- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-01-2025

US President Donald Trump said on Tuesday that his administration is discussing imposing a 10% tariff on goods imported from China on February 1 because fentanyl is being sent from China to Mexico and Canada, per Reuters.

Market reaction

At the press time, the AUD/USD pair is down 0.12% on the day to trade at 0.6262.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- GBP/USD roiled on Tuesday, finding support from 1.2300.

- UK labor data came in mixed, flubbing forecasts in both directions.

- With low-tier data on the docket for Wednesday, trade headlines will rule the roost.

GBP/USD spun in a circle on Tuesday, falling and then climbing in lockstep with global money flows into and out of the US Dollar. The Pound Sterling saw mixed labor data results from the UK, but the UK’s own labor department takes the numbers with a grain of salt. On the American side, US President Donald Trump brushed off his own campaign trail promises of instituting sweeping day-one tariffs on all of the US’ trading partners, focusing newer, more refined tariff threats on the US’ North American trade partners Canada and Mexico.

Markets have whipsawed as investors race to catch up with the newest headline generator on the block, President Trump. Investors have been betting big that the newly-minted US President wouldn’t impose day-one tariffs as he had long threatened, however a fresh round of updated trade rhetoric is keeping market sentiment tangled in the midrange.

Only low-tier data is on the offering for Wednesday, leaving Cable traders to focus on developing headlines likely to be concentrated during the US trading hours. Pound Sterling traders will be on the lookout for Friday’s S&P Global Purchasing Managers Index (PMI) figures due on both sides of the Atlantic.

GBP/USD price forecast

GBP/USD continues to grind its way into a half-hearted technical recovery, with bidders struggling to lock their grip on the 1.2300 level convincingly. Price action is tilted into the bullish side with technical oscillators pivoting into buy signals, but the pair remains steeply off of recent highs after knocking into a 15-month low last week.

Topside momentum is set to face firm technical barriers at the 50-day Exponential Moving Average (EMA) falling into 1.2500, the same level that the pair’s last major swing low clocked in late November.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- USD/CAD posts modest gains around 1.4340 in Wednesday’s early Asian session.

- Trump threatened 25% tariffs on Mexico and Canada on February 1, weighing on the CAD.

- Canadian headline CPI rose below consensus in December.

The USD/CAD pair trades with mild gains around 1.4340 during the early Asian session on Wednesday. The Canadian Dollar (CAD) weakens amid softer Canada’s December Consumer Price Index (CPI) inflation data and concerns about a trade war between the United States and Canada.

On Monday, US President Donald Trump said that he was thinking of imposing 25% tariffs on imports from Canada and Mexico on February 1 as both countries were allowing many people to cross the border as well as fentanyl. Trump’s remarks exert some selling pressure on the Loonie as Canada is highly dependent on trade with the US, with roughly 75% of its exports heading south.

Canadian Prime Minister Justin Trudeau stated that his government is ready to respond to any scenario if Trump implements tariffs on Canada. Trudeau added that Trump's promised prosperity for the United States would need Canadian resources to fuel it.

Canada’s CPI report has opened the door to the Bank of Canada (BoC) rate cut in January. Data released by Statistics Canada on Tuesday showed that the country’s CPI inflation eased to 1.8% YoY in December from 1.9% in November. This reading was slightly below the 1.9% expected.

“We believe that the Bank of Canada should continue to ease monetary policy by cutting its policy rate by 25 basis points next week. This would give us a little more hope of seeing economic growth above potential assuming Canada is able to avoid a tariff war with our largest trading partner,” said Matthieu Arseneau, economist at the National Bank of Canada.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

New Zealand’s Consumer Price Index (CPI) rose 2.2% YoY in the fourth quarter (Q4) of 2024, compared with the 2.2% increase seen in the third quarter, according to the latest data published by Statistics New Zealand on Wednesday. The market consensus was for a growth of 2.1% in the reported period.

The quarterly CPI inflation eased to 0.5% in Q4 from the previous print of 0.6% and in line with the market consensus of 0.5%.

Market reaction

At the time of writing, the NZD/USD pair is trading 0.04% higher on the day to trade at 0.5674.

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- NZD/USD dips on Tuesday, hovering near 0.5670 amid a sideways pattern.

- RSI stands at 54, hinting at positive momentum yet showing signs of a pullback.

NZD/USD edged lower to 0.5670 on Tuesday, extending its recent stretch of range-bound action between 0.5690 and 0.5565. The pair’s inability to sustain a decisive move outside this corridor highlights traders’ indecision, with buyers and sellers each awaiting a clearer catalyst. Despite slipping slightly, NZD/USD remains close to the upper band of its established consolidation zone.

Technical readings offer a mixed outlook. Although the Relative Strength Index (RSI) stands at 54 in positive territory, it has shown signs of moderating from previous levels, suggesting that upward momentum may be losing steam. In contrast, the Moving Average Convergence Divergence (MACD) histogram is displaying rising green bars—often taken as an indication that buyers have not completely bowed out. As a result, the pair appears to be at a crossroads, needing a stronger push from either side.

Looking ahead, an upside break above 0.5690 would signal a potential bullish extension, possibly targeting 0.5720 or higher if momentum holds. On the downside, failure to maintain current levels could see bears aiming for 0.5565, which has served as a reliable floor throughout the recent consolidation.

NZD/USD daily chart

- USD/CHF fluctuates sharply, soaring then retracting to open levels after Trump proposes tariffs.

- Mixed technical outlook; pair rebounds from key support but can't sustain above 20-day SMA.

