- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-11-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 02:30 (GMT) | Australia | RBA Assist Gov Debelle Speaks | |||

| 07:00 (GMT) | Germany | GDP (QoQ) | Quarter III | -9.8% | 8.2% |

| 07:00 (GMT) | Germany | GDP (YoY) | Quarter III | -11.3% | -4.3% |

| 09:00 (GMT) | Germany | IFO - Current Assessment | November | 90.3 | |

| 09:00 (GMT) | Germany | IFO - Expectations | November | 95.0 | |

| 09:00 (GMT) | Germany | IFO - Business Climate | November | 92.7 | |

| 11:00 (GMT) | United Kingdom | CBI retail sales volume balance | November | -23 | -35 |

| 12:05 (GMT) | Japan | BOJ Governor Haruhiko Kuroda Speaks | |||

| 14:00 (GMT) | U.S. | Housing Price Index, m/m | September | 1.5% | 1.1% |

| 14:00 (GMT) | U.S. | Housing Price Index, y/y | September | 8% | |

| 14:00 (GMT) | Belgium | Business Climate | November | -8.5 | |

| 14:00 (GMT) | U.S. | S&P/Case-Shiller Home Price Indices, y/y | September | 5.2% | 5% |

| 14:00 (GMT) | Eurozone | ECB President Lagarde Speaks | |||

| 15:00 (GMT) | U.S. | Richmond Fed Manufacturing Index | November | 29 | |

| 15:00 (GMT) | U.S. | Consumer confidence | November | 100.9 | 98 |

| 16:00 (GMT) | U.S. | FOMC Member James Bullard Speaks | |||

| 17:00 (GMT) | U.S. | FOMC Member Williams Speaks | |||

| 17:45 (GMT) | Canada | Gov Council Member Wilkins Speaks | |||

| 17:45 (GMT) | U.S. | FOMC Member Clarida Speaks |

FXStreet notes that the pound is the best performing G10 currency on a one day view on the back of both Brexit-related optimism and on hope that the UK economy can benefit significantly from vaccination against COVID-19. Nonetheless, economists at Rabobank expect the EUR/GBP pair to stabilize around the 0.88-0.89 area in the coming months.

“EUR/GBP is currently not trading far above the November low around 0.8861. This area provided decent support both in June and in September, indicating that a break lower could pave the way for a move towards the 0.87 area.”

“GBP still has a lot of hurdles to clear before investor confidence can increase another couple of notches and UK politics has the potential to sour the mood. We are expecting that EUR/GBP will trade mostly in the 0.88/0.89 region in the coming months. “

“There is scope for a relief rally in GBP on news that a deal has been signed, though the failure of the UK and EU to agree a comprehensive deal will likely limit upside potential.”

FXStreet reports that analysts at Natixis estimate that the US stock market index is almost at its equilibrium level, but that the eurozone index is still 20% below its equilibrium level.

“In the medium-term, the share of money in wealth must remain stable, equal to its optimal share. This means that total wealth increases in line with the money supply and that share prices rise in line with the money supply.”

“We see that the proportionality between the money supply, wealth and the stock market index implies in the United States, that equilibrium wealth is currently 21% higher than actual wealth and the equilibrium share price (S&P 500) is 3% higher than the actual share price and in the eurozone, that equilibrium wealth is currently 26% higher than actual wealth and the equilibrium share price (EuroStoxx) is 20% higher than the actual share price.”

Preliminary

data released by IHS Markit on Monday pointed to further robust growth in

business activity during November, at the fastest pace for over five-and-a-half

years.

According to

the report, the Markit flash manufacturing purchasing manager's index (PMI)

came in at 56.7 in November, up from 53.4 in October. That was the highest

reading since September 2014. Economists had expected the reading to edge down

to 53.0. A reading above 50 signals an expansion in activity, while a reading

below this level signals a contraction. The gain was underpinned by a marked

expansion in output, largely driven by a significant uptick in new business as

demand conditions improved. Moreover, the rise in production was the quickest since

March 2015.

