- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-11-2021

- The AUD/JPY reclaimed the 83.00 price level after dropping beneath it on Friday last week.

- The Asian session market sentiment is mixed, though mild risk-off, as the Japanese Topix is the only gainer.

- AUD/JPY: Crucial for AUD bulls to reclaim the 84.00 figure; otherwise, bears could push the pair towards the upslope support trendline around 81.00.

The AUD/JPY slides as the Asian session begins, trading at 83.18 during the day at the time of writing. The market sentiment is mixed, as Asian equity futures point to a lower open, most of them in the red, except for the Japanese Topix, which climbs 0.61%.

On Tuesday in the New York session, the sentiment was downbeat throughout the session, except for the last hour, when the S&P 500 pared some of its losses. In the FX market, risk-off market sentiment weighed on risk-sensitive currencies like the AUD. However, the safe-haven US dollar benefited from those flows, as the Japanese yen and the Swiss franc weakened.

AUD/JPY Price Forecast: Technical outlook

At press time, the AUD/JPY extended its rally to a two-day gain. As the Asian session begins, the pair is flat, trading above the confluence of the 200 and the 50-day moving averages (DMA’s), that in case of being broken, would compromise the 82.00 level.

In the outcome of the abovementioned, the November 19 swing low at 82.15 would be a medium resistance level. Right under the latter, the 100-DMA at 81.88 would be the last line of defense before giving way to Japanese yen bulls, towards the upslope support trendline that lies around the 81.00 figure.

On the other hand, if AUD bulls, reclaim the 84.00 price level, that would open the door for further gains, with the October 22 pivot low-turned resistance at 84.61. A breach of the latter, would expose the 85.00 figure.

-637733085689576247.png)

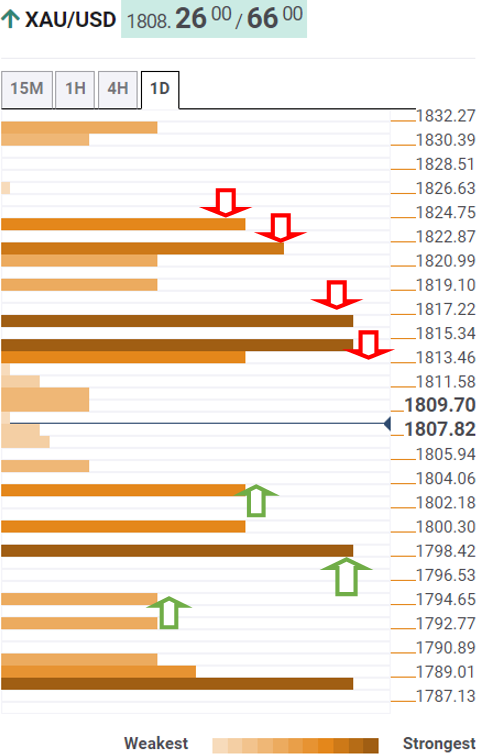

- Gold remains on the back foot around 13-day low, keeps 200-DMA breakdown.

- US President Biden’s nominations for Fed positions fuel rate hike odds and yields.

- Covid fears, strong DXY exert additional downside pressure ahead of a long economic calendar.

- Gold Price Forecast: Heading towards November low at $1,758.81

Gold (XAU/USD) seesaws around a three-week low, near $1,790 at the latest, following a four-day downtrend that dragged the quote below the 200-DMA. That said, firmer yields and hopes of a Fed rate hike weigh on the metal prices despite the latest inaction during early Wednesday’s Asian session.

US President Joe Biden’s nominations for the Federal Reserve’s (Fed) Chairman and Vice-Chair’s post boosted the market’s morale for the rate hike. The same helped the US 10-year Treasury yields and the US Dollar Index (DXY) to refresh the multi-day top. Also favoring the bond yields and the greenback was the US inflation expectations and concerns over the fresh covid wave in the Eurozone.

Given the cautiously optimistic view of Powell and Clarida over monetary policy tightening, hopes of the Fed’s faster rush towards the rate hikes gained additional support, which in turn favored yields and the DXY. However, mixed US PMIs triggered the gold’s bounce afterward.

US Markit PMIs flashed mixed numbers for November as the Manufacturing activity gauge rose past expectations and prior but not the Services index, which in turn weighed on the Composite figures. Additionally, US Richmond Fed Manufacturing Index crossed the expected figure of 5 but stayed below 12 previous readouts to 11 for November.

Even so, US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, rebound from a two-week low to 2.62% by the end of Tuesday’s North American session.

Amid these plays, US 10-year Treasury yields ran higher towards the yearly top marked in October, up five basis points (bps) to 1.676% whereas the DXY refreshed 16-month top to 96.61 before closing around 96.50. It’s worth noting that the Wall Street benchmarks closed mixed and the S&P 500 Futures print mild losses by the press time.

Looking forward, a busy economic calendar before Thursday’s Thanksgiving Day holiday will keep the gold traders equipped but the bears are likely to hold the reins. Among the key catalysts, October Durable Goods Orders, the second estimate of the Q3 Gross Domestic Product, the latest FOMC Meeting Minutes and October core PCE inflation are crucial.

Technical analysis

Gold bears keep reins below 200-DMA amid the strongest bearish MACD signals in two months, suggesting further downside targeting an upward sloping support line from late September around $1,780.

However, the 61.8% Fibonacci retracement (Fibo.) of August-November upside and a trend line support from early August, respectively $1,760 and $1,755, may challenge the gold bears afterward as the RSI line drops toward the oversold territory at a faster pace.

Meanwhile, corrective pullback needs to stay beyond the 200-DMA level of $1,792, also crossing the 38.2% Fibo. near $1,805, to convince short-term buyers.

Even so, tops marked in July and September around $1,834 offer a tough nut to crack for gold bulls.

Gold: Daily chart

Trend: Further weakness expected

“Chair Powell and Governor Brainard have similar views on monetary policy,” Goldman Sachs (GS) welcomes US President Joe Biden’s decision to nominate Jerome Powell as the Fed Chairman for the second term and Richard Clarida for Vice Chair’s post in their latest analytical report.

“Both believe that the current rise in inflation reflects transitory (but not necessarily short-lived) factors, while emphasizing that the FOMC would use its tools to preserve price stability if needed,” adds the US-based bank.

GS also said, “Powell and Brainard have also emphasized that they consider a broad set of indicators to gauge progress on the Fed's broad and inclusive employment goal, although Powell indicated in November that maximum employment might look different from pre-pandemic conditions.”

Additional quotes

The continuity in Fed leadership likely signals continuity in the current monetary policy stance, and we continue to expect liftoff shortly after tapering ends with the first hike in July 2022, the second in November, and a pace of two hikes per year thereafter.

Vice-Chair of Supervision, the open Governor's seat, and the seat left open by Governor Brainard. The White House has indicated that President Biden will make these appointments beginning in early December

Read: Betting on hawkish Fed

- EUR/USD fades bounce off yearly low, remains sidelined inside bullish chart pattern.

- Steady RSI, lacklustre MACD hints at additional sideways moves.

- 50-HMA, two-week-old resistance line restrict immediate upside moves.

- Sellers may eye late June 2020 lows on defying the wedge formation.

EUR/USD struggles to keep the rebound from the 16-month low around 1.1250 during the early Asian session on Wednesday.

The currency major pair refreshed the multi-day bottom the previous day before bouncing off 1.1226, which in turn portrayed a short-term falling wedge bullish chart pattern on the hourly play. However, steady RSI and sluggish MACD don’t favor the bulls, which in turn suggest further grinding towards the south.

That said, 50-HMA and a descending trend line from November 09, respectively around 1.1255 and 1.1280, limit the quote’s immediate recovery moves.

Following that, the stated wedge’s upper line around 1.1300 and 200-HMA level of 1.1345 will be important to invite EUR/USD bulls.

Alternatively, the support line of the wedge near 1.1215 and the 1.1200 threshold can lure the pair sellers ahead of June 2020 bottom near 1.1170.

Overall, EUR/USD bears remain in the driver’s seat until the quote crosses the 1.1345 hurdle.

EUR/USD: Hourly chart

Trend: Bearish

"I think that if there was the clear political will from the UK side these problems could be solved," said European Commission's Brexit point person Maroš Šefčovič during an interview with Politico on Tuesday.

The EU diplomat adds, per Politico, "But looking at how far we progressed over the last four weeks, the level of detail our U.K. partners want to discuss, I know that we will probably not be able to resolve everything before the end of the year."

Additional quotes

Šefčovič stressed that he was hoping the UK and the EU could still make ‘decisive progress this week’ on the issue of medicines trade between Great Britain and Northern Ireland, which would ‘generate positive momentum’ for the rest of the talks.

Medicines are a pressing issue as a grace period for border checks and regulatory approvals for drugs expires at the end of the year. Although the U.K. decided to unilaterally extend that grace period, there is a risk of uncertainty and trade disturbance for medicines if both sides don't reach a deal before the end of January.

However, Šefčovič warned that the de facto deadline for reaching a deal was actually this week because the EU will need a few weeks to implement any potential solution.

He said the Commission would "most probably" have to launch the necessary internal approval procedures by next week, suggesting that the window of opportunity for striking a medicines deal was likely closing this week.

Market reaction

Given the mixed concerns portrayed in the interview speech, GBP/USD holds on to the corrective pullback from the yearly low, around 1.3380 by the press time, following the news.

Read: GBP/USD reached a new year-to-date low at 1.3342 though bounced off towards 1.3370s

- AUD/USD struggles to extend corrective pullback from seven-week low.

- Mixed data joins fresh covid woes and cautious sentiment ahead of a busy calendar day to trigger market consolidation.

- Equities dwindle, Treasury yields stay firmer and DXY eases after refreshing 2021 peak.

- RBA’s Bullock precedes multiple US data to offer a busy day, RBNZ rate decision important too.

AUD/USD seesaws around 0.7225, following the bounce off October-start lows, during early Wednesday morning in Asia.

The Aussie pair initially dropped to the multi-day low on increased expectations of a Fed rate hike and mixed data at home before the absence of strong US PMIs triggered consolidation of the latest losses. However, the cautious mood in the market before a long line of data/events challenges the risk barometer pair’s rebound of late.

The Commonwealth Bank of Australia (CBA) released preliminary readings of November’s PMIs. The activity numbers suggest softer Manufacturing PMIs failing to beat the strong Services and Composite PMI figures. Other than the mixed data, comments from Marion Kohler, Head of Domestic Markets at the Reserve Bank of Australia (RBA), also favored the AUD/USD pair’s corrective pullback by citing record low interest rates.

