- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 22-02-2023

- NZD/USD has attempted recovery from 0.6210 as investors expect a string of bumper rate hikes by the RBNZ ahead.

- A fresh cyclone relief package by NZ Hipkins is subjected to fuel inflationary pressures further.

- Fed Bullard is favoring an aggressive monetary policy to squeeze the giant inflation.

The NZD/USD pair has sensed demand after dropping to near 0.6210 in the early Asian session. The Kiwi asset has rebounded as the Reserve Bank of New Zealand (RBNZ) is citing a string of bumper rate hikes to fade fresh fears of further acceleration in the inflationary pressures.

Despite pushing the Official Cash Rate to 4.75% on Wednesday, RBNZ Governor Adrian Orr is favoring more mega rate hikes. The New Zealand inflation has not peaked yet and a fresh cyclone relief package of NZ$300 million ($187.08 million) promised by NZ Prime Minister (PM) Chris Hipkins is subjected to fuel inflationary pressures further.

Economists at Westpac expect a peak of 5.5% in the OCR this year, up from our earlier forecast of 5.25%.” A note from Westpac stated “The RBNZ remains committed to bringing inflation back under control and sees the risks as being to the upside of its already-strong forecasts. As a result, we expect that it will carry through with its plans, at least in the near term.”

A slight recovery in the risk-appetite theme has supported the New Zealand Dollar. S&P500 futures have rebounded and have confidently recovered Wednesday’s losses. The alpha provided on the 10-year US Treasury bonds has slipped to near 3.92%.

Meanwhile, St. Louis Federal Reserve (Fed) President James Bullard has advocated an aggressive interest rate hike in the March monetary policy meeting to sharpen its tools in the battle against persistent inflation. Fed policymaker believes that the central bank has a chance to tame inflation significantly in 2023 without pushing the United States into a recession. Also, Fed Bullard has come forward with a terminal rate projection of 5.4%.

On Thursday, investors will see a power-pack action after the release of the annualized US Gross Domestic Product (GDP) (Q4) data. The economic data is seen unchanged at 2.9%. An upbeat US GDP data could infuse fresh blood into the US Dollar Index (DXY) ahead.

- The AUD/JPY drops below the 100-day EMA and the 92.00 psychological figure.

- AUD/JPY Price Analysis: Hits a new weekly low at 91.67, about to test the 200-DMA.

Due to a risk-off impulse, the AUD/JPY slides below the 20-day Exponential Moving Average (EMA), eyeing the intersection of the 200 and 50-day EMA at around 91.55/60. However, as the Asian session begins, the AUD/JPY is trading at 91.84, registering minuscule gains of 0.08%.

The AUD/JPY peaked during the week at around 93.01 on Tuesday and has enjoyed a downtrend of two straight days since then. The AUD/JPY failure to break above the last week’s high of 93.03 exacerbated a downfall of 120 pips or 1.30%. Oscillators like the Relative Strength Index (RSI) is neutral, while the Rate of Change (RoC) suggests that sellers are gaining momentum. Therefore, in the near term, the AUD/JPY might print a leg-down.

The AUD/JPY first support would be the 20-day EMA at 91.75. A breach of the latter will expose the confluence of the 200 and 50-day EMA at around 91.55/60, that once cleared, would pave the way toward 91.00. The sellers’ next stop would be the February 10 daily low of 90.22.

As an alternate scenario, the AUD/JPY first resistance would be the 92.00 figure. Once broken, the AUD/JPY will threaten the February 22 daily high at 92.68, followed by 93.00.

AUD/JPY Daily chart

AUD/JPY Key technical levels

- Silver price remains sluggish after posting the biggest daily loss in two weeks.

- Clear U-turn from 100-DMA, bearish MACD signals favor XAG/USD sellers.

- Buyers need daily closing beyond $22.60 to retake control.

Silver price (XAG/USD) struggles for clear directions at the weekly low surrounding $21.50 during early Thursday, after posting the biggest daily slump in a fortnight.

Although the early hours of the day restrict the metal’s moves, the XAG/USD remains on the bear’s radar while observing the previous day’s clear U-turn from the 100-DMA hurdle. Adding strength to the downside bias are the bearish MACD signals.

As a result, the Silver price is well-set to test the 200-DMA support of $21.00. However, the 50% Fibonacci retracement level of the metal’s upside from October 2022 to February 2023, around $21.35 will precede the latest swing low near $21.20 to probe the immediate downside.

In a case where the Silver bears dominate past 200-DMA, the 61.8% Fibonacci retracement level around $20.60, also known as the golden Fibonacci ratio, could act as an intermediate halt during the quote’s likely fall toward the $20.00 psychological magnet.

On the flip side, the Silver buyers are less likely to get convinced even if the metal offers a daily closing beyond the 100-DMA hurdle of $22.00.

That said, the 38.2% Fibonacci retracement and an 11-week-old horizontal resistance area, respectively near $22.15 and $22.55-60, could act as the last defense of the XAG/USD bears.

Overall, the Silver price is likely to remain bearish despite the latest inaction.

Silver price: Daily chart

Trend: Further downside expected

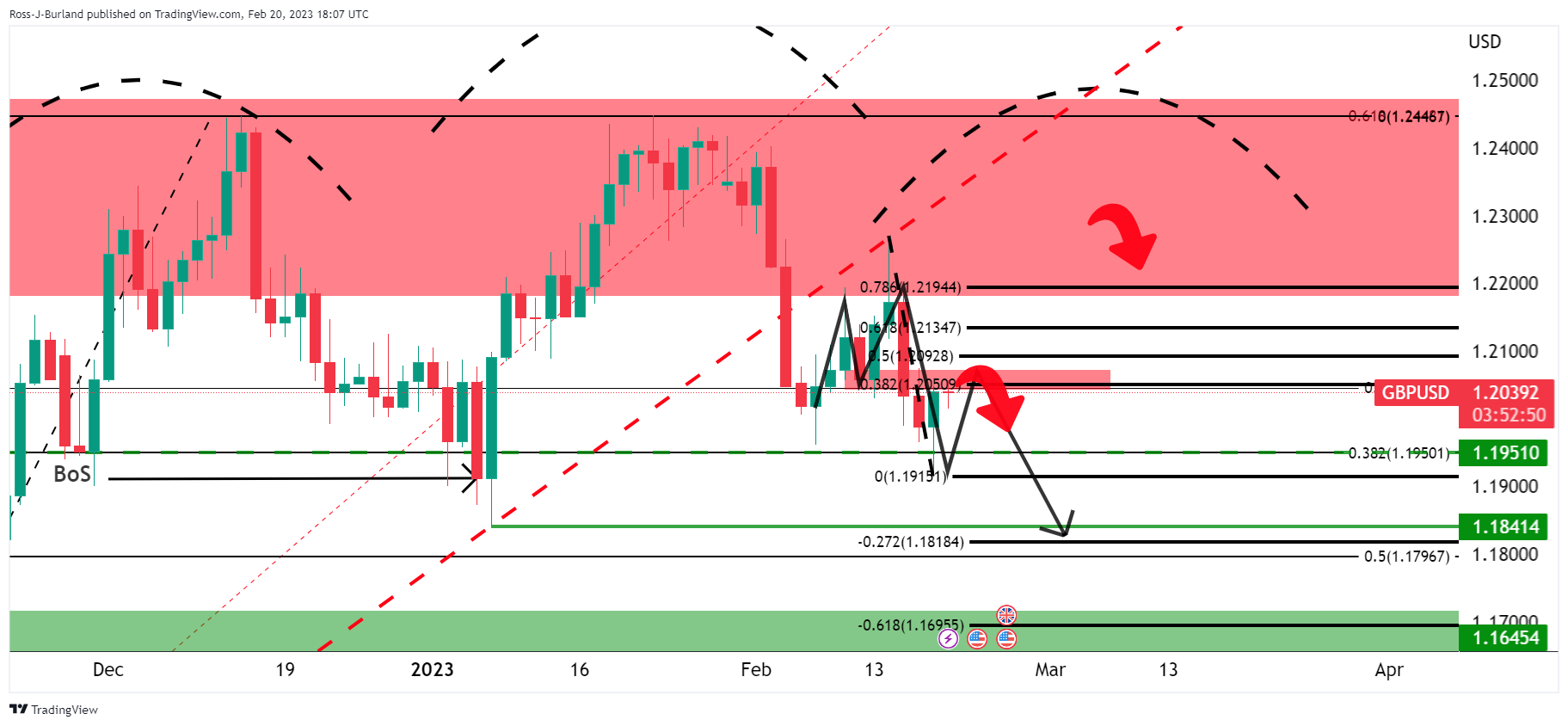

- GBP/USD is gauging an intermediate cushion around 1.2040, however, the overall market mood is still negative.

- Fed policymakers are still reiterating higher interest rates for a longer period to achieve the 2% inflation target.

- The annualized US GDP Q4 data is seen stable at 2.9%.

The GBP/USD pair has sensed a pause in the downside momentum after dropping to near 1.2040 in the early Asian session. It would be early to consider a loss in the downside momentum for the Cable as higher volatility might stay ahead of the release of the preliminary United States Gross Domestic Product (GDP) data for the fourth quarter of CY2022. The annualized economic data is seen stable at 2.9%

The Cable witnessed an intense sell-off in the late New York session after the release of the hawkish Federal Open Market Committee (FOMC) minutes. Federal Reserve (Fed) chair Jerome Powell and his mates are still reiterating higher interest rates for a longer period to drag the Consumer Price Index (CPI) to near 2% target.

Fed policymakers are worried that China’s reopening after the rollback of lockdown curbs and ongoing Russia’s invasion of Ukraine advocate upside risks in inflation. Domestically, a shortage of labor could propel a higher wage price index ahead.

Meanwhile, S&P500 futures have shown a recovery in the Asian session. The 500-US stocks basket futures have recovered their entire losses shown on Wednesday. A sense of optimism has been observed in the overall risk aversion theme.

The optimism could fade as President Joe Biden told that it was a "big mistake" for Russian President Vladimir Putin to temporarily suspend Russia's participation in the last remaining nuclear arms treaty between the two countries. Earlier, US Biden announced “Russia was suspending its participation in the New START treaty, which implements caps on the number of nuclear weapons deployed by each country and inspections of nuclear sites,” as reported by ABC News.

The Pound Sterling looks struggling again as the recovery in manufacturing activities is not sufficient enough to avoid the recession ahead. The preliminary United Kingdom manufacturing activities remained upbeat at 49.2, however, a figure below 50.0 is considered a contraction. UK households are struggling to address their usual demand due to higher food inflation, which is impacting their confidence in the economic prospects.

