- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-02-2023

- GBP/USD observe bids around 1.2000, however, the downside looks imminent amid geopolitical tensions.

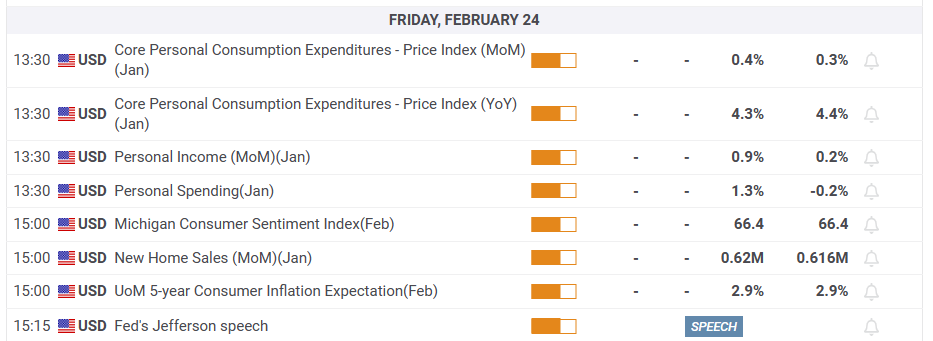

- The USD Index could be fueled for more gains if US PCE inflation delivers signs of recovery.

- BoE Mann has favored further policy tightening as she is worried about the extended persistence of inflation

The GBP/USD pair has sensed a buying interest around 1.2000 in the early Asian session. The Cable has shown a minor recovery despite the weak risk appetite of the market participants. The rebound move by the Pound Sterling should be considered a pullback move for now as the downside bias is still intact amid geopolitical tensions.

S&P500 futures have eased some gains as US President Joe Biden looks confident about an arms deal between China and Russia to support Moscow in its battle against Ukraine. The Biden administration is considering releasing intelligence it believes shows that China is weighing whether to supply weapons to support Russia’s war in Ukraine, as reported by Wall Street Journal. Earlier, US Secretary of State Antony Blinken warned, in an interview with CBS News, “China is seriously exploring supplying arms to Russia.”

Global equities could face severe pressure ahead as the central banks are not done with their policy tightening to contain the sticky inflation. Feb 10-22 Reuters poll of more than 150 strategists, analysts, and fund managers covering 17 global stock indices found 56% were expecting a correction in their local market in the next three months. Therefore, investors should brace for sheer volatility ahead.

The US Dollar Index (DXY) has surrendered some of its gains and has dropped to near 104.20. The USD Index is likely to remain volatile ahead of the release of the United States Core Personal Consumption Expenditure (PCE) Price Index data. On an annual basis, the economic data is seen higher at 4.3% vs. the former release of 4.4%. The monthly data is expected to escalate by 0.4% against 0.3% released earlier. And, January Personal Spending is expected to increase by 1.3% against a contraction of 0.2%.

On the United Kingdom front, the commentary from Bank of England (BoE) policymaker Catherine Mann indicates that the central bank should not consider the rate peak for now as the inflation figure is still in double digits despite pushing rates to 4%. BoE policymaker is worried about the extended persistence of inflation and sees the need for more tightening and believes that a pivot is not imminent.

- US Dollar Index fades upside momentum after refreshing seven-week top.

- Strong US data amplifies hawkish Fed concerns but yields suggest the moves are already priced in.

- US Core PCE Price Index for January will be crucial for immediate directions, geopolitical headlines are also important to watch.

US Dollar Index (DXY) bulls struggle to keep the reins around mid-104.00s, following a run-up to refresh the seven-week high to 104.78 mark, as traders await the Federal Reserve’s (Fed) favorite inflation number on Friday.

Upbeat US data joined geopolitical fears emanating from China and Russia underpinned the US Dollar’s run-up to refresh multi-day high. However, a pullback in the US Treasury bond yields, mainly on concerns that the strong data are already priced in the latest hawkish Fed moves, as well as in the expectations for the near-future moves, seems to have probed the DXY bulls afterward.

That said, Thursday’s second reading of the US Gross Domestic Product Annualized, better known as Real GDP, eased to 2.7% for the fourth quarter (Q4) versus 2.9% first forecasts. However, the Personal Consumption Expenditure (PCE) Price and Core PCE for the said period rose to 3.7% and 4.3% QoQ versus 3.2% and 3.9% respective first estimations. Additionally, the Chicago Fed National Activity Index improved to 0.23 in January from -0.46 (revised), versus 0.03 analysts’ estimates. On the same line, Initial Jobless Claims also eased to 192K for the week ended on February 17 from 195K (revised) prior, compared to 200K expected.

Elsewhere, the US 10-year Treasury bond yields marked a two-day downtrend near 3.89%, following a run-up to refresh a three-month high.

It should be noted that the absence of a fresh boost to the hawkish Fed concerns, other than what’s already known to the markets, seemed to have triggered the latest DXY retreat, especially ahead of the key US inflation data.

On the same line could be the recently mixed headlines surrounding China. On Thursday, US Treasury Secretary Janet Yellen signaled that the US will resume discussions with China on economic issues 'at an appropriate time' whereas China’s Commerce Ministry urged the US to create good conditions for trade with China. The news managed to trigger the pair’s bounce off a multi-day low on Thursday. On the same line were statements from China’s commerce ministry spokesperson who said, the recovery momentum in the country’s consumer market was strong in January while also adding, “The government will take more measures to revive and expand consumption.”

Elsewhere, the latest headlines suggesting China’s readiness to supply combat drones to Russia and the US Senators’ push to halt Chinese carriers overflying Russia on US flights seem to renew the market fears and put a floor under the US Dollar Index.

Against this backdrop, S&P 500 Futures print mild losses despite Wall Street’s positive closing.

Moving ahead, geopolitical headlines and Japan’s return from holiday may entertain DXY traders ahead of the US Personal Consumption Expenditures (PCE) Price Index data for January. That said, The PCE Price Index is expected to have risen by 4.9% YoY in January, versus 5% prior. Further, the more relevant Core PCE Price Index, known as Fed’s favorite inflation gauge, is likely eased to 4.3% YoY, compared 4.4% prior.

Also read: US PCE Inflation Preview: Can the US Dollar turn bullish for good?

Technical analysis

A convergence of the 100-day Exponential Moving Average (EMA) and 200-EMA, around 104.85-90 at the latest, appears a tough nut to crack for the US Dollar Index (DXY) bulls. The pullback moves, however, remain elusive unless breaking a three-week-old support line, close to 104.30 by the press time.

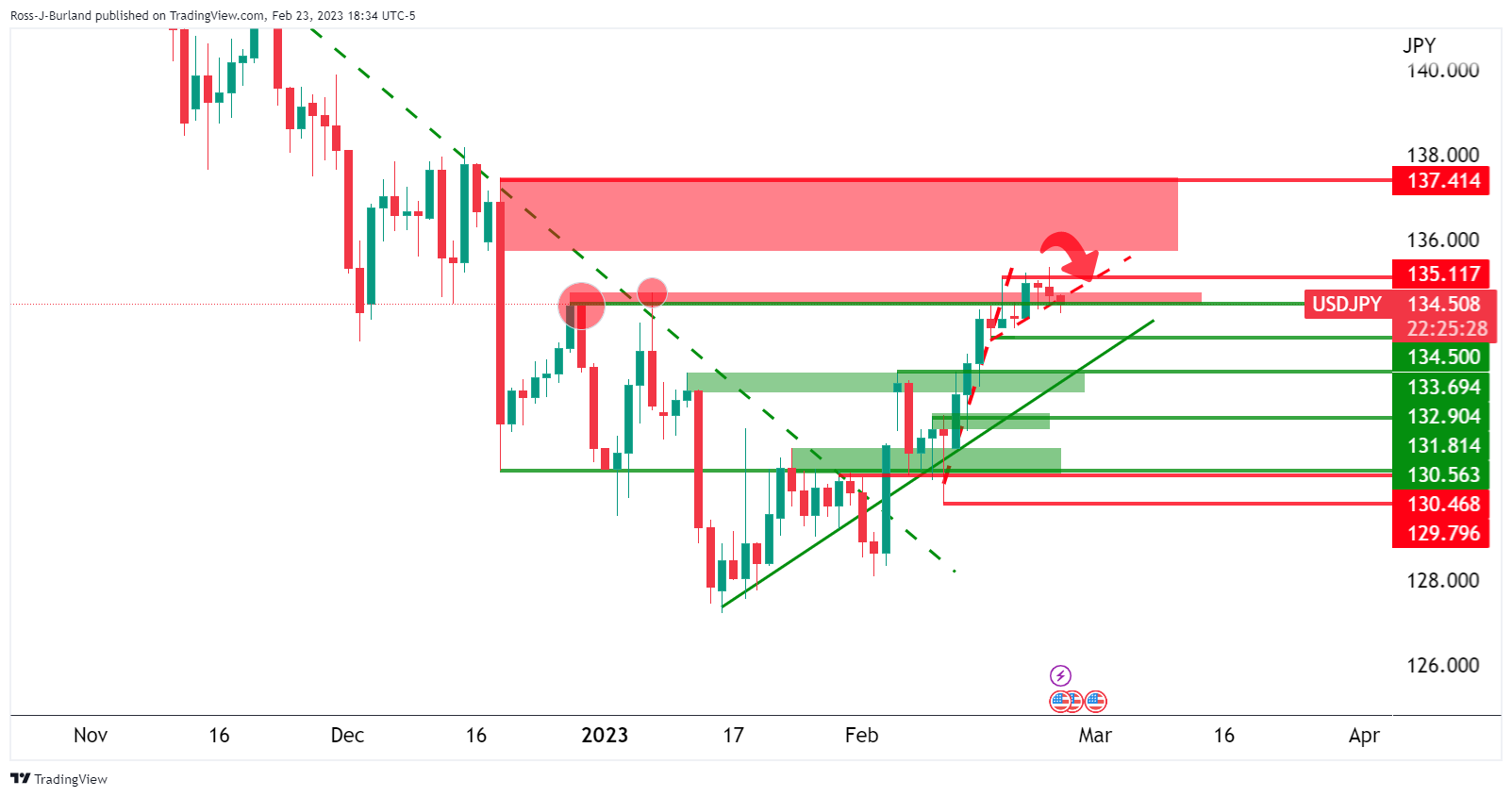

- USD/JPY is under pressure from a move to test key structure.

- The bears eye a break below 134.50 for the day ahead.

USD/JPY is offered at the start of Friday ahead of a busy schedule that will include Kazuo Ueda as the new head of the Bank of Japan speaking in parliament on Friday and key US inflation data. Japan's Consumer Price Index has also been released today but has done little to through the bears off their tracks as they move into longs that have been building over several days.