On the other hand, US Markit PMIs also flashed mixed numbers for November as the Manufacturing activity gauge rose past expectations and prior but not the Services index, which in turn weighed on the Composite figures. That said, US Richmond Fed Manufacturing Index crossed the expected figure of 5 but stayed below 12 previous readouts to 11 for November.

With the US activity numbers failing to extend the previous run-up Fed hawks took a breather following a strong push to the yields and US Dollar Index (DXY) after US President Joe Biden nominated Jerome Powell for Federal Reserve (Fed) Chairman and Richard Clarida for Vice-Chair’s post. Also challenging the AUD/USD bears were the covid concerns as the Eurozone flashes red signals while figures at home and in the US back the policymakers’ cautious optimism and rule out the fears of another round of local lockdowns.

Even so, the US Treasury yields ran higher towards the yearly top marked in October, up five basis points (bps) to 1.676%, whereas the Wall Street benchmarks closed mixed. Further, gold prices dropped for the fourth consecutive day to print a fresh three-week low before bouncing off $1,781.

Given the mixed catalysts and the AUD/USD pair’s failures to keep the recovery moves, traders seek more clues, backed by technical validation to extend the latest rebound. Hence, comments from RBA Assistant Governor (Financial System) Michele Bullock will be closely observed for fresh impulse ahead of the monetary policy decision from the Reserve Bank of New Zealand (RBNZ).

Additionally, multiple US data fill the calendar before Thursday’s Thanksgiving Day holiday. Among them, October Durable Goods Orders, the second estimate of the Q3 Gross Domestic Product, the latest FOMC Meeting Minutes and October core PCE inflation are crucial.

Hence, AUD/USD traders stay on the sidelines and await more clues.

Technical analysis

A clear downside break of the three-month-old ascending trend line joins bearish MACD signals to keep AUD/USD bears hopeful despite bouncing off a 78.6% Fibonacci retracement (Fibo.) of November 2020 to February 2021 upside, around 0.7200. That said, October’s low and a yearly support line, respectively near 0.7170 and 0.7140, can challenge the further downside ahead of the 2021 bottom of 0.7105.

Meanwhile, a corrective pullback should not only offer a daily closing beyond the previous support line from August close to 0.7260 but also successfully cross a downward sloping resistance line from November 02, around 0.7295, to convince the bull’s return.

- The British pound advances as the Asian session begins, up 0.09%.

- The GBP/JPY benefits from a stronger US dollar; as the Japanese yen weakened, the GBP/JPY pair rallied.

- GBP/JPY: The break of the bullish flag could propel the pair towards 156.00.

The British pound advances as the Asian Pacific session takes over the American session, up some 0.09%, trading at 153.94 at the time of writing. On Tuesday, the market sentiment was downbeat through the majority of the session. However, it recovered as the New York session wind down, with the S&P 500 and the Dow Jones Industrial rising, while the tech-heavy Nasdaq Composite fell.

During the day, earlier in the Tuesday Asian session, the British pound fell to 153.20, following the GBP/USD footsteps. However, as European traders got to their desks, downward pressure on safe-haven currencies weakened except for the US dollar. That said, the sterling jumped at the daily lows, pushing the GBP/JPY pair towards the 154.00 figure.

GBP/JPY Price Forecast: Technical outlook

-637733033125403126.png)

The price action of the GBP/JPY on Monday depicted a bullish-piercing pattern that needs confirmation. At press time, Tuesday’s candlestick needs to close above 154.44, to cement the upward bias; otherwise, the GBP/JPY would keep trading sideways though within a narrower range than the 152.40-154.30 range, as the top-trendline of a bullish flag lies close to the 154.00 figure.

If the GBP/JPY breaks above the bullish flag, the pair’s next target would be the November 4 swing high at 156.25.

On the flip side, failure of an upside break of the bullish flag would open the door for further downside. The first support would be the 50-DMA at 154.30. A breach of the latter would expose the confluence of the 100 and the 200-DMA around the 152.40-70 region.

- AUD/NZD outlook into the RBNZ event is bullish on a 25BP hike.

- Traders are fully pricing in a 25bp hike, although 50bp is the biggest risk.

The RBNZ meets today and analysts are overwhelmingly expecting a 25bp hike rather than 50bp. This is where the risk is for the cross. A 50bp increase will see the kiwi fly considering the market has clipped it wings on the basis that a hike has been well telegraphed for a long time

This brings us to the charts:

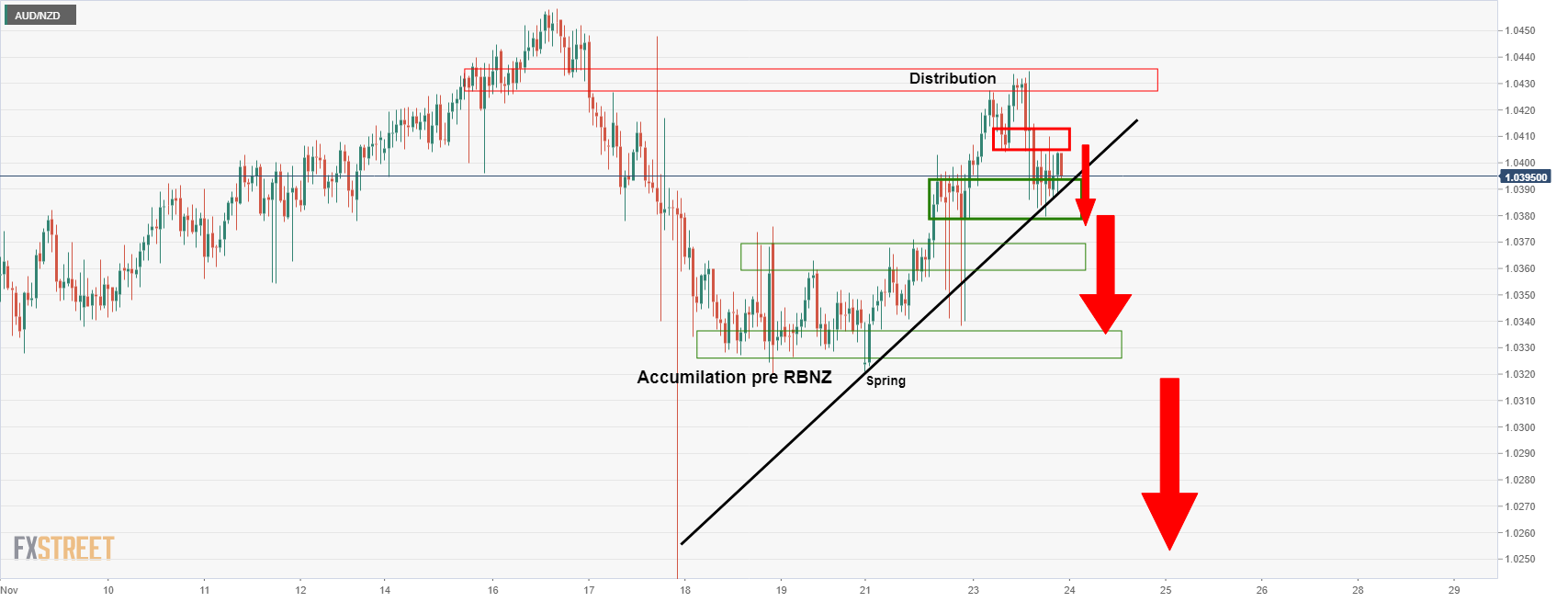

AUD/NZD daily chart

For the near term, this is the potential outlook for today's main event. Given the market will not be surprised that the RBNZ hikes, a move higher would not be unrealistic, especially as traders factor in the path of central banks in general. The RBNZ’s OCR track will be key in determining how far the kiwi could fall.

If there is a tendency towards an endpoint near 3% but dovish rhetoric, in so much that 25 bp OCR rate hikes will possibly be all we will get from the RBNZ between now and then, this leaves plenty of room for the RBA to catch up. Thus, there could be more value in the Aussie moving forward should a 2023 rate hike remain a possibility if inflation, wages and growth surprise to the upside.

In the event that there is a 50bp hike, there will be the toss-up between how detrimental this might be for the economy vs what this will mean to a market that is already long of NZD. The knee jerk will undoubtedly see a bid in the kiwi, especially as markets are nervous going into the meeting and waiting on the sidelines, waiting to pile in on such an outcome.

AUD/NZD H1 chart

The price would be expected to extend distribution that has started to take place ahead of the meeting. A break of the dynamic support would open the risk of a knee-jerk run on 1.0380 and then 1.0320 stops.

- NZD/JPY bounced at its 50DMA just under 79.50 to move back to the 80.00 level on Tuesday.

- Trade will be consolidative now ahead of the RBNZ rate decision.

- NZD/JPY has been falling within the confines of a bearish trend channel throughout November.

NZD/JPY rebounded from its 50-day moving average just under 79.50 on Tuesday and is now trading back at the 80.00 level, where it trades higher by about 0.2% on the day. Trade will likely be subdued in the coming hours ahead of the RBNZ releasing their latest monetary policy decision at 0100GMT on Wednesday, which will then be followed by a press conference with Governor Adrian Orr at 0200GMT.

NZD/JPY has been falling within the confines of a bearish trend channel throughout November, with the pair is now down more than 2.0% on the month. Tuesday’s modest rebound has not seen the top of this bearish trend channel threatened. A clean break above Monday’s highs at 80.17, beyond last week’s high at 80.66 and then past the 21DMA at 80.77 would be needed before technicians grow confident that the pair can recover back to early November highs above 82.00.

A hawkish outcome from the RBNZ in the form of a larger than expected 50bps rate hike, or hawkish rate guidance further out, or both, may be enough to spur such a move. Failing that though, if the bank goes ahead with a widely anticipated 25bps rate hike and fails to inspire the bulls with its rate guidance, NZD/JPY is likely to remain locked within the confines of the recent bear trend.

