- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-02-2023

Early Wednesday at 01:00 GMT market sees the key monetary policy decision by the Reserve Bank of New Zealand (RBNZ) amid hopes of another hawkish play by the New Zealand central bank.

RBNZ is up for fueling the market moves with its 10th consecutive rate hike, expectedly worth 0.50%, during early Wednesday. The Interest Rate Decision will be accompanied by the updated economic forecasts in the RBNZ Rate Statement, up for publishing at 01:00 GMT, whereas a press conference with RBNZ Governor Adrian Orr will follow at 02:00 GMT.

The same could push the New Zealand central bank towards announcing 50 basis points (bps) increase to the benchmark rates, from 4.25% to 4.75%.

It’s worth noting that the RBNZ paused its five 50bp rate hike trajectory with a whopping 0.75% increase in the benchmark rate during November 2022.

Ahead of the event, Australia and New Zealand Banking Group (ANZ) said,

We expect a 50bp hike. On balance, local data since the November MPS have pointed towards inflation pressures not being quite as bad as the RBNZ assumed. But the war on inflation is far from won.

On the same line, analysts at Westpac said,

In response to a still intense inflation outlook, the RBNZ is widely expected to deliver a 50bp rate hike to 4.75%, while their forecast for the peak OCR may be lowered slightly. Market pricing is a little short of 50bp for today, perhaps reflecting the cyclone impact on spending and confidence. Markets price the OCR to peak around 5.4%.

On the same line, FXStreet’s Dhwani Mehta said,

Any reaction to the RBNZ policy announcement could be soon reversed, as the dust settles and investors reposition ahead of the Minutes of the US Federal Reserve (Fed) February meeting.

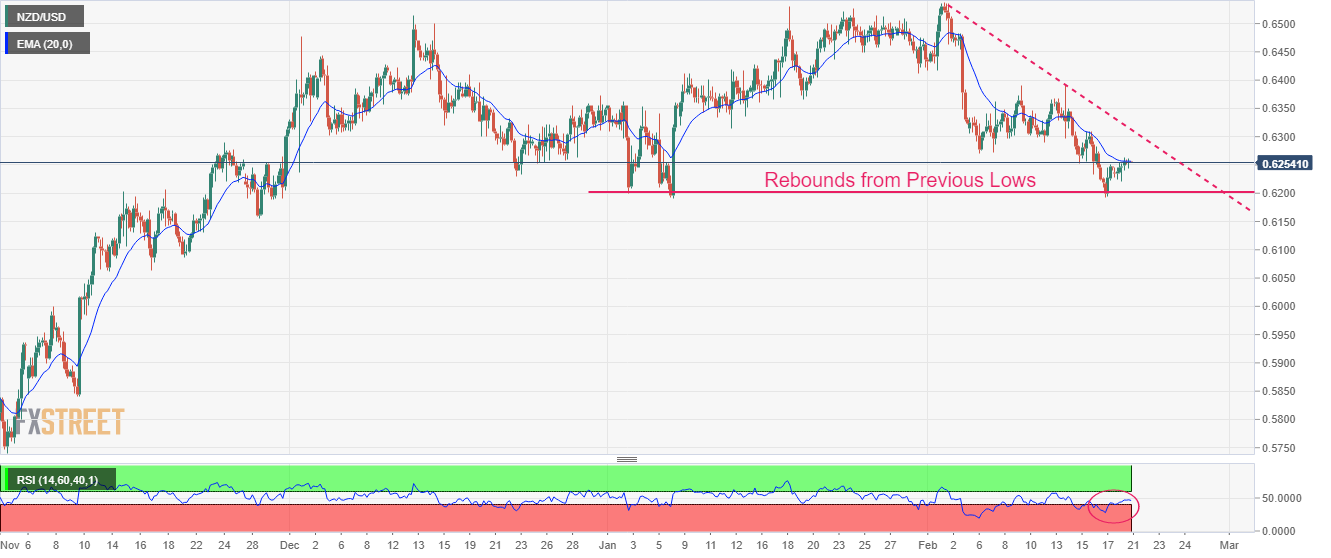

How could it affect NZD/USD?

NZD/USD stays defensive above 0.6200, mildly bid around the seven-week low as the 200-DMA defends Kiwi pair buyers even as the broad US Dollar strength, backed by upbeat US data, weigh on prices. It should be noted that the quote’s latest corrective bounce could be linked to the market’s preparations for the Federal Open Market Committee’s (FOMC) Monetary Policy Meeting Minutes.

Earlier in the week, the RBNZ Shadow board backed the market expectations of witnessing a 0.50% rate hike while the New Zealand Treasury signaled the need for RBNZ to hold the interest rates “higher for longer” due to the Cyclone reconstruction.

Given the clear early signals of witnessing a 0.50% rate hike, the NZD/USD appears well-set to consolidate the latest losses around the seven-week low. However, a negative surprise due to the natural calamity at home won’t hesitate to drown the Kiwi pair.

Apart from the interest rates, the economic forecasts and language of the RBNZ Rate Statement will also be the key for the NZD/USD pair traders to watch. That said, the bleak economic outlook and early signals for peak rates might tease the sellers despite the 0.50% rate hike announcement.

Technically, the Kiwi pair rests on the 200-DMA support surrounding 0.6180, pressured down by a three-week-old resistance line, close to 0.6285-90. However, the RSI (14) line is nearly oversold and hence the downside room appears limited.

Key notes

NZD/USD traders get set for the RBNZ

RBNZ Interest Rate Decision Preview: A 50 bps hike could rescue Kiwi bulls

About the RBNZ interest rate decision and rate statement

The RBNZ interest rate decision is announced by the Reserve Bank of New Zealand. If the RBNZ is hawkish about the inflationary outlook of the economy and raises the interest rates it is positive, or bullish, for the NZD. The RBNZ rate statement contains explanations of their decision on interest rates and commentary about the economic conditions that influenced their decision.

- USD/CHF is aiming to deliver a break above 0.9280 amid the risk aversion theme.

- Rising odds of more rates announcement by the Fed in its March monetary policy meeting are fueling US Treasury yields.

- The Swiss Franc asset has successfully tested the breakout of the downward-sloping trendline placed from 0.9600.

The USD/CHF pair is gathering strength to deliver a break above 0.9280 in the early Asian session. The Swiss franc asset is struggling to deliver more gains despite the risk aversion theme underpinned by the market participants.

An upbeat preliminary United States S&P PMI (Feb) data cleared that the economic activities are getting expansionary again, which could be the result of a rebound in consumer spending. This led to a sheer fall in the risk-perceived assets as expansionary economic activities support a hawkish view from the Federal Reserve (Fed).

S&P500 futures are offering mild gains in the early Tokyo session, however, the overall sentiment is still risk-off. The US Dollar Index (DXY) is struggling to extend gains above 103.90, however, the upside looks favored as volatility in the FX domain might remain high ahead of the Federal Open Market Committee (FOMC) minutes. Rising odds of more rates announcement by the Fed in its March monetary policy meeting are fueling US treasury yields. The return on 10-year bonds has jumped to near 4%.

On the Swiss Franc front, the commentary from Swiss National Bank (SNB) Vice Chairman Martin Schlegel failed to provide strength to the Swiss franc. SNB Schlegel cited the central bank is "still willing" to be active in the foreign currency markets in pursuing its goal of price stability.

USD/CHF technical outlook

USD/CHF has successfully tested the breakout of the downward-sloping trendline placed from November 21 high around 0.9600 on a four-hour scale. Usually, a successful test of a trendline breakout with an absence of solid downside pressure indicates the strength of bulls and prepares a platform for a confident upside move ahead.

The Swiss Franc asset has confidently shifted its auction above the 200-period Exponential Moving Average (EMA) at 0.9245.

Meanwhile, the Relative Strength Index (RSI) (14) is looking to enter into the bullish range of 60.00-80.00.

USD/CHF four-hour chart

-638126191664558028.png)

- Silver price grinds higher after three-day winning streak.

- Upbeat US data, yields underpin US Dollar rebound and probe XAG/USD bulls.

- A mentioning of Fed policymakers’ discussion on pivot could propel Silver price.

Silver price (XAG/USD) seesaws around $21.85 as bulls take a breather during early Wednesday, after three-day uptrend. In doing so, the bright metal fails to respect the US Dollar’s latest rebound but shows traders’ anxiety ahead of the week’s key event.

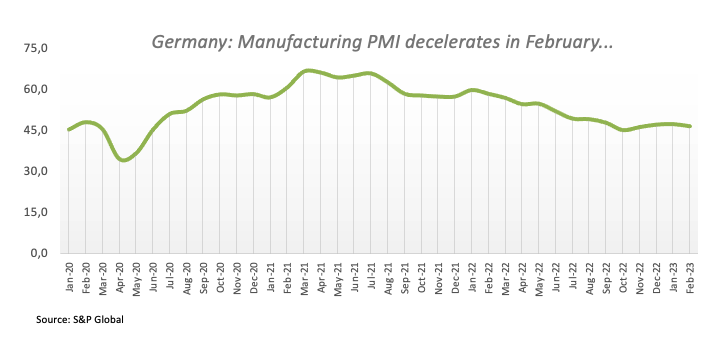

That said, the XAG/USD bulls could have traced the hopes of more industrial demand amid a recent jump in the manufacturing activity data from major economies, including the UK, the US, Germany and Europe.

On the other hand, the US Dollar Index (DXY) snapped a two-day downtrend to regain 104.00 on Tuesday, grinding higher around 104.20 by the press time, as the US PMIs for February propelled hawkish Fed bets.

It should be noted that the preliminary readings of the US S&P Global Manufacturing PMI rose to 47.8 from 46.9 prior and versus 47.3 market forecasts while the Services PMI jumped to the eight-month high to 50.5 compared to 47.2 expected and 46.8 previous readings. As a result, the S&P Global Composite PMI surpassed 47.5 analysts’ consensus and 46.8 previous reading to mark 50.2 figure.

Following the data, the FEDWATCH tool signals that the money market participants see the benchmark level peaking at 5.3% in July, and staying near those levels throughout the year, versus 5.10% expected by the US Federal Reserve (Fed).

Other than the Fed bets, the upbeat US data also propelled the US Treasury bond yields as the benchmark 10-year bond coupon refreshed a three-month high near 3.95%. Further, the two-year counterpart also jumped to the highest levels since early November 2022, to 4.73% at latest, which in turn propelled the US Dollar and should have capped the XAG/USD upside.

Elsewhere, Wall Street closed in the red as geopolitical fears emanating from Russia and China joined the aforementioned hawkish Fed bets, as well as downbeat earnings forecasts from the tops US retailers including Home Depot and Wall Mart.

Moving on, Fed Minutes should be eyed for policy pivot talks considering the latest cautiously optimistic tone of the policymakers. That said, XAG/USD may rally in case of a policymarkers’ discussion on pausing the rate hikes trajectory.

Technical analysis

Despite the latest rebound, Silver price needs to provide a daily closing beyond the 100-DMA, around $22.00 by the press time.

