- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-02-2024

Japan's Foreign Investment in Japanese Stocks increased by ¥382 billion through the week ended February 16, down from the previous week's ¥621.2 billion, but well within recent figures as foreign direct investment in Japanese securities moderates.

Foreign Bond Investment, foreign bonds issued within Japan's financial markets, declined ¥-560.8 billion, but still recovered compared to the previous week's ¥-1.495 trillion decline. Foreign bond issuance within Japan fell to its lowest levels since the week ended December 13.

About Japan's Foreign Investment

Securities investment, released by Ministry of Finance, referrers to bonds issued in a domestic market by a foreign entity in the domestic market’s currency. The report is released by the Ministry of Finance, detailing the flows from the public sector excluding Bank of Japan. The net data shows the difference of capital inflow and outflow. A positive difference indicates net sales of foreign securities by residents (capital inflow), and a negative difference indicates net purchases of foreign securities by residents (capital outflow).

- GBP/USD edges higher to 1.2638 amid the modest decline of the USD.

- Fed officials noted that they wanted to see more evidence before starting to cut rates.

- BoE’s Bailey said that inflation in the UK has fallen and that the technical recession last year is expected to have little effect.

- Investors will closely watch the UK and US PMI data for February, due later on Thursday.

The GBP/USD pair trades stronger below the mid-1.2600s during the early Asian section on Thursday. Investors will turn their attention to the UK and UK S&P Global Purchasing Managers Index (PMI) for February. The major pair currently trades around 1.2638, gaining 0.04% on the day.

The minutes of the January meeting of the FOMC showed most participants emphasized the risks of moving too quickly to ease the stance of monetary policy, while some participants noted the risk that progress toward price stability could stall. The FOMC policymaker highlighted the importance of carefully assessing incoming data in judging whether inflation is moving down sustainably to the 2% target.

The Bank of England (BoE) policymaker Swati Dhingra said on Wednesday that delaying interest rate cuts comes at a cost for living standards and could trigger a hard landing for the UK economy. Dhingra further stated that inflation in the UK is already on a firm downward path as she reaffirmed her case for easing monetary policy.

BoE governor Andrew Bailey said that inflation had “come down very rapidly” in the UK, and the technical recession the UK economy entered last year is likely to have a low impact. He added that the central bank doesn’t need obvious inflation to come back to target before cutting interest rates. The optimistic comments from BoE’s Bailey provide some support to the Pound Sterling (GBP) and act as a tailwind for GBP/USD.

Moving on, traders will monitor the UK S&P Global/CIPS PMI and the US S&P Global PMI for February. Also, the weekly Initial Jobless Claims, Existing Home Sales, and the Chicago Fed National Activity Index are due on Thursday. The FOMC’s Cook, Kashkari, Jefferson, and Harker are set to speak.

- WTI climbed back towards $78.00 per barrel on Wednesday.

- API US barrel counts lurched higher once more.

- Geopolitical concerns and hopes of refinery expansion keep barrel bids high.

West Texas Intermediate (WTI) US Crude Oil rebounded on Wednesday as barrel traders continue to price in possible supply lane constraints amidst geopolitical turmoil in the Middle East. Hopes of expanded US refinery activity eating away at a buildup of US Crude Oil supplies are also keeping barrel prices higher, but a growing overhang of US barrel counts is getting harder for energy markets to ignore.

According to the American Petroleum Insitute (API), US Crude Oil supply stocks unexpectedly rose once again for the week ended February 16, with an additional 7.168 million barrels added to US supply. This comes well above the forecast 4.298 million barrels and adds even further to the previous week’s surprise glut of 8.52 million barrels.

According to API barrel counts, US Crude Oil supplies are up an excess of nearly 18 million barrels since the week ended November 2.

US Crude Oil refineries have been slowly coming back online since overall refined petroleum product output declined in 2022 as several refineries went offline for overhauls, upgrades, or security concerns. Barrel traders are betting on an uptick in US refining capacity to eat away at record Crude Oil production within the US and other countries that are not part of the Organization of the Petroleum Exporting Countries (OPEC).

WTI technical outlook

WTI US Crude Oil climbed over 2% bottom-to-top from Wednesday’s low bids near $76.25, and WTI is climbing towards $78.00 per barrel as energy markets pin back into near-term highs.

Daily candlesticks show US Crude Oil in a notably sideways bent as bids knock into the 200-day Simple Moving Average (SMA) near $77.55. WTI has failed to pierce into fresh high ground since peaking at $79.20 in January, and Crude Oil longs are struggling to drag WTI further into bull country after barrel prices bottomed out in December at $67.97.

WTI peaked just shy of $94.00 per barrel last September, and remains down over 17% from that high.

WTI hourly chart

WTI daily chart

- NZD/USD snaps the six-day winning streak around 0.6177 in Thursday’s early Asian session.

- The FOMC January minutes show no hurry to cut the interest rates.

- The New Zealand annualized Trade Balance narrowed to -12.5 billion YoY in January versus -13.62 billion YoY prior.

- The US S&P Global PMI, weekly Initial Jobless Claims, and Existing Home Sales are due on Thursday.

The NZD/USD pair trades on a weaker note below the 0.6200 barrier during the early Asian section on Thursday. The January FOMC Minutes showed that policymakers will need to have greater confidence that inflation will return to target sustainably before cutting rates. NZD/USD currently trades near 0.6177, down 0.05% on the day.

According to minutes of the FOMC released Wednesday, Federal Reserve (Fed) officials were in no hurry to cut interest rates. Most participants said no cuts would be coming until the central bank held “greater confidence” that inflation was receding. The Fed members will assess both upside and downside risks and are worried about lowering rates too quickly. Traders have pushed out the first rate cut from the March to June meeting, and the expected level of cuts for 2024 is lowered to four from six.

On the Kiwi front, Statistics New Zealand revealed on Wednesday that the nation’s annualized Trade Balance narrowed to -12.5 billion YoY in January compared to the previous reading of -13.62 billion YoY (revised from -13.57 billion). Meanwhile, Imports came in at 5.91 billion versus 6.22 billion prior. Exports arrived at 4.93 billion from the previous month's 5.85 billion.

Looking ahead, investors will keep an eye on the US S&P Global PMI data, the usual US weekly Initial Jobless Claims, Existing Home Sales, and the Chicago Fed National Activity Index. Additionally, FOMC’s Cook, Kashkari, Jefferson, and Harker are set to speak later in the day. On Friday, the New Zealand Retail Sales for the fourth quarter (Q4) will be released.

- AUD/USD marginally down at 0.6550 after Fed reiterates hesitancy on rate cuts amid inflation concerns.

- US 10-year Treasury yields rise, while the DXY dips slightly, reflecting the Fed's cautious outlook.

- Mixed Australian PMI data shows services growth but manufacturing contraction, complicating RBA's policy path.

The Australian Dollar posted minuscule gains on Wednesday against the US Dollar, after the release of the Federal Reserve’s January meeting minutes emphasized policymakers remain hesitant to begin to ease policy. Therefore, the AUD/USD exchanges hands at 0.6550, down by 0.02% as the Asian session begins.

FOMC’s minutes failed to underpin the Greenback

The AUD/USD was subdued throughout most of the session until the minutes were released. The minutes showed that Fed officials are cautious about reducing interest rates prematurely. They stated that they would not consider it suitable to lower interest rates until there is "greater confidence" that inflation is on a sustainable path toward the 2% target. Despite recognizing that the risks associated with fulfilling both Fed’s mandates—price stability and maximum employment—are becoming more balanced, officials emphasized their continued focus on inflationary risks. They also noted that although the economic risks are tilted towards the downside, vigilance towards inflation remains a priority.

After the data, the US 10-year Treasury note yield resumed to the upside, ending the session three and a half basis points up at 4.319%, while the US Dollar fell. The US Dollar Index (DXY) an index that measures the currency’s performance against other six, dropped 0.05%, at 103.99.

Fed speakers remain hawkish, Aussie’s Manufacturing PMI contracts

The Richmond’s Fed President Thomas Barkin crossed the newswires, saying the latest inflation data is “less good,” expressing worries about services inflation.