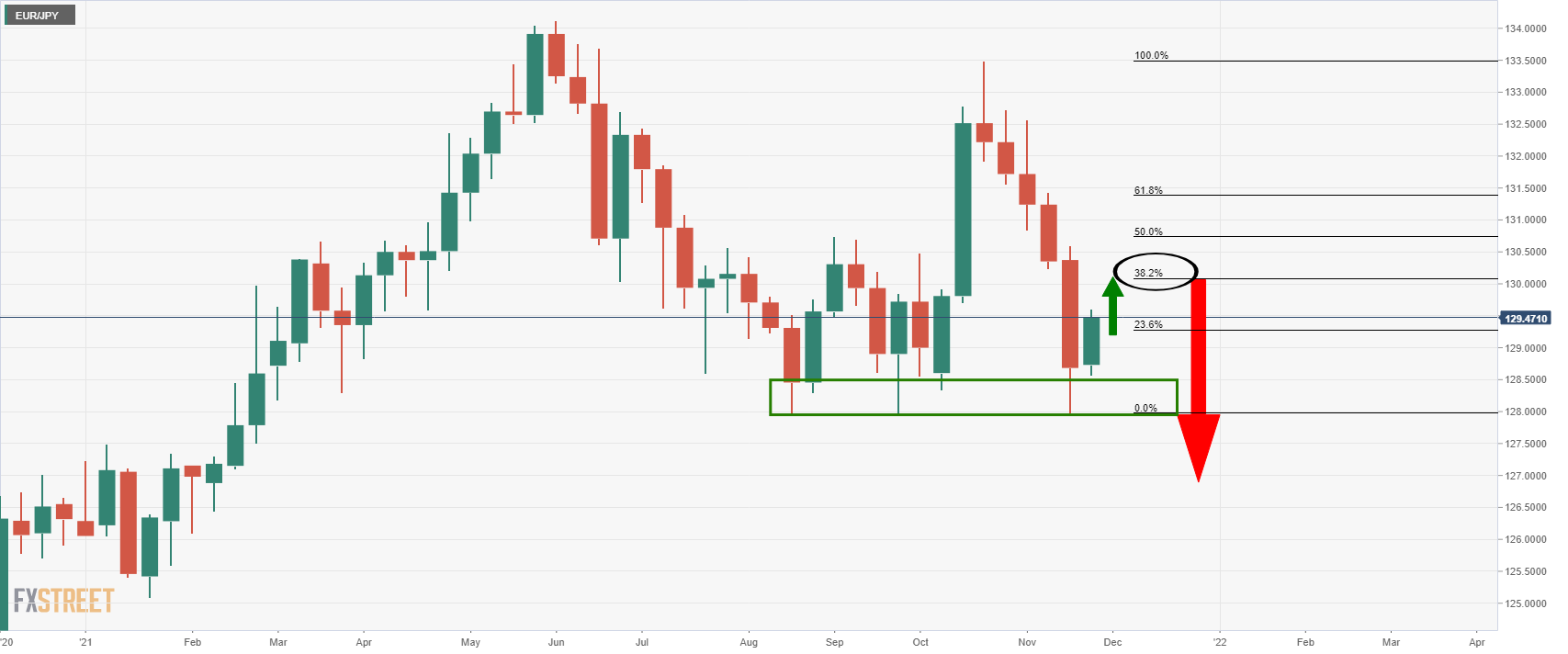

- EUR/JPY bulls are trying to take charge across the time frames.

- The cross is forming a support area on the daily and hourly charts.

The price is embarking on the 38.2% Fibonacci retracement level that meets old resistance as a confluence of the support structure. If the bulls commit to here, then the focus will be an upside extension towards the prior resistance next 129.80/00. On a break of this level, then a downside bias will start to take its form:

EUR/JPY H1 chart

EUR/JPY weekly chart

The above is a weekly chart that takes into account the long term support that has been forming over the past few months. This gives rise to an upside bias, at least for the near term. However, it by no means support the immanent case for the hourly chart's bullish trajectory, for there is plenty of room for a deeper consolidation below the current market level. However, it does solidify the overall bullish outlook.

Meanwhile, the daily outlook could be forecasted as follows:

If the bulls commit here, then there is the case for another test of the prior highs, but the current rally is hardly convincing compared to the prior daily bearish candle. With that being said, the bulls put in a strong performance during that candle that left a bullish shadow from which the price has extended higher.

- The Dow Jones Industrial is the main winner of the session at press time.

- The S&P 500 and the Nasdaq drop between 0.35% and 1.39%, amid risk-off market sentiment.

- Higher US Treasury yields impact heavy-tech company earnings, spurring a sell-off of tech stocks.

During the New York session, major US equity indices edge lower as Wall Street approaches the close. The S&P 500 losses 0.35%, sitting at 4,666.29, while the tech-heavy Nasdaq Composite follows the S&P 500 footsteps, sheds 1.39%, down to 15,634.65. The only winner of the session, the Dow Jones Industrial, climbs almost 0.21%, up to 35,693.55.

Sector-wise, the main winners are energy, financials, and real-estate, rising 3.06%, 1.24%, and 1.17%, each. The main losers are consumer discretionary, technology, and communications, falling 1.47%, 0.97%, and 0.51%, respectively.

Meanwhile, the US bond market sell-off continues; thus, Treasury yields keep rising after US President Joe Biden renominated Fed Chairman Jerome Powell to lead the Federal Reserve for the period ending in 2026.

The 10-year benchmark note rate climbs three basis points, up to 1.656%, while the US Dollar Index stabilizes around the 96.50 figure after rallying for three days.

In the commodities sector, the precious metals gold and silver lose 0.79 and 2.19% each, trading at $1,791 and $23.62, while the US crude oil benchmark, Western Texas Intermediate (WTI) rises 2.55%. trading at $78.71

S&P 500 Chart

-637732966797232262.png)

- EUR/CHF recovered on Tuesday amid strong Eurozone PMIs and hawkish ECB commentary.

- The pair’s recovery to 1.05 doesn’t yet signal the end of the recent bear trend.

Stronger than expected Eurozone PMIs and the hawkish tone comments made by influential ECB governing council member Isabel Schnabel helped the euro outperform its G10 peers on Tuesday. That helped pushed EUR/CHF 0.3% higher and back to the 1.05 handle. Much was made of a decisive break below the 1.05 level last Friday that saw the pair post multi-year lows around 1.0450. This is a level that has previously been vigorously defended by the SNB.

EUR/CHF is yet to break to the north of a downtrend that has been suppressing the price action since mid-November, however, implying the latest recovery could be little more than a dead cat bounce. The next key area of historic support is just under 1.0250.

Historic Weakness

The recent run of EUR/CHF weakness, which has seen the pair lose more nearly 3.0% since the end of August, is historically significant. The pair is down slightly more than 1.5% in the last 21 sessions, which ranks in the bottom decile when compared to the rolling 21 session percentage changes over the last five years. A better demonstration of the historic significance of EUR/CHF’s recent weakness is that it is 1.8% below its 50DMA and nearly 3.5% its 200DMA, scores which rank in the bottom 4th and 2nd percentiles respectively versus the last five years.

What next?

Driving the recent run of losses that has taken the pair back to fresh multi-year lows has been a combination of factors including faster inflation in the Eurozone versus Switzerland and a deterioration in the Eurozone’s pandemic outlook this winter. If inflation differentials have been a major factor continuing to drive EUR/CHF lower, then more downside may lay ahead if ECB’s Isabel Schnabel was correct in her assessment on Tuesday that the ECB risks missing its medium-term inflation remit. Equally, it might reasonably be argued that if the bank heeds her accompanying call for a wind-down in stimulus after the PEPP expires in March, central bank divergence may come to the pair’s aid. After all, the SNB is not expected to shift from its ultra-dovish stance any time soon.

- NZD/USD continues to trade around the 0.6950 mark having recovered from earlier lows under 0.6920.

- Though the pair is down more than 3.0% on the month, technicals do not suggest the kiwi is reaching oversold levels just yet.

NZD/USD has seen fairly choppy trading conditions on Tuesday, with the pair down as much as 0.5% when it hit session lows under 0.6920, before rebounding back to the 0.6950 mark since the arrival of US market participants. At current levels around 0.6950, the kiwi is trading flat on the day versus the US dollar. Trading conditions have died down in recent hours as NZD traders refrain from placing any further big bets ahead of Wednesday’s RBNZ monetary policy decision.

Technicals not coming to kiwi’s aid just yet

Since the start of the month, NZD/USD has dropped 3.0%. Failing a much larger hike than expected from the RBNZ at Wednesday’s meeting (of 50bps rather than 25bps) coupled with hawkish guidance on future rate hikes, the prospect for the pair recouping these losses is slim. Indeed, if the bank does opt to go with a 25bps rate hike and fail to impress markets with their guidance, a move back to session lows in the 0.6920 region and perhaps of the big figure just below it.

Technicals are unlikely to come to the kiwi’s aid just yet. NZD/USD’s 14-day Relative Strength Index score is at roughly 37.7, still above oversold territory (defined as 30 or lower). Meanwhile, NZD/USD’s Z-score to its 200-day moving average (i.e. the number of standard deviations away from the moving average) clocks in at -1.24. While this is in the bottom quartile of rolling Z-scores to the 200DMA recorded over the last five-year period, it doesn’t yet signal oversold conditions.

Typically, a Z-score to the 200DMA of under -2.00 is a better buy signal – this has been the case already on two occasions in 2021 (in mid-August and late-September). For NZD/USD’s Z-score to hit -2.00, the pair would need to fall back to roughly in line with the late-September low a few pips above 0.6950.

Westpac remains bullish on the pair in the medium-term, given that “global risk sentiment remains elevated, and NZ-US yield spreads remain attractive, while NZ commodity prices are rising”. The bank continues “to watch for this decline to run its course, and target a return to the Feb high of 0.7465+ by Q1 next year”.

What you need to know on Wednesday, November 24:

The dollar extended its gains, reaching fresh 2021 highs vs the EUR and the GBP. EUR/USD bottomed for the day at 1.1225, while GBP/USD fell to 1.3341. The sour tone of global indexes and higher government bond yields fueled demand for the safe-haven dollar.

Bank of England governor Andrew Bailey said that the bank may not return to offering a hard form of guidance, according to Reuters. It is not off the table that we give no guidance at all on rates, with decisions to be made meeting by meeting, the governor added, before stating that the UK labour market is very tight.

USD rivals recovered modestly from their intraday lows despite Wall Street edging lower, weighed by a sell-off in the tech sector, with the Nasdaq Composite being the worst performer. The AUD/USD pair trades around 0.7220 while USD/CAD stands at 1.2680.

Higher US government bond yields pushed USD/JPY to its highest since March 2017, with the pair currently trading around 115.00.

Investors’ concerns are related to continued inflationary pressures affecting economic growth, alongside mounting concerns of the spread of coronavirus contagions in the northern hemisphere.