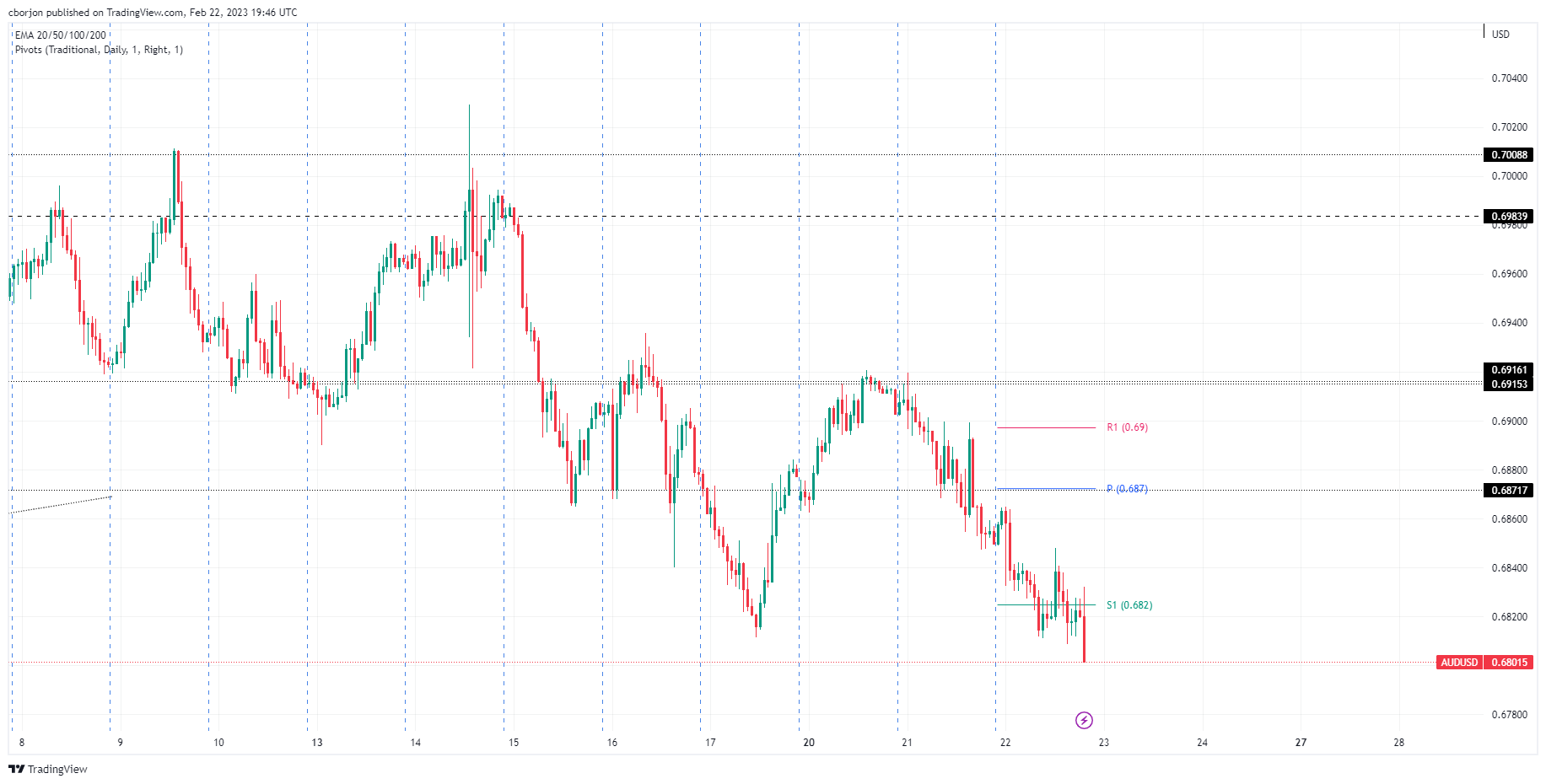

- AUD/USD steadies around multi-day low, probes two-day losing streak.

- Hawkish Fed Minutes, fears emanating from China, Russia weigh on Aussie pair.

- Downbeat Australia data add strength to the bearish bias.

- Second readings of the US Q4 PCE, GDP will be important ahead of Fed’s preferred inflation gauge.

AUD/USD picks up bids to refresh intraday high around 0.6810 as bears take a breather around the 1.5-month low, after a two-day downtrend, during early Thursday. In doing so, the Aussie pair might have cheered the latest geopolitical hints from US President Joe Biden but the broad pessimism surrounding the Ukraine-Russia war and the Fed’s aggression keeps the Aussie bears hopeful.

That said, President Joe Biden said on Wednesday, in an interview with ABC News, that he did not read into Vladimir Putin's decision to temporarily suspend participation in a nuclear arms treaty as a signal the Russian President was considering using nuclear weapons. US President Biden, however, called it a "big mistake", reported Reuters.

Although the headlines ease the geopolitical fears by a bit, comments from China's top diplomat Wang Yi and Russian President Putin weigh on the sentiment and the risk-barometer AUD/USD pair. China’s Diplomat Wang Yi met Russian President Vladimir Putin and said that they are ready to deepen strategic cooperation with Russia on Wednesday, as reported by Reuters. The Chinese policymaker also added that their relations will not succumb to pressure from third countries. Meanwhile, Putin noted that it's very important for them to have a cooperation with China and said he is looking forward to Chinese President Xi Jinping visiting Moscow.

Elsewhere, hawkish Federal Reserve (Fed) Minutes and statements suggesting higher interest rates from the Fed also weigh on the AUD/USD. As per the latest Federal Open Market Committee’s (FOMC) Monetary Policy Meeting Minutes, all participants agreed more rate hikes are needed to achieve the inflation target while also favoring further Fed balance sheet reductions. Adding strength to the hawkish Fed Minutes were statements suggesting that a few participants favored a 50 basis point (bps) rate hike, while some believed there was an elevated risk of a recession in 2023.

On the same line, St. Louis Federal Reserve President James Bullard also mentioned that the Fed will have to go north of 5% to tame inflation, as reported by Reuters. The policymaker also stated that he believes there are good chances they could beat inflation this year without creating a recession. The same suggests higher Fed rates for longer and exerts downside pressure on the AUD/USD price. Additionally, Federal Reserve Bank of New York President John Williams also highlighted the hawkish Fed concerns and weighed on the AUD/USD as he said, “Fed is absolutely committed to getting inflation back to 2%.”

It should be noted that downbeat prints of Australia’s Wage Price Index for the fourth quarter (Q4) join softer Q4 Construction Work Done and unimpressive Westpac Leasing Index for January to weigh on the AUD/USD price.

Amid these plays, the US Dollar Index (DXY) stretched its previous run-up to refresh the multi-day high while the US 10-year and two-year Treasury bond yields retreat from their three-month high. Further, Wall Street closed mixed and should have put a floor under the AUD/USD.

Moving on, AUD/USD bears will be interested in seeing a strong print of the Personal Consumption Expenditures for the fourth quarter (Q4), as well as no disappointment from the second readings of the US Gross Domestic Product (GDP) for the said period.

Technical analysis

A daily closing below the three-month-old ascending trend line, now immediate resistance near 0.6820, needs validation from the 200-DMA support surrounding 0.6800 to convince the AUD/USD bears.

New York's Federal Reserve John Williams explained that the 2% inflation is the foundational target and that price stability is an absolute imperative,

Key notes

We are absolutely committed to getting back to 2% over the next few years.

Although goods prices have come down in last several months, there are signs this may not go as quickly as hoped.

We have demand that exceeds supply, labor market is extraordinarily strong.

Monetary policy must bring demand and supply back into balance.

Don't want to allow inflation expectations anchor to slip.

President Joe Biden said on Wednesday, in an interview with ABC News, that he did not read into Vladimir Putin's decision to temporarily suspend participation in a nuclear arms treaty as a signal the Russian President was considering using nuclear weapons. US President Biden, however, called it a "big mistake", reported Reuters.

Additional statements

It's a big mistake to do that. Not very responsible. But I don't read into that that he's thinking of using nuclear weapons or anything like that.

Well look, I think we're less safe when we walk away from arms control agreements that are very much in both parties' interests and in the world's interest.

The idea that somehow this means they're thinking of using nuclear weapons, intercontinental ballistic missiles, there's no evidence of that.

Putin earlier this week backed away from the New START arms control treaty - a 2010 agreement that limits the number of Russian and U.S. deployed strategic nuclear warheads - and warned that Moscow could resume nuclear tests.

Market implications

Such headlines weigh on risk appetite and exert downside pressure on the Gold price, trading near $1,820 support by the press time.

Also read: Gold Price Forecast: XAU/USD slides on hawkish Federal Reserve Minutes, United States data eyed

- USD/CHF is almost flat as Thursday’s Asian session kicks in.

- USD/CHF Price Analysis: Downward biased, though it appears to have bottomed around 0.9000.

The USD/CHF clings to 0.9300 as the Asian Pacific session begins, but it’s trading beneath its opening price after printing a new weekly high of 0.9318 and gaining 0.39% on Wednesday. At the time of typing, the USD/CHF exchanges hands at 0.9302.

The USD/CHF pair is neutral to downward biased, with the long-term Exponential Moving Averages (EMAs), the 100 and 200-day EMAs, sitting above the exchange rate each at 0.9383 and 0.9454, respectively. In addition, the USD/CHF spot price remains below the January 6 daily high of 0.9409, which, once broken, could send the pair rallying to test the 200-day EMA.

Even though the USD/CHF bias is tilted to the downside, the pair appears to have bottomed around 0.9059. Also, the Relative Strength Index (RSI) and the Rate of Change (RoC) are bullish, suggesting buyers are piling in.

Therefore, the USD/CHF path of least resistance is upward in the near term. The first resistance would be the last week’s high at 0.9331. A decisive break and the following resistance tested would be the 100-day EMA at 0.9383, ahead of the 0.9400 figure. Once those two supply zones are conquered, buyers will aim toward the 200-day EMA at 0.9454 before posing a threat of the 0.9500 figure.

Contrarily, if the USD/CHF drops below the 50-day EMA at 0.9281, that would exacerbate a fall toward the February 14 daily low at 0.9135.

USD/CHF Daily chart

USD/CHF Key technical levels

- USD/CAD is looking to recapture the immediate resistance of 1.3550 amid a dismal market mood.

- An intense sell-off in the oil price after a heavy buildup of oil inventories reported by US API has impacted the Canadian Dollar.

- The RSI (14) is eyeing a break into the bullish range of 60.00-80.00 after a period of four months.

The USD/CAD pair is attempting to recapture the critical resistance of 1.3550 in the early Tokyo session. The Loonie asset witnessed a minor correction after a vertical upside move post hawkish Federal Open Market Committee (FOMC) minutes. The upside bias is still favored as the risk appetite of the market participants has weakened dramatically.

S&P500 futures are demonstrating marginal gains after a choppy trading session. The US Dollar Index (DXY) is aiming to test Friday’s high around 104.33 as investors have underpinned the risk-aversion theme.

Meanwhile, the oil price has refreshed its two-week low at $73.80 after the United States American Petroleum Institute (API) reported bumper oil stockpiles at 9.985 million barrels for the week ending February 17.

USD/CAD has overstepped the 61.8% Fibonacci retracement (placed from December 16 high at 1.3705 to February 2 low at 1.3262) at 1.3536 on a daily scale. The Loonie asset has also crossed the downward sloping trendline plotted from October 13 high at 1.3978, which indicates more upside ahead.

The 20-and 50-period Exponential Moving Averages (EMAs) are on the verge of delivering a bullish crossover at around 1.3445, which will be added to the upside filters.

Also, the Relative Strength Index (RSI) (14) is eyeing a break into the bullish range of 60.00-80.00 after a period of four months. An occurrence of the same will accelerate the upside momentum.

The Loonie asset might record more gains after surpassing February 22 high at 1.3568, which will drive the asset toward the round-level resistance at 1.3600 followed by November 29 high at 1.3645.

Alternatively, a break below February 6 high at 1.3474 will drag the asset to near 38.2% Fibo retracement at 1.3432. A slippage below the same will expose the asset to January 26 high of around 1.3408.

USD/CAD daily chart

-638127026243785618.png)

“Cyclone-related inflationary pressure may require higher rates for longer,” said Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr during an interview with Bloomberg TV on early Thursday in Asia, late Wednesday elsewhere.

Also read: RBNZ's Orr: Core inflation is too high, expectations elevated

Additional comments

There would need to be a large inflationary shock to return to 75bp rate hikes.

RBNZ is optimistic about a return to steady, low inflation.

RBNZ has been aggressive in its tightening.

It’s worth noting that RBNZ’s Chief Economist Paul Conway also crossed wires, via Reuters, while stating that a cyclone that hit New Zealand earlier this month was leading to greater uncertainty around GDP projection. RBNZ's Conway was testifying at parliament's Finance and Expenditure committee meeting, per Reuters.

NZD/USD stays pressured

The news fails to ease pressured off the NZD/USD pair as it holds lower ground near 0.6215 at the latest.