In the meantime, the Judo Bank Flash PMIs for February were released, with the Composite and Services exceeding January’s readings and exiting from recessionary territory. The Services PMI came at 52.8, up from 491, and the Composite PMI was 51.8, up from 49. The outlier was Manufacturing, which came at 47.7, missing December’s 50.1, suggesting that manufacturing activity is contracting.

Warren Hogan, Chief Economist Advisor at Judo Bank said: “The February Flash PMI results weaken the case for monetary policy easing any time soon. If anything, the improvement in activity indicators in 2024 and a slight uptick in the price indexes suggest that the risks to monetary policy remain even balanced.”

AUD/USD Price Analysis: Technical outlook

the AUD/USD continued to trade sideways after the release of the Fed’s minutes, though sellers stepped in around the 200-day moving average (DMA) at 0.6561, dragging prices below the 0.6550 area. If they would like to remain in charge, the pair must drop below the 100-DMA at 0.6547 and extend below the 0.6500 figure. Once that area is cleared, the next support emerges at the current year-to-date (YTD) low of 0.6442. On the upside, if buyers reclaim the 200-DMA, look for a challenge at the 0.6600 threshold.

Australia's Judo Bank Composite Purchasing Manager Index (PMI) returned to growth figures above 50.0 for the first time since last October, and saw its highest print since May of last year.

The Judo Bank Services PMI fueled the rebound, climbing from 49.1 to a nine-month high of 52.8.

Despite the improvement, Australia's Manufacturing PMI fell back into contraction, printing at 47.7 versus the previous 50.1. The Australian Manufacturing PMI component has only printed above the 50.0 level once in the last 12 consecutive prints.

As noted by Judo Bank, growth in Australia's private sector was driven entirely by the services sector in the first half of the first quarter of 2024, and business sector sentiment remained positive, albeit at a three-month low.

Judo Bank:

... overall sentiment in the Australian private sector remained positive in February, though the level of business confidence eased on the back of lingering concerns over the impact of high interest rates and inflation on sales.

Market reaction

The AUD/USD remains stuck near 0.6550 with the pair bolstered by the 200-hour Simple Moving Average (SMA) near 0.6520, but bullish momentum remains pinned below the week's near-term high around 0.6580.

About Australia's Judo Bank Composite PMI

The Composite Purchasing Managers Index (PMI), released on a monthly basis by Judo Bank and S&P Global, is a leading indicator gauging private-business activity in Australia for both the manufacturing and services sectors. The data is derived from surveys to senior executives. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the Australian private economy is generally expanding, a bullish sign for the Australian Dollar (AUD). Meanwhile, a reading below 50 signals that activity is generally declining, which is seen as bearish for AUD.

- The NZD/JPY pair rallied by 0.53% and stands at 92.88 as of Wednesday's session.

- The daily RSI shows strong buying momentum, reaching overbought conditions.

- A healthy technical correction may be on the horizon in the next sessions.

In Wednesday's session, the NZD/JPY was observed trading at 92.88, marking a 0.53% rally in its progress. The pair reveals sustained buying momentum with the Relative Strength Index (RSI), dwelling in the overbought zone indicating that a pullback may be incoming.

In the daily chart, the Relative Strength Index (RSI) consistently resides in the overbought, and the NZD/JPY pair shows signs of strong buying momentum. Notably, there's been a persistently positive slope, indicating a continued bullish undercurrent. To support this, the Moving Average Convergence Divergence (MACD) histogram is displaying green bars, marking positive momentum. It's been on a steady rise, further underlining the dominance of buyers.

NZD/JPY daily chart

Shifting attention to the hourly chart, the RSI hovers flat in both the positive area and the MACD histogram continues to print green bars, alluding to an overall bullish momentum despite interim dips.

NZD/JPY hourly chart

Overall, despite the short-term flattening depicted in the hourly chart, the significant bullish signals from the daily RSI and both MACD histograms suggest the pair might adhere to an upward trend. Moreover, the NZDJPY stands above its 20,100,200-day Simple Moving Averages (SMAs), reinforcing the predominance of the bulls. However, traders should consider the possibility of a correction in the next session, to consolidate gains.

New Zealand's NZD Trade Balance fell by 976 million in January, adding to the previous month's 368 million decline (revised from -323 million).

The annualized trade balance fell by slightly less at -12.5 billion YoY compared to the previous period's -13.62 billion YoY (revised from -13.57 billion).

January's Imports and Exports both grew less than previous, with MoM Imports coming in at 5.91 billion versus the previous 6.22 billion (revised from 6.26 billion), while monthly Exports came in down by nearly 20% at 4.93 billion compared to the previous 5.85 billion (revised from 5.94 billion).

Market reaction

The NZD/USD remains stuck in near-term chart churn as the pair struggles to make a clean bullish break into the 0.6200 handle, and the Kiwi is adrift near 0.6180.

About New Zealand's Trade Balance

The Trade Balance released by the Statistics New Zealand is a measure of balance amount between import and export, and it is published in New Zealand dollar terms. A positive value shows a trade surplus while a negative value shows a trade deficit. Any variation in the figures influences the domestic economy. If a steady demand in exchange for exports is seen, that would turn into a positive growth in the trade balance, and that should be positive for the NZD.

According to reporting by Axios, the US federal government could be pushed into another government shutdown scenario over spending bills.

The self-titled "Freedom Caucus", a collection of far-right adherents within the US legislature, is pushing for a sweeping set of year-long spending restrictions that could trigger a shutdown within the US government.

Key quotes

The House Freedom Caucus is officially pushing a one-year spending stopgap that could trigger a government shutdown if embraced by Speaker Mike Johnson.

In a new letter to Johnson on Wednesday, Freedom Caucus members say they prefer the spending stopgap if they can't get their way on using the budget process to push other policy priorities.

1% across-the-board cuts will start if there's not a new budget by April 30.

