- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-04-2022

- AUD/NZD climbs above 1.0990 swiftly after the kiwi CPI misses estimates.

- A minor fall in the NZ inflation will not scale down the hawkish tone of the RBNZ.

- Investors will keep an eye over the S&P Global Manufacturing PMI.

The AUD/NZD pair is experiencing a juggernaut demand as the Statistic New Zealand has reported the yearly inflation print at 6.9%. The numbers have arrived a little lower than the expectation of 7%, which are still keeping the odds of one more hike in the Official Cash Rate (OCR) of the Reserve Bank of New Zealand (RBNZ). Along with this, the quarterly kiwi Consumer Price Index (CPI) figure has dropped to 1.8% against the preliminary reading of 2%.

Last week, RBNZ Governor Adrian Orr elevated its OCR by 50 basis points (bps). This was the fourth consecutive rate hike by the RBNZ, which took its OCR to 1.5%. In a statement, the central bank dictated that this was the biggest rate hike in more than 20 years, whose sole purpose was to reduce the risks of inflation at best. A larger than expected move by the RBNZ will provide flexibility to the central bank in further interest rate decisions. It is worth noting that the RBNZ has been one of the most aggressive central banks, which is bringing the grounded rates to the neutral one quickly.

On the Aussie front, rate hikes by the Reserve Bank of Australia (RBA) are not seen yet as RBA policymakers have not found any price pressures that could force the agency to bring rate hikes on the table. Meanwhile, investors are focusing on S&P Global Manufacturing PMI, which will release on Friday. A preliminary estimate is seen at 57.8 against the prior print of 57.7.

- The lower inflation print at 6.9% has strongly pushed the kiwi pair below 0.6780.

- A tad lower inflation print may sustain the odds of one more rate hike by the RBNZ.

- The announcement of balance sheet reduction along with a rate hike will bring immense bids for the DXY.

