- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-06-2011

Stocks remain shy of session highs.

The dollar continues to drift along in a tight trading range. In turn, the Dollar Index has been mired near the neutral line for the past several hours.

The euro rose against the majority its most-traded counterparts after European leaders reassured investors a Greek default on its debts can be avoided, easing concern about a spreading regional credit crisis.

The common currency erased its decline versus the yen and dollar, as Luxembourg’s Jean-Claude Juncker said Italy was not in danger amid the euro area’s debt crisis. The Swiss franc remained higher against all its most-traded counterparts as Juncker said Greek Prime Minister George Papandreou had assured him the government would do everything ensure financial aid before the Greek parliament takes no confidence vote in his government tomorrow.

“Juncker had some comments about Italy not being in danger and these are overall soothing comments,” said Paresh Upadhyaya, head of Americas G-10 currency strategy at Bank of America Corp. in New York. “In the near-term, we’re going to be focusing on tomorrow’s no confidence vote in Greece.”

Greece needs parliamentary approval of a 78 billion-euro package ($111.6 billion) of budget cuts to ensure the payment of a fifth loan under last year’s 110 billion-euro bailout.

The new Greek finance minister, Evangelos Venizelos, who was named in Papandreou’s cabinet overhaul three days ago, came to Luxembourg with a “strong commitment” to the planned cuts that provoked street protests last week.

“We think right now, given the political shuffling Papandreou initiated with the appointment of a key rival as finance minister, it’s all but certain he will survive the vote tomorrow, said Bank of America’s Upadhyaya.

Select semiconductor stocks are getting slapped with another round of concerted selling pressure. Advanced Micro Devices (AMD 6.77, -0.23) and Broadcom (BRCM 30.88, -0.73) are among the hardest hit names in the space. General weakness in the semiconductor space has weighed on the broader tech sector. In turn, the overall tech sector is mired at the flat line. It is the only major sector that hasn't put together any kind of a gain.

AUD/USD printed session high on $1.0580 and retreated to curent $1.0566. Offers remain around $1.0580 with a break above targets next offers at $1.0610/15. Bids sitting at $1.0545/50.

EUR/JPY continues to go higher after it triggered resistance between Y114.65/75. Ctoss printed a high of Y114.88. Next level of resistance comes at Y115.15/20, further - at Y115.65/70. Initial support is around Y114.65/55. Cross currency holds around Y114.80.

- without decisive action EMU and global economy may be hurt;

- we need further support from EMU to bailout countries;

- need to widen EFSF;

- have to finish debate on debt restructuring/reprofiling as soon as possible;

- normalization of monpol should proceed gradually.

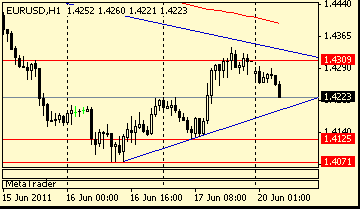

EUR/USD: $1.4200, $1.4345-50, $1.4400, $1.4125, $1.3925

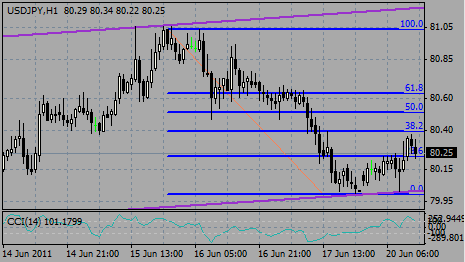

USD/JPY: Y80.00, Y79.30, Y79.00, Y81.40

EUR/JPY: Y117.50

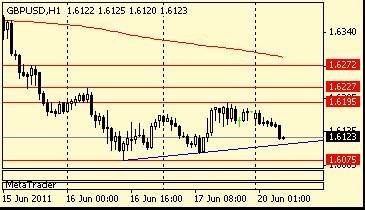

GBP/USD: $1.5950

AUD/USD: $1.0535, $1.0600

AUD/JPY: Y84.00

U.S. stocks futures point to a lower open Monday, after European officials failed to agree on a solution for Greece's debt crisis.

Greek debt woes continue to make pressure on stock markets around the world as investors worry that the country will default.

European finance ministers said Monday that Greece won't receive fresh loans until mid-July. Adding fuel to the fire, credit agency Moody's said Friday that it may downgrade Italy.

Despite Moody's warning, the Dow managed to break its six-week losing streak.

Companies: Ford Motor Co. (F, Fortune 500) plans to invest $1 billion in its Lincoln brand. Shares of the automaker fell 1% in premarket trading.

