- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-03-2022

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, rose to 2.90% by the end of Monday’s North American trading session.

In doing so, the inflation gauge regained upside momentum after declining on the previous day. That said, the

It’s worth noting that the inflation expectations rallied to an all-time high of 2.94% on March 11, 2022, but have been struggling afterward.

Even so, the inflation fears propel the hopes of the Fed’s 0.50% rate hike. As per the CME’s FedWatch Tool, there are 60% probabilities favoring such an outcome during May’s Federal Open Market Committee (FOMC).

That said, the recent Fedspeak has also been hawkish, fueling the US Treasury yields to a fresh three-year high. However, the US dollar struggles to cheer the run-up in bond coupons despite printing the two-day uptrend of late.

Read: Forex Today: Dollar surges with Powell’s comments

- Oil prices are firmer on the bull cross of 50 and 200-period EMAs, indicating more gains ahead.

- The RSI (14) is juggling in a bullish range of 60.00-80.00, which adds to the upside filters.

- WTI is hovering in the mid of 50% and 61.8% Fibo retracement.

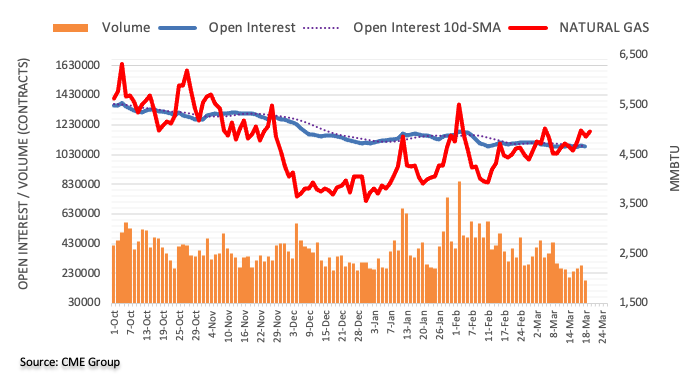

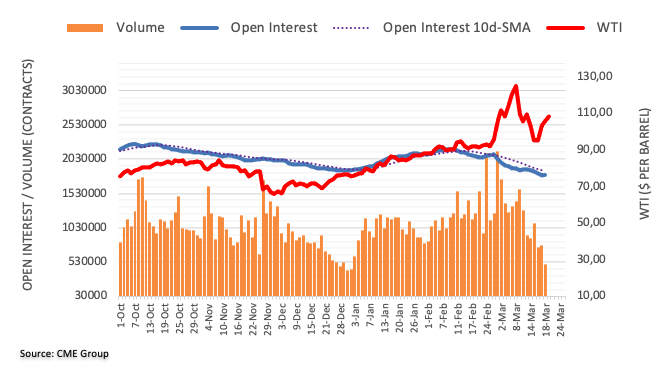

West Texas Intermediate (WTI), future on NYMEX, is trading around $111.00 after a juggernaut rally from March 16 low at $92.69. The oil prices have boiled significantly from the last week and a gain of almost 17% has been recorded.

On the hourly scale, oil prices have surpassed the 50% Fibonacci retracement (placed from March 8 high at $126.51 to March 15 low at $92.37), which is placed at $109.55. The trendline placed from March 16 low at 92.69, adjoining the March 18 low at $100.85 will continue to act as major support for the oil counter.

A bull cross, represented by the 50 and 200-period Exponential Moving Averages (EMAs) crossover, placed at $102.46, points to more gains ahead.

The Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.00, which signals more upside ahead.

Should the asset violate the March 10 high at $111.90, the placement of significant bids will push the oil prices higher to 61.8% Fibo retracement at $113.50. Breach of the latter will send the black gold to the round level at $115.00.

On the contrary, bears may lose control if the asset skids below Tuesday’s low at $110.00, which will drag the oil prices to the above-mentioned trendline at $108.60, followed by a 50-period EMA at $106.66.

WTI hourly chart

-637835030754357875.png)

- GBP/JPY remains on the front foot for the third consecutive day around five-week top.

- Clear upside break of five-month-old resistance line, bullish MACD favor buyers.

- Short-term bull cross adds to the upside bias, 10-DMA restricts immediate downside.

GBP/JPY holds onto the week-start gains around 157.50, the highest levels since early February, as bulls stay firmer beyond the key hurdle during Tuesday’s Asian session.

The cross-currency pair rallied past a downward sloping resistance line from October 2021 the previous day, now support around 157.30.

The trend line breakout takes clues from the bullish MACD signals and the 10-DMA’s piercing off the 21-DMA, known as a bull cross, to suggest the quote’s further upside.

That said, February’s high near 158.10 gains the immediate attention of the GBP/JPY bulls ahead of the October 2021 peak of 158.22.

In a case where the pair rallies past 158.22, June 2016 high near 160.15 will gain the market’s attention.

Alternatively, pullback moves remain less worrisome until staying beyond the resistance-turned-support line near 157.30.

Following that, the 10-DMA and the 21-DMA levels, surrounding 155.00 and 154.35 respectively, will act as the last defenses for the GBP/JPY bulls.

GBP/JPY: Daily chart

Trend: Further upside expected

- USD/CAD remains sidelined after refreshing multi-day low the previous day.

- WTI crude oil prices rise to fresh high since March 10 following an upbeat week-start.

- Market sentiment remains sour as yields rally on Fedspeak.

- Second-tier data, Canada’s Annual Budget Release may entertain traders but risk catalysts, Fedspeak are the key for clear directions.

USD/CAD struggles to overcome the eight-week low, flashed the previous day, by taking rounds to 1.2600 during Tuesday’s initial Asian session.

The loonie pair dropped for the fifth consecutive day at the latest as prices of Canada’s key export item, WTI crude oil, renewed weekly high. However, hawkish comments from the Fed policymakers and firmer US dollar challenged the sellers afterward.

That said, WTI crude oil prices extend the previous four-day uptrend around $111.00, up 0.25% at the latest.

The black gold’s latest recovery could be linked to the geopolitical risks emanating from Ukraine and Saudi Arabia. Recently, Ukraine President Volodymyr Zelenskyy recently mentioned that no immediate decision is possible on occupied Ukrainian territory per Interfax. Additionally, US President Joe Biden also cited fears of a cyberattack against the US.

Elsewhere, the US dollar took clues from the Treasury yields that rallied on upbeat Fedspeak. Atlanta Fed President Bostic and Richmond Fed’s Barkin initially promoted the US central bank’s ability to restrain inflation, indirectly signaling a faster pace of the rate hike. The comments got additional back up from Fed Chair Jerome Powell who said, “The Fed will raise rates by more than 25bps at a meeting or meetings if necessary.”

It’s worth noting that the US 10-year Treasury yields rallied to the fresh high since May 2019 after rising almost 15 basis points (bps) to 2.32% at the latest. The firmer yields weighed on the Wall Street benchmarks after the best week since November 2020.

Looking forward, comments from Fed Chair Jerome Powell will be eyed closely for fresh impetus while Canada’s Industrial Production Price and Raw Material Price Index for February will also direct short-term moves. However, major attention will be given to the Russia-Ukraine headlines and Fedspeak for a clearer view.

Technical analysis

A daily closing below the 200-DMA, around 1.2615 by the press time, directs USD/CAD bears towards an upward sloping support line from late October 2021, close to 1.2560 at the latest.

- EUR/USD struggles to defend the corrective pullback from 200-HMA, fortnight-long support line.

- Downbeat RSI joins short-term descending resistance line, 50-HMA to keep sellers hopeful.

- Bulls need validation from monthly high, sellers may aim for a mid-March swing low under 1.1010.

EUR/USD bears take a breather around 1.1020 during the initial Asian session on Tuesday, following a U-turn from short-term key support a few hours back.

The major currency pair’s rebound from a convergence of the 200-HMA and an upward sloping trend line from March 07 failed to gain support from the RSI, which in turn suggests another attempt to conquer the 1.1010 crucial support levels.

Following that, Friday’s bottom surrounding the 1.1000 psychological magnet may act as a validation point for the EUR/USD south-run targeting the March 14 swing low near 1.0900.

Meanwhile, the pair’s further recovery will aim for the 1.1050 resistance level comprising the 50-HMA and descending trend line from Thursday.

That said, the EUR/USD bull’s ability to cross the 1.1050 hurdle isn’t a guarantee to the pair’s rally as the early March’s top near 1.1120 and the monthly peak surrounding 1.1140 will act as additional filters to challenge the upside momentum.

Overall, EUR/USD prices are likely to consolidate the previous week’s recovery moves.

EUR/USD: Hourly chart

Trend: Further weakness expected

- USD/JPY has inked a fresh six-year high at 119.50 as DXY strengths on six more rate hikes in 2022.

- An unchanged BOJ’s policy has weighed pressure on the Japanese yen.

- This week: Fed Powell’s speech, Biden-NATO meeting, and Japan’s CPI will hold significant importance.