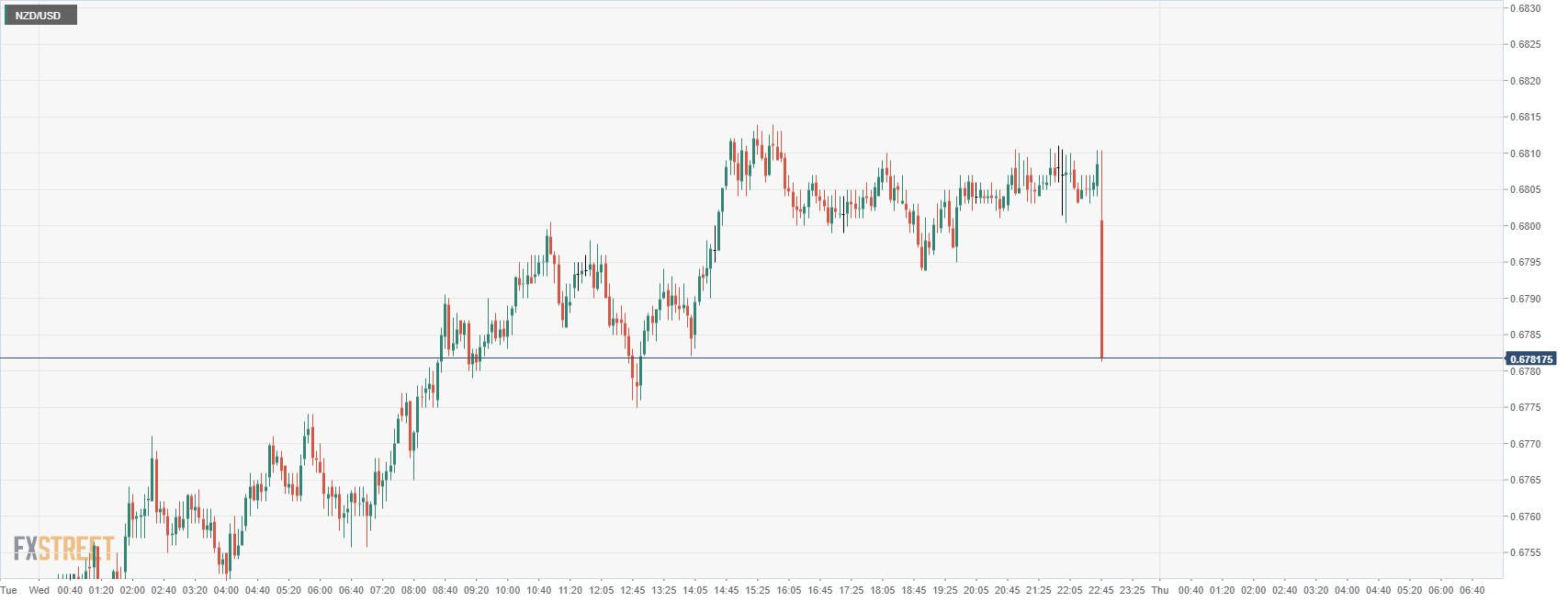

The NZD/USD pair has witnessed a sheer fall to near 0.6776 after the release of the NZ Consumer Price Index (CPI) at 6.9%. Statistics New Zealand has reported the yearly NZ inflation lower than the market consensus of 7.1% but significantly higher than the prior print of 5.9%. While the quarterly NZ CPI print has landed at 1.8%. A preliminary reading was seen at 2% and the previous figure was 1.4%.

This has still advanced the odds that the Reserve bank of New Zealand (RBNZ) will continue with the spree of raising the Official Cash Rate (OCR) further. In its last monetary policy announcement, the RBNZ raised its OCR by a whopping figure of 50 basis points (bps) to reduce the risks of inflation. After doing so, the OCR has reached 1.5%. The RBNZ clearly mentioned in its last monetary announcement that the elevation of this quantitative measure is the only way to contain the inflation mess. Rising household bills of energy are hurting the economy and henceforth may reduce the confidence of the consumers in the economy.

Meanwhile, the US dollar index (DXY) is facing headwinds of profit-booking, which has dragged the asset lower by 0.80% from its recent high of 101.03 on Wednesday. The elevated levels of the DXY resulted in long-liquidations, however, it should not be considered a reversal by the market participants yet.

San Francisco Fed President and FOMC member Mary Daly on Wednesday said that the case for a 50 bps rate hike in May is now "complete" and that the Fed can also make an announcement on the reduction of its balance sheet at the next meeting, reported Reuters. This is going to fetch bids for the mighty greenback in case of the announcement of balance sheet reduction along with a jumbo rate hike.

New Zealand Consumer Price Index, released by the Statistics New Zealand, has missed expectations and is weighing on NZD/USD as follows:

- CPI (QoQ) Q1 1.8% (est 2.0%; prev 1.4%).

- CPI (YoY) Q1 6.9% (est 7.1%; prev 5.9%).

NZD/USD is falling from 0.6806 to a low of 0.6783 so far:

The price jetted from the daily resistance as per the 5-min chart reaction above and is now on the verge of taking on hourly support near 0.6770:

As for the daily chart:

The bears are engaged and should support break, then the outlook is bearish thereafter:

About Consumer Price Index

Consumer Price Index released by the Statistics New Zealand is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchase power of NZD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. A high reading is seen as positive (or bullish) for the NZD, while a low reading is seen as negative.

New Zealand Consumer Price Index is coming up and the data is expected to that show consumer prices rose 7.4% YoY – the fastest increase since 1990 (in the wake of the July 1989 GST increase from 10 to 12.5%).

''Consensus expectations are for a slightly lower 7.1% print, and the RBNZ in the April Monetary Policy Review said they expected inflation would “peak around 7 percent in the first half of 2022”, '' analysts at ANZ Bank said.

Key quotes

''Whatever the headline inflation number, we suspect it’ll be the details of the release that will concern the RBNZ the most. Key measures of core inflation are already above the RBNZ’s 1-3% target band – and it’s likely underlying inflation pressures only continued to increase in Q1.''

''The data are likely to add further pressure to the RBNZ to rapidly remove monetary stimulus – including we think by lifting the OCR by 50bps to 2% at the May MPS.''

How might it affect NZD/USD?

