- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-01-2022

- GBP/JPY dropped 0.7% on Friday, falling from above 155.00 to around 154.00.

- Risk-off flows and soft UK data weakened sterling while safe-haven demand and lower global bond yields strengthened the yen.

GBP/JPY fell sharply on Friday and heavy downside in the global equity market and commodity space weighed on more risk-sensitive currencies such as sterling, whilst a sharp drop in global bond yields on safe-haven demand boosted the rate-sensitive yen. Much worse than expected UK Retail Sales figures for December made things worse for GBP and, though it wasn’t the worst performing G10 currency on the day, it fell 0.7% against the yen, which was the second-best performing G10 currency after its safe-haven counterpart the CHF. The net result for GBP/JPY was that it dropped sharply from above 155.00 all the way to 154.00 where it is currently stabilising ahead of the weekend FX market close.

After GBP/JPY broke below the 155.50 level on Thursday, above which it had been consolidating within a descending trendline for the past few sessions, the pair’s technical momentum has taken a marked turn for the worse. As poor earnings and Fed tightening fears drive losses in US (and global equities) that may continue into next week, GBP/JPY bears will be eyeig a test of the 50 and 200-day moving averages in the 153.00 to 153.40 area ahead of key support in the 152.50 zone. Amid a lack of notable economic events to distract from these themes, aside from maybe flash UK January PMIs on Monday, fundamental catalysts for GBP outperformance are few and far between. The BoE will probably hike interest rates again in February, which might reignite some GBP/JPY upside on central bank divergence, but this could still be some weeks away.

- US equities continued to fall on Friday after downbeat subscriber guidance from Netflix, whose shares dropped over 20%.

- The S&P 500 dropped another 1.6% towards 4400 after failing to test 4500 earlier in the session.

- The index is now down 5.4% on the week and has broken below its 200DMA for the first time since June 2020.

US equity markets continued to sell off on Friday, as downbeat earnings from tech giant Netflix weighed on sentiment and its competitors. NFLX shares dropped over 20% on Friday after the company on Thursday issued significantly worse than expected guidance for subscriber growth in Q1 2022. That weighed on other high earnings/value ratio stocks (or so-called “growth” stocks) which are concentrated in the tech sector, though also weighed on the market more broadly as well. The S&P 500 dropped 1.5% towards 4400 having failed an attempt to test the 4500 level again earlier in the session. The index is on course to end this week 5.4% lower and roughly 8.5% below the record highs hit at the start of the year above 4800. With the index on Friday breaking below its 200-day moving average (at 4429) for the first time since June 2020, the S&P 500 bears will now be eyeing a test of Q4 2021 lows in the 4300 area.

The Nasdaq 100, meanwhile, dropped another 2.4% to move below the 14.5K level, having long since let go of the 200DMA at just above 15.0K. That means the index is now down more than 7.0% on the week and is now about 13.5% lower versus its November record highs close to 16.8K. The Dow, meanwhile, was down a more modest 1.2% to underneath 34.3K, taking on the week losses to about 4.5%. The comparatively less growth stock weighted Dow is down just over 7.0% from the record highs it hit in the first week of 2022 near 37.0K. The Dow was weighed on Friday by downside in index heavyweight Disney amid fears the company will issue subscriber growth forecasts for Q1 2022 that are equally as bleak as Netflix.

In terms of the S&P 500 GICS sectors, Communication Services (which contains Netflix) was the worst performer dropping 3.5% and was closely followed by the Consumer Discretionary and Materials Sectors down 3.0% and 2.5% each. Amid the risk-off in stock markets, energy prices fell, weighing on the Energy sector which dropped 2.3%, whilst lower US bond yields (as a result of the safe-haven bid) hurt the Financials sector, which dropped 2.2%. Information Technology was down 1.6%, Health Care was down 1.1% and Industrials were down 0.9%. Lower yields helped the Real Estate hold its ground, with the sector down just 0.2% on the day. The classically defensive Utilities and Consumer Staples sectors, meanwhile, were down 0.2% and up 0.1% respectively.

Investors will fear that further underwhelming earnings might spur further broad selling pressure in US equities next week. Apple, Tesla and Microsoft are the biggest names that will be reporting. Otherwise, the Fed meeting on Wednesday will be the most important event, with traders keen to judge the tone of the meeting for signals as to how fast the bank might lift rates in the coming years. Some analysts have noted that if equities continue to aggressively sell-off, this could eventually dissuade Fed policymakers from hiking quite so aggressively, with market drops having forced the Fed’s hand before (think the end of 2018/early 2019). But amid much higher inflation than back then, the “line in the sand” in terms of equity market downside will be larger than in the past. In other words, where a 10% drop in the S&P 500 might have caused concern at the Fed in the past, given current inflation, a drop somewhere closer to 20% or more might be needed to turn heads at the Fed.

- After dropping sharply during Thursday’s US and Friday’s APac sessions, NZD/USD has stabilised in the 0.6725 area.

- Next week’s Fed meeting and New Zealand CPI data will be the key events to watch.

- NZD/USD will be eyeing a test of the 0.6700 level.

After dropping sharply late on Thursday/during early Friday Asia Pacific trade after slipping below an uptrend that has supported the price action going all the way back to mid-December, NZD/USD has stabilised in the 0.6725 area. The pair broke below the uptrend during Thursday’s US session as stocks on Wall Street declined, which at the time weighed broadly on risk assets such as NZD. Though US (and global) equities have continued to decline on Friday, a sharp drop in US bond yields (related to safe-haven demand) has dampened the safe-haven appeal of the US dollar, shielding NZD/USD from further losses.

Next week is a big one for NZD/USD traders. During Wednesday’s US session, the Fed will release their latest policy decision, where they are expected to give the green light for multiple rate hikes in 2022 starting as soon as March and may give more details on quantitative tightening. Shortly after and at the start of Thursday’s Asia Pacific session, Q4 Consumer Price Inflation data will be released out of New Zealand. A hotter than expected outturn could result in a strengthening of the market’s conviction that the RBNZ is set to continue the rate hiking cycle it began last year and remain well ahead of the Fed regarding the removal of monetary accommodation.

Whilst that might be enough to give NZD a temporary lift, the currency will as usual trade mostly as a function of USD flows and risk appetite. It's been a bumpy start to the Q4 US earnings season – Netflix, the first major US tech company to report, is down over 20% on the day after Thursday’s earnings release – and this may continue to weigh on NZD. Generalised fears about Fed hawkishness, as well as a potential escalation in geopolitical tensions in Eastern Europe, might also continue to weigh on risk appetite and the kiwi. It seems very likely that NZD/USD, which is down just over 1.0% on the week from above 0.6700, will test and perhaps even break below 0.6700 in the coming week.

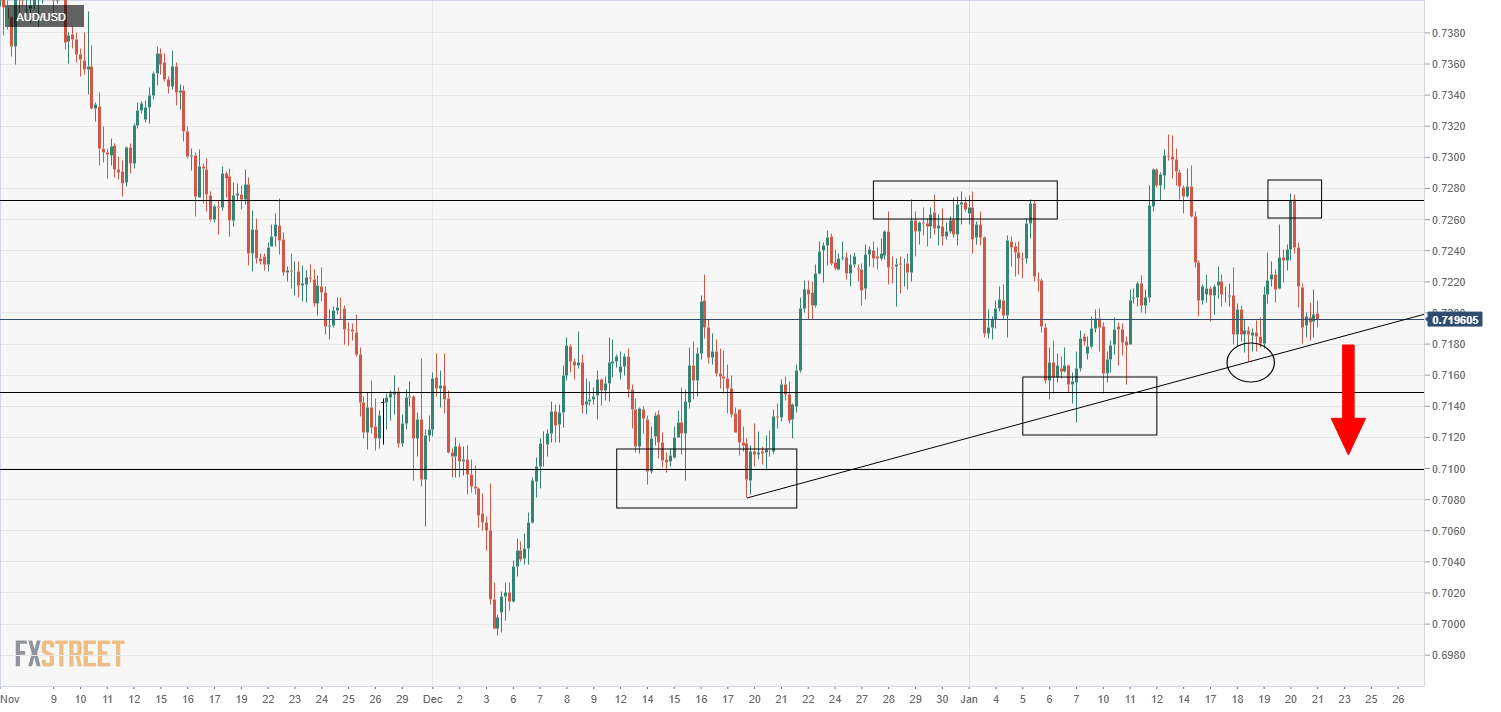

- AUD/USD is currently trading close to the 0.7200 level, as downbeat global risk appetite weighs on the Aussie.

