence market expectations about the Fed's future rate-hike path. This, in turn, will drive the USD demand and provide a fresh directional impetus to the NZD/USD pair. Nevertheless, spot prices seem poised to end in the red for the third successive week.

Technical levels to watch

GBP/USD closed in negative territory on Thursday but managed to hold above 1.2000. Support levels at 1.1850/1950 are set to hold in the next few weeks, economists at ING report.

A good week for UK data

“Following Tuesday's strong PMI release, the UK outlook has received another boost today in the form of a big jump in GFK consumer confidence. This has now returned to levels not seen since last April.”

“Slightly better growth prospects, sticky inflation and some further monetary tightening are the story across the US, the Eurozone and the UK at the moment – suggesting bilateral FX rates do not need to move too much.

“Three-month GBP/USD implied volatility has drifted under 10% and would tend to favour more modest moves in the spot. We think support levels at 1.1850/1950 may hold over the next couple of weeks.”

“There cannot be any business as usual with Russia as long as this war continues,” Germany’s Finance Minister Christian Lindner said on the sidelines of the G20 finance ministers and central bank governors' meeting on Friday.

More comments

German govt has sympathy for US pick to lead World Bank.

Must not fall behind previous criticism of Russia at G20.

We need absolute clarity - this is a war initiated by Putin.

We need to promote private investment.

German Economy Ministry paper on sanctions evasion largely conclusive, should be implemented that way.

There is no exact figure for Ukraine's financial need.

The expectation that there will be bilateral talks with China at the ministerial level soon.

Noticeable that China has defined its own perspective on the war in Ukraine, more ambivalent than allowable in our view.

Related reads

- EUR/USD Forecast: Sellers don't want to give up control

- ECB’s Nagel: Can't rule significant further rate hikes after March

On the sidelines of G20 finance ministers and central bank governors' meeting on Friday, US Treasury Secretary Janet Yellen said that “inflation is coming down if you measure it on a 12-month basis, but still core inflation, which I think will fall further, remains higher than is consistent with 2%.”

Additional comments

A "soft landing" without a recession is possible due to a strong labor market and strong US. balance sheets.

US economy is fundamentally in good shape.

Employment, you know, continues to increase. Households are in good shape. You know, we don't have balance sheet problems of the type that we had prior to the (2008-2009) global financial crisis.

Market reaction

The US Dollar Index shows little to no reaction to the above comments, keeping its range at around 104.70. The spot is trading 0.11% higher so far.

European Central Bank (ECB) policymaker and Bundesbank Chief Joachim Nagel said on Friday, he “can't rule significant further rate hikes after March.”

Additional quotes

“Latest data shows core inflation still too high.”

“ECB must be determined in tightening policy.”

“Can't rule out headline inflation has reached plateau but it's too speculative to say.”

Market reaction

The Euro failed to capitalize on the hawkish remarks. The EUR/USD pair is trading at 1.0588, down 0.05% on the day.

Focus remains on US monetary policy for the time being. Economists at Commerzbank discuss the USD outlook against the Euro.

Rate expectations for the US already quite high

“Speculation as to how the rate decision in March will go and how much further the Fed will move might remain the dominant drivers for USD and thus for the EUR/USD for now. However, it might get increasingly difficult for USD to gain further ground against the Euro. A lot has already been priced in and it is going to get difficult to further fuel the market’s expectations that have already moved a long way.”

“The EUR side of things also plays a part. The question of how far monetary policy tightening is going to go also arises for the ECB. The publication of the final consumer price data yesterday, in which the core rate was revised to the upside a little further to 5.3%, reminded everyone that the ECB too has quite a bit of work ahead of it.”

“The focus currently remains on the Fed and on how far interest rates in the US will rise. The USD, therefore, seems to be decisive in providing momentum. However, that can change again very quickly.”

USD/CNH needs to surpass the 6.9300 level to allow for extra upside in the short-term horizon, comment UOB Group’s Economist Lee Sue Ann and Market Strategist Quek Ser Leang.