- Future hinges on breaking 20-day SMA to revisit January highs, with risks below 0.9040.

The USD/CHF whipsawed during Tuesday's session after US President Donald Trump hinted that he could impose tariffs on Mexico and Canada as he was signing a tranche of executive orders on day 1. Therefore, the pair rose sharply towards its daily peak of 0.9114, before reversing course near its opening price at 0.9062, and is virtually unchanged.

USD/CHF Price Forecast: Technical outlook

The USD/CHF dipped towards a three-month-old support trendline near 0.9049 before buyers moved in, pushing the exchange rate past the 20-day Simple Moving Average (SMA) of 0.9085 and the 0.9100 figure. Nevertheless, the pair retreated below the former, near its opening price.

If USD/CHF resumes its uptrend and clears the 20-day SMA, the bulls will remain hopeful of pushing the exchange rate toward the January 13 high at 0.9200. A decisive break would signal that bullish momentum is growing, opening the door to testing last year’s peak of 0.9224.

Conversely, if USD/CHF dips below 0.9040, sellers could test the 100-day SMA at 0.9000. A decisive break will expose the 50-day SMA at 0.8960.

USD/CHF Price Chart – Daily

Swiss Franc FAQs

The Swiss Franc (CHF) is Switzerland’s official currency. It is among the top ten most traded currencies globally, reaching volumes that well exceed the size of the Swiss economy. Its value is determined by the broad market sentiment, the country’s economic health or action taken by the Swiss National Bank (SNB), among other factors. Between 2011 and 2015, the Swiss Franc was pegged to the Euro (EUR). The peg was abruptly removed, resulting in a more than 20% increase in the Franc’s value, causing a turmoil in markets. Even though the peg isn’t in force anymore, CHF fortunes tend to be highly correlated with the Euro ones due to the high dependency of the Swiss economy on the neighboring Eurozone.

The Swiss Franc (CHF) is considered a safe-haven asset, or a currency that investors tend to buy in times of market stress. This is due to the perceived status of Switzerland in the world: a stable economy, a strong export sector, big central bank reserves or a longstanding political stance towards neutrality in global conflicts make the country’s currency a good choice for investors fleeing from risks. Turbulent times are likely to strengthen CHF value against other currencies that are seen as more risky to invest in.

The Swiss National Bank (SNB) meets four times a year – once every quarter, less than other major central banks – to decide on monetary policy. The bank aims for an annual inflation rate of less than 2%. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

Macroeconomic data releases in Switzerland are key to assessing the state of the economy and can impact the Swiss Franc’s (CHF) valuation. The Swiss economy is broadly stable, but any sudden change in economic growth, inflation, current account or the central bank’s currency reserves have the potential to trigger moves in CHF. Generally, high economic growth, low unemployment and high confidence are good for CHF. Conversely, if economic data points to weakening momentum, CHF is likely to depreciate.

As a small and open economy, Switzerland is heavily dependent on the health of the neighboring Eurozone economies. The broader European Union is Switzerland’s main economic partner and a key political ally, so macroeconomic and monetary policy stability in the Eurozone is essential for Switzerland and, thus, for the Swiss Franc (CHF). With such dependency, some models suggest that the correlation between the fortunes of the Euro (EUR) and the CHF is more than 90%, or close to perfect.

- Pair inches up after dipping to the 0.6220 zone on Tuesday.

- Trump’s hinted tariffs on China weigh on risk assets, tempering AUD gains.

- RBA is likely to cut rates in February, keeping the Aussie on the defensive.

The Australian Dollar (AUD) mildly rose to 0.6270 on Tuesday, recovering after briefly falling near 0.6220 when United States (US) President Donald Trump reiterated plans to impose tariffs on China. Although the Reserve Bank of Australia (RBA) is widely expected to initiate a rate cut in February, the currency found modest footing in a calmer market atmosphere. Investors, however, remain cautious as the US Dollar (USD) climbs on revived tariff concerns.

Daily digest market movers: Aussie recovers mainly as markets await US tariffs directions

- In the wake of President Trump’s inauguration, the administration directed agencies to probe ongoing trade imbalances and currency manipulation, especially targeting China, Canada and Mexico.

- Despite uncertainties over Trump’s early trade agenda, a softer US Dollar provided a lift to stock markets in Europe and the US, as well as risk-driven currencies such as the Aussie.

- The CME FedWatch tool suggests a 55.6% chance the Federal Reserve (Fed) will hold rates steady at its May gathering, with rising chatter about a potential rate decrease by June.

- US 10-year yields hover around 4.60%, while US bond markets are calm following Martin Luther King Jr. Day. Traders brace for possible updates on tariffs policies in the days ahead.

- On the local front, markets are gearing up for a cut by the Reserve Bank of Australia as early as next month which might prevent any upside.

AUD/USD technical outlook: Indicators hint at choppy momentum amid bullish undercurrents

The AUD/USD pair’s price action remains volatile, briefly sliding toward 0.6220 before rebounding to 0.6275. The Relative Strength Index (RSI) currently sits around 52—still in positive territory but sharp, indicating a potential waning of bullish momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram exhibits rising green bars, supporting a constructive near-term view.

Although the Aussie’s short-lived dip underscores lingering downside risks, a sustained break above recent highs near 0.6300 could reinforce the pair’s recovery if trade policy anxieties recede.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- Gold spikes as investors seek safety after Trump's day-one tariff threats.

- US Dollar Index drops, Treasury yields fall, both tailwinds for Bullion prices.

- Escalating Middle East tensions increases global uncertainty, boosting Gold's safe-haven status.

