- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 22-11-2021

Atlanta Federal Reserve President Raphael Bostic said on Monday night interview on Bloomberg TV that faster taper would give us more optionality but added that we still have a covid economy, as reported by Reuters.

Key quotes

On Powell reappointment, says takes uncertainty out of the Fed, which is helpful.

Biden made a 'fine choice' in Powell and Brainard.

Has no trips to Washington on my calendar.

Asked if he would be open to one of the board openings, says those decisions are out of his hands.

We should be considering how fast we execute the taper.

On the inflation side expects the numbers to continue coming in strong.

Could be open to pulling forward another rate hike if appropriate in his dot plot for 2022 but also open to pushing them back too depending on how pandemic plays out.

Asked about supply chain constraints, says contacts still do not expect them resolved before summer of 2022 or later.

Hearing a lot about shortages of truckers.

Longer-run inflation expectations remain anchored, suggesting no erosion in confidence in the fed's approach.

Not convinced we need to have pre-pandemic employment levels to be considered maximum employment.

Market reaction

Given the mixed comments and mildly bid Wall Street benchmarks, S&P 500 Futures print 0.14% intraday gains following the comments from the Fed official. That said, gold prices paused corrective pullback around $1,809 at the latest.

Read: Gold Price Forecast: XAU/USD bears eye $1,790 as yields cheer Fed Chair nomination

- Gold licks its wounds after declining the most since September 16.

- Markets welcome US Pres. Biden’s decision to nominate Powell for Fed Chair, Clarida as vice Chairman.

- DXY refreshes 16-month high as Yields add over and above last week’s losses, preliminary PMIs for November eyed.

- Gold Price Forecast: Poised to challenge a critical support at 1,803.70

Gold (XAU/USD) defends the $1,800 threshold following the heaviest daily fall in over 10 weeks. That said, the yellow metal picks up bids to $1,809 during the early Asian session on Tuesday.

US President Joe Biden’s decision to nominate Jerome Powell for another term as the Federal Reserve (Fed) Chair and Richard Clarida for Vice-Chairman buoyed market sentiment the previous day. The traders’ zeal propelled US Treasury yields amid hopes of faster tapering and a rate hike during 2022, which in turn fuelled the US Dollar Index (DXY) to a new multi-day high and weighed down the gold prices.

Also exerting downside pressure on the gold were the firmer US data relating to manufacturing and housing, published on Monday. The US The Chicago Fed National Activity Index rose to 0.76 in October versus -0.18% (revised down figure). Further, US Existing Home Sales increased beyond 6.2M forecast and 6.29M previous readouts to 6.3M during the last month.

It’s worth noting that US Treasury Secretary Janet Yellen ruled out inflation fears like the 1970s and allowed the gold traders to lick their wounds near $1,800.

Even so, fears of inflation remain on the table as multi-billion dollars worth of the US stimulus is on the way. Additionally, fresh fears of the covid in the Eurozone threaten the lingering global supply chain and hint at the further worsening of the inflation pressure, as well as the market’s rush towards the US dollar due to its safe-haven nature.

For today, preliminary readings of the November month PMIs for the UK, Eurozone and the US will be important to watch for fresh impulse.

Technical analysis

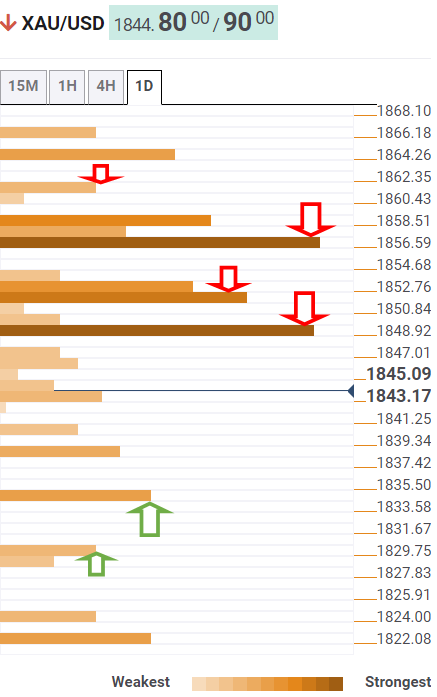

Not only a U-turn from the yearly resistance line but a clear downside break of the four-month-old horizontal support, now resistance, also keeps the gold sellers hopeful to visit the convergence of the 100 and 200-DMA.

Also supporting the gold sellers are the bearish MACD signals and the descending RSI line, not oversold.

It should be noted, however, that gold’s weakness past the DMA convergence, around $1,794-92, will be challenged by the 38.2% Fibonacci retracement (Fibo.) of January-March declines near $1,784. In a case where gold bears keep dominating past $1,784, an ascending support line from August, at $1,755 by the press time, will be in focus.

Meanwhile, 50% Fibo. level of $1,819 may challenge gold’s corrective pullback, if any, before the stated support-turned-resistance near $1,834.

Even if the bullion prices rise past $1,834, the 61.8% Fibonacci retracement level close to $1,851 and the yearly resistance line around $1,868 will test the gold buyers.

Gold: Daily chart

Trend: Further weakness expected

- EUR/USD heads lower as the Asian Pacific session begins, trades around the 1.1230s.

- The renomination of current Fed Chief Powell and the promotion of Lael Brainard to Vice-Chair, spurred demand for US dollar-denominated assets, the DXY steady around 96.40s.

- EUR/USD: The pair has a bearish bias, and the rallies have the potential of being sold, as a monetary policy between the Fed and the ECB, diverge.

The EUR/USD continue heading lower, as the New York session wanes and the Asian session begins, is trading at 1.1239, around the new year-to-date lows, at the time of writing.

US President Biden nominates Jerome Powell as the Federal Reserve Chairman

The New York session witnessed the renomination of Jerome Powell as Fed Chairman for another four years. Also, Fed Governor Lael Brainard, the other candidate to become the new Fed Chair, was elevated as Vice-Chairwoman, in substitution of current Vice-Chair Richard Clarida.

The shared currency immediately fell 40 pips, down to 1.1237, once the announcement was known, 30 minutes before Wall Street opened, happening amid a light US economic docket.

On Monday in the overnight session, COVID-19 infections rising in Austria, Germany, and Eastern Europe, alongside Eurozone macroeconomic data, spurred demand for the greenback. In coronavirus-related info, the German Chancellor Angela Merkel said that the situation in Germany is worse than anything they have seen so far, per Reuters.

Meanwhile, the Eurozone economic docket featured the Consumer Confidence and some ECB speakers. Data-wise, the Consumer Confidence fell to -6.8, more than the -5.5 foreseen by analysts. The data reflect the uptick in Covid-19 infections happening in the last weeks. The final reading is expected to show further deterioration as it will reflect the reimposing of restrictions.

In the meantime, some ECB speakers crossed the wires. The head of the Latvian central bank and ECB Governing Council member Martins Kazaks said that as long as price pressures are transitory and supply-side shocks, monetary policy should look through it. In the same posture, the Bank of France Chief, Francois Villeroy, said that the current “hump” in inflation is transitory. The central bank should be patient regarding tightening monetary policy conditions.

Therefore, as long as the economic docket remains light on both sides of the Atlantic, the dynamics lie in the US Dollar and market sentiment.

EUR/USD Price Forecast: Technical outlook

The single currency is on a downward free-fall. The pair has a bearish bias, with the daily moving averages (DMA’s) located well above the spot price, with the shorter time-frame ones, below the longer ones, all of them with a downward slope. Further, the Relative Strength Index (RSI), a momentum indicator at 26, flattish, in oversold conditions, suggests the pair could potentially reach a bottom.

In the outcome of the aforementioned, the first resistance to overcome would be the 1.1300. A break of the latter would expose the November 18 high at 1.1373, immediately followed by the psychological 1.1400.

Contrarily, the 1.1200 figure would be the first support if the euro keeps falling. The next demand area would be June 19, 2020, low at 1.1168, followed by 1.1100.

“Price pressures to subside as life normalizes in 2022,” US Treasury Secretary Janet Yellen said while crossing wires during late Monday night. The policymaker expected, “Monthly CPI around 0.2% to 0.3% in H2 of 2022.”

Earlier, US Treasury Secretary Yellen spoke during a CNBC interview while saying, “Inflation has reached a level that concerns most Americans.”

Additional comments

We do have to be concerned about inflation.

Inflation partly a reflection of pandemic impact on the economy.

White House is doing everything it can to address bottlenecks.

Fed needs to play important role to make sure inflation doesn't remain endemic.

Market reaction

Market players consolidate recent gains following the news amid a quiet Asian session on Tuesday.

“US will continue to press OPEC and oil companies on supply and price of oil,” said White House Press Secretary Jen Psaki, per Reuters, during late Monday night.

The White House official added that the US has talked with other countries on oil supply while also mentioning that the US continues to consider options on oil.

Additional quotes

Nothing to preview today on SPR (Strategic Petroleum Reserve) release.

US President Joe Biden hopes to make decisions on other fed posts soon.

On a different, Bloomberg shared comments from White House Economic Advisor Brian Deese saying, “Expect Biden to address gas prices in coming days.”

“Feel good about reaction to Powell, Brainard,” adds the diplomat per Bloomberg.