The USD/JPY pair has printed a fresh six-year high at 119.50 as DXY strengthens amid rising bets over six more rate hikes by the Federal Reserve (Fed) this year and souring market mood on uncertainty over the US President Joe Biden meeting with NATO allies on Thursday.

To corner the galloping inflation, Fed has been ‘loud and clear that the market participants should start bracing aggressive policy tightening this year. Fed policymakers have increased their interest rates by 25 basis points (bps) last week and are drawing an action plan to put forward six more rate hikes this year. This has underpinned the greenback against the Japanese yen. On the contrary, the Bank of Japan (BOJ) has kept its interest rate policy unchanged on Friday, which has also contributed to driving the asset higher.

The US dollar index (DXY) has overstepped 98.00 amid souring market sentiment. US President Joe Biden will meet other NATO allies on Thursday for a diplomatic solution to the Russia-Ukraine war. This may also lead to additional sanctions on the Russian economy and henceforth escalation in the tensions between the nations. Meanwhile, the 10-year US Treasury yields have surged near 2.3% as the US economy is shifting out from the new normal of grounded interest rates.

Although the headlines from the Russia-Ukraine war will remain a major drive, investors will also focus on Fed’s Chair Jerome Powell's speech, which is due on Wednesday. While the Japanese docket will report Consumer Price Index (CPI) numbers on Thursday.

- AUD/USD seesaws around two-week top after the week-start advances.

- Aussie Treasury yields rallied to three-year high, US bond coupons jumped as Fed speakers uttered faster rate hikes, inflation fears.

- Ukraine President Zelenskyy said no immediate solution possible on occupier territory.

- Speech from RBA’s Lowe will provide immediate direction, Fed’s Powell, risk catalyst eyed as well.

AUD/USD remains sidelined around the highest levels in two weeks, despite the recently sluggish moves near the 0.7400 threshold. That said, the quote snapped a four-day uptrend on Monday before trading mostly sluggish during Tuesday’s early Asian morning.

The Aussie pair witnessed a softer start to the week, after witnessing the bull’s play in the last, as comments from the Federal Reserve (Fed) policymakers and geopolitical fears from Ukraine, as well as anti-risk moves in China, challenge the bulls. Also testing the pair’s immediate moves is the cautious sentiment ahead of the Reserve Bank of Australia’s (RBA) Governor Philip Lowe at the Walkley Awards for Business Journalism.

Atlanta Fed President Bostic and Richmond Fed’s Barkin initially promoted the US central bank’s ability to restrain inflation, indirectly signaling a faster pace of the rate hike. The comments got additional back up from Fed Chair Jerome Powell who said, “The Fed will raise rates by more than 25bps at a meeting or meetings if necessary.”

It’s worth noting that the hopes of faster monetary policy normalization propelled the US Treasury yields and weighed on the Wall Street benchmarks, also fueling the Aussie bond coupons to refresh multi-month high around 2.7% of late.

However, the US dollar failed to cheer the comments despite posting the second positive daily close. It’s worth noting that February’s Chicago Fed National Activity Index rose past 0.29 expectations to 0.51, versus 0.59 prior (revised).

Elsewhere, the People’s Bank of China (PBOC) announced no change in the monetary policy and parted ways from the global bankers, which in turn joined firmer gold prices to help the AUD/USD battle with the bears. On the contrary, record high daily covid infections from China and fresh geopolitical fears from Saudi Arabia exert additional downside pressure on the quote.

In the case of the Ukraine-Russia crisis, Kyiv Leader Volodymyr Zelenskyy recently mentioned that No immediate decision is possible on occupied Ukrainian territory per Interfax. Additionally, US President Joe Biden also cited fears of a cyberattack against the US.

Despite multiple challenges to the sentiment, AUD/USD traders await comments from RBA Governor Philip Lowe amid hopes of witnessing any changes in the bias from the RBA Minutes that backed no rate hike.

Technical analysis

Unless declining back below 0.7370, AUD/USD remains on the way to challenge a horizontal resistance area from October 2021 around 0.7430-40.

US President Joe Biden crossed wires, via Reuters, late Monday while warning the CEOs to protect their companies against cyber attacks and invest in cybersecurity.

Also read: Ukraine President Zelenskyy: No immediate decision possible on occupied Ukrainian territory – Interfax

Additional comments

Putin's back is against the wall and he is talking about new false flags such as biological weapons.

That is a clear sign Putin is considering using both biological and chemical weapons.

FX reaction

The news adds to the Western hard stand against Russia and flagging of risk-off mood ahead. In a reaction, the Wall Street benchmarks closed in the red while Antipodeans remain pressured during the early Asian session on Tuesday.

Read: AUD/JPY struggles at 88.50 ahead of RBA’s Lowe speech

- The Australian dollar finished its four-day rally vs. the JPY.

- US equity indices finished with losses on a risk-aversion session.

- AUD/JPY Price Forecast: Upwards, but might consolidate ahead RBA’s Lowe.

The AUD/JPY rally lasted for four days as the cross-currency pair slid 0.10% on Monday, caused by a dampened market mood as hostilities between Russia and Ukraine persisted. As the Asian Pacific session begins, the AUD/JPY is trading at 88.35.

On Monday, US equity indices trading day ended in the red, reflecting risk-aversion in the financial markets. Meanwhile, in the FX space, the only gainer was the Canadian dollar, with the JPY being the laggard, followed closely by the EUR.

In the case of the Australian dollar, an absent economic docket left the pair adrift to pure market sentiment. With that said, the AUD/JPY overnight was subdued in a narrow 40-pip range, something worth noting due to the “normal” Average Daily Range (ADR) of 95-pips.

Late in the Asian session, at 01:00 GMT, the Reserve Bank of Australia (RBA) Governor Philip Lowe will talk at the Walkley Journalism awards. AUD/JPY traders need to be aware of it, as money market futures show that the investors expect RBA’s rates to finish around 1.46% by the end of 2022.

Due to the central bank policy divergence, the Bank of Japan’s (BoJ) staying dovish, while the RBA’s tilted neutral-hawkish, would favor the Australian dollar. That said, any Lowe’s “hawkish” comments could lift the AUD/JPY higher.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY is upward biased, as depicted by the daily chart. Nevertheless, Monday’s price action formed a dragonfly-doji right around the highs, so the pair might correct before resuming upwards, but the news could spur another leg-up as traders wait for RBA’s Lowe.

Upwards, the AUD/JPY first resistance would be 88.50. A decisive break upwards would expose the first resistance level, the R1 daily pivot point at 88.65. Once cleared, it would expose the R2 daily pivot at 88.90, followed by the 89.00 mark.

On the flip side, the AUD/JPY first support would be the daily pivot at 88.24. Breach of the latter would expose the S1 daily pivot at 87.98, followed by Monday’s low 87.88.

- GBP/USD juggles around 1.3160 ahead of UK’s CPI numbers.

- A higher CPI print may force the BOE to elevate the interest rate fourth time in a row.

- Risk-off impulse is barricading the cable to surpass 1.3200.

The GBP/USD pair is juggling in a narrow range of 1.3156-1.3170 as the market participants are waiting for the unfolding of the UK’s Consumer Price Index (CPI) numbers, which are due on Wednesday. A preliminary estimate for the UK’s CPI is 5.9%, much higher than the previous print of 5.5%.

The UK’s CPI numbers on Wednesday hold significant importance as the Bank of England (BOE) has increased its interest rates by 25 basis points (bps) last week. The BOE has elevated its borrowing rates for the third time in a row to corner the roaring inflation. Also, the BOE was the first central bank that raised its interest rates after the pandemic of Covid-19. So UK’s inflation print on Wednesday will dictate the likely monetary policy action by the BOE in its next policy announcement.

Apart from that, the British domain will also report the monthly and yearly Producer Prices Index (PPI) Core Output on Wednesday. A preliminary estimate for the monthly PPI Core Output is 0.9%, lower than the previous print of 1.1% while the yearly PPI Core Output is likely to land higher at 10% against the prior figure of 9.3%.

Meanwhile, the US dollar index (DXY) has reclaimed 98.00 decisively on rising bets over the six more interest rate hikes by the Federal Reserve (Fed) this year. Apart from that, the negative tone in the market amid uncertainty over the meeting between US President Joe Biden and NATO allies on Thursday has restricted the cable in a narrow territory.

Adding to the UK’s inflation, investors will also focus on speech Fed’s Chair Jerome Powell to get some more insights about the likely strategy of the Fed policymakers to tackle inflation, which is due on Wednesday.

“A meeting with Kremlin leader Vladimir Putin is necessary to determine Russia's position on ending the war he launched in Ukraine,” Interfax Ukraine news agency quoted President Volodymyr Zelenskyy as saying in a television interview, per Reuters.

The news cites Ukraine President Zelenskyy as adding, “It would not be possible to take a decision at such a meeting on what should be done with occupied territories in Ukraine.”