Key Quotes

24-hour view: “Yesterday, we held the view that USD ‘is likely to edge higher but it is unlikely to challenge the major resistance at 6.9300’. Instead of edging higher, USD traded choppily as it dropped to 6.8844, rebounded strongly to 6.9242 before easing off to close at 6.9187 (+0.15%). Despite the advance, upward momentum has not improved much. However, as long as 6.8900 is not breached, USD could rise to 6.9300 before the risk of a more sustained pullback increases.”

Next 1-3 weeks: “We highlighted yesterday (23 Feb, spot at 6.9050) that the USD strength that started early this month is intact as long as it stays above 6.8700. We added, a break of 6.9300 would shift the focus to 6.9500. While we continue to hold the same view, short-term upward momentum is beginning to wane and USD has to break above 6.9300 within the next 1-2 days or the risk of an end to the USD strength will increase quickly.”

- GBP/JPY attracts some dip-buying on Friday and snaps a two-day losing streak.

- BoJ Governor candidate Ueda's dovish remarks weigh on JPY and lend support.

- Bets for additional BoE rate hikes underpin the GBP and also act as a tailwind.

The GBP/JPY cross attracts some buyers in the vicinity of the weekly low, around the 161.20 region on Friday and refreshes the daily top during the early European session. Currently placed comfortably above the 162.00 mark, the cross snaps a two-day losing streak and stalls its recent pullback from the 100-day SMA, or a two-month high touched on Tuesday.

The Japanese Yen (JPY) weakens across the board in reaction to dovish remarks by the incoming Bank of Japan (BoJ) Governor Kazuo Ueda and turns out to be a key factor lending support to the GBP/JPY cross. Addressing the parliament for the first time since his nomination, Ueda said that the central bank must maintain the ultra-loose policy stance to support the fragile economy. He also added that the current monetary policy is a necessary and appropriate means to steadily meet the central bank's 2% target.

Justifying his outlook, Ueda noted that the recent rise in consumer inflation was driven mostly by surging import costs of raw materials, rather than strong domestic demand. This overshadows data showing that Japan's nationwide core CPI accelerated to 4.2% in January - marking the fastest rise since September 1981 - and weighs on the domestic currency. Apart from this, rising bets for additional rate hikes by the Bank of England (BoE) underpin the British Pound and boost the GBP/JPY cross.

The UK PMIs released on Tuesday indicated that business activity rose more than expected in February. This, in turn, raised hopes that the country may be able to avoid a steep economic downturn and could persuade the BoE to continue tightening its monetary policy to tame inflation. That said, worries about economic headwinds stemming from rapidly rising borrowing costs, along with geopolitical tensions, benefit the JPY's relative safe-haven status and might cap the GBP/JPY cross, at least for now.

Technical levels to watch

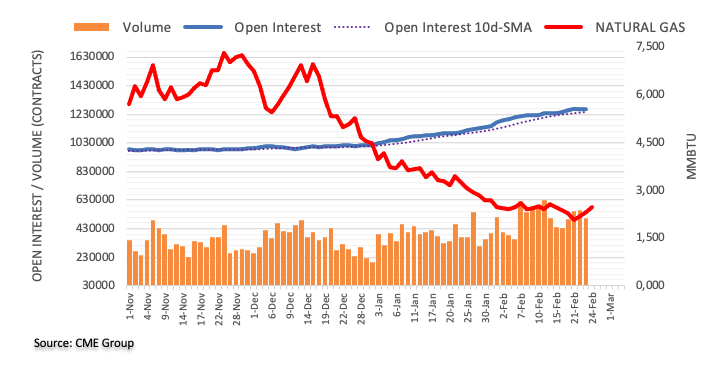

Considering advanced prints from CME Group for natural gas futures markets, open interest resumed the uptrend and increased by around 1.7K contracts on Thursday. On the other hand, volume shrank by nearly 60K contracts following three consecutive daily advances.

