- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-05-2011

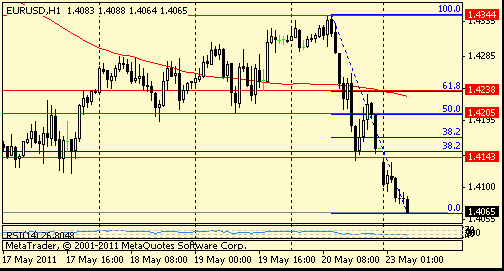

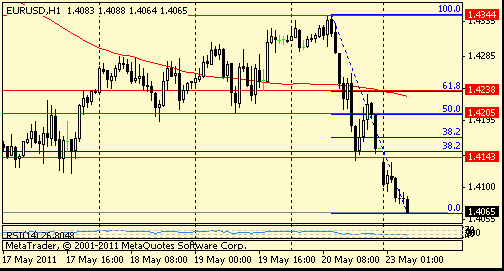

EUR/USD continues to recover, probing currently $1.4065 level with light stops seen scattered just above. Area of $1.4080 still expected to hold tech resistance and supply.

Stocks have spent most of the session drifting sideways in a narrow range near session lows, but they have managed to make a very minor upturn in recent trade. All three of the major equity averages are still trading with losses in excess of 1%, though.

Pressure against commodities also remains stiff and steady. As a result, the CRB Commodity Index continues to contend with a loss of more than 1% as well. A 2.4% drop in oil prices to $97.70 per barrel has weighed heavily on the CRB.

EUR/USD recovers to $1.4052, challenging Asian highs around $1.4048/50 area. Tech resistance and offers mentioned at $1.4080 on any further stretch.

Weakness among stocks continues to bolster buying interest among Treasuries, although the bounce by Treasuries hasn't been anything dramatic. More specifically, the benchmark 10-year Note is up about a dozen ticks. Still, that's enough to take the yield on the Note back toward its 2011 low.

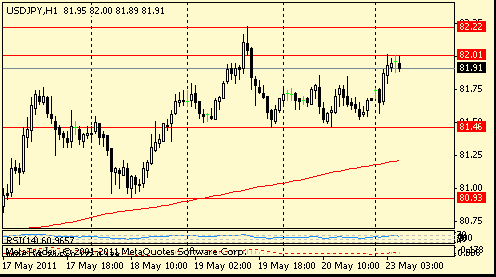

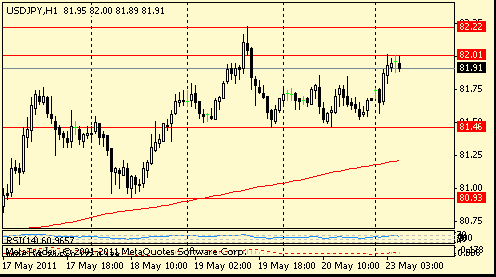

USD/JPY set stable around Y81.80 area in thin market. Offers remain at Y82.00, seemingly a distance away, bids back at Y81.30.

The euro slumped to a record low against the Swiss franc amid deepening concern Europe’s sovereign-debt crisis will worsen, damping the appeal of the region’s assets.

The European Central Bank will accept Greece’s government bonds as collateral in its refinancing operations as long as the country’s consolidation program stays on track, Ewald Nowotny, an ECB Governing Council member, told reporters today. Officials said last week it may not be able to take Greek sovereign debt as collateral if bond maturities are extended.

“With the authorities still seemingly divided over how to proceed with the debt crisis, there remain considerable short-term risks for the euro,” Derek Halpenny at Bank of Tokyo-Mitsubishi UFJ Ltd. wrote today.

Australia’s dollar was among the worst performers against the greenback after a Chinese manufacturing gauge fell to a 10-month low amid concern the global economic recovery will falter.

The preliminary purchasing managers’ index for China compiled by HSBC Holdings Plc and Markit Economics fell to 51.1 in May. It was 51.8 in April.