Contrary to the White House update, CNN came out with the news suggesting that nearly a dozen Congressional Democrats are urging President Joe Biden to combat high gas prices by not only releasing barrels from the US Strategic Petroleum Reserve but by banning US oil exports.

FX reaction

Having reacted positively to the news that Jerome Powell is nominated by US President Biden for a second term as the Fed Chair, the optimists seem to catch a breather ahead of the preliminary PMIs for November.

Read: WTI on the verge of a significant break to the downside

- AUD/USD has stalled on the downside and the focus is now for a correction.

- Bears eye a downside extension from critical resistance area.

AUD/USD is starting out in the Asian day in fresh cycle lows. The price fell on Monday from 0.7273 to a new low of 0.7221. The move came on the back of a strong surge in the greenback as the White House renominated Federal Reserve chair, Jerome Powell.

The dollar set a 16-month high against the euro on Monday after Federal Reserve Chair Jerome Powell was nominated for a second four-year term by President Joe Biden, while the single currency was hurt by COVID-19 related lockdowns. Lael Brainard, the Federal Reserve board member who was the other top candidate for the job, will be vice-chair. The market was positioned for a more dovish outcome and this set off a rally in the greenback.

The dollar got additional support from bullish comments at the end of the last week when the Federal Reserve officials Richard Clarida and Christopher Waller advocated for a faster pace of stimulus tapering amid a quickening recovery and heated inflation. Looking ahead, with respect to the Fed, the minutes of the Federal Open Market Committee's meeting early this month. These minutes are of the meeting where the Fed announced the start to tapering and traders will be holding for some more insight on how many Fed officials are considering faster tapering or earlier rate increases.

Domestically, the Net AUD short positions have edged lower, but remain fairly elevated reflecting the dovish tone of the Reserve Bank of Australia. However, the market is overstretched on the downside in the Aussie. October Retail Sales on Friday would be expected to move the needle, potentially. For the meantime, a pullback would be expected as per the following technical analysis:

AUD/USD technical analysis

The pair scored a fresh low which opens the risk of a downside continuation. However, in the first instance, a pullback to the 38.2% Fibonacci retracement level could be in order near to 0.7240.

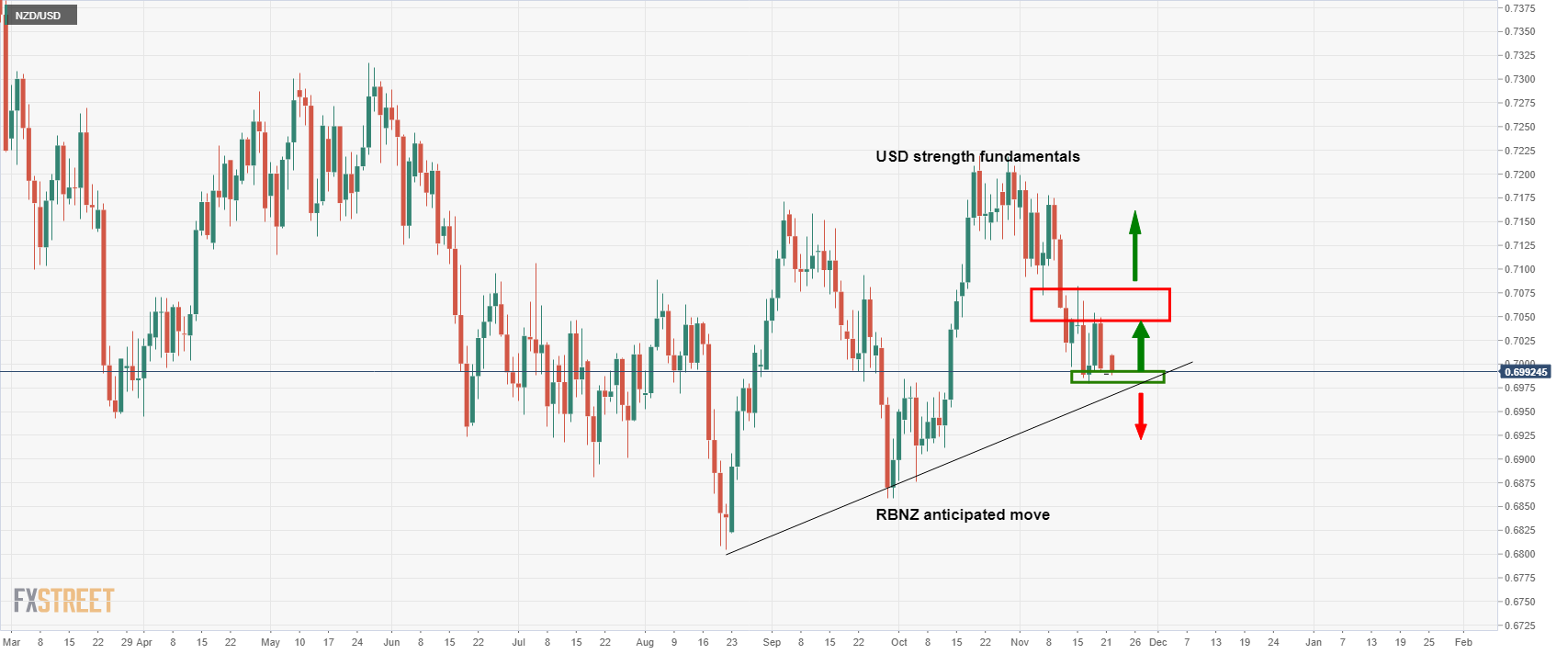

- NZD/USD remains pressured after two-day downtrend on downbeat data.

- New Zealand Q3 Retail Sales plunged to -8.3% versus +3.3% QoQ.

- Clear break of two-month-old support line, bearish MACD signals favor sellers.

NZD/USD stays depressed around 0.6960, following a two-day downtrend during early Tuesday morning in Asia. The Kiwi pair’s recent weakness could be linked to a clear break of an ascending support line support from late September and downbeat prints of New Zealand (NZ) Q3 Retail Sales.

New Zealand Retail Sales dropped past 3.3% QoQ to -8.3% during the third quarter (Q3). That said, the Retail Sales ex Autos followed the tune with -6.7% QoQ figures versus +3.4% previous readouts.

Also read: NZD/USD held back in flight into the US dollar ahead of RBNZ

As data disappointment follows the trend line breakdown, coupled with the bearish MACD signals, NZD/USD bears are up for challenging the 0.6900 threshold, also comprising multiple lows marked in early October.

It should be noted, however, that the last month’s bottom surrounding 0.6875 and September’s trough of 0.6859 will make it harder for the sellers to dominate further.

In a case where the quote remains pressured past 0.6860, the yearly low marked in August around 0.6805 will be in focus.

Meanwhile, the corrective pullback may aim for the previous support line near 0.6990 and the 0.7000 round figure as immediate resistances to tackle.

Also challenging the short-term NZD/USD buyers is the 61.8% Fibonacci retracement level of September-October upside, near the 0.7000 psychological magnet, followed by a descending resistance line from November 15, at 0.7030 by the press time.

NZD/USD: Four-hour chart

Trend: Further weakness expected

- NZD/USD bulls are nowhere to be seen ahead of the RBNZ.

- The US dollar thrives on Fed Powell's re-nomination.

NZD/USD is trading at 0.6950 as North America draws to a close. The pair moved from a low of 0.6947 to a high of 0.7013. Volatility is likely to pick up further as we move on towards the Reserve Bank of New Zealand.

''We expect a 25bp hike, but the market has gotten itself all tied up in knots expecting a super-hawkish tone,'' analysts at ANZ Bank said. ''Yet in reality, downside risks are emerging and higher swap/mortgage rates have already done the heavy lifting. Could the Kiwi have had its best days for 2021? Maybe.''

The markets are of the mind that record low-interest rates are now behind us. Analysts at Westpac, for instance, argue that ''a period of more normal rates beckons. And as the RBNZ attempts to cool the hot New Zealand economy, the challenge will be to engineer a soft landing.''

Meanwhile, the key driver on the day came with the rise in the greenback due to President Biden’s re-nomination of Powell for Fed Chair. Markets were pricing for a more dovish selection in Lael Brainard.

The dollar index against a basket of currencies DXY rose 0.42% on the day to 96.53, the highest since July 2020 which in turn, saw Kiwi get shunted through 0.70 to session lows, where it now sits.

- XAG/USD slumps close to 2% during the New York session, amid broad US dollar strength.

- The US 10-year Treasury yield advances up to 1.62% during the day, underpins the greenback.

- XAG/USD: The bias is tilted to the downside, as the 200-DMA at $25.30, remains above the spot price.

Siver (XAG/USD) slides during the New York session, as US President Joe Biden renominates current Fed Chair Jerome Powell for a second term. Further, elevated Lael Brainard to Vice-Chairwoman, maintaining continuity on the Federal Reserve. At press time, the white-metal plunges almost 2%, trading at $24.17.

Silver extended its fall, from November 18 high at $25.16, as investors brace the greenback, as expectations that the Fed would hike interest rates, rather sooner than later, increase. The decision of the White House to keep Powell around for four more years increased investors’ confidence, as portrayed by US equities.

