- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-09-2014

(raw materials / closing price /% change)

Light Crude 91.68 +0.13%

Gold 1,223.70 +0.14%

(index / closing price / change items /% change)

Hang Seng 23,837.07 -118.42 -0.49%

S&P/ASX 200 5,415.73 +52.77 +0.98%

Shanghai Composite 2,309.72 +19.85

FTSE 100 6,676.08 -97.55 -1.44%

CAC 40 4,359.35 -83.20 -1.87%

Xetra DAX 9,595.03 -154.51 -1.58%

S&P 500 1,982.77 -11.52 -0.58%

NASDAQ Composite 4,508.69 -19.00 -0.42%

Dow Jones 17,055.87 -116.81 -0.68%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2847 +0,01%

GBP/USD $1,6388 +0,17%

USD/CHF Chf0,9396 -0,03%

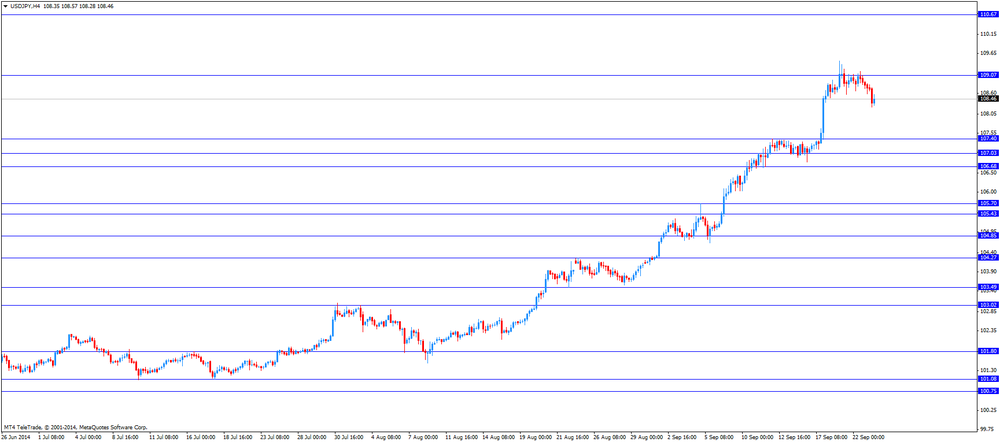

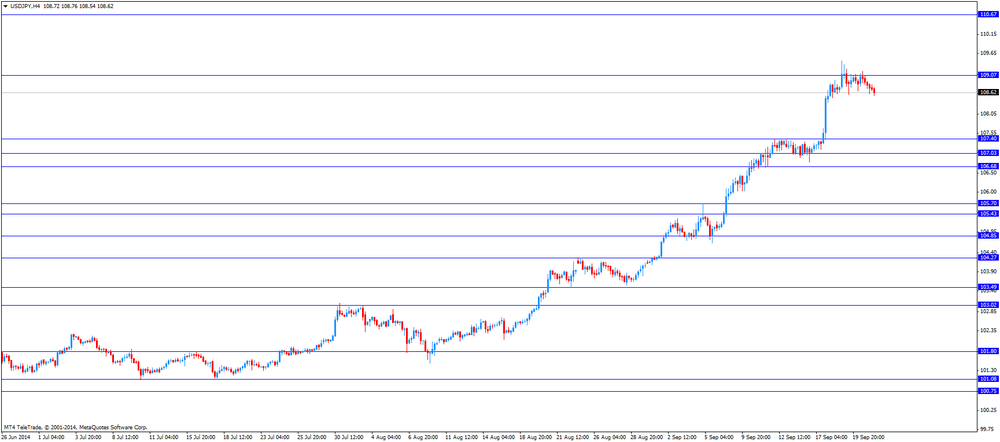

USD/JPY Y108,85 +0,03%

EUR/JPY Y139,86 +0,06%

GBP/JPY Y178,39 +0,21%

AUD/USD $0,8844 -0,27%

NZD/USD $0,8065 -0,57%

USD/CAD C$1,1074 +0,33%

(time / country / index / period / previous value / forecast)

