- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 22-04-2022

- The S&P 500, the Dow Jones, and the Nasdaq Composite recorded losses in a risk-off market mood.

- Fed speakers in the week support 50-bps rate hikes at the May 4-5 meeting.

- US Treasuries and the greenback finished the week higher amidst hawkish Fed comments.

US equities finished the week with substantial losses, reflecting a gloomy market mood amid concerns that the Fed would hike rates aggressively and high US Treasury yields. The S&P 500, the Dow Jones Industrial, and the tech-heavy Nasdaq Composite nose-dived recording losses between 2.6% and 2.8%, each sitting at 4,271.78, 33,811.40, and 12,839.29, respectively.

The Fed prepares the market for a 50-bps lift off

The market sentiment finished downbeat as the Federal Reserve prepared to lift rates to the 1% threshold. US central bank officials crossed the wires throughout the week and expressed that they favor a 50-bps lift to the Federal Funds Rate (FFR) at the May 4-5 meeting. It is expected to be a unanimous decision, as Fed Chair Powell gave the green light on Thursday, saying that a 50-bps increase is “on the table.”

In the meantime, the greenback remains in the driver’s seat, as depicted by the US Dollar Index, rising 0.49%, sitting at 101.118, while US Treasury yields, led by the 10-year benchmark note, finished flat at 2.903%.

- Also read: US Dollar Index reached a two-year-high at 101.331 on Fed policymakers comments

In terms of sector specifics, the less damaged were Consumer Staples, Utilities, and Real Estate, falling 1.59%, 1.68%, and 1.78% each. The worst performers were Materials, Health, and Communication Services, losing 3.73%, 3.63%, and 3.30%, respectively.

In the commodities complex, the US crude oil benchmark, WTI, lost 2.22%, trading at $101.08 a barrel, while precious metals like gold (XAU/USD) recorded losses of 1.04%, exchanging hands at $1931.12 a troy ounce, dragged down by a firm US dollar.

- Also read: WTI continues to trade in subdued in low $100s as oil traders mull slowing growth versus supply worries

- Also read: Gold Price Forecast: XAUUSD bears eyeing a break of the 50-DMA around $1930s

The week ahead in the US docket

The economic calendar for the US would feature March’s Durable Goods Orders, the US Gross Domestic Product for the Q1, and the Core Personal Consumption Expenditure (PCE) for March on annual and monthly readings, alongside the Chicago PMI.

Key Technical Levels

- The US Dollar Index (DXY), hits a fresh 25-month high on Fed official’s comments.

- Fed speakers in the week support 50-bps rate hikes at the May 4-5 meeting.

- US Dollar Index Price Forecast (DXY): Bulls target January’s 2017 highs near 103.82.

The US Dollar Index, a measurement of the greenback’s value against a basket of six currencies, finished the week on a higher note, gaining 0.62%, and ended at 101.118, though short of the 2-year high reached on Friday’s session at 101.331.

Factors like Fed speaking throughout the week increased the appetite for the buck. Additionally, rising US Treasury yields underpinned the greenback, as the 10-year US Treasury yield, the benchmark note, finished at 2.903%, in the week won 2.69%.

Summary of Fed speaking

On Thursday, Fed Chair Jerome Powell blessed a half-point interest rate increase by the May 4-5 meeting. Meanwhile, money market futures have fully priced in a 0.50% hike to the Federal Fund Rate, which would lift it to 1%.

Later on Friday and the last Fed speaker before the May meeting blackout, Cleveland’s Fed President Loretta Mester commented that she would like to get neutral to 2.5% by the end of the year. When asked about 75-bps increases, Mester added that “we don’t need to go there at this point.” Furthermore, she supported a 50-bps increase in May and a few more after.

Elsewhere, St. Louis Fed President James Bullard admitted that the Fed is behind the curve but not as everybody thinks, while adding that the Fed has hiked 75 bps before without the world coming to an end.

San Francisco Fed President Mary Daly noted that the Fed “will likely” raise rates by 50 bps at a couple of meetings. However, according to Yahoo Finance Interview, she is open to deliberating what size of increases are needed. Daly reiterated that the Fed needs to take a measured pace on rate hikes and get rates up to 2.5% by the end of the year.

The week ahead in the US docket

The economic calendar for the US would feature March’s Durable Goods Orders, the US Gross Domestic Product for the Q1, and the Core Personal Consumption Expenditure (PCE) for March on annual and monthly readings, alongside the Chicago PMI.

Analysts at ING expect Q1 data to show the US economy expanded at a 1-1.5% annualized rate, which would be below Q4 of 2021 at 6.9%, reflecting the Omicron wave of the pandemic that impacted mobility considerably.

“However, recent data has pointed to a renewed uptick in activity and we expect to see stronger GDP growth for the second quarter. Durable goods orders should also be healthy based on regional manufacturing data, the ISM report, and higher Boeing aircraft orders. That said, we anticipate a bit more weakness in the housing data as surging mortgage rates take some of the steam out of the housing market.”

US Dollar Index Price Forecast (DXY): Technical outlook

The US Dollar Index (DXY) retains its upward bias, as depicted by the daily chart. The 50 and the 200-day moving averages (DMAs) at 98.487 and 95.459, respectively, are well located under the DXY value, further cementing the upside bias. The Relative Strength Index (RSI) at 67.22 has enough room to spare if the DXY prints another leg up, near January’s 2017 highs around 103.82, before reaching overbought conditions. However, first, it would need to overcome some hurdles on its way north.

The DXY first resistance would be 102.00. A break above would expose March’s 24 daily high at 102.21, followed by March’s 20 2020 daily high at 102.99 and then the aforementioned 103.82 swing high.

- The Australian dollar plunged more than 100-pips amid a risk-off market mood.

- Fed Chief Jerome Powell spooked investors as he said that a 50-bps increase in May is “on the table.”

- AUD/USD Price Forecast: A tweezers-top in the daily chart exacerbated a move towards the 0.7200 region.

The AUD/USD extends Thursday’s losses and plummets 130-pips as market mood deteriorates. Fed policymakers continued telegraphing a 50-bps rate hike in the May meeting, while some investment banks expect even 75-bps increases. At the time of writing, the AUD/USD is trading at 0.7248

US equities reflect the abovementioned mood in the market, recording losses. The US 10-year Treasury yield records modest losses of one basis point, currently at 2.903%, while the greenback remains buoyant as shown by the US Dollar Index, gaining 0.55%, which was last seen at 101.180.

Fed Chief Jerome Powell put 50-bps increases in May “on the table”

In the week, some Fed officials expressed that the US central bank needed to move “expeditiously” towards neutral and emphasized that 50-bps hikes to the Federal Funds Rates (FFR) might be required. Even St. Louis Fed President Bullard stated that a 75-bps rate hike had to be considered. However, the words that resounded were made by Fed Chair Powell, who commented that a 50-bps rate hike in the May meeting “is on the table,” spooking investors as bond yields rose while US equities tumbled on Friday, their worst loss in the week.

Meanwhile, Nomura was in the headlines with a prediction that after a 50 bps rate hike in May, the Fed would follow up with two 75 bps rate hikes in June and July.

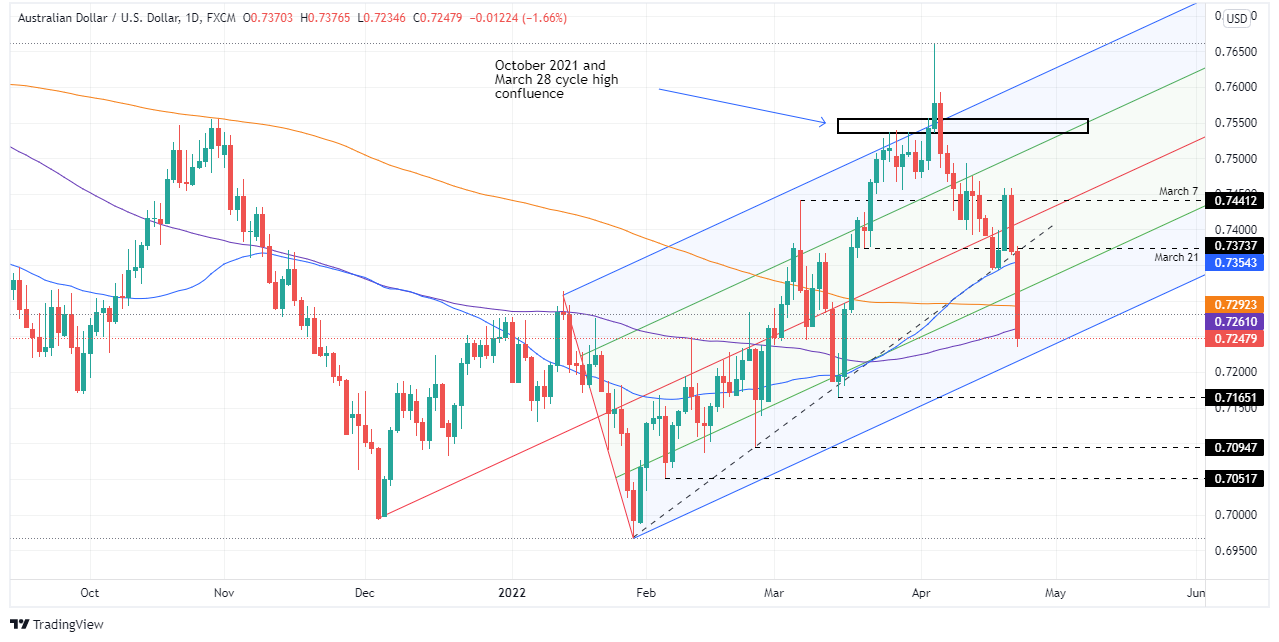

AUD/USD Price Forecast: Technical outlook

In Thursday’s article, I mentioned that “Thursday’s price action reversed Wednesday’s gains forming a tweezers top candle chart pattern,” a signal which means that selling pressure overtook buyers, “threatening to push prices further down.”

