- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-08-2014

(raw materials / closing price /% change)

Light Crude 96.40 +0.34%

Gold 1,292.50 -0.21%

(index / closing price / change items /% change)

Nikkei 225 15,454.45 +4.66 +0.03%

Hang Seng 25,159.76 +36.81 +0.15%

Shanghai Composite 2,240.21 -5.12 -0.23%

FTSE 100 6,755.48 -23.83 -0.35%

CAC 40 4,240.79 -13.66 -0.32%

Xetra DAX 9,314.57 -19.71 -0.21%

S&P 500 1,986.51 +4.91 +0.25%

NASDAQ 4,526.48 -1.03 -0.02%

Dow Jones 16,979.13 +59.54 +0.35%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3257 -0,45%

GBP/USD $1,6593 -0,13%

USD/CHF Chf0,9134 +0,46%

USD/JPY Y103,70 +0,75%

EUR/JPY Y137,48 +0,31%

GBP/JPY Y172,05 +0,62%

AUD/USD $0,9284 -0,13%

NZD/USD $0,8366 -0,66%

USD/CAD C$1,0968 +0,26%

(time / country / index / period / previous value / forecast)

00:00 Australia Conference Board Australia Leading Index June +0.2%

01:35 Japan Manufacturing PMI August 50.5 51.5

01:45 China HSBC Manufacturing PMI August 51.7 51.5

03:00 New Zealand Credit Card Spending July +7.0%

06:00 Switzerland Trade Balance July 1.38 1.91

06:58 France Manufacturing PMI August 47.8 47.9

06:58 France Services PMI August 50.4 50.3

07:28 Germany Manufacturing PMI August 52.4 51.8

07:28 Germany Services PMI August 56.7 55.5

07:58 Eurozone Manufacturing PMI August 51.8 51.4

07:58 Eurozone Services PMI August 54.2 53.6

08:30 United Kingdom Retail Sales (MoM) July +0.1% +0.4%

08:30 United Kingdom Retail Sales (YoY) July +3.6%

08:30 United Kingdom PSNB, bln July 9.5 10.1

12:00 U.S. Jackson Hole Symposium

12:30 U.S. Initial Jobless Claims August 311 299

13:45 U.S. Manufacturing PMI August 55.8 55.7

14:00 U.S. Leading Indicators July +0.3% +0.6%

14:00 U.S. Consumer confidence August -8 -9

14:00 U.S. Existing Home Sales July 5.04 5.01

14:00 U.S. Philadelphia Fed Manufacturing Survey August 23.9 20.3

Stock indices closed lower. Market participants are awaiting the release of the FOMC's minutes later in the day.

The Bank of England (BoE) released the minutes of its August meeting. Two members of the BoE's Monetary Policy Committee unexpectedly voted to hike interest rate to 0.75% from 0.5% in August. Other seven members voted to keep interest rate on hold. That was the first split in more than three years.

German producer price index decreased 0.1% in July, missing expectations for a 0.1% rise, after 0.0% in June.

On a yearly basis, German producer price index fell 0.8% in July, after a 0.7% drop in June.

Balfour Beatty Plc shares dropped 6.3% after rejecting a bid by Carillion Plc.

Carlsberg A/S shares fell 3.6% after the company lowered its full-year earnings forecast.

Heineken NV shares rose 7.9% after reporting the better-than-forecasted first-half profit.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,755.48 -23.83 -0.35%

DAX 9,314.57 -19.71 -0.21%

CAC 40 4,240.79 -13.66 -0.32%

Crude oil rose for the first time in three days as U.S. inventories declined more than expected last week. Stockpiles decreased by 4.47 million barrels in the week ended Aug. 15, the Energy Information Administration said in a weekly report. Analysts had expected a drop of 1.8 million. The refinery utilization rate rose for the first time in five weeks.

October WTI futures gained 0.25% to $93.11 a barrel on the New York Mercantile Exchange. The September contract, which expires today, rose 0.79% to $95.27.