Gold shed over 1%, plummeting to $1,781.94 a troy ounce, now struggling to recover above 1,790. Crude oil prices, on the other hand, were sharply up on the back of an announcement from US President Joe Biden. He said that the Department of Energy would release 50 million barrels of oil from the Strategic Petroleum Reserve (SPR) in an attempt to lower high gasoline prices. Markets reacted pushing the barrel $3 higher, with WTI now around $78.50.

The focus will be on US data on Wednesday, as the country will release multiple relevant figures ahead of the Thanksgiving long weekend. Among other things, the calendar includes October Durable Goods Orders, the second estimate of the Q3 Gross Domestic Product, the latest FOMC Meeting Minutes and October core PCE inflation, foreseen at 4.1% from 3.6% previously.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Altcoins to outperform leading cryptos

Like this article? Help us with some feedback by answering this survey:

- USD/JPY found strong resistance around the 115.00-20 area, near the top-trendline of a bearish-wedge formation.

- Risk-off market sentiment failed to benefit the Japanese yen, though higher US Treasury yields boosted the greenback.

- USD/JPY: Mid-term has an upward bias, but a bearish-wedge formation could push the pair towards 113.50 before resuming to the upside.

The USD/JPY extends its gains throughout the New York session, trading at 115.00 up some 0.15% at the time of writing. Risk-off market sentiment weighs on in US equities, as most indices fall, between 0.48% and 1.42%, except for the Dow Jones Industrial, which is flat at the day.

During the Asian and European sessions, the USD/JPY seesawed around the 114.54-115.15 range. In the Asian session, the USD/JPY spiked to the 115.14 area, though later retreated the upward move, down to the daily central pivot point around 114.50s, where the pair stalled, before resuming the uptrend.

The 10-year US Treasury yield closes to 1.70%

In the meantime, the US T-bond 10-year benchmark note, advances three and a half basis points, sitting at 1.662%, benefits the greenback. The US Dollar Index, which measures the greenback’s performance against a basket of six rivals, is flat at 96.51.

USD/JPY Price Forecast: Technical outlook

The USD/JPY has an upward bias, depicted by the daily moving averages (DMA’s) located below the spot price, with an upslope, confirming the bullish bias. However, Tuesday’s price action found strong resistance around the 115.00 area, close to the top-trendline of a bearish-wedge formation which usually breaks to the downside. A failure to overcome the abovementioned would open the door for a correction.

In that outcome, key support levels would be exposed, with the first support level at the November 19 cycle low at 113.58, followed by the confluence of the 50-DMA and the November 9 pivot low around the 112.70-80 area.

Conversely, if the USD/JPY has an upside break invalidating the bearish-wedge formation, it would open the door for higher prices, exposing crucial resistance areas. The March 2017 swing high at 115.51, followed by the 117.56.

- WTI rose more than $2.0 in a “sell the rumour, buy the fact” reaction to the White House SPR announcement.

- WTI broke above a key downtrend and bulls may well look for further upside in the coming days.

Front-month futures of the American benchmark for sweet light crude oil, West Texas Intermediary or WTI, jumped more than $2.0 per barrel on Tuesday to test the 50-day moving average at $78.92. With WTI now trading in the upper $78.00s, that marks a near $3.50 or near 5.0% rebound from lows witnessed during Asia Pacific trading hours in the low $75.00s.

Technical buying contributed to the rally on Tuesday as WTI broke above a key downtrend that had been suppressing the price action since 10 November. If the 50DMA and resistance in the form of the psychologically important $79.00 level can be broken, the next resistance of note is in the $79.30s, an area of support (on 15 November) turned resistance (on 19 November). Above that, there is the $80 mark and the 21DMA at $81.00.

Not the reaction the Biden administration wanted

As far as the Biden administration will be concerned, Tuesday’s reaction in crude oil markets to the announcement of the US’ Strategic Petroleum Reserve (SPR) release plans could not have gone any worse. To recap, the White House on Tuesday published plans to release up to 50M barrels of oil in the coming months (18M of that involving the acceleration of pre-approved sales). A number of other countries announced or were reported to be on the cusp of, their own oil reserve release plans, including China, India, Japan, South Korea and the UK.

The threat and anticipation of these plans in recent days has weighed heavily on oil prices. But the reaction to the actual announcement seems to have been one of “sell the rumour, buy the fact”. As high-profile commodity strategists have been reminding us for weeks now, a crude oil reserve release would only have a temporary effect on prices because it does nothing the fix the underlying long-term supply/demand imbalance that has supported prices in recent weeks.

Moreover, OPEC+ has sent signals that they will adjust output accordingly to account for the global reserve release. The Secretary General of the cartel has been vocal in recent days/weeks warning about the prospect of oil markets returning to a supply surplus sooner than expected and calling for the cartel to exercise patience with output hikes.

- EUR/USD bears get set for a run on the 1.1000 figure for the sessions ahead.

- Bears need to break the hourly support seen in recent lows near 1.1220.

EUR/USD is slightly up at the moment by some 0.14% after travelling from a low of 1.1226 and reaching as high as 1.1275. Nevertheless, not much more can be expected on a day where markets are subdued ahead of the Thanksgiving Day holiday Thursday in the US and key data tomorrow.

Overall, the focus is on the greenback. The dollar index, DXY, has held near 16-month highs that were made when Federal Reserve Chair Jerome Powell was picked for a second term. This disappointed the bears who had been placing bets on a more dovish outcome in Lael Brainard. Instead, The Powell-pick has reinforced market expectations that lift-off will happen in 2022.

'We are not expecting the data to suddenly weaken significantly in the next two months, so pressure on Fed officials to at least sound/look a bit more hawkish could only increase in the near term, including in confirmation hearings and in the December dot plot,'' analysts at TD Securities argued.

''We think the USD can remain firm against the funders as the prospect of a faster taper remains a risk the market is chewing on,'' analysts at TD Securities added.

All eyes on FOMC minutes

Currency markets have been mostly driven in recent months by market perceptions of the different paces at which global central banks reduce pandemic-era stimulus and raise rates. In that regard, Wednesday's FOMC minutes of the 2-3rd November will be key because Fed officials have seemed to be increasingly open to discussing a faster pace of policy normalisation of late. The minutes of the meeting could shed some light there. If the bar is seen lower for accelerating tapering and/or bringing forward rate liftoff then this could well fuel another strong rally in the greenback.

EZ data looking better

Meanwhile, the euro bounced off of 16-month lows on Tuesday, helped by better-than-expected business growth in the region. The preliminary read was better than expected, rising to 55.8 as services lifted 2 points to 56.6 (54.6). Manufacturing also edged higher to 58.6. ''November’s buoyancy, however, is facing headwinds from the recent COVID surge,'' analysts at ANZ Bank explained. ''Input and output prices both rose – price pressures are intensifying further in the euro area.''

However, the euro is going to be vulnerable as concerns grow over new COVID-19 restrictions in Europe, with Austria entering another full lockdown and Germany considering following suit. Germany's health minister has called for further restrictions on public spaces.

EUR/USD technical analysis

EUR/USD is resting at short-term technical support in the 1.1220/30 area. Commerzbank technical analysts Karen Jones and Axel Rudolph said in a report on Tuesday. that, ''if it breaks below this area, however, it would likely fall to $1.1000, which is the 78.6% retracement of 2020’s move,'' a follows ...

EUR/USD H1 chart

Bank of Canada Deputy Governor Paul Beaudry said on Tuesday that the pressures keeping inflation high should start "moving away" next summer, according to Reuters. Beaudry has been speaking in a virtual speech to a provincial regulator about the housing market. According to the deputy governor, the pandemic has intensified two of the main financial vulnerabilities faced by the Canadian economy; housing market imbalances and high levels of household debt.

Market Reaction

USD/CAD has not seen any noticeable reaction to the latest comments from BoC's Beaudry. The pair has been under pressure in recent trade amid an ongoing rise in crude oil prices and breifly dropped back under 1.2700, where it trades flat on the day.

