- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-11-2020

On Monday, the focus will be on indices of business activity in the manufacturing sector and services sector for November: at 08:15 GMT, France will report, at 08:30 GMT - Germany, at 09: 00 GMT - the Eurozone, at 09:30 GMT - Britain, and at 14:45 GMT - the United States.

On Tuesday, at 07:00 GMT, Germany will announce changes in GDP for the 3rd quarter. At 07:45 GMT, France will report changes in GDP for the 3rd quarter. At 09:00 GMT, Germany will present the IFO business environment indicator, the IFO current situation assessment indicator, and the IFO economic expectations indicator for November. At 11:00 GMT, Britain will publish the retail sales index according to the CBI for November. At 12:05 GMT Bank of Japan Governor Kuroda will deliver a speech. At 14:00 GMT, the US will release the S&P/Case-Shiller home price index for September. At 14:00 GMT ECB chief Lagarde will deliver a speech. At 15:00 GMT, the US will publish the consumer confidence indicator and the Fed-Richmond manufacturing index for November. At 20:00 GMT the RBNZ financial stability report will be released, and at 22:00 GMT RBNZ Governor Adrian Orr will deliver a speech.

On Wednesday, at 00:30 GMT, Australia will report changes in the construction work done for the 3rd quarter. At 09:00 GMT, Switzerland will present an index of Swiss investor expectations, according to ZEW and Credit Suisse data for November. At 13:30 GMT, the US will announce changes in the volume of GDP for the 3rd quarter, the volume of orders for durable goods for October, the balance of foreign trade in goods for October and the number of initial applications for unemployment benefits for October. At 14:00 GMT, Belgium will release the business sentiment index for November. At 15:00 GMT, the US will report changes in new building sales for October, personal spending and income levels for October, and present the University of Michigan consumer sentiment index for November. At 15:30 GMT, the US will announce changes in oil reserves according to the Ministry of energy. At 18:00 in the US, the Baker Hughes report on the number of active oil drilling rigs will be released. At 19:00 GMT in the US, the minutes of the Fed meeting will be published. At 21:45 GMT, New Zealand will announce a change in the foreign trade balance for October.

On Thursday, at 00:30 GMT, Australia will announce a change in the volume of capital expenditures in the private sector for the 3rd quarter. At 07:00 GMT, Germany will release the Gfk consumer climate index for December. At 09:00 GMT, the Euro zone will report changes in the aggregate M3 of money supply and private sector lending for October. At 12:30 GMT in the Euro area, the ECB monetary policy meeting accounts will be released. At 23:30 GMT, Japan will publish the Tokyo consumer price index for November.

On Friday, at 07:00 GMT, Britain will release the Nationwide house price index for November. At 07:45 GMT, France will announce changes in consumer spending for October and release the consumer price index for November. At 10:00 GMT, the Euro zone will publish an index of economic sentiment, an index of business optimism in industry and an index of consumer confidence for November.

On Sunday, at 23:50 GMT, Japan will report changes in industrial production and retail trade for October.

FXStreet reports that according to the Credit Suisse analyst team, the USD/JPY pair is expected to see a sustained move below 104.00 for a fall back to 103.05 and eventually 101.59/18.

“USD/JPY strength has quickly faded and we continue to look for a clear and weekly closing break below the key 104.02/00 price pivot to confirm a more important downturn with support below 103.65 seen next at the early November low and potential trend support from late July at 103.20/05.”

“Whilst a fresh rebound from 103.20/05 should be allowed for, our bias remains for this to be removed in due course for a move to what we see as more important support at 101.59/18 – the March low for the year and further potential trend support – where we look for a better floor.”

- Economic growth is probably stalling due to coronavirus spike

- The latter half of 2021 will be very strong

The European

Commission (EC) said on Thursday its flash estimate showed the consumer

confidence indicator for the Eurozone declined by 2.1 points to -17.6 in

November from an unrevised -15.5 in the previous month. That was the lowest

reading since May.

Economists had

expected the index to decrease to -17.7.

Considering the

European Union (EU) as a whole, consumer sentiment worsened by 2.2 points to -18.7.

Given this

month’s declines, both indicators were well below their long-term averages of

-11.2 (Eurozone) and -10.6 (EU).

