- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-11-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 04:30 | Japan | All Industry Activity Index, m/m | September | 0% | -0.2% |

| 08:10 | Eurozone | ECB's Yves Mersch Speaks | |||

| 09:30 | United Kingdom | PSNB, bln | October | -8.52 | -8.60 |

| 12:30 | Eurozone | ECB Monetary Policy Meeting Accounts | |||

| 13:30 | U.S. | Continuing Jobless Claims | 1683 | 1685 | |

| 13:30 | U.S. | FOMC Member Mester Speaks | |||

| 13:30 | U.S. | Initial Jobless Claims | 225 | 219 | |

| 13:30 | U.S. | Philadelphia Fed Manufacturing Survey | November | 5.6 | 7 |

| 13:40 | Canada | BOC Gov Stephen Poloz Speaks | |||

| 15:00 | Eurozone | Consumer Confidence | November | -7.6 | -7.3 |

| 15:00 | U.S. | Leading Indicators | October | -0.1% | -0.1% |

| 15:00 | U.S. | Existing Home Sales | October | 5.38 | 5.47 |

| 15:10 | U.S. | FOMC Member Kashkari Speaks | |||

| 15:30 | Canada | Bank of Canada publishes financial system review | |||

| 23:30 | Japan | National CPI Ex-Fresh Food, y/y | October | 0.3% | 0.4% |

| 23:30 | Japan | National Consumer Price Index, y/y | October | 0.2% | 0.3% |

The main US stock indices fell moderately, stepping back from record levels, as investors took a break to assess the situation with trade negotiations between the US and China, as well as a new reporting unit for retailers.

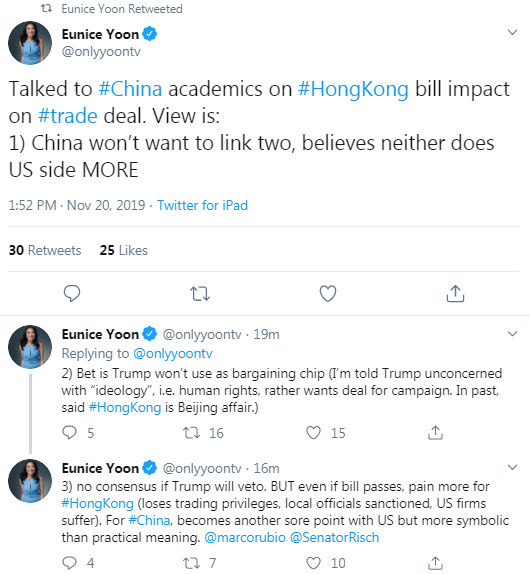

The Wall Street Journal (WSJ), citing former officials from President Trump’s administration, said current trade negotiations could be at an impasse that could disrupt the signing of the so-called first phase of the deal. Uncertainty surrounding trade also grew after the US Senate passed a bill supporting protesters in Hong Kong. This has led China to accuse the US of meddling in internal affairs.

These reports came after US President Donald Trump threatened again on Tuesday, raising tariffs on Chinese goods if Beijing didn’t make a deal. “If we don’t make a deal with China, I’ll just raise the tariffs even higher,” Trump said at a government meeting.

Negatives, however, helped somewhat soften quarterly results and forecasts from Target (TGT) and Lowe's (LOW). Target (TGT) reported a profit of 1.36 per share for revenue of $ 18.41 billion (+ 4.7% y / y). Analysts surveyed by Refinitiv expected the company to earn $ 1.19 per share on revenue of $ 18.49 billion. Comparable sales, a key indicator for retailers, rose 4.5%, exceeding the estimate of + 3.6%. TGT shares jumped 14.19%.

Lowe's (LOW) reported quarterly earnings of $ 1.41 per share, compared with an average analyst forecast of $ 1.35. However, the revenue of a retailer of goods for home improvement was below the average market forecast. Nevertheless, the company raised its forecast for earnings per share for the whole year and confirmed the forecast for annual revenue. LOW shares rose 3.54%.

Most DOW components recorded a decline (19 out of 30). Outsider were the shares of The Home Depot (HD; -2.10%). The biggest gainers were The Boeing Company (BA; + 1.01%).