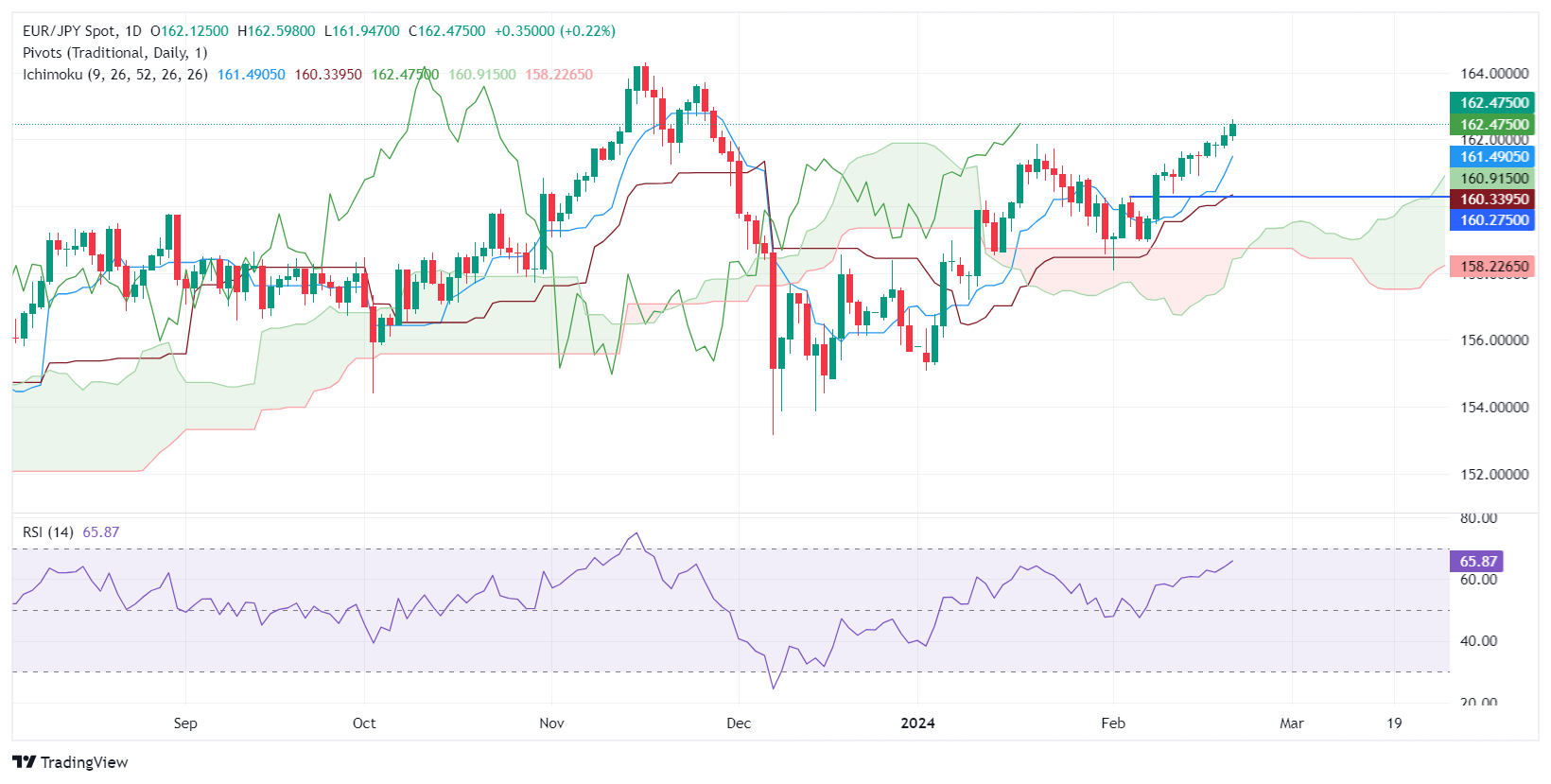

- EUR/JPY ascends to 162.47, marking a continuous rise influenced by recent Fed monetary policy insights.

- Technical analysis points to key resistance levels, with 163.00 and 163.72 as immediate targets.

- Potential pullback could see support tests at 161.48 and 160.91, depending on market dynamics.

The Euro extended its gains for the second straight day against the Japanese Yen and is up by 0.22% as the EUR/JPY trades at 162.47 late during the North American session.

The release of the latest Federal Reserve (Fed) minutes sponsored a leg-up in the EUR/JPY as the EUR/USD edged slightly up. From a technical standpoint, the pair is trading at year-to-date (YTD) highs, aiming to extend its gains. The first resistance would be the 163.00 figure, followed by the November 27 high at 163.72. A further upside is seen at 164.00, followed by last year’s high at 164.31.

On the flip side, if the pair drops below 162.00, that would pave the way to test the Tenkan-Sen at 161.48 before slumping toward the Senkou Span A at 160.91.

EUR/JPY Price Action – Daily Chart

The Greenback remained slightly on the back foot on Wednesday amidst alternating risk appetite trends and the lack of surprises from the FOMC Minutes, while bets on the potential timing of the first rate cut by the Fed continued to dominate the broad sentiment.

Here is what you need to know on Thursday, February 22:

The USD Index (DXY) traded with tepid losses around the 104.00 region against the backdrop of further advances in risk-linked assets. It is PMI day across the board on February 22, while the usual weekly Initial Jobless Claims are also due along with Existing Home Sales, and the Chicago Fed National Activity Index. In addition, FOMC’s Cook, Kashkari, Jefferson, and Harker are due to speak.

EUR/USD maintained its gradual bullish view and rose further north of the 1.0800 hurdle. On February 22, advanced PMIs in Germany and the broader Euroland are expected, seconded by the ECB Accounts and the final Inflation Rate in the euro bloc.

GBP/USD added to Tuesday’s gains and looked to consolidate the move beyond 1.2600 the figure. Preliminary PMIs will be the only releases of note across the Channel on February 22.

USD/JPY kept its multi-session consolidative phase well and sound around the 150.00 zone. In Japan, weekly Foreign Bond Investment readings are scheduled for February 22.

AUD/USD alternated gains with losses in the upper end of the range, an area coincident with the key 200-day SMA around the 0.6560 region. Flash Judo Bank PMIs are due Down Under on February 22.

The resurgence of the tight supply narrative lent support to the prices of WTI, which flirted once again with the $78.00 mark per barrel.

Gold prices advanced modestly to the $2,030 region, maintaining their positive streak in place. In the opposite direction, Silver prices extended their leg lower for the third consecutive day.

- The AUD/JPY trades on gains at 98.33 in Wednesday's session.

- Daily RSI for AUD/JPY suggests bullish momentum with a rising tendency and positive MACD.

- Hourly chart signals possible short-term bearish correction in a bullish bias.

- AUDJPY operating above key SMAs indicates long-term bullish sentiment.

In Wednesday's session, the AUD/JPY pair was spotted making moderate gains, trading at the 98.33 level. The technical landscape exhibits a generally bullish sentiment, boosted by positive momentum in the daily Relative Strength Index (RSI) RSI and Moving Average Convergence Divergence (MACD) histogram. However, a contrasting short-term bearish bias can be glimpsed on the hourly charts, suggesting possible corrective phases. Despite this, the prevailing upward drive exemplified by the pair's position above key SMAs aligns the broader perspective with the bulls.

The daily RSI for the AUDJPY pair hovers in the positive territory with a rising tendency indicating growing bullish momentum in the market. Meanwhile, the MACD histogram prints green bars, signifying positive momentum, and presents an incline that confirms the increasingly bullish sentiment.

AUD/JPY daily chart

Switching to the hourly perspective, the RSI trends lower into the negative territory. This divergence in the RSI values on the daily and hourly charts could hint at a near-term corrective bearish phase within the dominant bullish bias. The MACD histogram here is currently falling, producing red bars, suggesting a slightly stronger negative momentum in the vicinity.

AUD/JPY hourly chart

However, on a broader outlook, with the AUD/JPY operating above its primary SMAs (20, 100, 200-day), indicates the long-term sentiment favors the bulls. Thus, any short-term weakness might be perceived as a healthy technical correction.

- Market shuffles its feet as investors await latest Fed Minutes.

- EU and US PMIs slated for Thursday.

- Friday rounds out the trading week with a smattering of ECB speeches.

EUR/USD drifted into the midrange on Wednesday but is on the soft side as traders wait for the latest Federal Reserve (Fed) Minutes. It is unlikely that the Fed will deliver anything new for traders to chew on though. European and US Purchasing Managers Indices (PMIs) are slated for Thursday, where markets expect a slight improvement in the euro area and a softer print in US activity figures.

Friday wraps up the week with a smattering of speeches from policymakers from the European Central Bank (ECB). The Fed’s latest Monetary Policy Report also drops on Friday.

Daily digest market movers: EUR/USD pulls into the middle ahead of Fed Minutes

- The Fed’s Minutes from its last meeting will be poured over by investors looking for hints about how close the Fed is to cutting rates.

- The Fed still sees around three rate cuts this year, while money markets are still hoping for at least five, according to the CME’s FedWatch Tool.

- Markets are pricing in 70% odds of a first rate trim in June.

- Fed Minutes Preview: Traders await clues for rate outlook as expectations for cuts shift to second quarter

- The EU’s Consumer Confidence in February improved more than expected, printing at -15.5 versus the forecast -15.6, compared to the previous month’s print of -16.1.

- Thursday’s EU HCOB PMIs are broadly expected to recover, with the pan-euro area Composite PMI for February forecast to improve to 48.5 from 47.9.

- A below-50.0 print for the Composite component would represent a ninth straight month in contraction territory.

- Europe’s final Core Harmonized Index of Consumer Prices (HICP) inflation on Thursday is expected to confirm the preliminary print of 3.3% YoY.

- The US is expected to see a slight downtick in its PMI figures, with the Services component forecast to drop to 52.0 from 52.5 and the Manufacturing component expected to drop to 50.5 from 50.7.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the Swiss Franc.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.02% | 0.03% | -0.07% | 0.20% | 0.24% | 0.00% | -0.16% | |

| EUR | -0.01% | 0.02% | -0.09% | 0.19% | 0.22% | -0.02% | -0.18% | |

| GBP | -0.03% | -0.01% | -0.10% | 0.17% | 0.22% | -0.03% | -0.18% | |

| CAD | 0.07% | 0.08% | 0.10% | 0.26% | 0.30% | 0.06% | -0.09% | |

| AUD | -0.19% | -0.19% | -0.18% | -0.29% | 0.04% | -0.22% | -0.37% | |

| JPY | -0.24% | -0.23% | -0.21% | -0.31% | -0.03% | -0.24% | -0.41% | |

| NZD | 0.01% | 0.02% | 0.04% | -0.07% | 0.20% | 0.23% | -0.15% | |

| CHF | 0.14% | 0.16% | 0.19% | 0.09% | 0.37% | 0.40% | 0.16% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: EUR/USD grapples with 1.0800

EUR/USD remains on the bullish side of the 200-hour Simple Moving Average (SMA) near 1.0767 as the pair drifts into the high end in the near term. Price action has continued to extend a rough recovery from last week’s dip into the 1.0700 handle, but halting momentum sees bullish sentiment beginning to thin at the intraday level.