- We’re following the intent of Congress; it was clear that congressional intent was that Fed's lending facilities should expire at the end of December

- We need Congress to re-appropriate these funds

- Еhere’s up to $800 billion in potential firepower that can be deployed if needed through the Exchange Stabilization Fund and elsewhere

- Markets should be very comfortable that we have plenty of capacity left

- We'll be redoubling our efforts to sit down with Congress and get something done on stimulus

- Parts of the economy are roaring back but a lot of people are still struggling

- We want to get a targeted bill done for the people who really need it

- We're working to get vaccine distributed widely

U.S. stock-index futures fell slightly on Friday as worries over the prospects of the U.S. economy increased amid fears over fading stimulus and the risirising COVID-19 cases.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 25,527.37 | -106.97 | -0.42% |

Hang Seng | 26,451.54 | +94.57 | +0.36% |

Shanghai | 3,377.73 | +14.64 | +0.44% |

S&P/ASX | 6,539.20 | -8.00 | -0.12% |

FTSE | 6,354.74 | +20.39 | +0.32% |

CAC | 5,487.94 | +13.28 | +0.24% |

DAX | 13,121.74 | +35.58 | +0.27% |

Crude oil | $41.77 | -0.31% | |

Gold | $1,869.80 | +0.45% |

- Says emergency facilities have been very helpful

- It would be good to have more support coming from all directions

- Economy is working through the virus

- Fed has a robust plan for the policy; will keep rates at zero until max employment, 2% inflation

- Looking at the scale of asset purchases, currently providing tremendous amount of support

- We are in a pretty good place to see how this will play out with transition, fiscal support and vaccine

- Says he's looking towards the spring to see how things will go

(company / ticker / price / change ($/%) / volume)

ALCOA INC. | AA | 18.69 | -0.24(-1.27%) | 11830 |

ALTRIA GROUP INC. | MO | 40.01 | -0.05(-0.12%) | 7085 |

Amazon.com Inc., NASDAQ | AMZN | 3,115.00 | -2.02(-0.06%) | 33492 |

American Express Co | AXP | 113.65 | -0.49(-0.43%) | 2235 |

AMERICAN INTERNATIONAL GROUP | AIG | 38.5 | -0.04(-0.10%) | 859 |

Apple Inc. | AAPL | 118.71 | 0.07(0.06%) | 338153 |

AT&T Inc | T | 28.25 | -0.03(-0.11%) | 66786 |

Boeing Co | BA | 204.7 | -0.97(-0.47%) | 193759 |

Caterpillar Inc | CAT | 172.72 | -0.18(-0.10%) | 1319 |

Chevron Corp | CVX | 85.71 | -0.02(-0.02%) | 7594 |

Cisco Systems Inc | CSCO | 41.16 | -0.01(-0.02%) | 14719 |

Citigroup Inc., NYSE | C | 52 | -0.14(-0.27%) | 76783 |

Facebook, Inc. | FB | 273.5 | 0.56(0.21%) | 48863 |

FedEx Corporation, NYSE | FDX | 280.49 | 0.64(0.23%) | 6783 |

Ford Motor Co. | F | 8.81 | -0.01(-0.11%) | 290105 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 21.38 | 0.27(1.28%) | 88459 |