China is the nation’s biggest trading partner.

“A softening in Chinese manufacturing PMI overnight has been enough to revive fears that the pace of growth may be decelerating", Jane Foley, a senior currency strategist at Rabobank International wrote today. “The franc and the yen have inevitably benefited from it.”

Weakness among stocks continues to bolster buying interest among Treasuries, although the bounce by Treasuries hasn't been anything dramatic. More specifically, the benchmark 10-year Note is up about a dozen ticks. Still, that's enough to take the yield on the Note back toward its 2011 low.

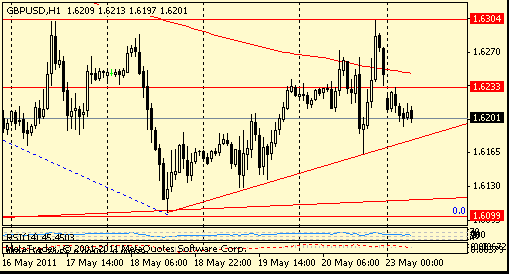

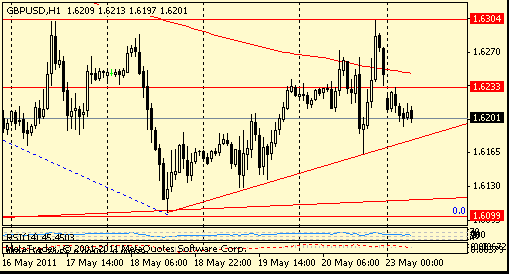

GBP/USD draggs down and triggered bids on $1.6100, slipping to the lows around $1.6085. Later rate recovered to the figure. Further bids at $1.6050.

Europe's major bourses are now closed for the day. Losses were steep - Britain's FTSE fell to a 1.6% loss; Germany's DAX dropped 1.8%; France's CAC closed 1.8% lower; Spain's IBEX sank 1.4%, and Portugal's PSI gave up 0.4%. Weakness in Europe was largely owed to disappointing data in the latest round of PMI Manufacturing readings. Fiscal concerns also continue to weigh on sentiment there.

As a result, stocks on Wall Street weaken too with losses of more than 1%.

AUD/USD holds a bit higher session lows - at $1.0495. Stops in place under that earlier low, with more sub $1.0450. rate trade much lower Asian high on $1.0650.

USD/CAD holds C$0.9801 area amid light flows after printing a session high on C$0.9810. Financial markets in Canada are closed in observance of Victoria Day holiday. Flows modest. Stops in place atop C$0.9820.

EUR/USD $1.4000, $1.3900, $1.4130

USD/JPY Y81.00, Y81.50, Y81.60, Y81.95, Y82.00

GBP/USD $1.6050, $1.6100, $1.6200

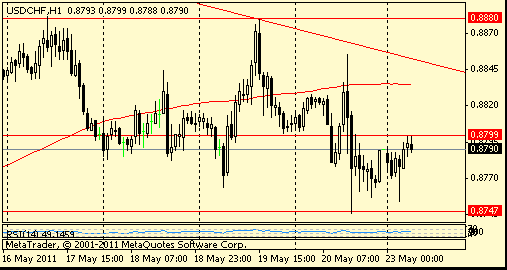

USD/CHF Chf0.8865

AUD/USD $1.0500, $1.0600

NZD/USD $0.7930

AUD/NZD NZ$1.3375

Before the bell the S&P futures declined (-1.0%) to 1314.75. July WTI crude oil futures are at $97.60 per barrel (-2.50%).Gold prices are at $1508.90 per troy ounce (-0.1%).

