- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-01-2024

- GBP/USD recovers some lost ground around 1.2693 on Wednesday.

- The January Richmond Fed Manufacturing Index came in at -15 vs. -7 consensus and -11 prior.

- The markets expect the Bank of England (BoE) to start cutting rates as early as May.

- Traders await the UK and US PMI reports on Wednesday.

The GBP/USD pair recovers its recent losses during the early Asian trading hours on Wednesday. The major pair has flirted with four-day lows near around 1.2650 and rebounded to nearly the 1.2700 mark. Investors await the release of January’s UK advanced Manufacturing and Services PMI for fresh impetus. GBP/USD currently trades near 1.2693, up 0.06% for the day.

According to the Richmond Fed Manufacturing Survey, the composite manufacturing index for January fell to -15 from -11 in December, worse than the market expectation of -7. Among its three component indices, shipments increased from -17 to -15, new orders dropped from -14 to -16, and employment fell significantly from -1 to -15.

The Federal Reserve (Fed) governor, Christopher Waller, stated that the Fed should cut rates "methodically and carefully" and not “rushed." Additionally, Atlanta Fed President Raphael Bostic said he sees rate cuts beginning in the third quarter, while San Francisco Fed President Mary Daly suggested policymakers must be patient about rate cuts. The less aggressive rate-cut stance from the Fed provides some support to the US Dollar (USD) and acts as a headwind for the GBP/USD pair.

On the other hand, investors place a bet that the Bank of England (BoE) will start cutting rates as early as May, with three more cuts over 2024 taking it to 4.25% from 5.25% now. However, there’s no change in monetary policy expected in its February meeting. Market players will take more cues from the data release on Wednesday. The preliminary UK S&P Global Services PMI is estimated to ease from 51.4 in December to 51.0 in January, while the Manufacturing PMI is projected to remain steady at 47.9.

The UK S&P Global/CIPS Purchasing Managers Index (PMI) and US S&P Global PMI reports will be released on Wednesday. The attention will shift to the US Gross Domestic Product (GDP) for Q4 on Thursday and the Core Personal Consumption Expenditures Price Index (Core PCE) on Friday. These figures might convince central bank policymakers about the further path of monetary policy.

- EUR/USD finds itself close to the 200-day SMA as investors brace for PMI figures.

- Wednesday sees preliminary PMI January data for both the EU and the US.

- Markets expect a European uptick but flattening US services.

EUR/USD drifts into a key midrange figure early Wednesday as European and US Purchasing Managers’ Index (PMI) figures loom over the market for the mid-week trading session.

Markets are broadly expecting pan-European HCOB Composite PMI figures to rebound in January from 47.6 to 48.0, which would represent an eighth straight month of sub-50.0 combined PMI activity for the European continent.

On the US side, market forecasts are looking for the S&P Global Manufacturing PMI component to hold steady at 47.9 while the Services PMI component is expected to tick down from 51.4 to 51.0.

After PMIs are done landing on markets, Thursday brings another rate call and monetary policy statement from the European Central Bank (ECB), which has broadly forecast a lack of movement on interest rates until the summer months barring any drastic changes to underlying economic figures. Still, investors will be keeping a close eye on the ECB’s policy statement for any clues about how deep into dovish or hawkish territory ECB President Christine Lagarde and her cohort of central bank policymakers are leaning following Wednesday’s PMI activity expectation figures.

Thursday also sees an update to US Gross Domestic Product (USD) on an annualized basis, with YoY GDP forecast to trim back to 2.0% from 4.9% for the year ended in December.

EUR/USD Technical Outlook

The EUR/USD saw a quick plunge into touch range of 1.0820 following a harsh rejection from the 200-hour Simple Moving Average (SMA) just above 1.0910, sending the major pair back below the 1.0900 handle for the third time in a week.

Daily candlesticks show the EUR/USD coiling tightly into the midrange as broad-market momentum tilts into the middle, and the pair is adrift on market tides in a congestion zone between the 50-day and 200-day SMAs near 1.0925 and 1.0850 respectively.

EUR/USD Hourly Chart

EUR/USD Daily Chart

- USD/JPY tipped into familiar highs near 148.70.

- Broad-market risk flows sent investors into the US Dollar.

- BoJ remains steadfast in its inaction on negative rates.

The USD/JPY hit a familiar hit bid at 148.70 as markets picked up the US Dollar (USD) through Tuesday, keeping the Japanese Yen (JPY) broadly lower on the day.

The Bank of Japan (BoJ) kept its policy rate locked in negative territory at -0.1% until the Japanese central bank sees more signs that inflation will avoid cooling off more than anticipated in the future. The BoJ is grappling with an opposite problem that is plaguing most global central banks; Japan’s long-standing struggle to stoke meaningful inflation within the domestic Japanese economy has the BoJ petrified that any upside moves in interest rates without already-rising wages and inflation pressures will cause structural deflation to set in.

Japan sees the next round of Tokyo Consumer Price Index (CPI) inflation figures on Thursday, where markets and the BoJ will both be keeping a close eye for any signs that price pressures will stop declining much below the BoJ’s desired 2% level. January’s Tokyo CPI for the year ended in January is forecast to tick down from 2.1% to 1.9%.

Friday also brings US Personal Consumption Expenditure (PCE) inflation figures, the Federal Reserve’s (Fed) favored methods of tracking US inflation. December’s Core US PCE Price Index is forecast to rise slightly from 0.1% to 0.2%, and the YoY Core figure is expected to ease to 3.0% from 3.2%.

USD/JPY Technical Outlook

USD/JPY continues to run ahead of the 200-hour Simple Moving Average (SMA) rising into the 147.00 handle, and the pair is up over 5% from 2024’s opening bids as Greenback bidding pressure keeps the pair close to medium-term high bids.

Daily candlesticks have the USD/JPY testing back into the high end after a failed bearish break of the 200-day SMA between 142.00 and 143.00, with the pair set for a bullish run into 2023’s late peak just shy of the 152.00 handle.

USD/JPY Hourly Chart

USD/JPY Daily Chart

- NZD/USD holds positive ground above 0.6100 despite the firmer USD.

- The US Richmond Fed Manufacturing Index remained sluggish in January.

- New Zealand's Consumer Price Index (CPI) for Q4 arrived at 0.5% QoQ vs. 1.8% prior, in line with market expectations.

The NZD/USD pair hovers around the 0.6100 mark during the early Asian session on Wednesday. The New Zealand Dollar (NZD) initially edged higher overnight before dropping back as the US Dollar strengthened. Meanwhile, the US Dollar Index (DXY) has reached new yearly highs above 103.00 as the markets turn cautious ahead of key US economic data. At press time, NZD/USD is trading at 0.6100, gaining 0.20% on the day.

On Tuesday, the US Richmond Fed Manufacturing Index was weaker than expected in January, coming in at -15 from -11, marking its third consecutive negative reading. This reading was below the market consensus of -7.

The Federal Reserve’s (Fed) official stressed that the central bank should cut rates "methodically and carefully.” The markets expect the Fed to cut rates slower and less aggressively than previously anticipated. According to the CME FedWatch Tool, the odds of a March rate cut fell to 44.3% from an 81% chance last week.

On the Kiwi front, Statistics New Zealand showed that New Zealand's Consumer Price Index (CPI) arrived at 0.5% QoQ in the fourth quarter of 2023 from the previous quarter's 1.8%, in line with market expectations. On an annual basis, the CPI inflation figure came in at 4.7% YoY, compared to the previous reading of 5.6%. In response to the data, the NZD gains traction above the 0.6100 psychological mark.

Market players will keep an eye on the US preliminary S&P Global PMI report, due on Wednesday. Later this week, the US Gross Domestic Product Annualized (Q4) and Core Personal Consumption Expenditures Price Index (Core PCE) for December will be in the spotlight.

- AUD/USD registers a 0.14% gain in the Asian session, stabilizing at the 200-DMA.

