- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-02-2022

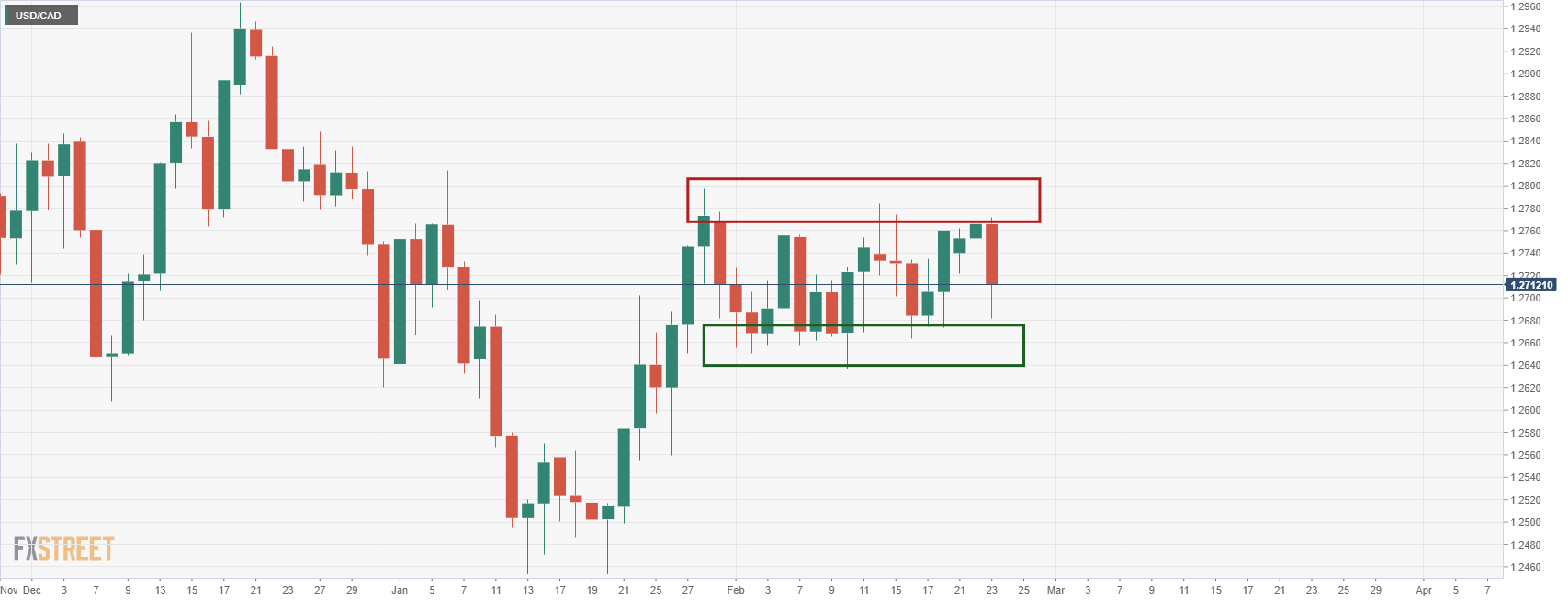

- USD/CAD struggles to keep the late Wednesday’s corrective pullback.

- Bearish MACD signals, failures to stay beyond short-term key supports keep sellers hopeful.

- Monthly descending trend line restricts immediate upside.

USD/CAD prints mild losses around 1.2730 on failure to keep the latest rebound during Thursday’s Asian session.

The Loonie pair refreshed weekly low the previous day before reversing from 1.2681. The rebound portrays the quote’s another U-turn from a two-week-old rising trend line and 100-SMA.

It should be noted, however, that the bearish MACD signals join the recently sluggish moves to favor sellers eyeing another attempt to break the stated SMA and support line, respectively near 1.2715 and 1.2695.

Following that, the recent lows near 1.2680 and the 200-SMA level of 1.2655 will entertain the USD/CAD bears before the monthly bottom of 1.2636.

Alternatively, further upside needs validation from the one-month-long resistance line, near 1.2765 at the latest.

Following that, a run-up towards the 1.2800 threshold and January’s peak surrounding 1.2815 can’t be ruled out.

Though, 1.2850 and the 1.2900 round-figure may test USD/CAD bulls after 1.2800.

USD/CAD: Four-hour chart

Trend: Further weakness expected

Ukraine declares the State of Emergency that markets had been waiting for.

Markets are in a trial spin of risk-off with the yen benefitting and AUD pressured to fresh risk-off lows at 0.7221.

There are also rumours that Russia's military action could begin at 4am local time (please note, this is not fact-checked but only a market rumour at the time of writing).

More to come...

- Bears are likely to strengthen once the cable slips below 1.3536.

- After violating the 50 and 200 EMA towards the south, bears have taken control.

- The RSI (14) has slipped below its range of 40.00-60.00, which adds to the downside filters.

The GBP/USD has slipped near the shared low of Tuesday and February 16 at 1.3539 in the American session as the cable loses ground after slipping below the 50-period and 200-period Exponential Moving Averages (EMA) on Wednesday.

GBP/USD is oscillating in a narrow range of 1.3536-1.3548 in the early Asian session after a bloodbath, which indicates that investors are initiating offers on expectations of a further downward move.

On an hourly scale, GBP/USD has fallen on the face after the major retreats from Wednesday’s high at 1.3621. It is worth noting that the 50 and 200 EMAs are on the verge of shaping a bearish crossover, which would add to the downside filters.

The Relative Strength Index (RSI) (14) has breached its oscillation range of 40.00-60.00 on lower side, which claims for more weakness ahead, showing no signs of divergence and oversold.

Bears are now eyeing Wednesday’s low at 1.3536, as violation of the same will push the cable towards the February 11 low at 1.3514, followed by February 15 low at 1.3486.

On the flip side, bulls can show up if the cable overstep Wednesday’s high at 1.3621 decisively towards Friday’s high at 1.3643 and January 20 high at 1.3662 respectively.

GBP/USD hourly chart

-637812531686305040.png)

- Silver record gains during the week, up 2.78%, despite rising US Treasury yields.

- San Francisco Fed's President Daly said that the Fed would need to hike more than four times, and looks to hike in March.

- XAG/USD Technical Outlook: Upward biased, as silver bulls prepare an attack towards $25.00.

Silver rally extends to six consecutive trading sessions amid rising tensions in the Russia/Ukraine conflict. At press time, XAG/USD is trading at $24.55.

Two US intelligence officials commented that Russia could invade Ukraine

Ukraine – Russia tensions increase. What started as a “calm” day in the financial markets has taken its toll, as US press via Newsweek expressed that an invasion from Russia could occur within 24/48 hours.

The article said that Ukraine’s President has been warned that Russia “will highly begin an invasion within 48 hours based on US intelligence.” As reported by a US intelligence official, Russia’s invasion would consist of airstrikes, cruise missiles, ground invasion, and cyberattacks.

At press time, the US 10-year Treasury Note yield rises five basis points sits at 1.998%, failing to weigh on the white metal, benefited by heightened tensions in Ukraine.

Appetite for safe-haven assets has increased in the last couple of weeks due to uncertainty in Eastern Ukraine. In the case of silver, the non-yielding metal rose to a four-week high above $24.60, leaving the 200-day moving average (DMA) at $24.24 below.

An absent US economic docket featured San Francisco Fed’s President Mary Daly emphasized the need to hike rates in the March meeting, though it is unclear how far the Federal Funds Rate needs to go and indicated that more than four rate hikes would be needed. Worth noting that analysts estimated the neutral rate to be somewhere around the 2.5% area.

XAG/USD Price Forecast: Technical outlook

The silver daily chart depicts neutral-upward bias after the broken ten-month-old downslope trendline, exposing the 200-DMA at $24.26. Nevertheless, a daily close over the abovementioned trendline would be required so that XAG bulls could use the $24.00-20 area as consolidation as they prepare to break the 200-DMA.

If the mentioned scenario plays out, XAG/USD’s first resistance would be January 20 daily high at $24.70. Breach of the latter would expose the $25.00 mark as the next support level. A decisive break would send XAG/USD rallying towards November’s 2021 highs at $25.40.

San Francisco Federal Reserve Bank President Mary Daly crossed wires, via Reuters, during an extended speech towards early Thursday morning in Asia.

The Fed policymaker initially said, “(She) No longer believes that raising U.S. interest rates every other meeting and delaying a reduction in the Fed's balance sheet until later in the year is appropriate, given signs that inflation is broadening and workers are not charging back into the labor force.”

Also read: Fed's Daly: Rates will be moved up this year to a level more consistent with where the economy is

Additional comments

I do think having a little more urgency to moving interest rates up to a level that’s in line with what the economy needs today is important.

Raising rates just once a quarter, as the Fed did after the Great Recession, ‘To my mind doesn’t satisfy the moment.’

Has also pulled forward her preferred timing for starting to reduce the Fed's balance sheet.

Expects the Fed to begin raising rates in March and subsequent meetings by a quarter-of-a-percentage point at a time, but did not rule out bigger half-point hikes if needed.

All of our possibilities are on the table.

There will be more data on inflation and on jobs before the Fed's March policy meeting.

Doesn't believe there is a case for 'frontloading' the Fed's response to inflation, especially since healing supply chains may help slow price rises.

We need to get policy in line but we can’t be impatient about doing it all today.

Market reaction

EUR/USD remains more or less the same after the latest Fedspeak while being burdened due to the risk-off mood. The major currency pair was last seen flirting with the 1.1300, after declining 0.20% the previous day.

Read: EUR/USD falls sharply towards 1.1300 as Ukraine – Russia conflict escalates

"Today, putin did not respond to a request for a phone call," said Ukraine President Volodymyr Oleksandrovych Zelenskyy during early Thursday morning in Asia.

Ukraine President Zelenskyy warned that Russia's move could escalate tensions while also saying, "Ukraine is not a threat to Russia."

During late Wednesday, Ukraine Foreign Minister Dmtryo Kuleba also requested an emergency meeting of the United Nations (UN) Security Council.

Read: Ukraine Foreign Minister Kuleba: We have asked the UN Security Council to convene an emergency meeting

Elsewhere European Union (EU) Foreign Ministyer Josep Borrell said that the EU encourages Russia to avoid escalatory moves.

FX implications

The news adds to the market's risk-off mood and weigh on the AUD/USD prices, considered risk-barometer in Asia.