Daily candlesticks have the pair knocking into the 200-day SMA near 1.0830, and topside momentum is facing a significant technical ceiling. The EUR/USD is still facing a pattern of descending highs, and the pair is still down around 3% from December’s peak bids near 1.1140.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Gold price threatens to end its streak of gains amid rising US Treasury yields.

- Market turns cautious ahead of FOMC Minutes and due to recent hawkish Fed indications.

- Adjustments in Fed rate forecasts following inflation reports and bond auctions affect Gold's appeal.

Gold price retreats on Wednesday after registering four days of straight gains as US Treasury bond yields rise in the vicinity of the release of the Minutes from the Federal Reserve’s (Fed) monetary policy meeting in January. Global equities portray a risk-off environment, while US Treasury bond yields resume to the upside amid speculation that the Minutes could reinforce the “hawkish hold” delivered by Fed Chairman Jerome Powell and his colleagues. At the time of writing, the XAU/USD exchanges hands at $2,022.51, down 0.07%.

Traders are eyeing the release of the Federal Open Market Committee (FOMC) Minutes. Fed officials crossed the newswires, expressing that the US central bank would begin to ease monetary policy toward the second half of 2024. However, on the consumer and producer side, January’s inflation data could cause policymakers to refrain from slashing rates as prices escalated above the 3% threshold.

That triggered a repricing on Fed rate cut expectations as shown by the Chicago Board of Trade (CBOT) data, with traders expecting the Federal Funds Rate (FFR) would be at 4.55% by the end of 2024.

Recently, a US 20-year bond auction triggered a jump in US Treasury yields, with the 10-year note yield up five basis points to 4.327%, a headwind for Gold prices.

Daily digest market movers: Gold retraces as traders expect less dovish Fed

- The CME FedWatch Tool sees traders expect the first 25 bps rate cut by the Fed in June 2024.

- Investors are pricing in 95 basis points of easing throughout 2024.

- The US Dollar Index, tracking the performance of the US Dollar against a basket of six major currencies, is currently trading within a narrow range around 104.10, up 0.03%.

- The latest inflation reports from the US triggered a change of language from Fed officials, who struck a “cautious” tone. Atlanta Fed President Raphael Bostic suggested the Fed is in no rush to ease policy.

- Richmond Fed President Thomas Barkin said the latest inflation reports were “less good,” adding that the US has “a ways to go” to achieve a soft landing.

- San Francisco Fed President Mary Daly stated, “We will need to resist the temptation to act quickly when patience is needed and be prepared to respond agilely as the economy evolves.”

- This week the US economic schedule will feature the release of the latest Federal Reserve Open Market Committee (FOMC) Minutes alongside Fed officials' speeches beginning on Wednesday.

- Traders will get further cues from US S&P Global PMIs, Initial Jobless Claims data and the Chicago Fed National Activity Index, usually a prelude to the Institute for Supply Management's (ISM) Manufacturing PMI.

Technical analysis: Gold stays above 100-day SMA, eyes key resistance near 50-day SMA

Gold is trading range-bound though tilted to the downside as the yellow metal has achieved a successive series of lower highs and lows. Stir resistance at the 50-day Simple Moving Average (SMA) at $2,033.54 might cap XAU/USD’s upside, but if cleared, that would pave the way to test the $2,050.00 figure. Upside risks lie at $2,065.60, the February 1 high.

On the flip side, if sellers step in and push prices below the $2,000 figure, that will expose the 100-day SMA at $2,002.05. The next stop would be the December 13 low at $1,973.13, followed by the 200-day SMA at $1,965.86.

Gold FAQs

Why do people invest in Gold?

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Who buys the most Gold?

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

How is Gold correlated with other assets?

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

What does the price of Gold depend on?

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- The NZD/USD is trading at 0.6167 with mild gains amid Wednesday's session.

- FOMC minutes might impact as the USD could strengthen on an unchanged Fed interest rates outlook.

- The RBNZ's policy rate outlook may add pressure on the NZD/USD pair amidst falling inflation.

In Wednesday's session, the NZD/USD traded modestly higher at 0.6167 with the upside limited amid speculations of the Federal Reserve’s (Fed) unchanged rate outlook and softer New Zealand inflation data making the Kiwi struggle to gain ground.

Ahead of the Federal Open Market Committee (FOMC) minutes, the USD holds its ground, with recent data reinforcing the notion that the Federal Reserve is unlikely to lower interest rates in the near term. However, markets will look for insights into the minutes to see the openness of the officials to start cutting or any additional information to continue shaping their expectations for the next meeting. As for now, the easing cycle is being delayed to June.

On the other side of the currency pair, New Zealand reported Q4 Producer Price Index (PPI) with input prices rising by 0.9% QoQ, down from Q3's 1.2%, and output prices by 0.7% QoQ, a slight reduction from 0.8% in the previous quarter. However, a year-on-year view saw an uptick in input prices of 1.9% from Q3's 1.5%. Even though inflation remains high in New Zealand, the easing pressures indicate a trend towards disinflation putting off additional tightening measures from the Reserve Bank of New Zealand’s (RBNZ) back. This aligns with the market expectations of disinflation continuing, and the RBNZ maintaining the policy rate hovering above its neutral estimate, with no additional tightening expected. In that sense, as the Fed and RBNZ seem to align, the pace of the pair may be dictated by the health of each country’s economies.

NZD/USD technical analysis

On the daily chart, the Relative Strength Index (RSI) readings for the NZD/USD show an escalation from the negative territory into the positive zone in the last sessions while the Moving Average Convergence Divergence (MACD) prints green bars, indicating that the bulls are in command.

In relation to the pair's position related to its main Simple Moving Averages (SMAs), it is positioned above the 20, 100, and 200-day SMAs, suggesting a longer-term bullish control.

NZD/USD daily chart

- GBP/JPY tested into the high end as the Yen recedes.

- UK Public Sector Net Borrowing declined sharply in January.

- UK PMIs due in Thursday, markets expected a mixed steady print.

GBP/JPY rotated on Wednesday, marking in a slight new high for the week as the Pound Sterling (GBP) gets a leg up from a broad-market pullback in the Japanese Yen (JPY). Bank of England (BoE) policymaker Swati Dhingra noted on Wednesday that the outlook for UK inflation remains bumpy, but downwards, noting that UK consumption still remains below pre-pandemic levels as the UK lags behind its developed economy cohorts in Europe and the US.

UK Public Sector Net Borrowing, which tracks the UK government’s budget surplus or deficit, tumbled to its lowest print in at least fifteen years, showing a net decline of £-17.615 billion, far below the forecast £18.4 billion. The figure fell back from the previous MoM print of £6.451 billion, though the National Statistics office tracking of the UK’s federal budget is prone to revisions as time goes on.

Thursday brings the UK’s latest Purchasing Manager’s Index (PMI) figures for February, and markets are expecting the UK S&P Global/CIPS Services PMI to tick down to 54.1 from 54.3 MoM. The Manufacturing PMI component is forecast to see a slight improvement to 47.5 from 47.0, and the Composite UK PMI is expected to hold steady at 52.9.

February’s GfK Consumer Confidence slated for Friday is expected to see a slight improvement to -18.0 from -19.0 to round out the trading week, and Japan will be out for Thursday as the country celebrates Japanese Emperor Naruhito’s birthday.

GBP/JPY technical outlook

The Guppy continues to drift into the high end with the pair sticking close to its highest bids since 2015. The GBP/JPY continues to be bolstered by the 200-hour Simple Moving Average (SMA) near 189.00 in the near-term, and momentum is holding firmly in the bullish side despite slowing gains on the chart.

The GBP/JPY continues to test into the 190.00 major handle, and the pair sees firm technical support after rebounding from the 200-day SMA below 182.00 in early 2024. The pair remains up around 6% from December’s choppy swing low into 178.00.

