- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-04-2022

- GBP/USD pressured at hourly resistance as markets monitor central banks.

- Money markets are pricing in 160 bps of BoE rate hikes by the end of 2022.

At 1.3029, GBP/USD is flat in Asia, pressured at an hourly resistance and has traded between a narrow range of 1.3022 and 1.3035. However, the pound has been falling against a strong euro while it was reasonably sideways versus the US dollar in the latter part of the day on Wednesday.

The focus overnight was on the hawkish comments from the European Central Bank officials that amplified bets that the central bank would soon hike interest rates, lifting the euro to a one-week high. It was also firm on the back of the expectations that French President Emmanuel Macron would win his reelection bid on Sunday after yesterday's debate.

Joachim Nagel, president of Germany's Bundesbank, joined a chorus of policymakers in saying the ECB could raise interest rates at the start of the third quarter. Meanwhile, traders have still focused on the future monetary policy path of the Bank of England also.

The BoE last month softened its language on the need for more interest rate increases while stressing downside risks to the economy. BoE monetary policymaker Catherine Mann gave a rather involved and counterbalancing appraisal of the MPC’s challenges.

''The key aspect was the need to address inflation,'' analysts at Westpac said, which was seen as more concerning and showing signs of spreading to pricing strategies (second-round effects), with front-loaded rate hikes. ''Although tightening could be reassessed if demand falters, the reverse could also be true if the economy continues to fare better and inflation is more persistent.' Money markets are pricing in 160 bps of BoE rate hikes by the end of 2022.

- EUR/USD is eyeing more downside to near 1.0800 on dovish ECB.

- ECB’s Lagarde sees inflation to get doubled by the end of this year.

- The DXY recovered swiftly as Fed’s Powell sounded aggressive on their policy stance.

The EUR/USD pair has witnessed a steep fall after failing to sustain above April 14’s high at 1.0923 as European Central Bank (ECB)’S President Christine Lagarde dictated a dovish stance at the International Monetary Fund (IMF) meeting on Thursday. The asset has experienced a sheer downside after sensing significant selling pressure above the psychological resistance of 1.0900.

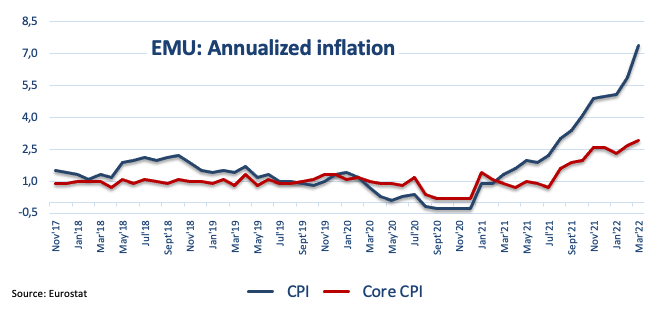

ECB’s President Christine Lagarde emphasized downsizing growth forecasts amid the Ukraine crisis, which has resulted in the reduction of real income of households led by higher energy bills and food prices. ECB’s top official warned that the inflation is expected to zoom 100% by the end of this fiscal year and considering the lower growth rate, investors should brace for the end of the Asset Purchase Program (APP), but a rate hike needs potential time.

Meanwhile, the Eurozone Consumer Confidence has surprisingly jumped to -16.9 against the estimates of -20 and the prior print of -18.7. However, it failed to provide any material impact on the shared currency.

The US dollar index (DXY) rebounded sharply in the New York session after Federal Reserve (Fed) chair Jerome Powell sounded a tad more hawkish on the policy stance. An interest rate decision to hike by rates 50 basis points (bps) is on the cards and the Fed is highly expected to drop hawkish guidance too for the remaining year.

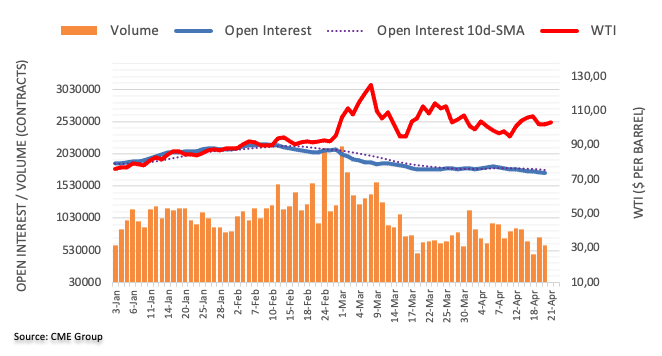

- WTI is juggling in a $1 range on disruption in the demand-supply mechanism.

- The IMF has lowered the global growth forecasts to 3.6% from January’s expectation of 4.4%.

- Blockades on Libya’s oil fields and export terminals have reduced the global oil supply by 0.55 million bpd.

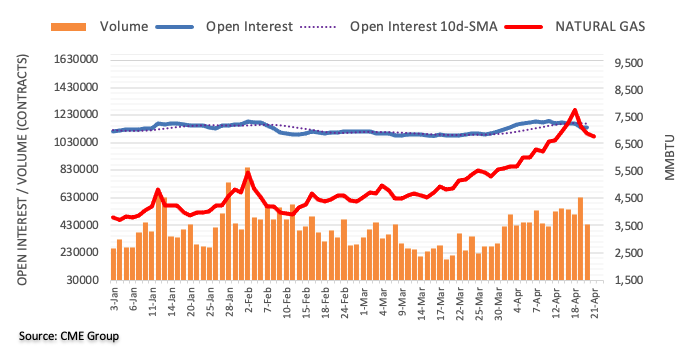

West Texas Intermediate (WTI), futures on NYMEX, is continued with its lackluster performance from the past few trading sessions. Trading sessions are settling in a minor range as investors are unable to decide whether to act upon supply worries or to underpin the fears of expected slippage in the demand catalyst.

Supply in the oil market is really tight as the OPEC+ (OPEC allies + Russia) are failing to meet their production targets. Russian oil is being prohibited by the Western leaders after its invasion of Ukraine, which forced major countries to impose sanctions on the former. An embargo on Russian oil by Europe is in discussion and carries a significant impact if it takes place. Meanwhile, additional cuts in the global supply of oil after Libya showed reluctance in oil supply amid political crisis and blockades on major oil fields has escalated pressure on the oil market. The barricades on Libya’s export terminals are resulting in the loss of more than 550,000 barrels per day (bpd).

On the demand front, a significant cut in the global growth forecasts by the International Monetary Fund (IMF) has raised clouds of uncertainty over the aggregate demand prospects. The IMF has reduced the worldwide growth expectations to 3.6% from the previously expected figure of 4.4% announced in January. Also, the lockdown measures in China due to the resurgence of the Covid-19 have produced headwinds for oil prices.

- The AUD/JPY remains positive in the week, so far up 1.34%.

- On Thursday, the AUD/JPY plunged more than 100-pips, spurred by a technical formation.

- AUD/JPY Price Forecast: Two bearish signals might exacerbate a correction in the AUD/JPY.

The Australian dollar posts modest gains despite two bearish technical analysis patterns, which threaten to lower the AUD/JPY prices as the Asian Pacific session begins. The AUD/JPY is trading at 94.68 and has gained some 0.09% at the time of writing.

US equities ended the session with losses, as Fed Chief Jerome Powell “scared” investors when he said that 50-bps rate increases are “on the table” for the May meeting. Meanwhile, Asian equity futures point to a lower open, carrying on Wall Street sentiment and weighing on risk-sensitive currencies, like the AUD, as investors scramble towards safe-haven peers.

On Thursday, the AUD/JPY began the Asian session on the right foot near the daily high, which was 95.58. However, late in the Asian session, the AUD/JPY formed a bearish engulfing candle in the 1-hour chart, that began the 100-pip plunge, from 95.58 to 94.40, late in the North American session.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY is upward biased, but price action in the last month formed a rising wedge with bearish implications, alongside a bearish engulfing candle pattern. Fuerhtmore, the Relative Strength Index (RSI), although at overbought territory at 70.77, aims lower, a signal that could exacerbate a move downwards.

Therefore, the AUD/JPY outlook is tilted to the downside in the short term. The pair’s first support would be March’s 28 daily high at 94.32. Once cleared, the next support would be April’s 13 daily high at 93.86, followed by April’s 5 daily low at 92.27.

Key Technical Levels

- USD/JPY is auctioning in a minor range of 127.82-128.71 as investors await Japan’s inflation.

- The BOJ will continue to stick with an ultra-loose policy despite a higher reading of inflation.

- The asset is balancing despite broader weakness in yen and a rebound in the DXY.

The USD/JPY pair is displaying back and forth moves within a narrow range of 127.82-128.71 since Thursday as investors are awaiting the release of Japan’s National Consumer Price Index (CPI). A yearly preliminary reading is advocating a decent surge in inflation as the economic data is expected to land at 1.3% against the prior print of 0.9%.

No wonder, the price pressures from higher energy bills and commodity prices will lift inflation in Tokyo. But still, they won’t be able to raise hopes of hawkish guidance from the Bank of Japan (BOJ). The growth prospects in Japan have yet not reached their pre-pandemic levels. Therefore, more stimulus will always be expected from their central bank.

On the dollar front, the US dollar index (DXY) has attracted some stellar bids after dropping below the critical support of 100.00. The DXY rebounds firmly after the odds of an aggressive hawkish stance from the Federal Reserve (Fed) in May progressed. It is worth noting that an escalation in the interest rate hike expectations after the speech from Fed’s chair Jerome Powell at the International Monetary Fund (IMF) meeting failed to insert any impact on the asset. Despite a broader weakness in the Japanese yen and a sharp rebound in the US dollar index (DXY), a lackluster performance from the major is indicating that yen is gaining strength now.

- The odds of a 50 bps interest rate hike have elevated after Fed Powell’s comments at the IMF meeting.

- Higher inflation pressures in a very tight labor market are compelling for squeezing the liquidity.

