- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-03-2022

The Bank of Japan minutes are being dripped through the wirse and come as follows:

BoJ minutes

One member said monetary easing is still needed in japan as inflation expectations are not anchored yet.

One member said nominal wage growth exceeding 2% crucial for japan to stably achieve BoJ'ss price goal.

One member said no change in BoJ's stance that maintaining powerful easing is appropriate.

More to come...

- USD/CAD has slipped below ascending triangle formation, which may strengthen loonie bulls further.

- Slippage of the RSI (14) below 40.00 will add to the downside filters.

- A bearish cross of the 20 and 200-period EMAs at 1.2707, points more weakness ahead.

The USD/CAD pair has remained vulnerable in the past few trading sessions. The major has eroded around 2.20% in the past eight sessions after sensing intensified selling pressure near March 15 high at 1.2871.

On the daily scale, USD/CAD is auctioning in an ascending triangle formation in which the upside remains capped while the asset updates its lows after some intervals. The upside of the ascending triangle formation is capped around 21 December 2020 high at 1.2735, which coincides with 20 August 2021 high and 20 December 2021 high. While, the lower trendline is placed from 1 June 2021 low at 1.2007, which follows 21 October 2021 low at 1.2288 and January 13 low at 1.2454.

A bearish cross of the 20 and 200-period Exponential Moving Averages (EMAs) at 1.2707, points more weakness ahead.

The Relative Strength Index (RSI) (14) is on the verge of dropping below 40.00, which is likely to add to the downside filters.

Should the asset slip below Wednesday’s low at 1.2542, loonie bulls may witness significant bids, which will drag the pair near the psychological support and 27 October 2021 high at 1.2500 and 1.2432 respectively.

On the flip side, greenback bulls may take over the control if the asset oversteps Tuesday’s high at 1.2624. This will send the pair towards 20-period EMA at 1.2675, followed by the psychological resistance at 1.2700.

USD/CAD daily chart

-637836758543755342.png)

- EUR/USD fails to extend late Wednesday’s corrective pullback.

- Multiple technical indicators challenge bulls below 1.1050.

- Downbeat RSI adds strength to the bearish bias targeting 1.0900.

EUR/USD struggles to holds 1.1000 threshold during Thursday’s Asian session, despite the latest rebound from 1.0964.

That said, the major currency pair’s sustained weakness below the 21-DMA, a downward sloping resistance line from early February and a 13-day-old previous support line joins sluggish RSI to keep sellers hopeful.

Hence, the EUR/USD bears are ready to challenge the weekly low surrounding 1.0960 before eyeing the short-term horizontal support zone near 1.0900.

However, a clear downside break of the 1.0900 will make the quote vulnerable to refresh yearly low, currently around 1.0800.

On the flip side, the 21-DMA and a six-week-long descending trend line, respectively around 1.1035 and 1.1045, will challenge the quote’s further rebound. Also important will be the support-turned-resistance line from March 07 near 1.1050.

Should the EUR/USD prices rise past 1.1050, a broad horizontal area from late January, around 1.1120-40, will be in focus.

EUR/USD: Daily chart

Trend: Further weakness expected

As markets head towards the key data/events, it becomes important to know the key risk catalysts surrounding the main events.

Among the data, the March month US PMIs and Durable Goods Orders for February will decorate the calendar whereas the latest headlines from the US, the UK and Russia pose challenges to the market sentiment. The reason could be linked to US President Joe Biden’s visit to the European friends from North Atlantic Treaty Organization (NATO).

Starting with the US, “The first shipment from a new, $800 million arms package for Ukraine that U.S. President Joe Biden authorized last week will start flying out of the United States in the next day or so, and will not take long to reach Ukraine, a senior U.S. defense official said on Wednesday,” per Reuters.

On the other hand, the UK is believed to have sent 6,000 missiles and $33 million for the Ukrainian military.

In response, the US Embassy in Moscow received a list of diplomats considered, “persona non grata” by the Russian Foreign Ministry.

Following the Russian notice, the US media quoted the White House communiqué urging Russia to stop expelling diplomats and personnel.

Market reaction

The news weighs on the market sentiment and challenges AUD/USD around a four-month high.

Read: AUD/USD flirts with 0.7500 at four-month high as USTR news battles pre-NATO, US data caution

- The NZD/JPY March rally has gained 8.48% in the month.

- NZD/JPY Price Forecast: A breach of the 85.00 mark would expose levels not seen since July 2015.

The New Zealand dollar extended its rally vs. the Japanese yen for the second time in the week, despite a downbeat market mood courtesy of tensions in Eastern Europe. As the Asian Pacific session is about to kick in, the NZD/JPY trades at 84.43 at the time of writing.

US equities finished Wall Street’s trading session with losses. In the meantime, the greenback traded firmly, as portrayed by the US Dollar Index rising 0.20% at 98.612, while the US Treasuries sell-off stalled, with yields down.

The NZD/JPY pair is a cross-currency pair traded mainly as pure market sentiment play. However, it appears to be decoupled from a positive correlation with the S&P 500. Since mid-February of 2022, the S&P 500 began sliding, as the US central bank turned hawkish, while the NZD/JPY began its 800 pip rally, from around 76.00 towards 84.00

Overnight, the NZD/JPY began on a higher note, around 84.00-30, reaching a daily low at 83.70. Late in the New York session, staged a rebound achieving a YTD high at 84.64, despite the negative divergence between NZD/JPY’s price action and the Relative Strength Index (RSI), a momentum indicator in the 1-hour chart.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY daily chart depicts the pair as upward biased. Furthermore, the 50-day moving average (DMA) at 78.12 just crossed over the 200-DMA at 78.04, forming a golden cross, which means the NZD/JPY is ready to make new highs unless a sudden market sentiment increases appetite for safe-haven peers.

With that said, the NZD/JPY’s first resistance would be the 85.00 mark. A breach of the latter would expose the April 2013 high at 86.41, followed by April 2014 at 89.92, and the 90.00 mark.

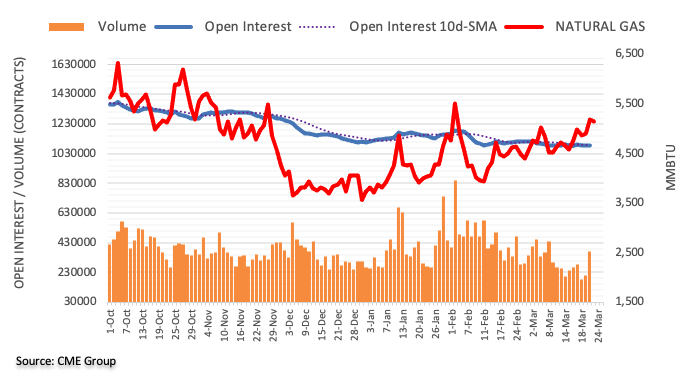

“China’s worst virus outbreak since the start of the pandemic has led to some oil refiners cutting back operations and is forcing analysts to rethink their demand estimates as strict lockdowns curb consumption,” said Bloomberg.

The analytics published during the early Thursday morning in Asia also claims, “The Covid-19 resurgence is posing a threat to global oil consumption and may accelerate demand destruction, helping to rein in bloated prices that soared on Russia’s war in Ukraine.”

Additional quotes

Independent refiners in the key hub of Shandong have been forced to resell crude cargoes and reduce processing as flights are canceled and traffic thins in some of China’s biggest cities.

China has managed to bring previous outbreaks quickly under control since Wuhan two years ago, but the highly infectious omicron variant is challenging the nation’s Covid Zero strategy.

Crude inventories at 20 sites in Shandong province -- where half of China’s independent refiners are based -- rose over the past two weeks, compared with an overall national trend of falling stockpiles, according to Ursa Space Systems.

The region’s processors have cut operating rates to around 50% of capacity, the lowest in five years excluding 2020, data from OilChem show.

Market reaction

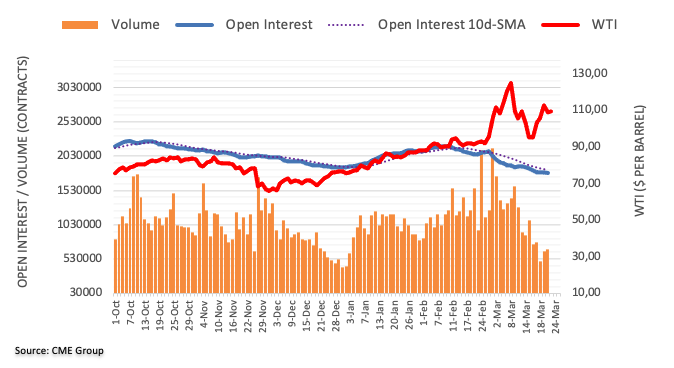

Following the news, WTI crude oil prices pause the previous day’s upside around a two-week high, trading sidelined near $113.70 by the press time.

Read: WTI Price Analysis: Bulls attack three-week-old resistance below $115.00

- The DXY is oscillating around 98.50, awaiting trigger for further rally.

- FOMC members: Daly and Mester have framed an aggressive hawkish path for the interest rate saga.

- While chances of US recession are very much limited.