GBP/JPY hourly chart

GBP/JPY daily chart

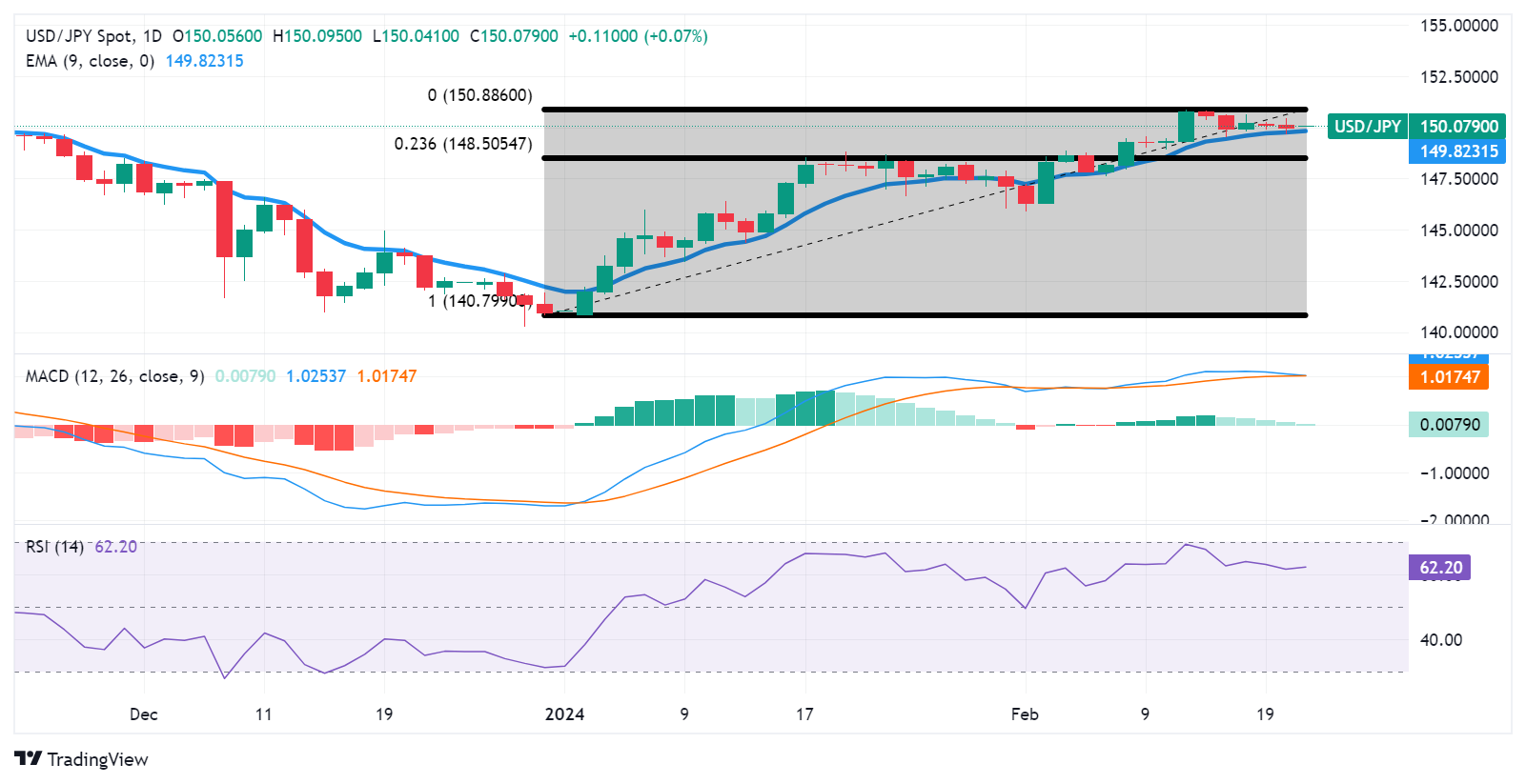

- USD/JPY reaches 150.30, gaining ahead of key Fed meeting insights, maintaining an upward trajectory.

- Technical indicators highlight bullish stance, with potential resistance near 151.00 amid intervention concerns.

- Support levels at 149.91 and 149.15 to be tested if retreat below 150.00 occurs, signaling possible shifts.

The USD/JPY climb above the 150.00 figure extended its gains ahead of the release of the minutes of the lates Federal Reserve’s (Fed) meeting. At the time of writing, the pair trades at 150.30, up by 0.20%.

The daily chart portrays the pair as upward biased, sigting above the Ichimoku Cloud (Kumo) and above the Tenkan and Kijun-Sen. That along with Relative Strength Index (RSI) studies at bullish territory, would suggest the USD/JPY could test the 151.00 figure and beyond, if not for Japanese authorities threats to intervene the markets. A breach above 151.00 would expose last year’s high of 151.91.

Conversely, if USD/JPY drops below the 150.00 mark, that would exacerbate a test of the Tenkan-Sen at 149.91. Once cleared, the next support would be the Senkou Span A at 149.15, followed by the Kijun-Sen at 148.39.

USD/JPY Price Action – Daily Chart

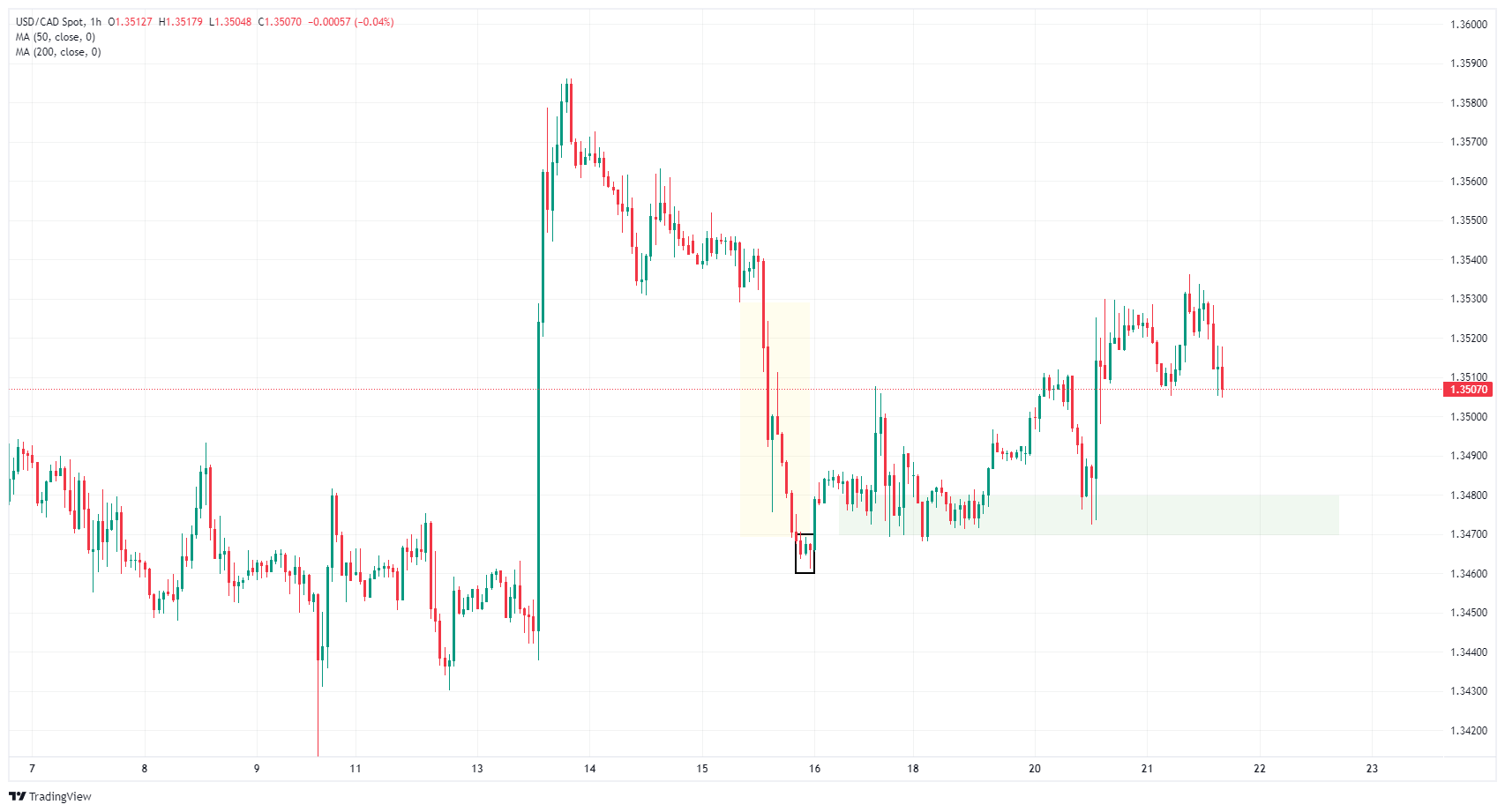

- USD/CAD tested a new high for the week but remains tepid.

