- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 22-03-2022

Reuters has reported that Japanese Prime Minister Fumio Kishida is likely to order an additional economic stimulus package by the end of March to cushion the impact of rising prices of oil and other goods on the economy, Yomiuri newspaper said on Wednesday.

''The move would follow Tuesday's parliamentary approval of a record $900 billion state budget for the fiscal year 2022. The size of the extra package is to be determined after scrutinising necessary measures to counter the effect of soaring costs, Yomiuri reported without citing sources.''

Meanwhile, USD/JPY has refreshed the highest levels last seen during early 2016:

-

USD/JPY crosses 121.00 to fresh high since 2016 as T-bond yields stay firmer ahead of Fed’s Powell

- USD/JPY remains on the front foot for the fourth consecutive day, renews six-year top.

- US 10-year, 2-year Treasury yields poke the highest levels since May 2019 as Fedspeak portrays rate-hike aggression.

- Japan PM Kishida is likely to unveil fresh stimulus, Ukraine-Russia crisis continues.

- Powell’s comments, second-tier US data will be important for intraday directions, NATO, key economics will offer a busy Thursday.

USD/JPY refreshes the highest levels last seen during early 2016 with 121.28 figures during Wednesday’s Asian session. That said, the quote seesaws around 121.15 by the press time.

The strong performance of the US Treasury yields and Wall Street seems to have underpinned the USD/JPY pair’s latest rally. Also positive for the yen pair are the chatters over further stimulus from the Japanese government.

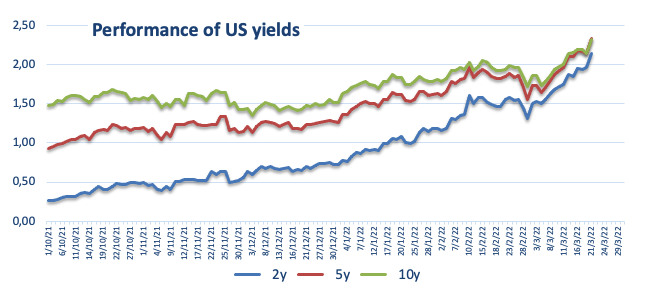

That said, yields of the US government bonds for 10-year and 2-year tenures rose to the highest since May 2019 as the Fedspeak keeps inflating expectations of faster rate hikes from the US central bank. Among them, St Louis Fed President, James Bullard and Cleveland Fed President Loretta Mester clearly showed signals of 50 basis points (bps) of a rate lift.

It should be noted that Yomiuri recently mentioned that the Japanese Prime Minister (PM) Fumio Kishida is expected to order the preparation of an additional economic stimulus package by the end of March.

Even so, a continuation of the Ukraine-Russia crisis and a light calendar in Asia challenges USD/JPY bulls of late. Ukraine’s President Volodymyr Zelenskyy who previously eased on his stand to faster the peace talks recently said, “Talks with Russia are difficult, at times confrontational.” On the other hand, war escalates in Mariupol. It’s worth observing that Moscow managed to pay the second tranche of Eurobond coupon payment in the USD and avoided default for the second consecutive time.

Amid these plays, S&P 500 Futures print mild gains while tracking the Wall Street benchmarks whereas the US 10-year bonds yield remains firmer around the multi-month high of 2.39%.

Moving on, Fed Chairman Jerome Powell’s speech will be crucial for fresh impulse amid the latest hawkish comments from Fed policymakers. Should Powell repeat the early-week speech that underpinned the bullish bias, USD/JPY has further room on the upside to travel. Also important to watch are the second-tier US data.

Technical analysis

USD/JPY is on the way to challenge the year 2016 peak surrounding 121.70 before heading towards December 2015 peak near 123.70. Alternatively, a pullback move may retest late 2016 top close to 118.65.

- The DXY has turned sideways in the absence of any potential trigger for further guidance.

- Goldman Sachs sees two 50 bps rate hikes and an interest rate at 2% by the end of 2022.

- Fed Powell’s speech may act as a key driver going forward.

The US dollar index (DXY) has entered into a tad wider range of 97.73-99.20 as investors await a major trigger that may dictate the direction of the greenback after an announcement of an interest rate hike by 25 basis points (bps) last week and delay of a ceasefire between Russia and Ukraine.

Fed Powell’s speech

The Federal Reserve (Fed) has announced seven interest rate hikes by the end of 2022 and the aggressive tightening stance has already underpinned the US Treasury Yields. The benchmark 10-year US Treasury yields has jumped above 2.38%. Despite the confirmation of six more interest rate hikes this year, investors are focusing on Fed Chair Jerome Powell’s speech on Wednesday. The speech is likely to dictate the action plan of elevating the interest rates.

Goldman Sachs said that they now see “two 50 basis point hikes starting with the next meeting (May and June), followed by four 25 basis point hikes into the end of the year.” Also, Goldman Sachs sees rate hikes to 2% by the end of 2022.

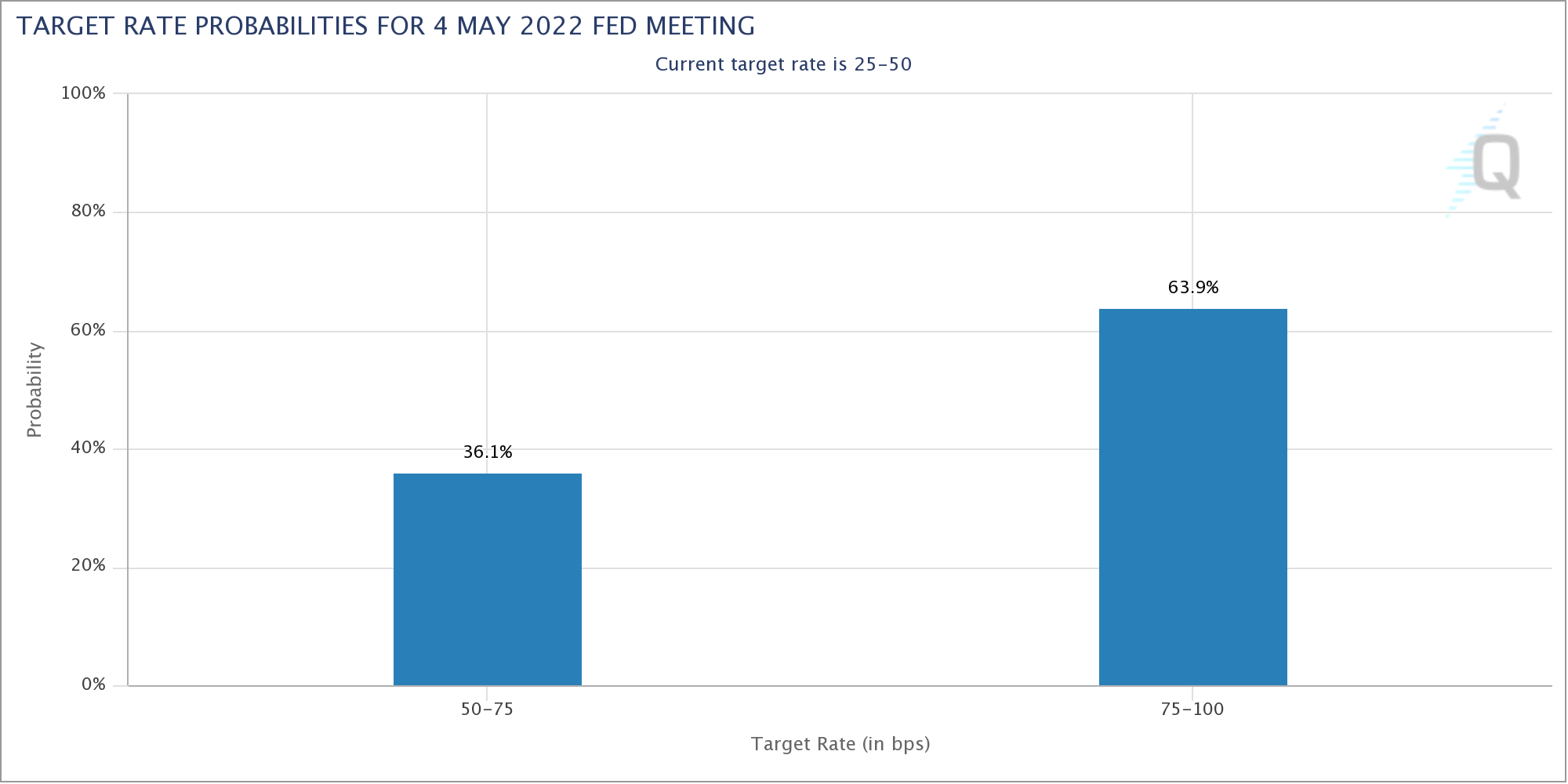

Well, a 50 bps rate hike has started gaining traction as traders are pricing in a 66.1% chance of a 50 bps hike at the Fed's May meeting, according to CME's FedWatch Tool, which is up from 50% chances unfolded a week ago.

NATO meeting and EU summit

US President Joe Biden will meet with other NATO allies in Brussels on Thursday to project a roadmap for a diplomatic solution to the ongoing slaughter of Ukraine by Russia. However, investors should be ready for more sanctions on Russia as an outcome of the meeting.

Apart from that, the summit of European Union (EU) leaders will also be attended by US President Joe Bide to discuss the embargo on Russian oil by EU members. Germany has denied withstanding the decision of banning Russian oil in the current scenario.

Major events this week: New Home Sales, Durable Goods Orders, Initial Jobless Claims, Market PMI (Manufacturing and Services), and Michigan Consumer Sentiment.