Almost all S&P sectors completed trading in the red. The largest decline was shown by the services sector (-0.8%). The utilities sector grew the most (+ 0.5%).

At the time of closing:

Dow 27,821.09 -112.93 -0.40%

S&P 500 3,108.46 -11.72 -0.38%

Nasdaq 100 8,526.73 -43.93 -0.51%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 04:30 | Japan | All Industry Activity Index, m/m | September | 0% | -0.2% |

| 08:10 | Eurozone | ECB's Yves Mersch Speaks | |||

| 09:30 | United Kingdom | PSNB, bln | October | -8.52 | -8.60 |

| 12:30 | Eurozone | ECB Monetary Policy Meeting Accounts | |||

| 13:30 | U.S. | Continuing Jobless Claims | 1683 | 1685 | |

| 13:30 | U.S. | FOMC Member Mester Speaks | |||

| 13:30 | U.S. | Initial Jobless Claims | 225 | 219 | |

| 13:30 | U.S. | Philadelphia Fed Manufacturing Survey | November | 5.6 | 7 |

| 13:40 | Canada | BOC Gov Stephen Poloz Speaks | |||

| 15:00 | Eurozone | Consumer Confidence | November | -7.6 | -7.3 |

| 15:00 | U.S. | Leading Indicators | October | -0.1% | -0.1% |

| 15:00 | U.S. | Existing Home Sales | October | 5.38 | 5.47 |

| 15:10 | U.S. | FOMC Member Kashkari Speaks | |||

| 15:30 | Canada | Bank of Canada publishes financial system review | |||

| 23:30 | Japan | National CPI Ex-Fresh Food, y/y | October | 0.3% | 0.4% |

| 23:30 | Japan | National Consumer Price Index, y/y | October | 0.2% | 0.3% |

Analysts at ABN AMRO expect the total investment to have contracted in Q3 and to continue to decline during the next couple of quarters in the Eurozone.

- "Fixed investment growth in the eurozone has remained resilient despite the contraction in industrial production and the drop in business confidence during the past six quarters.

- A large number of early indicators for investment in machinery and equipment, such as the new orders component of the eurozone industrial PMI and Ifo’s business climate in the capital goods industry (as well as its component about orders on hand) are consistent with a contraction in investment in machinery and equipment.

- All that said, we expect residential investment to continue to expand in the coming quarters, and to limit the pace of the decline in total fixed investment."

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories

increased by 1.379 million barrels in the week ended November 15. Economists

had forecast a gain of 1.500 million barrels.

At the same

time, gasoline stocks rose by 1.756 million barrels, while analysts had

expected a gain of 0.750 million barrels. Distillate stocks reduced by 0.974

million barrels, while analysts had forecast a decrease of 1.000 million

barrels.

Meanwhile, oil

production in the U.S. was unchanged at 12.800 million barrels a day.

U.S. crude oil

imports averaged 6.0 million barrels per day last week, up by 222,000 barrels

per day from the previous week.

- Trade uncertainty has been major factor weighing on economy in past year; cities business investment

- We've taken out insurance on trade but we still hear from business contacts saying they're waiting on clarity

- 0.4% tracking forecasts for GDP are quite a bit lower than consensus

- U.S. consumer has proven to be more resilient

- Most of the businesses we talk to that are consumer-facing continue to be quite upbeat

- We see some special factors weighing now that will begin to unwind in Q1

- I see economy growing slightly above trend in the next year

- I see inflation moving up to 2% and a bit above

- The slowdown in trade is a concern and a question mark but expect consumer and domestic growth to be solid for next year or year-and-a-half

Iris Pang, the economist for Greater China at ING, notes that the People's Bank of China (PBoC) has cut interest rates three times this month.

- "However, we should really see all these cuts as just one cut of five basis points. The policy implication is that the interest rate curve from the short rate to the five-year rate should reflect these cuts.

- The methodology by the PBoC to move almost the whole interest rate curve by cutting interest rates of various maturities means that the interest rate transmission mechanism in China does not function very well.

