- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 24-02-2022

- EUR/USD fades bounce off 20-month low, battles short-term key support area.

- Bearish MACD, risk-off mood keep sellers hopeful to visit 61.8% FE.

- Bulls need to cross two-week-old descending trend line to justify short-term strength.

EUR/USD retreats from 1.1220 during the initial Asian session on Friday, around 1.1190 by the press time.

The quote dropped to the lowest levels last seen during June 2020 before reversing from 1.1106 the previous day.

Even so, the major currency pair’s failure to stay beyond three-month-old horizontal support, around 1.1185-75, for longer joins bearish MACD signals to keep EUR/USD sellers hopeful.

The latest downside needs a clear break of 1.1175 to aim for the previous month’s low of 1.1121.

Following that, the latest bottom surrounding 1.1106 holds the key to a slump towards the 61.8% Fibonacci Expansion (FE) of the EUR/USD pair’s moves between September 2021 and February 2022, near the 1.1000 psychological magnet.

Alternatively, recovery moves can target the early February’s low near 1.1280 as a nearby aim. Though, a clear upside break of a two-week-long descending resistance line, near 1.1330 by the press time, will be necessary to confirm further advances.

In a case where EUR/USD remains firmer past-1.1330, double tops marked around 1.1480-85 will be crucial resistance to watch.

EUR/USD: Daily chart

Trend: Further weakness expected

Japan’s Prime Minister (PM) Fumio Kishida crossed wires, via Reuters, during early Friday morning in Asia while saying that they will strengthen sanctions against Russia.

Additional quotes

Will immediately impose sanctions against Russia in 3 areas including financial sector and military equipment exports.

Poland government will help evacuate Japanese citizens out of Ukraine.

Will do utmost to limit economic damage to Japan.

We have 240 days' worth of crude oil reserves, 2-3 weeks' worth of LNG.

Japan will work closely with G7 to decide on future plans when asked whether Japan will consider sanctions against Russia's energy companies.

Read: USD/JPY rallies to mid-115.00s despite drop in US yields, bulls eye 116.30 resistance

- The NZD dollar vs. the JPY is set to end tie week with gains, so far up 0.40%.

- Thursday’s North American session ended in the green, depicting a risk-on market mood.

- NZD/JPY Technical Outlook: Neutral-upward biased, confirmed by a bullish RSI.

On Thursday, the New Zealand dollar felt the weight of being a risk-sensitive currency greatly influenced by market sentiment guided by headlines of the Russian invasion of Ukraine, which kept investors on their toes, triggering a risk-off mood. However, once US President Biden enforced a new tranche of rigid sanctions on Russia, the market mood improved, and the pair recovered half of its earlier losses. So far, the NZD/JPY is trading at 77.30.

Thursday’s overnight session for North American traders portrayed a risk-off market mood as Russia’s commenced the invasion of Ukraine, announced by Russian President Vladimir Putin. The NZD/JPY pair dropped 130-pips sharply, from 77.88 to February’s 24 daily low at 76.63. Nonetheless, late in the North American session, US President Joe Biden announced new sanctions on Russia, which improved market sentiment through the end of Wall Street.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY ended the North American session, confined between the 50 and the 200-day moving (DMA), lying at 77.26 and 77.89, respectively. Furthermore, the Relative Strength Index (RSI) at 53.37 above the 50-midline and aiming higher signals the NZD/JPY as bullish biased with enough room before reaching overbought levels. That said, the NZD/JPY is neutral-upward bias.

Upwards, the NZDY/JPY first resistance would be the 200-DMA at 77.89. Breach of the latter would pave the way towards the 100-DMA at 78.34, but firstly, the NZD/JPY pair would need to clear 78.00.

On the flip side, the NZD/JPY first support would be the 50-DMA at 77.26. Once cleared, the next support would be 77.00, followed by February 24 daily low at 76.63.

Early Friday morning in Asia, Reuters conveyed the White House statements.

The news initially said that US President Joe Biden has been working with speech writers, policy team to finalize the State Of The Union (SOTU) address.

“China ties with Russia too limited to compensate for sanctions,” adds the White House (WH) afterward.

The WH also said, “(WH) Believes Putin has grander ambitions than Ukraine.”

FX implications

The news joins the slew of geopolitical updates suggesting further noise on the geopolitical front, which in turn can weigh on the risk barometer pairs like AUD/USD.

Read: AUD/USD fades corrective pullback below 0.7200 on Russia-Ukraine crisis

- AUD/USD struggles to keep the bounce off two-week low, dropped the most in a month on heavy risk-aversion.

- Russia’s invasion of Ukraine triggered market’s rush to risk-safety, Gold, USD benefited from sour sentiment.

- Chatters over large bombardment on Kyiv recently weigh on market’s mood.

- US Core PCE Inflation, Durable Goods Orders will add burden to watcher’s list.

AUD/USD seesaws around 0.7170 during the early hours of the Asian trading session on Friday, after posting the heaviest daily fall in a month.

Russia’s military attack on Ukraine triggered the flight to safety, which in turn drowned the Aussie pair the previous day, before activating a corrective pullback from a fortnight low on mixed chatters.

Russia finally invaded Ukraine from land, sea and air, without caring for international sanctions. The war conditions propelled the rush to traditional safe-havens like the US dollar and gold, which in turn weighed on the AUD/USD prices. However, the latest updates concerning US sanctions and terms of talks between Russia and Ukraine seemed to have stopped the south-run amid a generally quiet early Asian session.

As per the latest updates, Moscow’s military acquired Chernobyl and Ukraine President Zelenskyy signed a decree for general mobilization. Further, the Western leaders have announced more sanctions for Russia and showed readiness to support Kyiv with military power if conditions worsen.

On the contrary are the comments from Russia, like “Moscow is willing to negotiate the terms of Ukraine's surrender.” Additionally favoring the corrective bounce are the chatters that Ukraine President Zelenskyy said they need to discuss ceasefire with Russia.

It should be noted that the second reading of the US Q4 GDP matched 7.0% annualized forecasts but firmer figures of Personal Consumption Expenditure, Chicago Fed National Activity Index and Jobless Claims seemed to have added to the US dollar’s strength. Also favoring the greenback to stay firmer at the fresh 2022 high are the comments from Atlanta Fed President and FOMC member Raphael Bostic who favored three rate hikes this year. On the same line was Richmond Fed President and FOMC member Thomas Barkin said on Thursday that he hopes the Fed can restore interest rates back to pre-pandemic levels fairly quickly, reported Reuters. However, Cleveland Fed President Loretta Mester said on Thursday that she doesn't think raising interest rates by 50 bps in March is compelling, according to Reuters.

Amid these plays, Wall Street closed with mild gains after the initial plunge whereas the US 10-year Treasury yields closed more or less at the same level the previous day, after marking a volatile day.

Moving on, CNN’s news that Russia is up for bombardment on Kyiv can exert fresh downside pressure on the AUD/USD prices.

On the data side, US Core PCE Inflation data and Durable Goods Orders may join Fedspeak to offer extra directives to the AUD/USD prices.

Technical analysis

Despite bouncing off a two-week low, AUD/USD prices keep the downside break of a monthly support line, now resistance around 0.7180. As a result, the quote is likely to decline further towards the 0.7100 threshold. It’s worth noting that the 100-DMA level of 0.7238 acts as an extra filter to the north.

- USD/CHF has slipped below 0.9250 as investors turn cautiously optimistic post-US sanctions on Moscow.

- The undertone of the market is still negative and investors might stick to the risk-aversion theme.

- The DXY is waiting for fresh impetus from the Russia-Ukraine war for further direction.

The USD/CHF pair has retreated from Thursday’s high at 0.9288, trading back and forth in a radius of 0.9243-0.9264, and is expected to skid further as the undertone of the market turns cautiously optimistic. It seems that investors have started digesting the maximum worse, which can happen to the world economy through the Russia-Ukraine war.

On Thursday, USD/CHF has witnessed a juggernaut rally after Moscow operated a full-scale military action on Ukraine despite the fear of sanctions and warnings from the Western leaders. The major gained around 0.7% against Wednesday’s closing price. Amid the geopolitical crisis, the risk-off impulse remained active and investors chose the greenback over the Swiss franc.

The situation of Ukraine has worsened after the attacks from the Kremlin. As per the United Nations (UN) refugee agency, “An estimated 100,000 Ukrainians had fled their homes. Thousands were crossing into neighboring countries, including Romania, Moldova, Poland, and Hungary.”

Meanwhile, the US dollar index (DXY) is awaiting fresh impetus for further guidance after refreshing 2022 peak. On Thursday, the GDP numbers (annualized) from the US Bureau of Economic Analysis remained in line with the estimates of 7% but improved from the previous print of 6.9%. While the weekly Initial Jobless Claims by the Department of Labor slipped to 232k from the previous print of 249k.

However, Thursday’s Employment Level released by the Swiss Statistics improved to 5.239M above than the market estimates and previous print of 5.179M and 5.213M respectively.

Russian military forces are expected to begin a large-scale bombardment of the Ukrainian capital city of Kyiv from around 0300am local time (0100GMT), reported a CNN correspondent citing an intelligence report.