- For now, a key long-term uptrend from mid-December continues to offer support.

AUD/USD has consolidated close to 0.7200 and above a key long-term uptrend during Friday’s US session, after pulling back sharply from Thursday’s highs in the 0.7270s amid a downturn in global risk appetite. Traders seemed reluctant to force a bearish breakout below the upwards trendline that has supported the price action since mid-December this close to the weekend. Any push lower may have to wait until next week when more US equity earnings releases and what is likely to be a very hawkish Fed meeting risk putting US (and global) equities under further selling pressure.

A break below the key long-term uptrend would open the door to a test of support in the 0.7150 area and then perhaps a test of the annual lows around 0.7100. At current levels jus below the big 0.7200 figure, AUD/USD trades lower by about 0.2% on the week, as a broadly stronger dollar and weakness in risk assets in the latter half of the week outweighed earlier strength related to strong Australian economic data. Though this week’s labour market report does suggest a strong likelihood that the RBA axes its QE programme next month and brings forward rate hike guidance to allow for lift-off in 2022, the meeting remains some weeks away. Whilst next week’s Australia Q4 Consumer Price Inflation report could further spur hawkish RBA bets to the benefit of the Aussie, AUD/USD remains vulnerable to Fed-related USD flows and risk appetite.

Data released on Friday showed an increase in November retail sales in Canada of 0.7%, below the 1.2% of market consensus. Analysts at CIBC, point out the advance was modest in November, and warn that all of that ground and more appears to have been given back in December.

Key Quotes:

“Canadian retail sales posted a modest advance in November, but all of that ground and more appears to have been given back in December. The increase of 0.7% in November was a little weaker than the advance estimate and the consensus forecast (+1.2%), and reflected only a modest 0.2% advance in volume terms. Meanwhile the early estimate for a 2.1% decline in December suggests that sales weakened fairly severely, even before the worst of the Omicron-related cases and restrictions hit.”

“While we were expecting to see weakness in December, the decline appears to be a little larger than we were anticipating. If accompanied by disappointments in advance data for manufacturing and wholesaling next week, it could mean that December GDP was weaker than expected.”

“Signs of softening in the economy before the worst of the case counts and restrictions hit may also tip the scales slightly in terms of the Bank of Canada holding rates next week and waiting for signs of a recovery before hiking.”

Analysts from Rabobank consider the US dollar’s upside has further to run in the first half of 2022 and they maintain a 6 month price forecast for EUR/USD of 1.10.

Key Quotes:

“We remain constructive on the outlook for the USD, at least through the first half of the year. Aside from supportive interest rate differentials, the USD may be a beneficiary of safe-haven flows in the weeks ahead connected to the news-flow regarding a possible Russian invasion of Ukraine. That said, the bullish USD view is not without risks, particularly in the latter months of 2022.”

“Given that the market is short EURs, a renewed focus on the outlook for a change in direction for ECB policy could trigger a move higher in EUR/USD.”

“We expect EUR/USD can move to the 1.10 area by the middle of the year. However, we see risk that the USD could struggle to add to these gains in the latter part of 2022 and see a return to the 1.12 area on a 12 month view.”

- US dollar posts mixt results on Friday ahead of Fed’s week.

- Risk aversion and lower US yields weigh on USD/JPY.

- Pair drops for the second week in a row, next support at 113.50.

After a short-lived recovery, the USD/JPY resumed the downside and dropped to 113.59, reaching a fresh one-week low. It is hovering around 113.70, consolidating weekly losses and on its way to the lowest daily close in a month.

USD/JPY extends slide despite Fed’s expected hikes

The combination of risk aversion across financial markets and lower US yields weighed on the USD/JPY during the week. Momentarily it traded above 115.00 on Tuesday, and then resumed the downside.

If the slide continues, the next key level for USD/JPY is the 113.50 area (last week lows) and then 113.20. The negative momentum for the US dollar could be alleviate with a firm recovery above 114.70.

The key event next week is the FOMC meeting. No change in interest rate is expected on Wednesday but a clear sign of a March hike is seen. “A likely March rate hike has been well communicated, so a "prepare for liftoff" signal will not be market-moving. More important will be guidance on QT as well as the funds rate after March. We don’t expect definitive signals, unfortunately; the next dot plot update is in March. The result could be mixed messages”, warn analysts at TD Securities.

Technical levels

- Silver has fallen back under $24.50 on Friday despite a sharp decline in US government bond yields amid safe-haven demand.

- XAG/USD appears to be suffering from pre-weekend profit-taking after failing to break above its 200DMA on Thursday.

Despite a sharp drop in US bond yields on Friday amid heightened demand for safe-haven assets as global equities tumble, spot silver (XAG/USD) prices have been able to advance back to challenge weekly highs in the $24.70 area. Indeed, spot prices have actually reversed lower from Thursday’s highs and current trade about 0.3% lower on the day in the $24.30s. Typically, the combination of lower US bond yields (which reduces the opportunity cost of holding non-yielding silver) and risk-off flows would benefit safe-haven precious metals.

But XAG/USD, which still trades higher by more than 6.0% on the week, appears to be suffering from pre-weekend profit-taking after the pair on Thursday failed to break back above its 200-day moving average at $24.63. This failure could ultimately prove very costly. The last two times spot silver prices tested the 200DMA (in August and then again in November), prices failed to break above it and then ultimately fell by as much as 15% in the subsequent weeks.

With the Fed meeting, next week expected to greenlight an aggressive pace of monetary tightening in 2022, the scope for US bond yields and the US dollar to turn higher again is high. This could weigh heavily on precious metals. One factor this week that has been supporting prices has arguably been heightened geopolitical tensions in Eastern Europe with Russia seemingly on the verge of invading Ukraine. Any signs that a military incursion is underway/imminent may further boost safe-haven assets such as silver next week, which might be enough to shield it from hawkish Fed-related bearish vibes.

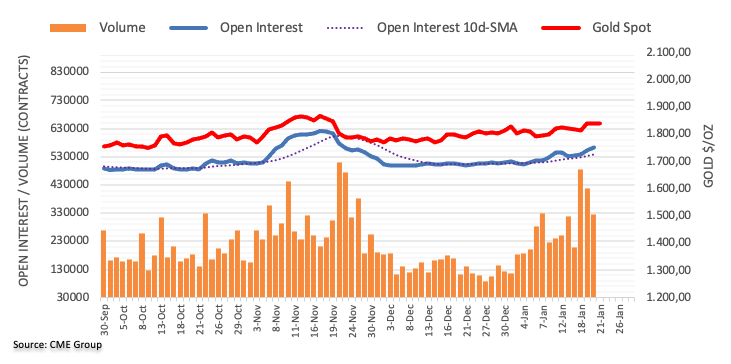

After a tarnished start to the week, gold made impressive gains, breaking above a key resistance area on Wednesday and reaching its highest level in nearly two months, near $1,850, on Thursday. FXStreet’s Eren Sengezer notes that the yellow metal retains a bullish bias and could target the $1,870 zone.

$1,830 aligns as first support

“Static resistance seems to have formed at $1,850. In case XAU/USD rises above that level and starts using it as support, it could target the $1,870 area. Ideally, this move would be accompanied by another leg lower in the 10-year US T-bond yield on a dovish Fed tone.”

“On the flip side, $1,830 (Fibonacci 23.6% retracement of the uptrend that started in October and ended in mid-November) aligns as first support. A daily close below that level could open the door for an extended correction toward $1,815 (Fibonacci 38.2% retracement).”

“Unless the yellow metal falls below the $1,805/$1,800 area, where the ascending trend line meets the 200-day SMA, the near-term outlook is likely to remain bullish.”

- GBP/USD has fallen to fresh weekly lows in the 1.3550s and is now below its 21DMA.

- Downbeat global risk appetite and weak UK data have weighed on the pair on Friday.

GBP/USD broke out to fresh weekly lows on Friday and has continued to press lower as the US trading session has gotten underway, with sterling succumbing to weak data and risk-off flows that are weighing broadly on risk-sensitive G10 currencies. At current levels just above the 1.3550 mark, GBP/USD now trades about 0.3% lower on the day, taking on the week losses to about 0.9%. With the latest drop having taken the pair back below the 21-day moving average for the first time since this time last month, the sterling bulls will be concerned that GBP’s near-term momentum has turned negative. The main area of support for cable traders to now keep an eye on is at the 1.3500 level.