- Business activity slightly recovered in Australia but remains shy of expanding.

- High US Treasury yields capped the AUD/USD rise on Tuesday’s session.

- Traders eye key US GDP data and the core PCE index on the horizon.

The AUD/USD opened the Asian session virtually unchanged, but on Tuesday registered decent gains of 0.14%, bracing at around the 200-day moving average (DMA) at 0.6578. The lack of catalyst keeps the pair within familiar levels, capped by the 50 and 100-DMAs, each above and below the current exchange rate. At the time of writing, the AUD/USD trades at 0.6579.

AUD/USD looms around the 200-DMA as Aussie’s business activity remains sluggish

Sentiment remains mixed as Wall Street’s closed mixed, with the Nasdaq and S&P 500 closing in the green, while the Dow Jones lost 0.25%. US Treasury bond yields in the belly and the long-end of the curve rose and boosted the Greenback (USD), capping the AUD/USD gains above the 200-DMA.

On the data front in the United States, the Philadelphia Fed Non-Manufacturing Index dropped to -3.7 from a revised 2.1 in December, while the Richmond Fed Manufacturing Index fell in January. The reading came at -15, below forecasts and the prior month’s -11 contraction.

In the meantime, money market futures trimmed the Fed’s odds for a rate cut in March, though in May, a fully 25 basis point (bps) cut is priced in, and the chances for a 50 bps lie at 50%.

The NAB Business conditions worsened to 7 in December on the Aussie front.

Recently, Australia’s Judo Bank Manufacturing PMI improved from 47.6 to 50.3, while the Services stood at recessionary levels despite improving from 47.1 to 47.9. The Composite Index rose by 48.1 from 46.9. Warren Hogan, Chief Economic Advisor at Judo Bank, said: “The Judo Bank Flash PMI for January provides a first look at the economy in the new year. Encouragingly, we have seen a modest improvement in business conditions in January, with a stabilization in service sector activity and a pick-up in manufacturing output.”

On the US front, the economic docket will feature S&P Global Flash PMIs, ahead of Thursday GDP and the Fed’s favorite inflation gauge, the core PCE.

AUD/USD Price Analysis: Technical outlook

Despite clinging to the 200-DMA, the AUD/USD could remain sideways, capped on the upside by the 0.6600 figure. A breach of the latter will expose the 50-DMA at 0.6649 before testing 0.6700. On the flip side, a drop below 200-DMA at 0.6577 and the 100-DMA at 0.6522, would open the door to test the 0.6500 mark. The further downside lies at the major support level at 0.6338, the latest cycle low on November 10.

- Australia's January Judo Bank Services PMI increases to 47.9 versus 47.1 previous.

- Manufacturing PMI Component hits 11-month high of 50.3.

Australia's Judo Bank Purchasing Managers' Index (PMI) showed a welcome rebound in the PMI Manufacturing component, hitting an 11-month high of 50.3 and helping to drag the Composite PMI Output Index to a four-month high of 48.1 versus December's print of 46.9.

Despite a continued overall decline in Australia's private sector activity in January, the pace of contraction has declined, and an easing of business contractions coincides with an improvement in business confidence at the start of 2024.

According to Judo Bank's Chief Economic Advisor Warren Hogan:

“The Judo Bank Flash PMI for January provides a first look at the economy in the new year. Encouragingly, we have seen a modest improvement in business conditions in January, with a stabilisation in service sector activity and a pick-up in manufacturing output.

Business confidence has also improved, measured by the future output index, which rose to the highest level in five months in January. Excluding the spike in August last year, it is the highest reading in a year."

Market Reaction

The AUD/USD is trading tightly near the 0.6580 level as Pacific and Oceania markets gear up for the Wednesday market session.

About the Australian Judo Bank PMI

The Manufacturing Purchasing Managers Index (PMI), released on a monthly basis by Judo Bank and S&P Global, is a leading indicator gauging business activity in Australia’s manufacturing sector. The data is derived from surveys of senior executives at private-sector companies. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the Australian Dollar (AUD). Meanwhile, a reading below 50 signals that activity among goods producers is generally declining, which is seen as bearish for AUD.

- NZ CPI inflation hits its coolest price growth in three years at 0.5% QoQ.

- Annualized CPI inflation cools to 4.7%, improved but still well above the RBNZ's 2% target.

New Zealand's Consumer Price Index (CPI) eased further in the fourth quarter of 2023, coming in at 0.5% QoQ in-line with forecasts and cooling off further from the previous quarter's 1.8%.

Annualized CPI inflation in New Zealand also matched expectations, coming in at 4.7% compared to the previous period's 5.6%.

StatsNZ noted that some minor adjustments had to be made to correct previous errors in several statistics, but noted that the overall direction and magnitude of the data release was unchanged as a result of the corrections.

According to StatsNZ, rises in Housing and household utilities (up 1.1%) were driven primarily by rising household energy (up 1.9%), but were offset by declines in the Food category (down 1.2%), fueled by a steep decline in the price of fruit and vegetables (down 6.4%).

New Zealand QoQ CPI inflation has cooled to its lowest price growth in three years, reaching a peak of 2.2% in October of both 2021 and 2022.

Market Reaction

The Kiwi (NZD) saw a quick jump against the US Dollar (USD) to drag the NZD/USD briefly back into the 0.6100 handle in early Wednesday trading action, but thin markets are set to fade the move in short order.

Why NZ CPI inflation matters to traders

With the Reserve Bank of New Zealand's (RBNZ) inflation target being around the midpoint of 2%, Statistics New Zealand’s quarterly Consumer Price Index (CPI) publication is of high significance. The trend in consumer prices tends to influence RBNZ’s interest rates decision, which in turn, heavily impacts the NZD valuation. Acceleration in inflation could lead to faster tightening of the rates by the RBNZ and vice-versa. Actual figures beating forecasts render NZD bullish.

- The XAU/USD trades at $2,030 seeing gains of 0.43%.

- Key indicators on the daily chart signal that the bears are catching their breath after last week's strong movements.

- The four-hour chart outlook suggests potential upward bias, with a positive RSI incline and MACD's green bars.

On Tuesday's session, the Gold spot price XAU/USD was spotted trading at $2,030, reflecting a 0.43% gain, as the bears are taking a breather after last week's notable 2% loss. The daily chart presents a neutral-to-bearish sentiment with the bears while, the four-hour indicators are slightly tilted to the upside, suggesting an imminent potential shift in momentum.

Fundamentally speaking, strong US economic data and hawkish sentiments from the Federal Reserve (Fed) have led to significant selling of metals, causing doubts about an impending Fed rate-cutting cycle. In that sense, as markets start to adjust their bets on the Fed, the upside potential for the metal is capped, as it is causing US yields, often seen as the cost of holding non-yielding metals to rise.

XAU/USD technical levels

The Relative Strength Index (RSI) on the daily chart is flat on the negative side. The Moving Average Convergence Divergence (MACD) displays an equivalently flat activity with negative red bars evidencing bearish sentiment. Despite this, the metal continues to cling just below the 20-day Simple Moving Average (SMA), while managing to remain above the 100 and 200-day SMAs. The maintaining of a position above the longer-term SMAs underscores a ruling bullish perspective in a broader sense, even amidst the bearish undertones polarizing the immediate scenario, particularly after a 2% loss last week.

Zooming into the four-hour timeframe, the momentum subtly changes. The same indicators remain flat, albeit with a small bias towards a buying sentiment. As per the Relative Strength Index (RSI), it shows positive slope taking place within the positive domain. Concurrently, the Moving Average Convergence Divergence (MACD) reflects a stationary display of red bars.

XAU/USD daily chart

- Mixed US Treasury yields: 10-year note rises to 4.136%, short-term yields dip slightly.

- Investor indifference to Richmond Fed data; eyes on upcoming ECB, Fed decisions impacting rate cut views.