Meanwhile, the

Markit flash services purchasing manager's index (PMI) rose to 57.7 in November

from 56.9 in the previous month. The latest reading signal the strongest

expansion in output since March 2015. Economists had expected the reading to drop

to 55.3. Contributing to the sharp increase in business activity was a faster growth

in new orders at service providers and one that was the quickest since September

2018.

Overall, IHS

Markit Flash U.S. Composite PMI Output Index came in at 57.9 in November, up

from 56.3 in October, signaling the fastest increase in private sector business

activity since March 2015.

Chris

Williamson, Chief Business Economist at HIS Markit noted: “November PMI surveys

provide the first post-election snapshot of the US economy, and makes for very

encouraging reading, though stronger economic growth is quite literally coming

at a price.”

U.S. stock-index futures rose on Monday as another encouraging vaccine update fueled hopes for a quick economic recovery next year.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | - | - | - |

Hang Seng | 26,486.20 | +34.66 | +0.13% |

Shanghai | 3,414.49 | +36.76 | +1.09% |

S&P/ASX | 6,561.60 | +22.40 | +0.34% |

FTSE | 6,340.95 | -10.50 | -0.17% |

CAC | 5,521.32 | +25.43 | +0.46% |

DAX | 13,207.83 | +70.58 | +0.54% |

Crude oil | $42.88 | +1.08% | |

Gold | $1,865.70 | -0.36% |

FXStreet reports that analysts at Credit Suisse note that S&P 500 ideally holds support at 3542/37 for an eventual break above 3629 for the completion of a bullish “pennant” pattern to reinforce the existing and larger bullish “triangle” pattern.

“Resistance stays seen at 3585/89 initially, then the near-term downtrend at 3611. Above 3629 remains needed to clear the way for a retest of the current high at 3645, then trend resistance from February, now at 3672, with fresh sellers expected here for now. Through this latter level is needed to inject momentum to the rally with resistance then seen at 3700 next, then 3765. “

“Below 3542/37 would warn of a retreat back to 3519/09, but with fresh buyers expected here.”

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 173.2 | 0.31(0.18%) | 4180 |

ALCOA INC. | AA | 19.27 | 0.45(2.39%) | 11580 |

ALTRIA GROUP INC. | MO | 40.15 | 0.21(0.53%) | 21402 |

Amazon.com Inc., NASDAQ | AMZN | 3,112.00 | 12.60(0.41%) | 75653 |

American Express Co | AXP | 114 | 1.42(1.26%) | 3827 |

AMERICAN INTERNATIONAL GROUP | AIG | 39.03 | 0.42(1.09%) | 2099 |

Apple Inc. | AAPL | 117.33 | -0.01(-0.01%) | 767353 |

AT&T Inc | T | 28.49 | 0.17(0.60%) | 120043 |

Boeing Co | BA | 202.29 | 2.67(1.34%) | 354973 |

Chevron Corp | CVX | 87.1 | 1.31(1.53%) | 26484 |

Cisco Systems Inc | CSCO | 40.96 | -0.01(-0.02%) | 60585 |

Citigroup Inc., NYSE | C | 52.41 | 0.76(1.47%) | 70002 |

Deere & Company, NYSE | DE | 260.52 | 1.96(0.76%) | 1394 |

E. I. du Pont de Nemours and Co | DD | 62.58 | 0.03(0.05%) | 2665 |

Exxon Mobil Corp | XOM | 37.63 | 0.69(1.87%) | 139328 |

Facebook, Inc. | FB | 270.82 | 1.12(0.42%) | 80474 |

FedEx Corporation, NYSE | FDX | 279 | 2.31(0.83%) | 4630 |

Ford Motor Co. | F | 8.8 | 0.06(0.69%) | 464433 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 21.44 | 0.19(0.89%) | 56271 |