On the same line were headlines from S&P Global Ratings that said on Monday it will withdraw all of its outstanding ratings on Russian entities to comply with a ban from the European Union, per Reuters.

Market reaction

Given the risk-negative nature of the news, market sentiment remained sour following the announcements. Wall Street closed in the red after posting the best weekly advances since November 2020.

Read: Forex Today: Dollar surges with Powell’s comments

- Kiwi bulls have failed to record a fresh yearly high above 0.6926, have resulted in double top formation.

- A range shift in the RSI (14) to 40.00-60.00 indicates a consolidative activity further.

- Bulls are hopeful above 0.6923, which will send the asset towards 0.7000.

The NZD/USD pair is oscillating in a ted narrow range of 0.6866-0.6923 since Thursday after failing to print a fresh yearly high above 0.6926. The kiwi bulls have attracted some significant offers near 0.6923 on Monday, which signals a corrective pullback going forward. Moreover, the asset needs to wait a little more to resume rallying again.

On an hourly scale, NZD/USD has witnessed decent selling pressure after the successful test of March 7 high at 0.6923. Usually, a failure to print fresh highs signifies that investors have sensed it as an expensive bet and have gone for inventory distribution. The trendline placed from February 24 low at 0.6630, adjoining the March 15 low at 0.6729 will remain major support for the asset.

It is worth noting that the Relative Strength Index (RSI) (14) has shifted in a range of 40.00-60.00 from a bullish range of 40.00-60.00, which signals either a consolidation or a downside move in coming trading sessions.

Should the asset drops below the minor trendline around 0.6866, which is placed from March 17’s average traded price at 0.6865, the asset will slip near March 10 low at 0.6811, followed by the broader trendline line placed from February 24 low of 0.6630 at 0.6785.

For the upside, bulls need to overstep March 7 high at 0.6923, which will drive the kiwi bulls higher to 23 November 2021 high at 0.6965. Breach of the latter will push the pair towards the psychological barricade at 0.7000.

NZD/USD hourly chart

-637834960226028790.png)

- The shared currency began on the wrong foot the week, 0.05% down.

- Risk-sentiment is off at the beginning of the week, as Russia-Ukraine talks stagnate.

- EUR/JPY Price Forecast: Upward biased but in consolidating.

The common currency rally against the Japanese yen stalled on Monday, courtesy of risk-aversion in the financial markets spurred by the Russia-Ukraine peace talks unable to progress amid global central bank tightening. At 131.61, the EUR/JPY reflects the abovementioned, as the safe-haven yen appreciates.

Wall Street’s finished the day with losses between 0.04% and 1%. Meanwhile, in the FX space, the Loonie rallied against most G8 currencies, while the JPY slightly gained vs. the euro.

Overnight, the EUR/JPY was subdued in the 131.60 area, but in the European session, it jumped towards the 132.00 area, only to find more sellers, which pushed the pair to the 131.40s area.

EUR/JPY Price Forecast: Technical outlook

Daily chart

The EUR/JPY is upward biased, though it faced strong resistance at the 132.00 mark. However, the EUR/JPY might consolidate, as the 78.6% Fibonacci level lies just at 131.28, meaning that the pair might trade in a narrow range before resuming upwards.

Hourly chart

The EUR/JPY 1-hour chart portrays the pair in consolidation, between the 131.00-132.00 range. Above the exchange rate lies the 50-simple moving average (SMA) at 131.61, while the 100 and the 200-SMA lie at 131.09 and 129.86, respectively. The EUR/JPY is upward biased, though downside risks remain.

If the cross-currency pair is going upwards, the first resistance would be the 50-SMA at 131.61. Breach of the latter would expose 132.00, followed by 132.50. On the flip side, the EUR/JPY first support would be the 78.6% Fibonacci level at 131.28. Once cleared, the next support could be the 100-SMA at 131.09, followed by the 131.00 mark. A sustained break would expose the area of the 200-SMA at 129.86 and the 130.00 mark.

- GBP/JPY advanced above 157.00 on Monday despite a somewhat risk-off market feel and is eyeing annual highs near 158.00.

- The pair was lifted by a surge in UK yields in tandem with their global peers.

- With dovish vibes expected from BoE’s Bailey later this week and fragile risk appetite, further upside may be more limited.

GBP/JPY’s post-dovish BoE policy announcement weakness last Thursday is now well in the rearview mirror, with the pair confidently pushing to the north of the 157.00 level and eyeing a test of annual highs around 158.00. It was a slightly risk-off session on Monday, with US equities falling as energy prices rose sharply, keeping inflation fears alive, while hawkish remarks from Fed Chair Powell stocked fears about the pace of US monetary policy tightening. That might typically weigh on GBP/JPY, but another key feature of Monday trade was a big rally in global (non-Japan) bond yields, led by a move higher in US yields.

The yen is sensitive to rising rates internationally as the Bank of Japan keeps yields fixed around zero all the way up to 10 years out with its Yields Curve Control policy. The fact that UK yields were up more than 10bps all the way across the curve has thus contributed to a significant widening of UK/Japan rate differentials, thus encouraging yen to sterling flows. After breaking above all of its major moving averages in the last few weeks, GBP/JPY still looks very much odds on to test annual highs around 158.00.

But traders would be wise not to count on rising UK yields pushing the pair ever higher as, say, has been the case with US yields and USD/JPY as of late. While this week’s UK Consumer Price Inflation data out on Wednesday might well further spice up, BoE Governor Andrew Bailey is likely later in the day to remind markets that only “modest” further tightening “might” be likely. Indeed, the BoE sounded much more worried about growth risks and the hit to real incomes over the coming months than it did about containing inflation.

Against the backdrop of a BoE likely to underwhelm the market’s tightening expectations, the prospect for a sustained break above 158.00 in the near term isn’t great. Not unless there is a massive further spurt in risk appetite (i.e. global equities recovering ground like they did last week). Amid seemingly stagnant Russo-Ukraine peace talk progress and a Western coalition likely to continue toughening Russia sanctions (the chatter now is of an EU embargo on Russian oil), plus also rising recession fears as the Fed warns of faster tightening ahead, the prospect for a continued risk appetite rally isn't good.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:00 (GMT) | Australia | RBA's Governor Philip Lowe Speaks | |||

| 05:00 (GMT) | Japan | Leading Economic Index | January | 104.7 | |

| 05:00 (GMT) | Japan | Coincident Index | January | 92.7 | |

| 07:00 (GMT) | United Kingdom | PSNB, bln | February | 2.9 | -9.8 |

| 09:00 (GMT) | Eurozone | Current account, unadjusted, bln | January | 35.65 | |

| 10:00 (GMT) | Eurozone | Construction Output, y/y | January | -3.9% | |

| 11:00 (GMT) | United Kingdom | CBI industrial order books balance | March | 20 | |

| 12:30 (GMT) | Canada | Industrial Product Price Index, y/y | February | 16.9% | |

| 12:30 (GMT) | Canada | Industrial Product Price Index, m/m | February | 3% | |

| 13:15 (GMT) | Eurozone | ECB President Lagarde Speaks | |||

| 14:00 (GMT) | U.S. | Richmond Fed Manufacturing Index | March | 1 | |

| 14:30 (GMT) | U.S. | FOMC Member Williams Speaks | |||

| 18:00 (GMT) | U.S. | FOMC Member Daly Speaks | |||

| 21:00 (GMT) | U.S. | FOMC Member Mester Speaks |

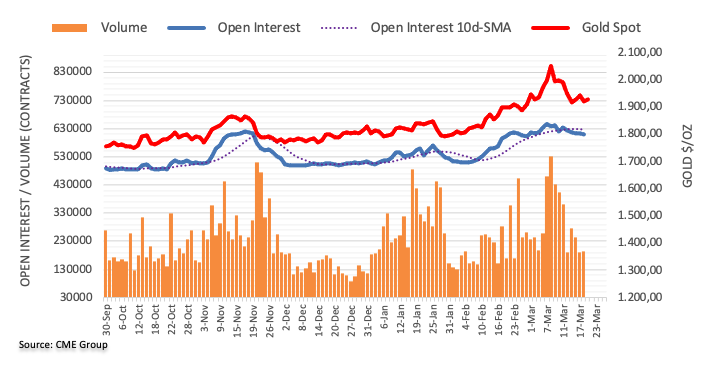

- Spot gold has advanced on Monday despite the US dollar and yields rising in wake of hawkish Powell commentary.

- XAU/USD is in the $1940 area and eyeing recent highs around $1950 as inflation and geopolitical concerns linger.

Spot gold (XAU/USD) has mostly been trading on the front-foot during US trading hours, despite the latest remarks from Fed Chair Jerome Powell, which struck market participants as far more hawkish than expected and boosted the US dollar/yields. Gold has rallied from early session sub-$1920 per troy ounce lows to current levels in the $1940 region, where it trades about 1.0% higher on the day. Last Thursday and Friday’s higher in the $1950 area are for now capping the price action.