- Fewer expected Fed rate cuts in 2024; focus on US GDP, Jobless Claims, Core PCE index this week.

US yields advanced on Tuesday, mainly the belly and the long-end of the yield curve, while the three-month bills and the 2-year note were down one basis point, each at 5.21% and 4.383%. At the same time, the US 10-year benchmark note rate is at 4.136%, up almost three basis points, while the 20 and 30-year bond coupons witnessed a rise of four and four and a half basis points, at 4.48% and 4.37%, respectively.

Investors eye central bank’s decisions amid evolving Economic Indicators

In the US, economic data featured the Richmond Fed Composite and Manufacturing Index experienced a decline, moving from -11 to -15 in January. Conversely, the Services Index saw an improvement, rising from 0 to 4.

Although the data was mainly ignored by investors, they had priced out Federal Reserve’s March 2024 rate cut, pushing it back to ward May. Traders should be aware that the European Central Bank (ECB) will review its monetary policy decision on Thursday, ahead of next week’s Federal Reserve decision.

If the ECB remains on keeping rates higher for longer, that could sponson a leg-up in US Treasury yields. Otherwise, a subtle change of tone on major central banks' monetary policy statements could trigger volatility in the markets.

A week ago, investors anticipated the Federal Reserve to implement rate cuts totaling 175 basis points in 2024. However, as of writing, they modified their expectations to 141 basis points of monetary easing, effectively reducing their forecast by one rate cut.

Ahead of the week, the US economic docket will feature the US Gross Domestic Product (GDP) for last year’s Q4, along with Initial Jobless Claims and the Fed’s preferred gauge for inflation, the Core Personal Consumption Expenditure (PCE) price index.

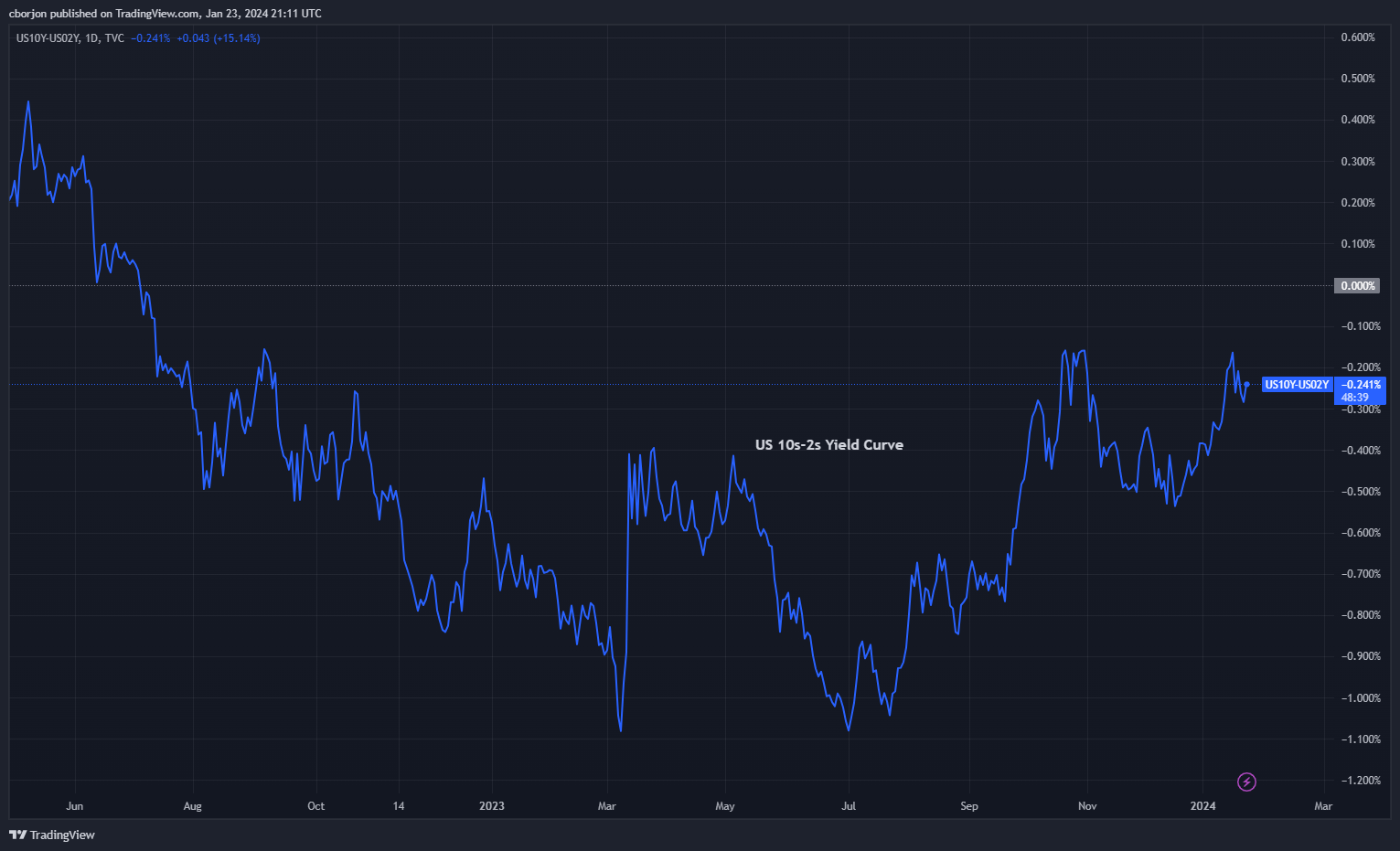

US 10s-2s Spread Chart

- Middle East tensions, Red Sea risks continue to prop up Crude Oil.

- Growing supply keeps barrel bids weighed down.

- Investors are caught in the middle between supply chain fears and actual supply.

Crude Oil markets roiled once again on Tuesday, sending West Texas Intermediate (WTI) US Crude Oil prices for a lap around familiar price levels between $75.00 and $73.50.

Crude Oil investors continue to fear a shattering of regional and global supply lines as Houthis remain dedicated to attacking civilian cargo ships bound for the Suez Canal through the Red Sea and the Israel-Hamas conflict continues to risk dragging the Middle East into a protracted conflict that could hamper global Crude Oil trade, if not outright production.

US production of Crude Oil tipped into record highs in the tail-end of 2023, and according to the Energy Information Administration (EIA) on Tuesday, Texas’ Crude Oil output is getting aided by an overall increase in the density of its Crude Oil, meaning Texas is pumping oil out of the ground with a higher specific gravity than normal, meaning it can be converted into more light sweet crude than lighter-gravity oils from other pumping locations.

The US-UK naval coalition has launched a total of eight strikes against critical Houthi rebel locations and weapon emplacements throughout Yemen, but the continued military operations have yet to translate into economic stability as civilian cargo ships continue to avoid the Red Sea, keeping nervous Crude Oil markets on edge.

Despite geopolitical tensions keeping oil barrel prices on the high side, energy markets are having a hard time ignoring that global Crude Oil production threatens to swamp out global demand. The US is on pace to hit new production records in both 2024 and 2025 according to forward-looking estimates by the EIA, and the impending completion of the Canadian Trans Mountain pipeline will only push the numbers of available refined products even higher in the future.

WTI Technical Outlook

WTI Crude Oil tested into new highs for 2024 this week near $75.50, and hourly candles are on the high side of the 200-hour Simple Moving Average (SMA) as near-term action tilts into bullish territory on the charts.

Daily candles show Crude Oil stuck on the low side of the 200-day SMA just below the $78.00 handle, and a slight bullish lean to prices see barrel bids getting snagged in a congestion zone between the 50-day and 200-day SMAs as Crude Oil prices drifts into a consolidation pattern, up nearly 10% from December’s swing low into $67.97.

WTI Hourly Chart

WTI Daily Chart

- EUR/JPY near 161.00, down 0.13% as Euro faces pressure before ECB decision in mixed markets.