General Electric Co | GE | 9.87 | 0.11(1.13%) | 757293 |

General Motors Company, NYSE | GM | 43.55 | 0.51(1.18%) | 70213 |

Goldman Sachs | GS | 226.05 | 2.70(1.21%) | 3701 |

Google Inc. | GOOG | 1,746.04 | 3.85(0.22%) | 5942 |

Hewlett-Packard Co. | HPQ | 20.66 | 0.21(1.03%) | 5227 |

Home Depot Inc | HD | 270.7 | 0.89(0.33%) | 8566 |

HONEYWELL INTERNATIONAL INC. | HON | 202.43 | 0.43(0.21%) | 726 |

Intel Corp | INTC | 45.51 | 0.12(0.25%) | 124324 |

International Business Machines Co... | IBM | 117.72 | 0.78(0.67%) | 8721 |

International Paper Company | IP | 49.88 | 0.45(0.91%) | 846 |

Johnson & Johnson | JNJ | 146.61 | 1.26(0.87%) | 32288 |

JPMorgan Chase and Co | JPM | 116 | 1.43(1.25%) | 37235 |

McDonald's Corp | MCD | 214.8 | 0.71(0.33%) | 2960 |

Merck & Co Inc | MRK | 81.52 | 1.07(1.33%) | 68640 |

Microsoft Corp | MSFT | 210.73 | 0.34(0.16%) | 155171 |

Nike | NKE | 133.6 | 0.62(0.47%) | 5246 |

Pfizer Inc | PFE | 37.07 | 0.37(1.01%) | 1042117 |

Procter & Gamble Co | PG | 139.67 | 0.37(0.27%) | 4221 |

Starbucks Corporation, NASDAQ | SBUX | 97.7 | 0.69(0.71%) | 6292 |

Tesla Motors, Inc., NASDAQ | TSLA | 499.9 | 10.29(2.10%) | 708382 |

The Coca-Cola Co | KO | 53.06 | 0.39(0.74%) | 21040 |

Travelers Companies Inc | TRV | 134.94 | 0.39(0.29%) | 301 |

Twitter, Inc., NYSE | TWTR | 44.96 | 0.28(0.63%) | 64710 |

UnitedHealth Group Inc | UNH | 337 | 2.30(0.69%) | 2721 |

Verizon Communications Inc | VZ | 60.25 | 0.21(0.35%) | 6894 |

Visa | V | 205 | 1.12(0.55%) | 12352 |

Wal-Mart Stores Inc | WMT | 151 | 0.76(0.51%) | 39314 |

Walt Disney Co | DIS | 142.43 | 1.36(0.96%) | 30882 |

Yandex N.V., NASDAQ | YNDX | 62.8 | 0.86(1.39%) | 16246 |

The Chicago

Federal Reserve announced on Monday the Chicago Fed national activity index

(CFNAI), a weighted average of 85 different economic indicators, came in at 0.83

in October, up from an upwardly revised 0.32 in August (originally 0.27),

pointing to faster growth in economic activity than in the previous month.

At the same

time, the index’s three-month moving average fell to +0.51 in October from

+0.55 in September.

According to

the report, three of the four broad categories of indicators used to construct

the index made positive contributions in October, and three of the four

categories increased from September.

Production-related

indicators made a positive contribution of +0.36 to the CFNAI in October, up

from -0.10 in September. Employment-related indicators contributed +0.39 to the

CFNAI in October, up from +0.30 in September. The contribution of the sales,

orders, and inventories category to the CFNAI improved to +0.08 in October from

a neutral value in September. Meanwhile, the contribution of the personal

consumption and housing category to the CFNAI moved down to -0.01 in October

from +0.12 in September.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 08:15 | France | Services PMI | November | 46.5 | 37.7 | 38 |

| 08:15 | France | Manufacturing PMI | November | 51.3 | 50.1 | 49.1 |

| 08:30 | Germany | Services PMI | November | 49.5 | 46.3 | 46.2 |

| 08:30 | Germany | Manufacturing PMI | November | 58.2 | 56.5 | 57.9 |

| 09:00 | Eurozone | Services PMI | November | 46.9 | 42.5 | 41.3 |

| 09:00 | Eurozone | Manufacturing PMI | November | 54.8 | 53.1 | 53.6 |

| 09:30 | United Kingdom | Purchasing Manager Index Manufacturing | November | 53.7 | 50.5 | 55.2 |

| 09:30 | United Kingdom | Purchasing Manager Index Services | November | 51.4 | 42.5 | 45.8 |

GBP rose against its major rivals in the European session on Monday, as another encouraging vaccine update bolstered risk appetite, while investors continued monitoring the progress of the UK-EU trade negotiations.