Gold rallied more than 1% and hit a two-month high of $2,745 on Tuesday as investors seeking safety bought the non-yielding metal following US President Donald Trump's remarks on tariffs. The Greenback, which initially advanced, has turned negative as depicted by the US Dollar Index (DXY), a tailwind for Bullion prices. The XAU/USD trades at $2,742 at the time of writing.

Trump’s first day in office improved risk appetite, only to suddenly turn risk-averse after he hinted at imposing tariffs on Canada and Mexico as he signed a tranche of executive orders. The Canadian Dollar (CAD) and the Mexican Peso (MXN) tumbled, consequently sending the Greenback to a daily high of 108.79, according to the DXY.

Despite this, the precious metal continued to trend higher, clearing key resistance at $2,730. In addition, US Treasury bond yields are dropping in the belly and long end of the curve, bolstering Gold prices. The US 10-year T-note yield tumbled five-and-a-half basis points (bps) to 4.572%.

In the Middle East, the ceasefire agreement between Israel and Hamas was set aside as Israeli forces began an operation in the West Bank city of Jenin. In response, Hamas called for escalating the fighting against Israel.

This week, the US economic docket will feature Initial Jobless Claims data, S&P Global Flash PMIs, and housing data.

Daily digest market movers: Gold price soars as US yields retreat

- Gold price rises as real yields tumbled three basis points. Measured by the 10-year Treasury Inflation-Protected Securities (TIPS) yield sits at 2.17%.

- President Trump confirmed that universal tariffs on all imports to the US are under consideration as well and will come at a later stage, Reuters reports.

- Market participants are pricing in near-even odds that the Fed will cut rates twice by the end of 2025, with the first reduction occurring in June.

XAU/USD technical outlook: Gold price breaks higher toward $2,750

The uptrend in Gold prices resumed after bulls had failed to clear the December 12 daily peak of $2,725. This opened the door for challenging the psychological $2,750 figure, and the record high at $2,790 ahead of $2,800.

Conversely, if sellers drive XAU/USD below $2,700, the first support would be the January 13 swing low of $2,656, followed by the confluence of the 50 and 100-day Simple Moving Averages (SMAs) at $2,642 to $2,644.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- The Canadian Dollar roiled on Tuesday, hitting multi-year lows before recovering.

- The Bank of Canada is expected to continue trimming interest rates this month.

- Canadian CPI inflation figures ticked down, but core measures accelerated.

The Canadian Dollar (CAD) went end-over-end on Tuesday, whipsawing as Loonie traders grapple with a mixed bag of political headlines and inflation data that strongly implies more rate cuts are on the table. Tariff talk is slowly absorbing most of the market’s available attention span, but a still-widening rate differential poses significant risks for the CAD.

US President Donald Trump held off on deploying his long-threatened package of day one tariffs on nearly all of the US’ largest trading partners, including Canada. Most market participants assumed (apparently rightly) that the talk of immediate tariffs via executive order were largely bluster for the campaign trail, but Donald Trump is still chasing the high of threatening global nations with self-imposed import taxes that would derail the financial well-being of his own citizens.

Daily digest market movers: Canadian Dollar goes parabolic on tariff Tuesday

- Canadian Consumer Price Index (CPI) inflation ticked down in December, falling to 1.8% YoY versus the expected hold at 1.9%. On a monthly basis, Canadian headline CPI contracted -0.4% MoM, in-line with expectations.

- Cooling headline inflation figures will be more than enough to push the Bank of Canada (BoC) into a fresh batch of rate cuts; interest rate futures traders are now pricing in 83% odds of a 25 bps rate trim from the BoC next week, up slightly from the previous 78%.

- Core inflation metrics, the BoC’s own CPI core measure, accelerated to 1.8% YoY versus the last print of 1.6%, but again the monthly figure contracted by -0.3% MoM.

- Donald Trump made a point of leaving the door open to a sweeping 25% tariff on all Canadian exports to the US, possibly in February.

- Mid-tier Canadian Retail Sales figures are due on Thursday, but no drastic swings or changes are expected on that front.

Canadian Dollar price forecast

Tuesday’s wide swing sent the Canadian Dollar spiralling into a fresh five-year low, pushing USD/CAD into the 1.4500 handle for the first time since March of 2020. Markets quickly recovered their footing to keep the pair under pressure and staring at a technical floor near 1.4300, but the damage was done and the Loonie is set to continue fighting a losing battle.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

The US Dollar remained on the defensive, adding to Monday’s pullback as further market chatter around US tariffs failed to underpin the initial bullish bias in the currency.

Here is what you need to know on Wednesday, January 22:

The US Dollar Index (DXY) retreated marginally and closed around the 107.60 zone following mixed US yields and rising uncertainty around Trump’s trade policies. The usual weekly Mortgage Applications by MBA are due along with the CB Leading Index, and the API report on US crude oil supplies.

EUR/USD extended its advance following extra USD selling, revisiting the area beyond the 1.0400 barrier on quite a convincing mood. The ECB’s C. Lagarde will speak on Wednesday.

GBP/USD remained well bid above 1.2300 the figure on the back of the persistent downward bias in the Greenback. The UK’s Public Sector Net Borrowing figures will be on the docket.

USD/JPY traded in a volatile fashion around the 155.50 zone as investors remained cautious in light of the upcoming BoJ meeting. Japan’s Balance of Trade is next on tap on January 23 followed by weekly Foreign Bond Investment.

Contrasting with its risky peers, AUD/USD charted humble losses on Tuesday, partially reversing an auspicious start to the week. The Westpac Leading Index is next on tap on the Australian calendar.