Natural Gas faces the next hurdle near $3.20

Prices of the natural gas extended the rebound after briefly visiting the sub-$2.00 region for the first time since September 2020 on Thursday. The uptick was in tandem with increasing open interest and this underpins the possibility of further gains in the very near term. Against that, a Fibo retracement of the December-February sharp decline near $3.20 per MMBtu now emerges as an initial hurdle for the current recovery.

USD/JPY squeezes around 134.70. Economists at ING believe that the pair could surge higher toward the 136/37 zone in the next few weeks.

USD/JPY should be back towards 125/126 into the summer

“Our view is that this corrective Dollar bounce could carry the USD/JPY pair up to the 136/137 area over the next couple of weeks.”

“But assuming that we are correct with the US disinflation story dominating again in the second quarter of 2023, USD/JPY should be back towards 125/126 into the summer.”

According to UOB Group’s Economist Lee Sue Ann and Market Strategist Quek Ser Leang, odds for further gains to the 135.50 in USD/JPY seem to be shrinking.

Key Quotes

24-hour view: “We expected USD to edge higher yesterday but we were of the view that ‘any advance is unlikely to break 135.50’. While our view for a higher USD was not wrong, instead of edging higher, it popped to a high of 135.36 in NY trade before pulling back sharply. The pullback is gathering momentum, and the bias is to the downside today. However, it remains to be seen if USD can break the strong support at 134.00. Resistance is at 134.80, followed by 135.20.”

Next 1-3 weeks: “We have held a positive USD view for more than a week now. As USD struggles to reach our objective of 135.50, we highlighted yesterday (23 Feb, spot at 134.95) that the risk for USD is still on the upside and only a break of 134.00 would indicate that USD strength has come to an end. USD subsequently popped to 135.36 before pulling back sharply. Upward momentum is waning rapidly and the likelihood of USD breaking 135.50 has diminished. In other words, the USD strength appears to be coming to an end, but confirmation will come with a break of 134.00.”

NZD/USD is right on key support at 0.62. Economists at ANZ Bank discuss Kiwi outlook.

Tight labour markets and sticky inflation remain the key themes

“Tight labour markets and sticky inflation remain the key themes. Of course, NZ is in that situation too, and alongside the USD, is on track to continue to top global league tables on the bond yield front. That, alongside an expected boost in economic activity post the cyclone has potential to offset what many fear is a fresh wave of USD strength.”

“But right here, right now, all eyes are on the 0.6200 level amid sluggish price action.”

“Support 0.5900/0.6090/0.6200 Resistance 0.6540/0.6675”

- AUD/USD remains depressed near its lowest level since January amid a bullish USD.

- Bets for additional rate hikes by the Fed, recession fears continue to benefit the buck.

- Traders now look to the Fed’s preferred inflation gauge for a fresh directional impetus.

The AUD/USD pair struggles to capitalize on the previous day's late bounce from a nearly two-month low and attracts some sellers near the 0.6825 region on Friday. Spot prices remain on the defensive around the 0.6800 mark through the early European session, with bears making a fresh attempt to extend the downtrend below a technically significant 200-day SMA.

A combination of supporting factors keeps the US Dollar pinned near a multi-week top, which, in turn, is seen acting as a headwind for the AUD/USD pair. The prospects for further policy tightening by the Federal Reserve remain supportive of elevated US Treasury bond yields and continue to underpin the USD. Apart from this, the prevalent cautious market mood benefits the Greenback's relative safe-haven status and weighs on the risk-sensitive Aussie.

The FOMC meeting minutes released on Wednesday showed that officials were determined to raise interest rates further to fully gain control over inflation. Moreover, the incoming upbeat US macro data pointed to an economy that remains resilient despite rising borrowing costs. In fact, the US Initial Jobless Claims unexpectedly fell last week and indicated a still-tight labor market. This should allow the Fed to stick to its hawkish stance for longer.