That’s what happened on Friday. The AUD/USD is 20-pips below the 100-day moving average (DMA) after plummeting 130-pips and leaving the 50 and the 200-DMA above the exchange rate, meaning that the AUD/USD could shift bearish if certain conditions are met.

If the AUD/USD Friday close is below the 100-DMA, that will exacerbate a move towards 0.7000; however, there would be some hurdles on its way down. If that scenario plays out, the AUD/USD first support would be 0.7200. Break below would expose March’s 15 cycle low at 0.7165, followed by February 24 swing low at 0.7094, and then February’s 4 pivot low at 0.7051, short of the 0.7000.

Cleveland Fed President and FOMC member Lorreta Mester, speaking in an interview on CNBC, said on Friday that the Fed wants to see tighter financial conditions, though not all at once. "We are in a recalibration phase for monetary policy," she said, adding that the Fed's goal is to bring inflation under control, but also to sustain the expansion and maintain healthy labour markets.

Additional Remarks:

"Markets are reading the same data we are."

"We need to be resolute on bringing rates up to neutral."

"I'd like to get to the neutral rate of 2.5% by the end of the year."

"Once at the neutral rate, the Fed will be in 'good position' to evaluate the economy."

"Things other than monetary policy are affecting inflation."

Asked about 75 bps point hike, Mester said "we don't need to go there".

"I'd rather be more deliberative and intentional."

"I would support a 50 bps rise in May and at a few more meetings after that."

An outsized move to the federal funds rate is "not the right way to go".

"I'd rather be more consistent."

"Once we get to neutral, where rates go will depend on how the economy behaves."

"Let's be on a methodical, not overly aggressive, path."

"The shock of a 75 bps rate hike is not needed."

"I'd favor doing 50 bps hikes earlier on in rate hike path."

"My forecast is for economic growth to slow to above 2% this year."

"I am confident we can put inflation on a downward trajectory and keep the expansion going."

"The risk of running inflation this high, this long is the risk to inflation expectations."

"It's important for the Fed to follow through with rate hikes."

"I want to be very deliberate and intentional, and to get to neutral expeditiously by the end of the year."

"I think it will take a few years to get inflation back to 2.0%, and balance sheet reductions will also reduce accommodation."

- USD/CAD rallied roughly 140 pips on Friday to hit its highest level in over one month above the 1.2700 mark.

- That marks the largest one-day percentage gain since November.

- The pair rallied as a function of risk-off flows, with recent BoC hawkishness and strong data failing to support CAD.

USD/CAD rallied roughly 140 pips on Friday to hit its highest level in more than one month above the 1.2700 mark and, at current levels in around 1.2720, trades with on the day gains of about 1.1%. The pair’s rally comes despite what would normally be a (minorly) bearish combination of better than expected Canadian (Retail Sales) data and worse than expected US (flash PMI) data.

The pair’s jump, its largest since November 2021 which also saw it break cleanly to the north of its 50 and 200-Day Moving Averages in the low-1.2600s, also comes despite hawkish commentary from BoC Governor Tiff Macklem earlier in the week, who signaled the likelihood of further 50 bps rate moves in the weeks ahead.

USD/CAD’s upside on Friday can largely be explained by a risk-off trend in the markets on Friday, with major US equity bourses sliding more than 2.0% each to hit fresh monthly lows and traders citing fears about global central bank policy tightening. Indeed, it's not just the BoC giving off a hawkish message in recent days. Fed Chair Jerome Powell effectively gave the nod to 50 bps rate hikes at upcoming meetings and even policymakers at the ECB are talking about rate hikes as soon as July.

Looking ahead to next week, traders will probably be hoping for some stabilisation in risk appetite on Monday and, if crude oil prices remain supported, that could set the stage for a USD/CAD pullback towards this week’s levels. BoC’s Macklem will also be back on the wires on Monday, with his comments likely again to be scrutinised closely.

- GBP/JPY has turned decisively lower on Friday, falling more than 200 pips back to 165.00 from earlier highs above 167.50.

- Weak UK data and risk-off flows in US equity markets were the main catalysts for the decline.

- That was enough to outweigh dovish remarks from BoJ Governor Kuroda.

GBP/JPY has turned decisively lower on Friday, falling more than 200 pips back to the 165.00 level from earlier highs above 167.50 to test support in the form of the March highs. At current levels just above the big figure, GBP/JPY trades with on the day losses of about 1.3%, which would mark the pair’s worst one-day drop since 4 March, when FX markets were experiencing a period of severe risk-off with the Russo-Ukraine war having only begun one week earlier.

Since then, FX market focus turned more to the inflationary impact of the way and currencies began trading more as a function of central bank policy divergence rather than risk appetite. At 165.00, GBP/JPY is still trading more than 9.0% above its sub-151.00 March lows, mostly as a function of the yen getting absolutely battered in the last few weeks on the idea that the BoJ would leave its policy settings unchanged as other major central banks (including the BoE) tighten to tackle inflation.

BoJ policy was in focus earlier on Friday, with Governor Hurahiko Kuroda doubling down on his dovish stance that 1) inflation, though higher in the short-term, isn’t yet showing signs of meeting the BoJ’s long-term 2.0% goal, meaning 2) it remains appropriate to maintain the policies of negative interest rates and yield curve control. Those remarks saw the yen weaken at the time, and GBP/JPY momentarily rally from under 165.00 to the upper 165.00s.

But the pair has since turned lower, primarily as a result of safe-haven flows out of the more risk-sensitive pound into the yen as selling pressure in US equity markets built. Whilst risk-off is one reason why GBP/JPY is lower on Thursday (it largely explains the outsized drops in NZD, AUD and CAD as well), another factor weighing heavily on pound sterling was Friday’s very weak UK data. Analysts agreed that the data undermines the case for BoE tightening in the months ahead, and will likely justify why BoE policymakers have in recent weeks started sounding more worried about the economy.

- The GBP/USD plummets to eighteen-month-lows around 1.2828.

- Weaker than expected, UK economic data and market sentiment were the drivers of the British pound fall.

- GBP/USD Price Forecast: Would fall towards 1.2675 if a daily close below 1.2854 is achieved.

The British pound plummets and breaks below 1.3000 and 1.2900 and reaches a fresh eighteen-month low around 1.2828, amidst a dismal market mood and continuing central bank speaking at an IMF event in Washington. At 1.2831, the GBP/USD weakened the most since November 2020.

Global equities are suffering a blood bath in the day. Global bond yields are rising, while the greenback remains buoyant and reaching a fresh YTD high around 101.33, up some 0.61%, as central bankers and finance ministers speak at an IMF panel.

UK economic data and market sentiment weighed on the GBP/USD

The GBP/USD fell on market sentiment and worse than expected UK economic data. The Gfk consumer sentiment hit its worst level since 2008. The UK’s Retail Sales were weaker than foreseen, and S&P Global PMIs for April beat expectations but Services and Composite trailed the previous month’s figures.

Elsewhere, the Bank of England (BoE) Governor Andrew Bailey said inflation would go higher in the UK courtesy of energy prices. Furthermore, Bailey added that the BoE would only make QT active sales in stable markets and cease if conditions change.

In the meantime, on Thursday, Fed Chair Powell added to the hawks in the Fed and said that a hike of 50 bps “is on the table for the May meeting,” while emphasizing that he favors “front-end loading” its tightening cycle. Also, St. Louis Fed President James Bullard admitted that the Fed is behind the curve but not as everybody thinks, while adding that the Fed has hiked 75 bps before without the world coming to an end.

Meanwhile, the US economic docket featured the S&P Global Flash US Manufacturing PMI for April, which rose by 59.7, higher than the 68.2 estimations, and smashed March’s figures. Regarding the Services and Composite component, both readings were shorter than the previous month’s reading.

GBP/USD Price Forecast: Technical outlook

The GBP/USD tumbled of late, below the former YTD high at 1.2972 and is trading below November 2020 lows at 1.2853, as the Relative Strength Index (RSI) aims aggressively towards bearish territory at 31.34 after the GBP/USD dropped 200-pips.

Despite the aforementioned, the GBP/USD has enough room for further losses, and a daily close below November 2020 lows would open the door for a test of September 2020 lows.

With that said, the GBP/USD first support would be 1.2800. A breach of the latter would expose September 28, 2020, lows at 1.2751, followed by 1.2700, and then September 23 swing low at 1.2675.

The US dollar could start to lose ground on a three to six month perspective according to analysts at Rabobank. Still, they don’t see the GBP/USD doing much better than the 1.28 to 1.30 range in the coming months.

Key Quotes:

“The USD remains well bid on hawkish rhetoric from the Fed. That said, since the publication of an 8.5% y/y print for US CPI inflation on April 12, a debate about whether the US has reached ‘peak inflation’ has been demanding attention. For many commentators, the expected rapid pace of Fed tightening this year risks sending the US economy into recession in 2023. In our view, the US economy is facing dual risks – the first from the Fed’s aggressive attempt to control inflation, the second from the impact of higher prices that will have particular impact on the pockets of poorer income households.”