That said, the S&P 500 and the Dow Jones Industrial rallied, the US Dollar is firm, while US Treasury yields rose after two bad auctions. As mentioned by FX Street’s analyst Joel Frank, “US 10-year bond yields were last up nearly 9bps on the session to 1.62%, with yields now back to their highest levels since last Wednesday and now only about 3bps below last week’s highs at 1.65%.”

“Medium-term bond bears will want to see the 1.65% level broken, opening the door to a move back towards annual highs set back in a mark of close to 1.77%,” Frank further added.

Read more: US 10-year yield shoots back above 1.60% while 2, 5 and 7-year yields all hit multi-month highs on Powell renomination, bad auctions

Meanwhile, the US Dollar Index, which tracks the buck’s performance against a basket of six currencies, is up almost half percent, sitting at 96.49.

XAG-USD Price Forecast: Technical outlook

The non-yielding metal daily chart depicts that silver trades between the 200 and the 100-day moving averages (DMA’s), at $24.06 and $25.30, respectively. That shows that the precious metal seems to be under selling pressure as the 200-DMA is viewed as a trendsetter lagging indicator. If the price of an asset is below the aforementioned, it means that the bias is bearish. Additionally, the Relative Strength Index (RSI), a momentum indicator that is at 49, aims lower, adding another downward signal on Silver.

The USD bulls, to accelerate the downtrend, need a daily close under the 100-DMA. In that outcome, the first demand level on the way south would be the 200-DMA at $24.05. A breach of the latter would expose the November 3 low at $23.02.

On the flip side, if XAG/USD bulls reclaim the $25.00 figure, that could pave the way for further upside, which could propel the price towards the August 4 high at $26.00.

-637732122826448220.png)

- EUR/GBP has been rangebound on Monday within 0.8380-0.8400ish parameters with market attention predominantly elsewhere.

- But things will hot up from Tuesday with the release of flash UK and Eurozone PMIs.

FX market focus has predominantly been on USD crosses on Monday, amid a broad strengthening of the buck in wake of Jerome Powell’s renomination as Fed chair which spurred an unwinding of dovish “Brainard” bets. As a result, the EUR/GBP pair hasn’t gotten much love or attention and has seen pretty boring trading conditions, with the pair ranging between its 21-month lows at just above 0.8380 and the 0.8400 level.

Week Ahead

Things will almost certainly get more interesting and volumes pick up for the pair as the week draws on. Flash Eurozone and UK Markit PMI surveys for November are released on Tuesday early during the European trading session. The former will be of particular interest in the context of the recent surge in Eurozone Covid-19 infections that have now translated into a tightening on health restrictions. Traders will want to see how this affects the restriction-vulnerable services sector. Deterioration is expected after a deterioration was seen in the preliminary November Eurozone Consumer Sentiment survey released on Monday.

BoE speakers will also be in focus this week, with Monetary Policy Committee (MPC) member Jonathon Haskel speaking on Tuesday, MPC member Silvana Tenreyro on Wednesday and then Haskel and Bailey again on Thursday. Various ECB policymakers will also come out of the woodworks, including President Christine Lagarde, who speaks on Thursday and Friday.

- USD/CAD is at eight-week highs and testing 1.2700 amid USD strength post-Powell's renomination.

- A lack of important Canadian economic events this week means the pair will be driven by oil, risk appetite and US dollar dynamics.

USD/CAD flew to fresh eight-week highs on Monday as it briefly moved above the 1.2700 level for the first time since early October. At current levels close to 1.2700, the pair is trading higher by just shy of 0.5% on the day. Now that resistance in the 1.2650 area has convincingly been broken and the pair is already at 1.2700, the next logical stop to the upside would be the 29 September high in the 1.2770s. Conversely, any retracement back lower may find buyer interest in the mid-1.2600s and then again around 1.2600.

The move higher was spurred by broad strengthening of the US dollar versus all of its major counterparts after the news broke of Jerome Powell’s renomination as Fed chair. With the loonie around 0.5% lower on the day versus the buck, that puts its in line with the losses seen by most of the majoriy of the rest of its G10 counterparts on the day versus the buck. GBP and EUR are down 0.4%, CHF, CAD and NZD 0.5% and JPY 0.8%. Oil prices were choppy throughout the day and, despite eventually ending the session with reasonable gains, did little to help the loonie.

Aside from a speech from Bank of Canada Deputy Governor Paul Beaudry, there is very little interest on the Canadian economic calendar this week. That means USD/CAD will likely be driven by oil, risk appetite and US dollar dynamics. On which note, US economic events are predominantly packed into Tuesday and Wednesday given Thursday is Thanksgiving holiday, with traders focused on US flash PMIs, Durable Goods Orders and October Core PCE inflation data.

Choppy oil prices

Front-month WTI futures were down over 1.0% at lows on Monday and briefly dipped under $75.00, printing fresh seven-week lows in the process, but eventually finished the day higher in the upper $76.00s for a daily gain of over $1.0. That still leaves WTI more than 10% below recent highs set back at the end of October of above $85.00 per barrel.

Oil traders are currently juggling developments in the politics of global oil supply. Bloomberg reported on Monday that the Biden administration is on the cusp of making a big announcement on crude oil reserve release plans that will sychronise with reserve releases from a number of other major oil-consuming nations. Reportedly, officials in Japan and India are looking at ways to release reserves in tandem with the US, while China has already publically made its plans to release reserves known.

But OPEC+ has delivered a counterstrike. Another Bloomberg report, citing delegates, suggested that the cartel may alter its plans to continue gradually hiking production in the months ahead if the US and other nations release oil reserves. Oil traders took this as a threat from OPEC+ to withhold supply to offset the impact of the oil reserve release.

- WTI is on the verge of a potential downside continuation.

- The demand side case is folding and the markets are concerned about covid again.

The price of a barrel of oil at the start of the week had taken a considerable knock in the price of WTI, travelling between a high of $77.13 and reaching as low as $74.79 on the day. However, in recent trade, the price established a low and has made tracks to the upside. At the time of writing, the price of oil is now up some 1.45% trading at $76.75.

The price was falling to a seven-week low after Japan said it may release oil from its strategic reserves. Japanese prime minister Fumio Kishida on the weekend said he is ready to cooperate with US requests to release oil from strategic reserves to bring down gasoline prices. At the same time, investors are concerned over the renewed lockdown measures in Europe. Additionally, weaker economic data from China are heightening demand worries.

This is hurting the demand-side argument for higher prices. Then, there were the reports of a coordinated Strategic Petroleum Reserve (SPR) release from the White House in concert with several other countries.

''The Biden administration has asked a wide range of countries, including China, to consider releasing stocks of crude,'' Reuters noted. ''The White House has also repeatedly pressed the OPEC producer group - which plans to meet on Dec. 2 - to maintain adequate global supply.''

Covid contagion risk is back

Meanwhile, analysts at TD Securities are more concerned over the potential for more widespread lockdowns in Europe as a measure to encourage better vaccination rates remains a more potent risk.

''In fact, our analysis suggests that the virus' ability to impact mobility trends has deteriorated over time. In turn, we continue to see a path for energy supply risk to resume its upward trajectory, particularly as global energy markets remain extremely vulnerable to a demand shock this winter,'' the analysts said.

''The rise in European natural gas prices could also see expectations for demand from gas-to-oil-and-fuel-oil switching rise once again, particularly if winter is cold.''

What you need to know on Tuesday, November 23:

The American dollar is the overall winner once again, reaching fresh 2021 highs vs the EUR and multi-month highs vs other major rivals. Most of the dollar’s strength came from US President Joe Biden, who nominated Jerome Powell for a second term as chair of the US Federal Reserve. Lael Brainard, who reportedly was the other top candidate for the position, will become the new vice-chair. President Biden said that he believes Powell to be the right person to pursue the goal of full employment and tackle inflation.

EUR/USD nears 1.1200, as the shared currency is suffering from what it seems the toughest covid wave so far. The situation has become critical in countries such as Austria and Germany, and restrictions are falling into place while facing strong opposition.

US Treasury yields advanced, with that on the 10-year note reaching 1.60%, helping USD/JPY to near the 115.00 region.

Commodity-linked currencies are down to roughly two-month lows on the greenback’s demand, with the AUD/USD pair around 0.7220 and USDCAD challenging the 1.2700 level.

Gold prices plunged on the dollar’s strength and trades at $1,803.00 a troy ounce. Crude oil prices ticked higher, with WTI currently hovering around $76.70 a barrel.

Stocks were mixed in Asia and Europe but edged higher in the US. Wall Street managed to shrug off the sour tone of their overseas counterparts and ended the day in the green.

XRP price heads south as Ripple fails to find buyers

Like this article? Help us with some feedback by answering this survey:

- The US 10-year treasury yield is back above 1.60% as yields rise after Powell’s renomination, two bad auctions.

- The rally in yields was led by a move higher in real yields as investors dumped inflation protection.

US bond yields rose sharply on Monday, with the rise initially spurred by the news that Jerome Powell had been renominated for a second term as Chairman of the Fed, but then exacerbated by two poor US government bond auctions. US 10-year bond yields were last up nearly 9bps on the session to 1.62%, with yields now back to their highest levels since last Wednesday and now only about 3bps below last week’s highs at 1.65%. Medium-term bond bears will want to see the 1.65% level broken, opening the door to a move back towards annual highs set back in mark of close to 1.77%.