British drug giants AstraZeneca (AZN) announced on Monday that its COVID-19 vaccine, developed in collaboration with the University of Oxford, showed an average efficacy rate of 70% in protecting against the virus. The announcement came after promising vaccine results from Pfizer (PFE)/BioNTech (BNTX) and Moderna (MRNA) earlier this month (their Covid vaccines were nearly 95% effective).

The news added to hopes that the working COVID vaccine could help to bring an end to the coronavirus pandemic that had killed more than 1.3 million people worldwide.

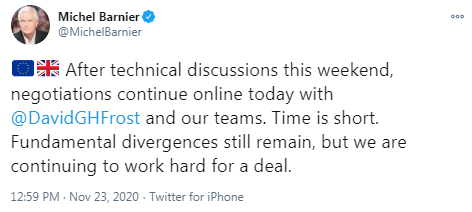

Market participants also continue to monitor Brexit headlines. The trade negotiations between the UK and the EU are to go online today as one member of the EU team contracted Covid-19. The EU's chief negotiator Barnier tweeted in the morning that "fundamental divergences still remain, but we are continuing to work hard for a deal." Meanwhile, Brussels correspondent for France 24 Dave Keating reported that he was hearing rumours that an emergency "temporary Brexit deal" could be agreed this week "to avoid no-deal happening in midst of COVID-19". He also pointed out that "this will not be a deal". "It's essentially an extension. The problem doesn't go away," he added.

Most investors still believe that the two sides will be able to clinch an agreement before the transition period ends on December 31.

FXStreet notes that the Japanese yen has risen about 4.4% against the US dollar so far this year probably because of the market’s Risk On-Risk Off (RORO) fixation. In 2021, economists at HSBC believe FX will shift away from RORO behaviour to relative economic growth. With a benign domestic growth outlook and probable outflows, they expect a less resilient JPY in the year ahead.

“We believe RORO will be superseded in 2021 by a greater fixation on economic activity, in particular, the relative experience of different countries and their ability to secure a recovery amid the uncertainty of COVID-19.”

“Japan’s real GDP for Q3 2020 rose 5.0% over the previous quarter on a seasonally adjusted basis, which was better than expected. But our economists cautioned that the level of GDP remains well below the pre-COVID-19 level. ...the Bank of Japan will likely maintain its ultraloose policy stance in the foreseeable future, while new Prime Minister Suga has ordered the Cabinet to come up with a third supplementary budget earlier this month that could exceed 3% of GDP.”

“With longer-dated US yields rising again (relative to the previous quarter), the discussions around Japanese investors hedging their buying of foreign assets, or even slowing them, look likely to fade. Such outflows are likely to persist and contribute to JPY weakness. All this points to a less resilient performance from the JPY, which we see USD/JPY rising gradually in the year ahead.”

- Hopeful that we could see outlines of Brexit deal at the end of this week

- Moves will have to be made on key issues

- We get a sense from both negotiating teams that they have made progress

FXStreet notes that GBP/USD has opened the week strongly for a break above resistance at 1.3310/19 for the completion of a near-term bullish “triangle” continuation pattern to clear the way for a challenge on long-term resistance at 1.3472/1.3514, per Credit Suisse.

“GBP/USD has opened the week strongly for a break above resistance at 1.3310/19 as looked for - the 78.6% retracement of the September fall and recent high – for the completion of a near-term bullish ‘triangle’ continuation pattern. This should add weight to our core bullish view from September that we are in the process of forming the potential ‘right-hand shoulder’ to a major basing process for a move to 1.3403/09 next and eventually back to long-term price and ‘neckline’ resistance at 1.3472/1.3514.”

