- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-02-2022

- AUD/USD flirts with intraday low, probes the positive week-start after three-week uptrend.

- Risk appetite sours as the West prepares for sanctions against Russia.

- Upbeat Aussie PMI, absence of US/Canadian traders earlier favored buyers.

- Return of full markets, US PMI and RBA’s Kent eyed for fresh impulse.

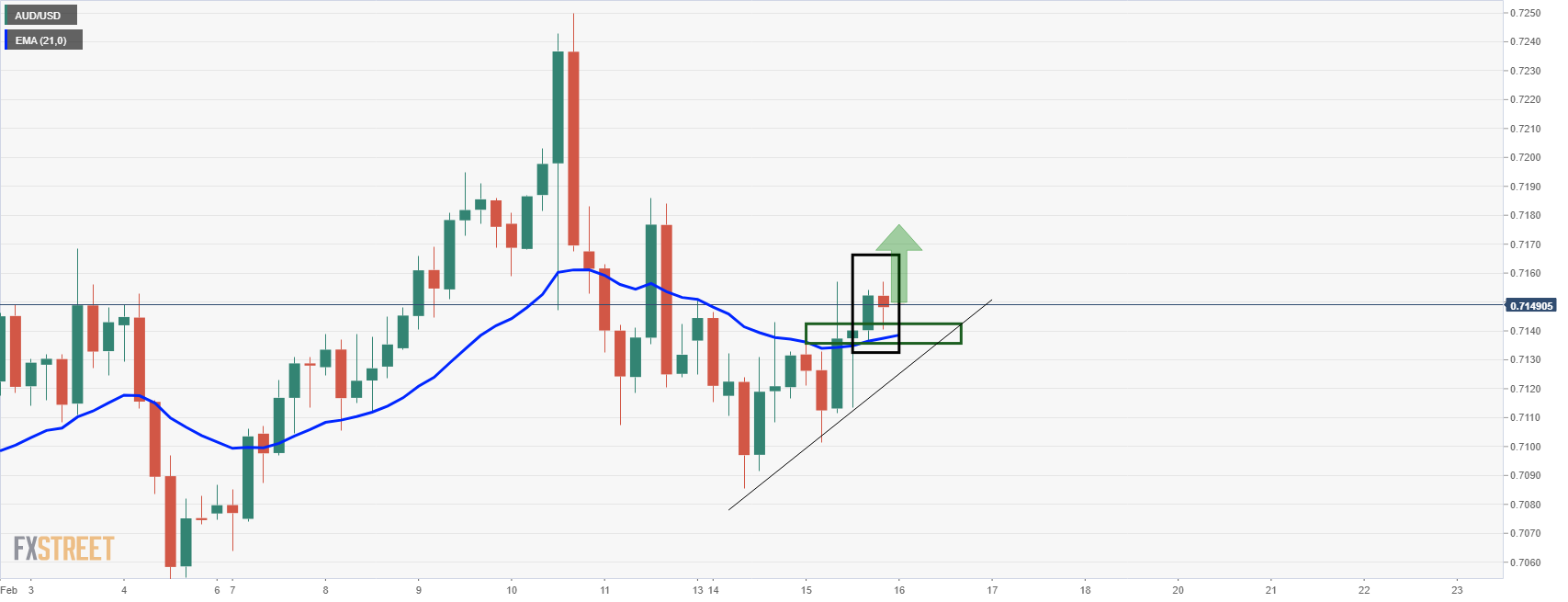

AUD/USD fails to extend the week-start gains amid fresh risk-aversion wave, taking offers around 0.7170 during Tuesday’s Asian. The pair rose for the last three weeks and offered a positive start to the current week before the latest rush to risk-safety weighed on the quote.

Russian President Vladimir Putin’s ordering of troops inside Eastern Ukrainian states, in the same of peacemaking, recently triggered the market’s risk-off mood. Sentiment previously sours as Putin recognized Donetsk and Luhansk in Eastern Ukraine as independent states and signed a decree "on friendship and cooperation".

While checking Russian President Putin’s latest moves, the Western warnings of Moscow’s readiness for an imminent invasion of Ukraine gain more accolades and spoil the mood. Also negative for the risk appetite are the latest actions by the US, EU, Canada and the UK to criticize the Russian actions.

That said, the UK and Canada are bracing for fresh sanctions on Russia while Japan hints to stop the chip exports to Moscow if it invades Ukraine. Elsewhere, Australia PM Scott Morrison said that they will be in lockstep with allies on sanctions on Russia.

Read: UK PM Johnson to chair COBRA meeting, Canada, US prepares economic sanctions over Russian actions

While portraying the mood, the S&P 500 Futures drop nearly 2.0% intraday by the press time and the US Dollar Index (DXY), as well as gold, benefits from the rush to risk-safety.

On Monday, AUD/USD cheered upbeat sentiment and stronger Aussie PMIs amid US Presidents’ Day holiday. Risk-tone initially improved on news that the US agreed on the Biden-Putin summit before Russian President Putin signaled no concrete plans for the summit. It’s worth noting that the Commonwealth Bank of Australia released Aussie PMIs for February and the Composite figures grew strong to 55.9 versus 46.7 in January.

It should be noted that the recent Fedspeak has gone softer and weighed on the Fed Fund Futures, which in turn challenge AUD/USD bears.

Moving on, the Reserve Bank of Australia (RBA) policymaker Christopher Kent is up for a speech and may offer immediate direction to the AUD/USD prices, as well as the return of the US and Canadian traders. However, major attention will be given to the US PMIs for February and the risk catalysts.

Read: US Markit PMIs Preview: Services sector has room for upside surprise, boosting the dollar

Technical analysis

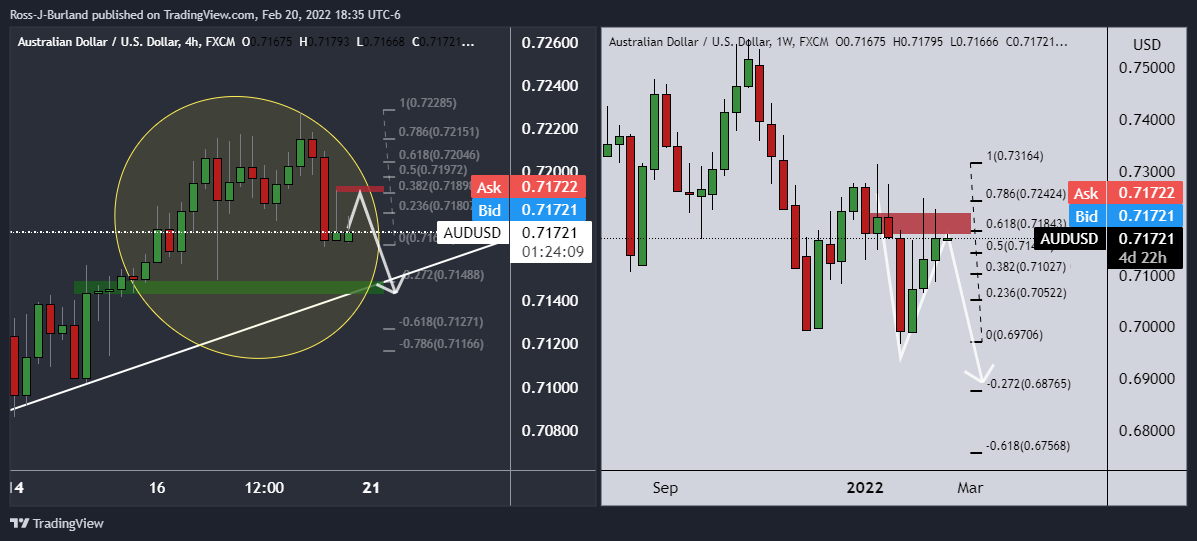

A three-week-old ascending trend line near 0.7150 puts a floor under short-term AUD/USD downside before directing the bears towards the 0.7100 threshold and the monthly low near 0.7050.

Alternatively, bulls remain absent until the quote crosses the 100-DMA level surrounding 0.7240.

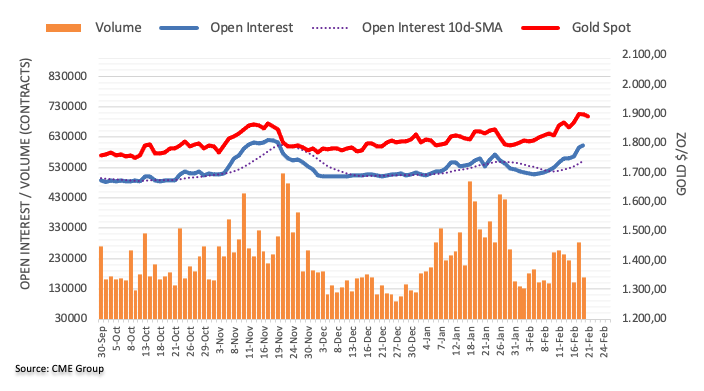

- Gold extended its rally for two consecutive days and gained 0.60% in the week.

- Heightened tensions in the Ukraine/Russian conflict increased the appetite for the safe-haven metal.

- XAU/USD Technical Outlook: Upward biased, helped by market sentiment. If the conflict escalates, the $2,000 mark is on the cards.

Tensions in the Ukraine/Russia region alongside Russia’s President Vladimir Putin recognizing two separatists Eastern Ukraine regions increased appetite for the safe-haven status of the yellow metal. At the time of writing, Gold is trading at $1,910, and up in the week some 0.60%.

Russia’s recognize Donetsk and Luhansk as independent states

On Monday during the North American session, the two separatist leaders sought recognition by Russia, which they got after a “long” speech of Russian President Vladimir Putin, who put in perspective the history of Ukraine and Russia. That said, Putin urged the Russian Parliament to support the decisions, signing a decree of cooperation and friendship with Donetsk and Luhansk leaders.

Russian President Putin ordered a peacekeeping operation in eastern Ukraine’s two separatist regions while reiterating that the West will impose sanctions anyway, adding that Russia has the right to take retaliatory measures.

Gold’s reaction

The non-yielding metal buyers took advantage of the US holiday observant of President’s day and pushed XAU/USD from $1,896 to $1,914, as war drums in Ukraine do not appear to fade.

West responses to Russian decision

The President of the European Commission said that the recognition of the two separatist territories in Ukraine is a “blatant violation of international law as well as of the Minsk agreements.” She emphasized that the EU will react with sanctions against those involved in this “illegal act.”

Across the pond, US President Joe Biden spoke with Ukraine President Zelensky. Further, US President Biden signed an executive order banning new investment, trade, and financing to the DNR and LNR regions while saying that he would announce additional measures. In the same rhetoric, Poland’s Prime Minister said that Russia’s decision is an act of aggression on Ukraine and said that sanctions should be imposed immediately. Meanwhile, in the UK, Foreign Minister Truss said that the UK would be announcing sanctions on Russia tomorrow in response.

