- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-08-2014

(raw materials / closing price /% change)

Light Crude 93.90 -0.06%

Gold 1,277.30 +0.15%

(index / closing price / change items /% change)

Nikkei 225 15,586.2 +131.75 +0.85%

Hang Seng 24,994.1 -165.66 -0.66%

Shanghai Composite 2,230.46 -9.75 -0.44%

FTSE 100 6,777.66 +22.18 +0.33%

CAC 40 4,292.93 +52.14 +1.23%

Xetra DAX 9,401.53 +86.96 +0.93%

S&P 500 1,992.37 +5.86 +0.29%

NASDAQ Composite 4,532.1 +5.62 +0.12%

Dow Jones 17,039.49 +60.36 +0.36%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3281 +0,18%

GBP/USD $1,6578 -0,09%

USD/CHF Chf0,9112 -0,24%

USD/JPY Y103,82 +0,12%

EUR/JPY Y137,90 +0,30%

GBP/JPY Y172,12 +0,04%

AUD/USD $0,9301 +0,18%

NZD/USD $0,8404 +0,45%

USD/CAD C$1,0938 -0,27%

(time / country / index / period / previous value / forecast)

00:00 U.S. Jackson Hole Symposium

12:30 Canada Retail Sales, m/m June +0.7% +0.6%

12:30 Canada Retail Sales ex Autos, m/m June +0.1% +0.6%

12:30 Canada Consumer Price Index m / m July +0.1% -0.1%

12:30 Canada Consumer price index, y/y July +2.4%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m July -0.1% 0.0%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y July +1.8%

14:00 U.S. Fed Chairman Janet Yellen Speaks

18:30 Eurozone ECB President Mario Draghi Speaks

Stock indices closed higher despite flash PMIs from the Eurozone. Investors speculate that the Fed may hike its interest rate sooner than expected.

Eurozone's preliminary manufacturing purchasing managers' index (PMI) declined to 50.8 in August from 51.8 in July, missing expectations for a fall to 51.4.

Eurozone's preliminary services purchasing managers' index (PMI) fell to 53.5 in August from 54.2 in July, missing expectations for a decline to 53.6.

Germany's preliminary manufacturing purchasing managers' index (PMI) decreased to 52.0 in August from 52.4 in July, beating expectations for a fall to 51.8.

Germanys' preliminary services purchasing managers' index (PMI) fell to 56.4 in August from 56.7 in July, beating expectations for a decline to 55.5.

French preliminary manufacturing purchasing managers' index (PMI) declined to 46.5 in August from 47.8 in July, missing forecasts of a rise to 47.9.

French preliminary services purchasing managers' index (PMI) rose to 51.1 in August from 50.4 in July, beating expectations for a fall to 50.3.

Raiffeisen Bank International AG shares rose 11.0% after reporting the better-than-forecasted second-quarter net income.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,777.66 +22.18 +0.33%

DAX 9,401.53 +86.96 +0.93%

CAC 40 4,292.93 +52.14 +1.23%

Crude oil rose as U.S. economic data pointed to stronger growth in the world's biggest oil-consuming nation. Existing home sales rose to a 10-month high, jobless claims slid more than forecast and a manufacturing index surged to the highest since 2010. This data are indicating that U.S. demand is looking strong.

WTI for October delivery rose 0.64% to $94.10 a barrel on the New York Mercantile Exchange.