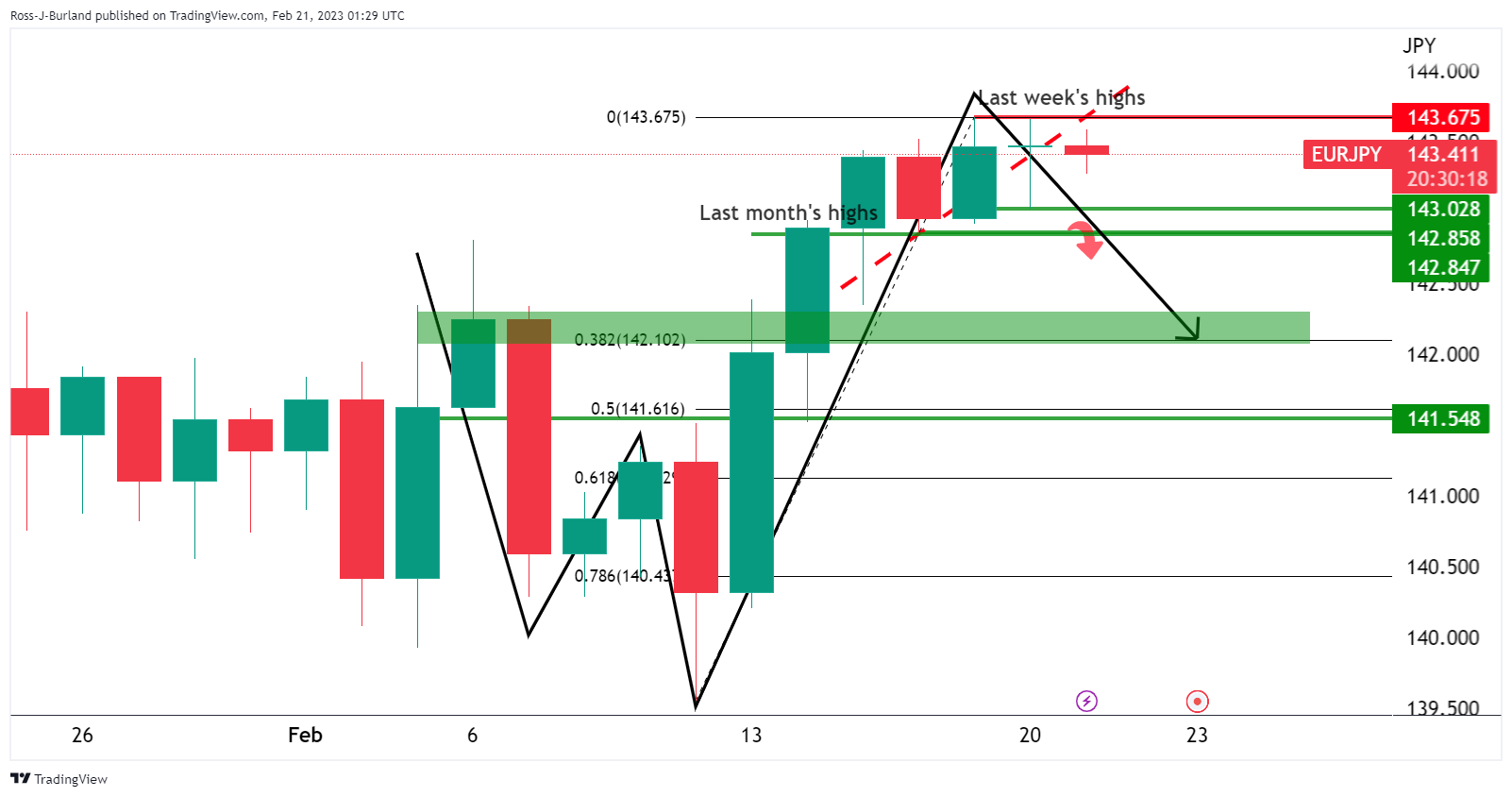

- EUR/JPY hit a new YTD high, though it dived back below 144.00.

- EUR/JPY Price Analysis: Rejected at 144.00, it could fall back towards 142.50s.

The EUR/JPY hit a fresh year-to-date (YTD) high at 144.16 on Tuesday, closing the session with gains of 0.26%. However, as Wednesday’s Asian Pacific session begins, the EUR/JPY exchanges hands at 143.70, below its opening price by a minuscule 0.03%.

During the last six days, the EUR/JPY was trading sideways, within 142.90-143.60, trapped, although the daily Exponential Moving Averages (EMAs) were resting below the price action. Even though the EUR/JPY pierced 144.00, failure to hold above the latter could exacerbate a re-test of 143.00, as bears take a respite.

The Relative Strength Index (RSI) is still in bullish territory, but its slope turned flat. While the Rate of Change (RoC), suggests that buying pressure is fading.

From an intraday perspective, the EUR/JPY 4-hour chart portrays the pair fluctuating at around Wednesday’s daily pivot point. Albeit the EUR/JPY has managed to extend its gains, the Relative Strength Index (RSI) suggests the cross would advance steadily instead of rallying sharply, which opens the door for a reversal.

The EUR/JPY first resistance would be 144.00. A breach of the latter will expose the R1 daily pivot at 144.21, followed by a downslope trendline that passes around 144.40, ahead of the R2 pivot point at 144.68. Once broken, the EUR/JPY can get to 145.00.

As an alternate scenario, the EUR/JPY first support would be the 20-EMA at 143.40, followed by the S1 daily pivot at 143.22. the next line of defense for EUR/JPY bulls would be the psychological 143.00 figure.

EUR/JPY 4-hour chart

EUR/JPY Key technical levels

“Japan manufacturers gloomy as global slowdown hurts,” said the latest monthly Reuters Tankan survey. The monthly poll, which closely tracks the Bank of Japan's quarterly tankan survey, canvassed 493 big non-financial Japanese firms, of which 244 replied. It was conducted from Feb. 8 to 17, reported Reuters.

The update seems suited after the survey for the manufacturing and services gauges both eased in the last two consecutive months.

That said, Reuters Tankan Manufacturing Index came in as -5.0 for February versus -6.0 in January. On the same line Tankan Non-Manufacturing Index eased to 17 for the said month versus 20.0 prior.

Also read: USD/JPY bulls eye a continuation as the US Dollar bounces back to life

- GBP/USD rose the most in over a week as UK business activity data renew hawkish BoE concerns.

- A pause in UK’s nurse strikes also strengthen the upside bias for the Cable.

- Brexit fears, US Dollar strength keeps bears hopeful.

- FOMC Minutes eyed for clear directions amid hawkish Fed bias, Brexit updates and wage talks between British union, government eyed.

GBP/USD grinds higher past 1.2100, mildly bid around 1.2115 during the initial hours of Wednesday’s Asian trading, as upbeat UK fundamentals keep Cable buyers hopeful ahead of the key Federal Open Market Committee’s (FOMC) Monetary Policy Meeting Minutes.

That said, strong UK data and hopes of overcoming multi-day-old nurse strikes in Britain seemed to have underpinned the GBP/USD pair’s latest run-up. However, upbeat US data and hawkish Fed talks also propelled the US Dollar and challenged the Cable buyers prior to the important Fed Minutes. The Brexit woes join the pre-event anxiety to act as additional filter towards the north.

As per the preliminary readings of the UK S&P Global/CIPS data for February, the Manufacturing PMI rose to 49.2 versus 46.8 expected and 47.0 prior while Services PMI jumped to a seven-month high of 53.3 compared to 48.3 market forecasts and 48.7 previous readings.

Following the upbeat data, Reuters quotes a survey of economists stating that the strength of the survey made it more likely that the BoE - grappling with an inflation rate still above 10% - would raise interest rates to 4.25% in March, despite further signs of easing price pressures in the PMI.

Elsewhere, Reuters reported that nurses will pause strike action in England and begin talks with the British government on Wednesday in a long-running dispute over pay and conditions, the Royal College of Nursing (RCN) said on Tuesday.

Alternatively, Brexit woes loom as the Eurosceptic Conservatives challenge UK Prime Minister’s talks with the European Union (EU) over the Northern Ireland (NI) border issue. The leader of Northern Ireland's largest unionist party (Jeffrey Donaldson, leader of the Democratic Unionist Party) said on Tuesday there was still work to be done to find a resolution to a dispute between Britain and the European Union over their post-Brexit trading arrangements with the province, per Reuters.

On the other hand, the business activity in the United States matched the likes of previously published US inflation numbers, Retail Sales and employment data and boosted the US Dollar.

Following the data, the FEDWATCH tool signals that the money market participants see the benchmark level peaking at 5.3% in July, and staying near those levels throughout the year, versus 5.10% expected by the US Federal Reserve (Fed).

Other than the Fed bets, the upbeat US data also propelled the US Treasury bond yields as the benchmark 10-year bond coupon refreshed a three-month high near 3.95% while the two-year counterpart also jumped to the highest levels since early November 2022, to 4.73% at latest.

As a result, the US Dollar Index (DXY) snapped a two-day downtrend to regain 104.00 on Tuesday, grinding higher around 104.20 by the press time.

Apart from the aforementioned catalysts, the challenges to risk appetite emanating from Russia and China also underpin the US Dollar and test the GBP/USD prices ahead o the Fed Minutes.

To sum up, Fed Minutes should be eyed for policy pivot talks considering the latest cautiously optimistic tone of the policymakers.

Technical analysis

Although the 200-DMA puts a floor under the GBP/USD price near 1.1935, a convergence of the 21-DMA and a three-week-old descending resistance line, close to 1.2165 at the latest, restricts short-term upside of the Cable pair.

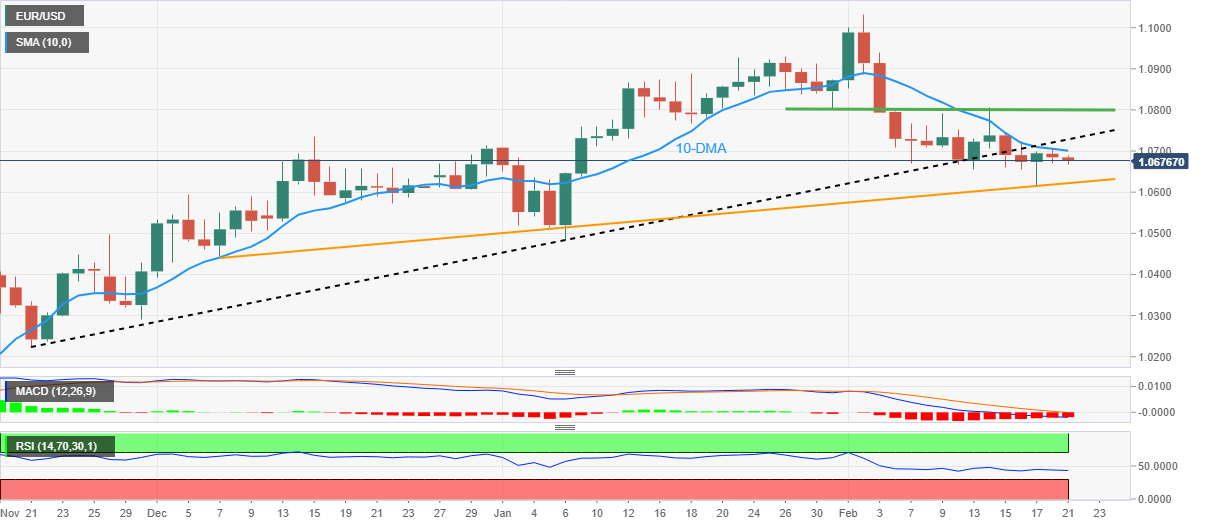

- EUR/USD is continuously facing selling pressure from 61.8% Fibo retracement around 1.0700.

- The 89-period (High-Low) SMA band is barricading the Euro consistently.

- A slippage by the RSI (14) into the bearish range of 20.00-40.00 will trigger a downside momentum

The EUR/USD pair has retreated after facing selling interest around 1.0650 in the early Tokyo session. The major currency pair remained extremely volatile as upbeat United States preliminary S&P PMI data resulted in accelerating odds for the continuation of the policy tightening spell by the Federal Reserve (Fed).

Risk-perceived assets like S&P500 witnessed a vertical sell-off as upbeat US PMI data strengthened recession fears. The Fed is going to consider the rebound in the scale of economic activities as a threat to the declining trend in the Consumer Price Index (CPI), which will be addressed by more rate hikes. This pushed the alpha provided on the 10-year US Treasury bonds to 4%.

Meanwhile, the upbeat Eurozone ZEW Survey- Economic Sentiment failed to provide support to the Euro. Higher-than-anticipated sentiment data indicates that the majority of institutional investors are holding an optimistic view on the economic projections.

The presence of potential sellers at the 61.8% Fibonacci retracement (placed from January 6 low at 1.0483 to February high at 1.1033) at 1.0693 is heavily deploying pressure on EUR/USD. This could drag the shared currency pair further.

The 89-period (High-Low) Simple Moving Average (SMA) band is barricading the Euro consistently.

Meanwhile, the Relative Strength Index (RSI) (14) is on the verge of slipping into the bearish range of 20.00-40.00. An occurrence of the same will trigger a downside momentum.

A decisive downside move below February 17 low at 1.0613 will drag the asset toward December 22 low at 1.0573. A slippage below the latter will extend the downside toward January 6 low at 1.0483.

In an alternate scenario, a break above February 16 high at 1.0722 will drive the asset toward 50% Fibo retracement at 1.0758, followed by February 14 high around 1.0800.