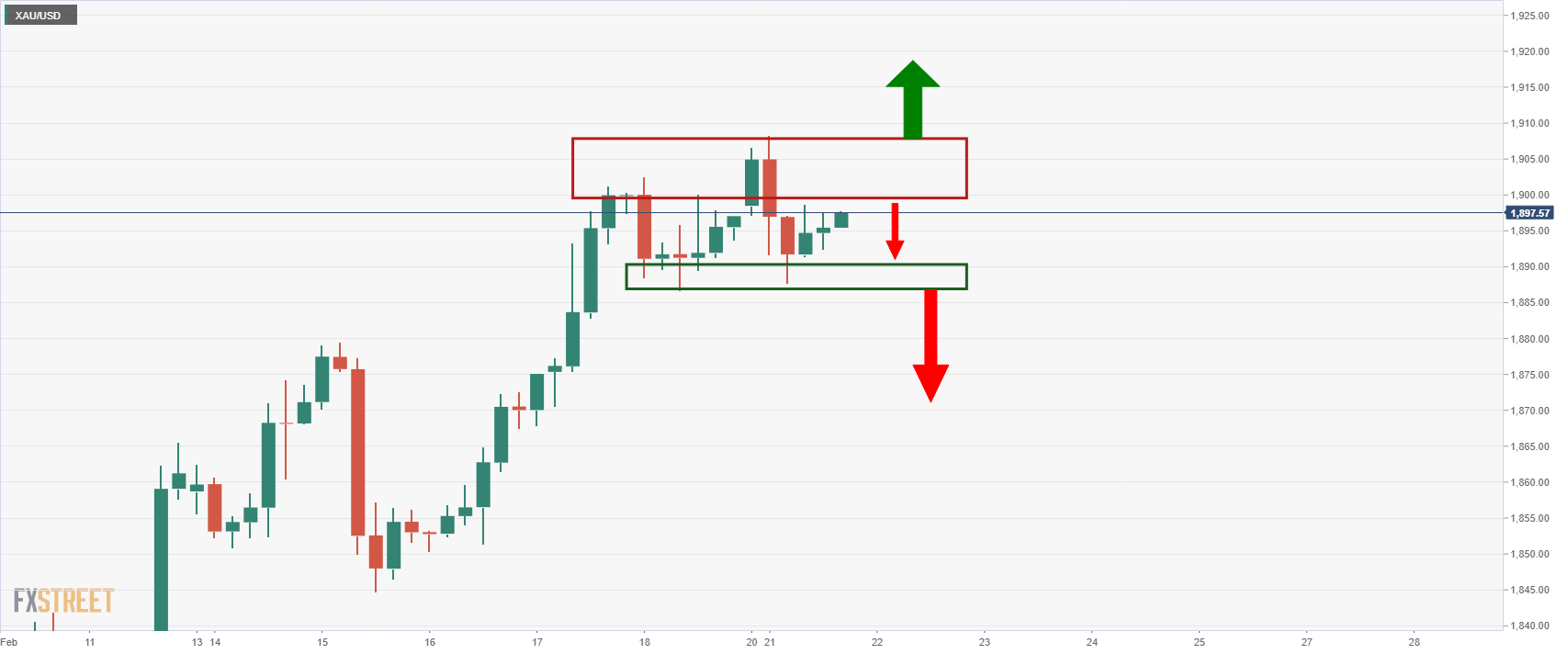

XAU/USD Price Forecast: Technical outlook

Gold is upward biased from a technical perspective. The daily moving averages (DMAs) reside well below XAU/USD spot price, with a bullish slope. That, alongside the break of a nine-month-old downslope resistance trendline, exacerbated the uptrend, helping XAU bulls reclaim the $1900 figure.

XAU/USD first resistance would be $1,916. Breach of the latter will expose January 2021 highs at $1,959, which once cleared could pave the way towards $2,000.

- EUR/USD takes offers to refresh intraday low, prints four-day downtrend.

- Clear break of 200-SMA, ascending trend line from late January favor sellers.

- MACD, RSI adds to the bearish bias targeting short-term support line.

- One-week-old descending trend line adds to the upside filters.

EUR/USD takes offers around 1.1300, printing a fourth consecutive daily downside during the initial Asian session on Tuesday. In doing so, the major currency pair justifies the market’s rush to risk-safety amid recently high fears concerning the Russia-Ukraine tussles.

Read: UK PM Johnson to chair COBRA meeting, Canada, US prepares economic sanctions over Russian actions

That said, the pair’s downside break of the 200-SMA and an upward sloping trend line from January 28 joins bearish MACD signals and descending RSI, not oversold, to keep EUR/USD sellers hopeful.

However, a 13-day-long support line near 1.1290 may test the pair sellers before directing them to the 61.8% Fibonacci retracement (Fibo.) of January-February upside, around 1.1265.

In a case where EUR/USD bears conquer 1.1265 support, 1.1230 and the 1.1200 threshold may act as buffers before directing the quote towards the late January’s bottom surrounding 1.1120.

Alternatively, 200-SMA and the previous support line guards immediate recovery moves of the EUR/USD prices around 1.1345-50.

Also challenging the pair buyers is a descending trend line from January 11, near 1.1375, as well as the 1.1400.

It’s worth noting that the quote’s run-up beyond 1.1400 will challenge the monthly peak of 1.1495.

EUR/USD: Four-hour chart

Trend: Further weakness expected

The West, as well as Japan, prepares harsh measures in response to Russian President Vladimir Putin’s decree "on friendship and cooperation," with Donetsk and Luhansk in Eastern Ukraine.

Firstly, UK PM Boris Johnson is up for a Cabinet Office Briefing Rooms (COBR) meeting at 06:30 GMT (01:30 ET) Tuesday. The agenda mentioned, “To discuss the latest developments in Ukraine and to coordinate the UK response including agreeing a significant package of sanctions to be introduced immediately.”

Following that, the Canadian Foreign Minister crossed wires while mentioning, “Canada strongly condemns Russian recognition of two breakaway regions in Eastern Ukraine, preparing to impose economic sanctions in response.”

Furthermore, the US ordered all remaining State Department personnel to leave Ukraine and US Embassy in Kyiv will be shifted to Poland while French Presidential Office mentioned, “France wants Friday's meeting of Russian and French Foreign Ministers in Paris to be maintained.”

It’s worth noting that Japan’s Yomiuri mentioned, “Japan to join US in halting semiconductor exports to Russia if it invades Ukraine.”

Additionally, Australia PM Scott Morrison said that they will be in lockstep with allies on sanctions on Russia.

Also read: Western nations moving swiftly to sanction Russia as cold war warms-up

FX reaction

The news weighed on the market’s risk appetite and drags Antipodeans like AUD/USD and NZD/USD, while also fueling gold prices.

Read: NZD/USD sellers attack 0.6700 as Russian headlines widen risk-off mood

- AUD/JPY has slipped below 82.50 as investors prefer Japanese yen on the risk-off episode.

- The labeling of Donetsk and Lugansk as independent by Russia has escalated tensions.

- The comments from RBA’s Christopher Kent will dictate March’s interest rate policy.

The AUD/JPY pair has attracted offers around 82.64 and is likely to settle below 82.50 amid the escalation of geopolitical tensions between Russia and Ukraine. Post recognizing the two regions of Ukraine: Donetsk and Lugansk as independent, Moscow has violated cooperation with NATO. Adding to that, the move by Russia has been considered as a prefix to invade Ukraine.

The move is claiming the credibility of Western warnings that Russia is planning to invade Ukraine and sanctions from Western leaders are getting much air. The escalation in the Russia-Ukraine tussle has hammered the macro/risk barometer. The Japanese yen has been underpinned against the antipodean on risk-off impulse as the rising geopolitical tensions are raising questions over the macro peace and stability.

Meanwhile, British foreign minister Liz Truss has said in a Twitter post that their administration will announce new sanctions on Moscow in response to Putin's decision. Should this occur, the risk-off episodes may stay longer on rising uncertainty and the aussie will continue to perform weaker against the Japanese yen.

Apart from that, the speech from the Reserve Bank of Australia (RBA)’s Christopher Kent will provide some insights on March’s interest rate policy, which is due on Tuesday. While the Tokyo Consumer Price Index (CPI) numbers from the Statistics Bureau of Japan on Friday will be under the radar.

- NZD/USD steps back after refreshing monthly high, pressured of late.

- Russia’s identification of Donetsk and Luhansk as separate states, ordering troops for peacemaking recently weighed on sentiment.

- NZ PM Ardern released details of Step 1 for unlocking, pre-RBNZ optimism initially favored kiwi bulls.

- Full markets, US PMI eyed for intraday directions but risk catalysts are more important.

NZD/USD began the trading week on a firmer footing before the latest pullback dragged it down to 0.6700 during the early hours of Tuesday morning in Asia.

The kiwi pair initially cheered hawkish hopes from the Reserve Bank of New Zealand (RBNZ) and news over the Biden-Putin meeting before Russian President Vladimir Putin’s actions roiled risk appetite. It’s worth noting that an off in the US and Canada curbed the market’s reaction to the anti-risk headlines.

With sustained improvement in New Zealand’s headlines inflation and jobs report, the RBNZ is well-set for a 0.25% rate hike and the chatters over 50 basis points (bps) of a lift aren’t off the table. Though, a faster spread of the covid in the Pacific nation joins geopolitical risks to test the bulls. On Monday, New Zealand (NZ) Prime Minister Jacinda Ardern unveiled “Step 1” of her five-step total unlock from the covid-led restrictions, including the border openings, which in turn offered extra tailwind to the NZD/USD prices before the risk-off mood weighed on the quote.

Reuters came out with the news conveying that Russia has the right to build and establish military bases in eastern Ukraine under a new agreement with separatist leaders. A few hours prior, Russian President Putin recognized Donetsk and Luhansk in Eastern Ukraine as independent states and signed a decree "on friendship and cooperation," which in turn triggered risk-aversion and weighed on the Antipodeans like NZD/USD. Also on the negative side were comments from Putin who turned down optimism over his meeting with US President Joe Biden by signaling no concrete plans for the summit.

Elsewhere, Federal Reserve Board Governor Michelle Bowman followed the tunes of Chicago Fed President Charles Evans and New York Federal Reserve Bank President John Williams while saying, “It is too soon to tell if the Fed should hike 25 or 50bps in March.”

Amid these plays, the US and European stock futures remain downbeat and the bund yields stay firmer.

Moving on, New Zealand’s Credit Card Spending for January, prior 1.2% YoY, will offer intermediate moves ahead of the preliminary US PMIs for February. However, major attention will be given to the full markets’ reaction and geopolitical headlines for clear direction.

Read: US Markit PMIs Preview: Services sector has room for upside surprise, boosting the dollar

Technical analysis

NZD/USD recently failed to cross the 0.6730-35 resistance confluence, including the 50-DMA and a descending trend line from October 28. However, firmer RSI and bullish MACD signals keep the buyers hopeful until the quote drops below a three-week-old support line, near 0.6630.