- We expect the PBoC to live with this until the MLF rate is truly market-based, at which point the PBoC can leave the MLF rate and the LPR to the market. By then, the policy interest rate will be the short-term interest rate alone.

- "Data-dependent" monetary policy is quite unusual in China because most of the time, the PBoC seems to have an interest rate path in mind for the year ahead. But the trade war has changed how the central bank projects its policy.

- A positive outcome from the trade war would mean the central bank can stay put on monetary policy, but the reverse will mean it needs to loosen further. The trade war has also resulted in massive infrastructure investments, which should enter into the production stage from the investment stage in the coming months. This will also affect how the PBoC manages monetary policy.

- As such, we expect the central bank to be more data-dependent than in the past.

- Aside from its interest rate policy, the PBoC also has a policy of managing liquidity. Cutting the reserve requirement ratio is a major tool here. Others include the injection or absorption of cash in the interbank market via the MLF and daily open market operations.

- After the RRR cut in September which injected CNY800 billion into banks, there were further targeted RRR cuts, which released CNY100 billion on 15 October and 15 November. Additionally, net liquidity injections between September and 20 November amounted to CNY55 billion. The total was an injection of CNY955 billion over just three months.

- This highlights that liquidity management is an important tool to guide interest rates lower."

Josh Nye, the Senior Economist at Royal Bank of Canada (RBC), provides his view on Wednesday's mostly in-line Canadian consumer inflation figures for October.

- “Headline inflation, which held steady for a third consecutive month in October, is likely to edge higher in the coming months before slipping back below 2% for much of 2020. A near-term rise in energy inflation (weekly gasoline prices now above year-ago levels for the first time in 2019) isn't expected to persist, while mortgage interest costs should continue to come off the boil next year. Core inflation has been remarkably steady since early-2018, seeing only the most modest of upward trends in 2019. Given strong wage growth in recent months, we'll be watching to see if core measures rise further in 2020. But with inflation expectations looking well anchored, the scope for stronger underlying inflation looks fairly limited.

- The BoC cited on-target inflation as one of the key reasons it opted against an "insurance" rate cut in October. The fact that core measures have hovered around 2% for nearly two years allows the BoC to weigh inflation risks "more symmetrically." That will leave monetary policy dependent on the growth outlook and trade risks. We think below-trend growth over the second half of this year will leave the door open to a rate cut in early-2020. Any disappointment in US-China trade talks (optimism fading a bit as of this morning) would add to the risk of a cut.”

U.S. stock-index futures fell on Wednesday, as worries over U.S.-China trade relations outweighed positive earnings results and guidance from Target (TGT; +10.0%) and Lowe's (LOW; +4.4).

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 23,148.57 | -144.08 | -0.62% |

Hang Seng | 26,889.61 | -204.19 | -0.75% |

Shanghai | 2,911.05 | -22.94 | -0.78% |

S&P/ASX | 6,722.40 | -91.80 | -1.35% |

FTSE | 7,256.92 | -66.88 | -0.91% |

CAC | 5,892.41 | -16.64 | -0.28% |

DAX | 13,140.23 | -80.89 | -0.61% |

Crude oil | $55.67 | +0.83% | |

Gold | $1,470.90 | -0.23% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 170.37 | -0.31(-0.18%) | 413 |

ALTRIA GROUP INC. | MO | 46.9 | -0.03(-0.06%) | 2957 |

Amazon.com Inc., NASDAQ | AMZN | 1,748.45 | -4.34(-0.25%) | 8365 |

American Express Co | AXP | 119.2 | -0.80(-0.67%) | 377 |

Apple Inc. | AAPL | 265 | -1.29(-0.48%) | 278964 |

AT&T Inc | T | 37.37 | -0.63(-1.66%) | 137548 |

Boeing Co | BA | 366.94 | -0.06(-0.02%) | 8786 |

Caterpillar Inc | CAT | 142.7 | -0.48(-0.34%) | 1401 |

Cisco Systems Inc | CSCO | 45.3 | -0.17(-0.37%) | 8166 |

Citigroup Inc., NYSE | C | 74.25 | -0.57(-0.76%) | 11227 |

Deere & Company, NYSE | DE | 173.5 | -0.15(-0.09%) | 525 |

E. I. du Pont de Nemours and Co | DD | 66.45 | 0.44(0.67%) | 2063 |

Exxon Mobil Corp | XOM | 67.66 | -0.16(-0.24%) | 7373 |

Facebook, Inc. | FB | 198.5 | -0.82(-0.41%) | 41801 |

FedEx Corporation, NYSE | FDX | 154.95 | -0.57(-0.37%) | 1919 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.25 | -0.03(-0.27%) | 102 |