EUR/USD two-hour chart

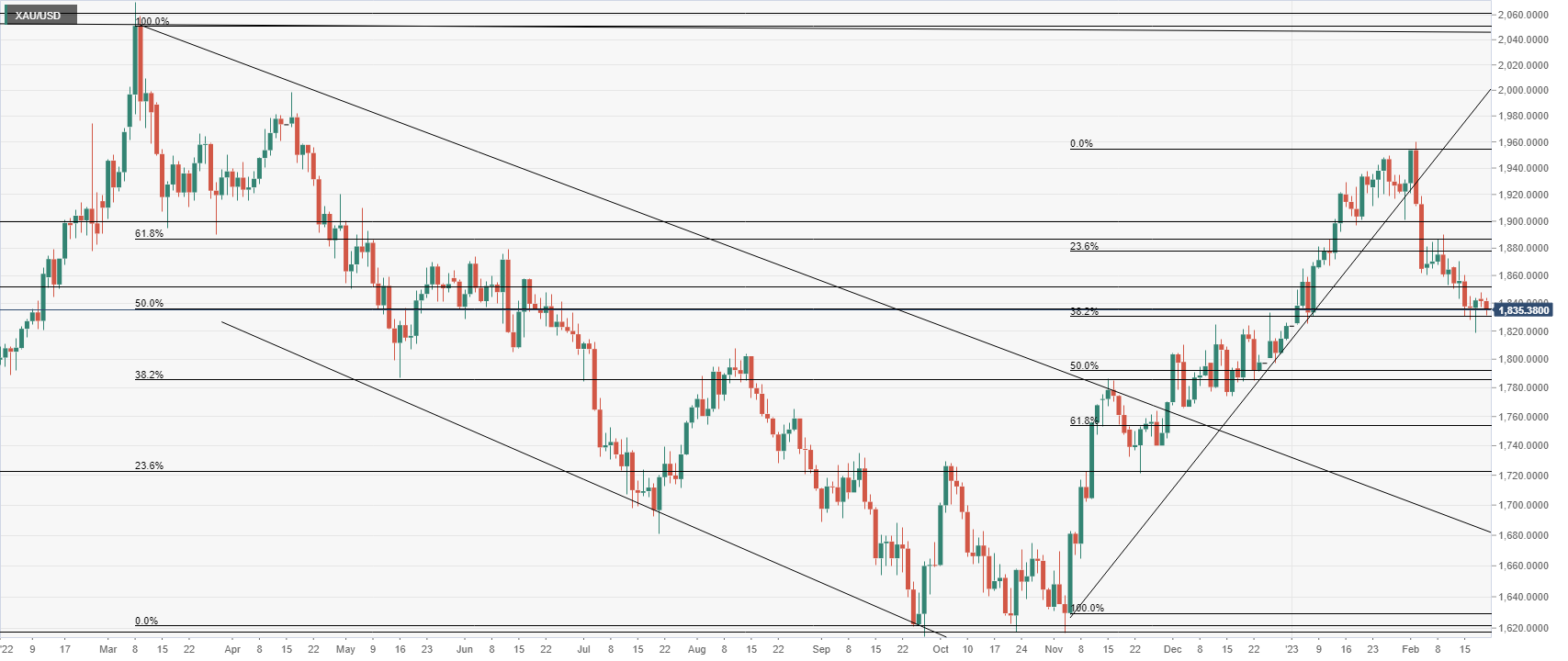

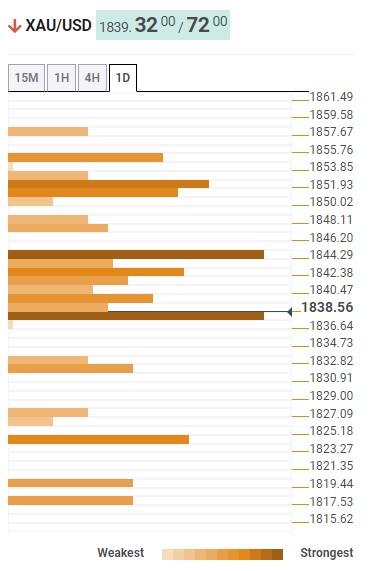

- Gold price remains depressed as United States data, geopolitical risk favor US Dollar bulls.

- XAU/USD technical analysis challenge bears by portraying a falling wedge bullish chart formation.

- Federal Reserve Minutes should defend hawkish bias to keep Gold bears hopeful, otherwise 200-SMA hurdle will be in focus.

Gold price (XAU/USD) holds lower grounds near $1,835, following a two-day downtrend, as markets await the key Federal Open Market Committee’s (FOMC) Monetary Policy Meeting Minutes during early Wednesday. That said, the upbeat prints of the United States activity data and the risk-off mood joined firmer US Treasury bond yields to underpin the US Dollar run-up and weighed on the XAU/USD of late.

Gold price drops on upbeat United States data

With the business activity in the United States matching the likes of previously published US inflation numbers, Retail Sales and employment data, the US Dollar got a boost from the statistics, which in turn weighed on the Gold price.

On Tuesday, the preliminary readings of the US S&P Global Manufacturing PMI rose to 47.8 from 46.9 prior and versus 47.3 market forecasts while the Services PMI jumped to the eight-month high to 50.5 compared to 47.2 expected and 46.8 previous readings. As a result, the S&P Global Composite PMI surpassed 47.5 analysts’ consensus and 46.8 previous reading to mark 50.2 figure.

Following the data, the FEDWATCH tool signals that the money market participants see the benchmark level peaking at 5.3% in July, and staying near those levels throughout the year, versus 5.10% expected by the US Federal Reserve (Fed).

Other than the Fed bets, the upbeat US data also propelled the US Treasury bond yields as the benchmark 10-year bond coupon refreshed a three-month high near 3.95% while the two-year counterpart also jumped to the highest levels since early November 2022, to 4.73% at latest.

Hence, upbeat data propels hawkish Fed bets and underpin the US Treasury bond yields and the US Dollar and exerts downside pressure on the Gold price. That said, the US Dollar Index (DXY) snapped a two-day downtrend to regain 104.00 on Tuesday, grinding higher around 104.20 by the press time.

Geopolitical tension also weighs on XAU/USD

Apart from the Federal Reserve-inflicted losses, the Gold price also bears the burden of the escalation of geopolitical tension surrounding China and Russia. The reason could be linked to comments from US Secretary of State Antony Blinken, who said the United States suspects China is considering providing military support to Russia. On the same line are the market concerns of the US-Taiwan trade deal. On the other hand, Russia suspended its nuclear arms treaty with the US and pledged to maintain its military actions in Ukraine.

That said, Russian President Vladimir Putin delivered his state of the nation address to Russia’s Federal Assembly while speaking to both houses of parliament on Tuesday. During the speech, Russian President Putin clearly mentioned, “Our task is to lead our economy to new frontiers,” which in turn highlights further geopolitical tension surrounding Ukraine. On the same line, US Deputy Treasury Secretary Wally Adeyemo said on Tuesday, “US and allies plan new sanctions this week to continue to isolate Russia over the war in Ukraine.”

It should be noted that the geopolitical fears joined the weaker-than-expected earnings forecasts from the major US retailers, namely Walmart and Home Depot, to highlight the risk-off mood and weighed on the Wall Street benchmark. The same favored the rush towards risk safety and propelled US Dollar while also weighing on the Gold price.

Federal Reserve Minutes appear as the key for Gold bears

Although markets position as bearish ahead of the Federal Reserve (Fed) monetary policy meeting minutes, the US central bank appears cautiously optimistic while announcing the latest rate hike worth 0.25%. Hints of the same will be sought for clear directions of the Gold price. Should the policymakers appear ready to talk policy pivot, the XAU/USD may witness a recovery, an absence of which could keep the Gold price weak.

Gold price technical analysis

Gold price keeps grinding inside a three-week-old falling wedge bullish chart formation on the four-hour (4H) play. That said, the looming bear cross on the Moving Average Convergence and Divergence (MACD) indicator keeps sellers hopeful while a steady Relative Strength Index (RSI) line suggests a continuation of sideways performance near the upper line of the stated wedge, which in turn could be risked on the Federal Reserve (Fed) Minutes.

That said, $1,838 is the key level as a break of which will confirm the falling wedge formation and suggest (theoretically) a run-up toward $1,940.

It’s worth noting that the 61.8% Fibonacci retracement level of the metal’s run-up from mid-December 2022 to early February 2023 and the 200-bar Simple Moving Average (SMA), respectively near $1,845 and $1,892, could test the Gold buyers after the confirmation of the bullish chart pattern.

Meanwhile, XAU/USD pullback should aim for January’s low near $1,825 before testing the latest bottom surrounding $1,818.

Following that, the stated wedge’s lower line, close to $1,812 by the press time, could challenge the Gold bears.

Overall, the Gold price remains bearish but the downward trajectory seems to lose momentum and forms a bullish chart pattern, which in turn can trigger a short-term recovery in case fundamentals support.

Gold price: Four-hour chart

Trend: Upside expected

- AUD/USD is expected to deliver more downside below 0.6850 amid the risk-off market mood.

- A solid case for the continuation of policy tightening by the Fed sent yields on fire.

- Higher Australian Wage Price Index could keep inflationary pressures elevated.

The AUD/USD pair is attempting to build a short-term cushion around 0.6850 in the early Asian session. The Aussie asset is expected to deliver more weakness after surrendering the 0.6850 cushion as the market mood is quite negative ahead of the release of the Federal Open Market Committee (FOMC) minutes.

S&P500 witnessed a massive sell-off on Tuesday as the upbeat preliminary S&P PMI data bolstered the expectations of more rates by the Federal Reserve (Fed) ahead. Upbeat economic activities indicate that the demand for labor could accelerate further, which will result in higher consumer spending. This might propel the United States Consumer Price Index (CPI) ahead. The US Dollar Index (DXY) climbed to near 103.90 amid the risk aversion theme.

A solid case for the continuation of policy tightening by Fed chair Jerome Powell sent yields on fire. The alpha generated on 10-year US Treasury bonds jumped to near 4%.

Preliminary S&P Manufacturing PMI (Feb) climbed to 47.8 from the consensus of 47.3 and the former release of 46.9. The Services PMI soared to 50.5 from the estimates of 47.2 and the prior release of 46.8.

For further guidance, the release of the FOMC minutes will be keenly watched. The FOMC minutes will provide the rationale behind hiking interest rates by 25 basis points (bps) to 4.50-4.75%. Apart from that, cues about the interest rate guidance will be in focus.

On the Australian front, after hawkish Reserve Bank of Australia (RBA) minutes, investors are focusing on the Labor Cost Index (Q4) data. On a quarterly basis, the economic data is seen steady at 1%. The annual data is expected to improve to 3.5% from the former release of 3.1%. Firms are offsetting the demand for labor by providing higher wages, which is going to keep Australian inflationary pressures at elevated levels.

- NZD/USD bears moved in as the US dollar surged on Fed sentiment.

- It is all about the RBNZ for today and then the Fed minutes.

NZD/USD has traded on the offer on Tuesday, falling from a high of 1.0698 to a low of 1.0637 so far. The US Dollar bulls stepped in to clean up some of the stale orders that were in the market contrary to the economic data of late that has flipped the script on the narrative surrounding the Federal Reserve.

DXY, an index that measures the greenback vs. a basket of currencies, rallied into last Friday's shorts and moved back into the 104.20s as investors swallowed yet another hard pill in inflationary pointing to US economic data on Tuesday. US Treasury yields hit new highs after both the services and manufacturing sectors in February with S&P Global PMIs beating their prior outcomes and estimates.

Traders are setting up for a longer-than-anticipated stiff monetary policy stance by the Federal Reserve following a slew of strong economic data. ''This process still has a ways to go, in our view,'' analysts at Brown Brothers Harriman explained. The analysts noted that the WIRP suggests 25 bp hikes in March, May, and June that takes Fed Funds to 5.25-5.50%.

''Given how strong the data have been recently, we see growing risks of a fourth 25 bp hike that takes us up to 5.50-5.75%, though that is not being priced in yet. This should eventually change,'' the analysts said. ''Strangely enough, an easing cycle is still expected to begin in Q4 but at much lower odds. Eventually, it should be totally priced out into 2024 in the next stage of Fed repricing.''

RBNZ eyed

The next major catalyst for the US Dollar will be the Federal Reserve's release of the minutes of its last meeting on Wednesday. However, in the meanwhile, the focus will be on the Reserve Bank of New Zealand.

''Today is all about the RBNZ,'' analysts at ANZ Bank said. ''We expect a 50bp hike, and given the inflation risks posed by Gabrielle, it’d be a surprise to see their OCR projections fall,'' they added.

''Greater uncertainty and a sense of resilience to higher rates locally and globally also potentially poses upside risks to the terminal OCR. We think that’ll ultimately be NZD-positive, as will the rebuilding better vibe, which all lies ahead. Bring on 2pm, let’s get this decision behind us!''

- USD/CAD reclaims 1.3500, distancing from the daily EMAs, as the uptrend accelerates.

- The major is testing a downslope trendline, which, if broken, the USD/CAD can rally to 1.3700.

The USD/CAD advanced in the North American session, though it retraced from 7-week highs at 1.3549, it retreated late in the session. Nevertheless, the USD/CAD is trading at 1.3537 and is gaining 0.65%.

After bottoming around 1.3262, the USD/CAD pair is gaining traction, and it’s approaching a four-month-old downslope resistance area at around 1.3560-75. Albeit, the major cleared significant hurdles on its way north, namely the 20, 50, 100, and 200-day Exponential Moving Averages (EMAs), consolidated within a 200-pip range. Nonetheless, the USD/CAD reclaiming the 1.3500 figure exacerbated the rally to multi-week highs.

For an uptrend resumption, the USD/CAD needs to break a downslope resistance trendline at around 1.3560-75. Once broken, the USD/CAD might test the 1.3600 psychological level. A breach of the latter, the USD/CAD will rally toward the January 3 daily high at 1.3685, followed by 1.3700.

As an alternate scenario, the USD/CAD first support would be 1.3500. Once cleared, the path toward the 50-day EMA at 1.3436 would be clear. The following demand area to be tested by the USD/CAD would be the confluence of the 20 and 100-day EMAs, at 1.3418 and 1.3413, respectively.