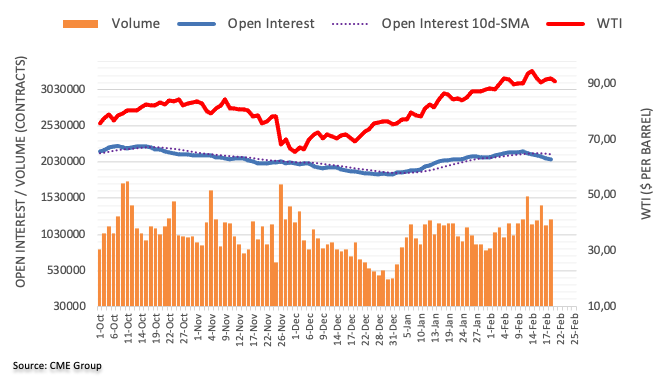

- WTI rallies more than 2% on Monday, courtesy of Russia’s President Putin, recognizing Donetsk and Luhansk as independent states.

- Oil prices jumped once the headline crossed the wires, almost $2.00.

- WTI Technical Outlook: Upward biased as long as it stays above $90,00.

On Monday, a session that looked to be of losses for Western Texas Intermediate (WTI) US crude oil benchmark resulted in a positive one courtesy of escalation of Russia/Ukraine tussles. At the time of writing, WTI is trading at $93.92 per barrel.

In the last three hours, tensions in Ukraine get to their peak as Russian President Vladimir Putin recognized Donetsk and Luhansk in Ukraine East as independent states. Furthermore, he ordered a peacekeeping operation in eastern Ukraine, two separatist regions.

That said, WTI’s jumped from the lows 92.00 and reached a daily high at $94.06 before retreating to the $93.90s region. Why oil jump? Russia is the third-largest oil and gas producer in the world. An escalation of the conflict pressures oil prices as uncertainty arises about any oil shortages amid the ongoing worldwide re-opening.

The West answers back

Russian President decision spurred responses from Western Europe and NATO members, led by the US. The President of the European Commission said that the recognition of the two separatist territories in Ukraine is a “blatant violation of international law as well as of the Minsk agreements.” She emphasized that the EU will react with sanctions against those involved in this “illegal act.”

Following those reactions, it was reported that US President Joe Biden spoke with Ukraine President Zelensky. At the same time, Poland’s Prime Minister said that Russia’s decision is an act of aggression on Ukraine and said that sanctions should be imposed immediately. Meanwhile, in the UK, Foreign Minister Truss said that the UK would be announcing sanctions on Russia tomorrow in response.

WTI Price Forecast: Technical outlook

From a technical perspective, WTI has an upward bias, as shown by the daily moving averages (DMAs) located above the price. Furthermore, from a market structure perspective, WTI stays trading in the $92.00-$94.00 area, close to the YTD high and the confluence of the 75% Pitchfork’s parallel line around $95.79.

However, on its way to the latter, WTI’s bulls will face some resistance levels on their way north. The first resistance would be $94.00. Breach of the latter would open the door towards February 16 high at $94.98, immediately followed by the YTD high at $95.79. Once cleared, WTI bulls would probe August 2014 highs at $98.55.

- The Kremlin’s recognition of two regions in eastern Ukraine as independent has escalated tensions.

- The DXY is eyeing to settle above 96.00 on risk-off impulse in the market.

USD/JPY is bleeding out on the prospects of an escalation on the geopolitical side in the Russian and Ukraine crisis. USD/JPY is trading at fresh lows near 114.71. Moscow is continuously jeopardizing the situation for Ukraine. The labelling of two regions in eastern Ukraine as independent entities has escalated the tensions. The statement of recognizing Donetsk and Lugansk as independent after signing a decree along with the support from Separatists is a violation of cooperation with the West.

The headlines from the Russia-Ukraine tussle will continue to keep the investors on their toes. However, the investors will also keep an eye over the US Markit PMI Composite reports on Manufacturing and Services and Consumer Confidence numbers, which are due on Tuesday.

The USD/JPY pair had otherwise witnessed some stellar bids around 114.75 after the Federal Reserve (Fed)’s Bard Governor Michelle Bowman keeps the windows open for a potential 50 basis points (bps) interest rate hike in March. The comments have cleared that an aggressive tightening policy of a 50 bps hike is under the choice list of the Fed to combat the rising inflation.

For deciding the extent of an interest rate hike, the Fed has to pass one more inflation report and employment figures, which may be very crucial before reaching an outcome. Adding to that, the Fed’s Michelle Bowman states that the Fed's balance sheet is highly required to scale down to an appropriate and manageable level that may help control the ramping-up inflation.

Meanwhile, the US dollar index (DXY) is eyeing to settle above 96.00 on geopolitical jitters. The market participants have also channelized their funds into DXY on a hawkish stance from the Fed’s Michelle Bowman, which has underpinned the greenback.

Russian President Vladimir Putin delivered a threatening speech in the New York session which has weighed on risk and encouraged a swift response from the West with harsh new sanctions being implemented.

Putin has signed a separatist recognition decree over eastern Ukraine regions and the decrees on recognizing the Donetsk and Luhansk People’s Republics also ordered the Russian armed forces to go into separatist territory on peacekeeping missions.

This has sparked retaliation from the US, UK, EU and UN and the Twitter feeds are quoting some key figures on the international stage in this regard:

- UN chief Guterres considers Russia's eastern Ukraine recognition a 'violation of territorial integrity, sovereignty of Ukraine, inconsistent with UN charter.

- UK govt says sanctions expected to go further if invasion happens, so they won’t go as far as full package prepared, The Guardian.

- UK govt confirms it will be announcing Russia sanctions tomorrow in response to Putin's declaration, The Guardian.

- White House official says Biden has started the call with France's Macron and Germany's Scholz.

- German government spokesman: Chancellor Scholz agreed with macron and Biden that Putin's decision won't go unanswered.

Update

Reuters recently came out with the news conveying that Russia has right to build and establish military bases in eastern ukraine under new agreement with separatist leaders.

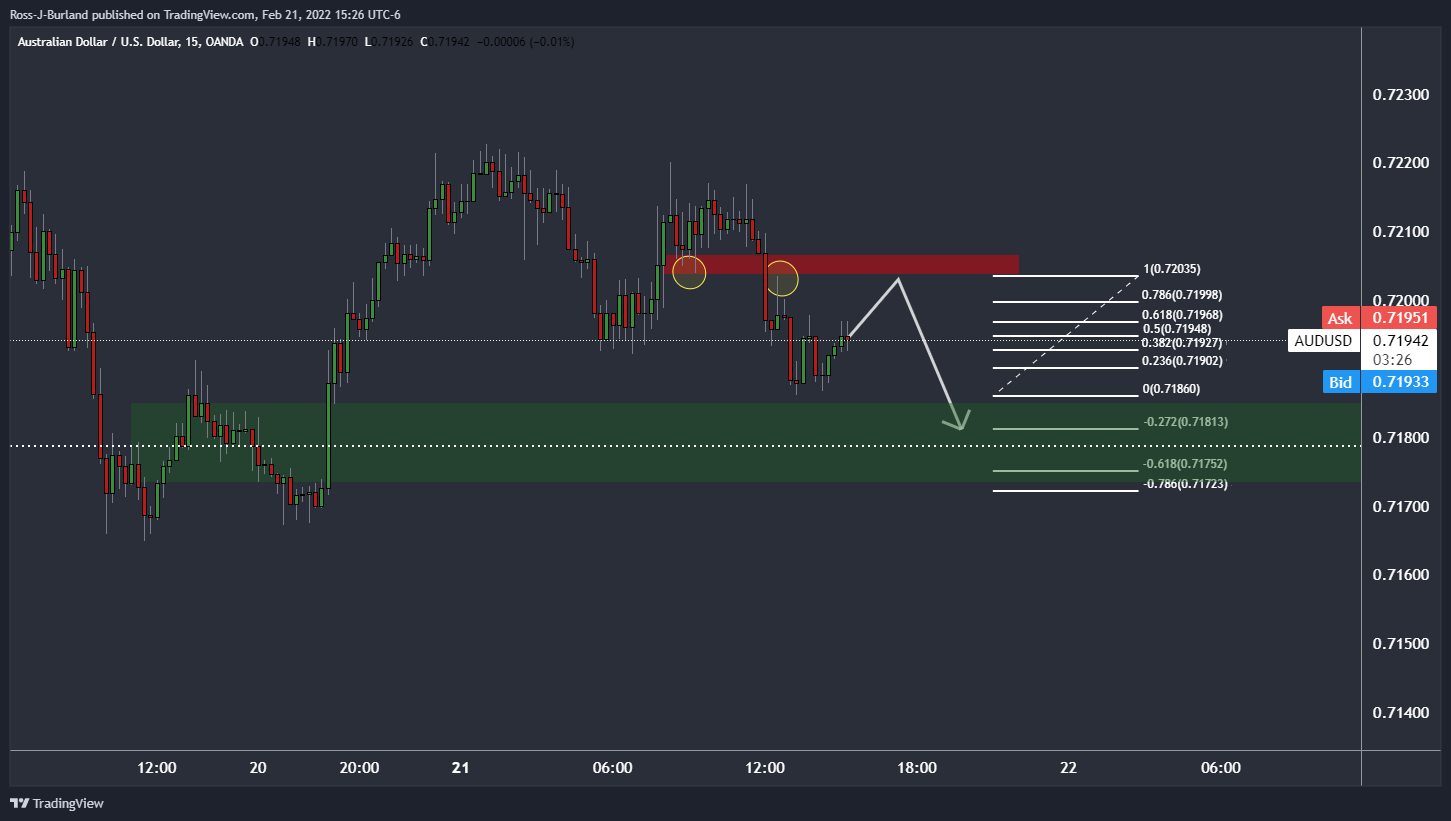

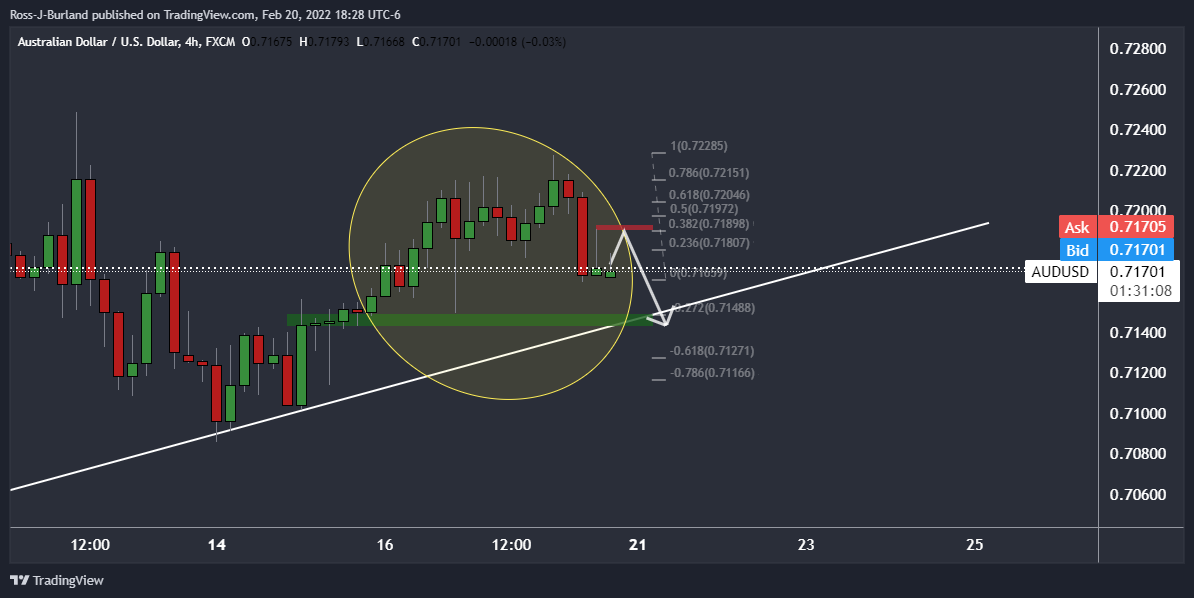

- AUD/USD resistance is identified near 0.72 the figure.