USD/JPY daily chart

USD/JPY is being capped at what could be the top of an impressive run of late that has lasted over the course of 2023 so far. On a break of 134.50, the bears will be keen on a test to 133.70 and will then eye 132.90.

USD/JPY H1 chart

From an hourly perspective, the price needs to get below the 134.50 structure to open 132.90 and 133.70 when it will be on the backside of the micro bullish dynamic trendline. A long squeeze will then be in play and risks of the bull's capitulation on the cards also.

A Reuters poll shows that nearly half of the Japanese firms say that new leadership at the central bank should revise its negative interest rate policies, while more than a quarter say its price target should be changed.

Meanwhile, Kazuo Ueda is the new head of the Bank of Japan and he will be speaking in parliament on Friday and Monday. Traders will be watchful of what he says with regard to the central bank's monetary easing.

We also have Japan’s headline Consumer Price Index which is expected to rise to 4.3% for the year in January from 4.0%. These data expectations are of course well above the BoJ’s 2% target.

Meanwhile, USD/JPY is trading lower by some 0.18% and offered ahead of the above events, moving into a build up of lonmgs from the last number of days.

- Silver price holds lower ground near one-week bottom, down for the third consecutive day.

- Three-month-old ascending trend line, 200-DMA to join nearly oversold RSI to challenge XAG/USD bears.

- Buyers remain off the table unless crossing 100-DMA.

Silver price (XAG/USD) remains on the back foot at the weekly low near $21.30 during early Friday in Asia. In doing so, the bright metal drops for the third consecutive day while extending the early-week pullback from the 100-DMA and a 3.5-month-old horizontal resistance area.

It’s worth noting that the bearish MACD signals keep the XAG/USD sellers hopeful. However, the RSI (14) appears oversold and suggests a pause in the metal’s south run.

As a result, an upward-sloping support line from late November, close to $21.20 by the press time, as well as the 200-DMA level of around $21.00, gain major attention.

Following that, the late November swing low of around $20.60-55 could act as the last defense of the Silver buyers before directing the commodity price towards November 2022 bottom near $18.80.

Meanwhile, recovery moves may initially aim for the $21.50 before jostling with the aforementioned horizontal resistance area and the 100-DMA surrounding $22.00-05.

In a case where the Silver price offers a daily closing beyond $22.05, February 09 high near $22.60 and the previous monthly low near $22.80 will be crucial to watch for the XAG/USD bulls.

Silver price: Daily chart

Trend: Limited downside expected

- GBP/JPY slid below crucial daily EMAs, namely the 200 and the 100-day EMAs.

- The GBP/JPY must crack the 161.00 figure for a bearish continuation.

- On the other hand, GBP/JPY buyers reclaiming 162.00 could pave the way for further upside.

The GBP/JPY registers minuscule gains as Friday’s Asian session begins after tumbling below the 200 and 100-day Exponential Moving Averages (EMAs), at 161.82 and 161.98, respectively. After forming a dark cloud cover and missing to hold to 162.00, the GBP/JPY is trading at around 161.70.

GBP/JPY Thursday’s price action changed the pair’s bias as sellers reclaimed solid support areas, which turned to resistance. Although the Relative Strength Index (RSI) is in bullish territory, its slope aims downwards, suggesting that sellers are gaining momentum. Still, the Rate of Change (RoC) suggests the opposite, that buyers are moving in. Therefore, the GBP/JPY bias is neutral.

For a GBP/JPY bearish continuation, traders must drag prices toward the 50-day EMA at 161.10. Once cleared, the GBP/JPY might test the 20-day EMA at 160.87 before dropping to the 160.00 figure.

As an alternate scenario, if the GBP/JPY reclaims 162.30, that could open the door for further upside. Hence, the GBP/JPY first resistance would be the February 23 daily high at 162.85. The next stop would be the weekly high at 163.75 before testing a major five-month-old downslope trendline that passes around.

GBP/JPY Daily chart

GBP/JPY Key technical levels

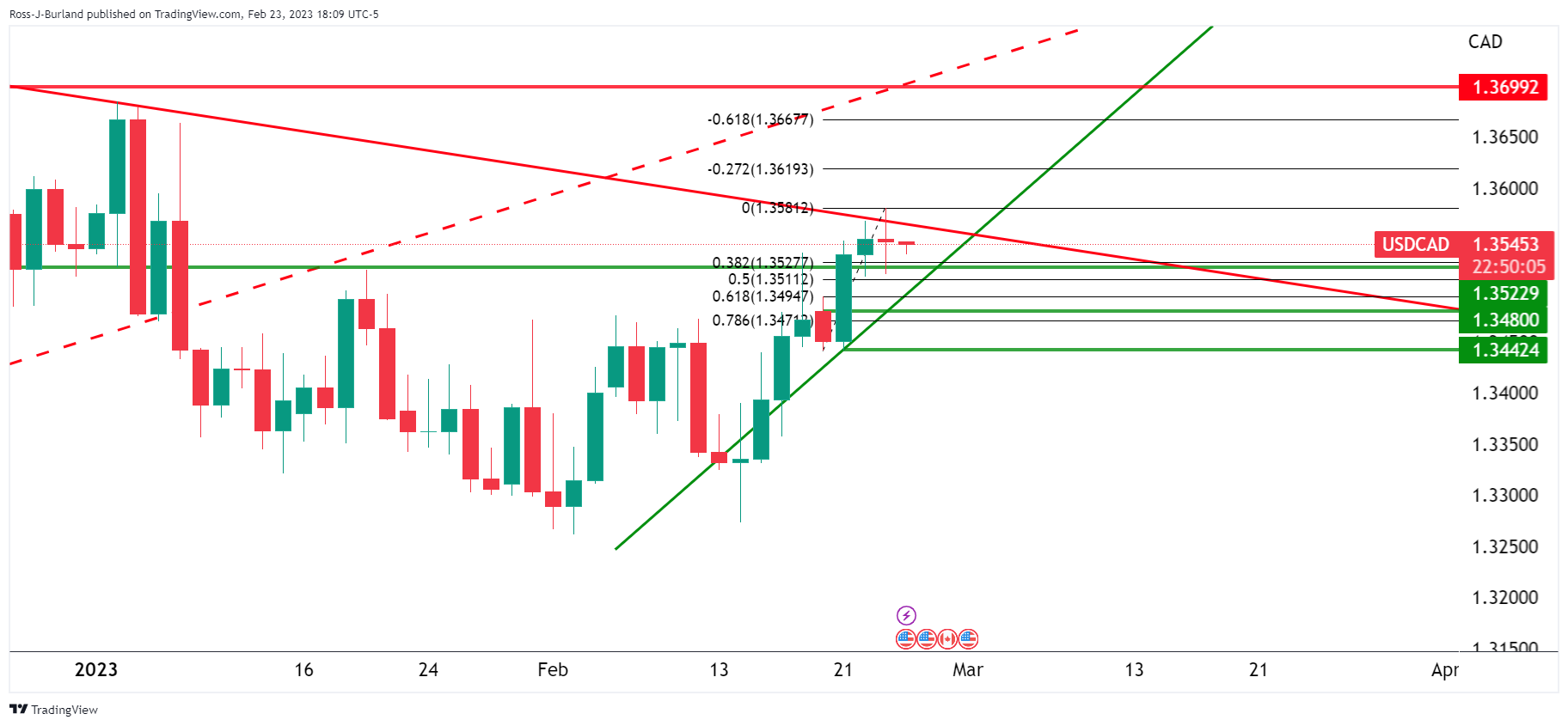

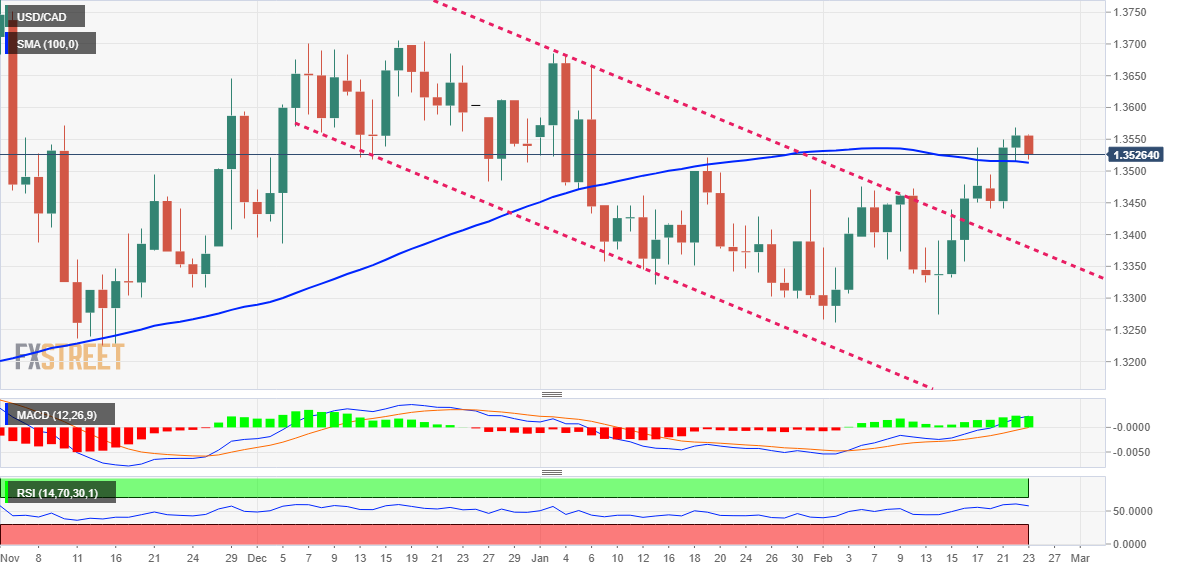

- USD/CAD is meeting resistance leaving the 38.2% Fibonacci retracement level towards 1.3500 exposed.

- US data will yet again be front and centre to end the week.

The US Dollar was bolstered by yet further evidence of an inflationary theme in the US economy with the strong economic data that continues to suggest the US Federal Reserve's monetary policy tightening could be extended if it is to bring down the highest inflation in decades. The number of Americans filing new claims for unemployment benefits unexpectedly fell last week, showing a still-tight labor market and a resilient US economy.

Meanwhile, the second estimate of US Q4 Gross Domestic Product being revised down 0.2% to 2.7% saar. The downward revision was driven by weakness in private consumption which was reported at 1.4% vs 2.1% in the preliminary estimate. The GDP deflator rose 4.3%, up from 3.9% in the previous estimate. The personal savings rate was revised to 3.9%, up 0.5pts.

Speaking of deflators, Friday's PCE deflator will be a key red news event. Ahead of the event, the Fed funds futures traders are now pricing for the federal funds rate to reach 5.34% in July, and staying above 5% all year. That rate is currently between 4.50%-4.75% range.