“The question for the USD pertains to whether all the good news regarding the US economic outlook and interest rate differentials is already in the price. It is our view that the USD could start to lose ground on a 3 to 6 month horizon against a broad basket of currencies. That said, with GBP held back by gloomy UK economics and complicated politics, we see risk that cable may do no better than a GBP/USD 1.28 to 1.30 range in the coming months.”

Data released in Canada on Friday showed a better-than-expected reading on February reital sles. Analysts at CIBC, point out that retail sales volumes held their own in February and March, despite the headwinds to goods spending of mounting inflationary pressure and reopening service industries.

Key Quotes:

“The 0.1% gain in February was a little better than the consensus and advance estimate (-0.5%) and represented only a modest decline in volume terms following a big gain in the prior month. The 1.4% increase estimated for March would likely still represent a modest gain in volume terms, even after accounting for strong inflationary pressure over the month. Overall, a flat trend on the goods side is a positive sign for overall consumer spending in February and March, with service industries reopening after the Omicron wave.”

“The advance estimate for March suggested a 1.4% increase in nominal sales, however given the strong inflation reading for the month that figure is likely much weaker in volume terms.”

“Spending on goods appears to have been a solid contributor to overall GDP in Q1, despite the headwinds of mounting inflationary pressures and spending on services rebounding again after January's restrictions were lifted. However, the impact of surging inflation on household disposable incomes will likely be a stronger headwind to sales volumes in Q2 and beyond, particularly because we don’t believe the pool of excess household savings built up during the pandemic is quite as deep as commonly perceived.”

- US dollar extends gains on Friday as Wall Street tumbles.

- US yields are relatively steady in the recent range, near multi-year highs.

- EUR/USD heads for the lowest weekly close since March 2020.

The EUR/USD dropped further on Friday on the back of a stronger US dollar and printed a fresh four-day low at 1.0769. It remains near the lows, under pressure, and looking at the 1.0760 support area.

Dollar soars, Lagarde turns hawkish?

The US dollar printed fresh highs across the board late on Friday as US stocks added to losses. The DXY gains 0.63% and trades at 101.25, the highest since 2020. At the same time, US yields remains around the recent range, at multi-year highs. The expectations of a more aggressive tightening from the Fed continue to support the dollar, particularly after Fed Chair Jerome Powell's comments on Thursday.

European Central Bank President Christine Lagarde said on Friday that the central bank’s purchase programme could end in early Q3 and added, that interest rates could raise in 2022. Her words looked more hawkish compared to Thursday’s speech but did not help the euro.

Testing key zone

The slide of EUR/USD pushed it to a critical support area seen around 1.0760, slightly above the multi-year low hit on April 14. The euro needs to hold above in order to avoid a deterioration in the already negative technical outlook.

“A slide below the 1.0760 price zone should open the door for a test of 1.0635, the low posted in March 2020. Further slides below the latter expose the 1.0520 region en route to the multi-year low posted in January 2017 at 1.0339. On the other hand, the pair needs to clear 1.0920 to have chances of further recoveries, aiming for 1.1010 first and the 1.1100 area later”, explained Valeria Bednarik, Chief Analyst at FXStreet.

Technical levels

US Treasury Secretary Janet Yellen said in an interview on Bloomberg TV on Friday that it is worth considering steps to lower US tariffs on Chinese goods in order to ease inflation, and that there would be some "desirable effects" of lowering tariffs.

Speaking in a CNBC interview earlier in the day, Yellen stated on Friday that the US economy is being very resilient in the face of a set of shocks and noted that inflation may have peaked, but that Russia's invasion of Ukraine will prolong inflationary pressures.

- Major US equity indices looked set to end the week on the back foot and at lows on Friday.

- Traders cited concerns about global monetary tightening from major central banks as weighing on sentiment.

- The S&P 500 slumped over 1.5% to near 4,320.

Major US equity bourses tumbled for a second successive session on Friday and look on course to close out the week at fresh monthly lows, with traders citing hawkish remarks from Fed, ECB and BoE officials this week as continuing to weigh on sentiment. Recently released and weaker than expected flash US Service PMI results probably also aren't helping sentiment. The S&P 500 was last trading down about 1.7% and near the 4,320 level, taking its run of losses since Thursday’s highs above 4,500 to nearly 4.5%.

The index was last on course to post a third successive weekly loss of about 1.7% and has now convincingly relinquished its grip on the 50-Day Moving Average, which resides just above 4,400 and earlier weekly lows in the 4,370 area. The bears will now inevitably be eyeing a return to sub-4,200 annual lows, given the lack of notable support levels in the interim.

In terms of the other major US indices, the Nasdaq 100 was holding up a tad better and last trading down about 1.2% on the day but still above 13,500, amid some stabilisation in long-term yields. On the week, however, the massive jump in long-term yields has put the tech/growth stock heavy index under heavy selling pressure and the Nasdaq 100 looks on course to end the week about 2.5% lower, a third week of losses in a row.

Turning to the Dow, the index is currently the worst performer of the major US indices on the day having lost about 1.7% to fall from its 21DMA near 34,700 to under its 50DMA at 34,250. But on the week, it has held up better than its peers. Nonetheless, the index is still on course to post a negative weekly close (down about 0.75%), which would mark a fourth successive weekly loss.

Dow underperformance on the final day of the week can in part be explained by underperformance in the health care sector (which is heavily represented in the index) after hospital operator HCA Healthcare issued downbeat profit forecasts and tumbled over 15% as a result, weighing on the entire sector. But this goes against the general tone to earnings so far this season.

According to Refinitiv data cited by Reuters, of the 99 companies to have posted earnings so far, 77.8% have beaten analyst forecasts, above the long-term 66% average beat rate. Focus will remain on earnings next week and whether decent numbers could give the beaten-up market some reason to cheer. Mega cap companies like Microsoft, Amazon, Apple, Boeing, Ford and Exxon Mobil will all be reporting.

- Despite US Treasury yields falling, the USD/JPY gains 0.27%.

- Fed hawkish comments and BoJ’s dovish chatters lift the USD/JPY to positive territory.

- USD/JPY Price Forecast: It might be headed to a lower correction.

The USD/JPY posted modest gains early in the New York session, from around 128.69 highs, despite falling US Treasury yields and a risk-off market mood. At the time of writing, the USD/JPY is trading at 128.68.

Global equities are being damaged by a risk-off market mood, while most global bond yields rise, except in the US. On Thursday, in an IMF panel, Fed’s Chair Powell aligned with the hawk chorus led by St. Louis President James Bullard and said that a hike of 50 bps “is on the table for the May meeting,” while emphasizing that he favors “front-end loading” its tightening cycle. Powell added that the US central bank wouldn’t count on the supply side healing to help inflation, implying that the Fed is focused on the demand side.

Elsewhere, James Bullard, St. Louis Fed President, admitted that the Fed is behind the curve but not as everybody thinks while adding that the Fed has hiked 75 bps before without the world coming to an end.

Meanwhile, money market futures have priced in a 100% chance of a 50 bps increase in May and June meetings, while the odds of a 75 bps remain lower.

Aside from this, the Japanese Minister of Finance (MoF) Suzuki discussed the possibility of coordinated intervention in the FX markets with US Treasury Secretary Janet Yellen, as reported. The MoF Suzuki said that he discussed the abrupt moves in the yen with Yellen and that the two agreed to uphold existing FX agreements.

Of late, the Bank of Japan (BoJ) Governor Haruiko Kuroda said that the economy is not so vulnerable as to need more easing, emphasizing that until CPI reaches and stays above 2% in a stable manner, it will continue its current stance.

Data-wise, the Japanese docket features inflation, which came at 1.2% y/Y as expected, while the core Consumer Price Index (CPI) aligned with the estimations at 0.8% y/y. The S&P Global Flash US Manufacturing PMI rose by 59.7, higher than the 68.2 estimations, and smashed March’s figures on the US front.

USD/JPY Price Forecast: Technical outlook

Since the middle of the week, the USD/JPY consolidated in the 127.80-129.10 area. The YTD high at 129.10 appears to hold for now, but the Relative Strength Index (RSI) at 79.59 in overbought territory suggests a lower correction is on the cards.

If that scenario plays out, the USD/JPY first support would be April 20 daily low at 127.45. Break below would expose April 2001 cycle highs around 126.85, followed by April’s 12 daily high at 126.31.

Upwards, the USD/JPY first resistance would be 129.00. A breach of the latter would expose the YTD high at 129.10, followed by the 130.00 line of the sand, expressed by Mr. Yen.

- US dollar rises sharply across the board during the American session amid risk aversion.

- S&P 500 falls more than 1% for the second day in a row.

- USD/CHF accelerates to the upside, eyes 0.9600.

The USD/CHF is rising sharply, approaching 0.9600 on Friday, boosted by a stronger US dollar across the board. The DXY is up 0.60%, trading above 101.00, at the highest since March 2020.

More than a rally

The US dollar gained speed during the American session and boosted USD/CHF to 0.9590, the highest level since June 2020. It remains near the top, holding onto significant gains.

Expectations for a more aggressive tightening from the Federal Reserve continue to weigh on markets. In Wall Street, main indices are falling more than 1% for the second day in a row. US yields are relatively steady on Friday, holding near multi-year highs.

Economic data from the US came in mixed on Friday with the S&P Global PMI. The Manufacturing index rose unexpectedly to the strongest in nine-month while the Service sector indicator tumbled to the lowest in three months. Next week's data includes the first estimate of Q1 GDP.