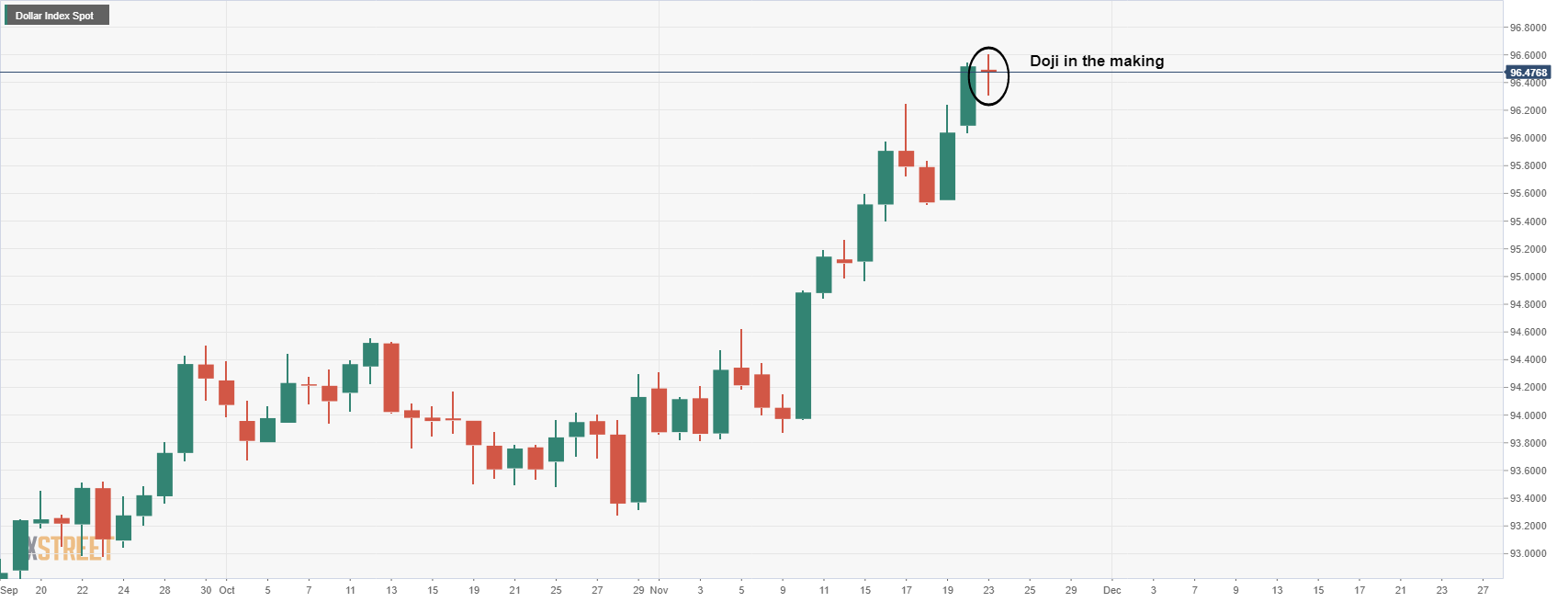

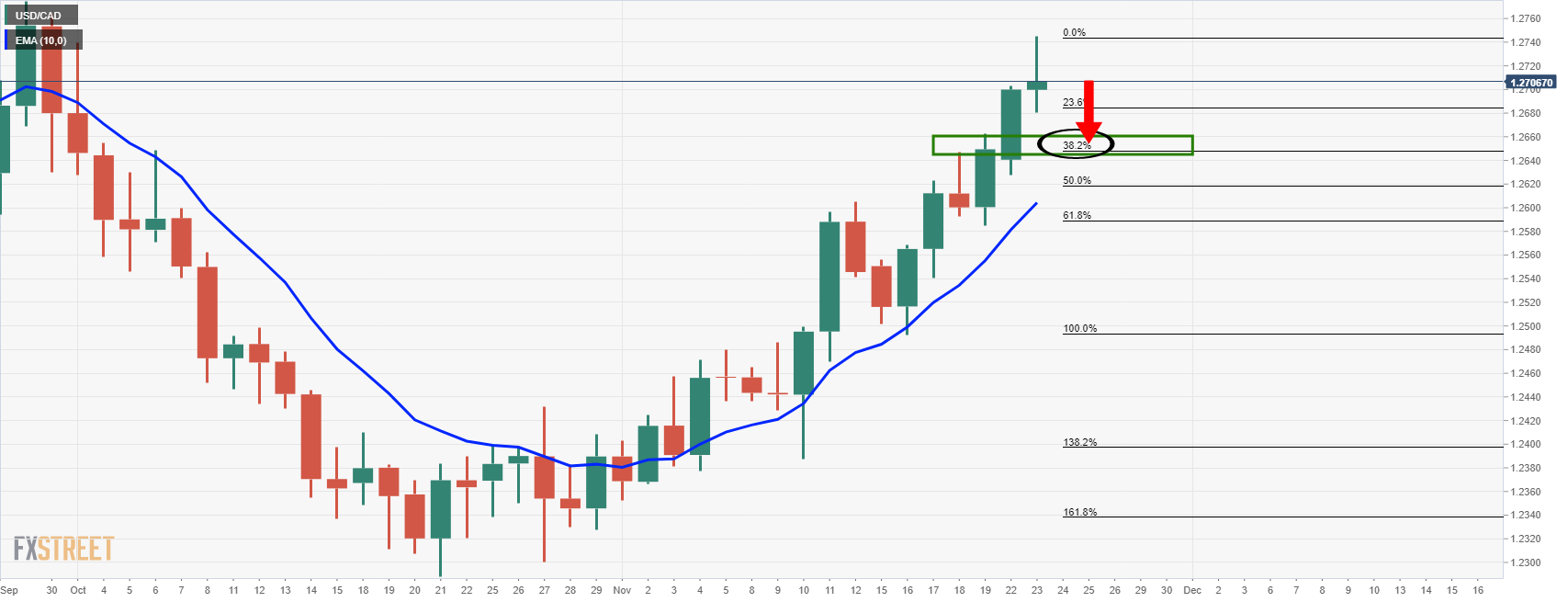

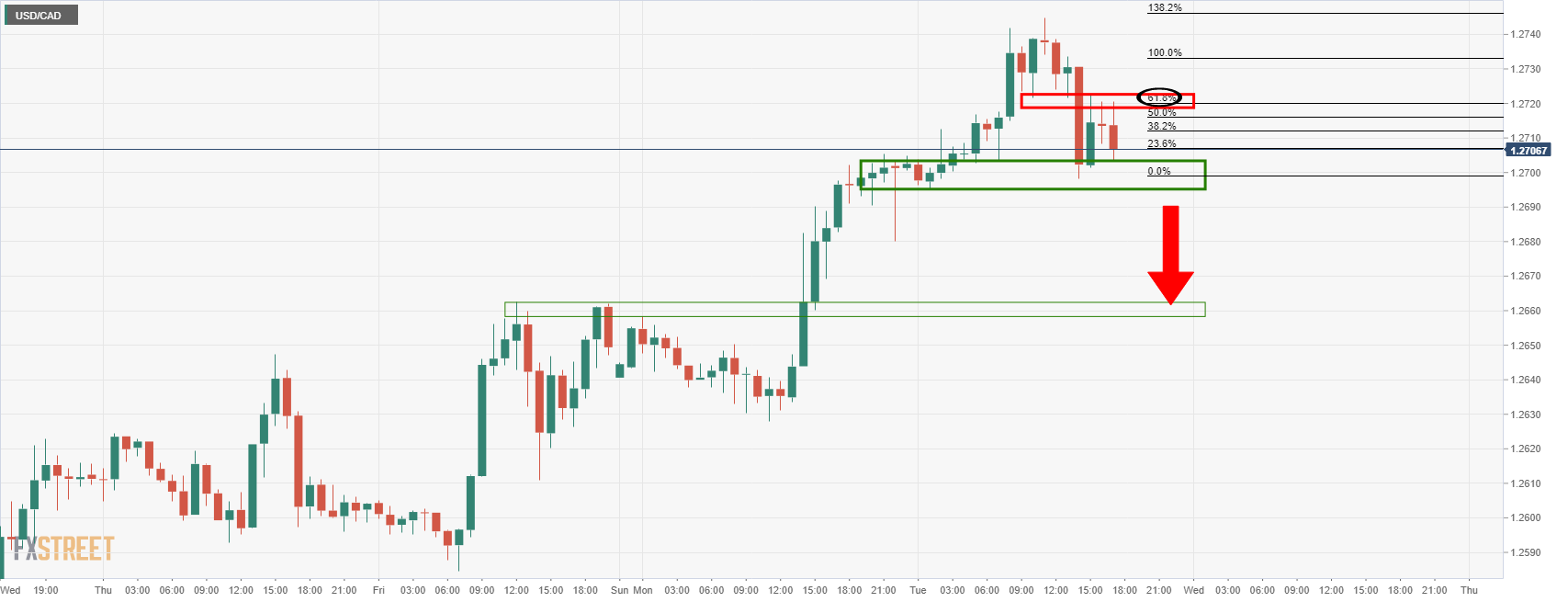

- DXY is lacking momentum on the lower time frames, forming a daily doji on the day.

- The uptrend in USD/CAD is coming under pressure with the price stalling on the bid.

USD/CAD is underperforming as it consolidated the prior three days of consecutive gains. The greenback is stalling on the bid also as measured by the DXY and is starting to form a topping candle. The following top-down analysis illustrates the potential for a significant correction on both the US dollar index and USD/CAD for the coming sessions.

DXY daily chart, spinning top

The spinning top or doji is a topping candle stick formation. However, this will only be confirmed as a high probability topping pattern if the next one to two candles are heavily bearish. The trend is strong in the greenback as per the prior engulfing candles in the series of the daily candles. Therefore, this may just be a pause ahead of the Federal Open Market Committee minutes on Wednesday.

Meanwhile, however, the commodity bloc currencies and high beta yen remain pressured although the Canadian dollar is holding up the best on an hourly basis according to the hourly Currency Strength Index, CSI. This leads to the prospects of a significant correction in USD/CAD as follows:

USD/CAD daily chart

From a daily perspective, the price could be on the verge of a 38.2% Fibonacci correction towards 1.2650. From an intraday perspective, traders can look to the hourly chart for confirmation of the downside bias.

USD/CAD H1 charts

Here we can see that the price fell sharply in the New York open. Bulls have failed to commit and the bears are piling in again. The support of 1.2700 is under pressure and a break there will open prospects of a downside continuation towards the daily target.

USD/CAD dynamic support scenario

Looking closer, however, 1.2680 guards a break of the dynamic trendline support. A break of this would equate to prospects of a much deeper correction, potentially all the way to the 200-EMA situated currently near the mid-Nov highs as a target around 100 pips lower at 1.2600 the figure.

- GBP/USD printed a new 2021 low at 1.3342 amid broad US dollar strength.

- BoE’s Haskel said that the path for interest rates is upwards.

- BoE’s Bailey said that the bank may not return to offering a hard form of guidance.

During the New York session, the British pound grinds lower, barely down 0.05%, trading at 1.3384 at press time. The market sentiment is downbeat, with US equity indices down. Further, the CBOE Volatility Index (VIX) is rising almost 7%, spurring a sell-off in the market as investors scramble toward safe-haven assets, with the US dollar benefitting from it. Also, risk-sensitive currencies like the GBP, the AUD, and the NZD, extend their losses throughout the week.

In the overnight session, the GBP/USD traded within a narrow range around the 1.3380s-1.3400 area. However, in the European session, the British pound failed to gain traction at 1.3448, retreating towards the figure, surpassing it on its way towards the R2 pivot point at 1.3344. Nevertheless, the downward move was faded, as Sterling recovered, at press time is trading below Monday’s low at 1.3384.

Also, in the European session, UK’s IHS Markit PMI figures for November were unveiled. The Manufacturing PMI rose to 58.2, higher than the 57.8. Additionally, the gauge for UK services came slightly better-than-expected, aimed lower to 59.6, from 59.1 in October.

BoE’s Haskel and Bailey talk about rates and forward guidance

During the New York session, some Bank of England (BoE) members have crossed the wires. Jonathan Haskel, a BoE Monetary Policy member, said that the path of interest rates is upwards. He noted that a rise in rates above the emergency level should be viewed as a symptom of economic recovery. Meanwhile, according to Reuters, Andrew Bailey, BoE Governor, said that the bank may not return to offering a hard form of guidance. However, he reiterated that it is not off the table that the central bank would not advise on rates. Bailey added that decisions are made meeting by meeting.

On the macroeconomic front, the US economic docket unveiled the IHS Markit PMI’s for November. The Manufacturing PMI rose to 59.1, higher than the 59 expected. The Services Index rose but lower than the 59.1 foreseen, to 57. Moreover, the Richmond Fed Manufacturing Index for November increased to 11, better than the five expected.