- A Fibo extension to the downside in measuring for the 50% mean revision leaves 0.7181 as a key target.

The price is attempting to break lower but there is some meanwhile support coming in at the lows. A correction to prior lows could be on the cards in a 50% mean reversion.

AUD/USD H1 chart

This could be expected to act as resistance and result in further selling for fresh hourly lows into the 0.7180's.

AUD/USD M15 chart

From a 15-min perspective, the resistance structure is made clearer with the above chart identifying the wicks of prior lows and highs near 0.72 the figure.

This would be expected to act as resistance on a retest as the price corrects from the hourly lows. A Fibo extension to the downside in measuring for the 50% mean revision leaves 0.7181 as a key target to the downside for a continuation.

- EUR/JPY slumped under 130.00 for the first time since February 3 on Monday as Russia escalated tensions with Ukraine & NATO.

- Russia announced its decision to recognise the independence of breakaway regions of eastern Ukraine and NATO nations are preparing sanctions.

- Geopolitical hostilities and the rising risk of a broader Ukraine/Russia conflict suggests EUR/JPY’s risks are tilted lower.

EUR/JPY slumped below support at the key psychological 130.00 area for the first time since February 3 on Monday, as the euro suffered from further escalation in the Russia/Ukraine crisis. The pair is now trading in the 129.75 area, down about 0.3% on the day and a more than 0.8% turnaround from earlier session highs nearer to 131.00. Russian President Vladimir Putin confirmed that Russia would be recognising the independence of the Donetsk and Luhansk People’s Republics in Donbas, two pro-Russia breakaway regions of Eastern Ukraine over which a bitter civil war was fought back in 2014/15.

Market participants interpreted Russia’s decision to recognise the breakaway regions as independent substantially increasing the risk of a broader military confrontation between the Russian and Ukrainian armies. The fear is that Russia will step in to back the separatist region as hostilities with Ukraine’s army ratchet up. Various EU and NATO nations are now understood to be preparing a preliminary round of sanctions against Russia, with Western nations claiming Russia’s declaration goes against international law. Given its dependence on Russian energy imports, the Eurozone economy is seen as vulnerable to any Russian counter-sanctions.

For this reason, over the course of the coming days and especially now since key support at the 130.00 level has been broken, EUR/JPY’s risks seem tilted to the downside. Traders will once again be looking at a long-term uptrend linking the November 2020, December 2021 and January 2022 lows which will offer support just under 129.00. In the meantime, the most immediate area of support is in the 129.50 area. A lack of notable tier one data releases out of the Eurozone or Japan should mean that geopolitics and broader risk appetite remains the major driver of the pair.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:00 (GMT) | Australia | RBA Assist Gov Kent Speaks | |||

| 07:00 (GMT) | United Kingdom | PSNB, bln | January | -16.8 | 3.5 |

| 09:00 (GMT) | Germany | IFO - Current Assessment | February | 96.1 | 96.6 |

| 09:00 (GMT) | Germany | IFO - Expectations | February | 95.2 | 96.5 |

| 09:00 (GMT) | Germany | IFO - Business Climate | February | 95.7 | 96.5 |

| 10:45 (GMT) | United Kingdom | MPC Member Ramsden Speaks | |||

| 11:00 (GMT) | United Kingdom | CBI industrial order books balance | February | 24 | 25 |

| 14:00 (GMT) | U.S. | Housing Price Index, y/y | December | 17.5% | |

| 14:00 (GMT) | U.S. | Housing Price Index, m/m | December | 1.1% | |

| 14:00 (GMT) | Belgium | Business Climate | February | 2.7 | |

| 14:00 (GMT) | U.S. | S&P/Case-Shiller Home Price Indices, y/y | December | 18.3% | 18.2% |

| 14:45 (GMT) | U.S. | Manufacturing PMI | February | 55.5 | 56 |

| 14:45 (GMT) | U.S. | Services PMI | February | 51.2 | 53 |

| 15:00 (GMT) | U.S. | Richmond Fed Manufacturing Index | February | 8 | |

| 15:00 (GMT) | U.S. | Consumer confidence | February | 113.8 | 109.8 |

- USD/RUB holds in the bullish territory as the Russian/Ukraine crisis unfolds.

- Volatility picks up in historical events for Russia and Ukraine.

The Russian ruble is volatile on Monday as the headlines roll in thick and fast regarding the developments at the Kremlin. Russia's President Vladimir Putin has announced his intention to sign a separatist recognition decree over eastern Ukraine regions.

The following illustrates the market volatility on the 1-hour chart and a timeline of how the price has reacted to various stages of the crisis unfolding on a daily basis since November 2021. This was when Satellite imagery showed a new build-up of Russian troops on the border with Ukraine.

USD/RUB H1 chart

USD/RUB daily chart

-637810717110523165.png)

What you need to take care of on Tuesday, February 22:

Risk aversion took over financial markets at the beginning of the week amid escalating geopolitical tensions in Eastern Europe. The greenback managed to advance against its high-yielding rivals but lost ground against safe-haven ones.

Mid US-afternoon, Russian President Vladimir Putin recognized Donetsk and Luhansk in Eastern Ukraine as independent states signed a decree "on friendship and cooperation." The world sees this decision as the first step towards an invasion, which also invalidates talks with Western nations.

Earlier in the day, EU's Josep Borrel, High Representative of the Union for Foreign Affairs and Security Policy, said that the EU is ready to 'strongly r'act' if Russia recognizes Donbass independence, which Putin did by the end of the American afternoon. Borrel tweeted:"The recognition of the two separatist territories in #Ukraine is a blatant violation of international law, the territorial integrity of Ukraine and the #Minsk agreements"

Markit published the preliminary estimates of its February PMIs for the EU. The services sector posted a nice comeback with the German index up to 56.6 and that of the EU printing at 55.8. The manufacturing PMI in both economies came in below expected, but well above the 50 level that divides contraction from economic expansion

The EUR/USD pair is approaching 1.1300 while GBP/USD battles around 1.3600. Commodity-linked currencies are down vs the greenback, despite gold is trading above $1,903 a troy ounce amid demand for safety, while crude oil prices surged on disruption fears, with WTI now changing hands at $92.75 a barrel.

US markets were closed due to President Day, but stocks futures edged firmly lower on Russia/Ukraine news. European and Asian futures are also down, hinting at an upcoming risk-off Tuesday.

Shiba Inu firms up support before SHIBA tests a breakout above $0.000030

Like this article? Help us with some feedback by answering this survey:

- On Monday, the EUR/GBP falls 0.13% during the day.

- Russian President Vladimir Putin’s recognition of Donetsk and Luhansk ad independent states worsened the market mood.

- EUR/GBP Technical Outlook: Downward biased, as sellers eye the YTD low at 0.8264.

The shared currency continued falling for the fourth consecutive day vs. the British pound during the North American session on Monday. At the time of writing, the EUR/GBP is trading at 0.8320, down 0.08%.

The market is in a risk-off mood, courtesy of increasing tensions in the Ukraine/Russia conflict. As of late, Russian President Vladimir Putin recognized the independence of the Donetsk and Luhansk in Ukraine’s East as independent states.

That said, global equity futures fall, led by Asian and European equity futures. At the same time, Gold is above the $1900 mark, while crude oil futures rise, with Brent and WTI. Each up close to 3%, sitting at $94.10 and $92.80.

In the overnight session for North American traders, the EUR/GBP reached a daily high at 0.8351. However, better than expected UK PMI’s alongside a dampened market mood weighed on the euro, pushing the pair towards lows 0.8300s.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP is downward biased from a technical perspective, as confirmed by the daily moving averages (DMAs) residing well above the exchange rate. On Monday, the EUR/GBP broke the bottom-trendline of a descending channel and eyes to break the January 28 daily low at 0.8305. The Relative Strength Index (RSI), an oscillator at 40 is aiming down, signals that EUR/GBP sellers have enough room to spare, to push the pair lower before reaching oversold conditions.

Therefore, the EUR/GBP first support would be January 28 daily low at 0.8305. Breach of the latter would expose 0.8300, followed by February 3 daily low at 0.8284, and then the 2017 April’s 17 daily high at 0.8117.

-637810707798772307.png)

- Prior to the close of US equity index futures trade, S&P 500 futures fell back under the 4300 level.

- Russia will recognise the independence of breakaway regions in Eastern Ukraine, ramping up tensions and weighing on sentiment.

- Hawkish Fed commentary may have added to the downside as US Core PCE inflation data looms later in the week.

S&P 500 futures fell sharply on Monday as geopolitical tensions simmered amid expectations that Russia would recognise the independence of two breakaway provinces in Eastern Ukraine, setting the stage for further military escalation in the region. After a long speech where he explained the history of Ukraine and was strongly critical of the country, Russian President Vladimir Putin made the recognition of the breakaway regions official. US equity index futures trade has been halted since 1800GMT and won’t yet restart for a few hours when Asia markets open, but now before S&P 500 futures dropped below the 4300 level for the first time since late January. When futures trade reopens, traders will undoubtedly be eyeing a test of January lows nearer to 4200.

Another factor that likely weighed on US equity futures on Monday was hawkish remarks from Fed policymaker Michelle Bowman. Bowman said it was too early to know if the US economy needs a 50bps rate hike in March, thus keeping the door open to the prospect of a larger rate move. As market commentators have pointed out, just because geopolitics has come to the forefront as the major market-moving theme in recent weeks doesn’t mean that investors have forgotten about Fed tightening fears. In the context of hawkish commentary on Monday, this week’s US data, especially Thursday’s January Core PCE inflation.

An upside surprise, which would come on the heels of upside surprises for both January’s Consumer and Producer Price Inflation readings, could further build the case for a 50bps move, though most analysts see the February CPI data as key. Regardless, hot data likely won’t go down well in the US equity space and, if coupled with further escalation of the Ukraine crisis, would imply a real risk of breaking out to fresh annual lows in the 4200 area. Note that Monday’s S&P 500 futures close left the index more than 10% below the record highs above 4800 hit at the start of the year, confirming a correction. Investors will worry whether this correction might now turn into a bear market (a 20% drop).