Global equities tumbled on the final trading day of the week with traders citing the usual concerns about Fed tightening as well as week Netflix earnings, and this has dragged other risk assets (like commodities) and bond yields lower in tandem. This has hurt sentiment towards the more risk-sensitive currencies in the G10 such as sterling, which has also suffered after a larger than expected drop in Retail Sales in December. Data released by the UK’s ONS on Friday showed that headline Retail Sales dropped 3.7% MoM, much larger than expectations for a 0.6% MoM decline.

“The December retail sales report is unequivocally bad news, and it's reasonably clear that elevated price pressures in the goods sector contributed to the retrenchment in spending,” analysts at BMO said. Meanwhile, should next week’s Fed meeting match or exceed expectations regarding hawkishness, that could be a recipe for broad USD strength and for cable to incur further losses. A drop back to 1.3400, where the 50DMA resides, looks increasingly on the cards. Markets continue to price in a strong likelihood that the BoE hikes interest rates again at its next meeting, with BoE speak this week not doing anything to dampen such speculation, but the next meeting isn't until February 3 (just under two weeks away).

- US dollar is mostly higher across the board on the back of risk aversion.

- Euro gains support from the rally against the pound.

- EUR/USD heads for weekly loss and still remains in the previous range.

The EUR/USD is rising on Friday, and after the beginning of the American session, it peaked at 1.1361 and then pulled back. The US dollar is posting mixed results across the board, ahead of the weekend.

The upside lost momentum amid risk aversion. Equity prices in Wall Street are falling again, with the Dow Jones losing 0.42% and the Nasdaq 1.52%. The negative tone is boosting Treasuries. The 10-year yield stands at 1.74%, while the 30-year 2.06%, both a one-week lows.

The US dollar benefits from negative sentiment. The upside finds some limit amid lower US yields. The predominant tone is the risk aversion so far.

The euro is showing strength in the market and with the Swiss franc and the yen is among the top performers. The EUR/GBP pair is rebounding sharply from two-year lows, and it trades at 0.8375, having the best day in months, and offers support to EUR/USD. Recent release data showed the Eurozone Consumer Confidence index declined from -8.4 to -8.5 in January.

Despite Friday’s gains, EUR/USD is about to end the week lower. It still remains under the 20-week simple moving average that stands at 1.1480. Next week, the key event will be the FOMC meeting. The Fed is expected to open the doors to a March rate hike.

The EUR/USD is back into the previous consolidation range of 1.1370/1.1220. If it manages to rise back above 1.1370 the outlook would improve. On the downside, a break under 1.1300 should clear the way to more losses and to a test of 1.1270.

Technical levels

- The stability around USD/TRY remains surprising.

- The pair keeps navigating the 13.00-14.00 range so far.

- Turkey’s Consumer Confidence improved to 73.2 in January.

USD/TRY extends the side-lined mood in the mid-13.00s at the end of the week.

USD/TRY calm after the CBRT decision

USD/TRY regains some upside traction and leaves behind two consecutive daily pullbacks on Friday, always against the backdrop of the broad-based consolidative mood within the 13.00-14.00 range in place since the beginning of the new year.

The pair’s consolidative stance appears well in place for yet another session after the Turkish central bank (CBRT) left the One-Week Repo Rate unchanged at 14.00% at its meeting on Thursday, matching the broad consensus.

The last time the CBRT kept the steady hand on rates was at the August 2021 event, which was followed by 500 bps rate cuts in the September (100 bps) , October (200 bps), November (100 bps) and December (100 bps) meetings.

In the domestic calendar, the Consumer Confidence improved to 73.2 for the current month (from 68.9). The higher reading comes after a marked advance in the “Financial situation expectation of household over the next 12 months” and the “General economic situation expectation over the next 12 months”.

What to look for around TRY

The pair keeps the multi-session consolidative theme well in place, always within the 13.00-14.00 range. Higher-than-expected inflation figures released earlier in the year put the lira under extra pressure in combination with some cracks in the confidence among Turks regarding the government’s recently announced plan to promote the de-dollarization of the economy. In the meantime, the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are forecast to keep the domestic currency under intense pressure for the time being.

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Potential assistance from the IMF in case another currency crisis re-emerges. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is advancing 1.01% at 13.4324 and a drop below 12.7523 (2022 low Jan.3) would pave the way for a test of 12.6793 (55-day SMA) and finally 10.2027 (monthly low Dec.23). On the other hand, the next up barrier lines up at 13.9319 (2022 high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

According to the flash estimate of the European Commission's Eurozone Consumer Confidence survey, the headline index fell to -8.5 in January versus forecasts for a drop to -9.0 from -8.4 the month prior. December's reading was revised slightly lower from -8.3.

Market Reaction

The euro has not reacted to the latest data, which was broadly in line with expectations. The Consumer Confidence Index is expected to improve in the coming months as the prevalence of the Omicron variant fades. At present, EUR/USD continues to trade in the 1.1340s, with its intra-day gains capped by the presence of the 21-day moving average just under 1.1350.

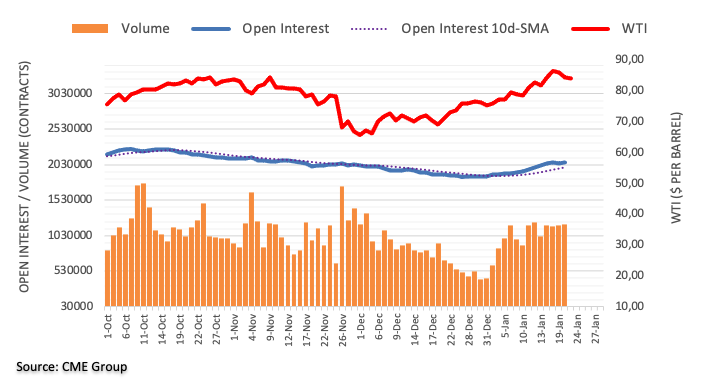

- WTI is up from earlier session lows under $83.00, but in the mid-$84.00s, still trades over $3.0 below weekly highs.

- Market commentators cited downbeat risk appetite and pre-weekend profit taking as weighing on the price action on Friday.

Front-month WTI futures have recovered back into positive territory on the day over the last few hours after dipping as much as 1.9% or just over $1.50 to under $83.00 earlier in the session. But at current levels in the mid-$84.00s, WTI still trades over $3.0 below its weekly highs in the upper-$87.00s. Market commentators said the latest pullback in prices is a reflection of the more downbeat tone of global risk appetite (global equities and bond yields are broadly lower), but could also be being driven by pre-weekend profit-taking.

Some analysts said that this week’s surprise build in US crude oil inventories, the first since November, has also weighed slightly on the price action. Nonetheless, WTI is still on course to end the week just under 50 cents higher, which would mark a fifth successive week of gains that saw the US crude oil benchmark hit its highest levels since September 2014. Continued expectations for robust demand growth combined with an increasingly tense geopolitical backdrop and ongoing OPEC+ supply concerns are likely to continue to underpin prices next week.

As tensions between Russia and Ukraine grow, so does the risk that it spills over into global commodity markets. In the view of strategists at ING, Commodity prices could soar if the Russia-Ukraine crisis escalates.

Tough sanctions would rattle commodity markets

“A scenario where the West fails to react with tough sanctions against Russia if it were to invade Ukraine means that the potential impact for commodity markets would be more limited, although the uncertainty would still likely be bullish in the short-term. There would still be a risk to Russian gas flows via Ukraine to Europe. While, depending on the scale of any invasion, it could also potentially have an impact on the production and export of Ukrainian agricultural commodities, including corn and wheat.”

“In a scenario where the West reacts strongly with sanctions that target key Russian industries, this could have a far-reaching impact on the commodities complex. It could potentially lead to a significant tightening in energy, metal, and agri markets, which would provide only a further boost to an asset class which already has an abundance of positive sentiment in it.”

“Even if sanctions are not imposed on certain industries, financial sanctions could still make trade difficult, as it would be an obstacle for making payments.”

The S&P 500 remains on course to the 200-day moving average (DMA) at 4438/28. Whilst analysts at Credit Suisse continue to look for an attempt to stabilize here, a weekly close below 4428 would warn of a more damaging downturn with next support seen at 4387/64.

Initial resistance is seen at 4495

“We maintain our negative bias for our core objective of the key long-term 200-DMA, currently at 4438/28. Whilst our bias remains to look for stabilization here, a close below 4438/28 would be seen to raise the prospect for further weakness yet with support seen next at the 78.6% retracement of the rally from last October at 4396, then gap support at 4387/64.”

“Of concern specifically for the S&P 500 is the weekly RSI momentum picture which if sustained into the close today would complete a major top. If confirmed, this would suggest that a rebound from the 200-DMA, if indeed even seen, is likely to be temporary.”

“Resistance is seen at 4495 initially, then 4532, with the immediate risk seen staying lower whilst below 4602/12.”

“VIX above 27.40 would warn of a further rise to 35.00.”

