- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 22-08-2014

The Federal Reserve Chair Janet Yellen said nothing new in Jackson Hole today. She said that the U.S. labour market is not yet fully recovered. But she added that the U.S. labour market was improving.

Janet Yellen said "there is no simple recipe for appropriate policy".

The Fed Chair offered no signal when the Fed will start to raise its interest rate.

Investors speculate that the Fed may hike its interest rate sooner than expected.

Stock indices closed lower after comments by the Fed Chair Yellen and due to rising tensions in Ukraine. Janet Yellen said that the U.S. labour market is not yet fully recovered. But she added that the U.S. labour market was improving. The Fed Chair Yellen offered no signal when the Fed will start to raise its interest rate.

Investors speculate that the Fed may hike its interest rate sooner than expected.

Tensions over Ukraine also weighed on markets. Ukraine said Russian humanitarian aid trucks crossed the Ukrainian border without being accompanied by the Red Cross.

The European Central Bank President Mario Draghi will also speak in Jackson Hole later in the day, but the European markets will be closed.

No major economic reports were released in the Eurozone.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,775.25 -2.41 -0.04%

DAX 9,339.17 -62.36 -0.66%

CAC 40 4,252.8 -40.13 -0.93%

The U.S. dollar traded mixed to higher against the most major currencies after comments by Federal Reserve Chair Janet Yellen in Jackson Hole. Janet Yellen said that the U.S. labour market is not yet fully recovered. But she added that the U.S. labour market was improving. The Fed Chair Yellen offered no signal when the Fed will start to raise its interest rate.

Investors speculate that the Fed may hike its interest rate sooner than expected.

Tensions over Ukraine also weighed on markets. Ukraine said Russian humanitarian aid trucks crossed the Ukrainian border without being accompanied by the Red Cross.

The euro declined against the U.S. dollar in the absence of any major economic reports in the Eurozone.

The European Central Bank President Mario Draghi will speak in Jackson Hole later in the day.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

The Canadian dollar traded mixed against the U.S. dollar after the mixed Canadian economic data. Retail sales in Canada climbed 1.1% in June, exceeding expectations for a 0.6% rise, after a 0.9% increase in May. May's figure was revised up from a 0.7% gain. That was the sixth straight increase in six months.

Retail sales excluding automobiles rose 1.5% in June, beating forecast of a 0.6% gain, after a 0.3% increase in May. May's figure was revised up from a 0.1% rise.

The consumer price index in Canada climbed 2.1% in July, after a 2.4% rise in June.

On a monthly basis, the consumer price inflation in Canada declined 0.2% in July, missing expectations for a 0.1% fall, after a 0.1% increase in June.

Canadian core consumer inflation (excluding eight volatile products) rose 1.7% in July, after a 1.8% rise in June.

On a monthly basis, Canadian core consumer inflation fell 0.1% in July, after a 0.1% decline in June. Analysts had expected the core consumer inflation to be flat.

The New Zealand dollar traded lower against the U.S dollar in the absence of any major reports in New Zealand.

The Australian dollar traded lower against the U.S. dollar in the absence of any major reports in Australia.

The Japanese yen traded lower against the U.S. dollar in the absence of any major reports in Japan.

Statistics Canada released consumer price index today. The consumer price index in Canada climbed 2.1% in July, after a 2.4% rise in June.

The Bank of Canada's inflation target is 2.0%.

On a monthly basis, the consumer price inflation in Canada declined 0.2% in July, missing expectations for a 0.1% fall, after a 0.1% increase in June.

Prices increased in all 12 categories. Shelter costs were up 3.0 per cent in July, while food prices jumped by 2.9% and gasoline prices rose 2.1%.

Canadian core consumer inflation (excluding eight volatile products) rose 1.7% in July, after a 1.8% rise in June.

On a monthly basis, Canadian core consumer inflation fell 0.1% in July, after a 0.1% decline in June. Analysts had expected the core consumer inflation to be flat.

EUR/USD $1.3300(E300mn), $1.3350(E508mn), $1.3400(E325mn)

USD/JPY Y103.10($350mn), Y103.35($400mn), Y104.00($450mn)

EUR/JPY Y138.70(E320mn)

GBP/USD $1.6650(stg251mn), $1.6700(stg140mn)

EUR/GBP Stg0.7900(E235mn)

AUD/USD $0.9200(A$450mn), $0.9300-10(A$373mn), $0.9350-60(A$773mn)

NZD/USD $0.8400(NZ$110mn)

USD/CAD C$1.0890-900($620mn), C$1.0905-10($337mn), C$1.0920-25($280mn), C$1.1000($1.23bn)

Statistics Canada released retail sales today. Retail sales in Canada climbed 1.1% in June, exceeding expectations for a 0.6% rise, after a 0.9% increase in May. May's figure was revised up from a 0.7% gain. That was the sixth straight increase in six months.