''The market is expecting the January headline data to remain at 5.0% YoY, in line with the previous month,'' analysts at Rabobank said. ''This would strengthen concerns that the downtrend in inflationary indicators may have stalled. Data in line with market expectations would thus add further weight to the view that the Fed will have to work harder to push inflation back to its target level. Currently implied market rates are pointing to a peak in Fed funds close to 5.33%.''

USD/CAD technical analysis

The above charts outline the boundaries for the price in USD/CAD that arrives with a meanwhile bearish bias as the bulls meet resistance following a burst to the upside on US Dollar strength. The bears eye a 38.2% Fibonacci retracement level towards 1.35 the figure for the day ahead.

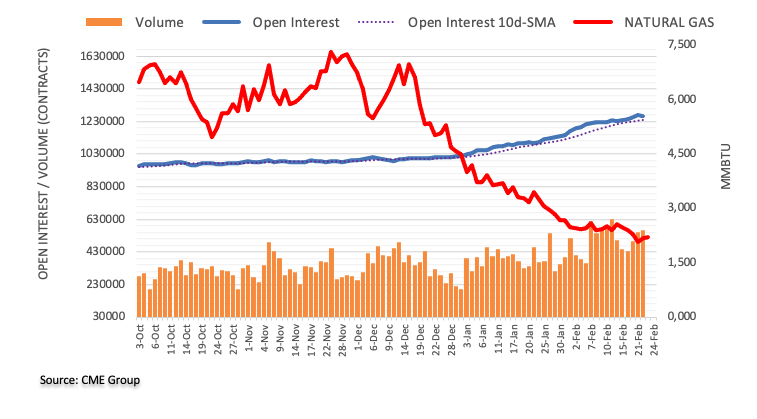

- WTI has extended its recovery above $75.50 as Russia sets to deepen supply cuts.

- Investors have started ignoring the impact of the huge oil inventory build-up reported by the US EIA.

- Chinese government’s commitment to revive and expand consumption is also providing support to the oil price.

West Texas Intermediate (WTI), futures on NYMEX, have stretched their recovery above $75.50 in the early Tokyo session. Earlier, the oil price displayed a sheer sell-off after the United States American Petroleum Institute (API) announced a huge build-up of oil inventories for the week ending February 17.

Now, the higher build-up of oil stockpiles has been confirmed by the US Energy Information Administration (EIA) at 7.6 million barrels.

However, the oil price has ignored the oil building and has started rising as Russia is expected to deepen oil supply cuts in retaliation to sanctions from Western allies. To restrict funding for arms and ammunition in the battle against Ukraine, Western allies are continuously tightening the price cap on oil provided by Moscow in the international market. This has forced the Kremlin to deepen supply cuts, which might take off the oil price due to a supply glitch.

Russia is considering an oil supply cut at its western ports by up to 25% from March that exceeds its former 500,000 barrels oil supply cut announcement.

Apart from that, an assurance of a demand recovery from China’s commerce ministry has infused fresh blood into the oil bulls. A Chinese commerce ministry spokesperson said at a news conference on Thursday, the recovery momentum in the country’s consumer market was strong in January. He further added, “The government will take more measures to revive and expand consumption.”

Meanwhile, the rising appeal for the US Dollar could spoil the oil bulls’ party. The US Dollar Index (DXY) has shifted its business comfortably above 104.00 as the Federal Reserve (Fed) is dedicated to bringing United States inflation to normalcy by reaching the terminal rate in no time. The expectations of a continuation of policy tightening are supporting the USD Index.

The unfortunate geopolitical tension between Russia and Ukraine has completed one year. The geopolitical issue recently became more vital and weighed on the market sentiment with the participation of the US and China being aggressive, actually in the adverse directions.

That said, Germany’s Der Spiegel came out with the news suggesting, China is negotiating with Russia over supplying 100 Kamikaze combat drones by April.

On the other hand, US Senators pushed for limiting flights and carriers over Russian territory, per Reuters. “The chairman of the Senate Foreign Relations Committee and the committee’s top Republican urged the Biden administration to halt Chinese airlines and other non-American carriers from overflying Russia on US routes,” said the news.

Elsewhere, “Russia still deeply isolated at UN, one year into Ukraine war,” reported Reuters.

The news also said that the United Nations General Assembly overwhelmingly isolated Russia on Thursday, marking one year since Moscow invaded Ukraine by calling for a "comprehensive, just and lasting peace" and again demanding Russia withdraw its troops and stop fighting.

Market implications

The news underpins the US Dollar’s strength amid a risk-off mood, even as the yields allowed Wall Street to close with mild gains.

Also read: Forex Today: US data fueled market concerns ahead of PCE inflation figures

- USD/CHF is looking for recovery after a pullback move amid the risk-off impulse.

- S&P500 futures have ignored the risk-aversion theme amid the upbeat US economic outlook.

- Geopolitical tensions between the US and China have improved the US Dollar appeal.

The USD/CHF pair has corrected marginally to near 0.9330 after printing a fresh six-week high around 0.9350 in the early Asian session. The Swiss franc asset is expected to recover sooner as the risk profile is supporting the safe-haven assets. The US Dollar bulls seem in control as the Federal Reserve (Fed) policymakers are reiterating the requirement of more rates by the central bank to bring down inflation to the 2% target.

The US Dollar Index (DXY) has shown a pullback to near 104.15, however, the upside bias is still favored as rising hawkish Fed bets have dampened the market mood. Contrary to the risk-aversion theme, S&P500 futures displayed recovery as investors are focusing on upbeat demand, recovery in economic activities, and rising labor requirements rather than underpinning the risk associated with higher interest rate projections.

The context that investors have started digesting higher interest rates by the Fed has resulted in a decline in the demand for US government bonds. The yields provided on 10-year US Treasury bonds dropped to near 3.89%.

Meanwhile, geopolitical tensions between the United States and China have improved the US Dollar appeal. US Treasury Secretary Janet Yellen cited on Thursday “Communication between US and China is important for the rest of the world. And, the US will resume discussions with China on economic issues 'at an appropriate time'.

For further guidance, US Core Personal Consumption Expenditure (PCE) Price Index and Personal Spending will be keenly watched. On an annual basis, the economic data is seen higher at 4.3% vs. the former release of 4.4%. The monthly data is expected to escalate by 0.4% against 0.3% released earlier. And, January Personal Spending is expected to increase by 1.3% against a contraction of 0.2%. A recovery in personal spending will accelerate the chances of more rates by the Fed.

On the Swiss Franc front, the rising Consumer Price Index (CPI) is creating troubles for the Swiss National Bank (SNB). Therefore, more rate hike announcements by SNB Chairman Thomas J. Jordan looks warranted to counter “increased inflationary pressure and a further spread of inflation”.

- EUR/USD remains depressed around seven-week low, fades late Thursday’s corrective bounce.

- Chatters that markets priced in higher rates seemed to have triggered rebound from multi-day low.

- Hawkish Fed concerns, geopolitical headlines keep Euro bears hopeful ahead of the key US Core PCE data.

EUR/USD holds lower ground near 1.0600, following a corrective bounce off multi-day bottom that ended up positing the four-day downtrend to early Friday morning in Asia. In doing so, the major currency pair justifies the broad US Dollar strength amid upbeat US data, as well as a pullback in the US Treasury bond yields ahead of the key US inflation clues.

That said, traders’ factoring in the multiple rate hikes seems to underpin the corrective pullback in the US Treasury bond yields and the US Dollar. “US Treasury yields slid in choppy trading on Thursday, with investors already factoring in strong economic data that has supported expectations of a few more interest rate hikes by the Federal Reserve this year,” said Reuters.

Alternatively, comments from US Treasury Secretary Janet Yellen signaled that the US will resume discussions with China on economic issues 'at an appropriate time' whereas China’s Commerce Ministry urged the US to create good conditions for trade with China. The news managed to trigger the pair’s bounce off a multi-day low on Thursday. On the same line were statements from China’s commerce ministry spokesperson who said, the recovery momentum in the country’s consumer market was strong in January while also adding, “The government will take more measures to revive and expand consumption.”

However, the latest headlines suggesting China’s readiness to supply combat drones to Russia and the US Senators’ push to halt Chinese carriers overflying Russia on US flights seem to renew the market fears and weigh on the AUD/USD prices.

Thursday’s US data dump signaled that the second reading of the Gross Domestic Product Annualized, better known as Real GDP, eased to 2.7% for the fourth quarter (Q4) versus 2.9% first forecasts. However, the Personal Consumption Expenditure (PCE) Price and Core PCE for the said period rose to 3.7% and 4.3% QoQ versus 3.2% and 3.9% respective first estimations. Additionally, the Chicago Fed National Activity Index improved to 0.23 in January from -0.46 (revised), versus 0.03 analysts’ estimates. On the same line, Initial Jobless Claims also eased to 192K for the week ended on February 17 from 195K (revised) prior, compared to 200K expected. Hence, the latest set of the US data has been following the upbeat economics released so far in February and has helped the US Dollar to remain firmer, after early Thursday’s retreat.

On the other hand, Eurozone Core Inflation refreshed a record high to 5.3% YoY for January, per the Core Harmonized Index of Consumer Prices measures, versus 5.2% expected and prior.

Against this backdrop, Wall Street closed mildly positive and the US Treasury bond yields retreat from the three-month high but the US Dollar Index (DXY) remains firm ahead of the key data.

Looking forward, a light calendar in the Asia-Pacific zone, as well as in Europe, highlights the US data for fresh impulse. As a result, the Personal Consumption Expenditures (PCE) Price Index will be the key, expected to have risen by 4.9% YoY in January, versus 5% prior. Further, the more relevant Core PCE Price Index, known as Fed’s favorite inflation gauge, is likely eased to 4.3% YoY, compared 4.4% prior.

Also read: US PCE Inflation Preview: Can the US Dollar turn bullish for good?

It should be noted that the second-tier German data will also be important to watch for extra directives.

Technical analysis

A convergence of the 100-day Exponential Moving Average (EMA) and an 11-week-old ascending support line, close to 1.0550 by the press time, appears a tough nut to crack for the EUR/USD bears.

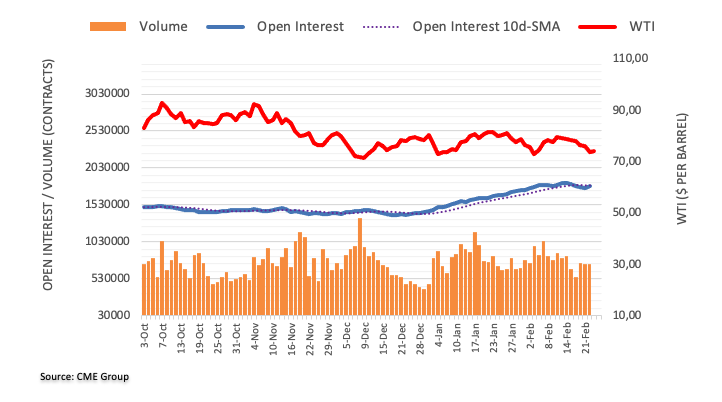

- Gold price is exposed for further downside to near $1,800.00 amid hawkish Fed bets.

