- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-07-2011

Greek loans to be extended to minimum 15 years, will provide EFSF loans at approx 3.5%. Greece will provide some collateral to cover risk. Banks willing to support Greece on voluntary basis. Private sector to contribute through a menu of options.

The dollar dropped against a basket of rival currencies on U.S. debt ceiling talks. In addition, the S&P reiterated the risk of a downgrade of U.S. debt within three months is at 50-50.

The euro hit the 2-week high versus the dollar on bets the European Financial Stability Facility may guarantee Greek bonds.

The Australia’s dollar rebounded and shows a steady growth.

The Canadian dollar rose for a third day versus its U.S. rival as today the Bank of Canada prompted investors to move forward the date of expected interest rate increases.

The yen gained after beating data from Japan Ministry of Finance, showing ?70.737 billion ($897 million) trade surplus in June.

After pausing for some time, stocks are slipping off of their morning highs. Overall gains remain strong, though.

Tech stocks continue to lag the rest of the market. The sector's 0.4% gain, which is less than half of what the S&P 500 has achieved, comes as weakness in F5 Networks (FFIV 100.73, -10.71) and Western Digital (WDC 35.30, -2.78) offsets strength in eBay (EBAY 34.04, +0.87) and Motorola Mobility (MMI 24.24, +1.83). F5's slide comes even though the company posted an upside earnings surprise for the latest quarter. eBay did the same last quarter, but investors have had a much more positive response to the company's numbers.

The stock market's upward push has taken pause, so as to give stocks a bit of a breather. As things currently stand, the S&P 500 is on pace for a weekly gain of more than 2%.

Financials have been a big driver of today's gains. The sector is now up 2.0%, which makes it the top performing sector in the broad market. For the week, financials are collectively up 3%.

Morgan Stanley (MS 23.26, +1.54) is a top performer among financials today. The stock's 7% spike comes in response to news that the investment bank and brokerage outfit had a narrower-than-expected loss for the latest quarter. Earlier this week peer Goldman Sachs (GS 134.39, +1.64) posted earnings that were well short of what had been widely expected on Wall Street.

"The largest contributors to the LEI in July were the real money supply (+0.3pp) and the yield curve (+0.4pp). Together, these two components reflect the Fed's ongoing economic support. Outside of the Fed's help, the LEI would have declined by 0.3% in July."

Analysts at HFE say July Philly Fed index at 3.2 is still much below its March high of 43.4, "thanks to the spike in oil prices". Details "show the new orders index up to 0.1 from -7.6, so it is still weak."

Stocks are trying to extend their opening advance following the latest data.

The Philadelphia Fed Survey for July came in at 3.20, which is better than the 0.00 reading that had been expected. It is also an improvement from the -7.70 that was posted for the prior month.

Leading Indicators for June registered a 0.3% increase, as had been widely anticipated.

EUR/USD $1.4210, $1.4300, $1.4315

USD/JPY Y79.00, Y79.25, Y79.50, Y80.00

EUR/JPY Y112.35, Y111.15, Y110. 80

GBP/USD $1.6125, $1.5875

HBP/JPY Y129.60

EUR/CHF Chf1.1600

AUD/USD $1.0700, $1.0750, $1.0850

AUD/JPY Y84.50

NZD/USD $0.8440

U.S. stocks were set for mild gains Thursday, as European leaders met in Brussels.

Before the summit's official start German Chancellor Angela Merkel and French President Nicolas Sarkozy reached consensus on a deal that would provide more aid to Greece.

Economy: The Labor Department's weekly report on initial unemployment claims climbed by 10,000 to 418,000 in latest week. Economists expected claims to rise to 411,000.

The Philadelphia Federal Reserve will release its July manufacturing survey at 14:00 GMT.

Federal Reserve Chairman Ben Bernanke is scheduled to testify in front of the Senate Banking Committee starting Thursday.

Companies: Express Scripts (ESRX, Fortune 500) announced early Thursday morning it will buy Medco Health Solutions (MHS, Fortune 500) in a deal worth $29.1 billion. Shares of Medco jumped more than 20% in premarket trading.

Travelers (TRV, Fortune 500) reported a net loss of $364 million, or 88 cents per share, on revenue of $6.4 billion. The insurer said it had $1.1 billion in catastrophe losses due to extraordinary tornado activity in April and May.

Morgan Stanley (MS, Fortune 500) reported a net loss of 38 cents per share, on revenues of $9.3 billion for the second quarter. Analysts had expected the bank to post a loss of 64 cents a share.

Phone maker Nokia reported a second-quarter loss, but shares were up 3.1% in premarket trading.

AT&T (T, Fortune 500) topped analyst earnings estimates by one cent, reporting earnings of 60 cents per share on revenue of $31.5 billion.

After the bell, investors will get earnings results from Intel competitor Advanced Micro Devices (AMD, Fortune 500), as well as software maker Microsoft (MSFT, Fortune 500).

As earlier happenes, this time oil failed to sustain a move above the 38.2% Fibonacci (of $114.83/89.61). Also initial resistance at $99.24 on Thursday). Initial support around $95.56-96.01 (23.6% Fibonacci, the 21-DMA and a supp line from Jun 27). Further support seen at $94.96 (200-DMA).