Powell said that the Fed needs to move expeditiously to get interest rates back to neutral, warning that could mean rate hikes of greater than 25bps intervals and said that the Fed might need to take rates above neutral. Some analysts said his remarks were nothing more than a reiteration of his post-Fed policy announcement remarks from last week, but markets responded by further upping the implied probability of a 50bps move in May to above 60% (from around 50% prior to his commentary).

The subsequent move higher in the US dollar (DXY +0.25%) and US bond yields (2s +17bps, 10s +15bps) would typically weigh on gold demand by making it more expensive for the holders of non-US dollar currency and via a higher “opportunity cost” of holding non-yielding assets. But risk-off market conditions (US equities are a little lower across the board) seem to be spurring some safe-haven demand, while a sharp upside in crude oil markets is keeping inflation fears alive and thus spurring some safe-haven demand. Oil prices have flown around $8.0 higher (in WTI) on the session as momentum towards an EU-wide embargo on Russian oil exports build.

Another bullish factor for gold is the fact that Russo-Ukraine peace talks appear to have largely stagnated, with no progress seen over the weekend, all while the brutality of the Russian assault on various Ukrainian cities rises. Hence, the momentum towards ever-stricter sanctions against the Russian economy remains strong. The calculation right now for gold appears to be that there is still plenty enough reason to continue adding to longs on any pullback to the $1900 area.

- The common currency slides some 0.34% as the New York session is about to expire.

- Risk-aversion keeps market players underpinning the greenback as US Treasury yields rise.

- EUR/USD Price Forecast: Downwards and a break below 1.1000 would exacerbate a renewed test of the YTD low around 1.0806.

The shared currency retraces from daily highs around 1.1070s, reflecting the risk-aversion of market players, as peace talks between Russia-Ukraine languish, as Fed and ECB speakers crossed the wires amid an absent economic docket. At 1.1017, the EUR/USD portrays the US dollar strength.

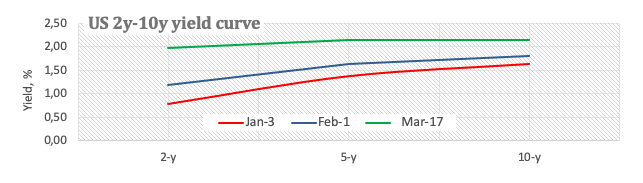

Fed Chair Powell, send 5s above 10s on hawkish remarks

Late in the New York session, the EUR/USD dropped as Federal Reserve Chief Jerome Powell spoke at NABE annual conference. At the same time, the US Dollar Index, a gauge of the greenback’s value vs. a basket of six majors, advances 0.27%, sitting at 98.502, while US Treasury yields rise sharply, with the 5-year sitting at 2.336%, higher than the 10-year T-note yield at 2.319%.

Jerome Powell said that the Fed would take the “necessary steps” to tame inflation towards the bank’s target of 2%, even if it needs to hike rates more than 25 basis points at a meeting or meeting. Furthermore, Powell added that “if we determine that we need to tighten beyond common measures of neutral and into a more restrictive stance, we will do that as well.”

Aside from this, some ECB speakers crossed the wires earlier in the European session. Vice President Luis de Guindos said that inflation is to stay firm longer than seen before. At the same time, ECB’s Klaus Knot noted that a hike this year is “realistic” in the same tone as ECB’s Holzmann, who said that a rate rise could send a clear message that the ECB is committed to tackling inflation, even before ending the QE.

Meanwhile, ECB’s President Madame Lagarde said that bottlenecks, energy, and food were pushing short-term inflation and added that the Ukraine war would have growth consequences in the Euro area.

Read more:

- Fed Chair Powell: Reiterates expectations that at the coming meeting will begin balance sheet reduction

- Fed Chair Powell: I don’t see an elevated likelihood of a recession in the next year

EUR/USD Price Forecast: Technical outlook

The EUR/USD bias is downwards, as shown by the daily chart. Even though in the last week, the common currency recovered some ground, the uptrend stalled at the mid-parallel line between the central and top Pitchfork’s parallel lines, around the 1.1100 mark, retreating to the 1.1000 area, as EUR/USD bears aim to push the pair towards the 1.1000 figure.

The euro’s first support would be 1.1000. A sustained break would expose the confluence of Pitchfork’s central line and the 1.0900 mark, and then the YTD low March 7 low at 1.0806.

What you need to take care of on Tuesday, March 22:

The greenback started the American session on the back foot but strengthened following comments from US Federal Reserve chief Jerome Powell. Speaking about the economic outlook at the National Association for Business Economics Annual Economic Policy Conference, Powell said that if they need to raise fed funds rate by more than 25 bps at a meeting or meetings, they will do so, adding that in times when circumstances change swiftly, Fed predictions might become out of date soon.

Also, he noted that the central bank is focused on restoring price stability while maintaining a healthy labor market. However, he added that “inflation is much too high” and that a reduction of the balance sheet could come as soon as the May meeting, but no decision has been made.

Fed Funds Futures imply traders see a 60.7% chance of the Fed raising rates 50 basis points in May, up from about 52% before Powell's comments.

Wall Street edged lower while government bond yields soared. The yield on the 10-year Treasury note peaked at 2.30%, while that on the 2-year note hit 2.12%. Among US indexes, the S&P posted a tepid decline, while the DJIA was the worst performer, down over 300 points.

Also, other Fed officials came out with hawkish comments. Richmond Fed President Thomas Barkin said the US economy is no longer in need of aggressive Fed support and that supply chains, the virus and now the war are all still impacting inflation. On the other hand, Raphael Bostic said that the increased uncertainty has reduced confidence and is now appropriated to move into a highly aggressive rate path. He predicted six rate hikes for this year and two more in 2023.

The EUR/USD pair hovers around 1.1010, while the GBP/USD pair trades at around 1.3150. AUD/USD battles around 0.7400 while USD/CAD trades near a fresh low of 1.2564, helped by rising gold and oil respectively.

Meanwhile, the Eastern Europe war is keeping west leaders on their toes. Concerns gyrate around the European dependence on Russian energy affects economic growth in the Union, with massive sanctions in the middle. Government bond yields are on the rise as speculative interest fears inflation will heat up further on the back of soaring oil and gas prices. The German government said it maintains its position that the country cannot function without Russian oil imports.

At the same time, Russia’s Deputy PM Novak said that crude oil price might rise to $300 a barrel if Russian oil is shunned, but that's unlikely. The commodity soared, with WTI now trading at around $110.00 a barrel.

Gold started the day with a soft tone but managed to post modest gains, now changing hands at around $1,930 a troy ounce.

XRP price swallows sellers as Ripple marches higher

Like this article? Help us with some feedback by answering this survey:

- The USD/CHF is advancing so far in the week, some 0.10%.

- Risk-aversion in the financial markets boosts the greenback as low-yielder peers drop.

- USD/CHF Price Forecast: Neutral-upwards if it remains above 0.9250.

USD/CHF incurred earlier losses during the North American session amid a risk-off market mood due to Russia-Ukraine woes while Fed’s Chair Powell crossed the wires. However, jumped of those lows, and at the time of writing, the USD/CHF is trading at 0.9326.

The market sentiment is downbeat, as portrayed by US equities, dropping. The US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, gains some 0.16%, sits at 98.30, underpinned by Jerome Powell’s remarks.

Read more:

- Fed Chair Powell: Reiterates expectations that at the coming meeting will begin balance sheet reduction

- Fed Chair Powell: I don’t see an elevated likelihood of a recession in the next year

Overnight, the USD/CHF began the week near last Friday’s close and jumped near the 200 and 50-hourly simple moving averages (SMAs), falling afterward near the S1 daily pivot at 0.9292 amidst a risk-off market mood which favored the Swiss franc.

USD/CHF Price Forecast: Technical outlook

The USD/CHF bias is neutral-upwards. In the last four days, the pair underwent a correction from around 0.9470s (a new YTD high) towards February 10 daily high, previously resistance-now-support at 0.9296. Further, as portrayed by the daily chart, the USD/CHF appears to be ready to resume the uptrend. Monday’s candlestick price-action is forming a doji after a downtrend, meaning “indecision” of USD/CHF traders.

That said, upwards, the USD/CHF first resistance would be January 31 daily high at 0.9343. A decisive break would expose November 24, 2021, a daily high at 0.9373, followed by 0.9400. On the flip side, the USD/CHF first support would be the 0.9300 mark, followed by 0.9296, followed by an eleven-month-old downslope trendline, previous resistance-turned-support around the 0.9260-75 area.

Fed Chair Jerome Powell remarked in a speech on Monday that he doesn't see an elevated likelihood of a recession in the next year, reported Reuters.

Additional Remarks:

"It's hard to say what the economy will look like in wake of recent events, but no one is sitting around waiting for the old regime to come back."