Market Reaction

There hasn't been any market reaction to these headlines yet but it certainly won't be a positive for global risk appetite if Russia does launch a second major assault on Ukraine. With the US and EU for now avoiding the most economically problematic sanctions on Russia, any risk-off reaction associated with further fighting probably wont be as severe.

- USD/JPY moved higher to near 115.50 on Thursday despite a drop in US yields, with bulls eyeing resistance around 116.30.

- Extreme volatility in global energy markets could have dampened the relative appeal of the energy import-dependent yen versus the buck.

- Fed members endorsing policy tightening despite geopolitical risks may also have helped the buck versus its safe-haven peer.

A sharp drop in US yields on Thursday as investors flocked to the safety of government bond markets and pared-back modestly on medium-term Fed tightening in wake of Russia’s invasion of Ukraine failed to dampen the dollar versus JPY. Both currencies performer well compared to the rest of their G10 counterparts given their safe-haven status, but a spike in erratic trade and a spike in global energy prices eventually saw the buck favoured. The pair closed Thursday trade in the 115.50 area, after rallying about 0.4% on the day and continues to trade subdued in this region as Asia pacific trade gets underway.

Risks to global energy prices are still very much tilted to the upside amid expectations for an intensification of the Russia/Ukraine war in the coming days, despite the US and EU for now avoiding sanctions on Russian energy exports. That suggests the yen (Japan a big net energy importer) may continue to underperform the US dollar (the US a net energy exporter) in the near future, regardless of what happens to yields and Fed tightening expectations.

Fed members were out in force on Thursday and the general consensus seemed to be that while war in Europe was a key risk to the outlook to monitor, it remains appropriate to press ahead with rate hikes next month. That has kept Fed tightening expectations for 2022 largely intact, even if calls for a 50bps hike in March have receded in recent days. The fact that holders of USD can bank on rising interest rates in the coming months is another reason to favour the buck over the yen in turbulent, risk-off market conditions.

If the recent surge in commodities keeps upwards pressure on yields, then it seems likely that USD/JPY might follow in the footsteps of the broader Dollar Index, which hit its highest since early 2020 in the mid-97.00s on Thursday. Bulls will be eyeing a test of the 2022 double top in the 116.30s. A break above could open the door to further progression towards late 2016/early 2017 highs above 118.00.

- The British pound drops 1.12% in the week vs. the yen, blamed on Russia’s invasion.

- On Thursday, the Average Daily Range (ADR) of the GBP/JPY was 250 pips.

- GBP/JPY Technical Outlook: Persist upward-biased post reclaiming the 100-DMA.

The British pound is set to end the day in the red as the North American session winds down, following a busy session in the financial markets, driven by headlines of the Russian invasion of Ukraine, which has taken a toll on risk market mood. However, following US President Biden’s new tranche of sanctions imposed on Russia and people linked to Vladimir Putin’s regime, witnessed a U-turn on US stocks, spurred by a risk-on mood. That said, the GBP/JPY is trading at 154,47.

On Thursday, during the Asian Pac session, the GBP/JPY was subdued in the 155.43-88 area. But as soon as the headlines of Russian President Putin said that a special military operation was underway in Ukraine, the risk-sensitive GBP plummeted, reaching a daily low at 153.36, a 250-ípip move.

GBP/JPY Price Forecast: Technical outlook

In Wednesday’s article, I mentioned that the “GBP/JPY daily chart depicts a double-top, following the rally from January 24 low at 152.90, to February 10 high at 158.06.” Additionally noted that the double-top target was 153.80. All in all, the GBP/JPY double-top target was achieved, probably helped by anxiety and panic in the financial markets, which boosted appetite for safe-haven peers.

Wednesday article here: GBP/JPY Price Analysis: Double top in the making, targets 153.80

So far, as the Asian Pac session begins, the GBP/JPY licks its wounds and prepares for the last trading day of the week. The GBP/JPY finalized the North American session above the 100-day moving average (DMA) at 154.38 after piercing the 200-DMA at 153.38.

That said, the cross-currency pair remains upward biased, though it would depend on risk appetite. The GBP/JPY first resistance level would be February 3 daily low at 155.04. A decisive break would expose the 50-DMA at 155.32, followed by the 156.00 figure.

- NZD/USD fails to pare the biggest daily loss in five months, fades bounce off one-week low.

- NZ Retail Sales rallied in Q4 but trade deficit widened, RBNZ’s Orr showed concerns over inflation.

- Markets panicked as Russia invaded Ukraine from all three sides, international sanctions escalate.

- Geopolitical updates are the key catalyst to watch, US data, Fedspeak may offer additional directions.

NZD/USD drops back below 0.6700, around 0.6690 by the press time, as mixed data from New Zealand (NZ) joins the broad risk-aversion due to the Russian invasion of Ukraine. In doing so, the kiwi pair reverses the corrective pullback from weekly low during the early hours of Friday’s Asian session.

New Zealand Q4 Retail Sales reversed the previous contraction of 8.1% with 8.6% of growth, versus -2.2% expected figures. Further, the Trade Balance dropped to $-1082M and $-7.71B MoM and YoY respectively, way below the $-477M and $-6.78B monthly and yearly figures in that order.

Although mixed NZ data could be spotted as the latest burden on the NZD/USD prices, the market’s risk-off mood was the major blow to the Kiwi pair. The quote flashed the biggest daily loss in five months on Thursday as Russia finally invaded Ukraine from land, sea and air, without caring for international sanctions.

Apart from the data, Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr recently crossed wires saying, “We’re particularly concerned about inflation expectations,” considering conditions in Ukraine. The policymaker also said, “Keep the possibility of moving rates quicker if necessary.”

As per the latest updates, Moscow’s military acquired Chernobyl and Ukraine President Zelenskyy signed a decree for general mobilization. Further, the Western leaders have announced more sanctions for Russia and showed readiness to support Kyiv with military power if conditions worsen. However, comments from Russia, like “Moscow is willing to negotiate the terms of Ukraine's surrender,” seemed to have triggered the latest bounce.

That said, Wall Street closed with mild gains after the initial plunge whereas the US 10-year Treasury yields closed more or less at the same level the previous day, after marking a volatile day.

It should be noted that the second reading of the US Q4 GDP matched 7.0% annualized forecasts but firmer figures of Personal Consumption Expenditure, Chicago Fed National Activity Index and Jobless Claims seemed to have added to the US dollar’s strength. Also favoring the greenback to stay firmer at the fresh 2022 high are the comments from Atlanta Fed President and FOMC member Raphael Bostic who favored three rate hikes this year. On the same line was Richmond Fed President and FOMC member Thomas Barkin said on Thursday that he hopes the Fed can restore interest rates back to pre-pandemic levels fairly quickly, reported Reuters. However, Cleveland Fed President Loretta Mester said on Thursday that she doesn't think raising interest rates by 50 bps in March is compelling, according to Reuters.

Moving on, geopolitical catalysts are the key for markets while US Core PCE Inflation data and Durable Goods Orders may join Fedspeak to offer extra directives.

Technical analysis

Despite posting the first daily closing below 50-DMA since Monday, NZD/USD refrained to break a one-month-old rising trend line, at 0.6650 by the press time, on a closing basis. The same favor the odds of a corrective pullback towards regaining above the stated DMA level, near 0.6730 at the latest.

- GBP/USD is oscillating in a range of 1.3376-1.3403 amid fewer headlines on geopolitical issues.

- US President Joe Biden imposes sanctions on Russia that will cut its technology imports.

- The DXY looks to rebound after skidding near 96.91 amid profit booking.

The GBP/USD pair has rebounded from the lows of 1.3273 and is oscillating in a narrow range of 1.3376-1.3403 as investors are waiting for fresh headlines from the Russia-Ukraine tussle. The cable has been hammered by the market participants on Thursday after a full-scale invasion by Russia. US President Joe Biden holds Russia seldom responsible for the death and destruction in Ukraine after an active Russian military activity in the Donbas region in eastern Ukraine.

The expectations of an imminent war turned real on Thursday after the Kremlin unleashed the most destructive war since 1945. The headlines of military troops, explosions, and gunfire amid the Russian attack on Ukraine kept the investors on their toes. A risk-off impulse heightened and investors started pouring their funds into safe-haven assets.

Meanwhile, US President has imposed more sanctions on Russia that may put deeper cuts on their technology imports. As per the new sanctions Sberbank and four other major Russian financial institutions — VTB Bank, Novikombank, Otkritie, and Sovcombank will be blocked.

US President Joe Biden said in a statement that "As we squeezed Russian’s access to finances and technology for strategic sectors of its economy, it can degrade its industrial capacity for years to come," "We estimate that the sanctions will cut off more than half of Russia's high tech imports, which will limit their ability to continue to modernize their military," as per Reuters.

The US dollar index (DXY) looks to rebound after the profit-booking that has sent the DXY lower towards 96.91 in the late American session, which has brought some bids in the pound.

Apart from the Russia-Ukraine war headlines, investors will also focus on GfK Group Consumer Confidence, which will be reported by Britain’s Growth from Knowledge on Friday.

- A recovery in sentiment after the US’s soft sanction response to Russia’s Ukraine invasion helped AUD/JPY recover from intra-day lows.

- The pair is back to trading in the 82.80 area, more than 1.0% up from earlier lows near 82.00.

- Given tensions remain high and markets on edge, the 83.00 area may continue to be viewed as a near-term ceiling.