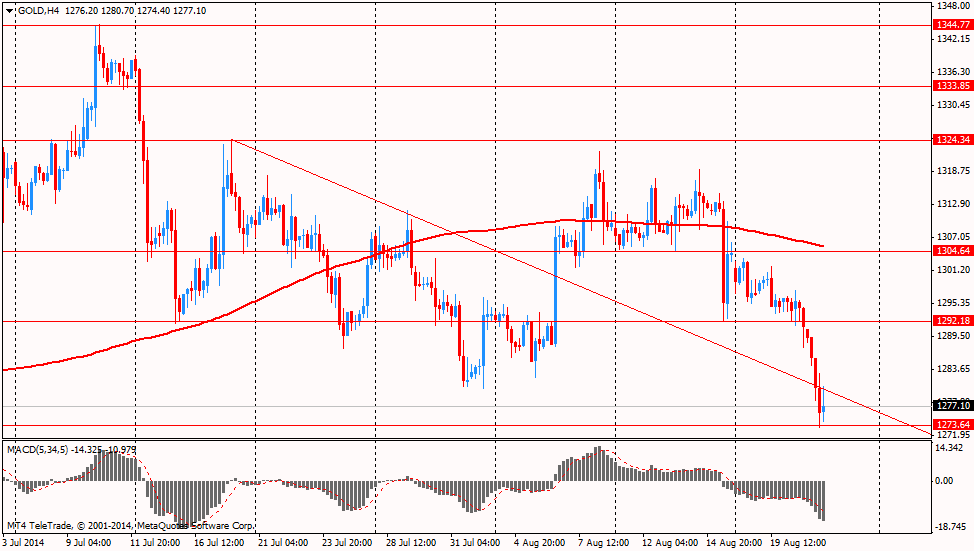

Gold fell to a two-month low on the outlook for higher U.S. interest rates that strengthened the dollar. Many U.S. policy makers raised the possibility they may boost rates sooner than anticipated, minutes of the Federal Reserve's July meeting showed yesterday. Futures traders are seeing more chance of rising interest rates by the middle of next year, reducing gold's allure because the metal only offers investors returns through price gains.

Gold for December delivery fell to $1,277.10 an ounce (-1.23%) on the Comex in New York.

The U.S. dollar traded lower against the most major currencies after the mostly positive U.S. economic data. Market participants are awaiting a speech by the Federal Reserve Chair Janet Yellen in Jackson Hole on Friday.

The number of initial jobless claims in the week ending August 16 in the U.S. fell by 14,000 to 298,000 from 312,000 in the previous week. The previous week's figure was revised from 311,000. Analysts had expected number of initial jobless claims to decrease by 13,000 to 299,000.

The U.S. preliminary manufacturing purchasing managers' index (PMI) rose to 58.0 in August from 55.8 in July, beating expectations for a decline to 55.7.

The Federal Reserve Bank of Philadelphia's manufacturing index climbed to 28.0 in August from 23.9 in July, beating expectations for a drop to 20.3.

The existing home sales in the U.S. rose 2.4% to 5.15 million units in July from 5.03 million units in June. June's figure was revised down from 5.04 million units. Analysts had expected a decrease to 5.01 million units in July.