- USD/CAD is ticking higher despite strong oil prices.

- Ris-off markets are hurting the commodity complex currencies as Putin addresses the nation.

The Canadian dollar weakened against its US counterpart on Friday and remains pressured at the start of the week despite the price of oil spiking on Monday. Risk-off is the theme as investors, mindful of Russia's military build-up around Ukraine, turn to the latest developments and announcements from the Kremlin.

Watch live: Putin speaks over Ukraine in contempt

At the time of writing, Russia's president, Vladimir Putin, is addressing the nation and making his opinions about Ukraine in contempt. This is hurting risk-FX and the CAD included as investors seek out safe-havens, such as gold which is breaking to the day's highs currently.

Meanwhile, during his long-winded speech, Putin is expected to say that he has signed a separatist recognition decree over eastern Ukraine regions which will be another step closer to the prospects of a European war and will likely hurt risk associated assets classes in financial markets.

The price of oil, however, is getting a boost as traders anticipate sanctions on Russian exports. The market has room to run higher considering investors opted to liquidate their length in WTI crude oil recently. Conflicting reports between escalation and de-escalation have made for a volatile landscape for the energy sector.

''Until there is some clarity in either direction, the risk premium is likely to remain baked into market pricing,'' analysts at TD Securities argued. ''With non-geopolitical supply factors starting to shift toward looser markets, energy prices are particularly vulnerable to a de-escalation in Russian-Ukrainian tensions in the immediate term.''

As for domestics, Canadian Retail Sales rose 2.4% in January from December, a flash estimate from Statistics Canada showed, supporting expectations for the Bank of Canada to begin hiking interest rates at the March 2 policy announcement.

- NZD/USD has fallen back to the 0.6700 area in recent trade as the US dollar enjoy a modest intra-day recovery.

- The buck has been underpinned in recent trade as geopolitical tensions regarding the Ukraine crisis rise.

- Ahead, aside from geopolitics, the main event of the week will be the RBNZ rate decision.

NZD/USD has fallen back to 0.6700 in recent trade after hitting fresh monthly highs in the 0.6730s earlier in the session, as the US dollar enjoys a modest intra-day recovery amid heightened geopolitical tensions. Russian President Vladimir Putin has been delivering a long, inflammatory speech where he practically criticised everything about the existence of the state of Ukraine and will soon announce a decision to recognise the independence of two breakaway Ukrainian regions. Investors have been buying safe-haven dollars in recent trade and selling other G10 currencies, including the kiwi, out of fear that this recognition will lead to an escalation of tensions between the militaries of Ukraine and Russia.

At current levels, NZD/USD is still trading with gains of about 01% on the day, with traders seemingly reluctant to short the kiwi/unload long positions ahead of this Wednesday’s RBNZ meeting. Analysts are split over whether the bank will hike by 25bps or 50bps and that hawkish risk seems to be underpinning NZD/USD in 0.6700 area. Otherwise, Fed speak and US data this week including flash February PMIs, the second estimate of Q4 GDP growth and January Core PCE data will be worth watching, but will likely play fiddle to the RBNZ meeting and geopolitical developments.

Russian President Vladimir Putin on Monday called Eastern Ukraine "ancient Russian lands" and said that the region is an integral part of Russian history. Putin said that the situation in Eastern Ukraine is "critical" and talked about how modern Ukraine was created by communist Russia under Boshevik leader Vladimir Lenin.

- Silver retreats from weekly tops around $24.00 as the Russian President recognize Donetsk and Luhansk as independent states.

- The white-metal falls despite a weaker US dollar across the board.

- XAG/USD Technical Outlook: Faces strong resistance around $24.00-$24.25 area.

Silver (XAG/USD) retreats from $24.00 despite growing concerns in geopolitical jitters in Eastern Europe. At the time of writing, XAG/USD is trading at $23.90.

Russia’s signed a decree recognizing Donetsk and Luhansk as independent states

War concerns between Russia and Ukraine increase. In the last couple of hours, amid a US bank holiday, the conflict in Eastern Europe grabs all the attention. Leaders from two Eastern Ukraine separatist regions urged Russian President Vladimir Putin, who, at 18:00 GMT, signed a decree recognizing them as independent states.

That said, the XAG/USD barely blinked at the reaction of the headline crossing the wires, steady around the $23.80 region.

During the overnight session for North American traders, the white metal failed to gain acceptance above the $24.00 mark, protected above by a ten-month-old downslope trendline and the 200-day moving average (DMA) at $24.25. It is worth noting that based on the price action, the $0,15 mean reversion move could be attributed to profit-taking, as the non-yielding metal, as shown by the 1-hour chart, stalled at the 50-hour moving average (HMA) around $23.86.

XAG/USD Price Forecast: Technical outlook

XAG/USD is neutral biased, depicted by the daily chart. The shorter time-frame daily moving averages (DMAs) reside below the spot price, indicating that XAG/USD aims upward. However, the presence of a ten-month-old trendline around the $24.00 mark, alongside the 200-DMA at $24.25, would be crucial resistance levels to overcome for XAG bulls if they would like to aim higher.

At press time, XAG/USD first resistance would be $24.00. Once cleared, it would expose the 200-DMA at $24.25. Breach of the latter would pave the way towards last year’s November 16 daily high at $25.40.

- EUR/USD dipped in recent trade as confirmation of Putin’s recognition of breakaway Ukrainian regions triggered fears of further escalation.

- The pair dipped back to the 1.1320 area to then find support at last Friday’s lows to trade flat.

EUR/USD dipped sharply in recent trade, falling from around the 1.1340 area to under 1.1320 in a matter of minutes after the Kremlin confirmed that Russian President Vladimir Putin would sign a decree recognising the independence of separatist Ukrainian regions. Traders sold their euro and bought safe-haven US dollar amid concerns that official Russian recognition of the statehood of the Donetsk and Luhansk People’s Republics makes a military confrontation between Ukraine and Russia much more likely.

Russia and the breakaway regions located in Ukraine’s East may well now sign some sort of defense partnership. Given that the breakaway regions have been escalating the conflict with Ukraine’s military in recent days, that could see Russian forces dragged into the fray to directly engage the Ukrainian military in combat. Russian military action against Ukraine would almost certainly see NATO countries impose tough economic sanctions on Moscow, leaving the Russian-energy import-dependent Eurozone vulnerable to Russian countermeasures, hence the downside in the euro.

Hawkish Fed speak on Monday from FOMC member Michelle Bowman, who said it was too early to know if the US economy needs a 50bps rate hike in March, further adds to the case for a lower EUR/USD on Monday. At current levels around 1.1320, the pair has not eroded all of its earlier gains and is trading flat on the day, though has found some support in the form of last Friday’s lows in the 1.1310s. Looking ahead, geopolitics will remain in the driving seat and with things likely to escalate further, that suggests downside risks for EUR/USD. A break below last Friday’s lows would free up a run towards last week’s lows in the 1.1280 area.

- AUD/USD bears moving in on risks associated with the Kremlin.

- Aussie wages are a focus for the week ahead.

AUD/USD is under pressure as the Kremlin announces that the Russian president, Vladimir Putin plans to sign Ukraine separatist recognition. At the time of writing, AUD/USD is sliding a handful of pips below the 0.72 figure with the swing lows of 0.7192 eyed ahead of 0.7165.

Putin is due to address the nation at any moment which is leaving markets on edge. He is expected to say that he has signed a separatist recognition decree over eastern Ukraine regions which will be another step closer to the prospects of a European war and hurt risk associated asset classes in financial markets.

Meanwhile, NATO leaders and the West will be expected to retaliate with sanctions and such announcements will follow shortly. EU's Josep Borrell said, ''if there is a recognition I will put the sanctions on the table for ministers to decide.''

The US is also prepared to impose swift and severe consequences if Russia invades Ukraine, with the White House noting and stating that Russia appears to continue preparations for a full-scale assault on Ukraine very soon. Biden's administration has already prepared an initial package of sanctions that include barring US financial institutions from processing transactions for major Russian banks. A G7 meeting is also due to take place this Thursday, a White House spokesman said.

Meanwhile, in Australia, the main domestic event will be wages data for the December quarter. Forecasts expect a rise of 0.7% to take the annual pace up to 2.4%, from 2.2%. ''That would be the fastest annual gain since late 2014, though still short of the 3%-plus the Reserve Bank of Australia (RBA) wants to see,'' Reuters reported.

''The RBA has said it is plausible a rate rise could come later this year, while markets are fully priced for a move to 0.25% by June.'' Analysts at TD securities argued that ''if wages surprise above 2.5% YoY, AU rates is likely to underperform as the markets test the RBA's dovish stance.''

AUD/USD technical analysis

The price is on the verge of a significant test of the trendline support on the hourly chart. 0.7192 guards the prospects of a run to the prior swing lows of 0.7165.

Russian President Vladimir Putin is to sign a decree recognise the breakaway regions of Eastern Ukraine, Donetsk and Luhansk, as independent nations, the Kremlin announced on Monday. Putin had informed the President of France and Chancellor of Germany of his decision shortly before the Kremlin made it official and they were reportedly "dismayed". France has subsequently called for a UN security council meeting on the Ukraine crisis, reported French press.

Market Reaction

Markets saw a risk-off reaction to confirmation that Russia will recognise the breakaway regions of Ukraine as independent as this is deemed as a big escalation that makes a military confrontation between Ukraine and Russia (i.e. a Russian invasion) significantly more likely. In FX markets, safe-haven currencies including USD and others have been gaining in recent trade while risk-sensitive currencies have been taking a hit. US equity futures continue to press to fresh lows of the day, with S&P 500 futures now down about 1.3% and underneath the 4300 level. Oil prices have been on the front foot with WTI rallying into the mid-$93.00s from as low as the mid-$92.00s just a few minutes ago.