Data released

06:58 France PMI (July) flash 50.1 53.0 52.5

06:58 France PMI services (July) flash 54.2 56.7 56.1

07:28 Germany PMI (July) flash 52.1 54.0 54.6

07:28 Germany PMI services (July) flash 52.9 56.1 56.7

07:58 EU(17) PMI (July) flash 50.4 51.5 52.0

07:58 EU(17) PMI services (July) flash 51.4 53.2 53.7

08:00 EU(17) Current account (May) unadjusted, bln -18.3 - -6.5

08:00 EU(17) Current account (May) adjusted, bln -5.2 - -5.4 (-5.1)

08:30 UK Retail sales (June) 0.7% 0.5% -1.4%

08:30 UK Retail sales (June) Y/Y 0.4% 0.3% 0.2%

08:30 UK PSNCR (June), bln 21.0 - 11.1

08:30 UK PSNB (June), bln 14.0 12.8 17.4

The euro fell against the dollar for the first time in three days after European officials signaled Greece may default on government bonds.

The 17-nation currency was weaker amid concern a summit won’t stop contagion from Greece spreading through Europe’s bond markets.

Luxembourg Prime Minister Jean-Claude Juncker said today he couldn’t rule out a so-called selective default on Greek debt.

“The word ‘default’ is still in these headlines; that, of course, is a bit disappointing,” said Jane Foley, a senior currency strategist at Rabobank International.

German Chancellor Angela Merkel and French President Nicolas Sarkozy reached an agreement on Greece after seven hours of talks in Berlin and details will be released at the summit in Brussels.

“I am not in charge of explaining if yes or no there will be a selective default,” Luxembourg’s Juncker told reporters today before the summit. “You can never exclude such a possibility, but everything should be done in order to avoid such a possibility.”

The Swiss franc fell against the dollar after Zurich-based newspaper Blick quoted Switzerland’s Economy Minister Johann Schneider-Ammann as saying the currency’s strength versus the euro is “alarming.”

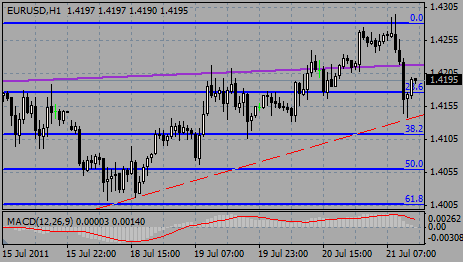

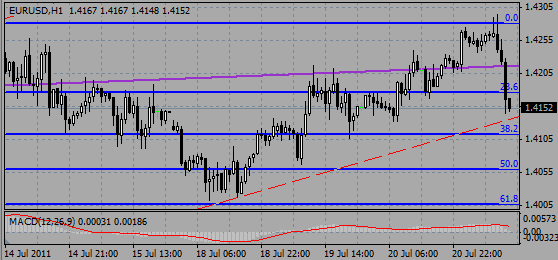

EUR/USD was close to $1.4300, but failed to break above. Rate corrected to session lows around $1.4138 before recovered to $1.4190.

GBP/USD fell from the highs on $1.6200 to $1.6120 before it was back to $1.6170.

USD/JPY tested Y79.00 and retreated to Y78.80.

US Jobless claims comes at 12:30 GMT.

Later, at 14:00 GMT, Philadelphia Fed index for July is due to comes.

EUR/USD recovered from session lows around $1.4138 and currently holds above $1.4170. Resistance/offers placed around earlier broken support at $1.4180. next resistance is near $1.4200 (38.2% $1.4294/1.4138).

The euro gets down ahead of EU summit. Earlier rate rose after Germany and France reached an agreement on addressing Greece’s debt crisis.

Canada’s dollar weakens today too after it rose yesterday to the highest since May 2.

The rate was earlier supported after Bank of Canada Governor Mark Carney adjusted wording in a statement to suggest interest rate increases will happen as early as September.

In its Monetary Policy report the central bank said inflation will average 2.8% between July and September and slow to 1.9% in the second quarter of next year . The so-called core rate, which excludes energy and food prices, will peak at 2.1% in the first quarter of 2012.

EUR/USD falls after it broke under the technical support at $1.4167 (76.4% $1.4133/1.4294). Rate holds at $1.4158 with next support between $1.4135/30.

EUR/USD $1.4210, $1.4300, $1.4315

USD/JPY Y79.00, Y79.25, Y79.50, Y80.00

EUR/JPY Y112.35, Y111.15, Y110. 80

GBP/USD $1.6125, $1.5875

HBP/JPY Y129.60

EUR/CHF Chf1.1600

AUD/USD $1.0700, $1.0750, $1.0850

AUD/JPY Y84.50

NZD/USD $0.8440

On Wednesday Canada’s dollar advanced to the highest since May 2 against the greenback as optimism that policy makers in Europe and the U.S. will address debt conflicts drove demand for higher-yielding assets.

The rate was supported after Bank of Canada Governor Mark Carney yesterday adjusted wording in a statement to suggest interest rate increases will happen as early as September.

Crude oil rose for a second day.

Banc of Canada Monetary Policy report said inflation will average 2.8% between July and September and slow to 1.9% in the second quarter of next year . The so-called core rate, which excludes energy and food prices, will peak at 2.1% in the first quarter of 2012.

The policy rate was kept at 1%, where it’s been since September.

Data showed Canadian wholesale sales increased 1.9% to C$47.6 billion ($50 billion) in May, the fastest rate in 18 months. The median was for a 0.1% rise.uch as 1.6 percent to $99.02 a barrel in New York.

Data:02:30 China HSBC Manufacturing PMI (Jul) Preliminar 48.91

04:30 Japan All Industry Activity Index (MoM) (May) 2.0% 1

Resistance 3: Y79.60 (Jul 13-14 high)

Resistance 3: Chf0.8330 (Jul 13 high)

Resistance 3: $ 1.6260 (Jun 22 high)

Resistance 3: $ 1.4480 (resistance line from May)

04:30 Japan All industry index (May) 1.8% 1.5%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.