"Climate change policy could affect relative price changes."

"It's a strong economy."

"The economy can handle less-accommodative monetary policy."

"This is a labor market that is out of balance."

"It is a great labor market for workers, but we need it to be sustainably tight."

"The strong labor market could be more sustainable if demand was brought back into line with supply."

"You could make a case that labor shortage will trigger more investment... I do think that will happen in the service industry."

"That could boost productivity and make high wage increases more sustainable."

"Financial conditions have tightened since late last year."

"We want to get back to a place that's away from highly accommodative conditions."

"In the medium term, I don't see a conflict between employment and inflation goals."

"The best thing we can do to keep a strong labor market is to stabilize prices."

"I tend to look at shorter part of the yield curve, not 2s to 10s."

Fed Chair Jerome Powell reiterated on Monday his expectations that at the upcoming Fed meeting, the central bank will begin the process of balance sheet reduction, a process to last three years. Monetary quantities are not an important part of the inflation story at this time, Powell noted, saying that having a strong labour market is important and a big focus. The current labour market is much tighter and hotter than before the pandemic, Powell added.

- The New Zealand dollar retreats from last week’s highs due to a downbeat market mood.

- Fed’s Powell: If needed, the fed would raise rates more than 25 bps at a meeting or meetings.

- NZD/USD Price Forecast: Neutral-upwards, a daily close above the 200-DMA is required to extend the uptrend further.

The NZD/USD begins the week with losses as it drops during the New York amid a risk-off market mood, due to the continuation of Russia’s invasion of Ukraine, as peace talks stagnate. At the time of writing, the AUD/USD is trading at 0.6892.

Fed speaking and geopolitical jitters grab headlines

Meanwhile, US Federal Reserve Chair Powell is crossing newswires. He said that economic projections could become outdated at times like this. Furthermore, he said that Fed’s actions and balance sheet reductions would bring inflation at the bank’s target of 2% in three years. Powell added that the central bank would set policy looking at the actual progress on inflation and emphasized that the Fed would hike more than 25 basis points if needed.

Elsewhere, the Russia – Ukraine conflict extends for the fourth consecutive week. Over the weekend, Ukraine’s President Zelensky said that he was ready to negotiate with Russian President Vladimir Puttin, but Turkish officials said Putin was not. Moreover, Moscow said the progress of talks with Ukraine is not as big as it should be, backpedaling on what they said to the Financial Times last week

Aside from this, in the last week, the US central bank hiked rates for the first time in three years while also signaling that it is ready to raise rates six more times through 2022, per the dot-plot shown. The markets have started to price in expectations, while Fed speaking dominates the US economic docket.

On Monday, Atlanta’s Fed President Raphael Bostic said that he predicts six hikes In 2022 and expressed that he would be “comfortable” if the Fed needs to hike aggressively. Bostic added that inflation would return to 2% by 2024 while hitting 4.1% by the year-end.

NZD/USD Price Forecast: Technical outlook

The NZD/USD is neutral-upwards but facing solid resistance at 0.6910, the 200-day moving average (DMA). Nevertheless, the NZD/USD broke above the 50 and 100-DMAs since last Wednesday, but a daily close above the 200-DMA is required to extend the uptrend further.

That said, the NZD/USD first resistance would be 0.6900. Breach of the latter would expose the 0.7000 mark, followed by the top-trendline of a descending channel around the 0.7050-70 area, and then the 0.7100 psychological level.

Fed Chair Jerome Powell said in a speech on Monday that there is an obvious need to move expeditiously to a more neutral level and even more restrictive levels if needed to restore price stability, reported Reuters. The risk is rising that there could be an extended period of high inflation that could push longer-term expectations uncomfortably higher, Powell added, noting that the Fed needs to move expeditiously to combat that.

Action on the balance sheet could come as soon as the next Fed meeting, but no final decision has yet been made, he continued, adding that if we need to tighten beyond the common measure of the neutral rate into a more restrictive stance, then we will do so. If we need to raise the Fed funds rate by more than 25bps at a meeting of meetings, we will do so, he warned, hinting towards a potential 50bps move.

As the outlook evolves, Powell continued, the Fed will adjust policy to restore price stability while preserving a strong labour market. Powell said that we are headed once again into more Covid-related supply disruptions from China, meaning that the timing and scope of supply-side relief remain highly uncertain. Russia's invasion of Ukraine may have significant effects on the US and world economies, he added, noting that the magnitude and persistence of these effects are highly uncertain.

Moreover, Powell continued, the war in Ukraine is likely to restrain economic activity abroad and further disrupt supply chains, creating spillovers to the US economy. The Fed must set policy based on actual progress on inflation and not assume significant near-term supply-side relief, Powell said, predicting that the Fed's actions on interest rates and the balance sheet will help bring inflation down to near 2.0% over the next three years.

History can provide grounds for optimism that the Fed can achieve a "soft landing", said Powell, though he warned that the Fed's projections can quickly become outdated at times like these with events developing rapidly.

Market Reaction

Powell's comments are largely a reiteration of his remarks in the post-meeting press conference last week. Still, it's a reminder of his new hawkish view that 1) rates could be lifted in 50bps intervals and 2) rates could be lifted above so-called "neutral" (seen by most between 2.0-2.5%) if needed to tame inflation. Thus, equities saw a bit of a drop, the US dollar saw a slight jump and US 2-year yields saw about a 4bps jump while 10-year yields were up about 3bps.

- US equity markets saw a choppy, indecisive start to the week against a backdrop of mostly negative Russo-Ukraine updates.

- The S&P 500 is trading a tad higher as investors await remarks from Fed Chair Jerome Powell from 1630GMT.

- The index managed to hit its highest level since mid-February.

US equity markets saw a choppy, indecisive start to the week, but, at the time of writing, have mostly been able to erase modest pre-market gains. Despite arguably negative news flow over the weekend – a lack of progress in Russo-Ukraine peace talks, chatter about an EU embargo on Russian oil exports – the S&P 500 is trading about 0.1% higher in the 4470 area after a dip back towards 4450 earlier in the session was bought into. The index managed to hit its highest level since mid-February at 4480. Directionless trade immediately ahead of remarks from Fed Chair Jerome Powell at 1630GMT isn’t too surprising – the Fed lifted interest rates by 25bps from near-zero for the first time in three years last Wednesday and new rate guidance suggested similar-sized hikes at every remaining meeting this year.

Powell is unlikely to deviate from this script, meaning there aren’t likely to be any meaningful trading opportunities in response to his comments. Nonetheless, the big man might give some more details on things like the Fed’s ideas about how it might conduct Quantitative Tightening, so will be worth keeping an eye on. Otherwise, a series of summits between European leaders are taking place this week, with the US President also showing his face, meaning geopolitics and, more specifically, Western sanctions on Russia will be a key theme this week.

In terms of the other major US indices, the Nasdaq 100 is currently flat in the 14,400 area, after a dip back to 14,250 earlier in the day was bought. The Dow is an underperformer as a result of steep downside in Boeing’s (-3.8%) share price, which makes up just under 4.0% of the index’s weighting after a 737-800 jet crashed in China. The index is currently trading about 0.5% lower, though for now remains well supported above the 34,500 level. The S&P 500 Volatility Index or VIX was last down at its lowest level in more than one month in the 23.00s, down about half a point on the day.

Richmond Fed President and FOMC member Thomas Barkin said on Monday that the US economy is no longer in need of aggressive Fed support, and that supply chains, the virus and now the war, are all still impacting inflation, reported Bloomberg. Interest rates are still far below the rate level that constrains the economy and we can move at a 50bps clip again to tame inflation, he added. Inflation expectations seem to have remained stable, Barkin added.

- The bulls are back in control and have pushed WTI back to the $110 area.

- Bullish catalysts include building expectations for an EU embargo of Russian oil and stagnant Russo-Ukraine peace talks.

The bulls are firmly back in control of global oil markets following a series of bullish catalysts over the weekend which have sent the front-month WTI future nearly $5.0 higher on the session to test the $110 per barrel area. As the Russian invasion of Ukraine rumbles on and Ukrainian officials defiantly reject Russian demands for its forces in the besieged city of Mariupol to surrender, EU governments are mulling whether to impose a blanket ban on Russian oil imports.

European leaders are convening with US President Joe Biden at a series of summits this weak aimed to forge agreement on strengthening of Western sanctions against Russia. News flow on the state of peace talks between Russia and Ukraine has also broadly been downbeat and, when combined with fears of restrictions on Russian oil exports, it's not too surprising to see oil prices making decent strides higher. Traders are also citing a weekend attack by Yemen’s Iran-aligned rebel Houthi militia against a Saudi Aramco refinery that caused a temporary drop in output as adding bullish impulses.