USD/CAD Daily chart

USD/CAD Key technical levels

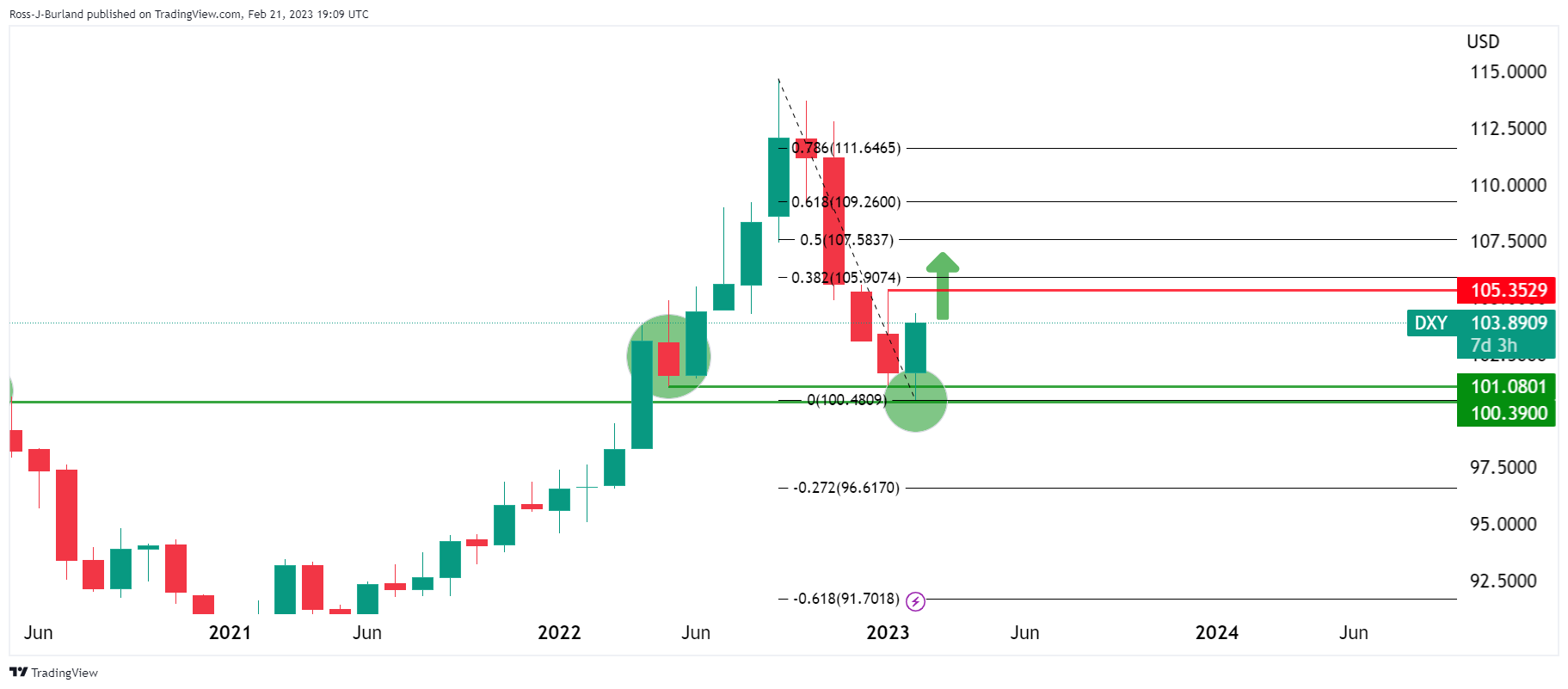

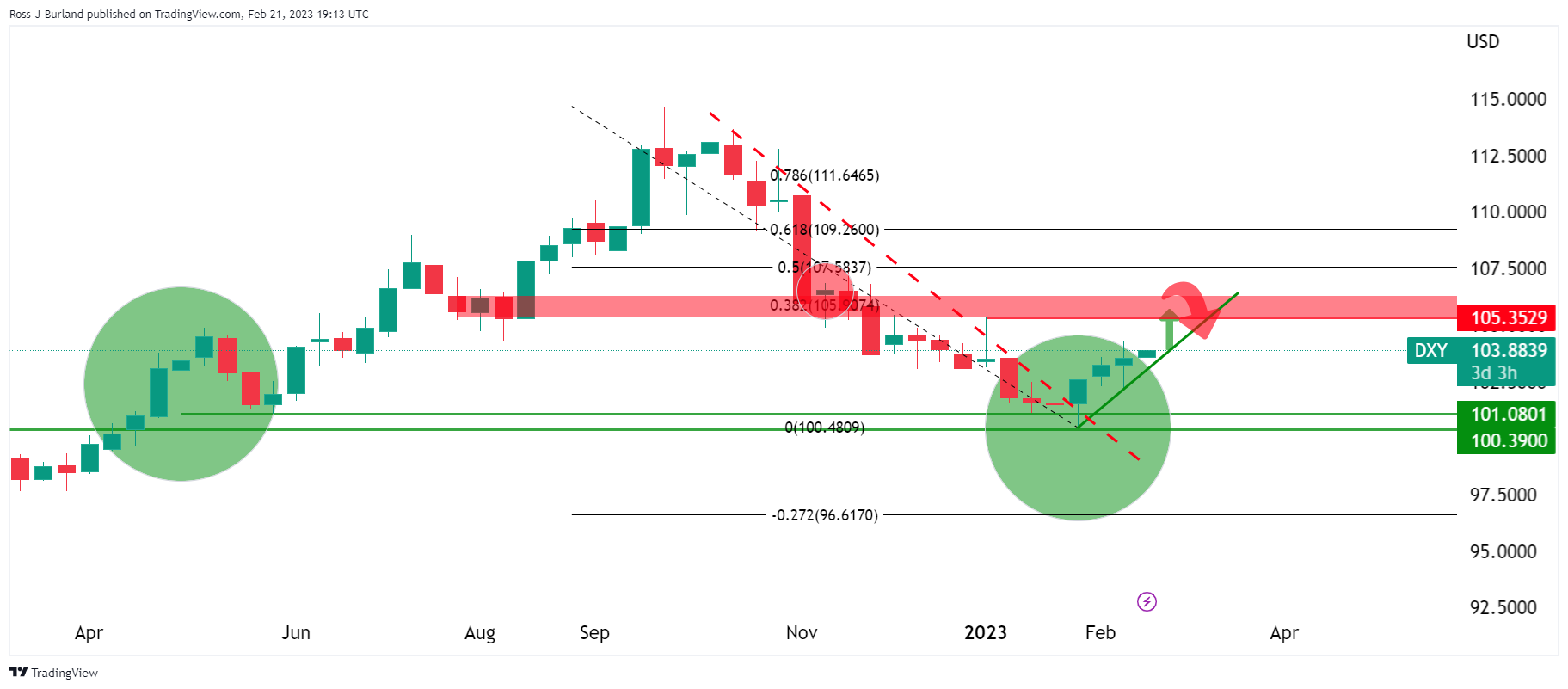

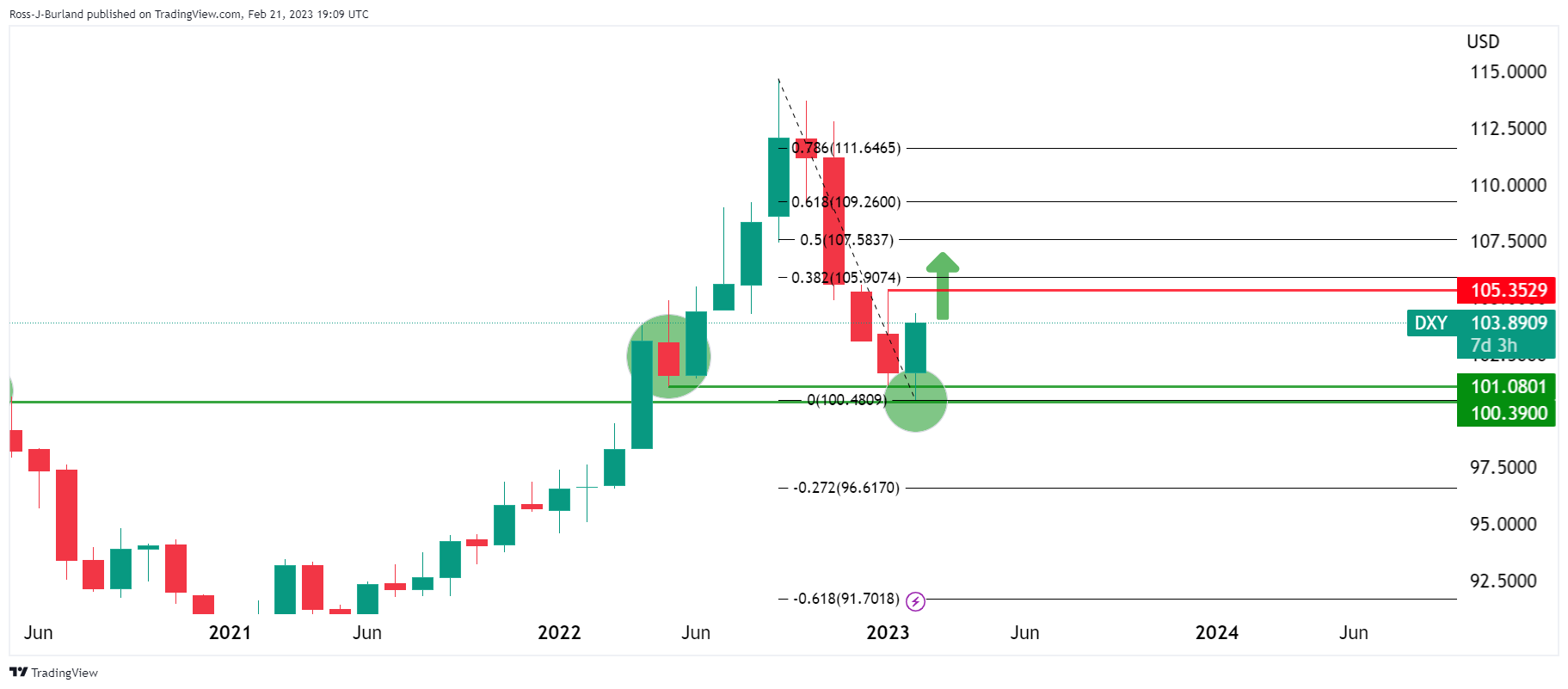

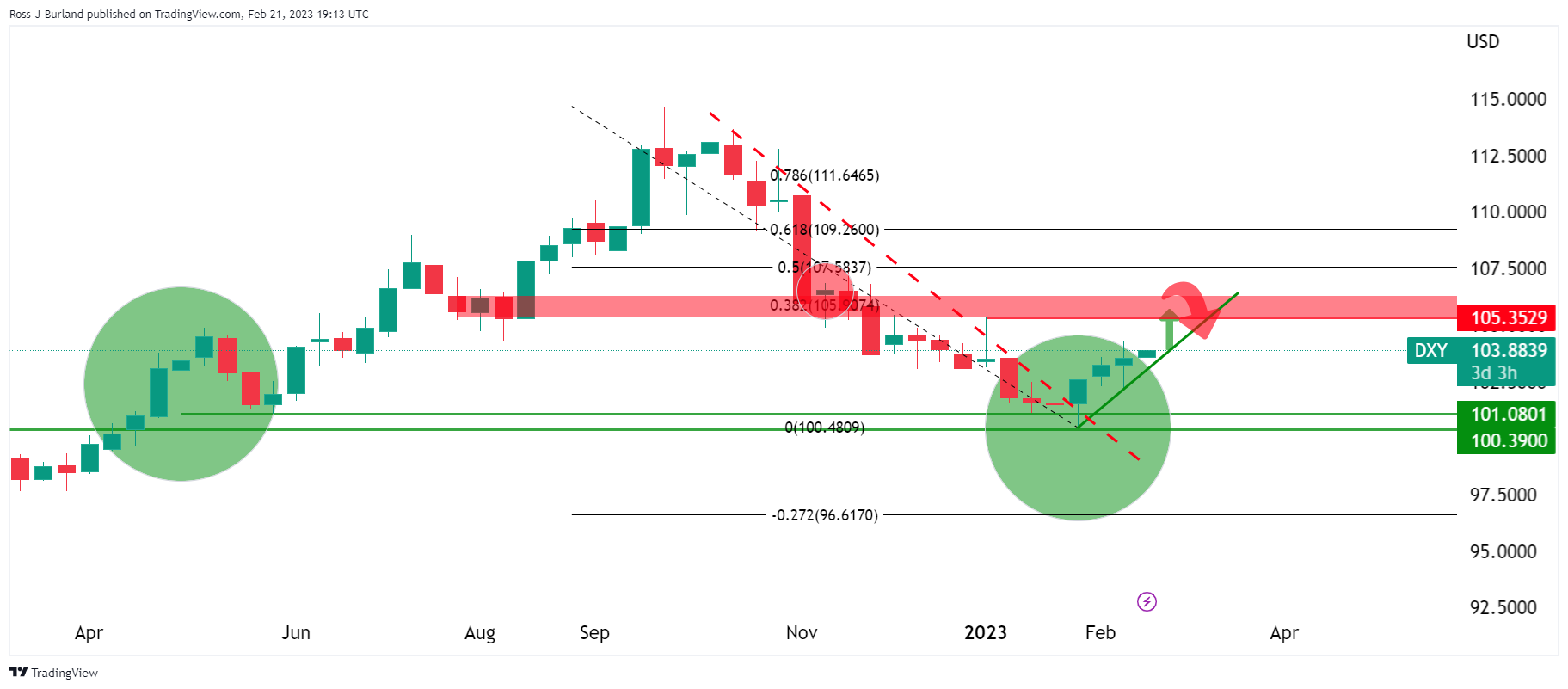

- The US Dollar is resurging and has been taken back into the control of the bulls.