- Canada’s New Housing Price Index declined slightly in January.

- Fed’s FOMC meeting Minutes to be the key release for Wednesday.

USD/CAD briefly tested a fresh high for the week, but the pair continues to churn in near-term consolidation levels as markets buckle down for the latest meeting Minutes from the Federal Reserve’s (Fed) Federal Open Market Committee (FOMC). Market momentum remains thin with US Purchasing Managers Index (PMI) figures due on Thursday, and the trading week will wrap up with the Fed’s latest Monetary Policy Report on Friday.

Canada saw its New Housing Price Index decline in January with the annualized figure softening at a slower rate than previous. Canadian Retail Sales are due on Thursday but are likely to be engulfed by the US PMI prints.

Daily digest market movers: USD/CAD cycles ahead of FOMC with key data around the corner

- Canada’s New Housing Price Index declined 0.1% in January MoM versus the previous flat print of 0.0%.

- The YoY figure fell 0.7%, less than the previous print of -0.9%.

- The FOMC’s latest meeting Minutes will draw plenty of scrutiny as money markets size up a June rate cut from the Fed.

- Fed Minutes Preview: Investors to scrutinize discussions as markets lean toward June for rate cuts

- Meanwhile, Richmond Fed President Thomas Barkin hit newswires, noting that while the US is on the “back end” of its inflation problem, there’s still further to go.

- Barkin also noted that much of the current declines in inflation have been centered around goods, with services prices remaining problematic for the Fed’s inflation targets.

- Fed's Barkin: Still ways to go to get to a soft landing

- Canada’s Retail Sales due on Thursday are expected to rebound with December’s MoM Retail Sales forecast to print at 0.8% versus the previous print of -0.2%.

- The US’ S&P Global Manufacturing PMI for February, also slated for Thursday, is expected to tick down to 50.5 from 50.7.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the Swiss Franc.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.03% | 0.00% | -0.11% | 0.14% | 0.20% | -0.10% | -0.22% | |

| EUR | 0.04% | 0.04% | -0.06% | 0.18% | 0.23% | -0.06% | -0.18% | |

| GBP | 0.00% | -0.04% | -0.11% | 0.13% | 0.21% | -0.10% | -0.21% | |

| CAD | 0.11% | 0.06% | 0.10% | 0.24% | 0.30% | 0.00% | -0.11% | |

| AUD | -0.13% | -0.22% | -0.14% | -0.25% | 0.06% | -0.24% | -0.36% | |

| JPY | -0.21% | -0.23% | -0.19% | -0.32% | -0.07% | -0.30% | -0.38% | |

| NZD | 0.10% | 0.06% | 0.10% | -0.01% | 0.23% | 0.30% | -0.12% | |

| CHF | 0.21% | 0.18% | 0.22% | 0.11% | 0.36% | 0.41% | 0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: USD/CAD adrift just north of 1.3500

USD/CAD found a little extra room on the high side early Wednesday, touching a new high for the trading week, but the pair remains firmly embedded in near-term technical congestion. The USD/CAD is sticking close to the 1.3500 handle as markets await a firm push in either direction.

The pair finally finished closing last week’s Fair Value Gap (FVG) at 1.3530. The USD/CAD sees a heavy support zone between 1.3480 and 1.3470, just above last week’s Order Block (OB) near 1.3460. Technicals favor a continued bullish break of character, but only if the pair is able to build enough momentum to return to last week’s peak bids near 1.3585.

Daily candles see the USD/CAD continuing to struggle near the 200-day Simple Moving Average (SMA) at 1.3478, but a pattern of higher lows supports a thin push into the bullish side. The USD/CAD is up 2.5% from the last swing low into the 1.3200 handle but still has a ways to go on the high side, still down nearly 3% from last November’s peak near 1.3900.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- Mexican Peso is virtually unchanged as Mexico's Retail Sales decline hints at economic pressure.

- Recent data may influence Banxico's rate decisions amidst reduced consumer spending reports.

- Investors' focus shifts to FOMC Minutes for insight into the Fed's rate trajectory and its impact on MXN.

The Mexican Peso (MXN) stays firm against the US Dollar (USD) even though data from Mexico suggests that consumers are spending less, which should weigh on the economy’s outlook. That capped the Peso’s advance while traders awaited the release of the latest Federal Reserve (Fed) meeting Minutes. At the time of writing, the USD/MXN exchanges hands at 17.05, unchanged.

Mexico’s National Statistics Agency revealed that Retail Sales plunged in December, in both monthly and annual figures, an indication that consumers are feeling the pain of higher interest rates set by the Bank of Mexico (Banxico). Today’s data summed to Monday’s Indicator of Economic Activity (IOAE), suggesting the economy shrank -0.7% MoM in January, which could weigh on Banxico’s decision to lower rates at the March meeting.

USD/MXN traders are eyeing the release of the Federal Open Market Committee (FOMC) January Minutes, which are not expected to rock the boat sharply. After the monetary policy statement release last month, Fed Chair Jerome Powell threw cold water on a rate cut in March, while most policymakers commented that the Fed is in no rush to cut rates.

Daily digest market movers: Mexican Peso fluctuates between minimal gains/losses ahead of Fed Minutes

- Mexico’s Retail Sales dropped -0.9% MoM, below estimates of 0.2% expansion. Yearly figures plummeted -0.2% vs. the forecast of a 2.5% increase.

- The Mexican currency could depreciate further if the Mexican government fails to resolve the steel and aluminum dispute with the United States. US Trade Representative Katherine Tai warned the US could reimpose tariffs on the aforementioned commodities.

- Mexico’s economic schedule will feature the release of the Gross Domestic Product (GDP) and February’s Mid-Month inflation data on Thursday.

- GDP is projected to have grown 0.1% in Q4 2023 and 2.4% YoY.

- Mid-month underlying inflation for February is foreseen cooling from 4.78% to 4.67 YoY, while headline inflation is projected to drop from 4.9% to 4.7%.

- On Tuesday, the Conference Board (CB) revealed its Leading Economic Index (LEI), which no longer signals an upcoming recession in the US.

- Recently, Richmond Fed President Thomas Barkin said the latest inflation reports were “less good,” adding the US has “a ways to go” to achieve a soft landing.

- Traders will get further cues from US S&P Global PMIs, Initial Jobless Claims data and the Chicago Fed National Activity Index. The latter is usually a prelude to the Institute for Supply Management’s (ISM) Manufacturing PMI.

- US economic data related to price pressures should greatly influence Federal Reserve officials. Although opening the door to easing policy, Fed officials have expressed numerous times that they will not rush rate cuts.

- Fed’s Bostic said patience is required, and he foresees two rate cuts, which could begin in the summer if the data justifies it. Fed’s Daly said, “We will need to resist the temptation to act quickly when patience is needed and be prepared to respond agilely as the economy evolves.”

- Market players are expecting the first rate cut by the Federal Reserve at the June monetary policy meeting as they have trimmed odds for March and May.

Technical analysis: Mexican Peso prints minimal losses as USD/MXN breaks above 17.05

The USD/MXN remains in consolidation, at around 17.05, awaiting a fresh catalyst. If buyers regain the 50-day Simple Moving Average (SMA) at 17.07, the pair could rally toward the 200-day SMA at 17.28. A breach of the latter will expose the 100-day SMA at 17.38, ahead of the 17.50 mark.

On the other hand, if sellers’ step in and cap USD/MXN’s upside, they need to push prices below the 17.00 figure. Once cleared, the next support would be the current year-to-date (YTD) low of 16.78, followed by the 2023 low of 16.62.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The US Dollar Index shows some weakness ahead of FOMC Minutes from the January meeting with a slight decline to 104.00.