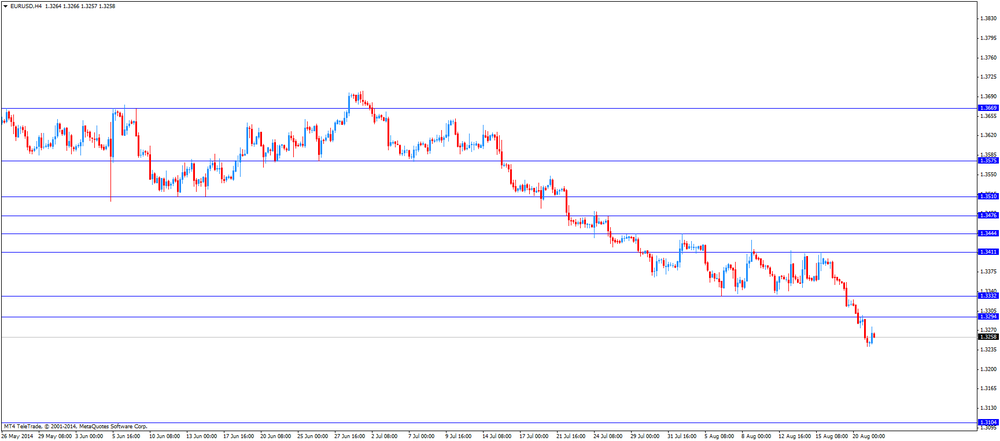

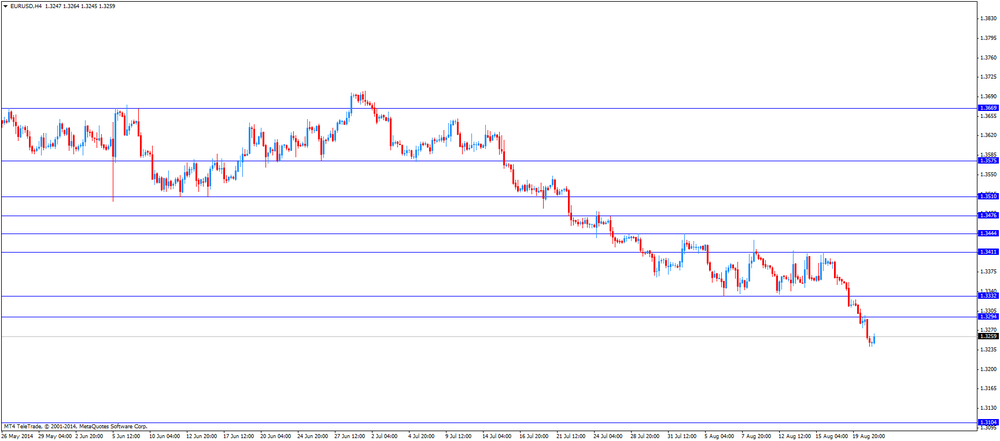

The euro traded higher against the U.S. dollar. Eurozone's preliminary manufacturing purchasing managers' index (PMI) declined to 50.8 in August from 51.8 in July, missing expectations for a fall to 51.4.

Eurozone's preliminary services purchasing managers' index (PMI) fell to 53.5 in August from 54.2 in July, missing expectations for a decline to 53.6.

Germany's preliminary manufacturing purchasing managers' index (PMI) decreased to 52.0 in August from 52.4 in July, beating expectations for a fall to 51.8.

Germanys' preliminary services purchasing managers' index (PMI) fell to 56.4 in August from 56.7 in July, beating expectations for a decline to 55.5.

French preliminary manufacturing purchasing managers' index (PMI) declined to 46.5 in August from 47.8 in July, missing forecasts of a rise to 47.9.

French preliminary services purchasing managers' index (PMI) rose to 51.1 in August from 50.4 in July, beating expectations for a fall to 50.3.

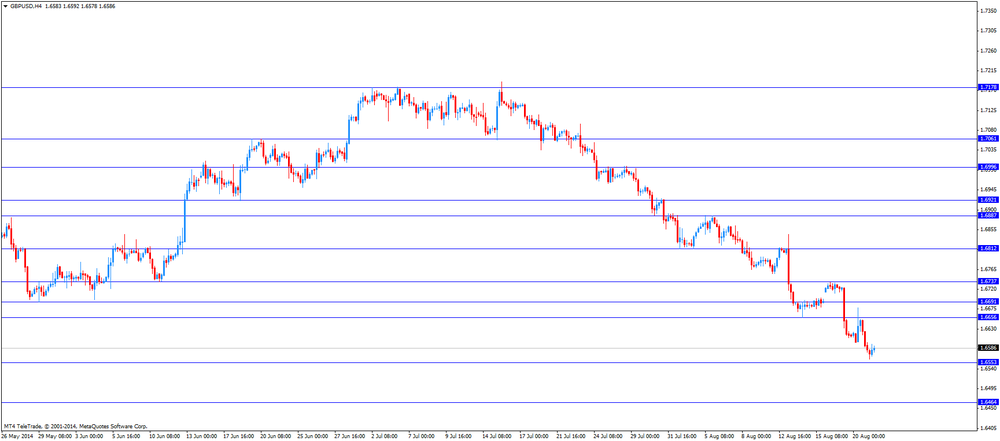

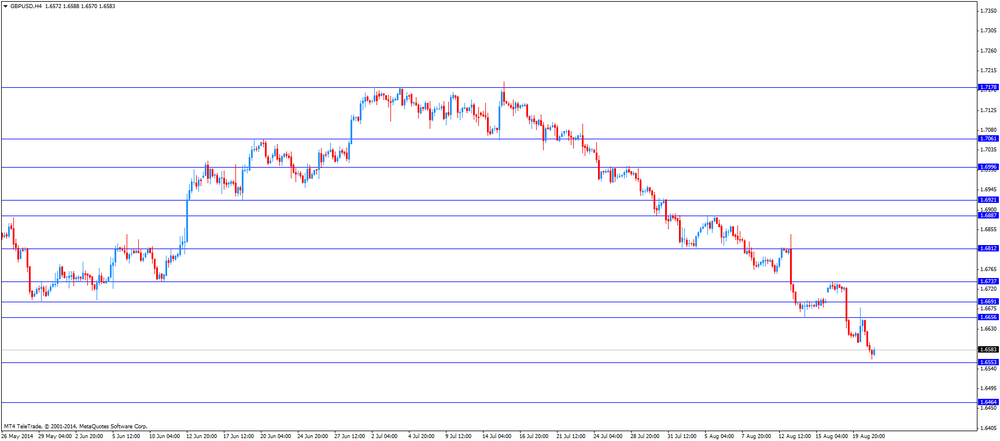

The British pound traded slightly higher against the U.S. UK retail sales increased 0.1% in July, missing expectations for a 0.4% rise, after a 0.2% gain in June. June's figure was revised up from a 0.1% increase.