- Despite Ichimoku Cloud break, bulls struggle at 161.24 resistance; eyes on 162.00, then 163.00 if surpassed.

- Below 161.00, EUR/JPY risk extends; next supports at Tenkan-Sen (160.21), 160.00, 159.25, 158.71.

The EUR/JPY seesaws at around the 161.00 figure in the mid-North American session, though it’s trading below its opening price by 0.13% and, at the time of writing, exchanges hands at 160.95.

Market mood is mixed, with two out of three US equity indices in the green, with the Dow Jones being the outlier, down by 0.32%. Nevertheless, the Euro’s weakness keeps the shared currency pressured ahead of Thursday's European Central Bank (ECB) monetary policy decision

The EUR/JPY is consolidating at around the current week's highs after buyers lifted the pair above the Ichimoku Cloud (Kumo), usually a sign that bulls are gathering momentum. Nevertheless, they had failed to edge above the November 21 swing low turned resistance at 161.24, so they could challenge the 162.00 figure. Once those two levels are cleared, the next stop would be the 163.00 figure, followed by the November 27 high at 163.72.

On the other hand, a daily close below 161.00 would open the door for further losses. The first support would be the Tenkan-Sen at 160.21, followed by the 160.00 figure. A breach of the latter, and the pair will extend its losses to the Senkou Span A at 159.25, followed by the Senkou Span B at 158.71.

EUR/JPY Price Action – Daily Chart

EUR/JPY Technical Levels

The strong presence of the risk-off sentiment lent extra legs to the US Dollar and prompted a marked correction in the risk-linked galaxy on Tuesday, as market participants quickly digested the BoJ event and got ready for the publication of advanced PMIs on Thursday as well as the BoC interest rate decision.

Here is what you need to know on Wednesday, January 24:

Further strength in the greenback in combination with higher yields across the curve and the intense risk aversion pushed the USD Index (DXY) to new yearly highs well north of 103.00. Next on tap in the US docket will be the preliminary Manufacturing and Services PMIs for the month of January.

It continued to rain around EUR/USD, which this time extended its downward bias to the 1.0820 region, or six-week lows. Moving forward, flash Manufacturing and Services PMIs in Germany and the Euroland will grab all the looks on Wednesday.

The selling pressure saw GBP/USD flirt with four-day lows near around 1.2650 on the back of the robust recovery in the greenback. Across the Channel, all the attention is expected to be on the release of January’s advanced Manufacturing and Services PMIs.

USD/JPY rapidly reversed a sudden pullback to the 147.00 zone and managed to return to levels well past the 148.00 hurdle as markets seem to have ignored a hawkish (ish) tilt from BoJ’s Ueda. On Wednesday, December Balance of Trade figures takes centre stage in the Japanese calendar.

AUD/USD navigated a volatile session, ending around Monday’s closing levels despite the firmer tone of the greenback and the mixed bias in the commodity complex. In Oz, Westpac will release its Leading Index for the month of December.

An inconclusive session left USD/CAD hovering around the 1.3470 region ahead of the key BoC interest rate decision on Wednesday. Consensus expects the central bank to keep the steady hand for the fourth meeting in a row.

Prices of WTI maintained its gradual yearly upside, although Tuesday saw the commodity recede slightly from Monday’s tops north of the $75.00 mark per barrel.

Despite extra gains in the greenback and increasing US yields, both Gold and its cousin Silver edged higher on Tuesday.

- The NZD/JPY pair holds strong at 90.15, making gains of 0.30%.

- The BoJ left its policy rate unchanged, just as expected.

- Despite the mixed short-term outlook, bulls retain control, with the pair trending above the key SMAs.

- Indicators on the four-hour chart signal a slight tilt towards selling momentum, with RSI and MACD in negative territory.

On Tuesday's session, the NZD/JPY pair made gains to 90.15 due to a 0.30% increase. Although the daily chart outlook remains neutral to bearish, bullish forces appear to maintain a strong stance. However, the pair's situation on the four-hour outlook tilts slightly towards the downside.

On the fundamental side, Governor Ueda from the Bank of Japan (BoJ) gave signs on when the bank will leave negative interest rates stating that the likelihood of achieving 2% inflation target is gradually rising. This reaffirms that the BoJ will eventually exit the ultra-loose monetary policy, which may provide some support to the Yen.

On the technical side, from a daily chart perspective, the indicators are presenting a mixed picture. The relative strength index (RSI) is trending upwards but remains in the bearish zone, suggesting a lack of strong buying momentum. This is further supported by the flat red bars display in the Moving Average Convergence Divergence (MACD), which indicates the presence of selling traction. However, the position of the cross above the 20, 100, and 200-day simple moving averages (SMAs) tells a different narrative, demonstrating that bulls retain robust long-term control.

Turning to the shorter-time frame, the RSI on the four-hour chart is also navigating in the bear territory with a negative incline, suggesting a possible continuation of the selling pressure in the near term. The MACD paints a similar picture with flat red bars, highlighting a pause in bullish activity. Considering these factors, the immediate momentum on the four-hour chart is slightly tipped in favour of the bears. Nonetheless, with the bulls demonstrating resilience, traders should keep a close eye for any potential shift in momentum that may hint towards a reversal of the short-term bearish trend as bulls are presenting a battle.

NZD/JPY technical levels

NZD/JPY daily chart

-638416346186941809.png)

- European stocks decline as risk rebound sees limited dip-buying.

- ECB due Thursday, Europe PMIS on Wednesday.

- Euro area PMIs expected to show slight growth.

European equity indexes initially climb on Tuesday, hitting near-term highs before revising direction once again and testing into the low side of recent activity.

European stocks weren’t able to follow US equities higher, lacking the same drive from AI tech stocks that saw the American equity sector climb into new highs once again on Monday.

This week sees another showing from the European Central Bank (ECB) who is expected to remain flat on interest rates for the time being despite broad-market hopes and expectations of faster, sooner rate cuts.

ECB policymakers have worked double time in the past week trying to talk down market hopes for rate cuts to begin soon, with some particularly determined investors hoping for rate cuts to start as early as March. ECB officials have pushed firmly back on overeager markets, setting a more reasonable hopeful deadline for the summer months.

European Consumer Confidence declined in January from -15.0 to -16.1 versus the forecast -14.3, and the ECB’s Bank Lending Survey kicked off the day’s overall losses after it was revealed that bank lending to both consumers and businesses have continued to decline through the third quarter, and further declines in credit facility access are expected though 2024’s first quarter.

Germany’s DAX and France’s CAC 40 both ended Tuesday down a little over a third of a percent with the DAX down 56.27 points and ending the day at €16,627.09 while the CAC 40 shed 25.21 points to close down at €7,388.04, losing 0.34% on the day.

The pan-European STOXX600 equity index shed 1.33 points to close down 0.28% at €471.53, and London’s FTSO held mostly flat on the day, closing down a scant 0.3% and down 1.98 points to £7,485.73.

DAX Technical Outlook

The DAX German equity index fell back after an early climb on Tuesday, touching an intraday peak above €16,700 before falling back once more. The major equity index is falling into a congestion zone between the 50-hour and 200-hour Simple Moving Average (SMA) near €16,600.00.

The DAX continues to mostly recover, climbing 1.7% from last week's lows near €16,328.00 but downside momentum is getting hard to ignore as the equity index sees frequent drops amidst steady moves higher.

Near-term prices see support from the 50-day SMA at €16,400.00, and a bearish extension would need to cross over the $15,800 barrier before extending into a meaningful downside trend.

DAX Hourly Chart

DAX Daily Chart

- GBP/USD falls over 0.40% to 1.2657, with a strong USD and high Treasury yields overshadowing Pound amid stock volatility.

- UK deficit reduction spurs tax cut speculation; BoE may hold rates in February, possible cuts from May.

- Traders eye S&P Global Flash PMIs in UK, US; US Q4 GDP, Core PCE price index as key upcoming events.