General Electric Co | GE | 11.41 | -0.09(-0.78%) | 52093 |

Goldman Sachs | GS | 218.6 | -1.44(-0.65%) | 1264 |

Google Inc. | GOOG | 1,311.50 | -3.96(-0.30%) | 1088 |

Hewlett-Packard Co. | HPQ | 20 | -0.11(-0.55%) | 1101 |

Home Depot Inc | HD | 224.72 | -1.14(-0.50%) | 44045 |

Intel Corp | INTC | 58.06 | -0.29(-0.50%) | 4525 |

International Business Machines Co... | IBM | 134.33 | -0.19(-0.14%) | 345 |

Johnson & Johnson | JNJ | 134.99 | 0.17(0.13%) | 1201 |

JPMorgan Chase and Co | JPM | 129.7 | -0.88(-0.67%) | 19769 |

McDonald's Corp | MCD | 193.17 | -0.27(-0.14%) | 3700 |

Microsoft Corp | MSFT | 149.65 | -0.23(-0.15%) | 68125 |

Nike | NKE | 93.31 | -0.30(-0.32%) | 12490 |

Pfizer Inc | PFE | 37.52 | -0.14(-0.37%) | 1623 |

Procter & Gamble Co | PG | 121.72 | 0.30(0.25%) | 2219 |

Starbucks Corporation, NASDAQ | SBUX | 83.5 | -0.16(-0.19%) | 2387 |

Tesla Motors, Inc., NASDAQ | TSLA | 361.7 | 2.18(0.61%) | 94498 |

The Coca-Cola Co | KO | 53.07 | -0.01(-0.02%) | 1205 |

Twitter, Inc., NYSE | TWTR | 29.35 | -0.09(-0.31%) | 34263 |

Visa | V | 182.42 | -0.35(-0.19%) | 7651 |

Wal-Mart Stores Inc | WMT | 120.18 | 0.29(0.24%) | 22144 |

Walt Disney Co | DIS | 147.91 | -0.47(-0.32%) | 21112 |

Yandex N.V., NASDAQ | YNDX | 38.72 | -0.71(-1.80%) | 20426 |

Johnson & Johnson (JNJ) initiated with Overweight at Cantor Fitzgerald; target $160

Statistics

Canada reported on Wednesday the country’s consumer price index (CPI) rose 0.3

percent m-o-m in October, following a 0.4 percent m-o-m decline in the previous

month.

On the y-o-y

basis, Canada’s inflation rate increased 1.9 percent last month, matching the

gains in September and August.

Economists had

predicted inflation would increase 0.3 percent m-o-m and 1.9 percent y-o-y in October.

According to

the report, prices for both goods (+1.3 percent y-o-y) and services (+2.2

percent y-o-y) rose in October at the same rates that were recorded in the

previous month. The cost of gasoline declined 6.7 percent y-o-y in October,

following a 10.0 percent y-o-y tumble in September. Excluding gasoline, the CPI

rose 2.3 percent y-o-y following three consecutive monthly gains of 2.4 percent

y-o-y.

Meanwhile, the

closely watched the Bank of Canada's core index rose 1.9 percent y-o-y in October,

the same pace as in the previous month. Economists had forecast an advance of

1.9 percent y-o-y.

- Side effects of monetary policy becoming more evident

Lowe's (LOW) reported Q3 FY 2019 earnings of $1.41 per share (versus $1.04 in Q3 FY 2018), beating analysts’ consensus estimate of $1.35.

The company’s quarterly revenues amounted to $17.388 bln (-0.2% y/y), missing analysts’ consensus estimate of $17.687 bln.