The US dollar index (DXY) is hovering around 98.50 despite rising odds of a 50 basis point (bps) interest rate hike by the Federal Reserve (Fed) in May’s monetary policy. To tame the galloping inflation, elevated borrowing rates are the only measure that may bring price stability. The DXY has been consolidating in a narrow range of 97.70-99.42 for the last two weeks.

Fed’s Daly sees interest rates at 2.5% at least

San Francisco Federal Reserve Bank President Mary Daly in her speech on Wednesday has dictated a significant hawkish stance going forward. The expectation of 2.5% borrowing rates to settle down the inflation has set the US Treasury yields on fire. For a 50 bps rate hike in May, Fed’s Daly has preferred to leave the context on data. Apart from that, the Federal Open Market Committee (FOMC) member has cleared that the Ukraine crisis possesses upside risk to inflation but it’s too early to call for a global recession and the US has a very minute chance of having a recession.

Fed’s Mester advocates some 50bps rate hikes this year

Cleveland Federal Reserve Bank President Loretta Mester has advocated 50 bps interest rate hikes by the Fed more than once by the end of 2022. The FOMC member reiterates that the markets are mature enough to handle the move and it is better to do that earlier rather than later. The Fed has to corner the inflation by deploying all necessary measures. Adding to that, the FOMC member reiterates the same punchline of Fed’s Daly that the streak of rate hikes won’t lead to the US in any recession.

Key events in the US this week: Durable Goods Orders, Continuing Jobless Claims, Initial Claims, Market PMI Composite, Pending Home Sales, Michigan Consumer Sentiment Index

Eminent issues on the back boiler: Russia-Ukraine war, EU leaders summit, NATO meeting, FOMC members' speeches

- WTI bulls take a breather at 11-day top amid overbought RSI.

- Sustained trading beyond the key SMAs keep buyers hopeful but a clear break of $115.00 becomes necessary for bulls.

WTI crude oil prices seesaw around a two-week high, easing to $113.60 during the early Asian session on Thursday.

The black gold’s latest pause could be linked to a failure to overcome a short-term important resistance amid overbought RSI conditions. Even so, the commodity’s sustained trading beyond the 100 and 200-SMA keep WTI buyers positive.

That said, a pullback towards the 100-SMA level surrounding $107.70 can’t be ruled out. However, any more weakness will make the quote vulnerable to decline towards breaking the $100.00 threshold while eyeing the 200-SMA near $99.70.

Should the WTI bears dominate past 200-SMA, the monthly low surrounding $92.36 will be on their radar.

Alternatively, an upside break of the aforementioned horizontal area established since March 03, around $115.00-114.70, will propel the quote towards $125.00.

Following that, the latest multi-month high of $126.51 will challenge the WTI bulls before directing them to the $130.00 threshold.

WTI: Four-hour chart

Trend: Pullback expected

“A Russian-drafted call for aid access and civilian protection in Ukraine that does not mention Moscow's role in the crisis failed at the U.N. Security Council on Wednesday,” said Reuters.

The news also mentioned that only Russia and China voted yes while the other 13 members abstained.

Market reactions

The news reveals China’s support to Russia, even though indirectly, which in turn becomes important as North Atlantic Treaty Organization (NATO) members accuse Beijing of helping Moscow in the Ukraine invasion. The same challenges the market sentiment and weigh on the AUD/USD prices at a four-month high.

Read: AUD/USD flirts with 0.7500 at four-month high as USTR news battles pre-NATO, US data caution

- AUD/USD seesaws around four-month high as upbeat commodity prices, USTR news contradicts cautious mood.

- USTR reinstates expired product exclusions from ‘Section 301’ China tariffs.

- US President Biden will meet NATO allies from Europe, more sanctions on Russia teased.

- Australia’s CBA PMIs came in softer for March, US PMIs, Durable Goods Orders will be eyed next.

AUD/USD bulls take a breather at a four-month high surrounding 0.7510 during early Thursday morning in Asia, retreating to 0.7500 after a two-day uptrend. The Aussie pair’s latest pullback could be linked to the market’s anxiety ahead of the key data/events lined up for publication on Thursday, as well as recently released downbeat Aussie PMIs.

Australia’s preliminary readings of Commonwealth Bank (CBA) PMIs for March came in below-forecast for Manufacturing and Services, down to 57.3 and 57.9 versus 59.0 and 62.7 expected. However, the figures are better than their previous readings and push Composite PMIs to 57.1 versus 56.6 prior.

Elsewhere, US Senator John Cornyn said he met with US Treasury Secretary Janet Yellen to discuss Russian gold sanctions. The news becomes more worrisome as US President Biden will be meeting his European counterparts from North Atlantic Treaty Organization (NATO) to push for more sanctions on Moscow. On Wednesday, the Wall Street Journal (WSJ) signaled that the Biden administration is working on heavy sanctions on around 300 Russian lawmakers. To counter the same, Russian President Vladimir Putin has said, “Russia will seek payment in roubles for gas sold to ‘unfriendly’ countries.”

Additionally, hawkish comments from the Fed policymakers backed chatters over 50 basis points (bps) of a Fed rate-lift and Quantitative Tightening (QT) in May, which in turn challenged the market sentiment and AUD/USD prices.

Alternatively, a pullback in the US Treasury yields and news from the US Trade Representative’s (USTR) office surrounding the Sino-American trade pact seems to have helped the AUD/USD prices, due to Australia’s trade ties with Beijing. In the latest update, USTR mentioned that it will reinstate 352 expired product exclusions from US ‘Section 301’ tariffs on imported goods from China. These exclusions were expired in 2020.

Also positive was a pullback in the US Treasury yields from three-year high and discussions in the Chinese media that the People’s Bank of China (PBOC) can announce rate cuts.

Amid these plays, Wall Street snapped a six-day uptrend but prices of gold and crude oil improved. That said, the US Dollar Index (DXY) also remained positive.

Looking forward, global markets are likely to remain anxious and may portray inaction ahead of the Biden meeting with NATO friends. Also important to watch are the March month US PMIs and Durable Goods Orders for February.

Read: Durable Goods Orders Preview: Upside surprise set to trigger next leg up in the dollar

Technical analysis

A daily closing beyond an ascending resistance line from the mid-January and a downward sloping trend line from June 2021, respectively around 0.7490 and 0.7480 at the latest, enables AUD/USD bulls to aim for a late 2021 peak surrounding 0.7560.

- USD/JPY may face the heat of an overbought situation but will remain a buy the dip counter.

- The asset may recapture six-year-old resistance near 121.70.

- Bulls are firmer above 10 and 20-period EMAs.

The USD/JPY pair is facing overbought pressures above 121.00 and is likely to perform subdued in the Asian session. The major has witnessed a dream rally in the past few trading sessions, which is visible from the full-bodied giant positive ticks on the weekly chart consecutively for three weeks. The greenback bulls are inching closer to six-year-old resistance at 121.70 considering a broader weakness in the Japanese yen.

On the weekly scale, USD/JPY has witnessed a juggernaut rally after a breakout out of the rising channel on the upside. The upper end of the rising channel is placed from 2 April 2021 high at 110.97 while the lower end is marked from 8 January 2021 low at 102.59. Moreover, the asset is holding above its five-year-old resistance at 118.66.

The Relative Strength Index (RSI) (14) is oscillating in a range of 60.00-80.00, which signals for the continuation of a bullish trend. However, an overbought scenario at this stage cannot be ruled out.

Meanwhile, the 10 and 20-period Exponential Moving Averages (EMAs) are aiming higher at 117.00 and 115.50 respectively, which adds to the upside filters.

Considering the overbought situation, the major may find some long liquidation and test its five-year-old resistance now support at 118.66, which will fetch some fresh bids that will drive the pair towards the psychological resistance of 120.00, followed by 29 January 2016 high at 121.67.

On the flip side, bears can take control if the pair slips below March 15 low at 117.70. This will drag the pair towards 10 and 20-period EMAs at 116.70 and 115.25 respectively.

USD/JPY weekly chart

-637836709528350574.png)

- The AUD/JPY finished Wednesday’s trading session with gains of 0.73%.

- Risk-aversion in the financial markets was not an excuse for the Aussie to gain.

- AUD/JPY Price Forecast: UJpward biased, though due to overbought conditions in the RSI, might correct lower before resuming upwards.

The AUD/JPY, one of the FX space risk barometers, rallies for seven consecutive days amidst a risk-off market mood in global equities, as portrayed by US stock indices which recorded losses between 1.29% and 1.49%. At the time of writing, the AUD/JPY is trading at 90.79

Factors like the Russia-Ukraine crisis and renewed worries of global inflation dampened the market sentiment. Ukrainian President Volodymyr Zelesnkyy called for more pressure on Russia as discussions stagnate, while Russia continues its airstrikes in the port city of Mariupol. Linked to this, US President Joe Biden is on his way to a two-day NATO summit in Brussels.

Overnight, the AUD/JPY seesawed around the 89.90-90.50 area but late in the North American session reached a new YTD high at 90.93.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY is upward biased. Despite the steepness of the rally, which could suggest that the AUD/JPY might be subject to a correction, the next resistance would be 91.00. Once cleared, the AUD/JPY following supply zone would be Pitchfork’s mid-parallel line between the top and the central ones, around 92.00, followed by the 93.00 mark.

On the flip side, the AUD/JPY first support will be the 90.00 mark. If that scenario plays out, the AUD/JPY nest support would be 89.00, followed by the March 21 daily high at 88.50.