Above the 200-week SMA

The USD/CHF is about to post the third weekly gain in a row, accumulating a gain of more than 300 pips. The weekly close will be the first one above the 200-week Simple Moving Average in two years.

USD/CHF weekly chart

In an interview on CNBC, US Treasury Secretary Janet Yellen stated on Friday that the US economy is being very resilient in the face of a set of shocks, reported Reuters. Inflation may have peaked, she noted, though noting also that Russia's invasion of Ukraine will prolong inflationary pressures.

The US will have to put up with high inflation for a while longer, she noted, saying that she knows the Fed will look carefully at data in responding to inflation. Yellen said there is a possibility that imposing import bans on Russian energy could drive oil prices higher throughout the global economy.

On China, Yellen noted that the US and its allies need to be careful that China doesn't undermine the impact of sanctions on Russia. This has not been the case so far, she noted, as China continuing to buy coal and oil from Russia is not a violation of sanctions.

European Central Bank President Christine Lagarde said on Friday that the bank's current Asset Purchase Programme (which is set to taper from EUR 40B in purchases this month to EUR 20B in June) is likely to end in early Q3, reported Reuters. Moreover, there is a strong chance that interest rates will be raised this year, she added.

Bank of England Governor Andrew Bailey on Friday remarked that the bank will only conduct active sales of assets on its balance sheet in stable market conditions and the bank will cease such operations if conditions change, reported Reuters. The BoE cannot have a constant ratchet upwards of its balance sheet, Bailey noted.

In a live IMF/World Bank meeting panel, Bank of Japan Governor Haruhiko Kuroda reiterated his dovish stance that, though Japan's inflation rate maybe around 2.0% for the time being, the BoJ should persistently continue with its current aggressive monetary easing in order to achieve its price target of 2.0% inflation in a sustainable manner, reported Reuters.

Additional Takeaways:

The rise of inflation in services has been limited, indicating that inflation in Japan has not been as widespread as in the US.

A rise in commodity prices leads to a net outflow of income from Japan's economy.

As Japan is a commodity importer, a rise in commodity prices pushes down on the economy through a decrease in households' real income and corporate profits.

Japan's output gap is still negative and economic overheating has not been of concern.

The BoJ's monetary policy should be to provide accommodative financial conditions and support the achievement of a full-fledged economic recovery.

Japan's economy seems to be more resilient against the rise in commodity prices than it was in 2008.

There is still ample room for pent-up demand to materialize as the impact of Covid-19 subsides.

Japan's inflation is expected to rise in the short run, but such a rise consists primarily of cost-push inflation and therefore lacks sustainability.

In Japan, it is unlikely that the current rise in commodity prices due to supply factors will immediately lead to a sustained rise in wages and prices.

The BoJ will continue to conduct policy under its existing framework of yield curve control.

Even with a cost-push shock like the current one, the BoJ has not faced the trade-off between prioritizing economic stability or price stability, unlike other central banks.

The BoJ's role in the current context is perfectly clear and it is to firmly support Japan's economic recovery.

The BoJ will carefully examine various risks, including Covid-19, and continue to conduct monetary policy appropriately under yield curve control.

Market Reaction

The yen has come under some selling pressure in recent trade in wake of the latest dovish remarks from Kuroda.

The People’s Bank of China (PBoC) appears reluctant to trigger further headline policy rate cuts. However, when most lockdowns are lifted, the central bank could resume monetary policy easing, weaking the Chinese yuan, economists at Société Générale report.

The yuan outlook is hinged on China’s monetary policy trajectory

“Mounting economic pains will pressure the government to relax its zero-Covid policy, and that by end April the lockdowns in Shanghai will be eased enough to allow supply chains to function nearly normally. If so, the PBoC could resume rate cuts to support the economy further, which would further weaken the yuan toward 6.50.”

“An overshoot to 6.70 or above cannot be ruled out, as the Fed is set to tighten aggressively. Besides, fiscal easing is underway, the credit impulse is picking up and infrastructure investment growth has started to reaccelerate.”

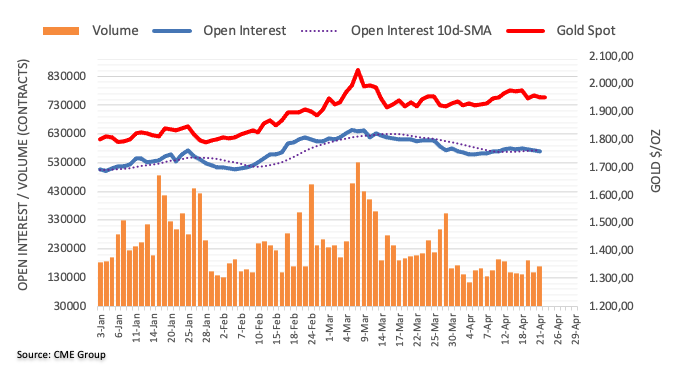

US yields are pushing up as the Federal Reserve deepened their hawkish tilt. Economists at TD Securities see few participants left with appetite to buy gold.

The right tail is narrow in gold

“Rates continue to reprice higher as the market pencils in another rate hike in 2022, pricing in ten additional hikes during the year, hinting at a larger overshoot of neutral.”

“Comex shorts have largely been wiped out, removing some fuel for price strength, while safe-haven flows have a historical tendency to dissipate. ETF flows also have a historical relationship with macro forces which argue for easing inflows and for the potential for significant outflows if the Fed can indeed reach neutrality at a fast pace and slow inflation.”

“The tug-of-war in precious metals is rather associated with the Fed's ability to do so, particularly given the slowing growth environment. With quantitative tightening only a few short weeks away, liquidity premia will continue to drive markets, but the threshold for significant CTA outflows remains elevated.”

- EUR/USD bounces off lows around 1.0790.

- German 10y bond yields approach the 1.00% yardstick.

- US flash Manufacturing PMI expected a tad higher in April.

The selling pressure remains well and sound around the single currency and keeps EUR/USD in the negative territory around the 1.0800 zone on Friday.

EUR/USD offered around 1.0800

No change to the offered stance in EUR/USD on Friday, although it managed to rebound from earlier losses in the 1.0790 area, always amidst the sharp recovery in the greenback and higher yields.

Despite US yields now give away part of the earlier advance, the German 10y bund yields remain firm and gradually approach the key barrier at 1.00%, an area last visited in June 2015.

Chair Lagarde spoke in Washington, D.C. earlier in the session, although she made no remarks on monetary policy.

In the euro calendar, advanced Manufacturing PMI in Germany and the EMU is expected at 54.1 and 55.3 for the current month. In the US, the manufacturing gauge is seen improving to 59.7 in the same period.

What to look for around EUR

EUR/USD’s price action shows further deterioration below the 1.0800 key support at the end of the week. The outlook for the pair still remains tilted towards the bearish side, always in response to dollar dynamics, geopolitical concerns and the Fed-ECB divergence. As usual, occasional pockets of strength in the single currency should appear reinforced by speculation the ECB could raise rates before the end of the year, while higher German yields, elevated inflation, the decent pace of the economic recovery and auspicious results from key fundamentals in the region are also supportive of a rebound in the euro.

Key events in the euro area this week: EMU, Germany Flash Manufacturing, Services PMIs (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Second round of the presidential elections in France (April 24). Impact on the region’s economic growth prospects of the war in Ukraine.

EUR/USD levels to watch

So far, spot is down 0.19% at 1.0809 and a break below 1.0757 (2022 low April 14) would target 1.0727 (low April 24 2020) en route to 1.0635 (2020 low March 23). On the upside, the next hurdle appears at 1.0936 (weekly high April 21) seconded by 1.1000 (round level) and finally 1.1064 (55-day SMA).

- Manufacturing PMI was a little stronger than expected, but Services PMI was much weaker than expected.

- The Dollar Index (DXY) did not react to the latest PMI data release.

IHS Markit's headline Manufacturing PMI rose to 59.7 in April from 58.8 in March, above expectations for a slight decline to 58.2, according to a flash estimate released on Friday.

Conversely, the headline Services PMI, fell to 54.7 from 58.0, much worse than expectations for it to remain unchanged at 58.0 in April. That dragged the Composite PMI down to 55.1 in April from 57.7 in March, larger than the expected drop to 57.0.

Market Reaction

The Dollar Index (DXY) did not react to the latest PMI data release.

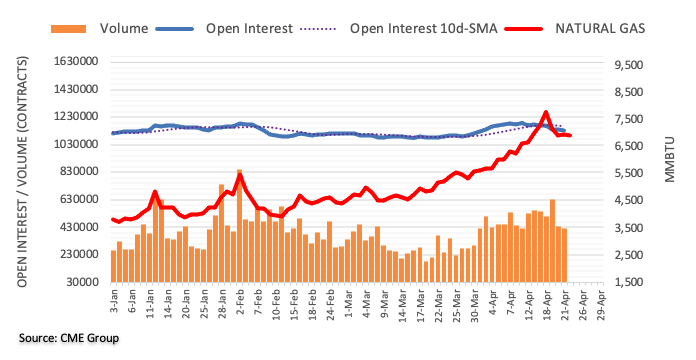

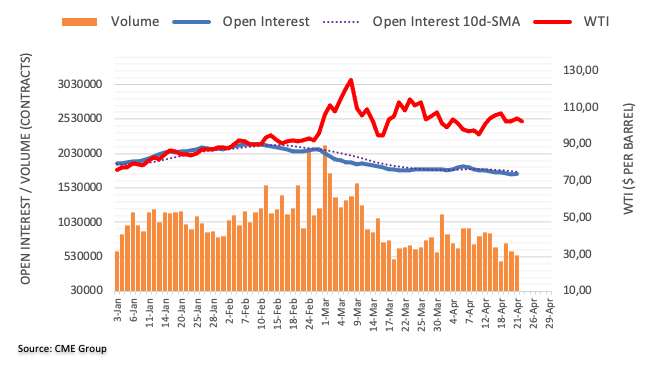

- WTI trades a few dollars lower on Friday but is within recent intra-day ranges in the low $100s.