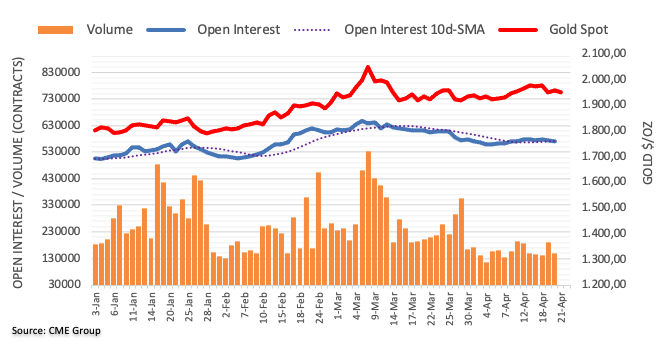

- A double bottom formation has raised expectations of a reversal in the gold prices.

Gold (XAU/USD) has bounced back sharply after hitting its potential support, which is placed near $1,940. The precious metal is shrugging off the fears of aggressive rate hike elevation after Federal Reserve (Fed)’s Jerome Powell bolstered the odds of 50 basis points (bps) interest rate hike by the Fed in May.

Fed’s Powell in his appearance at the International Monetary Fund (IMF) meeting along with European Central Bank (ECB) President Christine Lagarde, Bank of England (BOE) Governor Andrew Bailey, and other central bank leaders cited that a 50 bps rate hike is on the table this May. He further added that the Fed is likely to tighten the policy at a higher pace this time than in the previous hike cycles. Higher inflation pressures in a very tight labor market are compelling for squeezing the liquidity from the economy sooner rather than later.

Meanwhile, the US dollar index (DXY) has witnessed a serious attempt to rebound as a sheer upside has been recorded in the DXT after it slipped below the psychological support of 100.00. For a long time, Fed policymakers have been dictating that investors should brace a tight policy environment for a few quarters as it is highly required to tame the soaring inflation. Also, the 10-year US Treasury yields have climbed above 2.90% on hawkish guidance by the Fed and are aiming to hit 3% for the very first time in the last three years.

Gold Technical Analysis

On an hourly scale, XAU/USD has formed a double bottom chart pattern, which signifies a bullish reversal amid the absence of high-volume sellers while re-testing the critical bottom. The gold prices have witnessed a sheer upside after the successful retest of Wednesday’s low at $1,939.31. The Relative Strength Index (RSI) (14) has defended itself from slipping into the bearish range of 20.00-40.00. Also, the precious metal has established above 20-period Exponential Moving Average (EMA), which signals more gains ahead.

Gold hourly chart

-637861747465803916.png)

''UK prepares law to give ministers power to tear up Northern Ireland post-Brexit trade deal,'' according to the Financial Times.

The UK government is preparing legislation that will give ministers sweeping powers to tear up the post-Brexit deal governing trade in NI.

Meanwhile, David Frost who negotiated the Brexit deal, and other Senior Conservatives, have argued for large parts of the agreement between the UK and the EU to be set aside following evidence it is harming trade and creating barriers between Great Britain and Northern Ireland.

Any decision to delay the additional checks would spark a fresh row with Brussels, and this would likely weigh on the pound. Brussels has accused British Government of seeking to U-turn on its obligations.

Nevertheless, PM Boris Johnson has refused to rule out triggering a clause in the deal which would allow him to override some of the crucial clauses relating to trade across the Irish Sea.

- The British pound clings to its gains, up some 0.02%.

- A dampened market mood weighed on the GBP/JPY, but it held to its gains.

- GBP/JPY Price Forecast: The pair is range-bound but tilted to the downside in the H1 chart.

The GBP/JPY modestly advances as the New York session winds down, and Asian prepares to take over, up some 0.02%. At the time of writing, the GBP/JPY is trading at 167.27.

On Thursday, US equities finished in the red, as Fed Chief Jerome Powell spooked investors when he said that 50-bps rate increases are “on the table” for the May meeting. Meanwhile, global bond yields rose. The UK’s 10-year Gilts rose by two basis points, sitting at 2.034%, while the Bank of Japan (BoJ) keeps the 10-year JGB at bay near the 0.25% threshold.

Aside from this, the GBP/JPY was range-bound in the 167.00-91 area, though of late, GBP/JPY bears dragged the pair under the 167.34, the 50-hour simple moving average (SMA), opening the door for further losses.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY remains tilted upwards, but the Relative Strength Index (RSI), with readings of 77, shows the pair as overbought, which means that the cross-currency pair might be subject to a mean-reversion move or a consolation ahead.

The GBP/JPY 1-hour chart illustrates the pair as range-bound but tilted downwards, portrayed by successive series of lower or equal highs, lying below the YTD high at 168.42. Also, as of writing, is testing an upslope trendline, drawn from April 20 lows, which once broken would open the door for further losses.

With that said, the GBP/JPY first support would be the 167.00 figure. A breach of the latter would expose the S1 daily pivot at 166.80, followed by the 100-hour SMA at 166.56, and then the S2 daily pivot point at 166.37.

Key Technical Levels

- NZD/USD bleeding out as US dollar and yields firm.

- Hawkish Fed Powell keeps US yields running into the highest levels since 2018.

NZD/USD is closing the doors to North American traders down by over 1% on Thursday as Federal Reserve Chairman Jerome Powell told an International Monetary Fund panel that restoring price stability is "essential" and that a 50-basis point rate hike was "on the table" at the May Federal Open Market Committee meeting.

Consequently, the US 10-year yield rose 5.8 basis points to almost 2.89%, its highest level since December 2018 and the US dollar rebounded from the lows of the day of 99.81 to score as high as 100.63, bid into the Wall Street close. With inflation running roughly three times the Fed's 2% target, "it is appropriate to be moving a little more quickly," Powell added.

The S&P 500 and Nasdaq had already reversed course by the time Powell spoke, but they closed heavily with the Dow Jones Industrial Average also falling, losing 368.03 points, or 1.05%, to 34,792.76. The S&P 500 dropped 65.79 points, or 1.48%, to 4,393.66 and the Nasdaq Composite had lost 278.41 points, or 2.07%, to 13,174.65 but the end of the play, leaving a bearish outlook for Friday in Asia.

''The Kiwi is very sensitive to long end bond spreads (a reasonable proxy for terminal cash rate expectations), and the latter continue to rise in the US,'' analysts at ANZ Bank said.

''NZ expectations have also risen following last week’s post-RBNZ retracement, but with 125bps of hikes already “in the tin” here (compared to just 25 in the US), and a peak OCR of 4.13% already priced in by the end of 2023, there’s arguably less scope for upside, which in turn could cap the NZD. Broadly speaking, it’s a picture of other CBs catching up on NZ’s erstwhile rate advantage.''

Meanwhile, in economic news, the US Initial Jobless Claims fell to 184,000 during the week ended April 16 from 186,000 in the previous week. The Philadelphia Federal Reserve's monthly manufacturing index fell to 17.6 in April from 27.4 in March.

RBNZ in focus

Meanwhile, the inflation data from New Zealand underpinned the hawkish central bank rhetoric. The Reserve Bank of New Zealand has shown that it is keen to get the OCR to neutral as quickly as possible.

''Governor Orr reiterated this point at the IMF interview, noting that the balance of risks was weighted towards constraining inflation expectations in the medium term; he provided strong forward guidance for more rate increases in the coming quarters,'' analysts at Standard Chartered explained.

''We now expect the rate hikes to be frontloaded, versus our previous call of 25bps hikes at each of the five meetings from April to October, which would take the OCR to 2.25%,'' the analysts added. ''Given the 50bps hike in April and our expectation of another 50bps hike in May, we drop the 25bps hikes in August and October, keeping our end-2022 OCR unchanged at 2.25%.''

- The Australian dollar gave back Wednesday’s gains, losses of 1%.

- Fed Chief Jerome Powell spooked investors as he said that a 50-bps increase in May is “on the table.”

- More Fed officials add to the chorus of hawks expecting a 50-bps increase.

- AUD/USD Price Forecast: A tweezers-top in the daily chart opened the door for further downward pressure.

The Australian dollar reversed its Wednesday’s gains and could not hold above 0.7400, recording an 80-pip loss amid a session dominated by central bank speakers, led by Fed Chair Jerome Powell, who reiterated that a 50-bps increase for the May meeting is on the table. At the time of writing, the AUD/USD is trading at 0.7376.

The market mood of late turned dismal, as US equities are about to finish the trading session in the red. Meanwhile, US Treasury yields continue shooting higher, with the 10-year benchmark note sitting at 2.953%, up to six basis points, while the greenback staged a comeback, gaining 0.22%, sitting at 100.610.

Fed Chief Jerome Powell to discuss 50-bps increases in May

On Thursday, in an International Monetary Fund (IMF) panel, which was led by the Federal Reserve Chair Jerome Powell and the ECB President Mrs. Christine Lagarde, Jerome Powell said, “I[him] would say that 50 basis points will be on the table for the May meeting.” He added that “we [Fed] are committed to using our tools to get 2% inflation back.” Furthermore, Powell supported the idea of “front-end loading” moves if appropriate.

During the day, more Fed officials -San Francisco’s Fed Mary Daly, St. Louis President James Bullard- expressed the need to hike 50-bps in the May meeting. However, if needed, James Bullard even pushed towards a 75 bps rate hike.

Data-wise, an absent Australian docket left AUD/USD traders taking some cues from disappointing inflation data from New Zealand (NZ), which rose 6.9% y/y, lower than the 7.1% estimated, meaning that higher prices could be about to peak. On the US front, the Philadelphia Fed Manufacturing Index for April rose by 17.6, lower than the consensus at 21. At the same time, Initial Jobless Claims increased by 184K, more than the 180K estimated but almost in line with analysts’ expectations.

In the week ahead, the Australian and the US economic docket would feature S&P Global PMI Flash readings for April, including Manufacturing, Services, and Composite indices.

AUD/USD Price Forecast: Technical outlook

The AUD/USD is about to shift to a neutral-upward bias, as shown by the daily chart. Thursday’s price action reversed Wednesday’s gains forming a tweezers top candle chart pattern, usually bearish, which means that sellers overtook buyers, threatening to push prices further down.

The AUD/USD first support would be the 50-day moving average (DMA) at 0.7352. A breach of the latter would expose the confluence of the mid-parallel Pitchfork’s line between the central and bottom lines and the 200-DMA around the 0.7293-0.7305 range, followed by the 100-DMA at 0.7255.