- The Fed's intention to keep rates untouched may fuel further gains for the US Dollar.

The US Dollar Index (DXY) experienced a slight setback, resting at 104.00 in Wednesday’s session.

The US economy, backed by robust data, shows resilience, reflected in the strength of the Greenback in 2024. Meanwhile, the Federal Reserve (Fed) maintains a hawkish stance, dismissive of near-term rate cuts and keen on keeping rates at restrictive levels. The market aligns progressively with this view, reinforcing expectations of a delayed easing cycle.

Daily digest market movers: The US Dollar struggles to gain ground as investors look for drivers in the FOMC minutes

- The market’s highlight will be the release of the Federal Open Market Committee (FOMC) Minutes from the last January meeting at 19:00 GMT, which may fuel volatility in the next Fed decision expectations.

- As for now, the CME FedWatch Tool indicates a 20% chance of a rate cut at the next meeting in March and also remains low for May, reflecting the market sentiment leaning toward the Fed's intent to hold rates steady at restrictive levels.

- Markets are now pushing the start of the interest rate easing to June.

Technical analysis: DXY bulls stand weak and must recover the 100-day SMA

The indicators on the daily chart reflect a balance between buying and selling pressure. The Relative Strength Index (RSI) is in positive territory, but its negative slope suggests that buying momentum is losing steam. The Moving Average Convergence Divergence (MACD), with its decreasing green bars, implies that any bullish momentum is weakening and could potentially flip into a bearish bias.

Furthermore, the positioning of the index compared with its Simple Moving Averages (SMAs) provides an interesting perspective. Despite the bearish pressure, bulls have managed to keep the DXY above the 20-day and 200-day SMAs. This suggests that buyers continue to wield some strength in the broader time horizon.

However, the Dollar Index being below the 100-day SMA may hint at intermediate barriers for bullish movements. Hence, while the broader trend might still be inclined toward buyers, the short-term outlook presents a battle for control between bulls and bears.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

More and more ECB representatives believe that the inflation beast will soon be tamed. Economists at Commerzbank analyze domestic inflationary pressure and the latest inflation surveys among companies and show that it is far too early to sound the all-clear.

More companies are planning price increases again

The significant fall in inflation rates in the Euro Area obviously gives the ECB hope that the sharp rise in consumer prices has been halted. However, a closer look at the price trends in Germany calls for caution here. This is because the decline in the inflation rate has so far been solely due to the slowdown in external inflationary pressure, while domestic price pressure remained strong until the end of last year.

In addition, more companies have recently stated in the Ifo survey that they intend to raise their prices in the coming months.

As the situation is similar in the Euro Area, underlying inflation there should stabilize well above the ECB's inflation target of 2%.

Disappointment summarises the start of 2024 for the Australian Dollar (AUD). Economists at ING analyze Aussie’s outlook.

Softer data does not mean big RBA cuts

Australian inflation declined more than expected in the fourth quarter, and the RBA’s pushback against rate cut bets was also challenged by soft employment figures for January. That said, we do not doubt the determination of the RBA to keep rates higher for some time. Our expectations remain that monetary easing in Australia will only be a story for the second half of the year and be worth a total of 50 bps – significantly less than the Fed and RBNZ.

AUD is in a good position to rally once US data allows rate cut bets to rebound in the US, even though potential defensive positioning ahead of US elections in the third quarter (a Trump re-election would hit China-related sentiment) means AUD/USD could struggle to trade consistently above 0.7000.

- EUR/USD remains stable at 1.0807, with USD gaining ground amid anticipation of FOMC minutes.

- German economic growth projection for 2024 slashed to 0.2%, stoking recession fears.

- US Fed officials signal cautious approach to rate cuts, awaiting disinflation signs in labor and goods markets.

The EUR/USD pair is virtually unchanged in early trading during the North American session, as the Greenback (USD) trims some weekly losses, as the US Dollar Index (DXY) edges back above 104.00. At the time of writing, the major exchanges hands at 1.0807.

DXY rebounds over 104.00; German outlook and FOMC minutes eyed

The Eurozone (EU) economic docket was light, though news from Germany could weigh on the common currency. The German government updated its forecasts for 2024 expecting an economic growth of 0.2%, far less than the 1.3% previously foreseen. A weaker global demand, geopolitical uncertainty, and high inflation dent an economic recovery. In 2023, the economy shrank -0.3%, expected to enter a recession in the first quarter of 2024.

Regarding the economic situation, German Economy Minister Robert Habeck added, “Looking ahead, however, we see clear signs that the trend can improve again,” at a news conference presenting the annual economic report.

In the US, traders are awaiting the release of the latest Federal Open Market Committee (FOMC) minutes. However, the Richmond Fed President Thomas Barkin said the latest CPI and PPI reports were “less good,” showing the dependence of disinflation on goods. He commented that the labor market is improving while emphasizing the US has a “ways to go” to get a soft landing.

US Treasury bond yields had paired their earlier gains as investors await the release of January’s FOMC minutes. Since then, Federal Reserve (Fed) officials have expressed they are ready to cut rates but would not rush the beginning of the easing cycle. Later, the Atlanta Fed President Raphael Bostic will cross the wires.

EUR/USD Price Analysis: Technical outlook

Even though EUR/USD buyers regained the 1.0800 figure, the pair remains vulnerable to selling pressure after failing to reclaim the 200-day moving average (DMA) at 1.0826. If the pair slumps below 1.0800, look for a test of the day’s low of 1.0789 before tumbling toward February’s 20 low at 1.0761. Further downside lies at 1.0700, ahead of the last cycle low of 1.0694. Conversely, if buyers regain the 200-DMA, expect a test of the 1.0900 mark.

Economists at ANZ Bank currently favour an August cut from the Bank of England (BoE), but the main message is rates will be falling this summer.

Conditions for UK rate cuts unfold, August favoured

The conditions for rate cuts from the BoE this summer are unfolding, and we expect sharp falls in inflation as the economy moves through Q2. However, much of the reduction in inflation will be driven by base effects from lower energy and utility prices. The MPC will need to disentangle transient from more permanent signals on inflation. We think wage growth developments will help provide a yardstick for gauging underlying inflation trends.

Rather than rushing into rate cuts, we think there is merit in waiting for as much data as possible to be confident that inflation is sustainably on track to meeting the 2% inflation goal. That is why we currently favour an August rate cut over the preceding meeting in June. The August meeting will also be accompanied by the BoE’s updated economic and inflation forecasts.

The market is clearly pre-disposed towards holding an optimistic outlook on Federal Reserve rate cut prospects. Economists at Rabobank analyze its implications for the US Dollar (USD).

Market continues to recalibrate the pace and order of policy moves in the G10

Market implied policy rates indicate that the Fed is expected to cut rates by around 37 bps on a six-month view. This is more than is expected for most other G10 central banks.

We see scope for more broad-based USD strength over the spring as the market continues to recalibrate the pace and order of policy moves in the G10.

It is clear that the process of calibrating the timing and pace of central bank policy moves this year still has some way to go.

Given the relative resilience of the US economy compared with its peers and in consideration of the number of Fed rate cuts still priced in for this year, we see the USD as likely finding broad-based support as this process continues.

"Monetary policy needs to be forward-looking because moderation of the policy stancerequires time to implement and to feed through to the real economy," Bank of England (BoE) policymaker Swati Dhingra said on Wednesday.

"The outlook for headline inflation appears bumpy but downwards," she added and acknowledged that the UK consumption remains below pre-pandemic level, striking a contrast to the Euro area and the United States.

Dhingra further argued that overtightening the policy often comes with hard landings and scarring of supply capacity.

Market reaction

GBP/USD largely ignored these comments and was last seen rising 0.1% on the day at 1.2630.

- The Fed will release the minutes of the January policy meeting on Wednesday.

- Jerome Powell and co’s discussions surrounding the policy pivot will be scrutinized.

- The US Dollar has been outperforming its major rivals since the beginning of the year.

The Federal Reserve (Fed) will release the minutes of the January policy meeting on Wednesday. Investors will pay close attention to comments regarding the inflation outlook and the possible timing of a policy pivot.

Fed is widely expected to leave the policy rate unchanged in March.