Today the focus will be on the following factors:

- concerns about the Europe’s debt crisis intensified. Rating agency Standard & Poor's cuts Italy's credit worthiness to negative, thereby pointing the possibility of its lowering. The concerns were also intensified as Spain's centre-right opposition Popular Party took the lead in Sunday's local elections. The ruling Spanish Socialist Workers Party suffered its worst defeat in more than 30 years;

- Iceland's airspace temporarily closed down early Sunday because of a violent Grimsvötn volcano eruption. This may put pressure on shares of airlines. Before the bell shares of the world's largest airline United Continental Holdings Inc. (UAL) dropped 3.2 percent. Today the market’s focus also will be on shares of DAL and AMR;

- today major macroeconomic statistics are not expected, that may have a negative impact on trade;

- the world's major stock indexes are traded or have already closed the session by significant lower: the Nikkei -1.5%, the Hang Seng -2.1%, the Shanghai Composite -2.9%, the FTSE -1.7%, the CAC -1.8%, the DAX -1.8%.

Corporate news:

- Japanese consumer electronics giant Sony Corp. (SNE) is expecting an annual loss of $3.2 billion for the fiscal year ended March. Before the earthquake the company expected a profit of $0.9 billion. The company approved operating profit of $2.44 billion. Its annual report is scheduled to come on May 26;

- AM Krispy Kreme Doughnuts’ (KKD) shares climbed by 1.1 percent as the company's profit for the last quarter surpassed analysts' forecasts ($0.13 per share vs. expected $0.09). The company's revenue grew by 13.6 percent to $104.6 million, that higher than expected.

Currently the initial support for the S&P futures is near 1310.00 area (session low). The immediate resistance is at1325 area (session high).

U.S. stocks were headed for an early sell-off Monday, taking cues from world markets, which tumbled after rating agencies downgraded Greece and Italy late last week.

On Friday, rating agency Fitch cut Greece's credit rating by three notches to "highly speculative," putting it in junk bond territory. In addition, Standard & Poor's slashed Italy's outlook to 'negative' from 'stable.' These downgrades, combined with a weaker-than-expected reading on manufacturing in Europe released Monday, renewed concerns about the eurozone's debt crisis.

Furthermore, Spain's socialist ruling party was hit with the worst election defeat in years over the weekend, as citizens continued to protest the weak economy and high unemployment.

Companies: Shares of entertainment products maker Sony (SNE) slipped nearly 3% in premarket trading. The company posted a $3.19 billion annual loss and cut its full-year earnings outlook, to reflect damages of the earthquake and tsunami in Japan.

Shares of Krispy Kreme (KKD) jumped more than 9% in premarket trading, after the doughnut maker beat earnings per share by 4 cents on strong sales.

World markets:

Oil for July delivery fell $2.50, or more than 2%, to $97.60 a barrel.

Gold futures for July delivery slipped 90 cents to $1,508.50 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury jumped, pushing the yield down to 3.11% Monday from 3.15% late Friday.

July WTI Nymex crude slips back to $97.50 after rally off the lows of $97.10 fizzled out at $98.00. Support is currently seen at $96.75 ahead of $95.50.

Longs after the last $1.4000 dip proove themself as rate extends correction to retest the early Europe recovery highs of $1.4030/35. Above here and rate can edge on toward $1.4050 ahead of $1.4080. If rate remains below seen turning attention back on the $1.4000 area.

The euro slumped to a record low against the Swiss franc amid deepening concern Europe’s sovereign-debt crisis will worsen, reducing the appeal of holding the region’s assets.

S&P last week cut Italy’s credit-rating outlook to negative from stable, citing slowing economic growth and “diminished” prospects for a reduction of government debt. Fitch Ratings on May 20 lowered Greece’s long-term debt ranking to B+, four notches below investment grade, and said a voluntary extension of the nation’s bond maturities would be “a default event.”

“There’s a risk-aversive mood in the market, spurred by uncertainty about the European debt crisis,” said Toshiya Yamauchi, a senior currency analyst in Tokyo at Ueda Harlow Ltd., which provides foreign-exchange margin-trading services. “Concerns about a slowdown in the global economic recovery are also leading selling of the Aussie and kiwi.”