What you need to know on 22 April:

Risk-off trading conditions, triggered in part by a rise in US yields amid hawkish Fed rhetoric, saw US equities dip on Thursday and the safe-haven US dollar outperform, especially against its more risk-sensitive G10 peers like the Australian, New Zealand and Canadian dollars. The US Dollar Index (DXY) reversed an earlier dip below the 100.00 level to rally back into the 100.60s, where it trades with on-the-day gains of about 0.3%.

Fed Chair Jerome Powell, as expected, signaled that 50 bps rate hikes at upcoming meetings were likely and the usually more dovish leaning FOMC member Mary Daly even mentioned the possibility of a 75 bps move. AUD/USD and NZD/USD traded with respective losses of 1.0% and 1.1%, with the latter performer a tad worse following Thursday’s not as hot as feared New Zealand Q1 Consumer Price Inflation figures. USD/CAD, meanwhile, rallied from under 1.2500 towards the 1.2600 mark, as stronger oil prices failed to offer the loonie respite.

In terms of the rest of the major G10 currencies, the euro was the second-best performer on the day, with ECB President Christine Lagarde not saying anything new in her remarks at an IMF panel, but the normally more dovish leaning ECB Vice President Luis de Guindos earlier in the day hinting at the possibility of a first rate hike in July. His remarks seemed to endorse those recently made by some of the ECB’s more hawkish members in recent days pushing for a July hike and saw ECB tightening bets upped as a result.

This supported EUR/USD at the time, with the pair rallying as high as its 21-Day Moving Average in the 1.0930s in early European trade, only for the pair to then reverse 100 pips lower to the low 1.0800s during US trade as the buck regained ground, where it now trades about 0.2% lower on the day. GBP/USD saw similar price action, attempting to break above its 21DMA in the 1.3075 area only to then reverse back to the 1.3025 region where it is now trading lower by about 0.3% on the day.

Meanwhile, higher yields in the US (and elsewhere) saw the yen struggle, though albeit perform a little better than its risk-sensitive peers amid safe-haven demand as stocks fell. USD/JPY gained about 0.4% to rally into the 128.30s, with the bulls eyeing a potential retest of earlier multi-decade highs above 129.00 if 1) US yields keep pushing higher and 2) the BoJ keeps reiterating its dovish stance and defending its yield curve control target range.

In the coming session, flash PMIs will be released across the world, though probably won’t impact FX markets much amid all the focus on central banks, policy divergence and yields. UK and Canadian Retail Sales figures for March should garner some interest, as well as more remarks from ECB President Lagarde and BoE head Andrew Bailey.

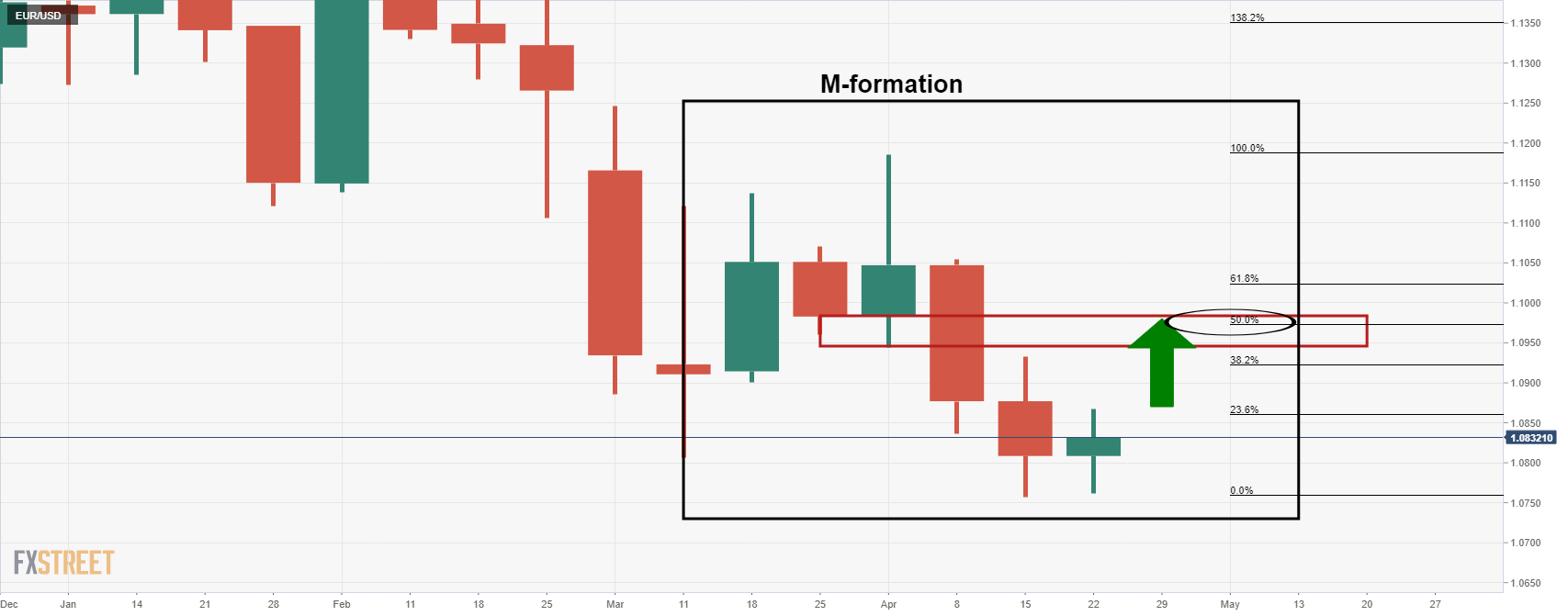

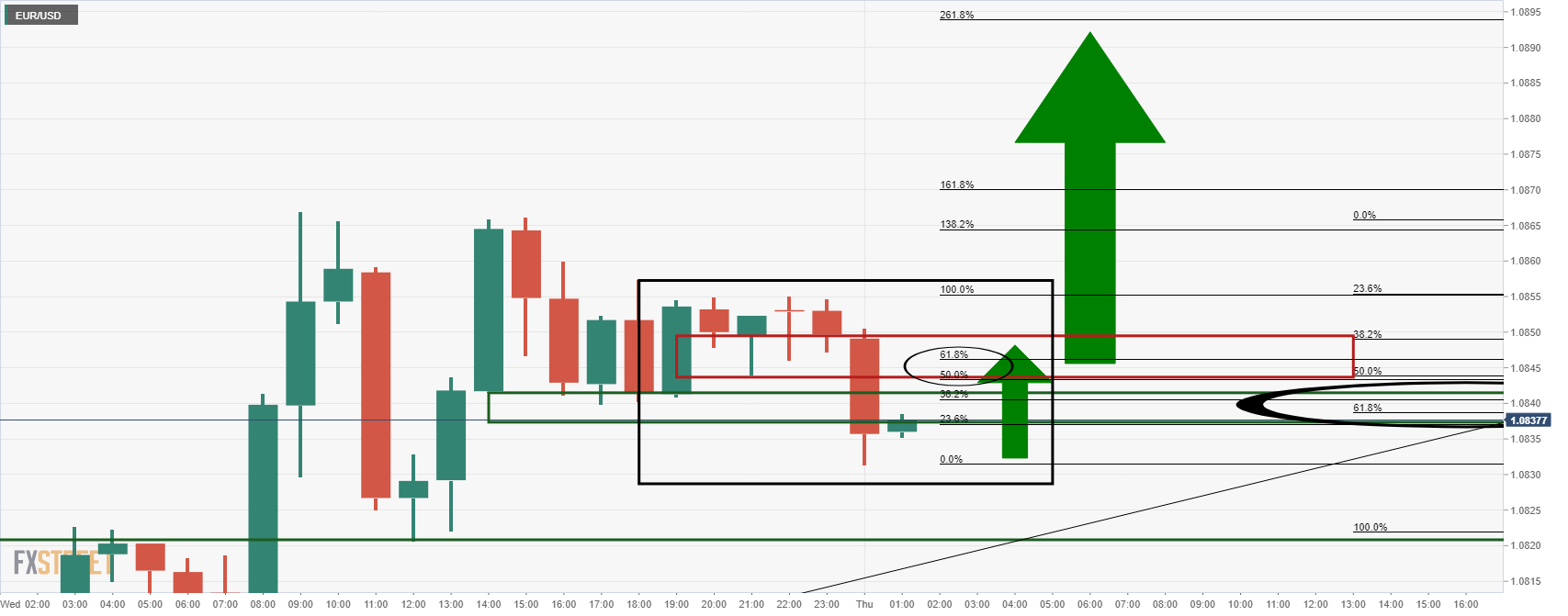

- EUR/USD bulls taking on the bears with eyes to 1.0950.

- The daily cancel or this week's candle need to close in the green.

As per the prior analysis, EUR/USD Price Analysis: Weekly bullish M-formation is starting to play out, the bulls have eyed the M-formation on the weekly chart. Following the prior session's sharp rally, there has been a correction on Thursday to mitigate the imbalance of price. In due course, an onwards continuation could be on the cards.

EUR/USD weekly chart

The M-formation is a reversion pattern and the bulls will be eyeing the neckline in order to mitigate the imbalance of the price. The area can be targeted from a lower time frame perspective. The daily chart is the first place to start such analysis in order to determine the progress of the formation of a bullish structure.

EUR/USD daily chart

The price has subsequently rallied towards the neckline of the M-formation following the bullish candlestick pattern with the doji followed by the bullish engulfing candle. However, there has been a strong rejection and the bulls will want to see the daily candle close higher than the prior days in order to add conviction to the upside thesis. That being said, so long as the week closes in the green, there will be prospects of a bullish continuation for next week.

- Major US equity indices reversed early gains on Thursday amid hawkish comments from Fed Chair Powell.

- The S&P 500 dipped back to 4,400, having earlier rallied above 4,500 on initial strength related to strong Tesla earnings.

Major US equity indices reversed early gains on Thursday as US yields rallied following hawkish comments from Fed Chair Jerome Powell, who endorsed the possibility multiple 50 bps rate hikes at upcoming Fed meetings. Strong earnings from Tesla (+2.8%) following Wednesday’s close helped the S&P 500 open Thursday trade roughly 0.75% higher and at one point surpass the 4,500 mark, but Powell’s comments that 50 bps rate hikes were “on the table” at upcoming meetings, which compounded an earlier hint from Fed’s Mary Daly that the Fed would even consider a 75 bps move, saw the index drop under 4,400.