00:00 Australia Conference Board Australia Leading Index July +0.4%

01:30 Australia RBA Financial Stability Review

01:35 Japan Manufacturing PMI (Preliminary) September 52.2 52.5

06:00 Switzerland UBS Consumption Indicator August 1.66

08:00 Germany IFO - Business Climate September 106.3 105.9

08:00 Germany IFO - Current Assessment September 111.1 110.6

08:00 Germany IFO - Expectations September 101.7 101.3

13:00 Belgium Business Climate September -7.3 -7.1

13:00 Switzerland SNB Quarterly Bulletin Quarter III

14:00 U.S. New Home Sales August 412 432

14:30 U.S. Crude Oil Inventories September +3.7

16:05 U.S. FOMC Member Narayana Kocherlakota

Stock indices closed lower. Weaker manufacturing and services purchasing managers' index from the Eurozone weighed on markets.

Eurozone's preliminary manufacturing purchasing managers' index (PMI) declined to 50.5 in September from 50.7 in August, missing expectations for a fall to 50.6.

Eurozone's preliminary services PMI decreased to 52.8 in September from 53.1 in August, missing expectations for a rise to 53.2.

Germany's preliminary manufacturing purchasing managers' index fell to 50.3 in September from 51.4 in August, missing expectations for a decline to 51.3.

Germany's preliminary services PMI rose to 55.4 in September from 54.9 in August, beating expectations for a drop to 54.6.

France's preliminary manufacturing purchasing managers' index increased to 48.8 in September from 46.9 in August, exceeding expectations for a gain to 47.1.

France's preliminary services PMI dropped to 49.4 in September from 50.3 in August, missing expectations for a decrease to 50.2.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,676.08 -97.55 -1.44%

DAX 9,595.03 -154.51 -1.58%

CAC 40 4,359.35 -83.20 -1.87%

Brent prices fell moderately, being at the same time near two-year low, while WTI oil prices have increased markedly. Market participants are watching the situation in Libya and Iraq, as well as assess the current data for China.

As it became known, preliminary index of purchasing managers (PMI), published by HSBC, in September amounted to 50.5 points against 50.2 in August. This value was higher than the average forecast of experts at the level of 50 points.

"Data on the PMI market reduced concern that slowing growth will affect demand in China. Today it is the basis for the price increase, "- said the analyst Samsung Futures Inc. Sung Hung Chi. According to the International Energy Agency, this year the share of China will have about 11% of world oil consumption.

However, market participants do not expect a further rise in oil prices. "Although the data for China are pleasantly surprised, the effect is not as large as the market is now more concerned about the proposal, rather than demand," - analyst Landesbank Baden-Wuerttemberg Frank Klump. According to OPEC, the cartel's production countries rose in August to 230 thousand. Barrels per day to 30.34 million barrels, or 0.5 million barrels higher than production in June.

Many investors now expect to report on commercial stocks in the United States for storage the previous week, which will be presented tomorrow. It is expected that crude oil inventories to rise slightly to 750 thousand barrels, distillate 300 thousand, and gasoline consumption will be reduced by 350 thousand. Any deviations from the predictions of 1 million. Barrels and above may be the reason for large-scale movements.

Small effect also had reports that the United States for the first time in conjunction with the five partner countries began air strikes on positions applied group "Islamic State" on Syrian territory. Air strikes are part of the military campaign, the Obama administration has approved nearly two weeks ago and aimed at the "deterioration and, ultimately, the destruction of" militants.

The cost of the November futures for the American light crude oil WTI (Light Sweet Crude Oil) rose to $ 91.59 a barrel on the New York Mercantile Exchange (NYMEX).

November futures price for North Sea Brent crude oil mixture fell $ 0.14 to $ 96.80 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded higher against the most major currencies after the U.S. economic data. The preliminary U.S. manufacturing purchasing managers' index remained unchanged at 57.9 in September, missing expectations for an increase to 58.1.