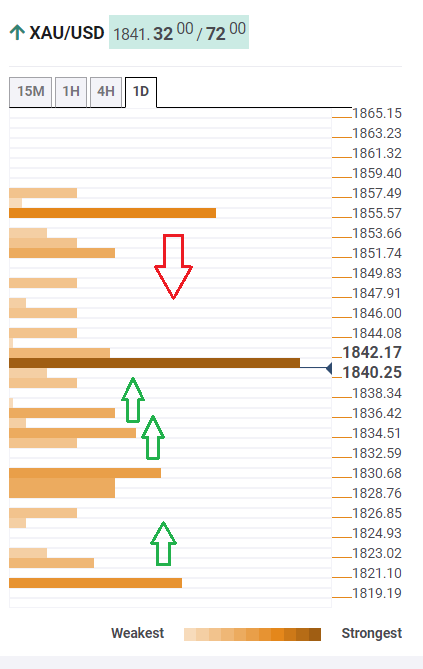

- Spot gold prices recovered from a dip back to $1830 as traders bought the dip at support.

- Lower bond yields/elevated demand for safe-haven assets on Friday is keeping gold supported above $1840.

Spot gold (XAU/USD) prices have in recent trade recovered back to the north of the $1840 level after falling back below, but finding excellent dip-buying interest at, the $1830 level early in the European trading session. At current levels around $1842, spot prices are back to trading modestly in the green again and remain close to the two-month highs at $1847 reached on Thursday. Broad market risk appetite is one of risk-off this Friday, with global equities and other risk assets lower and developed market bond yields also lower across the board.

The combination of lower bond yields (reducing the opportunity cost of holding non-yielding gold) and demand for safe-haven assets has underpinned gold prices and was likely a key reason why traders were so eager to buy the dip to $1830. Recall that the $1830 area had previously been a strong zone of resistance in recent weeks as Fed rate hike bets kept gold prices capped. Since the short-squeeze that sent XAU/USD shooting into the $1840s on Wednesday, this area of prior resistance has now turned to support.

Gold looks set to close out the week about 1.3% higher and two major factors that have been cited as supportive for the safe-haven metal include 1) geopolitical tensions and 2) easing from China’s central bank. Regarding the former, market participants are worried about the global economic ramifications of a potential Russian invasion into Ukraine, which some fear could prove inflationary (boosting demand for inflation hedges such as gold).

Meanwhile, the PBoC cuts interest rates across its Medium-Term Lending Facility, one and five-year Loan Prime Rates and Lending Facility Rate this week as it looks to shore up slowing Chinese economic growth. Easier monetary policy is typically positive for gold. However, gold bulls will be aware that the ability of these two themes to provide ongoing support for gold next week, when the market focus will be on what is likely to be a very hawkish Fed meeting, is questionable.

The Canadian dollar is modestly lower while intraday and daily charts highlight a mixed picture for USD/CAD currently. All in all, economists at Scotiabank expect the pair to break under 1.2450 and test the October low just below the 1.23 level.

Longer-term chart patterns do reflect a solid rejection of 1.2950

“Daily chart reflects solid demand for the USD on dips over the past week or so while intraday chart patterns indicate solid USD supply on intraday gains since Monday. The result is a fairly well-established 1.2450-1.2570 range that has played out this week.”

“Longer-term chart patterns do reflect a solid rejection (again) of 1.2950; trend indicators are tilted bearish for the USD across a range of timeframes; the Bearish Head & Shoulders breakdown (below the neckline trigger at 1.2640) remain in play. All of this points to solid USD resistance on minor gains, an eventual push under 1.2450 and, we expect, a retest of the Oct low just under 1.23 in the next few weeks.”

- EUR/USD resumes the upside and revisits the 1.1350 zone.

- The 1.1300 neighbourhood holds the downside so far.

The inability of EUR/USD to return to the area of YTD highs near 1.1480 in the short-term horizon should prompt the re-emergence of the selling sentiment.

Against that, a break below the 1.1300 are carries the potential to spark a deeper decline to, initially, the YTD low at 1.1272 (January 4) ahead of the December 2021 low at 1.1221 (December 15).

The longer term negative outlook for EUR/USD is seen unchanged while below the key 200-day SMA at 1.1715.

EUR/USD daily chart

XAU/USD Death Cross pattern is emerging. Yohay Elam, an Analyst at FXStreet, explains what it means and highlights levels to watch.

Fears of the Fed open the door to an increase in yields, adverse for gold

“The Death Cross is when the 50-day SMA crosses the 200-day SMA to the downside. They are about to ‘kiss’ and then cross at around $1,805.

The move seems inevitable and it will likely be followed by a downfall. Where to? All the way to $1,752. On the way down, there are plenty of support lines, including $1,829, $1,823, $1,810, $1,805, $1,800, $1,790, $1,785 and $1,762.”

“Bulls would be emboldened if XAU/USD recaptures $1,844 and more importantly $1,850. That would open the door to $1,865 and $1,900.”

“The next significant event to watch is the Federal Reserve's decision on January 26. If the bank signals an imminent rate hike in March and potentially bond-selling later this year, yields would jump and gold could suffer. Conversely, if Fed Chair Jerome Powell and his colleagues send a soothing message of ongoing support to the economy, XAU/USD could avoid the kiss of the Death Cross.”

See – Gold Price Forecast: XAU/USD to complete a major top amid rising Real Yields and stronger USD – Credit Suisse

GBP/USD is trading at a ten-day low as it extends Thursday’s drop under 1.36 into the mid-1.35s after a sharp decline in December retail sales in data. But economists at Scotiabank expect cable to recover towards the 1.38 level.

Current risk setting looks set to prevent GBP upside for now

“The 3.7% MoM drop widely missed expectations calling for a 0.6% decline, with the ex. auto fuel reading also disappointing at -3.6% vs -0.8% expected. The impact of Omicron on consumer spending was much larger than anticipated by economists, but retail spending should recover as the country leaves the virus wave behind.”

“We don’t think the print is enough to dissuade the BoE from hiking at its February meeting, but markets have trimmed their expectations with OIS markets pricing in 22bps of hiking compared to 26bps on Wednesday.”

“We expect the GBP to recover from its current slump toward the 1.38 level as additional BoE hikes come in, but the current risk setting looks set to prevent GBP upside for now.”

- DXY fades Thursday advance and returns to the 95.50 area.

- Further gains likely above the 4-month line near 95.30.

DXY comes under pressure after the daily bullish attempt faltered in the 95.80 region on Friday.

The intense upside in the dollar has recently surpassed the 4-month line, today near 95.30, and in doing so it has reinstated the short-term bullish bias. That said, the next target is seen at the weekly high at 95.83 (January 18) ahead of the YTD high at 96.46 recorded on January 4.

Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.22.

DXY daily chart

- USD/CAD remains well supported to the north of its 200DMA at 1.2500 as risk-off flows limit loonie upside.

- Weak Canadian Retail Sales and New House Price Index data has not moved the loonie.

- Markets are focused on next week’s Fed and BoC meetings.

USD/CAD has remained well supported to the north of its 200-day moving average at bang on 1.2500 as risk-off flows in global equities and profit-taking in crude oil limits demand for risk/commodity-sensitive currencies like the loonie. At current levels near 1.2520, the pair is trading with very modest gains of about 0.1% on the day, with the looie holding up better on the session in comparison to its antipodean dollar peers.

But the pair continues to trade well within the 1.2450-1.2550 range that has prevailed over the past six or so sessions. The US dollar’s broad recovery this week has prevented the Canadian dollar from taking advantage of higher crude oil prices and heightened expectations for imminent policy tightening from the BoC.

The loonie was not reactive to the latest Canadian Retail Sales or New House Price Index figures. The former showed sales growing at a slower than expected 0.7% MoM pace in November, while Statistic Canada’s flash estimate for December showed a 2.1% MoM drop, likely driven by surging Omicron infections last month. The New House Price Index, meanwhile, also grew at a more sluggish than expected MoM pace of 0.2% versus forecasts for 1.0%.

Ahead, there is little else on Friday’s calendar to get traders excited, though the release of the US December Leading Index at 1500GMT and a speech from US Treasury Secretary Janet Yellen at 1630GMT might be worth keeping an eye on. Next week, the Fed and BoC policy announcements on Wednesday will be the key events for USD/CAD traders to watch, though US flash PMIs (on Monday), advance Q4 GDP estimate (on Thursday) and Core PCE inflation on Friday will all also be worth watching.

- Canadian Retail Sales grew 0.7% MoM in November, below the 1.2% expected.

- StatsCan's flash estimate for December showed a 2.1% MoM drop.

According to a report released by Statistics Canada on Friday, Canadian Retail Sales rose 0.7% MoM in November, less than the expected 1.2% rise and a sharp acceleration from October's 1.5% MoM rise (which was revised lower from 1.6%). Statistics Canada's flash estimate for December showed that Retail Sales most likely fell by 2.1% MoM, suggesting a sharp downturn in the final month of 2021 as Omicron infections raged. The Core measure of Canadian Retail Sales rose 1.1% MoM in November, below the expected 1.3% gain and a decceleration from October's 1.3% gain.

Market Reaction

The loonie did not seem to react much to the latest Canadian Retail Sales report.

USD/JPY stays under bearish pressure with the yen finding demand as a traditional safe haven. Economists at Credit Suisse look for further weakness with support seen at 113.58/48, then 113.15.