The GBP/USD slumped more than 0.40% in the mid-North American session amid a strong US Dollar (USD) and high US Treasury bond yields underpinning the Greenback to the detriment of the Pound Sterling (GBP). At the time of writing, the major exchanges hands at 1.2657 after hitting a daily high of 1.2747.

Cable faces pressures as markets eye US GDP figures ahead

US stocks are trading mixed as companies reveal last year’s fourth-quarter results. On the data front, the Richmond Fed Composite and Manufacturing Index deteriorated further from -11 to -15 in January, while the Services edged up from 0 to 4.

During the European session, the Office for National Statistics (ONS) in the UK revealed the budget deficit was narrower than the figures of last year, printed a £-7.77 billion in December, lower than last year’s £-13.71 billion. That could open the door for a cut in taxes, as expressed by Chancellor Hunt and UK Prime Minister Rishu Sunak in the spring budget to be presented on March 6.

Moving to central banks, the Bank of England (BoE) isn’t expected to move the needle in February according to a Reuters poll. Nevertheless, investors see Governor Bailey and Co. slashing rates as early as May, with three additional cuts, which would drag the Bank Rate from 5.25% to 4.25%.

In the US, the Federal Reserve is expected to ease policy in June, via a Reuters poll. TD Securities analysts noted, “We still expect the Committee to maintain a cautious stance in the near term even amid an increasingly improving profile for consumer prices, as the Fed would like to ascertain that the recent progress in inflation is sustainable.” The poll suggests that most analysts estimate the Federal Funds Rate (FFR) would be adjusted from 5.25%-5.50% to 4.25%-4.50%.

Ahead on the week, the UK economic docket will feature S&P Global Flash PMIs on Wednesday, as in the US as well. On Thursday, the US calendar will unveil the preliminary reading for last year’s Q4 GDP figures and the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditure (PCE) price index.

GBP/USD Technical Levels

- The DXY Index showcases gains, jumping back above the 200-day SMA near 103.70.

- No relevant reports were released on Tuesday, focus is set on PCE and GDP data due later this week.

- Rising yields and markets delaying dovish bets on the Fed provide a boost to the Greenback.

The US Dollar (USD) index has been experiencing an uptrend, with the index currently trading up to the 103.70 level. This comes in anticipation surrounding upcoming key inflation data and the impact of rising yield as markets reduced their dovish bets on the Federal Reserve (Fed).

The US economy is maintaining its robustness as traders await key data and central bank meetings later this week. Despite a lack of major data or any Fed speakers, the market pushed back its easing expectations to roughly 125 bps over 2024, down from nearly 175 bps earlier this month, which has helped the Greenback recover.

Daily Digest Market Movers: US Dollar gains momentum as rising yields drive uptrend amid lacking high-tier reports

- On Thursday, the US will release December Personal Consumption Expenditures (PCE) data, which is expected to show that inflation has stagnated. Gross Domestic Product (GDP) figures from Q4 are also due that day and markets expect the economic activity to have cooled off.

- US bond yields are on the rise, with the 2-year yield at 4.40%, the 5-year yield at 4.06%, and the 10-year yield at 4.15%. All three rates are approaching their highest level in January as investors adjust their expectations on the next Fed decision.

- Projections from the CME FedWatch Tool show that the market's expectations for the start of the easing cycle have shifted to May.

Technical Analysis: DXY index recovers the 200-day SMA as bulls find a lift

The indicators on the daily chart reflect a mix of bullish and bearish sentiments. The Relative Strength Index (RSI) is in positive territory, indicating sustained buying pressure in the market that is underscored by the appreciating slope of the RSI plot.

Simultaneously, the Moving Average Convergence Divergence (MACD) paints a contrasting picture. The MACD histogram displays flat green bars, sporting a lack of bullish conviction. This stagnation of MACD hints at a balance in buying and selling pressures for the moment.

As for the Simple Moving Averages (SMAs), the DXY is trading above the 20-day SMA, indicating that the bulls maintain control in the immediate term. Nevertheless, the bearish undercurrent is evident with the index trading below the 100-day SMA. Yet the medium to long-term optimism remains as the index has recovered the crucial 200-day SMA.

Support levels: 103.50 (200-day SMA), 103.30, 103.00.

Resistance levels: 103.80, 104.00, 104.10.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- EUR/USD declines into five-week lows as safe haven flows pick up the Greenback.

- PMI figures from both the EU and the US due on Wednesday.

- ECB rate call to take center stage on Thursday, US PCE inflation on Friday.

The EUR/USD tumbled into fresh lows for 2024, hitting its lowest bids in nearly six weeks after the Euro extended broad-market declines on the back of souring consumer sentiment and declining bank lending activity confirmed by the latest Bank Lending Survey from the European Central Bank (ECB).

Europe saw extended declines in the Euro (EUR) after the ECB confirmed that business and lending activity in the euro area continued to decline. High interest rates exacerbated overall declines in bank lending activity across the continent, and European banks further tightened lending conditions through the fourth quarter of 2023.

Daily digest market movers: EUR/USD backslides as bad data releases pile up

- The European Consumer Sentiment Index declined to -16.1 in January versus the forecast rebound from December’s -15.0 to .14.3.

- The US Richmond Fed Manufacturing Index also declined to its lowest level in nearly four years in January, printing at -15 compared to December’s -11 and missing the market’s forecast recovery to -7.

- The ECB’s latest Bank Lending Survey showed bank lending activity declined further in the fourth quarter, with high interest rates and souring consumer sentiment specifically highlighted as key triggers.

- The ECB noted that European banks have broadly tightened lending conditions, squeezing credit access that has already seen slumping demand.

- Overall loan demand from both businesses and households is expected to decline further in 2024’s first quarter.

- Lending activity declines slowed in the fourth quarter, but continue to slowdown, exacerbating declines in economic activity.

- Wednesday brings Purchasing Managers’ Index (PMI) figures for both the euro area and the US.

- Markets are hoping the pan-European HCOB Composite PMI sees a slim gain from 47.6 to 48.0.

- The euro area’s Composite PMI has been in sub-50.0 contraction territory since July.

- US Services PMI is expected to decline slightly from 51.4 to 51.0.

- ECB descends on markets with its latest rate call on Thursday.

- Market expectations of steep and dep rate cuts from the ECB have been pushed back by central bank officials constantly warning that market hopes for rate cuts have run too far ahead of what policymakers can deliver.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.39% | 0.40% | 0.06% | 0.16% | 0.28% | 0.12% | 0.24% | |

| EUR | -0.40% | 0.01% | -0.34% | -0.23% | -0.12% | -0.27% | -0.15% | |

| GBP | -0.40% | -0.01% | -0.35% | -0.21% | -0.14% | -0.27% | -0.17% | |

| CAD | -0.08% | 0.32% | 0.33% | 0.09% | 0.19% | 0.04% | 0.16% | |

| AUD | -0.21% | 0.19% | 0.19% | -0.16% | 0.06% | -0.06% | 0.04% | |

| JPY | -0.28% | 0.11% | 0.12% | -0.21% | -0.07% | -0.13% | -0.03% | |

| NZD | -0.11% | 0.29% | 0.27% | -0.08% | 0.06% | 0.17% | 0.10% | |

| CHF | -0.26% | 0.14% | 0.16% | -0.19% | -0.04% | 0.03% | -0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: EUR/USD gets knocked back sharply from 1.0900 once again

The EUR/USD fell below the 1.0900 handle on Tuesday for the third time in less than a week after the pair saw a sharp rejection from the 200-hour Simple Moving Average (SMA) near 1.0915, shedding over eight-tenths of a percent top-to-bottom.

Tuesday’s decline sees the EUR/USD pair taking a bear run into the 200-day SMA after falling away from the 50-day SMA near 1.0920. EUR/USD intraday volatility sees the pair in rough consolidation trading between the 50-day and 200-day SMAs, and an extended decline will see the pair making a run at the last swing low near 1.0750.