GBP/USD Price Forecast: Technical outlook

The daily chart shows that the British pound has a downward bias, depicted by the daily moving averages (DMA’s) residing above the spot price. Also, successive series of lower highs and lower lows confirm the bearish trend.

The first support level on the way down would be the November 12 low at 1.3352. A breach of the latter would expose the figure at 1.3300, which was unsuccessfully broken during the last two months of 2020.

On the flip side, the first resistance would be 1.3400. A break of that level would expose crucial supply areas, like the downslope trendline, around 13450, followed by a test of the 1.3500 figure.

- XAU/EUR fell below its 21DMA at €1586 on Tuesday as Eurozone real yields rallied.

- Hawkish ECB commentary was the catalyst for the rise in yields, after markets reacted hawkishly on Monday to Powell’s renomination.

Euro-denominated spot gold (XAU/EUR) prices tumbled beneath their 21-day moving average at €1586 on Tuesday, taking losses on the week to over €50. Spot prices also fell below a key area of support in the form of the 5 January 2021 high at €1591. The next key area of support that the bears are likely to target is the late May/early June highs in the €1560s.

Euro-denominated spot gold’s decline this week was initially triggered after the announcement in the US that Jerome Powell would be renominated as Fed chair, prompting a rise in developed market real yields. The hawkish reaction to the news reflected an unwinding of bets that comparatively dovish Lael Brainard would be nominated as Fed chair.

Either way, the news pushed Eurozone real yields higher, but the move extended on Tuesday following more hawkish than expected commentary from influential ECB member Isabel Schnabel. She warned that inflation in the Eurozone would be higher than previously thought in 2022 and could stay above the ECB's target in the medium term. This supports the case for ending the PEPP in March despite the current Covid-19 wave, she added. According to ING, Schnabel’s comments “hint at how the ECB will try to cautiously join the exit lane” regarding ultra-accommodative monetary policy. Thus, the bank expects “the ECB to end PEPP in March 2022, introduce a new third transition purchase programme and to gradually move over to APP as the only asset purchase programme”.

German 5-year inflation-linked (real) yields rose from -2.40% to -2.30% on Monday and have continued higher to around -2.25% on Tuesday. Meanwhile, German 10-year inflation-linked yields, which rose above 7bps on Monday to above -2.0%, shot a further 10bps higher on Tuesday to above -1.90%. Higher real yields weigh on gold prices as it means the opportunity cost of holding non-yielding gold has gone up.

If the recent rally in Eurozone real yields does mark the start of a more prolonged move higher as the ECB slowly starts to wind down stimulus in 2022, this would weigh on XAU/EUR in the medium-term. Spot prices would likely fall back into the €1400-1550 range that persisted for most of 2021.

- AUD/USD edges lower as risk-sensitive currencies get hammered by the greenback.

- Fed’s Bostic adds to the group of Fed members that would like a faster pace of the bond taper.

- AUD/USD is headed towards 0.7169, though a break lower would expose 0.7105.

The AUD/USD grinds lower to an eight-week low during the New York session, barely down 0.04%, trading at 0.7219, at press time. The market sentiment is downbeat, as portrayed by US equity indices down. In the FX market, risk-sensitive currencies, like the Australian and the New Zealand dollar and the British pound, fall against the buck. Safe-haven currencies are also down, except for the US Dollar, as it seems that market participants were waiting for the renomination of current Federal Reserve Chairman Jerome Powell for another term.

In the overnight session, the AUD/USD remained subdued In a 0.7210-38 range, as investors kept bidding the greenback on the Powell propelled rally. Nevertheless, it reached a new eight-week low at 0.7207, bouncing off those levels towards the Monday low at 0.7220.

Fed speakers more vocal about a faster bond taper

On Monday, Fed Bank of Atlanta President Raphael Bostic said that the Fed might need to speed up the removal of monetary stimulus and allow for an earlier than expected increase in interest rates. That is in the tune of what Fed Governor Christopher Waller, and Vice-Chairman Richard Clarida, expressed each.

On the macroeconomic front, the US economic docket featured the IHS Markit PMI’s for November. Manufacturing PMI heightened to 59.1, better than the 59 expected. The Services Index rose but lower than the 59.1 foreseen, to 57. Moreover, the Richmond Fed Manufacturing Index for November increased to 11, better than the five expected.

AUD/USD Price Forecast: Technical outlook

The Australian dollar keeps extending its losses. On Monday, the pair broke below an upslope support trendline that accelerated the downtrend. The daily moving averages (DMA’s) are above the spot price. The Relative Strength Index (RSI) is at 32, edges lower, indicating that USD bulls could push the pair further down before reaching oversold conditions.

On the way down, the first support would be the September 30 low at 0.7169. A breach of the latter would expose the August 20 low at 0.7105.

On the flip side, the first resistance would be the upslope trendline around the 0.7240s region. A break would expose crucial levels, with the November 18 high at 0.7292, followed by the November 15 high at 0.7370.

-637732824489830408.png)

- NZD/USD is a tad lower on Tuesday but consolidating in the 0.6950 area ahead of Wednesday’s RBNZ meeting.

- The bank is expected to hike interest rates by at least 25bps to 0.75%.

NZD/USD has seen consolidative trading conditions over since the start of the European trading session and into US hours, with the pair currently subdued just to the south of the 0.6950 mark that it slipped below in early APac trade. On the day, NZD/USD trades with losses of about 0.2%, in line with the losses being observed by most other non-US dollar G10 currencies versus the buck. That takes the pair’s losses since the start of the week to about 0.7%, putting the currency second from the bottom of the weekly G10 performance table, with the yen the worst performer.

To the upside, there is notable resistance in the 0.6980 area and at 0.6970, an area that may be an attractive entry for the sellers. Meanwhile, the main area of downside support is the last-September lows around 0.6860.

RBNZ rate decision coming up

The losses in NZD come despite expectations that the RBNZ will hike interest rates for a second consecutive meeting on Wednesday, as it continues to pull back stimulus from an economy showing signs of overheating. Most economists expect the RBNZ to hike interest rates by 25bps to 0.75% on Wednesday. New Zealand Bank Bill futures for December 2021 trade close to 99.00, implying a 50bps move, a move which a minority of economists are predicting. If the bank does opt to disappoint the expectations of the hawkish minority by opting for a 25bps rate rise, some analysts suggest it may issue hawkish forward guidance to compensate.

Ahead of the meeting, the pair is likely to trade water. Westpac remains bullish on the pair in the medium-term, given that “global risk sentiment remains elevated, and NZ-US yield spreads remain attractive, while NZ commodity prices are rising”. The bank continues “to watch for this decline to run its course, and target a return to the Feb high of 0.7465+ by Q1 next year”. ANZ are more cautious, saying that (with regards to Wednesday’s RBNZ meeting) “the market has gotten itself all tied up in knots expecting a super-hawkish tone” and that “downside risks are emerging and higher swap/mortgage rates have already done the heavy lifting”. “Could the Kiwi have had its best days for 2021?” they ask.

- The Mexican peso among the worst performers on Tuesday.

- Caution across financial markets and the Turkish lira crisis weighs on sentiment.

- USD/MXN about to post the third-highest daily close in one year.

The USD/MXN is rising for the fourth consecutive day and it accelerated during the American session, climbing to 21.31, the highest intraday level since March 9. As of writing, it is hovering around 21.20, up more than 1% for the day.

The rally was triggered by a strong US dollar across the board and a cautious tone across financial market. The sharp devaluation of the Turkish lira also hit market sentiment and favored more gains in USD/MXN.

The USD/TRY was up almost 20% at one point of the session, at 13.50, before pulling back. It is trading at 12.75, up 12%. At the same time, the greenback remained strong supported by higher US yields. The rally that started on Monday after President Biden announced he will renominated Federal Reserve Chair Powell continued on Tuesday.

The biggest losers of the day are the Turkish lira followed by the Mexican peso. Also, commodity currencies remain pressured by the slide in gold and silver.

The USD/MXN is about to post the third-highest daily close since October 2020. If it remains above 21.15, the odds of more gains will remain intact. The next resistance might be seen at 21.45/50.

Technical levels

- The S&P 500 is on course to fall again, weighed by underperformance in tech amid higher US bond yields.

- Markets expect a more hawkish Fed in 2022, which is pushing real yields higher.

US equity markets are trading heavily on Tuesday, as traders reassess equity valuations amid a continued sharp rise in US real yields that reflect the rebuilding of Fed policy tightening expectations for 2022. Three-month eurodollar futures for December 2022 (a proxy for where markets think the Fed funds rate is going to be at the end of next year) currently trade close to 98.95, down from above 99.05 at the end of last week. That implies that Jerome Powell’s renomination to the Fed chair position for a second term has spurred markets to price in an additional 10bps in rate hikes for 2022 (now more than 80bps, or over three 25bps rate hikes). The 10-year TIPS yield now trades at -0.95%, up from under to -1.10% at the end of last week, whilst the nominal 10-year yield up about 10bps on the week to close to 1.65%.

As a result, the S&P 500 continues to trade on the back foot and is down 0.3% and under 4670 in early US trade, following Monday’s 0.4% loss than masks a 1.3% pullback from earlier session highs in the 4740s. The tech-laden S&P 500 communications services and information technology indices are both lower by about 1.0% on Tuesday, while the big tech-dominated Nasdaq 100 index is also down about 1.0%, following on from Monday’s 1.2% drop. Tech stock valuations tend to rely more on expectations for future earnings growth than on current earnings, meaning that valuations are more vulnerable to rising yields, which increases the opportunity cost of relying on future rather than current earnings.

Unsurprisingly, bank stocks are benefitting from the rise in real and nominal bond yields, with the S&P 500 financials index up nearly 0.8% on Tuesday. The S&P 500 energy index, meanwhile, rallied 2.5% amid rising crude oil prices (WTI is up nearly 2.0% on the day to $78.00). Oil markets seemingly saw a “sell the rumour, buy the fact” reaction to announcements from the US and other major oil-consuming nations of reserve releases. In fairness, analysts only thought this would have a modest impact on oil prices as a release of reserves doesn’t solve the structural imbalance currently being seen between supply and demand that has supported prices. OPEC+ also maintains the option to reduce output hikes in the months ahead to compensate for the oil reserve releases.

- US HIS Markit flash for November shows mixed data.

- US Service Index drops to lowest in two months.

- US Manufacturing Index rises more than expected to 59.1.