Read: AUD/USD eases from six-week top towards 0.7200 as Russia-Ukraine jitters sour sentiment

- AUD/USD retreats after refreshing multi-day top, pausing three-day uptrend of late.

- Wednesday’s initially upbeat mood spoiled as Ukraine declared state of emergency, as well as chatters over Russian troops.

- Aussie wage price data came in stronger but below RBA’s target, Fed’s Daly sounds cautiously optimistic.

- Aussie Private Capital Expenditure, second reading of US Q4 GDP will decorate calendar.

AUD/USD holds lower ground near 0.7230, following a pullback from a six-week high, as market sentiment sours on escalating fears of the Russia-Ukraine war. In doing so, the Aussie pair pauses three-day uptrend during the early Thursday morning in Asia.

The risk barometer pair rallied to the highest since mid-January the previous day before reversing from 0.7285 as the odds of an imminent Russian invasion of Ukraine gained pace, backed by the US intelligence. Also keeping the risk higher were cyber-attacks on Ukrainian banks and the government.

It’s worth noting that Kyiv recently declared a 30-day state of emergency and Foreign Minister Dmtryo Kuleba also requested an emergency meeting of the United Nations (UN) Security Council. Furthermore, satellite imagery company Maxar conveyed new deployments of Moscow’s troops in western Russia.

Such headlines weighed on the AUD/USD prices and probe the previous three-day uptrend.

In addition to the geopolitical fears, cautiously optimistic Fedspeak also contributed to the AUD/USD pair’s latest pullback. Recently, San Fransisco Fed President Mary Daly said on Wednesday that interest rates will be moving up this year to a level more consistent with where the economy is, according to Reuters. "It's too early to call how far rates will need to rise this year,” the policymaker added.

At home, Australia’s Wage Price Index for the fourth quarter (Q4) closely missed the 2.4% YoY forecast despite crossing 2.2% previous readout with a 2.3% level. The wage price gauge matched 0.7% expected figures on MoM. That said, the Construction Work Done contracted to -0.4% from -0.3%, versus +2.5% market consensus, during the stated period.

Given being in the driver’s seat, AUD/USD traders need to pay attention to the geopolitical headlines due to their recent fame. Talking about data, Australia Private Capital Expenditure for Q4, expected +2.6% versus -2.2% prior, will direct immediate moves ahead of the second reading of the US Q4 GDP, expected 7.0% versus 6.9% prior.

Technical analysis

Failures to provide a daily closing beyond the 100-DMA and a descending trend line from mid-November, respectively around 0.7240 and 0.7275, keep AUD/USD buyers cautious. However, sellers need validation from a four-month-old previous resistance line, close to 0.7180 for re-entry.

- Wednesday’s choppy session witnessed GBP/JPY moving towards February 22 daily low at 155.50.

- The British pound weakened in the session, benefitting safe-haven peers.

- GBP/JPY is downward biased as a double-top chart pattern looms, with a target of 153.80.

The GBP/JPY is subdued on Wednesday’s choppy trading session, as market sentiment fluctuated between risk-on/off. The GBP/JPY is trading at 155.73.

The market sentiment is downbeat as US equity indices fell 1.38% and 2.60%. In the FX space, the mood is mixed, as safe-haven peers like the US dollar, the Japanese yen, and the Swiss franc edged up vs. the British pound.

GBP/JPY Price Forecast: Technical outlook

GBP/JPY daily chart depicts a double-top, following the rally from January 24 low at 152.90, to February 10 high at 158.06. That said, in the last five days, the risk-off market mood boosted the prospects of the JPY, leading to a leg-down followed by a sudden spike to the 157.00 area retreating afterward to current levels.

Therefore, the GBP/JPY is downward biased, despite the daily moving averages (DMAs) residing below the spot price. Further, the double top’s target would be 153.50, 50-pips above the 200-DMA. That said, the GBP/JPY first support would be the “neckline” around 155.50. Breach of the latter would expose the 50-DMA at 155.27, followed by the 100-DMA at 154.37, and then the 153.80 double-top target.

Ukraine Foreign Minister Dmtryo Kuleba’s briefing on geopolitical tensions with Russia recently added to the risk-off mood as the diplomat conveyed the emergency meeting request to the United Nations (UN) Security Council.

Ukraine Foreign Minister Kuleba also said, “The plea by separatist leaders to Russia for military support is a further escalation of the security situation.”

Meanwhile, a satellite imagery firm Maxar also mentioned new deployments of Moscow’s troops in western Russia.

Additionally, the Dnipro International Airport in eastern Ukraine is closed to arrival and departures until 7:00 AM local time Thursday.

FX implications

AUD/USD is considered risk-barometer pair and holds lower ground near 0.7230 amid recent challenges to market sentiment. On the contrary, gold prices remain firmer due to the metal’s safe-haven appeal.

Read: Gold Price Forecast: XAU/USD looks to reclaim $1914 amid risk-aversion theme

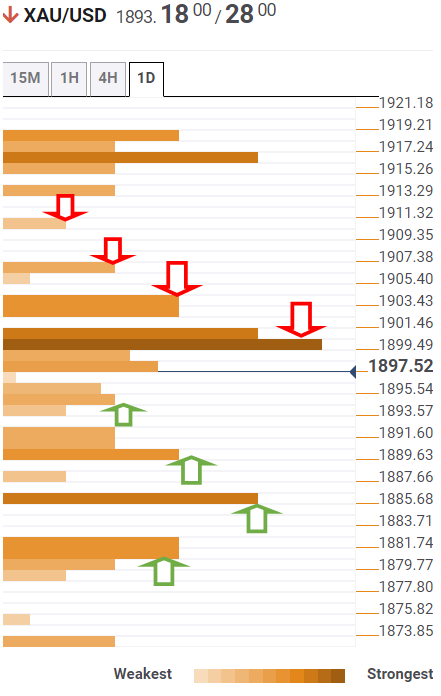

- Gold price is eyeing $1914.34 as investors prefer precious metal amid safe-haven appeal.

- The tensions between Russia and Ukraine escalated after the latter declared a state of emergency.

- Investors are eyeing Thursday's US GDP and Initial Jobless Claims.

Gold price is set to reclaim Tuesday’s high at $1914.34 as the uncertainty in the market reaches ceilings amid the geopolitical tensions between Russia and Ukraine. The economy is bracing for high inflation in the coming trading sessions as escalating sanctions fall on Russia to punish it for violating international law may continue to push oil prices higher.

On Wednesday, Ukraine called its citizens back from Russia and declared a state of emergency. While, Moscow began evacuating its Kyiv embassy, in the latest ominous signs for Ukrainians who fear an all-out Russian military onslaught, as per Reuters.

The lack of positive developments over the Russia-Ukraine tussle has put the investors on their toes and investors are very harsh on risk-sensitive assets.

The galloping volatility in the market has improved the safe-haven appeal and investors are pouring funds into the precious metal.

Meanwhile, the US dollar index (DXY) surpasses 96.00 on expectations of improvement in US Gross Domestic Product (GDP) numbers and Initial Jobless Claims, which are due on Thursday. An aggressive tightening policy by the Federal Reserve (Fed) in March’s monetary policy meeting is losing momentum as the economy can go through tough times amid the expectation of the most destructive war since 1945.

Gold Technical Analysis

On a 15-minute scale, XAU/USD has retreated after kissing the trendline placed from Monday’s low of $1886.66. The precious metal is expected to extend gains towards Monday’s high at $1914.34. The Relative Strength Index (RSI) (14) is likely to strengthen bulls after overstepping 60.00.

Gold 15-min chart

-637812499299111853.png)

- The shared currency in the week is recording a loss of 0.12%.

- Ukraine – Russia tensions keep grabbing the spotlight amid diplomacy failure.

- EUR/USD path of least resistance is downwards and soon could break under the 1.1300 handle.

On Wednesday, the EUR/USD slides as Ukraine – Russian tensions increase as US intelligence officials reported that Russia could invade Ukraine within the next 24/48 hrs. During the day, the EUR/USD reached a daily high at 1.1358, but worsened market mood witnessed ebbs flowing to the greenback. At the time of writing, the EUR/USD is trading at 1.1309.

During the day, the Eurozone reported inflation figures for January, with headline HICP Flash annual based increased 5.1%, barely unchanged, while so-called Core HICP came at 2.3% as estimated. ECB speakers parade continued in the day. Most ECB officials commented about inflations, seeing upside risks on it, and it could remain higher than expected and for longer than thought. ECB Vasle commented that it is time to move towards a normal monetary policy.

On the US front, San Francisco Fed President Mary Daly emphasized the need to hike rates in the March meeting, though it is not clear how far the Federal Funds Rate needs to go and indicated that more than four rate hikes would be needed. Worth noting that analysts estimated the neutral rate to be somewhere around the 2.5% area.

In the meantime, the US Dollar Index, a measure of the greenback’s performance vs. a basket of six rivals, is up 0.18, sitting at 96.20, while the US 10-year benchmark note sits at 1.984%, up three and a half basis points, a headwind for the EUR/USD.

EUR/USD Price Forecast: Technical outlook

The EUR/USD is downward biased from a technical perspective. EUR/USD bull’s failure to hold above the 100-day moving average (DMA) at 1.1389 exposed the pair to a significant amount of selling pressure. That said, the EUR/USD path of least resistance is to the downside.

The EUR/USD first support would be 1.1300. Breach of the latter would expose February 3 low at 1.1267, followed by 2021 December 15, at 1.1221, and then the 1.1200 mark.

San Fransisco Fed President Mary Daly said on Wednesday that interest rates will be moving up this year to a level more consistent with where the economy is, according to Reuters.

Additional Remarks:

"It's too early to call how far rates will need to rise this year."

"We are on a path toward an economy with tighter monetary policy."

"I expect we will start raising rates in March, and will be raising them in subsequent meetings to get closer to neutral."

"How close to neutral rates will get is not certain and will depend on the data."

"I don't see anything right now that would disrupt plans for a March rate hike."

"The geopolitical situation is part of larger uncertainty to navigate, but is not disrupting plans for liftoff."

"Inflation is well above our goal."

"We need to demonstrate that the Fed is committed not to allow perpetuating spiral of inflation."

"Raising rates at least four times would be my preference."

"Most likely it will need more than four rate hikes."

"I am committed to getting demand and supply in balance."

"Raising interest rates isn't slamming the brakes on the economy."