PNC Financial Services Group (PNC, Fortune 500) said early Monday that it will buy the U.S. retail banking division of Royal Bank of Canada (RY) for $3.45 billion.

There is no major data for today.

AUD/USD gets firmer to $1.0533, following the euro's gains. Initial support sitting at $1.0495/00. Resistance levels at $1.0575/80 with a break above opens a move towards $1.0610/15.

- still risks for EMU remain, including periphery;

- programs in Ireland, Portugal going well;

- Eurogroup satisfied with Ireland and Portugal.

- still risks for EMU remain, including periphery;

- programs in Ireland, Portugal going well;

- Eurogroup satisfied with Ireland and Portugal.

Data released:

06:00 Germany PPI (May) 0.0% 0.1% 1.0%

06:00 Germany PPI (May) Y/Y 6.1% - 6.4%

08:00 EU(17) Current account (April) adjusted, bln -5.1 - -3.0 (-4.7)

The euro remains under pressure after European governments failed to agree on releasing a loan payment to spare Greece from default on its debts.

“The euro is still very vulnerable due to the uncertainty about the outlook for Greece,” said Niels Christensen, chief currency strategist at Nordea Bank AB. “The risk is that the euro-dollar moves back down to around $1.40 by the end of this week.”

Papandreou kicked off a three-day debate yesterday on a confidence motion in his government. He called for the vote last week after opposition parties rejected pleas for national consensus and the prime minister’s handling of the crisis led to defections from his party. Antonis Samaras, leader of New Democracy, the largest opposition party in Greece, repeated his call for elections.

Greece needs approval of a 78 billion-euro package of budget cuts to ensure the payment of a fifth loan under last year’s 110 billion-euro bailout. Euro-area finance ministers pushed Greece to pass laws to cut the deficit and sell state assets, and left open whether the country will get the full 12 billion euros promised for next month.

EUR/USD recovered to $1.4256 after it tested bids on $1.4100/90. But it failed to set above. Euro retreated to $1.4220.

GBP/USD continues to hold around session highs on $1.6180 after it challenged lows around $1.6106.

USD/JPY fell to Y80.00 before it was back to Y80.38 and remains above the figure.

There is no major data for today.

The euro recovered Monday amid hopes for some progress on Greece's debt crisis, but the common currency remained vulnerable to any news from Greece and EU officials comments.

EMU finance ministers began a two-day meeting on Sunday to decide whether to give a E12 billion tranche of emergency loans to Greece. They will also discuss proposals for a second bailout that could be worth some 120 billion euros.

On Friday, leaders of Germany and France held out hopes for the second rescue package after they agreed on how to involve private holders of Greek bonds.

"The EUR will continue to remain dependent on Greece. If news turns ugly ... we could see EUR/CHF extend further below the 1.1950 record low," BNP Paribas analysts say.

Markets are also closely watching the result of a vote of confidence faced by the newly reshuffled Greek cabinet.

The dollar also weakened against the yen. A FOMC meeting on June 21-22 is unlikely to offer any support for the dollar.

The U.S. central bank is expected to hold interest rates near zero for an extended period.

Euro rise after news from Greece lifted EUR/JPY to keep higher. Currently cross trades near Y114.36. Support mentioned under Y114.00 - at Y113.75 with a break under widens losses. While resistance may cap the rise at Y114.65/75.

GBP/USD recovered from session lows around $1.6109 to hourly highs on $1.6174 - key resistance (76.4% Fibo of $1.6194/1.6109 move). Rate currently trades around $1.6164. Set above $1.6160 opens a way to $1.6195/00.

EUR/GBP recovers from session lows around stg0.8796. Cross currently holds around stg0.8808. A break and clear below stg0.8800 to open a deeper move toward stg0.8775/70.

EUR/USD: $1.4200, $1.4345-50, $1.4400, $1.4125, $1.3925

USD/JPY: Y80.00, Y79.30, Y79.00, Y81.40

EUR/JPY: Y117.50

GBP/USD: $1.5950

AUD/USD: $1.0535, $1.0600

AUD/JPY: Y84.00

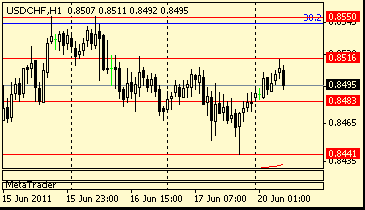

Resistance 3: Chf0.8610 (50.0 % FIBO Chf0.8890-Chf0.8330)

Resistance 3: $ 1.6270 (high of american session on Jun 15, МА (200) for Н1)

Resistance 3: $ 1.4500 (area of Jun 14 high)

06:00 Germany PPI (May) - 1.0%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.