- The kiwi is on the front foot and eyeing a break to the 0.70 area.

- A generalised rally in commodity prices is supporting NZD.

NZD/USD has been on firm grounds mid-week as it moves up towards 0.70 the figure. US stocks finished Wednesday's session lower, while crude oil futures rose together with gold prices. Nevertheless, the kiwi held up well.

The S&P 500 lost 1.2% to 4,456.24, the tech-heavy Nasdaq Composite was 1.3% off at 13,922.60 and the Dow Jones Industrial Average declined 1.3% to 34,358.50. The 10-year US Treasury yield fell 8 basis points to 2.30%.

''The Kiwi held up reasonably well overnight given the breather in global risk sentiment and fall in equities. That said, commodities and the AUD have rallied, led by oil. While higher oil prices aren’t a positive for NZ, the generalised rally in commodity prices is, and the NZD seems to be able to latch on to any thread of positivity at the moment,'' analysts at ANZ Bank explained.

''We still have mixed views on how things will unfold. Our forecasts call for a mild further strength by year-end (0.70) but we also acknowledge risks of a hard landing, which is becoming a bigger talking point in markets as each day passes. Ahead of expected back-to-back 50bp OCR hikes we think NZ short end rates haven’t yet peaked; all else equal that’s likely to limit how much lower the NZD might be able to go (until the Fed catches up).''

- EUR/USD has stuck around 1.1000 as investors await fresh impetus from EU leaders summit.

- EU members are mixed on the embargo of Russian oil, Germany reiterates to stick with Russian oil.

- A preliminary estimate for the US and Euro PMI is 56.3 and 56 respectively.

The EUR/USD pair is juggling around 1.1000 in the absence of any potential trigger that could dictate the further direction for the asset. Investors are waiting for the European Union (EU) leaders summit, which will also be joined by US President Joe Biden on Thursday.

The central attention of the meeting is likely to be attributed to an embargo on Russian oil. Following Russia’s invasion of Ukraine, the EU has concluded that Russia’s arbitrariness should be answered with an aggressive stick approach. Instead of that, the EU leaders are likely to discuss an embargo on Russian oil despite a higher dependency on oil imports from Moscow.

It is worth noting that Europe banks heavily on Russia to address its 30% demand for energy and 25% demand for oil. And, gauging a substitute on very short notice may escalate the threat of supply worries and eventually to slippage in manufacturing activities. However, EU members are mixed on banning Russian oil as Germany has stated that it is notwithstanding the decision of banning the Russian oil imports in the current scenario considering the boiling oil prices and supply chain bottlenecks.

Meanwhile, the US dollar index (DXY) has been struck around 98.60 and is indicating a volatility contraction going forward.

Apart from the EU leaders summit, investors will focus on Manufacturing PMI prints from the US and eurozone. The US Manufacturing PMI is likely to land at 56.3, lower than the previous figure of 57.3 while the eurozone PMI may reveal a figure of 56, lower than the prior print of 58.2.

- GBP/USD bulls are on the path for a firm test of critical resistance.

- Bears are waiting patently for a discount to present itself.

GBP/USD continues its advance towards a key area of resistance. The weekly M-formation shows that the price reverting towards the neckline of the pattern near to the 1.3350 mark.

GBP/USD weekly chart

This comes in towards a 61.8% golden ratio and 1.34 the figure. The bears will be moving in for the kill at this point and the price would be expected to continue on its southerly trajectory with 1.28 the figure in focus.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Japan | Nikkei Services PMI | March | 44.2 | |

| 00:30 (GMT) | Japan | Manufacturing PMI | March | 52.7 | |

| 08:15 (GMT) | France | Services PMI | March | 55.5 | 55 |

| 08:15 (GMT) | France | Manufacturing PMI | March | 57.2 | 55 |

| 08:30 (GMT) | Germany | Services PMI | March | 55.8 | 53.8 |

| 08:30 (GMT) | Germany | Manufacturing PMI | March | 58.4 | 55.8 |

| 08:30 (GMT) | Switzerland | SNB Interest Rate Decision | -0.75% | -0.75% | |

| 09:00 (GMT) | Eurozone | ECB Economic Bulletin | |||

| 09:00 (GMT) | Eurozone | Manufacturing PMI | March | 58.2 | 56 |

| 09:00 (GMT) | Eurozone | Services PMI | March | 55.5 | 54.2 |

| 09:30 (GMT) | United Kingdom | Purchasing Manager Index Manufacturing | March | 58 | 56.7 |

| 09:30 (GMT) | United Kingdom | Purchasing Manager Index Services | March | 60.5 | 58 |

| 11:00 (GMT) | United Kingdom | CBI retail sales volume balance | March | 14 | 10 |

| 12:30 (GMT) | U.S. | Continuing Jobless Claims | March | 1419 | 1410 |

| 12:30 (GMT) | U.S. | Durable goods orders ex defense | February | 1.6% | |

| 12:30 (GMT) | U.S. | Durable Goods Orders | February | 1.6% | -0.5% |

| 12:30 (GMT) | U.S. | Durable Goods Orders ex Transportation | February | 0.7% | 0.6% |

| 12:30 (GMT) | U.S. | Current account, bln | Quarter IV | -214.8 | -218 |

| 12:30 (GMT) | U.S. | Initial Jobless Claims | March | 214 | 212 |

| 13:45 (GMT) | U.S. | Services PMI | March | 56.5 | 56 |

| 13:45 (GMT) | U.S. | Manufacturing PMI | March | 57.3 | 56.3 |

| 13:50 (GMT) | U.S. | FOMC Member Charles Evans Speaks | |||

| 15:00 (GMT) | U.S. | FOMC Member Bostic Speaks | |||

| 23:30 (GMT) | Japan | Tokyo CPI ex Fresh Food, y/y | March | 0.5% | |

| 23:30 (GMT) | Japan | Tokyo Consumer Price Index, y/y | March | 1% |

- Gold moves higher for a fresh daily high on Wednesday.

- Risk-off is the theme and safe-haven flows are benefitting the gold price.

The price of gold is higher in mid-week trading as US stocks fell sharply following Moscow's plans to switch its natural gas sales to some countries to roubles. This has sent oil prices and tensions higher in global financial markets. At the time of writing, the gold price is trading near the highs of the day at $1,947.25. The yellow metal rallied from a low of $1,915.64 earlier in the day and is set on a fresh daily high and a bullish close.

Responding to Western sanctions that have hit Russia's economy hard, President Vladimir Putin said Moscow will seek payment in roubles for gas sales from "unfriendly" countries, while its forces bombed areas of the Ukrainian capital Kyiv a month into their assault

Prices for commodities such as oil and wheat have climbed as tensions in Ukraine have escalated, putting additional upward pressure on already high inflation due to supply chain bottlenecks. Rising inflation has led many central banks, including the US Federal Reserve, to take measures to rein in prices, such as by raising interest rates. However, gold can also benefit from the safe-haven flows amid the uncertainties surrounding the war.

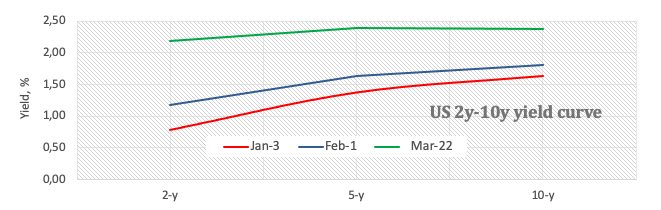

''Market participants are keenly watching US 10-year rates as they approach a trend-channel that has served multi-decade-long resistance. In this context, gold prices have remained incredibly resilient despite the explosive price action in rates markets following Chair Powell's comments,'' analysts at TD Securities explained.

US 10-year yield trend channel

The above chart illustrates the trend channel as the 10-year yield move sin towards 2.5%.

''While rates markets are now pencilling in higher odds for a 50bp hike in May, gold markets could be reflecting a growing cohort of participants interpreting the Fed's hiking path as being behind the curve on inflation, as the Fed moves too slowly and cautiously to tame inflation,'' the analysts at TD Securities said

''In this context, gold prices once again narrowly avoided catalyzing a massive CTA liquidation program last session, but the margin of safety remains low. Such a liquidation event would raise risks that safe-haven buyers could offload length in a vacuum concurrently with massive CTA liquidations. Fortunately, Shanghai traders have seemingly ended a period of liquidations and have meaningfully added to their gold in recent trading sessions.''