"The last thing you want is an economy that's going too fast."

"We want to gradually move rates up."

"Fed policymakers will deliberate whether balance sheet reductions will start after two rate hikes, or three rate hikes."

The S&P 500 index has pierced the weekly lows (24 Jan 4,222.62), printing a low of 4,221.51.

As per the prior analysis, If Russia does invade Ukraine, this could finally spark off the crash 'puts' have been telegraphing, the Ukraine crisis has started to play out as warned:

Amid Ukraine/Russia tensions and the potential for slowing growth, markets have been trading far more defensively on Wednesday, tipping the stocks markets over the edge of the abyss, almost:

SPX weekly chart

In the above analysis, the index has been shown to form a topping head & shoulders on the weekly chart with the price just having broken the prior weekly lows of Jan 24 2022. This is a significant development for financial markets are a pivotal point in the Ukraine crisis that just turned up a notch.

More to come...

- Risk appetite took a turn for the worse during US trade, forcing EUR/JPY to hand back early session gains.

- Amid fears that Russia is on the brink of invading Ukraine, the pair dropped back to the 130.00 area.

Risk appetite took a turn for the worse during US trading hours on Wednesday, forcing EUR/JPY to hand back early session gains that took it as high as the 130.70 mark. The pair has since dropped back to the 130.00 area, where it now trades with losses of 0.2% on the day versus the 0.3% gains it was trading with at session highs.

Market commentators citing the rising risk of a Russian military incursion into Ukraine as the major reason for the downturn in sentiment during US trade. Reports suggesting US intelligence had warned Ukraine of Russian plans to invade within 48 hours and Ukraine has just approved a state of emergency and urged its citizens to flee Russia.

Despite choppy, two-way trade on Wednesday that saw EUR/JPY swing within a more than 70 pip range, the day’s volatility has remained easily contained within Tuesday’s 129.40-130.80ish ranges. Indeed, as market participants continue to monitor the unpredictable geopolitical landscape and react to developments headline by headline, trading conditions are likely to remain choppy and difficult.

To the downside, weekly lows in around 129.40 is the major support to watch and below that is the long-term uptrend from November 2020. Given the ECB’s ongoing hawkish shift towards admitting that it will tighten in Q4 this year (see ECB’s Philip Lanes comments on Wednesday), a longer-term move under 129.00 seems unlikely.

US Department of Defence spokesperson Joh Kirby said on Wednesday that Russian forces are in an "advanced" state of readiness near Ukraine. Separately, the White House reiterated on Wednesday that US President Joe Biden does not have any plans to send soldiers to Ukraine to fight.

San Fransisco President and FOMC member Mary Daly on Wednesday said that it is now time to move away from the Fed's extraordinary support for the US economy, according to Reuters.

Additional Remarks:

"The timing and magnitude of rate hikes and balance sheet adjustments will depend on how the economy and data evolve."

"It is appropriate to begin policy adjustment in March, absent any significant negative surprises."

"By almost any measure, the economy is doing well and labor market gains have been broad-based."

"The focus for the next few years will be on bringing inflation back down, delivering a labor market that works for everyone, despite uncertainty."

"Inflation is too high and has spread beyond Covid-affected sectors."

"As the Fed adjusts policy and we move to a post-pandemic world, we need to keep in mind pre-pandemic challenges, including downward pressure on inflation."

Market Reaction

Daly's comments are nothing new and thus have not moved FX markets.

RBNZ Governor Adrian Orr said on Wednesday that the official cash rate (OCR) will be above neutral by this time next year, according to Reuters. There is a heightened global inflation environment, he warned, explaining why the RBNZ has decided to step off the gas pedal. There is a clear path of rate hikes ahead of us, Orr added, with inflation at currently unacceptable levels.

Market Reaction

Orr's remarks are in line with what he said in wake of the recent RBNZ policy meeting during Wednesday's Asia Pacific session and thus have not prompted a market reaction.

- AUD/JPY bears sink in their teeth and are plenty hungry.

- The Ukraine crisis has been turned up a notch and the cracks in risk sentiment and flowing through to the yen.

As per the prior analysis of AUD/JPY, as illustrated in the following article that warned of prospects of a turn in risk appetite due to blatant prospects of escalated tensions surrounding, the Ukraine crisis has started to play out as warned:

- If Russia does invade Ukraine, this could finally spark off the crash 'puts' have been telegraphing

AUD/JPY structure and a blueprint for potential price trajectory were drawn out on the daily chart with a bearish bias as follows:

AUD/JPY, daily chart, prior analysis

''If there is going to be a meaningful move in sentiment, the forex markets risk barometer, AUD/JPY, that is retesting the daily counter-trendline, could be shaken out of its tree in the coming days. Eyes will be on whether it can take out the recent lows of 82.12: ''

AUD/JPY live market analysis

Meanwhile, although we saw a secondary breach of the resistance in Asia and European sessions amidst a market that continued to price more benign outcomes of the crisis, the price has indeed succumbed to the growing angst:

Given the latest escalation of the Ukraine crisis, it would only be fair to forecast a more extreme outcome in price action that might be representative of the grave troubles that lie ahead for the global economy. After all, the volatility on the pair today has seen the price move between a range of 80 pips, most of which occurs in the first half of the New York session.

What is key to acknowledge on the daily chart is the prospect of today's close leaving an accompanying double top wick, similar in length to that of 10 Feb. If the price is to react to the news feeds just as it did on Feb 10, when UK Foreign Secretary Liz Truss and Russian FM Sergey Lavrov held fruitless talks, in the first signs that diplomacy was never going to be an option, then it wouldn't be too ambitious to expect a similar 2% follow through to the downside in the coming days.