The USD bulls, however, seem reluctant and prefer to wait for the release of the US Core PCE Price Index, the Fed's preferred inflation gauge. The data will play a key role in influencing market expectations about the Fed's future rate-hike path. This, in turn, should drive the USD demand in the near term and provide a fresh directional impetus to the AUD/USD pair. Nevertheless, spot prices remain on track to register losses for the second successive week.

Technical levels to watch

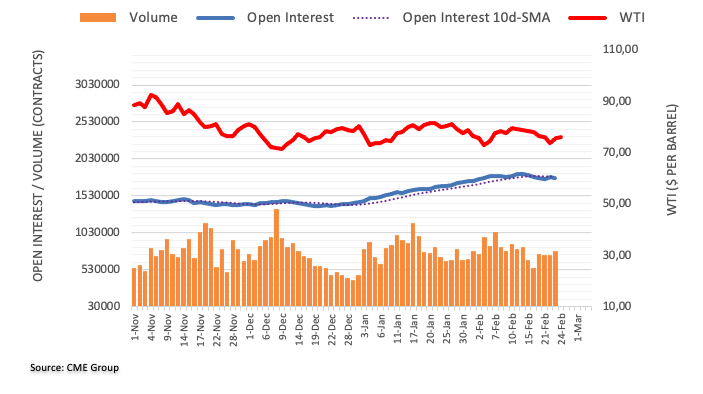

CME Group’s flash data for crude oil futures markets noted traders resumed the downtrend in their open interest positions on Thursday, this time following a drop of around 11.7K contracts. Volume, on the other hand, went up for the second session in a row, now by around 50.3K contracts.

WTI: A drop to the $72.00 region should not be ruled out

Thursday’s marked rebound in prices of the barrel of the WTI was accompanied by declining open interest, which is indicative that a more sustainable recovery seems not favoured for the time being. The next target on the downside, in the meantime, emerges at the 2023 low at $72.30.

Robust growth and sound monetary policy should support the Indian Rupee (INR) in the coming months, in the opinion of economists at Commerzbank.

RBI is expected to tighten policy further

“Tight monetary policy, an expected decline in inflation, and robust growth should support the Rupee in the coming months.”

“We expect a stable to lower USD/INR rate of 81.50 at year-end 2023.”

“RBI is expected to tighten policy further by another 25-50bp in 1H 2023. The central bank is projecting inflation to dip below 6% in Q1 2023 and to hold at around 5% in 2023.”

Source: Commerzbank Research

In the opinion of UOB Group’s Economist Lee Sue Ann and Market Strategist Quek Ser Leang, AUD/USD could slip back to the 0.6730 region in the near term.

Key Quotes

24-hour view: “Yesterday, we held the view that AUD could test 0.6775 before stabilization is likely. However, AUD did not quite test 0.6775 as it rebounded from a low of 0.6783. Despite the lackluster downward momentum, we continue to see room for AUD to test 0.6775 before a more sustained rebound is likely. On the upside, a breach of 0.6845 (minor resistance is at 0.6825) would indicate that 0.6775 is unlikely to come into view.”

Next 1-3 weeks: “We have expected AUD to weaken since late last week. In our update from yesterday (23 Feb, spot at 0.6810), we indicated that AUD is likely to weaken further to 0.6775, possibly 0.6730. We continue to hold the same view. All in all, only a breach of 0.6890 (no change in ‘strong resistance’ level) would indicate that AUD is not weakening further.