At current levels in the $109.00s, WTI is trading more than $15 higher versus last week’s lows in the $93.00 area but is still around $20 below earlier monthly highs near $130 per barrel. The significant distance that thus resides between WTI at current levels and major areas of support/resistance suggests that, from a technical perspective, choppy trading conditions are set to continue. The fundamentals back this up – as fears rebuild about how embargoed Russian oil is going to be replaced, all while global oil reserves sit at their lowest levels in years, the recipe for large swings (as already seen in March) is there.

ECB Governing Council member and Bundesbank President Joachim Nagel said on Monday that the ECB should raise interest rates if the price outlook required it and, if bond-buying ends in Q3 as now planned, rates could rise this year, reported Reuters. Nagel said the risks of tightening policy too late have increased and any delay could require sharper rate rises at a later date. A low inflation environment is unlikely to return, he continued, saying that the risks of second-round effects from the current high inflation are on the rise. The war in Ukraine is to weigh on Eurozone economic growth via lower consumption, confidence and trade, he concluded.

- The Australian dollar falls 0.12% in the North American session.

- Russia-Ukraine talks stall as fighting in Mariupol increases.

- AUD/USD Price Forecast: The bias remains upwards, confirmed by an upbreak of a falling-wedge and the 200-DMA.

The AUD/USD begins the week on the wrong foot as it falls in the North American session amid a risk-off market mood, due to the extension of Russia’s invasion of Ukraine, as peace talks stall. At the time of writing, the AUD/USD is trading at 0.7409.

Russia – Ukraine tussles update

The Russia – Ukraine conflict extends and aims to continue for the fourth week. Ukraine President Zelensky said he is ready to negotiate with Russian President Vladimir Puttin, but Turkish officials said Putin is not ready. Furthermore, Moscow said the progress of talks with Ukraine is not as big as it should be, backpedaling on what they said to the Financial Times last week.

A burst of negative market mood impacted the market when the Russian Foreign Ministry summoned the US ambassador on Monday and handed over a note of protest over “unacceptable” comments about Russian President Vladimir Putin by US President Joe Biden.

Fed speaking would increase in the week

Aside from this, in the last week, the US central bank hiked rates for the first time in three years while also signaling that it is ready to raise rates six more times through 2022, per the dot-plot shown. The markets have started to price in expectations, while Fed speaking dominates the US economic docket.

On Monday, Atlanta’s Fed President Raphael Bostic said that he predicts six hikes In 2022 and expressed that he would be “comfortable” if the Fed needs to hike aggressively. Bostic added that inflation would return to 2% by 2024, while it would hit 4.1% by the year-end.

Late in the early Tuesday Asian session, the Reserve Bank of Australia (RBA) Governor Philip Lowe would cross the wires.

AUD/USD Price Forecast: Technical outlook

The AUD/USD bias is upwards, after breaking a falling-wedge on March 17, but it faces solid resistance at 0.7441 on March 7 daily high. Furthermore, the same day, the AUD/USD left the 200-day moving average (DMA) below the spot price, two bullish signals on the AUD, alongside some procyclical currencies bid, with commodity-linked peers soaring due to higher commodity prices.

That said, the AUD/USD first resistance would be 0.7441. Breach of the latter would expose September 3 daily high at 0.7478, followed by October 28, 2021, daily high at 0.7555.

Worth noting; the 50-DMA is about to roll over the 100-DMA.

- EUR/USD extends the leg lower to the 1.1020 area.

- Immediately to the downside emerges the 1.1000 zone.

EUR/USD adds to the bearish note seen on Friday, although the pair trades mostly within the familiar range on Monday.

In case sellers push harder, the 1.1000 neighbourhood should offer decent contention. This area is also underpinned by the temporary support at the 10-day SMA at 1.0997 prior to the weekly low at 1.0900 (March 14).

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1525.

EUR/USD daily chart

The price of a barrel of Brent oil reached almost $140 at the beginning of March. The price then fell back to $100 but is now trading above $110 again. Strategists at Commerzbank expect Brent to trade above the $100 level before falling back in the second half of 2022 towards $90.

Oil prices temporarily near all-time high

“Oil demand is more robust than expected at the beginning of the year, despite high Corona infection numbers, and is expected to return to pre-covid pandemic levels as the year progresses.”

“The oil market is likely to remain tight for the time being if there are prolonged supply disruptions due to the Ukraine war and sanctions against Russia. However, Iranian oil exports could return to the market in the course of the year.”

“The price of a barrel of Brent oil should continue to trade above $100 for the time being, but fall back again in the second half of the year and trade at $90 at year-end.”

EUR/CHF has found a cap at the 55-day moving average (DMA) at 1.0375/77. Analysts at Credit Suisse look for the development of a broad range below this level and above parity.

Risks to turn back lower

“EUR/CHF is now turning back lower and breaking below near-term support at 1.0292, which completes a small intraday top. We, therefore, stay biased toward 1.0375/0404 capping the market for the development of a broad range between this level and parity.”

“Shorter-term, next supports are seen at 1.0258. Below 1.0186/77 would then turn the short-term risks lower within the broad range for a fall back to support at 1.0159, then 1.0112.”

“Should strength extend through 1.0377/0404, we see resistance next at the 38.2% retracement of the March-21/March-22 fall at 1.0423, then another retracement resistance at 1.0483/84.”

The Bank of England (BoE) hiked key rates by 25 bps but showed hesitance in its future tightening plans. As economists at Scotiabank expect the “Old Lady” to disappoint markets in the coming months, cable is at risk of falling to the 1.30 level.

GBP/USD seems on track for a test of the 1.31 zone

“We ultimately think the BoE will disappoint even current expectations (~5 more hikes by year-end) so a push higher in the GBP on increased hikes confidence offers another opportunity to sell, anticipating a renewed decline that we expect to re-test the 1.30 mark.”

“Following a failure to convincingly break past 1.32 on both of Thursday and Friday, the GBP now seems on track for a test of the 1.31 zone – although this area also provided solid support late last week. A firm drop below the figure would leave the GBP more likely to re-test 1.30 and extend its sharp downtrend since mid/late-Feb.”

The Russian Foreign Ministry summoned the US ambassador on Monday and handed over a note of protest over "unacceptable" comments about Russian President Vladimir Putin by US President Joe Biden. Biden was recorded saying he thinks Putin is a war criminal last week, reported Reuters. Russia informed the US that ties are on the verge of being severed.

EUR/JPY has surged above its 200-day moving average (DMA) at 130.04. Analysts at Credit Suisse look for strength to extend to the 10-month downtrend at 132.79.

Support is seen at 131.19

“We look for a fresh challenge on the 10-month downtrend, now seen at 132.79. Our bias would be for this to then cap again and for a retracement lower to emerge. A close above 132.79 though and then importantly the 133.16 YTD high would mark a more notable break higher with resistance seen next at 133.49 ahead of the 2021 high at 134.14.”

“Support is seen at 131.57 initially, with 131.19 ideally holding to keep the immediate risk higher. Below can see a pullback to 130.72, potentially the 200 and 55-DMA at 130.04/129.83, but with better buyers expected here.”

- EUR/USD is a little weaker below 1.1050 in a quiet start to the week, amid a lack of fresh catalysts.

- The pair is currently caught between support and resistance as it awaits remarks from Fed’s Powell and further geopolitical developments.

EUR/USD is a touch weaker just below the 1.1050 level in a quiet start to the week, amid a lack of pertinent, market-moving fundamental catalysts regarding the Russo-Ukraine war or other major themes (central banks and economics). For now, EUR/USD price action remains capped by the 21-Day Moving Average which is currently around 1.1080, as has been the case for the past three sessions. But to the downside, an uptrend from the earlier March lows in the 1.0800 area continues to offer support ahead of last Thursday and Friday’s lows just above 1.1000.

Technically speaking then, continued contained price action on Monday seems a good bet, though investors will be monitoring a speech from Fed Chair Jerome Powell, with the big guy slated to speak from 1600GMT. Powell isn’t likely to deviate from his remarks at last week's post-Fed policy announcement press conference when the bank lifted interest rates by 25bps for the first time in three years and signaled plans to lift rates at every remaining meeting this year. That means FX market trading opportunities are likely to remain fairly limited for the rest of the day.

Geopolitics is the wild card as Russo-Ukraine peace talks continue (no signs of progress towards a ceasefire just yet) and with EU leaders reportedly mulling a Russian oil import embargo. There is an EU Foreign Affairs Meeting on Monday that could produce some headlines on the matter that traders should be aware of; an EU embargo of Russian oil is a downside risk for the Eurozone economy and thus the euro. Looking ahead to the rest of the week, aside from geopolitics, the main catalysts will be Fed speak (with policymakers appearing every day) and US and Eurozone flash PMIs for March.