General Electric Co | GE | 9.67 | 0.01(0.10%) | 765388 |

General Motors Company, NYSE | GM | 43.17 | 0.35(0.81%) | 170418 |

Goldman Sachs | GS | 222.59 | -1.98(-0.88%) | 997 |

Hewlett-Packard Co. | HPQ | 20.87 | 0.37(1.80%) | 1034 |

Intel Corp | INTC | 45.68 | 0.06(0.13%) | 66741 |

International Business Machines Co... | IBM | 117.02 | -0.16(-0.14%) | 1952 |

Johnson & Johnson | JNJ | 147.49 | 0.35(0.24%) | 9172 |

JPMorgan Chase and Co | JPM | 115.08 | -0.48(-0.42%) | 12827 |

McDonald's Corp | MCD | 214.8 | -0.31(-0.14%) | 2656 |

Merck & Co Inc | MRK | 80.5 | 0.11(0.14%) | 7100 |

Microsoft Corp | MSFT | 212.63 | 0.21(0.10%) | 96404 |

Nike | NKE | 132.1 | 0.19(0.14%) | 23311 |

Pfizer Inc | PFE | 36.77 | 0.58(1.60%) | 1652889 |

Procter & Gamble Co | PG | 139.99 | 0.46(0.33%) | 2296 |

Starbucks Corporation, NASDAQ | SBUX | 97.14 | -0.62(-0.63%) | 4388 |

Tesla Motors, Inc., NASDAQ | TSLA | 498.5 | -0.77(-0.15%) | 606306 |

The Coca-Cola Co | KO | 52.99 | -0.14(-0.26%) | 13189 |

Twitter, Inc., NYSE | TWTR | 43.76 | 0.14(0.31%) | 24362 |

UnitedHealth Group Inc | UNH | 333 | -4.00(-1.19%) | 7055 |

Verizon Communications Inc | VZ | 60.22 | 0.01(0.02%) | 3017 |

Visa | V | 208.44 | 0.87(0.42%) | 3828 |

Wal-Mart Stores Inc | WMT | 151.78 | -0.34(-0.23%) | 16287 |

Walt Disney Co | DIS | 141.71 | -0.01(-0.01%) | 16149 |

Yandex N.V., NASDAQ | YNDX | 62.56 | 0.03(0.05%) | 2554 |

Statistics

Canada reported on Friday the New Housing Price Index (NHPI) rose 0.8 percent

m-o-m in October, following a 1.2 percent m-o-m climb in the previous month.

Economists had

forecast the NHPI to increase 1.0 percent m-o-m in October.

According to the report, new home prices rose in 21 out of the 27 census metropolitan areas (CMAs) surveyed in October, with Montréal (+2.7 percent m-o-m), St. Catharines-Niagara and Trois-Rivières (both +2.2 percent m-o-m) recording the largest monthly gains due to higher construction costs and strong market conditions.

In y-o-y terms, NHPI climbed 3.9 percent in October, following a 3.2 percent gain in the previous month. This was the largest y-o-y advance since June 2017.

Statistics

Canada announced on Friday that the Canadian retail sales surged 1.1 percent

m-o-m to CAD53.87 billion in September, following an upwardly revised 0.5

percent m-o-m gain in August (originally a 0.4 percent m-o-m advance).

Economists had

forecast a 0.2 percent m-o-m increase for September.

According to

the report, sales increased in 9 of 11 subsectors in September, accounting for 93.2

percent of total retail sales. The motor vehicle and parts dealers subsector

contributed the most to the sales advance in September, climbing 1.5 percent

m-o-m. Excluding motor vehicle and parts dealers, retail sales grew 1.0 percent

m-o-m in September compared to an unrevised 0.5 percent m-o-m gain in August

and economists’ forecast for a 0.2 percent m-o-m rise.

Meanwhile, core

retail sales, which excludes gasoline stations and motor vehicle and parts

dealers, rose 1.1 percent m-o-m in September after advancing 0.4 percent m-o-m

in August, bolstered by higher sales at general merchandise stores (+1.8 percent

m-o-m) and food and beverage stores (+0.9 percent m-o-m).

In y-o-y terms,

Canadian retail sales climbed 4.6 percent in September, following a revised 3.7

percent increase in August (originally a 3.5 percent surge).

- That has been our position throughout the negotiations and it remains our position

- Our negotiating position remains the same, we want an agreement that lets us take back control of our money, laws and borders

- We will continue to work hard to reach an agreement today and next week

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 07:00 | Germany | Producer Price Index (YoY) | October | -1% | -0.7% | -0.7% |

| 07:00 | Germany | Producer Price Index (MoM) | October | 0.4% | 0.1% | 0.1% |

| 07:00 | United Kingdom | PSNB, bln | October | -36.1 | -35.2 | -22.3 |

| 07:00 | United Kingdom | Retail Sales (YoY) | October | 4.6% | 4.2% | 5.8% |

| 07:00 | United Kingdom | Retail Sales (MoM) | October | 1.4% | 0% | 1.2% |

| 13:00 | Germany | German Buba President Weidmann Speaks |

GBP traded mixed against its major rivals in the European session on Friday, with declines versus AUD, NZD and CAD and gains versus USD, EUR, JPY and CHF.