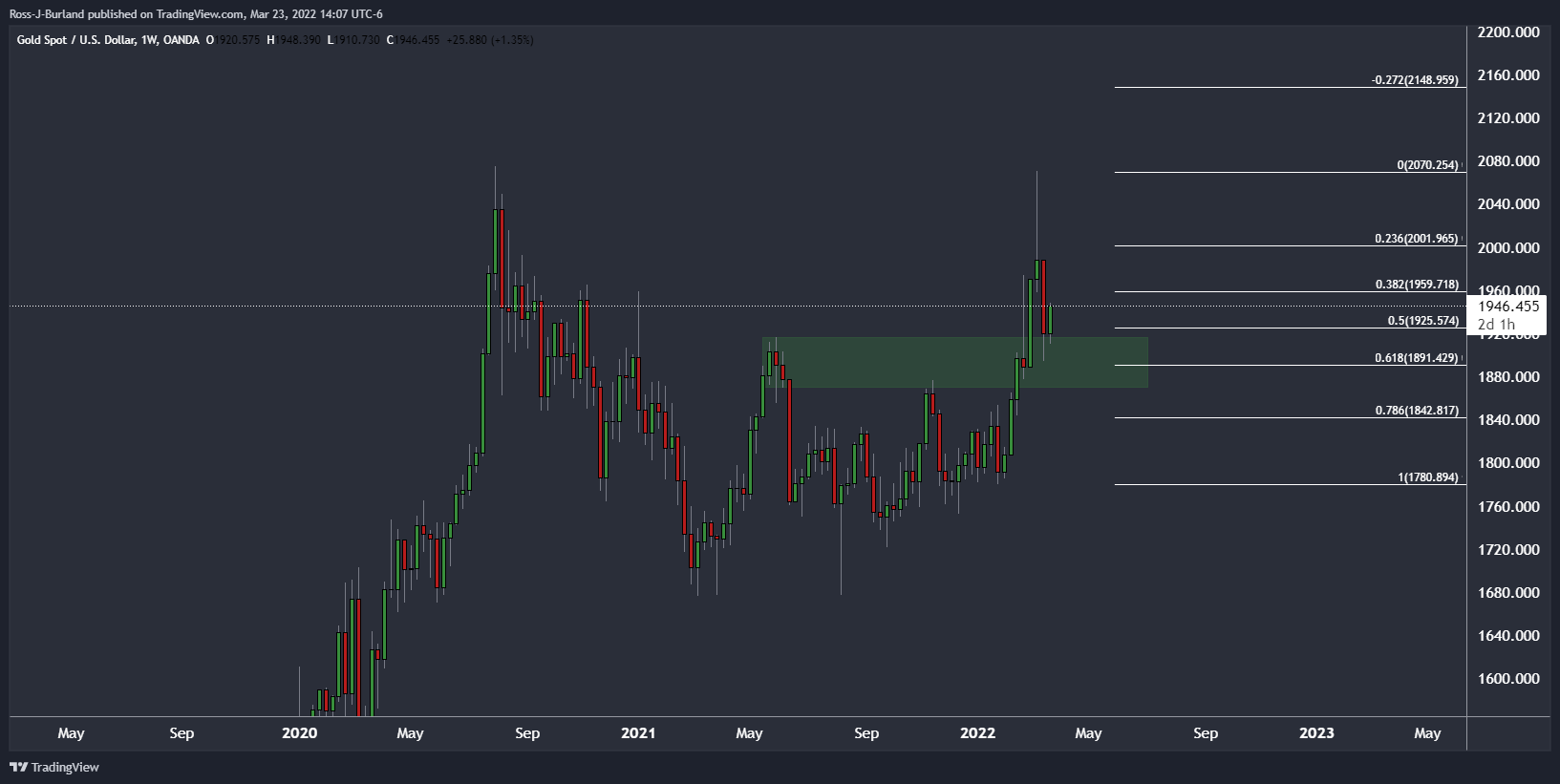

Gold technical analysis

The price is completing a 50% mean reversion of the monthly bullish impulse, as illustrated on the weekly chart where the price meets the prior highs and support block. This could see demand move in again and an extension of the upside in the comings weeks.

What you need to take care of on Thursday, March 24:

The dollar ended Wednesday mixed, as investors struggled to make something out of mostly worrisome headlines. Higher crude oil prices amid escalating tensions between Russia and western nations dented the market’s mood.

The barrel of West Texas Intermediate surged to $115.37 a barrel, while Brent changed hands at as high as $118.41 a barrel. Gold, on the other hand, advanced within range, posting intraday gains but holding below the weekly high at $1,941.24 a troy ounce.

European stocks edged lower, weighing on their American counterparts. US indexes trimmed Tuesday’s losses, ending the day with substantial losses.

Government bond pared their slumps, which resulted in yields retreating from multi-year highs. The yield on the 10-year US Treasury note peaked at 2.417%, to later shed roughly 10 basis points and hurt the dollar’s demand.

Secretary of State Antony Blinken announced that the US government formally accused Russian troops of committing war crimes in Ukraine. US President Joe Biden will meet his European NATO counterparts on Thursday, and more sanctions on Moscow are expected to be announced. Leaders will also discuss the Iran nuclear deal.

The pound was among the worst performers, with GBP/USD falling to 1.3147 on the back of higher UK inflation and the Budget report. According to official data, the Consumer Price Index jumped to 6.2% YoY in February from 5.5% in the previous month. Also, Finance Minister Rishi Sunak presented a new budget, which included upward revisions to inflation and downward revisions to growth. Tax growth expectations were downwardly revised to 3.8% from 6%. GBP/USD hovers around 1.3200 at the time being.

German Chancellor Olaf Scholz announced the country would build their own LNG terminals faster than planned, as bans on Moscow energy could put the region into recession. EU Consumer Confidence plummeted to -18.7 in March, according to preliminary estimates. EUR/USD is barely holding above 1.1000.

Commodity-linked currencies benefited from higher oil and gas prices, also getting a late boost from strengthening gold. The AUD/USD pair flirts with the 0.7500 level, while USD/CAD trades near a fresh monthly low of 1.2541.

The USD/JPY pair consolidated gains and settled just above the 121.00 mark, while USD/CHF edged lower, now trading near the 0.9300 figure.

Ethereum price to wreck short positions with a 20% jump

Like this article? Help us with some feedback by answering this survey:

- Precious metals benefit from a risk-off market mood and lower US Treasury yields, silver and gold up 1.25% and 0.96%, each.

- Russia exerts pressure on selling gas to non-friendly countries, as Putin intends to use the Russian rouble as a payment method.

- XAG/USD Price Forecast: Golden-cross in the daily chart paves the way for further gains.

Late in the New York session, Silver (XAG/USD) recovered some of its bright, as XAG bulls stage a recovery and reclaim the $25.00 mark, amidst lower yields and risk-aversion in the financial markets. At the time of writing, XAG/USD is trading at $25.09.

Global equities overnight were upwards, though since the mid-European session and through the North American one, a dampened market mood, have them recording losses. Russia-Ukraine tussles keep grabbing headlines, though both parties’ stances remain put, so there has been no change. Linked to this, US President Joe Biden is traveling to the two-day reunion at NATO offices in Brussels. The US, UK, and EU keep imposing sanctions in Russia, whom of late in the day, retaliated as Russian President Putin said they intend to use Russian roubles when selling gas to non-friendly countries. Those remarks lifted oil prices as WTI’s reclaimed the $114.00 mark.

In consequence, precious metals are rising. Gold (XAU/USD) is also up in the day, close to 1%, at $1939.52 a troy ounce, while the sell-off in US Treasuries stalled, as the 10-year T-note yield eases from weekly highs, losing five basis points, down at 2.321%, a tailwind for XAG/USD.

Fed speakers take the forefront

Early in the New York session, Loretta Mester, Cleveland Fed President, crossed the wires. She said that the Fed would need to do some 50 bps moves this year while favoring frontloading rate hikes to better position themselves for how the US economy evolves in the second half of 2022. Mester added that “I have no concerns that rate increases are going to push the US economy into recession.”

Loretta Mester added her name to the list of Fed officials that have expressed the need for a 50 bps increase to the Federal Funds rates, led by Fed Chair Powell, James Bullard, Raphael Bostic, Chris Waller, and Mary Daly.

XAG/USD Price Forecast: Technical outlook

Silver (XAG/USD) bias is upwards, further confirmed by Monday’s trading session. On that day, the 50-day moving average (DMA) rollover the 200-DMA, forming a golden-cross, a bullish signal that, although is lagging, could open the door for further gains on XAG/USD.

With that said, XAG/USD’s first resistance would be November 16, 2021, daily high at $25.40. Breach of the latter would expose August 4, 2021, daily high at $26.00, followed by July 16, 2021, at $26.45.

St. Louis Federal Reserve President James Bullard, who on Friday called for a dramatic increase in the Fed's overnight lending rate to more than 3% this year, is crossing the wires with the following comments dripping through:

- Russia's war will mean less globalization, more fragmentation around the world.

- Direct macroeconomic effects on u.s. economy from Russia's invasion is not that large.

- Could easily be that Europe is pulled into recession as a result of war.

- We've seen these kinds of oil prices before, didn't cause a recession in US.

- US economy will continue to grow above trend this year and next, labor markets will continue to improve further.

- It's not as if we are a little bit over on the inflation target; we are way over.

- All indications are that inflation will go up in the spring.

- High inflation has necessitated 'all of us' to think about how fast we need to move.

- We will have to move faster than what we are used to.

- We have to think bigger.

Bullard's messaging remains as hawkish as ever. After Powell’s comments Monday, Bullards said yesterday that the Fed needs to move aggressively to curb inflation and that he thinks 50 bp moves would “definitely be in the mix.”

''The plural "50 bp moves" is clearly not a base case, yet'', as analysts at Brown Brothers Harriman noted, ''but Bullard is certainly pushing hard for it,'' as well a balance sheet runoff to start ASAP.

- AUD/USD is taking on the 0.75 figure in midday New York.

- The US dollar is softer Fed's aggressive stance early this week fades.