EUR/USD Hourly Chart

EUR/USD Daily Chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Mexican Peso plummets as the USD/MXN tests key resistance level, which could shift the pair bullish.

- Risk appetite is mixed, though elevated US Treasury yields underpin the US Dollar.

- Upcoming economic data from Mexico, including the Economic Activity report and mid-month inflation figures, are closely watched by traders

The Mexican Peso (MXN) plunges sharply against the US Dollar (USD) on Tuesday on risk aversion in the FX space. This benefits safe-haven currencies to the detriment of the emerging market currency. That, along with a jump in Treasury yields in the United States, underpins the USD/MXN, which trades at 17.34, up by almost 1%.

Wall Street is trading mixed, weighed down by the sudden rise in US Treasury bond yields. The increase in yields is led by the belly and the long end of the yield curve, rising between four and seven basis points. The US Dollar Index (DXY), which tracks the buck’s performance against a basket of six other currencies, gains 0.37%, up at 103.74. The Greenback has been bolstered by traders pushing back their expectations of Federal Reserve (Fed) rate cutting from March until May, according to the CME FedWatch Tool data.

Across the border, Mexico’s economic docket will feature the release of the Economic Activity report, along with January’s mid-month inflation data.

Daily Digest Market Movers: Mexican Peso weakens the most since January 16, ahead of crucial data

- The former Bank of Mexico (Banxico) Governor and current General Manager of the Bank of International Settlements, Agustin Carstens, said that the central bank must not lower interest rates prematurely, adding that, “Recent developments allow us (central bankers) to look at the future with cautious optimism.” Carstens said that even though there’s progress on the disinflation process, “inflation is still above central bank targets in most countries and needs to fall further.”

- Agustin Carstens's posture and that of former Banxico Deputy Governor Everardo Elizondo suggest that policy should remain restrictive, which could deter the Mexican central bank from cutting rates, which currently sit at 11.25%, as traders await mid-January’s inflation report.

- Mid-month inflation in Mexico is expected to edge toward 4.78%, while the core is expected to dip further below the 5% threshold.

- The recent economic figures from Mexico indicate a deceleration in the economy, evidenced by Retail Sales falling short of expectations and being lower than those of October. Concurrently, projections for economic growth stand at 2.6%, which is under the anticipated 3%.

- On the US front, last week’s economic data paints a soft-landing outlook. Even though housing data was mixed, American household sentiment improvement, and lower inflation expectations underpinned the USD/MXN.

- Atlanta GDPNow model suggests last year’s Q4 likely expanded by 2.4%, spurred by strong retail sales, firm industrial production, a tight labor market and consumer sentiment improvement.

- Traders trimmed their bets for a dovish Federal Reserve in 2024. They stand at 139 basis points (bps) of cuts from 175 bps last week.

- Mexico witnessed a jump in headline inflation, but core data suggests the Bank of Mexico (Banxico) has done a good job, curbing elevated prices after hiking rates toward 11.25%.

- Despite indications from the December meeting minutes of Banxico (the Central Bank of Mexico) that it may consider easing its monetary policy, the inflation report for January poses a potential obstacle to any such policy relaxation.

- Standard Chartered analysts estimate the Bank of Mexico (Banxico) will lower rates to 9.25% in 2024.

- On January 5, a Reuters poll suggested the Mexican Peso could weaken 5.4% to 18.00 per US Dollar in the 12 months following December.

Technical Analysis: Mexican Peso falls to four-day low as USD/MXN meanders around 200-day SMA

The USD/MXN daily chart depicts buyers gathering momentum as they dragged the exchange rate to the brisk of breaching the 200-day Simple Moving Average (SMA) at 17.36. Once cleared, this could open the door to test the 100-day SMA at 17.42. Further upside is seen at the psychological 17.50 barrier, ahead of aiming toward the May 23 high at 17.99.

Failure to decisively break the 200-day SMA could open the door for a leg up, with first support at the 50-day SMA at 17.14, followed by the 17.05 swing low reached on January 22, ahead of the 17.00 figure.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Canadian Dollar flows follow the broader market.

- Bank of Canada rate call looms on Wednesday.

- Crude Oil on the high side bolsters Canadian Dollar.

The Canadian Dollar (CAD) is mostly steady on Tuesday as broad-market sentiment dictates the flow of CAD pairs as Loonie traders buckle down ahead of the Bank of Canada’s (BoC) latest rate call and subsequent press conference. Crude Oil markets are tipped into the high end heading into the mid-week, keeping the Canadian Dollar propped up and preventing pre-BoC pullbacks in the near term.

Canada saw new home prices flatten in December and decline on an annualized basis, but Canada’s housing bubble remains one of the worst in the G20 of developed economies with housing affordability at its worst in over four decades. Runaway home prices are expected to crimp economic growth and tilt the Canadian domestic economy into a recession in the first half of 2024.

Daily Digest Market Movers: Canadian Dollar traders pull to the middle ahead of BoC

- BoC rate call and monetary policy statement due on Wednesday, Canadian Dollar traders benched ahead of central bank statement release.

- CAD gains in Loonie pairs result from headline-driven weaknesses in peer currencies.

- Canada’s New House Price Index flatlined at 0.0% in December compared to the previous month’s -0.2%.

- New home prices in Canada eased 0.9% for the year ended December, in-line with the previous figure.

- Despite a near-term loosening of Canadian housing price growth, Canada sees one of the worst housing affordability ratios in the G20.

- Bank of Montreal (BMO) Chief Economist Doug Porter noted that Canada has entered a recession shortly after the last three runaway spikes in housing unaffordability.

- Crude Oil markets are on the high end on Tuesday, bolstering the Canadian Dollar with West Texas Intermediate (WTI) US Crude Oil holding between $75.00 and $73.00 per barrel.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Euro.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.36% | 0.25% | 0.00% | 0.02% | 0.16% | -0.04% | 0.20% | |

| EUR | -0.36% | -0.11% | -0.36% | -0.34% | -0.20% | -0.40% | -0.16% | |

| GBP | -0.25% | 0.11% | -0.26% | -0.24% | -0.10% | -0.30% | -0.06% | |

| CAD | 0.00% | 0.37% | 0.27% | 0.04% | 0.16% | -0.03% | 0.21% | |

| AUD | -0.02% | 0.34% | 0.23% | -0.03% | 0.14% | -0.06% | 0.18% | |

| JPY | -0.15% | 0.19% | 0.08% | -0.17% | -0.13% | -0.19% | 0.03% | |

| NZD | 0.02% | 0.38% | 0.29% | 0.03% | 0.05% | 0.18% | 0.23% | |

| CHF | -0.22% | 0.16% | 0.05% | -0.21% | -0.19% | -0.04% | -0.25% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: CAD sees gains as counterpart currencies shed weight

The Canadian Dollar (CAD) is getting propped up against the broader currency market on Tuesday as the Loonie’s major currency peers waffle heading into the middle of the week. The Canadian Dollar is on the high side against the Euro (EUR) by four-tenths of a percent, while gaining over a quarter of a percent against the Pound Sterling (GBP) and the Swiss Franc (CHF) as the European bloc currencies wither on market sentiment.

The US Dollar (USD) is holding mostly flat against the Canadian Dollar on Tuesday with the USD/CAD rotating sideways on the day. The pair hit an intraday low of 1.3453 before rebounding back within range of Tuesday’s opening bids of 1.3478.

The Dollar-Loonie pair caught a bounce from the 200-hour Simple Moving Average (SMA) on Monday near 1.3415, and the pair is holding on the high side ahead of headline drivers in the mid-week market session on Wednesday.

The USD/CAD continues to get mired in technical congestion between the 50-day and 200-day SMAs, with price action consolidating near the 1.3450 to 1.3500 region. The pair is currently trading up 2.3% from December’s swing low into 1.3177.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- The EUR/GBP slightly recovered to 0.8555 after hitting a low of 0.8545.