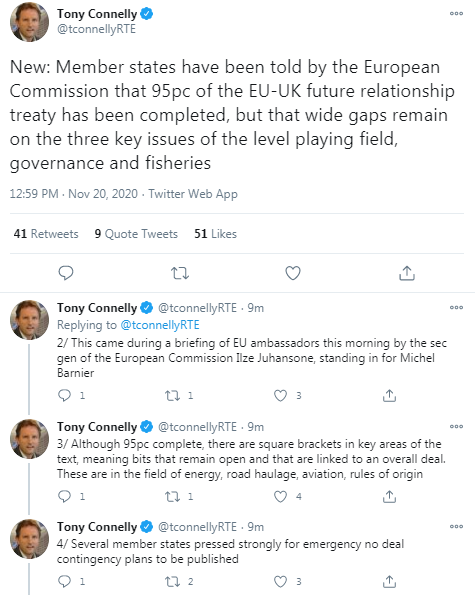

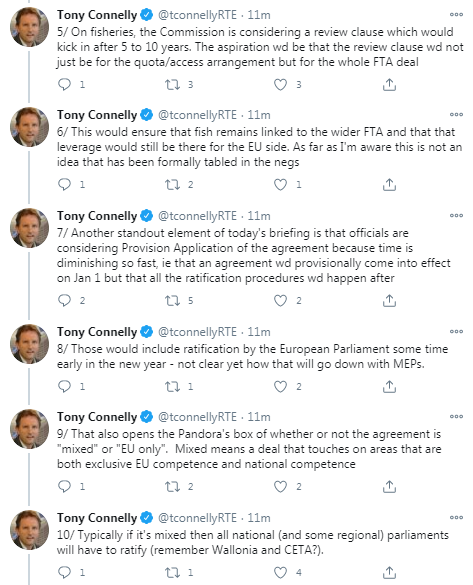

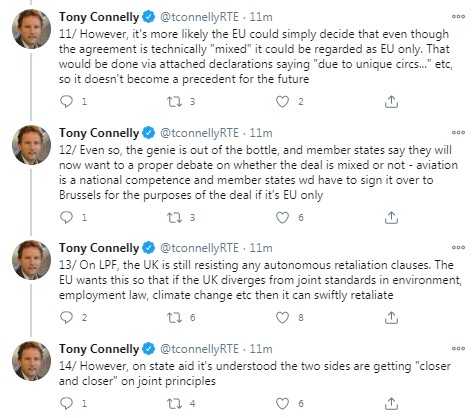

Hopes for a Brexit deal renewed after the EU diplomat said that the UK and the EU Brexit negotiators are very close to an agreement in trade talks on most issues, even if there are still differences on three main issues (level playing field, governance and fisheries). “We are very close to agreement on most issues but differences on the three contentious issues persist,” a senior EU diplomat told Reuters after the briefing from the senior member of the bloc’s executive European Commission. Meanwhile, another EU diplomat commented on the three core sticking points: “They still need their time. Some things on the level playing field have moved, albeit very, very slowly. Fisheries are not really moving anywhere right now.” Nonetheless, the EU officials reportedly still hope that negotiations can be finalized quickly if and once the necessary political decisions are taken in London.

The European Commission (EC) president Ursula von der Leyen also provided upbeat comments on Brexit talks. She noted that better progress had been seen in the last days better, with more movement on important files. However, der Leyen added that the sides still had a lot of work to do, as there were still "quite some meters to the finish line". “The whole team is engaged and working tirelessly day and night to reach the natural deadline we have to be done by the end of the year,” she said.

With EU chief Brexit negotiator Michel Barnier in self-isolation after one negotiator from his team tested positive for COVID-19, the talks with the UK will be conducted almost entirely online over the next few days.

The better-than-expected UK's retail sales data also offered cause for optimism. The Office for National Statistics (ONS) reported that the UK's retail sales surged 1.2 percent m-o-m in October following a downwardly revised 1.4 percent m-o-m climb in September (originally a 1.5 percent m-o-m jump). This was the sixth consecutive rise in retail sales. Economists had forecast a flat m-o-m reading.