Also read: NZD/USD bears on top as traders await more cues from US data

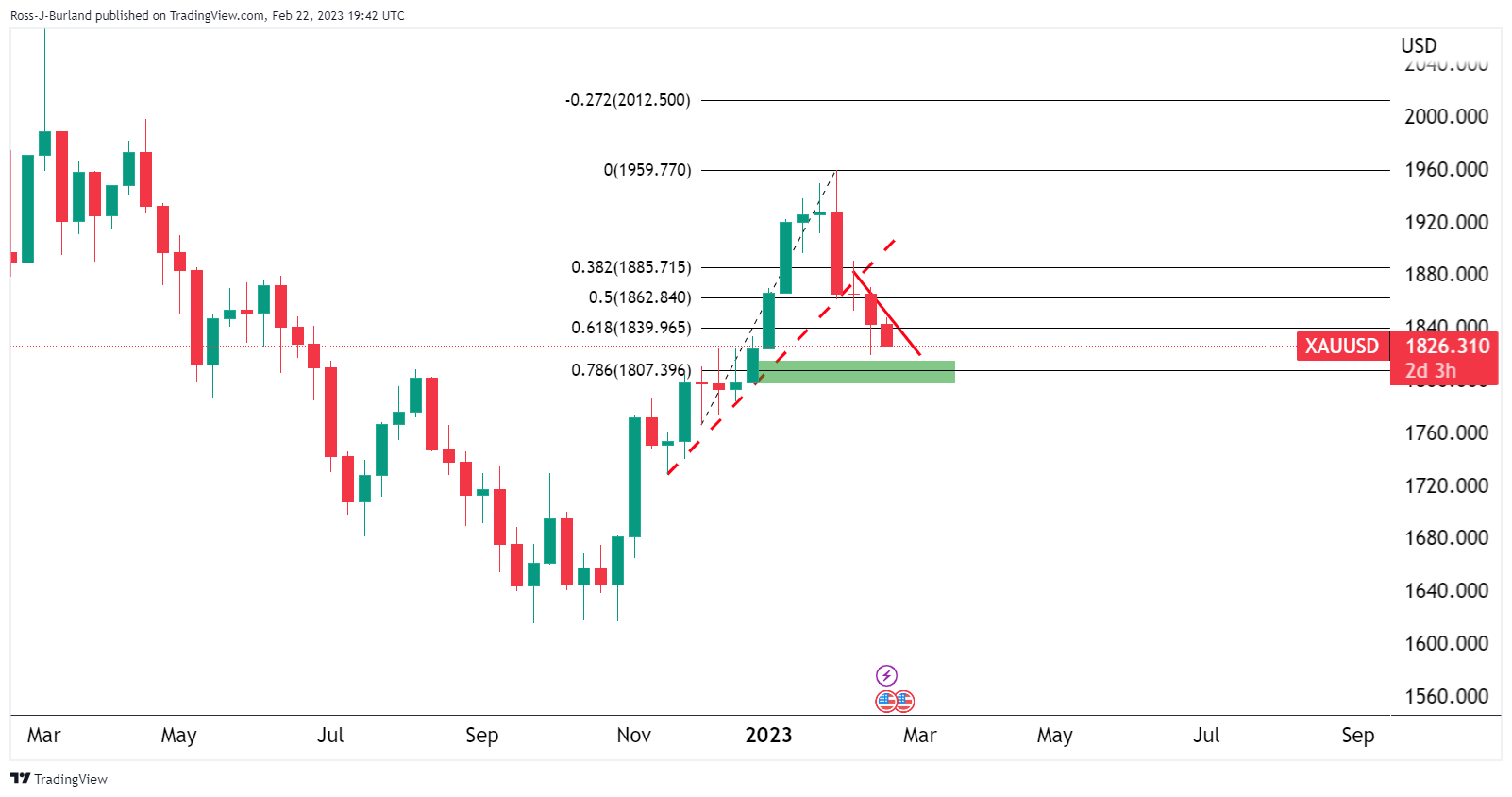

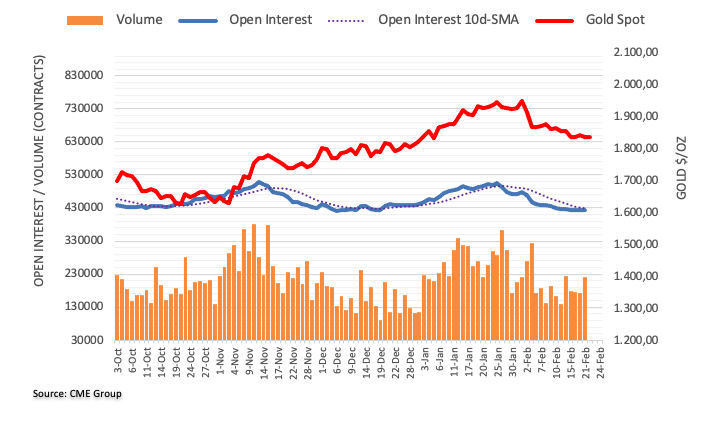

- Gold price remains pressured around short-term key support after three-day downtrend.

- XAU/USD drops as Federal Reserve Minutes suggest policymakers discussed need of more rate hikes.

- Geopolitical fears, comments from Fed’s Bullard also weigh on Gold price.

- Gold sellers poke 100-day Exponential Moving Average support with eyes on United States statistics.

Gold price (XAU/USD) bears the burden of hawkish Federal Reserve (Fed) bias, as well as the geopolitical fears, as the yellow metal pokes a short-term key support surrounding $1,820 during early Thursday. In doing so, the XAU/USD also justifies the hawkish comments from a Fed Official while portraying the cautious mood ahead of the second-tier United States data amid firmer US Dollar.

Gold drops on hawkish Federal Reserve Minutes

As per the latest the Federal Open Market Committee’s (FOMC) Monetary Policy Meeting Minutes, all participants agreed more rate hikes are needed to achieve the inflation target while also favor further Fed balance sheet reductions. Adding strength to the hawkish Fed Minutes were statements suggesting that a few participants favored a 50 basis point (bps) rate hike, while some believed there was an elevated risk of a recession in 2023.

Given the hawkish Fed Minutes, the odds of sustained rate hikes are high, which in turn weigh on the Gold price, via firmer US Dollar and Treasury bond yields.

Geopolitics, Fed’s Bullard also weigh on XAU/USD

In line with the FOMC Minutes, St. Louis Federal Reserve President James Bullard also mentioned that the Fed will have to go north of 5% to tame inflation, as reported by Reuters. The policymaker also stated that he believes there are good chances they could beat inflation this year without creating a recession. The same suggests higher Fed rates for longer and exert downside pressure on the Gold price.

Elsewhere, geopolitical fears surrounding China and Russia escalated and favored the rush towards the risk-safety, which in turn propelled the US Dollar and weighed on the XAU/USD. The reason could be linked to the comments from China's top diplomat Wang Yi who met Russian President Vladimir Putin and said that they are ready to deepen strategic cooperation with Russia on Wednesday, as reported by Reuters. The Chinese policymaker also added that their relations will not succumb to pressure from third countries. Meanwhile, Putin noted that it's very important for them to have a cooperation with China and said he is looking forward Chinese President Xi Jinping to visit Moscow.

US Dollar strength weigh on Gold ahead of data

Following the hawkish Federal Reserve minutes, comments from Fed’s Bullard and geopolitical fears, the US Dollar Index (DXY) stretched their previous run-up to refresh the multi-day high and pleased the Gold sellers.

That said, the DXY refreshed the weekly high and approached the seven-week high marked in the mid-February. It should be noted, however, that the US 10-year and two-year Treasury bond yields retreat from their three-month high and Wall Street also closed mixed, which in turn should have put a floor under the Gold price.

Gold price technical analysis

Gold price extends pullback from a 10-day Exponential Moving Average (EMA) towards testing the 100-day EMA support, following a failed attempt to cross the two-week-old resistance line.

The downside bias also takes clues from the Moving Average Convergence and Divergence (MACD) indicator’s bearish signals, which in turn suggests the downside break of the immediate 100-day EMA support of $1,820.

However, the Relative Strength Index (RSI) line, placed at 14, is near to the oversold territory and hence suggests the limited room towards the south. As a result, the 61.8% Fibonacci retracement level of the Gold price run-up from late November 2022 to early February 2023, close to $1,812, could challenge the XAU/USD bears.

In a case where the Gold price remains weak past $1,812, the $1,800 threshold and the last December’s low of $1,766 will be in focus.

Alternatively, the aforementioned two-week-old descending trend line and the 10-day EMA< respectively near $1,834 and $1,844, could challenge the XAU/USD rebound.

However, the Gold price recovery remains elusive unless crossing the February 09 swing high surrounding $1,890.

Overall, Gold price remains bearish but the downside room appears limited.

Gold price: Daily chart

Trend: Further downside expected

- EUR/USD has sensed a loss in the bearish momentum around 1.0600, more downside looks favored.

- Risky assets have been heavily dumped as a few Fed policymakers favored a 50 bps interest rate hike in the February meeting.

- ECB Lagarde has confirmed the continuation of the 50 bps rate hike spell for March.

The EUR/USD pair has gauged a cushion around 1.0600 in the early Asian session. Despite the hawkish commentary in the Federal Open Market Committee (FOMC) minutes, the major currency pair has sensed a loss in the downside momentum. Risk-perceived assets have been heavily dumped as a few Federal Reserve (Fed) policymakers favored a 50 basis point (bps) interest rate hike in February monetary policy meeting to tame stubborn inflation.

It seems that Fed policymakers are not gay with the easing United States Consumer Price Index (CPI) in the last three months and need to see more progress. Fed policymakers have reiterated that higher rates are required for a sufficient period of time to achieve the 2% inflation target. Fed chair Jerome Powell and his teammates are worried that the inflationary pressures are still prone to upside risks due to China's economic reopening and Russia's war with Ukraine.

Fed minutes conveying that higher interest rates will sustain longer have infused fresh blood into the US Dollar Index (DXY). The USD Index is looking for sustainability above 104.00 amid the risk-off mood. S&P500 futures witnessed marginal losses on Wednesday, portraying a risk aversion theme. The demand for US government bonds has marginally improved despite hawkish Fed minutes. The return delivered on the 10-year US Treasury yields has trimmed to 3.92%.

On the Eurozone front, European Central Bank (ECB) President Christine Lagarde clearly announced “Headline inflation has begun to slow down but reiterated that they intend to raise the key rates by 50 basis points (bps) at the upcoming policy meeting. She also cited that the central bank is not seeing a wage-price spiral in the Eurozone.