The Federal Reserve Bank of Richmond's manufacturing index climbed to 14 in September from 12 in August, beating forecasts for a decrease to 10.

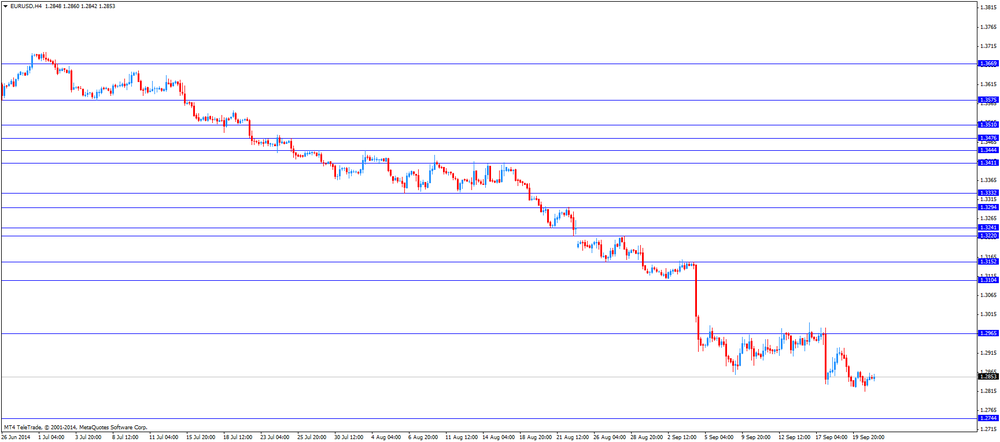

The euro rose against the U.S. dollar despite the weak manufacturing and services purchasing managers' index from the Eurozone. Eurozone's preliminary manufacturing purchasing managers' index (PMI) declined to 50.5 in September from 50.7 in August, missing expectations for a fall to 50.6.

Eurozone's preliminary services PMI decreased to 52.8 in September from 53.1 in August, missing expectations for a rise to 53.2.

Germany's preliminary manufacturing purchasing managers' index fell to 50.3 in September from 51.4 in August, missing expectations for a decline to 51.3.

Germany's preliminary services PMI rose to 55.4 in September from 54.9 in August, beating expectations for a drop to 54.6.

France's preliminary manufacturing purchasing managers' index increased to 48.8 in September from 46.9 in August, exceeding expectations for a gain to 47.1.

France's preliminary services PMI dropped to 49.4 in September from 50.3 in August, missing expectations for a decrease to 50.2.

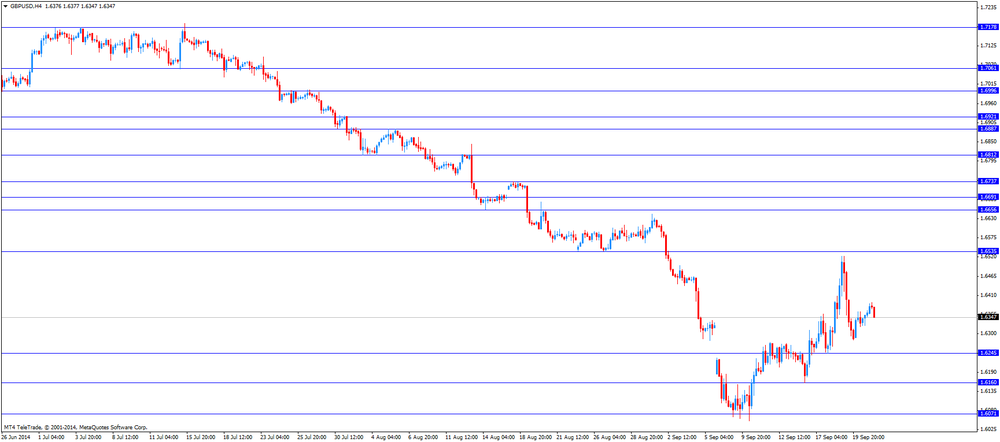

The British pound traded lower against the U.S. dollar. The number of mortgage approvals decreased to 41,588 in August from 42,715 in July, missing expectations for an increase to 42,900.