- Amid a lack of fresh developments, oil traders are mulling various oil market-relevant themes.

Crude oil prices continue to trade in uneventful fashion, with front-month WTI futures stuck within their intra-day ranges of the last few days in the low $100s, as traders mull various conflicting themes. At current levels of just under $102 per barrel, WTI trades with losses of a little over $2.0 on the day, with the crude oil bears eyeing a test of weekly lows at almost bang on $100. For now, though, WTI seems unwilling to relinquish the 21 and 50-Day Moving Averages, both of which reside in the $102.00s and have been acting as a magnet to the price action recently.

There haven’t been any fresh major developments amongst the major various themes affecting oil markets on Friday. On the bullish side, Russo-Ukraine peace talks still look stuck according to Russian President Vladimir Putin’s latest remarks and Western nations continue to fan tensions with Moscow by funneling more weapons to Ukraine and with the EU still mulling a blanket Russia oil import ban.

Meanwhile, OPEC+ supply woes remain in focus, with Russian oil output expected to fall precipitously this and next month (due to sanctions) whilst other smaller OPEC+ producers continue to struggle to keep up with recent output quota hikes. Libya has been in focus this week after political instability-related blockades saw output drop by 550K barrels per day this week.

Meanwhile, on the bearish side, concerns about a slowdown in global growth following more downbeat outlooks from the IMF and World Bank and amid a ramping up in central bank tightening bets have been in focus this week. Oil market participants have thus been downgrading their assessment for demand growth this year, with concerns further exaccerbated as lockdowns in Shanghai and other parts of the country drag on.

- A combination of supporting factors pushed USD/CAD to a multi-week high on Friday.

- Weaker oil prices undermined the loonie and remained supportive amid stronger USD.

- The fundamental backdrop favour bulls and supports prospects for additional gains.

The USD/CAD pair maintained its strong bid tone through the early North American session and was last seen trading near the 1.2680-1.2685 region, or the highest level since March 17.

The pair built on the previous day's solid rebound of over 130 pips from over a two-week low and gained strong follow-through traction for the second successive day on Friday. The momentum pushed the USD/CAD pair beyond a technically significant 200-day SMA and was sponsored by a combination of factors. The US dollar shot to a fresh 25-month high amid the prospects for a more aggressive policy tightening by the Fed. On the other hand, weaker crude oil prices undermined the commodity-linked loonie and acted as a tailwind for spot prices.

Fed Chair Jerome Powell sent a clear hawkish message on Thursday and said that a 50 bps interest rate increase will be on the table at the upcoming FOMC policy meeting on May 3-4. Powell also hinted at consecutive increases this year and the market was quick to price in three jumbo rate hikes this year. This, in turn, pushed the yield on the rate-sensitive 5-year US government bond above 3% for the first time since 2018. Moreover, the 10-year real yields turned positive for the first time in two years and continued boosting the buck.

Apart from this, the prevalent risk-off mood - as depicted by a generally weaker tone around the equity markets - was seen as another factor that benefitted the safe-haven greenback. Bulls seemed rather unaffected by better-than-expected Canadian Retail Sales data, which rose by 0.1% MoM in March. This, however, marked a sharp deceleration from February's strong 3.3% MoM growth and did little to provide any respite to the Canadian dollar. Hence, a further intraday appreciating move, beyond the 1.2700 mark, remains a distinct possibility.

Technical levels to watch

GBP/USD crashes through 1.30 and 1.29. Economists at Scotiabank expect cable to extend its slump towards the 1.28 level.

Psychological resistance stands at the mid -1.29s

“The pound’s multiple tests of 1.30 finally managed to break under the figure today and the 1.28 level now stands as the next clear target in its negative trend extending back to last summer.”

“The intraday low of 1.2862 is support after the 1.29 area.”

“Psychological resistance stands at the mid -1.29s followed by the 1.30 zone.”

The strong USD is hitting the CAD with a 0.8% loss on the day to trade into the high-1.26s. A weekly above above 1.2650 would signal further gains ahead to a test of the 1.27 level, economists at Scotiabank report.

Support after the mid-1.26s is the big figure

“A close above the 1.2650 mark for the week would signal further gains ahead to a test of the 1.27 level in the coming days.”

“Support after the mid-1.26s is the big figure.”

GBP/USD is underperforming on weak economic data and tested the November 2020 low near 1.2855. Economists at BBH expect cable to extend its slide towards the September 2020 low near 1.2675.

UK reported weak March retail sales data

“Headline sales came in at -1.4% MoM vs. -0.3% expected and a revised -0.5% (was -0.3%) in February, while sales ex-auto fuel came in at -1.1% MoM vs. -0.4% expected and a revised -0.9% (was -0.7%) in February.

“Manufacturing came in at 55.3 vs. 54.0 expected and 55.2 in March, services came in at 58.3 vs. 60.0 expected and 62.6 in March, and the composite PMI came in at 57.6 vs. 58.7 expected and 60.9 in March.”

“It’s clear from today’s data that the economy was already slowing before we moved into Q2, which will bring even greater headwinds that include hikes in payroll taxes and the cap on household energy costs.”

“Cable continues to sink and traded today at a new low for this move near 1.2860, just above the November 2020 low near $1.2855. Further losses are likely and a break below that low would target the September 2020 low near 1.2675.”

- EUR/USD comes under pressure and revisits the sub-1.0800 zone.

- Occasional bullish moves face a decent barrier near 1.0940.

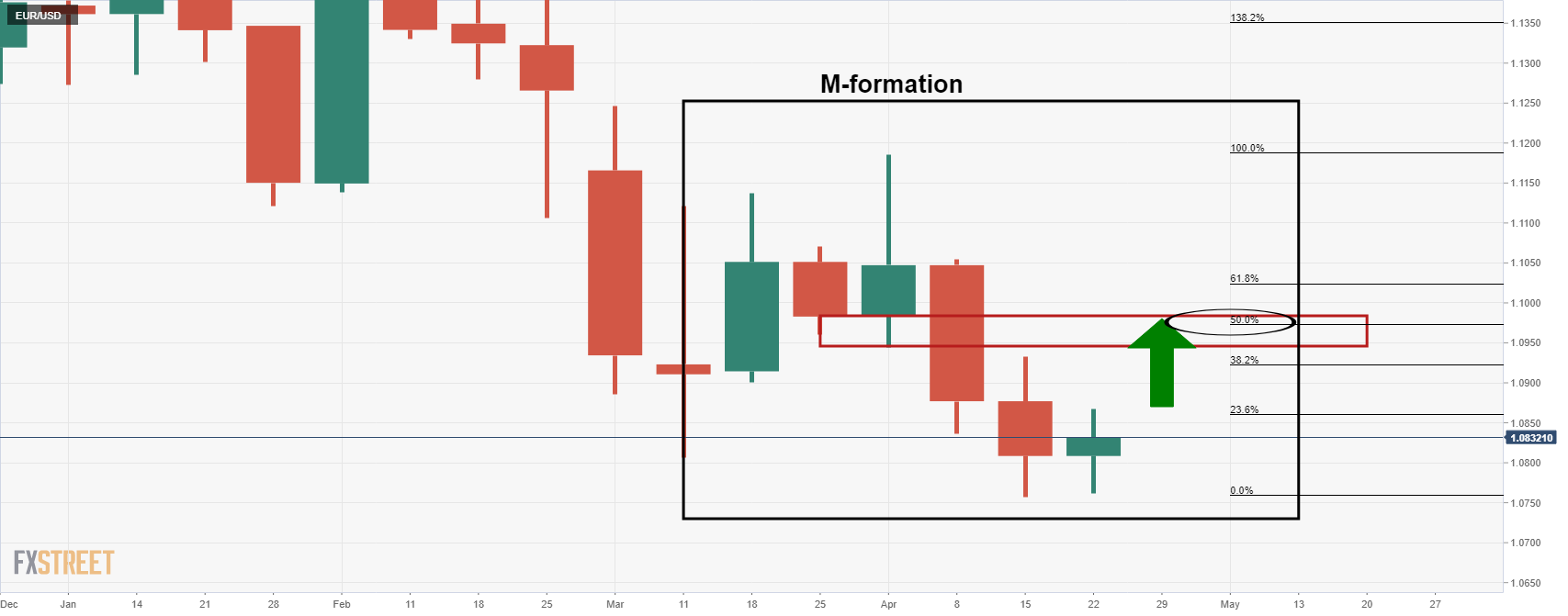

EUR/USD extends the rejection from the 1.0940 region and briefly breaks below the key support at 1.0800 on Friday.

It seems that while the 1.0940 region keeps capping the upside, further retracement looks likely in the pair in the short-term horizon. Against that, there is still room for EUR/USD to retest the 2022 lows near 1.0750.

While below the 200-day SMA, today at 1.1410, the outlook for the pair is expected to remain negative.

EUR/USD daily chart

EUR/USD has sharply corrected its drive through 1.09 yesterday to briefly trade under the 1.08 level before climbing marginally back above the figure. Economists at Scotiabank expect the pair to extend its decline.