- The USD Index is showing signs of reversal as the Fed is expected to continue its policy tightening.

- Gold price has comfortably shifted below the 38.2% Fibonacci retracement at $1,829.45.

Gold price (XAU/USD) has printed a fresh seven-week low of $1,819.00 as the Federal Reserve (Fed) policymakers are favoring reaching the terminal rate as early as possible. The reason behind quickly accessing the terminal rate is the upbeat labor market in the United States, which could underpin the Consumer Price Index (CPI) sooner.

The US Dollar Index (DXY) is showing signs of reversal after a corrective move to near 104.15 as the Fed is expected to continue its policy tightening spell to achieve price stability. This has exposed the Gold price to continue its downside momentum to near the round-level support of $1.800.00.

S&P500 futures recovered on Thursday as investors believe that the US economy is not exposed to recession fears as the economic outlook is steady amid stellar retail demand and robust labor need. Contrary to that, the 10-year US Treasury yields dropped below 3.90%.

On Thursday, the number of people filing for jobless claims for the first time dropped to 192K vs. the consensus of 200K. This has signaled again that the labor market is extremely tight and consumer spending will remain robust ahead.

Economists at TD Securities expect 25 bps rate hikes in March and May, with the Fed settling on a terminal Fed funds target rate range of 5.00%-5.25% by May. And, Fed chair Jerome Powell will keep higher rates for a longer period.

Gold technical analysis

Gold price has comfortably shifted below the 38.2% Fibonacci retracement (placed from November 3 low at $1,616.69 to February 2 high at $1.959.71) at $1,829.45 on a four-hour scale. The precious metal is expected to display more weakness below the immediate support at $1,819.00.

The 50-period Exponential Moving Average (EMA) at $1,840.00 is acting as resistance for the Gold price.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates more weakness ahead.

Gold four-hour chart

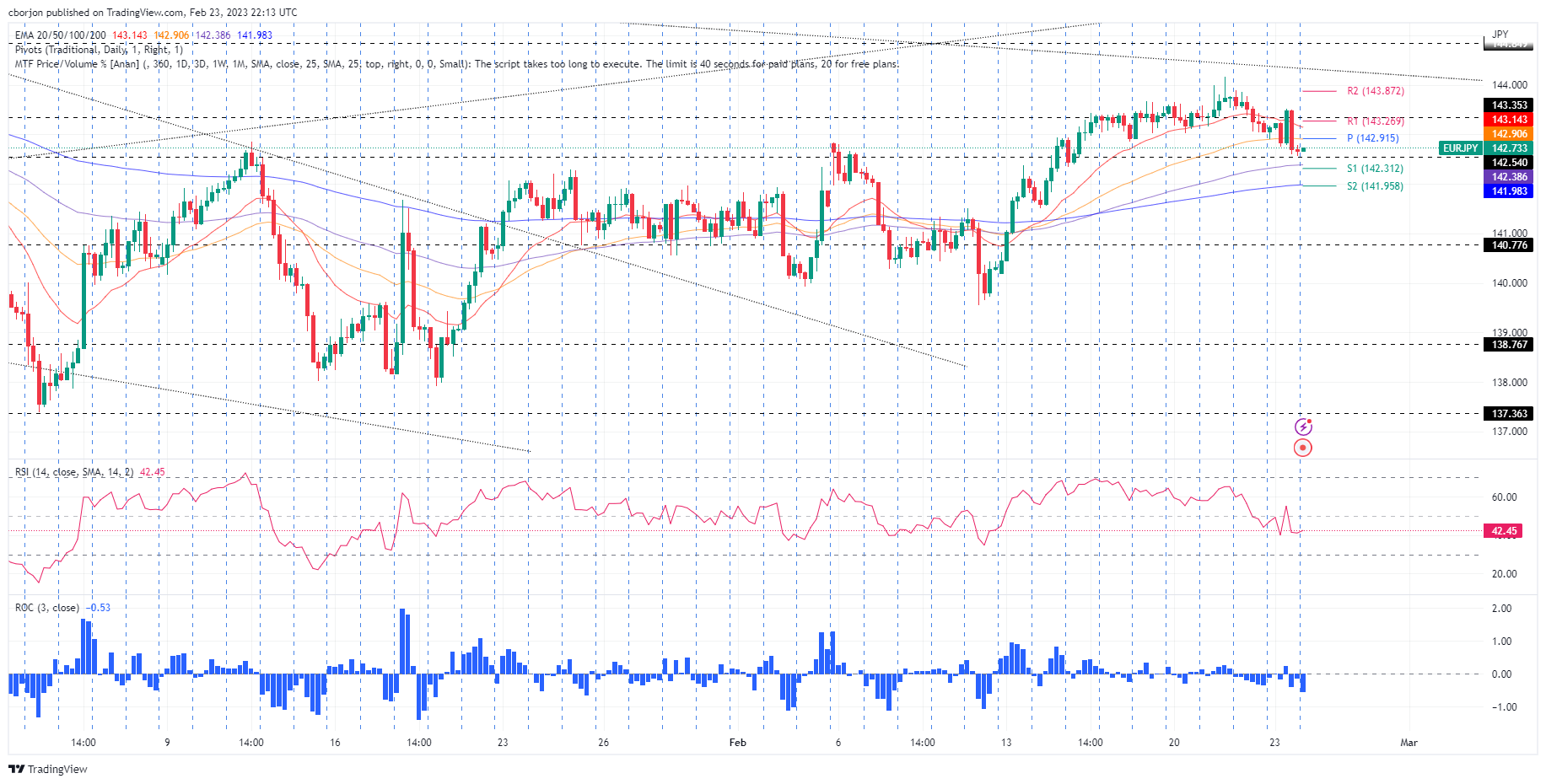

- EUR/JPY printed losses of 0.27% on Wednesday, but as the Asian session starts, it’s up 0.02%.

- Short term, the EUR/JPY peaked at around 144.00; hence further downside is expected before resuming the uptrend.

The EUR/JPY retraces after hitting a new weekly high at 144.16 on Tuesday but failed to hold to its earlier gains and dropped below 143.00, aiming toward the 20-day Exponential Moving Average (EMA) at 142.24. At the time of writing, the EUR/JPY exchange rate sits at 142.73, below its opening price by 0.22%, ahead of the Asian session beginning.

From a daily chart perspective, the EUR/JPY is still upward biased, even though the EUR/JPY has dived during the last couple of sessions and reached a weekly low of 142.56. Albeit the Relative Strength Index (RSI) aims downward, it still in bullish territory, suggesting that the shared currency could resume its uptrend. However, fundamental news could impact the overall uptrend of the EUR/JPY, and the pair might retreat on safe-haven flows.

From an intraday perspective, the EUR/JPY is neutral-upward biased, though it appears to have peaked around the 144.00 area. Since then, the EUR/JPY nosedived 150 pips, and at the time of typing, the spot price sits trapped within the daily pivot and the S1 pivot point. Therefore, the EUR/JPY could aim downwards before resuming its uptrend.

The EUR/JPY first support would be the 100-EMA at 142.38, followed by the S1 daily pivot point at 142.31. A breach of the latter and the EUR/JPY next stop would be the intersection of the 200-EMA and the S2 pivot point at around 141.95/98.

EUR/JPY 4-Hour chart

EUR/JPY Key technical levels

“The projected cash rate peak is not set in stone,” Reserve Bank of New Zealand (RBNZ) Assistant Governor, Karen Silk expressed her view Friday.

Additional comments

All rate hike options are on the table for the April meeting.

The RBNZ will do all it takes to control inflation.

There are still concerns on the inflation forecast.

NZD/USD defends corrective bounce

The news allows NZD/USD to remain firmer even as the geopolitical fears join broad US Dollar strength to challenge the bulls. The reason could also be linked to the early week RBNZ rate hike worth 0.25%.

That said, the Kiwi pair holds onto its rebound from the weekly low surrounding 0.6200, picking up bids to 0.6230 by the press time.

Also read: NZD/USD bulls seek a break above 0.6250

- AUD/USD retreats towards multi-day bottom, eyes the biggest loss in three weeks.

- Strong US data bolstered hawkish Fed bets and weighed on the risk barometer pair.

- Hopes of US-China trade negotiations underpinned corrective bounce ahead of latest geopolitical fears-inflicted fall.

- US Core PCE Price Index for January is the key data to watch for fresh impulse.

AUD/USD fails to defend the late Thursday’s corrective bounce off a seven-week low, dropping back to 0.6807 during early Friday in Asia, as markets await the Federal Reserve’s (Fed) preferred inflation gauge. In addition to the pre-data anxiety, hawkish Fed concerns and geopolitical fears surrounding China and Russia also weigh on the risk barometer pair.

As per Thursday’s US data dump, the second reading of the Gross Domestic Product Annualized, better known as Real GDP, eased to 2.7% for the fourth quarter (Q4) versus 2.9% first forecasts. However, the Personal Consumption Expenditure (PCE) Price and Core PCE for the said period rose to 3.7% and 4.3% QoQ versus 3.2% and 3.9% respective first estimations.

Additionally, the Chicago Fed National Activity Index improved to 0.23 in January from -0.46 (revised), versus 0.03 analysts’ estimates. On the same line, Initial Jobless Claims also eased to 192K for the week ended on February 17 from 195K (revised) prior, compared to 200K expected. Hence, the latest set of the US data has been in accordance with the upbeat economics released so far in February and has helped the US Dollar to remain firmer, after early Thursday’s retreat.

On the other hand, comments from US Treasury Secretary Janet Yellen signaled that the US will resume discussions with China on economic issues 'at an appropriate time' whereas China’s Commerce Ministry urged the US to create good conditions for trade with China. The news managed to trigger the pair’s bounce off a multi-day low on Thursday. On the same line were statements from China’s commerce ministry spokesperson who said, the recovery momentum in the country’s consumer market was strong in January while also adding, “The government will take more measures to revive and expand consumption.”

However, the latest headlines suggesting China’s readiness to supply combat drones to Russia and the US Senators’ push to halt Chinese carriers overflying Russia on US flights seem to renew the market fears and weigh on the AUD/USD prices.

Amid these plays, Wall Street closed mildly positive and the US Treasury bond yields retreat from the three-month high but the US Dollar Index (DXY) remains firm ahead of the key data.

