- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 22-02-2022

- USD/CAD fades upside momentum around one-week high, after rising for four consecutive days.

- Canada announces sanctions on Russia, US rules out hopes of diplomacy as Blinken-Lavrov, Biden-Putin talks are off for now.

- US PMIs improve in February but DXY eases amid Fed policymakers’ indecision.

- Risk catalysts are important for clear directions, Fedspeak eyed as well.

USD/CAD eases from a weekly high as it struggles to extend the four-day uptrend during Wednesday’s initial Asian session. That said, the Loonie pair seesaws around 1.2765 by the press time.

In doing so, the USD/CAD traders take clues from the recently steady WTI crude oil prices, Canada’s key export item while battling the Canadian dollar sellers during sour sentiment.

Receding odds of a diplomatic solution to the Russia-Ukraine tussles offered the latest blow to the market’s risk appetite as the US ruled out the scope of a summit between US President Joe Biden and his Russian counterpart Vladimir Putin. On the same line were comments from US Secretary of State Antony Blinken’s rejection of the need for Thursday’s meeting with Russian Foreign Minister Sergei Lavrov.

Previously, market sentiment soured after Russia’s Putin recognized Donetsk and Luhansk in Eastern Ukraine as independent states and signed a decree "on friendship and cooperation". In a reaction to Moscow’s moves, the West announced multiple sanctions on Russia.

In the latest blow, Canadian Prime Minister (PM) Justin Trudeau unveiled punitive measures for Russia’s latest actions. Canada’s Trudeau joined Western allies while saying, “Will ban Canadians from all financial dealings with the so-called ‘independent states’ of Luhansk and Donetsk.” The national leader also sanctions members of the Russian parliament who voted for 'illegal' decision to recognize these so-called republics while also banning the purchases of Russian sovereign debt. Additional measures suggest sanctions on two Russian banks, as well as deployment of up to 460 members of Canadian armed forces to operation reassurance.

It should be noted that WTI crude oil prices marked the first negative daily closing in four the previous day while reversing from the fresh eight-year high, recently steady around $91.30.

Read: WTI defends $91.00 on fears of Russian invasion, API data eyed

Amid these plays, S&P 500 Futures and the US 10-year Treasury yields remain sluggish after declining 1.0% and adding around 2.0% daily in that order the previous day.

Looking forward, the economic calendar seems light for the day and hence risk catalysts, as well as Fedspeak, will keep the driver’s seat.

Technical analysis

USD/CAD bulls need validation from a seven-week-old resistance line, around 1.2785 by the press time, to retake controls. Until then, the odds of witnessing a pullback towards the 21-DMA level near 1.2720 can’t be ruled out.

- EUR/USD struggles to extend recovery moves from eight-day low.

- Bearish MACD signals keep sellers hopeful inside three-week-old triangle.

- 100-DMA, horizontal area from November add to the upside filters.

- Sellers need validation from triangle’s support to aim for three-month-long horizontal support.

EUR/USD retreats towards 1.1300 during early Wednesday’s Asian session, fading the previous day’s corrective pullback from a weekly low.

The major currency pair bounce off the short-term triangle’s support the previous day to snap a three-day downtrend. However, a rebound failed to cross a convergence of the 21-DMA and 50-DMA, around 1.1330-35.

In addition to the failures to break the key moving average confluence, bearish MACD signals also keep sellers hopeful.

Though, a clear downside break of the stated triangle’s lower line, around 1.1290 by the press time, becomes necessary for the EUR/USD seller’s entry.

Following that, a downward trajectory towards a horizontal area from November, near 1.1235-30, will gain the bear’s attention.

Alternatively, recovery moves beyond 1.1335 needs to cross the triangle’s resistance line, at 1.1360 to convince buyers.

Even so, the 100-DMA and a three-month-old horizontal resistance zone, around 1.1390 and 1.1480-85 in that order, become tough nuts to crack for the EUR/USD buyers before retaking the controls.

EUR/USD: Daily chart

Trend: Further weakness expected

- On Tuesday, the USD/JPY reclaims the 115.00 mark amid a risk-off market mood in the FX market.

- USD/JPY Technical Outlook: Neutral upward biased, as long as it remains above 115.06.

As the Asian Pacific sesión begins, following a choppy trading North American session, the USD/JPY barely gains some 0.05%, trading at 115.06 at press time. Market conditions remain downbeat in the equity markets. In the FX space, risk-sensitive currencies, like the NZD, the AUD, and the GBP, were the gainers. Contrarily, the Japanese yen finished on the wrong foot but trimmed some of its earlier losses near Wall Street’s close.

The US 10-year Treasury yield rise one and a half basis points sits at 1.944%, a tailwind for the pair due to its positive correlation with the USD/JPY.

On Tuesday in the Asian session, the USD/JPY remained confined to the 114.50-80 region before breaking the range, rallying above the 115.00 mark.

USD/JPY Price Forecast: Technical outlook

The USD/JPY reclaimed the 50-day moving average at 114.84, exacerbating the upward move above 115.00. The USD/JPY remains neutral-upward biased in the near term but faces resistance on the January 18 daily high at 115.06. It is worth noting that the Relative Strength Index (RSI) at 50 is almost flat, suggesting the USD/JPY might consolidate before resuming the uptrend.

USD/JPY’s first support level would be the abovementioned 50-DMA at 115.06. Breach of the latter would expose last year’s November 24 daily high at 115.52, followed by the 116.00 mark and the January 4 cycle high at 116.35.

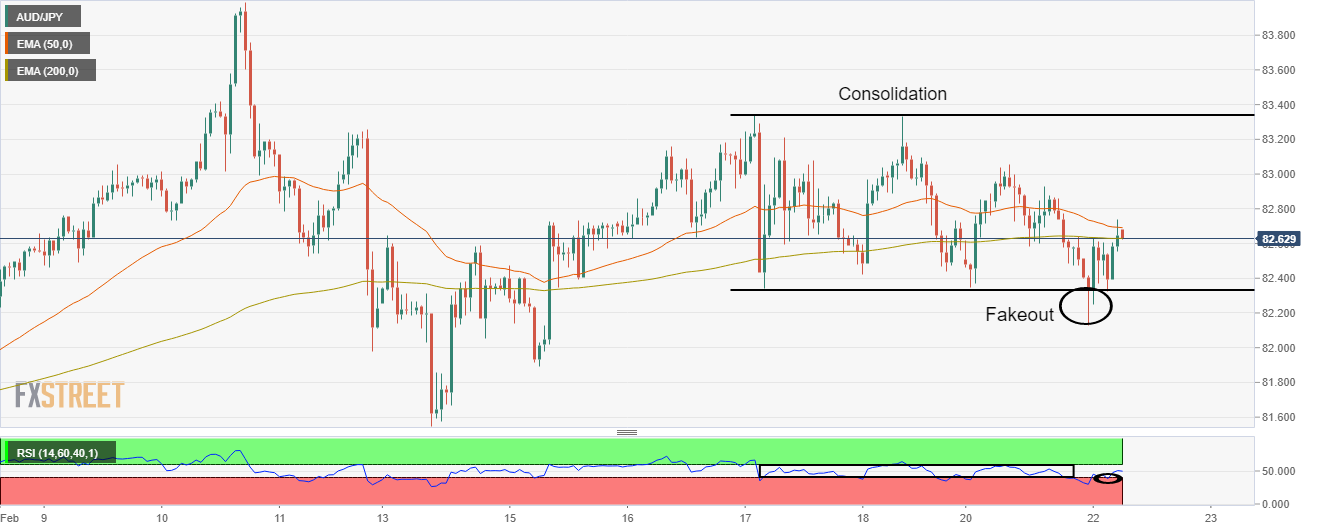

- AUD/JPY has sensed selling pressure near 83.18 as sanctions on Russia may escalate further.

- Blinken-Lavrov meeting has been abandoned as Moscow’s arbitrariness.

- The risk-off impulse seems set to kick in again.

The AUD/JPY pair has witnessed some significant offers near Tuesday’s high of 83.18 as the uncertainty has shot up and the risk-off mood may underpin the safe-haven appeal. US Secretary of State Antony Blinken has abandoned the meeting with Russian Foreign Minister Sergey Lavrov as the former claims that Moscow has not stopped an invasion of Ukraine despite various sanctions threats and peace-making suggestions. Therefore, meeting with a Russian diplomat makes no sense anymore.

Moreover, the US will continue to impose sanctions on Russia alongside the aggression of Moscow on Ukraine.

Earlier, the Kremlin recognizes two regions of Ukraine: Donetsk and Luhansk as ‘independent’ and build troops over there to invade Ukraine. Separatist leaders adjoin Russia and have provided clean chit to establish military bases, which has spooked the market.

AUD/JPY, as a risk barometer, has performed strongly after hitting the lows of 82.14 on Tuesday but is likely to surrender gains amid the escalating geopolitical tensions further.

On Tuesday, Australia pulls its diplomats out of Ukraine on rising expectations of imminent strikes between Russia and Ukraine. Adding to that, the Australian administration has urged Australians to leave Ukraine.

Apart from the headlines of the Russia-Ukraine tussle and flood of sanctions on Moscow, the investors will focus on the quarterly and yearly Wage Price Index (WPI) from the Australian Bureau of Statistics on Wednesday. While the Tokyo Consumer Price Index (CPI) data from the Statistics Bureau of Japan on Thursday will be keenly watched.

In addition to the latest blow to the hopes of the Blinken-Lavrov meeting, rejections of the Biden-Putin summit also posed challenges to the market sentiment during early Wednesday morning in Asia.

Before a few minutes, US Secretary of State Antony Blinken rejected the need for Thursday’s meeting with Russian Foreign Minister Sergei Lavrov while citing the start of Moscow’s invasion of Ukraine.

Read: US Secretary Blinken: It doesn't make sense for me to meet with Russia's Lavrov anymore

Following that, the White House ruled out the scope of a summit between US President Joe Biden and his Russian counterpart Vladimir Putin, which triggered optimism earlier in the week.

Elsewhere, an anonymous US Diplomat was recently quoted saying, “US officials did not discuss increasing oil production during US trip to Saudi Arabia last week.”

The official also added, “OPEC countries understand our concerns about the importance of the stability of global oil markets.”

Market reactions

The risk-off mood gains pace with each negative headline concerning the Russia-Ukraine tensions, which in turn helps prices of oil and gold.

Read: WTI defends $91.00 on fears of Russian invasion, API data eyed

- WTI pauses pullback from fresh eight-year high, sidelined after snapping three-day winning streak.

- US Secretary of State Blinken rules out need for meeting Russian Foreign Minister Lavrov, lourd blast heard in Donetsk.

- West started rolling out sanctions, Canada was the latest one.

- Weekly oil inventory data from API, risk catalysts can keep bulls hopeful.

WTI crude oil prices remain steady at around $91.40, following a pullback from the fresh multi-month high. In doing so, the energy benchmark pushes back the sellers after the quote printed the first negative daily closing in four by the end of Tuesday’s settlement.

Although US President Biden’s speech may have helped markets to take a sigh of relief, Western sanctions on Russia and escalating fears of Moscow’s imminent invasion of Kyiv keep oil buyers hopeful. It is worth noting that the firmer yields seemed to have triggered the latest profit-booking of WTI but the geopolitical woes keep it firmer ahead of the weekly industry stockpile data from the American Petroleum Institute (API).

US President Biden’s comments like, “We have no intention of fighting Russia,” seem to have played the role of turning now the fears of a full-fledged war between the West and Moscow. However, Russian President Vladimir Putin’s request for troops to the decision body at home, as well as US Secretary of State Antony Blinken’s rejection of the need for Thursday’s meeting with Russian Foreign Minister Sergei Lavrov, blow the cautious optimism.

Elsewhere, Canada followed the path of the UK, the US and the European Union while announcing the latest sanctions over Russia, which in turn keep the geopolitical fears on the table and favor oil buyers.

Also underpinning the WTI oil prices is the inability on the part of the OPEC+ to match supply increase commitments. The energy cartel raised output by 400,000 barrels per day (bpd) recently but hasn’t had success in delivering the production hike due to outages in multiple units and geopolitical fears.

It’s worth observing that the upbeat prints of the US PMIs for February join softer USD to also favor WTI buyers.

Moving on, developments surrounding Russia and Ukraine will be crucial for oil traders to watch as the bulls are likely to keep reins. Also important will be the API Weekly Crude Oil Stock for the week ended on February 18, prior -1.076M.

read: Crude oil prices eye $100 ahead of Russia sanctions

Technical analysis

Unless providing a daily closing below 21-DMA level of 89.47, WTI crude oil prices are likely to remain on the bull’s radar.

- The USD/CHF trims Monday’s losses, so far 0.01% up in the week.

- US President Joe Biden condemned Russia’s actions and imposed sanctions.

- USD/CHF Technical Outlook: A tweezers-bottom could exacerbate a move towards 0.9250.

The USD/CHF is recovering as the Wall Street session winds down following US President Joe Biden's speech in which he addressed the conflict in Ukraine and imposed some sanctions on Russia and the two separatist states. At press time, the USD/CHF is trading at 0.9215.

US President Joe Biden condemned Russia’s actions and imposed sanctions

Two hours before Wall Street closed, US President Biden hit the stage. He condemned Russian President Putin’s latest actions and announced new sanctions to Russian peers in his speech. He said that Russia made a “flagrant violation of international law and demands a firm response.” Biden added that Russia added blood supplies to the border and noted that “you don’t need blood unless you’re preparing a war.

US Sanctions

- Halted the Nord stream 2 in conjunction with Germany.

- Sanctions to Russia’s “Military bank” and VEB Bank.

Market’s reaction

The abovementioned sanctions improved the market sentiment for a while, but in the end, US equity indices edged lower, finishing Tuesday’s session in the red.

USD/CHF Price Forecast: Technical outlook

Putting aside geopolitical news, the USD/CHF remained subdued on Tuesday during the Asian session. However, as European traders got to their desks, the USD/CHF jumped on a mean reversion move, paring Monday’s losses.

USD/CHF Tuesday’s price action formed a “tweezers-bottom” candle pattern that denotes an upward bias. Furthermore, the USD/CHF daily moving averages (DMAs) are below the spot price, another signal of buying pressure on the pair. Nevertheless, to further cement that bias, USD/CHF bulls would need a daily close above February 21 close at 0.9158.

In that outcome, USD/CHF’s first resistance would be February 10 daily high at 0.9296. Once that supply zone is cleared, the next ceiling would be January 31 daily high at 0.9343, followed by last year’s November 24 daily high at 0.9373.

- AUD/USD is facing barricades near 0.7233 after the Western leaders impose sanctions on Russia.

- The risk-off impulse in the market has underpinned the greenback against the Aussie.

- The sanctions on Russian sovereign debt would block its administration to access Western financing.

The AUD/USD was facing barricades near 0.7233 on Tuesday as the Wester leaders imposed sanctions on Russia. The Kremlin has violated international law by sending troops to eastern Ukraine. Moscow has been supported by the separatist leaders from Donetsk and Luhansk, which have been labelled as ‘independent’ by the Russian leader Vladimir Putin.

Despite the various peace-making suggestions and threats of imposing sanctions by the World leaders, Russia continues to build troops near eastern Ukraine. Many major economies have loaded up sanctions on Moscow.

On Tuesday, Britain hit Russian banks with sanctions while Germany barricades a new gas pipeline from Russia despite the fact that Germany banks upon Russia for its domestic gas usage.

US President Joe Biden has put some serious sanctions on Moscow. "We're implementing full blocking sanctions to large Russian financial institutions, VEB, and their military bank," President Joe Biden said. The move might block the Russian administration from Western financing.

The sanctions imposed on Russia have spurt the volatility in an already highly uncertain market. The antipodean is underperforming against the greenback and is likely to continue underperformance as the safe-haven appeal is getting more traction.

The US dollar index (DXY) has rebounded from Wednesday’s low at 95.97 and has surpassed 96.00 in the early Asian session.

Meanwhile, the quarterly and yearly Wage Price Index (WPI) from the Australian Bureau of Statistics is due on Wednesday. While, the US PMI monthly Composite Reports on Manufacturing and Services has landed at 56, higher than the previous figure of 51.1 on Tuesday.

US Secretary Blinken says now that Russia's invasion is beginning, it doesn't make sense for me to meet with Russia's Lavrov anymore. He says he sent a letter today to him informing him of that.

More to come...

Market implications

This is a potential catalyst for a risk-off session in Asia.

More to come...

- NZD/USD bears have moved out of the way and the bulls are in charge in early Asia.

- All eyes will turn to the RBNZ as the Russian risk abates as a chorus of Western measured sanctions ease, markets.

NZD/USD is currently trading at 0.6734 and is coming to a close in the North American session, up by over 0.5%. Commodity-FX is getting a lift from inflation expectations and the kiwi is poised for further gains on expectations of a hawkish outcome from the Reserve Bank of New Zealand today.

The Russian factor is not impacting risk as hard as it has done as traders begin to look through the headlines that have so far not delivered anything that indicates Russian troops are infiltrating the borders of Ukraine. So far Russia’s presence in Ukraine is limited to the two separatist areas which Putin recently formally recognised.

Additionally, the measured sanction response from the West has steadied the markets. In the North American session, US president Biden announced the first tranche of sanctions on Russia by implementing sanctions on Russian sovereign debt and by imposing sanctions on Russian elites and family members. Biden also announced that the US will be working with Germany to halt the Nord stream 2 while also issuing full blocking sanctions on two Russian banks.

As for the RBNZ, ''market expectations continue to favour a 25bp (rather than 50bp) RBNZ OCR hike today; if delivered, that should provide a fairly solid base for the NZD on the view that measured hikes will be more digestible for the economy and are less likely to deliver a hard landing,'' analysts at ANZ bank said in a note today.

''NZ’s long term interest rates are already best in class – so the interest rate differential box has already been ticked and that won’t change much with a lesser hike. But with markets split on the OCR decision, expect more volatility, especially with Russia/Ukraine tensions still apparently escalating.''

Dr. Raphael W. Bostic who is the chief executive officer of the Federal Reserve Bank of Atlanta is currently speaking and has said that the US economy is "still quite strong" as officials try to figure out the economy "in real time".

Bostic said companies and output remain constrained by the inability to find workers but when it comes to demand and spending, "people are ready to go".

Key comments

No clear evidence demand will fall off in the coming months; growth is expected to continue.

Modal outlook is not for the recession, but "eventually there will be some slowdown" in growth.

Not sure yet how sanctions on Russia will impact economy.

Uncertainty could lead to some retrenchment of investment.

More to come...

- USD equities have recovered from intra-day session lows after Biden’s Russia sanction announcement in something of a relief rally.

- Ukraine President Zelensky issued a decree to recruit reservists.

- The S&P 500 chopped around the 4300 level, ending the day down more than 1.0%.

US equities recovered from intra-day lows on Tuesday in wake of US President Joe Biden’s announcement of new sanctions targeting Russian banks, sovereign debt and wealthy individuals, joining the UK and EU who had already announced similar measures. In the aftermath of Biden’s remarks, where he urged that the door for diplomacy remains open, US equities staged a rebound, perhaps on hope that a diplomatic resolution could yet avoid further escalation and sanctions. But the news that the Ukrainian President had issued a decree to recruit more reservists led to fresh choppiness just prior to the close.

Some analysts warned not to read too much into the price action with US equities trading at monthly lows, saying the rebound could have been nothing more than a “buy the fact” reaction after the sanctions unveiled by Biden were largely in line with expectations. Others said the recovery might have been driven by dip-buying, with some traders cautioning that US equity markets have been overly sensitive to developments in Eastern Europe and should instead focus more on domestic fundamentals.

Either way, the S&P 500 index chopped either side of the 4300 level on Tuesday, ending the session more than 1.0% lower. Bears continue to eye a potential test of the January lows in the low 4200s and a close at current levels would confirm that the index has fallen back into “correction” territory (i.e. more than 10% below recent record highs).

Meanwhile, the Nasdaq 100 index also recovered from intra-day lows, but was unable to regain the 14K level and also dropped more than 1.0%, while the Dow tanked roughly 1.5% to test 33.5K and eye a test of January lows in 33.1K area. The S&P 500 CBOE Volatility Index or VIX remained under 30.00 after testing February highs at 32.00 earlier in the session.

- EUR/USD rallies as risk lifts heading into the close on Wall Street with stocks turning less negative.

- US president Joe Biden's speech and announcements of sanctions are not enough to tip risk over the edge of the abyss.

- Bull flag pattern on the hourly chart is starting to shape up for a breakout to the upside. Eyes on 1.1350's.

EUR/USD was recovering following US president Joe Biden's speech where despite his warnings that Russia is setting up to invade deeper into Ukraine, this is still speculation. The sanctions imposed on Russia are not seen to be disruptive to the global economy and for that reason, risk has rallied in financial markets. So far, there has been no further escalation of the crisis and no evidence that Russia is encroaching on Ukraine outside of the current borders. EUR/USD has subsequently corrected back towards 1.1340 and stays on the green by some 0.30% towards the closing hour on Wall Street.

US Biden announced sanctions

US president Biden announced the first tranche of sanctions on Russia by implementing sanctions on Russian sovereign debt. The US will be working with Germany to halt the Nord stream 2 while also issuing full blocking sanctions on two Russian banks. Additionally, the US will be imposing sanctions on Russian elites and family members.

This is another whipsaw for traders in forex due to the developments in Ukraine a day after Russian President Vladimir Putin recognized two breakaway regions in the country and ordered troops to the area. Putin said the troops would be "peacekeeping" in the breakaway regions - a claim dismissed by the United States as "nonsense".

However, so long as Russia does not invade deeper, there could still be room for diplomacy and the markets are of the mind that there can be a resolve to this crisis. Biden also said he was hopeful diplomacy is still available. The Dow and Nasdaq were down more the 2% shortly before the comments from Biden but have since recovered some ground lost on the day. Currently, the Dow Jones is now down by just 0.9% and the S&P 500 0.4%.

As far as diplomacy, the White House said on Sunday a summit between the US and Russia will go ahead only "if an invasion hasn't happened." This means that the meeting between Secretary of State Antony Blinken and Russian Foreign Minister Sergey Lavrov in Europe this week will be a critical stepping stone in this direction.

However, this meeting will also depend on the condition that Moscow's troops don't further encroach into Ukraine between now and then. Earlier on Tuesday, NATO Secretary-General Jens Stoltenberg said that the alliance believed Russia was still planning a big assault on Ukraine following Moscow's recognition of two separatist regions in the former Soviet republic's east.

The Guardian reported earlier, ''Putin confirmed that Russia had recognised the expanded borders of the two Russian-controlled territories in east Ukraine in remarks to the press.

'We recognised the states,' he said.

That means we recognised all of their fundamental documents, including the constitution, where it is written that their [borders] are the territories at the time the two regions were part of Ukraine.

His dry explanation has explosive consequences: Russia could use the territorial claims as a cause to launch an invasion of more Ukrainian territory, saying it was defending the interests of its proxy states in Donetsk and Luhansk.

Putin stopped short of saying that he was about to launch a further invasion.

But we expect, and I want to underline this, that all the difficult questions will be solved during negotiations between the current Kyiv government and the leadership of this government.

But Kyiv has always resisted negotiating directly with the governments of the Russian-controlled territories, saying it wants to speak with Moscow directly.

Having recognised the territories and received authorisation to use military force abroad on Tuesday evening, it has become clear that Russia is building the framework for what could be a broader conflict in Ukraine.''

EUR/USD technical analysis

The bull flag pattern on the hourly chart is starting to shape up for a breakout to the upside. On the 15-min chart below, the bulls could be looking to engage at this juncture in the 1.1330s with eyes on the 1.1350s for the sessions ahead:

EUR/USD M15 chart

- USD/CAD has pulled back to the 1.2750 area having earlier tested key resistance in the upper 1.2700s.

- Focus remains very much on geopolitics, with US President Biden just announcing new sanctions on Russia.

In choppy trading conditions as FX market participants observe developments in the rapidly escalating Russia/Ukraine crisis saw USD/CAD rally to test a key level of resistance in the upper 1.2700s on Tuesday. The pair has since pulled back from session highs in the 1.2780s to near the 1.2750 mark, where it now trades flat on the day and close to the centre of the day’s 1.2720-1.2780ish range. US President Joe Biden just delivered a speech where he, as expected, unveiled new US sanctions against Russian banks, sovereign debt and wealthy individuals, joining the likes of the UK and EU who had already announced similar measures.

Focus now shifts back to the ceasefire line between Ukraine and the separatist-held provinces in its east, where fighting has picked up in recent days, as well as Russia-backed attempts to stage so-called “false-flag” events. Russia’s parliament on Tuesday gave President Vladimir Putin permission to authorise the creation of Russian military bases in the separatist regions of eastern Ukraine, and as Russian forces continue to amass on Ukraine’s borders, investors fear a full-scale invasion looms.

This suggests more choppiness ahead of the likes of USD/CAD and technicians will be eyeing a potential break above resistance near-1.2800, which could open the door to a push towards December highs above 1.2950. One thing to bear in mind for USD/CAD though is that a full-scale Russian invasion of Ukraine would likely see oil prices shoot through the roof on fears of global supply disruption, which could weigh on the pair. For the time being then, USD/CAD will likely continue to swing between recent 1.2650-1.2800 levels until the geopolitical picture becomes clearer.

What you need to take care of on Wednesday, February 23:

Short-lived optimism ruled financial markets during London trading hours, as Ukrainian President Volodymyr Zelenskyy said that he believes there would not be war nor a wider escalation. However, European and American authorities have anticipated sanctions on Russia. The positive sentiment did not last long, and risk aversion dominated the US session.

The UK was the first to take action, announcing the country would sanction five Russian banks and three individuals, adding that this is just the first tranche of what the government is prepared to do. Also, Ursula von der Leyen, President of the European Commission, tweeted that “the Union remains united in its support for Ukraine's sovereignty and territorial integrity” and that “a first package of sanctions will be formally tabled today.”

US President Joe Biden gave a press conference on the matter. Among other things, he said: “We have no intention of fighting Russia,” adding that US forces in Europe will help Baltic allies, but "these are totally defensive moves on our part." He says the U.S. and allies "will defend every inch of NATO territory and abide by the commitments we made to NATO."

Soft words from Biden helped Wall Street to trim part of its intraday gains, pushing the greenback lower at the end of the day.

The EUR/USD pair remained lifeless around 1.1350, while the GBP/USD pair saw a little more action but ended the day around 1.3560. The USD/CAD retreated sharply ahead of the close and settled around 1.2740, while AUD/USD advanced for a second consecutive day and settled around 07220.

Safe-havens CHF and JPY edged lower against their American rival, while Gold Prices consolidated gains, with spot now trading around $1,900 a troy ounce. Crude oil prices edged lower, with WTI settled at $91.60 a barrel.

Markit flash PMIs for the EU, and the US were generally encouraging, indicating economic expansion in February as the world seems ready to put an end to the coronavirus pandemic.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Crypto markets test new higher lows before moving higher

Like this article? Help us with some feedback by answering this survey:

- The British pound advances some 1.02% during the week as Eastern Europe tensions escalate.

- US equities record losses in the day, while the so-called fear index, the VIX, reaches 30.43.

- GBO/JPY Technical Outlook: A bullish engulfing candle looms, which could pave the way for a move towards 157.00.

The British pound rises as the Ukraine – Russia conflict in Eastern Europe escalates. At the time of writing, the GBP/JPY is trading at 156.26.

The market sentiment remains fragile amid the escalation of the crisis. US equities remain in the red, while the CBOE Volatility Index (VIX), also known as the fear index, reaches the 30.43 mark.

During the overnight session for North American traders, the GBP/JPY edged lower towards 115.50 in the Asian session, consolidating in a range of 50-pips. Later, rallied towards the 156.50 area, retreating towards the 156.30s.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY is upward biased, as depicted by the daily moving averages (DMAs), which reside well below the spot price. Tuesday’s pullback witnessed some buying pressure lifting the pair around the February 14 daily low at 155.30, some 20-pips above the latter, accelerating a move towards 156.00. Furthermore, Tuesday’s price action is forming a “bullish-engulfing” candle pattern, which, once completed, would spur a rally towards 157.00.

In that outcome, the GBP/JPY first resistance would be February 3 daily high at 156.50. Breach of the latter would expose January 18 daily low at 156.91, followed by February 18 daily high at 157.29.

US President Joe Biden, in a national address on Tuesday, called the latest steps by Russia to recognise the independence of breakaway regions in eastern Ukraine, as well as to move troops into the area, the beginning of a Russian invasion of Ukraine. Thus, Biden said that he will begin to impose sanctions on Russia that are far beyond earlier sanctions, given Russia's move was a flagrant violation of international law.

The first tranche of sanctions starts now, Biden stated on Tuesday, saying that the US is issuing the full blockage of two Russian banks and is to impose sanctions on Russian elites and their family members. The US will also implement comprehensive sanctions on Russian sovereign debt. Russia will pay an even steeper price if it continues with the path of aggression.

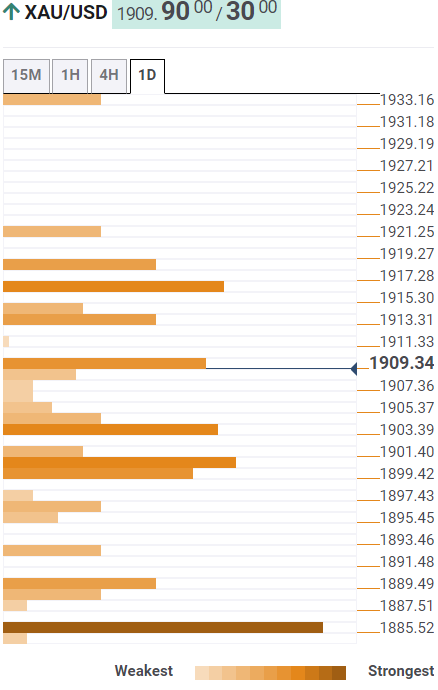

- Gold price trapped in a range as sellers emerge to sell the news on Russia.

- Fed is moving back into focus as the Russian risk premium starts to decay.

- Traders watching for further deployment of Russian troops in expanded borders of Donetsk and Luhansk.

The price of gold, XAU/USD, has been stuck in a sideways range this week so far, bouncing around between $1,914 and $1,886 as traders juggle the chorus of headlines surrounding the Ukraine crisis. At $1,905 during the time of writing, gold is trading near flat on the day so far.

Traders have been whipsawed in financial markets due to the developments in Ukraine a day after Russian President Vladimir Putin recognized two breakaway regions in the country and ordered troops to the area. Putin said the troops would be "peacekeeping" in the breakaway regions - a claim dismissed by the United States as "nonsense".

In the face of a slew of sanctions imposed by Western powers, such as the UK, US and EU, the Kremlin said it remained open to diplomacy but, so far, there has been no confirmation of any summit between Russia and the aforementioned nations. The White House said Sunday a summit between the US and Russia will go ahead only "if an invasion hasn't happened."

Blinken & Lavrov meeting is critical

Meanwhile, talks between Secretary of State Antony Blinken and Russian Foreign Minister Sergey Lavrov in Europe this week are the main focus. This meeting, however, also depends on the condition that Moscow's troops don't further encroach into Ukraine. However, this condition might have already been severed as there are concerns that Russia now recognises the expanded borders of Donetsk and Luhansk.

The Guardian has recently reported, ''Putin confirmed that Russia had recognised the expanded borders of the two Russian-controlled territories in east Ukraine in remarks to the press.

'We recognised the states,' he said.

That means we recognised all of their fundamental documents, including the constitution, where it is written that their [borders] are the territories at the time the two regions were part of Ukraine.

His dry explanation has explosive consequences: Russia could use the territorial claims as a cause to launch an invasion of more Ukrainian territory, saying it was defending the interests of its proxy states in Donetsk and Luhansk.

Putin stopped short of saying that he was about to launch a further invasion.

But we expect, and I want to underline this, that all the difficult questions will be solved during negotiations between the current Kyiv government and the leadership of this government.

But Kyiv has always resisted negotiating directly with the governments of the Russian-controlled territories, saying it wants to speak with Moscow directly.

Having recognised the territories and received authorisation to use military force abroad on Tuesday evening, it has become clear that Russia is building the framework for what could be a broader conflict in Ukraine.''

Meanwhile, the sanctions are flowing with Britain publishing a list thereof and Germany already freezing the Nord Stream 2 Baltic Sea gas pipeline project, which would have significantly increased the flow of Russian gas. This is fundamentally critical for the price of commodities and gold given the risks of even higher inflation for which gold is often considered to be a hedge.

''Russia is the third-largest oil producer (behind the United States and Saudi Arabia) accounting for 11% of world production, of which is consumers only about a third and exporting the rest,'' analysts at ANZ Bank said.

''Russia is also a major supplier of gas to Europe. Germany has advised that it will not grant regulatory approval for Nord Stream 2, the recently completed gas pipeline from Russia to Germany. This pushed up gas prices by 10%.''

Fed consideration

''Nearing a geopolitical climax, gold bugs are selling the news on Russia,'' analysts at TD Securities argued.

''Gold prices have struggled to firm north of $1900/oz despite the significant escalation in the Ukraine crisis. After all, gold prices have rallied significantly ahead of the escalation in response to the associated geopolitical risk premium, leaving traders to sell-the-news on the event.''

''A path towards de-escalation could also be a catalyst for a substantial repricing in gold, considering that expectations for a 50bp hike in March from the Fed have also eased as a result of the conflict. We still expect the crushing weight of a hawkish Fed to ultimately sap appetite for precious metals.,'' the analysts finalised.

Gold technical analysis

The analysts also explained that the rise in Russin risk premium catalyzed a breakout from gold's wedge pattern, bringing in some chartist demand and sparking a substantial CTA buying program.

''Without sustained buying behaviour, gold prices are unlikely to remain in an uptrend, particularly as real rates rise sharply amid dual tightening via hikes and quantitative tightening,'' the analysts argued.

''However, if gold prices are going to succumb to this macro regime as we expect, then CTAs are accumulating at the top.''

Directors at three of the Federal Reserves regional banks voted to increase the discount rate, or interest rate charged on commercial banks for emergency loans, ahead of the January FOMC meeting, minutes released on Tuesday showed. The rate hike recommendation came from the directors at the Federal Reserve banks of Cleveland, St Louis and Kansas City. At the January meeting, the Fed voted unanimously to keep interest rates on hold 0.0-0.25%. According to the minutes, the three regional Fed directors who supported an earlier rate hike did so given "elevated inflation or to help manage economic and financial stability risks".

Market Reaction

Markets are much more focused on geopolitics with US President Joe Biden's announcement of sanctions against Russia due any moment now.

- AUD/JPY swung between low-82.00 to low-83.00 ranges on Tuesday, buffeted by safe-haven flows and rising global commodity prices.

- Whilst the escalating Russia/Ukraine crisis will remain a key driver, Aussie traders will also watch upcoming WPI data on Wednesday.

AUD/JPY has been choppy on Tuesday, swinging between lows not far above 82.00 and session highs to the north of the 83.00 level. On the one hand, heightened geopolitical tensions as the Russia/Ukraine crisis continues to escalate has put pressure the pair as market participants seek haven assets such as the yen. On the other hand, geopolitical tensions are contributing to upwards pressure on global commodity prices, favouring the commodity export-dependent Aussie. At current levels in the 82.80s, the pair trades with on the day gains of just under 0.5%, as traders continue to monitor geopolitical developments ahead of the release of Q4 Australian Wage Price Index (WPI) figures during Wednesday’s Asia Pacific session.

The data, if hotter than expected, could encourage the RBA to pivot their policy guidance in a more hawkish direction at a faster pace. The RBA has only so far conceded that a first rate hike may come before the end of the year and emphasised that they are willing to be patient, implying any such hike would come towards the end of the year. Hot WPI figures might encourage that timeline to be brought forward, which could provide tailwinds for the Aussie. Otherwise, the data calendar is pretty sparse this week for AUD and JPY so geopolitics and risk appetite will remain in the driver’s seat.

- The EUR/JPY drops from daily highs amid a mixed market mood.

- EUR/JPY faces a wall of resistance around the 130.50-75 area that would be difficult to surpass.

- EUR/JPY Technical Outlook: Neutral-downward biased, as the daily chart shows.

Tuesday’s Price action witnessed a rally short-lived of the EUR/JPY above the 200-day moving average (DMA) at 130.76, followed by a retracement on the back of worsening market mood. At the time of writing, the EUR/JPY is trading at 130.26.

The market sentiment is mixed. Global equities take a hit, as European and US equity indices record losses, except for the FTSE100, IBEX, and Stoxx600. In the FX space, risk-sensitive currencies rise, while safe-haven peers are the laggards in the day.

During the overnight session, the EUR/JPY remained subdued but rallied on improving market mood, stalling around Pitchfork’s borrow trendline around the 130.70.85 region, near the US cash equities open. Following that, geopolitical headlines increased the appetite for the Japanese yen vs. the shared currency.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY is neutral-biased. The 200-DMA is still above the spot price, but the 50 and the 100-DMAs lie 10-pips below, confirming the abovementioned. However, the confluence of a four-month-old downslope trendline, Pitchfork’s bottom trendline, and the 200-DMA justify the neutral-downward bias, as EUR buyers face a wall of resistance levels ahead.

That said, the EUR/JPY first support level would be the confluence of the 50 and 100-DMAs around the 130.11-19 area. A clear break would expose 130.00, followed by a trip to the January 25 YTD low at 128.24.

- GBP/USD is facing resistance on the hourly chart near 1.36 the figure.

- The 38.2% and 50% ratios are in focus around the area between 1.3580 and 1.3570.

- BoE and Ukraine crisis have been the main fundamental drivers on Tuesday.

GBP/USD is back to flat on the day having travelled between a low of 1.3538 and a high of 1.3604. The price is trying to break to the upside through trendline resistance but is meeting some meanwhile horizontal resistance, as illustrated below. Meanwhile, the mix of uncertainty surrounding the Ukraine crisis and a less hawkish outlook at the Bank of England are potential stumbling blocks for the bulls in the foreseeable future.

At the start of the week, Russian President Vladimir Putin ordered troops into two breakaway regions of eastern Ukraine which have resulted in bouts of risk-off in financial markets, at times supporting the US dollar. Putin said the troops would be "peacekeeping" in the breakaway regions - a claim dismissed by the United States as "nonsense".

Consequently, among other sanctions from other nations, including the US and EU, the British PM Boris Johnson has announced fresh sanctions on Russia on Tuesday. The BBC reported that ''five banks have had their assets frozen, along with three Russian billionaires, who will also be hit with the UK travel bans.'' The PM stressed these could be extended, but faced calls for tougher action now.

In other news, BoE's Deputy Governor, Dave Ramsden, today advocated for more monetary tightening, but he also sees a "modest" rate hike over the coming months. The BoE raised interest rates to 0.5% this month from 0.25%, with Ramsden part of a minority who then voted for a bigger increase to 0.75%. Shaun Osborne, the chief currency strategist at Scotiabank, said in a note today, "Ramsden cautioned that current market pricing for rate hikes would leave inflation below target in two years — echoing the warning from the Bank at this month’s meeting that markets are too aggressively priced for policy tightening.''

Markets will also keep a close eye on a number of other BoE speakers including Governor Bailey (who testifies to the Parliament’s Treasury committee) and Chief Economist Pill.

''Markets have moved to price a real chance of a 50bps hike by the MPC at their March meeting,'' analysts at TD Securities explained. ''We believe the MPC is more likely to err on the side of sequential 25bps hikes rather than opt for a 50bps hike.''

GBP/USD technical analysis

The price had broken out of the downtrend's resistance line and is now facing resistance on the hourly chart near 1.36 the figure. The 38.2% and 50% ratios align with prior structures between 1.3580 and 1.3570 that would be expected to act as support should there be a correction in the coming sessions.

- The Australian dollar remains in the front foot in the week, up some 0.68%.

- Despite a mixed market mood, the US Dollar Index fails to weigh on the AUD.

- AUD/USD Technical Outlook: Range-bound but close to an upward break if it remains above 0.7200.

The Australian dollar stays firm in the North American session as tensions in Ukraine increase. At the time of writing, the AUD/USD is trading at 0.7223. The market sentiment is downbeat in the equity space, while in the FX complex, risk-sensitive currencies remain in the front seat, to the detriment of safe-haven peers.

Meanwhile, the US Dollar Index visited the 96.00 mark during the session, falling to the 95.96 figure, down 0.12%, while the US 10-year Treasury yield edges up two basis points, up at 1.948%.

Tensions between Ukraine and Russia intensified as Russian President Putin asked the Upper House Parliament to deploy Russia’s armed forces abroad. At the same time, NATO’s Chief Stoltenberg said they would continue to provide Ukraine strong political support while saying that NATO has over 100 jets on high alert.

In the US, Secretary of State Blinken said that yesterday’s actions are the beginning of the latest Russian invasion of Ukraine. Blinken added that Russia poses a threat to the security of people everywhere in the world.

Back to the AUD/USD, the Australian economic docket featured the ANZ Consumer Confidence, which dropped 1.4%, despite easing restrictions in NSW. In the last week, inflationary expectations ticked a tenth up from 5% to 5.1%. Meanwhile, the US economic docket revealed the IHS Markit Manufacturing, Services, and Composite PMIs for February, all of them better than foreseen. Later, the Conference Board reported that Consumer Confidence for February beat expectations came at 110.8 vs. 110.0 estimations but trailed January 113.8 print.

AUD/USD Price Forecast: Technical outlook

The AUD/USD is neutral-biased as it stays confined between the 50 and 100-day moving averages (DMAs), with the latter above the former. However, it broke above a three-month-old downslope trendline in the near term, opening the door for further upside, but would need a daily close above it.

If the abovementioned plays out, the AUD/USD first resistance would be the 100-DMA at 0.7240. Breach of the latter would expose December’s 30 daily high at 0.7275, followed by the 0.7300 mark.

- WTI has pulled back sharply to the $93.00 area after hitting fresh seven-year highs at $96.00 earlier in the session.

- Oil markets await US/EU sanction announcements on Russia after it recognised the independence of breakaway regions in East Ukraine.

- As the risk of a full-scale Russia/Ukraine war rises, commodity strategists continue to call for WTI to hit $100/barrel.

Oil prices have seen considerable chop on Tuesday, with front-month WTI futures at one point hitting fresh seven-year highs at the $96.00 level, before pulling back sharply to underneath $93.00. Choppy trade conditions are being driven by the unusually high level of uncertainty pertaining to ongoing escalation of the Russia/Ukraine crisis. The US and EU are readying a round of fresh economic sanctions against Russia after the country broke international law in recognising pro-Russia rebel-held regions of Eastern Ukraine as independent nations. Meanwhile, Russia’s Parliament just voted in favour of allowing troops to be deployed on a “peacekeeping” mission to the rebel-held regions in Donetsk and Luhansk.

NATO Secretary-General Jens Stoltenberg was recently on the wires and continued to reiterate warnings that Russia continues preparations for a full-scale invasion of Ukraine and many geopolitical strategists view Russia’s latest move as making war with Ukraine more likely. Energy market participants thus continue to fret about potential disruptions to European/global energy supplies should the West enact even tougher sanctions on Russia in case of a full-scale invasion and this should continue to underpin oil prices. Russia produces more than 11M barrels of oil per day, over 10% of global supply. It also supplies about 40% of the EU’s natural gas consumption, with any disruption to gas supplies likely to have a spillover effect on crude oil markets via higher demand.

Calls for oil to hit $100 per barrel are growing loader. Indeed, front-month Brent futures came very close in earlier trade. “The potential for a rally over $100 a barrel has received an enormous boost," analysts at oil broker PVM said on Tuesday, adding that “those who have bet on such a move anticipated the escalation of the conflict”. Elsewhere, analysts at Julius Baer said “we see the oil market in a period of frothiness and nervousness, spiced up by geopolitical fears and emotions… Given the prevailing mood, oil prices may very likely climb into the triple digits in the near term”.

Other themes being watched include indirect US/Iran talks about a return to the 2015 nuclear pact, which could end US sanctions on Iranian oil exports, thus freeing up well over 1M barrels per day in additional supply for global markets. Meanwhile, OPEC+ output policy amid heightened geopolitical tensions in Eastern Europe is under scrutiny. Iraq’s Oil Minister played down the prospect that the group might deviate from their existing policy of increasing output quotas by 400K barrels per day/month.

Geopolitics will remain the main theme to watch, with traders waiting for US/EU sanction announcements and keeping an eye on military developments in Eastern Ukraine. US President Joe Biden will be unveiling sanctions/talking about Ukraine and Russia at 1800GMT. Coming up, on Wednesday, oil traders will be watching the release of weekly US crude oil inventory data from the American Petroleum Institute, which comes a day later than usual owing to the US holiday on Monday.

- US Markit Manufacturing PMI rose more than expected in Feburary accrodin to the flash estimate.

- Index hits highest level in two months.

The economic activity in the US manufacturing sector continued to expand in February, at a fastest pace than it did in January, with IHS Markit's Manufacturing PMI rising to 57.5 (preliminary) from 55.5. This reading came in above market’s expectation of 56.0.

“The pace of economic growth accelerated sharply in February as virus containment measures, tightened to fight the Omicron wave, were scaled back. Demand was reported to have revived and supply constraints, both in terms of component availability and staff shortages, moderated”, commented Chris Williamson, Chief Business Economist at IHS Markit.

- Markit Services PMI much higher than expectations in February.

- Composite Index rises to 56.0 in February from 51.1 in January.

The business activity in the US service sector gained momentum in February with IHS Markit's flash Services PMI rising to 56.7, up from 51.2 and above the 53 of market consensus. Furthermore, the Composite PMI edged higher to 56 from 51.1 in the same period.

“Boosting the latest rise in business activity was a quicker increase in new work intakes. Companies noted the strongest expansion in sales since last July. International demand for US services also strengthened in February. With demand conditions improving, service providers continued to hire extra staff. The increase was marked and the fastest in nine months. On the price front, there were sharper increases in both input costs and output prices. Notably, the rate of charge inflation hit a series peak”, mentioned the report.

- Silver record gains during the week, up some 1.30%, despite rising US Treasury yields.

- Market players ignored positive US macroeconomic data in favor of geopolitical headlines.

- XAG/USD Technical Outlook: Neutral-upward, and if it achieves a daily close above $24.00, a move towards the 200-DMA is on the cards.

Silver rally extends to four consecutive trading sessions notwithstanding rising tensions in the Russia/Ukraine conflict. At press time, XAG/USD is trading at $24.20.

In the meantime, the US 10-year Treasury Note yield rises almost two basis points sits at 1.948%, failing to weigh on the white metal, benefited by heightened tensions in Ukraine.

Appetite for safe-haven assets has increased in the last couple of weeks due to uncertainty in Eastern Ukraine. In the case of silver, the non-yielding metal rose to a four-week high but soon will face strong resistance at the 200-day moving average (DMA) at $24.26.

US Markit PMIs came better than expected, while Consumer Confidence falls

During the North American session, some US macroeconomic news crossed the wires. The US Markit Manufacturing and Services PMI for February rose more than expected. The former increased to 57.5 vs. 56.0 estimations, while the latter rose 56.7 vs. 53.0 foreseen. The Markit Composite Index, a measure of both readings, carried on both sectors, expanding to 56.0 from 51.1 January’s reading.

Late, the Conference Board released the Consumer Confidence for the same period as the abovementioned economic indicators. Consumer confidence rose by five-tenths from 110.0 to 110.5, as foreseen but trailed January’s 113.8.

Market players did not react to the abovementioned data, as their primary focus is on geopolitical tussles.

XAG/USD Price Forecast: Technical outlook

The silver daily chart depicts neutral-upward bias after the broken ten-month-old downslope trendline, exposing the 200-DMA at $24.26. Nevertheless, a daily close over the abovementioned trendline would be required so that XAG bulls could use the $24.00-20 area as consolidation as they prepare to break the 200-DMA.

If the mentioned scenario plays out, XAG/USD’s first resistance would be $24.26. Breach of the latter would expose January 20 daily high at $24.70. Once cleared, the $25.00 mark would be the next roof. A decisive break would send XAG/USD rallying towards November’s 2021 highs at $25.40.

- EUR/GBP still on its way to post the first gain in five days.

- Upside capped by the 20-day simple moving average.

The EUR/GBP jumped on Tuesday from two-week lows near 0.8300 to 0.8382, reaching the highest level since last Wednesday. On American hours it is pulling back, trading back under 0.8350, after being unable to hold above the 20-day simple moving average (0.8370).

From Ukraine to BoE comments

The pound weakened earlier on Wednesday following comments from Bank of England deputy governor Dave Ramsden. He said that “some further modest tightening in monetary policy is likely to be appropriate in the coming months”. His words were seen as less hawkish compared to his previous comments. A surprise approached considering that the latest economic report from the UK was firm.

The crisis in eastern Ukraine took another step on Wednesday. Sanction from the European Union and the US are expected to be announced at any time. An escalation of the conflict could weaken the euro further.

Key levels

A daily close above 0.8370 in EUR/GBP should clear the way for a test of the 0.8400 area that also contains the 55-day moving average. A recovery above should alleviate the bearish pressure. The next resistance stands at 0.8425/30.

On the downside, 0.8330 is again a support level to consider, followed by the 0.8300/05 zone. A consolidation below 0.8300 would point to more losses.

Technical levels

The head of the Russian parliament said on Tuesday that Russian President Vladimir Putin had asked for permission to use Russian troops abroad. The Russian parliament will now vote on this request. Presumably, this refers to Russia's plans to set up military bases in the pro-Russia breakaway regions of Eastern Ukraine which Russia recognised as independent nations on Monday. However, the vote could allow Putin to order a further military incursion into Ukraine.

Market Reaction

Market sentiment remains choppy on Russia/Ukraine/NATO headlines and the latest news appears to have driven a few negative ticks in US equity markets. The S&P 500 recently pulled back under 4350 and into the 4330s where it now trades back in the red on the day by about 0.3%.

- The S&P 500 has recovered back to trade flat near 4350 after hitting fresh monthly lows in the 4310s.

- Equity markets remain very much driven by geopolitical headlines, with US sanctions on Russia expected to be announced soon.

- The index is trading just under 10% below January’s record highs, meaning it isn’t on course to confirm a “correction”.

It was a choppy start to the session, with the S&P 500 index falling as much as 0.7% in the immediate aftermath of the open to hit fresh monthly lows just above 4310, though having since recovered back to trading flat in the 4350 area. At current levels, the index is trading just under 10% below the record highs it printed at the start of the year – a close of more than 10% below a recent peak would confirm that US equities have undergone a “correction”.

Investors remain nervous ahead of the official announcement of US sanctions against Russia sometime later in the day. The US and its NATO allies are hitting Russia with new sanctions after it recognised the independence of two breakaway regions of Eastern Ukraine and move troops into the area on a “peacekeeping” mission. Market commentators have noted how markets are set to remain very much driven by Russia/Ukraine headlines, making for difficult, unpredictable trading conditions. Investors are worried recent escalation from the Russians raises the risk of a broader Russia/Ukraine conflict, thus raising the risk that the West imposes larger sanctions on Russia that could have an inflationary impact on the global economy.

In the background, traders are also mulling Fed tightening, after Fed policymaker Michelle Bowman on Monday said she had not yet decided whether the Fed should hike interest rates by 25 or 50bps in March. The latest round of US data releases, which saw S&P/Case-Shiller Home Price inflation exceed YoY expectations in December, a stronger rebound than expected in both the Services and Manufacturing sectors according to the preliminary February Markit PMI surveys and slightly better than forecast flash February Consumer Confidence figures have not impacted US equity market sentiment. That speaks to the fact that US data has been and will likely continue to play second fiddle to the themes of geopolitics. Traders may take more notice of Friday’s January Core PCE inflation report if it affects Fed tightening expectations in anyway.

Looking at the other major US indices, the Nasdaq 100 index has recovered back to the north of the 14K level after briefly dipping below 13.9K and now trades 0.3% higher on the day. Bears will be eyeing a test of annual lows in the 13.7K area should the index lose grip of 14K level once more. The Dow, meanwhile, has lost its grip on the 34K level and trades about 0.4% lower on the day. The S&P 500 CBOE Volatility Index, or VIX, has fallen back under 29.00 after briefly testing February highs in the 32.00 area earlier in the session.

- The NZD extend its gains in the week, so far up 0.62%.

- On Tuesday, the global equities sell-off accelerated, while in the FX space, risk-sensitive currency rise vs. safe-haven peers.

- RBNZ: Money market futures have priced in a 100% chance of a 25 bps increase, while odds of a 50 bps lie at 30%.

During the North American session, the New Zealand dollar gains against most G8 currencies, while safe-haven peers stay under pressure. At the time of writing, the NZD/USD is trading at 0.6736, gains 0.63%.

Market participants are risk-off, portrayed by European and US equity futures recording losses. In the FX complex story is different, with the high-beta currencies up, led by the NZD, although contained within familiar levels.

Russia/Ukraine updates

Headlines in the Russian/Ukraine region appear to grab less of traders’ attention. On Monday, Russian President Vladimir Putin recognized two separatist regions known as Donetsk and Luhansk as independent states. His decision was immediately followed by the reactions of Western Europe and the US.

The US President Biden signed an executive order banning investment, trade, and financing to the two Ukraine separatist regions. At the same time, the US Secretary of State Blinken said that it requires a swift and firm response. Also, the European Commission President Von der Leyen said that the Russian decision is a “blatant violation of international law and the Minsk agreements.”

That said, the UK and the Eurozone have imposed sanctions on Russia. Read more here:

- UK PM Johnson: Sanctioning 5 Russian banks, three individuals, only first tranche of what UK willing to do

- EU will hit three Russian banks with an asset freeze and lock them out of EU markets - WSJ

Putting geopolitical jitters aside, on February 23, the Reserve Bank of New Zealand (RBNZ) will host its first monetary policy meeting of the year. Inflation data came hotter than the RBNZ estimated in Q4, which came at 5.7% y/y, well above the central bank target band. That cements a continuation of the bank’s tightening cycle, but the question is, how far would the RBNZ go? Money markets future priced in a 100% odd of 25 bps increase in the meeting, with a 30% chance of a 50 bps hike.

NZ and US economic docket

Regarding the economic docket, New Zealand revealed the Credit Card Spending for January, which rose to 5.5% y/y, higher than the previous month. While on the US front, Markit PMIs for February were featured, with Manufacturing and Services beating estimations, the former at 57.5 higher than the 56 foreseen, while the latter at 56.7 from 53 expected.

According to the latest Consumer Confidence survey conducted by the US Conference Board, US Consumer Confidence fell to 110.5 in February from 111.1 in January. That was a smaller drop than the expected decline to 110.0. The Present Situation Index rose to 145.1 from 144.5 last month, while the Consumer Expectations Index fell a little to 87.5 from 88.8.

Market Reaction

The DXY does not seem to have reacted to the latest Consumer Confidence figures and continues to pivot either side of the 96.00 level.

- EUR/USD regains composure and advances beyond 1.1300.

- The greenback remains offered as risk aversion fades away.

- The US Consumer Confidence comes next in the docket.

The single currency managed to leave behind the geopolitics-led pessimism seen earlier in the session and pushed EUR/USD to the 1.1370 region on Tuesday.

EUR/USD up on dollar weakness

EUR/USD, therefore, reverses three straight sessions with losses and bounces off daily lows in the 1.1290/85 band following the irruption of the appetite for the risk complex, which in turn encouraged USD-bears to return to the market and drag the US Dollar Index (DXY) back to the negative territory.

Bolstering the upside momentum in spot also emerges the moderate rebound in yields of the German 10y Bund to 3-day highs around the 0.28% zone.

In the domestic calendar, better-than-expected Business Climate in Germany for the month of February also underpinned the recovery in the pair. Across the pond, house prices tracked by the FHFA’s House Price Index rose 1.2% MoM in December, while the S&P/Case-Shiller Index rose 18.6% YoY in the same month. Further US data saw flash Manufacturing PMI at 57.5 in February, while the Conference Board will publish its Consumer Confidence gauge later in the session.

What to look for around EUR

EUR/USD continues to look to the geopolitical scenario and the risk appetite trends for near-term direction. On this, further deterioration of the Russia-Ukraine front should keep the pair under pressure via a stronger dollar. In the meantime, the improvement in the pair’s outlook appears underpinned by fresh speculation of a potential interest rate hike by the ECB at some point by year end, higher German yields, persevering elevated inflation and a decent pace of the economic activity and other key fundamentals in the region. The threat to this view, as usual, comes from the Fed and a potential tighter-than-expected start of the normalization of its monetary conditions.

Key events in the euro area this week: Germany, EMU Flash PMIs (Monday) – Germany IFO survey (Tuesday) – Germany GfK Consumer Confidence, EMU Final January CPI (Wednesday) – Eurogroup Meeting, Germany Final Q4 GDP, EMU Final Consumer Confidence, ECB Lagarde (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is gaining 0.32% at 1.1344 and faces the next up barrier at 1.1395 (weekly high Feb.16) followed by 1.1487 (200-week SMA) and finally 1.1494 (2022 high Feb.10). On the other hand, a drop below 1.1287 (weekly low Feb.22) would target 1.1279 (weekly low Feb.14) en route to 1.1186 (monthly low Nov.24 2021).

According to economists at Scotiabank, USD/KRW will likely fall below the 1,190 level before trading even lower once external uncertainties start to fade away.

BoK expected to hold its policy rate steady at 1.25%

“The Bank of Korea (BoK) is expected to hold its policy rate steady at 1.25% on Thursday, but remains on track to deliver another 25bp rate hike in the second quarter.”

“As a traditional high-beta currency, the Korean won will remain susceptible to external uncertainties. In the near-term, the ongoing Russia-Ukraine crisis could dampen market sentiment abruptly.”

“USD/KRW is now staying in an ascending channel, and will likely fall below the 1,190 level before trading even lower when external uncertainties start to fade away.”

USD/CAD continues to hold its well-established range around 1.27. Economists at Scotiabank highlights the key technical levels to keep an eye on.

Firm resistance remains at 1.2790/00

“Firm resistance remains 1.2790/00.”

“We spot support at 1.2720/25 intraday.”

“Stronger support is at 1.2670/75.”

- After hitting fresh multi-month highs at $1914, spot gold is consolidating above $1900 as the Russia/Ukraine crisis escalates.

- As traders worry about the rising risk of a full-scale Russian military incursion into Ukraine, gold will likely remain supported.

As the Russia/Ukraine crisis continues to escalate, most recently with Russia recognising the independence of and moving troops into two separatist regions in eastern Ukraine, prompting NATO nations to announce/prepare new sanctions on Russia, gold has moved back above $1900. Spot prices (XAU/USD) hit fresh multi-month highs at $1914 on Tuesday and, though pulling back from these highs printed during Asia pacific trade as dip-buying facilitating an intra-day rebound in global equities markets, has remained above the key $1900 level.

With market participants nervous that Russia/pro-Russia separatists in Eastern Ukraine could initiate further hostilities against Ukraine, thus further escalating the risk of an all-out Ukraine/Russia conflict, gold is likely to remain well underpinned this week. Brent oil spiked to close to $100 per barrel on Tuesday and EU natural gas prices were up sharply as Germany pledged not to approve the Nord Stream 2 pipeline that would bring gas directly to Germany from Russia. The upside risks posed to global inflation from any continued spike in energy prices as a result of further Russia/Ukraine crisis escalation is likely boosting demand for gold as an inflation hedge.

Recent Fed speak and US data releases have not had much of an impact on gold in recent days as price action takes its cue from geopolitics. Hawkish commentary from Fed’s Michelle Bowman on Monday, who essentially said she was still undecided as the whether the Fed should hike rates by 25 or 50bps in March, was roundly shrugged off. That suggests that other Fed speak this week is also likely to be ignored, or, at least, play second fiddle, with this also likely the case for Friday’s January US Core PCE inflation data. Ahead of that, traders should keep an eye on upcoming US PMI and CB Consumer Confidence surveys, both the flash readings for February.

EUR/USD touched a fresh weekly low of 1.1288 but has managed to rebound. Economists at note that the world’s most popular currency pair could dive to the 1.1180 mark on failure to hold 1.1280.

Risk of decline if 1.1280 breaks

“A break below last week low of 1.1280 can take the pair towards 1.1260 and projections of 1.1180.”

“First hurdle is at 1.1410.”

10-year US Treasury yields faced resistance near 2.06% and has subsequently broken below a steeper channel. However, economists at Société Générale expect yields to stay above the 1.66% level.

Channel band at 1.92% caps immediate upside

“March 2021 peak of 1.77% is first layer of support. A large downside is not envisaged; the neckline of the Inverse Head and Shoulders confirmed earlier at 1.66% is expected to be an important level.”

“Channel band at 1.92% caps immediate upside.”

The safe-haven US dollar has given back some ground versus the euro. Still, economists at Rabobank expect the EUR/USD pair to edge lower towards 1.11 in the coming months before paring back losses later in the year.

Some indigestion on attempts to break below 1.13

“The market is already positioned long of USD and this appears to be creating some indigestion on attempts to break below EUR/USD 1.13.”

“Given the ongoing geopolitical risks, signs that the ECB will remain cautious on policy tightening and expectations that the Fed will be hiking rates in just a few weeks’ time, we see scope for EUR/USD to edge towards 1.11 during H1 before turning higher later in the year.”

USD/JPY is coming under increasing pressure following the further rise in geopolitical tensions. A close below the 55-day moving average (DMA) at 114.50 should see weakness extend further towards next support at 114.16, then more importantly at 113.59/48, analysts at Credit Suisse report.

Close below 113.59/48 to see a bearish ‘double top’ established

“A close below 55-DMA and potential uptrend from late September at 114.50 would raise the prospect of further weakness in the broader range with support seen next at 114.16, then 113.59/48 – the January lows and 38.2% retracement of the September/January rally. A close below here would see a bearish ‘double top’ established to mark a more important turn lower, with next support seen at the December lows and 200-DMA at 112.56/17.

“Resistance at the 115.13 capping can keep the immediate risk lower. Above can see strength back to 115.80/88, but with fresh sellers expected here.”

- USD/CHF staged a solid rebound from the four-week low touched earlier this Tuesday.

- A recovery in the risk sentiment undermined the safe-haven CHF and extended support.

- Bulls seemed unaffected by modest USD weakness as the focus remains on geopolitics.

The USD/CHF pair maintained its bid tone through the early North American session, with bulls now awaiting sustained strength above the 0.9200 round-figure mark.

The pair staged a goodish rebound from the 0.9150 area, or the four-week low touched earlier this Tuesday and has now reversed a major part of the previous day's losses. The momentum was sponsored by receding safe-haven demand amid a turnaround in the global risk sentiment, which weighed on the Swiss franc and extended some support to the USD/CHF pair.

A Kremlin spokesperson said Russia is still open to a diplomatic solution and has an interest in that. This helped ease concerns about the worsening Ukraine crisis and triggered a solid recovery in the equity markets. That said, the risk of a further escalation in tensions between Russia and the West over Ukraine should cap the optimistic move in the markets.

In fact, Britain imposed sanctions on five Russian banks, while German Chancellor Olaf Scholz issued an order to halt the process of certifying the Nord Stream 2 gas pipeline. The United States is also expected to announce new economic sanctions against Russia. This comes after the latter recognized two breakaway regions in eastern Ukraine as independent entities.

Nevertheless, the USD/CHF pair, so far, has managed to stick to its intraday gains and seemed rather unaffected by modest US dollar weakness. Meanwhile, a strong intraday rally in the US Treasury bond yields should help limit any meaningful USD decline. This, in turn, favours bullish traders and supports prospects for a further appreciating move for the pair.

Market participants now look forward to the release of the flash US PMI prints for February. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to the USD/CHF pair. The focus, however, will remain on the situation in Ukraine, which will drive the market sentiment and allow traders to grab some short-term opportunities.

Technical levels to watch

USD/RUB is inching closer to the hurdle of 81.00/81.50. A move above the latter would open up gains towards 82.85 and potentially the 2016 high of 86.00, economists at Société Générale report.

Important support aligns at 74.25/73.70

“Weekly MACD has crossed into positive territory denoting prevalence of upside momentum.”

“If the pair establishes itself beyond 81.00/81.50, this could signal a larger up move towards 82.85 and perhaps even towards the peak of 2016 at 86.00.”

“The low formed earlier this month at 74.25/73.70 should be an important support near-term.”

According to a WSJ reporter, the EU will announce plans to hit three Russian banks with an asset freeze and a lock-out from the EU markets. Russia's VEB, Rossiya and Promsvyazbank will be the three bank's affected, with the latter two also being sanctioned by the UK.

- USD/TRY adds to the weekly rebound near 14.0000.

- The pair edges higher despite the offered bias in the dollar.

- Markets’ focus remains on the Russia-Ukraine conflict.

The Turkish lira depreciates further and motivates USD/TRY to clinch fresh 6-week tops around 13.9000 on Tuesday.

USD/TRY now targets 14.0000

USD/TRY advances for the third session in a row and extends the positive start of the week despite the greenback now sheds initial gains on the back of renewed inflows into the risk-associated universe.

However, further deterioration in the geopolitical scenario sent prices of the European reference Brent crude to the area just below the psychological $100.00 mark per barrel earlier in the session, just to give away part of those gains afterwards. On this, it is worth recalling that Turkey is a large oil-dependent economy, and higher oil prices are expected to morph into extra inflationary pressures and hurt households’ confidence.

The offered stance in the lira comes in tandem with further consolidation in yields of the Turkey 10y bond around the 20% area.

In the Turkish calendar, Capacity Utilization eased a tad to 76.6% in February (from 77.6%) and Manufacturing Confidence ticked higher to 109.8 (from 109.5) also for the current month.

What to look for around TRY

The pair attempts to break above its multi-week consolidative theme and approaches the 14.00 mark. The lira, in the meantime, remains surprisingly stable so far this year, particularly after the government announced a lira time-deposit protected scheme in late December and after the CBRT left the policy rate unchanged in the last couple of meetings. However, the lira is expected to remain under scrutiny amidst rampant inflation, negative real interest rates and the omnipresent political pressure to favour lower interest rates.

Key events in Turkey this week: Capacity Utilization, Manufacturing Confidence (Tuesday) – Economic Confidence Index (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is advancing 1.19% at 13.8299 and a drop below 13.4317 (weekly low Feb.11) would expose 13.2327 (monthly low Feb.1) and finally 12.7523 (2022 low Jan.3). On the other hand, the next up barrier lines up at 13.9013 (monthly high Feb.22) seconded by 13.9319 (2022 high Jan.10) and then 18.2582 (all-time high Dec.20).

- GBP/USD slipped back to the 1.3550 area in recent choppy trade with FX markets mixed as traders assess Russia/Ukraine developments.

- Russia recognised the independence on rebel-held regions in Eastern Ukraine and moved in troops on Monday, escalating tensions with Ukraine.

- The UK has already announced sanctions and the EU and US are expected to follow suit shortly.

GBP/USD has come under selling pressure on Tuesday, falling back to the 1.3550 area in recent trade from earlier session highs at 1.3600 to now trade with losses of about 40 pips of 0.3% on the day. G10 FX market trade is choppy and mixed as traders/market participants assess the fallout of Russia’s decision on Monday to recognise the independence of rebel-held territories in Eastern Ukraine and to subsequently sign new defense agreements with the regions. Russian troops have since moved in on a “peacekeeping” mission to the rebel-held areas of Donetsk and Luhansk. Investors fear this could be a precursor to a broader Russia/Ukraine conflict as separatist forces continue to accuse Ukraine’s military of aggression.

UK PM Boris Johnson recently became the first major Western nation to formally announce sanctions against Russia for what it says is a breach of international law and this may have something to do with recent GBP underperformance. Indeed, at present, GBP is the worst performing G10 currency on the day and, somewhat oddly, other risk-sensitive G10 currencies such as NZD, NOK and SEK have all been performing very well. Traders will likely continue to face difficulties navigating choppy, unpredictable trading conditions as further sanction announcements from the EU and US beckon and NATO leaders continue to warn of the risk of further Russian aggression against Ukraine.

In terms of domestic UK fundamentals, BoE Deputy Governor Dave Ramsden was on the wires on Tuesday and was cautious about the longer-term outlook for policy amid heightened geopolitical uncertainty. Ramsden said that the BoE would need to continue to raising interest rates a little more over the coming months, but warned that the Russia/Ukraine crisis was making it harder to predict the longer-term policy path.