WTI prices declined further and approached the $75.00 mark per barrel on the back of the stronger Dollar and investors’ assessment of Trump’s tariffs.

Gold prices rose to two-month peaks past the $2,740 mark per ounce troy in response to rising uncertainty surrounding potential announcements by President Trump. Silver prices added to the positive start to the week and traded closer to the $31.00 mark per ounce.

- Traders respond to fresh tariffs comments from President Trump, overshadowing improved investor sentiment in equities.

- The Federal Reserve’s data-dependent stance remains intact, with market consensus leaning toward a possible June rate cut.

- Bond yields hover around 4.60%, a sharp reduction from last week's highs, reflecting changing risk appetite.

- US economic outperformance persists, yet abrupt policy shifts could dent the Dollar’s near-term recovery efforts.

The US Dollar Index (DXY) trades just above 108.00 and flips into losses if more selling pressure arises. Tuesday’s trading was quiet as markets are responding to late-Monday comments from United States (US) President Donald Trump about tariffs on its North American neighbours.

Daily digest market movers: USD sees red despite Trump proposing tariffs on Canada and Mexico

- Equities push modestly higher on Tuesday, with European stocks largely unchanged and US futures up around 0.50%.

- US yields sit near 4.60%, well below last week’s levels; however, President Trump’s sudden trade policy announcements have sparked reversals in currency pairs and risk assets.

- Tariff chatter points to a 25% levy on imports from Canada and Mexico by early February, which immediately pressured the Canadian Dollar (CAD) and Mexican Peso (MXN).

- Strong Dollar narrative endures and many analysts view these trade moves as noise, believing the ongoing rally’s core drivers including the US economic dominance and steady Fed policy as major drivers to the upside for the Buck.

- The Federal Reserve (Fed) media blackout precedes Chair Powell’s press conference on January 29; the market prices July as the earliest date for a single rate cut, contingent on forthcoming data.

- CME FedWatch Tool suggests a near 55% probability of unchanged rates in May, implying a June rate cut if inflation moderates.

DXY technical outlook: Sellers repel attempt to reclaim 20-day SMA

The US Dollar Index broke beneath its 20-day Simple Moving Average near 108.50 and buyers’ efforts to retake that threshold proved unsuccessful. With DXY still hovering around 108.00, a fresh rejection at the 20-day SMA suggests building downside risk. If sellers maintain control, the Greenback could face a deeper pullback despite broader fundamentals pointing to US economic resilience. However, any signs of supportive trade or a shift in Fed expectations might rapidly ignite renewed Dollar demand.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- The Dow Jones climbed 450 points on Tuesday as investors brush off tariff fears.

- President Donald Trump pivoted on his threats of day-one tariffs.

- Tariff threats from the White House are still leaking through, now for February.

The Dow Jones Industrial Average (DJIA) absorbed newly-minted President Donald Trump’s last-minute pivot away from enacting sweeping tariffs on his first day in office with jubilation. The major equity index climbed over 400 points and is now testing the 44,000 handle for the first time since mid-December.

Equity markets caught a firm bid after incoming President Donald Trump failed to enact a package of tariffs that would have levied significant fees across the board on most imported goods on his first day in office. Donald Trump is still pushing his threats of enacting stiff import taxes on some of his closest allies, including Canada and Mexico, but investors are willing to call his bluff now that tariffs have fallen into the usual cycle of eternally coming “in a couple of weeks”, a common box that many of Donald Trump’s bespoke campaign promises tend to fall into.

Economic data remains limited throughout the rest of the week, at least until Friday’s S&P Global Purchasing Managers Index (PMI) print, leaving investors to grapple with political headlines as traders readjust to life under the ‘Trump two-step’. After a four-year hiatus, traders will have to get comfortable with Presidential musings delivered via social media apps and inconsistent policy claims that clash with previous statements, often sent only hours apart.

Dow Jones news

All but five of the Dow Jones’ listed securities are gaining ground on Tuesday, with gains being led by 3M (MMM) leading the charge higher after a firm beat of Q4 earnings forecasts. 3M’s fourth-quarter performance outpaced analyst expectations enough to earn a 5% upswing to $148 per share, although the company’s annualized performance came in slightly softer than expected.

Dow Jones price forecast

The Dow Jones gained further ground on Tuesday as investors bid the index back into the high end, keeping their eyes locked on record peaks set in late November just above 45,000. Despite a recent slow grind into the low end, price action has pivoted firmly bullish in the near-term, with all but one of the last six straight trading sessions closing higher.

More patient technical traders will be waiting for a fresh stop and a pullback to confirm a higher low before reloading on fresh bids. Despite a firm bounce, the Dow’s strong plunge from record highs dragged the index worryingly close to the 200-day Exponential Moving Average (EMA) near 41,300.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Mexican Peso trims gains post-Trump inauguration amid tariff threats against Mexico and Canada.

- President Sheinbaum commits to defend Mexico's sovereignty, seeks dialogue with heightened US tensions.

- Mexico's Retail Sales show resilience in November; key inflation and economic activity data expected this week.

The Mexican Peso erased some of Monday’s gains on US President Donald Trump’s inauguration day after the latter threatened to impose 25% tariffs on Mexico and Canada as soon as February 1. Therefore, the USD/MXN jumped to a daily high of 20.79, before stabilizing at current exchange rates, trading at 20.59, up 0.60%.

Tariff rhetoric is back following last night Trump’s remarks, sending the currencies of the country’s neighbors plunging versus the US Dollar. However, as Tuesday’s session evolves, the emerging market currency has recovered as fears dissipated.