“Whilst a fresh rejection from the long-term resistance at 1.3472/1.3514 should be allowed for, we continue to look for an eventual break to see a major base secured, clearing the way for a move above 1.4300.”

FXStreet reports that economists at Danske Bank believe there will be tailwinds to the Norwegian krone from external factors, strong domestics and the possibility of Norges Bank starting to raise rates next year and expect a downward sloping path for EUR/NOK over the coming year projecting 10.40 in twelve months.

“Like those of its peers, the Norwegian recovery is experiencing a setback from new restrictions. That said, restrictions in Norway are far lighter than in most other European countries. We should expect activity and labour market data to level off in the coming months. With a stable to stronger NOK and lower capacity utilisation, we expect inflation to move towards the 2% target in the coming year.”

“In our base case, we expect continued support for NOK from the external environment and domestic economic outperformance and Norges Bank to lead the developed world’s hiking cycle. However, the topside seems capped by the oil price, limited potential for further USD weakness and relatively high-cost levels in Norway. In addition, in the very near-term seasonality fears may weigh.

“We project EUR/NOK at 10.80 in 1M, 10.60 in 3M, 10.50 in 6M and 10.40 in 12M.”

FXStreet reports that analysts at Credit Suisse apprise that NZD/USD continues to grind higher, prodding above the 0.6942/45 highs to test the even more important December 2018 high at 0.6970.

“Although we might see another reversal back lower, with a major base in place, as well as the recently completed bull ‘triangle’, we stay biased higher medium-term and look for an eventual clear close above the key 2019 and recent range highs at 0.6942/45.”

“Beyond 0.6945 would see the December 2018 high at 0.6970 just above. Removal of here in due course should subsequently see an acceleration of upside momentum, up to the June 2018 high at 0.7054/60 and eventually 0.7111/58.”

“First support is seen at 0.6913/05, then 0.6879/62, below which would trigger a correction back to the ‘neckline’ to the large base at 0.6811/6796."

FXStreet reports that FX Strategists at UOB Group see a probable move to 6.5200 if USD/CNH stays below 6.5500 in the next weeks.

Next 1-3 weeks: “We have held a negative view in USD for about 2 weeks now. In our latest narrative from Wednesday, we indicated that USD ‘is likely to weaken to further to 6.5200’. USD subsequently dropped to 6.5319 before staging a relatively robust recovery. Downward momentum has waned and unless USD can move and stay below 6.5500 within these 1 to 2 days, the prospect for a move to 6.5200 would diminish quickly. Conversely, a break of 6.6000 (no change in ‘strong resistance’ level) would indicate that the weak phase in USD has run its course.”

Reuters reports that Bank of England Chief Economist Andy Haldane said that the coronavirus crisis will leave lasting scars in the form of higher debt and unemployment, missed education and mental health problems, especially for people on the lowest incomes.

"The vaccine announcements of the past few weeks offer hope at the end of the tunnel," Haldane said.

"Nonetheless, even with a vaccine, it's clear this crisis will lead to some lasting scars, particularly on the poorest and the most disadvantaged."

Haldane said about two-thirds of the loss had been recouped so far, and hoped the recovery would prove sharper than after previous recessions, reflecting the speed of the collapse and the recent progress on vaccines.

"I think it's now reasonable and realistic to speak of next year as turning a leaf for us economically," he said.

FXStreet reports that economists at Danske Bank expect to see EUR/GBP move towards 0.86, If we get a simple free-trade agreement.

“In line with our expectation, negotiations have extended into November and we are still yet to see a Brexit agreement. We expect a deal in the second half of November but will be more concerned if there is no progress around 1 December, which we believe would weigh on GBP if this is the case.”