AUD/USD is higher by 0.45% as it moves in on the 0.75 figure during New York trade. The boost to the US dollar from US Federal Reserve's aggressive stance early this week faded and investors waited for President Joe Biden to unveil new sanctions against Russia during his trip to Europe.

Energy and commodity prices, in general, are strong which is giving the Aussie boost. However, US president Joe Biden, who heads to Brussels on Wednesday for talks with NATO and European leaders, will push Europe to reduce reliance on Russian oil and gas. Nevertheless, the European Union seems unlikely to agree to a ban on Russian oil.

Meanwhile, the release of stronger than expected February Australian labour data has ticked another box on the country’s journey towards tighter monetary policy. At 4.0%, the February unemployment rate sank to a near 14 year low, while the employment change was double market expectations at 77.4K.

The market is positioned for rates hikes from the RBA this year suggesting it may be hard for the Aussie to rally much further on hawkish commentary from their respective central bankers, analysts at Rabobank argued. ''That said, given the links of both currencies to commodity exports, we see the potential for both to edge a little higher vs the USD though the course of this year.'' Nevertheless, the analysts also noted that ''espite the signs that the RBA is edging towards a policy tightening, the RBA remains one of the most cautious central banks in the G10.''

- The Swiss franc benefits amid a risk-off market mood, as reflected by the USD/CHF down 0.25%.

- Falling US Treasury yields, led by the 10-year, underpin the USD/CHF pair.

- USD/CHF Price Forecast: An inverted head-and-shoulders in the 4-hour chart looms, though to confirm its validity, would need to reclaim 0.9373.

Overnight, the USD/CHF reached a daily high at 0.9357, but a risk-off market mood, which benefitted the low-yielder Swiss franc, impeded USD bulls to reclaim the neckline of an inverted head-and-shoulders pattern forming in the 4-hour chart. At 0.9304, the USD/CHF slides and aims to test the 0.9300 mark.

Risk-aversion is back, as reflected by global equities, which could not shrug off Russia-Ukraine tensions. Meanwhile, the US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, advances 0.22%, sitting at 98.637 but failing to underpin the USD/CHF. US Treasury yields are dropping from weekly highs, led by the 10-year benchmark note falling six basis points down at 2.306%.

USD/CHF Price Forecast: Technical outlook

From the daily chart perspective, the USD/CHF is upward biased. However, USD bulls faltering to keep the exchange rate above 0.9343 exposed the pair to the 0.9297-0.9343 range.

4-Hour chart

The USD/CHF is also upward biased from an intraday perspective, as depicted by the simple moving averages (SMAs) in a bullish order. However, the 50-SMA lies above the spot price at 0.9360, almost confluence with the neckline of the inverted head-and-shoulders, acting as the first resistance level.

It is worth noting that an inverted head-and-shoulders pattern could be forming, but the USD/CHF would need to break upwards to confirm the right-shoulder formation. That said, the USD/CHF first resistance would be an upslope trendline drawn from March 7 lows, around 0.9320. Breach of the latter could push the price towards the 50-SMA at 0.9360. A decisive break would expose the inverted head-and-shoulders neckline near November 24, 2021, cycle high around 0.9360-75, followed by the 0.9400 mark.

Reuters has reported that the United States will announce a package of Russia-related sanctions on political figures and oligarchs on Thursday while US President Joe Biden meets with NATO leaders on Ukraine, US national security adviser Jake Sullivan said on Wednesday.

''Sullivan, speaking to reporters as Biden headed to Brussels for the NATO summit, said G-7 leaders will also agree on Thursday to coordinate on sanctions enforcement and plan to issue a statement.

He also said officials will have more to say on Friday about European energy issues.''

Meanwhile, the euro has been offered in recent trade as the tensions continue to mount:

-

EUR/USD pressured within bullish corrective phase

- EUR/USD is pressured in New York trade as traders weigh the risks associated with higher energy prices.

- A rise in cases “likely” caused by a more transmissible COVID-19 strain is also a concern.

- US president Joe Biden is heading to Brussels for talks with NATO and European leaders.

At 1.005, EUR/USD is down 0.20% during the time of writing and has travelled from a high of 1.1043 to a low of 1.0964 so far. The bears are engaged on the back of another sharp increase in oil and natural gas prices. Additionally, traders are on standby for announcement of fresh sanctions against Russia by the US during the president's trip to Europe.

US president Joe Biden is heading to Brussels for talks with NATO and European leaders and will seek European leaders to reduce their nation's dependency on Russian oil and gas. Biden is expected to announce new sanctions on members of the Russian parliament over Moscow's invasion of Ukraine.

However, the European Union currently is not expected to agree to a ban on Russian oil which would also weigh on the euro, especially now that Russia will insist that "unfriendly countries" pay for Russian natural gas exports only in rubles going forward, according to reports.

Russian President Vladimir Putin said Wednesday that he told Russian government officials a number of Western countries made "illegitimate decisions on the so-called freezing of the Russian assets," which has resulted in a line being crossed "over the reliability of their currencies" and has undermined the trust for those currencies, the Associated Press reported.

Putin said it "made no sense" to supply Russian goods to the European Union and the United States and receive payment in foreign currencies, including the euro and US dollars. Putin is outlining certain measures to switch to payments for "our natural gas, supplied to so-called unfriendly countries" in Russian rubles but will continue to supply natural gas in accordance with volumes and prices fixed in previously concluded contracts. Russia provides about 40 percent of Europe’s natural gas.

Covid wave swells over Europe

Several European countries have lifted coronavirus restrictions too “brutally”, the World Health Organization (WHO) has warned, as they are witnessing a rise in cases “likely” caused by a more transmissible COVID-19 strain. WHO Europe director Hans Kluge said to be “optimistic, but vigilant” about the pandemic’s development in Europe, adding that cases were on the rise in 18 out of 53 states in the region.

“The countries where we see a particular increase are the United Kingdom, Ireland, Greece, Cyprus, France, Italy and Germany,” Kluge said. “Those countries are lifting the restrictions brutally from too much to too few,” he added. Epidemiologists have noted that rising cases were partly due to the spread of the highly contagious BA.2 sub-lineage of the Omicron variant which has become dominant in many countries. However, it does not appear to cause more severe disease compared with other strains.

EUR/USD technical analysis

The weekly chart above shows that the price is correcting the weekly bearish impulse and stalling at a 50% mean reversion in resistance territory. The bears are moving in ana bearish close on the week could be significant and continue to weigh on the price outlook towards a downside extension in coming weeks

- The Canadian dollar remains firm vs. the greenback, with the USD/CAD down 0.37% in the week.

- Russia/Ukraine woes and US central bank hawkishness could not stop CAD bulls from extending USD/CAD losses.

- USD/CAD Price Forecast: Downward biased once the 200-DMA was breached.

USD/CAD drop extends to seven straight days amid a risk-off market mood in the equity markets, which has faltered to underpin the FX markets, portraying an upbeat sentiment, favoring commodity-driven currencies while safe-haven peers are the laggards of the day. At the time of writing, the USD/CAD is trading at 1.2557.

A downbeat market sentiment keeps global equities pressured while the greenback remains firm. The US Dollar Index, a gauge of the greenback’s value against a basket of six currencies, climbs 0.22% sits at 98.639. The US 10-year treasury yield easies from YTD highs, down two basis points at 2.348%.

Russia will receive roubles when selling oil and gas; boosts the Loonie

Russia – Ukraine’s woes are back in the forefront, keeping investors on their toes. Ukrainian President Zelensky stated that talks with Russia are intricate and sometimes confrontational. On the Russian front, Foreign Minister Lavrov said that NATO’s eastward expansion continues irrespective of whether a particular nation is a member.

Later, Russian President Vladimir Putin said they intend to use Russian roubles when selling gas to non-friendly countries, which caused a jump in oil prices, ultimately benefitting the Canadian dollar.

It’s worth noting that Canada’s oil and energy exports contribute just under 10% of its GDP.

In the meantime, Western Texas Intermediate (WTI’s), the US crude oil benchmark, rises almost 5%, exchanges hands at $114.06 per barrel a day, a headwind for the USD/CAD.

The US economic docket featured more Fed speakers. On a call with reporters, Loretta Mester, Cleveland Fed President, said that the Fed would need to do some 50 bps moves this year while favoring frontloading rate hikes to better position themselves for how the US economy evolves in the second half of 2022. She further added that “I have no concerns that rate increases are going to push the US economy into recession.”

USD/CAD Price Forecast: Technical outlook

The USD/CAD is downward biased once the pair broke under the 200-day moving average (DMA), sitting at 1.2609. Given that March 3 low at 1.2586 gave way to the USD/CAD, sellers’ next target would be the YTD low at 1.2450. Nevertheless, it would find some hurdles on the way south.

The USD/CAD first support would be 1.2550. Breach of the latter would expose September 3, 2021, daily low at 1.2493, followed by January 19 YTD low at 1.2450.

- The oil bulls remain in control with WTI up more than $5.0 on the day in the $114.00 area.

- WTI has now recovered more than 50% of its pullback from multi-year highs near $130 to $93 earlier this month.

- Traders have cited a major Russian pipeline outage, a bullish US inventory report and expectations for more sanctions as bullish.