Eminent issues on the back boiler: EU Leaders Summit, NATO meeting, and Fed Powell’s speech.

- USD/CAD remains pressured around two-month low, holds onto the key technical level break.

- Bearish MACD joins downside break of 200-DMA, nine-month-old rising trend line to favor sellers.

- Bulls need validation from February’s low for fresh entry.

- 50% Fibonacci retracement of June-December 2021 upside lures sellers.

USD/CAD bears keep reins around the lowest levels since late January, pressured near 1.2565 during Wednesday’s initial Asian session.

In doing so, the sellers cheer the previous day’s clear downside break of an ascending trend line from June 2021 and the 200-DMA.

Given the bearish MACD signals supporting the latest break of the key technical supports, now resistance, USD/CAD bears have a pleasant journey ahead.

That said, the 50% Fibonacci retracement (Fibo.) of the pair’s rally during June to December 2021, around 1.2485, becomes nearby support to watch during the quote’s further weakness.

However, the yearly low surrounding 1.2450 will challenge the USD/CAD sellers afterward.

On the contrary, the support-turned-resistance line and the 200-DMA will challenge the corrective pullback respectively around 1.2585 and 1.2615.

Following that, the previous month’s low near 1.2635 will challenge the USD/CAD buyers before activating further run-up.

USD/CAD: Daily chart

Trend: Further weakness expected

New Zealand Prime Minister Jacinda Ardern announced the easing of covid-linked activity restrictions on early Wednesday morning in Auckland. The national leader said, "This is not the end, but in some ways it is also a new beginning," per NZ Herald.

Key changes (from NZ Herald)

The Government has scrapped the limit on outdoor gatherings and revealed the end of vaccine pass use and mandates for some industries from next month.

The number of people allowed to gather inside increases from 100 to 200 under the red light traffic setting.

Masks will continue to be used, but today's move means outdoor concerts, sports and other outdoor events would be able to resume under the red setting.

The traffic light changes will kick in from this Friday.

Vaccine passes will not longer be required to be used from April 4.

The Government is also ending the controversial vaccine mandates in education, police or Defence Force workers and those workplaces using them from April 4.

The red light setting that currently applies to New Zealand would be reviewed again on April 4 - and would be reviewed again regularly after that point.

Market reaction

NZD/USD cheers the positive announcement by refreshing 2022 high around 0.6970.

Read: NZD/USD prints fresh 2022 highs

- The NZD/JYP, a risk barometer in the FX space, is up by almost 8.5% in the month.

- Asian equity futures point to a higher open, underpinning the NZD/JPY pair.

- NZD/JPY Price Forecast: Upward biased, above 83.00; otherwise selling pressure might push the pair lower.

The New Zealand dollar extends its rally, reaching a new YTD high at 84.53 vs. the Japanese yen, amid an upbeat market mood, which favored one of the risk-barometers in the FX space, the NZD/JPY pair. As the Asian Pacific session is about to begin at the time of writing, the NZD/JPY is trading at 84.44.

US stock indices finished Tuesday’s session in the green, reflecting an appetite for riskier assets. Meanwhile, Asian equity futures are recording gains ahead of the Asian open.

Overnight, the NZD/JPY pair braced to the 50-hourly simple moving average (SMA) around 82.13, jumping towards the 83.00 mark. Once the European session kicked in, the cross-currency pair breached the 84.00 barrier, though late in the North American session, the NZD/JPY registered the new YTD high at 84.31.

NZD/JPY Price Forecast: Technical outlook

From a daily chart perspective, the NZD/JPY is upward biased. However, to further find new support/resistance levels, an analysis of the weekly chart is needed.

Upwards, the NZD/JPY first resistance would be 85.00. Once cleared, the next resistance would be the 86.00 mark, followed by April 2013 cycle highs around 86.41.

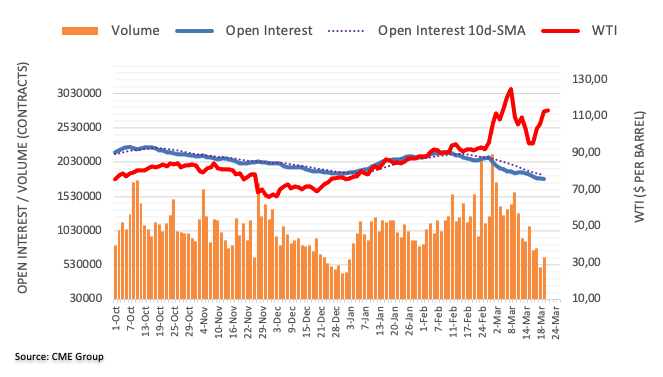

- WTI hovers around $108 ahead of the EU summit outcome on the embargo of Russian oil.

- Germany has denied withstanding the Russian oil ban due to higher dependency.

- Investors will focus on oil stockpiles reports from the EIA.

West Texas Intermediate (WTI), futures on NYMEX, is oscillating in a narrow range of $107.20-111.74 after sensing a minor correction near $113.00 on Tuesday. The oil prices are likely to trade directionless on the mixed response from the European Union (EU) players on the embargo of Russian oil. Nations in the European domain part ways with some countries like Germany, which clearly stated that withstanding the US in retaliation for Russia’s invasion of Ukraine, would cause some serious dents on their economy.

Europe has a significant dependency on Russian oil and energy. More than a quarter of Europe‘s oil consumption is derived from Russia and an embargo on Russian oil in times when the Eurozone is going through supply chain bottlenecks and galloping oil prices won’t be a better option.

On the supply side, damage in the Caspian Pipeline Consortium (CPC) may reduce the oil exports by around one million barrels per day (bps). However, its impact is yet not reflected in the oil prices.

Meanwhile, the American Petroleum Institute (API) has reported a slippage in oil stockpiles on Tuesday. The oil stockpiles landed at -4.28M, much lower than the previous print of 3.754. On Wednesday, the oil stockpiles report from the Energy Information Administration (EIA) will remain in focus.

On the dollar front, the US dollar index (DXY) has slipped near 98.40 on easing the risk-aversion theme. The speech from the Federal Reserve (Fed) Chair Jerome Powell will be the major event to be watched on Wednesday.

“The Biden administration is preparing new sanctions on most members of Russia’s State Duma, the lower house of parliament, as the US continues its crackdown on Moscow over its ongoing war against Ukraine,” said Wall Street Journal (WSJ).

The news cites unnamed US Officials to hint that the announcements could come as soon as Thursday.

Also portraying the Ukraine-Russia tussles were the latest comments from Ukraine’s President Volodymyr Zelenskyy who said, “Talks with Russia are difficult, at times confrontational.” Kyiv’s leader also adds, “100,000 people were living in the besieged city of Mariupol in inhuman conditions, without food, water or medicine.”

Furthermore, a leaders’ statement from the North Atlantic Treaty Organization (NATO), shared by Nikkei, also highlight grim concerns. “The North Atlantic Treaty Organization (NATO) has begun coordinating to express concern about cooperation between Russia and China in a joint statement to be finalized at the emergency summit on the 24th,” said the news.

Nikkei also mentioned, “If China supports Russia in military and economic terms, Russia's invasion of Ukraine will regain momentum, and the conflict with the United States and Europe may intensify.”

Market implications

Alike the previous versions, the latest Ukraine-Russia negatives have been less effective and couldn’t stop the S&P 500 Futures from printing mild gains above 4,500.

Read: Forex Today: Dollar gives up despite worrisome developments

- AUD/USD led G10 currency pair gainers by refreshing yearly top, trading sidelined of late.

- Softer greenback, firmer stocks favored bulls, three-year high US Treasury yields fail to propel USD, nor stop equity bulls.

- Ukraine showed signs of compromise, Russia paid a second bond coupon but the war continued.

- RBA’s Lowe again pushed back rate-hike expectations but Fedspeak has been hawkish.

AUD/USD bulls cheered firmer equities and softer greenback to refresh 2022 high around 0.7075 during early Wednesday morning in Asia.

The risk barometer pair renewed its four-month top the previous day despite strong US Treasury yields and mixed sentiment over Ukraine and Russia. In doing so, the Aussie pair became the biggest daily gainers in the G10 currency pairs despite indecision over the market’s risk profile.

The US 10-year and 2-year Treasury yields rose to the highest since May 2019 as the Fedspeak keeps inflating expectations of faster rate hikes from the US central bank. Among them, St Louis Fed President, James Bullard and Cleveland Fed President Loretta Mester clearly showed signals of 50 basis points (bps) of a rate lift.

On the other hand, Reserve Bank of Australia (RBA) Governor Philip Lowe reiterated his dislike for aggression towards rate hikes by saying, “(RBA) will not respond until there is evidence of pervasive price pressures.”

Elsewhere, Ukraine’s President Volodymyr Zelenskyy who previously eased on his stand to faster the peace talks recently said, “Talks with Russia are difficult, at times confrontational.” On the other hand, war escalates in Mariupol. It’s worth observing that Moscow managed to pay the second tranche of Eurobond coupon payment in the USD and avoided default for the second consecutive time.

Apart from the aforementioned play surging covid numbers in China and Europe, with the new variant gaining attention in the bloc, also challenges the market sentiment, but was mostly ignored.

Amid these plays, Wall Street benchmarks regained their mojo and the stock futures are up too.

Moving on, a light calendar in Asia may put AUD/USD at the mercy of risk catalysts while comments from Fed Chair Powell and second-tier US economics may entertain the pair traders afterward.