The company also raised FY 2019 EPS guidance to 5.63-5.70, up from its prior guidance of $5.45-5.65, vs. analysts’ consensus estimate of $5.67 and reaffirmed FY 2019 revenues guidance at ~72-74 bln (+2% yr/yr) vs. analysts’ consensus estimate of $72.53 bln.

LOW rose to $117.46 (+3.58%) in pre-market trading.

Target (TGT) reported Q3 FY 2019 earnings of $1.36 per share (versus $1.09 in Q3 FY 2018), beating analysts’ consensus estimate of $1.18.

The company’s quarterly revenues amounted to $18.414 bln (+4.7% y/y), generally in line with analysts’ consensus estimate of $18.450 bln.

The company also raised FY 2019 EPS guidance to $6.25-6.45 vs. analysts’ consensus estimate of $6.17 and its prior guidance of $5.90-6.20.

TGT rose to $121.00 (+9.16%) in pre-market trading.

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. fell 2.2 percent in the week ended November 15, following a 9.6 percent

climb in the previous week.

According to

the report, refinance applications decreased 7.7 percent, while applications to

purchase a home went up 6.7 percent

Meanwhile, the

average fixed 30-year mortgage rate fell to 3.99 percent from 4.03 percent.

“U.S. and China

trade anxieties and protests in Hong Kong pulled U.S. Treasurys lower last

week, and the 30-year fixed mortgage rate followed the same path, dipping below

4%,” noted Joel Kan, MBA’s associate vice president of economic and industry

forecasting. “Rates have stayed in the same narrow range of around 4% since

July, so we may be starting to see the expected slowdown in refinancing as the

pool of eligible homeowners shrinks.”

Piotr Matys, the Senior Emerging Markets FX Strategist at Rabobank, notes that Hong Kong has become an even bigger thorn in the already complicated trade talks between the U.S. and China.

- “The CEEMEA currencies came under modest selling pressure with losses led by the South African rand. However, as long as the US and China continue to negotiate and there is sufficient conviction amongst market participants that talks will conclude in a phase one deal being signed in the coming weeks, it is too early to expect a new leg lower in the CEEMEA FX space against the US dollar. For a broad selloff to materialize, trade talks would have to completely collapse as it was the case in August. The Hong Kong Human Rights and Democracy Act is an issue that could slow down the process of reaching an agreement, but one should not overreact and assume that it could become an impenetrable obstacle.”

- Adds Russia to produce 556-560 million tons of oil in 2019

- Global oil demand growth in 2020 is expected to be around 1 million barrels per day

FX Strategists at UOB Group suggest USD/JPY continues to target the key support at the 108.00-handle in the near-term.

- "24-hour view: We highlighted yesterday “there is scope for rapid drop in USD to extend lower but any weakness is likely limited to a test of 108.40”. However, USD traded in a relatively quiet manner between 108.44 and 108.84 before settling on a soft note at 108.53. We continue to detect a weak underlying tone and from here, USD could challenge last week’s low near 108.25. The next support at 108.00 is not likely to come into the picture for today. Resistance is at 108.70 followed by 108.85.

- Next 1-3 weeks: USD rose to 109.06 yesterday, not far below our 109.15 ‘strong resistance’ level. As highlighted last Friday (15 Nov, spot at 108.50), only a break of 109.15 would indicate that the current downward pressure has eased. Until then, the bias is still on the downside even though after yesterday’s price action, 108.00 may not come into the picture so soon (the minor support at 108.25 may temporarily check any decline in USD)."

- Says seeing protracted weakness in the Eurozone

- Endorses call for review of monetary policy strategy

Helicopter money could be both the best and worst options for the European Central Bank if the euro-area slowdown morphed into a recession, according to a Peterson Institute paper.

With monetary and fiscal policy limited -- the former by a depleted toolbox, the latter by budget rules -- handing out cash to the public could be an appealing alternative measure to combat a downturn, former IMF chief economist Olivier Blanchard wrote in the paper with Jean Pisani-Ferry.

However, such a dramatic step is fraught with hurdles, as well as major risks, including compromising the ECB’s independence. It would require the blessing of the bloc’s member states, including typical naysayers like Germany, and would also face hurdles, such as whether payments should be equal across the 19-country region or weighted by economic might. Such decisions on how to distribute funds would put the central bank in a very difficult position.