At current levels in the 4,390s, the S&P 500 is trading with on the day losses of nearly 1.5%, with the bears eyeing a test of monthly lows near 4,370. The Nasdaq 100, unsurprisingly, was the underperformer of the major US indices, dropping closer to 2.0% and under 13,750 for the first time this month. The Nasdaq 100 is more heavily weighted to high price-to-earnings ratio tech and so-called growth stocks, which tend to suffer in an environment of rising interest rates.

The Dow, which is weighted a little more towards value/cyclical stocks which tend to hold up better when interest rates rise, dropped a little less than 1.0% to give up 35,000 status. A weaker than expected US Philadelphia Fed Manufacturing survey for April and robust weekly jobless claims numbers didn’t have an impact on market sentiment, with central bank speak taking the limelight.

Looking ahead, earnings remain in focus and could potentially offer the market a bit of a lift. For the most part, it's been a decent earnings season thus far, with the notable exception of the Netflix debacle earlier in the week. Most recently, United Airlines Holdings and American Airlines Group posted strong results and saw strong gains on Thursday after predicting a return to profit this quarter amid a rapid recovery in travel demand.

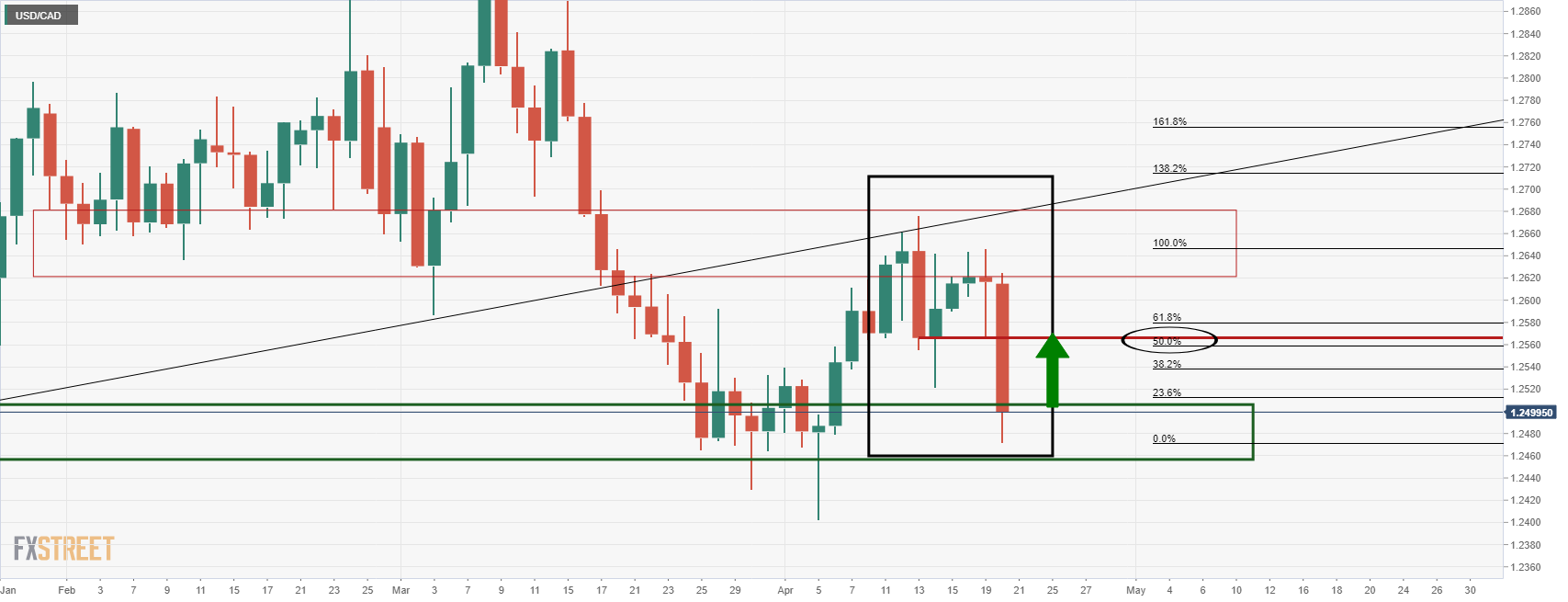

- USD/CAD is testing the ber's commitments at daily resistance.

- A 50% mean of the daily range near 1.2555 could act as first support.

As per the prior analysis, USD/CAD Price Analysis: Bulls are stepping in and eye significant correction, the bulls took on the bears and rallied right back into the M-formation's neckline as illustrated in the following charts:

USD/CAD daily chart, prior analysis

The M-formation is a reversion pattern so the price would now be expected to revert back to at least the neckline of the pattern:

USD/CAD, live market

The price has moved in aggressively, as per the daily chart. However, there were opportunities on the lower time frames to take advantage of the move.

USD/CAD M15 chart

The area of rotation identified in the prior analysis from the hourly chart acted as an area of liquidity from which the 15-min and lower time frame chart traders would have likely engaged from within.

meanwhile, for the rest of the week, traders will be looking to see whether 1.26 the figure will deny the bulls of further upside at this juncture which would leave the price trapped between daily support and resistance:

The daily chart's 50% mean reversion of the recent range could be the first area of support that may hold initial tests around 1.2555.

- The EUR/JPY braces to gain supported by ECB hawkish comments, amidst a stronger yen,

- ECB’s de Guindos shifted hawkish, saying that a rate hike in July is possible.

- EUR/JPY Price Forecast: Negative divergence in the daily chart to push the pair towards 137.50.

The shared currency clings to gains in the mid-New York session after printing a YTD high at 140.00. At the time of writing, the EUR/JPY is trading at 139.06, up some 0.24%.

The Japanese yen recovered substantial ground versus the commodity currencies, like the Aussie, the Loonie, and the kiwi. In the case of the low-yielder EUR, it failed, which was lifted by hawkish comments of ECB Vice-President Luis de Guindos, who said that a rate hike in July is possible, while he sees no reason why APP could not end by July.

Market’s reaction

The EUR/USD jumped on those remarks but of late retreated those gains and meanders around 1.0850. In the case of the EUR/JPY, the central bank divergence between the ECB and the Bank of Japan (BoJ) favors the former, which is about to finish its QE program, while the latter remains stimulating the Japanese economy. So the EUR/JPY held to gains, though from a technical perspective, it is forming an inverted hammer after an uptrend, which means the price is exhausted and may consolidate or resume lower.

EUR/JPY Price Forecast: Technical outlook

As abovementioned, exhaustion lies in the EUR/JPY pair. If EUR/JPY bulls fail to record a daily close above 139.00, that will exert additional downward pressure on the cross-currency pair. Also, the Relative Strength Index (RSI) in overbought territory (72.34) formed a negative divergence with price action as the EUR/JPY records higher highs, the RSI prints lower highs.

With that said, the EUR/JPY’s first support would be the psychological 138.00 mark. A break would expose February 2018 highs near 137.50, followed by April’s 19 daily low at 136.83.

- On Thursday, the GBP/USD is losing some 0.18%

- A positive market mood and hawkish Fed chatter lifted US Treasury yields, underpinning the greenback.

- GBP/USD Price Forecast: Bulls struggling at 1.3100 opened the door for further downside pressure.

The British pound fell short of testing the 1.3100 mark, which left it vulnerable to selling pressure; consequently, the GBP/USD prices declined to the daily low at 1.3022. At the time of writing, the GBP/USD is trading at 1.3043, down some 0.18%.

European and US equities are trading with gains, while US Treasury yields rise. The greenback remains underpinned by the latter, as shown by the US Dollar Index, up some 0.22%, sitting at 100.571. Some central bank speaking is dominating newswires

The central bank speaking parade continues

Of late, Fed Chief Jerome Powell said that moving a little quicker is appropriate, and a 50bps hike will be on the table for the May meeting. Powell added that the economy is performing strongly, and the labor market remains tight.

Earlier, St. Louis President James Bullard reiterated that the Fed is behind the curve and will not have a hard landing. He emphasized that a 75bps hike had been done, and the world did not come to an end.

On Thursday, San Francisco Fed President Mary Daly noted that the Fed “will likely” raise rates by 50 bps at a couple of meetings. However, she is open to deliberating what size of increases are needed, according to Yahoo Finance Interview. Daly reiterated that the Fed needs to take a measured pace on rate hikes and get rates up to 2.5% by the end of the year.

Meanwhile, in the European session, BoE’s Catherine Mann said on Thursday that she would need to look at whether 25 bps or additional interest rates hikes are required so the BoE could tame inflation. She added that “If we see rising energy prices and slowing sales, then, in some sense, we are already in stagflation; though, it is a little premature to use such a term.”

With that said, the GBP/USD outlook in the near term is tilted downwards. As the Federal Reserve prepared for successive meetings of 50-bps rate hikes, the BoE’s last 25-bps increase had one dissenter, Jon Cunliffe, who said on April 4 that the central bank might not need to take sustained action to stop stickier inflation in the UK.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is stills tilted to the downside. Given that GBP/USD bulls failed to break 1.3100, they opened the door for further downside. Furthermore, the Relative Strenght Index (RSI), which was aiming higher, turned bearish, sitting at 43.56.

With that said, the GBP/USD first support would be 1.3000. Once cleared, the next support would be April’s 19 daily low at 1.2980, followed by the YTD low at 1.2972.

Fed Chair Jerome Powell, when asked about the topic of inflation at an IMF panel, noted that the Fed is no longer counting on inflation coming back down, as these expectations of supply-side easing have been let down in the past. Powell noted that, of course, it would be great if supply-side pressures eased and inflation came back down, but emphasised the Fed's focus on getting interest rates back to neutral "expeditiously" in order to be prepared either way.

Additional Takeaways:

"We have a job to do regarding demand."

There are more job openings than unemployed people.

"We've got a demand/supply imbalance in the US labor market and elsewhere".

"We have seen some tightening in financial conditions".

Speaking at an IMF panel alongside ECB President Christine Lagarde and other central bank leaders, Fed Chair Jerome Powell was questioned on the appropriateness of the money market's pricing of three 50 bps rate hikes over the next three Fed meetings. Whilst Powell was careful to clarify that he will not endorse any specific market pricing, he said that he did think that markets were priced appropriately given that, with inflation elevated, it makes sense for the Fed to move faster in tightening policy compared to previous hiking cycles.