The U.K. public sector net borrowing posted a surplus of £10.9 billion in August, after a deficit of £0.47 billion in July. July's figure was revised from a deficit of £1.10 billion. Analysts had expected a surplus of £10.3 billion.

The Canadian dollar dropped against the U.S. dollar after Canadian retail sales. Retail sales in Canada declined 0.1% in July, missing expectations for a 0.4% rise, after a 1.2% increase in June. June's figure was revised up from a 1.1% gain.

Canadian retail sales excluding auto sales dropped 0.6% in July, missing expectations for a 0.1% fall, after a 1.5% increase.

The New Zealand dollar fell against the U.S dollar in the absence of any major economic reports from New Zealand.

Market participants are awaiting Fonterra's annual results on Wednesday.

In the overnight trading session, the New Zealand dollar, Australian dollar and yen were supported by the better-than-expected preliminary Chinese HSBC manufacturing purchasing managers' index. The HSBC manufacturing purchasing managers' index rose to 50.5 in September from 50.2 in August, beating expectations for a decline to 50.0

The Australian dollar declined against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded decreased against the U.S. dollar in the absence of any major economic reports from Japan. Markets in Japan were closed for a public holiday.

Gold prices rose today, closer to one-week high, which was due to geopolitical factors and speculative buying. But gold is still near nine-month low after last week the Fed reduced its bond-buying program by $ 10 billion.

Today, the demand for the precious metal has recovered after the United States announced that for the first time on Monday with five partner countries began air strikes on positions applied group "Islamic State" on Syrian territory. Air strikes are part of the military campaign, the Obama administration has approved nearly two weeks ago and aimed at the "deterioration and, ultimately, the destruction of" militants.

Meanwhile, we add that the rise in prices is constrained by the strengthening of the dollar: it lowers the metal's appeal as an alternative asset and rises in the price of dollar-denominated commodities for buyers in other currencies. The dollar against a basket of six major currencies held just below four-year high due to expectations of an early rise in interest rates the Fed.

However, investment demand for gold bullion continues to decline. The assets of the world's largest holder of gold investment institutions ETFs SPDR Gold Trust at the end of Monday fell by 1.79 m and fell to the level of 774.65 m - the lowest rate since December 26, 2008.

"Investors withdraw funds from precious metals, seeing a reduction of risks in the world and the strengthening of the dollar, said the director of ETF Securities Danny Leydler. - "We believe the current price of gold is very attractive for long-term investors."

Apparently, today the price of gold price dynamics limited support level of $ 1207.00 per ounce and resistance level $ 1,240.0 an ounce, experts say.

The cost of the October gold futures on the COMEX today rose to 1221.50 dollars per ounce.

U.S. stock futures fell as a government crackdown on tax-saving mergers sent drugmakers with pending cross-border deals lower.

Global markets:

Hang Seng 23,837.07 -118.42 -0.49%

Shanghai Composite 2,309.72 +19.85 +0.87%

FTSE 6,657.37 -116.26 -1.72%

CAC 4,360.95 -81.60 -1.84%

DAX 9,619.74 -129.80 -1.33%

Crude oil $91.40 (+0.59%)

Gold $1226.00 (+0.66%)