The preliminary reading of the HIS Markit showed mixed signs in November. The Manufacturing Index rose more than expected to 59.1, the highest in two months. The Service sector Index fell unexpectedly to 57 from 58.7, against market consensus of 59.1.

Meanwhile, the Composite PMI dropped from 57.6 in October to 56.5 in November, below the market consensus of 57.4.

“Private sector firms signalled a sharp upturn in business activity during November, despite the rate of expansion slowing from October. Softer overall growth was largely led by the service sector, as manufacturers posted a slightly stronger increase in production. Nevertheless, pressure on capacity remained stark as labour and material shortages weighed on the private sector”, the report mentioned.

Chris Williamson, Chief Business Economist at IHS Markit, considered the US economy continues to run hot. “Despite a slower rate of expansion of business activity in November, growth remains above the survey’s long-run pre-pandemic average as companies continue to focus on boosting capacity to meet rising demand.” He added the slowdown “underscores how the economy is struggling to cope with ongoing supply constraints.”

- XAG/USD slumps for the second consecutive day broke below $24.00.

- Higher US T-bond yields, rise towards 1.646%, strengthen the greenback.

- XAG/USD: Failure to reclaim $23.53 opens the door for further downside, towards $23.00.

Silver (XAG/USD) plummets during the New York session, down 2.98%, trading at $23.44 at the time of writing. In the overnight session, the white metal could not break resistance above the $24.30s, plunging afterward, firstly towards $24.00, falling further as the European session began, reaching a daily low of $23.34.

It seems that market participants were waiting on Federal Reserve Chairman Jerome Powell’s renomination. US Treasury yields climb, with the US 10-year T-bond yield, advancing two basis points, up to 1.646%, the greenback with the US Dollar Index sits at 96.51, flat at press time after reaching a new year-to-date high around 96.61, and US equities fall, except for the Dow Jones Industrial rising 0.16%.

Now that the market is confident that the US central bank would have continuity in its monetary policy, the US Dollar extended its rally on Tuesday. According to sources cited by Bloomberg, “the market has unwound hedges against a more ‘dovish’ personnel shift.”

Meanwhile, money markets futures, with the 3-Month Eurodollar futures (a proxy for where markets expect the Federal funds rate to be in December), has dropped 10 points in his week, sits at 98.95, the lowest level in the year. The market has priced in 80 basis points of tightening over the next year, expecting at least three 25 basis points rates.

On the macroeconomic front, the US economic docket featured the IHS Markit PMI’s for November. The Manufacturing PMI came at 59.1, a tick higher than the 59, while the Services and the Composite rose to 57 and 56.5, respectively, lower than the foreseen. Further, the Richmond Fed Manufacturing Index for November increased to 11, better than the five expected.

XAG/USD Price Forecast: Technical outlook

Silver (XAG/USD) has a downward bias, depicted by the daily moving averages (DMA’s) above the spot price. Also, the Relative Strength Index (RSI), a momentum indicator, is below the 50-midline aiming lower at 40, accelerating its fall, so XAG/USD may put another leg-down towards the November 3 low at $23.02.

On the flip side, if silver bulls keep the price above the 50-DMA at $23.53, the non-yielding metal could stabilize within the $23.50-$24.00 range.

-637732779936004917.png)

- EUR/GBP remains stuck within recent 0.8380-0.8420ish ranges.

- UK and Eurozone PMIs were both strong on Tuesday, while hawkish ECB commentary lent support to the pair.

EUR/GBP continues to range within well-defined 0.8380-0.8420ish parameters, as has been the case since last Wednesday. The pair trades higher by about 0.25% just to the north of 0.8400 on Tuesday, having risen from Asia Pacific levels in the 93.80s to match weekly highs in the 0.8420s before reversing lower again. Consolidative trading conditions in recent days reflect a broader lack of conviction amongst market participants as various themes such as BoE/ECB policy normalisation, economic performance and the impact of the pandemic are weighed against each other.

Strong PMIs, central bank speak

Tuesday saw the release of IHS Markit’s widely followed November PMI surveys for both the UK and Eurozone. Surveys for both regions were stronger than markets had been expecting, with composite PMI in the Eurozone unexpectedly rising to 55.8 from 54.2 in October and composite PMI in the UK falling much less than expected to 58.6 from 59.1. The Eurozone survey showed that, as a result of shortages, supply chain disruptions and higher energy costs, input inflation hit record highs and a record number of firms reported raising their own prices.

The strong and inflationary Eurozone PMI surveys were released alongside influential ECB governing council member Isabel Schnabel making surprisingly hawkish comments. She warned that inflation in the Eurozone would be higher than previously thought in 2022 and could stay above the ECB's target in the medium term. This supports the case for ending the PEPP in March despite the current Covid-19 wave, she added. According to ING, Schnabel’s comments “hint at how the ECB will try to cautiously join the exit lane” regarding ultra-accomodative monetary policy. Thus, the bank expects “the ECB to end PEPP in March 2022, introduce a new third transition purchase programme and to gradually move over to APP as the only asset purchase programme”.

Turning back to the UK PMI survey, it was not just the headline numbers that were strong. Businesses reported the fastest growth in new orders in five months, whilst (as was the case in the Eurozone survey) cost pressures were at record levels. IHS chief business economist Chris Williamson said that “a combination of sustained buoyant business growth, further job market gains and record inflationary pressures gives a green light for interest rates to rise in December”. He added that the data showed a “welcome pick-up in GDP growth after the slowdown seen in the third quarter”.

But UK money markets seemingly need more convincing. Three-month short sterling December 2021 futures (a proxy for where the BoE’s bank rate will be next month) pushed to close to seven-week highs on Tuesday at 99.80. That implies that short-term interest markets are only pricing about 10bps worth of tightening at the December BoE meeting or about a 66% chance that the bank hikes rates by 15bps. This time two weeks ago, markets were pricing a 15bps hike with certainty.

Waning confidence that the BoE might hike in December could reflect the slightly more dovish than expected tone adopted by BoE governor Bailey over the weekend, who said that inflation risks were two-sided. There were also comments from dovish leaning BoE member Jonathon Haskel this morning, who reiterated his expectation that inflationary pressures would ultimately prove transitory and conceded that, if the labour market remained tight, interest rates would have to rise. These comments did not impact sterling at the time.

Perhaps money market reluctance to price a 15bps rate hike from the BoE in December reflects concerns about the pandemic raging in Europe. According to ING, "the vicinity of the UK to the EU, where cases are rising dangerously and new restrictions are being discussed, maybe keeping a floor on EUR/GBP”. “Markets could be reluctant to speculate that the UK will be able to dodge another serious Covid wave” the bank added.

- Swiss franc weakens and turns negative for the day.

- USD/CHF trims gains after reaching levels near 0.9350.

The combination of a weaker Swiss franc and a firm US Dollar boosted USD/CHF to 0.9344, the highest level since September 30. It then pulled back to the 0.9325 zone trimming daily gains.

The Swiss started to lose momentum during the European session following economic data from the Eurozone and then it dropped further as EUR/CHF rebounded. The cross is back above 1.0500, as it continues to recover from multi-year lows it reached last week at 1.0445.

The cautions tone across markets should keep the demand for the Swiss franc strong but at the same time, inflation pressures in the Eurozone (reflected in the PMI HIS November preliminary report) and some potential profit-taking favor a rebound in EUR/CHF and kept USD/CHF near monthly highs.

USD/CHF short-term outlook

While clearly above 0.9300, the USD/CHF could continue to look for more gains in the short-term. A slide below could alleviate the bullish pressure with the next support at 0.9250. On the upside, the immediate resistance is located at 0.9345 and then the September top at 0.9368.

Technical levels

- Spot gold momentarily dropped below $1790 on Tuesday amid further upside in US real yields.

- Yields have been on the upwards march since Monday’s announcement of Powell’s renomination as Fed chair.

Spot gold (XAU/USD) prices broke below a key area of support in recent trade, tumbling beneath both the 200 and 50-day moving averages, both of which sit close to $1790. As of right now, prices have recovered a little and XAU/USD is trading around $1790, meaning prices are down about 0.8% on the day. This follows Monday’s steep 2.2% decline and means dollar-denominated gold has lost nearly $60 in value so far this week.

Traders will remember that the bulk of the decline was triggered on Tuesday as markets reacted hawkishly to the news of Jerome Powell’s renomination as Chairman of the Fed for a second term. The hawkish reaction was a result of market participants unwinding bets that Lael Brainard would be announced as the new Chair, potentially heralding in a more dovish policy lean. As it happened, Lael Brainard was picked as the new Vice Chair of the Fed, and will replace Richard Clarida in the role in February.

Real yields rising

Real US government bond yields saw a sharp rise on Monday and this, coupled with a decline in inflation expectations, was the main driver of gold’s decline at the time. Real yields have continued to rally on Tuesday as markets price in a more hawkish Fed policy stance in 2022. December 2022 three-month eurodollar futures (a proxy for where markets expect the Federal funds rate to be next December) has dropped about 10 points this week to 98.95, its lowest level yet this year. In other words, markets now price in about 80bps worth of tightening over the course of 2022, the most hawkish that expectations have been since the onset of the pandemic.

The 5-year US TIPS yield is up another 2bps on Tuesday at -1.66%, after surging more than 12bps on Monday. The 10-year US TIPS yield is up a further 3bps and back to the north of -1.0% after Monday’s 10bps rally. The move higher in US TIPS yields (and lower in prices) reflects a lower demand for protection against inflation (TIPS are indexed to CPI). A reduced appetite for inflation, as markets bet that a Powell-led Fed is more likely to fulfill its medium-term inflation remit, also weighs on gold, as has been seen.

In terms of what's next for gold, the focus is firmly on the December Fed meeting and any indications that recent chatter amongst Fed officials about accelerating the pace of QE taper in January translates into a broader consensus. Any decision to accelerate QE tapering would likely accelerate the recent upside seen in real yields, which would be bad for precious metals. In the meantime, as long as the dollar remains bid and yields buoyant, gold will remain suppressed, with the bears perhaps targetting support at the $1760 area to the downside.

According to Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, the USD/JPY bulls are likely to aim to test March 2017 high at 115.51.

Key Quotes:

“USD/JPY is now trading above the 115.00 mark, at levels last seen in March 2017, with the March 2017 high at 115.51 as well as the 115.60 61.8% Fibonacci retracement of the move down from 2015 being in focus. Then there is the 117.56 level, the 1998-2021 resistance line and 119.41, the downtrend from 1975. We have a near term uptrend at 113.72.”