"50 bps rate hikes are on the table", Powell said, who emphasised the Fed's commitment to achieving its 2.0% inflation target. Powell also noted that many at the Fed thought 50 bps rate hikes would be appropriate going forward, echoing the remarks of many of his FOMC colleagues in recent days. Powell also reiterated his usual observations that the US economy is very strong and that the labour market is very tight.

Market Reaction

The initial reaction in the US dollar has been modest weakness, with the DXY pulling back under 100.50 in recent trade from earlier session highs in the 100.60 area.

Bank of England Governor Andrew Bailey has been talking about the state of and outlook for the UK economy. Here are the key takeaways from his remarks.

Additional Remarks:

The UK's inflation shock has more in common with the Eurozone than the US.

Quite a few businesses have been talking about a shortage of migrant labour.

"We are in a period of unprecedentedly large shocks".

"We must ask whether series of price shocks is affecting inflation expectations".

The question is whether the UK labour market will slow down.

The BoE is looking to see whether businesses intend to hoard labour.

The inflation target is going through the most severe test since it was created.

Short-run inflation expectations are increasing and this is not a surprise.

"We are seeing some increase in medium-term inflation expectations, but this does not amount to a de-anchoring".

"We must not be complacent about inflation expectations".

"We must not be complacent about inflation expectations".

"We are walking a very tight line between tackling inflation, and the output effects of real-income shock".

- EUR/USD has reversed back from highs in the 1.0930s to under 1.0850, with the pair taking cues from yields spreads.

- EUR/USD was supported in early European trade by hawkishness from the ECB VP, but reversed amid a US yields rally.

- With the pair having rejected its 21DMA, bears will be eyeing a near-term test of annual lows around 1.0750.

Movements in yield spreads as a function of rhetoric from central bankers dictated the price action for EUR/USD on Thursday. Comments from the usually dovish leaning ECB Vice President Luis de Guindos earlier in the European morning regarding the possibility of lift-off in July sparked a rally in Eurozone yields that lifted EUR/USD has high as the 1.0930s.

However, since the start of US trade, US yields have gained upside momentum amid hawkish Fed chatter (2s +13 bps to above 2.70% and 10s +11 bps to the mid-2.90s%), triggering a reversal back below 1.0850. A solid US weekly jobless claims report, disappointing US Philly Fed manufacturing survey and slightly better than expected Eurozone Consumer Confidence survey all had little impact on the pair.

Where, at earlier session highs, EUR/USD had traded with on the day gains of about 0.75% and tested its 21-Day Moving Average, the pair now trades with modest losses of about 0.1% in the 1.0830s. Focus now turns to upcoming remarks at 1800BST from both of the heads of the Fed and ECB and focus looks set to remain on the policy divergence between the two banks.

Whilst the ECB is now seen lifting interest rates by as much as 75 bps this year to end its negative interest rate experiment, US money markets pricing are now pricing interest rates ending the year at 2.95%, meaning an implied more than 250 bps in additional rate cuts over the next six meetings between now and December. This massive rate advantage that the US holds over the euro, despite recent hawkish ECB shifts, its making it tough for EUR/USD to sustain rebounds.

After the pair rejected its 21DMA in the low-1.0900s, short-term bears will be eyeing a push lower back towards annual lows around 1.0750. Over the slightly more medium term, bears will be eyeing a test of the 2020 lows in the 1.0630 area.

- The Swiss franc extends its losses in the week, down 1.24%.

- Risk-on market mood and higher US Treasury yields weighed on the CHF.

- USD/CHF Price Forecast: A daily close above 0.9533 would open the door for a 0.9600 test.

On Thursday, the USD/CHF grinds higher amidst an upbeat market mood, up some 0.37% in the North American session. At the time of writing, the USD/CHF is trading at 0.9535.

So far, the market sentiment remains positive, as the European and US equities remain trading in the green. US Treasury yields remain elevated in the North American session, underpinning the greenback. The US Dollar Index, a gauge of the buck’s value vs. a basket of its peers, edges up 0.17%, sitting at 100.514, near the daily highs, after falling under the 100.000 threshold.

The Swiss franc fall is courtesy of market sentiment. Due to its status as a safe-haven peer, it usually depreciates in times of risk-on market mood. Also, the Swiss National Bank (SNB), one of the most actives central banks in FX, favors a weak CHF, so it’s not rare seeing it intervening in the USD/CHF and the EUR/CHF pairs.

USD/CHF Price Forecast: Technical outlook

The last two days’ USD/CHF price action kept the bullish bias on the pair, further confirmed by Wednesday’s close above 0.9480. the daily moving averages (DMAs) reacted to recent price action and turned upwards, but the Relative Strength Index (RSI) at 71.26, within the overbought territory, might put a lid on USD/CHF gains.

The USD/CHF first resistance would be June 2020 highs at 0.9538. A breach of the latter would expose the 0.9600figure. Once cleared, the following supply zone would be Ju

Key Levels to Watch

- Rising global yields as a result of hawkish ECB and Fed speak is weighing heavily on silver.

- XAG/USD has dumped over 2.5% on the day back to near $24.50.

- Bears are eyeing a test of recent lows in the $24.00 area, where the 200DMA also resides.

Chatter from ECB Vice President Luis de Guindos regarding a possible ECB rate hike as soon as July earlier in the morning meant that global yields were already on the front foot heading into the US trading session and the latest remarks from Fed’s Mary Daly about how the Fed will likely be raising interest rates by 50 bps at the next “couple” of Fed meetings has ignited further upside. At the time of writing, US 2-year yields were up 12 bps to trade back above 2.7% and 10-year yields were up 10 bps to trade in the mid-2.90s%.

The rise in US (and global) yields as bond market participants up their bets on central bank tightening in wake of the latest round of rhetoric from ECB and Fed policymakers has seen spot silver (XAG/USD) prices incur sharp losses. XAG/USD was last trading down by more than 2.5% on the day near the $24.50 per troy ounce mark, having dumped below its 21 and 50-Day Moving Averages earlier in the day, both of which reside closer to the $25.00 level.

Markets are braced for further central bank rhetoric in the coming hours, with both Fed Chair Jerome Powell and ECB President Christine Lagarde slated to speak from 1800BST. Should their comments add further fuel to the global yield rally, XAG/USD bears will be eyeing further downside and may target support in the $24.00 area in the form of earlier monthly lows and the 200DMA.

- US dollar gains momentum during the American session amid higher US yields.

- Risk appetite fades, and crude oil prices retreat.

- USD/CAD bounces after Wednesday’s slide, back above 1.2500.

The USD/CAD broke above 1.2500 and climbed to 1.2521, hitting a fresh daily high. It remains near the top with a bullish tone amid a stronger US dollar.

CAD trims Wednesday’s gains

The USD/CAD extended Wednesday’s slide in European hours and bottomed at 1.2457, the lowest level in two weeks. Yesterday, Canadian inflation data came in above expectations, with the annual headline at 6.7%., the highest since February 1991. Last week the Bank of Canada raised the key rate by 50 bp, and another such hike is expected at the next meeting June 1.

The USD/CAD is accelerating to the upside, trimming some of Wednesday’s losses amid a stronger US dollar. The DXY turned positive and is back at 100.50, after bottoming hours ago at 99.82.

Higher US yields are pushing the greenback to the upside. The US 10-year rose from 2.85% to 2.94%, while the 30-year climbed from 2.89% to 2.98%. The sell-off in Treasuries took place following comments from Fed’s officials. Mary Daly mentioned they will likely raise rates by 50 bps at some meetings.

Negative pressure alleviates

The recovery back above 1.2505 alleviated the negative momentum. If the USD/CAD keeps rising, the next resistance stands at 1.2550 followed by 1.2580. A decline back below 1.2500 should put the pair back into a negative very short-term outlook. The key support stands at 1.2460: a consolidation below would open the door to more losses and a potential decline to 1.2405 (April 5 low).

Technical levels

San Francisco Fed President and FOMC member Mary Daly on Thursday reiterated that the Fed needs to get rates to 2.5% by the end of the year in an interview with Yahoo Finance. "We will likely be raising interest rates by 50 bps at a couple of Fed meetings" she noted, saying that the Fed would deliberate over whether hikes of 25 bps, 50 bps or 75 bps are needed.

It is an open question how far rates may need to go above 2.5%, Daly added, before repeating her view that the Fed will be able to achieve a "soft landing" for the US economy. The economy has demonstrated that it can self-sustain, she noted, before stating that she would not necessarily call the inflation peak, given lockdowns in China, the Russo-Ukraine war and ongoing supply chain bottlenecks.

The labour markets in the US are frothy and pushing up inflation, Daly said, though she said she doesn't see a wage-price spiral beginning.

"We have seen some evidence of Russian forces addressing some of the issues they faced earlier in the war in Ukraine," a Western official told Reuters on Thursday. Russian President Vladimir Putin's failed in his initial pre-war objectives but is still in a position to win inside Ukraine, the official continued.

Western nations have been scrambling in recent days to increase the pace of arms shipments to Ukraine's military. On Thursday, US President Joe Biden announced $800M in new military aid for Ukraine and said the US would be sending weapons “directly to the front lines of freedom”.

US Treasury Secretary Janet Yellen on Thursday said that a significant amount of the focus at this week's IMF, World Bank and G20 meetings has been on Russia's "reckless, devastating" war in Ukraine, reported Reuters.

Additional Takeaways:

- Shared the US's commitment for another $500 million in aid to be sent to Ukraine with the Ukrainian Prime Minister.

- Ukraine needs urgent will deploy aid as quickly as possible.

- The US and its allies agreed to tighten the vice of sanctions against Russia.

- The US is doing everything it can to address food security risks from the Ukraine war.

- A top priority is to end the Covid-19 pandemic and overcome the hurdles of vaccinating the world population.

- An objective with sanctions on Russia has been to impose maximum pain on Russia while mitigating the impact on US allies.

- The US needs to be careful about a complete European ban on imports of Russian energy as this would increase oil prices.

- The proceeds from oil and gas sales are an important revenue source for Russia and it would be desirable to reduce those.