As sentiment in US equity markets recovered in the aftermath of US President Joe Biden’s announcement of fresh sanctions against Russia for its invasion of Ukraine, AUD/JPY received significant tailwinds. Though the pair has failed to get back above the 83.00 level, at current levels in the 82.80s, it still trades about 1.0% higher versus earlier intra-day lows in near 82.00. That still leaves it down about 0.4% down on the session, but nonetheless marks an impressive intra-day recovery.

Risk appetite took a turn for the better following Biden’s Russia sanction announcements as the US President confirmed that Russia’s energy sector would not be targeted given European dependence on Russian energy imports. Some have pointed out that ahead of the November 2022 mid-term elections, the Biden administration has a strong aversion to anything that might pump global energy-driven inflationary pressures even further.

The soft sanctions helped ease demand for safe-havens such as the yen and helped spur inflows into more risk-sensitive currencies such as the Aussie, facilitating AUD/JPY’s intra-day rebound. But the war in Ukraine is set to intensify in the coming days with Russia still a long way from achieving its goals (which the US thinks entails the “decapitation” of the Ukrainian government).

The US and EU have said that everything is still on the table regarding Russia sanctions. If things start to get really gnarly in Ukraine, public pressure on the US and EU to “do more” to deter Russian aggression could grow. In other words, Russian energy exports remain in the firing line and Russia may yet see itself kicked off of SWIFT. For this reason, the chances for risk appetite to stage a more lasting rebound remains slim and rallies towards 83.00 in AUD/JPY may continue to be viewed as good sell opportunities.

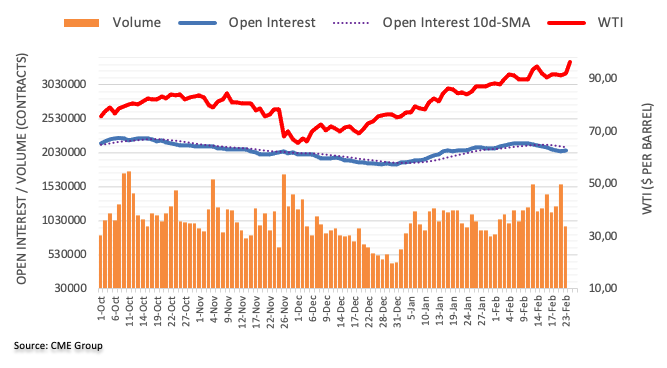

- WTI fell back to near $93.00 having spiked as high as $100 earlier in the session as Russia invaded Ukraine.

- US and EU sanctions have for now avoided the Russian energy sector, easing supply disruption concerns.

- President Biden also said the US would release oil from the SPR.

Oil markets saw the most intra-day volatility since in nearly three months on Thursday, with front-month WTI futures surging over $8.0 to above $100 for the first time since 2014, only to then drop all the way back to $93.00. The initial surge in crude oil prices was triggered as Russia launched a full-scale military assault on Ukraine during Thursday’s Asia Pacific session on fears that subsequent economic sanctions from the West would lead to global oil supply disruptions.

Analysts at UBS noted that Russia is the world’s third-largest producer and second-largest exporter of crude oil. “Given low inventories and dwindling spare capacity, the oil market cannot afford large supply disruptions” they said. But concerns about global supply disruption eased later in the session as it become clear that US and EU sanctions on Russia would not target its energy sector, resulting in the sharp pullback.

US President Joe Biden also said that the US would release oil from its Strategic Petroleum Reserves to ease supply shortage concerns, news which when combined with a larger than expected build in weekly US oil inventories, weighed on prices. Despite Thursday’s more than $9.0 intra-day swing, analysts largerly remained of the conviction that oil prices would remain well supported moving forward.

The Russia/Ukraine conflict will likely intensify in the coming days and tensions between Russia and NATO are set to remain at multi-decade highs, suggesting that the significant geopolitical risk premia that remain priced into crude oil likely isn't going anywhere anytime soon. One alternate theme for investors to watch is signs of further progress in nuclear negotiations between the US and Iran.

Iran’s top security official on Thursday was upbeat on the prospects of finding a good deal with Western powers following recent progress. A deal could see the US lift sanctions on Iranian exports that analysts have said could free up 1.3M barrels in supply to global markets.

- The EUR/USD losses in the day some 0.81%, amid Russia’s offensive on Ukraine.

- Conflict woes between Ukraine and Russia dampened market players’ mood.

- EUR/USD Technical Outlook: Neutral-downward biased, though a daily close below 1.1200, could exacerbate a move towards 1.1100.

The shared currency is dropping during the North American session, though it rebounds off daily lows at 1.1106, and is recovering slightly as the session progresses, amid a renewed upbeat market mood, portrayed by US equity indices with gains. At the time of writing, the EUR/USD is trading at 1.1207.

In the meantime, the US Treasury yields pare earlier losses, with the US 10-year T-note yield flat, sitting at 1.970%, while the greenback remains bid, with the US Dollar Index up 0.96%, currently at 97.12, retreating from the 97.73 level, last seen in July 2021.

At the moment, the market sentiment improved. However, woes in the Ukraine – Russia conflict remain. In the Asian session, Russian President Vladimir Puttin announced that a special military operation in Ukraine was underway. Russia’s operation deployed bombers loaded with weapons, special forces and launched missiles to Ukrainian command centers.

Western and NATO countries condemned the attack from Russia to Ukraine and will impose another tranche of sanctions, more decisive and harmful than the previous ones. Some of the sanctions that wi imposed are: freezing assets in the EU and blocking Russian banks to EU financial markets, while UK’s prime minister is pushing for Russia’s ejection of the SWIFT payment system.

Regarding macroeconomic data, the EU economic docket featured ECB speakers. ECB’s Stoumaras mentioned that the APP would remain until the end of 2022, while Holzman commented that the Ukraine conflict would delay the end of QE. Regarding inflation, ECB Schnabel said that it is higher than expected and broadening but emphasized it would tame under 2% in the year.

Across the pond, US Initial Jobless Claims for the week ending on February 19 rose to 233K, lower than the 235K foreseen, while PCE Prices for the Q4 rose to 6.3% q/q, lower than the 6.4% estimations.

Therefore, the EUR/USD pair would still be subject to market sentiment. If tensions dwindle, it could be probable that the EUR/USD could print another leg-up towards the 1.1300 area. In comparison, further escalation would witness another attempt at the 1.1100 level.

EUR/USD Price Forecast: Technical outlook

The EUR/USD is downward biased as depicted by the daily moving averages (DMAs) above the exchange rate. Nevertheless, the sudden jump on the pair, attributed to ECB’s hawkish tone perceived on its February monetary policy, spurred a rally to 1.1400. From a technical perspective, the EUR/USD is neutral-downwards.

On the downside, the EUR/USD first support would be 1.1200. Breach of the latter would expose last year’s November 24 daily low at 1.1186, followed by February 24 daily low at 1.1106.

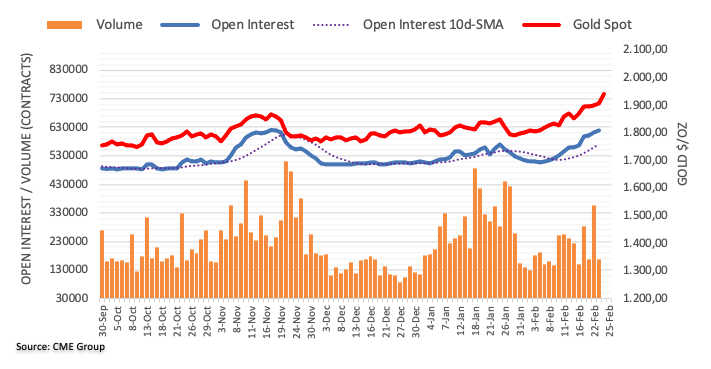

Spot gold changed course after hitting a multi-month high of $1,974.40 a troy ounce and plummeted to $1,877.96, now bouncing modestly from the latter. The bright metal began shedding ground heading into the US opening, accelerating its slide afterwards. A recovery in Wall Street put the final nail on gold's coffin and pushed it below the 1,900 level. Stocks cheered comments from US President Joe Biden, who announced several aggressive international sanctions on Russian people and institutions.

-637813292648216783.png) Gold trades near a fresh weekly low and the near term picture hints at another leg south, mainly on a break below the aforementioned daily low.

Gold trades near a fresh weekly low and the near term picture hints at another leg south, mainly on a break below the aforementioned daily low.

What you need to take care of on Friday, February 25:

Panic took over financial markets as Russia launched a military attack on Ukraine. Moscow attacked not only the Donbass region but got near Kyiv during US trading hours. Russia ignores global sanctions and seems determined to take full control of Ukraine.

A nuclear waste storage facility in Chernobyl, Ukraine, was destroyed after Russian forces entered and fighting broke out, an advisor to the Ukrainian Interior Ministry told NBC. The advisor warned that radioactive dust could cover the territories of Ukraine, Belarus and the EU.

Russian President Vladimir Putin said that they had no other chance but to act differently, as all previous attempts to change the situation were fruitless. He added that Russia remains a part of the global economy and do not plan to damage the system they belong to.