Odds are the EUR/USD gaps higher at the Monday open

“Sunday’s French presidential elections are the next key risk on the horizon for the EUR, but with odds rising that Macron defeats Le Pen, odds are the EUR gaps higher at the Monday open; only modest gains should be expected, however, as Macron’s lead has held up since the first round.”

“Continued re-tests of the 1.08 zone throughout this week point to the EUR’s downtrend extending below the figure with an eye for the next psychological support zone at the 1.07 mark, after intermediate support at ~1.0760, followed by the 2020 low of 1.0636.”

“Resistance is ~1.0850 and the 1.09 area.”

- DXY adds to the optimism seen in the second half of the week.

- Further north of the YTD peak at 101.06 comes 103.00.

DXY pushes higher and clinches fresh 2022 highs in the 101.05/10 band on Friday.

The sharp rebound from the 99.80 region (April 21) carries the potential to extend further. Against that, the breakout of the so far 2022 high at 101.06 (April 22) on a convincing fashion could motivate the index to attempt a visit to the 2020 high at 102.99 (March 20).

The current bullish stance in the index remains supported by the 7-month line near 96.60, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 95.45.

DXY daily chart

- NZD/USD is down another 0.8% to the 0.6675 region amid a risk-off backdrop and a strong buck.

- NZD/USD is trading at its weakest since late February and is down roughly 2.0% versus earlier weekly highs above 0.6800.

Though by no means the worst-performing of the major risk-sensitive G10 currencies, the kiwi is nonetheless suffering amid a combination of weakness in the European equity space and strength in the US dollar as markets digest recent hawkish central bank chatter. NZD/USD was last trading down about 0.8% on the day near the 0.6675 level and at its lowest levels since late February, a roughly 2.0% reversal lower from earlier weekly highs above 0.6800 when the pair tested its 50-Day Moving Average.

On which note, technical selling as a result of the earlier failure to break back above the 50DMA is another factor to consider as to why the pair has come under such intense selling pressure over the past two days. Thursday’s not as hot as feared Q1 2022 New Zealand Consumer Price Inflation report likely also didn’t help the kiwi’s cause, given that it has (very slightly) taken the pressure off the RBNZ to raise interest rates as aggressively in the coming quarters.

Of course, an admittedly small reduction in RBNZ tightening bets comes at a time when major US banks are falling over themselves to hawkishly revise their Fed policy calls for the next few meetings. In wake of remarks from various Fed policymakers including Chairman Jerome Powell over the last few days, the consensus view on Wall Street now appears to be that the Fed will raise rates by at least 50 bps at its next three meetings, and might go 75.

Risk appetite in the global equity space is ropey as a result, not least because ECB policymakers have also been talking about possible rate hikes as soon as July this week, and this makes for an unfavourable backdrop for NZD/USD. Bears will likely be eyeing a test of support in the form of the late February lows at 0.6630 in the coming sessions. Before FX markets wind down for the weekend, flash April PMI survey results for the US are released at 1445BST and could trigger some FX market volatility.

- AUD/USD dropped to a fresh multi-week low, around the 200-day SMA on Friday.

- The technical setup supports prospects for a further near-term depreciating move.

- Sustained move beyond the 0.7400 mark is needed to negate the bearish outlook.

The AUD/USD pair witnessed heavy selling for the second successive day on Friday and tumbled to its lowest level since March 17 during the mid-European session. The pair was last seen trading flirting with the very important 200-day SMA, around the 0.7300 round-figure mark.

The overnight sustained break below the 0.7355-0.7350 confluence, comprising an ascending trend-line extending from the YTD low and the 50-day SMA, was seen as a key trigger for bearish traders. Moreover, technical indicators on the daily chart have just started drifting into negative territory and support prospects for further losses.

Acceptance below a technically significant moving average will reaffirm the bearish outlook and prompt fresh selling, paving the way for a slide towards the 0.7250 region. The AUD/USD pair could extend the downward trajectory and drop below the 0.7200 mark, towards testing the next relevant support near the 0.7175-0.7165 region.

On the flip side, the 0.7350-0.7355 confluence support breakpoint should now cap any attempted bounce. Subsequent move up is more likely to attract fresh selling and fizzle out near the 0.7400 mark. The latter should act as a pivotal point for short-term traders, which if cleared decisively could trigger a short-covering rally.

The AUD/USD pair could then accelerate the momentum towards the weekly high, around the 0.7455-0.7460 region. The upward trajectory could further get extended and allow bulls to aim back to reclaim the 0.7500 psychological mark.

AUD/USD daily chart

-637862289565788736.png)

Key levels to watch

- EUR/JPY alternates gains with losses around 139.00.

- Above 140.00 comes the 141.05 level (June 2015).

EUR/JPY seems to have moved into a consolidative phase following recent cycle peaks around 140.00 (April 21).

The continuation of the uptrend looks the most likely scenario for the time being, although some consolidation appears in the pipeline first. That said, if the cross clears 140.00, then the focus of attention will be on the June 2015 high at 141.05. Beyond this level, there are no hurdles of note until the 2014 high at 149.78 (December 2014).

In the meantime, while above the 200-day SMA at 130.52, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

Russian President Vladimir Putin held a call with European Council President Charles Michel earlier on Friday and, according to Russian news agency Tass (cited by Reuters).

Putin reportedly told Michel that the possibility of him holding direct talks with Ukrainian President Volodymyr Zelenskyy depends on concrete results of talks between the two sides' negotiating teams. Kyiv is showing it is not ready to seek a mutually acceptable solution, Putin told Michel.

Michel on Wednesday visited Kyiv and pledged that the EU will give a further EUR 1.5B in military aid to Ukraine.

- GBP/USD continues to trade below 1.2900 and eye a test of November 2020 lows at 1.2850.

- The slid from above 1.3000 in wake of poor UK Retail Sales, Consumer Confidence and PMI data earlier this session.

- Further evidence of weak consumption/consumer sentiment undermines the argument for further aggressive BoE tightening this year.

GBP/USD continues to trade to the south of the 1.2900 level ahead of the start of US trade, with the pair having dumped more than 1.0% from above 1.3000 earlier in the morning following abysmal UK data. The pair hit its lowest since Q4 2020 in the 1.2960s at one point and came close to testing November 2020 lows at 1.2950. Longer-term bears might now wait for the pair to retrace back towards the upper 1.2900s and look to test support turned resistance just under 1.3000 before adding to short positions once again.

To recap Friday’s UK data, Retail Sales collapsed 1.4% MoM in March, much larger than the expected 0.3% MoM decline, while UK GfK Consumer Confidence in April printed its second-worst reading since records began 50 years ago. Flash April PMI survey results also missed expectations across the board, with the batch of data out on Friday together collectively reflecting the impact of a worsening cost-of-living crisis in the UK as consumers are squeezed on all angles by falling real wages and higher taxes.

Analysts warned that consumer health and consumption in the UK could fall further later this year, which could undermine the case for significant further policy tightening from the BoE, where policymakers are becoming more and more concerned about economic weakness as a result of the cost-of-living squeeze.

Analysts have been warning for some time that money market pricing, which currently points to another 167bps of BoE rate hikes this year, is excessive. As this becomes more and more the market’s consensus view, the case for a sustained break back above 1.3000 for GBP/USD is significantly weakened.

Growing discontent with the UK PM Boris Johnson within his Conservative party is another theme that could provide some downside risks for the pound. Some of the party’s MPs have reportedly been drafting so-called “no confidence” letters to submit if regional election in May go badly (as expected), in wake of the PM being fined by the police over the “partygate” scandal where he broke his own lockdown rules.

Headline Retail Sales in Canada rose by 0.1% MoM in March, according to the latest figures released by Statistic Canada on Friday, above expectations for a 0.4% MoM decline. March's 0.1% growth rate marked a substantial slowdown from February's strong 3.3% MoM growth rate, which was revised a tad higher from 3.2%.

The headline beat was driven by a large beat on expectations in Core Retail Sales growth in March. Core Retail Sales grew 2.1% MoM versus expectations for a much more modest growth rate of 0.1%, marking only a modest decline from February's 2.9% growth rate.

Market Reaction

USD/CAD saw some modest kneejerk weakness in wake of the latest robust Canadian retail sales numbers, pulling back a few pips from session highs in the 1.2680s, but the pair continues to trade with significant on-the-day gains and near one-month highs given risk-off flows and a strong US dollar.

- USD/JPY struggled to gain traction and oscillated in a range on the last day of the week.

- A combination of factors benefitted the safe-haven JPY and capped any meaningful gains.

- Aggressive Fed rate hike bets pushed the USD to a two-year peak and extended support.

The USD/JPY pair seesawed between tepid gains/minor losses through the mid-European session and now seems to have stabilized just below mid-128.00s.

A combination of diverging forces failed to provide any meaningful impetus to the USD/JPY pair and led to subdued/range-bound price action on the last day of the week. Investors now seem worried that Japan would intervene to support its currency, along with a weaker risk tone, underpinned the safe-haven Japanese yen. This, in turn, acted as a headwind for spot prices, though rising US Treasury bond yields lifted the US dollar to a fresh two-year high and offered some support.

Fed chair Jerome Powell on Thursday all but confirmed a 50 bps rate hike at the upcoming policy meeting on May 3-4 and also hinted at consecutive increases this year. The markets were quick to price in three jumbo rate hikes this year, which, in turn, pushed the yield on the rate-sensitive 5-year US government bond above 3% for the first time since 2018. Moreover, the 10-year real yields turned positive for the first time in two years and continued underpinning the greenback.