Retail sales excluding automobiles rose 1.5% in June, beating forecast of a 0.6% gain, after a 0.3% increase in May. May's figure was revised up from a 0.1% rise.

U.S. stock-index futures were little changed as investors awaited a speech by Federal Reserve Chair Janet Yellen for cues on the timing of higher interest rates.

Global markets:

Nikkei 15,539.19 -47.01 -0.30%

Hang Seng 25,112.23 +118.13 +0.47%

Shanghai Composite 2,240.81 +10.35 +0.46%

FTSE 6,772.89 -4.77 -0.07%

CAC 4,259.08 -33.85 -0.79%

DAX 9,360.8 -40.73 -0.43%

Crude oil $93.52 (-0.49%)

Gold $1279.50 (+0.32%)

(company / ticker / price / change, % / volume)

| McDonald's Corp | MCD | 94.54 | +0.01% | 1.2K |

| Verizon Communications Inc | VZ | 48.93 | +0.12% | 0.7K |

| Nike | NKE | 79.25 | +0.39% | 0.7K |

| Cisco Systems Inc | CSCO | 24.89 | 0.00% | 5.8K |

| The Coca-Cola Co | KO | 41.40 | -0.02% | 2.1K |

| Pfizer Inc | PFE | 28.81 | -0.03% | 1.1K |

| Johnson & Johnson | JNJ | 103.44 | -0.05% | 2.1K |

| UnitedHealth Group Inc | UNH | 83.73 | -0.05% | 0.3K |

| Merck & Co Inc | MRK | 58.82 | -0.05% | 0.6K |

| American Express Co | AXP | 89.09 | -0.06% | 0.3K |

| Walt Disney Co | DIS | 90.33 | -0.06% | 9.4K |

| Wal-Mart Stores Inc | WMT | 75.50 | -0.07% | 0.8K |

| Goldman Sachs | GS | 175.00 | -0.09% | 1.0K |

| Chevron Corp | CVX | 127.82 | -0.09% | 0.2K |

| Visa | V | 215.54 | -0.10% | 0.3K |

| International Business Machines Co... | IBM | 191.04 | -0.10% | 0.3K |

| JPMorgan Chase and Co | JPM | 58.44 | -0.10% | 6.4K |

| Travelers Companies Inc | TRV | 93.85 | -0.10% | 0.6K |

| 3M Co | MMM | 144.34 | -0.11% | 0.3K |

| AT&T Inc | T | 34.60 | -0.12% | 3.4K |

| Exxon Mobil Corp | XOM | 99.13 | -0.15% | 2.4K |

| Microsoft Corp | MSFT | 45.15 | -0.15% | 1.2K |

| Procter & Gamble Co | PG | 83.14 | -0.17% | 0.9K |

| General Electric Co | GE | 26.38 | -0.19% | 0.9K |