- The ECB meets this Thursday with no policy change expected.

- The Pound maintains superiority over the Euro due to anticipations of less easing by the BoE in 2024.

In Tuesday's trading session, the EUR/GBP stabilised at 0.8555 after hitting its lowest level since September lows around 0.8545. Weak Consumer Confidence data from the European Commission, weakened the Euro, while the Pound has a slight advantage as markets bet on less easing of the Bank of England (BoE) in 2024.

As for now, the United Kingdom and the Eurozone economies continue to navigate uncertainties with both regions noticing demands for loans and credit dropping in Q4. The British economy is holding somewhat resilient with inflation remaining stubbornly high which is making markets expect less easing by the Bank of England in 2024.

The ECB (European Central Bank) meets on Thursday and President Lagarde might resist market bets on policy easing and maintain a cautious. As for now, investors are forecasting 150 bps of rate cuts in 2024 but the policy statement and Lagarde's tone might affect those odds. Regarding the BoE, its next meeting is due on March 6 and markets are seeing less easing than the ECB, of 125 bps in 2024 which seems to be giving a slight advantage to the Pound over the Euro.

EUR/GBP levels to watch

The indicators on the daily chart reflect the overall bearish sentiment. The Relative Strength Index (RSI) bolsters this viewpoint, as its position is in negative territory with a negative slope, indicating a sustained seller's market.

The Moving Average Convergence Divergence (MACD) histogram tells a similar story as it prints rising red bars.

The Simple Moving Averages (SMAs) align with these previous indicators. It unveils the pair's standing below the 20, 100, and 200-day SMAs, signaling the prevalent strength of the bears in a broader context. It mirrors the uphill struggle that buyers may confront in the short-term scheme.

EUR/GBP daily chart

-638416232254498636.png)

A strong start to the year for the US Dollar is set to continue, probably supported by both risk aversion and somewhat higher yields, analysts at HSBC say.

JPY and CAD are likely to consolidate in the weeks ahead

As the gap between market pricing and central bank guidance remains wide, we expect this USD strength to continue over the near term, notably against the EUR and GBP, in addition to the risk-on currencies, like the AUD and NZD.

Geopolitical risks will also carry scope to add further momentum to recent market moves. Beyond these global headwinds, the EUR and GBP also face domestic economic challenges, for which a ‘high for longer’ rate outlook seems unlikely to offer sustained support for these currencies.

However, not every currency is set to weaken against the USD over the near term. For example, the JPY has been the worst-performing G10 currency year-to-date, but we look for a near-term consolidation, followed by a medium-term modest recovery. We think that any hint from the Bank of Japan (BoJ) about approaching an end to its ultra-loose monetary policy could provide disproportionate support for the JPY after recent weakness.

The CAD may stabilise against the USD, as its weakness so far in 2024 looks overdone, relative to rate differentials and risk appetite.

New Zealand’s Consumer Price Index (CPI) report for the fourth quarter (Q4) will be released on Tuesday, January 23 at 21:45 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of four major banks regarding the upcoming NZ inflation data.

Headline CPI is expected to rise by 0.5% quarter-on-quarter vs. 1.8% in Q3, while the year-on-year rate is expected at 4.7% vs. the prior release of 5.6%. If so, it would be the lowest since Q2 2021. The RBNZ’s Q4 CPI projection is higher at 0.8% QoQ and 5.0% YoY.

ANZ

We expect annual CPI inflation to decelerate sharply to 4.7% YoY in Q4, below the RBNZ’s November MPS forecast of 5.0% YoY. However, the expected downward surprise versus RBNZ’s November forecast is driven entirely by the tradables component, which we expect to fall from 4.7% to 3.4% YoY. We expect non-tradable inflation of 5.7% YoY, in line with the RBNZ’s November forecast. Given the RBNZ’s focus on this component, it’s surprises here that will matter for the OCR outlook, particularly in context of the RBNZ’s impatience as expressed in the November Monetary Policy Statement. We see the risks as balanced around 5.7%. We expect the suite of core inflation measures to move materially lower. This is absolutely what the RBNZ needs to see, but we are cognisant that these measures are also influenced by weaker tradable inflation, whereas the RBNZ’s primary focus is domestic inflation risks.

Westpac

Inflation is set to again fall short of the RBNZ’s forecasts. We expect consumer prices to have risen by 0.5% in the December quarter, leaving them up 4.7% over the past 12 months. In contrast, the RBNZ’s last published forecasts assumed a 0.8% rise over the quarter (+5.0% for the year to December). Our lower inflation forecast reflects softness in the prices for volatile items like international airfares and food over the past quarter, as signalled by Stats NZ’s expanded suite of monthly price indicators. The bigger question is what’s happening to the underlying trend in prices. We expect most core inflation measures – including measures of domestic price pressures – will moderate, but remain at levels well above the RBNZ’s target range.

TDS

We expect Q4 CPI inflation to print on consensus at 0.5% QoQ (RBNZ: 0.8%), decelerating sharply from the 1.8% QoQ in Q3. This lifts the annual headline to 4.7% YoY, also much lower than 5.6% YoY last quarter. Food prices are likely to be a big drag this quarter, down 1.1% QoQ while petrol prices continue to be on the retreat. However, rent prices appear more sticky and could be a concern to the RBNZ, especially after it flagged that strong population growth poses upside risk to inflation. If CPI inflation does print below RBNZ's forecast, the RBNZ may scale back its hawkish rhetoric at the Feb meeting given the disappointing economic data (e.g., GDP, labour market) in Q4.

ING

We recently updated our estimates for the fourth quarter CPI in New Zealand, and expect a 0.4% QoQ print which translates into 4.6% YoY. Consensus is centred at 4.7%, signalling that expectations are for a marked undershot compared to the latest RBNZ fourth quarter CPI projections at 5.0%.

USD/MXN reversed after briefly testing the 200-Day Moving Average (DMA). Economists at Société Générale analyze the pair’s outlook.

17.42/17.55 likely to cap upside

USD/MXN has resumed its decline after testing the trend line drawn since 2021 at 18.48 (now near 18.10). Recent attempt of rebound has faltered near 200-DMA (17.42/17.55).

Daily MACD has started posting positive divergence however signals of bounce are not yet visible in price action; the Moving Average near 17.42/17.55 must be overcome to denote a meaningful up move.

Holding below the Moving Average, the pair could head lower towards last year’s low of 16.60 and projections of 16.40/16.10.

- EUR/USD drops 0.12% in North American trade, to 1.0855 after rallying to 1.0915, swayed by Fed policy outlook.

- Positive Wall Street sentiment vs. Eurozone confidence drop and ECB's tighter credit affect EUR/USD.

- Upcoming ECB policy decision, US GDP estimate set to shape EUR/USD amidst inflationary pressures.

The EUR/USD dropped some 0.12% in early trading during the North American session amid an upbeat market mood. At the same time, traders adjusted their speculations on rate cuts by the US Federal Reserve (Fed). The pair traded at 1.0855 after hitting a daily high of 1.0915 in the European session.

EUR/USD traders are awaiting the ECB’s Lagarde and Co. decision on Thursday

Wall Street’s sentiment reflects optimism amongst investors, who seem confident that the US economy will avoid a recession. In the meantime, odds that the Fed would cut rates in March plunged from 63.1% a week ago to 38.6%, following last week’s Fed officials declaring that it’s too soon to ease policy.

Aside from this, the European Central Bank (ECB) Bank Lending Survey revealed that credit has tightened while demand for loans diminished, taking a hit from higher interest rates set by the ECB. According to the ECB's survey, banks expect a slight increase in demand for loans to companies and mortgages.