Moving on, qualitative headlines may entertain the AUD/USD traders ahead of the key US data. That said, the Personal Consumption Expenditures (PCE) Price Index is expected to have risen by 4.9% YoY in January, versus 5% prior. Further, the more relevant Core PCE Price Index, known as Fed’s favorite inflation gauge, is likely eased to 4.3% YoY, compared 4.4% prior.

Also read: US PCE Inflation Preview: Can the US Dollar turn bullish for good?

Technical analysis

The 200-DMA support, at the 0.6800 threshold by the press time, restricts immediate AUD/USD downside.

- GBP/USD is dropping 0.20% on Thursdays as bears eye 1.2000.

- On its way down, the GBP/USD fell below the 100-day EMA, which exacerbated a test of 1.1991.

The GBP/USD tumbles below the 100-day Exponential Moving Average (EMA) as Wall Street prepares for Thursday’s close, with decent gains on a risk-on impulse. In the FX space, the US Dollar (USD) exerts pressure on most G8 currency pairs, particularly the Pound Sterling (GBP). At the time of writing, the GBP/USD is trading at 1.2018, below its opening price.

After hitting a daily high of 1.2074, the GBP/USD retreated and broke below 1.2036, the 100-day EMA, on its way to the day’s lows at 1.1991. However, the GBP/USD recovered some ground and reclaimed the 1.2000 figure as the US Dollar softened.

From a daily chart perspective, the GBP/USD is neutral to downward biased, with all the long-term EMAs resting above the spot price. In addition, the Relative Strength Index (RSI) at bearish territory aims south, indicating that sellers are gathering momentum. Therefore, GBP/USD downside is expected.

If the GBP/USD falls below the 1.2000 figure, the next support would be the weekly low of 1.1985. A breach of the latter will expose a support trendline that passes around the February 14 low of 1.1914. That will set the stage for GBP/USD sellers to regain 1.1900.

As an alternate scenario, once the GBP/USD reclaims the 100-day EMA at 1.2036, that would open the door toward 1.2100, where the 20 and 100-day EMAs lie. A rally beyond that supply area and the 200-day EMA will be up for grabs at 1.2129.

GBP/USD Daily chart

GBP/USD Key technical levels

- NZD/USD bears need to get below the consolidation and 0.6200.

- NZD/USD bulls eye a move above 0.6250 for a short squeeze.

NZD/USD is up 0.20% following a move from a low of 0.6202 to a high of 0.6251 wedged between a sideways channel. The bulls need to get above and hold above the 0.6250s and the bears below 0.6200.

Analysts at ANZ Bank explained that having ''succumbed to a gradual firming in the USD DXY in the wake of another round of stronger than expected US data.''

The analysts noted that a ''tight labour markets and sticky inflation remain the key themes. Of course NZ is in that situation too, and alongside the USD, is on track to continue to top global league tables on the bond yield front. That, alongside an expected boost in economic activity post the cyclone has potential to offset what many fear is a fresh wave of USD strength,'' the analysts at ANZ Bank explained. ''But right here, right now, all eyes are on the 0.6200 level amid sluggish price action.''

Indeed, the greenback is firmer on the prospect of further monetary policy tightening after the Minutes of the Jan. 31-Feb. 1 Federal Open Market Committee meeting released Wednesday showed only "a few" participants wanted a larger 50 basis point increase at the meeting.

Looking ahead, Friday's PCE deflator a key red news event. Ahead of the event, the federal funds target rate band stands at 4.50% to 4.75% ''The market is expecting the January headline data to remain at 5.0% YoY, in line with the previous month,'' analysts at Rabobank said.

''This would strengthen concerns that the downtrend in inflationary indicators may have stalled. Data in line with market expectations would thus add further weight to the view that the Fed will have to work harder to push inflation back to its target level. Currently implied market rates are pointing to a peak in Fed funds close to 5.33%.''

NZD/USD technical analysis

The bulls are lurking as the price moves to the backside of the down channel and a break of the 0.650s opens the risk of a move into the shorts that have gathered since breaking below 0.6370. a move below 0.6200 opens the risk of a downward continuation with 0.6150 eyed as a key support base.

- USD/JPY is on the backside of the prior bullish trend.

- The US Dollar remains in favour on hawkish data.

- The price is capped by the 135s so far and a move below 134.50 will be key for the week ahead.

USD/JPY is trading offered in the afternoon on Wall Street and is down some 0.2% within the range of the day between 135.36 and 134.60. The US Dollar rose against its major trading partners on Thursday ahead of the release of an update to Q4 Gross Domestic Product growth (that missed expectations) and Weekly Initial Jobless Claims, (that beat expectations) as well as the Personal Consumption Expenditure (that also beat expectations) and was revised upward to 3.7%, indicating inflation was much stronger than initially thought and helping to stoke bearish sentiment among traders.

Consequently, US Treasury yields edged lower in choppy trading, with those on the 10-year pulling back from three-month highs. This occurred despite investors pricing in the strong economic data of late that commenced with the last Nonfarm Payrolls report at the start of this month.

Benchmark 10-year Treasury notes were down at 3.881%, while the yield curve measuring the gap between the two- and 10-year Treasury notes was still inverted indicating a looming recession. Nevertheless, the US Dollar retained its strength against its major peers. The US Dollar index, which measures the greenback vs. a basket of currencies, DXY

climbed to a high of 104.779 before falling back to the 104.50s. The index is still up from the day's low of 104.308.

The greenback is firmer on the prospect of further monetary policy tightening after the Minutes of the Jan. 31-Feb. 1 Federal Open Market Committee meeting released Wednesday showed only "a few" participants wanted a larger 50 basis point increase at the meeting. All in all, officials favoured a moderation in the pace of rate hikes although they indicated that containing high inflation would be key to how much further rates need to rise which makes Friday's PCE deflator a key red news event. Ahead of the event, the federal funds target rate band stands at 4.50% to 4.75%

Friday will provide the Fed’s favoured inflation measure, the PCE deflator. ''The market is expecting the January headline data to remain at 5.0% YoY, in line with the previous month,'' analysts at Rabobank said. ''This would strengthen concerns that the downtrend in inflationary indicators may have stalled. Data in line with market expectations would thus add further weight to the view that the Fed will have to work harder to push inflation back to its target level. Currently implied market rates are pointing to a peak in Fed funds close to 5.33%.''

USD/JPY technical analysis

USD/JPY is on the backside of the prior bullish trend but remains supported by the hourly bullish trendline. However, the price is capped by the 135s so far and a move below 134.50 will be key for the week ahead.

What you need to take care of on Friday, February 24:

Risk aversion continued underpinning the American Dollar on Thursday, reaching fresh February highs against most major rivals. The Greenback advanced during Asian trading hours on the back of hawkish FOMC Meeting Minutes, picking up momentum during the US session and after mixed United States figures.

On the one hand, the annualized pace of growth in the country was downwardly revised to 2.7% from 2.9% in the last quarter of 2022, according to the second estimate of the Q4 GDP estimate. On the other, inflationary pressures in the same period were higher than previously estimated, as Personal Consumption Expenditure Prices rose by 3.7% QoQ, while the core reading came in at 4.3% higher than the 3.9% gain from the third quarter of 2022. The figures further fueled speculation the US Federal Reserve will continue to hike rates in the upcoming meetings while a potential pivot on monetary policy is farther away.

Wall Street edged lower with the news, with major indexes reaching fresh February lows. US indexes trimmed part of their losses ahead of the close, preventing the US Dollar from advancing further.

EUR/USD fell to 1.0576 and remained below 1.0600 by the US close. GBP/USD trades at around 1.2020, while the USD/JPY settled at around 134.50. Commodity-linked currencies recovered some ground against their American rival ahead of the close, with AUD/USD hovering around 0.6800 and USD/CAD trading at 1.3540.

Market players are now waiting for the US January Personal Consumption Expenditures Price Index, the Federal Reserve’s favorite inflation gauge. The PCE Price Index is expected to have risen by 4.9% YoY in January, easing from the previous 5%, while the more relevant core PCE Price Index is foreseen at 4.3%, after printing 4.4% in December.

Gold maintain its bearish tone and trades at around $1,823 a troy ounce. Crude oil prices, on the other hand, recovered some ground and WTI hovers around $75.30 a barrel.

Like this article? Help us with some feedback by answering this survey:

- USD/CHF resumed its uptrend as the 20-day EMA is about to cross over the 50-DMA.

- USD/CHF Price Analysis: Could shift neutral-upwards once it regains 0.9400.

The USD/CHF climbs above 0.9300, extending its gains after cracking the previous weekly high and reaching a new one at 0.9348 on Thursday. At the time of typing, the USD/CHF exchanges hand at 0.9342.

The USD/CHF pair is neutral to downward biased, indicated by the long-term Exponential Moving Averages (EMAs), the 100 and 200-day EMAs, resting above the exchange rate at 0.9384 and 0.9455, respectively. Furthermore, the USD/CHF trades beneath the January 6 daily high of 0.9409, keeping the bearish bias intact. If this rate is surpassed, the USD/CHF can reach the 200-day EMA level.

Even though the USD/CHF bias is tilted to the downside, the pair appears to have bottomed around 0.9059. Also, the Relative Strength Index (RSI) and the Rate of Change (RoC) are bullish, suggesting buyers are moving in.

Therefore, the USD/CHF path of least resistance is upward in the near term. The first resistance would be the January 12 high at 0.9360. A decisive break and the following resistance tested would be the 100-day EMA at 0.9384, ahead of the 0.9400 figure. Once those two resistance areas are broken, buyers will aim toward the 200-day EMA at 0.9454 before posing a threat of the 0.9500 figure.

Contrarily, if the USD/CHF drops below the 50-day EMA at 0.9283, that would exacerbate a fall toward the February 14 daily low at 0.9135.

USD/CHF Daily chart

USD/CHF Key technical levels

- A short squeeze could be in order for the sessions ahead in EUR/USD.

- If the bulls can stay above 1.0550s then buyers will be on the lookout for a move into the 1.0620s.

EUR/USD printed fresh lows on Thursday on the third day of there being shorts in the market which gives rise to the prospects of a move up for the final stages of the week. The following illustrates such a scenario and puts the spotlight on the bearish trendline resistance.

EUR/USD daily charts

As we can see, the price is jammed in on the front side of the daily trendline still. However, a correction into shorts could be on the agenda for the end of the week to square up some of the books and that exposes the upside fo a short squeeze towards prior shorter-term support structures as follows:

EUR/USD H1 chart

EUR/USD started out the week inside of the prior week's range so on a break of the day's lows on Tuesday,m this confirmed that there were sellers in the market and a continuation to the downside was most probable for the days ahead.