In contrast, the Bank of Japan on Wednesday offered to buy unlimited amounts of Japanese government bonds to defend the 0.25% yield cap for the third time since February. Moreover, the BoJ has repeatedly said that it remains ready to use powerful tools to avoid long-term interest rates from rising too much and sustain the current powerful monetary easing to support economic recovery. The resultant Fed-BoJ policy divergence further extended support to the USD/JPY pair.

The fundamental backdrop favours bullish traders and supports prospects for an extension of the strong appreciating move. That said, extremely overbought conditions on daily/weekly/monthly charts warrant some caution. Next on tap will be the release of the flash US PMI prints. This, along with the US bond yields, the US bond yields and the market risk sentiment will influence the USD/JPY pair.

Technical levels to watch

- Recent US bond yields and dollar upside has weighed heavily on silver.

- XAG/USD hit fresh one-month lows and came close to hitting $24.00 earlier but has since recovered to near $24.30.

- The bears are eyeing a break under $24.00 and a test of the 200DMA at $23.87 just below it.

Recent upside in US and global government bond yields, catalysted primarily by hawkish Fed commentary on Thursday from Chairman Jerome Powell and other bank policymakers, plus further upside in the US dollar that has seen the DXY momentarily hit fresh annual highs above 101.00 has weighed heavily on spot (XAG/USD) silver prices on Friday.

XAG/USD at one point went as low as $24.05 per troy ounce to print fresh lows for the month and eye March’s lows at $23.97, but has since rebounded back to around $24.30, where it still trades with on the day losses of about 1.4%. The rebound from lows was facilitated by a pullback in the DXY to the 100.80s, and amid buying ahead of the 200-Day Moving Average at $23.87.

The Fed will enter blackout this weekend ahead of the 3-4 May policy meeting. Various banks have been upping their calls for Fed tightening in recent days in wake of recent rhetoric, with Nomura notably calling for a 50 bps move in May followed by two 75 bps hikes at the next two meetings in June and July.

While there won’t be fresh Fed rhetoric to pump expectations for tightening before the next meeting, that doesn’t mean US yields and the US dollar won’t continue trading with an upside bias, as has been the case now for many consecutive weeks. Should that continue, a breakdown in XAG/USD below the $24.00 level and its 200DMA is on the cards. Looking ahead, a potential catalyst for some price action could come in the form of Friday’s flash US PMI survey results for April, which are scheduled for release at 1445BST.

The BoJ is expected to confirm its accommodative policy once again at its meeting later in the month, suggested Lee Sue Ann, Economist at UOB Group.

Key Takeaways

“In a stark divergence with its G7 peers, the BoJ kept its preference for easing (“it expects short and long-term policy interest rates to remain at their present or lower levels”).”

“With inflation large stemming from an uncertain supply shock while domestic demand remains weak, we are certain that the BoJ will keep its current easy monetary policy intact for 2022 and will maintain its massive stimulus, possibly at least until FY2023.”

Economist at UOB Group Lee Sue Ann reviews the latest inflation figures in New Zealand.

Key Takeaways

“CPI climbed 1.8% q/q in 1Q22, an increase from 1.4% q/q in 4Q21. Compared to the same period a year ago, CPI advanced 6.9% y/y, an acceleration from 5.9% y/y in 4Q21. This is the largest movement since a 7.6% annual increase in the Jun 1990 quarter.”

“The latest inflation readings bolster the case for the Official Cash Rate (OCR) to be lifted further. Earlier this week (19 Apr), Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr said that further tighening is needed.”

“We think that it is now likely that the RBNZ will hike by another 50bps at the May meeting, which will include the release of a Monetary Policy Statement (MPS). From there, the RBNZ may pause at the 13 Jul meeting, before moving again in Aug (after having had more data at hand, including 2Q22 CPI data due on 18 Jul).”

- EUR/USD loses further momentum and breaches 1.0800.

- Germany, EMU flash PMIs came in a mixed tone in April.

- ECB Lagarde speaks later in the European afternoon.

The selling bias in the European currency picks up pace and drags EUR/USD back below the 1.0800 area at the end of the week.

EUR/USD depressed on USD-buying

EUR/USD adds to Thursday’s pullback and recedes further after climbing as high as to the 1.0940 zone in the previous session.

Indeed, the re-emergence of the bid bias in the greenback put the pair under renewed and quite strong downside pressure following another hawkish message from Chief Powell at his speech at the IMF event on Thursday.

The so far downtick in spot comes pari passu with further upside in US and German yields, particularly in the short end and the belly of the curve. In the German cash market, the 10y bund yields trade at shouting distance from the key 1.00% barrier, an area last visited back in June 2015.

Data wise in the euro bloc, preliminary readings for the Manufacturing and Services PMIs in Germany and the Euroland came in mixed for the month of April. Still in the region, Chair Lagarde is also due to speak later on Friday.

Across the pond, flash PMIs for the current month will also be published.

What to look for around EUR

EUR/USD’s price action shows further deterioration below the 1.0800 key support at the end of the week. The outlook for the pair still remains tilted towards the bearish side, always in response to dollar dynamics, geopolitical concerns and the Fed-ECB divergence. As usual, occasional pockets of strength in the single currency should appear reinforced by speculation the ECB could raise rates before the end of the year, while higher German yields, elevated inflation, the decent pace of the economic recovery and auspicious results from key fundamentals in the region are also supportive of a rebound in the euro.

Key events in the euro area this week: EMU, Germany Flash Manufacturing, Services PMIs (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Second round of the presidential elections in France (April 24). Impact on the region’s economic growth prospects of the war in Ukraine.

EUR/USD levels to watch

So far, spot is down 0.26% at 1.0803 and a break below 1.0757 (2022 low April 14) would target 1.0727 (low April 24 2020) en route to 1.0635 (2020 low March 23). On the upside, the next hurdle appears at 1.0936 (weekly high April 21) seconded by 1.1000 (round level) and finally 1.1064 (55-day SMA).

- Gold Price remains vulnerable amid hawkish Fed, firmer USD and yields.

- Fed Chair Powell suggested aggressive tightening going forward.

- Friday’s closing is critical for XAUUSD’s bullish traders after the decline.

Gold Price remains weighed down by the narrative of an increasingly hawkish Fed, which got a boost after the central bank President Jerome Powell talked up front-loading rate hikes. The US dollar continues to follow its northward trajectory, piggy-backing the Treasury yields while no progress on the Russia-Ukraine crisis also offers support. Technically, XAUUSD needs a daily close above the SMA21 one-day to reverse the downtrend. Will that materialize?

Also read: Gold Price Forecast: Weekly close above 21-DMA is critical for XAUUSD buyers

Gold Price: Key levels to watch

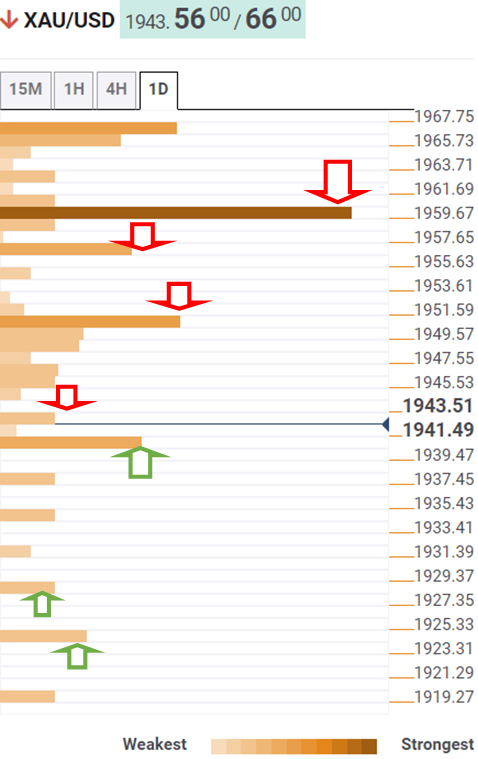

The Technical Confluences Detector shows that gold price is looking to attempt a minor recovery, as it challenges the Fibonacci 23.6% one-day at $1,943, at the moment.

If buyers manage to take over control, then Gold Price could recover further to test $1,950, a powerful confluence of the SMA200 four-hour and Fibonacci 61.8% one-day.

Acceptance above the latter will expose the Fibonacci 61.8% one-week level at $1,956. The last line of defense for XAUUSD sellers is envisioned at $1,960.

At that level, the previous year’s high, SMA10 one-day and Fibonacci 61.8% one-month coincide.

On the downside, the immediate support line is seen at the previous week’s low of $1,940, below which the SMA50 one-day at $1,935 will come into play.

Further down, the pivot point one-day S2 at $1,928 could get tested on selling resurgence. The next downside cap awaits at the pivot point one-week S2 at $1,924.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

- USD/CAD gained strong positive traction for the second successive day on Friday.

- Weaker oil prices undermined the loonie and acted as a tailwind amid stronger USD.

- Investors look forward to Canadian Retail Sales, flash US PMIs for a fresh impetus.

The USD/CAD pair added to its intraday gains and shot to its highest level since March 17, around the 1.2680 region during the first half of the European session.

A combination of factors assisted the USD/CAD pair to build on the overnight solid rebound from over a two-week low and gain strong follow-through traction for the second successive day on Friday. A softer tone around crude oil prices undermined the commodity-linked loonie. This, along with broad-based US dollar strength, acted as a tailwind for spot prices.