With the bulls seemingly now very much back in charge in global oil markets, front-month WTI futures are trading near session highs in the $114.00 area. Prices are up more than $5.50 on the day, taking on-the-week gains to more than $9.0 and signifying that WTI has now recovered more than 50% of its pullback from earlier monthly highs in the $130 area to as low as the $93 region. Traders are pointing to an announcement from Russia that more than 1M barrels per day (over 1% of global supply) in exports via its Caspian Pipeline Consortium (CPC) pipeline, which runs through Khazakstan, has been halted due to storm-damaged berths.

“Prices are primarily rising on the loss of CPC Blend crude exports out of Novorossiisk, which accounts for about 1.3 million barrels per day of exports, adding further bullish fuel to the fire as the drop in Russian crude exports finally appears underway,” said an analyst at Kpler. The immediate drop in Russian exports as a result of apparent maintenance issues comes against the backdrop of severe sanctions placed by Western nations on the Russian economy in response to its invasion of Ukraine.

And more sanctions may well be forthcoming in the next few days, with EU nations reportedly split over to implement a Russian oil import ban and with US President Joe Biden set to arrive in the EU on Wednesday. The US President will take part in a series of emergency NATO and EU summits as leaders. “You'll know at the end of April what the total loss of Russian oil is” said Trafigura's Ben Luckock at the FT Commodities Global Summit, who predicted record backwardation and that WTI could hit $150 by Summer and $200 at a later date.

Elsewhere, the latest official weekly US inventory figures were bullish, with headline crude oil inventories posting a larger than expected draw of more than 2.5M barrels and gasoline stocks also falling by more than expected. US production, meanwhile, remained unchanged at 11.6M barrels per day. Oil prices saw modest upside in wake of the data, but WTI was unable to break convincingly back above $115.00.

- The USD/MXN remains down in the week around 1%.

- Geopolitical woes in Eastern Europe and Fed speaking keep riskier assets pressured.

- Rabobank: Banxico will hike 50 bps and expect the bank rates to end around 8% in 2022.

- USD/MXN Price Forecast: Downward biased, as bears eye a break of 20.1500, exposing the 20.00 psychological level.

Despite a risk-off market mood in the financial markets, courtesy of Russia – Ukraine tensions and hawkish Federal Reserve expectations of rate hikes larger than 25 bps, the Mexican peso rally has extended to seven consecutive days. At the time of writing, the USD/MXN is trading at 20.1706, down some 0.53%, reflecting the peso strength.

Risk aversion is back again. European and US equities are falling, while the greenback stays firm, as shown by the US Dollar Index, up 0.28%, at 98.701. US Treasury yields are almost flat, as shown by the 10-year T-note, down for the first time in the week one basis point, at 2.366%.

Geopolitical jitters back at the forefront

Ukraine’s President Zelensky said that talks with Russia are confrontational and complex. At the same time, the Russian Foreign Minister Lavrov commented that NATO’s eastward expansion continues irrespective of whether a particular nation is a member. Of late, Russian President Vladimir Putin said they intend to use Russian roubles when selling gas to non-friendly countries, which caused a jump in oil prices, benefiting the peso prospects due to the Mexican economy being dependent on crude exports.

Banxico’s to hike 50 bps – Rabobank

“Banxico will announce its latest rate decision on Thursday, March 24th, and we expect another 50bp hike taking the policy rate up to 6.50%. This is expected by the majority of analysts, and the market is fully priced for a 50bp move.”

The analysts at Rabobank added that “last week’s FOMC and Russia’s invasion of Ukraine has led us to revise our forecast to factor in another two 50bp increases and two more 25bp increases, taking the policy rate up to 8.00% by year-end.”

Fed speaking continues

The US economic docket featured more Fed speakers. Earlier, Fed Chief Powell talked about digital currencies, leaving monetary policy aside. Meanwhile, Cleveland Fed President Loretta said that the Fed would need to do some 50 bps moves this year while favoring frontloading rate hikes to better position themselves for how the US economy evolves in the second half of 2022. She further added that “I have no concerns that rate increases are going to push the US economy into recession.”

Putting this aside, the US New Home Sales for February rose 0.772M lower than the 0.81M estimated.

USD/MXN Price Forecast: Technical outlook

In the near term, the USD/MXN is downward biased. On its way south, it has broken several support levels, like the 20.3117 February 25 daily low, and at press time, it is approaching February 23 daily low at 20.1558.

If the USD/MXN clears the latter, USD/MXN’s next support would be 20.00, followed by June 25, 2021, a daily low at 19.7049.

- USD/JPY continues to trade with an upside bias and is now above 121.00 and at fresh multi-year highs.

- The pair’s gains on the month now stand at an impressive 5.3%, though it is looking technically overbought.

- Wednesday’s upside reflects a continued stream of hawkish Fed speak, with upside momentum in US yields having eased.

USD/JPY continues to trade with an upside bias and, though having pulled back from fresh multi-year highs it hit above 121.40 earlier in the day, remains support above 121 and trading with on-the-day gains of about 0.25%. Though subdued price action in US bond market (meaning unchanged yields) removes one major tailwind for the pair, higher oil prices with US President Joe Biden due to arrive in Europe on Wednesday and Western nations subsequently expected to announce new sanctions against Russia is undermining the yen. The US is net crude oil exporter, shielding the buck from the negative impact oil price upside, whereas Japan is a big net energy importer.

Wednesday’s upside may also be a reflection of a continued and steady stream of Fed speak, with policymakers indicating their desire to support/openness towards larger 50bps rate hikes at upcoming meetings. This is reinforcing the hawkish message conveyed by Fed Chair Jerome Powell on Monday and is underpinning the US dollar even if the move higher in US yields has run out of steam. Either way, USD/JPY’s rally abve 121.00 on Wednesday takes its on-the-month gains to now roughly 5.3%.

The hawkish shift from the Fed serving to ensure that US bonds cannot be used as a safe haven amid the ongoing Russo-Ukraine conflict, making a significant reversal lower in yields unlikely. Higher yields mean the US dollar is the haven of choice to hedge geopolitical risk, as opposed to the yen. That, combined with the aforementioned vulnerability of the Japanese economy to high energy prices, means the outlook for a sustained drop in USD/JPY isn’t great, even though by many metrics, the pair is very overbought.

USD/JPY’s 14-Day Relative Strength Index score hit 83.50 on Wednesday, its highest since late 2016. A score above 70.00 is considered overbought. While that does suggest some profit-taking and consolidation likely lays ahead, the RSI’s ability to predict a turnaround has been patchy over the last two years. Looking to the rest of the week, more Fed speak, flash March US PMIs and Japanese Tokyo inflation data will all be worth watching, while traders continue to monitor geopolitical developments.

San Francisco Fed President and FOMC member Mary Daly said on Wednesday that she wants to march rates to about 2.5% given that inflation is at the top of her mind, reported Reuters. The real neutral rate is about 0.5%, meaning the nominal rate is around 2.5%, Daly noted, adding that some increase in the policy rate to above the neutral rate in 2023 is likely to be required.

If inflation comes down, we might find just a little restrictive policy is just right, but if inflation moves up, we will need to be more restrictive, she noted. We are prepared to do whatever its takes to achieve price stability, Daly continued, adding that policymakers project a front-loading of rate increases.

Additional Remarks:

"Balance sheet adjustments would also deliver at least another rate hike worth of tightening."

"This is quite a bit of frontloading compared to prior cycles."

"The data will tell us if 50bps is the right recipe."

"I have everything on the table."

"The data will help us determine how much is necessary."

"The Ukraine conflict poses upside risk to inflation."

"The conflict is a modest risk to growth, but would not deliver stagflation."

"It's too early to call whether we will have a global recession, but there is a very limited chance of a US recession".

- Wall Street futures trimmed Tuesday’s gains as optimism faded.

- The better performance of the US dollar undermines gold demand.

- Gold Price bounces modestly from a Fibonacci level at $1,925.00 remains range-bound.

Gold Price stands at around $1930.00 a troy ounce, still struggling for direction as financial markets try to assess central banks and war-related headlines, although pressuring the upside and nearing the weekly high of $1,941.24. XAUUSD is raising on the back of a souring market’s mood, with Wall Street changing course after Tuesday’s gains. The US dollar is also appreciating in a risk-averse environment, mainly against its European rivals. Commodity-linked currencies, on the other hand, are finding support in soaring oil prices, reaching fresh multi-month highs versus the greenback.

Meanwhile, US indexes remain in the red, maintaining Gold Price afloat. US indexes had briefly extended their slides after the initial slump, now consolidating early losses. The Nasdaq Composite is doing better than its counterparts, down a modest 0.19%. The Dow Jones Industrial Average, on the other hand, remains near its daily lows, currently down 244 points.

Sentiment-related trading has been the main theme ever since Russia invaded neighbor Ukraine, which initially sent Gold Price towards its record highs in the $2,070 price zone. The crisis continued to escalate on a daily basis, but demand for the safe-heaven metal receded on the back of the broad dollar’s strength. Additionally, the greenback benefited from a more aggressive US Federal Reserve stance on monetary policy, as current actions to tame inflation have probed insufficient.

US Treasury yields are playing an important role in the market’s direction. Government bonds had pared their Tuesday’s slump, but not before the yield on the 10-year Treasury note peaked at 2.417%, a fresh multi-month high. The yield on the 2-year note peaked at 2.198%, but is now hovering around 2.15%.