The break of the February lows on Wednesday confirmed that sellers were committed to the downside and Thursday's shorts have taken on fresh lows for the month. However, there is a three-day phenomenon in markets which concludes with a correction and given the timing of the week, a short squeeze could be in order for the sessions ahead. If the bulls can stay above 1.0550s then buyers will be on the lookout for a bullish structure to target a move into the 1.0620s and into at least Thursday's shorts if not higher.

- Western Texas Intermediate prices advance more than 2%, trimming its Wednesday losses.

- US stockpiles have increased the most since 2021, as reported by the US EIA.

- Russia’s plan to cut its oil output supported WTI and oil prices.

Western Texas Intermediate (WTI), the US crude oil benchmark, advances shy of 2% on Thursday, trimming some of its Wednesday’s losses spurred by a strong US Dollar (USD). Nevertheless, WTI is staging a comeback, exchanging hands at $75.78 per barrel.

Sentiment shifted sour as the US Dollar extended its gains, capping oil’s rally. The US Dollar Index (DXY) advances 0.24%, up at 104.752 for the third consecutive day, bolstered by the Fed’s latest monetary policy minutes.

On Wednesday, the Federal Reserve revealed its latest meeting minutes which were tilted hawkish, with policymakers agreeing to raise rates 25 bps, while few members wanted a 50 bps hike. Officials acknowledged the labor market’s tightness and warranted further increases to curb elevated inflation.

Data from the US Energy Information Administration on Thursday showed that oil inventories have risen to their highest level since May 2021. Crude oil stockpiles grew by 7.6 million barrels to 479 in the last week ending February 17, 2023. Meanwhile, inventories in Cushing, Oklahoma, jumped to 40.4 million, the highest level since June 2021.

WTI retreated on the data release, though Russia’s intention to reduce its oil exports from western ports in March by as much as 25% reignited fears of an oil shortage. Consequently, WTI and Brent’s prices have jumped.

In another data, the US Department of Labor revealed that unemployment claims continued downward, while the US economy grew at a 2.7% pace quarterly in Q4 2022, lower than the 2.9% previous reading. The greenback rallied on the data and weighed on WTI, which retreated from daily highs around $75.92.

WTI Key technical levels

- USD/CAD aims higher and tests a significant resistance trendline in the daily chart.

- The latest FOMC minutes suggested that the Fed will continue to hike rates.

- Upbeat US economic data underpinned the US Dollar and bolstered the USD/CAD.

- Rising oil prices capped the USD/CAD rally on Thursday.

The USD/CAD clash with a four-month-old downslope resistance trendline, gaining 0.15% daily. At the time of writing, the USD/CAD exchanges hands at around 1.3565.

USD/CAD to continue upwards on Fed and BoC policy divergence

Wall Street continues to pare some of its losses. The US Dollar (USD) is gaining some traction as the Federal Reserve is ready to continue tightening monetary conditions, as revealed by the Federal Reserve’s (Fed) last meeting minutes. The minutes showed a slightly hawkish tone as a few officials advocated for a 50 basis point increase in interest rates, but ultimately, they all agreed on a 25 basis point hike. Officials commented that the labor market remains tight and added that growth risks are tilted to the downside.

In the meantime, the US Bureau of Labor Statistics (BLS) revealed that unemployment claims for the week ending on February 18 came at 192K, below last week’s 194K and lower than the 200K expected. Gross Domestic Product (GDP) in the US expanded in the fourth quarter by 2.7%, shy of the first estimate of 2.9%.

The strong growth in the 2022 second half compensated for the 1.1% economic decline during the first six months. Although there was a slowdown in economic activity during the last two months of 2022, it seems the economy has picked up the pace again at the beginning of 2023.

The US Dollar Index (DXY), which tracks the buck’s value vs. six currencies, advances 0.14% at 104.635, the reason for the latest uptick in the USD/CAD pair. Nevertheless, the rally was capped by the jump in oil prices, with WTI’s advancing 2%, trading at $75.32 PB.

On the Canadian front, Average Weekly Earnings eased from 4% to December’s 3.4% YoY. It was the 19th month of growth, with 17 of the 20 sectors reporting gains.

Given the backdrop, the USD/CAD might continue to edge higher. Divergence in monetary policy between the Fed and the Bank of Canada (BoC) warrants further upside in the pair. The BoC announced that it would pause, while Fed officials had stated the need for higher for longer. Therefore, USD/CAD upside is expected.

USD/CAD Technical analysis

The USD/CAD pair is testing a four-month-old resistance trendline, drawn from November highs of 1.3808, which passes at around the 1.3560/80 area. Also, the Relative Strength Index (RSI) is still bullish and aiming north, putting at risk the previously-mentioned trendline. Once cleared, the USD/CAD could test 1.3600, followed by the next resistance at 1.3664, the January 6 high.

- Mexican peso losses momentum versus US Dollar after hitting fresh multi-year highs.

- Dollar gains momentum as Wall Street trims gains.

- Inflations eases modestly in Mexico, Banxico’s minutes point to a smaller rate hike.

The USD/MXN is trading at daily highs at 18.42, up for the day. Earlier it bottomed at 18.30, the lowest level since April 2018. The rebound took place amid a stronger US Dollar across the board and amid a bearish reversal in US stock markets.

The greenback strengthened following US economic data that included a new revision of Q4 GDP, a decline in jobless claims and a rebound in the Chicago Activity Index.

The USD/MXN is rebounding after testing levels under 18.30. The mentioned level is critical and a consolidation below would point to further weakness. If the current correction extends it would face resistance at the 18.50 area. A recovery above would add support for an extension toward 18.68.

Inflation decelerates slowly in Mexico, Banxico to slow down

The Bank of Mexico released the minutes from its latest Board meeting held on February 9. They surprised market with a 50 basis points rate hike, against expectations of a 25 bps hike. The minutes showed board members considered rate hikes could rise more moderately at the next meeting due on March 30.

The end of the rate hike cycle looks near but inflation is still far from Banxico’s 3% target. Data released on Thursday showed inflation decelerated more than expected during the first half of February. The annual rate dropped from 7.94% to 7.76% while the core index reached 8.38%.

USD/MXN daily chart

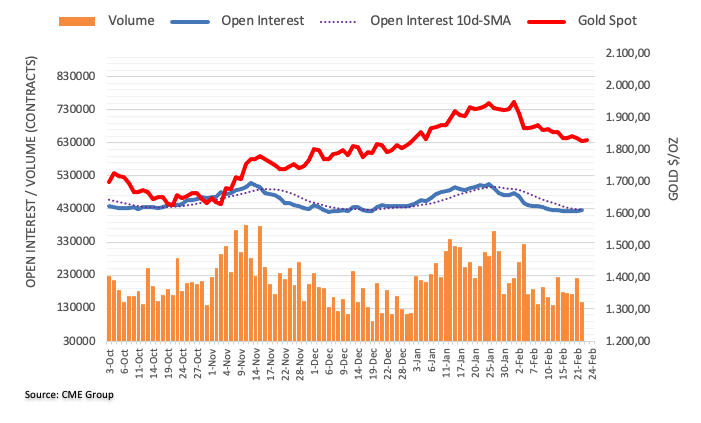

Gold is consolidating around the 55-Day Moving Average (DMA). The long-term 200-DMA, currently seen at $1,776, is expected to floor the yellow metal at the very latest, according to strategists at Credit Suisse.

Move above $1,998 can reassert an upward bias

“Gold has been capped at resistance at $1,973/98 as expected and is now consolidating around the 55-DMA, currently seen at $1,858, but so far managed to remain clearly above the long-term 200-DMA, currently seen at $1,776, which we would expect to floor the precious metal at the very latest.”

“Above $1,998 can reassert an upward bias for a test of long-term resistance from the $2,070/72 record highs of 2020 and 2022.”

- US Q4 GDP revised lower, inflation indicators revised higher.

- Jobless Claims, Chicago Fed Activity surpassed expectations.

- Gold’s rebound fails to rise above $1,830.

Gold prices rebounded after hitting fresh monthly lows amid risk appetite and an intraday reversal of the US Dollar. XAU/USD bottomed at $1,817 following the release of US economic data, the lowest level since late December and then bounced back toward the $1,830 area.

Data released in the US came in mixed. Initial Jobless Claims dropped to 192K, the lowest level in three weeks. The second reading of Q4 GDP showed a lower annualized growth rate of 2.7% below the 2.9% of the previous estimate. Inflation indicators of the GDP report were revised higher. The Chicago Fed’s National Activity Index rose from -0.43 to 0.23, surpassing expectations.

Investors continue to digest the FOMC minutes and the new economic numbers. The Dow Jones is climbing 0.43% and the Nasdaq is rising 0.50%. US yields are modestly lower, hovering near monthly highs.

The US Dollar peaked after the release of US data while Gold bottomed at $1,817, the lowest since December 30. The yellow metal then rebounded toward $1,830 but it was unable to rise back above that key short-term level.

Following Wall Street’s opening bell the Dollar gained momentum again and pushed XAU/USD back to the downside. XAU/USD is approaching the $1,820 area, which is critical. A consolidation below would open the doors to more weakness, targeting initially $1,812.

XAU/USD daily chart

The FOMC meeting minutes provided additional information about the Committee's decision to hike rates by 25 bps in February. Economists at TD Securities look for a 5.25% terminal rate at the May meeting.

Fed is likely to keep policy restrictive for longer

“The minutes signaled that the FOMC is not done yet in terms of further rate hikes, and it is looking to maintain a restrictive policy stance for the foreseeable future.”

“We expect 25 bps rate hikes in March and May, with the Fed settling on a terminal Fed funds target rate range of 5.00%-5.25% by May. However, we do note a sizable upside risk to our terminal rate projection, where strength in upcoming releases on CPI and PCE inflation, as well as the labor market, could very well sway Fed to continue to hike beyond the May meeting.”

“We continue to like owning 10y Treasuries as the Fed is likely to keep policy restrictive for longer, resulting in weak growth later this year and in 2024.”

- AUD/USD climbs despite upbeat economic data in the United States suggesting further Federal Reserve tightening is needed.

- FOMC’s minutes were hawkish and emphasized the need for higher for longer.

- Initial Jobless Claims dropped in the latest week, while the US economy expanded in Q4 2022.

AUD/USD recovered some ground on Thursday after falling to fresh February lows at 0.6803, though it recovered some ground, despite overall US Dollar (USD) strength across the board. A risk-on impulse is another reason that it’s underpinning the Australian Dollar (AUD). At the time of typing, the AUD/USD exchanges hands at 0.6826, above its opening price by 0.39%.

AUD/USD to remain pressured after latest FOMC minutes, US data

US equities have opened in the green after the Federal Reserve Open Market Committee (FOMC) revealed its minutes. The minutes were slightly hawkish, with some officials pushing for a 50 bps rate hike, though all agreed to raise 25 bps. Policymakers remained worrisome about the tightness of the labor market and commented that growth risks are skewed to the downside. Also, they commented on financial conditions for the first time. According to the Chicago Fed National Financial Conditions Index, conditions remained the loosest since February 2022. This could trigger some attention from Fed officials at subsequent meetings.