FXStreet reports that NZD/USD is back pressuring against the 0.6942/45 resistance and analysts at Credit Suisse look for a clear break in due course, with the next key level at 0.6970.

“NZD/USD is making another attempt at the key 2019 and recent highs resistance at 0.6942/45. Although we might see another cap here again, with a major base in place, as well as the recently completed bull ‘triangle’, we stay biased higher and look for an eventual breakout.”

“Beyond 0.6945 would see the December 2018 high at 0.6970 next, where we would expect to see another pause. Removal of here in due course should subsequently see an acceleration of upside momentum, up to the June 2018 high at 0.7054/60 and eventually 0.7111/58.”

“First support is seen at 0.6905, then 0.6879/62, below which would trigger a correction back to the ‘neckline’ to the large base at 0.6811/6796."

- Says that whole team is engaged on Brexit and working day and night

- Brexit deal has to be done by the end of the year

- We still have a lot of work to do and time pressure is high

- There are still problems with level playing field but there is progress on state aid

- Refuses to comment on how far Brexit trade deal has advanced

- We will tell G20 leaders tomorrow it is important to maintain economy support measures as long as needed

FXStreet reports that U.S. yields lifted recently (0.75% to 0.95% for the ten years) partly in response to the news around the vaccines; markets will be closely watching the progress of the vaccines. Bill Evans, Chief Economist at Westpac, has raised his US 10-year Treasuries forecast and expects the yield curve to steepen in the next year.

“Up till now our forecast profile for US 10 year Treasuries through 2021 had been to remain in a 0.65% – 0.75% range through to the end of the year, before lifting to 1.1% through 2022. We have now brought that rate profile in 2022 forward to 2021 with the 10-year bond rate rising from 0.80% in December through to 1.2% by end-2021. We accept that the Federal Reserve may remain active in the QE space through 2021 but feel that the optimism associated with the successful distribution of vaccines through 2021 will be the dominant market force while providing the Fed with some scope to ease back on support.”

“The RBA is projected to hold around 17% of the bonds on issue when it completes its QE program by June next year. Compared to the US Federal Reserve (22% now) and RBNZ (36%, projected) the RBA’s share of outstanding AGS is modest; the prospect that the RBA will extend its QE program beyond June seems realistic although we expect that AUD bonds will continue to trade at a slight premium over USD bonds. Consequently, the expected rise in US bond rates can be expected to lift AUD bond rates, steepening the yield curve.”

“Despite lifting our long bond forecasts we remain comfortable with the estimated timing of the revision to the three-year bond rate target remaining at around mid–2022, but markets may be less patient.”

- Says that Q4 growth may be close to zero or even negative

- Expects NPLs to rise in H1 2021

FXStreet reports that in opinion of FX Strategists at UOB Group, the prospects of USD/CNH to slip back to the 6.5200 level appear to be losing traction.

Next 1-3 weeks: “We have held a negative view in USD for about 2 weeks now. In our latest narrative from Wednesday, we indicated that USD ‘is likely to weaken to further to 6.5200’. USD subsequently dropped to 6.5319 before staging a relatively robust recovery. Downward momentum has waned and unless USD can move and stay below 6.5500 within these 1 to 2 days, the prospect for a move to 6.5200 would diminish quickly. Conversely, a break of 6.6000 (no change in ‘strong resistance’ level) would indicate that the weak phase in USD has run its course.”

Reuters reports that the World Trade Organization said that global goods trade had rebounded sharply in the third quarter from COVID-19 lockdowns.

Goods trade barometer had surged to 100.7 points from a record low of 84.5 points in August, the WTO said.

"The latest reading indicates a strong rebound in trade in the third quarter as lockdowns were eased, but growth is likely to slow in the fourth quarter as pent-up demand is exhausted and inventory restocking is completed," the WTO said.

Bloomberg reports that president-elect Joe Biden said he has chosen a Treasury secretary, promising an announcement either next week or the week after.

“You’ll soon hear my choice for Treasury,” Biden said. “I’ve made that decision, we’ve made that decision, and you’ll hear that either just before or just after Thanksgiving.”