“In a way, helicopter money can be seen as a replacement for the still missing common fiscal capacity,” Blanchard and Pisani-Ferry said. “Its implementation, however, would raise operational, legal, and political challenges.”

Climate change could shave off 3% of world growth over the next 30 years, according to a study from the Economist Intelligence Unit.

Africa, South America and the Middle East are likely to be impacted the hardest by climate change, the report states. This is because they have higher average temperatures and smaller economies in size, making them more vulnerable to the impact of climate change.

The International Monetary Fund expects global growth to reach 3% this year, its lowest level since the global financial crisis.

However, the United States – the world’s largest economy, would not escape to the effects of climate change. The U.S. could see its growth rate reduced by more than 1% over the next three decades as a result of climate change. The National Bureau of Economic Research had highlighted in August that growth per capita in the U.S. could shrink by 10.5% over the next 81 years amid expected higher temperatures across the globe.

“The EIU’s climate change model calculates that by 2050, the U.S. economy will be 1.1% smaller than it would have been in the absence of climate change,” the EIU report said.

“Recent events in the U.S. have demonstrated the serious vulnerabilities that exist even in major developed economies,” the EIU highlighted in its study, mentioning the higher frequency and intensity in wildfires seen in California.

Occasional bullish attempts in EUR/JPY are seen meeting a tough hurdle in the 121.34/80 band, in opinion of Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank.

“EUR/JPY is seeing a decent bounce from the 55 day ma, this is located at 119.47 currently. Rallies should find tougher resistance at 121.34/80. This is the location of the 200 day ma, the 50% Fibonacci retracement and the late July high. Currently the intraday Elliott wave counts are suggesting scope to retest this resistance, but if seen, it should again hold the topside. While capped here, attention remains on the 118.72 uptrend. This should hold the initial test, however longer term the risk has increased for a break lower. Failure here will target the 117.09 October low ahead of the 115.87 September low”.

Barclays Research discusses its expectations for FOMC minutes.

"We expect the minutes to show that members favored one further cut in the policy rate in October and agreed to send a message that the Fed was through with providing insurance for now given the lag between changes in the policy rate and economic outcomes. That said, the FOMC statement contains an easing bias owing to residual uncertainties plaguing the global outlook and we expect many members to hold the view that the Fed should be prepared to ease further (eg, act as appropriate) to sustain the outlook. The minutes may appear somewhat stale in any assessment of the balance of risks given the October employment data and reported progress on US-China trade discussions came after the committee met. We also expect to read extensive discussion on the steps taken to quell unrest in short-term funding markets and progress toward a standing repo facility," Barclays adds.

In view of Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, Cable’s upside remains limited by the key handle at 1.30 the figure.

“GBP/USD remains capped by the psychological resistance at 1.3000 and the recent high at 1.3013. Directly above here we have the 200 week ma at 1.3116, the 50% retracement of the move down from 2018 at 1.3167, the 5 year downtrend at 1.3185 and the 1.3187 May high and these remain our short term targets, this is TOUGH resistance and we look for the market to fail here. Above here lies 1.3382 the 2019 high. It remains immediately bid above the 1.2764/ 23.6% retracement. Failure at 1.2764 will see a slide to the 200 day ma at 1.2703. This guards 1.2582 (September high). Below 1.2582 lies the 1.2466 uptrend. The uptrend guards 1.2196/94”.

Signs of excessive financial risk-taking as well as slowdown in bank profitability are some of the biggest challenges in the euro area, the European Central Bank (ECB) said.

“Downside risks to global and euro area economic growth have increased and continue to create financial stability challenges,” the ECB said in a press release Wednesday.

The central bank had already warned in May of “persistent downside risks,” which included global trade uncertainty and the U.K.’s departure from the EU.

“While the low interest rate environment supports the overall economy, we also note an increase in risk-taking which could, in the medium term, create financial stability challenges”, Luis de Guindos, Vice-President of the ECB said in a statement.