“As our base case remains a simple free-trade agreement covering goods and that a deal will be finalised over the next two to three weeks, we expect EUR/GBP to move lower in the very near term, supported by the positive vaccine news favouring cyclical currencies. We forecast 0.86 in 1-12 months, which we believe will be the new trading midpoint in the coming year, although we believe risk is skewed towards it going lower than 0.86 in the very near-term in the event of a deal. If we are wrong and instead head for no deal, we believe EUR/GBP will move markedly higher (yet stay below parity).”

eFXdata reports that TD Research discusses its case for staying positive on the USD in the near-term.

"Double-dip fears should help the case for more Fed easing and we expect officials to make QE more accommodative by lengthening the average maturity of purchases, probably in December. Fed is unlikely to be the only central bank doing its part to provide further accommodation, "TD notes.

So, we do not anticipate a major threat to the FX reaction function or our broad USD view. One additional factor that also adds some support to our defensive FX posture is that the pace of international reserve buying has tapered off. While we think that this may not necessarily mark the end of it, another major USD down-leg is not possible without the reserve community diversifying its holdings, we think," TD adds.

According to the report from IHS Markit/CIPS, business activity across the UK private sector decreased in November, which ended a four-month period of expansion. The downturn was driven by the fastest reduction in service sector output since May amid temporary business closures among leisure and hospitality companies. In contrast, manufacturing production expanded at a robust pace during November and the rate of growth accelerated since the previous month. The latest manufacturing PMI survey nonetheless pointed to a sharp lengthening of supplier delivery times amid severe delays at UK ports, alongside a robust degree of stock building as manufacturers sought to accumulate critical inputs before the end of the Brexit transition period on 31st December 2020.

Adjusted for seasonal influences, Flash UK Composite Output Index – which is based on approximately 85% of usual monthly replies – dropped from 52.1 in October to 47.4 in November and pointed to the sharpest downturn in overall business activity since May. The underperformance of the service economy (45.8) relative to the manufacturing sector (56.3) was the widest in almost 25 years of data collection, reflecting the severe impact on business activity from a second lockdown in England and tightened COVID-19 restrictions across the rest of the UK.

Manufacturing growth was mainly linked to a sustained recovery in production volumes after stoppages at the start of the pandemic. Survey respondents also commented on rising demand from export markets, especially in China and the EU. The latter was often linked to pre-purchasing due to Brexit uncertainty as European customers sought delivery of orders before the end of the transition period.

Looking ahead, private sector companies remain optimistic that business activity will increase during the next 12 months. The degree of optimism improved since October and was the strongest since March 2015. While some firms simply commented on an expected rebound from low levels of activity in November, there were also widespread reports that hopes of an end to COVID-19 restrictions and positive vaccine news had spurred business confidence about the year ahead.

According to the report from IHS Markit, Eurozone business activity fell sharply in November as countries introduced more aggressive measures to counter rising coronavirus disease 2019 (COVID19) infection rates.

The flash Eurozone Composite PMI slumped from 50.0 in October to 45.1 in November, its lowest since May. With the exceptions of the declines seen in the first two quarters of this year, the average PMI reading of 47.6 in the fourth quarter so far is the lowest since the closing quarter of 2012 (during the region’s debt crisis) and indicative of a steep decline in GDP.

The deteriorating performance was broad-based, albeit with the service sector hardest hit from virus containment measures. While manufacturing output growth merely slowed in November to the lowest since the start of the sector’s recovery back in July, attributable to a marked slowing in order book growth, service sector output fell for a third month running, with the rate of decline accelerating sharply to the fastest since May.

Inflows of new orders rose in manufacturing at the slowest rate recorded over the past five months, while new business placed at service providers collapsed to an extent not seen since May. Hospitality, travel and consumer-facing companies reported especially weak demand due to additional measures implemented by various governments across the region amid second waves of virus infections.

Looking ahead, business expectations about the coming 12 months recovered most of the slump seen in October to run at the second highest since February. Manufacturers were especially upbeat, with confidence rising to the strongest since March 2018, though service providers also grew more optimistic about the year ahead, commonly attributed to encouraging news of vaccine developments in recent weeks.