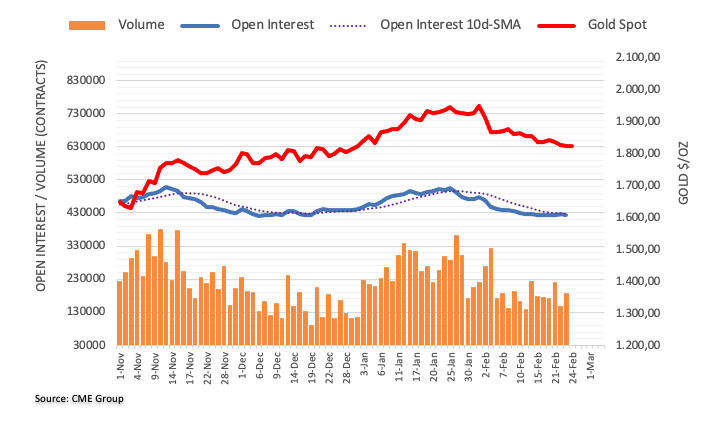

Open interest in gold futures markets shrank by around 1.5K contracts after two consecutive daily builds on Thursday, according to preliminary readings from CME Group. Volume, instead, remained choppy and went up by around 37.1K contracts.

Gold: Next on the downside comes $1800

Gold prices dropped for the third straight session on Thursday. The downtick, however, was amidst shrinking open interest and hints at the likelihood that a deeper drop appears somewhat curtailed for the time being. Immediately to the downside in the precious metal comes the key $1800 region per ounce troy.

The Fed’s preferred inflation gauge, the Core Personal Consumption Expenditure (Core PCE), will be published on Friday, February 24 at 13:30 GMT and as we get closer to the release time, here are the forecasts of economists and researchers of eight major banks.

US PCE Price Index is foreseen at 4.9%year-on-year in January easing from the previous 5%, while the more relevant Core PCE Price Index is expected to fall a tick to 4.3% YoY. On a monthly basis, Core PCE inflation is forecast to rise by 0.4%, above 0.3% reported in December.

ING

“The Fed’s favoured measure of inflation, the core personal consumer expenditure deflator, looks set to rise by 0.4% MoM, more than twice the 0.17% MoM required over time to produce YoY inflation of 2%.”

Deutsche Bank

“We'll have to wait until Friday for the main event this week as the latest core PCE deflator (DB at +0.5% MoM vs. +0.3% last month) come out. If our forecast for core PCE is correct the YoY rate will be sticky at 4.4% and could edge up to 4.5% with the three-month (3.9% vs. 2.9%) and six-month (4.6% vs. 3.7%) annualised growth rates going back up.”

SocGen

“We pencil in gains for the PCE of 0.5% MoM for headline and 0.4% for core. Some on the street estimate +0.55% for core which would take the annual rate up to 4.5% from 4.4% in December. The outcome may decide how the second half of the month pans out and if budding speculation of 50 bps in March is simply outlandish, or not.”

TDS

“We expect core PCE prices to accelerate in Jan to its strongest MoM pace in five months. We project January core PCE inflation to have accelerated to 0.5% MoM, driven by a lessening in core goods price deflation and strong core services inflation (also outside of housing services). The YoY rate likely stayed unchanged at 4.5%, suggesting price gains remain elevated. With also stronger gasoline prices in January, headline PCE inflation likely ended up at 0.5% MoM.”

NBF

“Still in January, the annual core PCE deflator may have moved down from 4.4% to a 15-month low of 4.3%.”

CIBC

“The Fed’s preferred gauge of inflation, core PCE prices, likely maintained a 0.3% monthly pace, slightly slower than its CPI counterpart given the lower weight of shelter in the index, causing the annual rate to subside to 4.3%.”

Citibank

“We expect a strong 0.54% MoM increase in core PCE inflation in January with upside risks of a print that rounds to 0.6%. This would imply core PCE rising to 4.5% YoY from 4.4% in December.”

Credit Suisse

“We anticipate an above-consensus acceleration in both headline and core PCE, from 0.1% MoM and 0.3% MoM in Dec to 0.6% MoM and 0.5% MoM respectively. If realized, these readings would be seen as reinforcing hawkish Fed policy risks, and on the margin might bring further weight to the scenario of a 50 bps hike in March. At the same time, weaker than expected reading would represent a more substantial surprise relative to now more hawkish consensus, and as such needs to be considered as a tactical tail risk. This said, we suspect that the bar for a downside PCE surprise to trigger an actual challenge of the recent shift in Fed policy expectations is very high. A particularly weak data surprise would also likely lead to speculation about possible ‘technical’ reasons behind it, which might undermine its credibility and ultimately its market impact.”