The US Dollar strengthened after the release of the latest meeting minutes. That sent the AUD/USD to new February lows, though the AUD/USD is erasing some of its Wednesday losses on Thursday.

Data from the United States (US) portrayed the tightness of the labor market after the Department of Labor (DoL), revealed Initial Jobless Claims for the week ending on February 18. The claims rose by 192K, below the 200K estimated and beneath the last week’s 194K. In a separate report, the US Department of Commerce (DoC) featured the US Gross Domestic Product (GDP) for Q4 on its second estimate came at 2.7%, below the prior’s reading of 2.9%.

The US Dollar Index (DXY), which tracks the buck’s value vs. six currencies, slides 0.01% at 104.85, the reason for the latest uptick in the AUD/USD pair.

In the meantime, Private Capital Expenditure in Australia rose 2.2% in Q4 2022, higher than Q3’s data at 0.6% QoQ.

AUD/USD Technical analysis

The AUD/USD is testing the 100-day Exponential Moving Average (EMA) at 0.6829, which, once cleared, will pave the way for further upside toward the 200-day EMA at 0.6859. Nevertheless, the Relative Strength Index (RSI) at bearish territory and the EMA above could cap the AUD/USD rally, which would put into play the 0.6800 figure. Therefore, the AUD/USD downtrend is intact, and it could shift neutral if buyers reclaim the 200-day EMA.

What to watch?

The EUR has corrected lower against the USD so far in February. Economists at MUFG Bank expect the world’s most popular currency pair to continue its decline.

Stronger cyclical outlook for the Eurozone economy is better priced in now

“The EUR’s recent loss of upward momentum could reflect that the stronger cyclical outlook for the Eurozone economy is better priced in now.”

“The EUR would be vulnerable to a further correction lower if core inflation was to fall more quickly as well in the coming months.”

“We see room for EUR/USD to continue correcting lower in the near-term.”

The US Dollar Index (DXY) may see slightly further near-term strength. Nonetheless, analysts at Credit Suisse maintain their broader rangebound outlook.

DXY will eventually resolve its recent range lower

“DXY has edged above the 55-DMA at 103.45. This leaves us mildly biased towards a slightly deeper recovery to 105.63, potentially the 38.2% retracement of the 2022/2023 fall and 200-DMA at 106.15/45. We would expect this to prove the extent of the recovery though, and we would look for this to cap to define the top of a broader range.”

“Post this consolidation phase, our bigger picture view remains that the market will eventually resolve its recent range lower, triggering further weakness later on in the year to test 99.82/37, then the 61.8% retracement at 98.98.”

- Cable continues to vacillate around the mid-1.2000s.

- UK CBI Distributive Trades surprised to the upside in February.

- BoE’s C.Mann favoured extra tightening in the next months.

The inconclusive price action around the dollar seems to be enough to spark a humble advance in GBP/USD to the 1.2050 region on Thursday.

GBP/USD looks to USD, risk trends, BoE

GBP/USD trades slightly in the positive territory at the beginning of the second half of the week, as the quid appears underpinned by another hawkish message from BoE’s Mann as well as some loss of upside momentum in the buck.

Back to the BoE, well-known hawk member C.Mann favoured extra tightening at the upcoming gatherings, at the time when she ruled out any emergence of a pivot in the bank’s monetary stance.

In the UK data space, the CBI Distributive Trades improved to 2 for the current month (from -23) ahead of Friday’s release of the Consumer Confidence gauged by Gfk for the month of February.

News from the money market sees the 10-year Gilt yields in the positive foot near the 3.70% level, or multi-week highs.

What to look for around GBP

Same as with the rest of the risk complex, the British pound is expected to track the dollar’s price action and the policy divergence between the Federal Reserve and the Bank of England when it comes to near-term direction.

Furthermore, the UK economy’s bleak outlook for the remainder of the year in combination with persistent elevated inflation leaves the prospects for further gains in the Sterling somewhat curtailed in the short term, while the BoE approaching its terminal rate does not look helpful for the quid either.

Key events in the UK this week: Gfk Consumer Confidence (Friday).

GBP/USD levels to consider

As of writing, the pair is retreating 0.06% at 1.2038 and faces the next support at 1.1930 (200-day SMA) followed by 1.1914 (monthly low February 17) and finally 1.1841 (2023 low January 6). On the flip side, the breakout of 1.2164 (55-day SMA) would open the door to 1.2269 (weekly high February 14) and then 1.2447 (2023 high January 23).

The Zloty should benefit from a stronger Euro in 2023. However, economists at Commerzbank expect the EUR/PLN to move back higher in 2024.

Rising EUR/PLN rates in 2024

“We forecast the Euro to appreciate further through the rest of 2023 but weaken once again during 2024. Given the Zloty’s high-beta relationship to the Euro, we see EUR/PLN drifting down to around 4.65 by the end of 2023 as inflation moderates globally, which will alter perceptions about Poland’s negative real interest rate.”

“In 2024, we forecast EUR/PLN to rise again towards 4.80 as inflation will likely remain stubbornly above target.”

Source: Commerzbank Research

Economists at TD Securities expect the EUR/USD to move within a 1.05-1.11 range through the second quarter of the year. Thus, the pair is nearing the lower end of the range.

EUR upside this year

“While we continue to see EUR upside this year, we have downshifted our anticipated range versus the USD.”

“We now see EUR/USD in a 1.05-1.11 range through Q2, suggesting we're getting close to buy the dip territory.”

“EUR's drivers are broad-based reflecting the importance of China reopening, the easing terms of trade shock, relative growth and central bank outlooks.”

S&P 500 is set to find a short-term floor at the key cluster of supports around 3984/26, with the infdex expected to trade in a broad range over the medium-term, analysts at Credit Suisse report.

Temporary setback

“We look for the 63 and 200-DMAs and the 38.2% retracement of the 2022/23 upmove at 3984/26 to hold, in line with our view that this a temporary setback, ahead of further strength in due course to test key resistance at the 61.8% retracement of the 2022 fall and summer 2022 high at 4312/4325. We look for this to then prove a tough barrier to define the top of what we believe could be a broad and lengthy range.”

“Below 3886 is needed to suggest we may have seen a ‘false’ break higher and more important downturn within the broad range, with the next support then seen at 3764.”

- Chicago Fed National Activity Index recovered sharply in January.

- The US Dollar stays resilient against its rivals after this data.

The Federal Reserve Bank of Chicago's National Activity Index (CFNAI) rose to 0.23 in January from -0.46 in December. This reading came in much better than the market expectation of 0.03.

"The CFNAI Diffusion Index, which is also a three-month moving average, edged up to –0.10 in January from –0.15 in December," the publication further read. "Fifty-one of the 85 individual indicators made positive contributions to the CFNAI in January, while 34 made negative contributions."

Market reaction

The US Dollar Index clings to modest daily gains at 104.60 after this report.

- USD/JPY regains strong positive traction on Thursday and climbs to a fresh YTD peak.

- The upbeat US macro data reaffirms hawkish Fed expectations and underpin the USD.

- A positive risk tone weighs on the safe-haven JPY and remains supportive of the move.

The USD/JPY pair catches some bids during the early North American session and jumps to a fresh YTD peak, around the 135.35 region in the last hour.

The latest leg of a sudden spike follows the upbeat US data, which showed that Initial Jobless Claims unexpectedly fell to 192K during the week ended February 17. This further points to the underlying strength in the US labour market, which, along with persistently high inflation, should allow the Fed to continue hiking interest rates for longer. This, to a larger extent, offsets a downward revision of the US Q4 GD, which showed that the world's largest economy expanded by a 2.7% annualized pace against the 2.9% rise estimated previously.

Nevertheless, hawkish Fed expectations remain supportive of elevated US Treasury bond yields and continue to lend support to the US Dollar. This, in turn, is seen as a key factor pushing the USD/JPY pair higher. Apart from this, a modest recovery in the global risk sentiment - as depicted by a generally positive tone around the equity markets - undermines the safe-haven Japanese Yen (JPY) and provides an additional boost to the major. The momentum could also be attributed to some technical buying above the 135.00 psychological mark.

It, however, remains to be seen if bulls can capitalize on the move or opt to lighten their bets as the market focus now shifts to the Bank of Japan (BoJ) Governor candidate Kazuo Ueda's testimony on Friday. Investors will closely scrutinize Ueda's view on the future of yield curve control (YCC) and super-easy monetary policy. This, in turn, will play a key role in driving the JPY in the near term and determine the next leg of a directional move for the USD/JPY pair.

Technical levels to watch

- Initial Jobless Claims in the US decreased by 3,000 in the week ending February 18.

- US Dollar Index stays in positive territory above 104.50.

There were 192,000 initial jobless claims in the week ending February 18, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 195,000 (revised from 194,000) and came in slightly better than the market expectation of 200,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.1% and the 4-week moving average was 191,250, an increase of 1,500 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending February 11 was 1,654,000, a decrease of 37,000 from the previous week's revised level," the DOL noted.

Market reaction

The US Dollar stays resilient against its rivals after this data with the US Dollar Index clinging to modest daily gains at around 104.60.

- The US BEA revised Q4 GDP lower to 2.7% from 2.9%.

- US Dollar Index clings to modest daily gains above 104.50.

The real Gross Domestic Product (GDP) of the US expanded at an annualized rate of 2.7% in the fourth quarter, the US Bureau of Economic Analysis' (BEA) second estimate showed on Thursday. This reading came in below the initial estimate and the market expectation of 2.9%.

"The updated estimates primarily reflected a downward revision to consumer spending that was partly offset by an upward revision to nonresidential fixed investment," the BEA explained in its publication. "Imports, which are a subtraction in the calculation of GDP, were revised up."

Market reaction

With the initial reaction, the US Dollar Index edged slightly higher and was last seen rising 0.1% on the day at 104.60.

- EUR/USD attempts to bounce off fresh 7-week lows near 1.0580.

- A deeper decline targets the YTD low near 1.0480.

EUR/USD remains under pressure and briefly pierced the 1.0600 support for the first time since early January.

If sellers push harder, spot could extend the downside to the 2023 low at 1.0481 (January 6), an area reinforced by the proximity of the temporary 100-day SMA, today at 1.0441.

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0329.

EUR/USD daily chart

Nasdaq 100 is correcting lower, but economists at Credit Suisse look for key supports at 11912/699 to hold.

Break below 11912/699 would open up further weakness again

“Nasdaq 100 setback is likely to extend further to the key 63 and 200-day averages at 11912/699. We view this as a temporary setback as long as the market holds above here, with medium-term MACD momentum very close to turning outright positive”.