- There will be more specific details on bolstering food supplies in the coming weeks.

- Measures on supply and demand side are important for food security.

- US supply chains are not secure and are not resilient.

- Producing everything at home would be more expensive. Ideally, trusted partners could help provide efficiencies.

EUR/USD is being driven by developments at the short end of the interest rates curves and clearly the speed with which the European Central Bank (ECB) normalises policy will be important. Here are three possible scenarios on the ECB’s path to normalisation and its implications for the EUR/USD pair, according to economists at ING.

Base case

“The ECB ends net asset purchases in the second quarter of 2022 and starts hiking interest rates by 25bp in September with another 25bp in December. We expect only two additional rate hikes, bringing the refi rate to 1.0% by the end of 2023, with no further hikes in 2024. Given the fact that the market virtually prices three 25bp hikes from the ECB this year – we look for EUR/USD to trace out a 1.05-1.10 range, ending the year at 1.10. In 2023, the emergence of Fed easing expectations could see the dollar turn around and EUR/USD end the year at 1.15.”

Earlier and more aggressive normalisation

“The ECB ends net asset purchases in June and hikes interest rates by 25bp in July with another 25bp in September. The ECB follows in the Fed’s footsteps, hikes rates by 25bp in December 2022, March, June and December 2023 with another 50bp in 2024, bringing the refi rate to 2%. Multi-year ECB tightening cycle would probably mean more for 2023 than 2022 EUR/USD forecasts. The pair could be trading at 1.20-25 by end-2023 here.”

The fear is back move

“The ECB still sticks to normalisation, hikes rates by 25bp in September and December but delivers no further rate hikes. The more subdued ECB scenario would probably have more impact on EUR/USD this year and could see EUR/USD pinned down near 1.05.”

- USD/JPY rose back into the mid-128.00s on Thursday, as the yen came back under pressure amid rising global yields.

- Traders are now braced for remarks from central bank policymakers including Fed Chair Powell, which could catalyse further upside.

- The bulls are eyeing a potential retest of multi-decade highs printed earlier in the week above 129.00.

USD/JPY rose back into the mid-128.00s on Thursday, as traders deemed Wednesday’s yen recovery to be little more than a dead cat bounce/bear market rally. At current levels near 128.30, the pair is trading with on the day gains of about 0.4%, with the yen amongst the G10 outperformers as a result of a rebound in Eurozone and US bond yields in the run-up to ECB and Fed commentary later this evening from their respective central bank heads.

Japan’s Finance Minister, speaking at the G7 meeting, said little to support the beleaguered yen, reiterating his stance that recent yen weakness is unfavourable and that stability is important, but not signaling any direct intentions to intervene. Meanwhile, the BoJ bought JGBs to defend the upper limit of its -0.25% to 0.25% target range, which theoretically means the bank added stimulus, further hurting the yen’s cause.

Given this backdrop, the USD/JPY will be eyeing a retest of earlier weekly highs above the 129.00 level. Traders will be waiting to see whether remarks from Fed Chair Jerome Powell can catalyse the next leg of the rally towards 130.00, a level last hit in April 2002.

EUR/USD has climbed back above the 1.09 level this morning. In the opinion of economists at Rabobank, the pair will end the year moderately higher.

Moving on?

“Around four European Central Bank (ECB) officials have indicated that rates could be raised in Q3. there is a clear sense that the Governing Council may be opening up the prospect of a rate move a little earlier than many economists have been expecting.”

“Assuming a win by the incumbent in France’s run-off election, the EUR could benefit further from relief.”

“Our short-term forecast of EUR/USD 1.08 was breached earlier this week. We expect EUR/USD to push back to its 1.10 pivot into the summer and beyond.”

How sustainable is the flood of capital finding its way into gold? In the opinion of strategists at TD Securities, the yellow metal is set to see fewer investors willing to buy the safe-haven asset.

The right tail is narrow in gold

“Thus far, the gold's prices have remained extremely resilient against an aggressively hawkish Fed, as a protracted war in Ukraine simultaneously raised both geopolitical uncertainty and inflation risks, thereby fueling demand for the yellow metal as a safe haven. This trend has also likely been exacerbated by the concurrent decline in global equity and bond prices, which is consistent with fears that Treasuries may be less potent havens in a higher-inflation regime.”

“While the Fed is signaling its intent to combat inflation by reaching policy neutrality by year-end, and to start an aggressive QT regime, outflows from gold markets have been scarce as participants are happy to retain some optionality against the Fed's stated plan amid growth concerns.”

“Safe-haven flows are likely to subside as the fear trade dissipates, leaving fewer participants left to buy gold. Comex shorts have also largely been wiped out, further removing some fuel for price strength. In this context, the right tail is narrow in gold.”

GBP’s rebound from sub-1.30 levels extended into the high-1.30s today before selling pressure emerged near the figure. Economists at Scotiabank expect GBP/USD to decline towards the 1.2850 zone.

GBP/USD faces firm resistance in the mid-1.31s

“The pound remains caught in a downward trajectory since late-Feb with price action pointing to another break under 1.30 and losses extending toward the mid-1.28s.”

“A test of 1.31 with an aim to take out last week’s high of 1.3150 would leave the GBP technical picture looking much more positive but the pound faces firm resistance in the mid-1.31s.”

“Support after the mid-1.30s and the figure is Tuesday’s low of 1.2981 followed by 1.2974.”

EUR/JPY has surged above medium-term resistance at 137.50/54 to mark a further significant break higher. Next resistance is seen at 141.06/18, analysts at Credit Suisse report.

Support at 138.47/39 set to hold to keep the immediate risk higher

“EUR/JPY maintains the strong tone following its break above key resistance from the 2018 and recent highs at 137.50/54, which marked a significant break higher to open up further medium-term upside.”

“We stay biased higher, with resistance seen next at 140.03/09, ahead of the June 2015 high and 78.6% retracement of the 2014/2016 fall at 141.06/17. We would look for this to then cap at first for a phase of consolidation. Big picture though, we would look for this to be followed by a break higher with resistance then seen next at 141.74, then 142.42.”

“Support is seen at 139.28 initially, then 138.91, with 138.47/39 now ideally holding to keep the immediate risk higher. Below can see a setback to support next at 137.54/50, potentially 136.95, but with buyers expected to show here.”

US President Joe Biden, in a speech about the latest $800M US military aid package for Ukraine, said that the US is sending weapons "directly to the front lines of freedom", reported Reuters on Thursday. "We are in a critical window as Russia sets the stage for the next phase of war," Biden said, noting that the latest aid package includes heavy artillery, drones, dozens of howitzers and ammunition.

Moreover, the US is sharing timely intelligence with Ukraine, Biden stated, calling the battle of Kyiv a "historic victory" for the Ukrainians, though noting that now is the time to accelerate assistance. The new package will ensure a steady flow of weapons into Ukraine over the next few weeks, Biden said, though he warned that he had almost exhausted the "draw down" authority Congress had given to him, noting he will be asking Congress for more.

In order to sustain Ukraine for the duration of the fight, Biden said he would be asking Congress for more money next week. Biden also said that the US would be providing $500M in direct aid to the Ukrainian government and that the US will ban all Russia-affiliated ships from US ports.

EUR/USD has managed a solid recovery from sub-1.08 levels. Economists at Scotiabank note that the pair needs to surpass the 1.0950 zone to mark an important change of the bearish trend.

Downward pressure remains well in place since last summer

“Downward pressure remains well in place since last summer and the EUR has only managed modest recoveries. The EUR would have to break past the daily high of 1.0936 and the 1.0950 area to suggest a clear change of trajectory.”

“Support after the mid-1.08s is the figure area and ~1.0780.”

Eurozone Consumer Confidence rose by 1.8 points to -16.9 in April from -18.7 in March, data released by the European Commission on Thursday showed. That was a better outcome than the expected decline to -20.0. In the European Union as a whole, Consumer Confidence rose from -19.6 to -17.6 in April.

Market Reaction

The euro did not react to the latest better than expected Consumer Confidence figures. FX markets are instead in wait-and-see mode ahead of remarks from Fed Chair Jerome Powell and ECB President Christine Lagarde later in the session.

An ECB source reportedly told Econostream that some ECB policymakers, for example Austria's Robert Holzmann, will push for a 50 bps rate hike, though any such move is not a foregone conclusion. A 50 bps Deposit Facility Rate hike and a 25 bps hike in the Refinancing Rate would narrow the corridor in one move, the source said, before conceding that the ECB would first want to prime markets for any such move.

Earlier in the day, ECB President Christine Lagarde said that the ECB will maintain optionality in current conditions of high uncertainty.

- USD/JPY attracted some dip-buying buying near the 23.6% Fibo. level support on Thursday.

- A combination of factors weighed on the safe-haven JPY and acted as a tailwind for the pair.

- Investors now look forward to Fed Chair Jerome Powell’s speech for a fresh trading impetus.

The USD/JPY pair maintained its bid tone through the early European session and held steady above the 128.00 mark, still down around 50 pips from the daily swing low.

A generally positive tone around equity markets undermined the safe-haven Japanese yen, which was further weighed down by the Bank of Japan's intervention to check the rise in Japanese 10-year yields. Bullish traders further took cues from a goodish rebound in the US Treasury bond yields, bolstered by hawkish Fed expectations.

That said, speculation that officials would respond to the yen's recent slump capped the upside for the USD/JPY pair amid a softer tone surrounding the US dollar. Investors also seemed reluctant and preferred to wait on the sidelines ahead of Fed Chair Jerome Powell's speech at an International Monetary Fund event later during the US session.

From a technical perspective, the overnight sharp corrective pullback from the 129.40 area, or a fresh 20-year high stalled near the 23.6% Fibonacci retracement level of the 121.28-129.41 parabolic rise. The mentioned support, around the 127.60-127.50 region, coincides with the 100-hour SMA and should now act as a key pivotal point for short-term traders.

A convincing break below should pave the way for deeper losses and drag the USD/JPY pair towards the 127.00 mark. The said handle marked ascending trend-line support extending from the monthly low. Some follow-through selling has could accelerate the fall towards testing the next relevant support near the 126.35 region, or the 38.2% Fibo. level.