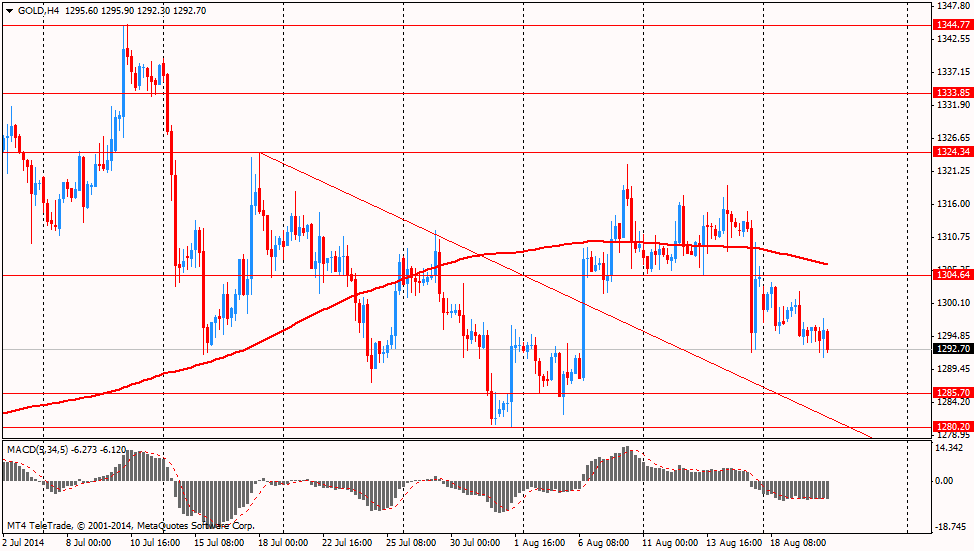

Gold fell slightly as a stronger dollar cut demand. The dollar rose before the Federal Reserve releases the minutes of its July meeting, which may give clues on when policy makers will raise borrowing costs. Fed Chair Janet Yellen will speak Aug. 22 at a central bankers' meeting in Jackson Hole, Wyoming.

Gold was under pressure as diplomatic efforts to end the conflict in Ukraine intensified as the government said forces continue to push back pro-Russian separatists in fighting in the country's east.

Gold for December delivery was little changed at $1,292.70 an ounce (-0.30%) on the Comex in New York.

The U.S. dollar traded mixed to lower against the most major currencies ahead of the FOMC's minutes. Market participants are awaiting the release of the FOMC minutes later in the day.

The greenback remained supported by yesterday's strong U.S. housing market data. Housing starts in the U.S. jumped 15.7% to 1.093 million units in July from 945,000 units in June. That was the strongest rate since November.

The number of building permits rose by 8.1% to 1.052 million units in July from 973,000 in June.

Investors also speculate that the Fed will raise interest rates much earlier than the European Central Bank.

The euro traded mixed against the U.S. dollar. German producer price index decreased 0.1% in July, missing expectations for a 0.1% rise, after 0.0% in June.

On a yearly basis, German producer price index fell 0.8% in July, after a 0.7% drop in June.

The British pound traded mixed against the U.S. dollar. The British currency was still supported by the Bank of England's minutes. The Bank of England (BoE) released the minutes of its August meeting. Two members of the BoE's Monetary Policy Committee unexpectedly voted to hike interest rate to 0.75% from 0.5%. Other seven members voted to keep interest rate on hold. That was the first split in more than three years.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance jumped to +11% in August from +2% in July, exceeding expectations for a climb to +4%.

The Canadian dollar traded mixed against the U.S. dollar after Canadian wholesale sales. Canadian wholesale sales increased 0.6% in June, missing expectations for a 1.3% gain, after a 2.3% rise in May. May's figure was revised up from a 2.2% increase.

The New Zealand dollar fell against the U.S dollar due to the strong U.S. currency, but later recovered a part of its losses. No major economic reports were released in New Zealand.

The Australian dollar decreased against the U.S. dollar after comments by Reserve Bank of Australia Governor Glenn Stevens, but later recovered its losses. Mr Stevens told the House Economics Committee in Brisbane that the Aussie remains high because Australia is more attractive for international investors than other countries. He added that the Australian currency will "go down at some point", but he doesn't know when. The RBA governor said there is no need in intervention.

Australia's leading index declined 0.1% in June, after a 0.1% rise in May.