Tensions between the US and Mexico heightened as Mexican President Claudia Sheinbaum emphasized that she will defend the country’s sovereignty and independence but stressed that she will pursue dialogue with Trump.

Mexico’s Retail Sales in November shrank less than foreseen in monthly figures. In the 12 months through November, sales disappointed investors as the economy continued to show deterioration in consumer spending.

Ahead in the docket, Mexico will feature January’s Mid-Month Inflation figures, and the Economic Activity Indicator for November. Across the north of the border, Initial Jobless Claims for the week ending January 18 and Flash PMIs would update the status of the economy.

Daily digest market movers: Mexican Peso depreciates after two days of gains

- The Mexican Peso main driver of Tuesday’s session was Trump’s tariff rhetoric.

- Mexico’s Retail Sales dropped 0.1% MoM in November, yet improved compared to the 0.3% contraction expected by the consensus. On an annual basis, sales plummeted 1.9%, worse than the 1.2% decrease projected by economists.

- Banxico Deputy Governor Jonathan Heath was dovish, saying that headline and core inflation figures may hit 4% in January, adding that the central bank “does not need to exaggerate a restrictive posture.”

- Divergence between Banxico and the US Federal Reserve favors further upside in the USD/MXN pair.

- Economists polled by Reuters revealed that they foresee Banxico cutting interest rates by at least 150 basis points to 8.50% by the end of the year.

- In the Fed’s latest Summary of Economic Projections, officials estimate they will cut interest rates by 50 basis points.

- Mid-Month Inflation in January is foreseen dropping from 4.44% to 3.93%. Underlying inflation is expected to rise modestly from 3.62% to 3.69%.

- Money market futures have priced in 41.5 bps of Fed rate cuts in 2025, according to CME FedWatch Tool data.

USD/MXN technical outlook: Mexican Peso falls as USD/MXN climbs past 20.50

The USD/MXN has consolidated somewhat near the 20.50 to 20.90 area during the last four trading days, a sign that neither buyers nor sellers are sure about the direction of the pair.

Nevertheless, the reduction of the interest rate differential despite the Greenback being extremely overbought suggests the exotic pair could challenge the 21.00 level. If surpassed, the next stop would be the March 8, 2022 peak at 21.46, followed by 21.50 and the 22.00 psychological level.

Conversely, if the pair tumbles below the 50-day SMA, the next support would be the 100-day SMA at 20.04, which is ahead of the 20.00 mark.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

The tick lower in inflation in December to 1.8% was above our own assumption for a 1.5% increase, but largely due to a smaller than assumed reduction in prices from the temporary GST/HST holiday in December, and was still slightly below market expectations for a 1.9% reading, RBC Economics' Assistant Chief Economist Nathan Janzen notes.

Risks on price growth tilted to the downside

"Controlling for the tax distortion, price growth was mixed but is still consistent with further signs of underlying easing in price growth."

"The CPI data will be impacted by the tax holiday into February, but a weakened Canadian GDP and elevated unemployment rate (with the potential for protectionist U.S. trade policy to make both worse) is pushing inflation expectations from businesses and households lower."

"That leaves the risks on price growth tilted to the downside and argue for further BoC interest rate cuts."

USD/CNH fell sharply below 7.26 at one point after Trump announced there was no immediate plans for tariffs and calls for further study. USD/CNH was last seen at 7.2712 levels, OCBC's FX analysts Frances Cheung and Christopher Wong note.

Tariff situation remains highly uncertain

"That said, tariff development remains highly uncertain in terms of timing, magnitude and scope of products, hence its implication on markets can be binary for now. A longer delay in tariff announcement may provide an extended breather for risk proxies, and USD/CNH could trade lower. However, a swift implementation of tariff is expected to undermine sentiments and provide a boost to USD/CNH."

"For now, it appears that Trump is in the midst of trying to cut a deal, threatening with 25% tariffs on Mexico and Canada today and setting a deadline of 1 Feb. For China, tariff concerns should restrain the offshore yuan from strengthening too much, though it’s also unlikely to see CNH trade weaker until there’s greater clarity on the US’s trade policies. In the interim, stale CNH shorts could be forced to unwind if there is a longer delay in announcing tariffs on China."

"Daily momentum is bearish bias while RSI fell. Risks are skewed to the downside. Support at 7.2540 and 7.22 levels. Resistance at 7.2950 (50 DMA), 7.33 (21 DMA)."

- EUR/USD drops to a low 1.0355 on Tuesday, shedding part of its weekly gains.

- RSI stands at 52 in positive territory, yet its rapid decline raises concern over near-term resilience.

- MACD histogram features rising green bars, hinting at underlying buyer interest despite the downward slope.

The EUR/USD sits around 1.0380, indicating a dip of 0.30% on Tuesday’s trade but managed to clear part of its daily losses. Despite occasional attempts at recovery, the pair has failed to generate sustained momentum on the upside, suggesting sellers remain firmly in control in the bigger picture.

Technically, the Relative Strength Index (RSI) is perched at 52 but declining swiftly, undermining confidence in an immediate rebound. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram continues to show rising green bars, a signal that some degree of bullish sentiment still lurks beneath the current price action. This contrast between a softening RSI and a firming MACD underscores the market’s indecision at present levels.

Looking forward, traders will keep an eye on whether EUR/USD can find a stable footing above the 1.0300 region or if further selling could push it back toward this month’s trough near 1.0240. On the flipside, any sustained push above 1.0400 would draw attention to the pair’s recent peak at 1.0435, potentially shifting short-term prospects back in favor of the bulls.