According to the report from IHS Markit, new lockdown measures to curb the spread of coronavirus disease 2019 (COVID-19) led to an accelerated decline in services activity across Germany in November. However, the country’s manufacturing sector continued to exhibit strong growth, helping to support overall economic activity. Elsewhere, the recent progress in the development of COVID-19 vaccines saw business confidence towards future output perk up to the highest for over two-and-a-half years.

The Germany Composite Output Index fell to its lowest for five months in November. However, at 52.0, from 55.0 in October, it remained comfortably above its level in the second quarter of the year during the initial lockdown phase. Services business activity (index at 46.2) contracted for the second month in a row in November, with the rate of decline accelerating to the quickest seen since May amid closures across the hospitality and leisure industry. The manufacturing output index meanwhile remained elevated at 62.7, albeit down from October’s peak of 65.1 – its first correction for seven months.

Service providers recorded a marked drop in inflows of new work that was the steepest for six months, which they linked not only to the restrictions on activity, but also hesitancy amongst clients. By contrast, manufacturing order books extended their recent recovery, helped by rising exports sales, albeit with the data highlighting some loss of momentum in the rate of growth. Overall private sector new business rose marginally and at the slowest rate for five months.

Flash data pointed to a broad-based increase in firms’ expectations for output in the year ahead. Buoyed in particular by growing hopes that an effective vaccine would bring about more normal operating conditions over the next 12 months, business confidence rose sharply to its highest since March 2018. Service providers recorded the most notable improvement in sentiment since October, though it was manufacturers who generally remained the most upbeat about the outlook.

During today's Asian trading, the US dollar fell against major world currencies amid increased risk appetite in global markets due to news about the possibility of an early start of vaccination against COVID-19 in the States.

Moncef Slaoui, head of the US government's pre-vaccination program, said that vaccination in the US could begin as early as December 11-12. On Friday, US Pfizer Inc. and Germany's BioNTech applied for emergency use in the US of their coronavirus vaccine.

Experts note that the news about vaccines suggests that the global economic recovery will begin sooner rather than later, and the dollar is therefore losing its attractiveness as a "safe haven"asset. In general, the current news background is positive for risky assets and negative for the dollar, especially given the continuation of the ultra-soft policy of the Federal reserve system.

The ICE index, which tracks the dollar's performance against six currencies (the euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), fell 0.15%.

CNBC reports that at the conclusion of the historic G-20 summit in Saudi Arabia leaders of the world’s 20 biggest economies have pledged to address the global recession caused by the coronavirus and outlined plans to accelerate an equitable and sustainable recovery.

“We are committed to leading the world in shaping a strong, sustainable, balanced and inclusive post-COVID-19 era,” G-20 leaders said.

“The COVID-19 pandemic and its unprecedented impact in terms of lives lost, livelihoods and economies affected, is an unparalleled shock that has revealed vulnerabilities in our preparedness and response and underscored our common challenges,” the final communique said.

The group pledged to “spare no effort to protect lives, provide support with a special focus on the most vulnerable, and put our economies back on a path to restoring growth, and protecting and creating jobs for all.”

The G-20 also pledged to mobilize more resources to address the immediate financing needs to support the research, development, manufacturing, and distribution of safe and effective Covid-19 diagnostics, therapeutics and vaccines.

FXStreet reports that according to FX Strategists at UOB Group, EUR/USD is expected to navigate between 1.1840 and 1.1890 in the very near-term.

24-hour view: “We expected EUR to strengthen last Friday but we were of the view that ‘a break of the major resistance at 1.1920 is unlikely’. EUR subsequently rose to a high of 1.1890 before easing off and traded sideways for the rest of the sessions. The movement is viewed as part of a consolidation phase and EUR could trade sideways, expected to be within a 1.1840/1.1890 range. Looking forward, 1.1890 is acting as a solid resistance and break of this level could potentially lead to a rapid rise towards the major resistance at 1.1920.”