The soft tone of equities is being exacerbated by soaring oil prices. In the absence of relevant macroeconomic figures, financial markets rotate around the Russia-Ukraine crisis. Crude oil prices are once again on the run, following some comments coming from Moscow. President Vladimir Putin said that they intend to use Russian rouble when selling gas to “non-friendly” countries, clarifying that they will respect their contracts on supply. The barrel of WTI is currently changing hands at $113.65, its highest in two weeks. Higher oil prices provide unexpected support to Gold Price.

Also read: Gold Price attempts to rebound after testing key support

Gold Price Technical Outlook

XAUUSD has spent the week hovering around a Fibonacci level, the 50% retracement of this year’s rally at $1,925.20. Movements away from the level have been shallow, although Gold Price bottomed the previous week near the next Fibonacci support level at $1,980.00, while intraday advances fell short of nearing the 38.2% retracement at $1,960.00. Market participants are looking for a clear break of any of those extremes for more sustained directional strength.

Technical readings in the daily chart suggest that Gold Price may come under further pressure, as it has been unable to move beyond a flat 20 DMA for over a week, meeting sellers around it. The same chart shows that technical indicators are directionless around their midlines, reflecting side-lined speculative interest.

From a fundamental perspective, however, XAUUSD has room to appreciate further and retest bears’ determination at around the $2,000 figure, while a break above the latter could result in a test of record highs in the $2,070 price zone.

- The NZD/USD drops from around 0.6970s as market mood dampened on Russia/Ukraine woes.

- The greenback remains firm, underpinned by Fed policymakers.

- Cleveland’s Fed President Mester adds her name to the Fed’s hawks list.

- NZD/USD Price Forecast: The break above the 200-DMA shifted the bias to upwards, though faces solid resistance around 0.7000.

The NZD/USD slides amid Wednesday’s downbeat market sentiment, courtesy of increasing tensions in the Russia-Ukraine conflict, which took the back seat at the beginning of the week, as the US central bank grabbed the attention after hiking rates and Fed speaking. At the time of writing, the NZD/USD is trading at 0.6960.

Reflection of the market mood is equities, with European and US stocks indices falling. In the FX space, the greenback advance as shown by the US Dollar Index, rising 0.35%, sitting at 98.760, while the 10-year benchmark note eases from weekly highs, down one basis point, down to 2.366%.

Russia – Ukraine war update

Ukraine’s President Zelensky said that talks with Russia are confrontational and complex. At the same time, the Russian Foreign Minister Lavrov commented that NATO’s eastward expansion continues irrespective of whether a particular nation is a member. Meanwhile, US President Joe Biden is expected to announce sanctions on more than 300 members of Russia’s lower chamber of Parliament on Thursday.

Fed officials parade continues

The US economic docket would feature more Fed speakers. Earlier, Fed Chief Powell talked about digital currencies, leaving monetary policy aside. Of late, Cleveland Fed President Loretta Mester has added her name to the list of hawks in the US central bank. On Wednesday, Mester said that the Fed would need to do some 50 bps moves this year while favoring frontloading rate hikes to better position themselves for however the US economy evolves. She further added that “I have no concerns that rate increases are going to push the US economy into recession.”

Aside from this, the US New Home Sales for February rose 0.772M lower than the 0.81M estimated, a report mainly ignored by NZD/USD traders.

NZD/USD Price Forecast: Technical outlook

Tuesday’s price action showed that the NZD/USD pair broke above the 200-day moving average(DMA)at 0.6909, shifting the bias from neutral-upwards to upwards, however it faced strong resistance around the 0.6970 area, some pips short of the 0.7000 psychological level.

With the Relative Strength Index (RSI) a momentum indicator around 66, with some room before reaching overbought conditions, the NZD/USD might test the 0.7000 mark. If that scenario plays out, the NZD/USD first resistance would be 0.6974, followed by 0.7000, and then the downslope trendline of a descending channel around 0.7050-70 area.

On the flip side, the NZD/USD first support would be the 200-DMA at 0.6909. Breach of the latter would expose January 13 previous resistance-now-support at 0.6890, followed by February 23 daioly high resistance-now-support at 0.6809.

The flash estimate of March Eurozone Consumer Confidence dropped to -18.7 in March from -8.8 the month prior, data from the European Commission on Wednesday showed. That was much steeper than the expected drop to -12.9 and marked the worst such reading since May 2020.

Market Reaction

While the data alludes to a larger than expected know to public confidence in the Eurozone as a result of the Ukraine war and its economic impact, the euro has not reacted, with EUR/USD continuing to trade slightly to the south of the 1.1000 level.

- UK Chancellor of the Exchequer Sunak’s announcement of new tax cuts has failed to give GBP a lasting lift.

- GBP/USD continues to trade in subdued fashion near the 1.3200 level after hot UK CPI also failed to lift sterling.

While the latest fiscal/tax policy announcements from the UK Chancellor of the Exchequer will certainly cheer up the British public, it has done little to cheer up pound sterling, which continues to underperform versus the majority of its G10 peers. Chancellor Rishi Sunak’s announcement of a fuel duty tax cut, a lift to the tax-free earnings threshold, a slight reduction to the tax rate for the bottom bracket and new support for businesses seemed not to impress FX market participants.

GBP/USD continues to languish near the 1.3200 level, broadly in line with its pre-Spring Statement announcement levels, with traders seemingly still very much of the view that the new policies won’t do much to improve the fairly weak outlook for the UK economy. That suggests the BoE is likely to stick to its new dovish line that only modest further monetary tightening “might” be appropriate in the months ahead.

At current levels in the 1.3190s, GBP/USD is trading with losses of about 70 pips or 0.5% on the session, with sterling also failing to garner impetus from higher-than-expected UK Consumer Price Inflation figures out earlier in the session. Headline UK inflation hit its highest in 30-years at 6.2% in February, more than expected. Attention now turns to remarks from BoE Governor Andrew Bailey, who will be appearing at a summit later in the day.

- EUR/USD challenges weekly lows near 1.0960.

- The dollar remains bid on geopolitics, inflation.

- EMU Flash Consumer Confidence next on tap in the docket.

The selling pressure keeps hurting the single currency and drags EUR/USD to the area of weekly lows around 1.0960.

EUR/USD weaker on USD-buying

EUR/USD came under renewed and strong downside pressure following the intense improvement in the sentiment around the dollar, which was exacerbated in response to persevering geopolitical unease along with the resurgence of inflation jitters.

In addition, investors' hunt for safety collaborated with the demand for bonds and forced yields on both sides of the Atlantic to shed part of the recent gains.

In the domestic calendar, the European Commission will publish the flash gauge of the Consumer Confidence in the region for the current month. Across the pond, New Home Sales contracted 2.0% MoM in February, or 0.772M units.

What to look for around EUR

EUR/USD comes under pressure and breaches the key support at the 1.1000 yardstick midweek. So far, pockets of strength in the single currency should appear reinforced by the speculation of the start of the hiking cycle by the ECB at some point by year end, while higher German yields, elevated inflation, the decent pace of the economic recovery and auspicious results from key fundamentals in the region are also supportive of a firmer euro for the time being.

Key events in the euro area this week: EC Flash Consumer Confidence (Wednesday) – Germany, EMU Flash PMIs (Thursday) – Germany IFO Business Climate (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Impact of the geopolitical conflict in Ukraine.

EUR/USD levels to watch

So far, spot is retreating 0.47% at 1.0975 and faces the next up barrier at 1.1137 (weekly high March 17) followed by 1.1229 (55-day SMA) and finally 1.1277 (100-day SMA). On the other hand, a drop below 1.0960 (low March 22) would target 1.0900 (weekly low March 14) en route to 1.0805 (2022 low March 7).

Cleveland Fed President and FOMC member Lorreta Mester on Wednesday reiterated her view that we (the Fed) are going to need to do some 50bps rate hikes this year, reported Reuters.

Additional Remarks:

"I would like to frontload some of our interest rate hikes and it is better to do that earlier rather than later."

"Frontloading rate hikes better positions policy for however the US economy evolves."

"I don’t have concerns on beginning to reduce the balance sheet and raise rates at the same meeting."

"By reducing the balance sheet, it will have a good effect on not further distorting the yield curve."

"Markets can handle such a move and we need to get on with the process."

"We have to do what we can do to get inflation under control."

"I do think we need to be more aggressive earlier rather than later."

"I am supportive of getting the balance sheet process started."

"We will need to bring interest rates up this year and next to tame inflation."

"Some wage increases we are seeing are outstripping productivity growth."

"It is going to take some deliberate policy actions on our part to bring inflation down."

"There are no concerns that rate increases are going to push the US economy into recession."

"We need to get inflation under control for both sides of the mandate."

"I supported 25bps at the last meeting because it was coupled with ongoing rate increases."

- Wall Street futures trimmed Tuesday’s gains as optimism faded.

- The better performance of the US dollar undermines gold demand.

- Gold bounces modestly from a Fibonacci level at $1,925.00 remains range-bound.

Spot gold accelerated its advance and reached a fresh daily high of$1,93 a troy ounce, helped by the poor performance of US indexes. The Dow Jones Industrial Average opened 200 points lower, having ever since extended its slump to currently trade roughly 230 points lower. The S&P 500 shed 0.73% at the time being, while the Nasdaq Composite trades some 110 points lower.