Hawkish commentary from Fed policymakers James Bullard and Christopher Waller last week spurred increased bets that the Fed might hike interest rates by 50bps at its next meeting, so traders should be on notice for further hawkish remarks that could provide downside risk to EUR/USD. Flash PMIs, meanwhile, will give an early indication as to how the Ukraine war is impacting sentiment. Should a bearish combination of negative Russo-Ukraine updates, weaker than expected Eurozone PMIs and hawkish Fed commentary spur a downside break of EUR/USD’s recent uptrend and a move back under 1.1000, the door would be opened to a retest of last week’s 1.0900ish lows.

USD/IDR is expected to trade within the 14,260-14,400 range for the time being, suggested Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“Last week, we expected USD/IDR to trade between the two major levels of 14,240 and 14,410. USD/IDR subsequently traded within a narrower range than expected (14,250/14,345).”

“The price actions offer not many clues and we expect USD/IDR to trade sideways this week, likely between 14,260 and 14,400.”

USD/CAD trends are relatively flat on the session, with the pair trading narrowly around the 1.26 point. Positive underlying fundamentals, tighter Bank of Canada policy and positive seasonal trends suggest growing downside risk for USD/CAD, economists at Scotiabank report.

Clear move under 1.2565/75 to open up further downside

“We do think that firm domestic growth trends, rising interest rates, and firm commodity prices point towards the CAD remaining firm – and strengthening a bit more obviously – in the coming months when seasonal trends tend to be more positive for the CAD.”

“We note that Friday’s close for the USD was the lowest weekly close for spot since late Jan, suggesting that the recent, sideways range trade around the 1.2750 point may be showing signs of breaking down (bearishly for the USD).”

“A clear move under 1.2565/75 would signal more immediate downside risk for the USD.”

“USD rallies remain a sell.”

- DXY adds to Friday’s gains in the 98.30 region on Monday.

- Bulls initially target the weekly top at 99.29 (March 14).

DXY picks up some traction and advances to the 98.40/45 band at the beginning of the week.

The continuation of the bid tone in the index carries the potential to extend to the next target of note at the 99.00 neighbourhood ahead of the weekly high at 99.29 (March 14), all ahead of the 2022 peak at 99.41 (March 7).

The current bullish stance in the index remains supported by the 6-month line just below 96.00, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 94.55.

DXY daily chart

USD/JPY continues its strong surge higher. In the view of analysts at Credit Suisse, the pair is set to soar as high as 123.00.

Support is seen at 118.47/37

“USD/JPY has cleared the 118.61/66 highs of 2018 with ease to further reinforce the existing large base from last year. Although a knee-jerk pullback should be allowed for, we maintain our core bullish with resistance seen next at 120.66/68 ahead of the 2016 high at 121.69 and eventually our ultimate objective still at 122.90/123.00.”

“Support moves higher to 119.08 initially, then 118.79, with 118.47/37 ideally holding to keep the immediate risk higher. Below can see a setback to 117.80/70, potentially the 13-day exponential average at 117.57, but with fresh buyers expected here.”

EUR/USD trades narrowly. As long as the world’s most popular currency pair stays below the 1.11 level, a re-test of 1.10 and a subsequent fall to 1.09 is on the cards, according to economists at Scotiabank.

Euro is not out of the woods yet

“The EUR is not out of the woods yet, and we think it will still need to hold above 1.11 for longer or risk a re-test of 1.10 in the near-term that then targets 1.09.”

“The daily high of 1.1070 is resistance followed by 1.1090/00, 1.1120, and the Thursday peak of 1.1137.”

“Support is ~1.1035 followed by 1.1010/00 and the mid-1.09s.”

USD/CAD fell sharply last week. The pair is testing the lower edge of the recent range at 1.2587/79. Economists at Credit Suisse look for the market to hold above here to maintain the range, with a break above 1.2645/59 needed to cement a floor at this key level.

A close below 1.2579 would clear the way for a fall to the YTD lows at 1.2450/48

“USD/CAD is challenging important support at the lower boundary of the recent range at 1.2587/79, which includes the recent price low and the uptrend from June 2021. We expect this level to hold for a bounce back to the middle of the range, with resistance seen at 1.2645/59 initially, then at 1.2693/98 and eventually at the recent price high at 1.2775/78.

“Above 1.2775/78 would raise the risk of a more sustained turn back higher again and clear way to challenge last week’s high at 1.2867/71, which we would then expect to break for a renewed attempt to test the YTD high at 1.2895/2901.”

“A sustained close below 1.2587/79 would warn of a deeper setback within the broader range, with support then seen at 1.2557/52 initially, then at 1.2483 and eventually at the YTD lows at 1.2450/48, which we expect to hold at the very latest.”

- Silver lacked any firm directional bias and oscillated in a range on the first day of a new week.

- Last week’s failure near the 200-hour SMA suggests that the recent bounce has lost steam.

- The mixed technical set-up warrants some caution before placing aggressive directional bets.

Silver seesawed between tepid gains/minor losses on Monday and remained confined in a narrow trading band, around the $25.00 psychological mark through the early North American session.

From a technical perspective, last week's goodish rebound from the $24.45 area faltered near the 200-hour SMA. The mentioned barrier, currently around the $25.35-$24.40 region, should act as a pivotal point and help determine the next leg of a directional move for the XAU/USD.

Sustained strength beyond the aforementioned barrier will be seen as a fresh trigger for bullish traders and set the stage for a further near-term appreciating move. The XAG/USD might then surpass an intermediate resistance near the $25.75-$25.80 and reclaim the $26.00 round figure.

The momentum could further get extended and push spot prices towards the next relevant hurdle near the $26.40 region en-route the $27.00 mark and mid-$27.00s. That said, neutral oscillators on daily/hourly charts warrant caution before placing aggressive bullish bets around the XAG/USD.

On the flip side, sustained weakness below the $24.85 area might protect the immediate downside ahead of the $24.45 area. Some follow-through selling would make the XAG/USD vulnerable and accelerate the slide towards testing the very important 200-day SMA support near the $24.00 mark.

Silver 1-hour chart

-637834673542946596.png)

Technical levels to watch

Atlanta Fed President and FOMC member Raphael Bostic said on Monday that the war in Ukraine had not changed his thinking on balance sheet reduction, which could happen quickly and faster than last time, reported Reuters. The Fed has not yet settled on the appropriate pace for the balance sheet runoff, he added, but he expects there to be a "symmetry of scale" relative to last time. Moreover, continued Bostic, balance sheet reductions will inform the appropriate pace of rate hikes.

On the economy, Bostic said that he sees inflation at 4.1% by the year's end and does not predict a recession, with GDP still expected to grow at a pace of 2.8% this year. Inflation will return back to 2.0% by 2024, he said, adding that he is comfortable with more aggressive rate hikes if the data says that's appropriate. My baseline, he noted, is that we won't need to take interest rates above neutral, but he is open to the idea if needed. Bostic said earlier in the day that his estimate for the neutral rate of interest is 2.25%.

- Rising commodity prices assisted the resources-linked aussie to attract some dip-buying on Monday.

- The Fed’s hawkish outlook, elevated US bond yields underpinned the USD and might cap the upside.

- The Ukraine crisis weighed on investors’ sentiment and might further keep a lid on gains for AUD/USD.

The AUD/USD pair recovered a major part of its modest intraday losses and was last seen trading in the neutral territory, just above the 0.7400 round-figure mark.

The pair attracted some dip-buying near the 0.7375 region and has now moved well within the striking distance of the two-week high touched earlier this Monday. A fresh leg up in commodity prices turned out to be a key factor that benefitted resources-linked currencies, including the aussie. That said, a combination of factors might hold back bulls from placing aggressive bets and cap gains for the AUD/USD pair, at least for now.

Investors remain nervous amid the worsening situation in Ukraine, which was evident from a softer tone around the equity markets. This, in turn, drove some haven flows towards the safe-haven US dollar and might keep a lid on any meaningful upside for the perceived riskier Australian dollar. Apart from reviving safe-haven demand, the buck was further underpinned by the Fed's hawkish outlook and a fresh leg up in the US Treasury bond yields.

It is worth recalling that the Fed announced the start of the policy tightening cycle last week and indicated that it could raise rates at all the six remaining meetings in 2022. Moreover, various FOMC members have backed the case for a more aggressive policy stance by the US central bank to combat stubbornly high inflation. This assisted the yield on the benchmark 10-year US government bond to stand tall near the highest level since June 2019.

Hence, the market focus will be on Fed Chair Jerome Powell's scheduled speech later during the US session. Apart from this, traders will take cues from fresh developments surrounding the Russia-Ukraine saga, which will continue to play a key role in driving the broader market risk sentiment. This, along with the US bond yields, might influence the USD price dynamics and produce some trading opportunities around the AUD/USD pair.

Technical levels to watch

- GBP is a modest underperformer amid a broadly quiet/subdued start to the week for FX markets.

- GBP/USD continues to trade in the mid-1.3100s and continues to struggle ahead of the 1.3200 mark.