In terms of the rest of the curve, 2-year yields were up just shy of 8bps on the day to 0.58%, their highest since March 2020. 5-year and 7-year yields were up more than 10bps each to above 1.30% and just under 1.55% respectively, with both hitting highs since February 2020. The 30-year yield was up 7bps to 1.97%. The move higher was led by real yields, with the 5-year TIPS yield up 14bps to above -1.70% (marking a more than 20bps rally in the last two sessions) and the 10-year TIPS yield up 13bps on the day to just under -1.0%.

The comparatively larger drop in real versus nominal yields meant that inflation expectations on Monday fell. 5-year breakevens, which were as high as 3.31% last Tuesday, are now down just over 3bps on the day to 3.06%, while 10-year breakevens fell back to 2.60%, now 15bps below last week’s highs.

Hawkish reaction to Powell renomination

US bond markets reacted hawkishly to the news of Fed Chair Jerome Powell’s renomination for the second term as Fed Chair. This is not so much because Powell is viewed as a hawk, but more so because Lael Brainard, who was the main alternative contender for the position, is seen as much more dovish than Powell. A Fed headed by Brainard would essentially be expected to keep rates lower for longer, so the hawkish market reaction is mostly about pricing out this dovish risk.

Fed funds futures for next December fell by 8.5bps to 99.285, meaning that three full 25bps rate hikes are now nearly priced in by the end of 2022. According to analysts at TD Securities, Powell's nomination “provides a little bit more legitimacy to market pricing in terms of Fed tightening next year”. The comparatively large spike in real yields is indicative of an easing of inflation fears, with investors opting to sell the inflation protection provided by TIPS amid greater confidence a Powell-led Fed will fulfill its medium-term inflation mandate.

Bad Auctions

With sentiment in bond markets already on the rocks amid hawkish Fed bets, poor demand at two key auctions further shook-up sentiment. A $58B sale of 2-year US government paper saw the high yield come in at 0.623%, more than 1.1bps above the When Issued, the biggest such tail since February 2020 at the start of the Covid-19 crisis phase. Meanwhile, a $59B auction of five-year government notes tailed by 1bps and saw primary dealers take up the largest percentage of any 5-year sale since February.

- AUD/USD has been in the hands of the bears to start the week.

- Bulls are focused on a retest of the prior hourly lows for the day ahead.

AUD/USD is meeting a critical area of support at the start of this week following a significant test of a 61.8% golden ratio on the daily chart. This leaves the focus on the downside, from a swing trading perspective, although there could be opportunities on the nearer term charts to the upside in development.

The following illustrates the market structure on both the daily and hourly time frames from which traders can assess with regards to planning their next trade in AUD/USD.

AUD/USD daily chart

On the daily chart, the bears are testing both the daily 61.8% ratio that meets horizontal resistance as well as the dynamic trendline resistance. If resistance holds up here, then the focus will be on the downside for a test of the next support area near the 0.7170s ahead of 0.7105 prior daily swing lows.

AUD/USD H1 chart

From an hourly perspective, however, the price is yet to break the support and there is, therefore, a focus on the upside towards the prior lows and a 38.2% Fibonacci retracement area:

The 38.2% confluence area comes in at around 0.7250 which will be a focus for the sessions ahead if support holds.

In a speech alongside US President Joe Biden and Fed Vice Chairman nominee Lael Brainard on Monday, Fed Chair Jerome Powell said that strong policy actions and vaccine rollouts had set the stage for a strong economic recovery. We know that high inflation takes a toll on families, Biden continued, adding that the Fed will use its tools to support jobs but also to make sure high inflation doesn't become entrenched.

Market Reaction

There hasn't been any market reaction to Powell's remarks, which added nothing new.

Fed Board of Governors member and incoming Vice Chairman of the FOMC Lael Brainard said on Monday in a speech alongside US President Joe Biden and Fed Chair Jerome Powell that she is committed to getting inflation down at a time when people are worried about how far their paychecks will go. I look forward to working with Powell to build a durable recovery, Brainard added, saying that, by working together, we will see a strong recovery for all Americans.

Market Reaction

There hasn't been any market reaction to Brainard's comments, though it is notable how much emphasis Brainard placed on bringing down inflation versus boosting employment. Perhaps when she next speak properly on policy and the economy she will sound more hawkish.

US President Joe Biden on Monday said that he believes Fed Chair Jerome Powell to be the right person to pursue the goal of full employment and tackle inflation, according to Reuters. In a speech addressing the economy and to explain his decision to renominate Powell as Chairman of the Fed for another term, Biden explained that Powell's steady and decisive leadership put the economy on the road to a robust recovery.

Moreover, Biden praised Powell for maintaining the integrity of the Fed during the previous Trump administration years. Biden also praised Brainard as a qualified and dedicated public servant, as well as a steadfast voice for financial regulation. Finally, President Biden said he looks forwards to adding more members to the Fed board over the coming weeks.

Market Reaction

There was no market reaction to Biden's remarks. The big moves of the day (dollar up, yields up, stocks up initially, then underperformance in tech amid higher yields) have already happened after the news of Powell's nomination as Fed chair.

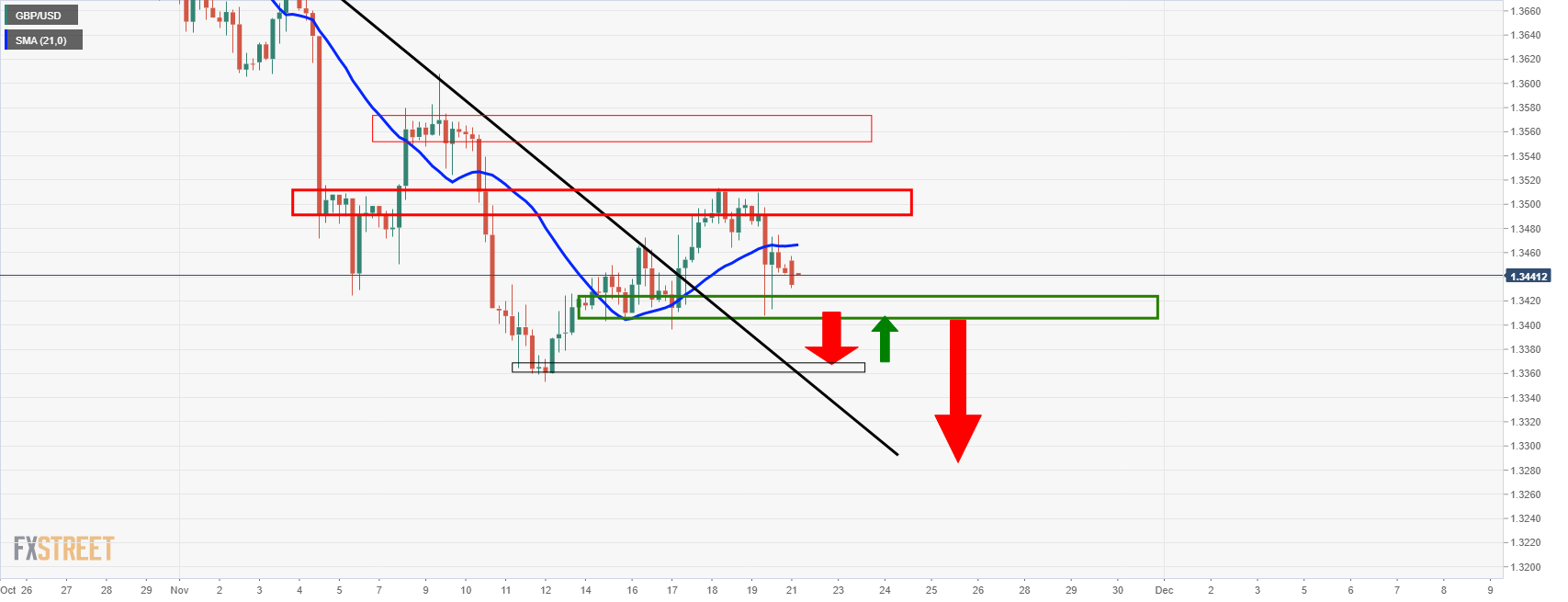

- GBP/USD falls close to 0.40%, as US President Biden nominates Fed’s Chair Powell for a second term.

- BoE’s members keep expressing worries about inflation, though the market remains cautious as the central bank disappointed in its last meeting.

- US Treasuries and the US Dollar advance firmly during the day, as investors express that the reappointment of Powell is good for the US economy.

After closing in the red on Friday, the British pound extends its fall against the greenback, down some 0.36%, trading at 1.3394 during the New York session at the time of writing. In the overnight session, cable traded choppy, within the 1.3420-50 range, despite some Bank of England’s members talking with the press over the weekend. Furthermore, the White House released a statement, nominating the Fed’s Chairman Jerome Powell to a second term, that witnessed a slide of 50 pips in the pair, under 1.3400.

BoE’s policymakers continue expressing worries about elevated prices

After disappointing a rate hike at its previous meeting, market participants begin to be more cautious regarding BoE’s Governor Andrew Bailey comments. Over the weekend, Governor Bailey expressed that inflation could be “elevated for longer,” though there is also the chance that it could not be as permanent as feared.

Bailey further added that “there are risks both ways. Obviously, our concern would be that if it gets into second-round effects, it could be elevated for longer.” During the last week, Governor Bailey expressed that he is uneasy about the inflation outlook.

However, the BoE failed to hike rates, as money market futures have foreseen, following comments from Bailey and the new Chief Economist Pill, expressing concerns about inflation which investors interpreted as a rate hike.

Brexit jitters keep GBP bulls at bay, as talks between the Eurozone and the UK regarding North Ireland and fishing rights slowed down, maintaining investors uneasy, moving from risk-sensitive currencies towards safe-haven ones.

Meanwhile, the US Dollar Index extends its gains, up 0.48%, sitting at 96.45, underpinned by Fed’s Jerome Powell nomination. Also, US Treasuries extend their gains during the day, with the 10-year Treasury yield advancing seven basis points, sitting at 1.60%, as investors view the reappointment as a continuation of the monetary policy path drawn by the Fed in the last couple of meetings.

Therefore, central bank policy divergence seems to favor in the near-term the British pound. However, another failure to hike overnight rates by the BoE on the December meeting would question its credibility, as members express opinions concerning inflation, though voting differently. Regarding the US, the Fed could probably use its monetary policy meeting in December to increase the bond taper pace or leave it untouched, as some policymakers have been vocal, about inflation hitting 6%, three-times the central bank target, leaning towards a faster QE's reduction pace, that could leave room for the central bank to act.

- Gold is under pressure as the US dollar rallies on Fed expectations.

- EUR/USD pressured by the central bank divergence theme and Covid risks.

- XAU/EUR bears are in control and eye the test of $1,590 in a 50% mean reversion.

Gold prices fell on Friday and have extended their losses as the US dollar catches a bid across the board which is weighing on the yellow metal. Against the euro, gold is down by some 1.7% as markets note the divergence between the Federal Reserve and European Central Bank. XAU/EUR trades at $1,608.66 and has travelled within a range of between $1,640.22 and $1,605.78 so far.

The notion that the Fed is on a faster path of tapering and closer to a rate hike than the ECB was underpinned on Friday. Fed officials said the central bank should consider speeding up the reduction in its bond-buying program. Vice Chair Clarida said he’ll be watching data ahead of December’s meeting before discussing whether to make any adjustments.

Fed vs ECB outlook

Meanwhile, the number of states in Germany are increasing that have started to impose social restrictions to combat the rising number of COVID-19 cases. This is leading to an exodus from the single currency. However, it still remains to be seen if the ECB will respond to the renewed COVID-19 restrictions.

It is clear that the central bank's governor, President Christine Lagarde, still expects inflation to “increase further until the end of the year.” However, she also expressed her concerns of moving too soon. “We must not rush into a premature tightening when faced with passing or supply-driven inflation shocks” she explained when talking to the Frankfurt European Banking Congress. “An undue tightening would represent an unwarranted headwind for the recovery,” she added.

The ECB's next meeting is not until December 16 where President Lagarde will be expected to “focus on the medium term, not on current inflation numbers.” There is a contrast there to that of the Fed. The dollar set a 16-month high against the euro on Monday after Federal Reserve Chair Jerome Powell was nominated for a second four-year term by President Joe Biden.

The dollar index against a basket of currencies DXY rose 0.40% on the day to 96.468, the highest since July 2020. Traders will now look to when the Fed will release minutes from its Nov. 2-3 meeting on Wednesday, which will be evaluated for any new indications that Fed officials are becoming more concerned about stubbornly high inflation.

Meanwhile, analysts at TD Securities argued that Gold prices are now vulnerable to a deeper consolidation. ''The yellow metal's prices have been buoyed by rising stagflationary winds, which ultimately catalyzed a breakout from a multi-month downtrend from all-time-highs amid a significant wave of CTA short covering and an increase in Chinese appetite for gold,'' they said.

XAU/EUR technical analysis

The price is on the verge of a move to the 50% mean reversion area that has a confluence with the prior resistance at the start of the year near $1,590. However, the M-formation is a reversion pattern, so the price could be expected to move back to the neckline of the pattern near $1,630 first. The 38.5% Fibonacci has already been met, after all, and this price could be subject to an imminent correction. With that being said, the daily candle is strongly bearish, so momentum is with the bears.

- The S&P 500 printed fresh record highs in the 4740s as investors cheered Fed Chair Powell’s reappointment.

- The Nasdaq 100 was initially higher, but downside in growth names amid higher bond yields has pulled the index lower.

US stock markets rallied to fresh record highs as investors cheered the appointment of Fed Chair Jerome Powell for a second term. The S&P 500 lept as high as the 4740s immediately following the 1430GMT US cash open, though since fallen back to about 4710, with on-the-day gains of about 0.2%.

The Nasdaq 100 index, which also lept higher at the open to nearly touch 16.8K for the first time, has since fallen back under 16.5K and is now trading down by 0.5% on the day. Underperformance in the duration-sensitive index is not surprising given the sharp rise in US government bond yields in response to Powell’s renomination as Fed chair. Duration-sensitive stocks, or growth stocks, are those whose valuation is disproportionately based on expectations for future earnings growth rather than on current earnings, thus leaving this valuation sensitive to changes in bond yields. Higher bond yields raise the opportunity costs of holding growth stocks.

The less growth/duration-sensitive stock exposed Dow Jones Industrial Average Index rallied 0.6%, boosted amid a sharp rise in banking names. The S&P 500 financials index was up nearly 2.0% on Monday, boosted amid the sharp rise in US bond yields.

Status-quo, Stability

Markets cheered US President Joe Biden’s decision to select Powell for a second term as Fed Chair, as it maintains the status quo at the bank with regards to policy plans. According to Randy Frederick, managing director of trading and derivatives at Charles Schwab, “markets like predictability ... while Brainard may have been a fine choice, the markets would not know what to expect from her even though the general consensus was that it meant lower rates for longer”.

US President Joe Biden is reportedly preparing to announce a release of crude oil reserves from the US Strategic Petroleum Reserve (SPR) alongside several other countries as soon as Tuesday, said a Bloomberg reporter on Monday according to Reuters.

The countries likely to release crude oil reserves alongside the US include China, India, South Korea and Japan, with the latter four all major importers of energy.

The report follows earlier reports suggesting that OPEC+ might be willing to adjust their own output policy if the US and other nations release oil reserves. In other words, they may delay planned output hikes, which will reduce any bearish impact a sychronised global oil reserve release will have on prices.

Market Reaction

Front-month WTI futures have been choppy in recent trade, swinging between the $75.00 per barrel and $77.00 levels amid the conflicting headlines.

- USD/JPY remained subdued in the overnight session, but in the Powell news, rallied 60 pips.

- On Friday, Fed’s Waller and Clarida expressed their interest in a faster bond taper, in the case of accelerating inflation.

- High US Treasury yields closing to the 1.60% threshold lifted the USD/JPY pair.

The USD/JPY edges higher during the New York session, trading at five-year tops, up 0.59%, trading at 114.67 at the time of writing. The market sentiment is upbeat, spurred by US President Biden renominating the Fed Chair Jerome Powell for a second term. Also, some Fed policymakers expressed that they would like to increase the pace of the bond taper, worried that inflation could get out of their hands.

In the overnight session, the USD/JPY pair remained subdued within the 114.00-114.27 area. However, during the American session, the renomination of Fed Chairman Powell increased investors’ confidence, lifting US major equity indices in tandem with US Treasuries and the buck.

As the New York session progresses, the US Dollar Index, which measures the buck’s performance against a basket of its peers, advances 0.43%, sitting at 96.45, clinging to the 96.40 threshold. Further, rising US Treasury yields benefit the greenback. The 10-year benchmark note rate is up to five basis points, up to 1.593%, thus boosting the USD against the Japanese yen.

USD/JPY Price Forecast: Technical outlook

In the daily chart, the USD/JPY depicts an upside bias. The daily moving averages (DMA’s) reside below the spot price, though approaching an interest level around the 114.70-115.00 area, unsuccessfully broken three times. However, a daily break above the 115.00 figure would open the door for further gains. The first resistance would be December 2016 swing highs around 118.66.

On the flip side, the first support would be the November 19 high at 114.53. A break under that level would expose 114.00, followed by the November 19 low at 113.58.

- Spot gold dropped as low as $1810 on Monday amid a hawkish reaction to the new of Powell’s renomination.

- Prices have since recovered a tad to the $1820 area, but remain capped by the 21DMA.

Spot gold (XAU/USD) saw a sharp sell-off on Monday, with prices slumping from the $1840 region to print session lows just above $1810, before recovering back to around $1820. The drop was triggered by news of Fed Chair Jerome Powell’s reappointment for a second term as Fed Chair. At present, spot gold trades with on the day losses of about 1.8% and is now under its 21-day moving average (which resides at $1822) again for the first time since 4 November. This level will now act as resistance and, with the US dollar strengthening and US bond yields surging, gold bears will likely eye a move towards the $1800 level and a test of the 200 and 50DMAs which sit just below its either side of $1790.