| Intel Corp | INTC | 35.08 | -0.20% | 3.5K |

| Caterpillar Inc | CAT | 107.72 | -0.23% | 1.4K |

| Home Depot Inc | HD | 90.70 | -0.49% | 1.4K |

| United Technologies Corp | UTX | 109.47 | -0.54% | 10.5K |

EUR/USD

Offers $1.3485, $1.3445, $1.3415, $1.3400, $1.3370, $1.3330

Bids $1.3240, $1.3230, $1.3200

GBP/USD

Offers $1.6845, $1.6800/10, $1.6750, $1.6680

Bids $1.6550, $1.6510, $1.6500

AUD/USD

Offers $0.9400, $0.9370, $0.9350, $0.9315

Bids $0.9300, $0.9240, $0.9220, $0.9200

EUR/JPY

Offers Y138.20, Y138.00

Bids Y137.60, Y137.00, Y136.75, Y136.50, Y136.25/20

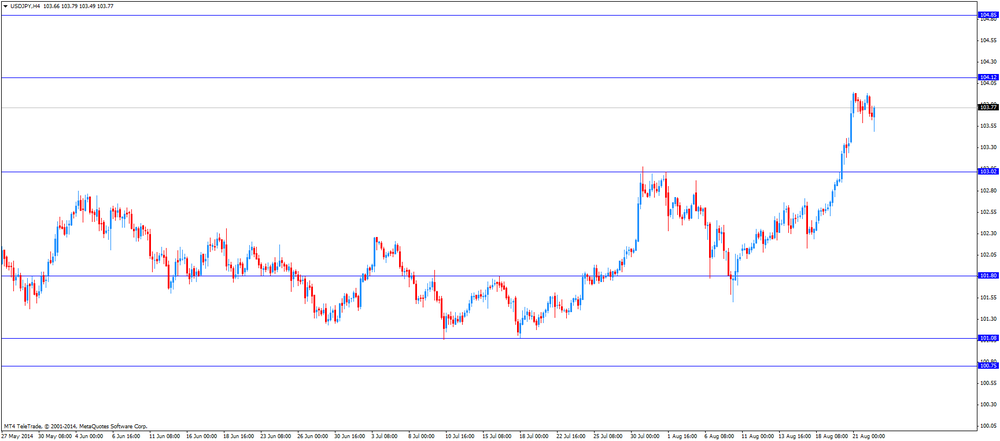

USD/JPY

Offers Y104.90, Y104.45, Y104.10, Y104.00

Bids Y103.10, Y102.70, Y102.30, Y102.15, Y102.00

EUR/GBP

Offers stg0.8100, stg0.8035

Bids stg0.8000, stg0.7970, stg0.7950/40, stg0.7900

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 U.S. Jackson Hole Symposium

The U.S. dollar traded mixed to higher against the most major currencies ahead of speech by Federal Reserve Chair Janet Yellen in Jackson Hole later in the day. Market participants are awaiting that speech by Federal Reserve Chair Janet Yellen may reveal Fed's next monetary policy moves.

The greenback strengthened this week due to strong economic data from the U.S. and Wednesday's FOMC's minutes. Investors speculate that the Fed may hike its interest rate sooner than expected.

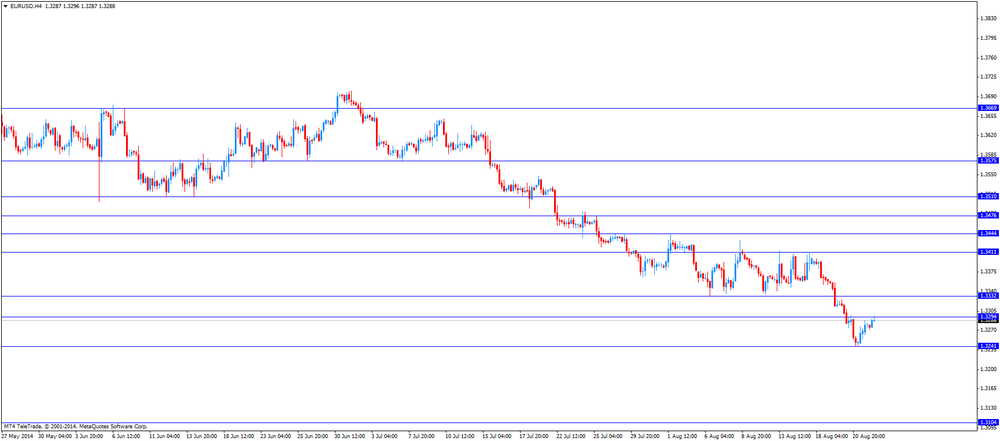

The euro traded lower against the U.S. dollar in the absence of any major economic reports in the Eurozone.

The European Central Bank President Mario Draghi will speak in Jackson Hole later in the day.

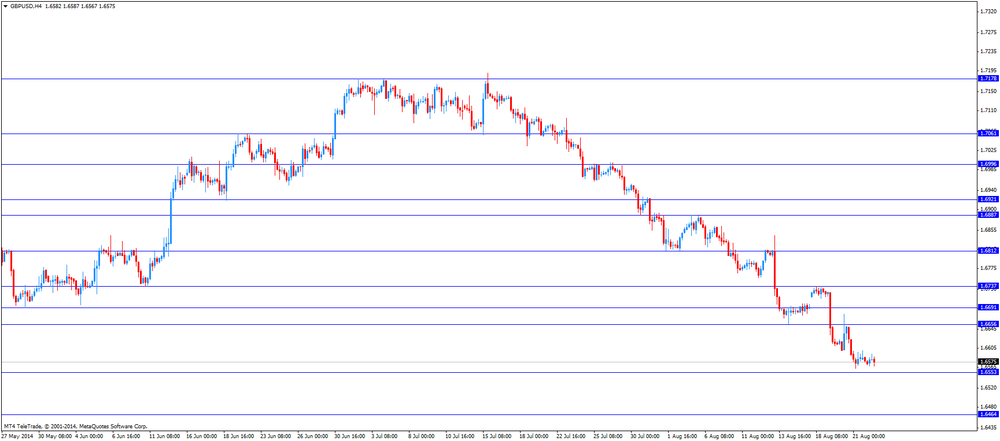

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian consumer price index and retail sales.

The consumer price index in Canada is expected to decline 0.1% in July, after a 0.1% rise in June.