-

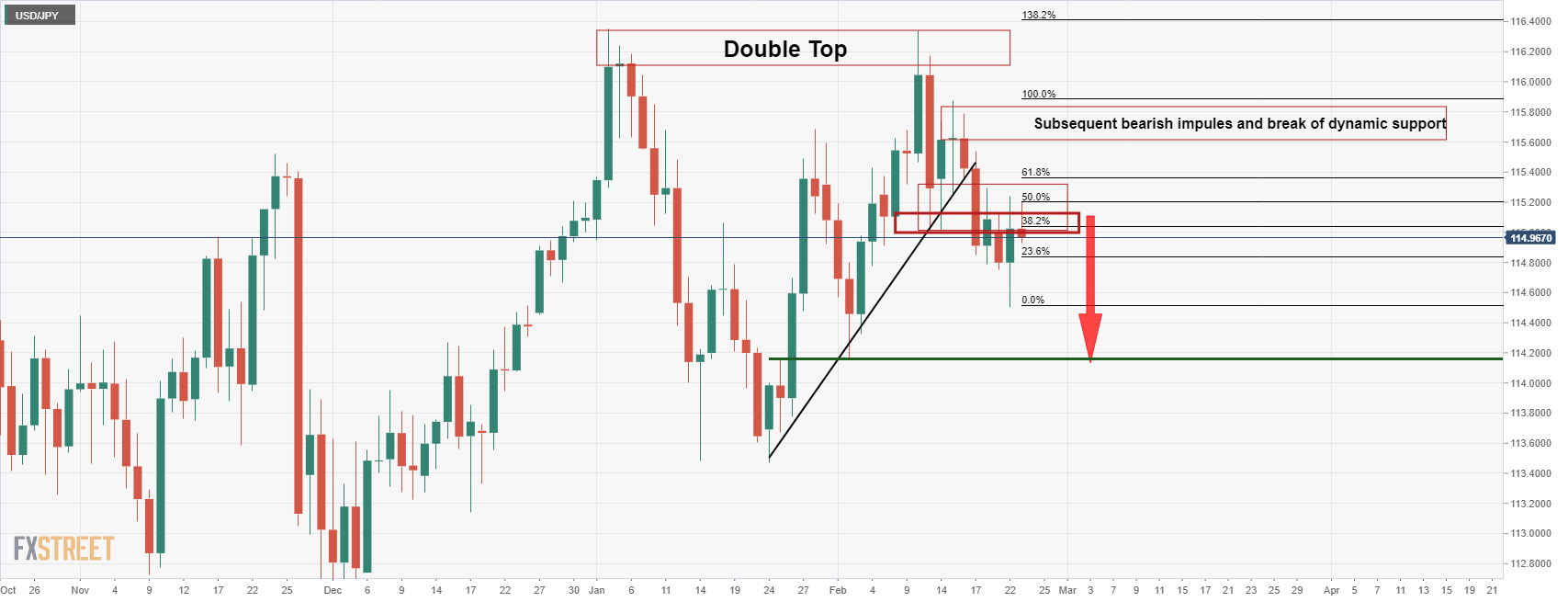

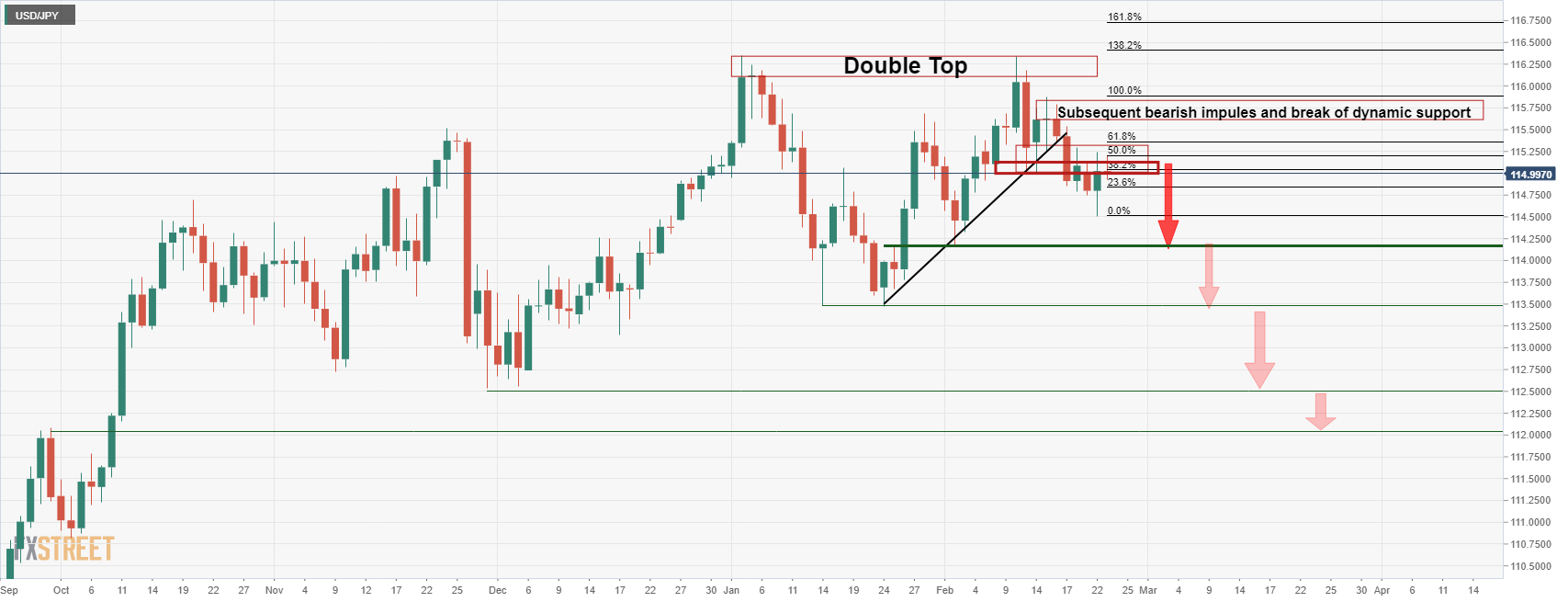

USD/JPY's Price Analysis: Weekly and daily pin bars are highly bearish

If there risk sentiment continues to be beaten down into the end of the week, taking into consideration the bearish market structure in USD/JPY as well, along with a less hawkish outlook for the Reserve Bank of Australia, then we could see the makings of a bearish structure below the counter trendline once again resulting in a bearish M-formation, as illustrated on the drawings above. The key levels in this respect are 83.05, 82.50 and 82.12 with 81.50 as the longer-term, target.

USD/JPY daily chart

''The above analysis, as per USD/JPY's Price Analysis: Weekly and daily pin bars are highly bearish, illustrates the bearish bias given the series of bearish events in price action since the double top was accompanied by a bearish engulfing close on Feb. 11. We have since seen a break of the trendline support and retests back into the cluster of offers below 115.30.

The price is failing there and near a 50% mean reversion of the bearish impulse that broke the dynamic support. This leaves the attention on the downside towards 114.20 for the days ahead as the last defence for much lower levels.''

What you need to take care of on Thursday, February 24:

The day started with investors optimistic about Eastern Europe developments, but the market’s sentiment deteriorated during US trading hours, resulting in the greenback strengthening against most of its major rivals.

Ukraine declared the State of Emergency starting February 24 and for 30 days amid reports from US intelligence indicating Russia will likely invade within the next 48 hours, despite multiple sanctions imposed on Russia from West countries. Also, multiple Ukrainian government websites went offline after a DDoS attack blamed on Russia.

In the UK, Bank of England Governor Andrew Bailey said they would consider selling assets after the main rate hit 1%, and referred to a “quite gradual” path to unwinding the balance sheet. He also added that the word transitory for inflation was becoming overused.

The EUR/USD pair trades around the 1.1300 level, approaching its weekly at 1.1287. The GBP/USD pair is firmly lower and at weekly lows in the 1.3530 price zone. Commodity-linked currencies, on the other hand, are correcting lower, but still holding on to intraday gains. Generally speaking, risk aversion is likely to persist.

The Japanese yen and the CHF edged higher against their American rival, although gains were limited.

Spot gold is up, trading at around $1,908 a troy ounce. Crude oil prices ended the day little changed, with WTI trading little changed at around $91.80 a barrel.

Wall Street start the day with gains, but gave up on risk aversion and ended in the red.

Binance dives into play to earn gaming with Netmarble’s ‘Golden Bros’ NFT collection

Like this article? Help us with some feedback by answering this survey:

- NZD/USD has pulled back to near 0.6770 from earlier highs above 0.6800 as risk appetite deteriorates amid geopolitical concerns.

- But the kiwi is still the best performing G10 currency in the afterglow of Wednesday’s hawkish RBNZ meeting.

- NZD/USD continues to trade higher by about 0.6% on the day.

NZD/USD has pared a significant portion of its earlier gains and now trades back near the 0.6770 level, having at one point been as high as 0.6810, where it was up about 1.2% at the time. Risk appetite has taken a turn for the worse since the onset of US trade this Wednesday as a result of rising fears that Russia might be on the brink of invading Ukraine, weighing on risk assets like the kiwi. But the pair still trades with gains of about 0.6% on the day and remains the best performing currency in the G10, as the kiwi retains an underlying bid as a result of Wednesday’s more hawkish than anticipated RBNZ meeting.

To recap quickly, the bank lifted interest rates by 25bps to 1.0% as expected, disappointing some calls for a 50bps hike, but said it had been close to implementing the larger rate hike. The central bank also revised higher its projected interest rate path to a peak of 3.35% from 2.6% previously, much more than previously expected and announced plans to start actively selling down its New Zealand government bond holdings. “Given how much work the RBNZ believes it has ahead of it,” analysts at Westpac said, “the risk of a 50bp move at any given meeting remains live”.

The RBNZ’s hawkish shift arguably makes it the first G10 central bank to signal that it wants to take monetary policy into tight territory, i.e. interest rates well above the so-called “neutral rate”. That may help underpin NZD in the coming weeks/months, though an important FX market driver in the near-term is set to remain geopolitics and Fed tightening expectations. If Russia really does plan on invading Ukraine anytime soon, it might be a while before NZD/USD is able to get back above 0.6800 again. Rather, a move back under 0.6700 on risk aversion/USD safe-haven bid, seems more likely.

- US equities are down for a fourth successive session on Wednesday as fears of a Russian invasion of Ukraine build.

- The S&P 500 fell back under the 4300 level to then hit fresh monthly lows under 4260.

US equities were down for a fourth consecutive session on Wednesday fears about a full-scale Russian invasion of Ukraine continued to rise. The S&P 500 fell back under the 4300 level and hit fresh monthly lows under 4260, with bears eyeing a test of annual lows around 4222. At current levels near 4250, the index trades with losses of about 1.2% on the day. The Nasdaq 100 index dropped 1.7% to hit fresh annual lows under 13.7K, while the Dow fell a further 0.9% and back below 33.5K and is also eyeing a test of annual lows in the 33.3K area. The S&P 500 CBOE Volatility Index rose about half a point into the mid-29.00s, still a little below February’s double top in around 32.00.

Regarding the latest on the Russia/Ukraine front, following various sanction announcements from the likes of the US, UK and EU over the last two days, satellite imagery has continued to show a build-up of Russian troops on Ukraine’s borders. In response, Ukraine declared a national emergency and instructed citizens in Russia to flee, while Moscow started an evacuation of its diplomatic staff in Kyiv. Elsewhere, reports earlier in the session citing US intelligence officials said that the US had warned Ukraine of a Russian plan to mount a full-scale assault within the next 48 hours.

As investors question whether there will or won’t be a major Russia/Ukraine conflict, and ponder how Western sanctions against Russia in the event of a full-scale assault would impact the global economy, US equity markets unsurprisingly remain tetchy. In the absence of more certainty, and against a backdrop of expectations for a significant degree of Fed tightening this year, the prospect for any meaningful rebound looks slim at present.

- Bears take charge and are testing below critical support structures across the timelines.

- USD/JPY has been pressured by a chorus of concerning headlines surrounding the Ukraine crisis.

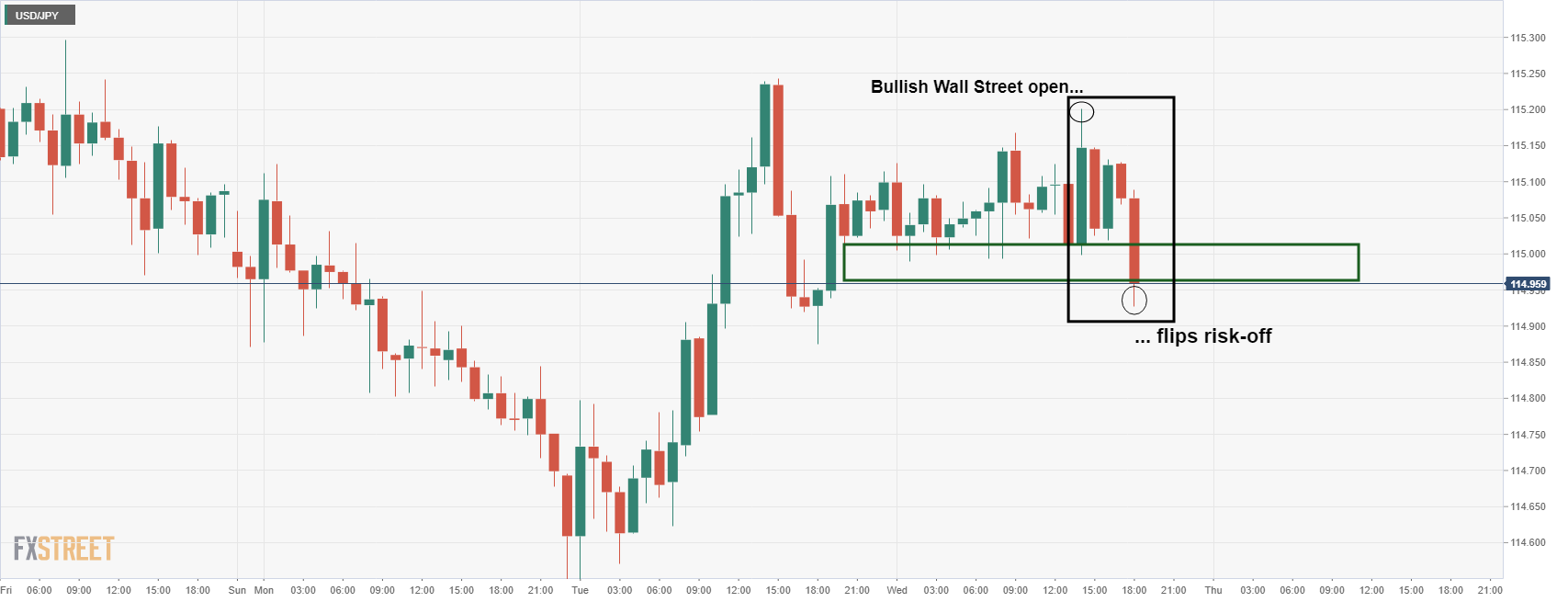

USD/JPY is under pressure as the yen picks up a safe-haven bid amid the latest bullish developments for the currency pertaining to the onset of war between Russia and the West.