- US Dollar bulls target 105.35 and 106.00 thereafter.

The US Dollar is trading in confluence to the persistent inflationary theme since data over the last several days has turned the screw and flipped the script with regard to the timings of a Federal Reserve pivot.

Higher Treasury yields and a projected 5.3% terminal Fed funds rate have seen a resurgence in the US Dollar index, DXY. This index measures the greenback vs. a basket of currencies as the following technical analysis will illustrate that is leaning with a bullish bias:

Taking into consideration the fundamentals as outlined above, has the US Dollar got room to go on the upside until any major-looking resistance is seen?

DXY monthly chart

Looking at the above chart and the monthly structures, we can see that there have been plenty of reactions from the recent lows near 101.00 over many months of history in the DXY index. If the index is going to continue to use that as a support base, then where is the next area of liquidity for the greenback as per the DXY chart going to be?

Given the momentum behind the bid as per the monthly chart's recent candle's engulfment of the prior month's body, it is evident that the bulls are in control and by some margin with 105.35 eyed:

The 38.2% Fibonacci retracement is also compelling near 106.00.

Down on the weekly chart, 106 is seen as a clear target and resistance area:

From a daily perspective, the 104.30s were pinned but there is room to go on the upside following the correction into old resistance that is now acting as a support structure.

In conclusion, while being on the front side of the dynamic support line, the bulls can target at least the space between today's highs and all the way to the start of the year's highs near 105.35:

What you need to take care of on Wednesday, February 22:

The US Dollar stands victorious across the FX board as risk aversion led the way. The market focus remained on geopolitical tensions as the conflict between the US and Russia escalated in the last 24 hours. The latest on the matter came from Secretary of State Antony Blinken, who said the United States suspects China is considering providing military support to Russia. Moscow responded by suspending its nuclear arms treaty with the US and pledging to maintain its military actions in Ukraine.

Wall Street returned from the long weekend and followed the negative lead of their overseas counterparts. US indexes are sharply down, losing roughly 2% each. The slump was exacerbated by renewed price pressure concerns after the release of the US S&P Global PMIs. The Manufacturing and Services index came in better than anticipated. Still, the official report noted that "firms continued to seek to pass on greater input costs to customers through hikes in output charges. The rise in selling prices was the quickest for four months and strong overall." Continued inflationary pressures mean the US Federal Reserve will remain on the tightening path for longer.

Annual inflation in Canada rose by 5.9% in January, down from 6.3% in December. Also, the Bank of Canada's Core CPI, which excludes volatile food and energy prices, was up by 5% on a yearly basis from 5.4% in December.

United Kingdom Prime Minister Rishi Sunak Spokesperson said the prime minister had stated unequivocally that there are still substantive issues to be resolved with the EU, bringing back to the table Brexit woes.

Beyond US S&P Global PMIs, European ones were mixed, with the services sector expanding but the manufacturing one still in contraction mode. UK figures, on the other hand, were quite encouraging.

EUR/USD trades at around 1.0650, not far from an early low at 1.0636. GBP/USD hovers around 1.2110, with the Pound supported by upbeat local data.

Commodity-linked currencies are sharply down, with AUD/USD trading at 0.6855 and USD/CAD up to 1.3520.

The USD/JPY flirts with 135.00, while USD/CHF trades at around 0.9270.

Spot gold trades at $1,833 a troy ounce, maintaining its bearish route, while crude oil prices also eased, and WTI stands at $76.60 a barrel.

The Reserve Bank of New Zealand will announce its monetary policy decision early on Wednesday.

Like this article? Help us with some feedback by answering this survey:

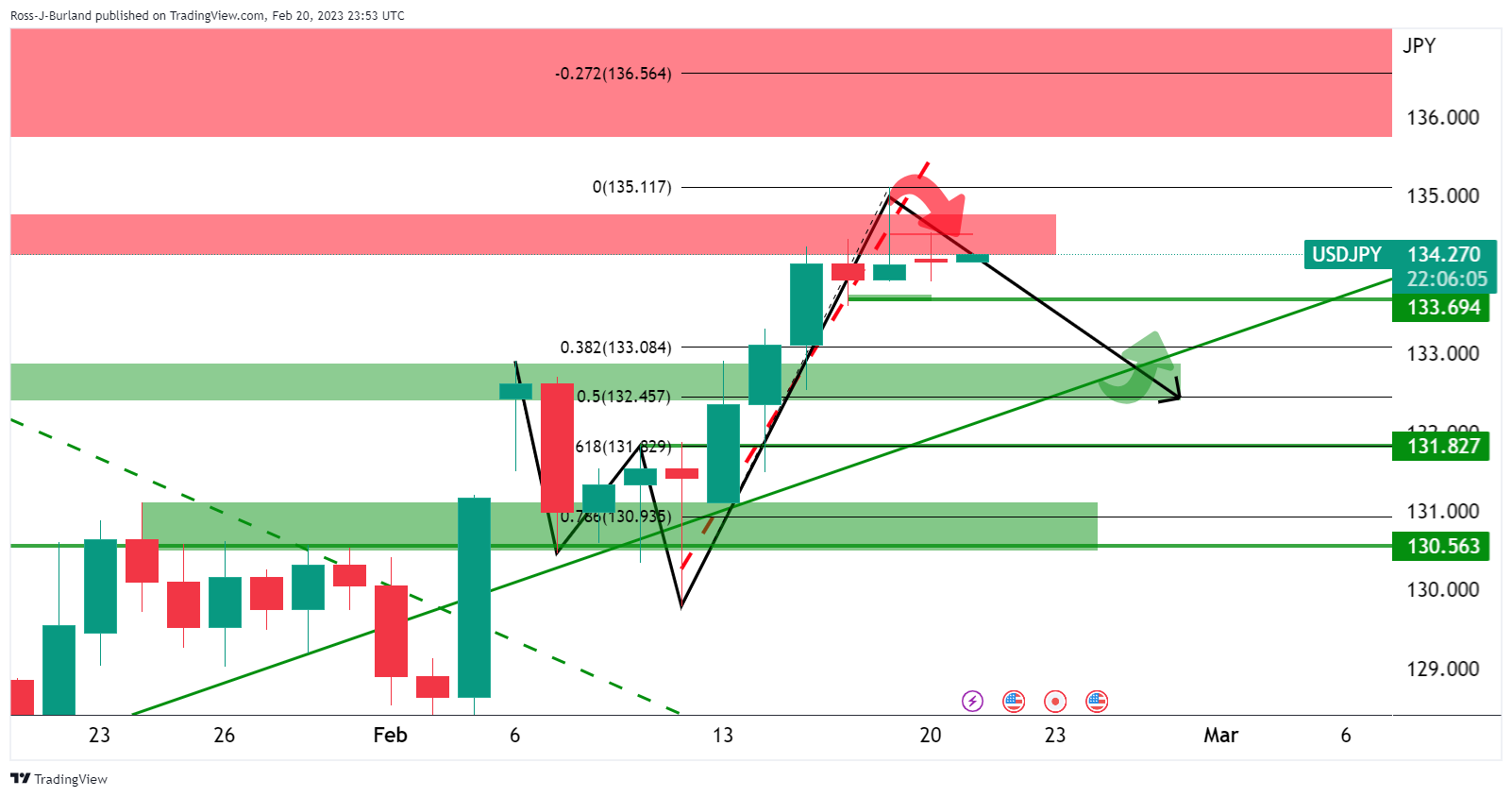

- USD/JPY is biased to the upside as a resurgence int he US Dollar is underway.

- 134.50 is a line on the sand and the market has a bullish bias towards 137.50 while above it.

USD/JPY is pressing higher despite the technicals that have been biased to the downside, at least for the meanwhile move into the length that had been piling up in the market over the past several days. Instead, the bulls stay in control and have homed in on the 135 area as volume return to the forex space.

At the time of writing, USD/JPY is trading at 134.98 and has travelled between a low of 134.14 and a high of 135.22 so far. The US Dollar has been offering good two-way business on the day in volatile trading. However, the dominant theme remains an inflationary one and that is fueling the bid in the middle of the US session following yet more positive US economic data.

US Treasury yields hit new highs on Tuesday on the confirmation in the US data that both the services and manufacturing sectors have been robust in the month of February with S&P Global PMIs beating both prior and estimates. Investors are setting up for a longer-than-anticipated stiff monetary policy stance by the Federal Reserve following a slew of strong economic data. ''This process still has a ways to go, in our view,'' analysts at Brown Brothers Harriman explained.

The analysts noted that the WIRP suggests 25 bp hikes in March, May, and June that takes Fed Funds to 5.25-5.50%. ''Given how strong the data have been recently, we see growing risks of a fourth 25 bp hike that takes us up to 5.50-5.75%, though that is not being priced in yet. This should eventually change,'' the analysts said.

''Strangely enough, an easing cycle is still expected to begin in Q4 but at much lower odds. Eventually, it should be totally priced out into 2024 in the next stage of Fed repricing.''

The next major catalyst will be the Federal Reserve's release of the minutes of its last meeting on Wednesday, which will give traders a glimpse of how high officials are projecting interest rates will go following this impressive run of recent data for the first months of the year including stronger than expected jobs and inflation numbers.

USD/JPY & DXY technical analysis

In all of the above, it will be interesting to see how much further the US Dollar, DXY, can go:

We have seen a number of reactions from the recent lows over many months of history in the DXY index as the above illustrates, so why would it be any different this time around? 101.00 is a strong level of support so the thesis is higher from here, in the meanwhile at least.

The 38.2% Fibonacci retracement is eyed as the first target near 106.00 on a break of the prior month's highs of 105.35.

Down on the weekly chart, 106 is a clear target and resistance area:

From a daily perspective, the 104.30s were pinned but there is room to go on the upside following the correction into old resistance that is now acting as a support structure. A continuation, therefore, can be anticipated to breach the space between today's highs and all the way to the start of the year's highs near 105.35:

USD/JPY technical analysis

This leaves a bullish bias on the US Dollar pairs and the Yen would be expected to weaken into the overhead USD/JPY four-hour resistance in the coming days.

Zoomed in ...

134.50 is a line on the sand and the market has a bullish bias towards 137.50 while above it.

- Speculations for further tightening by the Federal Reserve underpin the US Dollar, a headwind for oil prices.

- China’s reopening and Russia expected to cut its oil production capped WTI’s fall.

- WTI Technical analysis: Neutral to downward biased; once it breaks $75.00, a retest of monthly lows is likely.

Western Texas Intermediate (WTI), the US crude oil benchmark, is erasing Monday’s gains which fell shy of reaching the 20-day Exponential Moving Average (EMA), and dropped towards the lows of the week around 75.97 before settling around the current price. At the time of typing, WTI is losing 0.94%, trading at 76.64 per barrel.

Oil prices affected by a strong US Dollar

The strong US Dollar (USD) narrative is hitting the commodities market. During the last week, Federal Reserve (Fed) officials continued their hawkish rhetoric while data supported some of their comments. Traders should remember that although Cleveland and St. Louis Fed Presidents Loretta Mester and James Bullard do not vote in the FOMC, both supported raising rates by 50 bps.

That spurred speculations that the US Federal Reserve (Fed) might hike rates not twice but three times, which could lift the Federal Funds Rate (FFR) to the 5.25%-5.50% mark.

Meanwhile, the US Dollar Index (DXY), which tracks the buck’s value vs. a basket of six currencies, advances 0.29%, up at 104.184, a headwind for dollar-denominated assets. Therefore, a strong USD makes oil prices expensive for foreign countries.

Aside from this, China’s reopening is a factor playing into WTI’s price, and capped oil prices fall in Tuesday’s session. Russia’s announced that it plans to cut production by 500,000 bpd or about 5% of its output in March as retaliation to the West imposing price caps on Russian oil and oil-related products.