Resistance moves to 114.55

“Further sharp weakness in equity markets continue to see the yen strengthen on a broad basis and this leaves the spotlight for USD/JPY back on the recent low and 38.2% retracement of the rally from September at 113.58/48. Below here can see weakness extend to test the December lows, seen starting at 113.15 and stretching down to 112.56/54, with a better floor looked for here.”

“Should weakness extend this would warn of further weakness to the potential uptrend from January 2021, currently seen at 112.20, with the key long-term 200-day average now at 111.48.”

“Resistance is seen at 113.96 initially, then 114.22, with the immediate risk seen lower whilst below 114.55. Above can raise the prospect of further choppy ranging for strength back to 115.05/06, but with a break above here needed to mark a near-term base.”

Bank of Japan Governor Haruhiko Kuroda said on Friday that, unlike in the US and Europe, we have to continue extremely accommodative monetary policy for the time being. The pandemic has had a significant negative impact on the Japanese economy, he added, saying that Japan's economy may come under strong downward pressure due to rising Omicron variant cases. Kurodo continued that the BoJ is not afraid of inflation because it is so low, whilst maintaining that the bank is determined to achieve 2.0% inflation as soon as possible.

Market Reaction

The yen did not react to Kuroda's characteristically dovish comments.

Bank of England policymaker Catherine Mann said on Friday that expectations for prices and wages, if realised, are ingredients for headline inflationary pressures that could stay strong for longer, perhaps well into 2023. Residual strength in both wages and prices are likely to continue well into 2022, she added.

Additional Remarks:

"There are headwinds facing these price and wage expectations."

"Inflation data since November have not been consistent with the stabilizing inflation rate which was the forecast at that time."

"If the effects of the demand-supply imbalances apparent in 2021 continue, we could see another jump in wages and prices in 2022 yielding outturns where CPI inflation stays strong for longer."

"Policy actions by other central banks have cross-border ramifications which will be important for the MPC."

"The next steps could exhibit a shallower path."

"To the extent that monetary policy actions now dampen expectations, and to the extent that any deceleration of global prices is passed-through to UK inflation, steps could exhibit a shallower path."

"We will make an assessment with regard to February policy only after reviewing the research from staff."

"To the extent that financial markets are already cautioning decisions, the next steps could exhibit a shallower path."

"Changing expectations is the first defense against a reinforcing wage-price dynamic."

"We aim to bring inflation back down to target such that workers can enjoy real wage gains from their labor."

"What monetary policy needs to do now is to temper 2022 expectations for wage and price increases to prevent them from being embedded in the decision-making of firms and consumers."

"To the extent that global inflation underpins UK domestic inflation, monetary policy’s reaction would have to be more severe than appropriate for domestic conditions alone."

"Going into 2022, current price and wage expectations coming from the DMP survey are inconsistent with the 2% target, and if they are realized in 2022 are likely to keep inflation strong for longer."

"Ingredients appear to be in place for inflation to stay strong for longer, but costs becoming embedded in prices to create a reinforcing dynamic is not inevitable."

- EUR/USD has been ebbing higher after bouncing at 1.1300 level but gains are for now capped by the 21DMA.

- The pair is currently watching remarks from ECB President Lagarde, who has been speaking at the WEF.

After bouncing at support including the 1.1300 level, the 50-day moving average just at 1.1319 and an uptrend that has been supporting the price action going all the way back to late November, EUR/USD has been ambling higher. For now, the 21DMA at 1.1346 has been capping the intra-day gains and at current levels near 1.1340, EUR/USD is trading about 0.3% higher on the session, having now erased all of Thursday’s losses. On the week, the pair still looks on course to lose about 0.6%, mainly as a result of a broad-based dollar rebound following its positioning-related sell-off the week prior.

Fundamental newsflow remains light, with no new notable data releases out of Europe on Friday morning so far and no notable US events aside from a speech from US Treasury Secretary Yellen at 1630GMT. Prior to that, January Eurozone Consumer Confidence figures are out at 1500GMT but are unlikely to result in much euro volatility. The main themes in FX markets at present are 1) central bank tightening and 2) risk-off slows, with the latter, as of late, a function of rising expectations for the former, particularly from the Fed. On the topic of central bank policy, as markets gear themselves up for next week’s Fed meeting (expected to be a hawkish affair), market focus is on comments from ECB President Christine Lagarde. She is currently speaking in an online event put on by the World Economic Forum. For now, she has not said anything new, leaving EUR/USD unmoved.

European Central Bank President Christine Lagarde said on Friday that geopolitics and weather factors are driving energy prices higher, but that the ECB is not seeing wages being bid up. Lagarde added that demand in Europe is not excessive and, as a result, we are unlikely to face the same inflation as the US.

International Monetary Fund Managing Director Kristalina Georgieva said on Friday that the Fed is acting responsibly as inflation in the US is now turning into an economic and social concern. The IMF's MD warned that interest rate hikes by the Fed could "throw cold water" on what is already a weak recovery in some places. She called what the Fed is doing to communicate the current policy shift "hugely important".

Market Reaction

There was no reaction to Georgieva's remarks.

- EUR/JPY accelerates losses and flirts with the 128.50 area.

- Further decline should not be ruled out for the time being.

EUR/JPY intensifies the daily pullback and re-visits the mid-128.00s for the first time since mid-December.

Price action in the cross now seems to favour extra decline in the short-term horizon, particularly after EUR/JPY remains unable to retest/surpass the YTD peaks in the 131.50/60 region (January 5). That said, the next support of relevance now emerges at the December low at 127.83 (December 3).

While below the 200-day SMA, today at 130.52, the outlook for the cross is expected to remain negative.

EUR/JPY daily chart

Economist at UOB Group Ho Woei Chen, CFA, reviews the leatest decision by the PBoC to reduce the policy rates.

Key Takeaways

“The People’s Bank of China (PBOC) set the benchmark 1Y Loan Prime Rate (LPR) lower by 10 bps to 3.70% and the 5Y LPR by a smaller quantum of 5 bps to 4.60% today. This was the second consecutive cut to the 1Y LPR following a 5 bps reduction in Dec. For the 5Y LPR, this was the first cut since May 2020 as it was kept unchanged in Dec.”

“The cut to 5Y LPR (which mortgages in China are pegged to) suggests some softening of the official stance towards the real estate market but the smaller cut still indicates that the PBOC wants to target support for the businesses rather than fueling a rebound in the real estate market.”

“While we think the PBOC has room to lower the LPR further, any further cuts will likely be small. We thus factor in another 15 bps cut to the LPR in 1H22 and the PBOC is likely to be on hold thereafter in 2H22.”

“Another 50 bps reduction in the banks’ reserve requirement ratio (RRR) is also likely in the pipeline to help guide the lending rates lower.”

- The UK political crisis, dismal domestic data dragged GBP/USD to a nearly two-week low.

- The mixed technical set-up warrants some caution before placing aggressive bearish bets.

The GBP/USD pair continued losing ground through the mid-European session and dropped to a near two-week low, around the 1.3555 region in the last hour.

Against the backdrop of the UK political turmoil, dismal domestic data undermined the British pound and dragged the GBP/USD pair lower for the second successive day on Friday. This also marked the fifth day of a negative move in the previous six and seemed unaffected by moded US dollar weakness, weighed down by retreating US Treasury bond yields.

From a technical perspective, acceptance below the 23.6% Fibonacci retracement level of 1.3161-1.3749 move up was seen as a key trigger for bearish traders. The subsequent downfall might have already set the stage for an extension of the recent pullback from the vicinity of mid-1.3700s, or a two-month high touched last Thursday.

Meanwhile, technical indicators on the daily chart – though have been losing positive traction – are still holding in the bullish territory. Hence, any further downfall is more likely to find decent support near the 1.3540-1.3530 confluence. This comprises 100-day SMA and the 38.2% Fibo., which should now act as a pivotal point.

A convincing break below will suggest that the GBP/USD pair has topped out in the near term and dragged spot prices to the 1.3500 psychological mark. The downward trajectory could further get extended towards the 50% Fibo. level, around the 1.3455 region.

On the flip side, the 23.6% Fibo. level, around the 1.3610 region, now seems to act as immediate strong resistance. Any further move up might continue to meet with a fresh supply near the 1.3660 area, which if cleared decisively will suggest that the corrective slide has run its course. The GBP/USD could then reclaim the 1.3700 round-figure mark.

GBP/USD daily chart

-637783579745274428.png)

Technical levels to watch

The AUD/USD pair is trading just below the 0.7200 mark. Analysts at Credit Suisse look for a break below support at 0.7174/69 to suggest the corrective recovery is over and broader downtrend resumed.

Below 0.7169 next support aligns at 0.7129

“We look for a break below support from the shorter-term uptrend from December at 0.7174/69 to suggest the corrective recovery is over and broader downtrend resumed in line with the major top completed last year.”

“Below 0.7169 and we would see support next at the January YTD low at 0.7129, removal of which should add momentum to the decline for a move back to 0.7089/82 and eventually a retest of medium-term support at 0.6992/91 – the late 2020 and 2021 lows.”

“Below 0.6992/91 should then open up an eventual move to 0.6758, which remains our core medium-term objective.”