However, the whole world condemned the situation and announced sanctions on Russia. The UK has been among the most aggressive, as UK Prime Minister Boris Johnson pushed for Russia to be ejected from SWIFT system. Earlier in the day, Johnson said that the UK would provide Ukraine defensive weaponry while doing everything to keep Britain safe. Additionally, he said that the kingdom will agree with allies “on a massive package of economic sanctions designed in time to hobble the Russian economy.”

NATO Secretary General Jens Stoltenberg said on Thursday that Russia is using force to try to rewrite history, as reported by Reuters. Among other things, he said that the organism will deploy “capabilities and forces including NATO Response Force," adding that they would do whatever is necessary to shield the alliance from aggression.

French President Emmanuel Macron said that Russia’s deliberate choice to attack Ukraine violated UN rules, adding that France stands beside Ukraine and that the country will respond “without weakness” to this act of war. Finally, he noted that sanctions against Russia would factor in the energy sector.

US President Joe Biden announced a series of sanctions on Russian institutions and people, aimed to maximize the long-term impact on Russia and minimize the effect on the rest of the world. Finally, the European Council agreed on further restrictive measures that will impose “massive and severe consequences” on Russia for its actions.

Gold soared to $1.974.40 a troy ounce, its highest since September 2020. The metal pulled back ad plummeted to the current $1,880.00 price zone during US trading hours, where it currently stands, as market players unwind fear-related trades following US President Biden's statement.

Meanwhile, Federal Reserve Raphael Bostic noted that Fed policy is poised to return to a more normalized stance. Among other things, he added that he is “very open” to going for more than 3 rate hikes this year.

EUR/USD recovered from a fresh 2022 low of 1.1105 to currently trade around 1.1200. The GBP/USD pair stands at around 1.3400, while commodity-linked currencies also shed part of their intraday gains

Crude oil prices also dipped into negative territory after reaching multi-year highs. WTI traded as high as $100.50 a barrel, now changing hands at around $92.20.

Wall Street trimmed most of its intraday losses, trading mixed ahead of the close. The Nasdaq Composite is the best performer, up over 200 points after shedding roughly 4% at the beginning of the day.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Investors fleeing cryptocurrencies as residents flee Kyiv

Like this article? Help us with some feedback by answering this survey:

- Gold printed a 14-month-old fresh high around $1,974 amid the Ukraine – Russia war escalation.

- US Treasury yields fell, though the US Dollar strengthened across the board.

- XAU/USD Price Forecast: If bulls hold above the $1916 mark, they could remain hopeful of reaching higher prices.

Gold (XAU/USD) climbs in the North American session, thought retreats from 14-months daily highs at $1,974.48, as the Ukraine – Russia conflict escalated, with Russia invading Ukraine, as a growing appetite for safe-haven assets increases, to the detriment of riskier assets. At press time, XAU/USD is trading at $1,919.50.

In the meantime, the US Treasury yields fall as the appetite for US Treasuries thrives. The US 10-year T-note yield dwindles six basis points sits at 1.918%, a headwind for the non-yielding metal. Contrarily, the greenback remains bid, moving in tandem with XAU/USD, with the US Dollar Index up 1.08%, currently at 97.23, retreating from the 97.73 level, last seen in July 2021.

How is Russian-Ukraine war impacting financial markets? Follow our live coverage updates

XAU/USD Price Forecast: Technical outlook

XAU/USD is upward biased, as depicted by the daily chart. Gold bull’s pushed the price towards a daily high at $1,974.78 and, on its way north, broke June 2021 highs at $1,916.60. If XAU bulls achieve a daily close above the latter, they could remain hopeful of keeping spot gold trading in the $1,916-$1,959 area.

The XAU/USD first resistance would be June 6 daily high at $1,959.06. Breach of the latter would expose February 24 daily high at $1,974.78, followed by a move towards $2,000.

US President Joe Biden was scathing in his criticism of Russia's attack on Ukraine on Thursday and announced that he would be authorising new sanctions on Russia, including on exports. Biden said that the sanctions are designed to maximise the long-term impact on Russia's economy but minimise the impact on Europe. We will prevent Russia from doing business in dollar, yen, pounds and euros, Biden continued, and we have sanctioned Russian banks holding more than $1T in assets. Biden bragged about recent weakness experienced by the Russian ruble, and in Russian credit default swaps, as indicative of the success of Western sanctions in their impact on the Russian economy.

Biden said that while he would be sending US troops to fight in Ukraine, he will be authorising additional forces to go to Germany to reassure allies in Eastern Europe. There is no doubt that the US and NATO will meet their Article 5 commitment, Biden reiterated. If Russia attacks the US or West with cyberattacks, the US will respond, Biden said.

Biden confirmed that the Russian energy sector would not be targeted by US sanctions and said that oil and gas companies should not exploit the crisis and hike prices. Biden reiterated that the US is working to secure global energy supplies and said that his administration would release additional oil from the SPR as needed.

Russian government spokesperson Dmitry Peskov said on Thursday that Moscow is willing to negotiate the terms of Ukraine's surrender. Peskov said that Russian President Vladimir Putin is ready to talk with Ukrainian President Volodymyr Zelensky if Ukraine agrees to compromise on Russia regarding its "red lines". These include that Ukraine guarantees neutral status, as well as the removal of certain weapons from its territory.

- NZD/USD has pulled back sharply from Wednesday’s post-RBNZ highs above 0.6800 to the 0.6660 area as Russia invades Ukraine.

- As the fighting continues and amid uncertainty regarding the NATO response, risks remain tilted to the downside.

Wednesday’s post-hawkish RBNZ optimism that helped lift NZD/USD briefly to the north of the 0.6800 level is now well in the rear-view mirror, with NZD/USD having now reversed more than 2.0% lower from its earlier weekly peaks. Though the move didn’t come as too much of a surprise to geopolitical strategists and news addicts, Russia’s decision to initiate an invasion against Ukraine on Thursday seemed to catch global FX markets off guard. FX investors have piled into safe-haven currencies like the US dollar at the expense of more risk-sensitive currencies like the New Zealand dollar.

At current levels in the 0.6660 area, NZD/USD trades about 1.6% lower on the day, the pair having seemingly found some short-term support at its 21-Day Moving Average at 0.6650. A more than 1.5% drop is a big one-day move for NZD/USD and, typically, would be followed by some consolidation/mean-reversion. But with the geopolitical situation regarding Russia’s ongoing assualt into Ukraine fluid, such a bet would be risky. Price action is likely to remain heavy and risks tilted to the downside for NZD/USD as the war continues and the world waits to see how the US/EU will respond.

- The EUR/GBP is 0.39% up in the week.

- A risk-off market mood caused a fluctuation In the pair, benefitting the low-yielder euro.

- EUR/GBP is neutral biased, even though the DMAs reside above the spot price.

On Thursday, The EUR/GBP climbs during the day, so far 0.12% amid Russia’s invasion of Ukraine, spurring a risk-off market mood. At the time of writing, the EUR/GBP is trading at 0.8355, after reaching a daily high, precisely at the 50-day moving average at 0.8378.

During the overnight session for North American traders, the EUR/GBP cross-currency broke below February 23 daily low at 0.8325, a signal of bearishness in the markets. Then the pair pressured towards February 21 and 22, daily lows around 0.8309 short of the figure, a zone of intense buying pressure, as witnessed by the EUR/GBP reaction, jumping almost 80-pips towards the daily high at 0.8380.

In the meantime, on Thursday, the EU and UK dockets witnessed ECB and Bank of England’s (BoE) officials speaking. Regarding ECB’s speaking, Stoumaras member of the ECB, mentioned that the APP would remain until the end of 2022, while Holzman commented that the Ukraine conflict would delay the end of QE. Regarding inflation, ECB Schnabel said that it is higher than expected and broadening but emphasized it would tame under 2% in the year.

In the meantime, BoE member Ben Broadbent said that “QT is not intended to be an active monetary policy instrument, the bank reate will be.”

Therefore, as noted by central bank speaking, it appears that some ECB hawks are easing their hawkish tone amid the Ukraine conflict, so the shared currency could weaken in the near term, influenced by Ukraine developments. Contrary, the Bank of England (BoE) has pushed back against aggressive hiking rates, something worth noting, as Bailey pushed back on Wednesday, saying there are two-sided risks to the inflation forecast.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP price action in the last three days, as depicted by the daily chart, is not clear. However, the EUR/GBP daily moving averages (DMAs) above the exchange rate could suggest it is downward biased, but at the moment is neutral.

Upwards, the EUR/GBP resistance levels would be the 50-DMA at 0.8378. Breach of the latter would open the door towards 0.8400, followed by the 100-DMA at 0.8428. On the flip side, February 23 daily high at 0.8354 would be the first line of defense for EUR/GBP bulls, followed by 0.8309, and then February 3 daily low at 0.8284.

New US sanctions on Russia are not expected to severely target the energy sector reported Politico on Thursday, as cited by Reuters. Russian energy giant Rosneft is not expected to be a target of a new sanctions package, Politico continued.

Market Reaction

Markets remain on tenterhooks watching developments in the war in Ukraine and the world's reaction. Whilst failure to target Russia's energy sector and deal the country currently in the process of invading Ukraine the most severe economic pain may draw ire from some critics pushing for a stronger response, a softer US response may be treated positively by markets. If the Russian energy sector is not targeted, this would lower the potential global inflationary risks associated with the current Ukraine/Russia conflict, lessening one layer of uncertainty.