Data-wise, US oil inventories and data, which were to be released on Tuesday, was postponed in observance of President’s Day and moved to Wednesday and Thursday.

WTI Technical analysis

From a technical perspective, WTI is still neutral to downward biased, capped by all the Exponential Moving Averages (EMAs) resting above oil’s price. In addition, the Relative Strength Index (RSI) is in bearish territory and is aiming downwards. The Rate of Change (RoC), albeit steadily, shows that sellers continue gaining momentum.

Hence, WTI’s first support would be $75.97. Once cleared, the oil price would tumble to the last week’s low at $75.36, followed by the MTD low at $72.30.

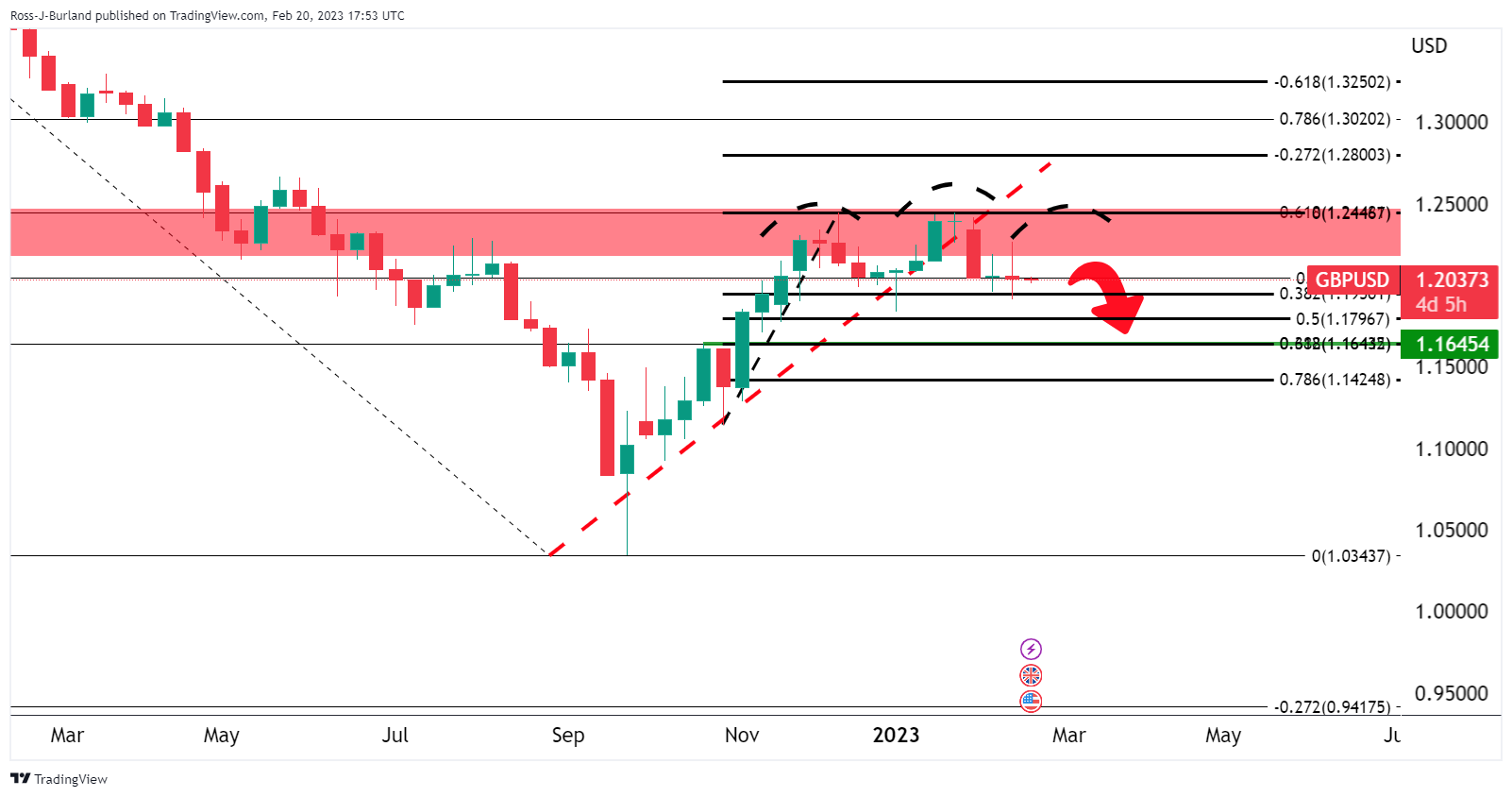

- GBP/USD target 1.2270 for the days ahead.

- GBP/USD bears need to get below 1.1900.

Forex markets are unforgiving and prices are two-way as volume kicks in again following the slow start to the week on Monday that was put down to a US holiday. GBP/USD rallied from a 50% mean reversion of Friday's bullish run and broke to 1.2150 on Tuesday, breaking a key resistance around 1.2050 which has invalidated the prior downside bias for the time being as the following top-down analysis will illustrate:

At the start of the week, it was shown in the following article that there was a case for lower due to the formation of the weekly head and shoulders:

While the thesis remains valid, the meanwhile price action is pointing to a bullish continuation of the correction of the the final days of last week's bearish leg:

Zoomed in ...

The M-formation's neckline was broken on Tuesday, invalidating the bearish thesis from the start of the week's analysis:

In the meantime, instead, the bulls are in control and are now needing to rely on the 1.2070s as a possible newly formed support structure as illustrated below:

1.2270 is eyed as an upside target for the days ahead of the market and does not just remain in a consolidative structure bounded by 1.1900 and 1.2150.

- EUR/USD drops steadily as traders wait for FOMC’s minutes.

- US S&P Global PMI for February showed the economy’s resilience, except for manufacturing activity.

- ECB’s Rehn commented that lifting rates in March is appropriate and should continue until the summer.

EUR/USD extends its bearish continuation after Monday’s gains, offset by the US Dollar (USD), were sponsored by a risk-off impulse, despite upbeat data revealed in the Euro area. Nevertheless, US PMIs showed after Wall Street’s opening justified US Dollar strength, hence the EUR/USD fall. At the time of writing, the EUR/USD declined 0.37%, trading at 1.0661.

US economic data underpins the US Dollar, a headwind for the EUR

S&P Global announced that the US economy experienced a boost in business activity in February, with all indices exceeding expectations. However, despite this positive development, the S&P Global Manufacturing PMI indicated that manufacturing activity remained in contractionary territory, coming at 47.8.

Meanwhile, according to wires, geopolitical developments surrounding the conflict between Russia and Ukraine have escalated. Anthony Blinken, the US Secretary of State, cautioned China against providing additional military support to Russia during its invasion of Ukraine. He also stated that there would be severe repercussions if such assistance were given. Meanwhile, in a display of US support after Blinken’s remarks, President Joe Biden visited Ukraine’s President Zelenskyy in Kyiv.

Earlier in the European session, mixed PMI data for the bloc was unveiled by S&P Global. The S&P Global Services and Composite PMIs were better than expected in Germany and the Eurozone, though the Manufacturing Indices remained in contraction. Aside from this, the German ZEW economic sentiment improved to 28.1

In central bank speaking, a slew of European Central Bank (ECB) officials added to the chorus of hawks, namely Rehn. He said it’s appropriate to raise rates beyond March, and rates need to peak around the summer of 2023 while pushing back against rate cuts.

Given the backdrop, the EUR/USD fell from around the week’s high and has retraced below the 1.0660 area. However, EUR/USD traders will face a solid support area around the 50 and 20-day Exponential Moving Average (EMAs), followed by further demand areas. Nevertheless, neither sellers/buyers have opened new positions, as they await the release of the latest FOMC meeting minutes.

EUR/USD Technical analysis

The single currency’s failure to crack the 100-day EMA at 1.0842 exacerbated the EUR/USD’s pair fall toward the 1.0600 area. In addition, further Relative Strength Index (RSI) lower readings, as buyers’ pressure fades, and the Rate of Change (RoC) indicating that sellers are gathering momentum justified the leg-down. Therefore, the EUR/USD path of least resistance is downwards.

The EUR/USD next support would be the 1.0600 mark. A breach of the latter will drive prices to the 50-day EMA at 1.0584, followed by the 20-day EMA at 1.0584.

- USD/MXN cannot drop to fresh YTD lows after hitting 18.3301 on February 17.

- Positive divergence between the RSI and USD/MXN price action suggests further upside is warranted.

- USD/MXN: If it reclaims 18.45, it could test $18.70; otherwise, the YTD lows are targeted.

The Mexican Peso (MXN) weakens vs. the US Dollar (USD) as Wall Street’s session begins, yet stills exchanging hands below Monday’s high of 18.4366, which would further warrant downward action. However, the USD/MXN is registering decent gains of 0.23%, trading at 18.3977.

From a daily chart perspective, the USD/MXN remains downward biased. In the last three days, USD/MXN sellers had been unable to drag prices towards the $18.00 psychological barrier, beneath the YTD low of 18.3301.

Momentum indicators like the Relative Strength Index (RSI), albeit in bearish territory, suggest that buying pressure could be building. The Rate of Change (RoC) hit the neutral level after three-straight days of equal to no volatility.

The USD/MXN needs to conquer Monday’s high for an upward reversal. Once cleared, the USD/MXN might rally toward the confluence of February 16 and 17 daily highs and the 20-day EMA at the 18.66/68 area. A decisive break will expose the 50-day EMA at 18.9428, ahead of the psychological $19.00 area.

For a bearish continuation of the USD/MXN, sellers must challenge the $18.00 figure once they cleared the YTD low at 18.3301. If the USD/MXN reclaims 18.0000, the next support would be April 17, 2018, swing low at 17.9388, followed by July 19, 2017, daily low of 17.4498.

USD/MXN Daily chart

USD/MXN Key technical levels

- Gold price slides after failing to break Monday’s high of 1847.45, down 0.08%.

- US S&P Global PMIs for February were better than expected, except for the Manufacturing Index, which remained in contractionary territory.

- China-US tensions around military aid on Russia dented market mood.

Gold price slides in the North American session while the US Dollar (USD) rises sharply on risk aversion. Expectations that the US Federal Reserve (Fed) would tighten monetary conditions “aggressively” keeps investors uneasy. At the same time, Fed officials hawkish rhetoric added to those speculations, with money market futures expecting rates as high as the 5.25%-5.50% range. The XAU/USD is exchanging hands at around 1838.58.

US business activity in February improved

US equities opened in the red as sentiment remains sour. S&P Global revealed that the US economy in February posted a recovery in business activity, with all the indices above estimates. However, as measured by the S&P Global Manufacturing PMI, manufacturing activity remained at 47.8 in the contractionary territory.

“Despite headwinds from higher interest rates and the cost of living squeeze, the business mood has brightened amid signs that inflation has peaked and recession risks have faded,” said Chris Williamson, a chief business economist at S&P Global Market Intelligence. He added that supply constraints had alleviated delivery times.

US bond yield capped Gold’s advance

The US Dollar Index, a gauge of the buck’s value vs. a basket of currencies, began to trim some of its earlier gains following the release of the PMI report, after hitting a daily high of 104.260, it’s down 0.12% at 103.878. Contrarily, the US 10-year benchmark note rate sits at 3.908%, gains six bps, capping the yellow metal rally, with XAU’s bulls eyeing a test of the $1850 area.

Geopolitical-wise, the US Secretary of State Anthony Blinken warned China not to provide further lethal military help to Russia in its invasion of Ukraine, adding that “serious consequences” would happen if it did so. In the meantime, US President Joe Biden visited Ukraine’s President Zelenskyy in Kyev, showing US support after Blinken’s comments.

What to watch?

Aside from this, Wednesday’s US economic docket will feature the latest FOMC meeting minutes, which could shed some light regarding the forward path that the US Federal Reserve would follow in monetary policy.

Gold technical analysis

XAU/USD’s daily chart suggests the yellow metal as neutral biased. It should be said that if XAU/USD does not print a new high in the week, that could pave the way for further downside. Oscillator-wise, the path of least resistance is downwards, with the Relative Strength Index (RSI) in bearish territory aiming south, while the Rate of Change (RoC) displays buying pressure is fading.

Therefore, the XAU/USD first support would be the 100-day Exponential Moving Average (EMA) at $1820.45, followed the last week’s low of $1818.97. A breach of the latter will expose the $1800 mark.

Is there a buying opportunity in Gold after the recent drop? XAU/USD is starting to look oversold. Therefore, strategists at Standard Chartered recommend adding exposure to the yellow metal.

Subsequent support levels for XAU/USD are at $1,810, followed by $1,780

“Gold broke below a strong support level at $1,840; the next support is at $1,810, followed by $1,780.”

“We would gradually add exposure to Gold (especially those who are underinvested), given that XAU/USD is starting to look oversold. Moreover, central bank demand remains strong and we expect that to continue supporting Gold prices.”