Following news that Russian President Vladimir Putin had sent troops into separatist regions of Ukraine, the prospects of a deeper infiltration into the country was announced just after the Wall Street open by the United States of America. According to US intelligence, Russia will invade within 48hrs.

Further reports enhanced the risk-off moves on Wednesday that cited convoys of military equipment moving towards Donetsk in eastern Ukraine from the direction of the Russian Frontier. Consequently, Ukraine has planned to declare a state of emergency and the yen started to breakdown the hourly support vs the US dollar as follows:

USD/JPY H1 chart

The price action on the hourly time frame is making for a bearish structure, confirming the bias:

The M-formation would be expected to pull in the bulls for a restest to the neckline near 115.05/15. This resistance would be expected to equate to a full-on breakout below the counter-trend lines and the sideways topping structure that has been building over the course of this week.

Meanwhile, from a longer-term perspective, the week and daily price action and market structure also give us a few clues on where the bias is on a technical basis.

USD/JPY weekly chart

The weekly chart has been giving signs of bullish exhaustion since the middle of the month with the weekly wicks left unfilled by subsequent weeks of trading activity. The Bulls are tired and are throwing in the towel.

Additionally, the daily chart shows the bulls are losing the battle to the bears as follows:

USD/JPY daily chart

The above analysis illustrates the bearish bias given the series of bearish events in price action since the double top was accompanied by a bearish engulfing close on Feb. 11. We have since seen a break of the trendline support and retests back into the cluster of offers below 115.30.

The price is failing there and near a 50% mean reversion of the bearish impulse that broke the dynamic support. This leaves the attention on the downside towards 114.20 for the days ahead as the last defence for much lower levels:

European Central Bank Chief Economist Philip Lane said that inflation rates in the Eurozone will remain higher than expected for longer than originally thought, according to Reuters citing Germany's Faz. As a result, the ECB is revising its assessment of the duration of inflation, Lane added, saying that inflation may be approaching its medium-term target. Lane reiterated that he expected inflation to ease in the course of the year, but that it is uncertain as to how fast and how far it will fall. Geopolitical tensions are currently a very significant risk factor, especially for Europe, Lane concluded.

Market Reaction

Lane's recognition that ECB inflation forecasts will need to be lifted at the coming policy meeting, likely implying that the ECB will end its net bond-buying in Q3 and start lifting interest rates in Q4, has not surprised the market, though is an important moment for ECB policy. The euro has not reacted.

- Ukraine - Russia conflicts, grab market participants’ attention, again.

- Bank of England members at the UK Parliament Treasury Committee pushed back against “aggressive” monetary policy tightening.

- GBP/USD Technical Outlook: Failure at 1.3600 originated a move towards 1.3500.

The British pound’s failure to hold above 1.3600 exacerbated a move towards the 1.3550 area as geopolitical angst rises and Bank of England dovish language. At press time, the GBP/USD is trading at 1.3551.

Update of the Ukraine crisis in Eastern Europe

Ukraine – Russia tensions increase. What started as a “calm” day in the financial markets has taken its toll, as US press via Newsweek expressed that an invasion from Russia could occur within 24/48 hours.

The article said that Ukraine’s President has been warned that Russia “will highly begin an invasion within 48 hours based on US intelligence.” Russia’s invasion would consist of airstrikes, cruise missiles, ground invasion, and cyberattacks, as reported by a US intelligence official.

Earlier on the day, BoE’s officials spoke before the UK Parliament Treasury Select Committee on Wednesday. The BoE Governor Andrew Bailey said that inflations risks are tilted to the upside but still “two-sided,” cautioning investors against aggressive betting on future interest rates. At the same hearing, another member who voted for a 50-bps rate hike at February’s policy meeting said the decision had been finely balanced. Another, who also voted for a 50-bps increase, said he now sees “modest” tightening over the coming months.

So, geopolitical anxiety and BoE’s dovishness boosted the prospects of the greenback, weighing on the GBP. Furthermore, the GBP/USD bull’s failure to break the 1.3600 mark exacerbated cable’s downward move, caused by profit-taking and selling pressure, as the GBP/USD fell 50-pips.

In the meantime, the US Dollar witnessed fresh ebbs into it, as the US Dollar Index, which measures, the greenback’s value against a basket of six currencies, edges up 0.17%, sitting at 96.19.

GBP/USD Price Forecast: Technical outlook

In the last two days, the GBP/USD finished with losses, though never below the 1.3550 mark. Initially appeared to be consolidation before resuming the uptrend, but Wednesday’s price action has fueled the expectations of a more significant than estimated downward move.

The GBP/USD first support would be 1.3550. Breach of the latter exposes the 50-day moving average (DMA) at 1.3512, followed by the 100-DMA at 1.3502.

- The price has formed a weekly pennant and the rising wedge could be subject to a breakout.

- Russian invasion could occur within 48hrs according to the US, risk-off is hurting high beta currencies.

The Canadian dollar was trying to strengthen against its US counterpart on Wednesday as global financial markets started off calm in Asia. However, risk sentiment flipped on its head with investors waiting to see Russian President Vladimir Putin's next move after he sent troops into separatist regions of Ukraine.

The news fell in just after the opening on Wall Street that Ukraine had planned to declare a state of emergency after warnings from the US that Russia will invade within 48hrs. Further reports enhanced the risk-off moves that cited convoys of military equipment moving towards Donetsk in eastern Ukraine from the direction of the Russian Frontier.

Additionally, the price of oil has rallied on the news that the US will sanction the company building Russia's Nord Stream 2 pipeline. This leaves the outlook for CAD uncertain considering the high beta status it holds to global equities, commodity prices and specifically to oil:

-637812367521912757.png)

USD/CAD daily chart

From a technical perspective, the picture is no clearer given the price is stuck between a sideways daily channel as follows:

1.2640 is a key support level that guards a break of critical weekly structure.

USD/CAD weekly chart

However, the weekly chart may hold some clues:

The price has formed a pennant and given the current trajectory to the upside, the bias would be for a bullish breakout. However, when scaling out, the broader trend is bearish and the rising wedge could be subject to a breakout to target as low as 1.23 the figure:

- The AUD/USD record gains during the week of 1.13%.

- Ukraine – Russia tussles dominate news headlines as tensions elevate.

- AUD/USD Technical Outlook: Under downward pressure as AUD/USD sellers probe 0.7240.

Benefitted from the Reserve Bank of New Zealand (RBNZ) 25 bps rate hike and its “hawkish” forward guidance, the AUD/USD climbs to fresh monthly highs, around 0.7280. However, a sudden swing in the market mood due to elevated tensions in Ukraine decreased appetite for risk-sensitive currencies like the AUD. At the time of writing, the AUD/USD is trading at 0.7243.

In the meantime, the US Dollar witnessed fresh flows into it, as the US Dollar Index, a gauge of the greenback’s value against a basket of its peers, edges up 0.10%, sitting at 96.12.

Ukraine – Russia crisis escalates

According to Sputnik, around 15:39 GMT, explosions were heard at the Donetsk airport. Meanwhile, Interfax reported that Ukrainian government websites are reportedly under cyberattack, including Ukrainian banks. It is worth noting that Ukraine declared a state of emergency on Wednesday of 30 days and urged citizens to flee Russia. At the same time, Russia closed its embassy in Ukraine and evacuated the staff.

That weighed on the AUD/USD pair, as depicted by the 40-pip drop from daily highs, but found support near the February 10 daily high at 0.7245, a crucial support level for AUD bulls in the event of extending the uptrend.

In the Asian session, the Australian economic docket featured the Wage Price Index (WPI) for Q4 of 2021. The headlines aligned with expectations at 0.7% q/q, while the year-over-year figure came at 2.3%, short of the 2.4 estimations. Analysts at ANZ said that “this WPI was not strong enough to make a June rate hike more certain than not.”

AUD/USD Price Forecast: Technical outlook

The AUD/USD retracement from Wednesday’s daily highs left a long up-wick depicted by the candle in the daily chart, indicating that traders’ book profits and sellers could have opened fresh short bets. A move below February 10 high at 0.7245 could exacerbate a move towards a three-month-old downslope support trendline, around the 0.7180-95 area, but first AUD/USD sellers would need a clear break below 0.7200.

- Gold has been on the front foot in recent hours, pushing towards $1910 and eyeing weekly highs just above it.

- Following US warnings to Ukraine that a Russian invasion could come within 48 hours, market anxiety is elevated.

- The precious metal is thus finding demand amid a decent safe-haven bid.

Spot gold (XAU/USD) prices have been on the front foot in recent trade hours, rallying from earlier session lows in the $1890 area to current levels at highs of the day just below $1910 as geopolitical angst rises. At current levels, the precious metal trades with on-the-day gains of about 0.5% and is now eyeing a test of weekly highs $1914 area. Given recent reports that the US has warned Ukraine that a Russian invasion could come within 48 hours against the backdrop of recent positive technical momentum, a continued push higher seems odds on.

The immediate area of resistance to note beyond this week’s highs is the early June 2021 highs at $1916.60. A break above this level of resistance could open the door to a push on towards a double top from 2020/early 2021 in the $1960 area. Such moves would likely be contingent on further escalation on the geopolitical front, and if US intelligence is right about Russia’s plans to invade within 24 hours, that would fit the bill.

In this scenario, market participants would rush into safe-havens like gold amid uncertainty about how the Western sanction response against Russia would impact the global economy (inflationary disruptions to energy supplies?). Meanwhile, Russia taking control over Ukraine would bring conflict right onto NATO borders (Poland), raising the risk of direct military escalation between NATO and Russia. Russia also might feel emboldened to exert pressure on the Baltic NATO nations that border it further to the north, raising the risk of a NATO/Russia clash in another arena.

Amid such high stakes, XAU/USD price action will continue to trade as a function of geopolitical developments while Fed commentary and US data takes a back seat. One notable trend in recent days, however, has been markets paring back on Fed tightening expectations somewhat given elevated geopolitical uncertainty. This has also likely been helping gold.

European Central Bank governing council member and Bank of Spain head Pablo Hernandez de Cos said on Wednesday that the surge in Eurozone inflation is lasting longer than expected and is largely a result of energy. There are inflation risks to the upside and are most in the short-term, he added, adding that there is a higher likelihood that inflation remains at 2.0% in the medium-term. However, he said he sees no risk of inflation staying persistently above 2.0% and, given the uncertainty, the ECB must be adaptable and open to possibilities.

The ECB will not raise rates until its net bond buying has ended, de Cos noted, though we can't rule out the possibility that liftoff conditions will be met earlier than expected. The ECB is to decide upon its options, he continued, though gradualism is key. The current situation differs from the 1970 oil crisis, he noted.

Market Reaction

With markets much more focused on geopolitcs right now, de Cos's remarks have been largely ignored.

- Spot silver hit fresh monthly highs at $24.50 on Wednesday as fears rose of a Russian invasion of Ukraine.

- XAG/USD also broke above a key long-term downtrend, a bullish signal in the near-term.

Spot silver (XAG/USD) prices broke out to fresh monthly highs on Wednesday, surging beyond Tuesday’s highs in the $24.30 per troy ounce area to hit the $24.50 mark, boosted as fears of a Russian invasion into Ukraine rose. At current levels near highs of the day in the $24.40s, silver prices currently trade with on the day gains of nearly 1.5%, with the bulls now eyeing a test of annual highs printed back in mid-January in the $24.70s.

The latest upside, much of which has come since the US open on press reports that the US had warned Ukraine that a Russian invasion could begin within 48 hours, saw XAG/USD break above a key downtrend that has been capping the price action going all the way back to July 2021. If the bullish breakout can last (signified if silver holds and closes near $24.50), that would be a bullish sign in the near-term. Some short-term speculators might even target a test of the Q4 2021 highs just under $25.50.

Ukraine declared a state of emergency on Wednesday and urged citizens to flee Russia, while Russia is evacuating its diplomatic staff from Ukraine, all while ceasefire violations in the Donbas continue to accelerate. The drumbeat of war is clearly growing and this may help keep silver prices underpinned in the coming sessions. The US dollar has been pushing higher on a safe-haven bid in recent trade, which could undermine silver, but any such weakness is likely to be short-lived.

Data released on Wednesday showed Eurozone’s Inflation came in at 5.1% in January, on a yearly basis, according to Eurostat. Core figures rose by 2.3%, matching the 2.3% consensus forecasts. Analysts at Danske Bank revise their 2022 forecast for HICP (inflation) and core inflation to 4.7% and 2.4%, respectively, due to higher commodity and goods price inflation.

Key Quotes:

“The euro area recovery from the pandemic has been accompanied by protracted supply chain bottlenecks that have stifled activity, especially in the manufacturing sector. After supplier delivery times lengthened to unprecedented levels during 2021, there have been tentative signs of easing supply chain stress of late.”

“We now foresee HICP inflation in 2022 at 4.7% due to higher commodity and goods price inflation pressures and expect euro area core inflation to average 2.4% in 2022. Upside risks continue to stem particularly from a further escalation in the UkraineRussia tensions, that could send gas prices sharply higher. Stronger than expected commodities demand from a rebound in travelling activity and the Chinese cyclical recovery also pose upside risks in our view.”

- The USD/CHF leans towards 0.9175, the 200-DMA sparked by a swing in the market mood.

- USD/CHF Technical Outlook: Neutral-downwards after falling under 0.9200.

The USD/CHF retreats from a wall of resistance levels around the 0.9200 mark amid increasing tensions in Ukraine in the last hour, spurring a swing in market players’ sentiment. At the time of writing, the USD/CHF is trading at 0.9176.

Ukraine – Russia crisis escalates

Summarizing what happened in the last hour, around 15:39 GMT, explosions were heard at the Donetsk airport, according to Sputnik. Meanwhile, Interfax reported that Ukrainian government websites are reportedly under cyberattack, including Ukrainian banks.

That said, during the overnight session, the USD/CHF retreated from daily highs above the 0.9218 area, near the 200-hour simple moving average (SMA) at 0.9220 before the European session. The free-fall began once European traders got to their desks, pushing the pair towards the 200-day moving average (DMA) at 0.9175.

USD/CHF Price Forecast: Technical outlook

USD/CHF is neutral biased amid failure to hold the 0.9200 mark. The new trading range would be 0.9150-0.9200, as witnessed in the last three days, except for Wednesday, reaching a daily low at the abovementioned 200-DMA.

The USD/CHF path of least resistance in the short term is downwards. Breach of the 200-DMA would expose February 21 daily low at 0.9150. Once cleared, the next stop would be January 21 daily low at 0.9107, followed by the April 2021 lows at 0.9018.

+

- A deterioration in market sentiment boosts the US dollar.

- EUR/USD remains in recent range, now with a bearish intraday bias.

The EUR/USD retreated further from the 1.1360 area and dropped to 1.1320, erasing daily gains. The move lower took place amid a deterioration in market sentiment that boosted safe-haven assets.

DXY turns positive, still in range

The US dollar gained momentum during the American session as US stocks indices turned negative. The Dow Jones is falling 0.17% and the Nasdaq drops 0.57% after opening in positive territory.

Headlines about the crisis in Ukraine sent equity markets lower. Ukraine announced a state of emergency starting at midnight for 30 days and after the US warned of a full-scale Russian invasion within 48 hours.

The DXY is now up 0.03% after holding in negative ground most of the day. The index is moving toward the upper limit of the current range. Like the DXY, the EUR/USD continues to move sideways in the short term around 1.1330.

A daily close below 1.1300 should point to further weakness while if it rises above 1.1400, the euro would gain strength.

Technical levels

- EUR/GBP pushed back above 0.8350 on Wednesday with risk appetite choppy on fears of a full-scale Russia invasion into Ukraine.

- More dovish-leaning commentary from BoE policymakers on Wednesday before the UK parliament TSC also hindered GBP’s cause.

Though trading conditions are calmer on Wednesday versus Tuesday’s choppiness, EUR/GBP continues to trade with an upside bias and recently pushed above the 0.8350 level, up a further 0.25% on the day following Tuesday’s 0.3% rise. The market’s broader appetite for risk remains choppy and Russia/Ukraine crisis headline-driven, with the latest reports that the US has warned Ukraine of Russian plans to launch an assault within 48 hours denting sentiment. Given GBP’s status as comparatively more risk-sensitive versus the euro, that suggests a continued upside bias to the pair on Wednesday and, perhaps, for the rest of the week, likely makes sense.

In that sense, bulls will likely be targeting weekly highs in the 0.8380s set on Tuesday and last week’s highs at 0.8400 just above it. The dovish leaning tone to BoE commentary, with policymakers, speaking before the UK parliament’s Treasury Select Committee (TSC), on Wednesday has further added support to EUR/GBP. Governor Andrew Bailey said he saw inflation risks as tilted to the upside though as still two-sided and cautioned investors against getting overly aggressive betting on future interest rate hikes.

Meanwhile, one BoE members who voted for a larger 50bps rate hike at this month’s policy meeting said the decision had been finely balanced, while another (who also voted for 50bps) said he now sees “modest” tightening over the coming months. Most recently, BoE’s Silvana Tenreyro was on the wires as well, and she also talked about a further “modest” tightening of policy. This might have supported EUR/GBP more was it not for the fact that traders have begun talking about how Russia/Ukraine uncertainty will likely lead the ECB to be a little more dovish/cautious at the upcoming March meeting.

Looking ahead to the rest of the week, central bank speak and economic data is likely to take a back seat to the theme of geopolitics in Eastern Europe. If US intelligence officials are right and Russia does mount a full-scale invasion within 48 hours, that would likely be the most important market event since the onset of the pandemic. The question for EUR/GBP would be whether it ought to shoot higher to reflect weaker risk appetite or lower to reflect Eurozone economic vulnerability given its reliance on Russian energy imports.

- The yellow-metal is so far up 2.06% in the week.

- The market mood is upbeat as players shrug off the US-imposed sanctions to Russia, perceived as mild.

- XAU/USD Technical Outlook: Gold buyers in charge above $1877, eyeing a daily close above $1900.

Gold is subdued on a choppy trading session, clinging to the $1,900 mark amongst an overall upbeat market mood, following a series of sanctions imposed by the US to Russia, which appeared to be measured, an excuse for investors to seek riskier assets. XAU/USD is trading at $1,907 at the time of writing.

Safe-haven assets felt the market sentiment swing, as shown by the US Dollar Index, falling 0.07%, sitting at 95.99. Nevertheless, the US 10-year Treasury yield uptick five basis points, sitting at 1.991%, putting a lid to the upward move by the non-yielding metal.

Update of the Ukraine – Russia crisis

In the meantime, Ukraine’s crisis headlines ease a tad. EU Ambassadors approved sanctions on Russia, and US Secretary Blinken said that the February 24 meeting with Russian Foreign Minister Lavrov makes no sense. Alongside sanctions imposed by the US, Canada, Australia, and Japan, added to the list of countries imposing bans to Russia.

Meanwhile, Reuters reported that Ukraine will introduce a state of emergency within all Ukraine regions, ex-Donetsk/Luhansk, for 30 days, and could be further extended for the same amount.

The US economic docket featured Tier-3 macroeconomic data, mainly ignored by market players.

XAU/USD Price Forecast: Technical outlook

During geopolitical conflicts, gold is one of the sought safe-havens by investors, meandering around the $1900 mark for the last five days. Worth noting that XAU/USD buyers pushed the yellow-metal price above Pitchfork’s uptrend channel while breaking a nine-month-old trendline in the process, leaving the last year’s November 16 daily high at $1877 a crucial support for XAU bulls to keep the upward bias.

That said, XAU/USD’s first resistance is $1900. A decisive break would expose June 1, 2021, a daily high at $1,916. Breach of the latter will expose January 2021 highs at $1,959, which once cleared could pave the way towards $2,000.

- USD/TRY moves higher and approaches the 13.90 region.

- The lira remains on the defensive despite the risk-on mood.

- Turkey 10y bond yields rose to 2-week highs past 21%.

The Turkish currency depreciates further and now sends USD/TRY back to the proximity of 13.90 on Wednesday.

USD/TRY up on geopolitical risks

USD/TRY approaches the area of YTD highs just below the 14.00 barrier as the Turkish currency remains on the back foot in response to rising geopolitical concerns and equally increasing uncertainty surrounding the conflict in Easter Ukraine.