Hawkish bond market reaction

US bond markets reacted hawkishly to the news of Fed Chair Jerome Powell’s renomination for a second term as Fed Chair. This is not so much because Powell is viewed as a hawk, but more so because Lael Brainard, who was the main alternative contender for the position, is seen as much more dovish than Powell. A Fed headed by Brainard would essentially be expected to keep rates lower for longer, so the hawkish market reaction is mostly about pricing out this dovish risk.

The 2-year yield rose as much as 6bps to its highest levels since March 2020 above 0.55%, the 5-year rose as much as 8bps to its highest levels since February 2020 at close to 1.30% and the 10-year rose over 5bps to just under 1.60%. But at the same time as nominal US bond yields have moved higher, inflation expectations have also fallen, a reflection of greater confidence in a Powell-led Fed’s ability to fulfill its inflation mandate in the medium-term. 5-year breakeven inflation expectations dropped back about 5bps to close 3.0%, while 10-year breakevens fell by a similar amount to under 2.60% for the first time since 10 November.

The rise in US nominal yields despite a drop in inflation expectations can be explained by a sharp rise in US real yields. The 5-year TIPS yield rallied by over 12bps to close to -1.70%, while the 10-year TIPS yield was up 10bps to close to -1.0%, a reflection of a market keen to unload inflation protection. That eagerness to unload inflation protection in part explains the drop in gold which is seen by many investors as an effective long-term inflation hedge. But higher bond yields also weigh on gold in that a rise in real yields increases the opportunity cost of holding non-yielding precious metals, which explains gold’s typically negative correlation to real yields.

The hawkish market reaction also, unsurprisingly, boosted the US dollar, with the DXY hitting fresh year-to-date highs just shy of the 96.50 mark. This makes dollar-denominated gold more expensive to purchase for the holders of other currencies, thus reducing demand via the exchange rate avenue.

In an interview with Boersen Zeitung, European Central Bank Governing Council member and head of the Bank of France François Villeroy de Galhau reiterated his expectation that the current "hump" in inflation is transitory. As a result, he said, that means we should be patient and vigilant and that premature tightening would be a mistake.

From today's perspective, he continued, we should end PEPP net purchases in March 2022, though what the ECB does beyond March 2022 remains up for discussion, with a decision to be taken in December. He noted that an increase in the pace of purchase under the APP is a possibility, but not a necessity.

Market Reaction

EUR/USD continues to trade in the 1.1250 region and has not reacted to Villeroy's remarks.

- USD/CAD rallies as Jerome Powell renomination seems that would be a continuation in the Fed monetary policy.

- The US Dollar Index climbs to 16-month new highs, above 96.40.

- An absent economic data from Canada keep investors focused on the dynamics around the US economy.

The USD/CAD begins the week on the right foot, advances during the New York session, trading at 1.2680 at the time of writing. In the overnight session, the greenback was steady. However, in the last hour, it is rallying as US President Joe Biden reappointed Federal Reserve Chairman Jerome Powell for a second term. Also, nominated Lael Brainard, the other candidate, to a Vice-Chairman role.

US Dollar advances as Fed Chairman Powell got renominated

Meanwhile, the US Dollar Index, which tracks the greenback’s performance against a basket of six rivals, advances 0.39%, sitting at 96.44, its highest level reached since July 2020, underpinned by rising US bond yields, as the market sees the reappointing of Powell as a continuation to the current monetary policy.

Further, in the last couple of weeks, investors seem convinced that the Fed will hike rates by the middle of 2022. Powell renomination cemented those expectations as the US 10-year Treasury yield is up a half percent, closing onto the 1.60% threshold. Further, in the last week, Fed policymakers have expressed their interest in increasing the QE’s reduction pace, so the US central bank could have room to maneuver as inflation keeps posting new highs in subsequent months.

Also, the Loonie failed to capitalize on higher crude oil prices, as the Western Texas Intermediate (WTI) advances 0.71%, trading at $76.05, at press time.

An absent economic docket in Canada has weighed on the CAD, as investors focus on the US dollar dynamics. On the US front, the Chicago Fed National Activity Index for October rose 0.76, better than the September -0.18 reading.

Therefore, throughout this week, USD/CAD could appreciate. Robust US macroeconomic data on the last couple of weeks, and the Fed’s preferred gauge for inflation, the PCE, would be featured in the week. A higher reading could increase the chances of the US central bank acting to tackle elevated prices, thus boosting the greenback.

USD/CAD Price Forecast: Technical outlook

-637731916042443888.png)

The USD/CAD is trading above Friday’s high at 1.2661, which now acts as support. The 1-hour chart depicts the pair’s upward bias, though it finds strong resistance at the R1 pivot point around 1.2681, retreating towards current levels. The 1-hour simple moving averages (SMA’s) reside below the spot price, so corrections lower in the near term could be viewed as buying opportunities for USD bulls.

Resistance levels are located at 1.2700. The confluence of a downslope trendline in the daily chart and the September 29 high at 1.2774 would be challenging to overcome on the way to 1.2800.

On the flip side, the first support would be the November 19 high at 1.2661, followed by the 100-SMA at1.2605.

Following an increase of 7.0% in September, Existing Home Sales in the US rose by 0.8% in October, taking the rolling 12-month sales number to 6.34M homes, according to data published by the National Association of Realtors on Monday.

The report also showed that the median existing home price was $353,900 in October, up 13.1% YoY.

Market Reaction

FX markets have not reacted to the latest US housing numbers, just as they were not expected to. The DXY is currently trading at fresh year-to-date highs just under 96.50, boosted recently amid the news of Jerome Powell's renomination as Fed chair.

Consumer confidence in the euro area weakened in November with the European Commission's Consumer Confidence Indicator falling to -6.8 (flash) from -5.5 in October. This reading came in slightly worse than median forecasts for -5.5.

The data reflects an uptick in Covid-19 infections in the Eurozone over the last few weeks. The final consumer confidence indicator, released later in the month, will likely show further deterioration to reflect the imposition in recent days of lockdown restrictions.

Market Reaction

The data has not impacted FX markets, with EUR/USD trading just under 1.1250, just above year-to-date lows printed earlier in the session in the 1.1230s.

- EUR/USD printed fresh YTD lows on Monday in the 1.1230s after Powell’s renomination as Fed chair.

- Markets reacted hawkishly as dovish Brainard bets were priced out and participants bet on a hawkish Fed shift.

- The pair has since recovered back above the 1.1250 mark.

EUR/USD has seen choppiness in recent trade, dropping from around 1.1280 to fresh year-to-date lows in the 1.1230s, before rebounding back above 1.1250, where it trades lower on the day by about 0.3%. The sharp drop in recent was triggered by the news that the White House has decided to reappoint current Fed Chair Jerome Powell for a second term. Lael Brainard, currently a member of the Fed’s Board of Governors and was also touted for the position as Fed Chair, will take the position as Vice Chair of the Fed.

Hawkish reaction as Powell renominated

The move lower in EUR/USD reflects a broader hawkish market reaction to the news of Powell’s renomination. US 2-year yields rose as much as 6bps to fresh highs since March 2020 above 0.55% and the 5-year yield surged nearly 8bps to hit its highest since February 2020 at not far from 1.30%. Meanwhile, the December 2022 eurodollar future (a proxy for market expectations for the Federal Funds rate) dropped 10bps to fresh year-to-date lows at 98.965, having closed last Friday at 99.065. That implies markets are pricing 10bps in addition rate hikes by the end of next year now that Powell has been renominated for a second term.

This reflects an unwind in “dovish risk” presented by a possible Brainard nomination. A Fed under Brainard would have been expected to (by most market participants) to have a higher tolerance for a more prolonger overshoot on its inflation target and to place more emphasis on the labour market recovery. It may also reflect the fact that, with his renomination all-but secured (he should easily be approved as Fed Chair again in the Senate), Powell can now shift hawkishly on policy without fear of upsetting the White House.

EUR/USD on the ropes

A rebuilding of hawkish Fed expectations adds to the growing pile of reasons to favour further EUR/USD downside. As the pandemic in Europe worsens and Germany gets closer to locking down (Chancellor Angela Merkel on Monday called for tougher restrictions), the Eurozone economy is expected to take a hit in Q4 2021. This adds more reasons for the ECB to be dovish. The bank was already dovishly insisting that it would not react to what it sees as a transitory spike in inflation and can now use lockdown/pandemic related-economic weakness to further justify this stance. Some are calling for the PEPP QE programme to be extended in March, given that the emergency phase of the pandemic will not yet be deemed over (a condition for the ending of the programme).

The next area of key support resides in the 1.1140-1.1170 region, an area that will be closely watched by many of the bears. But technicians do note that EUR/USD is now heavily oversold, with its 14-day Relative Strength Index (RSI) score now back under 30.00 again. A technical correction in the coming days back to the 1.1300s could be on the cards, but may ultimately be seen as an opportunity to reload shorts.

Developing story...

- AUD/USD has dropped back from highs in the 0.7270s to under 0.7250 after Powell’s renomination as Fed Chair.

- Dollar strength represents an unwind of dovish Brainard bets, as well as bets on a hawkish Fed shift.