On a yearly basis, U.K. retail sales climbed 2.6% in July, after a 3.4% rise. June's figure was revised down from a 3.6% gain.

The U.K. public sector net borrowing posted a deficit of £1.1 billion in July, after a surplus of £9.79 billion in June. June's figure was revised from a surplus of £9.51 billion. Analysts had expected a surplus of £10.1 billion.

The Swiss franc traded higher against the U.S. dollar. Switzerland's trade surplus rose to 3.98 billion Swiss francs in July from a surplus 1.41 billion Swiss francs in June, exceeding expectations for an increase to a surplus of 1.91 billion Swiss francs. June's figure was revised up from a surplus of 1.38 billion Swiss francs.

The New Zealand dollar traded lower against the U.S dollar due to the strong U.S. currency and the weaker-than-expected economic data from China and New Zealand, but later recovered its losses.

China's preliminary HSBC manufacturing purchasing managers' index dropped to 50.3 in August from 51.7 in July, missing expectations for a decline to 51.5.

China is New Zealand's second biggest export partner.

Credit card spending in New Zealand rose 4.5% in July, after a 6.0% gain in June. June's figure was revised down from a 7.0% increase.

The Australian dollar traded lower against the U.S. dollar due to the strong U.S. currency and the weaker-than-expected economic data from China, but later recovered its losses.

The Conference Board released its leading index for Australia. The index climbed 0.4% in June, after a 0.2% rise in May.

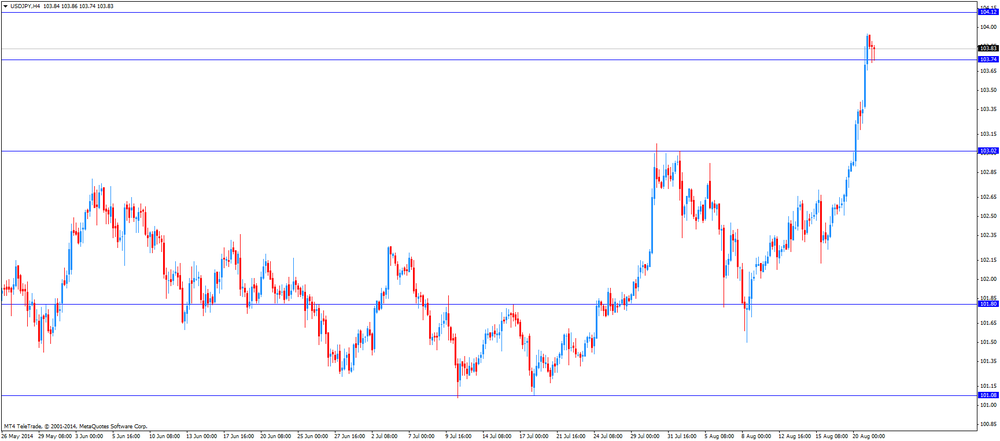

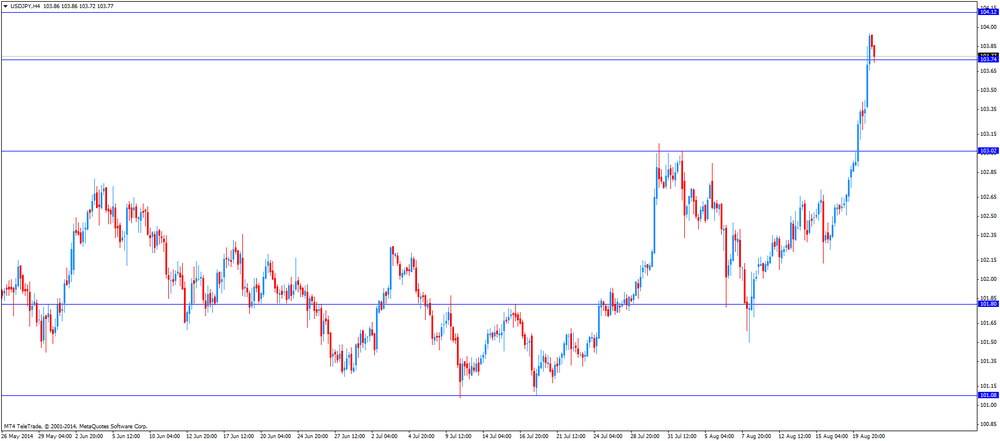

The Japanese yen traded slightly higher against the U.S. dollar.