Richmond Fed President and FOMC member Thomas Barkin said on Thursday that he hopes the Fed can restore interest rates back to pre-pandemic levels fairly quickly, reported Reuters. Barkin added that it is timely to normalise rates given strong demand, the tight labour market and high inflation. Barkin said that he expects goods prices will be disinflationary or perhaps even deflationary, offsetting a rise in service prices.

Cleveland Fed President and FOMC member Loretta Mester said on Thursday that she doesn't think raising interest rates by 50bps in March is compelling, according to Reuters.

Additional Remarks:

- Mester personally believes labor force participation will continue to move up from current levels but it is complicated to know when and by how much.

- Tightness in the labor market is not going to magically disappear any time soon and officials have to consider that for monetary policy.

- Mester supports raising the fed funds rate in march

- The Fed will have more information on the situation in Ukraine and on inflation over time.

- The Fed needs to have a series of movements for rate increases.

- A situation where the Fed raises rates once and stays steady for a year would not be appropriate now.

US President Joe Biden has been presented with a "menu" of options for potential cyberattacks designed to disrupt Russia's ability to sustain military operations in Ukraine, reported NBC News. Citing four unnamed sources, NBC News reported that no final decision had been made.

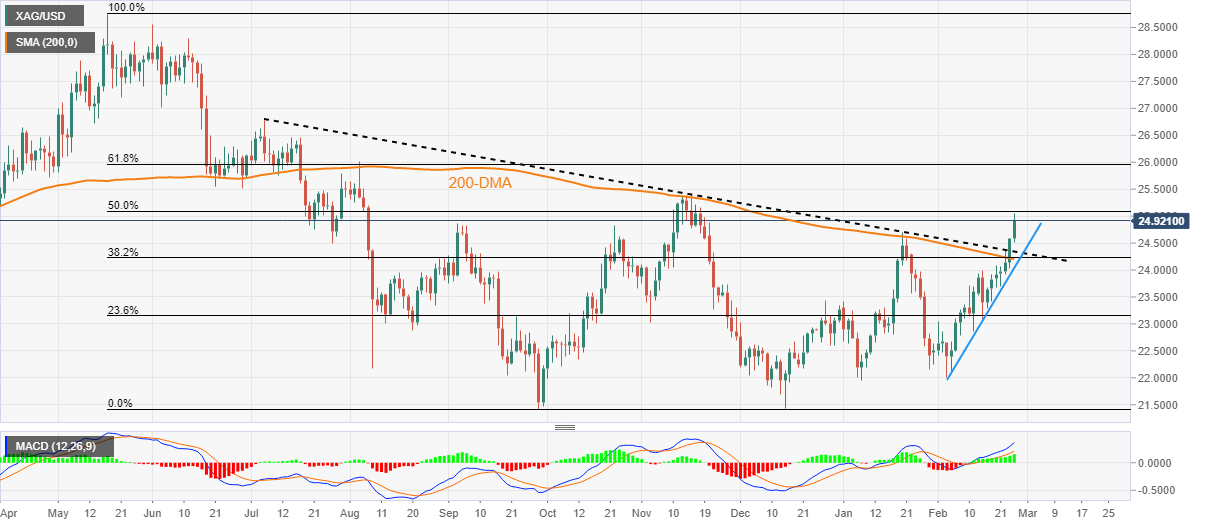

- Spot silver hit its highest since last August above $25.50 but pulled back sharply to the $24.75 area.

- But as fighting in Ukraine intensifies and Western powers ready economic sanctions against Russia, silver may remain underpinned.

After hitting its highest level since August 2021 above the $25.50 per ounce mark earlier in the session as investors piled into safe-haven assets after Russia initiated war with Ukraine, spot silver (XAG/USD) have pulled back sharply. Prices are now back in the $24.75 region and retesting support in the form of earlier monthly highs, with on-the-day gains having been eroded to “just” 0.8% from more than 4.0% at earlier highs.

The pullback was not driven by any fundamental catalyst; indeed, the news coming out of Ukraine has remained grim throughout the day with non-stop fighting being reported across the country. Rather, sentiment took a slight turn for the better after the US open, with global equities bouncing a little from earlier lows. That seems to have triggered some quite aggressive profit-taking in spot silver. In the context of silver’s monthly performance (it is still over 10% higher in geopolitical tensions), Thursday’s pullback from highs is hardly catastrophic.

Ahead, as the fighting in Ukraine intensifies and investors remain uncertain about what sanctions Western nations will hit Russia with, and what economic impact these will have, geopolitical risk premia is set to remain elevated. That argues for ongoing support in precious metals markets, suggesting some traders might view Thursday’s US session pullback to the $24.70s as a dip-buying opportunity.

The Chernobyl power plant has been captured by Russian forces, an advisor to Ukraine's Presidential Office said on Thursday, Reuters reported. The advisor said that it is impossible to say whether or not the power plant is safe and warned that this is one of the most serious threats to Europe today.

Market Reaction

There has not been any market reaction to the latest headlines regarding the Chernobyl power plant but fears about another disaster add another layer of uncertainty to the market.

- WTI gained up to 7.60% in the day but retreated to $96.00 as bulls take a breath.

- Ukraine – Russia woes keep grabbing market players’ attention, so WTI’s could resume its rally in any moment.

- WTI Technical Outlook: If WTI bulls keep prices above $95.79, they could have a second chance towards $100.

The US crude oil benchmark, Western Texas Intermediate (WTI), is rallying 5% during the day, but at one time, it broke the $100 barrier for the first time since July 2014. At press time, WTI is trading at $96.28.

The market sentiment remains downbeat, attributed to Russia’s invasion of Ukraine, grabbing news headlines around the globe. During the Asian session, Russian President Vladimir putting announced that a special military operation in Ukraine was underway. The military deployment by Russia were bombers loaded with weapons, special forces, and the launch of missiles to Ukrainian command centers.

As the invasion grows, Western and NATO countries condemned the attack from Russia to Ukraine and are expected to impose another round of sanctions, harsher than the previous ones. Some of the sanctions that could be imposed are: freezing assets in the EU and blocking Russian banks to EU financial markets, while UK’s prime minister is pushing for Russia’s ejection of the SWIFT payment system.

Putting Ukraine/Russia’s woes aside, Iran Nuclear talks have improved, as reported by Iran’s top security official, that said that it is possible to achieve a good agreement regarding a nuclear deal, as reported by Reuters.

With the latest developments crossing the wires, the US is working on a plan with the International Energy Agency over a combined release of additional crude from strategic petroleum reserve, per Reuters sources.

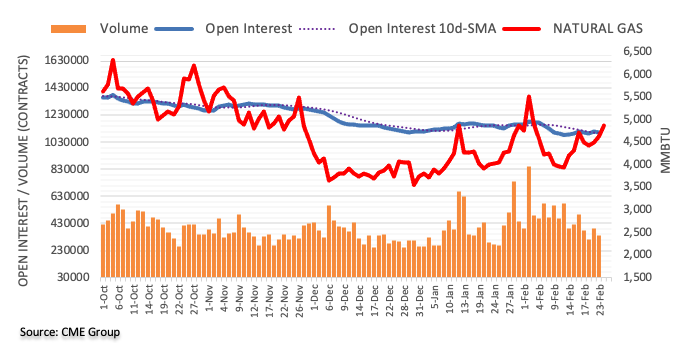

Meanwhile, the US Energy Information Administration revealed its weekly report. They said that “working gas in storage was 1,782 Bcf as of Friday, February 18, 2022, according to EIA estimates. This represents a net decrease of 129 Bcf from the previous week. Stocks were 209 Bcf less than last year at this time and 214 Bcf below the five-year average of 1,996 Bcf. At 1,782 Bcf, the total working gas is within the five-year historical range,” as reported by the US EIA.

Market’s reaction to Putin announcing the invasion of Ukraine

WTI’s rallied from the $92.78 region towards $100.50, close to an $8.00 move, followed by a retracement towards the $96.20 area, as American traders got to their offices.

WTI Price Forecast: Technical outlook

WTI daily chart depicts the US crude oil benchmark is upwards, despite retreating from daily highs around $100.50. Nevertheless, to further extend the rally, WTI bulls will need a daily close above February 14 daily high at $95.79. If that is achieved, then WTI bulls would remain hopeful for a second attempt to breach and sustain the $100.00 mark.

Therefore, WTI’s first resistance level would be $96.00. Breach of the latter would expose crucial resistance levels. The next one would be $97.00, followed by August 2014 cycle high at $98.55, and then an attack towards $100.00.

UK PM Boris Johnson announced a raft of new sanctions against Russia in the UK parliament:

- UK to impose an asset freeze against all major Russian banks, including an immediate asset freeze against VTB.

- UK to bring in legislation to prohibit the Russian state from raising sovereign debt.

- UK on Tuesday to bring in legislation to prohibit all major Russian companies from raising finance of UK markets.

- UK to introduce legislation to limit deposits that Russian nationals can hold in UK bank accounts.

- UK will look to extend the full range of sanctions measures against Belarus.

- UK to sanction over 100 individuals, entities and subsidiaries.

- UK to ban aeroflot aircraft from landing in the UK.