EUR/USD daily chart

USD/JPY fell, tracking the gap lower in UST yields. Focus next on BoJ MPC (Fri). We are looking for 25bp hike on Friday. USDJPY last seen at 155.46 levels, OCBC's FX analysts Frances Cheung and Christopher Wong note.

Daily momentum is bearish

"Economic data has been supportive. Jobless rate easing, trade unions calling for another 5-6% wage increase. Fast Retailing (Uniqlo) announced it will raise starting pay for new employees by 10% and 5% for other employees. Meiji Yasuda announced raising wages by an average of 5% for all 47k staff starting April."

"Elsewhere, JP CPI, PPI were all higher, paving the way for BoJ policy normalization. Divergence in Fed-BoJ policies should bring about further narrowing of UST-JGB yield differentials and this should underpin the broader direction of travel for USD/JPY to the downside. The risk is a dovish hike, as this may suggest that USDJPY’s move lower may be more constrained."

"Daily momentum is bearish while RSI fell. Risks skewed to the downside. Next support at 154.30 (23.6% fibo retracement of Sep low to Jan high) and 152.80 (200 DMA). Resistance at 157.15 (21 DMA), 158.80 (recent high)."

- USD/JPY stable despite volatility after Trump announces possible 25% tariffs on neighboring countries.

- US Dollar Index (DXY) gains 0.29%, reaching 108.30, amid positive market sentiment.

- Focus on upcoming Bank of Japan meeting; potential for 25 basis point rate hike expected.

The USD/JPY was virtually unchanged during the North American session on Tuesday, as traders assessed US President Donald Trump’s threats to impose 25% tariffs on Canada and Mexico as soon as February 1. The Greenback recovered as the major hit a daily high of 156.20. However, fears faded as the pair traded near 155.54, virtually unchanged.

USD/JPY consolidates near 155.50 on President Trump's proposed tariffs on Canada and Mexico

Market sentiment remains upbeat, and the US Dollar climbs, as depicted by the US Dollar Index (DXY), which tracks the basket of six currencies against the buck, rising 0.29% to 108.30.

Meanwhile, traders in the FX markets would continue to be attentive to Trump’s rhetoric, which sent ripples late Monday in the US as he signed a tranche of executive orders, including illegal immigration and naming cartels as global terrorist organizations.

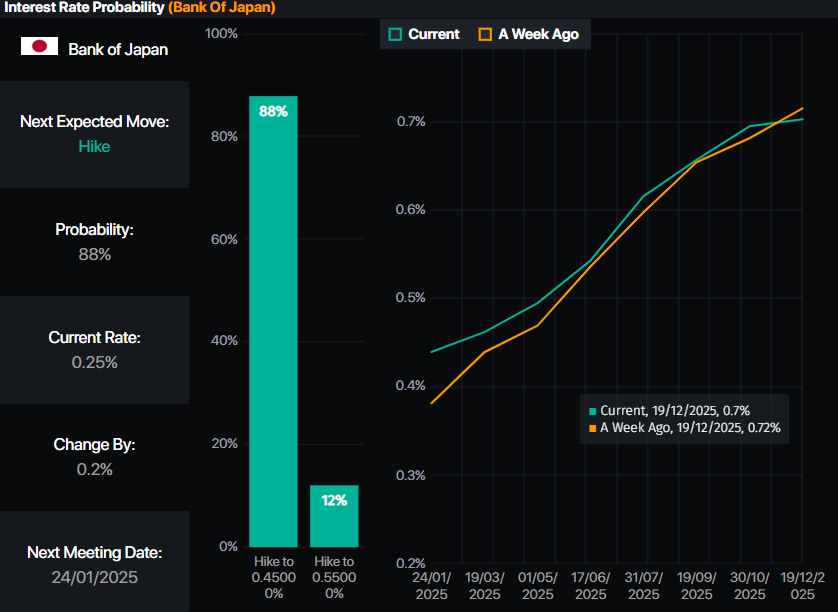

In addition, USD/JPY traders are focused on the Bank of Japan's (BoJ) next monetary policy meeting. Interest rate probabilities suggest the BoJ would likely raise rates by 25 basis points to 0.50% for the first time since July last year.

Source: Prime Market Terminal

This week, the US economic schedule remains absent until Thursday, when the Initial Jobless Claims data will be released, followed by Friday’s S&P Flash PMIs. In Japan, the docket will feature Trade Balance data and foreign Investment figures ahead of the BoJ meeting.

USD/JPY Price Forecast: Technical outlook

The USD/JPY uptrend remains intact, but recently, sellers stepped in and dragged spot prices from around 158.80 to the current level. Despite this, bears failed to clear a support trendline drawn from September 2024 lows near 154.50. Nevertheless, if USD/JPY holds below 156.00, further downside is seen once 155.00 is cleared. The next support would be the 154.50, followed by the 154.00 mark.

On the other hand, if USD/JPY rises past the Senkou-span A at 156.41, a test of 157.00 is on the cards. If surpassed, a jump toward the January 15 high of 158.03 is likely.

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.25% | 0.30% | -0.06% | 0.56% | 0.33% | 0.45% | 0.20% | |

| EUR | -0.25% | 0.06% | -0.24% | 0.30% | 0.08% | 0.21% | -0.07% | |

| GBP | -0.30% | -0.06% | -0.34% | 0.24% | 0.01% | 0.14% | -0.12% | |

| JPY | 0.06% | 0.24% | 0.34% | 0.61% | 0.37% | 0.48% | 0.23% | |

| CAD | -0.56% | -0.30% | -0.24% | -0.61% | -0.23% | -0.10% | -0.37% | |

| AUD | -0.33% | -0.08% | -0.01% | -0.37% | 0.23% | 0.12% | -0.14% | |

| NZD | -0.45% | -0.21% | -0.14% | -0.48% | 0.10% | -0.12% | -0.27% | |

| CHF | -0.20% | 0.07% | 0.12% | -0.23% | 0.37% | 0.14% | 0.27% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

- AUD/USD slumps to near 0.6220 as Trump threatens to impose tariffs on China.