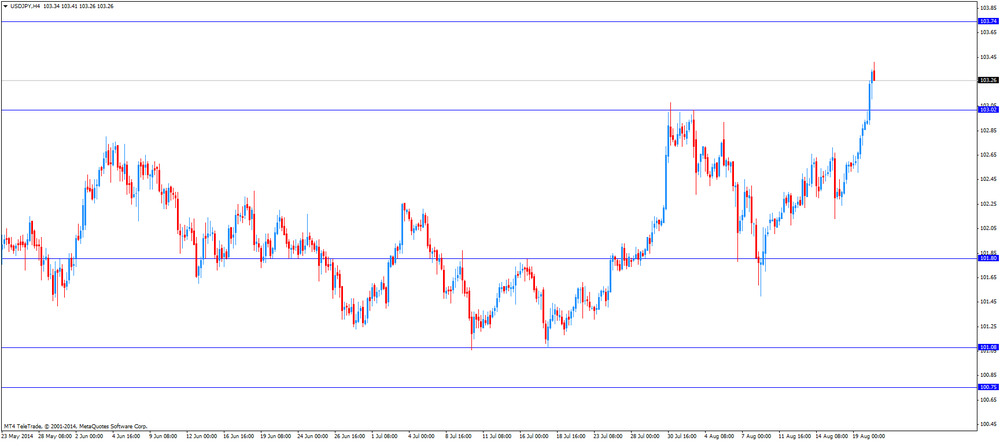

The Japanese yen traded lower against the U.S. dollar after the weaker-than-expected economic data from Japan. Japan's adjusted trade deficit declined to 1,023.8 billion yen in July from a deficit of 1,067.8 in June, missing expectations for a fall to a deficit of 770 billion yen. June's figure was revised up from a deficit of 1,080.8 billion yen.

Japan's all industry activity index fell 0.4% in June, missing expectations for a 0.2% decline, after a 0.6% increase in May.

The Reserve Bank of Australia (RBA) Governor Glenn Stevens told the House Economics Committee in Brisbane:

- The Aussie remains high because Australia is more attractive for international investors than other countries;

- The Australian currency will "go down at some point", but he doesn't know when;

- There is no need in intervention;

- There had been improvement in employment growth this year and a strengthening of leading indicators;

- The growth of Australian economy is expected to be between 2% and 3% through June 2015.

EUR/USD $1.3250(E325mn), $1.3350-55(E225mn), $1.3400(E461mn)

USD/JPY Y102.00($250mn), Y102.50($450mn), Y102.75-80($200mn), Y103.00($985mn)

EUR/JPY Y136.65(E184mn)

GBP/USD $1.6650(stg184mn)

USD/CHF Chf0.9100($440mn)

AUD/USD $0.9225(A$149mn), $0.9335(A$149mn)

USD/CAD C$1.0880($276mn), C$1.0900($130mn)

U.S. stock futures were little changed as Lowe's and Target Corp. reduced its revenue projection for this year and investors awaited minutes from the Federal Reserve's last meeting.

Global markets:

Nikkei 15,454.45 +4.66 +0.03%

Hang Seng 25,159.76 +36.81 +0.15%

Shanghai Composite 2,240.21 -5.12 -0.23%

FTSE 6,750.06 -29.25 -0.43%

CAC 4,226.33 -28.12 -0.66%

DAX 9,270.52 -63.76 -0.68%

Crude oil $95.23 (+0.84%)

Gold $1297.20 (+0.03%)

(company / ticker / price / change, % / volume)