“The rebound in real yields and the USD is likely to level off, in our view, fading headwinds against Gold. The bright metal can also serve as an attractive hedge against short-term volatility due to geopolitical tensions.”

Economists at ING expect a hawkish 50 bps RBNZ hike, which could lift the New Zealand Dollar, but dovish risks have risen.

Watch the cyclone risk

“We are aligned with the consensus call for a 50 bps rate hike.”

“There is one key risk to our call though: the impact of the cyclone in New Zealand. This has triggered growing speculation that the RBNZ will only hike by 25 bps or even pause, and is probably behind the drop in NZD/USD to 0.6200. Admittedly, this downside risk has become more material now, but we stick to our call for a hawkish 50 bps hike by the RBNZ, and we think this will lift the New Zealand Dollar tomorrow.”

“However, we think this may be one of the last times the RBNZ has a direct positive impact on NZD as many factors suggest a dovish pivot will come soon.”

See – RBNZ Preview: Forecasts from six major banks, 50 bps seems appropriate

European Central Bank President Christine Lagarde said on Tuesday that they are not seeing a wage-price spiral in the Eurozone and explained that wage growth is a part of 'catching up,' as reported by Reuters.

Lagarde further noted that the headline inflation has begun to slowdown but reiterated that they intend to raise the key rates by 50 basis points at the upcoming policy meeting.

Market reaction

These comments don't seem to be helping the Euro find demand. As of writing, EUR/USD was down 0.2% on the day at 1.0662.

- Existing Home Sales in the US continued to decline in January.

- US Dollar Index stays in positive territory above 104.00.

Existing Home Sales in the US declined by 0.7% in January to an adjusted annual rate of 4 million, the National Association of Realtors (NAR) reported on Tuesday. This reading came in below the market expectation of 4.1 million.

"The median existing-home sales price increased 1.3% from one year ago to $359,000," the NAR further noted in its publication.

Commenting on the data, “home sales are bottoming out,” said NAR Chief Economist Lawrence Yun. “Prices vary depending on a market’s affordability, with lower-priced regions witnessing modest growth and more expensive regions experiencing declines.”

Market reaction

This data doesn't seem to be having a noticeable impact on the US Dollar's performance against its major rivals. As of writing, the US Dollar Index was up 0.22% on the day at 104.10.

The Mexican Peso is the second-best performing EM currency with a gain of nearly 6% YTD. Analysts at Société Générale ponder the possibility of a move below 18.00 in the USD/MXN pair.

50-DMA near 19.00 set to provide resistance

“Whether USD/MXN has a go at 18.00 is probably down to the FOMC minutes and US PCE.”

“The 50-Day Moving Average near 19.00 is likely to provide resistance.”

“Failure to hold 18.30 can lead to persistence in the decline towards the lower band of a multi-month channel near 18.10 and 17.90/17.60.”

- S&P Global Services PMI recovered above 50 in February's flash estimate.

- US Dollar Index continues to push higher above 104.00.

Business activity in the US services sector expanded in early February following January's contraction with S&P Global Services PMI rising to 50.5 from 46.8 in January. This reading surpassed the market expectation of 47.2.

Additionally, the Manufacturing PMI edged higher to 47.8 from 46.9, compared to analysts' estimate of 47.3, and the Composite PMI improved to 50.2 from 46.8.

Commenting on the data, "February is seeing a welcome steadying of business activity after seven months of decline," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"The improved supply situation has taken price pressures out of manufacturing supply chains but the survey data underscore how the upward driving force on inflation has now shifted to wages amid the tight labor market," Williamson added. "By potentially stoking concerns over a wageprice spiral, accelerating service sector price growth will add to calls for higher interest rates, which could in turn subdue the nascent expansion."

Market reaction

The US Dollar gathered strength against its rivals with the initial reaction and the US Dollar Index was last seen rising 0.35% on the day at 104.22.

The minutes from the Reserve Bank of Australia's (RBA) February Board meeting were relatively hawkish. Stronger than expected Australian wages could lift the AUD/USD pair towards the 0.70 level, in the view of economists at Commerzbank.

Minutes confirm RBA's hawkish shift

“The minutes of the RBA’s February meeting has confirmed the RBA's renewed hawkish bias. The minutes show that in view of higher-than-expected inflation and wage data, a 50 bps hike was also considered at the last interest rate decision.”

“The focus now turns to the wage index data for Q4 2022 due for release on Wednesday, which, if stronger than expected, underlines the upside risks to the RBA outlook and is likely to push AUD/USD more towards the upside of its current 0.68-0.70 trading range.”

- The index clings to daily gains around the 104.00 hurdle.

- US yields resume the upside and prop up the dollar on Tuesday.

- Advanced PMIs are seen rebounding a tad in February.

The greenback, when measured by the USD Index (DXY), manages well to keep business around the 104.00 neighbourhood on Tuesday, up modestly for the day so far.

USD Index looks bid amidst higher yields

The index keeps the buying interest well in place in the wake of the opening bell in Wall St. on Tuesday, as US markets return to the usual activity following Monday’s holiday.

The move higher in US yields underpins the resumption of the uptrend in the dollar, while the somewhat offered stance in the risk complex also collaborates with the upside pressure in the buck.

In the US data space, the flash Manufacturing PMI is seen at 47.1 in February and 50.5 when it comes to the Services gauge, both prints surpassing estimates and higher than the January readings.

Later in the session, Existing Home Sales for the month of January are due followed by a 3-month/6-month Bill Auctions.

So far, market participants are expected to remain on the cautious side in light of the publication of the FOMC Minutes and the release of inflation figures measured by the PCE on Wednesday and Friday, respectively, all against the backdrop of the persistent broad debate between market expectations of the Fed’s next steps and the hawkish narrative from policy makers.

What to look for around USD

The dollar flirts once again with the key 104.00 zone amidst some tepid weakness in the risk complex as US traders resume the activity on Tuesday.

The probable pivot/impasse in the Fed’s normalization process narrative is expected to remain in the centre of the debate along with the hawkish message from Fed speakers, all after US inflation figures for the month of January showed consumer prices are still elevated, the labour market remains tight and the economy maintains its resilience.

The loss of traction in wage inflation – as per the latest US jobs report - however, seems to lend some support to the view that the Fed’s tightening cycle have started to impact on the still robust US labour markets somewhat.

Key events in the US this week: Flash Manufacturing/Services PMI, Existing Home Sales (Tuesday) – MAB Mortgage Applications, FOMC Minutes (Wednesday) – Advanced Q4 GDP Growth Rate, Initial Jobless Claims, Chicago Fed National Activity Index (Thursday) – PCE, Core PCE, Personal Income/Spending, Final Michigan Consumer Sentiment, New Home Sales (Friday).

Eminent issues on the back boiler: Rising conviction of a soft landing of the US economy. Slower pace of interest rate hikes by the Federal Reserve vs. shrinking odds for a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is gaining 0.25% at 104.13 and faces the next hurdle at 104.66 (monthly high February 27) seconded by 105.63 (2023 high January 6) and then 106.44 (200-day SMA). On the other hand, the breach of 102.58 (weekly low February 14) would open the door to 100.82 (2023 low February 2) wand finally 100.00 (psychological level).

Sterling is a notable out-performer on the day, following better-than-expected UK data. Economists at Scotiabank believe that the GBP/USD could extend its rise to the 1.2165/70 zone.

Sterling’s technical condition looks more positive

“A surprise monthly budget surplus added to the lift for the GBP as it casts government finances in a generally more favourable light for the fiscal year overall ahead of next month’s budget. The Chancellor might use some of that unexpected cash to ease the domestic cost of living crunch.”

“The GBP has found support against the 200-DMA (1.1937 today) over the past two weeks and intraday gains through the 1.21 area are bullish from a short-term point of view, setting Cable up for a test of 1.2165/70.”

Economist at UOB Group Lee Sue Ann assesses the prospects for further tightening by the Bank of England.

Key Takeaways

“While the UK economy managed to avert a recession at the end of 2022; the fall in Jan’s PMIs shows the manufacturing sector kicking off 2023 on the back foot, in much the same way as it ended 2022. Consumer confidence is below levels seen during the financial crisis, COVID-19 pandemic, and recessions in both the 1980s and 1990s.”

“The latest jobs numbers suggest that the tight labour market will remain a stubborn source of domestic inflationary pressure for some months. Meanwhile, inflation remains in double digits, five times above the Bank of England (BOE)’s target. And there seems to be little signs that UK wage growth is slowing.”

“We are penciling in 25bps hikes at the next 2 meetings on 23 Mar and 11 May, seeing the Bank Rate peak at 4.5%. We recognize, though, the risks to our forecasts given the BOE’s challenge of fighting inflation amid a difficult economic outlook, as reflected by the range of views on the MPC at their last meeting on 2 Feb.”

EUR/USD continued to trade in a subdued range at the start of the week. Economists at OCBC Bank expect the world’s most popular currency pair to remain confined within 1.0620-1.0720.

Risks remain skewed to the downside

“Risks remain skewed to the downside but the range of 1.0620-1.0720 should hold.”

“Support at 1.0610, 1.05 and 1.0460 (38.2% fibo retracement of September low to February high).”

“Resistance at 1.0730 (50-Day Moving Average) and 1.08 (21-DMA).”

See – EUR/USD: Downside pressure to build on a clear daily close under 1.0680 – Scotiabank

- USD/CAD regains positive traction on Tuesday and is supported by a combination of factors.

- Softer Canadian CPI print, sliding oil prices undermine the Loonie amid modest USD strength.

- Traders now eye US PMIs for some impetus; focus remains on FOMC minutes on Wednesday.

The USD/CAD pair catches fresh bids during the early North American session on Tuesday and spikes to the top end of its daily range in reaction to rather unimpressive Canadian macro data. The pair is currently trading just below the 1.3500 psychological mark, up around 0.30% for the day, and seems poised to appreciate further.

Against the backdrop of weaker crude oil prices, softer Canadian consumer inflation figures weigh on the commodity-linked Loonie and provide a modest lift to the USD/CAD pair. In fact, Statistics Canada reported that the headline CPI rose by 0.5% in January, slightly lower than the 0.6% expected. Adding to this, the yearly rate decelerated more than anticipated, to 5.9% from the 6.3% previous.

Moreover, the Bank of Canada's (BoC) Core CPI, which excludes volatile food and energy prices, also missed estimates and came in at a 5% YoY rate, down from the 5.4% previous. This fuels speculations that the BoC will pause the policy-tightening cycle and overshadows the better-than-expected Canadian monthly Retail Sales figures, which recorded a strong growth of 0.5% in December.

The US Dollar (USD), on the other hand, continues to draw support from rising bets for at least a 25 bps lift-off at the next two FOMC policy meetings in March and May. Apart from this, the prevalent risk-off mood - amid looming recession risks and geopolitical tensions - benefits the safe-haven Greenback and supports prospects for a further appreciating move for the USD/CAD pair.

Next on tap is the US economic docket, featuring the release of the flash PMI prints for February and Existing Home Sales data. This, along with the broader risk sentiment, will influence the USD and provide some impetus to the USD/CAD pair. Apart from this, traders will take cues from oil price dynamics to grab short-term opportunities ahead of the FOMC minutes on Wednesday.

Technical levels to watch

- EUR/USD adds to Monday’s pullback, always below 1.0700.

- Further weakness could retest the monthly low near 1.0610.

EUR/USD keeps the side-lined theme well in place in the lower end of the range in the sub-1.0700 region so far on Tuesday.

If bears push harder, then the pair could confront the next support of note at the February low at 1.0612 (February 17). The breakdown of this level could prompt a potential test of the 2023 low at 1.0481 (January 6) to start shaping up in the short-term horizon.

So far, the bearish sentiment is expected to persist as long as the 3-month resistance line, today just beyond 1.0900 the figure, caps the upside.

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0328.

EUR/USD daily chart

- Retail Sales in Canada increased at a stronger pace than expected in December.

- USD/CAD pushes higher toward 1.3500 in the early American session.

Statistics Canada reported on Tuesday that Retail Sales rose by 0.5% on a monthly basis in December. This reading came in higher than the market expectation for an increase of 0.2%.

"Core retail sales—which exclude gasoline stations and motor vehicle and parts dealers—increased 0.4%," Statistics Canada noted in its publication. "In volume terms, retail sales increased 1.3% in December."

Market reaction

Despite the upbeat data, USD/CAD trades in positive territory and edges higher toward 1.3500 in the early American session. Soft inflation figures from Canada seem to be weighing on the Canadian Dollar.

- Monthly CPI in Canada rose at a softer pace than expected in January.

- USD/CAD rises toward 1.3500 after soft inflation data.

Annual inflation in Canada, as measured by the Consumer Price Index (CPI), declined to 5.9% in January from 6.3% in December. This reading came in below the market expectation of 6.1%. On a monthly basis, CPI rose 05% in January, compared to analysts' estimate of 0.7%.