- UK to immediately suspend or prohibit all dual-use export licenses to Russia.

- UK to lay legislation to prohibit a wide range of high tech exports to Russia, plus exports to the extractive industry.

On SWIFT, Johnson said that nothing is off of the table.

Cleveland Fed President and FOMC member Loretta Mester on Thursday said that the unfolding situation in Ukraine would be a consideration for the Fed when determining the appropriate pace at which to remove monetary policy accommodation, Reuters reported. Events in Ukraine have implications for the medium-run economic outlook in the US, she added, with geopolitical events adding some upside risks to the inflation forecast even as they put some downside risk to near-term growth forecasts.

Accommodation will be removed at the pace necessary to bring inflation back under control while sustaining activity and healthy labour markets, Mester said. She added that she expects some improvement in inflation readings later in the year as demand moderates and capacity constraints begin to ease. Mester said she expects inflation to remain above 2.0% this year, with risks tilted to the upside.

- US dollar adds to gains across the board on American hours.

- AUD/USD remains under pressure, testing 0.7100.

The AUD/USD dropped further during the American session as cautions prevails across financial markets following Ukraine’s invasion. The pair bottomed at 0.7094, hitting the lowest level since February 14. It then rebounded rising back above 0.7100, although still remains under pressure.

The greenback continues to be the top performer, boosted by risk aversion. The DXY is up by 1.30%, at the highest since 2020. On American hours, US yields moved to the upside, giving more strength to dollar’s rally. The US 10-year yield rose to 1.95% and the 30-year to 2.26%.

US economic data came in above expectations. Initial and continuing claims dropped more than expected to 232K and 1.47M, respectably. Q4 GDP growth was revised higher from an annualized rate of 6.9% to 7%. New Home Sales fell to 801K. Market participants ignored US data as the focus remains in the Ukraine invasion and price action across financial markets.

Levels to watch

The sharp reversal in AUD/USD leaves the pair vulnerable to more losses in the short term. A consolidation under 0.7100, would clear the way for a test of the 0.7045/50 area (Feb 4 low). On the upside, a recovery above 0.7165 should alleviate the bearish pressure. Only a daily close above 0.7235 would suggest more gains ahead.

Technical levels

Ukraine's Ambassador to the US said on Thursday that the Ukraine government remains in full control of Kyiv and that Russian helicopters had been shot down just outside of the city. The attack is ongoing in many areas, he continued, but Ukraine intends to continue fighting and protecting its country.

Russian President Vladimir Putin said on Thursday that we were forced to take these measures, referring to Russia's invasion of Ukraine earlier that day, according to Reuters. We had no other chance but to act differently given all of our previous attempts to change our situation were fruitless, he explained. Russia remains a part of the global economy and we do not plan to damage the system that we belong to, Putin continued, adding that our partners should understand that and not punish us out from this system.

Atlanta Fed President and FOMC member Raphael Bostic said on Thursday that the Fed will be monitoring events in Ukraine closely to assess their potential economic and financial impact, according to Reuters.

We need to tighten policy due to high inflation and a strong US economy, San Fransisco Fed President and FOMC member Mary Daly said on Thursday, according to Reuters.

Bank of England Deputy Governor Ben Broadbent said on Thursday that it is possible that the BoE's balance sheet could decline even as the bank rate falls, according to Reuters. The Monetary Policy Committee (MPC) does not intend quantitative tightening to be an active policy instrument, Broadbent added, noting that, instead, the bank rate would be.

Market Reaction

GBP has not reacted to Broadbent's comments with focus much more on geopolitics right now. GBP/USD was last trading 1.5% lower at annual lows underneath the 1.3350 level.

The shock of war hanging over Europe has clouded the global economic outlook, European Central Bank executive board member Isabel Schnabel said on Thursday.

Additional Remarks:

"Uncertainty speaks in favour of a gradual and data-dependent normalisation."

"Reversing the current exceptional measures has the potential to mitigate inflationary pressures."

"Ending net asset purchases when inflation is robustly converging to our target also credibly underlines that our actions are solely guided by our mandate, refuting concerns about fiscal dominance."

"Inflation has proven more persistent and more broad-based than expected."

"Labour market slack is being reabsorbed at a faster pace than anticipated and pipeline pressures continue to build up."

"Our sequencing is clear."

"Inflation is not only higher than expected, but price pressures are also visibly broadening."

"Current measured inflation would be even higher if the costs of owner-occupied housing were included."

"The broad-based nature of recent upward surprises implies that significant uncertainty remains as to when the inflation peak will eventually be reached."

"Inflation is unlikely to fall back below our 2% target this year."

"A faster and more frontloaded recovery, in turn, risks increasing pressure on wages."

"We are currently witnessing the strongest labour market in the history of the single currency."

"It is now becoming increasingly likely that, in the medium term, inflation will approach our 2% target from above, rather than from below."

UK PM Boris Johnson is pushing very hard for Russia to be kicked out of the SWIFT international payments system, the FT reported on Thursday. The UK paper said that such a move would deal a heavy blow to Russian banks and the country's ability to conduct international trade. The FT article said that the German Chancellor Olaf Scholz had on Thursday warned Johnson that his country would not support such a move and nor would the EU. Shortly after the FT report was published, Ukraine's foreign minister was on social media calling for Russia to be kicked out of SWIFT.

Market Reaction

Markets remain jittery but the latest headlines do not appear to have provoked a reaction.

- US dollar extends gains across the board amid risk aversion.

- Russian invasion into Ukraine shocked financial markets.

- EUR/USD trades at the lowest since May 2020.

The EUR/USD fell under 1.1120 hitting the lowest level since May 2020. The pair remains under pressure after the Russian military invaded Ukraine. The panic mode across financial markets is boosting the US dollar.

How is the Russian-Ukraine war impacting financial markets? Follow our live coverage updates!

So far on Thursday, EUR/USD lost more than 175 pips, the worst daily decline in months. The DXY is up by 1.41% above 97.50 at the strongest since July 2020.

Stocks in Wall Street are falling sharply but off lows. The Dow Jones is down by 2.05% and the Nasdaq by 1.05%.

During the last hours, the US dollar also gained momentum supported by a rebound in US yields highs. The US 10-year printed a fresh high at 1.93% and the 30-year climbed to 2.24%.

- US equity markets tumbled in line with their global peers and other risk assets on Thursday as Russia invaded Ukraine.

- But sentiment took a turn for the better at the open; US equities pared a decent portion of pre-market losses.

- The S&P 500 was last down just under 1.5%, having been as much as 2.6% down in the pre-markets.

US equity markets tumbled in line with their global peers and other risk assets on Thursday as worst fears were confirmed, with Russia commencing a full-scale invasion of Ukraine. Sentiment did take a turn for the better after the open of US trade, however, seemingly as a result of profit-taking by holders of short positions, or amid dip-buying. The S&P 500 was last trading in the 4170 area, having seen a substantial more than 1.5% rally from pre-market trade lows just above 4100. At current levels, the index trades with losses on the day of slightly more than 1.0%.

The rebound was driven by tech and growth stocks as investors flocked into US bonds, pushing yields down and reducing the opportunity cost of holding high earnings ratio stocks. The Nasdaq 100 index was last trading just 0.5% down just below the 13.5K level, a more than 3.0% rebound from pre-market trade lows just above 13.0K. Meanwhile, the Dow, an index more weighted towards economically sensitive stocks and less towards tech/growth, was last trading down about 1.9%, reflecting broader fears about the impact of the new European war on the global economy.

The US, UK and EU all promised to hit Russia with unprecedented economic sanctions, fanning investor fears the conflict will have a highly inflationary impact (European gas futures are already up around 50% on the day). “I do not think many investors have dealt with the combination of surging inflation, which was last really seen in the early 80s, combined with full-scale military operation in Europe, which again, the last time that happened was second world war,” observed one analyst. “It's a confidence knocker,” they added, “saying that this is sort of uncharted territory for a lot of people”.

- The USD/JPY is climbing in the week 0.38%, as demand for safe-haven currencies rises.

- USD/JPY plunged on Putin’s “special military operation” headline, but it is paring earlier losses.

- USD/JPY Technical Outlook: Upward biased in the daily and the 1-hour chart, but higher volatility levels, suggest following the markets in the short-term, caution is warranted.

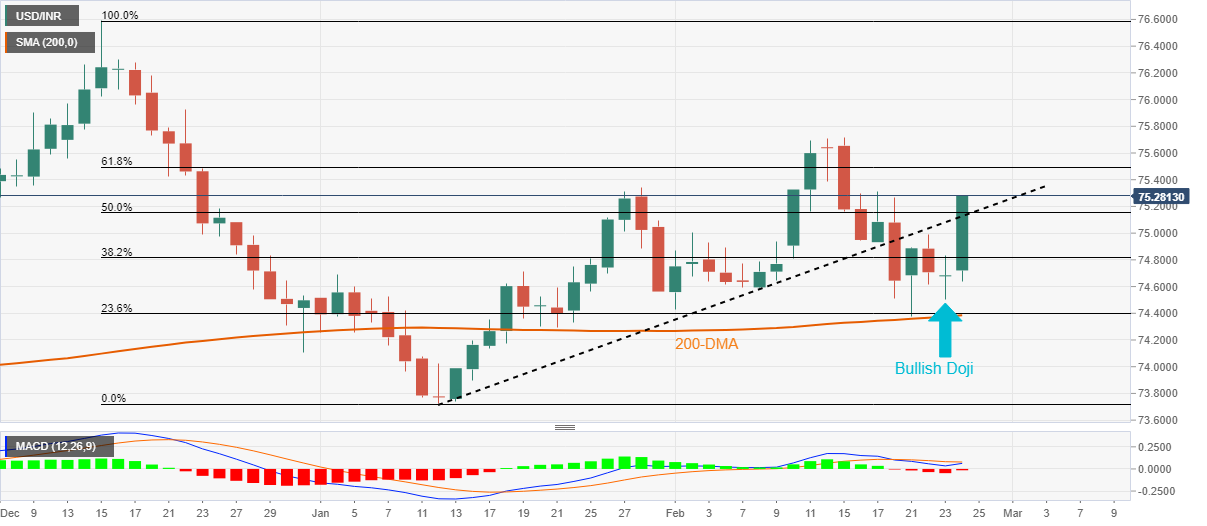

USD/JPY rises sharply from daily lows around 114.40 to highs 115.30s amid the Russian invasion of Ukraine, which started on Thursday during the Asian Pacific session. That said, investors’ mood dampened as flows through safe-haven peers increased. At the time of writing, the USD/JPY is trading at 115.39.

During the Asian session, the UN hosted an emergency security council meeting. Around that time, Russian President Putin unveiled a speech announcing a “special military operation” in Ukraine, aiming to de-nazify and de-militarize the country.

How is Russian-Ukraine war impacting financial markets? Follow our live coverage updates!

Market’s reaction

The USD/JPY initial reaction to newswires was downwards, with the pair plummeting 70 pips and breaking the 50-day moving average (DMA) at 114.87 on its way down and reached a daily low at 114.40. Once European traders got to their offices, the pair recovered its losses and some more, trading near February 23 daily highs at 115.20.

USD/JPY Price Forecast: Technical outlook

The USD/JPY Is upward biased, as shown by the daily chart from a technical perspective. The daily moving averages (DMAs) reside below the spot price, though it faces resistance around 115.52, November 24, 2021, daily high.

Due to geopolitical developments, it is suggested to take a short-term approach amid high volatility levels witnessed in the financial markets. That said, the USD/JPY 1-hour chart has a bullish bias, and USD/JPY would lean towards February 22 daily high at 115.24 as support. If the pair achieves to print a daily close above it, a move towards the 116.00 figure and YTD high at the 116.30 area is on the cards.

Upwards, the pair's first resistance would be February 17 daily high at 115.53, followed by February 16 cycle high at 115.79 and the February 15 115.82. On the flip side, the USD/JPY first support would be February 22 daily resistance turned support at 115.23. Breach of the latter would expose the 200-hour simple moving average (SMA) at 115.18, followed by the confluence of the 50-100 hour SMAs at 114.97 and 114.93, respectively.

According to a senior US defense official, the Russians are making a move on Kyiv, with their assaults thus far aimed at taking Ukraine's main population centres, reported Reuters.

Additional Remarks:

- Russian action on Ukraine is an initial phase of a large-scale invasion.

- The US has seen Russian forces advance on three main axes of assault.

- One main axis is from Belarus to Kyiv.

- Russians have every intention of basically decapitating the Ukrainian government.

- More than 100 Russian launched missiles were used in the onslaught.

- Cruise, surface-to-air and sea-launched missiles were all used by the Russians.

- The United States hasn't seen Russian forces move into the western part of Ukraine, but this is still the initial phase of the attack.

- Russian targets thus far focused primarily on military and defense objectives, including 10 airfields.

- The US does not have a good sense of casualties.

- Russia used about 75 aircraft in the attack, though there were no indications of any amphibious assaults yet by Russian forces in Ukraine.

- The US does not believe the full scope of Russian electronic warfare capabilities have come into play, "and they may yet".

- US troops remain outside of Ukraine and continue to be postured to reassure allies.

- The US has seen indications that Ukraine is resisting and fighting back.

- Gold prices dropped more than $50 from the daily high.

- XAU/USD now up modestly after a sharp correction.

- US dollar remains strong, US yields limit upside in gold.

Gold prices experience a sharp correction from the peak of $1974 to the $1920 area. It is now approaching $1940. Volatility remains at extreme levels in metals.

Equity prices are holding onto sharp losses across the globe amid the escalation of the Ukraine conflict. Russian troops invaded Ukraine on Thursday and triggered a rally in commodity prices, including gold.

During the last hours, US yields moved toward daily highs supporting the correction in gold prices.

Above the $1965 area, gold lost momentum, and after some stabilization near $1960, XAU/USD corrected quickly to as low as $1912. A break lower could trigger a deeper pullback. The following support stands at $1890.

On the upside, the immediate resistance is located at $1940; and a break higher could easily send XAU/UD to $1950. If the rally continues, a consolidation above $1965 should keep the road clear for $2000.

How is Russian-Ukraine war impacting financial markets? Follow our live coverage updates!

Technical levels

-637813129463055816.png)

Richmond Fed President and FOMC member Thomas Barkin said on Thursday that we will have to see if the Russian invasion of Ukraine changes the argument for policy normalisation. The US is not that exposed to the Russian economy, he said, stating that the Fed will need to watch how this effects energy markets and if the conflict expands.

Market Reaction

The dollar has not been impacted and continues to derive support as a result of safe-haven demand. The DXY recently climbed to fresh year-to-date highs and is near 97.50.

- New Home Sales fell 4.5% in January after December's 12.0% drop.

- The US dollar did not react to the latest US data with geopolitics the main focus.

Following a massive 12.0% MoM surge (which was upwardly revised from a 11.9% gain) in the number of New Home Sales in the past 12-months in December, the 12-month rolling number of New Home Sales was down 4.5% in January, data published by the US Commerce Department showed on Thursday. That meant the number of New Home Sales in the US over the past 12 months dropped to 801K in January from 839K the month prior, a tad less than the 806K expected.

Market Reaction

The US dollar did not react to the latest US data with geopolitics the main focus.

- USD/TRY clocked new YTD peaks around 14.60.

- The lira comes under pressure on geopolitical concerns.

- Yields of the Turkey 10y bond rose to multi-week highs past 23%.

Sellers remain in control of the sentiment surrounding the Turkish lira and pushed USD/TRY to fresh cycle peaks around 14.60 earlier in the session.

USD/TRY: An imported currency crisis in the offing?

USD/TRY extended the uptrend for the fifth consecutive session on Thursday, as the selling pressure around the lira intensified after Russia attacked Ukraine early on Thursday.

The worsening geopolitical scenario pushes crude oil prices and gold to fresh cycle highs, while the greenback navigates at shouting distance from 2022 peaks when tracked by the US Dollar Index, all key factors weighing on the Turkish currency.

In addition, yields of the Turkey 10y benchmark bond climb to levels last seen in early January above the 23.0% level, in stark contrast with the performance of the bonds markets overseas.

USD/TRY key levels

So far, the pair is advancing 2.73% at 14.1860 and a drop below 13.4317 (weekly low Feb.11) would expose 13.2327 (monthly low Feb.1) and finally 12.7523 (2022 low Jan.3). On the other hand, the next up barrier lines up at 14.6052 (2022 high Feb.24) seconded by 18.2582 (all-time high Dec.20).

- GBP/USD has been on the back foot relentlessly on Thursday, dropping from around 1.3550 to current levels under 1.3350.

- The pair is on course for its biggest one-day drop since September 2020 amid risk-off amid Russia’s invasion into Ukraine risk-off.

- Economic uncertainty seems to be weighing particularly hard on GBP, as the BoE tightening outlook is dampened.

Key levels of support have fallen like dominoes on Thursday as GBP/USD continues to succumb to woes related to Russia’s broad/ongoing assault on Ukraine. As traders ditch risk-sensitive currencies like sterling in favour of safe-haven currencies like the US dollar or Japanese yen as global equities tumble, GBP/USD is on course for its biggest one-day drop since September 2020 of roughly 1.5%. That drop has seen the pair fall from the 1.3550 area to current levels under 1.3350 and, in doing so, fall below key support at 1.3500 and 1.3360 to print fresh annual lows.

Such a big intra-day move might have some traders questioning whether the bears might soon run out of steam. Typically, some amount of mean reversion might be expected for GBP/USD after such a big intra-day drop. That suggests hopes for the pair to test sub-1.3200 2021 lows may have to wait. But with recent geopolitical developments having thrown the outlook for the global economy and central bank policy into uncertainty, GBP/USD’s near-term bias may well remain negative. Any rebound back towards 1.3400, say, may be viewed as a good opportunity for the sellers to reload on positions.

The UK economy was already faced with the prospect of a large hit to living standards in the form of higher taxes, energy prices and phone bills (the latter two starting as of Q2). The latest surge in gas and oil prices (UK gas futures rose more than 30% on Thursday) amid expectations of supply disruptions from Russia due to the West’s sanction response only darkens the outlook. BoE policymakers have in recent days emphasised that upcoming policy tightening will be “moderate” and the latest developments will further dampen tightening expectations. That probably partly explains why on Thursday, GBP has been one of the worst-hit G10 currencies versus the US dollar.