The deterioration of the Russia-Ukraine scenario poses heightened risks to Turkey’s macro stability, while the prospects of higher crude oil prices in response to potential supply disruptions is also another factor weighing on the lira so far.

Further out, the proximity of the start of the Fed’s tightening cycle also puts the lira under extra scrutiny amidst the elevated levels of foreign debt held by domestic companies and lenders.

USD/TRY key levels

So far, the pair is advancing 0.44% at 13.8352 and a drop below 13.4317 (weekly low Feb.11) would expose 13.2327 (monthly low Feb.1) and finally 12.7523 (2022 low Jan.3). On the other hand, the next up barrier lines up at 13.9013 (monthly high Feb.22) seconded by 13.9319 (2022 high Jan.10) and then 18.2582 (all-time high Dec.20).

Bank of England policymaker Silvana Tenreyro said on Wednesday that further increases in energy costs and tradable goods prices are likely to imply a somewhat greater persistence in inflationary pressures, according to Reuters. A further modest tightening of monetary policy settings, she continued, would be consistent with inflation returning to the BoE's 2.0% target sustainably, she added, caveating that the exact scale of tightening required is uncertain.

Additional Remarks:

"The impact of the February rise in bank rate is more likely to have its peak impact when inflation is still above target than if we had waited too much longer."

"My policy decisions will seek to manage any temporary trade-offs that arise between inflation and the volatility of output."

"With the inflation pick-up from higher tradeable goods price inflation now set to be larger and likely more persistent than previously expected, I thought an earlier tightening would strike a better balance."

"The associated fall in real income is also likely to weigh on demand, independently of the policy stance."

Market Reaction

GBP has not reacted to commentary from Tenreyro but is instead weakening in line with a downturn in risk appetite after Newsweek reported that the US has warned Ukraine of a Russian plan to invade in the next 48 hours.

According to US intelligence sources speaking to Newsweek, the US has informed Ukraine of a Russian plan to invade with 48 hours. An intelligence official told Newsweek that the US had informed Ukrainian President Volodymyr Zelenskyy that the Russian plan would involve airstrikes, cruise missiles, ground troops and cyber attacks.

NZD/USD has pushed above some key resistance levels at 0.6718/32. Next key resistance is seen at 0.6873/91, which it is expected to cap, according to analysts at Credit Suisse.

Further consolidation is likely

“We shift our stance in favor of a lengthier consolidation phase, with resistance for further recovery seen at the December highs as well as the 50% retracement of the October 2021-January 2022 fall at 0.6855/6873, which we would look to try to cap at first.”

“Were 0.6855/6873 to break, the YTD high at 0.6891 is expected to serve as a more solid barrier. Above here would signal a challenge of the falling 200-day moving average at 0.6949, however, this is not our base case for now.”

“On the flip side, a close below 0.6732/18 and a fall back below the recent lows at 0.6678 would relieve the recent upward pressure. Only below 0.6601/6589 would reassert the still intact medium-term downtrend though.”

The S&P 500 is on course to retest the 4223/4199 key support cluster. The risk for a break below here is seen rising sharply, which would open up further losses towards 3855/15, analysts at Credit Suisse report.

Weekly RSI holds a major top

“We maintain our negative outlook for a retest of a cluster of supports at 4223/4199. Although a fresh hold here should be allowed for, downside risks are seen increasing and with weekly RSI momentum maintaining a large top we are now biased to a break lower.”

“Below 4199 on a weekly closing basis would complete a large ‘head & shoulders’ top to warn of a further fall to the 38.2% retracement of the entire 2020/2021 bull trend at 3855/15.”

“A close above 4595 remains needed to ease the threat of a top.”

AUD/USD has broken above a key resistance zone at 0.7186/7213. Further upside is likely toward 0.7315/40, which is the key 200-day moving average (DMA) and 2022 high, but analysts at Credit Suisse expect this zone to cap for further consolidation.

Signs of further strength

“We see immediate resistance at the December 2020 highs at 0.7275/77 and then further above at the YTD highs at 0.7315, which should hold the recovery for now. With the falling 200-DMA just above at 0.7340/42, we would look for a cap here to define the top end of the range.”

“A move back below the October downtrend and recent lows at 0.7171/64 would quickly reassert the core bearish trend, with next supports seen at 0.7099/84, then 0.7063/49 and eventually the YTD lows at 0.6972/62.”

EUR/USD continues to pivot in a tight range between 1.13-1.14. In the view of economists at Scotiabank, the European Central Bank's (ECB) slow pace of normalization could drag the pair down to the 1.10 level.

Long-run oscillators remain bearish

“Short and medium-term trend oscillators are flat – suggesting a continuation of the choppy range trade for now. Longer-run oscillators remain bearish, however, and we think this continue to imply resistance to EUR gains above 1.14 and very firm resistance at 1.15 in the weeks ahead.”

“We think the ECB’s slow course towards monetary policy normalization leaves the EUR prone to softness in the medium-term (and continue to target a year-end rate of 1.10 versus the USD).”

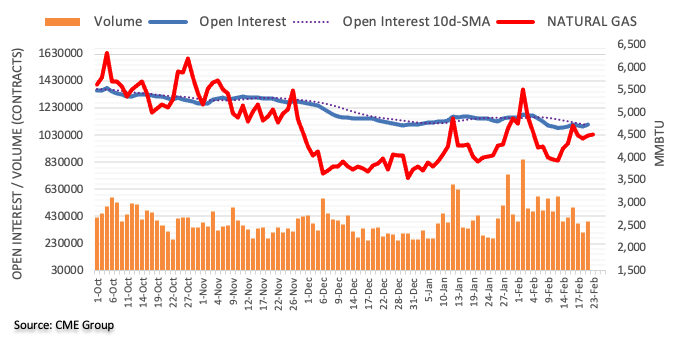

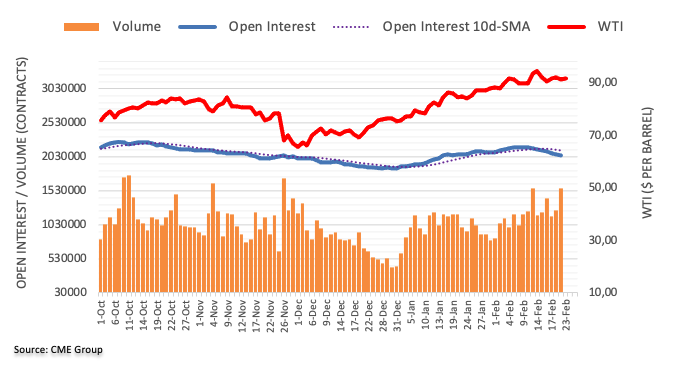

- WTI is trading more calmly on Wednesday and is currently roughly flat in the $92.00 area awaiting fresh geopolitical developments.

- As geopolitical risk premia remains elevated, oil is likely to remain a buy on dips.

- A possible US/Iran nuclear deal, which would free up 1.3M BPD in exports, is a downside risk traders should note.

After Tuesday’s choppy session which saw front-month WTI futures print fresh seven-year highs at $96.00 per barrel before swinging lower again, oil markets are experiencing calmer conditions on Wednesday. WTI is currently trading towards the top of mid-$90 to mid-$92.00 intra-day ranges near the $92.00 mark, where it is broadly flat on the day. Wednesday’s roughly $2.0 intra-day range compares to Tuesday’s intra-day range of more than $5.50.

Crude oil markets are continuing to monitor developments regarding the Ukraine crisis as fears about a full-scale Russian invasion of Ukraine remain elevated and Western nations hit Russia with sanctions over its recognition of the independence of breakaway Ukrainian regions. These sanctions have so far been focused on targeting Russian banks and wealthy individuals, with US President Joe Biden on Tuesday making it clear that the US wasn’t yet to target Russian commodity exports.

The geopolitical impetus for WTI to push above $96.00 and on towards $100, thus, is not yet there. But US officials have signalled that if Russia takes further aggressive action against Ukraine all options for further sanctions are on the table and this is a key risk oil traders will be monitoring in the coming days. “The prospect of more conflict in Ukraine should safeguard the geopolitical risk premium,” said one commodity analyst, whilst another warned that “There is a risk that Russia will retaliate to the sanctions by reducing deliveries of its own accord”.

Thus, for now, it seems likely that dips back towards $90.00 will continue to be bought, as has been the case over the past two or so weeks. Eyes will be on a meeting of the UN General Assembly on Ukraine later in the day, which should generate fresh geopolitical headlines, as well as US weekly oil inventory data from the American Petroleum Institute at 2130GMT.

Another theme at the top of oil traders’ minds is the prospect of a US/Iran nuclear deal. A deal would pave the way for the US to lift sanctions on Iranian crude oil exports. According to ING, would ease concerns over OPEC+ spare capacity (or lack thereof). The bank said “Iran is currently producing at around 2.5mln BPD but is estimated to have a capacity of closer to 3.8mln BPD, therefore, over time there is the potential for 1.3mln BPD of additional supply to come onto the market”. “Nuclear talks in Vienna are reaching a sensitive and important point” said Iran's foreign minister on Wednesday.

The New Zealand dollar is the best performing G10 currency on a one-day view after the messages of the Reserve Bank of New Zealand (RBNZ) in today’s policy meeting went beyond what the market had been expecting. This should cement a move higher towards 0.71 though NZD/USD may struggle to reach it if geopolitical tensions continue to remain the dominant theme, economists at Rabobank report.

Upping the ante

“The RBNZ hiked rates by 25 bp for a third consecutive meeting, in line with the Bloomberg survey of economists. That said, the committee made clear that the decision to announce a 25 bps rate hike rather than a 50 bps move had been finely balanced for many members. In addition to the rate hike, the RBNZ also announced that it would commence the gradual reduction of the Bank’s bond holdings.”

“Although we are forecasting a move higher towards NZD/USD 0.71 on a three-month view, this could be thrown off kilter if geopolitical news worsens and the safe-haven USD finds additional support.”

“In view of the far more cautious tone of the RBA, we do see scope for AUD/NZD to move lower. Our three-month AUD/NZD forecast stands at 1.03.”

- EUR/USD adds to Tuesday’s advance near 1.1360.

- Further upside needs to clear the 1.1360 region.

EUR/USD extends the weekly rebound and revisits the 1.1360 zone on Wednesday.