Sentiment-related trading has been the main theme ever since Russia invaded neighbour Ukraine, which initially sent Gold Price towards its record highs in the $2,070 price zone. The crisis continued to escalate on a daily basis, but demand for the safe-heaven metal receded on the back of the broad dollar’s strength. Additionally, the greenback benefited from a more aggressive US Federal Reserve stance on monetary policy, as current actions to tame inflation have probed insufficient.

US Treasury yields are playing an important role in the market’s direction. Government bonds had pared their Tuesday’s slump, but not before the yield on the 10-year Treasury note peaked at 2.417%, a fresh multi-month high.

The soft tone of equities is being exacerbated by soaring oil prices. In the absence of relevant macroeconomic figures, financial markets rotate around the Russia-Ukraine crisis. Crude oil prices are once again on the run, following some comments coming from Moscow. President Vladimir Putin said that they intent to use Russian rouble when selling gas to “non-friendly” countries, clarifying that they will respect their contracts on supply. The barrel of WTI is currently changing hands at $113.65, its highest in two weeks. Higher oil prices provide unexpected support to Gold Price.

Also read: Gold attempts to rebound after testing key support

XAUUSD Technical Outlook

XAUUSD has spent the week hovering around a Fibonacci level, the 50% retracement of this year’s rally at $1,925.20. Movements away from the level have been shallow, although Gold Price bottomed the previous week near the next Fibonacci support level at $1,980.00, while intraday advances fell short of nearing the 38.2% retracement at $1,960.00. Market participants are looking for a clear break of any of those extremes for more sustained directional strength.

Technical readings in the daily chart suggest that Gold Price may come under further pressure, as it has been unable to move beyond a flat 20 DMA for over a week, meeting sellers around it. The same chart shows that technical indicators are directionless around their midlines, reflecting side-lined speculative interest.

From a fundamental perspective, however, XAUUSD has room to appreciate further and retest bears’ determination at around the $2,000 figure, while a break above the latter could result in a test of record highs in the $2,070 price zone.

Swiss National Bank (SNB) meets on Thursday, March 24 at 08:30 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of four major banks upcoming central bank's Interest Rate Decision.

The SNB is set to keep rates on hold at -0.75%. Importantly, market participants will watch closely the language and classification of the Swiss franc.

Nordea

“Inflation is rising in Switzerland; the pace is much slower than in other developed markets, but it will put pressure on the central bank to act. The war between Russia and Ukraine does not help. Switzerland imports a relatively large volume of metals and energy, which will add to the already rising inflation pressure. Nonetheless, the current market turmoil has resulted in material safe haven flow and FX appreciation, which is why we expect the central bank to stay put for now.”

BBH

“SNB is expected to keep rates steady at -0.75%. We expect upward revisions to the inflation forecasts, but the trajectory should continue to suggest liftoff won’t be seen until 2024 at the earliest. Of note, forecasts for 2024 will be added at this meeting and will be a key part of the bank’s forward guidance. Swaps market is pricing in over 50 bp of tightening over the next 12 months, which seems too aggressive.”

Credit Suisse

“We don’t expect any change to the central bank’s main policy rate, which currently stands at -0.75%. The SNB’s room for maneuver is not as broad as it used to be given the rise in inflation, in particular when it comes to countering appreciation pressures on the Swiss franc. However, given the ongoing Ukraine conflict and the darkening economic outlook for the euro area attached to it, we do not think the SNB will risk raising its long-term inflation forecast closer to 2%yoy or possibly even above. Therefore, we expect the central bank’s long-term inflation forecast to remain visibly below 2% YoY. We believe the SNB will continue labelling the Swiss franc as ‘highly valued’ and will reiterate its willingness to intervene in the foreign exchange markets. We find this argument less and less convincing, though.”

Citibank

“SNB Policy Rate: Citi Forecast -0.75%, Consensus -0.75%, Previous -0.75% (Franc still highly valued). Despite more franc strength, a dovish signal from the SNB, such as raising the franc assessment to ‘overvalued’, seems unlikely as the franc has already moved away from euro parity without intervention. The strong franc remains convenient for the SNB for now given the prospects for a higher 2022 inflation trajectory from 1.0% to at least 2.0% (Citi 2.3%). More interesting is what happens thereafter – rising core inflation suggests the SNB is likely to change little in its assessment. We expect the SNB will ultimately follow the ECB on rate hikes, likely with a one-hike delay (March 2023 could be when SNB first hikes if the ECB commences lift-off in December) but if the ECB’s rate hike cycle gets stuck – then the SNB may shift towards sheet reduction. The SNB may only seek to weaken the franc to the 1.10 area vs EUR once global inflation rates decline next year.”

Russian Deputy Prime Minister Alexander Novak said on Wednesday that he doesn't have any information to suggest someone at OPEC+ is proposing lifting oil output above the existing plan, reported Reuters. Novak continued that it is too early to talk about the need to adjust Russia's OPEC+ quota because of sanctions and said that Russian companies expect difficulties with logistics and payments on energy supplies in April and May.

Market Reaction

Oil markets continue to tick higher, with front-month WTI futures currently at session highs in the $114.00 area and up about $5.50 on the day, with the latest headlines unlikely to do much to dissuade the bulls.

New Home Sales in the US fell to 772K in February from 810K the month prior, corresponding to a 2.0% MoM decline, after declining 8.4% a month earlier, data released by the US Census Bureau on Wednesday showed.

EUR/GBP remains in familiar ranges. In the view of analysts at Rabobank, the pair is likely to trend higher into the middle of the year and beyond.

Even on the bleakest scenario growth, the eurozone would still achieve 2.3% this year

“Assuming the market retains its expectation that energy black-outs and stagflation will be avoided in the eurozone, EUR/GBP is likely to avoid another retreat towards the recent lows close to 0.82 and should head higher towards the middle of the year.”

“Stagflationary risks could come from a worsening in the energy crisis in Europe. This week ECB President Lagarde offered reassurances that this was not on the cards and that even on the bleakest scenario growth that the Eurozone would still achieve 2.3% this year. As long as the market holds on to this outlook, we expect EUR/GBP to push higher towards 0.85 on a three to six-month view.”

- AUD/USD witnessed modest intraday pullback from the fresh YTD top touched on Wednesday.

- The Fed’s hawkish outlook, elevated US bond yields underpinned the USD and capped the upside.

- The Russia-Ukraine crisis weighed on investors’ sentiment and also benefitted the safe-haven buck.

- Upward pressure on commodity prices helped limit deeper losses for the resources-linked aussie.

The AUD/USD pair remained on the defensive through the early North American session and was last seen hovering near the daily low, around mid-0.7400s.

The pair witnessed modest pullback from the 0.7480 area or the highest level since early November 2021 touched earlier this Wednesday and eroded a part of the previous day's strong gains. The recent blowout rally in the US Treasury bond yields, bolstered by the Fed's hawkish outlook, acted as a tailwind for the US dollar. This, in turn, was seen as a key factor that acted as a headwind for the AUD/USD pair.

It is worth recalling that the Fed last week indicated that it could raise rates at all the remaining six meetings in 2022. Moreover, Fed Chair Jerome Powell suggested that the US central bank could adopt a more aggressive policy response to combat stubbornly high inflation. This, in turn, pushed the yield on the benchmark 10-year US government bond to the highest level since 2019 earlier this Wednesday.

Apart from this, modest pullback in the equity markets drove some haven flows towards the greenback and weighed on the perceived riskier aussie. The lack of progress in the Russia-Ukraine peace negotiations kept investors on the edge and benefitted the safe-haven buck. Russian Foreign Minister Sergei Lavrov said that talks with Ukraine are difficult as Kyiv is constantly changing its position.

Separately, Italy's Prime Minister Mario Draghi noted that Russia is not showing interest in a truce for successful peace talks. This, in turn, tempered investors' appetite for riskier assets and exerted some downward pressure on the AUD/USD pair. The downside, however, remains cushioned amid rising commodity prices, which continued lending some support to the resources-linked Australian dollar.

In fact, commodity prices have been facing upward pressure amid concerns over global supply chain disruptions following Russia's invasion of Ukraine and the imposition of fresh COVID-19 restrictions in China. This, in turn, warrants some caution before confirming that the AUD/USD pair has topped out in the near term and positioning for any meaningful corrective slide amid absent economic releases.

Technical levels to watch

USD/CAD is little changed on the session as key trend support at 1.2575 continues to prop up the pair. A break below the latter would open up additional losses to the 1.24 level, economists at Scotiabank report.

Key support at 1.2575 under pressure

“Intraday and daily trend signals remain aligned bearishly for USD/CAD, which suggests ongoing downside pressure (and limited scope for USD rebounds at present).”

“We spot resistance at 1.2640/50 while a clear break under 1.2575 should see spot push lower to the 1.24 area fairly quickly.”

- EUR/USD fades Tuesday’s gains and refocuses on the downside.

- A drop to 1.0900 looks increasingly likely near term.

EUR/USD flirts with the weekly low around 1.0900 amidst the offered stance in the risk complex.

Extra weakness is expected to meet the next support at the weekly low at 1.0960 (March 22), while a breach of it should expose a potential retracement to another weekly low at 1.0900 (March 14).

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1514.

EUR/USD daily chart