On the flip side, the daily swing high, around the 128.60 region, now seems to act as an immediate resistance ahead of the 128.85 region and the 129.00 round-figure mark. Sustained strength beyond will suggest that the corrective decline has run its course and lift the USD/JPY pair back towards retesting the two-decade peak, around the 129.40 region.

USD/JPY 1-hour chart

-637861444650742649.png)

Key levels to watch

- EUR/USD fades the earlier spike to the vicinity of 1.0940.

- ECB’s rate-setters see a probable rate hike in July.

- Chair Powell speaks later on the global economy.

Following the earlier spike to fresh 2-week highs in the 1.0935/40 band, EUR/USD comes under some mild downside pressure and now returns to the area below 1.0900 on Thursday.

EUR/USD now looks to Powell

EUR/USD keeps the bid bias unchanged so far this week and maintains the rebound from Monday’s sub-1.0800 levels well in place amidst the persistent corrective downside in the greenback.

Further rebound in the pair comes amidst the equally positive performance in US and German yields, which manage well to regain upside traction and reverse Wednesday’s pullback.

Earlier in the euro docked, inflation figures in the broader Euroland came a tad below the flash prints for the month of March, while the European Commission’s flash Consumer Confidence is due later in the day.

In the US calendar, Initial Claims rose by 184K in the week to April 16 and the Philly Fed Manufacturing Index deflated to 17.6 in April (from 27.4). Later in the NA session, Chief Powell will speak on The Global Economy at an IMF event.

What to look for around EUR

EUR/USD regains some composure and trespasses 1.0900 to clinch fresh multi-day tops. The duration and extension of the ongoing bounce, however, remains to be seen, as the outlook for the pair still remains tilted towards the bearish side, always in response to dollar dynamics, geopolitical concerns and the Fed-ECB divergence. As usual, occasional pockets of strength in the single currency should appear reinforced by speculation the ECB could raise rates before the end of the year, while higher German yields, elevated inflation, the decent pace of the economic recovery and auspicious results from key fundamentals in the region are also supportive of a rebound in the euro.

Key events in the euro area this week: Final EMU Inflation Rate, Flash EMU Consumer Confidence (Thursday) – EMU, Germany Flash Manufacturing, Services PMIs (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Second round of the presidential elections in France (April 24). Impact on the region’s economic growth prospects of the war in Ukraine.

EUR/USD levels to watch

So far, spot is up 0.40% at 1.0893 and faces the next up barrier at 1.0936 (weekly high April 21) seconded by 1.1000 (round level) and finally 1.1078 (55-day SMA). On the other hand, the break below 1.0757 (2022 low April 14) would target 1.0727 (low April 24 2020) en route to 1.0635 (2020 low March 23).

Bank of England policymaker Catherine Mann said on Thursday that the consequent embedding of current overall inflation into firms' own-pricing is a concern because it may point to a situation in 2023 where pricing remains robust even as demand remains weak, reported Reuters.

Additional Remarks:

The BoE's remit recognises that shocks will push inflation away from 2% and that appropriate monetary policy can temporarily tolerate such a deviation.

These days, there is uncertainty at all horizons and among all relationships, and, of course, shocks continue to affect both financial intermediation and the real economy.

"I am watching surveys and other data closely to see whether and when firms receive the demand signal that would alter their pricing expectations."

If the consumption hit is moderated by other policies or by savings and other smoothing behaviours, it may be well into 2023 before firms receive the demand signal.

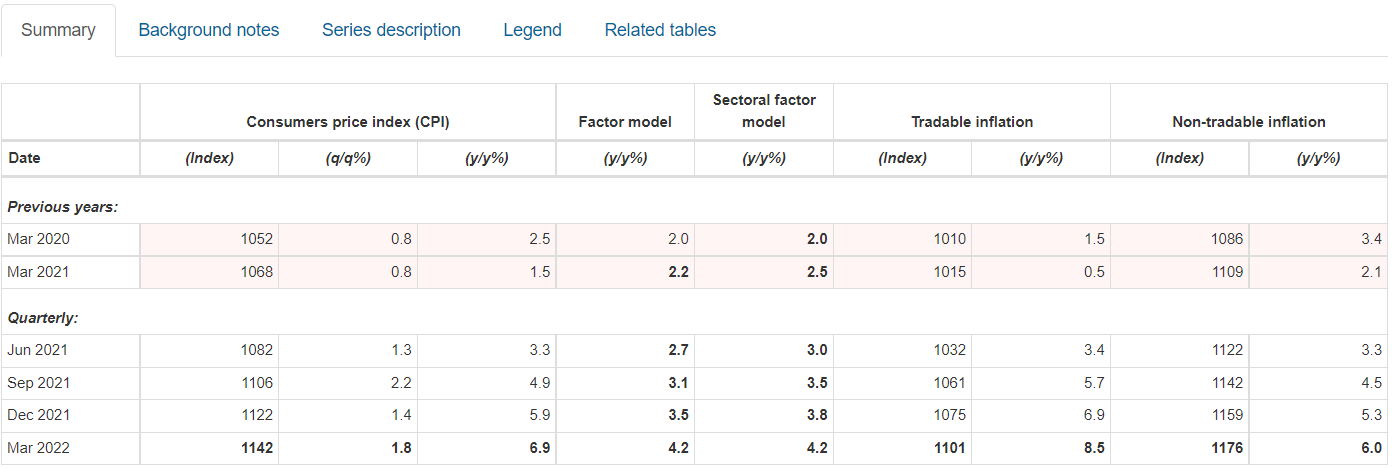

- NZD/USD pulled back under 0.6800 on Thursday after finding resistance at its 50-DMA at 0.6816 a day earlier.

- The kiwi is a modest G10 underperformer after NZ CPI data came in not quite as hot as feared.

- But the RBNZ is still expected to press ahead with aggressive tightening in the coming quarters.

The New Zealand dollar was a modest G10 underperformer on Thursday, as traders pulled back slightly on their expectations for RBNZ interest rate hikes in the coming years after not as hot as feared Q1 inflation figures. Inflation surged 1.8% QoQ in New Zealand in Q1, according to the latest Consumer Price Index (CPI) figures, while the YoY rate of inflation jumped to 6.9%, its fastest rate since 1990. But that missed expectations for a 2.0% QoQ and 7.1% YoY rise in the CPI.

After hitting resistance in the form of the 50-Day Moving Average at 0.6816 on Wednesday, NZD/USD has reversed back into the 0.6780s, where it trades lower on the day by about 0.3%. Most analysts agreed that, even if the latest inflation figures were not quite as hot as feared, the RBNZ is still very likely to raise interest rate by 50 bps again at its next meeting in May, following last week’s 50 bps rate rise to 1.50%.

As a result, kiwi underperformance has been modest. Looking ahead, NZD/USD traders are bracing for commentary from Fed Chair Jerome Powell later in the session and he is expected to solidify expectations for 50 bps rate moves at the Fed’s next few policy meetings. USD risks seem tilted to the upside and the NZD/USD bears will be eyeing a potential retest of this week’s lows in the 0.6720 area.

- AUD/USD edged lower on Thursday and eroded a part of the overnight gains to the weekly high.

- Bets for aggressive Fed rate hikes revived the USD demand and exerted some downward pressure.

- The risk-on impulse helped limit deeper losses as investors now await Fed Chair Powell’s speech.

The AUD/USD pair remained on the defensive through the mid-European session and was last seen hovering near the lower end of its daily trading range, around the 0.7425-0.7420 region.

As investors digested more hawkish RBA minutes released earlier this week, the AUD/USD pair met with a fresh supply on Thursday and eroded a part of the overnight gains to the weekly high. China vowed to cut steel output in 2022, which, in turn, was seen as a key factor that acted as a headwind for the resources-linked Australian dollar. Apart from this, the emergence of some US dollar dip-buying exerted some downward pressure on spot prices.

The greenback drew support from a fresh leg up in US Treasury bond yields, boosted by hawkish Fed expectations, and has now reversed its early lost ground to the weekly low. In fact, the markets seem convinced that the Fed would tighten its monetary policy at a faster pace to curb soaring inflation and have been pricing in multiple 50 bps rate hikes. This had sent the US 10-year real yields into the positive territory for the first time in two years.

That said, the risk-on impulse - as depicted by strong move up in the equity markets - capped the safe-haven buck and offered some support to the perceived riskier aussie. Apart from this, softer US macro data further held back the USD bulls from placing aggressive bets and helped limit deeper losses for the AUD/USD pair. Investors also seemed reluctant ahead of Fed Chair Jerome Powell's speech at an International Monetary Fund event later during the US session.

Nevertheless, the bias seems tilted firmly in favour of the USD bulls and supports prospects for the resumption of the AUD/USD pair's recent sharp pullback from the YTD peak touched on April 5. That said, it will still be prudent to wait for sustained weakness below the 0.7400 mark before confirming that this week's bounce from the 0.7340 region, or the one-month low has lost steam.

Technical levels to watch

Gold maintains a slight upward bias in its broader sideways range. A break past the $2,070/75 highs would resolve the range higher for a fresh bull trend, strategists at Credit Suisse report.

Break below $1,877 to reassert the broad sideways range

“Gold above $1,877 can maintain an immediate upward bias in the broader sideways range.”

“Only above the $2,070/75 highs though would be seen to resolve the range higher for a fresh bull trend, with resistance then seen at $2,280/2,300.”

“A break below $1,877 can further reassert the broad sideways range with support then seen next at $1,845/31.”

- The Philly Fed Manufacturing Index saw a larger than expected drop to 17.6 in April from 27.4 last month.

- There was no FX market reaction, with markets instead focused on upcoming central bank speak.

According to a report from the Federal Reserve Bank of Philadelphia released on Thursday, the headline Manufacturing Activity Index of the Manufacturing Business Outlook Survey fell to 17.6 in April from 27.4 in March. That was larger than the expected decline to 21.0.

Subindices:

- Business Conditions fell to 8.2 from 22.7

- Capital Expenditures fell to 19.9 from 24.8

- Employment rose to 41.4 from 38.9

- New Orders fell to 17.8 from 25.8

- Prices Paid rose 84.6 from 81.0

Market Reaction

There was no market reaction to the latest US data, with markets more focused on upcoming Fed speak from the likes of Fed's Jerome Powell and ECB's Christine Lagarde later in the day.