“Short-term resistance moves to 0.7233, with 0.7277/84 ideally now capping to keep the immediate risk lower. A break can clear the way for a lengthier corrective recovery still with resistance seen next at 0.7315, then 0.7341/47.”

EUR/JPY has completed another bearish “outside day”. Economists at Credit Suisse stay biased lower for 128.29/19, then the 2021 low and major channel support at 127.51/21.

Resistance is seen at 130.10

“EUR/JPY has seen yet another large bearish ‘outside day’ to further reinforce its near-term top and prior “reversal day” and we look for this to keep the risk directly lower.”

“Support is seen initially at 128.56/55 ahead of the 78.6% retracement of the December/January rally and potential trend support at 128.29/19. Whilst we would look for this to hold at first, the broader risk is seen lower for an eventual break and a fresh test of what we see as more important support at the 2021 low and lower end of the medium-term channel at 127.51/21.”

“Resistance is seen at 129.39 initially, then 129.52, with the immediate risk seen staying lower whilst below 130.10. Above can see a recovery back to 130.47/57, but with fresh sellers expected here.”

NZD/USD extends its aggressive rejection from its 55-day moving average (DMA) at 0.6848 and analysts at Credit Suisse continue to look for the core downtrend to resume. The kiwi is set to retest major support from the lows of 2021 and 38.2% retracement of the entire 2020/2021 bull trend at 0.6703/6697.

Initial resistance is seen at 0.6752/60

“With medium-term momentum still outright negative, we continue to look for the core downtrend to resume. Below near-term price support from the early January lows at 0.6752/33 should add weight to our view for a retest of major support from the lows of 2021 and 38.2% retracement of the entire 2020/2021 bull trend at 0.6703/6697.”

“Whilst 0.6703/6697 should continue to be respected our bias remains firmly for an eventual clear and sustained break in due course to open up an eventual move to our core objective at 0.6511/6488.”

“Resistance is seen at 0.6752/60 initially, with 0.6806/19 now ideally capping to keep the immediate risk lower. Above can see a recovery back to 0.6848/61, but with fresh sellers expected here again.”

AUD/USD dribbles back below 0.72. A breach of 0.7130 would clear the way towards 0.7070 and December low of 0.6990, economists at Société Générale report.

0.7130 is first support

“AUD/USD has struggled to establish itself above the daily Ichimoku cloud (now at 0.7280) denoting lack of steady upside momentum.”

“Failure to hold 0.7130 can take the pair back towards 0.7070 and December low of 0.6990.”

- Gold corrected further from a two-month high touched on Thursday amid hawkish Fed expectations.

- The risk-off mood, retreating US bond yields acted as a tailwind and helped limit any further downfall.

- Investors might also refrain from placing aggressive bets ahead of the FOMC policy meeting next week.

Gold extended the overnight retracement from the $1,848 area, or a two-month high and witnessed some follow-through selling on the last trading day of the week. The corrective pullback picked up pace during the early part of the European session and dragged spot prices to the $1,828 region in the last hour. The downfall lacked any obvious catalyst and could be solely attributed to some profit-taking amid expectations that the Fed will tighten its monetary policy at a faster pace than anticipated.

Investors now seem convinced that the Fed would begin raising interest rates in March to combat stubbornly high inflation. The bets were reaffirmed by last week's data, showing that the headline US CPI surged to the highest level since June 1982 and core CPI registered the biggest advance since 1991. Moreover, the markets have also been pricing in the possibility for a total of four rate hikes in 2022, which, in turn, was seen as a key factor that drove flows away from the non-yielding gold.

Meanwhile, concerns that rising borrowing costs could dent the earnings outlook for companies tempered investors' appetite for perceived riskier assets. This was evident from a weaker trading sentiment around the equity markets, which could extend support to the safe-haven gold. The dominant risk-off mood dragged the US Treasury bond yields further away from the multi-year highs touched earlier this week. This should further help limit the downside for the precious metal, at least for the time being.

Traders might also refrain from placing aggressive directional bets and prefer to wait on the sidelines ahead of the upcoming FOMC policy meeting on January 25-26. In the absence of any major market-moving economic releases from the US, this further makes it prudent to wait for a strong follow-through selling before confirming that gold has topped out. Nevertheless, the XAU/USD, at current levels, remains on track to post gains for the second successive week.

Technical outlook

From a technical perspective, the XAU/USD, so far, has managed to find some support near the $1,830 resistance breakpoint. Some follow-through selling would pave the way for a further decline and accelerate the fall towards the $1,812 horizontal zone. The next relevant support is pegged near the very important 200-day SMA, currently around the $1,804 region, and of the $1,800 round figure. This is closely followed by ascending trend-line support, around the $1,790 region.

On the flip side, the $1,840-$1,842 area now seems to act as an immediate resistance ahead of the overnight swing high, around the $1,848 region. A sustained strength beyond has the potential to lift gold prices further towards a downward-sloping trend-line extending from June 2021 swing high, currently around the $1,860 region.

-637783558031254997.png)

Kit Juckes, Chief Global FX Strategist at Société Générale, sticks with short EUR trade in the near-term. However, EUR/USD is set to bounce back towards 1.15 later in the year.

Break of 1.12 to trigger a move below 1.10

“We’re sticking to a core view that EUR/USD has more downside in the first half of this year, but plenty of upside in the second half.”

“We expect a break of 1.12 to trigger a move below 1.10, but we’ll see 1.15 again later in the year.”

- EUR/USD meets support in the 1.1300 neighbourhood.

- The dollar looks offered on the back of lower yields.

- ECB Lagarde, flash Consumer Confidence next on tap.

The single currency regains the smile at the end of the week and helps EUR/USD returning to the 1.1350 region.

EUR/USD up on dollar weakness

EUR/USD manages to reverse Thursday’s pullback and meets buying interest in the 1.1300 zone, regaining upside traction soon afterwards. The recent price action in spot falls within a consolidative theme, always amidst alternating risk appetite trends in the global markets.

Friday’s uptick in spot comes amidst the offered stance in the greenback, which in turns appears under pressure amidst another decline in US yields along the curve.

In the euro calendar, the European Commission (EC) will publish its Consumer Confidence gauge for the month of January along with speeches by ECB’s Board member Fernandez-Bollo and Chairwoman Lagarde.

Across the pond, the only release will be the Leading Index tracked by the Conference Board.

What to look for around EUR

EUR/USD came under pressure after hitting new YTD highs in the 1.1480 region earlier in the month, finding some contention in the low-1.1300s so far this week. In the meantime, the Fed-ECB policy divergence and the performance of yields are expected to keep driving the price action around the pair for the time being. ECB officials have been quite vocal lately and now acknowledge that high inflation could last longer in the euro area, sparking at the same time fresh speculation regarding a move on rates by the central bank by end of 2022. On another front, the unabated advance of the coronavirus pandemic remains as the exclusive factor to look at when it comes to economic growth prospects and investors’ morale in the region.

Key events in the euro area this week: ECB Lagarde, EC’s Flash Consumer Confidence (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. ECB stance/potential reaction to the persistent elevated inflation in the region. ECB tapering speculation/rate path. Italy elects President of the Republic in late January. Presidential elections in France in April.

EUR/USD levels to watch

So far, spot is gaining 0.27% at 1.1341 and faces the next up barrier at 1.1480 (100-day SMA) seconded 1.1482 (2022 high Jan.14) and finally 1.1510 (200-week SMA). On the other hand, a break below 1.1300 (weekly low Jan.21) would target 1.1272 (2022 low Jan.4) en route to 1.1221 (monthly low Dec.15 2021).

USD/CNH is trading near 6.33, a double bottom. Failure at this point can lead to next leg of downtrend, according to economists at Société Générale.

6.3300 is a crucial support

“USD/CNH has formed a double bottom near 6.3300 however a break past the neckline at 6.4000 will be essential for affirming an extended up-move.”

“Failure to hold 6.3300 can lead to next leg of downtrend.”

The latest UK retail sales figures were disappointing. But some perspective is required. Some of this fall is undoubtedly linked to Omicron. Economists at MUFG Bank still expect the Bank of England (BoE) to hike rates in February but the aggressive pricing of four rate hikes in 2022 may end pounding the pound.

A fragile UK consumer

“The December Retail Sales report has just been released in the UK and the 3.7% drop MoM in overall sales was much larger than expected. The data followed GfK Consumer Confidence earlier today, which showed the index dropping from -15 to -19, the lowest since February 2021.”

“Of course, the emergence of Omicron is the obvious explanation and the markets will likely ignore this given the speed in which Omicron is passing as a disruptive factor for the economy.”

“We don’t think this data places any doubt over a February rate hike by the BoE but it should place some doubt over the pricing of four rate hikes this year. At some stage, we see an adjustment that would result in some GBP underperformance.”

GBP/USD has come under renewed bearish pressure on Friday. Disappointing UK data and failure of 1.3600 support points to further losses, FXStreet’s Eren Sengezer reports.

Next support for the pair aligns at 1.3530

“The UK's Office for National Statistics reported that Retail Sales in December declined by 3.7% on a monthly basis. This print missed the market expectation for a decrease of 0.6% by a wide margin.”