Biden is said to have been considering current Federal Reserve governor Lael Brainard, who has previously served in a top political post at the Treasury Department during the Obama administration. He is also said to have considered former Fed governor Roger Ferguson, and former Fed Chair Janet Yellen.

FXStreet reports that according to Westpac, many currencies are still ploughing higher and A$’s commodity fundamentals remain in very good shape.

“The A$’s vaccine jolt higher has run into resistance around 0.73 this week. Global equities are pausing for breath too, caught in a tug of war between medium-term vaccine optimism and tightening restrictions to curb covid spikes. But many currencies are still forging higher and A$ has slipped to the bottom half of the G10 tables, ceding its usual outperformance position when the US$ broadly declines.”

“The RBA’s stepped-up pace of asset purchases may be one background factor capping the A$. Other headwinds include China’s intensifying threats to Australian exports, even as both nations sign the RCEP ‘free trade agreement’.”

“The US$ is likely to breakdown to fresh lows at some point. US rebound momentum was already faltering and will surely slow further following the latest patchwork of local efforts to contain the virus’ spread. That, and reduced hopes for a large-scale fiscal stimulus that would have come with a blue wave US election outcome should see the Fed deliver a strong dovish message at their mid-December meeting.”

Reuters reports that EU official told ambassadors in Brussels that the EU and Britain are very close to agreement on most issues as time runs out for a trade deal but they are still at odds over fishing rights, guarantees of fair competition and ways to solve future disputes.

"We are both close and far away. It seems that we are very close to agreement on most issues but differences on the three contentious issues persist," a senior EU diplomat said after ambassadors were briefed on Friday by an EU negotiator.

The chief Brexit negotiators suspended direct talks on Thursday after a member of the EU team tested positive for COVID-19, but officials continued working remotely to clinch an EU-UK trade deal that would come into force in just six weeks.

According to the report from Istat, in September 2020 the seasonally adjusted turnover index decreased by 3.2% compared to the previous month (-4.9% the domestic market and +0.2% in non-domestic market); the third quarter increased by 33.4% compared to the previous quarter (+35.3% in domestic market and +29.8% in non-domestic market).

The seasonally adjusted industrial new orders index decreased by 6.4% compared to August (-5.7% in domestic market and -7.3% in non-domestic market); the third quarter increased by 40.7% compared to the previous quarter (+42.6% in domestic market and +38.0% in non-domestic market).

With respect to the same month of the previous year the calendar adjusted industrial turnover index decreased by 4.6% (-4.5% in domestic market and -4.9% in non-domestic market). Calendar working days in September 2020 were 22, one more than September 2019.

The unadjusted industrial new orders index increased by 3.2% with respect to the same month of the previous year (+5.1% in domestic market and +0.4% in non-domestic market).

CNBC reports that the American Chamber of Commerce in Shanghai said in a survey that the outlook for U.S. businesses in China is improving, whether politically or revenue-wise.

Out of 124 company leaders surveyed from Nov. 11 to 15, only two said they are more pessimistic about doing business in China following President-elect Joe Biden’s win this month.

Just over half, or 54.8%, said they are “more optimistic” and 8.1% are “much more optimistic” given the expected change from President Donald Trump’s administration, the survey found.

“The majority of our respondents look at it as a positive,” Ker Gibbs, president of AmCham Shanghai, told. “The Biden administration would be a positive to the stability of the environment, the stability of the relationship.”

Under a Biden administration, only 5.6% of AmCham Shanghai survey respondents expect more tariffs. Instead, 70.2% anticipate new U.S. leadership will work more with other countries to put pressure on trade relations with China.

Reuters reports that BofA said that investors stormed into riskier assets last week, pumping $27 billion into equity funds as positive COVID-19 vaccine updates led to euphoric buying of shares in worst-hit sectors such as banks, travel and leisure and oil.

Citing data from EPFR, the bank said inflows into global stocks in the last two weeks soared to $71.4 billion, the biggest ever. The flows were led by U.S. and emerging market stocks.

FXStreet reports that Westpac see the aussie fading at the 0.7350 barrier.

“The combination of positive vaccine news, record China steel production driving record demand for iron ore and commodities in general, plus Lowe’s comments that ‘negative rates were still extraordinarily unlikely in Australia’ have lifted A$ sentiment in recent sessions.”