Extra gains in the pair needs to surpass the 5-month line around 1.1360 to mitigate downside pressure and allow for a probable test of the weekly high at 1.1395 (February 14). Further up is seen the 200-week SMA at 1.1487 closely followed by the 2022 peak at 1.1494 (February 10).

In the longer run, EUR/USD is expected to keep the negative outlook as long as it trades below the key 200-day SMA, today at 1.1628.

EUR/USD daily chart

- USD/CAD came under intense selling pressure on Wednesday and dived to a fresh weekly low.

- The risk-on impulse weighed on the safe-haven USD and exerted downward pressure on the pair.

- Bulls seemed rather unimpressed by softer crude oil prices, which tend to undermine the loonie.

The USD/CAD pair continued losing ground through the early North American session and dropped to a fresh weekly low, around the 1.2680 region in the last hour.

Having faced rejection near the 1.2780-1.2785 supply zone, the USD/CAD pair witnessed aggressive long-unwinding trade on Wednesday amid renewed US dollar selling bias. The fact that new economic sanctions on Russia were not as bad as feared helped ease the nervousness about the situation in Ukraine and boosted investors' confidence. This was evident from a generally positive tone around the equity markets, which, in turn, weighed on the safe-haven greenback.

That said, a fresh leg up in the US Treasury bond yields should act as a tailwind for the greenback. Apart from this, modest downtick in crude oil prices could undermine the commodity-linked loonie and help limit any further losses for the USD/CAD pair, at least for now. The fundamental backdrop supports prospects for the emergence of dip-buying around the USD/CAD pair and warrants some caution for bearish traders amid absent relevant market moving economic releases.

From a technical perspective, the good two-way price moves witnessed over the past four weeks or so points to indecision among traders over the next leg of a directional move for the USD/CAD pair. Moreover, repeated failures near the said trading range hurdle make it prudent to wait for some follow-through buying before positioning for any meaningful upside. Nevertheless, any subsequent decline is more likely to find decent support near the 1.2655-1.2650 region.

Technical levels to watch

- AUD/USD hit its highest levels since mid-January on Wednesday in the 0.7275 area as risk appetite picked up.

- AUD was only very briefly undermined by weak WPI data, which saw some traders pare back their RBA tightening bets.

AUD/USD surged to its highest level since mid-January in the 0.7275 area on Wednesday amid a broad pick-up in macro risk appetite, with market participants taking the view that US sanctions against Russia announced on Tuesday weren’t quite as harsh as feared. The Aussie, which has been getting tailwinds from buoyant equity markets (S&P 500 futures are up nearly 1.0% in pre-market trade), is now up about 0.8% on the session versus the buck. The brief dip that saw the pair fall to session lows in the 0.7220 area during the Asia Pacific session in wake of softer than expected Australia Q4 Wage Price Index (WPI) data is now well in the rear-view mirror.

AUD/USD is also likely getting a lift from its close correlation to its antipodean counterpart – NZD/USD is up more than 1.0% on the session following Wednesday’s more hawkish than anticipated rate guidance from the RBNZ on Wednesday. The Aussie’s outperformance on Wednesday (it sits in second place in the G10 performance table after NZD) comes despite traders paring back on their RBA tightening bets in wake of the latest WPI figures. The YoY rate of WPI came in at 2.3%, below the expected 2.4%.

“Today's figures support the view that it may take some time to lift wages growth such that the 'norm' becomes a wage rise of 3-4%, rather than the 2% of recent year” said analysts at HSBC. “The RBA is seeking to run the economy hot for a while to try to reset these wage settings norms” they added. But AUD/USD has been undeterred and looks intent on testing earlier annual highs just to the north of the 0.7300 level. One risk to this would be if the Ukraine crisis further escalates, triggering a USD/safe-haven FX bid, potentially sending the pair back towards 0.7200.

- USD/JPY witnessed subdued/range-bound price moves through the early North American session.

- The risk-on mood undermined the safe-haven JPY and acted as a tailwind amid rising US bond yields.

- The emergence of fresh USD selling failed to impress bullish traders or provide impetus to the major.

The USD/JPY pair extended its sideways price move through the early North American session and was last seen trading with modest intraday gains, just above the 115.00 psychological mark.

The pair struggled to capitalize on the previous day's goodish rebound from mid-114.00s, or a two-and-half-week low and witnessed subdued/range-bound trading on Wednesday. Renewed US dollar selling bias held back traders from placing bullish bets, though a combination of factors helped limit the downside for the USD/JPY pair.

As investors digest the recent developments surrounding the Russia-Ukraine saga, a generally positive tone around the equity markets undermined the Japanese yen's safe-haven status. Apart from this, a fresh leg up in the US Treasury bond yields further inspired bullish traders and extended some support to the USD/JPY pair.

The fundamental backdrop supports prospects for further gains. That said, the risk of an imminent Russian invasion of Ukraine warrants some caution. Hence, it will be prudent to wait for some follow-through buying before confirming that the pullback from the vicinity of the multi-year high, around the 116.35 area, has run its course.

There isn't any major market-moving economic data due for release from the US, suggesting that the focus will remain glued to fresh geopolitical developments. Apart from this, traders will take cues from the broader market risk sentiment and the US bond yields to grab some short-term opportunities around the USD/JPY pair.

Technical levels to watch

- DXY extends Tuesday’s bearish move to the 95.80 region.

- Further consolidation seems the name of the game for DXY.

DXY adds to the recent weakness although it remains largely within the prevailing consolidation theme.

That said, occasional bullish attempts remain so far capped by last week’s top at 96.43 (February 14), while the 95.70 area is expected to hold the downside for the time being.

The short-term constructive stance remains supported by the 5-month line, today near 95.40, while the outlook for the dollar is seen as positive above the 200-day SMA at 93.82 in the longer run.

DXY daily chart

The core trend for gold looks in the process of turning higher again, in the view of strategists at Credit Suisse. A break past $1,917/23 would open up further gains towards the $2,075 record high.

Initial support align at $1,845

“Gold has seen a weekly close above the $1,877 high of November and the spotlight turns to the June 2021 high and retracement resistance at $1,917/23. Above here should add momentum to the rally to confirm a base has indeed been established to raise the prospect of a move back to the $2,075 record high.

“Support is seen moving to $1,845 initially, then more importantly at the 200-day average at $1,809.”

- GBP/USD has pulled back under 1.3600 again from earlier highs in the 1.3620s amid dovish BoE vibes.

- The pair continues to trade a little higher on the day with the dollar weaker amid a broadly risk-on market mood.

Dovish-leaning commentary from BoE officials speaking before the UK Parliament’s Treasury Select Committee on Wednesday seems to have weighed on GBP/USD a touch on Wednesday, as focus remains primarily on the Russia/Ukraine crisis. The pair has pulled back to around the 1.3600 level from earlier session highs in the 1.3620 area and continue to trade about 0.1% higher on the day, boosted by a slightly weaker US dollar amid better risk appetite.

Market commentators said that the sanctions announced by the US against Russia on Tuesday weren’t as harsh as feared, facilitating the broad rebound in risk assets and selling pressure on safe havens. Market commentators did also note that US officials also committed to implementing further sanctions on Russia if needed.

Regarding commentary from BoE policymakers on Wednesday, analysts said the general tone was aimed at cooling BoE tightening bets. Firstly, Governor Andrew Bailey said he saw inflation risks as tilted to the upside though still two-sided and cautioned investors against getting overly aggressive betting on future interest rate hikes. Meanwhile, one BoE members who voted for a larger 50bps rate hike at this month’s policy meeting said the decision had been finely balanced, while another (who also voted for 50bps) said he now sees “modest” tightening over the coming months.

Analysts at Monex Europe said that “BoE communications since February's meeting have largely taken aim at cooling market-implied policy rates”. Another analyst at CIBC said that the market-implied pace of tightening this year (144bps) was too aggressive. Perhaps, then, given the dovish BoE vibes on Wednesday, it isn’t too surprising to see GBP underperform in the G10 space (only safe-haven currencies USD and JPY are doing worse). For now, as markets await more certainty on the geopolitical front, GBP/USD may continue to undulate within recent 1.3550-1.3650ish ranges.

- A combination of supporting factors pushed NZD/USD to over a one-month high on Wednesday.

- A more hawkish RBNZ stance, the risk-on mood provided strong lift to the perceived riskier kiwi.

- Modest USD weakness remained supportive of the move, though overbought RSI might cap gains.

The NZD/USD pair maintained its strong bid tone heading into the North American session and was last seen trading just below the 0.6800 mark, or over a one-month high.

The pair gained strong positive traction on Wednesday after

the Reserve Bank of New Zealand (RBNZ) hiked interest rates, as expected, and indicated that more tightening could be necessary. In the accompanying policy statement, the RBNZ noted that the decision between a 25bp and 50bp hike was finely balanced and also increased the official cash rate (OCR) peak forecast.

In fact, New Zealand's central bank projected that the cash rate would reach 2.2% by the end of 2022 and 3.35% in the last quarter of 2023, 0.75% higher than its November forecast of 2.6%. This, along with the risk-on impulse in the markets, provided a goodish lift to the perceived riskier kiwi and pushed the NZD/USD pair higher for the seventh successive day.

The intraday positive momentum seemed unaffected by the risk of an imminent Russian invasion of Ukraine, instead took cues from the emergence of fresh US dollar selling. The upbeat mood around the global equity markets undermined the safe-haven greenback, which, so far, has failed to draw any support from a fresh leg up in the US Treasury bond yields.

Apart from the aforementioned factors, sustained strength beyond the previous monthly high, around the 0.6730-0.6735 region, prompted technical buying and contributed to the strong bid tone. It, however, remains to be seen if bulls are able to capitalize on the move or opt to take some profits off the table amid slightly overbought RSI (14) on hourly charts.

There isn't any major market-moving economic data due for release from the US, though developments surrounding the Russia-Ukraine saga might influence the USD price dynamics. Traders will further take cues from the broader market risk sentiment to grab some short-term opportunities around the NZD/USD pair.

Technical levels to watch

- EUR/JPY reclaims the area above the 130.00 mark.

- The cross needs to leave behind the 200-day SMA at 130.38.

EUR/JPY extends the rebound from weekly lows near 129.30 (February 22) and regains the 130.00 barrier and beyond on Wednesday.

Further recovery in EUR/JPY now faces the next resistance of note at the weekly high at 131.90 (February 16), which is regarded as the last defence for a potential move to the 2022 peak at 133.15 (February 10).