- The RBA is expected to start reducing interest rates in February.

- The US Dollar recovers sharply as Trump confirms that the tariff plan is on track.

The AUD/USD pair falls sharply to near 0.6220 in Tuesday’s North American session after a couple of failed attempts to revisit the key resistance of 0.6300. The Aussie pair slumps as United States (US) President Donald Trump threatens to raise tariffs on China, a move that would also hurt the Australian export sector, being the leading trading partner of China.

Trump’s presidential memo showed that he directed federal agencies to evaluate trade relationships with China and other North American economies.

Meanwhile, growing expectations that the Reserve Bank of Australia (RBA) could pivot to policy-easing in the policy meeting in February. RBA's dovish bets swelled after the board said in the December meeting that it gained some confidence that inflation is moving sustainably towards the target.

The US Dollar (USD) rebounds sharply and recovers most of Monday’s losses as Trump confirms that the tariff plan is still on. The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, bounces back from an almost two-week low of 108.00.

AUD/USD discovers buying interest after revisiting an over four-year low of 0.6170. However, the outlook of the pair is still bearish as the 50-week Exponential Moving Average (EMA) near 0.6526 is sloping downwards.

The 14-week Relative Strength Index (RSI) bounces back after turning oversold near 30.00. However, the overall momentum will remain bearish until it stays inside the 20.00-40.00 range.

Going forward, the pair would face more downside if it fails to hold the January 13 low of 0.6131. This will push it lower to the round-level support of 0.6100 and the April 2020 low of 0.5990.

On the flip side, a decisive breakout above the January 6 high of 0.6302 will open doors to the December 18 high of 0.6340 and the round-level resistance of 0.6400.

AUD/USD weekly chart

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

The Pound Sterling (GBP) has softened in line with the EUR through the overnight session, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

GBP slips back from Monday’s peak

“UK data reports were mixed—wage growth picked up again in November but the 5.6% increase in Average Weekly Earnings was a bit below consensus. Payrolls fell a larger than expected 47k in December, however, which may be the data point the BoE homes in on at the February 6th policy decision.”

“GBP has slipped back from yesterday’s intraday peak near 1.2345 but is maintaining a minor uptrend on the USD that has developed over the past week. Support is 1.2220 and 1.2185 (firmer).”

The Euro (EUR) has slipped back to the mid-1.03 area after failing to hold gains through the low 1.04s yesterday, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

EUR weakens after failing to hold 1.04+ gains

“It’s all headline-driven movement, with little regard for fundamental developments, however limited. The German ZEW investor survey for January showed a minor improvement in sentiment but weaker expectations amid sluggish domestic growth.”

“The EUR is maintaining some of yesterday’s rally. While the failure to hold gains through the low 1.04 area (initial retracement resistance from the EUR’s Sep/Jan decline in the EUR sits at 1.0422) looks a little disappointing, the EUR is holding the break above trend resistance, now support, at 1.0318. A clear move through 1.0420/25 should add to corrective momentum.”

Euro (EUR) jumped overnight on headlines that Trump is not planning to impose new tariffs yet, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

Headlines to drive 2-way trades in the near term

“In the near term, we may see further unwinding of EUR shorts should Trump leave universal tariffs alone in the interim. EUR may even have a good chance of trading higher should ZEW survey expectations come in better than expected later today.”

“Daily momentum is mild bullish while RSI rose. Risks remain skewed to the upside. Key resistance at 1.0440 (50 DMA). Break out exposes the pair to 1.05, 1.0570 levels (38.2% fibo retracement of Sep high to Jan low). Support at 1.0340 (21 DMA), 1.0240, 1.02 (recent low). Expect headlines to drive 2-way trades in the near term.”

- USD/CAD finds bids as the Canadian headline CPI decelerated in December on year. Month-on-month CPI deflated.

- Soft Canadian inflation data stokes hopes that the BoC would continue reducing interest rates by 50 bps.

- US Trump prepares to impose 25% tariffs on Canada and Mexico on Feb 1.

The USD/CAD pair witnesses buying interest near 1.4430 in Tuesday’s North American session as Statistics Canada reported that soft inflation data for December. The agency showed that the headline inflation rose at a slower pace of 1.8%, compared to estimates and the former release of 1.9% on year.

Month-on-month headline CPI deflated by 0.4%, as expected, against a flat reading in November. Soft CPI data has deepened risks of inflation undershooting the Bank of Canada’s (BoC) target of 2%. This scenario would force the BoC to continue unwinding the policy restrictiveness at an ongoing pace. The BoC has been reducing its interest rates at a larger-than-usual pace of 50 basis points (bps) from its last two policy meetings.

However, the Reuters poll in the January 10-16 period showed that the BoC is almost certain to cut interest rates by 25 basis points (bps) to 3% in the policy meeting later this month.

The outlook of the Canadian Dollar was already vulnerable as US President Donald Trump confirmed that he would impose 25% tariffs on Canada and Mexico on February 1. Also, Trump’s plan to accelerate strategic oil reserves weighed on the Loonie, given that Canada is the leading exporter of Oil to the US and resulting lower Oil prices from higher production would lead to lower foreign inflows.