According to the central bank, institutions such as investment funds and insurance companies have been more risk-taking in the current low interest rate environment. This means that in case of a sudden market shock, for instance, stress among these institutions could spread to the wider financial system – leading to losses for companies and individuals. The ECB also cited risks in the property market. Riskier firms are taking on more borrowing and property prices continue to rise in “a number” of euro area countries.

Citi flags a risk of a sharp rise in net USD demand over coming weeks, which may result in rising USD liquidity premiums and a subsequent spike in USD against its counterparts.

"Investor focus shifts to the prospect for a potential broad based tightening in the year-end USD liquidity premium following the NY Fed’s update on its money market operations schedule. More recently after September end, USD liquidity premiums have been shrinking on expectations that the Fed will likely be able to adequately supply USD funding to year-end. However, major bank money market desks in NY are anticipating a sharp rise in net USD demand over coming weeks to year-end and the investor focus is turning on whether the NY Fed’s schedule may be enough to cater for the anticipated demand. Should the Fed fall short, this may result in rising USD liquidity premiums thereby leading to a spike in USD in the FX space," Citi adds.

An increasing number of governments and central banks are taking steps to boost economic growth — but those policies will be less effective if the U.S. and China don’t reach a “phase one” trade deal, a Morgan Stanley executive said.

The absence of that deal will prolong economic uncertainty globally, said Gokul Laroia, co-chief executive of Asia Pacific for Morgan Stanley. That uncertainty has caused businesses to hold back plans to invest and expand — a major reason behind slowing growth in many countries.

“A deal coupled with policy is much more impactful than just policy. And the effectiveness of whether it’s monetary or fiscal (policy) is a lot lower when you don’t have a trade deal done, and when you have an inherent amount of uncertainty hanging over the corporate world not just in Asia, but globally,” Laroia told CNBC.

The U.S. and China agreed to work towards a “phase one” deal. But Washington and Beijing have since sent mixed signals about whether or not the partial deal would be done.

Laroia said he’s optimistic that a “phase one” deal will be reached, which will benefit the economy and financial markets.

MUFG Research discusses GBP/USD outlook ahead of the UK Dec-12 General Elections.

"The likelihood of the GBP suffering a setback in the run up to the election has now been reduced although certainly not eliminated. It will still be difficult for cable to break above 1.3000 until there is more clarity. Public opinion polls would need to shift decisively to trigger a more volatile GBP. It has not happened yet broadly, although we note Britain Elects Poll Tracker shows the gap closing. Downside risks for GBP would increase if the gap starts to narrow across a wider number of polls, which would increase political uncertainty. It would open up GBP more to weakness coming through from the UK economy. Key support for cable is located at 1.2800, and then at 1.2700, the 200-day moving average," MUFG adds.

China will revise its 2018 gross domestic product (GDP) estimate in the next few days to reflect an increase in the number of businesses and assets recorded in the last census, officials said.

China’s fourth National Economic Census, released on Wednesday, included “richer” data points that showed more business entities and a bigger total asset base in 2018 than assumed under earlier GDP estimates, Li Xiaochao, deputy head of the statistics bureau told.

While the revisions typically have no immediate bearing on policy, some analysts see other implications for longer-term economic targets if past estimates are revised higher.

Li said the details of the revision would be made public “in a few days” but declined to say if they would lead to higher or lower output or GDP growth rate for 2018. China routinely revises its annual GDP data, typically making a final revision at the end of the calendar year.

The world’s second-largest economy grew to 90.03 trillion yuan in 2018, according to preliminary revisions this year. The 6.6% growth was the slowest in almost three decades but was in line with Beijing’s target of around 6.5%.

The Danske Bank analysts highlight the key event risks lined up for release in the day ahead.

“Following a few quiet days on the data front, the Riksbank is set to present its Financial Stability report today. This will most likely contain the usual messages about risks associated with household indebtedness, as well as banks' funding and appropriate capital buffers. We expect no major news in today's report. The ECB will also present its Financial Stability report today. In the US, FOMC meeting minutes are due for release. At the October meeting, the Fed cut its target range by 25bp to 1.50-1.75% as expected, but it seems that the Fed now wants to stay on hold to monitor how things play out. As there is a clear division in the committee, it will be interesting to see if the minutes will give us any information on the different stances within the Fed. We believe that the Fed will deliver one more cut in three to six months, as we still believe the US economy is fragile.”