(company / ticker / price / change, % / volume)

| E. I. du Pont de Nemours and Co | DD | 71.58 | +0.13% | 1.7K |

| McDonald's Corp | MCD | 93.87 | -0.06% | 34.3K |

| Chevron Corp | CVX | 123.39 | -0.08% | 439.7K |

| Boeing Co | BA | 128.45 | -0.12% | 25.3K |

| Cisco Systems Inc | CSCO | 24.94 | -0.12% | 5.1K |

| Visa | V | 213.45 | -0.20% | 22.4K |

| Johnson & Johnson | JNJ | 107.66 | -0.20% | 1.4M |

| Exxon Mobil Corp | XOM | 96.30 | -0.25% | 1.2K |

| AT&T Inc | T | 35.40 | -0.28% | 1.0K |

| Caterpillar Inc | CAT | 100.62 | -0.28% | 0.1K |

| The Coca-Cola Co | KO | 42.10 | -0.28% | 746.2K |

| Walt Disney Co | DIS | 89.02 | -0.30% | 28.9K |

| International Business Machines Co... | IBM | 192.52 | -0.31% | 201.8K |

| 3M Co | MMM | 145.25 | -0.32% | 9.2K |

| Intel Corp | INTC | 34.60 | -0.32% | 1.5K |

| JPMorgan Chase and Co | JPM | 60.71 | -0.33% | 24.0K |

| Verizon Communications Inc | VZ | 50.00 | -0.36% | 16.7K |

| Procter & Gamble Co | PG | 84.50 | -0.37% | 0.1K |

| Microsoft Corp | MSFT | 46.85 | -0.45% | 1.8K |

| General Electric Co | GE | 25.96 | -0.46% | 8.4K |

| Nike | NKE | 80.22 | -0.61% | 0.1K |

| Wal-Mart Stores Inc | WMT | 75.40 | -1.19% | 617.4K |

| Pfizer Inc | PFE | 29.70 | -1.59% | 125.1K |

Statistics Canada released retail sales data today. Retail sales declined 0.1% in July, missing expectations for a 0.4% rise, after a 1.2% increase in June. June's figure was revised up from a 1.1% gain.

Sales at general merchandise stores fell 2.7%, while sales at supermarkets and grocery stores decreased 1.1%.

Motor vehicle and parts sales jumped 1.6%.

Retail sales excluding auto sales dropped 0.6% in July, missing expectations for a 0.1% fall, after a 1.5% increase.

Upgrades:

Downgrades:

Other:

Chevron (CVX) initiated with a Neutral at JP Morgan, target $133

Exxon Mobil (XOM) initiated with a Neutral at JP Morgan, target $104

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

01:45 China HSBC Manufacturing PMI (Preliminary) September 50.2 50.0 50.5

06:58 France Manufacturing PMI (Preliminary) September 46.9 47.1 48.8

06:58 France Services PMI (Preliminary) September 50.3 50.2 49.4

07:28 Germany Manufacturing PMI (Preliminary) September 51.4 51.3 50.3

07:28 Germany Services PMI (Preliminary) September 54.9 54.6 55.4

07:58 Eurozone Manufacturing PMI (Preliminary) September 50.7 50.6 50.5

07:58 Eurozone Services PMI (Preliminary) September 53.1 53.2 52.8

08:30 United Kingdom BBA Mortgage Approvals August 42.8 42.9 41.6

08:30 United Kingdom PSNB, bln August -1.1 10.3 10.9

The U.S. dollar traded mixed to lower against the most major currencies. The greenback took a breather after a recent rally.

The greenback increased in recent months on speculation the Fed will start to hike its interest rate sooner than expected.

The existing home sales in the U.S. are expected to increase to 5.21 million units in August from 5.15 million units in July.

The euro rose against the U.S. dollar despite the weak manufacturing and services purchasing managers' index from the Eurozone. Eurozone's preliminary manufacturing purchasing managers' index (PMI) declined to 50.5 in September from 50.7 in August, missing expectations for a fall to 50.6.

Eurozone's preliminary services PMI decreased to 52.8 in September from 53.1 in August, missing expectations for a rise to 53.2.

Germany's preliminary manufacturing purchasing managers' index fell to 50.3 in September from 51.4 in August, missing expectations for a decline to 51.3.

Germany's preliminary services PMI rose to 55.4 in September from 54.9 in August, beating expectations for a drop to 54.6.

France's preliminary manufacturing purchasing managers' index increased to 48.8 in September from 46.9 in August, exceeding expectations for a gain to 47.1.