Data-wise, the Eurozone (EU) Consumer Confidence dropped from 15.0 in December to -16.0 in January, revealing the EU’s commission, missing estimates for a rise to -14.3. Further catalysts are expected to rock the boat as the ECB would announce its monetary policy decision on Thursday. Across the pond, the US economic docket will announce the 2023 Q4 Gross Domestic Product (GDP) preliminary estimate, along with the Fed’s preferred gauge for inflation, the Personal Consumption Expenditures (PCE).

EUR/USD Price Analysis: Technical outlook

Even though the EUR/USD is resuming its downtrend, sellers would face stirring support at the 200-day moving average (DMA) at 1.0844. Once cleared, further downside is seen at the 1.0800 figure, followed by the 100-DMA at 1.0771. On the other hand, if buyers lift the major to the 1.0900 handle, expect a challenge of the 50-DMA at 1.0920, before buyers could extend the recovery towards he January 16 high at 1.0951.

The risk-reward is tilted back towards fading the recent US Dollar strength, analysts at TD Securities say.

Last stop on the USD award tour

We think we're getting close to good levels to start selling the USD again.

Although US data remains strong, the Fed can use the trends in core PCE to justify the start of rate cuts. The Fed wants to engineer a soft landing, which allows it to emphasize disinflation over growth now. Fed text and comments analysis remains dovish too.

After the recent correction higher in the USD, it does not look as cheap or oversold. It now looks more balanced versus not just macro drivers but also our positioning indicators. This means that the USD's move higher should now start to see greater resistance and risk-reward tilts towards fading the USD strength.

EUR/USD continues to track shorter-dated yields. Kit Juckes, Chief Global FX Strategist at Société Générale, analyzes the pair’s outlook.

The ECB will ease more slowly than the Fed and

EUR/USD has been tracking 2-year yield differentials in this rate-dominated market. We expect that spread to narrow from 170 bps now to under 100 bps in the second half of the year. If we took the correlation between EUR/USD and the yield differential at face value, that would have the Euro peaking close to 1.2000 but that seems unlikely to us; relative growth trends are likely to be an anchor.

However, we remain confident enough that a) the ECB will ease more slowly than the Fed and b) rate differentials will matter as much as perceived growth differentials, that EUR/USD will continue its slow-motion recovery and make a new lower cyclical high at some point this year (but well before the US election).

EUR/GBP offered below 0.8600. Economists at Rabobank analyze Pound Sterling’s outlook.

High debt levels will limit the scope for spending

Relatively slow growth and high debt in the UK are not a good combination for a new government. The lessons learnt from the Truss debacle have highlighted that the markets have no tolerance for unfunded spending commitments and stressed the importance of budgetary prudence. This should narrow scope for spending giveaways after the election and potentially reduce the likelihood that GBP is undermined by political upheaval.

We continue to expect the GBP to reclaim a little ground vs. the EUR this year and retain our forecast of EUR/GBP 0.8400 by year-end.

US Dollar Index (DXY) advances towards 103.50. Economists at Scotiabank analyze Greenback’s outlook.

The softer risk backdrop for markets may be extending the USD some support on the day

The softer risk backdrop for markets may be extending the USD some support on the day – and suggest limited scope for gains in the currencies overall.

Another quiet session for FX may be in store, with little in terms of data or event risk. DXY gains through 103.50 should provide the USD with a little more lift broadly from a technical point of view, however, and revive the January rally after the recent consolidation.

USD/CAD edged off highs on Monday. Economists at Scotiabank analyze the pair’s outlook.

Whether there is a springboard for renewed upside momentum to develop remains to be seen

Spot gains from the intraday low Monday – equating to (failed) a test of the 40-DMA (1.3417 today) – are strong enough on the chart to suggest that the USD’s recent drift lower has stopped. But whether there is a springboard here for renewed upside momentum to develop remains to be seen.

Intraday gains through 1.3480 minor resistance should see the USD pick up a little more support to retest the low/mid-1.3500s.

GBP/USD trades softer in range. Economists at Scotiabank analyze the pair’s outlook.

Price signals are bearish

Spot losses on the session so far look relatively mild and the GBP remains well within recent trading ranges. But price signals are bearish.

Intraday trading has developed a bearish ‘evening star’ pattern over the past 24 hours and the GBP is trading through minor trends support last week’s low at 1.2600.

Daily trading is shaping up negatively, albeit with a long way to go throughout the session still. Another test of strong GBP support around 1.2600 may be developing.

- The US Dollar is flat to a touch softer in the aftermath of the BoJ meeting.

- Traders try to keep powder dry towards main events on Thursday and Friday.

- The US Dollar Index sees pressure building on 103 to break lower.

The US Dollar (USD) is flat again, though it keeps flirting with a break below the important 103-level in the US Dollar Index (DXY). Markets are having difficulties with the Bank of Japan (BoJ) rate decision this Tuesday. BoJ governor Kazuo Ueda has tested markets’ patience by not hiking, and postponing the long awaited exit out of negative rates. Markets are not reacting very well to the nerve game the BoJ is playing, with US yields jumping higher and equities flat to mildly negative.

On the economic front, some very light data lies ahead of Thursday and Friday. In the run-up to the US Gross Domestic Product (GDP) and rate decision from the European Central Bank (ECB) along with comments from ECB’s head Christine Lagarde on Thursday, traders are looking for some clues in the Redbook index and Richmond Fed Manufacturing Index for January. Certainly that last one might initiate some moves in the Greenback, seeing the recent poor performance of several Manufacturing Index numbers over the past few weeks.

Daily digest market movers: BoJ hits nerves

- The Bank of Japan (BoJ) has kept its interest rates unchanged. Governor Kazuo Ueda said that easing will still take place even when negative interest rates end. There was no commitment on the timing of when the actual hike would happen. Markets are not reacting well on being left in the dark on the timing of the first rate hike.

- Holders of Belarusian EU bonds have sent a notice of default to Minsk, according to RBC.

- Around 13:55 GMT the Redbook Index is due to be released. Previous was at 5%.

- Near 15:00 the Richmond Fed Manufacturing Index for January is due to be released. Previous number was at -11 with -7 expected. Expect some market movements on the back of this number as several Manufacturing Indices have fallen into contraction and might be the first signal of a possible recession or downturn for the US economy.

- Around 16:30 the US Treasury will allocate a 52-week bill.

- A 2-year Note will be placed in the markets by the US Treasury near 18:00.

- Equity markets are not digesting the BoJ rate decision. Equities are looking for direction with most indices in the red by 0.50%. Only outlier is the Chinese Hang Seng, up over 2.6% after the Chinese government is set to issue further supportive measures for the Chinese stock markets.

- The CME Group’s FedWatch Tool shows that markets are pricing in a 97.4% possibility for an unchanged rate decision, with a slim 2.6% chance of a cut.

- The benchmark 10-year US Treasury Note jumps back up to 4.13% after its decline on Monday to sub 4.10%.

US Dollar Index Technical Analysis: Week kicks off

The US Dollar Index (DXY) is not giving up that easily on its opportunity to possibly pop back up above the important resistance at the 200-day SImple Moving Average (SMA) near 103.48. Despite downside pressure with lower highs and lower lows, the DXY for now is not selling off as one would expect in these kinds of conditions. Expect the main rehearsal to come on Thursday with the ECB rate decision, ahead of the US Federal Reserve meeting next week.

There are some economic data points that could still build a case for the DXY to get through those two moving averages again and run away. Look for 104.44 as the first resistance level on the upside, in the form of the 100-day SMA. If that gets scattered as well, nothing will hold the DXY from heading to either 105.88 or 107.20, the high of September.

A bull trap looks to be underway, where US Dollar bulls were caught buying into the Greenback when it broke above both the 55-day and the 200-day SMA in last week's trading. Price action could decline substantially and force US Dollar bulls to sell their positions at a loss. This would see the DXY first drop to 102.60, at the ascending trend line from September. Once below it, the downturn is open towards 102.00.

Bank of Japan FAQs