A nuclear waste storage facility in Chernobyl, Ukraine was destroyed after Russian forces entered and fighting broke out, an advisor to the Ukrainian Interior Ministry told NBC. The advisor warned that radioactive dust could cover the territories of Ukraine, Belarus and the EU.

How is the Russian-Ukraine war impacting financial markets? Follow our live coverage updates!

- The USD/CHF keeps fluctuating in the week, but the Russian invasion increased demand for the greenback, in the day is up 0.64%.

- USD/CHF Technical Outlook: The pair in the short-term is upwards, but geopolitical headlines rule price action, caution is warranted.

On Thursday, the USD/CHF rallies from the 0.9170 area towards 0.9250 on safe-haven flows attributed to Russia’s invasion of Ukraine, which began during the start of the Asian session, impacting negatively the market mood. At press time, the USD/CHF is trading at 0.9225.

During the Asian session, we had the UN security council meeting, and as the meeting was taking place, Russian President Vladimir Putin released a speech announcing a special military operation in Ukraine, aiming to de-militarize the country.

How is Russian-Ukraine war impacting financial markets? Follow our live coverage updates!

Market’s reaction

The USD/CHF barely moved in the initial reaction to the headline. Nevertheless, as the European session got underway, the pair jumped 50+ pips, reaching a daily high at 0.9247.

USD/CHF Price Forecast: Technical outlook

The USD/CHF is neutral in the daily chart from a technical perspective. During the day, so far broke upwards, leaving behind all the daily moving averages (DMAs), but it is worth noting that happened in the last four trading days.

Current geopolitical developments suggest taking a short-term look due to the volatility implied in such events. The USD/CHF 1-hour chart depicts the pair broke ALL the simple moving averages (SMAs) and will lean to February 23 high and the 200-hour SMA confluence around the 0.9212-18 as the first support. As long as the pair remains above, upward moves towards the daily high at 0.9247 might be on the cards. Otherwise, bearish sentiment will overtake the current bullishness of the USD/CHF.

Upwards, the USD/CHF resistance levels lie in the daily high at 0.9247, followed by February 16 high at 0.9261, and February 15 daily high at 0.9274. On the flip side, the first support would be the abovementioned 0.9212-18 area, followed by the figure at 0.9200 and today’s daily low at 0.9172.

EUR/USD sinks to the the mid-1.1100s. The 2022 low at 1.1121 emerges as the next target – removal of which would clear the way for a substantial drop to the 1.07 area, economists at Scotiabank report.

EUR fall may steady in the low/mid 1.11s in the short-run

“EUR/USD is experiencing a sharp intraday selloff – the largest 1-day decline since March 2020 – which leaves the late Jan low at 1.1121 exposed.”

The EUR fall may steady in the low/mid 1.11s in the short-run but the broader outlook for the EUR deteriorates quite significantly in the short-to-medium term if the EUR trades below 1.11.”

“After recent rejections of 1.15, a potential double top has developed on the daily chart which would be triggered on a break of 1.1121 (and would target a drop to the 1.07 area).”

USD/CAD has moved up through the low/mid 1.28 area. Economists at Scotiabank believe that the pair could reach the 1.20/30 region.

Support seen at 1.2800/1.2790

“Technically, additional gains look more than likely from here and although the situation can change quickly, it might not change quickly enough to stop USD/CAD from pushing on to the 1.29/1.30 zone.”

“Support is 1.2790/00 now.”

German Defense Minister Christine Lambrecht said on Thursday that Berlin is ready to comply with further NATO requests, as well as to extend support to NATO air policing in Romania. There will be tangible and painful sanctions for Russia, he added.

How is the Russian-Ukraine war impacting financial markets? Follow our live coverage updates!

The S&P 500 saw an aggressive fall yesterday of nearly 2%. Analysts at Credit Suisse look for a clear break (and ideally weekly close) below 4199 to signal an important change of trend lower with the next meaningful support seen at 3855/15.

Break of 4223/4199 to establish a major “head & shoulders” top

“We look for a clear break (and ideally weekly close) below 4199 to mark the completion of a large ‘head & shoulders’ top to signal an important change of trend lower. We would then see next support at 4122/17 ahead of the lows from May last year at 4061/57.”

“Whilst we would look for an initial hold at 4061/57 we would expect a break in due course with the next meaningful support seen at the 38.2% retracement of the entire 2020/2021 bull market at 3855/15. The ‘measured top objective’ though is seen set lower at 3625/20.”

“Resistance is now seen at 4267 initially, then 4310, with the immediate risk seen lower whilst below 4342.”

- USD/CAD broke out of a multi-week-old trading range and shot to a near two-month high.

- Russia-Ukraine crisis boosted the safe-haven USD and remained supportive of the move.

- Rallying oil prices extended support to the loonie and capped gains, for the time being.

The USD/CAD pair retreated a few pips from a near two-month high set during the mid-European session and was last seen trading around the 1.2820 region, still up 0.70% for the day.

The brutal market reaction to Russian President Vladimir Putin's announcement on Thursday to launch a special military operation in Ukraine forced investors to take refuge in the safe-haven US dollar. This, in turn, assisted the USD/CAD pair to gain strong positive traction and breakout of a near four-week-old trading range.

Since the pre-dawn attack, Russian forces have reportedly destroyed Ukrainian military bases and air defence systems. Missiles have targeted major Ukrainian cities, including the capital Kyiv, and explosions were seen in cities along the coast. Moreover, Russian troops continued to cross the Ukrainian border from several directions.

How is Russian-Ukraine war impacting financial markets? Follow our live coverage updates!

The worsening situation in Ukraine kept investors on the edge and pushed the greenback back closer to the 2022 high touched in January. That said, a blowout rally in crude oil prices extended some support to the commodity-liked loonie and turned out to be the only factor that kept iid on any further gains for the USD/CAD pair, for the time being.

On the economic data front, the Prelim US Q4 report showed that the economy expanded by 7.0% during the fourth quarter of 2021, matching the original estimates. Separately, the US Weekly Initial Jobless Claims fell to 232K the last week from the 249K previous. The data did little to influence the USD or provide any impetus to the USD/CAD pair.

Hence, the market focus will remain glued to developments surrounding the Russia-Ukraine saga, which will play a key role in driving the risk sentiment and the USD demand. Nevertheless, sustained break through the aforementioned trading range hurdle, around the 1.2780-1.2785 region, supports prospects for additional gains for the USD/CAD pair.

Technical levels to watch

- EUR/USD collapses to fresh lows in the mid-1.1100s.

- The 2022 low at 1.1121 emerges as the next target.

EUR/USD tanks to the 1.1150 region following increasing risk aversion on Thursday.

Such a sharp move now paves the way for a probable challenge of the YTD low around 1.1120 (January 28). Further down, there are no support levels of note until the round levels at 1.1100 followed by 1.1000.

The negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1622.

EUR/USD daily chart

- US BEA revised Q4 GDP growth to 7% as expected.

- US Dollar Index holds above 97.00 after the data.

The US Bureau of Economic Analysis (BEA) announced on Thursday it revised the annualized Gross Domestic Product growth in the fourth quarter to 7% in its second estimate from 6.9% in its initial estimate.

This reading came in line with the market expectation.

"The updated estimates primarily reflected upward revisions to nonresidential fixed investment, state and local government spending, and residential fixed investment that were partly offset by downward revisions to personal consumption expenditures (PCE) and exports," the BEA explained its publication.

Market reaction

The US Dollar Index showed no immediate reaction to this data and was last seen rising 1% on the day at 97.15.

- AUD/USD witnessed aggressive selling and reversed its gains recorded over the past three sessions.

- Russia-Ukraine conflict benefitted the safe-haven USD and weighed on the perceived riskier aussie.

- Investors now eye US data, though the focus will remain on geopolitics and the situation in Ukraine.

The AUD/USD pair maintained its heavily offered tone through the mid-European session and was last seen trading around the 0.7165 region, or the one-week low.

Russian military forces invaded Ukraine earlier this Thursday and fired missiles at several Ukrainian cities. Reports indicated that as many as 40 Ukrainian soldiers and 10 civilians were killed by Russian shelling. Ukraine added that troops continue to pour across its borders into the eastern regions and landing by sea at the cities of Odesa and Mariupol in the south.

The worsening situation in Ukraine triggered a massive sell-off in the global equity markets. Investors rushed to take refuge in traditional safe-haven assets, which boosted the US dollar and prompted aggressive selling around the perceived riskier aussie. The bearish pressure remained unabated amid fears about a further escalation in tensions between Russia and the West.

The United States and its allies were quick to condemn Russia's actions and President Joe Biden said that he would meet the leaders of G7 to map out more severe measures against Russia. This, in turn, kept investors on the edge, which was evident from the ongoing freefall in the financial markets and forced the AUD/USD pair to reverse its gains recorded over the past three trading sessions.

Market participants now look forward to the US economic docket, highlighting the release of the Prelim GDP report and the usual Weekly Initial Jobless Claims. The data, however, might do little to influence the USD price dynamics. The focus remains on developments surrounding the Russia-Ukraine saga, which will drive the broader risk sentiment and provide some impetus to the AUD/USD pair.

Technical levels to watch

- DXY posts strong gains and reclaims the area above 97.00.