Technical analysis

Although successful trading above the 200-DMA level of 0.7300 keeps AUD/USD buyers hopeful, a 10-week-old ascending resistance line, near 0.7485 challenges the quote’s further upside.

- The USD/JPY continues rallying for the third consecutive day, up 1.41% in the week.

- Fed’s Bullard, Daly, and Mester favor aggressive rate hikes, thus increasing the odds of a 50 bps move in May.

- USD/JPY Price Forecast: The 1-hour chart depicts the pair as upward biased.

The USD/JPY clings to the 120.00 mark following Tuesday’s session in which the pair reached a new YTD high at 121.03, in a session where US Treasury yields skyrocketed, led by the 10-year benchmark note up close to nine basis points, up at 2.384%. At 120.86, the USD/JPY reflects the greenback strength amidst an upbeat market mood.

On Tuesday, US equities finished the day in the green. Though of late, the greenback finished downwards, as reflected by the US Dollar Index down 0.03%, sat at 98.444.

Fed speaking driving the majors, US Treasury yields keep rising

The US economic docket featured more Fed speaking, following US Fed Chief Jerome Powell’s Monday’s appearance at the NABE conference. Powell reiterated that “inflation is too high” and signaled that the Fed is ready to hike rates higher than 25 bps at its next “meeting or meetings.”

US Treasury yields immediately reacted upwards, as investors positioned themselves ahead of the May 4 FOMC monetary policy meeting, where the odds of a 50 bps hike are close to 70%.

St. Louis Fed President James Bullard said that “The Fed needs to move aggressively to keep inflation under control,” emphasizing his calls of interest rates above 3% this year. Bullard added that 50 bps moves would definitely be on the mix. Later, San Francisco Fed’s Mary Daly said that inflation is too high, and she commented that it is time to eliminate accommodation.

Cleveland Fed President Loretta Mester is crossing the wires at press time. Mester said that “front-loading rate hikes is appealing” while adding that raising rates around 2.5% will be appropriate.

The Japanese economic docket will feature the Leading Economic Index on its Final reading for January, alongside the Coincident Index Final.

Elsewhere, Russia and Ukraine’s tussles have taken a backseat of late. US President Joe Biden would meet with his European allies on Thursday in Brussels and are expected to announce another tranche of sanctions against Russia over its invasion of Ukraine.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is upward biased, though it faced solid resistance at 121.00. However, once the USD/JPY retreated towards 120.50s and advanced steadily to current price levels, the USD/JPY found support on an upslope trendline, as shown by the hourly (H1) chart.

Upwards, the USD/JPY first resistance would be 121.00. Breach of the latter would expose January 25. 2016 resistance at 121.68, followed by 122.00. On the flip side, failure to reclaim 121.00 would leave the pair vulnerable to further selling pressure. The USD/jPY first support would be 120.38, followed by 120.00, and then the 50-hour simple moving average (SMA) at 119.85.

“I think we will need 50 bps at some meetings, based on my forecast,” said Cleveland Fed President and FOMC member Loretta Mester.

Additional comments

We really need to get inflation under control.

Getting inflation under control is the best thing we can do to make sure healthy labor markets continue.

Important to use both of our tools to get inflation on a better trajectory.

Balance sheet won't be main tool to fight inflation, but we will 'do what we need to do' to reduce it.

Aim is to be nimble and hit goals of full employment, stable prices.

Under some dire scenarios, not base case, Ukraine conflict could hit US growth, but right now inflation is the bigger concern.

Financial markets are supportive of Fed's getting inflation under control.

In the old days monetary policy wanted to surprise people; these days we are trying to be transparent.

Constrained supply, excess demand for labor is pushing up on inflation, can't be complacent.

Market reaction

Fed’s Mester joins other hawks in the monetary policy board to support the strong US Treasury yields, recently poking a three-year high. However, neither the US dollar nor equities match the bond moves.

Read: Forex Today: Dollar gives up despite worrisome developments

- GBP/USD bulls stay on course for a key weekly resistance target.

- The M-formation is playing out with price correcting the weekly bearish impulse.

Hawkish comments from Fed Chair Jerome Powell yesterday have injected another wave of re-pricing into US rates markets. However, the pound has continued higher in a technical move towards a weekly resistance level as per the following chart:

GBP/USD weekly chart

The M-formation is a compelling pattern that is playing out with the price reverting towards the neckline of the pattern near 1.3350. This comes in towards a 61.8% golden ratio and 1.34 the figure. Should the area hold, the price would be expected to continue on its southerly trajectory with 1.28 the figure in focus.

- Euro bulls have rebounded from 1.0960 after a corrective pullback as DXY weakens.

- EU will discuss an embargo on Russian oil in a meeting with Biden.

- Investors will focus on Fed Powell’s speech going forward.

The EUR/USD has witnessed a decent buying interest after a corrective pullback towards 1.0962 amid a positive undertone in the market. The asset is auctioning in a ted wider range of 1.0900-1.1120 after printing a fresh 22-months low near 1.0800.

The shared currency has remained vulnerable in the last two months as Russia’s invasion of Ukraine has posed a serious threat of stagflation in Europe. Rising oil and metal prices have spurred the prices attributed to manufacturing and other economic activities. A continent like Europe, which has a principal dependency on oil and energy from Russia, is facing the heat of sanctions on the Russian economy. The war between Russia and Ukraine has not only impacted the life and infrastructure of Ukraine and the financials of Moscow but has also impacted the supply chain structure of Europe.

Investors are eying the European Union (EU) leaders summit on Thursday, which will also be attended by US President Joe Biden. The EU has announced that a boycott of Russian oil will be the major agenda of the discussions. Therefore, investors will find fresh impetus from the summit.

While the US dollar index (DXY) surrendered its opening gains of Tuesday in the late New York session. The DXY slipped near 98.50 after failing to surpass 99.00 in multiple attempts. The market participants will focus on the speech from Federal Reserve (Fed) Chair Jerome Powell on Wednesday. The speech is likely to dictate the roadmap of imposing six more interest rate hikes by the end of 2022.

- GBP/JPY saw a historic rally on Tuesday, surging above resistance at 158.00 to hit more than five-year highs above 160.00.

- That marked a 1.9% gain, the best on-the-day rally since November 2020.

- Tuesday’s push higher takes the pair on-the-month gains to now nearly 4.0%, as higher stocks/yields hurt the yen.

GBP/JPY saw a historic rally on Tuesday, surging above a key long-term area of resistance around 158.00 to surpass 160.00 for the first time since June 2016. That marked a 1.9% gain, the best on-the-day rally since November 2020, on the day when Pfizer announced successful Covid-19 vaccine trial results. Tuesday’s push higher takes the pair on-the-month gains to now nearly 4.0% and means that GBP is, against the Japanese yen at least, back to its pre-Brexit levels.

A continued improvement in risk appetite in global equities coupled with a historic run higher in US and global bond yields as the Fed pivots hawkishly has had disastrous effects for the yen, which has been battered across the board, including versus GBP. But GBP/JPY’s on-the-month gains aren’t as strong as some of its other G10 peers like AUD/JPY and NZD/JPY, given 1) GBP is more exposed to economic weakness as a result of the Ukraine war and 2) GBP is still being help back by last week’s dovish BoE policy announcement.

Looking ahead, GBP/JPY trades may fear that the pair’s rally is getting a little overextended and if the recent rally in global equities and yields slows/reverses, the pair will likely see some profit-taking. The previous ceiling of 158.00 for 2021 and the start of 2022 may now have turned into a floor, with any retracement back to this area likely to be viewed as a good buying opportunity, assuming market conditions are still unfavorable to the risk appetite/yield sensitive yen. In terms of the economic calendar, UK Consumer Price Inflation and Retail Sales data for February and flash PMI data for March will be worth a watch, as well as remarks from various BoE policymakers throughout the week.

- Investors were in a risk-on mood, supporting the kiwi to fresh 2022 highs.

- Eyers are on the Fed and RBNZ with a focus on inflation risks.

NZD/USD is ending on Wall Street on firm footing and making fresh highs for the year, travelling from 0.6863 to a high of 0.6964, up 1.16% at the time of writing. The moves are despite recent comments from US Federal Reserve Chair Jerome Powell.

Powell yesterday dialled up the hawkishness of the Fed further, forcing bond yields to react. In addition, the USD remains a favoured safe haven currency and, as yet, the Russia/Ukraine peace talks have not yielded any tangible results. Traders are pricing in a 66.1% chance of a 50 basis point hike at the Fed's May meeting, according to CME's FedWatch Tool, up from slightly more than 50% a week ago. As a result, DXY was up for the third straight day and trading near 99 the figure that outs the May 25 2020 high near 99.975 in focus.

However, the tide has turned on Tuesday. Investors were in a risk-on mood, as US stocks rose and dented some of the safe-haven appeal of the greenback, with equities getting a lift, in part, from bank shares on Fed rate hike expectations. ''The move was a tad surprising given talk of bigger Fed hikes and the growing concern locally about the prospect of a hard landing, but in the end, plain old “risk on” sentiment held the day,'' analysts at ANZ bank said.

''Amid a quiet week locally, the Kiwi was always going to dance to a global beat, and positioning could cap it down the track (speculative positioning swung from short to long last week according to CFTC – which helps in part explain the rally). But for now it is basking in glory (alongside AUD, CAD, and to a lesser extent NOK) as the 3 best performers in the G10 this year. That does square away nicely with moves in commodities.''

Inflation risks in focus

Meanwhile, earlier in the US session, St. Louis Fed President James Bullard repeated his call for the Fed to move aggressively on Bloomberg TV. Additionally, San Francisco Fed President Mary Daly said she believes the main risk to the economy is a worsening of already high inflation as oil prices climb due to the conflict in Ukraine and a disruption in supply chains from China's COVID-19 countermeasures.

Domestically, inflation expectations in New Zealand have risen aggressively over the past year and analysts at ANZ Bank said there’s a real risk that recent price spikes could cause expectations to become unanchored from the RBNZ’s 2% target for CPI inflation – especially as Omicron exacerbates already stretched domestic supply chains.

''The RBNZ already saw inflation expectations as the most significant risk in the February MPS, and now that risk of unanchored expectations is even stronger.

This is a key reason why we think the RBNZ should hike the OCR aggressively by 50bps in both April and May. It will hurt, but its considerably better than what they would need to do to the economy if inflation expectations continue to spiral further in the wrong direction.''

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 07:00 (GMT) | United Kingdom | Producer Price Index - Output (MoM) | February | 1.2% | 0.9% |

| 07:00 (GMT) | United Kingdom | Producer Price Index - Input (MoM) | February | 0.9% | 1.2% |

| 07:00 (GMT) | United Kingdom | Producer Price Index - Output (YoY) | February | 9.9% | 10.1% |

| 07:00 (GMT) | United Kingdom | Producer Price Index - Input (YoY) | February | 13.6% | 13.9% |

| 07:00 (GMT) | United Kingdom | Retail Price Index, m/m | February | 0% | 0.8% |

| 07:00 (GMT) | United Kingdom | HICP ex EFAT, Y/Y | February | 4.4% | |

| 07:00 (GMT) | United Kingdom | Retail prices, Y/Y | February | 7.8% | 8.2% |

| 07:00 (GMT) | United Kingdom | HICP, m/m | February | -0.1% | 0.6% |

| 07:00 (GMT) | United Kingdom | HICP, Y/Y | February | 5.5% | 5.9% |

| 12:00 (GMT) | U.S. | Fed Chair Powell Speaks | |||

| 14:00 (GMT) | U.S. | New Home Sales | February | 0.801 | 0.81 |

| 14:30 (GMT) | U.S. | Crude Oil Inventories | March | 4.345 | 0.025 |

| 15:00 (GMT) | Eurozone | Consumer Confidence | March | -8.8 | -12.9 |

| 15:45 (GMT) | U.S. | FOMC Member Daly Speaks | |||

| 23:50 (GMT) | Japan | Monetary Policy Meeting Minutes |

- Despite looking extremely overbought across a range of short-term technical measures, AUD/JPY’s historic move higher went into overdrive on Tuesday.

- The pair lept 2.0% to fresh multi-year highs above 90.00 and is eyeing its 2017 highs at 90.30.

- The recent surge higher in stocks and global yields has battered the yen across the board, not just versus AUD.

Despite now looking extremely overbought across a range of short-term technical and quantitative measures, AUD/JPY’s historic move higher went into overdrive on Tuesday. At current levels just to the north of the psychologically important 90.00 mark, AUD/JPY is trading at four and a half year highs with gains of about 2.0% on the day, putting it on course for its best one-day performance since November 2020. That was the day the successful Pfizer Covid-19 vaccine trial data was announced.

AUD/JPY now trades a massive more than 6.5% above its lows from just one week ago in the 84.50 area and its on-the-month gains stand at roughly 8.0%. That means, with seven full trading session of the month left, the pair is on course to post its largest percentage one-month gain since October 2011, more than a decade ago. A continued improvement in risk appetite in global equities coupled with a historic run higher in US and global bond yields as the Fed pivots hawkishly has had disastrous effects for the yen, which has been battered across the board, not just versus the Aussie.

But importantly, AUD/JPY is yet to crack above a key high from 2017 in the 90.30 area and there is another key long-term high in the 90.75 area just above it. Failure to break above these levels swiftly in the coming sessions might signal some, at this point, much overdue profit-taking. Given the backdrop of still very elevated geopolitical risks, analysts are wary on the prospects for the recent rally in the global equity space to continue and, if the recent upwards trajectory does slow, that would remove one tailwind for AUD/JPY.

The recent move higher in global yields is also looking a little stretched and rates strategists have been warning to expect some consolidation, albeit still at higher levels, ahead. That would remove another key tailwind for the pair. However, amid intense speculation about an upcoming hawkish pivot from the RBA, all while the BoJ continually reiterates its usual ultra-dovish stance, many FX strategists will continue to view AUD/JPY as a buy-on-dips.

The only problem for the technicians is that there isn't any notable support until all the way down at 86.00 (roughly 4.0% lower versus current levels). Unless there is a big reversal lower in equities and yields, it's hard to picture AUD/JPY falling back to such levels. Bulls may instead mull adding to longs around key psychological levels, like perhaps the 88.00 mark.

- Markets are anticipating Fed will raise interest rates by 50 basis points at both its May and June meetings.

- USD/CAD prints fresh session lows nevertheless.

USD/CAD is sliding into fresh session lows at 1.2567 as the US dollar stalls and losing some 0.2% on the day so far. The greenback is giving back territory despite Federal Reserve Chair Jerome Powell putting the possibility of half-percentage-point interest rate hikes on the table.

Earlier in the day, the greenback saw its biggest one-day percentage gain since March 10 on Monday as the Fed opened the door for raising rates by more than 25 basis points at upcoming policy meetings in order to contain inflation.

In the wake of Powell's comments, markets are anticipating that the central bank will raise interest rates by 50 basis points at both its May and June meetings. Nevertheless, investors were in a risk-on mood and US stocks rose and dented some of the safe-haven appeal of the greenback.

Meanwhile, West Texas Intermediate (WTI) crude oil prices are falling following a jump of 7% a day earlier as the European Union considers banning Russian oil imports amid that country's invasion of Ukraine. ''EU nations are arguing over banning the purchase of about four-million barrels per day of Russian oil that are the largest part of the continent's imports, though reports say there is little consensus on whether the group will go ahead with a ban, which would force it to compete for alternative supplies,'' Reuters explained.

- Wall Street is set to finish Tuesday’s trading session in the green.

- The sell-off of US Treasuries continues, while the 10-year yield closes to 2.40%.

- S&P 500 Price Forecast: Bulls reclaiming the 200-DMA might open the door for further gains.

US stocks recovered on Tuesday, following Monday’s hawkish remarks of Fed Chief Jerome Powell, who said that “inflation is too high” and opening the door for 50 basis points increases.

The S&P 500 is advancing some 1.10%, sitting at 4517 above the 200-day moving average (DMA), a bullish signal for dip buyers. Meanwhile, the tech-heavy Nasdaq rises almost 2%, sits at 14,106.28, while the Dow Jones Industrial climb 0.69%, up at 34792.36.

On Monday, US central bank chief Jerome Powell said that “if we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so.”

Meanwhile, money market futures have priced at least a 63.9% chance of a 50 basis point increase to the Federal Funds Rate (FFR) in the May 4 Fed monetary policy meeting, as shown by CME Fed Watch Tool.

In the meantime, the sell-off on US Treasuries continues, as reflected by the US Treasury yields rising. The 10-year benchmark note gains six basis points, sitting at 2.384%. The greenback is barely down 0.01%, at 98.461.

Sector-wise, consumer discretionary, communication services, and financials rose 2.65%, 2.17%, and 1.62%, respectively. Meanwhile, the energy sector is logins 0.57%, weighed by Russia – Ukraine tussles, while Hungary and Germany backpedaled the ban of Russian oil.

S&P 500 Price Forecast: Technical outlook

The S&P 500 broke above the 200-DMA at 4473.08, as mentioned above. However, a daily close above it would open the door for further gains. Nevertheless, as equities are highly sensitive to market mood, stock traders need to be aware of it before opening fresh bullish bets on the S&P 500 index.

With that said, the S&P 500 first resistance would be September 4545.85. Once cleared, the next resistance would be February 2, daily high at 4595.81, short of the following resistance, the 4600 mark.

- Silver has stabilised around $24.80 in recent trade despite further upside for US equities and bond yields.

- Geopolitical risks remain elevated as Russo-Ukraine war continues and Western leaders sound the alarm about potential Russian chemical weapons attacks.

- For now, support at $24.50 is holding, but a bearish break could see the 200 and 50DMAs at $24.00 tested.

Spot silver (XAG/USD) prices have stabilised in recent trade in the $24.80 area having dipped as low as the $24.50s earlier in the day, despite global equities and bond yields continuing to push higher, usually a double whammy for precious metals. In fairness, XAG/USD prices are still trading down by about 1.5% on the day. But it appears that against the backdrop of still very much elevated energy and other commodity prices (that is keeping stagflation fears alive), the bears werent yet ready to push the precious metal below last week’s lows in the $24.50 area.

Indeed, geopolitical risks remain elevated as the Russo-Ukraine war rumbles on and Western leaders sound the alarm about potential Russian chemical weapons attacks that could be used to break the current deadlock. Such a move would further accelerate the imposition of ever-harsher Western sanctions on Russia, with the EU now leaning towards a blanket Russian oil import ban. But this week’s further hawkish shift from Fed Chair Jerome Powell who stoked expectations that the Fed might hike rates by more than 25bps at upcoming meetings seems to have overridden geopolitical concerns for now.

Indeed, there has been a lot of focus on the recent resultant sharp upside seen across US and global yields, which has increased the opportunity cost of holding non-yielding assets like silver. Should recent upside yield moves continue, and should risk appetite in the equity space also remain healthy as has (to the surprise of many) been the case over the past week or so, a bearish break in XAG/USD is likely. The next major support below $24.50 is the 200 and 50-Day Moving Averages in the $24.00 area.

What you need to take care of on Wednesday, March 23:

The American dollar edged lower against most major rivals on Tuesday, except against the Japanese yen, with USD/JPY soaring to 121.02, its highest since February 2016. The greenback advanced during the Asian session, following the lead of soaring US government bond yields after Fed Chair Powell hinted at a 50 bps hike in May.

However, European indexes managed to post some modest gains, putting a halt to the dollar’s demand. Wall Street followed the lead of its overseas counterparts, also posting gains and weighing on the dollar. Speculative interest ignored bonds sell-off that sent the yield on the US 10-year Treasury note to a multi-month high of 2.39%.

The EUR posted a tepid advance vs the greenback, with the pair now trading in the 1.1020 price zone. The Union is too close and too affected by the Russia-Ukraine conflict to actually see its currency appreciate, despite mounting speculation the ECB will have to hike rates by at least 50 bps before the year-end.

The GBP/USD pair reached a fresh three-week high of 1.3273, retaining most of its intraday gains by the end of the day.

The AUD/USD pair reached a fresh 2022 high of 0.7469, trading nearby ahead of the Asian opening, while USD/CAD consolidated losses near its weekly low at 1.2564.

Crude oil prices started the day with a strong footing but finished the day with modest losses. WTI settled at around $10.900 a barrel.

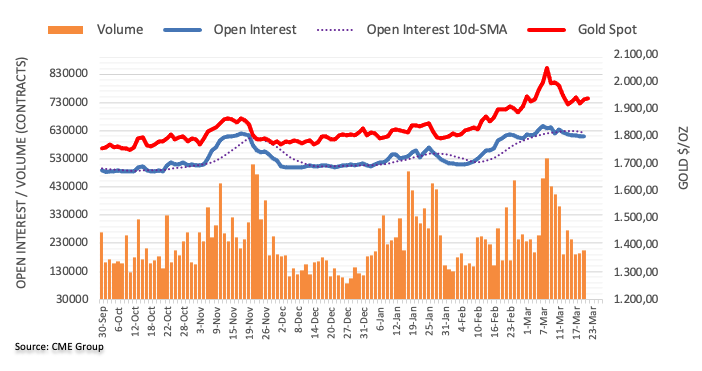

Gold edged sharply lower during US trading hours, bottoming for the day at $1,910.64 a troy ounce. It later recovered and ended at around $1,922.00.

Meanwhile, the number of coronavirus contagions keeps rising in Europe, mostly linked to the BA2 variant. The World Health Organization blamed it on European governments lifting restrictions too soon.

Additionally, Russia continues to escalate its attack on Ukraine, with no solution at sight for the Eastern European crisis.

Top 3 Price Prediction Bitcoin, Ethereum XRP: Crypto bulls are back in town

Like this article? Help us with some feedback by answering this survey:

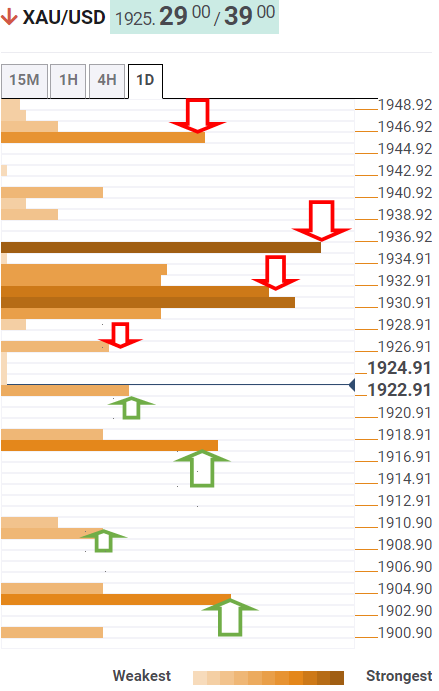

- Gold is trapped between daily support and resistance.

- Markets digest Fd Powell and risk appetite returns, capping golds recovery.

- Gold Weekly Forecast: Technicals turn bearish after weekly decline

The gold price is suffering a 0.7% blow on the day so far albeit stabilising above the lows made at the start of the US day. XAU/USD is trading at $1,921.48 after falling from $1,938 and meeting a low of $1,910.73. The US dollar fell, correcting a move higher the previous day as comments from US Federal Reserve Chair Jerome Powell faded and a rise in equities markets help boost risk-on sentiment.

Traders are pricing in a 66.1% chance of a 50 basis point hike at the Fed's May meeting, according to CME's FedWatch Tool, up from slightly more than 50% a week ago. However, gold prices remain extremely well-supported despite the explosive price action in rates markets following Chair Powell's comments. As a result, DXY was up for the third straight day and trading near 99 the figure that outs the May 25 2020 high near 99.975 in focus.

The mood, nevertheless, is risk on and the dollar is giving back some ground in afternoon trade on Wall Street. The Dow Jones Industrial Average rose 0.8% with the S&P 500 up by 1.13% and the Nasdaq Composite adding 1.85% while the US yields soar to multi-year highs by putting the possibility of the half-percentage-point rate hikes on the table. Two-year, five-year, 10-year and 30-year Treasury yields all stood at their highest levels since 2019.

''While the Chair's comments were entirely consistent with the messaging at the undeniably hawkish FOMC meeting, Powell additionally noted that the Fed will be driven by actual inflation rather than forecasts. This opens the door to an imminent 50bp hike, as the Fed's ability to tame inflation in the near-term is extremely limited,'' analysts at TD Securities explained.

Fed behind the curve

The analysts explained also that, 'in turn, the market is now 80% priced for a 50bp hike in May. In this context, gold prices have remained incredibly resilient. This could potentially highlight a growing cohort of participants interpreting the Fed's hiking path as being behind the curve on inflation, as the Fed moves too slowly and cautiously to tame inflation.''

Finally, the analysts argued that ''while CTAs were lent a lifeline to trend followers amid ongoing negotiations between Russia and Ukraine, the margin of safety is narrowing once more.''

''This would raise risks that safe-haven buyers could offload length in a vacuum concurrently with massive CTA liquidations, but Shanghai traders have seemingly ended a period of liquidations and have meaningfully added to their gold in the recent trading session.''

Gold technical analysis

The price is trapped between daily support and resistance although there is a bias to the downside while below the counter trendline. The correction of the latest daily bearish impulse has met a 38.2% ratio already which is an additional bearish factor as sellers move in at a discount. There are prospects of a firmer test of the support in the $1,880 for the days ahead:

The hourly chart is also offering a bearish bias the price moves in and stalls at resistance as illustrated above.

- The EUR/JPY reached a new YTD high at 133.33 during the New York session.

- An upbeat market mood weighs on safe-haven peers, like the JPY and the CHF.

- EUR/JPY Price Forecast: A daily close above 133.00 would cement the upward bias; otherwise, a mean reversion move is on the cards.

On Tuesday, during the North American session, the shared currency reached a new YTD high vs. the Japanese yen. Factors like an improved market sentiment despite stalled peace talks between Russia and Ukraine, and central bank tightening, were not able to stop the rally above the 133.00 mark for the first time since October 2021. The EUR/JPY is trading at 133.15 at the time of writing.

As abovementioned, an upbeat market sentiment surrounds the markets.European equities closed with gains. Meanwhile, US stock indices record gains between 0.59% and 1.73% across the pond.

Overnight, the EUR/JPY stayed subdued around the 131.50 area. However, the cross-currency pair rallied once the European session kicked in, though it reached a YTD high at 133.33 during the New York session.

EUR/JPY Price Forecast: Technical outlook

From a daily chart perspective, the EUR/JPY is upward biased, though a daily close above a ten-month-old downslope trendline above 132.80.90 is needed to pave the way for further gains. Otherwise, the EUR/JPY would be vulnerable to a mean reversion move.

Hourly chart

The EUR/JPY intraday is bullish, though as the Relative Strength Index (RSI) gets out of overbought conditions at 66.98, the EUR/JPY could aim lower before resuming upwards.

If that scenario plays out, the EUR/JPY first support would be 133.00. Breach of the latter would expose 132.74, followed by 132.33, and then 132.00.

- On Tuesday, the shared currency trims some of Monday’s losses, up some 0.07%.

- Risk appetite increased, despite continuing advance of the Russia-Ukraine conflict and a hawkish Fed.

- EUR/USD Price Forecast: Downward biased below the 1.1100 mark.

After two days of losses in the North American session, the shared currency climbs amid a risk-on market mood and a firmer greenback. At the time of writing, the EUR/USD is trading at 1.1025.

The financial market sentiment is upbeat, as reflected by global equities. The greenback is almost flat during the day, as portrayed by the US Dollar Index, which after reaching the 98.97 daily high, retreating towards 98.489, for a minimal 0.01% gain. Meanwhile, US Treasuries keep advancing for the second consecutive day, led by the 10-year benchmark note, which gains six basis points, sitting at 2.377%.

Fed and ECB speaking grab the headlines

On Monday, Fed’s Chief Jerome Powell said that the US central bank would take the “necessary steps” to tame inflation down towards the 2% target. He emphasized that he favors 50 basis points increases, pretty much aligned with what other Fed policymakers have said.

On Tuesday, Fed speakers continued. St. Louis Fed’s James Bullard said that the Fed needs to get policy-neutral, saying that “faster is better” and reiterated that 50 basis points increases would be in the mix.

Later, San Francisco Fed’s Mary Daly said that inflation is too high, and two supply chain shocks push it “much higher.” She added that it is time to eliminate accommodation, marching up to neutral and determining if the US central bank would need to go above it, as she does not see inflation at 2% by 2022.

Elsewhere, the Eurozone economic docket featured some European Central Bank (ECB) speakers. ECB’s Luis de Guindos said that the possibility of stagflation could be dismissed. Later in the European session, Francois Villeroy said that the ECB should take a cautious approach to normalizations while it needs to focus on underlying medium-term prices.

Meanwhile, ECB’s President Madame Lagarde said that bottlenecks, energy, and food were pushing short-term inflation and added that the Ukraine war would have growth consequences in the Euro area.

EUR/USD Price Forecast: Technical outlook

The EUR/USD bias is downwards, though, on Tuesday, the EUR/USD jumped off from daily lows around 1.0969 and broke above the 1.1000 mark, exposing the mid-line between the top and central Pitchfork’s parallel lines around 1.1080-90. Nevertheless, the downtrend remains intact unless EUR/USD bulls push the pair above the 1.1100 mark, which could pave the way for further gains.

The EUR/USD first support would be the 1.1000 mark on the downside. Breach of the latter would expose Pitchfork’s central parallel-line, which also confluences near the 1.0900 mark, that once cleared would open the door towards March 7 YTD low at 1.0806.

San Fransisco Fed President Mary Daly said on Monday that we now have policy-supported demand combined with fragile supply chains, which is a recipe for inflation, reported Reuters.

Additional Remarks:

On the economy, inflation and supply chains...

"Inflation is too high, and added to that you have two supply chain shocks further pushing up on inflation."

"Oil supply shocks can limit growth, but we are in a different situation than in the 1970s."

"Uncertainty is an issue as this war proceeds."

"The main risk I see is inflation pressures, which are more than we want, need, or thought 3 months ago."

"The pandemic in many ways is the 'culprit' behind high inflation."

"Going forward, I expect some of this to roll off, helping get supply and demand back in balance."

"Supply chains will hopefully repair as well."

"I shaved a little off my own growth forecast, I now see it at about trend."

"At-trend growth of about 2%, against all these headwinds, is really quite remarkable."

"I expect the Fed's policy adjustment and other factors to bring inflation down."

"I don't think we'll be at 2% inflation by end of year."

"I don't have a new-found fear that we've lost inflation anchor."

"I see well-anchored inflation expectations."

"I do have a concern that when inflation stays higher for longer, that 'tugs' at the inflation anchor."

On policy...

"It's time to remove accommodation, marching up to neutral, looking if we need to go over neutral."

"Right now full employment seems to be met, the labor market is extraordinarily tight and inflation is too high."

"It's time to tighten policy in the United States, despite uncertainty with Ukraine and Covid."

On markets...

"The yield on 10-year treasury is low for understandable factors, including safe-haven buying."

"Markets also don't expect runaway inflation."

- AUD/USD bid as commodities run higher in the face of hawkish Fed.

- The Russian invasion of Ukraine puts upward pressure on commodities.

AUD/USD is making a fresh high in midday New York trade touching 0.7452 having travelled from a low of 0.7375 in risk-on markets. The US dollar is giving back territory despite Federal Reserve Chair Jerome Powell putting the possibility of half-percentage-point interest rate hikes on the table.

Earlier in the day, the greenback saw its biggest one-day percentage gain since March 10 on Monday as the Fed opened the door for raising rates by more than 25 basis points at upcoming policy meetings in order to contain inflation.

''His tone was more hawkish than his post-FOMC press conference last week. Of course, a lot can happen between now and the May 3-4 meeting. Recall that a 50 bp hike at the March 15-16 meeting was over 80% priced in last month before it became clear that 25 bp was most likely,'' analysts at Brown Brothers Harriman said.

Nevertheless, in the wake of Powell's comments, markets are anticipating that the central bank will raise interest rates by 50 basis points at both its May and June meetings. Nevertheless, investors were in a risk-on mood and US stocks rose and dented some of the safe-haven appeal of the greenback.

The Dow Jones Industrial Average rose 0.8% with the S&P 500 up by 1.13% and the Nasdaq Composite adding 1.85% while the US yields soar to multi-year highs by putting the possibility of the half-percentage-point rate hikes on the table. Two-year, five-year, 10-year and 30-year Treasury yields all stood at their highest levels since 2019.

Meanwhile, net AUD short positions have dropped sharply to their lowest levels since August 2021 while soaring commodity prices are offering the AUD support vs. the USD in the spot market. The Russian invasion of Ukraine is adding some serious upward pressure on commodities. Crude oil has surged higher on reports Europe was considering a ban on Russian oil as several European countries push for the fifth round of sanctions on Russia,.

- NZD/USD pushed to its highest level since late November in the 0.6950 area on Tuesday.

- The kiwi’s rally on Tuesday comes amid strong risk appetite and a broad push higher in the global equity space.

- NZD also has the added tailwind of one of the most hawkish central banks in the G10 in the RBNZ.

NZD/USD rallied to the 0.6950 area on Tuesday and, in doing so, pushed to its highest level since late November. At current levels almost bang on the round figure, the pair is trading with gains of just shy of 1.0% on the session and is up more than 1.2% versus Asia Pacific session lows in the 0.6860s. Indeed, the kiwi is the best performing G10 currency on the day by a reasonably significant margin, despite a weakening in Consumer Sentiment in Q1 2022 versus Q4 2021 according to the latest release by Westpac.

The kiwi’s impressive rally on Tuesday comes amid strong risk appetite and a broad push higher in the global equity space – conditions typically good for the likes of NZD and AUD. But the kiwi (and Aussie) are also benefitting from their relative distance to the Ukrainian conflict versus, say, the likes of NOK, SEK and other more risk-sensitive European currencies. Indeed, if investors are looking to allocate towards a currency that 1) can benefit from risk-on, 2) can benefit from higher commodities and 3) is less exposed to the negative economic effects of the Ukraine war, the kiwi (and Aussie) pretty much tick all boxes.

The kiwi also has the added tailwind of one of the most hawkish central banks in the G10 in the RBNZ. The RBNZ is already well ahead of the Fed in the current hiking cycle and things are expected to stay that way with the bank likely to lift interest rates in 50bps intervals at coming meetings. That might explain why the kiwi has been able to rebuff post-hawkish Fed USD strength better than most of its other G10 peers.

Looking ahead, the major drivers of risk appetite (geopolitics, Fed rhetoric etc.) will remain important for NZD/USD. There isn’t anything of importance on the New Zealand economic calendar this week, but FX traders should keep an eye on a barrage of Fed speak throughout the rest of the week that will give more insight into which policymakers support what tightening path ahead, plus US flash March PMIs on Thursday.

- The Mexican peso advances firm vs. the greenback, despite falling oil prices.

- An upbeat market sentiment boosts emerging market currencies.

- USD/MXN Price Forecast: Neutral biased, but up and downside risks remain.

The Mexican peso rallies firmly despite that the US Federal Reserve hiked rates for the first time in three years, but interest rates differentials still favor the Mexican peso. At 20.2964. the USD/MXN reflects the 5.50% differential between Mexico and the US.

In the meantime, European and US stock markets continue advancing during the day, reflecting the positive market sentiment. Meanwhile, oil prices dropped from daily highs near the $115.00 mark as Germany and Hungary backpedaled from a potential embargo on Russian oil, easing pressures on the black gold. That stopped the fall of the USD/MXN pair, as traders were looking to push the exchange rate towards February 23 daily low at 20.1558, short of the psychological 20.00 barrier.

Meanwhile, the US Dollar Index advances on the day some 0.96%, sitting at 98.536, putting a headwind for the USD/MXN.

Overnight, the USD/MXN opened near Monday’s low, around 20.30s. Once the North American session began following a bank’s holiday in Mexico, the Mexican peso strengthened as USD/MXN traders pushed the pair towards 20.2494 lows.

USD/MXN Price Forecast: Technical outlook

The USD/MXN bias is neutral, as depicted by the daily chart. On Friday last week, the USD/MXN broke below the 200-DMA at 20.4155, exacerbating a move towards the YTD lows. Nevertheless, USD/MXN traders need to be aware that a dampened market mood, would significantly affect Emerging Markets’ currencies, weakening the peso.

Upwards, the USD/MXN first resistance would be the 200-DMA at 20.4155. Breach of the latter would expose the 50-DMA at 20.5634, followed by the January 28 cycle high at 20.9130, short of the 21.00 barrier. On the flip side, the USD/MXN first support would be February 23 daily low at 20.1558, followed by the psychological 20.00 barrier and June 25, 2021 low at 19.7050.

- The Swiss franc is gaining 0.13% on Tuesday.

- Higher US Treasury yields failed to underpin the USD/CHF pair.

- USD/CHF Price Forecast: An inverted head-and-shoulders in the 4-hour chart looms, though to confirm its validity, would need to reclaim 0.9373.

After reaching a daily high at 0.9375, and a daily low at 0.9314, the USD/CHF stabilizes below January’s 31 pivot high at 0.9343, amid a risk-on market mood and higher US Treasury yields. The USD/CHF is trading at 0.9327 at press time during the North American session.

In the meantime, the US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, advances some 0.01%, sits at 98.474 but fails to underpin the USD/CHF. At the same time, US Treasury yields are soaring, led by 5s and 10s, each one at 2.397% and 2.381%, respectively.

Overnight, the USD/CHF began in the Asian session on a higher note, pushing through November 24, 2021, high at 0.9373, but USD bulls failed to hold their reins, as the pair dropped sharply, breaking on its way the 100, 200 and the 50-hour simple moving averages (SMAs) on its way south, to stabilize near the 0.9320 mark.

USD/CHF Price Forecast: Technical outlook

From the daily chart perspective, the USD/CHF is upward biased. However, USD bulls faltering to keep the exchange rate above 0.9343 exposed the pair to the 0.9297-0.9343 range.

4-Hour chart

The USD/CHF is also upward biased from an intraday perspective, as depicted by the simple moving averages (SMAs) in a bullish order. However, the 50-SMA lies above the spot price at 0.9357 and would be the first resistance level.

It is worth noting that an inverted head-and-shoulders pattern could be forming, but the USD/CHF would need to break upwards to confirm the right-shoulder formation. That said, the USD/CHF first resistance would be 0.9357. A decisive break would expose the inverted head-and-shoulders neckline near November 24, 2021, cycle high at 0.9373, followed by the 0.9400 mark.

- GBP/USD hit a near two-week high above the 1.3200 level on Tuesday rising, as much as 0.7% to the 1.3250s.

- The pair has been underpinned by strength in risk appetite as global equities move higher, resulting in a weaker USD.

- GBP/USD’s breakout above resistance in the 1.360-1.3200 are could be a key technical milestone, but UK fundamentals are weak.

GBP/USD hit a near two-week high above the 1.3200 level on Tuesday, rising as much as 0.7% to the 1.3250s as a continued push higher in global equity markets spurred risk appetite in currency markets. Though it remains well supported against its more interest rate sensitive safe-haven peer the yen, post-hawkish Fed Chair Jerome Powell US dollar strength on Monday has proven short-lived versus most of the buck’s G10 peers. While markets are upping bets on a more aggressive and further-reaching Fed tightening cycle, optimism that the new policy switch is “appropriate” given the backdrop of high inflation and a hot US labour market seems to be supporting sentiment.

The ongoing improvement in risk appetite, to which pound sterling is normally quite sensitive, has been able to overpower recent dovish BoE-related weakness in GBP/USD. Of course, that means that if global equities do start selling off again, the pair is at risk of giving up its newfound 1.32 status once more. There are still plenty of reasons why there could be a swift reversal lower in stocks; the Russo-Ukraine war (maybe Russia starts chucking chemical weapons around), a toughening of Western sanctions against Russia (potential EU embargo of Russian oil) and a worsening of the China Covid-19 outbreak to name a few.

GBP/USD’s breakout above key resistance in the 1.360-70 area and the 1.3200 level is a key technical milestone that opens the path towards a (technically driven) push towards 1.3300. Indeed, the pair has already bounced off of resistance in the form of the late-February/early March lows in the 1.3275 area. While the main driver of GBP/USD at present is currently a macro story of risk-on, if that switches back to forex fundamentals and central bank divergence, the UK economy’s comparatively weaker position and the BoE’s comparatively more dovish stance weakens the prospect for a sustained rally.

Looking to the immediate future, focus is on February UK Consumer Price Inflation data scheduled for release on Wednesday, to then be followed by another speech from Fed Chair Powell, ahead of flash UK and US PMIs on Thursday.

The Indonesian rupiah (IDR) is set to move only slightly downward over coming months despite the Federal Reserve rate hike cycle, economists at ING report.

Possibly higher rates and a surprisingly resilient currency

“We believe that rising inflation and a round of tightening from the central bank will be enough to nudge long-end rates to peak at roughly 7.05%, especially with the US Federal Reserve taking on a more pronounced hawkish tilt.”

“IDR will likely face some depreciation pressure in the coming months given the possible financial market outflow related to the Fed rate hike cycle. However, we have noted a relatively more resilient currency with IDR benefiting from positive export dynamics as higher global commodity prices translate to higher export earnings.”

“We are likely to see only a mild depreciation episode for IDR in 2022, especially if Bank Indonesia pushes ahead with a modest tightening cycle of its own.”

- The USD/CAD grinds higher after five days in the red.

- Fed’s Chair Powell approves 50 bps rate hikes and could happen not just once.

- USD/CAD Price Forecast: Broke the 200-DMA, exposing the USD/CAD to further downward pressure, with 1.2500 as the next target.

The USD/CAD snaps five days of consecutive losses amid a risk-on market mood. At the same time, oil prices ease from around $115.00, thus weighing on the Loonie, as the greenback reflects recent hawkishness from Federal Reserve policymakers, led by Fed’s Chair Powell saying that a 50 bps increase is on the cards, aligned with Fed hawks Bullard, Bostic, Waller, and Barkin. At the time of writing, the USD/CAD is trading at 1.2611.

Fed’s hawkishness and higher US Treasury yields keep the US dollar strong

Meanwhile, European and US equities keep trading in the green, while the DXY retraced from daily highs near the 99.00 mark around 98.481, up some 0.01%. Meanwhile, US Treasury yields are surging, in the day, as market players begin to price in hikes of the US central bank. Worth noting that the yield in 5s at 2.380% is higher than the 10-year T-note yield at 2.368%, something that USD/CAD traders need to be aware of.

The US economic docket featured more Fed speaking. St. Louis Fed’s James Bullard said that the Fed needs to get policy-neutral, saying that “faster is better” and reiterated that 50 basis points increases would be in the mix.

The Canadian economic docket featured the Producer Price Index for February monthly, which rose 3.1%, higher than January’s 2.5%, while the Raw Materials Prices increased by 29.8%, but lower than the previous reading at 30.5%.

USD/CAD Price Forecast: Technical outlook

The USD/CAD just crossed below the 200-day moving average (DMA) at 1.2607, additionally to the 50-DMA crossing under the 100-DMA, each located at 1.2681 and 1.2687, respectively. Also, on March 18, the USD/CAD broke an upslope trendline, drawn from late January, support which once broken exposed the abovementioned 200-DMA.

With that said, the USD/CAD bias is neutral-downwards. The first support would be a six-month-old upslope trendline around 1.2560-75. Breach of the latter could pave the way for further downside, with the January 19 daily low at 1.2450, followed by November 10, 2021, cycle low at 1.2387.

Upwards, the first resistance would be the 200-DMA at 1.2607. Once cleared, the next resistance would be 1.2650, followed by the confluence of the 50 and 100-DMA around 1.2681-87.

- USD/TRY advances marginally around the 14.80 region.

- Turkey 10y yields climb to record highs past 25.00%.

- The risk-on sentiment reclaims ground lost.

The Turkish lira remains on the defensive albeit marginally and lifts USD/TRY to the 14.85 region on Tuesday.

USD/TRY remains capped by 15.00

USD/TRY advances for the fourth consecutive session so far on Tuesday despite the sentiment appears to be favouring the risk complex.

The Turkish lira, in the meantime, remains unable to benefit from the better mood in the riskier assets, apparently following hopes of a positive outcome at the ongoing Russia-Ukraine talks.

The selling pressure in the lira comes amidst a new record high in the Turkey 10y benchmark note yields, this time trespassing the 25.0% level.

What to look for around TRY

The lira eases some ground and trades closer to the area of YTD lows vs. the US dollar. In the very near term, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the Russia-Ukraine peace talks. Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of easing, real interest rates remain negative and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is gaining 0.15% at 14.8430 and a drop below 14.5217 (weekly low March 15) would expose 13.7063 (low February 28) and finally 13.5091 (low February 18). On the other hand, the next up barrier lines up at 14.9889 (2022 high March 11) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level).

- Silver has been under selling pressure in recent trade and is eyeing a break below last week’s lows around $24.50.

- Equities are rallying, undermining silver’s safe-haven appeal, and yields are higher, increasing silver’s “opportunity cost”.

Spot silver (XAG/USD) prices have been coming under selling pressure in recent trade and are currently trading at session lows in the $xx per troy ounce, with the bears eyeing a test of last week’s lows at the $24.50 mark. Despite a lack of fresh positive developments regarding the Russo-Ukraine conflict (still no discernable progress in peace talks) and despite recent Fed hawkishness, risk appetite is strong and global equities firmly on the front foot, weighing on demand for safe-havens like silver. Some recent headlines alleging that there is a push going on behind the scenes within the Democrat party to revive Biden’s failed Build Back Better fiscal stimulus package might be helping risk appetite at the margin.

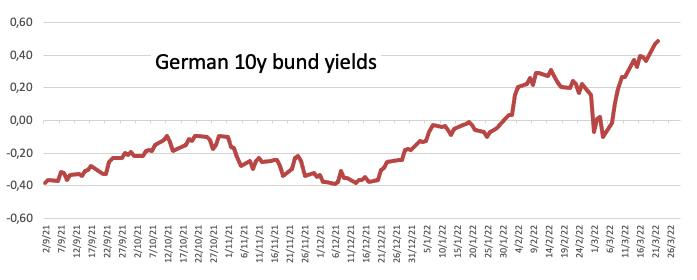

Either way, US (and global) yields are also rising sharply in tandem with US (and global) equities, raising the opportunity cost of holding non-yielding assets such as silver. The US 10-year, for example, is nearing 2.40% for the first time since May 2019, up more than 6bps on the day and taking month-to-date gains to more than 50bps. This sharp rise is largely a result of the recent hawkish Fed shift towards signaling 1) a faster pace of rate hikes (i.e. 50bps intervals at each meeting are likely) and 2) a higher terminal rate (i.e. of above so-called “neutral”).