“We look for a clear and sustained break above 12856 post this setback and some further consolidation. We would then see resistance next at 13175, ahead of the 50% retracement and summer 2022 highs at 13603/721.”

“Below 11912/699 would open up further weakness again within the Q4 2022 range, with the next level at 11550, then 11252/50.”

- USD/CAD retreats from its highest level since January and is pressured by a combination of factors.

- A goodish rebound in Crude Oil prices underpins the Loonie and weighs on the pair amid a softer USD.

- The technical setup favours bullish traders and supports prospects for the emergence of dip-buying.

The USD/CAD pair comes under some selling pressure on Thursday and maintains its offered tone heading into the North American session. The pair is currently placed around the 1.3530 region, down less than 0.20% for the day, and so far, has managed to hold its neck above the 100-day Simple Moving Average (SMA).

A goodish recovery in Crude Oil prices underpins the commodity-linked Loonie, which, in turn, is seen as a key factor weighing on the USD/CAD pair. Apart from this, a slight improvement in the global risk sentiment acts as a headwind for the safe-haven US Dollar and exerts additional downward pressure on the major.

That said, elevated US Treasury bond yields, bolstered by the prospects for further policy tightening by the Federal Reserve, should limit any meaningful downside for the Greenback. Furthermore, looming recession risk should cap Oil prices and contribute to limiting the downside for the USD/CAD pair, at least for now.

From a technical perspective, last week's sustained breakout through a downward sloping trend-channel was seen as a fresh trigger for bullish traders. A subsequent move and acceptance above the 100-day SMA adds credence to the constructive setup and supports prospects for a further appreciating move for the USD/CAD pair.

Hence, a further decline below the 1.3500 psychological mark could be seen as a buying opportunity and remain limited near the 50-day SMA, currently around the 1.3460 region. This is followed by the 1.3440 horizontal support, which if broken decisively could drag the USD/CAD pair back towards challenging the 1.3400 mark.

Some follow-through selling will negate any near-term positive outlook and prompt aggressive technical selling. The USD/CAD pair might then accelerate the fall further towards testing the next relevant support near the 1.3330-1.3325 region en route to the 1.3300 mark and last week's swing low, around the 1.3275-1.3270 zone.

On the flip side, the overnight swing high, around the 1.3565-1.3570 area, now seems to act immediate hurdle ahead of the 1.3600 round figure. A sustained strength beyond the latter should allow the USD/CAD bulls to aim back towards retesting the YTD peak, around the 1.3680-1.3685 region touched in January.

USD/CAD daily chart

Key levels to watch

- The upside bias in DXY loses some impetus near 104.50.

- Further upside could revisit the 2023 top around 105.60 near term.

DXY struggles for direction in the upper end of the weekly range around 104.50 on Thursday.

The ongoing price action favours the continuation of the uptrend for the time being. Further bouts of strength should clear the February high at 104.68 (February 23) to allow for a probable challenge of the 2023 top at 105.63 (January 6).

In the longer run, while below the 200-day SMA at 106.45, the outlook for the index remains negative.

DXY daily chart

GBP/USD is trading little changed on the session but has lost a cent or so from yesterday’s peak. Economists at Scotiabank expect the pair to suffer a susbtantial drop to 1.1860 on failure to hold the above the low-1.19s.

Technical undertone for GBP/USD is bearish

“The GBP is tracking a little softer on the short-term charts and the technical undertone for GBP/USD is bearish. But the Pound is still trading above recent lows and key (longer term) support defined by the convergence of the 100 and 200-day MA signals at 1.1930/35.”

“Scope for GBP gains is limited (firm resistance at 1.2140/50 now) and loss of support in the low 1.19s will target a quick drop to major support at 1.1860 (Jan low).”

EUR/USD has eased below 1.06. Economists at Scotiabank expect the pair to extend its fall.

Modest gains are likely to remain well offered

“Short and medium-term trends are tilted bearish for the EUR.”

“EURUSD losses below key support in the upper 1.06s earlier this week increased technical pressure on the EUR and suggest more losses are likely in the short run and perhaps beyond.”

“There is little in terms of support below the market ahead of the mid-1.04 area – 1.0461 is the 38.2% Fib retracement of the 0.95/1.10 rally and looks to be the likely destination for the EUR over the next few weeks.”

“Resistance is 1.0650/75. Modest EUR gains are likely to remain well offered.”

- GBP/USD turns lower for the second successive day, though lacks follow-through selling.

- Hawkish Fed expectations, elevated US bond yields underpin the USD and exert pressure.

- A positive risk tone caps the buck and acts as a tailwind amid bets for more BoE rate hikes.

The GBP/USD pair meets with a fresh supply following an intraday uptick to the 1.2075 region and drops to a fresh daily low during the mid-European session. Spot prices manage to rebound from the vicinity of the 1.2000 psychological mark and now seem to have stabilized in neutral territory, just below the 1.2050 area.

The US Dollar remains pinned near a multi-week high, which, in turn, is seen as a key factor exerting some downward pressure on the GBP/USD pair. The FOMC meeting minutes released on Wednesday reaffirmed market expectations that the US central bank will continue to continue to tighten its monetary policy to tame stubbornly high inflation. Furthermore, the recent upbeat US macro data pointed to an economy that remains resilient despite rising borrowing costs and should allow the Fed to stick to its hawkish stance.

In fact, the markets are now pricing in at least a 25 bps lift-off at the next three FOMC policy meetings. This, in turn, assists the US Treasury bond yields to hold steady near the YTD peak and continues to underpin the Greenback. That said, a modest recovery in the global risk sentiment - as depicted by a generally positive tone around the equity markets - keeps a lid on the safe-haven buck. Apart from this, rising bets for additional interest rate hikes by the Bank of England (BoE) contribute to limiting losses for the GBP/USD pair.

The UK PMIs released on Tuesday indicated that business activity rose more than expected in February and fueled optimism that the country may be able to avoid a steep economic downturn. This, in turn, could persuade the BoE to keep its foot on the accelerator in its race against inflation. Hence, it will be prudent to wait for a sustained break below the 1.2000 mark before confirming that the GBP/USD pair's recent bounce from a technically significant 200-day Simple Moving Average (SMA) has already run out of steam.

Next on tap is the US economic docket, featuring the release of the Prelim (second estimate) Q4 GDP print and the usual Weekly Initial Jobless Claims. Traders will further take cues from comments by influential FOMC members - Atlanta Fed President Raphael Bostic and San Francisco Fed President Mary Daly. This, along with the US bond yields and the broader risk sentiment, will drive the USD and provide some impetus to the GBP/USD pair.

Technical levels to watch

UOB Group’s Economist Lee Sue Ann reviews the latest interest rate decision by the RBNZ.

Key Takeaways

“The Reserve Bank of New Zealand (RBNZ) decided to raise its official cash rate (OCR) by 50bps to 4.75% at its first meeting of the year. Today’s hike follows the 75bps hike at its final meeting of 2022, which was the largest increase since the New Zealand central bank introduced the OCR in 1999. Once again, the RBNZ signaled that the OCR still needs to increase, to ensure inflation returns to within its target range over the medium term.”

“Similar to the Nov Monetary Policy Statement, the RBNZ’s OCR forecasts today show the OCR peaking at 5.5% this year. It reiterated that it expects a recession starting in 2Q23, but the economy is seen rebounding back a little sooner next year. Meanwhile, it now sees inflation accelerating to 7.3% in the current quarter from 7.2% in 4Q22.”

“At this juncture, we are keeping to our forecast of three more 25bps rate hikes at its 5 Apr, 24 May and 12 Jul monetary policy meetings. This should bring the OCR to a peak of 5.50% by 3Q23.”

Economists at Nordea discuss JPY's outlook and maintain a bullish stance.

Turn-around in BoJ monetary policy expected later this year

“We remain fairly optimistic on JPY due to our expectations of a turn-around in BoJ monetary policy later this year.”

“With inflation reaching the highest point in decades and an outlook for higher wage growth ahead, the time should be ripe for a normalisation of BoJ’s stimulative monetary policy.”

“Moreover, JPY’s safe-haven status should come in handy if the negative risk outlook for the global economy and stocks materialise, and/or other G10 central banks are forced to cut rates.”

- EUR/JPY treads water around the 143.00 zone on Thursday.

- Extra gains appear on the cards above the 200-day SMA.

EUR/JPY alternates gains with losses in the 143.00 region on Thursday, an area coincident with the temporary 100-day SMA.

While the cross looks somewhat side-lined for the time being, a convincing breakout of the 2023 high at 144.16 (February 21) could spark extra strength to, initially, the December 2022 peak at 146.72 (December 15).

In the meantime, while above the 200-day SMA, today at 141.37, the outlook for the cross is expected to remain positive.

EUR/JPY daily chart

NZD/USD is up on the day. Moving away from the central bank and focusing on technical, economists at OCBC Bank see risks of bounce.

Falling wedge?

“Bearish momentum on daily chart intact while RSI is near oversold conditions. A falling wedge pattern appears to be forming and this is typically associated with a bullish reversal.”

“Support at 0.6170/85 levels (100, 200-DMAs), 0.6130 (38.2% fibo retracement of October low to Jan-Feb double top) and 0.6010 (50% fibo).”

“Resistance at 0.6280 (23.6% fibo), 0.6360 (21, 50-DMAs).”

EUR/USD extended its slide on Wednesday and touched its lowest level since early January at 1.0600. A move towards 1.05 is on the cards, economists at ING report.

EUR/USD remains soggy

“For the short term, EUR/USD remains soggy and it is hard to rule out a break under 1.0600 towards the 1.05 area.”

“Our game plan remains that 1.04/1.05 could now be some of the lowest EUR/USD levels of the year – but it feels like EUR/USD could trade on the offered side for a few weeks yet.”

GBP/USD erased a large portion of gains it recorded on Tuesday but managed to hold comfortably above 1.2000. Economists at OCBC Bank note that the pair needs to clear the 1.2160 to enjoy further gains.

Bullish divergence?

“Bearish momentum on daily chart faded while RSI rose. Potential bullish divergence not ruled out.”

“Key resistance at 1.2160 levels (21, 50-DMAs). A break above this can see GBP gains gather traction but failure to clear could see GBP revert to recent range.”

“Support at 1.1930/50 (23.6% fibo retracement of September low to December high, 100, 200-DMAs).”

Economist at UOB Group Lee Sue Ann assesses the latest set of data releases in the UK economy.

Key Takeaways

“While the UK economy managed to avert a recession at the end of 2022; the fall in Jan’s PMIs shows the manufacturing sector kicking off 2023 on the back foot, in much the same way as it ended 2022. Consumer confidence is below levels seen during the financial crisis, COVID-19 pandemic, and recessions in both the 1980s and 1990s.”