Meanwhile, the US Dollar (USD) has rebounded strongly on Tuesday after plummeting on Monday as Trump has not denied the imposition of tariffs, though have delayed, citing that “We are not ready for that yet.” The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, climbs above 108.50.

US Dollar (USD) saw a sharp drop after Trump announced no immediate tariffs on China. USD/CNH saw a sharp move below 7.26 overnight before rebounding. DXY was last at 108.50 levels, OCBC FX analysts Frances Cheung and Christopher Wong note.

Risks skewed to the downside

“Subsequent headlines came by quoting Trump imposing a 1 February deadline and tariff of as much as 25% on Mexico and Canada. Not surprisingly, MXN and CAD came under pressure. An absence of immediate tariffs but a 1 February deadline suggests that this is a strong call for Mexicans and Canadians to come back to the negotiating table quickly. Nevertheless, this underscores the fluidity of tariff developments. Tariff uncertainty remains in terms of timing, magnitude and scope of products.”

“And we continue to hold to the view that the implications on markets can be very much 2-way. On one hand, a longer delay on tariff announcement will continue to provide a breather for risk proxies while consensus trade (long USD) unwinds. On the other hand, a swift implementation of tariff would undermine sentiments and boost the USD. We do not expect a one-way trade in Trump regime.”

“Daily momentum is bearish while RSI fell. Risks skewed to the downside. Support at 108, 107.50 (50DMA). Resistance at 108.75 (21 DMA), 110.10 levels. With Trump inauguration done and dusted, next few days will be closely watched with regards to executive orders, executive actions he will sign.”

Markets generally and high beta FX in particular breathed a sigh of relief yesterday when the WSJ reported that President Trump would not impose aggressive tariffs immediately on returning to the White House. Rather, the incoming administration will take a more considered approach to tariff action after reviewing existing arrangements, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

USD reverses some of Monday’s drop

“The US Dollar (USD) tumbled but losses partially reversed late yesterday after Trump wheeled out the 25% tariff threat on Canada and Mexico (and additional tariffs on China) from February 1, citing border issues (drugs, illegal immigrants). The USD is trading higher on the session so far today, with the CAD and MXN predictably underperforming, but the DXY remains well below Monday’s opening levels.”

“Trade tariffs are still coming in some form but the apparent capriciousness of policymaking means anticipating the president’s decisions gets all the harder. That’s probably deliberate but higher uncertainty means higher volatility for markets broadly. The JPY and Asia FX are relative out-performers on the session, limiting losses to the USD to around –0.2/0.3%.”

“Assuming the 25% tariff threat is just that (while very harmful for Canada and Mexico, the negative repercussions for the US economy would be significant as well), a more considered approach to trade tariffs that yesterday’s WSJ report hinted at may still be a drag on the USD’s near-term outlook, given sentiment and positioning that was geared around (aggressive) ‘tariffs from day one’.”

- The US Dollar enters the second day of choppy trading with a firm recovery.

- Markets trembled after US President Trump confirmed upcoming tariffs on Canada and Mexico in February.

- The US Dollar Index (DXY) trades higher again with 109.00 in focus.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, got knocked on Monday when tariffs were not part of the executive orders signed by Donald Trump in his first hours as US President. Markets got wrong footed thinking the stance on tariffs got eased and would face broad delay. However, a surprise comment from US President Trump late Monday night triggered a turnaround with reversals in all major pairs, including the US Dollar. President Trump said the application of 25% tariffs on imports from Canada (CAD) and Mexico (MXN) is due at the start of February, with Canadian Dollar (CAD) and Mexican Peso (MXN)devaluing as an immediate reaction. Overall, reversals are taking place on Tuesday from Monday’s losses on nearly all fronts and asset classes impacted by those comments.

Daily digest market movers: Fundamentals to drive this week

- The US Treasury will publish some data this Tuesday in an otherwise very empty economic calendar ahead. At 16:30 GMT, 3-month, 6-month and 52-week Bills will be allocated in the markets.

- Equities are tying up with gains on Tuesday. European equities are flat, while US futures are up near 0.50%.

- The CME FedWatch tool projects a 54.2% chance that interest rates will remain unchanged at current levels in the May meeting, suggesting a rate cut in June. Expectations are that the Federal Reserve (Fed) will remain data-dependent with uncertainties that could influence inflation during US President Donald Trump’s term.

- The US 10-year yield is trading around 4.56% and has a long road to recover if it wants to head back to last week’s levels near 4.75%.

US Dollar Index Technical Analysis: Recovery could get dangerous

The US Dollar Index (DXY) fell in the hands of the bears on Monday, with the bulls taking over again on Tuesday. However, traders need to be aware of some potholes in the road ahead should the DXY head back to 109.00 and higher. With the ongoing recovery on Tuesday, some pivotal upside levels could cause a heavy rejection, resulting in a dead-cat-bounce, trapping US Dollar bulls and squeezing them out towards 107.00 and lower.

If this recovery wants to continue its ascent, the pivotal level to gain control of is 109.29 (July 14, 2022, high and rising trendline). Further up, the next big upside level to hit before advancing further remains at 110.79 (September 7, 2022, high). Once beyond there, it is quite a stretch to 113.91, a double top from October 2022.

On the downside, the first area to watch is 107.85-107.90, which held Monday’s correction. Further down, the convergence of the high of October 3, 2023, and the 55-day Simple Moving Average (SMA) around 107.35 should act as a double safety feature to catch any falling knive.

US Dollar Index: Daily Chart

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.