“Nearby support below 113.72 lies at 112.73/112.56, then the 111.66 July high which should hold the downside.”

“Loss of 110.80 is needed to destabilise the chart and allow for a deeper sell-off to key near term supports at 109.07/10 and 108.73 (July and August low).”

- WTI has pushed higher into the mid-$76.00s and is eying resistance at $77.00.

- The US announced it will release 50M barrels of oil over the coming months.

Oil prices have been choppy in recent trade, with front-month WTI futures recently turning highs and reclaiming the $76.00 level despite the much anticipated official announcement by the White House that it will release crude oil reserves. At present, WTI trades around $76.50, a few cents higher on the day and still well within recent $75.00-$77.00 ish ranges.

The $77.00 area presents strong resistance, as it not only marks this week’s high, but also last Thursday’s low. Slightly above that, there is more resistance in the form of a downtrend that has been capping the price action since the tumble from the 9 November high at just under $85.00. For WTI’s technical momentum to turn decisively more positive, it would need to break above this downtrend. In this case, the next target on the upside would be the 50 and 21-day moving averages, which currently reside close to $79.00 and $81.00 respectively.

Crude oil reserve release announcements

Earlier in the session, the White House announced that it would release as much as 50M barrels of oil from the Strategic Petroleum Reserve (SPR). The sale of 18M of these barrels has already been approved by Congress but would be sped up. Alongside the announcement from the US, officials in India announced that they would release 5M barrels from their reserves and there were reports that China could release over 7M barrels. Moreover, Japan was reported to be prepared to release several days' worth of consumption, which analysts said could amount to a release of about 5M barrels of oil.

The announcement by the US and other nations appear to have been roughly in line with what markets had been pricing for and commodity analysts broadly seem to agree that the impact on oil markets will be short-lived. According to a UBS analyst, “SPR releases are a tool used to cover temporary production disruptions and are not useful to fix imbalances caused by lack of investment and still rising demand”.

Economists at ING believe that EUR/SEK is not overvalued in the short-term and a cautious Riksbank announcement may generate more SEK weakness this week.

Key Quotes:

“The Riksbank has been resistant to include a rate hike in its published rate projection, which as of September went out as far as 3Q 2024. That might change this week, with the inclusion of a notional rate rise for the final quarter of 2024, though even that isn’t totally guaranteed. ”

“The latest rise in Covid-19 cases across Europe adds another potential reason for caution this week. That caution probably means it is also too early to hear about the Bank’s balance sheet plans beyond next year. ”

“We expect the Riksbank to push back against market speculation that the tightening cycle will start as early as 2022. We think the Riksbank will disappoint hawkish expectations this week, and we expect some dovish re-pricing of rate expectations. ”

“In FX, this should translate into more SEK weakness in our view, although losses should be more marked against the USD than against the EUR. Still, EUR/SEK may approach the 10.20 level this week.”

- USD/CAD continued scaling higher for the third successive day on Tuesday.

- Sliding oil prices undermined the loonie and acted as a tailwind for the pair.

- A stronger USD remained supportive, though overbought RSI capped gains.

The USD/CAD pair maintained its bid tone heading into the North American session and was last seen trading just below mid-1.2700s.

A combination of factors assisted the USD/CAD pair to prolong its recent strong upward trajectory and gain follow-through traction for the third successive day on Tuesday. This also marked the fifth day of a positive move in the previous six and pushed the pair to the highest level since early October.

WTI crude oil remained well within the striking distance of a multi-week low touched on Monday, which, in turn, undermined the commodity-linked loonie. Apart from this, the prevalent bullish sentiment surrounding the US dollar turned out to be a key factor that acted as a tailwind for the USD/CAD pair.

The market reacted little after the US announced to release 50 million barrels of crude from the Strategic Petroleum Reserve. This was the first coordinated move with some of the world's largest oil consumers, like China, India, South Korea, Japan and Britain, in an attempt to cool oil prices.

Meanwhile, the USD remained well supported by growing acceptance that the Fed would raise interest rates sooner rather than later to contain stubbornly high inflation. The bets increased further after US President Joe Biden nominated Jerome Powell to serve as the Fed chairman for a second term.

The fundamental backdrop seems tilted in favour of bullish traders and supports prospects for additional gains. That said, RSI on the daily chart has just started moving into the overbought territory and warrants some caution ahead of Tuesday's release of the flash US PMIs for November.

Technical levels to watch

- USD/TRY shot momentarily above 13.00 and nearly hit 13.50, before sharply dropping back, as volatile lira conditions worsen.

- With no signs of an about-face in inappropriately dovish CBRT policy, the lira remains highly vulnerable to further selling.

Rapid depreciation in the value of the Turkish lira has accelerated as the start of the US trading session draws closer. USD/TRY is experiencing highly volatile trading conditions and just in the last hour underwent what might be described as a flash crash, vaulting above 13.00 and as high as 13.50 only to then reverse back to the 12.70s in a matter of minutes. At current levels just under 13.00, the pair is up by over 12% on the day, taking its gains on the month to more than 30% and gains on the year to north of 70%. That means that the Turkish lira has now lost over 40% of its worth when compared to the US dollar this year.

The selling pressure reflects a continued flight of capital out of the country as fears continue to build that Turkish President Recep Erdogan’s steps to undermine central bank independence risk sending the country into hyperinflation and economic ruin. USD/TRY upside was worsened on Tuesday morning after Turkish President Recep Erdogan rebuffed the notion of an early election, saying the date is set to June 2023. Amid the recent tumble in the value of the lira, opposition parties have been calling for an early election.

The Turkish President on Monday defended the CBRT’s recent decision to continue cutting interest rates (to 14.00%), despite inflation in October closing in on 20%, and vowed to win his “economic war of independence”. Erdogan unconventionally believes that inflation can be brought under control by lowering interest rates, not raising them, and has destroyed any semblance of CBRT independence by firing officials who refuse to do his bidding.

Former central bank deputy governor Semih Tumen, who was fired by Erdogan last month, wrote scathing criticism of CBRT policy on Twitter. “This irrational experiment which has no chance of success must be abandoned immediately and we must return to quality policies which protect the Turkish lira's value and the prosperity of the Turkish people” he said. As the lira’s tumble accelerates, analysts are already now starting to expect that the CBRT is going to be forced into implementing emergency rate hikes. But there are no signs of such a policy shift just yet, and as such, the lira remains highly vulnerable to further selling pressure.

- EUR/USD struggled to capitalize on its modest intraday recovery from a multi-month low.

- Fresh COVID-19 jitters undermined the euro and capped the upside amid a stronger USD.

- Hawkish Fed expectations, elevated US bond yields acted as a tailwind for the greenback.

The EUR/USD pair surrendered a major part of its intraday gains and retreated back below mid-1.1200s heading into the North American session.

The pair gained some positive traction on Tuesday and recovered around 50 pips from the 1.1225 area, or the lowest level since July 2020. The uptick was further supported by upbeat German/Eurozone PMI prints for November, though a combination of factors capped the upside for the EUR/USD pair.

Investors now seem concerned about the economic fallout from the rising number of COVID-19 infections and the reimposition of lockdown measures in Europe. This could provide the European Central Bank (ECB) another reason to be more dovish, which, in turn, acted as a headwind for the shared currency.

On the other hand, the prospects for an early policy tightening by the Fed assisted the US dollar to hold steady near a 16-month peak. The markets bets were reinforced after US President Joe Biden nominated Jerome Powell to serve as the chairman of the Federal Reserve for a second term.

Meanwhile, expectations for an eventual Fed rate hike move pushed the yield on the benchmark 10-year US government bond back above the 1.65% threshold. This was seen as another factor that underpinned the greenback and kept a lid on any meaningful recovery for the EUR/USD pair, at least for now.

Market participants now look forward to the release of the flash US PMIs for some impetus during the early North American session. The focus, however, will be on Wednesday's release of the Prelim (second estimate) US Q3 GDP, Durable Goods Orders, Core PCE Price Index and the FOMC meeting minutes.

Technical levels to watch

Bank of England Monetary Policy Committee member Jonathon Haskel said on Tuesday that the path of interest rates is upwards, according to Reuters. Haskel noted that a rise in rates to above emergency levels should be seen as a symptom of the economic recovery and that he is optimistic about the outlook for a recovery in UK productivity.

If monetary policy is too accommodative, he continued, we may have a problem with second-round inflation effects and we are trying to be vigilant to understand if the labour market is persistently tight. We need to see clear evidence of both a recovery in the size of the economy and on strength of the labour market before raising rates.

Market Reaction

Haskel's comments might be interpreted as dovish given that he mentioned how clear evidence of a recovery in the size of the economy was also a condition for rate hikes, rather than just clear evidence of a tight labour market. Some might see this as Haskel raising the bar for a first 15bps rate hike in December.

Nonetheless, GBP/USD has not reacted to Haskel's comments and continues to trade lower by about 0.3% on the session in the 1.3350 area.

The White House announced on Tuesday that it will make up to 50M barrels of oil available from the Strategic Petroleum Reserve (SPR), according to Reuters. 32M barrels will be sold over the next several months, while 18M in sales over the next few months will speed up sales already authorised by the US Congress.

The White House added that China, India, South Korea, Japan and the UK would also be releasing oil reserves in tandem with the US, and that the Biden administration stands ready to take additional action on oil prices if necessary.

The release is in line with market expectations. Analysts at Citi had previously estimated that the US could release between 45M and 60M barrels from its reserves. The bank said that when the release of reserves by other nations was taken into account, 100-120M barrels of oil could end up being released.

Market Reaction

Oil markets have seen a bit of chop in recent trade, but front-month WTI futures remain broadly in line with where they were prior to the announcement around the $75.70-$75.80 area. On the day, WTI is down just under 1.0%.

- Brexit woes dragged GBP/USD lower for the third successive day on Tuesday.

- Bulls seemed unimpressed by stronger UK PMIs for the month of November.

- Hawkish Fed expectations underpinned the USD and added to the selling bias.

The GBP/USD pair continued losing ground through the mid-European session and dropped back closer to mid-1.3300s, or monthly low set on November 12.

The impasse over the post-Brexit arrangement in Northern Ireland and fishing rights continued acting as a headwind for the British pound. This, in turn, was seen as a key factor that dragged the GBP/USD pair lower for the third successive day on Tuesday. Relations between Britain and the European Union have deteriorated recently after the UK threatened to trigger Article 16, potentially leading to a trade war.