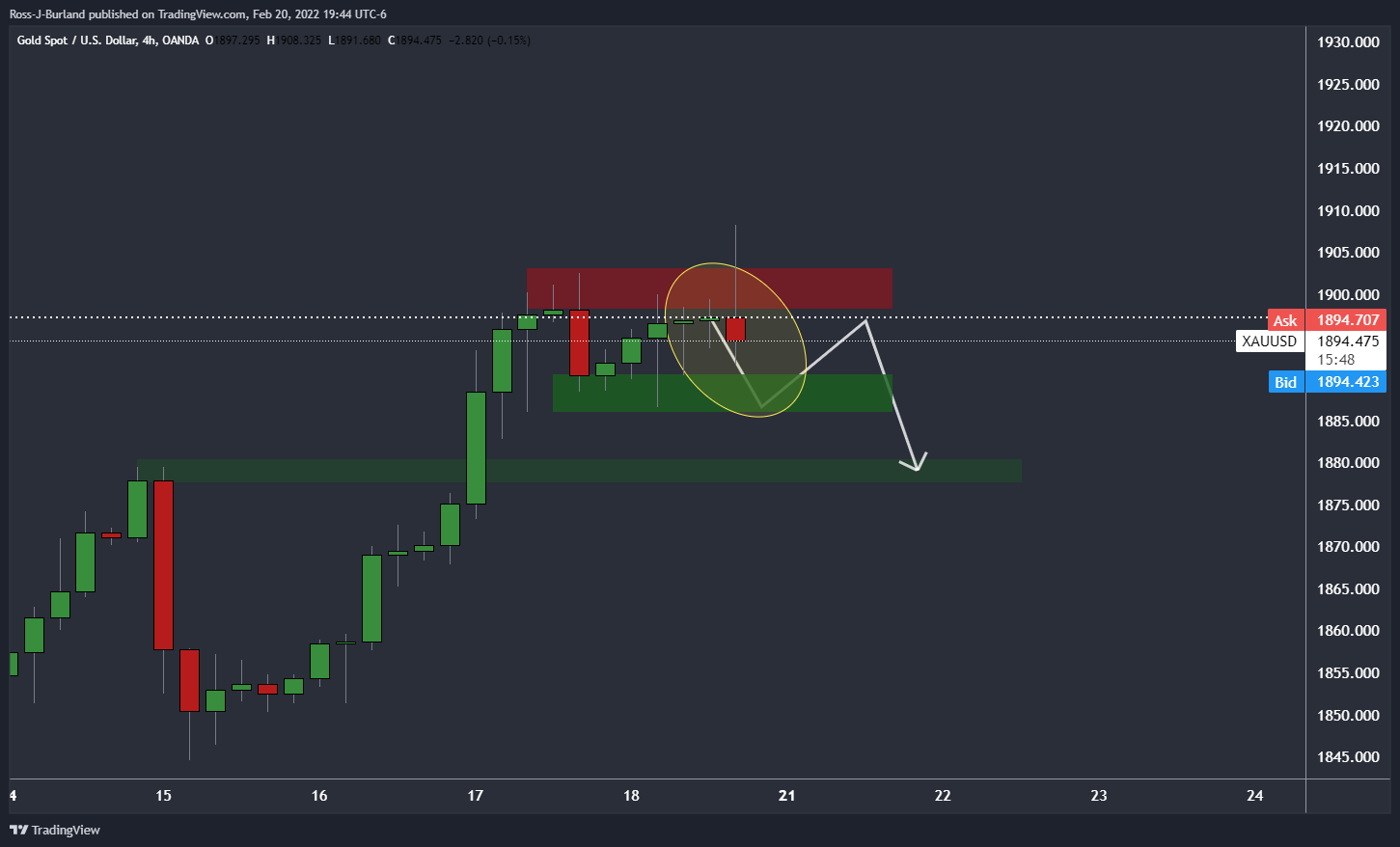

- Gold is subdued as markets await developments from the Kremlin.

- Russia's President Putin is to address the nation at 1800 GMT which could be market impactful.

Gold has been trapped in a sideways consolidation in Monday's range and between the toing and froing of headlines centred around the Russian/Ukraine drama. It is the zero hour for diplomacy and the Kremlin has regretfully said there were no concrete plans for a summit over Ukraine between the Russian and US presidents. The safe-havens, such as gold and the US dollar, are benefitting, thus trapping the yellow metal in a risk-off boundary.

At the time of writing, XAU/USD is flat at $1,895.92 and has travelled between $1,887.66 and $1,908.32 on the day so far. Reports that Russian president Vladimir Putin and US president Joe Biden had agreed in principle to a summit had sparked up a risk-on vibe in the opening hours of the week, weighing on precious metals.

US president Joe Biden will participate in the G7 meeting this Thursday, a White House spokesman said. The official also said, however, that the US is prepared to impose swift and severe consequences if Russia invades, adding that Russia appears to continue preparations for a full-scale assault on Ukraine very soon.

Putin to address the nation

The focus for the immediate future will be on Putin at the top of the hour where he is scheduled to address the nation. Markets will be on the edge of their seats to understand whether Putin has decided today whether to recognise the independence of two breakaway regions in eastern Ukraine.

The BBC wrote that ''the Donetsk and Luhansk regions have been contested by Ukraine and Russia-backed rebels for years, with regular violence despite a ceasefire agreement.

Leaders of both regions asked Russia to recognise their independence on Monday.

But Western powers fear such a move could be used as a pretext for Russia to invade its neighbour.

Since 2019, Russia has issued large numbers of passports to people living in the two regions.

Analysts say that if the two regions were recognised as independent, Russia might send troops into Ukraine's east under the guise of protecting its citizens.''

Market implications

Should there be signs of the infiltration of troops into the region, such an escalation will be a big blow for markets and gold would be expected to benefit on the knee-jerk s trend-followers and speculators reengage.

Gold, technical analysis

The price is trapped in 4-hour range traders are waiting for the breakout, one way or the other.

- The British pound holds its daily gains following positive UK economic data amid Eastern Europe escalation.

- The greenback remains trading softer despite an appetite for safe-haven peers.

- GBP/USD Technical Outlook: Neutral-upwards despite that the 200-DMA resides above the exchange rate.

The British pound retreats from daily highs amid increasing tensions in Eastern Europe. At the time of writing, the GBP/USD is trading at 1.3614, up some 0.13%. As abovementioned, geopolitical jitters caused a fall in the GBP/USD as of late amid a US bank holiday.

Risk-aversion looms the financial markets. Europea bourses trade in the red, while US equity futures drop between 0.73% and 1.66%. Further, the greenback keeps weakening in the day, with the US Dollar Index down 0.14%, sitting at 95.91.

UK’s Services PMI smashed expectations

The UK reported better than estimated Markit PMIs for February in the European session, led by the Services Flash rising to 60.8, higher than the 55.5 foreseen. Further, the Manufacturing Flash rose to 57.3, a tenth up than estimations, while the Composite rose to 60.2, higher than the 55.

The GBP/USD reacted positively to the news and rose to 1.3630. However, a shift in market mood put a lid on the move, even retreating most of the gains, as Russian/Ukraine headlines continue to grab investors’ attention.

Later in the day, Federal Reserve Governor Michelle Bowman, a voter in 2022, said that she favors a rate hike in the March meeting, though she is assessing its size. It is worth noting that her view on rates and balance sheet reduction would depend on the economy while emphasizing that the challenge for the Fed would be to bring inflation down without harming the economic expansion.

On Tuesday, the economic docket in the UK will feature Bank of England’s (BoE) Ramsden, followed by the release of CBI Industrial Trend Orders for February. Across the pond, House Prices data for December, Markit PMIs, and Consumer Confidence for February would be followed closely by GBP/USD traders.

GBP/USD Price Forecast: Technical outlook

From a technical perspective, the GBP/USD is neutral-upward biased, despite the 200-day moving average (DMA) located above the exchange rate, at 1.3683. That alongside a nine-month-old downslope trendline would be crucial barriers to overcome in the event of the pair achieving higher prices

The GBP/USD first resistance would be the trendline abovementioned around the 1.3635-50 area. Breach of the latter would expose the 200-DMA at 1.3683. Once it is cleared, the next support would be the 1.3700 mark.

On Wednesday, the Reserve Bank of New Zealand (RBNZ) will announce its decision on monetary policy. A 25 bps rate hike is expected. Analysts at Wells Fargo see a 25 bps rate hike as opposed to a 50 bps hike considering the governor of the bank spoke about a cautious approach to tightening.

Key Quotes:

“We, along with the consensus, expect the central bank to raise rates another 25 bps to 1.00%. After the economy slumped in Q3 due to a COVID-related lockdown, incoming data show a solid rebound from Q4 last year, as reflected in employment and retail spending data. Meanwhile, inflation pressures have also intensified, as the Q4 headline CPI firmed to 5.9% year-over-year with an acceleration also in underlying inflation as well as non-tradables inflation.”

“Against this backdrop, we expect the RBNZ to continue its shift toward a less accommodative monetary policy stance at next week's policy meeting. At the same time, we favor a more measured 25 bps rate hike as opposed to a larger 50 bps increase, particularly after the central bank governor said late last year the RBNZ would take a “cautious” approach to tightening by moving in 25 bps increments “for now.”

Data released on Monday showed the Producer Prince Index in Germany jumped to 25% (annual). Analysts at Commerzbank point out prices of energy and intermediate products continued to rise and is being felt in the prices of consumer and capital goods. The numbers indicate that the rise in consumer prices is not expected to level off for the time being according to them.

Key Quotes:

“German producer prices keep rising strongly. Compared with the previous month, they increased by a seasonally adjusted 1.9% in January. Although this is not as strong as in December (+4.9%), this is primarily due to the fact that energy prices, which had literally shot up in December, were no longer quite as strong.”

“The January figures thus show that price pressure at the upstream levels remains strong and, if anything, has recently increased once again. This suggests that consumer prices will also continue to rise strongly in the months ahead. We expect inflation in Germany to hover around 5% into the fall. The inflation rate for the euro zone is unlikely to be much lower. This keeps up the pressure on the ECB to normalize its ultra-expansive monetary policy at least somewhat.”

An agreement between the US and Iran on a return to compliance with the 2015 nuclear deal could be reached within the next couple of days reported the WSJ on Monday citing officials involved in the talks, with US President Joe Biden having set restoring the agreement as a top foreign policy goal. The report added that negotiators are still wrangling over significant final demand from Tehran, including the scope of sanctions relief.

Market Reaction

Oil prices have not been affected in recent trade, report largely in fitting with commentary from other sources in recent days.

- Geopolitical tensions favor the safe-haven appeal of the Swiss franc vs. the greenback.

- The USD/CHF broke the 200-DMA, accelerating the downtrend.

- USD/CHF Technical Outlook: Neutral-downward biased and could shift downwards if the USD/CHF reclaims the 0.9107 mark.

Increasing tensions in Eastern Europe triggered a flight to safe-haven peers, in the case of the USD/CHF, a headwind for the USD, boosting the Swiss franc. Furthermore, the break of the 200-DMA accelerated a move towards 0.9100. At the time of writing, the USD/CHF is trading at 0.9154.

The market mood is risk-off by the no-resolution of the Ukraine/Russia conflict. European bourses remain to trade in the red, reflecting investors risk-aversion. The cash US equity indices are closed during the US President’s day and would resume trading on February 22. However, US indices in the futures market are trading with losses.

During the overnight session, the USD/CHF retreated from daily highs above the 0.9200 figure before the European session. The downtrend resumed once European traders got to their desks, breaking the February 18 daily low at 0.9191.

USD/CHF Price Forecast: Technical outlook

On Monday, the USD/CHF broke the 200-day moving average (DMA), which also confluences with the February 3 daily low at 0.9177, accelerating the downtrend.