“We still see fresh closures/curfews and stay at home orders in the US and Europe as capping 0.7350 for now.”

“Signs that Asian central banks are becoming concerned by recent currency strength also acts as a cap on the A$ too.”

“Weakness to 0.7180/0.7210 is another opportunity to buy though.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:30 | Japan | Manufacturing PMI | November | 48.7 | 48.3 | |

| 00:30 | Japan | Nikkei Services PMI | November | 47.7 | 46.7 | |

| 07:00 | Germany | Producer Price Index (YoY) | October | -1% | -0.7% | -0.7% |

| 07:00 | Germany | Producer Price Index (MoM) | October | 0.4% | 0.1% | 0.1% |

| 07:00 | United Kingdom | PSNB, bln | October | -36.1 | -35.2 | -22.3 |

| 07:00 | United Kingdom | Retail Sales (YoY) | October | 4.6% | 4.2% | 5.8% |

| 07:00 | United Kingdom | Retail Sales (MoM) | October | 1.4% | 0% | 1.2% |

During today's Asian trading, the US dollar declined against the euro and rose moderately against the yen on news of the agreement of the leader of the Republican majority in the US Senate, Mitch McConnell, to resume negotiations on new measures to support the us economy.

The head of the democratic minority in the US Senate, Chuck Schumer, said on Thursday that Mitch McConnell had agreed to resume negotiations with Democrats on a new package of measures to support the US economy amid the continuing increase in the incidence of coronavirus in the country. US Treasury Secretary Steven Mnuchin, in turn, in a letter to the head of the Federal reserve system Jerome Powell on Thursday said that some emergency lending programs will not be extended after December 31.

Meanwhile, European Central Bank President Christine Lagarde promised a major stimulus package from the Central Bank in December, noting that the eurozone economy is likely to be" severely affected " by the rapid rise in COVID-19 and new restrictive measures.

The yen declined against the dollar. Consumer prices in Japan in October decreased by 0.4% in annual terms after zero changes a month earlier. This is the biggest drop in more than four years. Analysts had forecast a 0.3% contraction.

The ICE index, which tracks the dynamics of the US dollar against six currencies (euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), rose 0.02%.

FXStreet reports that Goldman Sachs commodity analysts Jeffrey Currie and Mikhail Sprogis, said that there is still a “strong strategic case for gold”.

“In our view, the structural bull market for gold is not over and will resume next year as inflation expectations move higher, the U.S. dollar weakens and E.M. retail demand continues to recover.”

“Near term, however, it may be difficult for gold to generate a meaningful momentum in either a higher or lower direction.”

“Under our economist forecast (assuming our bullish oil forecast) short-term U.S. real rates will average -2.1% over the next five years. Five-year tips yield is currently -1.2%, which implies material downside potential.”

“We believe the bulk of gold purchases which happened this year were made by investors who were more concerned about the real purchasing power of the dollar vs. losses in their equity portfolios,”

According to the report from the Federal Statistical Office, in October 2020, the index of producer prices for industrial products decreased by 0.7% compared with the corresponding month of the preceding year. In September the annual rate of change all over had been –1.0%. Compared with the preceding month September the overall index increased by 0.1% in October 2020 (+0.4% in September).

Energy prices as a whole decreased by 2.9%. On an annual basis, prices of petroleum products were down 16.0%, prices of natural gas (distribution) decreased by 5.2%.

The overall index disregarding energy was 0.1% up on October 2019.

Prices of intermediate goods decreased by 0.4% compared to October 2019. Prices of non-durable consumer goods decreased by 0.5% compared to October 2019. Food prices decreased by 1.3%. Pork prices were down 19.5% presumably due to the lockdown of food service industry in spring and to the ban on imports of German pork by China and other Asian countries starting in September. Compared to September prices of pork fell by 4.0%.