France's preliminary services PMI dropped to 49.4 in September from 50.3 in August, missing expectations for a decrease to 50.2.

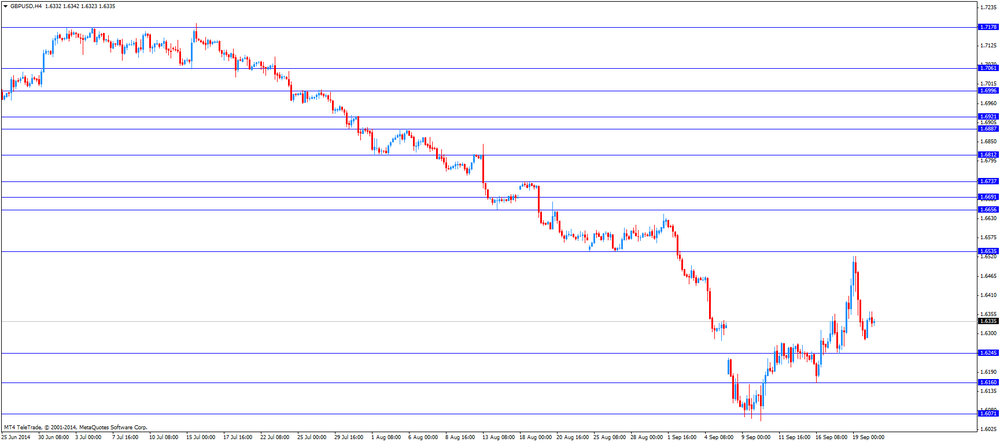

The British pound traded higher against the U.S. dollar despite the weak economic data from the U.K. The number of mortgage approvals decreased to 41,588 in August from 42,715 in July, missing expectations for an increase to 42,900.

The U.K. public sector net borrowing posted a surplus of £10.9 billion in August, after a deficit of £0.47 billion in July. July's figure was revised from a deficit of £1.10 billion. Analysts had expected a surplus of £10.3 billion.

The Canadian dollar increased against the U.S. dollar ahead of Canadian retail sales. Retail sales in Canada are expected to rise 0.4% in July, after a 1.1% gain in June.

Canadian retail sales excluding automobiles are expected to decline 0.1% in July, after a 1.5% rise in June.