Therefore, the USD/CHF is neutral-downward biased and would be downwards once it breaks the next support level at January 21 daily low at 0.9107. Breach of the latter would expose the January 13 daily low at 0.9192, the bottom of the trading range, which once cleared would expose April’s 2021 lows at 0.9018.

-637810562718170144.png)

- Yen rises amid risk aversion on the back of geopolitical tensions.

- USD/JPY with a bearish bias while under 115.10.

The USD/JPY is holding onto daily losses and trading under 115.00 on Monday’s American session. The pair bottomed at 114.79, slightly above last week low. The dollars ix mixed while the yen is mostly higher across the board.

Yen benefits as Putin’s comments hit markets

The Japanese yen is among the top performers on Monday, rising at a modest pace, supported by risk aversion. Equity prices are falling in Europe with the CAC 40 falling by 1.48% and the DAX 1.36%. US markets are closed due to President’s Day. Dow Jones futures are falling 0.68%. The DXY is falling 0.15%, off lows. It remains in the 96.15/95.70 range.

Market sentiment deteriorated amid rising tensions regarding the Ukrainian border. Russian President Vladimir Putin mentioned that Russia should recognize the independence of separatist regions of Ukraine if no process is made.

USD/JPY testing key short-term support

The USD/JPY is moving with a bearish bias in the very short term, testing the 114.75/80 support area. A break lower should clear the way to more losses, targeting 114.45 initially.

A recovery above the 20-SMA (Simple moving average) in the four-hour chart, currently at 115.10, would change the bias from negative to neutral.

Technical levels

Russian President Vladimir Putin said on Monday that he would make the decision as to whether or not to recognise the breakaway regions of Eastern Ukraine as independent nations on Monday, after being urged by most of the members of his cabinet, as well as leaders in Russia's State Duma, to do so. Putin stated that Russia is not "talking about" adding the two break-away regions of Ukraine into Russia's territory. Negotiations on the Donbass region are in a deadlock, he said, adding that if no progress is made in resolving crisis, then Russia should recognise the independence of the regions.

Market Reaction

The broad market mode remains one of nerviousness. Seperate reports suggested that Putin has already made up his mind to recognise the independence of the breakaway regions inside Ukraine. Such a recognition could turn up the heat in the region significantly; pro-Russia separatist forces have already been staging false flag attacks and blaming them on Ukraine's military in recent days and shelling across the ceasefire line has been escalating in recent days.

The pro-Russia separatists have also been increasing the inflammatory rhetoric and misinformation in recent days; claiming they have uncovered plans for a Ukrainian assault to take back control of the region and claiming Ukraine is planning a "genocide" on Russian speakers in the area. A Russian recognition of the independence of the breakaway regions in Donbas paves the way for Russia to provide direct military support for the region's forces against "Ukrainian aggression". I.e. another major pretext for Russia to attack Ukraine.

UK Defense Minister Ben Wallace on Monday warned that over the last 48 hours, the UK has continued to observe increasing troop numbers, as well as movement to "launch" areas near Ukraine's border. Wallace added that there has been a proliferation of false flag events and, as a result, the UK continues to have a strong cause for concern that Russian President Vladimir Putin might still be committed to an invasion of Ukraine. Wallace urged Putin to rule out an invasion of Ukraine.

- WTI was flat near $92.00 on Monday as traders weighed escalating Russia/Ukraine/NATO tensions against a possible US/Iran nuclear deal.

- Investors continue to fret that Russia could be about to invade Ukraine as tensions in Donbass continue to rise.

- The Saudi Aramco and Vitol CEOs were bullish on oil demand in recent commentary, helping keep WTI supported above $90.00.

Crude oil prices stabilised on Monday, with front-month WTI futures last trading flat in the $92.00 per barrel area, as traders weigh ongoing escalation in the Russia/Ukraine crisis against the rising likelihood of a new US/Iran nuclear pact. According to the newsflow coming out of Russia, President Vladimir Putin appears to be on the verge of, or at least being strongly pushed towards, recognising the two breakaway regions of Eastern Ukraine as independent nations. Fighting across the ceasefire line that separates the so-called Donetsk and Luhansk People’s Republics with Ukraine has continued to escalate in recent days, unnerving investors and supporting oil prices.

As NATO officials continue to warn that Russia is preparing to invade Ukraine, investors are fretting that Russia and its allied separatists in the East of Ukraine are looking to create a false pretext for military action. There is a high degree of uncertainty regarding the sanctions Western nations would place on Russia in the event of an invasion, but most agree there would be disruption to global oil supply. That explains why WTI has been able to hold so well above the $90.00 in recent days, despite the prospect of a US/Iran nuclear deal bringing over 1M barrels per day in exports back onto global markets.

In terms of the latest on the US/Iran front; an Iranian foreign ministry spokesperson said “significant progress” had been made, following comments from a senior EU official last Friday that a deal was “very, very close”. “A deal would obviously be a bearish development for the market if Iran is able to ramp up exports fairly quickly,” analysts at ING remarked. “However, just how bearish would depend on where we are with Russia-Ukraine by that time, the bank concluded. “If a Russian invasion takes place as the U.S. and UK have warned in recent days,” analysts at Commonwealth Bank said, “Brent futures could spike above $100/bbl, even if an Iranian deal is reached.”.

In that sense, it isn’t too surprising that dips towards $90.00 continue to be bought, especially given the bullish crude oil demand backdrop. The world’s largest oil company Saudi Aramco over the weekend said that that demand is rising, especially in Asia. The company’s boss remarked that “with the global recovery we’re seeing today, there is more demand for products and we see that from different enclaves, especially in Asia”. Meanwhile, the CEO of major oil producer Vitol Group was also bullish, telling Bloomberg TV on Monday that “demand is going to surge in the second half” of the year and likely exceed 100M BPD if travel continues to return to normal. The CEO warned that “eventually we’re going to run out of spare capacity.”

- The USD/RUB has gained 6.44% in the last three days.

- Separatist leaders sought recognition of Russian President Putin, which could undermine talks between Russian/US officials.

- USD/RUB Technical Outlook: Escalation of the conflict, could spur a jump towards 80.41, followed by 80.95.

The USD/RUB advances 1.54% during the North American session, trading at 78.81 at press time. Financial market mood seesaws courtesy of high tension in the Russia/Ukraine conflict, while investors left economic information and fundamentals side until the conflict resolution. The former caused a jump in crude oil prices, with Brent oil sitting at $92.03 per barrel, while Western Texas Intermediate (WTI) is trading at $90.78 per barrel.

Russia/Ukraine conflict updates

The latest developments in the Russia/Ukraine conflict keep uncertainty surrounding the markets. The Donetsk and Luhansk region leaders asked Russian President Vladimir Putin to recognize them as independent Republics when a Sputnik correspondent reported artillery fire “heard” at Donetsk airport.

In the meantime, Russia’s President Vladimir Putin said that Ukraine does not plan to fulfill the Minsk Agreement. As a result, Putin said that Russia ought to consider recognizing the independence of those two regions in Eastern Ukraine.

Analysts suggest that any recognition of the latter might also undermine the prospects of peace talks between Russian and US officials, to be held on February 24 in Geneva, as Russian Foreign Minister Lavrov commented that he plans to meet US Secretary of State Blinken

It is worth noting that Russian Banks imported USD 5 Billion in foreign currency in December, as it pre-empts a possible spike in demand for non-Rub banknotes.

Therefore, if a resolution fails to be achieved, that would be a headwind for the RUB. Also, sanctions imposed on Russia may spark a significant depreciation of the RUB vs. the USD, pushing the USD/RUB exchange rate towards January 2016 highs at 85.98.

USD/RUB Price Forecast: Technical outlook

The USD/RUB has rallied 6.44% in the last three days, threatening to reach the YTD high sitting at 80.41. Also, the weekly moving averages (WMAs) sit well below the exchange rate, in a bullish order, with the shorter time-frames above the longer time ones.

The USD/RUB first resistance would be the YTD high at 80.41. Breach of the latter would expose November’s 2020 highs around 80.95, and then March 2020 highs at 82.86.

- USD/TRY picks up pace and trades close to 13.70.

- Investors’ attention remains on the geopolitical scenario.

- Turkey’s Central Government Debt Stock rose to TL 2,844.4B.

The Turkish lira adds to Friday’s losses and lifts USD/TRY to the upper end of the recent range near 13.70 on Monday.

USD/TRY looks to risk trends

USD/TRY flirts with the area of recent highs near 13.70 despite the renewed offered stance in the greenback and amidst the broad-based upbeat mood surrounding the risk-associated universe.

In fact, investors remain vigilant on the developments from the Russia-Ukraine-US standoff ahead of the Blinken-Lavrov meeting on February 24 in Geneva, while there is still a ray of hope around a diplomatic solution of the conflict.

In the domestic calendar, Foreign Arrivals rose 151.40% in January vs. the same month of 2021, while the Central Government Debt Stock rose to TL 2,844.4B during last month.

What to look for around TRY

The pair keeps its multi-week consolidative theme well in place around the mid-13.00s for the time being. The lira, in the meantime, remains surprisingly stable so far this year, particularly after the government announced a lira time-deposit protected scheme in late December and after the CBRT left the policy rate unchanged in the last couple of meetings. However, the lira is expected to remain under scrutiny amidst rampant inflation, negative real interest rates and the omnipresent political pressure to favour lower interest rates.

Key events in Turkey this week: Central Government Debt Stock (Monday) – Capacity Utilization, Manufacturing Confidence (Tuesday) – Economic Confidence Index (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is advancing 0.13% at 13.6456 and a drop below 13.4317 (weekly low Feb.11) would expose 13.2327 (monthly low Feb.1) and finally 12.7523 (2022 low Jan.3). On the other hand, the next up barrier lines up at 13.6767 (weekly high Feb.15) seconded by 13.9319 (2022 high Jan.10) and then 18.2582 (all-time high Dec.20).

- NZD/USD has pushed back above 0.6700 on Monday despite global equities falling on geopolitical tensions.

- The pair is eyeing a break above key resistance in the 0.6730s, which would open the door towards 0.6800.

- NZD bulls are in charge ahead of this week’s key RBNZ meeting, amid chatter about a 50 bps hike.

Despite sharp downside in the global equity space on further escalation of military tensions between Ukrainian and pro-Russia separatist/Russia forces, as well as continued Russia/NATO tensions in the background, NZD/USD has managed to push back above 0.6700 on Monday. As this Wednesday’s RBNZ meeting – where markets participants are split between expecting a 25 bps or 50 bps hike – looms, the pair has gained 0.4% on the session and is one of the better G10 performers on the day.

NZD/USD bulls are intent on testing earlier monthly highs in the 0.6730s although escalating geopolitical angst continues to weigh heavily on other risk assets (like stocks) and could yet spoil the party. This is a key area of support turned resistance so far in 2022 and a break above it would open the door to a run back towards 0.6800 and annual highs near the 0.6900 level. Geopolitics aside, while Wednesday’s RBNZ meeting steals the show this week, New Zealand Q4 Retail Sales figures out on Friday will be of note for the kiwi traders.