The yen gained versus all but two of its 16 most-traded peers. Spain’s Socialist party suffered its worst electoral defeat in more than 30 years and Standard & Poor’s on May 20 said it may lower Italy’s credit rating. The Dollar Index climbed to a nine-week high as a Chinese manufacturing index fell to its lowest level in 10 months, boosting demand for the American currency as a haven amid concern the global economic recovery will sputter.

The British pound climbed against the euro as Bank of England Chief Economist Spencer Dale said that monetary policy makers should boost interest rates even if Britain’s economic recovery isn’t yet guaranteed.

“I’m not at all confident that the recovery has taken hold and will definitely power away,” Dale said in an interview with the Financial Times published May 21 in London. “However, I’m even more worried about what’s going on in terms of inflation.”

EUR/USD

Offers: $1.4020, $1.4030/35, $1.4045/50, $1.4080

Bids: $1.3970/65, $1.3955/50, $1.3915/00, $1.3870/60

USD/JPY

Offers: Y81.95/00, Y82.25, Y82.40/50

Bids: Y80.95, Y80.65/60, Y80.00

- let's wait on troika report on Greece;

- important that adjustment programs not be weakened;

- view that there's an easy way out is dangerous;

- No need to discuss collateral if Greece plan on track.

Picking up well after earlier lows of Y81.31 with the pair back to mid range on the day around Y81.72. Offers are now seen ahead of Y82.00 with stops set on a break of Y82.10 ahead of offers Y82.20/25.

EUR/JPY Y111.20

GBP/USD $1.6050, $1.6100, $1.6200, $1.6320

USD/CHF Chf0.8865

AUD/USD $1.0500, $1.0600

NZD/USD $0.7930

AUD/NZD NZ$1.33

Nikkei -0.52% 9460.63

Monday morning sees the release of the flas manufacturing and services PMI releases for the main European states, including Germany, which is expected to see the data comes in at 61.0 and 57.0 and France at 57.0 and 62.1 respectively. The data leads up to the EMU data itself, which is expected to come in at 57.5 and 56.5 with the composite number coming in at 57.3.

Inflation in the UK was shown on Tuesday to have hit its highest annual rate since 2008 in April at 4.5 per cent, up from 4 per cent in March.

Sterling rallied in the immediate aftermath, investors thinking that the Bank of England would be forced to lift the UK’s main interest rate from its historic low of 0.5 per cent by at least 25 basis points before the end of the year.

On Wednesday, though, minutes from the Bank’s May monetary policy committee meeting showed 6-3 split in favour of holding rates. But for one of the three calling for a rate rise, Andrew Sentance, who advocated a 50bp rise, this was his last rate-setting meeting.

His replacement on the MPC Ben Broadbent was expected to take a stance broadly in line with the majority of members. Even the remaining two hawks on the committee, Spencer Dale and Martin Weale appeared to be faltering in their support of a rate rise.

Mervyn King, Bank governor, has maintained throughout the current wave of inflation rises that price pressures would drop towards the end of the year as VAT increases and higher commodity prices damp demand.

Eurozone debt concerns drove a late surge in haven buying of the dollar on Friday.

Sterling was 0.1 per cent lower over the week. The euro remained 0.3 per cent higher over the week, in spite of a 1% fall on Friday as eurozone debt concerns came to the fore.

Fitch downgraded its long-term sovereign debt rating on Greece from double B plus to B plus, and put the country on “rating watch negative”.

This overshadowed Monday’s data showing eurozone CPI rose to 2.8 per cent in April, from 2.7 per cent in March. The euro was 0.4 per cent higher versus the pound at £0.8741.

The yen fell lastweek, as Thursday’s growth data showed the Japanese economy slipped into its third recession in a decade . The Japanese currency lost 1.1 per cent against the dollar over the week and was 1.4 per cent weaker against the euro.

Gross domestic product fell by an annualised 3.7% in the first three months, after a revised fall of 3% in last quarter of 2010. Analysts had expected the economy to contract by just 1.9%.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.