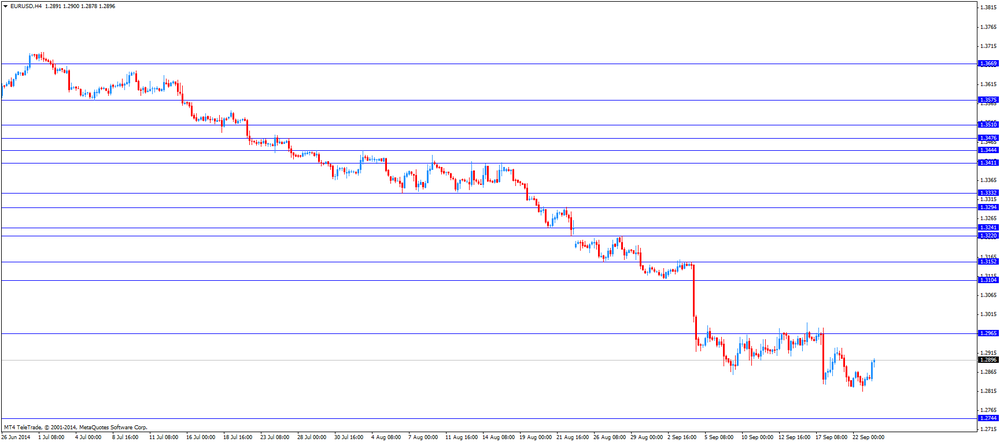

EUR/USD: the currency pair rose to $1.2900

GBP/USD: the currency pair increased to $1.6414

USD/JPY: the currency pair fell to Y108.24

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m July +1.1% +0.4%

12:30 Canada Retail Sales ex Autos, m/m July +1.5% -0.1%

13:20 U.S. FOMC Member Jerome Powell Speaks

18:00 U.S. FOMC Member Narayana Kocherlakota

22:45 New Zealand Trade Balance, mln August -692 -1125

EUR/USD

Offers $1.2995, $1.2950/56, $1.2930/35

Bids $1.2800, $1.2788

GBP/USD

Offers 1.6480/85, 1.6430/35

Bids 1.6300, $1.6210/00, $1.6180

AUD/USD

Offers $0.9100, $0.9050-55, $0.8940/60

Bids $0.8825, $0.8800, $0.8778/77, $0.8750/57

EUR/JPY

Offers Y140.00

Bids Y138.80, Y138.20

USD/JPY

Offers Y110.00, Y109.50

Bids Y107.48

EUR/GBP

Offers stg0.7980

Bids stg0.7800

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index July +0.2% +0.5%

01:30 Australia RBA Financial Stability Review

01:35 Japan Manufacturing PMI (Preliminary) September 52.2 52.5 51.7

06:00 Switzerland UBS Consumption Indicator August 1.66 1.35

08:00 Germany IFO - Business Climate September 106.3 105.9 104.7

08:00 Germany IFO - Current Assessment September 111.1 110.6 110.5

08:00 Germany IFO - Expectations September 101.7 101.3 99.3

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. new home sales. New home sales in the U.S. are expected to increase to 432,000 units in August from 412 units in July.

The euro traded lower against the U.S. dollar due to the weaker-than-expected Germany's Ifo business climate index and comments by the European Central Bank President Mario Draghi. The Ifo business climate index for Germany declined to 104.7 in September from 106.3 in August. That was the fifth successive in five months and the lowest level since April 2013.

Analysts had expected the Ifo business climate index to fall to 105.9.

The European Central Bank (ECB) President Mario Draghi said in a French radio interview on Wednesday that the ECB will keep its monetary policy accommodative for as long as needed to bring inflation to 2% inflation target.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar. Switzerland's UBS consumption indicator declined to 1.35 points in August from 1.67 points in July. July's figure was revised up from 1.66 points.

EUR/USD: the currency pair fell to $1.2826

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:00 Belgium Business Climate September -7.3 -7.1

14:00 U.S. New Home Sales August 412 432

16:05 U.S. FOMC Member Narayana Kocherlakota

Stock indices traded lower on weaker manufacturing and services purchasing managers' index from the Eurozone.

Eurozone's preliminary manufacturing purchasing managers' index (PMI) declined to 50.5 in September from 50.7 in August, missing expectations for a fall to 50.6.

Eurozone's preliminary services PMI decreased to 52.8 in September from 53.1 in August, missing expectations for a rise to 53.2.

Germany's preliminary manufacturing purchasing managers' index fell to 50.3 in September from 51.4 in August, missing expectations for a decline to 51.3.

Germany's preliminary services PMI rose to 55.4 in September from 54.9 in August, beating expectations for a drop to 54.6.

France's preliminary manufacturing purchasing managers' index increased to 48.8 in September from 46.9 in August, exceeding expectations for a gain to 47.1.

France's preliminary services PMI dropped to 49.4 in September from 50.3 in August, missing expectations for a decrease to 50.2.

Current figures:

Name Price Change Change %

FTSE 6,683.92 -89.71 -1.32%

DAX 9,637.75 -111.79 -1.15%

CAC 40 4,369.28 -73.27 -1.65%

Asian stock closed mixed despite the better-than-expected Chinese preliminary HSBC manufacturing purchasing managers' index. The HSBC manufacturing purchasing managers' index rose to 50.5 in September from 50.2 in August, beating expectations for a decline to 50.0

Markets in Japan were closed for a public holiday.