It’s been a subdued start to the week for pound sterling as market participants continue to digest last week’s dovish BoE policy announcement that threw cold water on expectations for multiple further interest hikes this year. GBP is currently sat at the bottom of the G10 performance table, and down about 0.2% on the day versus the buck, in otherwise quiet FX market trade amid a lack of notable fresh macro drivers. Markets are awaiting fresh developments regarding the Russo-Ukraine war, as well as a barrage of Fed and BoE speak plus a smattering of tier one and two UK/US data releases throughout the week.

GBP/USD is thus experiencing fairly contained trading conditions as it pivots either side of the 1.3150 level and, as has been the case for the last three sessions, continues to struggle as it nears the 1.3200 level. The pair’s failure to get back above the 1.3200 level and key resistance in the 1.3160-75ish area in the form of the 2021 lows is not a good omen heading into this week.

If many analysts are right that last week’s aggressive rally in global equities (which supported GBP/USD at the time) was just a short-term bear market dead cat bounce, then the pair’s next stop could be a retest of recent lows around 1.3000. If the bearish thesis proves wrong and cable is able to bust above 1.3200, the next area of resistance for traders to be aware of is in the 1.3260-70 area.

- Mounting concerns related to the Russian invasion of Ukraine keep investors in cautious mode.

- Global stocks trade mixed, but government bond yields are on the rise.

- Gold Price is neutral, but technical signs hint at another leg lower.

Gold Price heads into the US, opening trading at around $1,925 a troy ounce, retaining modest intraday gains in a risk-averse environment. The market’s mood is sour amid persistent tensions between Russia and Ukraine. Moscow attacks mounted over the weekend, and peace talks are a far chance now. That said, safe-haven assets are posting modest intraday advances, as financial markets seem to be on pause ahead of a new catalyst.

Asian and European indexes trade mixed, but government bond yields are up, with the yield on the US 10-year Treasury note up to 2.20% amid concerns inflation will keep on rising, regardless of central banks’ measures. Oil prices resumed their advances after Russia’s Deputy PM Novak said crude price might rise to $300 a barrel if Russian oil is shunned, but that's unlikely. Gold Price may recover the upside should the news hit Wall Street.

Also read: Commodity traders eye big gains as Fed risks another recession – What’s next? [Video]

XAUUSD Technical Outlook

XAUUSD is stuck around the 50% retracement of the January/March rally, with increased bearish potential. The bright metal is meeting sellers around a flat 20 DMA, while the daily Momentum heads firmly lower within negative levels.

Gold price bottomed last week at $1,895 a troy ounce, just ahead of the 61.8% retracement of the mentioned rally at $1,890.60, a critical support level. On the other hand, the 38.2% retracement comes at around $1,960, where selling interest has proved strong.

Technicals hint at a decline, while fundamentals hint at an advance. The aforementioned Fibonacci levels are critical as XAUUSD could find its way on a clear break of any of those.

- USD/JPY was seen consolidating its recent strong gains to the highest level since February 2016.

- A softer risk tone extended some support to the safe-haven JPY and capped gains for the major.

- Elevated US bond yields, the Fed’s hawkish outlook underpinned the USD and acted as a tailwind.

- The divergent Fed-BoJ monetary policy outlook supports prospects for further near-term gains.

The USD/JPY pair extended its sideways/consolidative price moves through the mid-European session and remained confined in a range just a few pips below the multi-year peak set on Friday. The pair was last seen trading around the 119.20-119.25 region, nearly unchanged for the day.

Following the recent strong run-up of over 450 pips from the monthly low, around the 114.65 region, a softer risk tone drove some haven flows towards the Japanese yen and capped the USD/JPY pair. The worsening situation in Ukraine kept a lid on the recent optimistic move in the markets and benefitted traditional safe-haven assets.

Ukraine's government defiantly rejected Russian calls to surrender the port city of Mariupol in exchange for humanitarian corridors. This comes after Russian forces advanced into the besieged port of Mariupol following one of the deadliest rockets strikes on Saturday. This, in turn, tempered investors' appetite for riskier assets.

Investors, however, remain hopeful about an eventual Russia-Ukraine peace deal. In fact, Turkey's foreign minister had said that both sides were nearing an agreement on critical issues. This, along with the divergent monetary policy adopted by the Fed and the Bank of Japan (BoJ), should act as a tailwind for the USD/JPY pair.

It is worth recalling that the Fed last week announced the start of the policy tightening cycle and indicated that it could raise rates at all the six remaining meetings in 2022. Moreover, influential FOMC members have backed the case for a more aggressive policy stance by the US central bank to combat stubbornly high inflation.

The Fed's hawkish outlook remained supportive of elevated US Treasury bond yields. This has resulted in a further widening of the spread between the US and Japanese 10-year government bond yields amid a more dovish BoJ. The fundamental backdrop supports prospects for further gains for the USD/JPY pair, though overbought RSI warrants caution.

Investors also seemed reluctant to place aggressive bets and preferred to wait on the sidelines ahead of Fed Chair Jerome Powell's speech later during the US session. In the meantime, the US bond yields will influence the USD price dynamics. Apart from this, the broader risk sentiment could provide some impetus to the USD/JPY pair.

Technical levels to watch

Atlanta Fed President and FOMC member Raphael Bostic on Monday said that the Fed needs to get its benchmark Federal Funds interest rate to "neutral" as quickly as we can, reported Reuter. Bostic said he currently estimates the "neutral" rate to be around 2.25%.

Employers are trying to set wages to catch up to inflation, Bostic added, saying also that his current hope is that very high wage growth as a response to the pandemic will not become a permanent feature. If we get inflation under control, Bostic added, we can avoid inflation expectations shifting higher.

Atlanta Fed President and FOMC member Raphael Bostic said on Monday that he expects six rate hikes in 2022 followed by a further two in 2023, reported Reuters. Elevated uncertainty has tempered confidence that an extremely aggressive rate path is appropriate, he noted, adding that with the conflict in Ukraine, we need to be extra-observant and prepared to adapt our thinking on policy and the economy.

In 2022, getting inflation back under control is a top priority and the Fed will do "all in its power", Bostic added, commenting that the US labour market is tight. Uncertainty is likely to reduce economic activity, Bostic noted, though caveating that he is yet hearing that from his contacts. The war in Ukraine will intensify uncertainty and push up prices, as well as exacerbate supply chain problems, Bostic noted, saying that the risks to the policy path are in both directions and the Fed will adapt as appropriate.

Bostic commented that it is critical to resolve the significant imbalance between labour supply and demand. Disruption to Russian energy could imperil growth in the EU, he added, noting that the US has the capacity to boost oil and wheat output, but that it would take time.

- EUR/JPY falters once again in the 132.00 region on Monday.

- Extra gains look on the cards with the target at the 2022 high.

EUR/JPY fades part of the recent strong upside after testing the decent hurdle near the 132.00 mark, or monthly highs.

The cross gathered extra upside traction following the recent breakout of the 200-day SMA (129.97). The surpass of the 131.90/132.00 area could likely allow EUR/JPY to attempt an assault of the 2022 top at 133.15 (February 10).

In the meantime, while above the 200-day SMA, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

- USD/CAD gained some positive traction on Monday and snapped four days of the losing streak.

- The Fed’s hawkish outlook acted as a tailwind for the USD and remained supportive of the move.

- Bullish crude oil prices underpinned the loonie and might cap any meaningful gains for the pair.

The USD/CAD pair held on to its modest intraday gains through the first half of the European session and was last seen trading just a few pips above the 1.2600 mark.

The pair attracted some dip-buying in the vicinity of the monthly low on Monday, though the attempted recovery lacked bullish conviction and was capped by a combination of factors. Crude oil prices rallied over 4% on the first day of a new week and underpinned the commodity-linked. This, along with subdued US dollar price action, acted as a headwind for the USD/CAD pair, at least for the time being.

Oil prices built on last week's goodish rebound from the monthly low and gained strong follow-through traction amid reports that the European Union will consider whether to impose an oil embargo on Russia. Adding to this, attacks by Yemen's Iran-aligned Houthi group caused a temporary drop in output at a Saudi Aramco refinery joint venture in Yanbu and provided an additional lift to the black liquid.

On the other hand, the US dollar, so far, has struggled to gain any meaningful traction, which, in turn, failed to impress bullish traders or provide any meaningful impetus to the USD/CAD pair. That said, the Fed's hawkish outlook, indicating that it could raise rates at all the six remaining meetings in 2022, helped limit any downside for the buck and extended some support to the major.

Nevertheless, the USD/CAD pair, for now, seems to have snapped four successive days of the losing streak and remains at the mercy of fresh developments surrounding the Russia-Ukraine saga. Apart from this, traders will take cues from Fed Chair Jerome Powell's scheduled speech later during the US session, which, along with the USD and oil price dynamics, should provide some impetus to the pair.

Technical levels to watch

USD/MYR is now expected to remain sidelined within the 4.1800-4.2100 range so far, suggested Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes