- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-06-2014

Most stock declined due to the weaker-than-expected consumer confidence in the Eurozone. Eurozone's consumer confidence dropped to -7.4 in June, missing expectations for an increase to -6, after -7 in May.

Concerns over escalating violence in Iraq also weighed on stock markets.

Eurozone's current account surplus increased to 21.5 billion euros in April from 19.6 billion euros in March. March's figure was revised up from 18.8 billion dollar.

The U.K. public sector net borrowing increased to £11.48 billion in May, from £9.00 billion in April. April's figure was revised from £9.6 billion. Analysts had expected a rise to £11.8 billion.

German producer price index declined 0.2% in May, missing expectations for a 0.2% rise, after a 0.1% fall in April. On a yearly basis, German producer price index dropped 0.8% in May, after a 0.9% decline in April. Analysts had expected a 0.7% fall.

Shire Plc rose 17% after AbbVie Inc. said Shire rejected a bid of as much as 27.3 billion pounds.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,825.2 +17.09 +0.25%

DAX 9,987.24 -16.76 -0.17%

CAC 40 4,541.34 -21.70 -0.48%

The U.S. dollar traded higher against the most major currencies. The U.S. currency recovered a part of its losses after the Fed's interest decision. The Fed pointed out that interest rates will remain unchanged for a considerable time after the Fed's asset purchase program ends.

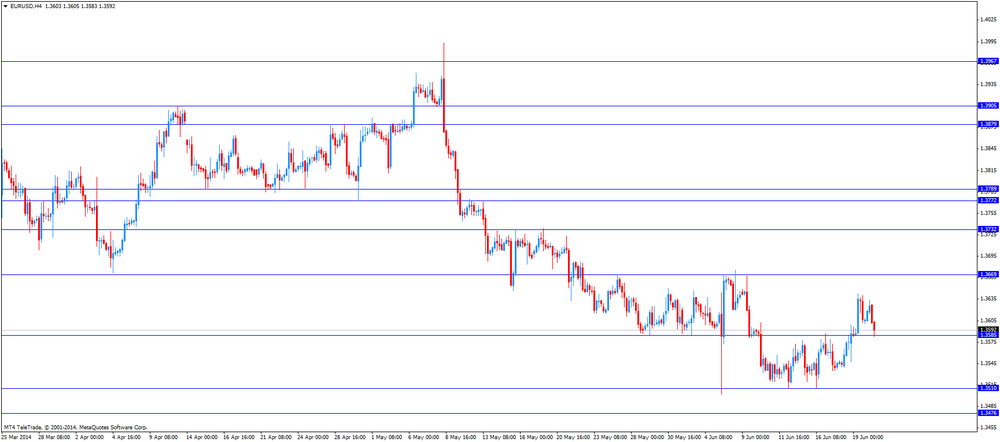

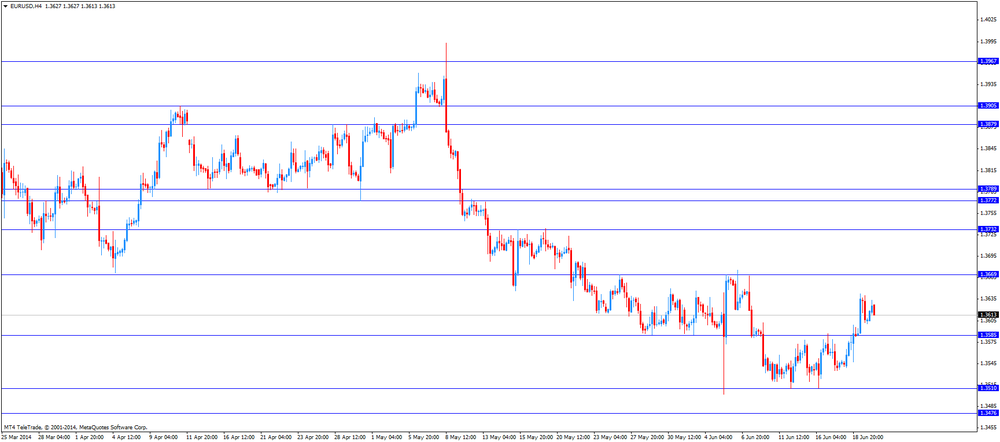

The euro traded lower against the U.S. dollar after of the consumer confidence in the Eurozone. Eurozone's consumer confidence dropped to -7.4 in June, missing expectations for an increase to -6, after -7 in May.

Eurozone's current account surplus increased to 21.5 billion euros in April from 19.6 billion euros in March. March's figure was revised up from 18.8 billion dollar.

German producer price index declined 0.2% in May, missing expectations for a 0.2% rise, after a 0.1% fall in April. On a yearly basis, German producer price index dropped 0.8% in May, after a 0.9% decline in April. Analysts had expected a 0.7% fall.

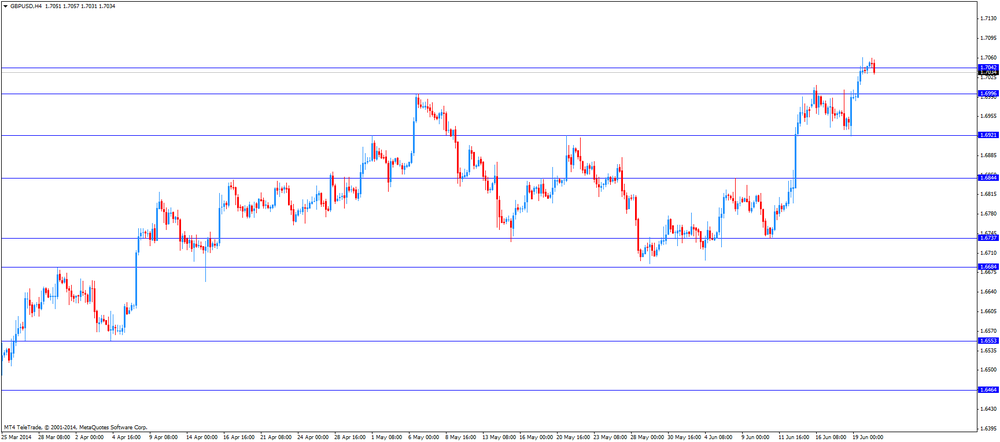

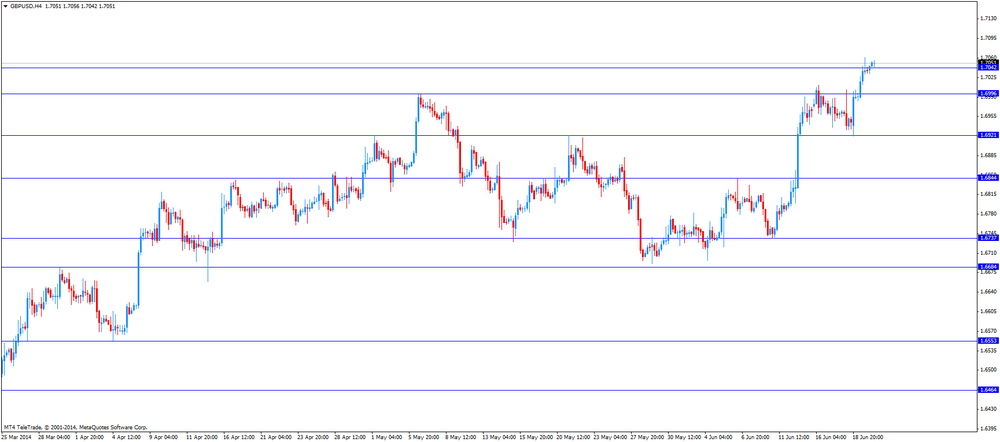

The British pound traded lower against the U.S. dollar after the U.K. economic data. The U.K. public sector net borrowing increased to £11.48 billion in May, from £9.00 billion in April. April's figure was revised from £9.6 billion. Analysts had expected a rise to £11.8 billion.

The Canadian dollar rose against the U.S. dollar ahead of the Canadian consumer inflation and retail sales. Retails sales in Canada increased 1.1% in April, exceeding expectations for a 0.4% gain, after a 0.1% increase in March. March's figure was revised up from a 0.1% fall.

The Canadian core retail sales excluding automobiles rose 0.7% in April, exceeding expectations for a 0.4% rise, after 0.2% gain in March. March's figure was revised up from a 0.1% rise.

The consumer price inflation in Canada increased 0.5% in May, exceeding expectations for a 0.2% gain, after a 0.3% rise in April. On a yearly basis, the Canadian consumer price index increased 2.3% in May, beating expectations for a 2.1 gain, after a 2.0% rise in April.

The core consumer price index in Canada climbed 0.5% in May, beating expectations for a 0.2% rise, after a 0.2% gain in April. On a yearly basis, the Canadian core consumer price index rose 1.7% in May, exceeding expectations for a 1.5% increase, after a 1.4% rise in April.

The New Zealand dollar declined against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports in Australia.

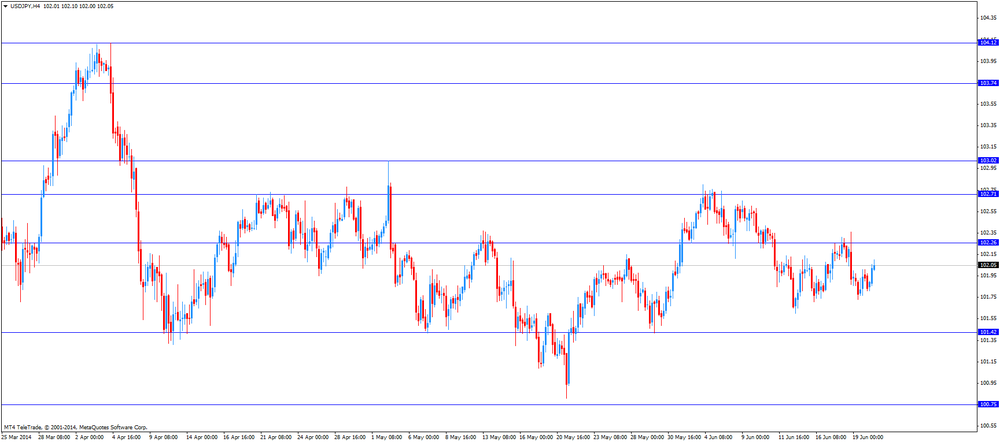

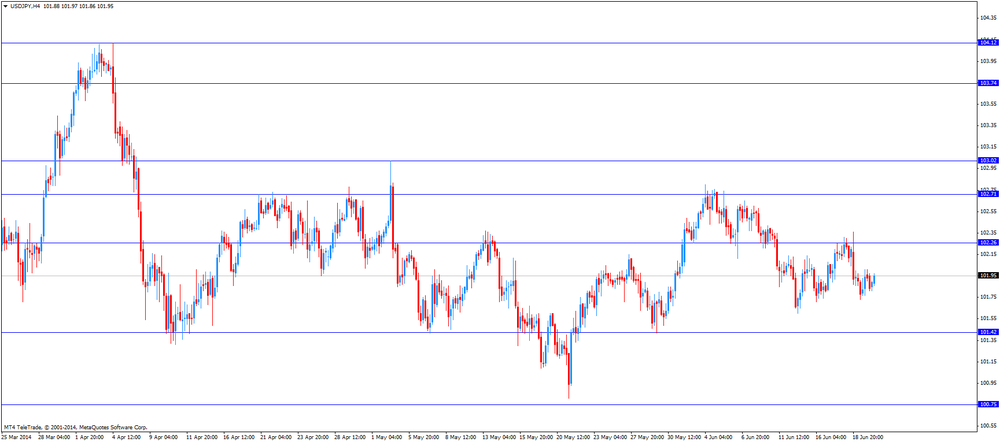

The Japanese yen decreased against the U.S. dollar. The Bank of Japan Governor Haruhiko Kuroda said at the annual meeting of the National Association of Shinkin Banks in Tokyo on Friday that Japan's economy has continued to recover moderately and the easing would continue until the 2% inflation target was reached. He added that the BoJ could make adjustments to hit the 2% target if required.

Mr. Kuroda pointed out the BoJ could introduce additional stimulus measures should Japan's economic activity and prices deviate from the baseline recovery scenario.

Brent oil prices fell slightly today, but continued to be held near the level of $ 115 per barrel, near nine-month high, which is associated with an increased risk of supply disruptions from Iraq due to fighting between government forces and Sunni insurgents.

"The events unfolding in Iraq will continue to dictate the direction of the market and maintain oil prices at a high level", - said Barbara Lambrecht, an analyst at Commerzbank. Recall that in the last month, Iraq produced about 3.5 million barrels of oil per day, in connection with what is the 2nd largest producer of OPEC after Saudi Arabia.

It is worth noting that the Iraqi army is trying to discourage Sunni militants in the country's largest refinery with capacity of 300,000 barrels per day. If the plant does not resume work soon, Baghdad would have to increase imports of petroleum products. Fighting until they reached the south of Iraq, where most of the country's largest oil fields and export terminals, but foreign oil companies take out staff from the country.

U.S. President Barack Obama has sent to Iraq to 300 military advisers and said he was ready to "target" military action if the need arises. However, he said that American troops will not return to Iraq.

Meanwhile, markets are still considering the application of the Federal Reserve System, in which there is no indication of when interest rates may rise. In addition, the Fed forecast a rate hike in the long run declined from 4% to 3.75%. Central Bank decided to reduce its purchases of bonds by $ 10 billion a month to $ 35 billion, saying the U.S. economy is showing "quite steady growth" to continue the reduction program.

Cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 106.49 per barrel on the New York Mercantile Exchange (NYMEX).

August futures price for North Sea Brent crude oil mixture fell $ 0.20 to $ 114.68 a barrel on the London exchange ICE Futures Europe.

Gold prices declined during the first half of today's trading, but then began to recover, allowing return to 9-week high.

Experts note that the projections from the Federal Reserve on interest rates increased the demand for the metal as a hedge against inflation.

The Fed noted that the rates will not be raised further for some time. Some investors had hoped that the Fed will bring little time rate increase and against this background sold gold. No aggressive action by the Fed and encouraged investors to gold. Now, even the good macroeconomic data for the U.S. investors will be treated differently.

"Despite such a strong push market, it is worth noting that the prospects of" bulls "in this market is not too happy. Lack of physical demand for gold provides a "ceiling" prices ", - said the expert Wild Bear Capital.

As demand for the precious metal as a safe haven risen since the Iraqi army fighting with Sunni Islamist militants are still going on Friday.

U.S. President Barack Obama said Thursday that he was sending 300 U.S. military advisers in Iraq and is ready to take military action in the target if necessary.

Meanwhile, we add that the physical market demand for gold was weak. According to traders, a slight increase in demand earlier this week was offset by increases in prices on Thursday.

The cost of the August gold futures on the COMEX today rose to $ 1316.0 per ounce.

Statistics Canada released retail sales. The retails sales in Canada increased 1.1% in April, exceeding expectations for a 0.4% gain, after a 0.1% increase in March. March's figure was revised up from a 0.1% fall. That was the first increase in 5 months.

Motor vehicle and parts sales increased 2.4%. That was the biggest gain.

The Canadian Core retail sales excluding automobiles rose 0.7% in April, exceeding expectations for a 0.4% rise, after 0.2% gain in March. March's figure was revised up from a 0.1% rise.

EUR/USD $1.3500, $1.3550, $1.3570, $1.3590, $1.3600, $1.3625/30, $1.3635, $1.3650, $1.3670, $1.3700

USD/JPY Y101.00, Y101.20, Y101.50, Y101.70, Y102.00

GBP/USD $1.6925

USD/CAD Cad1.0820, Cad1.0835, Cad1.0840, Cad1.0850

USD/CHF Chf0.8920, Chf0.8925, Chf0.9025

EUR/CHF Chf1.2160, Chf1.2210

NZD/USD NZ$0.8755

U.S. stock futures were little changed amid optimism that the economic recovery will accelerate.

Global markets:

Nikkei 15,361.16 +245.36 +1.62%

Hang Seng 23,167.73 -13.99 -0.06%

Shanghai Composite 2,023.73 -31.78 -1.55%

FTSE 6,827.86 +49.30 +0.73%

CAC 4,575.92 +45.55 +1.01%

DAX 10,015.48 +85.15 +0.86%

Crude oil $107.03 (+0.56%)

Gold $1313.50 (-0.05%)

(company / ticker / price / change, % / volume)

| Exxon Mobil Corp | XOM | 102,95 | 0,31% | 12.6K |

| Pfizer Inc | PFE | 29,67 | 0,27% | 0.3K |

| Johnson & Johnson | JNJ | 104,07 | 0,25% | 1.7K |

| AT&T Inc | T | 35,44 | 0,23% | 11.4K |

| Boeing Co | BA | 133 | 0,14% | 0.2K |

| The Coca-Cola Co | KO | 41,84 | 0,12% | 0.2K |

| General Electric Co | GE | 26,96 | 0,11% | 30.6K |

| Verizon Communications Inc | VZ | 49,52 | 0,10% | 31.6K |

| JPMorgan Chase and Co | JPM | 57,35 | 0,09% | 9.8K |

| Home Depot Inc | HD | 80,5 | 0,07% | 0.7K |

| Merck & Co Inc | MRK | 58,31 | 0,02% | 1.0K |

| Chevron Corp | CVX | 132 | 0,01% | 0.5K |

| Microsoft Corp | MSFT | 41,51 | 0,00% | 0.6K |

| Procter & Gamble Co | PG | 80,24 | 0,00% | 1.1K |

| Cisco Systems Inc | CSCO | 24,7 | -0,04% | 51.4K |

| International Business Machines Co... | IBM | 182,6 | -0,12% | 1.4K |

| Intel Corp | INTC | 30.04 | -0,17% | 0.2K |

Retails sales in Canada increased 1.1% in April, exceeding expectations for a 0.4% gain, after a 0.1% increase in March. March's figure was revised up from a 0.1% fall.

The Canadian core retail sales excluding automobiles rose 0.7% in April, exceeding expectations for a 0.4% rise, after 0.2% gain in March. March's figure was revised up from a 0.1% rise.

The consumer price inflation in Canada increased 0.5% in May, exceeding expectations for a 0.2% gain, after a 0.3% rise in April.

The core consumer price index in Canada climbed 0.5% in May, beating expectations for a 0.2% rise, after a 0.2% gain in April.

EUR/USD

Offers $1.3695/00, $1.3688, $1.3670/80, $1.3650

Bids $1.3600, $1.3580, $1.3550, $1.3535, $1.3515/10

GBP/USD

Offers $1.7110/20, $1.7090, $1.7080/85

Bids $1.7000, $1.6980, $1.6950, $1.6910/00

AUD/USD

Offers $0.9500, $0.9450, $0.9440

Bids $0.9380, $0.9350, $0.9320

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y139.00

Bids Y138.50, Y138.20, Y138.00

USD/JPY

Offers Y102.75/80, Y102.50

Bids Y101.70, Y101.50, Y101.00

EUR/GBP

Offers stg0.8100, stg0.8080, stg0.8050, stg0.8035/40, stg0.8000

Bids stg0.7950, stg0.7900

Economic calendar (GMT0):

06:00 Germany Producer Price Index (MoM) May -0.1% +0.2% -0.2%

06:00 Germany Producer Price Index (YoY) May -0.9% -0.7% -0.8%

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

08:00 Eurozone Current account, adjusted, bln April 18.8 19.4 21.5

08:30 United Kingdom PSNB, bln May 9.6 11.8 11.5

09:00 Eurozone ECOFIN Meetings

The U.S. dollar traded higher against the most major currencies. The Fed's interest decision on Wednesday still weighed on the U.S. currency. The Fed pointed out that interest rates will remain unchanged for a considerable time after the Fed's asset purchase program ends.

The euro declined against the U.S. dollar ahead of the consumer confidence in the Eurozone. Eurozone's consumer confidence should increase to -6 in June, after -7 in May.

Eurozone's current account surplus increased to 21.5 billion euros in April from 19.6 billion euros in March. March's figure was revised up from 18.8 billion dollar.

German producer price index declined 0.2% in May, missing expectations for a 0.2% rise, after a 0.1% fall in April. On a yearly basis, German producer price index dropped 0.8% in May, after a 0.9% decline in April. Analysts had expected a 0.7% fall.

The British pound traded lower against the U.S. dollar after the U.K. economic data. The U.K. public sector net borrowing increased to £11.48 billion in May, from £9.00 billion in April. April's figure was revised from £9.6 billion. Analysts had expected a rise to £11.8 billion.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian consumer inflation and retail sales. The consumer price index in Canada should climb 0.2% in May, after a 0.3% gain in April. The Canadian core consumer price index should increase 0.2% in May.

The retail sales in Canada should rise 0.4% in April, after a 0.1% decline in March.

EUR/USD: the currency pair declined to $1.3583

GBP/USD: the currency pair decreased to $1.7031

USD/JPY: the currency pair was up to Y102.10

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m April -0.1% +0.4%

12:30 Canada Retail Sales ex Autos, m/m April +0.1% +0.4%

12:30 Canada Consumer Price Index m / m May +0.3% +0.2%

12:30 Canada Consumer price index, y/y May +2.0% +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m May +0.2% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y May +1.4% +1.5%

14:00 Eurozone Consumer Confidence June -7 -6

Stock indices traded slightly higher. The Fed's comments on Wednesday still supported the stock markets. The Fed pointed out that interest rates will remain unchanged for a considerable time after the Fed's asset purchase program ends.

But concerns over escalating violence in Iraq weighed on stock markets.

Eurozone's current account surplus increased to 21.5 billion euros in April from 19.6 billion euros in March. March's figure was revised up from 18.8 billion dollar.

The U.K. public sector net borrowing increased to £11.48 billion in May, from £9.00 billion in April. April's figure was revised from £9.6 billion. Analysts had expected a rise to £11.8 billion.

German producer price index declined 0.2% in May, missing expectations for a 0.2% rise, after a 0.1% fall in April. On a yearly basis, German producer price index dropped 0.8% in May, after a 0.9% decline in April. Analysts had expected a 0.7% fall.

Shire Plc rose 13% after AbbVie Inc. said Shire rejected a bid of as much as 27.3 billion pounds.

Current figures:

Name Price Change Change %

FTSE 100 6,828.72 +20.61 +0.30%

DAX 10,017.43 +13.43 +0.13%

CAC 40 4,563.28 +0.24 +0.01%

The Bank of Japan Governor Haruhiko Kuroda said at the annual meeting of the National Association of Shinkin Banks in Tokyo on Friday:

- Japan's economy has continued to recover moderately and the easing would continue until the 2% inflation target was reached;

- The BoJ could make adjustments to hit the 2% target if required;

- Japan's economy is expected to continue a moderate recovery;

- The BoJ could introduce additional stimulus measures should Japan's economic activity and prices deviate from the baseline recovery scenario;

- The annual consumer inflation should accelerate in or after October;

- The 2% target should be reached during fiscal 2015.

Asian stock traded mixed in the absence of any major economic reports. Markets were subdued in lacklustre trading. Investors monitor closely events unfolding in Iraq.

The Bank of Japan Governor Haruhiko Kuroda said at the annual meeting of the National Association of Shinkin Banks in Tokyo on Friday that Japan's economy has continued to recover moderately and the easing would continue until the 2% inflation target was reached. He added that the BoJ could make adjustments to hit the 2% target if required.

Mr. Kuroda pointed out the BoJ could introduce additional stimulus measures should Japan's economic activity and prices deviate from the baseline recovery scenario.

Indexes on the close:

Nikkei 225 15,349.42 -11.74 -0.08%

Hang Seng 23,194.06 +26.33 +0.11%

Shanghai Composite 2,026.67 +2.94 +0.15%

HTC Corp. shares rose 2.3% in Taipei after the company's Chief Executive Officer Peter Chou said he is seeing improvement from the second quarter.

Isuzu Motors Ltd. increased 3.6% in Tokyo after JPMorgan Chase & Co. recommended the company's shares.

EUR/USD $1.3500, $1.3550, $1.3570, $1.3590, $1.3600, $1.3625/30, $1.3635, $1.3650, $1.3670, $1.3700

USD/JPY Y101.00, Y101.20, Y101.50, Y101.70, Y102.00

GBP/USD $1.6925

USD/CAD Cad1.0820, Cad1.0835, Cad1.0840, Cad1.0850

USD/CHF Chf0.8920, Chf0.8925, Chf0.9025

EUR/CHF Chf1.2160, Chf1.2210

NZD/USD NZ$0.8755

Economic calendar (GMT0):

06:00 Germany Producer Price Index (MoM) May -0.1% +0.2% -0.2%

06:00 Germany Producer Price Index (YoY) May -0.9% -0.7% -0.8%

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

08:00 Eurozone Current account, adjusted, bln April 18.8 19.4 21.5

08:30 United Kingdom PSNB, bln May 9.6 11.8 11.5

The U.S. dollar traded slightly lower against the most major currencies. The U.S. currency remained under pressure due to Fed's comments that interest rates in the U.S. will remain unchanged for a considerable time after the Fed's asset purchase program ends.

Escalating violence in Iraq also weighed on the U.S. currency.

The New Zealand dollar traded slightly higher against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen traded mixed against the U.S. dollar. The Bank of Japan Governor Haruhiko Kuroda said at the annual meeting of the National Association of Shinkin Banks in Tokyo on Friday that Japan's economy has continued to recover moderately and the easing would continue until the 2% inflation target was reached. He added that the BoJ could make adjustments to hit the 2% target if required.

Mr. Kuroda pointed out the BoJ could introduce additional stimulus measures should Japan's economic activity and prices deviate from the baseline recovery scenario.

EUR/USD: the currency pair increased to $1.3625

GBP/USD: the currency pair climbed to $1.7050

USD/JPY: the currency pair declined to Y101.80

The most important news that are expected (GMT0):

09:00 Eurozone ECOFIN Meetings

12:30 Canada Retail Sales, m/m April -0.1% +0.4%

12:30 Canada Retail Sales ex Autos, m/m April +0.1% +0.4%

12:30 Canada Consumer Price Index m / m May +0.3% +0.2%

12:30 Canada Consumer price index, y/y May +2.0% +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m May +0.2% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y May +1.4% +1.5%

14:00 Eurozone Consumer Confidence June -7 -6

EUR / USD

Resistance levels (open interest**, contracts)

$1.3687 (2397)

$1.3661 (3456)

$1.3642 (1808)

Price at time of writing this review: $ 1.3630

Support levels (open interest**, contracts):

$1.3605 (1774)

$1.3574 (1176)

$1.3550 (4014)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 30662 contracts, with the maximum number of contracts with strike price $1,3700 (3893);

- Overall open interest on the PUT options with the expiration date July, 3 is 42496 contracts, with the maximum number of contracts with strike price $1,3550 (5057);

- The ratio of PUT/CALL was 1.39 versus 1.41 from the previous trading day according to data from June, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.7300 (385)

$1.7201 (2222)

$1.7103 (2488)

Price at time of writing this review: $1.7048

Support levels (open interest**, contracts):

$1.6995 (1023)

$1.6898 (1180)

$1.6799 (1672)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 19326 contracts, with the maximum number of contracts with strike price $1,7100 (2488);

- Overall open interest on the PUT options with the expiration date July, 3 is 23176 contracts, with the maximum number of contracts with strike price $1,6700 (2252);

- The ratio of PUT/CALL was 1.20 versus 1.20 from the previous trading day according to data from June, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.