AUD/USD has reversed lower from previous session highs in the 0.7270s, amid a knee-jerk strengthening of the USD after the announcement from the White House that Jerome Powell would be nominated for a second term as Fed Chair. AUDUSD has now slipped back to the 0.7240s, where it still trades with on-the-day gains of about 0.15%. Analysts said that AUD outperformance on Monday could be to do with stronger iron ore prices, as well as positive reopening news in the region.

According to Westpac; “the A$ should remain under modest pressure given further weakness in Chinese steel prices/ super weak October steel production data, the continued slide in coal markets, the more dovish RBA Governor’s speech to the ABE last week, European Covid cases/ lockdowns, rising tension on the Russia/ Ukraine border, weakness in EM currencies, plus the stronger US$”. In terms of specific levels, the bank states that “a test down to the 0.7170/ 0.7220 region remains the next objective while gains will be capped by the 0.7290/ 0.7310 region”.

Powell renomination prompts hawkish reaction

The hawkish kneejerk reaction (i.e. dollar strengthening) to the news of Powell’s renomination reflects an unwind of dovish bets on a Brainard nomination. Had Brainard been nominated to the position of Chairman, the expectation amongst market participants would have been that there would have been a greater tolerance for high inflation and a greater emphasis on patience and returning to pre-Covid-19 employment levels.

Now that he has secured the renomination, some analysts have facetiously joked that Powell might now turn more hawkish, as some other Fed members have judging by recent rhetoric. Whilst this was initially presented by some as a joke, the reaction in bond markets to Powell’s renomination suggests that market participants truly are now betting on some sort of hawkish shift at the Fed. 2-year US yields are now up more than 6bps on the day to fresh post-pandemic highs above 0.55%.

- Gold witnessed selling for the third successive day and retreated further from multi-month tops.

- Hawkish Fed expectations, elevated US bond yields and a stronger USD weighed on the metal.

- Fresh COVID-19 jitters could help limit losses and warrant caution for aggressive bearish traders.

Gold extended last week's retracement slide from the $1,877 area, or a five-month peak and lost additional ground for the third successive day on Monday. The XAU/USD continued drifting lower through the early North American session and dropped to fresh two-week lows, around the $1,830 region in the last hour. US government bonds witnessed fresh selling amid growing market acceptance that the Fed will need to act more decisively to slow inflation. In fact, the yield on the two-year US Treasury note, which is highly sensitive to interest rate expectations, held steady near the highest level since March 2020. This turned out to be a key factor that drove flows away from the non-yielding yellow metal.

Meanwhile, hawkish Fed expectations, along with rising US bond yields continued acting as a tailwind for the US dollar. This, along with a generally positive tone around the equity markets, further acted as a headwind for dollar-denominated commodities, including gold. That said, concerns about the economic fallout from new COVID-19 restrictions in Europe could benefit the precious metal's safe-haven status and help limit deeper losses. Austria said that it would be the first country in Western Europe to reimpose a full lockdown to tackle rising infections, while Germany warned that it may follow suit. This, in turn, warrants some caution for aggressive bearish traders.

The US economic docket features the only release of Existing Home Sales and is unlikely to provide any meaningful impetus to gold prices. This might further hold back traders from placing fresh directional bets ahead of this week's key US macro releases – flash PMI prints on Tuesday, the Prelim Q3 GDP (second estimate), Durable Goods Orders and Core PCE Price Index on Wednesday. Apart from this, the FOMC monetary policy meeting minutes on Wednesday will play a key role in influencing the near-term USD price dynamics and provide a fresh impetus to the commodity. Hence, it will be prudent to wait for a strong follow-through selling before confirming that the metal has topped out already and positioning for a deeper corrective pullback.

Technical outlook

Even from a technical perspective, the XAU/USD, so far, has managed to hold its neck above the $1,834-32 strong horizontal resistance breakpoint. The mentioned hurdle-turned-support should act as a key pivotal point for traders, which if broken decisively might prompt some technical selling. Gold might then accelerate the decline towards testing the next relevant support near the $1,810-08 region before eventually dropping to the $1,800 round figure.

On the flip side, the $1,848-50 area now seems to have emerged as immediate strong resistance. Some follow-through buying has the potential to push spot prices beyond the $1,863-65 intermediate hurdle, towards testing a multi-month high level of $1,877 touched last Tuesday.

Levels to watch

White House announced on Monday that Federal Reserve Chair Jerome Powell was nominated for a second four-year term by President Joe Biden.

Lael Brainard, who reportedly was the other top candidate for the position, will become the new vice-chair, the press release further revealed.

Market reaction

The dollar gathered strength against its major rivals on this announcement and the US Dollar Index was last seen reading at its highest level since July 2020 at 96.28, rising 0.22% on a daily basis.

Key takeaways as summarized by Reuters

"Powell has provided steady leadership during an unprecedentedly challenging period."

"Brainard has played a key leadership role at the Fed."

"Powell and Brainard share the administration’s focus on ensuring that economic growth broadly benefits all workers."

"Powell and Brainard have advanced key priorities that Biden shares including addressing financial risks from climate change, staying ahead of emerging risks to financial system."

"US meeds steady, independent and effective leadership at the fed so it can advance goals of keeping inflation low and prices stable."

"Biden has full confidence in Powell and Brainard's experience, judgement and integrity to continue delivering on those mandates."

"Biden still has three fed seats to fill, including vice chair for supervision, and intends to make those starting in early December."

"Biden is committed to improving diversity in the board's composition."

"Biden is confident Powell and Brainard's focus on keeping inflation low, prices stable and delivering full employment will make US economy stronger than ever before."

The October Chicago Fed National Activity Index (CFNAI), released by Federal Reserve Bank of Chicago, rose to 0.76 from -0.18 in September, its highest since April 2022. That follows an improvement seen in other October sentiment surveys, such as ISM and Markit's PMI surveys, which showed economic conditions improving on the month. Covid-19 infections dropped back at the end of Q3/start of Q4 and most economists expect the US economy to accelerate into the year's end. Another rise in Covid-19 infections does pose a risk, however.

Market Reaction

FX markets did not react to the latest release.

- USD/CHF went above 328.00 for the first time since May 2020 on Monday amid Europe lockdown fears.

- Interest rate hikes from Hungary’s central bank have failed to prevent a weakening of HUF in recent weeks.

USD/HUF hit fresh 18-month lows on Monday, with the pair briefly eclipsing 328.00 for the first time since May 2020, up slightly more than 0.5% on the day. The more heavily traded EUR/HUF pair hit a fresh record higher above 370.00 for the first time ever. Central European currencies have been under pressure at the start of the week amid concerns about lockdowns in the region scuppering the prospect for continued economic growth. The Polish Zloty hit its weakest versus the euro since 2009.

On Monday, Austria became the first nation in Central/Western Europe to implement a full lockdown on all of its citizens. The Czech Republic, meanwhile, implemented new rules saying only those who are vaccinated or have recovered from Covid-19 in the last six months can enter restaurants or use other services.

A rapid rise in interest rates in Hungary and Poland has not been enough to stem recent currency weakness, seemingly reflecting concerns that the two countries’ central banks may risk failing to fill their inflation mandates in the medium-term. For reference, the YoY rate of CPI in Hungary hit 6.5% in October, while the Hungarian central bank lifted interest rates by 30bps to 2.1% last week, with rates now having been lifted by 1.5% since June. Concerns about the region returning to lockdown may well encourage the Hungarian central bank not to hike interest rates as market participants deem appropriate to address inflation risks, risking further HUF weakness.

The next psychologically important level eyed by the bulls for USD/HUF is at 330.00. If this breaks, then the pair could see a run towards record highs just above 340.00. The backdrop of a strong dollar amid strong US data and an increasingly hawkish Fed suggests that such a move might only be a matter of time.

The dollar’s appreciation in November still hasn’t emerged in CFTC FX positioning data that continues to show most G10 currencies’ net positions rising against USD, explains Francesco Pesole – FX Strategist at ING.

Key Quotes:

“November has so far been a month dominated by a strengthening of the dollar across the board, but this has however not translated into a rise in USD net positioning as reported by the CFTC. USD net aggregate positioning versus reported G10 currencies (i.e. G9 excluding NOK and SEK)

was unchanged in the last weeks of October and the first week of November, and then inched lower (now at +9.8% of open interest) in the week ending 16 November.”

“The surprise increase in USD net shorts was largely due to the jump in JPY, CAD and AUD net longs, which more than offset the slight decrease in EUR net positioning and the drop in GBP net positioning.”

“It is not uncommon to see CFTC FX positioning lag the moves in the spot market, and we can reasonably expect an increase in USD net-longs across the board in the next CFTC COT report.”

The Biden Administration is set to announce whether or not it will renominate current Fed Chair Jerome Powell for a second-term pick, Lael Brainard, on Monday, according to Punchbowl, citing multiple sources with knowledge of the move.

Powell remains the heavy favourite to secure the nomination, according to most political betting sites. Smarkets implied odds for the renomination of the current Fed Chair currently stand at just over 66.0%.

Market Reaction

Markets have not seen any reaction to the news that the announcement could come sooner than expected, but could be choppy on the actual announcement.

- AUD/USD staged a goodish rebound from the 0.7225 area or multi-week low.

- The set-up favours bearish traders and supports prospects for additional losses.