“On the downside, 1.3530 (Fibonacci 38.2% retracement of the one-month-old uptrend) could be seen as the next bearish target ahead of 1.3500 (psychological level).”

“Resistances are located at 1.3600 (psychological level, Fibonacci 23.6% retracement, 100-period SMA) and 1.3650 (50-period SMA, static level).”

The rotation out of US assets showed no sign of lessening. In the tech-heavy Nasdaq, the correction snowballed to 9.1%. Failure to defend the trough of last October at 14380pts would open up projections of 14050/13990pts, economists at Société Générale report.

Near-term resistance is at daily Ichimoku cloud near 15600pts

“A revisit of the trough of last October at 14380pts is not ruled out. Failure to defend this support can result in persistence of the correction towards projections of 14050/13990pts; this is likely to be a crucial support.”

“Near-term resistance is located at daily Ichimoku cloud near 15600pts.”

See – EUR/SEK: Significant recovery in US tech stocks needed to return to 10.20/40 – ING

FX Strategists at UOB Group believe that the downside pressure in USD/CNH should mitigate on a break above 6.3710 in the short-term horizon.

Key Quotes

24-hour view: “Yesterday, we were of the view that USD could drift lower but the major support at 6.3390 is unlikely to come under threat”. Our view was not wrong as USD dipped to 6.3419 before rebounding. The underlying tone has firmed somewhat and USD could edge higher from here. That said, any advance is unlikely to break 6.3610. Support is at 6.3460 followed by 6.3420.”

Next 1-3 weeks: “Our latest narrative from Monday (17 Jan, spot at 6.3610) still stands. As highlighted, the odds for further USD weakness are not high. However, only a breach of 6.3710 (no change in ‘strong resistance’ level) would indicate that the downside risk has dissipated. Looking ahead, any decline in USD is expected to encounter solid support at 6.3390 and 6.3300.”

- AUD/USD witnessed fresh selling on Friday and drifted back closer to the weekly low.

- The risk-off mood was seen as a key factor weighing on the perceived riskier aussie.

- Retreating US bond yields kept the USD bulls on the defensive and helped limit losses.

The AUD/USD pair now seems to have entered a bearish consolidation phase and was seen oscillating in a narrow trading band near the daily low, just below the 0.7200 mark.

Having faced rejection near the 100-day SMA on Thursday, the AUD/USD pair met with a fresh supply on the last day of the week and was pressured by the dominant risk-off theme. Investors turned nervous amid reviving fears about strong inflationary pressures and the prospects for a faster policy tightening by the Fed, which could dent the earnings outlook for companies. The anti-risk flow was evident from a weaker trading sentiment around the equity markets, which was seen as a key factor weighing on the perceived riskier aussie.

Meanwhile, the global flight to safety dragged the US Treasury bond yields further away from the multi-year highs touched earlier this week. This, in turn, undermined the US dollar and extended some support to the AUD/USD pair, at least for the time being. That said, expectations that the Fed would begin raising interest rates in March to combat stubbornly high inflation continued acting as a tailwind for the greenback. Moreover, the markets have been pricing in the possibility for a total of four rate hikes in 2022, which further favours the USD bulls.

The fundamental backdrop supports prospects for a further near-term depreciating move. The negative outlook is reinforced by the formation of a bearish flag pattern on the daily chart. Some follow-through selling below the weekly low, around the 0.7170 area, will validate the bearish bias and turn the AUD/USD pair vulnerable. Investors, however might refrain from placing aggressive bets ahead of the FOMC meeting on January 25-26. The outcome will provide fresh clues about the timing when the Fed will commence its rate hike cycle and influence the USD price dynamics.

In the meantime, the US bond yields will drive the USD demand. This, along with the broader market risk sentiment, should allow traders to grab some short-term opportunities around the AUD/USD pair amid absent relevant market moving economic releases from the US.

Technical levels to watch

- DXY remains side-lined around the 95.60 region on Friday.

- US yields extends the correction lower along the curve.

- CB Leading Index will be the sole release in the US docket.

The greenback, in terms of the US Dollar Index (DXY), reverses Thursday’s uptick and returns to the 95.60 region, all amidst the renewed consolidative mood.

US Dollar Index looks to risk trends, yields

The index extends the consolidation in the upper end of the recent range, coming under some selling pressure after failing around the 95.80 region once again.

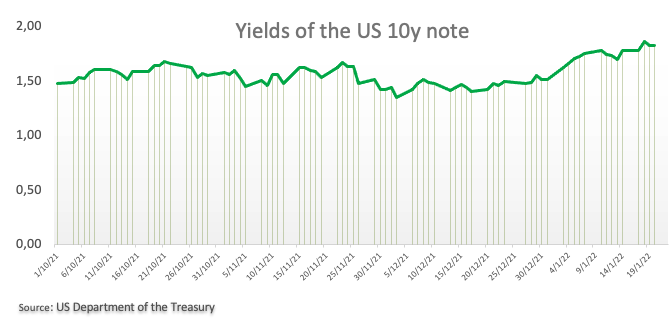

The retracement in the dollar echoes another so far negative session in the US money markets, where yields extend the corrective move lower. On this, yields of the key 10y benchmark note have returned to the sub-1.80% level, some 10 bps down from recent tops just past 1.90% (January 19).

In the meantime, the greenback seems to lack conviction to retest/surpass the key barrier at 96.00 the figure based on the idea that much of the Fed’s tightening this year, including a rate hike in March, appears to be already priced in among investors.

On the US data sphere, the only release will be the Conference Board’s Leading Index for the month of December.

What to look for around USD

The index came under some downside pressure soon after recent peaks near 95.90. In fact, the recovery from as low as the 94.60 area (January 14) almost fully reclaimed the ground lost earlier in the new year, always on the back of the sharp move higher in US yields, firmer speculation of a sooner move on rates by the Federal Reserve, supportive Fedspeak and the strong march of the US economic recovery.

Key events in the US this week: CB Leading Index (Thursday).

Eminent issues on the back boiler: Start of the Fed’s tightening cycle. US-China trade conflict under the Biden’s administration. Debt ceiling issue. Potential geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is losing 0.13% at 95.64 and a break above 95.83 (weekly high Jan.18) would open the door to 96.46 (2022 high Jan.4) and finally 96.93 (2021 high Nov.24). On the flip side, the next down barrier emerges at 94.81 (100-day SMA) followed by 94.62 (2022 low Jan.14) and then 93.27 (monthly low Oct.28 2021).

If USD/JPY breaks below 113.40 it could retest the 113.00 neighbourhood in the next weeks, suggest FX Strategists at UOB Group.

Key Quotes

24-hour view: “We highlighted yesterday that ‘the bias for USD is tilted the downside but any weakness is unlikely to break 114.00’. The expected USD weakness exceeded our anticipation USD dropped to 113.94. Downward momentum has improved and USD is likely to weaken further. A break of the support at 113.70 would not be surprising but the next support at 113.40 is unlikely to come under threat. Resistance is at 114.05 followed by 114.20.”

Next 1-3 weeks: “Yesterday (20 Jan, spot at 114.35), we highlighted that the outlook is mixed and USD could trade within a range of 113.70/115.25. There is no change in our view for now even though we did not expect the quick improvement in shorter-term downward momentum. Looking ahead, if USD breaks 113.40, it could lead to a decline to 113.00. At this stage, the chance for USD to break 113.40 is not high but it would increase further as long as USD does not move above 114.45 within these few days.”

A progression of higher peaks and troughs has led USD/RUB towards 77.30 earlier this month. The pair is now in a consolidation phase but economists at Société Générale expect USD/RUB to resume its advance towards the April high of 78.10/78.30.

Daily Ichimoku cloud at 74.30/74.00 should contain the downside

Currently, a pause is underway, however, daily Ichimoku cloud at 74.30/74.00 should contain the downside. Defending this support, the ongoing bounce is expected to persist.”

“Next potential hurdles are located at April 2021 high of 78.10/78.30 and projections of 79.80.”

- USD/JPY continued losing ground for the third straight day and dropped to a fresh weekly low.

- The risk-off mood benefitted the safe-haven JPY and exerted pressure amid sliding bond yields.

- Hawkish Fed expectations acted as a tailwind for the USD and helped limit any further losses.

The USD/JPY pair maintained its offered tone through the early European session, albeit has managed to recover a few pips from the weekly low. The pair was last seen trading just below the 114.00 mark, still down around 0.20% for the day.

The pair extended this week's rejection slide from the key 115.00 psychological mark and witnessed some follow-through selling for the third successive day on Friday. The downward trajectory dragged the USD/JPY pair back closer to the monthly swing low and was sponsored by a combination of factors.

Concerns that rising borrowing costs could dent the earnings outlook for companies tempered investors' appetite for perceived riskier assets. This was evident from a weaker tone around the equity markets, which forced investors to take refuge in safe-haven currencies, including the Japanese yen.

Bearish traders further took cues from the ongoing retracement slide in the US Treasury bond yields from multi-year highs, which undermined the US dollar. That said, the prospects for a faster policy tightening by the Fed acted as a tailwind for the buck and helped limit losses for the USD/JPY pair.