Indexes on the close:

Nikkei 225 closed

Hang Seng 23,837.07 -118.42 -0.49%

Shanghai Composite 2,309.72 +19.85 +0.87%

EUR/USD: $1.2840(E200mn), $1.2870(E200mn), $1.2900(E749mn), $1.2950(E550mn)

USD/JPY: Y108.30($230mn), Y108.50($250mn), Y109.00($200mn), Y110.00-10($200mn)

GBP/USD: $1.6220(stg200mn), $1.6350(stg100mn), $1.6400(stg482mn), $1.6425(stg185mn)

USD/CHF: Chf0.9250($250mn), Chf0.9330-35($910mn), Chf0.9370($200mn), Chf0.9450($210mn)

AUD/USD: $0.8800(A$400mn), $0.8900(A$844mn)

NZD/USD: $0.8200(NZ$400mn), $0.8320(NZ$1.0bn)

USD/CAD: C$1.0900($350mn), C$1.0940-50($205mn), C$1.1000($336mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

01:45 China HSBC Manufacturing PMI (Preliminary) September 50.2 50.0 50.5

06:58 France Manufacturing PMI (Preliminary) September 46.9 47.1 48.8

06:58 France Services PMI (Preliminary) September 50.3 50.2 49.4

07:28 Germany Manufacturing PMI (Preliminary) September 51.4 51.3 50.3

07:28 Germany Services PMI (Preliminary) September 54.9 54.6 55.4

07:58 Eurozone Manufacturing PMI (Preliminary) September 50.7 50.6 50.5

07:58 Eurozone Services PMI (Preliminary) September 53.1 53.2 52.8

08:30 United Kingdom BBA Mortgage Approvals August 42.8 42.9 41.6

08:30 United Kingdom PSNB, bln August -1.1 10.3 10.9

The U.S. dollar traded mixed to lower against the most major currencies. The greenback remained supported by speculation the Fed will start to hike its interest rate sooner than expected.

The New Zealand dollar traded slightly higher against the U.S dollar in the absence of any major economic reports from New Zealand.

Market participants are awaiting Fonterra's annual results on Wednesday.

The New Zealand dollar, Australian dollar and yen were supported by the better-than-expected preliminary Chinese HSBC manufacturing purchasing managers' index. The HSBC manufacturing purchasing managers' index rose to 50.5 in September from 50.2 in August, beating expectations for a decline to 50.0

The Australian dollar climbed against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen rose against the U.S. dollar in the absence of any major economic reports from Japan. Markets in Japan were closed for a public holiday.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.6390

USD/JPY: the currency pair fell to Y108.59

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m July +1.1% +0.4%

12:30 Canada Retail Sales ex Autos, m/m July +1.5% -0.1%

13:20 U.S. FOMC Member Jerome Powell Speaks

18:00 U.S. FOMC Member Narayana Kocherlakota

22:45 New Zealand Trade Balance, mln August -692 -1125

EUR / USD

Resistance levels (open interest**, contracts)

$1.2975 (2724)

$1.2941 (2110)

$1.2891 (310)

Price at time of writing this review: $ 1.2849

Support levels (open interest**, contracts):

$1.2818 (3755)

$1.2780 (3259)

$1.2752 (5425)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 54148 contracts, with the maximum number of contracts with strike price $1,3000 (4934);

- Overall open interest on the PUT options with the expiration date October, 3 is 58862 contracts, with the maximum number of contracts with strike price $1,3000 (5654);

- The ratio of PUT/CALL was 1.09 versus 1.10 from the previous trading day according to data from September, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.6601 (1443)

$1.6502 (2699)

$1.6405 (1479)

Price at time of writing this review: $1.6376

Support levels (open interest**, contracts):

$1.6294 (4656)

$1.6197 (1966)

$1.6099 (3395)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 31727 contracts, with the maximum number of contracts with strike price $1,6700 (3731);

- Overall open interest on the PUT options with the expiration date October, 3 is 41309 contracts, with the maximum number of contracts with strike price $1,6300 (4656);

- The ratio of PUT/CALL was 1.30 versus 1.30 from the previous trading day according to data from September, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.