The AUD/USD pair maintained its bid tone heading into the North American session and was last seen hovering near the top end of its daily trading range, just above mid-0.7200s.

A generally positive tone around the equity markets turned out to be a key factor that extended some support to the perceived riskier aussie on the first day of a new week. This, along with a subdued US dollar price action, assisted the AUD/USD pair to recover a part of Friday's losses to the lowest level since October 6.

From a technical perspective, last week's downfall confirmed a near-term bearish break below an upward sloping channel extending from the 0.7100 neighbourhood, or YTD low set in August. This, in turn, supports prospects for an extension of the recent sharp pullback from levels just above mid-0.7500s, or a multi-month high.

The bearish outlook is reinforced by the fact that the AUD/USD pair is trading well below technically significant moving averages – 100 and 200-day SMA. Apart from this, bearish technical indicators are still far from being in the oversold conditions on the daily chart and further add credence to the near-term negative bias.

Hence, any subsequent positive move might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly near the 0.7300 mark. This should now act as a key barrier for the AUD/USD pair, which if cleared might trigger a short-covering move and allow bulls to challenge 100-DMA, around the 0.7355-60 region.

On the flip side, the 0.7225 area now seems to have emerged as immediate support. This is followed by the 0.7200 mark. Some follow-through selling will validate the bearish breakdown and turn the AUR/USD pair vulnerable to accelerate the fall towards the 0.7140-35 intermediate support en-route the 0.7100 round-figure mark.

AUD/USD daily chart

Technical levels to watch

- GBP/USD is rangebound under 1.3450 despite a slightly more dovish sounding BoE’s Bailey over the weekend.

- The pair awaits FOMC minutes, the Fed Chair nomination, UK flash PMIs and more BoE speak this week.

GBP/USD is rangebound just to the south of 1.3450 at the start of what is likely to be quite a busy week for the pair. On the USD side of the equation, FOMC minutes are out on Wednesday and the Fed Chair is likely to be nominated by Tuesday, both of which could see choppiness in the buck. Meanwhile, UK flash November PMIs are out on Tuesday and speeches from BoE officials are smattered throughout the week. Liquidity conditions in FX markets are likely to be thin from Thursday onwards, given the closure of US markets on Thursday for Thanksgiving and then the expectation many will remain on holiday on Friday.

For now, GBP/USD is content to range within 1.3420-1.3450ish parameters. Support is at 1.3400 in the form of last week’s lows, while there is resistance around 1.3500 in the form of last week’s highs. The pound has shrugged off commentary from Bank of England governor Andrew Bailey over the weekend, even though the governor was not as hawkish sounding on inflation as he has come across in past weeks. He noted that the risks to the bank’s inflation forecasts are two-sided, which some analysts took as a sign that the bar for a rate hike in December is a little higher than previously thought.

The latest commentary, plus the ongoing worsening of the outlook for the European economy, is seeing GBP Short-Term Interest Rate (STIR) markets reduce expectations for a 25bps rate hike in December. December 2021 sterling LIBOR futures currently trade close to 99.80, having spent most of the last two weeks around 99.75. That implies markets are pricing 5bps less in monetary tightening in December (10bps rather than 15bps). That can loosely be interpreted as STIR markets suggesting a 2/3rds chance of a rate hike in December, down from it being fully priced last week. Another rate hold in December from the BoE presents a clear downside risk to GBP.

Elsewhere, that the UK’s Covid-19 situation remains stable. The seven-day moving average infection rate remains about 40K, close to where it has spent most of the last two months. PM Boris Johnson reiterated on Monday that nothing in the data shows the UK should move to “Plan B” Covid-19 health restrictions. In terms of the latest on the Brexit front, talks on both the access of French fishermen to UK water and on the implementation of the Northern Ireland protocol rumble. The European Commission said on Monday morning there had been some progress no fishing, but that talks were moving too slowly and called for an intensification of discussions.

According to Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, the EUR/CHF cross could target 1.0255/35, or the April 2015 low in the long term.

Key Quotes:

“EUR/CHF has sailed through the 1.0505 2020 low and remains under pressure. This introduces scope to the 1.0255/35 April 2015 low and 50% retracement of the move 2015-2018. Rallies will find nearby resistance at the 1.0590 downtrend. Additional resistance lies at 1.0629, the November 2020 low and the 2016 low and the 1.0696 19th August low.”

“A close above 1.0938 the mid-September high is needed to negate our longer term negative bias (not favoured).”

- EUR/USD was seen consolidating its recent losses to the lowest level since early July 2020.

- Rising COVID-19 infections in Europe weighed on the euro amid sustained USD buying.

- Hawkish Fed expectations, elevated US bond yields held the USD near a 16-month peak.

The EUR/USD pair remained on the defensive through the mid-European session and was last seen trading with modest losses, around the 1.1275-70 region.

The pair, so far, has struggled to register any meaningful recovery and remained well within the striking distance of a 16-month low touched on Friday. The shared currency remained on the defensive amid worries about the economic fallout from the return of COVID-19 restrictions in Europe.

Austria said that it would be the first country in Western Europe to reimpose a full lockdown to tackle rising infections, while Germany warned that it may follow suit. This could provide the European Central Bank with another reason to go slow on tightening its monetary policy.

Conversely, the US dollar stood tall near the highest level since July 2020 and remained well supported by hawkish Fed expectations. In fact, the Fed funds futures indicate the possibility for an eventual Fed rate hike move in July 2022 and a high likelihood of another raise by November.

The market speculations were reaffirmed by a fresh leg up in the US Treasury bond yields, which, in turn, acted as a tailwind for the greenback. The fundamental backdrop supports prospects for further losses, though oversold conditions held back traders from placing fresh bearish bets.

Nevertheless, the EUR/USD pair seems vulnerable to prolong its bearish trajectory and any recovery attempt might still be seen as a selling opportunity. Traders now look forward to the release of the Eurozone Consumer Confidence Index and the US Existing Home Sales data for a fresh impetus.

Technical levels to watch

The coronavirus situation in Germany is worse than anything they have seen so far, German Chancellor Angela Merkel said on Monday, per Reuters.

Merkel further added that tighter curbs are needed.

Market reaction

These comments don't seem to be having a significant impact on risk sentiment. As of writing, Germany's DAX 30 Index was virtually unchanged on the day at 16,177. In the meantime, the shared currency stays on the back foot at the start of the week with the EUR/USD pair trading in the negative territory below 1.1300.

In its monthly report published on Monday, Germany's Bundesbank said that it expects inflation in Germany to be just below 6% in November, as reported by Reuters.

Additional takeaways

"Germany's headline inflation seen well above 3% for longer, core inflation substantially above 2%."

"The economic recovery will likely take a breather."

"From today's standpoint, GDP could tread water in the autumn quarter of 2021."

"Macroeconomic conditions also point to stronger wage increases for collective bargaining agreements to be renewed in the near future."

Market reaction

These comments don't seem to be having a significant impact on the shared currency's market reaction. As of writing, the EUR/USD pair was posting small daily losses at 1.1280.

- Silver caught fresh bids near the $24.50 resistance breakpoint, now turned support.

- The set-up seems tilted in favour of bulls and supports prospects for further gains.

- A sustained break below the $24.00 mark is needed to negate the positive outlook.

Silver attracted fresh buying near mid-$24.00s on the first day of a new week and climbed back closer to the key $25.00 psychological mark during the early part of the European session.

From a technical perspective, the recent pullback from over a three-month high has been along a downward sloping channel. Against the backdrop of a strong from a 14-month low touched in September, the mentioned channel constitutes the formation of a bullish flag pattern on short-term charts.

The positive outlook is reinforced by the fact that technical indicators on the daily chart – though have been losing momentum – are still holding comfortably in the bullish territory. Adding to this, the emergence of dip-buying near a strong horizontal resistance breakpoint favours bullish traders.

Silver 4-hour chart

This, along with the formation of an ascending channel on the daily chart, supports prospects for the resumption of the prior/well-established uptrend witnessed over the past two months or so. Some follow-through buying will reaffirm the constructive setup and pave the way for additional gains.

Silver daily chart

The XAG/USD might then accelerate the move back towards testing the $25.35-40 region, or the highest level since August 5 set earlier this month. The momentum could push the white metal beyond the $25.60 intermediate resistance and allow bulls to reclaim the $26.00 round-figure mark.

On the flip side, the $24.50 region resistance breakpoint, now turned support, should continue to protect the immediate downside. This is followed by the $24.10-$24.00 confluence, comprising of 100-day SMA and the lower end of the ascending channel, which if broken will negate the positive bias.

Levels to watch

- USD/JPY regained positive traction on Monday and reversed the previous session’s losses.

- A positive risk tone undermined the safe-haven JPY and extended some support to the pair.

- Fed rate hike bets, elevated US bond yields benefitted the USD and remained supportive.

The USD/JPY pair held steady above the 114.00 round-figure mark through the early part of the European session, albeit lacked any follow-through buying.

The pair regained positive traction on the first day of a new trading week and built on Friday's late rebound from a one-and-half-week low, around the 113.60-55 region. A generally positive tone around the equity markets undermined the safe-haven Japanese yen and turned out to be a key factor that acted as a tailwind for the USD/JPY pair.