Additionally, the Bank of Canada's Core CPI, which excludes volatile food and energy prices, dropped to 5% on a yearly basis from 5.4% in December.

Market reaction

USD/CAD pushed higher with the initial reaction and was last seen gaining 0.22% on the day at 1.3480.

- NZD/USD edges lower on Tuesday and is pressured by a combination of factors.

- Hawkish Fed expectations continue to underpin the USD and act as a headwind.

- A weaker risk tone contributes to driving flows away from the risk-sensitive Kiwi.

- Traders now eye US PMIs for some impetus ahead of the RBNZ on Wednesday.

The NZD/USD pair comes under some renewed selling pressure on Tuesday and remains depressed heading into the North American session. Spot prices, however, manage to recover a few pips from the daily low and defend the 0.62000 round-figure mark, at least for the time being.

The US Dollar buying interest remains unabated amid firming expectations for further policy tightening by the Fed, which, in turn, is seen as a key factor weighing on the NZD/USD pair. In fact, the markets seem convinced that the US central bank will stick to its hawkish stance for longer and are pricing in at least a 25 bps lift-off at the next two FOMC meetings in March and May. This, in turn, triggers a fresh leg up in the US Treasury bond yields and continues to underpin the buck.

Meanwhile, worries about economic headwinds stemming from rapidly rising borrowing costs, along with geopolitical tensions, take a toll on the global risk sentiment. This is evident from a generally weaker tone around the equity markets, which further benefits the Greenback's relative safe-haven status and drives flows away from the risk-sensitive Kiwi. The downside for the NZD/USD pair, however, remains limited ahead of the Reserve Bank of New Zealand (RBNZ) meeting on Wednesday.

The RBNZ is expected to hike interest rates by 50 bps, though some investors anticipate a pause in the policy tightening cycle in the wake of severe flooding and cyclone damage. Apart from this, investors will take cues from the accompanying policy statement for clues about the future rate-hike path. The focus will then shift to the FOMC meeting minutes, which will play a key role in influencing the USD price dynamics and help determine the next leg of a directional move for the NZD/USD pair.

Heading into the key central bank event risk, Tuesday's US economic docket - featuring the flash PMI prints and Existing Home Sales data - might provide some impetus to the NZD/USD pair. Apart from this, the broader risk sentiment should allow traders to grab short-term opportunities.

Technical levels to watch

EUR/USD has slipped somewhat intraday. A daily close below the 1.0680 mark would add downside pressure, economists at Scotiabank report.

Intraday gains to remain limited

“EUR/USD drift from resistance around the 1.0700/10 area looks poised to extend a little more.”

“Short-term trend dynamics are EUR-negative and broader price trends are tilting more negative for the EUR below key trend and retracement support at 1.0680.”

“Look for intraday gains to remain limited and for downside pressure on spot to build on a clear daily close under 1.0680.”

- Silver faces rejection near the 100-day SMA and comes under some selling pressure on Tuesday.

- The setup still favours bearish traders and supports prospects for a further depreciating move.

- A sustained strength beyond the $22.55-$22.60 region is needed to negate the bearish outlook.

Silver edges lower on Tuesday and snaps a two-day winning streak, albeit manages to hold above the $21.50 level heading into the North American session.

From a technical perspective, the recent bounce from the YTD low, around the $21.20-$21.15 region set last Friday faltered ahead of the $22.00 mark on Monday. The said handle coincides with the 100-day Simple Moving Average (SMA) support breakpoint and should now act as a pivotal point for the XAG/USD.

Some follow-through buying beyond the $22.15 zone, representing the 38.2% Fibonacci retracement level of the recent rally from October 2022, might prompt some technical buying. The momentum could lift the XAG/USD further, though is more likely to meet with a fresh supply near the $22.55-$22.60 hurdle.

That said, a sustained strength beyond the latter will shift the bias back in favour of bullish traders and pave the way for additional gains. The XAG/USD might then accelerate the positive move to 23.6% Fibo. level, around the $23.00 mark, before climbing to the $23.35-$23.40 strong horizontal resistance.

On the flip side, the 50% Fibo. level, around the $21.35 area, seems to protect the immediate downside ahead of Friday's swing low, around the $21.20-$21.15 zone. Failure to defend the said support levels could make the XAG/USD vulnerable to weaken below the $21.00 mark, towards the $20.60 region.

Given that technical indicators on the daily chart are holding deep in the negative territory, the downward trajectory could get extended further towards challenging the $20.00 psychological mark. The XAG/USD could eventually drop to test the next relevant support near the $19.75-$19.70 horizontal zone.

Silver daily chart

Key levels to watch

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the latest trade balance results in Malaysia.

Key Takeaways

“Exports posted the smallest gain since Oct 2020 at 1.6% y/y in Jan (Dec 2022: revised down to +5.9% from +6.0%), undershooting our estimate (+7.5%) and Bloomberg consensus (+9.0%). It also marked the fifth straight month of growth slowdown, in part due to a shorter working month as a result of Chinese New Year celebration. Similarly, import growth dwindled to a 24-month low of 2.3% (UOB est: +10.0%, Bloomberg est: +9.6%, Dec: revised down to +11.5% from +12.0%), leaving a narrower trade surplus of MYR18.2bn last month (Dec: revised up to +MYR28.1bn from +MYR27.8bn).”

“Jan’s export growth surprised on the downside as external demand for both manufactured and agriculture goods declined, which fully offset the impact of higher overseas sales of mining products. Almost all export destinations recorded sluggish performance last month, led by China (-11.9%), the US (-0.6%) and India (-30.6%).”

“We maintain our marginal export growth forecast of 1.5% for this year (MOF est: +2.2%, 2022: +25.0%) given the lingering macro headwinds and year-ago high base effects. Potential spillover effects from China’s economic reopening, Malaysia’s trade diversification and greater access to global markets, as well as commodity price earnings will be wildcards for the country’s export growth outlook this year.”

- The index reverses two consecutive daily pullbacks on Tuesday.

- Further rebound could see the monthly high near 104.70 revisited.

DXY picks up pace and advances to 2-day highs past the 104.00 hurdle on turnaround Tuesday.

The ongoing price action favours some consolidation in the upper end of the range. Immediately to the upside now comes the February top at 104.66 (February 17), while the surpass of this level exposes a probable move to the 2023 high at 105.63 (January 6) in the not-so-distant future.

In the longer run, while below the 200-day SMA at 106.44, the outlook for the index remains negative.

DXY daily chart

The Canadian Dollar little changed ahead of Consumer Price Index (CPI) data. Strong monthly figures could help the Loonie to cope with USD strength, economists at Scotiabank report.

USD gains should resume above 1.3475/80

“Jan CPI data is forecast to rise 0.6% in the month. Headline inflation is likely to slow somewhat 6.1%, from 6.3%, and core inflation is expected to slow somewhat as well.”

“Strong, monthly gains in prices and still elevated core price pressures will bolster market expectations that the Bank of Canada still might have to tighten monetary policy still further. This should help contain CAD losses against the stronger USD to recent ranges and give the CAD a boost on the crosses.”

“We expect USD support on dips to the low/mid 1.34s.”

“Resistance is 1.3475/80. USD gains should resume above this point.”

See – Canadian CPI Preview: Forecasts from six major banks, downward path could see a minor detour

Canada CPI Overview

Statistics Canada will release the consumer inflation figures for January later during the early North American session on Wednesday, at 13:30 GMT. The headline CPI is expected to rise by 0.7% during the reported month, more than the 0.6% fall in December. The yearly rate, however, is expected to ease to 6.1% from the 6.3% in the previous month. More importantly, the Bank of Canada's (BoC) Core CPI, which excludes volatile food and energy prices, is estimated to rise 0.2% in January and edge higher to 5.5% on a yearly basis as compared to -0.3% and 5.4%, respectively, in December.

Analysts at CIBC offer a brief preview of the key macro data and explain: “A slight rebound in gasoline prices, coupled with a further rapid increase in mortgage interest costs, could have seen prices rise by 0.8% on the month and the annual rate of inflation hold steady at 6.3%. However, further moderation in imported goods prices should mean that core inflation excluding food, energy and mortgage interest likely rose at a monthly pace which is broadly consistent with a 2% inflation target.”

How Could it Affect USD/CAD?

Ahead of the key release, the USD/CAD pair struggles to capitalize on its intraday positive move and once again fails near the 1.3500 psychological mark. A modest recovery in crude oil prices underpins the commodity-linked Loonie and acts as a headwind for the major. A stronger-than-expected Canadian CPI print will be enough to provide a fresh lift to the domestic currency and drag the pair further away from its highest level since January 6 touched last Friday.

Conversely, a weaker-than-expected report should reaffirm market expectations that the BoC will pause the policy-tightening cycle following eight rate hikes in the past 11 months. This, along with the underlying bullish sentiment surrounding the US Dollar, bolstered by bets for additional rate hikes by the Fed and looming recession risks, could boost the USD/CAD pair. Nevertheless, the data is likely to infuse some volatility ahead of the FOMC meeting minutes on Wednesday.

Key Notes

• Canadian CPI Preview: Forecasts from six major banks, downward path could see a minor detour

• USD/CAD Analysis: Setup favours bullish traders ahead of Canadian CPI

• USD/CAD to extend bounce towards December peak of 1.3700 on a move beyond 1.3530 – SocGen

About Canadian CPI

The Consumer Price Index (CPI) released by Statistics Canada is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of CAD is dragged down by inflation. The Bank of Canada aims at an inflation range (1%-3%). Generally speaking, a high reading is seen as anticipatory of a rate hike and is positive (or bullish) for the CAD.

NZD/USD is expected to continue its downside movement, in the opinion of economists at OCBC Bank.

Support at 0.6170/85 levels, resistance at 0.6280

“Bearish momentum on daily chart intact while RSI shows signs of falling. Risks remain skewed to the downside for now.”

“Support at 0.6170/85 levels (100, 200-DMAs), 0.6130 (38.2% fibo retracement of October low to Jan-Feb double top) and 0.6010 (50% fibo).”

“Resistance at 0.6280 (23.6% fibo), 0.6360 (21, 50-DMAs).”

See – RBNZ Preview: Forecasts from six major banks, 50 bps seems appropriate

A drop below 6.8490 should be indicative that a visit to 6.9000 in USD/CNH could be running out of steam in the near term, comment Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia at UOB Group.

Key Quotes

24-hour view: “We expected USD to trade sideways between 6.8650 and 6.8880 yesterday. However, USD dropped to a low of 6.8548 before settling at 6.8586 (-0.18%). Despite the drop, there is no marked increase in downward momentum and USD is unlikely to weaken much further. Today, USD is more likely to trade in a range, expected to be between 6.8530 and 6.8800.”

Next 1-3 weeks: “We have expected USD to strengthen since early this month. After USD exceeded our previous target of 6.8800, we highlighted last Friday (17 Feb, spot at 6.8780) that ‘the outlook for USD remains positive and the focus is at 6.9000’. Since then, USD has not been able to make any headway on the upside. Upward pressure has waned somewhat but only a break of 6.8480 (no change in ‘strong support’ level) would indicate that USD is not advancing further to 6.9000.”

Gold price is falling towards the $1,830 mark. Tomorrow, the release of the minutes of the February 1 FOMC meeting is unlikely to provide fresh trade impetus, in the opinion of economists at Commerzbank.

Demand picks up in China and India following slide in Gold

“Market participants will be focusing on tomorrow’s publication of the minutes of the Fed’s meeting in early February. As it took place before the buoyant US labour market and inflation data that led to interest rate expectations being reassessed on the market, however, the significance of the minutes is likely to be limited.”

“Price slide seems to have pushed up Gold demand in India and China last week. The higher demand is meeting with reduced supply after Fold imports were postponed in anticipation of a possible cut in import tax that did not then materialise.

“Jewellery retailers there are replenishing their stocks following the New Year festivities. This reveals yet again how price sensitive Gold buyers are in India and China. Though this does not mean that they are able to drive prices significantly up, they can preclude or at least slow any further price fall.”

Canada will release inflation figures at 13:30 GMT. Economists at Société Générale highlight the key technical levels to watch in the USD/CAD pair.

1.3260/1.3220 is likely to be an important support

“CPI in Canada could be a mover today after the towering employment gains. A stronger inflation outcome could pile pressure on the BoC to delay the pause and raise rates again in March.”

“USD/CAD is facing interim hurdle at 1.3530 representing the 61.8% retracement from December.”

“An initial pullback is not ruled out however the ascending trend line drawn since last June at 1.3260/1.3220 which is now also the 200-DMA is likely to be an important support.”

“A move beyond 1.3530 can result in an extended bounce towards December peak of 1.3700.”

See – Canadian CPI Preview: Forecasts from six major banks, downward path could see a minor detour

- EUR/JPY clinches new 2023 peaks around 144.00 on Tuesday.

- The continuation of the uptrend targets the December 2022 high near 146.70.