- Initial Claims were a tad higher than expected but Continued Claims saw a much larger than expected drop.

- There was no FX market reaction, with markets instead focused on upcoming central bank speak.

There were 184,000 US Initial Jobless Claims in the week ending on 16 April, the latest data released by the US Department of Labour showed on Thursday, a tad above the expected decline to 180,000 from 186,000 a week earlier. That meant the four-week average number of initial claims rose to 177,250 in the week ending on 16 April from 172,750 a week earlier.

Continued Claims, meanwhile, fell to 1.417M in the week ending on 9 April, larger than the expected drop to 1.455M from 1.475M a week earlier. As a result, the Insured Unemployment Rate dropped to 1.0% from 1.1% a week before.

Market Reaction

There was no market reaction to the latest US data, with markets more focused on upcoming Fed speak from the likes of Fed's Jerome Powell and ECB's Christine Lagarde later in the day.

- WTI is stable in the low $100s as traders mull various crude oil market themes.

- Concerns about OPEC+ supply amid expectations for further Russian output decline and difficulties in Libya are keeping prices above $100.

- But rising concerns about slowing global growth this week prevented WTI from testing $110.

Crude oil markets are trading in stable fashion, with front-month WTI futures trading near the $103.00 level, with the 21 and 50-Day Moving Averages (DMA) at $102.70 and just under $101.00 constraining the price action as oil traders mull various competing themes. There has been chatter throughout the week about a potential EU ban on Russian crude oil imports, which could put the nation’s output under further pressure. The International Energy Agency already predicts Russian output to fall by as much as 3M barrels per day (BPD) by May.

Meanwhile, oil traders have also had to contend with increased concerns about the output capacity other major OPEC+ producers, after news broke earlier this week about disruptions in Libya (a 550K shortfall, the state-owned oil producer said) and a Reuters survey revealed OPEC+ output missing its output target by a massive 1.5M barrels per day in March. Fears about near-term crude oil market tightness are for now keeping WTI supported to the north of the $100 per barrel mark.

But oil traders have also had to contend with growing fears about a global growth slowdown as rampant global inflation spurs central banks to tighten financial conditions and amid the negative impact of the Russo-Ukraine war and most recent lockdowns in China. This, combined with some chatter about the Kazakh Caspian Pipeline Consortium (which carries roughly 1M BPD or 1% of global supply) soon returning to full capacity, is keeping WTI pinned in the low $100s for now.

Later in the session, oil traders will be watching what various central bank heads, including the Fed’s Jerome Powell and ECB’s Christine Lagarde, have to say on monetary policy, and whether this impacts broader risk appetite.

- GBP/USD witnessed an intraday turnaround from the one-week high touched on Thursday.

- Sustained break below the 1.3000 mark would set the stage for additional near-term losses.

- Any attempted recovery is more likely to remain capped near the 1.3100 round-figure mark.

The GBP/USD pair faded a mid-European session bullish spike to a one-week low and dropped to a fresh daily low, around the 1.3030-1.3025 region in the last hour.

The US dollar drew support from a fresh leg up in US Treasury bond yields, bolstered by hawkish Fed expectations, and has now recovered a major part of its early losses to the weekly low. This, in turn, was seen as a key factor behind the GBP/USD pair's sharp intraday slide of over 50 pips. From a technical perspective, the pair's inability to capitalize on the positive move and the emergence of fresh selling at higher levels suggests that the near-term downfall might still be far from over. Hence, any subsequent move up is likely to remain capped near the 1.3100 confluence hurdle.

The said handle comprises 200-period SMA on the 4-hour chart and a descending trend line, which should act as a pivotal point and help determine the near-term trajectory. A convincing breakthrough would suggest that the GBP/USD pair has formed a base below the 1.3000 psychological mark. This, in turn, would pave the way for additional gains and push spot prices to the next relevant hurdle near the 1.3145-1.3150 area, above which bulls might aim to reclaim the 1.3200 round figure. The positive momentum could further get extended towards the 1.3260-1.3265 horizontal zone.

On the flip side, the 1.3000-1.2990 area might continue to protect the immediate downside. Sustained weakness below, leading to a subsequent break through the YTD low, near the 1.2975-1.2970 zone, would make the GBP/USD pair vulnerable to resume its previous well-established bearish trend. The downward trajectory could then drag spot prices to the 1.2910-1.2900 support zone en-route the mid-1.2800s support zone. The GBP/USD pair could eventually drop to test the 1.2820 intermediate support ahead of the 1.2800 round-figure mark.

GBP/USD 4-hour chart

-637861395166533167.png)

Key levels to watch

- EUR/USD extends the rebound to the 1.0940 region.

- A move to the 1.1000 hurdle should not be ruled out.

EUR/USD’s upside momentum picks up extra pace beyond the 1.0900 yardstick on Thursday.

Further advance appears in store for the pair in the very near term with the immediate hurdle now at the psychological 1.0000 barrier. The surpass of the latter should put a test of the 55-day SMA, today at 1.1077, back on the radar.

While below the 200-day SMA, today at 1.1415, the outlook for the pair is expected to remain negative.

EUR/USD daily chart

- DXY extends the corrective downside to the sub-100.00 area.

- The 97.70 region is expected to offer strong contention.

DXY retreats for the second session in a row and revisits the area below the key 100.00 mark on Thursday.

Price action around the index continues to favour extra weakness. Against that, the dollar’s decline could extend to the late-March lows in the 97.70 area, where decent contention is predicted to emerge.

The current bullish stance in the index remains supported by the 7-month line near 96.60, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 95.41.

DXY daily chart

- EUR/JPY quickly leaves behind Wednesday’s retracement.

- Above 140.00 comes the 141.05 level (June 2015).

EUR/JPY clocked new peaks around 140.00 on Thursday, an area last seen back in June 2015.

The continuation of the uptrend looks the most likely scenario for the time being. That said, if the cross clears 140.00, then the focus of attention will be on the June 2015 high at 141.05. Beyond this level, there are no hurdles of note until the 2014 high at 149.78 (December 2014).

In the meantime, while above the 200-day SMA at 130.48, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

Below are key highlights from the statement by Christine Lagarde, President of the European Central Bank, for delivery at the forty-fifth meeting of the International Monetary and Financial Committee.

"The economy is reopening, the labour market continues to improve, the high levels of savings accumulated during the pandemic can be used to partly cushion the energy price shock, and ample policy support remains in place."

"Inflation will be higher if the prices of energy and other commodities increase further and new supply bottlenecks arise."

"We continue to carefully monitor risks to the inflation outlook."

"Our monetary policy will depend on the incoming data and our evolving assessment of the outlook."

"In the current conditions of high uncertainty, we will maintain optionality, gradualism and flexibility in the conduct of monetary policy."

Market reaction

These comments don't seem to be having a significant impact on the shared currency's performance against its major rivals. As of writing, EUR/USD was up 0.5% on the day at 1.0905.

- Silver witnessed aggressive selling on Thursday and dropped to over a one-week low.

- The technical set-up favours bearish traders and supports prospects for further losses.

- Attempted recovery could now be seen as a selling opportunity near the $25.00 mark.

Silver came under intense selling pressure on Thursday and dropped to a one-and-half-week low, around the $24.70-$24.65 region during the first half of the European session.

From a technical perspective, the overnight bounce struggled to find acceptance above the 200-period SMA on the 4-hour chart and the subsequent sharp fall favours bearish traders. The negative outlook is reinforced by the fact that the XAG/USD earlier this week confirmed a bearish break through the lower end of an upward sloping channel extending from the monthly low.

Moreover, technical indicators on the daily chart have just started drifting into bearish territory and support prospects for further losses. That said, RSI on hourly charts is hovering near the oversold zone and warrants some caution before placing aggressive bearish bets. Nevertheless, the XAG/USD seems vulnerable to prolonging this week's decline from the six-week high.

The ongoing downward trajectory seems strong enough to drag spot prices to the next relevant support near the $24.25 region. This is closely followed by the $24.00 round-figure mark and the very important 200-day SMA, around the $23.85 region, which if broken will be seen as a fresh trigger for bearish traders and pave the way for a further near-term depreciating move.

On the flip side, attempted recovery might now confront stiff resistance near the $25.00 psychological mark ahead of the overnight swing high, around the $25.30 region. Any further move up is more likely to attract fresh selling and remain capped near the aforementioned ascending trend-channel support breakpoint, now turned resistance, around the $25.70 region.

Silver 4-hour chart

-637861334267743226.png)

Key levels to watch

Lee Sue Ann and Quek Ser Leang, FX Strategists at UOB Group, noted NZD/USD now looks poised for extra consolidation, likely within the 0.6715-0.6835 range.

Key Quotes

24-hour view: “NZD soared to a high of 0.6812 before pulling back sharply after NY close. The sharp and rapid pullback has room to extend to 0.6755. The next support at 0.6735 is unlikely to come under threat. Resistance is at 0.6795 followed by 0.6810.”

Next 1-3 weeks: “Our latest narrative was from Tuesday (19 Apr, spot at 0.6735) where ‘while downward momentum has not improved by much, there is scope for NZD to weaken further to 0.6700’. Yesterday (20 Apr), NZD rebounded strongly and took out our ‘strong resistance’ level at 0.6795. The breach of the ‘strong resistance’ indicates that downward pressure has eased. The current movement is viewed as part of a consolidation phase and NZD is likely to trade within a range of 0.6715/0.6835 for now.”

- EUR/GBP gained strong positive traction on Thursday and rallied to a near two-week high.

- The overnight hawkish comments by the ECB policymaker underpinned the shared currency.

- Subdued action around the British pound did little to hinder the strong intraday positive move.

The EUR/GBP cross added to its strong intraday gains and jumped to a nearly two-week high, around the 0.8365 region during the first half of the European session.

Following the previous day's good two-way price moves, the EUR/GBP cross caught aggressive bids on Thursday and built on its recent bounce from mid-0.8200s, or the multi-week low touched on April 14. The European Central Bank (ECB) policymaker Martins Kazaks said on Wednesday that “a rate hike is possible as soon as July.” This comes on the back of the recent surge in the German 10-year benchmark yields to a level last seen in July 2015, near the 1.00% psychological mark on Tuesday, and underpinned the euro.