| Goldman Sachs | GS | 174.00 | +0.02% | 0.1K |

| Visa | V | 215.00 | 0.00% | 0.3K |

| Boeing Co | BA | 125.54 | -0.03% | 0.9K |

| 3M Co | MMM | 143.34 | -0.04% | 0.6K |

| International Business Machines Co... | IBM | 189.97 | -0.05% | 1.4K |

| Microsoft Corp | MSFT | 45.30 | -0.07% | 7.8K |

| United Technologies Corp | UTX | 108.48 | -0.07% | 0.9K |

| AT&T Inc | T | 34.45 | -0.09% | 2.2K |

| Exxon Mobil Corp | XOM | 99.40 | -0.09% | 1.2K |

| Walt Disney Co | DIS | 90.00 | -0.10% | 6.5K |

| UnitedHealth Group Inc | UNH | 83.38 | -0.11% | 0.2K |

| McDonald's Corp | MCD | 94.35 | -0.11% | 0.3K |

| Verizon Communications Inc | VZ | 48.64 | -0.12% | 2.3K |

| American Express Co | AXP | 88.00 | -0.14% | 4.1K |

| The Coca-Cola Co | KO | 41.20 | -0.15% | 1.1K |

| Cisco Systems Inc | CSCO | 24.60 | -0.16% | 0.3K |

| Nike | NKE | 78.37 | -0.18% | 0.4K |

| General Electric Co | GE | 26.00 | -0.19% | 1.0K |

| Intel Corp | INTC | 34.25 | -0.26% | 2.4K |

| JPMorgan Chase and Co | JPM | 57.40 | -0.28% | 0.4K |

| Pfizer Inc | PFE | 28.85 | -0.31% | 6.2K |

| Home Depot Inc | HD | 87.93 | -0.34% | 4.1K |

| Wal-Mart Stores Inc | WMT | 74.20 | -0.91% | 1.3K |

Upgrades:

Downgrades:

Other:

Home Depot (HD) target raised to $100 from $95 at Argus

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Leading Index June +0.1% -0.1%

04:30 Japan All Industry Activity Index, m/m June +0.6% -0.2% -0.4%

06:00 Germany Producer Price Index (MoM) July 0.0% +0.1% -0.1%

06:00 Germany Producer Price Index (YoY) July -0.7% -0.8%

08:30 United Kingdom Bank of England Minutes

10:00 United Kingdom CBI industrial order books balance August 2 4 11

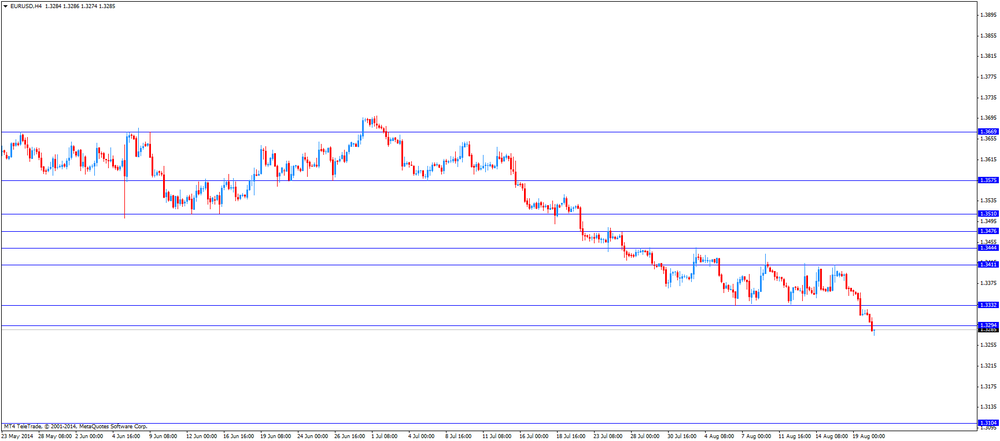

The U.S. dollar traded higher against the most major currencies ahead of the FOMC's minutes. Market participants are awaiting the release of the FOMC minutes later in the day.

The greenback remained supported by yesterday's strong U.S. housing market data. Housing starts in the U.S. jumped 15.7% to 1.093 million units in July from 945,000 units in June. That was the strongest rate since November.

The number of building permits rose by 8.1% to 1.052 million units in July from 973,000 in June.

Investors also speculate that the Fed will raise interest rates much earlier than the European Central Bank.

The euro traded declined against the U.S. dollar due to speculation that the Fed will raise interest rates much earlier than the European Central Bank.

German producer price index decreased 0.1% in July, missing expectations for a 0.1% rise, after 0.0% in June.

On a yearly basis, German producer price index fell 0.8% in July, after a 0.7% drop in June.

The British pound rose against the U.S. dollar after the Bank of England's minutes. The Bank of England (BoE) released the minutes of its August meeting. Two members of the BoE's Monetary Policy Committee unexpectedly voted to hike interest rate to 0.75% from 0.5%. Other seven members voted to keep interest rate on hold. That was the first split in more than three years.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance jumped to +11% in August from +2% in July, exceeding expectations for a climb to +4%.

The Canadian dollar traded mixed against the U.S. dollar ahead of Canadian wholesale sales. Canadian wholesale sales are expected to increase 1.3% in June, after a 2.2% gain in May.