Federal Reserve Chairman Jerome Powell said in the post-meeting press conference in January that he doesn’t see a rate cut in March as likely. "If we saw [an] unexpected weakening in the labor market, that would make us cut rates sooner,” Powell further explained. After the January labor market report showed that Nonfarm Payrolls rose by 353,000, investors saw that as a confirmation of a delay in the policy pivot and refrained from pricing in a rate cut in March.

With an interest rate reduction as early as March becoming increasingly unlikely, investors started to assess whether May would be the right time for the Fed to start loosening the policy. However, the recent data from the US showed that the economy expanded at a stronger pace than expected in the fourth quarter and the disinflation process lost momentum at the beginning of the year. The Bureau of Labor Statistics reported that core inflation in the US, as measured by the change in the Core Consumer Price Index (CPI), rose 3.9% in January, matching December's increase and surpassing analysts' estimate of 3.7%. Following these developments, the probability of a May rate cut declined toward 30% from above-50% earlier in February, as per the CME FedWatch Tool.

Previewing the January FOMC Minutes “the FOMC's change of tone between the December and January meetings portrayed a Committee that has welcomed the progress made on inflation, but that would prefer to see further confirmation amid strong activity data,” TD Securities analysts said in a note. “The minutes are likely to unveil further color regarding those discussions, as well as talks around QT tapering.”

When will FOMC Minutes be released and how could it affect the US Dollar?

The Fed will release the minutes of the January policy meeting at 19:00 GMT on Wednesday. The USD Index (DXY), which tracks the USD’s valuation against a basket of six major currencies, rose more than 2% in January and it’s up 0.65% so far in February.

The market positioning suggests that the USD has more room on the upside if FOMC Minutes feed into expectations for a delay in the policy pivot until June. On the other hand, the USD could come under renewed selling pressure if the publication shows that policymakers are willing to consider a rate reduction by May. However, policymakers’ comments in the minutes are likely to be outdated due to the fact that the meeting took place before the latest inflation and employment data releases. Hence, the market reaction could remain short-lived.

Eren Sengezer, European Session Lead Analyst at FXStreet, shares a brief technical outlook for the USD Index:

“The 100-day Simple Moving Average and the Fibonacci 50% retracement of the October-December downtrend form a pivot area at 104.00-104.10. If DXY fails to stabilize above this region, 103.70 (200-day SMA) aligns as the next important support before 103.25 (Fibonacci 38.2% retracement). Looking north, 104.75 (Fibonacci 61.8% retracement) and 105.00 (psychological level, static level) could be set as the next bullish targets in case 104.00-104.10 holds as support.”

US Interest rates FAQs

What are interest rates?

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%.

If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

How do interest rates impact currencies?

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

How do interest rates influence the price of Gold?

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank.

If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

What is the Fed Funds rate?

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure.

Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Over the past six months, Gold prices have risen over 3%. Economists at ANZ Bank analyze the yellow metal’s outlook.

Gold’s recent price consolidation is likely to extend till the end of Q1

Gold’s recent price consolidation is likely to extend till the end of the first quarter. However, we expect the price to rise towards $2,200 by year-end.

Upcoming elections and prospective rate cuts will support Gold investment.

See – Gold Price Forecast: Fed policy will remain key to the outlook for XAU/USD in the months ahead – ING

In an interview with Sirius XM on Wednesday, Richmond Federal Reserve Bank President Thomas Barkin said that the US still has "ways to go" go get to a soft landing, per Reuters.

Key takeaways

"Big picture of US data on inflation and jobs has been remarkable."

Recent data on PPI and CPI have been less good, showing dependence of disinflation on goods."

"January data made things harder but should not put too much weight on the month's information given seasonal issues."

"Ease of hiring is not yet back to normal but conditions are improving."

"Interest sensitive sectors are struggling but people still have money to spend on services, experiences."

"Productivity metrics are poor, need to be viewed over longer time periods."

"Weaker growth overseas should not have much impact on a US recovery driven by domestic consumption."

"US is on the back end of its inflation problem; question now is how much longer it will take."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen trading flat on the day at 104.05.

- Wall Street's main indexes are set to open lower on Wednesday.

- Investors await Federal Reserve's January policy meeting minutes.

- Nasdaq futures are down more than 0.5% ahead of the opening bell.

S&P 500 futures fall 0.35%, Dow Jones futures drop 0.24%, and Nasdaq futures lose 0.64% ahead of the opening bell on Wednesday.

S&P 500 (SPX) fell 0.6% on Tuesday, Dow Jones (DJIA) lost 0.17% and Nasdaq (IXIC) declined 0.92%.

What to know before stock markets open

- The Consumer Staples Sector rose 1.13% as the best-performing major S&P sector on Tuesday. The Technology Sector plunged 1.7% before hitting the Tuesday close in the red 1.27% as the weakest major sector.

- Discover Financial Services (DFS) was the biggest gainer on the day, rising 12.6% to close at $124.42 on Tuesday. On the other hand, Expeditors International of Washington Inc. (EXPD) fell 6.9% to end at $115.57 as one of the biggest decliners, just beat out by Trade Desk Inc. (TTD), which fell 7.163% to hit closing bell at $82.56.

- Retailer giant Walmart Inc. (WMT) reported an adjusted earning per share of $1.8 ahead of the opening bell on Tuesday. The company said that it expects consolidated net sales to rise in the range of 3%-4% and announced that it will buy smart-TV producer Vizio (VZIO) for about $2.3 billion.

- Home Depot Inc. (HD) said net income in Q4 was $2.8 billion and the adjusted earnings per share was $2.82. The company, however, said that if projects sales for the fiscal year 2024 to be below estimates, citing slowing demand for discretionary items such as flooring, furniture and kitchen, per Reuters.

- The Federal Reserve will release the minutes of the January policy meeting on Wednesday. On Thursday, preliminary February Manufacturing and Services PMI reports for Germany, the Euro area, the UK and the US will be scrutinized by market participants.

- NVIDIA Corp. (NVDA) and Synopsys Inc. (SNPS) will release quarterly earnings after the closing bell on Wednesday.

- The Bureau of Labor Statistics reported on Friday that the Producer Price Index (PPI) for final demand in the US rose 0.9% on a yearly basis in January. This reading followed the 1% increase recorded in December but came in above the market expectation of 0.6%. The annual Core PPI rose 2% in the same period, compared to December's increase of 1.8%. On a monthly basis, the Core PPI was up 0.5% following the 0.1% decline recorded in the previous month.

- Inflation in the US, as measured by the change in the Consumer Price Index (CPI), softened to 3.1% on a yearly basis in January from 3.4% in December, the BLS reported on Tuesday. This reading came in above the market expectation of 2.9%. The Core CPI, which excludes volatile food and energy prices, rose 3.9% in the same period and matched December's increase, surpassing analysts' estimate of 3.7%.

S&P 500 FAQs

What is the S&P 500?

The S&P 500 is a widely followed stock price index which measures the performance of 500 publicly owned companies, and is seen as a broad measure of the US stock market. Each company’s influence on the computation of the index is weighted based on market capitalization. This is calculated by multiplying the number of publicly traded shares of the company by the share price. The S&P 500 index has achieved impressive returns – $1.00 invested in 1970 would have yielded a return of almost $192.00 in 2022. The average annual return since its inception in 1957 has been 11.9%.

How are companies chosen to be included in the S&P 500?

Companies are selected by committee, unlike some other indexes where they are included based on set rules. Still, they must meet certain eligibility criteria, the most important of which is market capitalization, which must be greater than or equal to $12.7 billion. Other criteria include liquidity, domicile, public float, sector, financial viability, length of time publicly traded, and representation of the industries in the economy of the United States. The nine largest companies in the index account for 27.8% of the market capitalization of the index.

How can I trade the S&P 500?

There are a number of ways to trade the S&P 500. Most retail brokers and spread betting platforms allow traders to use Contracts for Difference (CFD) to place bets on the direction of the price. In addition, that can buy into Index, Mutual and Exchange Traded Funds (ETF) that track the price of the S&P 500. The most liquid of the ETFs is State Street Corporation’s SPY. The Chicago Mercantile Exchange (CME) offers futures contracts in the index and the Chicago Board of Options (CMOE) offers options as well as ETFs, inverse ETFs and leveraged ETFs.

What factors drive the S&P 500?