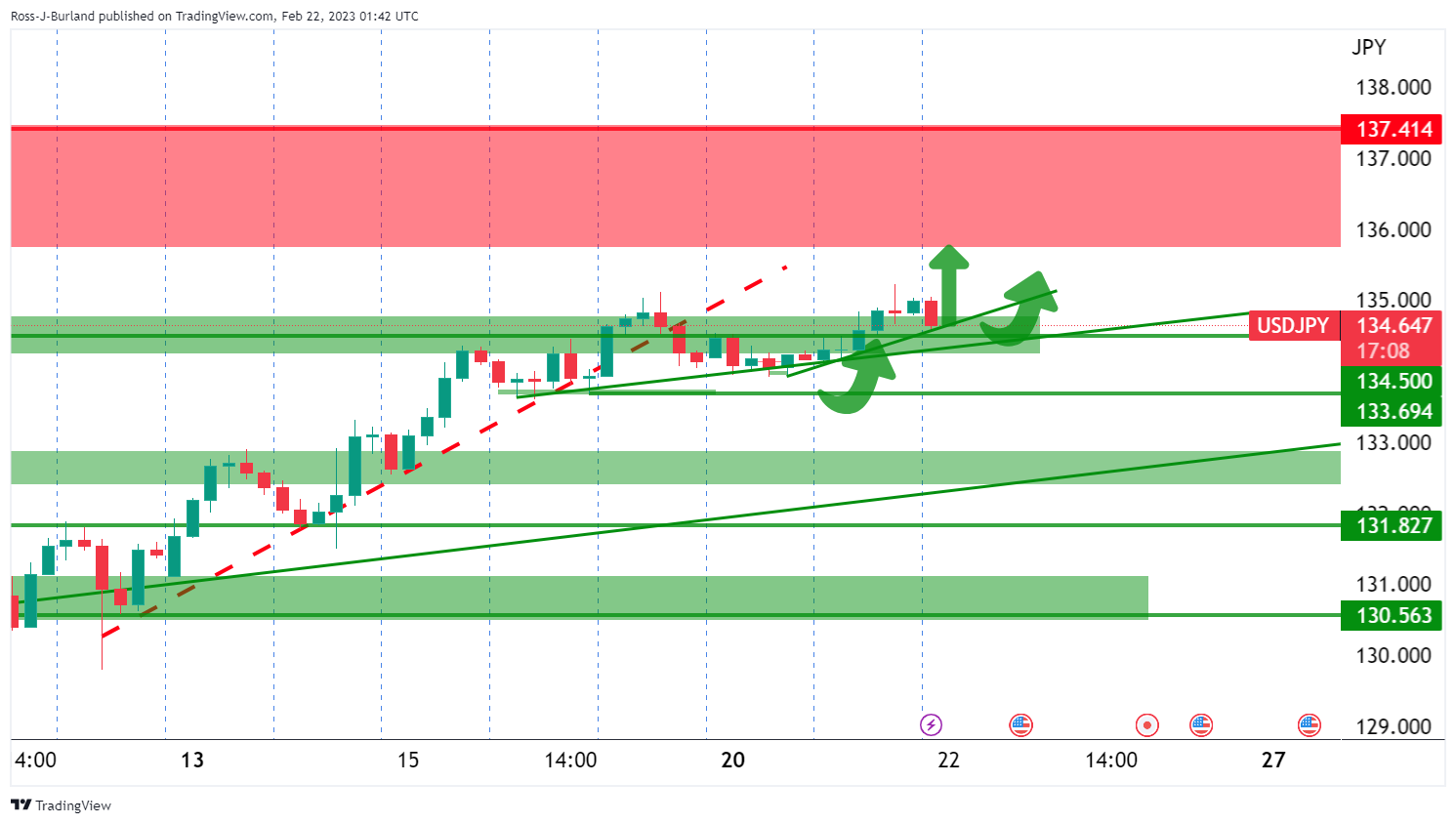

- USD/JPY's line in the sand is 134.50 currently and bulls need to commit at this juncture.

- The bears will be looking for a weekly close below 134.50.

USD/JPY is holding in bullish territories while on the front side of the meanwhile bullish tren's dynamic support as illustrated on the daily chart above. There are prospects of a move towards the 137.40/50 for the foreseeable future while the support structure holds up.

USD/JPY daily chart

On the other hand, bears will be keen on a retest of the bull's commitments at 134.50 and should they break below with little fight from the bulls, then we could be looking at a very different scenario for the days and possibly weeks ahead:

The daily and weekly charts outline a bearish scenario if the bears really go to town on support and manage to get a weekly close below 134.50 this week or even next week.

- NZD/USD bears are in town on a stronger US Dollar.

- RBNZ struck a hawkish tone but US data dominates.

NZD/USD is bid by some 0.11% but pressured overall following the release of a hawkish set of Federal Open Market Committee minutes whereby a few participants had favoured raising rates by 50 basis points which has put a bid in the US Dollar but left the US Treasury Yield relatively stable.

''Markets have been forced to reprice interest rate expectations, not just higher, but also questioning the view that once peak rates are hit, central banks will pivot quickly to cutting interest rates,'' analysts at ANZ Bank said in a note on Thursday morning in Asia.

''The early 2023 indications are that economic activity is more resilient than data implied in Q4 and that monetary tightening is not yet bearing down on broader economic activity. Economic resilience is to be lauded, but central banks are uncomfortable with current levels of aggregate expenditure and labour market demand.''

''They need to stay hawkish and are not yet in a position to declare that interest rates are “sufficiently restrictive”. If the upcoming run of February data for the US confirm robust economic activity, it is difficult to see how risk will recover in the near term.''

Speaking of which, this week will provide The Fed’s favoured inflation measure, the PCE deflator. ''The market is expecting the January headline data to remain at 5.0% YoY, in line with the previous month,'' analysts at Rabobank said. ''This would strengthen concerns that the downtrend in inflationary indicators may have stalled.

Data in line with market expectations would thus add further weight to the view that the Fed will have to work harder to push inflation back to its target level. Currently implied market rates are pointing to a peak in Fed funds close to 5.33%.''

Domestically, the overall tone of the Reserve Bank of New Zealand's statement yesterday remained hawkish, and of note, they landed firmly on the side of economics rather than emotions, the analysts at ANZ Bank explained today.

''They also highlighted the longer-term inflationary risks surrounding cyclone recovery, which speak to stronger activity and a higher OCR. There isn’t enough information available just yet, but in time, that could play into NZD strength in upcoming meetings.''

- The minutes showed that some Federal Reserve officials wanted a 50 bps rate hike.

- Policymakers’ worries are linked to a tight labor market and commented inflation risks are tilted upwards.

- AUD/USD Price Analysis: Spiked towards 0.6830 before reversing its path to print a new weekly low of around 0.6801.

AUD/USD prolonged its losses during the Wednesday session and dropped nearby the day’s low of 0.6808 after the release of the Federal Open Market Committee (FOMC) minutes, which revealed that “few participants” favored a 50 bps rate hike. At the time of writing, the AUD/USD exchanges hands at 0.6826.

Summary of the FOMC’s minutes

The FOMC revealed in its minutes that some Federal Reserve policymakers wanted a more aggressive rate hike, with minutes citing that “a few participants favored raising rates by 50 bps.” Further, all the Fed board members agreed that more rate hikes are needed to achieve the Fed’s target and that balance sheet reduction would continue according to the plan.

Fed policymakers reiterated that inflation risks remain skewed to the upside, including China’s reopening and Russia’s invasion of Ukraine, reiterating that the labor market remains tight. Participants said the economic outlook is weighed on the downside, and some participants saw prospects of a recession in 2023.

AUD/USD Reaction to FOMC’s minutes

The AUD/USD 1-hour chart shows a spike towards 0.6832 before the AUD/USD reversed its course, breaching south of the S1 daily pivot point at 0.6825. It should be said that volatility has increased, and after reaching a low of 0.6808, as of late, the AUD/USD is tumbling sharply, eyeing a break below the 0.6700 mark.

AUD/USD 1-Hour chart

AUD/USD Key technical levels

- Gold price is in a bearish trend and the FOMC minutes have fuelled a sell-off.

- Gold price's weekly chart shows support near the 78.6% Fibonacci retracement level at $1,807.

Gold price is under pressure by some 0.3% on the day and remains in the hands o the bears following the first Federal Open Market Committee Minutes of 2023.

The minutes were released whereby investors have been searching for further insights into the near-term path for policy and any comments regarding the possibility of the Federal Reserve going back to 50 bps hikes. The minutes showed that a few participants had favoured raising rates by 50 basis points which has put a bid in the US Dollar but left the US Treasury Yield relatively stable. This has left the Gold price somewhat pressured around the low of the day near $1,825.54 after the yellow metal fell from a high of 41,846.05 earlier in the day.

FOMC minutes key notes

- A few participants favoured raising rates by 50 basis points.

- All participants agreed more rate hikes needed to achieve Federal Open Market Committee's job, inflation objectives.

- Participants said restrictive monetary policy needed until Fed confident inflation falling to 2%; added that process likely to take 'some time'.

- All participants favored further fed balance sheet reductions under current plan.

- Participants said uncertainty associated with outlooks for economy, job market and inflation was 'high'.

- Participants saw upside risks for inflation, including china's economic reopening and Russia's war in Ukraine.

- Participants said risks to economic outlook weighted to downside.

- A number of participants said drawn-out US debt limit process could pose 'significant risks' to the financial system, economy.

- Participants said job market 'very tight,' labor demand outstripping available supply.

- Participants said continued tight job market would contribute upward pressure to inflation.

- Participants said inflation in last three months has eased, but they need to see more progress.

- Some participants saw elevated prospect of recession in 2023.

Meanwhile, analysts at Rabobank noting the recent strength of recent economic data, explained that current remarks of Fed officials may be more forthcoming in terms of providing clues for the next FOMC meeting on March 23, than the February 1 minutes.

In this regard, St. Louis Fed President James Bullard reinforced the hawkish sentiment ahead of the Fed minutes on Wednesday. Bullard said that the Fed has to get inflation on to a sustainable path down toward its 2% goal this year or risk a repeat of the 1970s, when interest rates had to be repeatedly ratcheted up. '

Looking ahead for the rest of the week, in terms of forthcoming data releases, the market consensus is pointing to strength in the personal consumption and spending data signalling robust domestic demand. ''The Fed’s favoured inflation measure, the PCE deflator, is also due for release this week,'' analysts at Rabobank explained.

''The market is expecting the January headline data to remain at 5.0% y/y, in line with the previous month. This would strengthen concerns that the downtrend in inflationary indicators may have stalled. Data in line with market expectations would thus add further weight to the view that the Fed will have to work harder to push inflation back to its target level. Currently implied market rates are pointing to a peak in Fed funds close to 5.33%.''

Gold technical analysis

Gold price's weekly chart shows support near the 78.6% Fibonacci retracement level at $1,807. The market is on the backside of the prior bullish trend and on the front side of the bear trend as illustrated above, thus offering a bearish bias to the said and shown support structure.

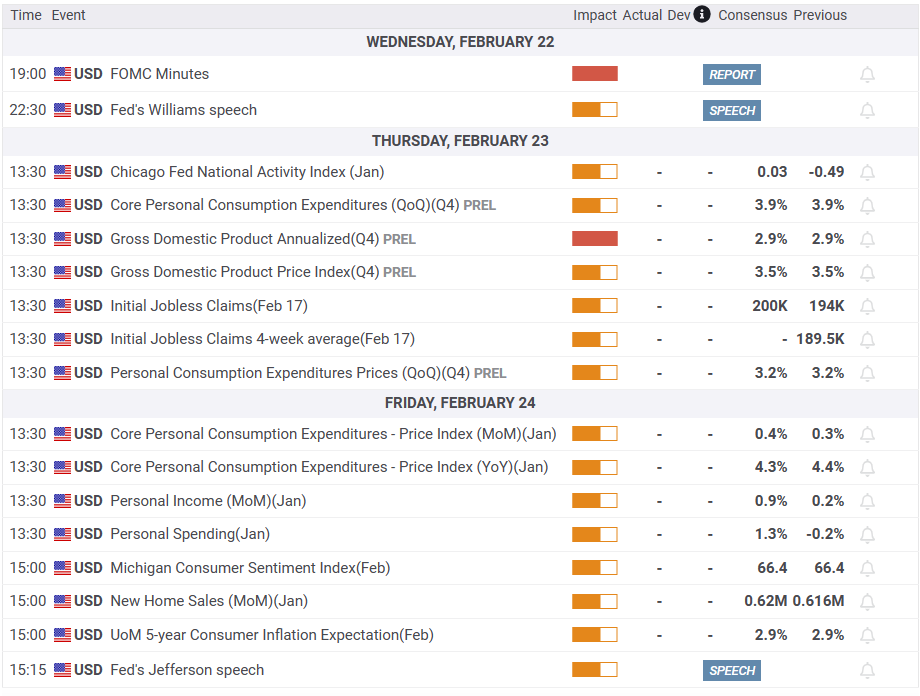

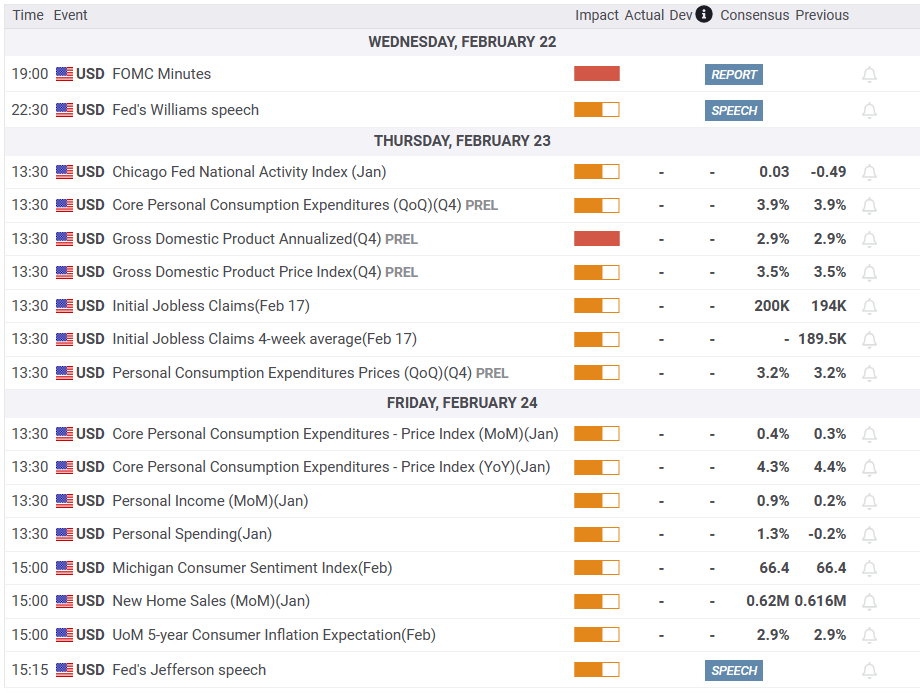

What you need to take care of on Thursday, February 23:

The US Dollar maintained its hawkish bias, accelerating its advance by the end of the American session and following the Federal Open Market Committee (FOMC) Meeting Minutes. The document showed that a few participants favored a 50 basis point (bps) rate hike, while some believed there was an elevated risk of a recession in 2023. More relevant, all participants agreed more rate hikes are needed to achieve the inflation target while also favor further Fed balance sheet reductions. Finally, participants stated that the continued tight job market would continue to put upward pressure on inflation.

Mid-US session, St. Louis Federal Reserve President James Bullard said more aggressive interest rate hikes now would give the FOMC a better chance to tame inflation, adding he believes there are good chances they could beat inflation this year without creating a recession.

Stock markets, in the meantime, suffered from geopolitical tensions throughout the day, dipping further in the red with the FOMC statement. China’s top diplomat, Wang Yi, said on Wednesday that his nation is ready to deepen strategic cooperation with Moscow adding their relationship will not succumb to pressure from other countries. Russian President Vladimir Putin, on the other hand, highlighted the relevance of cooperation with China, adding he is looking forward to Chinese President Xi Jinping visiting Moscow.

The EUR/USD pair flirts with the 1.0600 level by the end of the American session. Earlier in the day, In Europe, Deutsche Bank lifted its forecast on the European Central Bank (ECB) terminal rate to 3.75% from 3.25% previously. ECB Governing Council member Francois Villeroy de Galhau, however, noted that the central bank is not obliged to raise borrowing costs at every meeting, as the deposit rate is already at restrictive levels, suggesting financial markets may have overshot when betting on the ECB rates’ peak.

GBP/USD trades at around 1.2050. AUD/USD defies the 0.6800 mark, while USD/CAD hovers around 1.3550. Finally, USD/JPY remains stable, just below the 135.00 level.

Spot gold collapsed ahead of FOMC Meeting Minutes and trades around $1,826 a troy ounce. Crude oil prices also edged sharply lower, with WTI now changing hands at $73.90 a barrel.

Assessing the chances of a Bitcoin price pullback due to FOMC minutes

Like this article? Help us with some feedback by answering this survey:

The Reserve Bank of New Zealand's governor, Adrian Orr has said that core inflation is too high and that expectations are elevated.

The top central banker is speaking at the Finance and Expenditure Committee on points related to the February Monetary Policy Statement.

Key notes

- Rebuild activity may add to inflationary pressure.

- Monetary conditions need to tighten further.

More to come...

The first FOMC Minutes of 2023 has been released with investors searching for further insights into the near-term path for policy and any comments regarding the possibility of the Federal Reserve going back to 50 bps hikes.

Key notes from FOMC minutes

A few participants favoured raising rates by 50 basis points.

All participants agreed more rate hikes needed to achieve Federal Open Market Committee's job, inflation objectives.

Participants said restrictive monetary policy needed until Fed confident inflation falling to 2%; added that process likely to take 'some time'.

All participants favored further fed balance sheet reductions under current plan.

Participants said uncertainty associated with outlooks for economy, job market and inflation was 'high'.

Participants saw upside risks for inflation, including china's economic reopening and Russia's war in Ukraine.

Participants said risks to economic outlook weighted to downside.

A number of participants said drawn-out US debt limit process could pose 'significant risks' to the financial system, economy.

Participants said job market 'very tight,' labor demand outstripping available supply.

Participants said continued tight job market would contribute upward pressure to inflation.

Participants said inflation in last three months has eased, but they need to see more progress.

Some participants saw elevated prospect of recession in 2023.

US Dollar and Treasury Yields update

The US Dollar ran higher from a new low at 104.25 in the NY session in anticipation of a hawkish outcome ad sat at 104.35 moments ahead of the release.

DXY is moving up to fresh highs on the prospects of a 50bp rate hike next time around. However, the price action is volatile and bears are fading bullish attempts within the first 15 min candle:

About the FOMC minutes

FOMC stands for The Federal Open Market Committee which organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

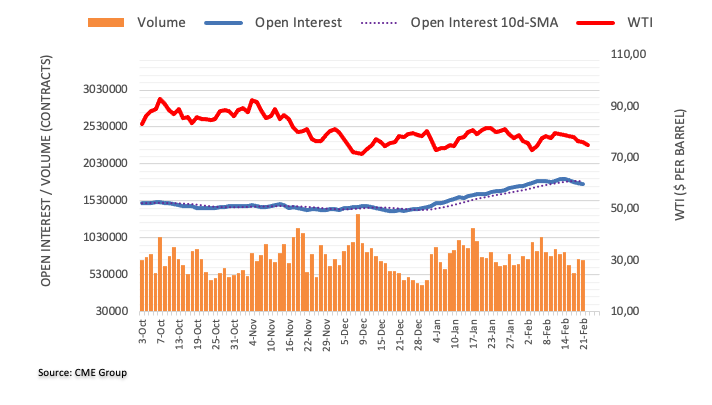

- Western Texas Intermediate remains under pressure from a strong US Dollar.

- Expectations that the Fed would tighten further than expected reignited.

- Russia’s cutting oil production and China’s reopening are a tailwind for WTI.

Western Texas Intermediate (WTI), the US crude oil benchmark, is losing more than 2.50% on Wednesday, as investors remain uneasy on upbeat US economic data that could warrant further tightening by the Federal Reserve. Hence, WTI is trading at $73.97 per barrel, down by 2.86%.

The Federal Reserve Open Market Committee (FOMC) will reveal the minutes of their first reunion of 2023. Recent hawkish rhetoric by Fed officials is eyed by traders, who would like to assess how many members of the FOMC were open to considering a 50 bps rate hike.

Given the backdrop, speculations for a higher terminal rate for the Federal Funds Rate (FFR) bolstered the US Dollar (USD), as shown by the US Dollar Index advancing 0.23%, at 104.335. investors should be aware that WTI, denominated in US Dollars, would be more expensive for holders of other currencies, explaining WTI’s fall during the session.

China’s reopening continued to cap WTI losses on Wednesday due to an expected increase in oil demand. According to Morgan Stanley, global oil demand would grow by about 36%, based on China’s removal of Covid-19 restrictions.

Furthermore, Russia’s cutting its oil output by 500K bpd would likely keep oil prices underpinned.

WTI Technical analysis

From a technical perspective, WTI is neutral-to-downward biased, unable to dip below the $70.00 barrier, the YTD low. Momentum indicators remain bearish, namely the Relative Strength Index (RSI) and the Rate of Change (RoC); hence another leg-down is expected. WTI’s first support would be $74.00. Break below will expose the MTD low at $72.30, followed by the YTD low at $70.10.

In an alternate scenario, if WTI reclaims the 20-day Exponential Moving Average (EMA) at $77.41, that could pave the way for further upside.

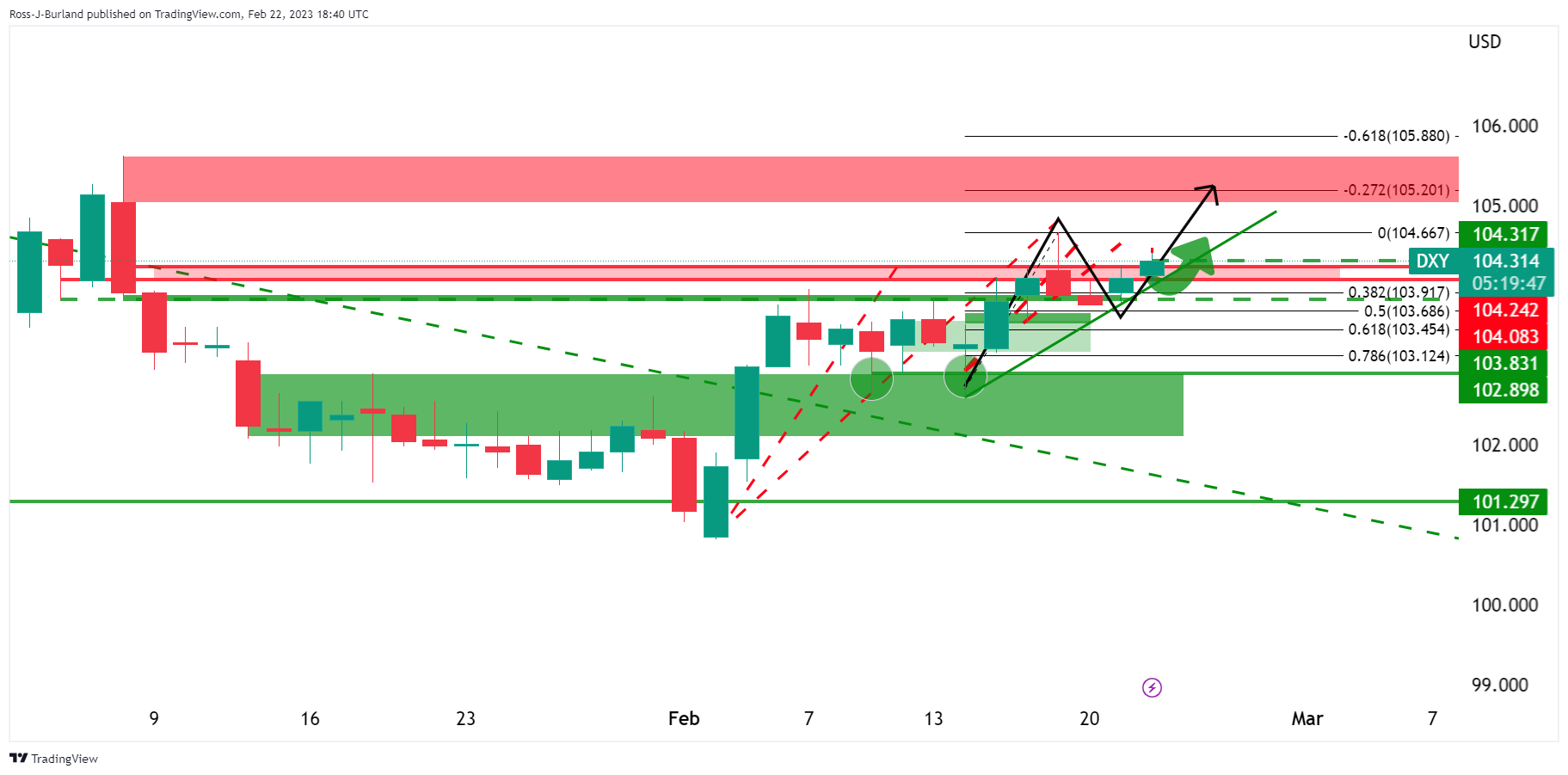

- DXY is on the move to the upside ahead of the FOMC minutes.

- Supported by a 38.2% Fibonacci on the daily chart, the 105.20s territories are eyed.

The US Dollar moved up on Wednesday as measured by the DXY index vs. a basket of currencies as traders get set for the Federal Open Market Committee minutes following a slew of strong economic data of late. At the time of writing, DXY is trading at 104.30 and it has ranged between a low of 104.006 and a high of 104.415 so far.

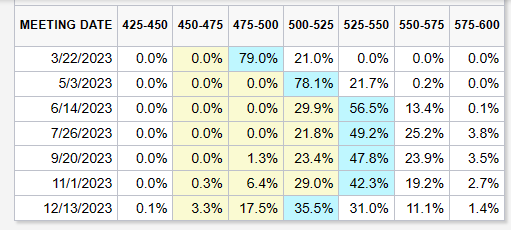

The FOMC February meeting minutes will provide further insights into the near-term path for policy but the Fed funds futures traders are now pricing the fed funds rate to reach 5.35% in July, and remain above 5% all year. The Fed's target range stands at 4.5% to 4.75%, having climbed strongly from 0% to 0.25% in March 2022.

The US data of late has eased recession fears but it has also reinforced worries that the Fed needs to stay higher for longer in terms of its interest rate hiking path. On top of a slew of past data, the latest survey data released on Tuesday showed US business activity unexpectedly rebounded in February to reach its highest in eight months and St. Louis Fed President James Bullard reinforced the hawkish sentiment ahead of the Fed minutes on Wednesday.

Bullard said that the Fed has to get inflation on to a sustainable path down toward its 2% goal this year or risk a repeat of the 1970s, when interest rates had to be repeatedly ratcheted up. ''Given the strength of recent economic data, current remarks of Fed officials may be more forthcoming in terms of providing clues for the next FOMC meeting on March 23, than the February 1 minutes,'' analysts at Rabobank said.

''In terms of forthcoming data releases, the market consensus is pointing to strength in the personal consumption and spending data later in the week signalling robust domestic demand. The Fed’s favoured inflation measure, the PCE deflator, is also due for release this week,'' the analysts explained further.

''The market is expecting the January headline data to remain at 5.0% YoY, in line with the previous month. This would strengthen concerns that the downtrend in inflationary indicators may have stalled. Data in line with market expectations would thus add further weight to the view that the Fed will have to work harder to push inflation back to its target level.''

US Dollar index technical analysis

The index has been climbing along trendline support and has moved up from the correction into the 38.2% Fibonacci on the daily chart. A continuation through current resistance opens risk to test the 105.20s territories.

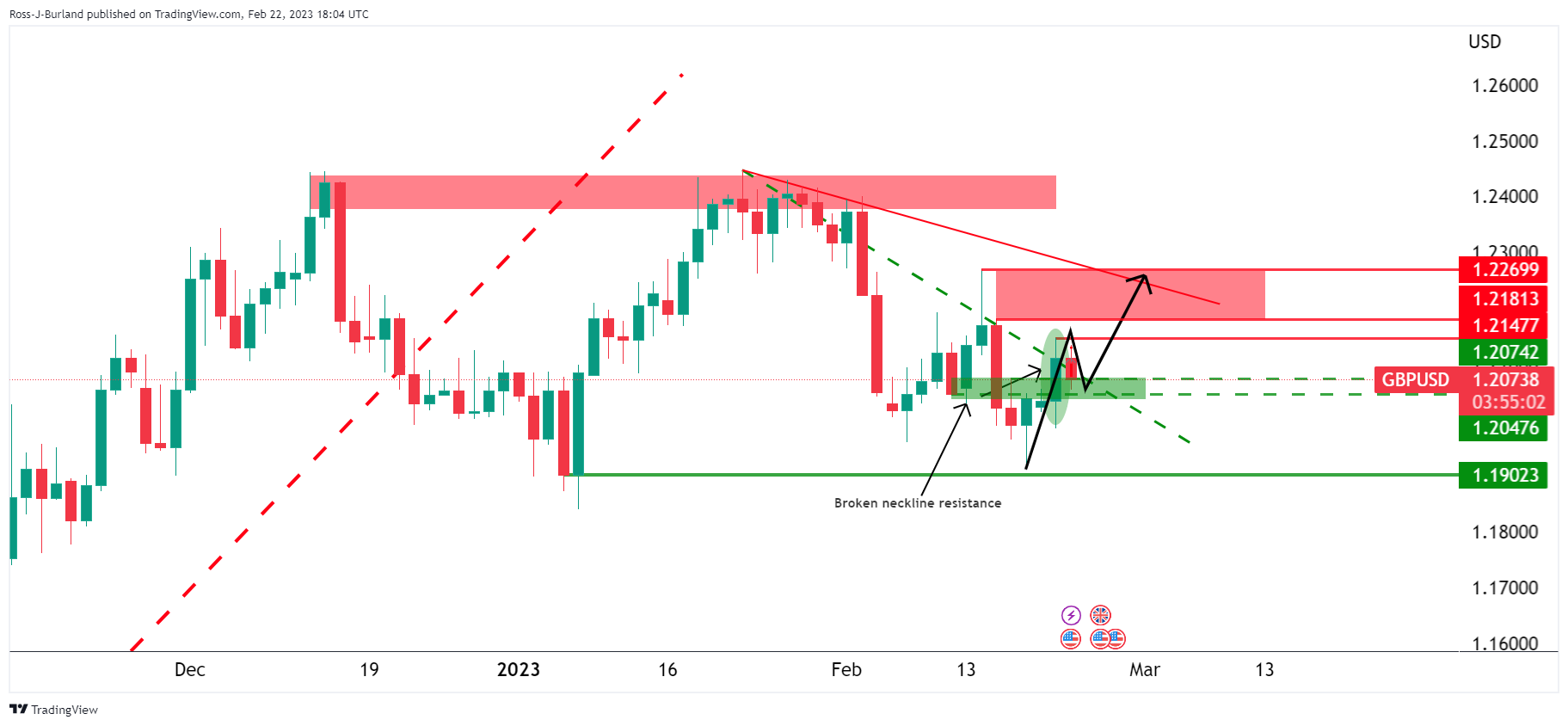

- GBP/USD bears eye a 50% mean reversion to test into the 1.2030s.

- Bulls could commit to the 38.2% support in the lows for the day so far, 1.2055.

As per the prior analysis, GBP/USD Price Analysis: Bulls spring to life on backside of bear trend, GBP/USD rallied through a key resistance area on the daily chart and it is now using this as a support zone as traders await the minutes from the Federal Open Market committee.

The US Dollar gained modestly on Wednesday due to a slew of recent strong economic data that while easing recession fears, the data has reinforced concerns that the Federal Reserve’s stance will remain hawkish for longer which is capping progress in the Pound vs. the US Dollar.

GBP/USD prior analysis

The M-formation's neckline was broken on Tuesday, invalidating a bearish thesis from the start of the week's analysis:

The bulls were in control and needed to rely on the 1.2070s as a possible newly formed support structure as illustrated below:

1.2270 was eyed as an upside target for the days ahead of the market and does not just remain in a consolidative structure bounded by 1.1900 and 1.2150.

GBP/USD update

The price is holding in the presumed support area and a 50% mean reversion is on the cards to test into the 1.2030s if the 38.2% does not hold first in the lows for the day so far, 1.2055.

- USD/CAD collides with solid resistance and retreats to its 1.3520s lows.

- Traders are bracing for additional forward guidance from the US Federal Reserve.

- If the BoC pauses, the USD/CAD will extend its gains.

The USD/CAD is barely unchanged ahead of the FOMC’s minutes release, though slightly tilted to the downside, with losses of 0.05%. Traders worried that the Fed would raise rates further than expected, dampening the market mood during the last couple of weeks. At the time of typing, the USD/CAD is trading at around 1.3530s.

USD/CAD turns negative, drops 0.06%, before FOMC’s minutes release

Wall Street’s bulls are taking a respite before the Fed releases its minutes. US economic data throughout the last two weeks justified the need for further tightening, meaning a higher USD/CAD exchange rate. Inflation data in the US slowed down, except for the monthly readings of the Producer Price Index (PPI), which came above estimates and the prior’s month data. In addition, a Fed regional manufacturing index reported on its survey that prices jumped the most in 10 months, exacerbating a reassessment of how high the Fed will go. Therefore, worried investors turned to safety and bought the US Dollar (USD).

Consequently, the US 10-year Treasury bond yield spiked 40 basis points (bps) and underpinned the greenback.

Aside from this, the Canadian side revealed that inflation cooled down, a sign for the Bank of Canada (BoC) to pause its hiking cycle. Meanwhile, New Home Prices in Canada dived 0.2% in January from December data from Statistics Canada showed on Wednesday, but the annual rate slowed to 2.7%.

Hence, the USD/CAD broke above 1.3500 after trading sideways for almost two months. Nevertheless, the major faced a four-month-old resistance trendline and was rejected after hitting multi-week highs at 1.3560 and dropping toward 1.3520s.

What to watch?

USD/CAD Key technical levels

- Silver price clashed with the 200-day EMA and retreated afterward.

- If XAG/USD dives below $21.50, a test of the YTD low at $21.18 is on the cards.

- Oscillators turned bearish, opening the door for Silver’s further downside.

Silver price battles at the 200-day Exponential Moving Average (EMA) at $21.93 though it failed to crack the latter and retraced towards Tuesday’s lows as the North American session progressed. Investors awaiting the latest FOMC minutes sought safety in the US Dollar (USD), a headwind for the white metal. At the time of typing, the XAG/USD is trading at $21.62, down 0.70% in the day.

From a daily chart perspective, XAG/USD remains neutral to downward biased, as the white metal stays beneath the important 200-day EMA. Wednesday’s price action remains negative, while the Relative Strength Index (RSI) and the Rate of Change (RoC) indicate that sellers are gathering momentum.

The XAG/USD 4-hour chart portrays the white metal as neutral to downward on an intraday bias. As of typing, Silver has breached the daily pivot point at $21.81, followed by the S1 pivot at $21.66. A bearish continuation is the most probable scenario due to several reasons. The Relative Strength Index (RSI) dived below the 50-mid line, a signal to go short, while the Rate of Change (RoC) is aiming aggressively downwards.

Therefore, the XAG/USD first support would be the S2 pivot point at $21.50. A breach of the latter will expose the S3 daily pivot at $21.35, ahead of the YTD low of $21.18. As an alternate scenario, XAG/USD reclaims the 200-day EMA could pave the way toward $22.00.

XAG/USD 4-hour chart

XAG/USD Key technical levels

Analysts at MUFG Bank have a neutral bias for the USD/JPY pair and they see it trading in the 128.00 – 138.00 range over the next weeks. They affirm that market attention is set to intensify again in the month ahead over potential shifts at the Bank of Japan ahead of Governor Kuroda’s final meeting.

Maintaining our neutral USD/JPY bias for the month ahead

“Stronger US growth and firmer inflation at the start of the year have also provided a more solid external backdrop for USD/JPY and will make a break back below the 130.00-level a tougher nut to crack in the near-term. On the topside the next important resistance level is provided by the 200-day moving average that comes in at just below the 137.00-level. After weighing up risks from the repricing of BoJ and Fed policy outlooks, we are maintaining our neutral USD/JPY bias for the month ahead.”

“Risks appear more titled to the upside for USD/JPY in the near-term. After finding good support at around the 130.00-level over the past month, the pair is moving back towards the 200-day moving average at just below the 137.00-level. A break above the 137.00-level could open the door to a more extended rebound. Potential fundamental triggers for a higher USD/JPY include: i) the Fed displaying more concern over persistent inflation risks and the lack of slowdown in the US labour market prompting it to signal that rates need to rise even further above 5.00%, and or ii) the new BoJ governor signaling a stronger desire to leave policy settings unchanged for longer until at least a comprehensive assessment of policy has been conducted.”

- Mexican Peso outperforms among emerging market currencies.

- USD/MXN holds near multi-year lows, despite risk aversion and higher US yields.

- Strong support emerges around 18.30 while critical resistance seen at 18.50.

The USD/MXN reversed after reaching a daily high near 18.50 and dropped to 18.35, matching the lowest level since 2018. The pair continues to move with a bearish bias despite risk aversion.

Looking at the FOMC minutes

Market participants await the outcome of the minutes from the latest FOMC meeting. They will look for clues about the future of US monetary policy.

Ahead of the minutes, the US dollar holds firms in the market supported by higher US yields and risk aversion. The latest round of economic numbers showed an unexpected recovery in the service sector, favoring expectations of a hawkish Fed.

Despite higher US yields, a firmer dollar and a deterioration in market sentiment, the Mexican Peso continues to rise versus the greenback. Among emerging market currencies, the MXN is one of the best performers of the last week and also over the last 30 days.

The Mexican Peso is receiving support from Banxico which is seen raising rates again at the next meeting after a hawkish surprise at the latest board meeting.

Key levels

Bias in USD/MXN continues to be tilted to the downside. The area around 18.30 is the key support. A break lower could open the doors for a slide toward 18.00. A recovery above 18.50 should alleviate the bearish pressure.

Technical levels

Strategists at Commerzbank have adjusted their Gold price forecast. They now expect XAU/USD to slump toward $1,800 in the first half of the year before drifting back higher toward $1,950 by year-end.

Gold likely to remain under pressure in the short term

“In the short term, the Gold price is likely to remain under pressure due to continued robust US economic activity and only slowly falling inflation, both supporting US interest rate hike expectations.”

“As soon as an end to US interest rate hikes becomes apparent, the precious metal's attractiveness should slowly increase again. This will be all the more the case if it becomes clear that the Fed will have to take back some of its interest rate hikes again.”

“We have lowered our forecasts for the first half of the year from $1,850 to $1,800. However, we remain optimistic for the second half of the year and continue to expect a gradual increase towards $1,950.”

Source: Commerzbank Research

On Thursday, the Bank of Korea meets and it is expected to stand pat. Economists at Société Générale expect the Won to struggle.

BoK to keep the key 7-day repo rate unchanged at 3.50%

“We expect the BoK to keep the key 7-day repo rate unchanged at 3.50% tomorrow. However, the board members’ view of terminal rate is likely to be evenly split between 3.50% and 3.75%. This may not be of much help to the currency.”

“For USD/KRW, an extension towards 1,320 could be on the cards if the FOMC minutes are hawkish and US PCE causes more inflation jitters on Friday.”

See – BoK Preview: Forecasts from four major banks, first pause in a year

- Gold remains firm at around $1,835, with traders awaiting Fed minutes.

- Money market futures began to price in interest rates in the US in the 5.25%-5.50%.

- Gold Price Analysis: Range-bound, trapped within the 50/100-DMA.

Gold price recovers some ground, though it remains almost flat compared to its opening price. However, it clings to minimal gains before the release of the US Federal Reserve’s (Fed) last monetary policy meeting minutes. At the time of writing, the XAU/USD is trading at $1,835.10 a troy ounce.

Financial markets await the FOMC’s last meeting minutes

US equities bounced at the Wall Street open, but traders remained cautious amidst growing speculations that the Fed would turn more hawkish than expected. Money market futures are projecting 75 bps of additional tightening, as seen in the CME Fed Watch Tool. Nevertheless, US Dollar (USD) bulls are taking a respite, with the US Dollar Index (DXY) edging lower by 0.07% at 104.088, undermined by US bond yields, mainly the 10-year benchmark note rate down five basis points (bps), at 3.900%.

Source: CME FedWatch Tool

The economy in the United States is solid, justifying Fed official’s hawkish rhetoric

Tuesday’s data release, particularly S&P Global PMI for February, showed that business conditions in the United States (US) are improving, with both the Services and Composite PMIs exceeding estimates and expanding territory. The outlier was the Manufacturing Index, which improved but stood in a contractionary area.

US PMIs data summed up to last week’s inflation and justifies the need for additional rate hikes from the Fed, whose officials led by the Cleveland and St. Louis Fed Presidents Loretta Mester and James Bullard, stated that there was compelling evidence to raise rates by 50 bps on February’s one meeting.

What to watch?

Gold technical analysis

XAU/USD’s daily chart suggests the yellow metal consolidated after hitting a daily high of $1,846.09. Nevertheless, failure to pierce the weekly high at $1,847.45 could pave the way for further downside, but the release of the Fed’s minutes could rock the boat and trigger upward/downward movements in the yellow metal. Oscillators aim downward, namely the Relative Strength Index (RSI) and the Rate of Change (RoC).

Therefore, the XAU/USD first support would be the 100-day Exponential Moving Average (EMA) at $1,820.59, followed the last week’s low of $1,818.97. A breach of the latter will expose the 200-day EMA at the $1,803.04 mark.

As an alternate scenario, a break above $1,847.45 and the XAU/USD’s next target would be $1,850, immediately followed by the 50-day Exponential Moving Average (EMA) at $1,852.50 and the 20-day EMA at $1,862.52.

USD trades narrowly mixed. Shaun Osborne, Chief FX Strategist at Scotiabank, believes that a hawkish tone in FOMC Minutes could propel the Dollar.

USD set to gain a little ground in the near-term

“I’m still leaning towards the idea of the USD gaining a little ground in the near-term.”

“There are no major data releases scheduled for North America today. However, the Fed releases the Feb 1 FOMC minutes. The chances of the pace of policy tightening picking up again are low but a hawkish undertone to the minutes (more support for bigger hikes or a developing sense from policymakers that they view policy peaking at a slightly higher point) will bolster expectations that the Fed cycle will extend beyond 5.25% into mid-year and lift the USD.”

- FOMC minutes at the center stage, market participants await Fed’s clues.

- Japanese Yen among top performers on Wednesday as US yields pull back.

- USD/JPY unable to hold above 135.00, slides and losses momentum.

The USD/JPY is falling on Wednesday, retreating after hitting on Tuesday at 135.22, the highest level since mid-December. The pair bottomed at 134.35. It is hovering around 134.50/60 as market participants await the minutes from the latest FOMC meeting.

Bullish, limited by 135.00 ahead of the Fed

Again, the pair was rejected from above 135.00. It remains bullish in the short-term even despite some risk aversion. Recent US data has been supporting the perspective of a hawkish Fed, sending US yields to the upside, and hence, supporting the dollar.

At 19:00 GMT, the Federal Reserve will release the minutes of their latest monetary policy meeting in February 1. At that meeting, the Fed slowed down and raised rates by 25 basis points. Comments from Fed’s officials could trigger volatility across the board, although a lot had happen since early February and the minutes could be outdated.

As market participants continue to expect a hawkish Fed, policy normalization from the Bank of Japan is seen later this year, particularly after governor Kuroda’s last meeting on March 10. Some do not rule out a surprise.

“Although the USD is finding support on the market’s acceptance that Fed rates will likely stay higher for longer on the back of resilience in the US economy, we see potential for USD/JPY to edge moderately lower on a 12 month view on the assumption that the BoJ makes some cautious steps towards reversing its ultra-accommodative policy”, wrote Rabobank’s analysts. They see scope for the USD/JPY to move to 125 on a 12 months view.

Technical levels

The Reserve Bank of New Zealand (RBNZ) hiked interest rates by 50 basis points to 4.75%. Economists at TD Securities now forecast a 5.50% peak by July.

5.50% Terminal

“The RBNZ retained its focus on the medium-term outlook and hiked its cash rate 50 bps as expected, but a 75 bps hike was considered as the alternative option.”

“Our new call has us forecasting the RBNZ hiking the OCR an additional 50 bps, in 25 bps clips at its May and July meetings, taking terminal to 5.50%.”

USD/JPY is expected to move downward over the coming months. Economists at Rabobank see the pair at 125 on a 12-month view.

USD/JPY to edge moderately lower on a 12-month view

“Although the USD is finding support on the market’s acceptance that Fed rates will likely stay higher for longer on the back of resilience in the US economy, we see potential for USD/JPY to edge moderately lower on a 12-month view on the assumption that the BoJ makes some cautious steps towards reversing its ultra-accommodative policy.”

“We see scope for USD/JPY to move to 125 on a 12-month view.”

Economists at ING remain doubtful that the Dollar has further to run on the Fed story. However, a resurgence in geopolitical risk means that defensive USD positions may linger.

USD helped by geopolitical uncertainty

“Markets will watch with great interest the content of the FOMC minutes today. With markets pricing in close to a 5.50% peak rate, we would essentially need to see evidence that multiple members voiced the desire to hike by 50 bps at the start of February. That would back the cause for a 50 bps move in March and likely lift the USD. However, the bar is set quite high after the recent hawkish comments, and we don’t see a very high chance of a hawkish surprise today.”

“The current instability in the geopolitical picture warrants caution and a bit more support to the Dollar may be on the cards, even though we see a good chance that the USD upside correction has peaked.”

- EUR/USD looks under pressure near the monthly lows.

- The resistance line around 1.0915 keeps capping the upside.

EUR/USD extends the side-lined trade and remains close to the February lows.

If sellers regain the upper hand, pair could slip back to the February low at 1.0612 (February 17) in the near term. The breach of this level could see a potential test of the 2023 low at 1.0481 (January 6) emerge on the horizon.

So far, extra losses remain on the cards as long as the 3-month resistance line, today near 1.0915, caps the upside.

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0329.

EUR/USD daily chart

EUR/USD slips to low 1.06s. Economists at Scotiabank believe that the world’s most popular currency pair could sustain a sharp fall to the 1.04/05 zone.

A retest of last week’s low at 1.0613 looks inevitable

“There is a soft undertone to price action here, even if movement is relatively limited.”

“Sustained losses below support at 1.0680 points to more EUR weakness ahead; a retest of last week’s low at 1.0613 looks inevitable at this point and a deeper drop towards 1.04/1.05 is a real possibility (1.0461 is the 38.2% retracement of the 0.95/1.10 rally).”

- GBP/USD attracts some dip-buying on Wednesday, albeit lacks any follow-through.

- Bets for additional BoE rate hikes underpin the GBP and lend support to the major.

- Hawkish Fed expectations, looming recession risks benefit the USD and cap the pair.

- Traders also seem reluctant and prefer to wait for the release of the FOMC minutes.

The GBP/USD pair trims a part of intraday losses and climbs back closer to the 1.2100 mark during the early North American session on Wednesday. Spot prices, however, remain below a multi-day peak, around the 1.2145-1.2150 region touched the previous day, as traders keenly await the FOMC minutes before placing fresh bets.

Ahead of the key risk, some repositioning trade prompts some US Dollar selling and lends support to the GBP/USD pair. Apart from this, expectations for additional interest rate hikes by the Bank of England (BoE) act as a tailwind for the British Pound. The speculations were fueled by UK PMIs released on Tuesday, which indicated that business activity rose more than expected in February. This, in turn, lifted optimism that the YJ may be able to avoid a steep economic downturn.

The downside for the USD, meanwhile, is likely to remain limited amid growing acceptance that the Fed will stick to its hawkish stance for longer in the wake of stubbornly higher inflation. In fact, the US CPI and PPI data released last week showed that inflation isn't coming down quite as fast as hoped. Adding to this, several FOMC policymakers, including Fed Chair Jerome Powell, recently stressed the need to keep lifting rates gradually to fully gain control of inflation.

Hence, the FOMC minutes will be closely scrutinized for fresh clues about the Fed's future rate-hike path. This will play a key role in influencing the near-term USD price dynamics and help determine the next leg of a directional move for the GBP/USD pair. In the meantime, looming recession risks, along with geopolitical tensions, should benefit the Greenback's relative safe-haven status and contribute to capping any meaningful upside for the major, at least for the time being.

Technical levels to watch

- The index manages well to keep the trade above the 104.00 mark.

- Extra gains are likely and could retest the 2023 top around 105.60.

DXY tries to extend the weekly recovery further north of the 104.00 barrier on Wednesday.

The ongoing price action favours the continuation of the uptrend for the time being. Further bouts of strength should clear the February high at 104.66 (February 17) to allow for a probable challenge of the 2023 top at 105.63 (January 6).

In the longer run, while below the 200-day SMA at 106.44, the outlook for the index remains negative.

DXY daily chart

- USD/CAD pulls back from its highest level since January touched earlier this Wednesday.

- Sliding Oil prices undermine the Loonie and help limit the downside amid a bullish USD.

- The setup supports prospects for additional gains, though bulls await the FOMC minutes.

The USD/CAD pair retreats from the 1.3560 area, or the highest level since January 6 touched this Wednesday and drops to a fresh daily low in the last hour. Spot prices, however, quickly recover a few pips and hold steady around the 1.3535 region during the early North American session.

The US Dollar remains pinned near a multi-week high amid growing acceptance that the Fed will stick to its hawkish stance. Apart from this, bearish Crude Oil prices undermine the commodity-linked Loonie and act as a tailwind for the USD/CAD pair. Bulls, however, refrain from placing aggressive bets and prefer to move to the sidelines ahead of the FOMC meeting minutes, due for release later during the US session.

From a technical perspective, the overnight strong rally and a daily close above the 100-day Simple Moving Average (SMA) validated the recent bullish breakout through a descending trend channel. Adding to this, oscillators on the daily chart have been gaining positive traction and support prospects for a move towards reclaiming the 1.3600 mark, en route to the YTD peak around the 1.3680-1.3685 area touched in January.

On the flip side, the daily swing low, around the 1.3515 area, coinciding with the 100-day SMA, now seems to protect the immediate downside. Any further decline below the 1.3500 mark might be seen as a buying opportunity and is more likely to remain limited near the 1.3445-1.3440 horizontal zone. The latter should act as a pivotal point, which if broken might prompt technical selling and pave the way for deeper losses.

The USD/CAD pair could then slide towards the 1.3400 round figure. The corrective pullback could get extended further towards the next relevant support near the 1.3330-1.3325 area and the 1.3300 mark. Bears might eventually aim to challenge last week's swing low, around the 1.3275-1.3270 region.

USD/CAD daily cahrt

Key levels to watch

USD/CAD has established above the 1.35 level. Economists at Scotiabank expect the pair to test the 1.36/37 area.

Flows are liable to favour the USD

“Risk appetite looks soft and flows are liable to favour the USD in the short run.”

“A bullish alignment of intraday and daily DMI oscillators supports the bullish backdrop for the USD; the charts suggest a fairly easy push on to the 1.36/1.37 range from here to retest the peaks seen in December.”

See: CAD is likely to struggle to make considerable ground against USD and EUR for now – Commerzbank

Cable corrected sharp gains from Tuesday earlier in the session. Economists at Scotiabank believe that the GBP/USD pair could see more weakness ahead.

GBP vulnerable to more downside

“Intraday patterns look a little soft but not decisively so.”

“The main problem for the GBP is that yesterday’s bounce stalled just below the 55-Day Moving Average (1.2171) which has served as something of a block on gains recently.”

“Failure to progress leaves the GBP vulnerable to more downside probing and a test of key medium-term support around 1.1925 (where the 100 and 200-DMA converge currently).”

The Canadian inflation data for January surprised on the downside and caused the Loonie to trade weaker. Economists at Commerzbank expect the CAD to remain vulnerable against the USD and the EUR.

Some market participants worry that the BoC will drop behind compared with the Fed and ECB

“Some market participants might worry that – in view of a combination of weaker than expected inflation and a significant fall in retail sales – the BoC will drop behind compared with the Fed and ECB; that is putting pressure on the CAD.”

“The Loonie is likely to struggle to make considerable ground against USD and EUR for now, in particular, if weaker economic data reflects the slowing effect of monetary policy tightening in Canada over the coming months.”

“We expect that the BoC will turn out to be hawkish though and that this will also be reflected in its rhetoric in case of a continued tight labour market and/or continued stubborn core inflation levels. That should support the Loonie.”

- EUR/JPY comes under pressure following recent YTD peaks.

- Further upside should refocus on the December 2022 high near 146.70.

EUR/JPY faces some selling pressure after surpassing the 144.00 hurdle on Tuesday, or new 2023 tops.

While the cross looks somewhat side-lined for the time being, a convincing breakout of the 2023 high at 144.16 (February 21) could spark extra strength to, initially, the December 2022 peak at 146.72 (December 15).

In the meantime, while above the 200-day SMA, today at 141.34, the outlook for the cross is expected to remain positive.

EUR/JPY daily chart

- AUD/USD drifts lower for the second successive day and drops to a fresh low since January.

- Hawkish Fed expectations, recession fears underpin the Greenback and weigh on the major.

- Investors keenly await the key FOMC meeting minutes before placing fresh directional bets.

The AUD/USD pair remains under some selling pressure for the second straight day on Wednesday and drops to the 0.6810 area, or a fresh low since January 6 during the mid-European session.

The US Dollar (USD) remains pinned near a six-week top amid hawkish Fed expectations and turns out to be a key factor weighing on the AUD/USD pair. In fact, the markets seem convinced that the US central bank will continue to hike interest rates in the wake of stubbornly high inflation. The bets were reaffirmed by the US CPI and PPI data released last week, which showed that inflation isn't coming down quite as fast as hoped.

Moreover, the incoming robust US macro data points to an economy that remains resilient despite rising borrowing costs. This comes on the back of hawkish comments by several FOMC officials, including Fed Chair Jerome Powell, stressing the need to keep lifting rates gradually to control inflation. The prospects for further policy tightening remain supportive of elevated US Treasury bond yields and underpin the Greenback.

Hence, the market focus will remain glued to the release of the FOMC meeting minutes, due later during the US session. Investors will look for fresh cues about the Fed's future rate-hike path, which will influence the USD and provide a fresh directional impetus to the AUD/USD pair. In the meantime, the looming recession risks, along with geopolitical tensions, should benefit the safe-haven buck and weigh on the risk-sensitive Aussie.

Nevertheless, the aforementioned fundamental backdrop suggests that the path of least resistance for the AUD/USD pair is to the downside. Even from a technical perspective, the recent breakdown and acceptance below the 50-day SMA favour bearish traders. Some follow-through selling below the 0.6800 mark will reaffirm the negative outlook and set the stage for a slide towards testing sub-0.6700 levels, or the YTD low set in January.

Technical levels to watch

EUR/USD is still trading south of 1.07. A break under last week’s low of 1.0615 could open up further losses to the 1.0485 mark, economists at BBH report.

Germany reported a mixed February IFO business climate survey

“The Euro is trading lower near 1.0625 and nearing a test of last week’s low near 1.0615. Break below that would set up a test of the January 6 low near 1.0485.”

“Headline came in at 91.1 vs. 91.2 expected and a revised 90.1 (was 90.2) in January. Current assessment came in at 93.9 vs. 95.0 expected and 94.1 in January, while expectations came in at 88.5 vs. 88.4 expected and 86.4 in January. While many of the survey indicators appear to have bottomed, we warn against getting too excited about the eurozone outlook as the hard data remain weak.”

St. Louis Federal Reserve President James Bullard told CNBC on Wednesday that the Fed will have to go north of 5% to tame inflation, as reported by Reuters.

Additional takeaways

"US economy is stronger than what we previously thought."

"We need to get inflation down in 2023."

"Silicon Valley layoffs have no bearing on overall strength of labor market."

"Still think we can get inflation down while maintaining a strong labor market."

"Still in a low productivity growth regime."

"Fed should only slow down once it's got to the terminal rate."

"Markets may be overpricing risk of recession in 2023."

"I forecast moderately slow growth this year with inflation declining."

"Fed's risk is inflation doesn't come down or inflation reaccelerates."

Market reaction

These comments don't seem to be having a noticeable impact on the US Dollar's performance against its rivals. As of writing, the US Dollar Index was up 0.08% on the day at 104.25.

Economist at UOB Group Enrico Tanuwidjaja reviews the latest results from the current account in Indonesia.

Key Takeaways

“Indonesia’s 4Q22 current account (CA) position recorded another quarter of surplus to the tune of USD4.3bn (or an equivalent of 1.3% of GDP), though slightly lower than 3Q22's USD4.5bn (1.3% of GDP).”

“The capital and financial account recorded a significantly lower deficit of just USD0.4bn (0.1% of GDP), down from USD5.5bn (1.6% of GDP) on the back of stellar FDI inflows into the country and the easing of portfolio capital outflows in 4Q22.”

“Overall, Indonesia recorded an even stronger CA surplus amounting to USD13.2bn in 2022 (1% of GDP), after registering USD3.5bn surplus in 2021 (0.3% of GDP). This comes on the back of more than a decade of persistent deficit amidst strong import demand. Nevertheless, we expect easing commodity prices (though remained steady), possibly higher imports notably due to higher services deficit, and higher primary deficit to turn its CA position into a deficit of circa 0.3% of GDP in 2023.”

The New Zealand Dollar has strengthened modestly. The main trigger for the Kiwi’s rebound has been the RBNZ’s latest policy update. However, economists at MUFG Bank expect the NZD bounce to be short-lived.

RBNZ disappoints expectations for a lower terminal rate peak

“The RBNZ decided to raise their key policy rate by a further 50 bps to 4.75% in line with the consensus.”

“The RBNZ still believes that it has work to do to get rates into more restrictive territory to bring inflation back to their target. The RBNZ’s updated forward rate guidance continued to signal that they plan to raise the policy rate to a peak of 5.50% this year. The timing of reaching the terminal rate was pushed back a little from Q3 to Q4.”

“The RBNZ is more inclined to slow the pace of hikes further by delivering smaller 25 bps hikes at upcoming policy meetings. One final larger 50 bps hike can’t though be completely ruled out in April.”

“At best we see today’s RBNZ policy outcome providing only temporary support for the Kiwi which has been one of worst performing G10 currencies so far this year.”

Economists at BNP Paribas discuss the USD outlook against the EUR and JPY.

Dollar to weaken somewhat versus the Euro

“We expect the Dollar to weaken somewhat versus the Euro. The USD's valuation is expensive, positioning in the market is very long and the long-term interest rate differential should narrow.”

“The Yen has already weakened significantly versus the Dollar, reflecting the increased policy divergence between Fed and BoJ. We expect USD/JPY to remain around current levels in the near term. In 2023, the Yen should strengthen versus the Dollar considering that the federal funds rate should have reached its terminal rate.”

Following his meeting with Russian President Vladimir Putin, China's top diplomat Wang Yi said that they are ready to deepen strategic cooperation with Russia on Wednesday, as reported by Reuters.

"Our relations will not succumb to pressure from third countries," Wang added.

Meanwhile, Putin noted that it's very important for them to have a cooperation with China and said he is looking forward Chinese President Xi Jinping to visit Moscow.

Market reaction

These comments don't seem to be having a significant impact on market mood. As of writing, US stock index futures were trading virtually unchanged on the day.

Economist at UOB Group Lee Sue Ann suggests the Bank of Korea could keep the policy rate unchanged at 3.50% at this week’s event (February 23).

Key Quotes

“Views are now mixed whether the BOK would carry on tightening its monetary policy after a cumulative 300bps rate hike since Aug 2021. The BOK was also clear in its messaging that the room for further monetary tightening remains.”

“However, barring a change to global inflation trajectory where price gains are expected to slow this year, we maintain our view that the BOK is done with its rate hikes and would stay on hold at 3.50% through 2023.”

The RBNZ's determination to get ahead of inflation will likely see it deliver a 5.5% OCR peak by mid-year, in the opinion of economists at Westpac.

The RBNZ is grappling with an uncertain environment

“We now expect a peak of 5.5% in the OCR this year, up from our earlier forecast of 5.25%.”

“The Reserve Bank remains committed to bringing inflation back under control and sees the risks as being to the upside of its already-strong forecasts. As a result, we expect that it will carry through with its plans, at least in the near term.”

“However, the RBNZ also recognises the downside risks to activity in the years ahead, as higher mortgage rates squeeze households’ spending power.”

“Cyclone Gabrielle will add to medium-term inflation pressures at the margin, but the scale of the impact is hard to gauge at this early point.”