Downward momentum is expected to pick up pace once GBP/USD leaves behind the 1.1950 level in the next few weeks, note UOB Group’s Economist Lee Sue Ann and Market Strategist Quek Ser Leang.

Key Quotes

24-hour view: “We highlighted yesterday that ‘while there is room for GBP to weaken further, it is unlikely to break the major support at 1.2000’. The anticipated weakness exceeded our expectations as it dropped to 1.1993 before rebounding slightly. Downward momentum has improved a tad and GBP is likely to edge lower today but it is unlikely to threaten the support at 1.1950. Resistance is at 1.2040, a breach of 1.2065 would indicate that the current mild downward pressure has eased.”

Next 1-3 weeks: “Two days ago (22 Feb, spot at 1.2115), we held the view that ‘the current price movements appear to be part of a broad consolidation range’ and we expected GBP to trade between 1.2000 and 1.2210. Yesterday, GBP dipped below 1.2000 as it dropped to 1.1993. Downward momentum is showing signs of building but GBP has to break the major support at 1.1950 before a sustained decline is likely. The chance of GBP breaking below 1.1950 is low at this stage, but it would remain intact as long as GBP stays below 1.2105 within the next few days.”

- The index maintains the positive bias well past 104.00.

- US yields recede further ahead of key US data.

- US inflation tracked by the PCE takes centre stage.

The greenback, in terms of the USD Index (DXY), looks to extend the weekly advance well north of the 104.00 barrier at the end of the week.

USD Index focused on data, Fedspeak

The index advances for the fourth consecutive session amidst the continuation of the weekly recovery in levels last seen back in early January.

The relentless march north in the dollar comes despite some loss of upside momentum in US yields across the curve and appears underpinned by the perception that the Fed could remain within a more restrictive territory for longer.

So far, CME Group’s FedWatch Tool sees the probability of a 25 bps rate hike at nearly 72%, while the terminal rate is seen beyond the key 5.0% level.

In the US docket, the PCE/Core PCE will be in the limelight along with Personal Income, Personal Spending, New Home Sales and the final Michigan Consumer Sentiment gauge.

In addition, FOMC Governor P.Jefferson (permanent voter, centrist) and Cleveland Fed L.Mester (2024 voter, hawk) are also due to speak.

What to look for around USD

The dollar remains bid north of the 104.00 barrier amidst the generalized lack of traction in the risk complex and rising cautiousness prior to key releases in the US docket.

The probable pivot/impasse in the Fed’s normalization process narrative is expected to remain in the centre of the debate along with the hawkish message from Fed speakers, all after US inflation figures for the month of January showed consumer prices are still elevated, the labour market remains tight and the economy maintains its resilience.

The loss of traction in wage inflation – as per the latest US jobs report - however, seems to lend some support to the view that the Fed’s tightening cycle have started to impact on the still robust US labour markets somewhat.

Key events in the US this week: PCE, Core PCE, Personal Income/Spending, Final Michigan Consumer Sentiment, New Home Sales (Friday).

Eminent issues on the back boiler: Rising conviction of a soft landing of the US economy. Slower pace of interest rate hikes by the Federal Reserve vs. shrinking odds for a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is gaining 0.02% at 104.60 and faces the next hurdle at 104.77 (monthly high February 23) seconded by 105.63 (2023 high January 6) and then 106.46 (200-day SMA). On the other hand, the breach of 103.41 (55-day SMA) would open the door to 102.58 (weekly low February 14) and finally 100.82 (2023 low February 2).

- Silver is seen consolidating this week’s downfall back closer to the YTD low.