Prices of capital goods increased by 0.9% compared to October 2019, durable consumer goods by 1.4%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1946 (4032)

$1.1921 (2008)

$1.1905 (2747)

Price at time of writing this review: $1.1877

Support levels (open interest**, contracts):

$1.1836 (123)

$1.1810 (722)

$1.1777 (2457)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 4 is 103401 contracts (according to data from November, 19) with the maximum number of contracts with strike price $1,1200 (6547);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3390 (1516)

$1.3364 (1647)

$1.3325 (1472)

Price at time of writing this review: $1.3278

Support levels (open interest**, contracts):

$1.3188 (1000)

$1.3143 (688)

$1.3082 (1262)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 23703 contracts, with the maximum number of contracts with strike price $1,3500 (2734);

- Overall open interest on the PUT options with the expiration date December, 4 is 39978 contracts, with the maximum number of contracts with strike price $1,2700 (12070);

- The ratio of PUT/CALL was 1.69 versus 1.16 from the previous trading day according to data from November, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

According to the report from Office for National Statistics, in October 2020, retail sales volumes increased by 1.2% when compared with September; the sixth consecutive month of growth in the industry. Economists had expected sales to remain unchanged.

In October, growth in the volume of sales for non-store retailing at 6.4%, household goods stores at 3.2% and department stores at 3.1% all contributed to the overall monthly increase in retail sales.

In October, the year-on-year growth rate in the volume of retail sales saw a strong increase of 5.8%, with feedback from a range of businesses suggesting that consumers had started Christmas shopping earlier this year, further helped by early discounting from a range of stores.

Looking at October’s total retail sales values (excluding fuel), which is a comparable measure to our online series, sales increased by 7.9% when compared with February; driven by a strong increase in sales online at 52.8% in comparison to reduced store sales at negative 3.3%.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 44.11 | 0.16 |

| Silver | 24.04 | -1.11 |

| Gold | 1866.657 | -0.29 |

| Palladium | 2321.74 | -0.52 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -93.8 | 25634.34 | -0.36 |

| Hang Seng | -187.32 | 26356.97 | -0.71 |

| KOSPI | 1.78 | 2547.42 | 0.07 |

| ASX 200 | 16.1 | 6547.2 | 0.25 |

| FTSE 100 | -50.89 | 6334.35 | -0.8 |

| CAC 40 | -36.79 | 5474.66 | -0.67 |

| Dow Jones | 44.81 | 29483.23 | 0.15 |

| S&P 500 | 14.08 | 3581.87 | 0.39 |

| NASDAQ Composite | 103.11 | 11904.71 | 0.87 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Japan | Manufacturing PMI | November | 48.7 | |

| 00:30 (GMT) | Japan | Nikkei Services PMI | November | 47.7 | |

| 07:00 (GMT) | Germany | Producer Price Index (YoY) | October | -1% | -0.7% |

| 07:00 (GMT) | Germany | Producer Price Index (MoM) | October | 0.4% | 0.1% |

| 07:00 (GMT) | United Kingdom | PSNB, bln | October | -36.1 | -35.2 |

| 07:00 (GMT) | United Kingdom | Retail Sales (YoY) | October | 4.7% | 4.2% |

| 07:00 (GMT) | United Kingdom | Retail Sales (MoM) | October | 1.5% | 0% |

| 13:00 (GMT) | Germany | German Buba President Weidmann Speaks | |||

| 13:30 (GMT) | Canada | Retail Sales, m/m | September | 0.4% | 0.2% |

| 13:30 (GMT) | Canada | New Housing Price Index, YoY | October | 3.2% | |

| 13:30 (GMT) | Canada | New Housing Price Index, MoM | October | 1.2% | 1% |

| 13:30 (GMT) | Canada | Retail Sales YoY | September | 3.5% | |

| 13:30 (GMT) | Canada | Retail Sales ex Autos, m/m | September | 0.5% | 0.2% |

| 15:00 (GMT) | Eurozone | Consumer Confidence | November | -15.5 | -17.7 |

| 18:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | November | 236 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.7284 | -0.28 |

| EURJPY | 123.209 | 0.15 |

| EURUSD | 1.18757 | 0.19 |

| GBPJPY | 137.614 | -0.07 |

| GBPUSD | 1.32645 | -0.03 |

| NZDUSD | 0.69195 | -0.03 |

| USDCAD | 1.30664 | -0.11 |

| USDCHF | 0.91038 | -0.06 |

| USDJPY | 103.741 | -0.04 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.