Japan's preliminary manufacturing purchasing managers' index rose to 52.4 in August from 50.5 in July, exceeding expectations for an increase to 51.5.

The Federal Reserve released on Wednesday the FOMC' minutes of the meeting held on July 29-30, 2014. Some FOMC members believe that the Fed could tighten its monetary policy sooner than expected due to improvements in labour market conditions and strengthening recovery in U.S. economy.

Most FOMC members want to wait for more information.

Most Fed officials believe that the Fed can wait until 2015 before hiking its interest rate.

At the last meeting, the FOMC reduced its monthly bond purchasing program by $10 billion and kept its interest rate near zero.

The Fed's next move could depend on the economy performs in the second half of 2014. The unemployment rate was 6.2% in July. The U.S. economy expanded at a 4% annual rate in the second quarter after contracting 2.1% in the first quarter.

The Fed also said that inflation had moved closer to its 2% target.

EUR/USD $1.3250(E325mn), $1.3350-55(E225mn), $1.3400(E461mn)

USD/JPY Y102.00($250mn), Y102.50($450mn), Y102.75-80($200mn), Y103.00($985mn)

EUR/JPY Y136.65(E184mn)

GBP/USD $1.6650(stg184mn)

USD/CHF Chf0.9100($440mn)

AUD/USD $0.9225(A$149mn), $0.9335(A$149mn)

USD/CAD C$1.0880($276mn), C$1.0900($130mn)

U.S. stock futures climbed amid speculation the Federal Reserve will continue to support the economy as central bankers meet in Jackson Hole.

Global markets:

Nikkei 15,586.2 +131.75 +0.85%

Hang Seng 24,994.1 -165.66 -0.66%

Shanghai Composite 2,230.46 -9.75 -0.44%

FTSE 6,770.01 +14.53 +0.22%

CAC 4,275.01 +34.22 +0.81%

DAX 9,366.46 +51.89 +0.56%

Crude oil $92.90 (-0.59%)

Gold $1278.10 (-1.32%)

(company / ticker / price / change, % / volume)

| Cisco Systems Inc | CSCO | 24.72 | +0.04% | 0.3K |

| Microsoft Corp | MSFT | 44.97 | +0.04% | 1K |

| Chevron Corp | CVX | 127.59 | +0.08% | 0.2K |

| The Coca-Cola Co | KO | 41.29 | +0.10% | 7.3K |

| Goldman Sachs | GS | 174.23 | +0.11% | 0.7K |

| UnitedHealth Group Inc | UNH | 83.52 | +0.11% | 1.0K |

| Intel Corp | INTC | 34.54 | +0.12% | 9.4K |

| Johnson & Johnson | JNJ | 103.33 | +0.12% | 3.4K |

| Procter & Gamble Co | PG | 82.91 | +0.12% | 0.6K |

| Exxon Mobil Corp | XOM | 99.83 | +0.13% | 1.2K |

| Pfizer Inc | PFE | 28.93 | +0.14% | 1.2K |

| Verizon Communications Inc | VZ | 48.89 | +0.14% | 12.9K |

| Boeing Co | BA | 127.55 | +0.16% | 0.3K |

| AT&T Inc | T | 34.59 | +0.17% | 2.8K |

| International Business Machines Co... | IBM | 190.43 | +0.17% | 0.3K |

| Visa | V | 216.62 | +0.19% | 0.1K |

| JPMorgan Chase and Co | JPM | 57.76 | +0.21% | 0.7K |

| Nike | NKE | 79.09 | +0.23% | 0.1K |

| 3M Co | MMM | 144.96 | +0.25% | 0.6K |

| Caterpillar Inc | CAT | 107.97 | +0.25% | 0.6K |

| General Electric Co | GE | 26.43 | +0.27% | 2.7K |

| Wal-Mart Stores Inc | WMT | 75.19 | +0.31% | 0.6K |

| American Express Co | AXP | 88.77 | +0.32% | 0.1K |

| McDonald's Corp | MCD | 94.53 | +0.36% | 1.4K |

| United Technologies Corp | UTX | 109.71 | 0.00% | 1.0K |

| Home Depot Inc | HD | 90.66 | -0.10% | 2.5K |

| Merck & Co Inc | MRK | 59.40 | -0.13% | 0.1K |

| Walt Disney Co | DIS | 89.70 | -0.16% | 2.2K |

Upgrades:

Downgrades:

Other:

Tesla Motors (TSLA) initiated with a Outperform at Credit Agricole, target $300

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index June +0.2% +0.4%

01:35 Japan Manufacturing PMI (Preliminary) August 50.5 51.5 52.4

01:45 China HSBC Manufacturing PMI (Preliminary) August 51.7 51.5 50.3

03:00 New Zealand Credit Card Spending July +6.0% Revised From +7.0% +4.5%

06:00 Switzerland Trade Balance July 1.41 Revised From 1.38 1.91 3.98

06:58 France Manufacturing PMI (Preliminary) August 47.8 47.9 46.5

06:58 France Services PMI (Preliminary) August 50.4 50.3 51.1

07:28 Germany Manufacturing PMI (Preliminary) August 52.4 51.8 52.0

07:28 Germany Services PMI (Preliminary) August 56.7 55.5 56.4

07:58 Eurozone Manufacturing PMI (Preliminary) August 51.8 51.4 50.8

07:58 Eurozone Services PMI (Preliminary) August 54.2 53.6 53.5

08:30 United Kingdom Retail Sales (MoM) July +0.1% +0.4% +0.1%

08:30 United Kingdom Retail Sales (YoY) July +3.6% +2.6%

08:30 United Kingdom PSNB, bln July 9.5 10.1 -1.1

12:00 U.S. Jackson Hole Symposium

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decline by 12,000 to 299,000.

The U.S. preliminary manufacturing purchasing managers' index (PMI) is expected to fall to 55.7 in August from 55.8 in July.

The existing home sales in the U.S. are expected to decrease to 5.01 million units in July from 5.04 million units in June.

The euro traded slightly higher against the U.S. dollar after flash PMIs from the Eurozone. Eurozone's preliminary manufacturing purchasing managers' index (PMI) declined to 50.8 in August from 51.8 in July, missing expectations for a fall to 51.4.

Eurozone's preliminary services purchasing managers' index (PMI) fell to 53.5 in August from 54.2 in July, missing expectations for a decline to 53.6.

Germany's preliminary manufacturing purchasing managers' index (PMI) decreased to 52.0 in August from 52.4 in July, beating expectations for a fall to 51.8.

Germanys' preliminary services purchasing managers' index (PMI) fell to 56.4 in August from 56.7 in July, beating expectations for a decline to 55.5.

French preliminary manufacturing purchasing managers' index (PMI) declined to 46.5 in August from 47.8 in July, missing forecasts of a rise to 47.9.

French preliminary services purchasing managers' index (PMI) rose to 51.1 in August from 50.4 in July, beating expectations for a fall to 50.3.

The British pound traded mixed against the U.S. dollar after the weaker-than-expected UK retail sales. U.K. retail sales increased 0.1% in July, missing expectations for a 0.4% rise, after a 0.2% gain in June. June's figure was revised up from a 0.1% increase.

On a yearly basis, U.K. retail sales climbed 2.6% in July, after a 3.4% rise. June's figure was revised down from a 3.6% gain.

The U.K. public sector net borrowing posted a deficit of £1.1 billion in July, after a surplus of £9.79 billion in June. June's figure was revised from a surplus of £9.51 billion. Analysts had expected a surplus of £10.1 billion.

The Swiss franc traded slightly higher against the U.S. dollar after the better-than-expected trade data from Switzerland. Switzerland's trade surplus rose to 3.98 billion Swiss francs in July from a surplus 1.41 billion Swiss francs in June, exceeding expectations for an increase to a surplus of 1.91 billion Swiss francs. June's figure was revised up from a surplus of 1.38 billion Swiss francs.