- The setup favours bearish traders and supports prospects for further losses.

- A sustained move beyond the $22.00 barrier could negate the bearish bias.

Silver enters a bearish consolidation phase on Friday and oscillates in a narrow trading band through the early European session. The white metal is currently placed around the $21.30-$21.25 area, just above the YTD low touched last week, and seems vulnerable to slide further.

The XAG/USD now seems to have found acceptance below the 50% Fibonacci retracement level of the recent rally from October 2022. This comes on the back of this week's repeated failures near the $22.00 mark, or the 100-day Simple Moving Average (SMA), and could be seen as a fresh trigger for bearish traders.

That said, Relative Strength Index (RSI) on the daily chart is flashing slightly oversold conditions and warrants some caution. This makes it prudent to wait for some near-term consolidation or a modest bounce before placing fresh bearish bets around the XAG/USD positioning for any further depreciating move.

Nevertheless, the XAG/USD seems poised to weaken further below the $21.00 mark (200-day SMA) and accelerate the fall towards the next relevant support near the $20.60 zone. The downward trajectory could get extended further towards the $20.00 psychological mark en route to the $19.75-$19.70 region.

On the flip side, the $21.55-$21.60 region now seems to act as an immediate hurdle. Any subsequent move-up might continue to attract fresh sellers near the $22.00 mark. The said handle is closely followed by the 38.2% Fibo. level, around the $22.15 zone, which should now act as a key pivotal point.

A sustained strength beyond could trigger a short-covering rally and lift the XAG/USD towards the $22.55-$22.60 supply zone. Bulls might eventually aim to reclaim the $23.00 round-figure mark, which coincides with the 23.6% Fibo. level.

Silver daily chart

Key levels to watch

Here is what you need to know on Friday, February 24:

Although the US Dollar managed to stay resilient against its major rivals on Thursday, it seems to have lost its bullish momentum on the last trading day of the week. The US Bureau of Economic Analysis' (BEA) Personal Consumption Expenditures (PCE) Price Index data, the US Federal Reserve's preferred gauge of inflation, will be featured in the US economic docket alongside Personal Spending and Personal Income figures for February. January New Home Sales data and Fedspeak will also be watched closely by market participants.

US PCE Inflation Preview: Can the US Dollar turn bullish for good?

The BEA announced on Thursday that it revised the annualized real Gross Domestic Product (GDP) growth for the fourth quarter to 2.7% from 2.9%. On a positive note, weekly Initial Jobless Claims stayed below 200,000 for the sixth straight week, reminding investors of tight labor market conditions. The US Dollar Index (DXY) edged higher after this data but the improving market mood, as reflected by considerable gains in Wall Street's main indexes, limited the DXY's upside. Meanwhile, the benchmark 10-year US Treasury Bond yield lost nearly 1% on Thursday and declined below 3.9% early Friday.

US Core PCE Inflation Preview: US Dollar selling opportunity? Three reasons to expect a slide.

EUR/USD registered small losses on Thursday. The pair stays in a consolidation phase at around 1.0600 in the early European session. The data from Germany revealed that the GDP contracted by 0.4% on a quarterly basis in the fourth-quarter, compared to the initial estimate of -0.2%.

Following some fluctuations during the Asian trading hours, USD/JPY holds steady below 135.00 in the European morning. Incoming Bank of Japan (BoJ) Governor Kazuo Ueda said on Friday that the weak Japanese Yen was good for exports, inbound tourism and some service sectors. Ueda, however, also acknowledged that the weak Yen was impacting household negatively. "We would need to normalize policy if inflation makes headway towards 2% target," Ueda further noted.

GBP/USD closed the second straight in negative territory on Thursday but managed to hold above 1.2000. The pair stays relatively quiet early Friday.

Gold price touched its lowest level of 2023 below $1,820 on Thursday but erased its daily losses amid retreating US T-bond yields. XAU/USD moves sideways at around $1,825 on Friday.