The economy of the eurozone will not fall into a recession although it is growing less than expected and there will be a recovery in the next year or two, the European Central Bank's chief economist Philip Lane said.

"The economy is growing less quickly than what we hoped. The dynamic is disappointing but not negative. We expect a recovery in the next year or two," Lane told Italian daily la Repubblica.

Lane said the current inflation rate of 1% in the euro area was "unsatisfactory". He added that eurozone countries should take advantage of the current low interest rates to reduce their debt piles rather than "waste the additional resources for new expenses or cuts to taxes".

According to the report from Federal Statistical Office (Destatis), in October 2019 the index of producer prices for industrial products decreased by 0.6% compared with the corresponding month of the preceding year. Economists had expected a 0.4% decrease. In September 2019 the annual rate of change all over had been -0.1%. Compared with the preceding month September 2019 the overall index fell by 0.2% in October 2019 (+0.1% in September 2019).

Energy prices as a whole decreased by 3.1% (-0.1% compared to September 2019). On an annual basis prices of petroleum products decreased by 10.1% and prices of natural gas (distribution) by 8.8% whereas prices of electricity rose by 3.4%.

The overall index disregarding energy was 0.3% up on October 2018 and decreased by 0.2% compared to September 2019.

Prices of intermediate goods decreased by 1.7% compared to October 2018. This was the greatest price decline on an annual basis since July 2016 (-2.1% on July 2015). Compared with September 2019 prices of intermediate goods fell by 0.7% in October 2019.

Prices of durable consumer goods were up 1.4%, prices of capital goods increased by 1.5%. Prices of non-durable consumer goods increased by 2.3% compared to October 2018 (+0.2% on September 2019). Food prices were up 3.0%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1170 (5363)

$1.1138 (2908)

$1.1117 (2008)

Price at time of writing this review: $1.1071

Support levels (open interest**, contracts):

$1.1059 (3747)

$1.1030 (3385)

$1.0991 (3311)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 6 is 101240 contracts (according to data from November, 19) with the maximum number of contracts with strike price $1,1200 (5621);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3017 (1563)

$1.2972 (1079)

$1.2940 (2117))

Price at time of writing this review: $1.2908

Support levels (open interest**, contracts):

$1.2872 (228)

$1.2854 (307)

$1.2830 (1782)

Comments:

- Overall open interest on the CALL options with the expiration date December, 6 is 30313 contracts, with the maximum number of contracts with strike price $1,3000 (5290);

- Overall open interest on the PUT options with the expiration date December, 6 is 33168 contracts, with the maximum number of contracts with strike price $1,2200 (2280);

- The ratio of PUT/CALL was 1.09 versus 1.07 from the previous trading day according to data from November, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 60.73 | -2.49 |

| WTI | 55.17 | -3.07 |

| Silver | 17.12 | 0.65 |

| Gold | 1472.205 | 0.06 |

| Palladium | 1761.98 | 1.46 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -124.11 | 23292.65 | -0.53 |

| Hang Seng | 412.71 | 27093.8 | 1.55 |

| KOSPI | -7.45 | 2153.24 | -0.34 |

| ASX 200 | 47.4 | 6814.2 | 0.7 |

| FTSE 100 | 16.1 | 7323.8 | 0.22 |

| DAX | 14.11 | 13221.12 | 0.11 |

| Dow Jones | -102.2 | 27934.02 | -0.36 |

| S&P 500 | -1.85 | 3120.18 | -0.06 |

| NASDAQ Composite | 20.72 | 8570.66 | 0.24 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.68271 | 0.28 |

| EURJPY | 120.235 | -0.07 |

| EURUSD | 1.10775 | 0.06 |

| GBPJPY | 140.299 | -0.31 |

| GBPUSD | 1.29257 | -0.19 |

| NZDUSD | 0.64304 | 0.53 |

| USDCAD | 1.32658 | 0.47 |

| USDCHF | 0.9904 | 0.1 |

| USDJPY | 108.535 | -0.12 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.