The core consumer price index in Canada is expected to be flat in July, after a 0.1% decrease in June.

Retail sales in Canada are expected to rise 0.6% in June, after a 0.7% increase in May.

EUR/USD: the currency pair fell to $1.3261

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m June +0.7% +0.6%

12:30 Canada Retail Sales ex Autos, m/m June +0.1% +0.6%

12:30 Canada Consumer Price Index m / m July +0.1% -0.1%

12:30 Canada Consumer price index, y/y July +2.4%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m July -0.1% 0.0%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y July +1.8%

14:00 U.S. Fed Chairman Janet Yellen Speaks

18:30 Eurozone ECB President Mario Draghi Speaks

Stock indices traded lower ahead of speech by Federal Reserve Chair Janet Yellen in Jackson Hole later in the day. Market participants are awaiting that speech by Federal Reserve Chair Janet Yellen may reveal Fed's next monetary policy moves.

Investors speculate that the Fed may hike its interest rate sooner than expected.

The European Central Bank President Mario Draghi will also speak in Jackson Hole later in the day, but the European markets will be closed.

No major economic reports were released in the Eurozone.

Current figures:

Name Price Change Change %

FTSE 100 6,758 -19.66 -0.3 %

DAX 9,326.66 -74.87 -0.8 %

CAC 40 4,250.32 -42.61 -1.0 %

Most Asian stock indices closed higher, following gains on U.S. markets. U.S. markets increased yesterday due to the better-than-expected economic data in the U.S. The U.S. preliminary manufacturing purchasing managers' index (PMI) rose to 58.0 in August from 55.8 in July, beating expectations for a decline to 55.7.

The Federal Reserve Bank of Philadelphia's manufacturing index climbed to 28.0 in August from 23.9 in July, beating expectations for a drop to 20.3.

The existing home sales in the U.S. rose 2.4% to 5.15 million units in July from 5.03 million units in June. Analysts had expected a decrease to 5.01 million units in July.

Market participants are awaiting that speech by Federal Reserve Chair Janet Yellen in Jackson Hole later in the day may reveal Fed's next monetary policy moves.

Indexes on the close:

Nikkei 225 15,539.19 -47.01 -0.30%

Hang Seng 25,112.23 +118.13 +0.47%

Shanghai Composite 2,240.81 +10.35 +0.46%

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 U.S. Jackson Hole Symposium

The U.S. dollar traded mixed to lower against the most major currencies ahead of speech by Federal Reserve Chair Janet Yellen in Jackson Hole later in the day. Market participants are awaiting that speech by Federal Reserve Chair Janet Yellen may reveal Fed's next monetary policy moves.

The greenback strengthened this week due to strong economic data from the U.S. and Wednesday's FOMC's minutes. Investors speculate that the Fed may hike its interest rate sooner than expected.

The New Zealand dollar traded higher against the U.S dollar in the absence of any major reports in New Zealand.

The Australian dollar rose against the U.S. dollar in the absence of any major reports in Australia.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major reports in Japan.

EUR/USD: the currency pair rose to $1.3291

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m June +0.7% +0.6%

12:30 Canada Retail Sales ex Autos, m/m June +0.1% +0.6%

12:30 Canada Consumer Price Index m / m July +0.1% -0.1%

12:30 Canada Consumer price index, y/y July +2.4%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m July -0.1% 0.0%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y July +1.8%

14:00 U.S. Fed Chairman Janet Yellen Speaks

18:30 Eurozone ECB President Mario Draghi Speaks

EUR / USD

Resistance levels (open interest**, contracts)

$1.3380 (1997)

$1.3350 (11230

$1.3326 (290)

Price at time of writing this review: $ 1.3287

Support levels (open interest**, contracts):

$1.3265 (5010)

$1.3232 (4895)

$1.3206 (4520)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 56669 contracts, with the maximum number of contracts with strike price $1,3400 (6704);

- Overall open interest on the PUT options with the expiration date September, 5 is 62116 contracts, with the maximum number of contracts with strike price $1,3100 (6434);

- The ratio of PUT/CALL was 1.10 versus 1.11 from the previous trading day according to data from August, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.6801 (1852)

$1.6702 (1085)

$1.6605 (414)

Price at time of writing this review: $1.6582

Support levels (open interest**, contracts):

$1.6497 (1924)

$1.6399 (810)

$1.6300 (643)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 28800 contracts, with the maximum number of contracts with strike price $1,7000 (2760);

- Overall open interest on the PUT options with the expiration date September, 5 is 29545 contracts, with the maximum number of contracts with strike price $1,6800 (4026);

- The ratio of PUT/CALL was 1.03 versus 1.02 from the previous trading day according to data from August, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.