RTTNews reports that Statistics New Zealand said that retail sales volume in New Zealand soared a record 28.0 percent on quarter in the third quarter of 2020, recovering from the 14.6 percent drop in the Covid-19 ravaged second quarter.

On a yearly basis, retail sales volume advanced 8.3 percent after sinking 14.2 percent in the three months prior.

By industry, the main movements were: electrical and electronic goods retailing, up 28 percent; motor vehicle and parts retailing, up 14 percent; hardware, building, and garden supplies, up 14 percent; supermarket and grocery stores, up 4.7 percent; department stores, up 12 percent; and recreational goods retailing, up 17 percent.

Food and beverage services had the largest fall, down 6.2 percent, followed by accommodation, down 8.1 percent.

The value of retail sales was up 7.4 percent on year in Q3, with 14 of the 16 regions showing higher sales values.

The total value of stock held was NZ$8.0 billion, down 4.7 percent (NZ$394 million), compared with a year earlier. Ten of the 15 retail industries recorded falls in stock in September 2020 compared with September 2019.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1968 (1392)

$1.1933 (4211)

$1.1906 (2003)

Price at time of writing this review: $1.1876

Support levels (open interest**, contracts):

$1.1830 (128)

$1.1807 (1032)

$1.1775 (2426)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 4 is 104169 contracts (according to data from November, 20) with the maximum number of contracts with strike price $1,1200 (6550);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3453 (1524)

$1.3393 (2518)

$1.3350 (2185)

Price at time of writing this review: $1.3325

Support levels (open interest**, contracts):

$1.3209 (1000)

$1.3160 (697)

$1.3096 (1258)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 24826 contracts, with the maximum number of contracts with strike price $1,3500 (2750);

- Overall open interest on the PUT options with the expiration date December, 4 is 40597 contracts, with the maximum number of contracts with strike price $1,2700 (11992);

- The ratio of PUT/CALL was 1.64 versus 1.69 from the previous trading day according to data from November, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -106.97 | 25527.37 | -0.42 |

| Hang Seng | 94.57 | 26451.54 | 0.36 |

| KOSPI | 6.08 | 2553.5 | 0.24 |

| ASX 200 | -8 | 6539.2 | -0.12 |

| FTSE 100 | 17.1 | 6351.45 | 0.27 |

| DAX | 51.09 | 13137.25 | 0.39 |

| CAC 40 | 21.23 | 5495.89 | 0.39 |

| Dow Jones | -219.75 | 29263.48 | -0.75 |

| S&P 500 | -24.33 | 3557.54 | -0.68 |

| NASDAQ Composite | -49.74 | 11854.97 | -0.42 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 08:15 (GMT) | France | Services PMI | November | 46.5 | 37.7 |

| 08:15 (GMT) | France | Manufacturing PMI | November | 51.3 | 50.1 |

| 08:30 (GMT) | Germany | Services PMI | November | 49.5 | 46.3 |

| 08:30 (GMT) | Germany | Manufacturing PMI | November | 58.2 | 56.5 |

| 09:00 (GMT) | Eurozone | Services PMI | November | 46.9 | 42.5 |

| 09:00 (GMT) | Eurozone | Manufacturing PMI | November | 54.8 | 53.1 |

| 09:30 (GMT) | United Kingdom | Purchasing Manager Index Manufacturing | November | 53.7 | 50.5 |

| 09:30 (GMT) | United Kingdom | Purchasing Manager Index Services | November | 51.4 | 42.5 |

| 13:30 (GMT) | U.S. | Chicago Federal National Activity Index | October | 0.27 | |

| 14:45 (GMT) | U.S. | Manufacturing PMI | November | 53.4 | 53 |

| 14:45 (GMT) | U.S. | Services PMI | November | 56.9 | 55.3 |

| 18:00 (GMT) | U.S. | FOMC Member Daly Speaks | |||

| 20:00 (GMT) | U.S. | FOMC Member Charles Evans Speaks |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.