There will also be plenty of US data and Fed speak to keep an eye on, the highlights of which include flash February PMIs, the second estimate of Q4 GDP growth and January Core PCE inflation. Markets have dialed down bets on a 50 bps rate hike in March after key FOMC members pushed back against the idea last week. A hot Core PCE reading – which would come on the heels of elevated Consumer and Producer Price Inflation readings for January – would bolster expectations for a rapid series of rate hikes between now and the end of the year.

In a discussion on recent nuclear exercises with his security council on Monday, Russian President Vladimir Putin accused Ukraine of not intending to fulfill the Minsk peace agreements, according to Reuters. As a result, Putin said that Russia ought to consider recognizing the independence of the two breakaway regions in Eastern Ukraine. If Russia faces the threat of Ukraine joining NATO, Putin continued, the threat to our country will increase substantially.

Meanwhile, Russia's Foreign Minister Sergey Lavrov said that the West isn't willing to discuss Russian security demands, whilst also accusing the West of "cherry-picking" from Russia's security proposals. However, Lavrov did say that diplomatic efforts with the US should continue and noted that there had been some progress in talks with the US.

- Gold hit fresh multi-month highs near the $1910 on Monday but has since dropped back under the $1900 handle.

- Geopolitics remains the wildcard that could stoke surprise volatility in either a bullish or bearish direction.

Spot gold (XAU/USD) prices hit fresh multi-month highs near the $1910 on Monday during Asia Pacific session, but have again failed to hold to the north of the $1900 handle. In recent trade, the precious metal has been caught going sideways in the mid-$1890s, with the prospect for a fresh push higher again on Monday limited by the lack of market volumes stateside. US markets are shut on Monday for President’s Day so it is likely to be a very quiet US session.

Geopolitics remains the wildcard that could stoke surprise volatility in either a bullish or bearish direction. The Russian rouble has been coming under significant pressure on Monday, indicative of rising fears of a Russian invasion/military incursion into Ukraine that would trigger a round of sanctions from Western countries on Moscow. Violence between pro-Russia separatists and Ukraine’s military in the contested Donbas region has continued on Monday, the former group upping the inflammatory rhetoric in accusing Ukraine’s military of shelling and planning a full-scale assault.

This is keeping gold underpinned close to recent highs. At current levels in the mid-$1890s, the precious metal trades close to flat on the day and only about 0.75% below earlier session highs. One bearish risk to note for gold is whether a summit between Russian President Vladimir Putin and US President Joe Biden goes ahead this week following recent chatter. The meeting could be a good opportunity to ease tensions somewhat. Otherwise, US data and Fed speak will be worth watching, but will, for the most part, play second fiddle to the Ukraine crisis.

- AUD/USD regained positive traction on Monday, albeit struggled to capitalize on the move.

- Modest USD weakness was seen as a key factor that contributed to the intraday move up.

- Russia-Ukraine tensions dented the risk sentiment and capped the perceived riskier aussie.

The AUD/USD pair retreated a few pips from the daily high and was last seen trading around the 0.7200 round-figure mark, still up 0.40% for the day.

The pair attracted fresh buying on the first day of a new week, though a turnaround in the global risk sentiment kept a lid on any further gains for the perceived riskier aussie. The early optimism faded rather quickly after a Kremlin spokesperson said that there were no concrete plans yet for a Putin-Biden meeting.

Adding to this, UK Foreign Minister Liz Truss noted that a Russian invasion of Ukraine looks highly likely. Moreover, a spokesperson for Germany's foreign ministry noted that we are in an extremely dangerous situation and sanctions against Russia would be put in place after further infringements of Ukraine.

Meanwhile, Russian state-controlled media, citing Russian military officials, said that five people who tried to cross the Ukraine/Russian border were killed. The officials further added Ukrainian armed vehicles were also destroyed in Russia's Rostov region, fueling fears of an imminent Russian invasion of Ukraine.

This, in turn, tempered investors appetite for perceived riskier assets, which was evident from a fresh leg down in the global equity markets. The anti-risk flow extended some support to the safe-haven US dollar and turned out to be a key factor that held back bulls from placing aggressive bets around the AUD/USD pair.

There isn't any major market-moving economic data due for release from the US on Monday, leaving the AUD/USD pair at the mercy of the broader market risk sentiment. The focus, however, will be on the upcoming meeting between the US Secretary of State Antony Blinken and Russian Foreign Minister Sergei Lavrov planned for February 24.

Technical levels to watch

- EUR/USD flirts with the 5-month line near 1.1370.

- The next up barrier comes at the weekly high at 1.1395.

EUR/USD fades the initial spike to the 1.1390 region on Monday.

Extra gains in the pair needs to clear the 5-month line near 1.1370 to alleviate downside pressure and allow for another test of the weekly high at 1.1395 (February 14). Further up is seen the 200-week SMA at 1.1487 closely followed by the 2022 peak at 1.1494 (February 10).

In the longer run, EUR/USD is expected to keep the negative outlook as long as it trades below the key 200-day SMA, today at 1.1637.

EUR/USD daily chart

According to Russian state-controlled media citing Russian military officials on Monday, Russian troops and border guards prevented Ukrainian "saboteurs" from breaching the Ukraine/Russian border. Five people who tried to cross the border were killed, the officials said, and Ukrainian armed vehicles were also destroyed in Russia's Rostov region.

- Silver witnessed an intraday turnaround from the four-week high touched last week on Friday.

- The setup favours bullish traders and supports prospects for the emergence of some dip-buying.

- Sustained strength beyond the $24.00 mark is needed to confirm the near-term positive outlook.

Silver continued with its struggle to find acceptance above the $24.00 mark and witnessed an intraday turnaround from the four-week high touched last week on Friday. The white metal, for now, seems to have snapped three days of the winning streak and was last seen trading near the daily low, around the $23.75-$23.70 region heading into the North American session.

From a technical perspective, the recent strong rebound from the monthly low, around the $22.00 mark has been along an upward sloping channel and points to a short-term uptrend. The constructive set-up is reinforced by the fact that technical indicators on the daily chart are holding comfortably in the positive territory and are still far from being in the overbought zone.

That said, repeated failures near the aforementioned handle warrant some caution for aggressive bullish traders. This makes it prudent to wait for sustained strength beyond the $24.00 mark before positioning for a move towards the $24.25 confluence hurdle. The latter comprises the very important 200-day SMA and a descending trend-line extending from July 2021 swing high.

A convincing breakthrough will be seen as a fresh trigger for bullish traders and lift the XAG/USD back towards the YTD high, around the $24.70 region. The momentum could further get extended towards reclaiming the key $25.00 psychological mark en-route November 2021 high, around the $25.35-$24.40 region.

On the flip side, any further decline pullback is likely to find decent support near the $23.30 region ahead of the $23.round-figure mark. Failure to defend the said support levels will shift the bias in favour of bearish traders and make the XAG/USD vulnerable. The next relevant support is pegged near the $22.75 region, below which the metal could slide to the mid-$22.00 mark.

Silver daily chart

-637810443605253528.png)

Technical levels to watch

- DXY reverses the recent strength and drops below 96.00.

- The positive stance remains unchanged above the 5-month line.

DXY fades two consecutive sessions with gains and drops to as low as the 95.70 region on Monday.

The index seems to have moved into a consolidative phase for the time being. A close above last week’s top at 96.43 (February 14) should open the door to further upside in the near term.

The short-term constructive stance remains supported by the 5-month line, today near 95.40, while the outlook for the dollar is seen as positive above the 200-day SMA at 93.76 in the longer run.

DXY daily chart

- EUR/USD has pulled back from earlier highs near 1.1400 and is back under 1.1350 as geopolitical angst dampens sentiment.

- However, strong Eurozone PMI data, which showed a strong service sector recovery this month, is slowing the decline.

- The pair still trades in the green by about 0.2%.

A continued escalation in violence in Ukraine’s Donbass region and further inflammatory rhetoric from pro-Russia separatist forces located there, coupled with uncertainty over whether this week’s alleged Biden-Putin summit will go ahead has seen risk appetite pare back recently. After topping out in the 1.1390 area shortly after Monday’s European open, EUR/USD has subsequently dropped back below the 1.1350 mark, where it still trades with gains of about 0.2% on the day. Eurozone flash PMI surveys for February were released earlier on Monday and showed a significantly better than expected rebound in service sector sentiment, reflective of falling Omicron infection rates and associated restrictions being eased.

That strong service sector recovery has helped ease the pace of EUR/USD’s pullback from earlier session highs and, near the 1.1350 mark, the pair is trading bang in the middle of its recent 1.1310s-1.1390s range of the past few sessions. FX strategists suspect FX market conditions will remain choppy on Ukraine crisis uncertainty in the coming days. Aside from geopolitics, Fed speak, US flash PMIs, January US Core PCE inflation and any further commentary from ECB policymakers will all be worth a watch as traders assess the timing and pace of Fed/ECB monetary tightening.

With EUR/USD sat close to the middle of 2022’s low-1.1100s to 1.1500 range, the pair’s medium-term technical bias remains neutral. Trading conditions will be unusually quiet this Monday due to US market closures for President’s Day holiday.

- GBP/USD regained positive traction on Monday amid the emergence of fresh USD selling.

- Russia-Ukraine tensions tempered the initial optimism and helped limit the USD downfall.

- Bulls need to wait for sustained breakthrough a downwards sloping trend-line resistance.

The GBP/USD pair attracted fresh buying on the first day of a new week and climbed to the 1.3640 area, back closer to the monthly high tested last week.

The optimism led by the news that US President Joe Biden and his Russian counterpart Vladimir Putin have agreed in principle to hold a summit on the Ukraine crisis undermined the safe-haven US dollar. Apart from this, rising bets for an additional interest rate hike by the Bank of England acted as a tailwind for the British pound and provided an additional lift to the GBP/USD pair.

The initial market reaction, however, turned out to be short-lived and faded rather quickly after a Kremlin spokesperson said that there were no concrete plans yet for a Putin-Biden meeting. Adding to this, UK Foreign Minister Liz Truss said that a Russian invasion of Ukraine looks highly likely drove some haven flows towards the buck and capped gains for the GBP/USD pair.

From a technical perspective, the pair, so far, has been struggling to break through a downward sloping trend-line resistance extending from July 2021. This is closely followed by the very important 200-day SMA, around the 1.3685 region and the 1.3700 mark. Sustained strength beyond will set the stage for a further appreciating move amid bullish technical indicators on the daily chart.

The GBP/USD pair might then aim to retest the YTD high, around mid-1.3700s before extending the momentum further towards reclaiming the 1.3800 mark for the first time since October 2021.

On the flip side, any meaningful might continue to attract some dip-buying near the 1.3600 mark and remain limited near the 1.3575-1.3570 region. Some follow-through selling, leading to subsequent weakness below near mid-1.3500s could make the GBP/USD pair vulnerable. The downward trajectory could then get extended towards challenging the key 1.3500 psychological mark.

GBP/USD daily chart

-637810419842677712.png)