Investors seem convinced that the Fed would begin raising interest rates in March to combat stubbornly high inflation and have been pricing in the possibility for a total of four hikes in 2022. Hence, the market focus will remain glued to the upcoming FOMC monetary policy meeting on January 25-26.

The outcome will be looked upon for fresh clues and clearer signals about the likely timing when the Fed will commence its rate hike cycle. This, in turn, will play a key role in influencing the near-term USD price dynamics and help determine the next leg of a directional move for the USD/JPY pair.

In the meantime, the US bond yields will drive the USD demand. Apart from this, traders will take cues from the broader market risk sentiment for some short-term opportunities around the USD/JPY pair amid absent relevant market moving economic releases from the US.

Technical levels to watch

EUR/USD was denied a move below 1.1300 overnight and enjoyed a small rebound in the Asian session. In the opinion of economists at ING, markets may continue to look at the dollar with favour in the coming weeks, dragging the world’s most popular currency pair down to the 1.12 level.

Markets received contrasting messages from the ECB

“While the minutes from the December meeting clearly highlighted growing concerns about inflation and a hawkish bloc within the Governing Council that is growing stronger and louder, President Lagarde argued in favour of a more cautious approach to tightening – especially compared to that of the Fed.”

“Lagarde is set to speak again today and we can reasonably expect more pushback against speculation the ECB will have to start hiking already this year, largely on the back of expectations that inflation will not prove as concerning later in the year as in other developed economies.”

“Our view is still that more Fed-induced dollar strength should keep some pressure on the pair, and a return to the 1.1200 November lows should be on the cards in the coming weeks.”

Mood continues to sour ahead of the weekend. This is the main reason for the EUR/GBP correction higher. But economists at ING expect the pair to break below 0.83 as the Bank of England (BoE) will hike rates at its next meeting on February.

Only a small correction higher in EUR/GBP

“This morning’s quite weak January consumer confidence and December retail sales numbers did not hit the pound particularly hard, with the recovery in EUR/GBP mostly due to the unsupportive global risk sentiment to which the pound is more exposed than the euro.”

“We think that EUR/GBP has further to drop on the back of policy divergence as we expect the BoE to hike rates again in February, a month where we could well see a break below the 0.8300 level in the pair.”

EUR/USD has declined toward 1.1300 during the Asian trading hours on Friday but managed to erase its daily losses. Technical signs suggest that recovery attempts are likely to remain limited in the short-term, FXStreet’s Eren Sengezer reports.

Sellers to take action with a drop below 1.1300

“EUR/USD has been posting lower highs on the four-hour chart since the beginning of the week, suggesting that recovery attempts remain technical in nature.”

“The Relative Strength Index (RSI) stays below 50, confirming the view that buyers remain uninterested for the time being.”

“The 200-period SMA forms the first resistance at 1.1320. In case the pair stays below that level, 1.1300 (psychological level) aligns as first support before 1.1270.”

“On the upside, the descending trend line acts as a static hurdle at 1.1340 ahead of 1.1350, (00-period SMA and the Fibonacci 61.8% retracement of the latest uptrend) and 1.1380 (Fibonacci 50% retracement).”

The Swedish krona dropped by more than 1% vs USD on Thursday as US tech stocks came under fresh pressure. Stabilisation in US equities looks necessary for EUR/SEK to return to its December range, economists at ING report.

The big loser in the US tech slump

“While having a generally high beta to global equity dynamics, SEK has the highest positive sensitivity in G10 to swings in tech stocks, with the underperformance of this segment having been a major factor behind SEK’s underperformance at the start of this year.”

“Riksbank’s very slow transition from its ultra-dovish stance, rising inflation and the exposure to the European slowdown caused by Omicron are set to keep a lid on SEK in the near-term.”

“A significant stabilisation/recovery in US tech stocks will likely be needed to send EUR/SEK back into its December/early-January 10.20/10.40 range, unless the Riskbank sounds particularly hawkish at the 10 February meeting, which we doubt will be the case.”

USD/JPY is trading below 114.00 and remains on track to close the second straight week in the negative territory. However, economists at Citibank expect the pair to retest 116.30 next week given expectations for a hawkish FOMC meeting.

Expectations for a hawkish FOMC meeting

“Market now prices in >1 hike for March FOMC and >4 hike for 2022 as a whole. It has been an incredible shift in Fed tightening expectations since the shift by Powell to drop the word ‘transitory’.”

“Near-term resistance in USD/JPT is found at the recent high at 116.30, which could be tested over the next week, given expectations for a hawkish FOMC meeting."

- GBP/USD edged lower for the second successive day on Friday amid the UK political turmoil.

- The disappointing release of the UK Retail Sales did little to provide any meaningful impetus.

- Subdued USD demand held back bearish traders from placing fresh bets and helped limit losses.

The GBP/USD remained on the defensive following the release of dismal UK macro data and was last seen hovering near the weekly low, around the 1.3585 region.

The pair extended the previous day's sharp retracement slide from the 1.3660 area and witnessed some selling through the first half of the trading on Friday. The British pound continues to be weighed down by the UK political crisis amid growing demands for Prime Minister Boris Johnson's resignation over a series of lockdown parties in Downing Street.

Apart from this, a slump in the UK monthly Retail Sales further undermined sterling and dragged the GBP/USD pair lower for the second successive day. In fact, the UK's Office for National Statistics reported that the total value of inflation-adjusted sales at the retail level plunged 3.7% in December as against market expectations for a fall of 0.6%.

That said, increasing bets for additional rate hikes by the Bank of England, along with the announcement that COVID-19 restrictions in the UK would be lifted next week, helped limit losses for the GBP/USD pair. Moreover, subdued US dollar demand was seen as another factor that held back traders from placing aggressive bearish bets around the major.

The mixed fundamental backdrop warrants some caution before positioning for an extension of the recent pullback from the vicinity of mid-1.3700s, or the highest level since October touched last week. Moreover, investors might also prefer to move on the sidelines ahead of the upcoming central bank event risk – the FOMC meeting on January 25-26.

Technical levels to watch

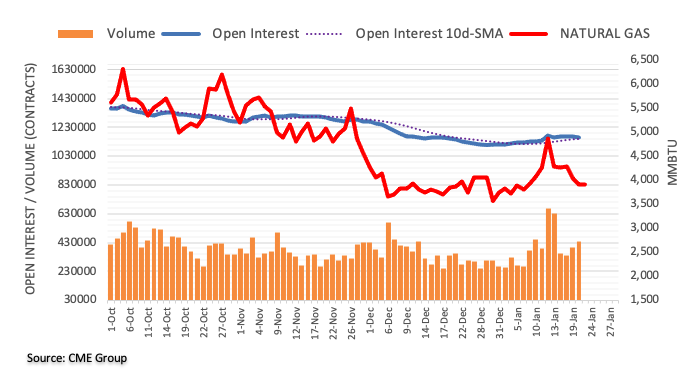

Considering advanced figures for natural gas futures markets, traders scaled back their open interest positions for the second session in a row on Thursday, this time by around 5.7K contracts. On the other hand, volume added to Wednesday’s build and rose by around 36.5J contracts.

Natural Gas: A drop to $3.60 is not ruled out

Thursday’s moderate pullback in prices of natural gas was in tandem with shrinking open interest, leaving the prospects for further downside somewhat diminished for the time being. The commodity, in the meantime, is expected to meet quite decent contention in the $3.60 area per MMBtu, or December 2021 lows.

Here is what you need to know on Friday, January 21:

Safe-haven flows continue to dominate the financial markets on the last trading day of the week with global equity indexes suffering heavy losses. The Russia-Ukraine conflict, inflation fears and the US Federal Reserve's policy tightening prospects force investors to seek refuge. The US Dollar Index, which advanced to its highest level in more than a week at 95.86 on Friday, is staying relatively calm early Friday. In the absence of high-tier data releases, the risk perception is likely to impact markets heading into the weekend.

Despite the People Bank of China's policy loosening steps, the Shanghai Composite Index is down more than 0.8% and the Nikkei Index lost 0.9% on Friday. US stocks futures indexes are down between 0.2% and 1% in the early American session. The S&P 500 Index has already lost 4% this week and the risk-sensitive Nasdaq Composite Index registered its lowest daily close since June on Thursday.

The risk-averse market environment is ramping up the demand for the risk-free US Treasury bond, allowing yields to edge lower. The benchmark 10-year US Treasury bond yield continues to edge lower toward 1.75% and is falling nearly 2% on a daily basis.

EUR/USD edged lower toward 1.1300 during the Asian trading hours on Friday but staged a modest rebound in the early European morning. The shared currency is likely to outperform its risk-sensitive rivals in the current market atmosphere and hold its ground against the greenback in the near term.

GBP/USD trades below 1.3600 early Friday after failing to stage a rebound on Thursday. The disappointing data from the UK, which showed that Retail Sales fell by 3.7% on a monthly basis in December, is making it difficult for the British pound to find demand.

Gold extended its rally toward $1,850 on Thursday but ended up closing the day in the negative territory below $1,840. Another leg lower in US T-bond yields could help the yellow metal gather strength but XAU/USD's upside could be capped amid profit-taking ahead of the weekend.

USD/JPY stays under bearish pressure with the JPY finding demand as a traditional safe haven. The pair is trading below 114.00 early Friday and remains on track to close the second straight week in the negative territory.