EUR/USD: the currency pair fell to $1.3274

GBP/USD: the currency pair rose to $1.6678

USD/JPY: the currency pair increase to Y103.41

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m June +2.2% +1.3%

18:00 U.S. FOMC meeting minutes

EUR/USD

Offers $1.3485, $1.3445, $1.3415, $1.3400, $1.3370, $1.3325

Bids $1.3250, $1.3230, $1.3200

GBP/USD

Offers $1.6845, $1.6800/10, $1.6750, $1.6680

Bids $1.6600, $1.6555, $1.6510

AUD/USD

Offers $0.9400, $0.9370, $0.9350, $0.9315

Bids $0.9260, $0.9240, $0.9220, $0.9200

EUR/JPY

Offers Y138.20, Y138.00, Y137.60

Bids Y136.75, Y136.50, Y136.25/20

USD/JPY

Offers Y104.10, Y104.00, Y103.50, Y103.40

Bids Y102.70, Y102.30, Y102.15, Y102.00, Y101.50

EUR/GBP

Offers stg0.8100, stg0.8035

Bids stg0.7980, stg0.7950/40, stg0.7900

Stock indices traded lower ahead of the FOMC's minutes. Market participants are awaiting the release of the FOMC minutes later in the day.

The Bank of England (BoE) released the minutes of its August meeting. Two members of the BoE's Monetary Policy Committee unexpectedly voted to hike interest rate to 0.75% from 0.5%. Other seven members voted to keep interest rate on hold. That was the first split in more than three years.

German producer price index decreased 0.1% in July, missing expectations for a 0.1% rise, after 0.0% in June.

On a yearly basis, German producer price index fell 0.8% in July, after a 0.7% drop in June.

Balfour Beatty Plc shares dropped 7.2% after rejecting a bid by Carillion Plc.

Heineken NV shares rose 7% after reporting the better-than-forecasted first-half profit.

Current figures:

Name Price Change Change %

FTSE 100 6,751.1 -28.21 -0.42%

DAX 9,300.61 -33.67 -0.36%

CAC 40 4,241.91 -12.54 -0.29%

The Bank of England (BoE) released the minutes of its August meeting. Two members (Martin Weale and Ian McCafferty) of the BoE's Monetary Policy Committee unexpectedly voted to hike interest rate to 0.75% from 0.5%. Other seven members voted to keep interest rate on hold. That was the first split in more than three years.

Investors expect that the Bank of England will raise its interest rate in the earlier 2015. The main reason for the delay could be the weaker wage growth. The average earnings index, including bonuses, dropped by 0.2% in the three months to June, missing expectations for a 0.1% decrease, after a 0.4% rise in the three months to May. That was first negative average earnings index since March-May 2009.

But the BoE Governor Mark Carney said on Sunday that the Bank of England don't need to wait for wage growth to rise its interest rate.

Most Asian stock indices closed higher due to yesterday's strong U.S. housing market data. Housing starts in the U.S. jumped 15.7% to 1.093 million units in July from 945,000 units in June. That was the strongest rate since November.

The number of building permits rose by 8.1% to 1.052 million units in July from 973,000 in June.

Japan's adjusted trade deficit declined to 1,023.8 billion yen in July from a deficit of 1,067.8 in June, missing expectations for a fall to a deficit of 770 billion yen. June's figure was revised up from a deficit of 1,080.8 billion yen.

Japan's all industry activity index fell 0.4% in June, missing expectations for a 0.2% decline, after a 0.6% increase in May.

BHP Billiton Ltd. shares dropped 3.9% after announcing a spinoff and refraining from a share buyback.

Indexes on the close:

Nikkei 225 15,454.45 +4.66 +0.03%

Hang Seng 25,159.76 +36.81 +0.15%

Shanghai Composite 2,240.21 -5.12 -0.23%

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Leading Index June +0.1% -0.1%

04:30 Japan All Industry Activity Index, m/m June +0.6% -0.2% -0.4%

06:00 Germany Producer Price Index (MoM) July 0.0% +0.1% -0.1%

06:00 Germany Producer Price Index (YoY) July -0.7% -0.8%

08:30 United Kingdom Bank of England Minutes

The U.S. dollar traded higher against the most major currencies. The greenback was supported by yesterday's U.S. housing market data. Housing starts in the U.S. jumped 15.7% to 1.093 million units in July from 945,000 units in June. That was the strongest rate since November.