EUR/USD: the currency pair rose to $1.3277

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Initial Jobless Claims August 311 299

13:45 U.S. Manufacturing PMI (Preliminary) August 55.8 55.7

14:00 U.S. Consumer confidence August -8 -9

14:00 U.S. Existing Home Sales July 5.04 5.01

14:00 U.S. Philadelphia Fed Manufacturing Survey August 23.9 20.3

EUR/USD

Offers $1.3485, $1.3445, $1.3415, $1.3400, $1.3370, $1.3325

Bids $1.3240, $1.3230, $1.3200

GBP/USD

Offers $1.6845, $1.6800/10, $1.6750, $1.6680

Bids $1.6550, $1.6510, $1.6500

AUD/USD

Offers $0.9400, $0.9370, $0.9350, $0.9315

Bids $0.9240, $0.9220, $0.9200

EUR/JPY

Offers Y138.20, Y138.00, Y137.90

Bids Y137.00, Y136.75, Y136.50, Y136.25/20

USD/JPY

Offers Y104.90, Y104.45, Y104.10, Y104.00

Bids Y103.10, Y102.70, Y102.30, Y102.15, Y102.00

EUR/GBP

Offers stg0.8100, stg0.8035

Bids stg0.7970, stg0.7950/40, stg0.7900

Stock indices traded higher after flash PMIs from the Eurozone. Eurozone's preliminary manufacturing purchasing managers' index (PMI) declined to 50.8 in August from 51.8 in July, missing expectations for a fall to 51.4.

Eurozone's preliminary services purchasing managers' index (PMI) fell to 53.5 in August from 54.2 in July, missing expectations for a decline to 53.6.

Germany's preliminary manufacturing purchasing managers' index (PMI) decreased to 52.0 in August from 52.4 in July, beating expectations for a fall to 51.8.

Germanys' preliminary services purchasing managers' index (PMI) fell to 56.4 in August from 56.7 in July, beating expectations for a decline to 55.5.

French preliminary manufacturing purchasing managers' index (PMI) declined to 46.5 in August from 47.8 in July, missing forecasts of a rise to 47.9.

French preliminary services purchasing managers' index (PMI) rose to 51.1 in August from 50.4 in July, beating expectations for a fall to 50.3.

Air Berlin Plc shares jumped 8.6% after posting a positive second-quarter net income.

Raiffeisen Bank International AG shares rose 7.6% after reporting the better-than-forecasted second-quarter net income.

Current figures:

Name Price Change Change %

FTSE 100 6,769.95 +14.47 +0.21%

DAX 9,353.04 +38.47 +0.41%

CAC 40 4,266.45 +25.66 +0.61%

Asian stock indices closed mixed after the weaker-than expected China's preliminary HSBC manufacturing purchasing managers' index. China's preliminary HSBC manufacturing purchasing managers' index dropped to 50.3 in August from 51.7 in July, missing expectations for a decline to 51.5.

Japanese shares benefited from the weaker yen. The yen weakened after yesterday's release of FOMC minutes. Investors speculate that the Fed may raise its interest rate sooner than expected.

Indexes on the close:

Nikkei 225 15,586.2 +131.75 +0.85%

Hang Seng 24,994.1 -165.66 -0.66%

Shanghai Composite 2,230.46 -9.75 -0.44%

EUR/USD $1.3200(E855mn), $1.3360(E359mn), $1.3300(E1.06bn), $1.3340(E204mn)

USD/JPY Y103.00($834mn), Y103.35($400mn

EUR/JPY Y136.65(E184mn)

EUR/GBP stg0.7925(E403mn), stg0.7985(E250mn), stg0.8000(E686mn)

AUD/USD $0.9250(A$250mn), $0.9290(A$130mn), $0.9350-60(A$297mn), $0.9375(A$726mn)

USD/CAD C$1.0850($434mn), C$1.0945($330mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index June +0.2% +0.4%

01:35 Japan Manufacturing PMI (Preliminary) August 50.5 51.5 52.4

01:45 China HSBC Manufacturing PMI (Preliminary) August 51.7 51.5 50.3

03:00 New Zealand Credit Card Spending July +6.0% Revised From +7.0% +4.5%

06:00 Switzerland Trade Balance July 1.41 Revised From 1.38 1.91 3.98

06:58 France Manufacturing PMI (Preliminary) August 47.8 47.9 46.5

06:58 France Services PMI (Preliminary) August 50.4 50.3 51.1

07:28 Germany Manufacturing PMI (Preliminary) August 52.4 51.8 52.0

07:28 Germany Services PMI (Preliminary) August 56.7 55.5 56.4

07:58 Eurozone Manufacturing PMI (Preliminary) August 51.8 51.4 50.8

07:58 Eurozone Services PMI (Preliminary) August 54.2 53.6 53.5

08:30 United Kingdom Retail Sales (MoM) July +0.1% +0.4% +0.1%

08:30 United Kingdom Retail Sales (YoY) July +3.6% +2.6%

08:30 United Kingdom PSNB, bln July 9.5 10.1 -1.1

The U.S. dollar traded higher against the most major currencies after the Federal Open Market Committee's (FOMC) minutes. Some FOMC members believe that the Fed could tighten its monetary policy due to improvements in labour market conditions and strengthening recovery in U.S. economy.

Most FOMC members want to wait for more information.

Investors speculate that the Fed may hike its interest rate sooner than expected.

The New Zealand dollar traded lower against the U.S dollar due to the strong U.S. currency and the weaker-than-expected economic data from China and New Zealand.

China's preliminary HSBC manufacturing purchasing managers' index dropped to 50.3 in August from 51.7 in July, missing expectations for a decline to 51.5.

China is New Zealand's second biggest export partner.

Credit card spending in New Zealand rose 4.5% in July, after a 6.0% gain in June. June's figure was revised down from a 7.0% increase.

The Australian dollar traded lower against the U.S. dollar due to the strong U.S. currency and the weaker-than-expected economic data from China.

The Conference Board released its leading index for Australia. The index climbed 0.4% in June, after a 0.2% rise in May.

The Japanese yen declined against the U.S. dollar due to the strong greenback.

Japan's preliminary manufacturing purchasing managers' index rose to 52.4 in August from 50.5 in July, exceeding expectations for an increase to 51.5.

EUR/USD: the currency pair declined to $1.3241

GBP/USD: the currency pair fell to $1.6562

USD/JPY: the currency pair increased to Y103.95

The most important news that are expected (GMT0):

12:00 U.S. Jackson Hole Symposium

12:30 U.S. Initial Jobless Claims August 311 299

13:45 U.S. Manufacturing PMI (Preliminary) August 55.8 55.7

14:00 U.S. Consumer confidence August -8 -9

14:00 U.S. Existing Home Sales July 5.04 5.01

14:00 U.S. Philadelphia Fed Manufacturing Survey August 23.9 20.3

Asian stocks outside Japan fell for the first time in nine days after a private gauge of Chinese manufacturing dropped more than economists forecast.

The preliminary Purchasing Managers' Index from HSBC Holdings Plc and Markit Economics was at 50.3 in August, trailing all 22 estimates in a Bloomberg News survey of economists and missing the 51.5 median forecast. The measure dropped from July's 51.7 and was at a three-month low. Numbers above 50 indicate expansion.

Japan's Topix index bucked the trend, climbing 0.9 percent.

China Shenhua Energy Co., the nation's biggest coal producer by market capitalization, declined 1.9 percent in Hong Kong.

Gambling firm Tatts Group Ltd. slumped 5.8 percent in Sydney after profit missed estimates.

Dainippon Screen Manufacturing Co. jumped 3.4 percent in Tokyo after Mitsubishi UFJ Morgan Stanley Securities Co. advised buying shares of the semiconductor-equipment maker.

Nikkei 225 15,586.2 +131.75 +0.85%

Hang Seng 24,994.1 -165.66 -0.66%

S&P/ASX 200 5,638.86 +4.26 +0.08%

Shanghai Composite 2,230.46 -9.75 -0.44%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3344 (1125)

$1.3299 (50)

$1.3269 (27)

Price at time of writing this review: $ 1.3245

Support levels (open interest**, contracts):

$1.3221 (5007)

$1.3197 (4586)

$1.3166 (5661)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 55697 contracts, with the maximum number of contracts with strike price $1,3400 (6503);

- Overall open interest on the PUT options with the expiration date September, 5 is 61990 contracts, with the maximum number of contracts with strike price $1,3100 (6427);

- The ratio of PUT/CALL was 1.11 versus 1.11 from the previous trading day according to data from August, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.6801 (1832)

$1.6703 (902)

$1.6606 (324)

Price at time of writing this review: $1.6567

Support levels (open interest**, contracts):

$1.6497 (1869)

$1.6399 (747)

$1.6300 (643)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 28530 contracts, with the maximum number of contracts with strike price $1,7000 (2764);

- Overall open interest on the PUT options with the expiration date September, 5 is 29217 contracts, with the maximum number of contracts with strike price $1,6800 (4027);

- The ratio of PUT/CALL was 1.02 versus 1.06 from the previous trading day according to data from August, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.