Investors remain worried about slowing fuel demand in the wake of COVID-19 lockdowns in China - the world's biggest oil importer - and the prospect of weaker global growth. This, to a larger extent, overshadowed concerns about tight global supply and a potential European Union (EU) embargo on Russian gas, which, in turn, prompted fresh selling around crude oil.

On the other hand, the US dollar climbed to its highest level since March 2020 and continued drawing support from expectations for a more aggressive policy tightening by the US central bank. In fact, Fed Chair Jerome Powell all but confirmed a 50 bps rate hike at the upcoming policy meeting on May 3-4 and also hinted at consecutive increases this year.

The markets were quick to react and started pricing in three straight 50 bps rate hikes, which, in turn, pushed the rate-sensitive 5-year US government bond above 3% for the first time since 2018. The selloff in the US fixed income markets continued on Friday. This, along with the risk-off impulse, further boosted demand for the safe-haven greenback.

Market participants now look forward to the Canadian monthly Retail Sales and the flash US PMI prints for a fresh impetus during the early North American session. Apart from this, the US bond yields and the broader market risk sentiment will influence the USD. Traders will further take cues from oil price dynamics for short-term opportunities around the USD/CAD pair.

Technical levels to watch

- GBP/USD witnessed aggressive selling on Friday and plunged to its lowest level since November 2020.

- Dismal UK Retail Sales weighed heavily on sterling and exerted pressure amid sustained USD buying.

- Technical selling below the 1.3000 round-figure further accelerated the intraday bearish momentum.

The GBP/USD pair came under intense selling pressure on the last day of the week and tumbled to its lowest level since November 2020 during the first half of the European session.

The British pound weakened across the board in reaction to the disappointing release of the UK monthly Retail Sales figures and failed to gain any respite from mixed PMI prints. This, along with strong pickup in the US dollar demand, further aggravated the bearish pressure surrounding the GBP/USD pair.

From a technical perspective, sustained weakness below the 1.3000 psychological mark was seen as a key trigger for bearish traders and prompted aggressive technical selling. The subsequent breakthrough the 1.2900 round figure now seems to have set the stage for a further near-term depreciating move. The negative outlook is reinforced by the fact that technical indicators on the daily chart are holding deep in bearish territory. That said, RSI on hourly charts is already flashing extremely oversold conditions, warranting caution for aggressive traders and positioning for further intraday losses.

Nevertheless, the GBP/USD pair seems vulnerable to prolonging a near one-month-old descending trend and accelerating the slide further towards the next relevant support near the mid-1.2800s. Bears might then aim to test October 2020 low, around the 1.2820 region, which could act as a near-term base. On the flip side, any meaningful recovery attempt back above the 1.2900 round-figure mark now seems to confront stiff resistance and remain capped near the previous YTD low, around the 1.2970-1.2975 area.

GBP/USD 4-hour chart

-637862145291897929.png)

Key levels to watch

The EUR/USD pair continues to edge lower toward 1.08. In case buyers fail to defend this level, the shared currency is likely to suffer additional losses ahead of the weekend, FXStreet’s Eren Sengezer reports.

Euro's sharp reversal a bad sign for bulls

“Unless the market mood improves in the second half of the day, EUR/USD might find it difficult to stage a recovery.”

“On the downside, 1.08 (psychological level) aligns as the first support. In case this level turns into resistance, further losses toward 1.0760 (post-ECB low) and 1.0730 (April 24, 2020, low) could follow.”

“1.0830 (20-period SMA, 50-period SMA) forms the initial resistance ahead of 1.0850 (Fibonacci 23.6% retracement of the April downtrend) and 1.0880 (100-period SMA).”

50 basis points rate hikes will be on the table at the upcoming Federal Reserve (Fed) meetings. However, Gold Price is showing its strength against this backdrop, economists at Commmerzbank report.

Gold bucks rising interest rate expectations

“Gold is presumably being kept in check primarily by the rising bond yields. After dipping briefly, yields on ten-year US Treasuries are nearing the 3% mark again. The increased yields probably also reflect the higher interest rate expectations.”

“Judging by the Fed Fund Futures, the market is now anticipating a big rate hike at the next meeting. The interest rate expectations for the subsequent meetings have also risen noticeably – with rate hikes of nearly 50 basis points priced in for the meetings in June, July and September. The fact that gold is not falling or indeed coming under serious pressure against this backdrop is a sign of strength.”

“It seems that market participants do not entirely believe that the Fed will succeed in getting inflation under control with the expected rate hikes. Furthermore, they appear concerned that the Fed will strangle the economy by following an overly aggressive course.”

USD/JPY remains side-lined and is expected to trade between 126.90 and 129.40 in the next weeks, commented FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang.

Key Quotes

24-hour view: “We expected USD to ‘consolidate and trade sideways between 127.40 and 128.80’ yesterday. USD subsequently traded between 127.71 and 128.70. The price actions still appear to be part of a consolidation even though the slightly firmed underlying tone suggests a higher trading range of 128.00/129.00.”

Next 1-3 weeks: “Our view from yesterday (21 Apr, spot at 128.20) still stands. As highlighted, USD has likely moved into a consolidation phase and is expected to trade within a range of 126.90/129.40 for now.”

- The index adds to Thursday’s advance around 101.00.

- US yields extend the upside on Thursday.

- Flash April PMIs will be the salient event later in the session.

The greenback, in terms of the US Dollar Index (DXY), extends the bounce in the second half of the week and flirts with the key 101.00 mark on Friday.

US Dollar Index up on Fed, yields, geopolitics

The index is up for the second session in a row and already tests the boundaries of the 101.00 hurdle at the end of the week in a context dominated by renewed weakness in the risk complex, higher US yields and increasing geopolitical tensions.

Indeed, yields in the short end of the curve climb to new cycle peaks and approach the 2.80% area for the first time since December 2018, while the 10y benchmark note yields trade close to the 3.00% mark, also in levels last seen in late 2018.

The dollar saw its buying interest reinvigorated following the speech by Chair Powell at the IMF event on Thursday, when he practically confirmed a 50 bps rate hike at the May gathering. This view has been also underpinned by other members of the FOMC in past sessions.

The geopolitical landscape shows no progress amidst the utter absence of a diplomatic attempt to negotiate a solution to the conflict.

In the US docket, the preliminary figures for the Manufacturing and Services PMIs will be the only publications of note later in the NA session.

What to look for around USD

The dollar faces renewed buying interest and challenges the 2022 highs past the 101.00 barrier. So far, the greenback’s price action continues to be dictated by the likeliness of a tighter rate path by the Fed as well as geopolitics. In addition, the case for a stronger dollar also remains well propped up by high US yields and the solid performance of the US economy.

Key events in the US this week: IMF World/Bank Spring Meetings, Flash Services/Manufacturing PMIs (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is advancing 0.39% at 101.02 and the breakout of 101.91 (high March 25 2020) would open the door to 102.00 (round level) and finally 102.99 (2020 high March 20). On the other hand, initial contention emerges at 99.57 (weekly low April 14) followed by 97.68 (weekly low March 30) and then 97.24 (100-day SMA).

- UK Manufacturing PMI rises to 55.3 in April, a big beat.

- Services PMI in the UK comes in at 58.3 in April, misses estimates.

- GBP/USD pierces through 1.2900 on mixed UK PMIs.

The seasonally adjusted S&P Global/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) rose to 55.3 in April versus 54.0 expected and 55.2 – in March’s final reading.

Meanwhile, the Preliminary UK Services Business Activity Index for April dropped sharply, arriving at 58.3 versus March’s final readout of 62.6 and 60.0 expected.

Chris Williamson, Chief Business Economist at S&P Global, commented on the survey

“The survey data signal a marked cooling in the pace of UK economic growth during April, caused by an abrupt slowing in demand. Orders received by manufacturers have almost stalled, driven by an increasing loss of exports, and growth of demand for services has slumped to among the weakest since the lockdowns of early 2021.”

“High prices and the associated rising cost of living were often cited as a principal cause of lower demand, with covid also continuing to affect many businesses. Brexit and transport delays were seen as having further impeded export sales, while the Ukraine war and Russian sanctions also led to lost overseas trade.”

FX implications

The slowest rise in UK private sector output for three months in April puts the BOE in a tricky position, exacerbating the pain in the GBP.

Therefore, GBP/USD accelerated its decline and briefly breached the 1.2900 level on the data release.

At the time of writing, the pair is trading at 1.2902, down roughly 1% on the day.

- EUR/GBP gained strong positive traction on Friday and surged to a near two-week high.

- Dismal UK Retail Sales weighed heavily on the British pound and remained supportive.

- Bets for an early ECB rate hike underpinned the euro and provided an additional boost.

The EUR/GBP cross caught aggressive bids during the early European session and rallied to a two-week high, around the 0.8375-0.8380 region in the last hour.

Following the overnight sharp intraday pullback of around 70 pips, the EUR/GBP cross regained strong positive traction on Friday amid the emergence of heavy selling around the British pound. The UK Office for National Statistics reported that Retail Sales declined by 1.4% in March as against a fall of 0.3% anticipated. Moreover, sales excluding the auto motor fuel sales also missed estimates and dropped 1.1% during the reported month, suggesting that soaring inflation is impacting consumption.

Apart from this, the more hawkish remarks by some ECB policymakers this week lifted bets for a 25 bps rate hike in July and further contributed to the shared currency's relative outperformance. It is worth recalling that ECB Vice President Luis de Guindos had said that a rate hike is possible in the second half of the year. Adding to this, ECB Governing Council member Pierre Wunsch suggested a probable rate hike in July and also anticipated that rates could be positive as soon as this year.