The number of building permits rose by 8.1% to 1.052 million units in July from 973,000 in June.

The New Zealand dollar traded lower against the U.S dollar due to the strong U.S. currency. No major economic reports were released in New Zealand.

The Australian dollar traded lower against the U.S. dollar after comments by Reserve Bank of Australia Governor Glenn Stevens. Mr Stevens told the House Economics Committee in Brisbane that the Aussie remains high because Australia is more attractive for international investors than other countries. He added that the Australian currency will "go down at some point", but he doesn't know when. The RBA governor said there is no need in intervention.

Australia's leading index declined 0.1% in June, after a 0.1% rise in May.

The Japanese yen traded lower against the U.S. dollar after the weaker-than-expected economic data from Japan. Japan's adjusted trade deficit declined to 1,023.8 billion yen in July from a deficit of 1,067.8 in June, missing expectations for a fall to a deficit of 770 billion yen. June's figure was revised up from a deficit of 1,080.8 billion yen.

Japan's all industry activity index fell 0.4% in June, missing expectations for a 0.2% decline, after a 0.6% increase in May.

EUR/USD: the currency pair declined to $1.3300

GBP/USD: the currency pair fell to $1.6600

USD/JPY: the currency pair increased to Y103.26

The most important news that are expected (GMT0):

10:00 United Kingdom CBI industrial order books balance August 2 4

12:30 Canada Wholesale Sales, m/m June +2.2% +1.3%

18:00 U.S. FOMC meeting minutes

Asian stocks fell after valuations reached the highest level this year and as BHP Billiton Ltd. (BHP) slumped, dragging materials shares to the largest decline on the regional gauge.

U.S. inflation weakened to the slowest pace in five months in July, holding below the Federal Reserve's target. Minutes of the Fed's July 29-30 meeting, when the stimulatory bond-buying program was reduced by $10 billion for a sixth time, are released today and Fed Chair Janet Yellen will speak to global central bankers later this week.

QBE climbed 5.6 percent to A$11.31, the most since May 2013. The Australian insurer's share sale and debt refinancing will raise about $1.5 billion, Chief Executive Officer John Neal said on a call with reporters yesterday.

BHP Billiton lost 3.9 percent to A$38.13 after yesterday announcing it's poised for the biggest spinoff in the mining industry, separating aluminum, coal and silver assets to create a company valued around $15 billion after it begins trading next year. BHP's London-listed shares fell the most in almost three years. A decision to skip a widely anticipated share purchase will disappoint investors, who had expected a $3 billion buyback, Citigroup Inc. said.

Coca-Cola Amatil Ltd. lost 2.1 percent to A$9.54 in Sydney after flagging a second consecutive drop in full-year earnings amid weak consumer confidence and rising costs in Indonesia.

Nikkei 225 15,454.45 +4.66 +0.03%

Hang Seng 25,137.26 +14.31 +0.06%

S&P/ASX 200 5,634.6 +10.83 +0.19%

Shanghai Composite 2,240.21 -5.12 -0.23%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3372 (758)

$1.3341 (53)

$1.3323 (27)

Price at time of writing this review: $ 1.3306

Support levels (open interest**, contracts):

$1.3293 (5069)

$1.3274 (4689)

$1.3249 (4725)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 55021 contracts, with the maximum number of contracts with strike price $1,3400 (6230);

- Overall open interest on the PUT options with the expiration date September, 5 is 61068 contracts, with the maximum number of contracts with strike price $1,3100 (6361);

- The ratio of PUT/CALL was 1.11 versus 1.10 from the previous trading day according to data from August, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.6901 (2418)

$1.6801 (1821)

$1.6703 (518)

Price at time of writing this review: $1.6605

Support levels (open interest**, contracts):

$1.6497 (1805)

$1.6399 (734)

$1.6300 (643)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 27685 contracts, with the maximum number of contracts with strike price $1,7000 (2771);

- Overall open interest on the PUT options with the expiration date September, 5 is 29220 contracts, with the maximum number of contracts with strike price $1,6800 (4032);

- The ratio of PUT/CALL was 1.06 versus 1.07 from the previous trading day according to data from August, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.