Should the toxic combination of rallying equities and bond yields continue to undermine demand for precious metals, things could get ugly for XAG/USD. With the pair already down move than 2.0% on the day from earlier session highs closer to $25.50, a break below $24.50 could open the door to a run lower towards the 200 and 50-Day Moving Averages in the $24.00 area. Ahead, geopolitics aside, Fed speak is the main focus over the coming days, with Fed Chair Jerome Powell scheduled to speak against on Wednesday.

Belarus could "soon" join the war in Ukraine, US/NATO officials said on Tuesday, tweeted a CNN reporter, and are already taking steps to do so. "Putin needs support" and "anything would help" one official was quoted as saying. The reporter said that Belarusian opposition told them that combat units are ready as soon as the next few days, with thousands prepared to deploy.

Market Reaction

There wasn't any reaction to the latest reports, which adds to recent speculation about Belarus joining the fight on the side of Russia.

Senior Economist at UOB Group Alvin Liew reviews the latest interest rate decision by the BoJ.

Key Takeaways

“The Bank of Japan (BOJ), as widely expected, decided to keep its policy measures unchanged at its Monetary Policy Meeting (MPM) and downgraded the view on the economy due to impact from COVID-19 on 18 Mar 2022.”

“In a stark divergence with its G7 peers who are on the cusp or already normalizing monetary policy, the BOJ kept its preference for easing as it retained the statement that “it expects short- and long-term policy interest rates to remain at their present or lower levels.” It also highlighted the extremely high uncertainties over how the Russia-Ukraine war will affect Japan's economic activity and prices.”

“With the inflation largely stemming from an uncertain supply shock while domestic demand remains weak, we are certain that the BOJ will keep its current easy monetary policy intact for 2022 and will maintain its massive stimulus, possibly at least until FY2023.”

Economists at Rabobank maintain that the USD will remain supported in the near-term. Therefore, they forecast EUR/USD at 1.08 on a one-month view though see the pair edging higher towards 1.12 on a one-year view.

EUR/USD to pivot around the 1.10 level in the coming months

“The imbalances in the supply and demand of commodities caused by Russia’s pariah status could create stresses in some markets for years. This is likely to underpin safe-haven demands of USDs. The fact that this coincides with an aggressive pick-up in the pace of Fed tightening strengthens the near-term outlook for the USD.”

“In view of the risks to Europe stemming from energy supply, we would not rule out a dip in EUR/USD as far as 1.08 on a one-month view. That said, we expect EUR/USD to pivot around the 1.10 level in the coming months rising towards 1.12 on a one-year view.”

- EUR/USD made a U-turn and reversed the drop to 1.0960.

- The continuation of the upside targets the 1.1140 region.

EUR/USD reverses two consecutive daily pullbacks and manages to quickly leave behind daily lows in the 1.0960 region on Tuesday.

Further buying interest should meet the immediate barrier at the 20-day SMA at 1.1052, which is deemed as the last obstacle for a visit to the weekly peak at 1.1137 (March 17).

The longer run negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1519.

EUR/USD daily chart

USD/CAD holds a narrow range around 1.26. Although the pair may experience some more range trading in the short-term, economists at Scotiabank expect the loonie to gain traction as commodity prices stay elevated.

Technical pointers suggest more downside risk for USD/CAD

“With crude still trading well north of $100 and commodity prices generally elevated while broader market volatility continues to recede, we remain constructive on the CAD outlook – although rising US yields may become a headwind for the loonie if domestic yields fail to keep up.”

“So far, however, gains have been capped around 1.2620/25 and we note that short-term trend signals continue to lean bearish, limiting scope for USD gains.”

“We look for more range trading in the short run but feel technical pointers continue to suggest more downside risk for the USD.”

Markets have sharply re-priced central bank expectations for the Bank of England (BoE). However, expectations are still too high, therefore, the pound could suffer significant damage, economists at Scotiabank report.

GBP/USD could challenge 1.34 if the stars align

“After falling to ~117bps expected by year-end on Friday, OIS pricing is back to expecting a Bank Rate above 2% at the end of this year with ~140bps in hikes projected. This implied policy rate is about 65bps higher than where BoE communications suggest it will be at the December meeting, and we think it will be tough for the GBP to gain ground against the USD while a re-pricing of hike expectations weighs on it.”

“Smaller than expected damage from the war in Ukraine may be GBP positive but even prior to the war the BoE seemed unlikely to meet lofty market expectations.”

“If the stars align, the GBP could aim for a test of 1.34, but gains beyond this level look limited – while a re-test of 1.30 towards 1.28 seems the more likely development.”

In the view of economists at Scotiabank, the EUR/USD pair is set to move downward as Fed’s hawkishness and the ongoing war in Ukraine weigh on the shared currency.

Widening yield spreads and war risk weigh on the euro

“Markets are already showing around an 85% chance of two 25bps hikes in 2022 – which we think is the most that the ECB will hike by this year – so there is limited scope for EUR gains on a more hawkish tone from the ECB.”

“With the Fed moving more aggressively and overshooting its neutral rate, yield differentials will remain a EUR headwind over the next few quarters.”

“We see the EUR aiming for a re-test of 1.08 in coming days/weeks on war and Fed/ECB risks.”

EUR/USD looks to be coming under pressure again. The current expected consolidation stays seen as temporary ahead of a retest and eventual break of the recent low at 1.0806, analysts at Credit Suisse report.

Consolidation stays seen as temporary

“We remain of the view that the current consolidation is temporary ahead of the broader trend turning lower again. Near-term support is seen at 1.0950, ahead of 1.09, below which should clear the way for a retest of uptrend support from early 2017 low and the recent low at 1.0825/06. Whilst a fresh hold here should be allowed for, we continue to look for a sustained break lower in due course.”

“Below 1.0806, we see support next at 1.0775/66, ahead of 1.0727 and eventually the 2020 low itself at 1.0635.”

“Above 1.1070/72 is needed to ease the immediate downside bias for strength back to 1.1120 and then the recent high and Fibonacci retracement at 1.1138/45, potentially as far as 1.1275, but with fresh sellers expected here.”

- WTI has eased back from APac session highs in the $113.00s to under $110 amid fresh profit-taking.

- The EU is reportedly split over whether or not to press ahead with a Russian oil import ban.

After rising as high as the $113.00s during Asia Pacific trade as oil market participants responded to chatter about a potential EU ban on Russian oil imports and weekend news of disruptions to Saudi energy infrastructure, front-month WTI futures have eased back somewhat. Prices are now back to trading beneath $110 per barrel, down about $3.50 versus Monday’s closing highs in the upper $112.00s. That still leaves prices higher by more than $15 versus last week's lows, though still some $20 lower versus earlier monthly highs.

Reports that EU foreign ministers are split over whether to press ahead with the Russian oil embargo likely prompted some profit-taking, with Germany reportedly still of the view that the bloc remains too dependent on Russian energy to take such a step. “The proposed ban is still some way from becoming policy because a significant number of EU nations oppose the ban... Still, the fact that the ban is being discussed at all is a significant shift” said analysts at Commonwealth Bank of Australia.

Looking ahead, geopolitical developments remain in the forefront, though traders will also be focused on the latest weekly Private API crude oil inventory data release at 2130 GMT. Oil traders continue to fret about uncertainty regarding the extent of loss of Russian supply at a time when global oil reserves are at multi-year lows.

Gold jumped from a low of $1,782 at the start of 2022 to a high of $2,070 as Russian-to-Western world tensions peaked in the second week of March, before it fell back towards $1,925 as geopolitical tensions related to the war in Ukraine moderated somewhat. Strategists at TD Securities expect XAU/USD to average $1,863 this year.

Gold to drift below low-$1,800s by year-end if Fed policy gets much more aggressive

“Based on the pattern of market behaviour over the last several years, we see considerable volatility and expect the yellow metal to average about $1,863 this year.”

“Average prices are likely to be highest in the latter part of H1-2022 as inflation stays at multi-decade highs, economic growth wanes and the Fed is seen as being behind the curve.”

“The outlook deteriorates in the latter part of the year as central bank policy gets much more aggressive in their fight against inflation, which should see price the yellow metal drift to modestly below low-$1,800s by year-end.”

“If the Fed does not become restrictive, the yellow metal can test the record $3,100 (in current dollars) found back in January 1980.”

- Higher international yields (versus Japan) and more dovish BoJ commentary are hitting the yen hard on Tuesday.

- USD/JPY hit multi-year peaks above 121.00 before backing off somewhat, with on the month gains near 5.0%.

The yen continues to suffer at the hands of a bearish combination of dovish BoJ rhetoric and higher/rising yields elsewhere and is the worst-performing G10 currency on Tuesday by a substantial margin. After BoJ Governor Haruhiko Kuroda reiterated on Tuesday that it remains premature to exit from its ultra-accommodative monetary stance and US 10-year yields surged to fresh multi-year highs above 2.35% (now up nearly 20bps on the week and 50bps on the month), USD/JPY was propelled to its highest level since February 2016 above 121.00.

The pair has since eased back to just above the 120.50 mark, but continues to trade with on-the-day gains of about 0.9%, taking its on-the-month gains to nearly 5.0%. The main driver of the move higher in yields that has propelled USD/JPY to multi-year peaks has been the Fed’s hawkish shift in its policy guidance. In wake of the central bank’s policy announcement last Wednesday and Fed Chair Jerome Powell’s speech on Monday, markets are upping their bets that 1) the Fed moves more quickly to lift rates (i.e. in larger intervals than 25bps per meeting) and 2) that the Fed takes interest rates higher than so-called “neutral” (the 2.0-2.5% area).