NZD/USD has been firmly bid and was just over 1% higher for the day on Wednesday as Wall Street draws to a close. The US dollar was sliding as US yields corrected which gave a boost to risk apatite and the commodity complex.

The technical outlook for the data is as follows:

If there is anything short of expectations, the Bird could come under a lot of selling pressure, in line with the illustration above considering the resistance. On the other hand, there could also be a sell the fact scenario considering how far the bird has rallied already overnight. Otherwise, it it could be a matter of a deeper test of resistance from the get-go.

Why it matters to traders?

With the Reserve Bank of New Zealand's (RBNZ) inflation target being around the midpoint of 2%, Statistics New Zealand’s quarterly Consumer Price Index (CPI) publication is of high significance. The trend in consumer prices tends to influence RBNZ’s interest rates decision, which in turn, heavily impacts the NZD valuation. Acceleration in inflation could lead to faster tightening of the rates by the RBNZ and vice-versa. Actual figures beating forecasts render NZD bullish.

- GBP/JPY has rebounded from 166.43 as investors are gung-ho on a minor correction.

- A higher UK inflation print has bolstered the expectations of one more rate hike by the BOE.

- Sheer weakness in the Japanese yen may hurt the economy more than its attached benefits.

The GBP/JPY pair is displaying a modest bounce in early Tokyo after a correction to near 166.43 on Wednesday. The cross lost strength after hitting a multi-year high of 168.43 amid broader weakness in the Japanese yen.

The pound bulls are performing strongly against yen from a longer-term perspective led by higher expectations of a tight policy stance by the Bank of England (BOE) in May. A significant jump in the UK’s inflation has bolstered the odds of one more rate hike by the BOE in May. The UK’s yearly Consumer Price Index (CPI) landed at 7%, which may elevate the interest rates from their current levels at 0.75%. In today’s session, pound bulls may remain on the sidelines as investors are awaiting the speech from BOE Governor Andrew Bailey. The speech is likely to be the last appearance from BOE’s Bailey till the announcement of the interest rate decision in May. Therefore, it will have a significant impact on the sterling.

Meanwhile, the Japanese yen is resisting further downside after the verbal intervention from the Japanese Finance Minister Shunichi Suzuki. He warned that the impact of a weaker yen could be more on the Japanese economy than its benefits to the exporters. However, the Bank of Japan (BOJ) is still keeping a dovish tone and citing the threats of sheer decline in yen.

- On Wednesday, the EUR/JPY recovered some of its previous day’s losses, down 0.21%.

- Mixed market sentiment could keep the EUR/JPY range-bound.

- EUR/JPY Price Forecast: It is upward biased and could challenge the YTD high around 139.60s.

The Japanese yen trims some of Tuesday’s losses and forms an inverted hammer in an uptrend, usually a signal that means price exhaustion, after a 210-pip steeper rally. As the Asian Pacific session begins, the EUR/JPY is trading at 139.03 at the time of writing.

The market sentiment is mixed as the Asian session begins

The market sentiment is mixed. Most US equities finished Wednesday session with gains while Asian stock futures point to a lower open. The Japanese yen recovered some ground against most of the G8 majors, but in the case of the EUR/JPY, its gains amounted to 0.21%.

On Wednesday, the EUR/JPY opened near the YTD highs around 139.50s, to then fall on the back of profit-taking due to the slight decline in the price, which pulled the EUR/JPY to record a daily low at 138.39.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY daily chart depicts the pair as upward biased. The daily moving averages (DMAs) below the spot price confirm the aforementioned, but oscillators suggest a correction dip might lie ahead. The Relative Strength Index (RSI) signals the pair as overbought at 71.64, and unless RSI drops below 70, the chances of resuming upwards decrease.

Meanwhile, the EUR/JPY 1-hour chart depicts the pair as upward biased and sits near Thursday’s daily pivot at 138.94. Furthermore, it broke a trendline, 10-pips above the 50-hour simple moving average (SMA) at 132.62, paving the way for further gains.

With that said, the EUR/JPY’s first resistance would be the daily pivot at 138.94. A break above would expose 139.28, followed by the R1 daily pivot at 139.50 and then the YTD high at 139.67

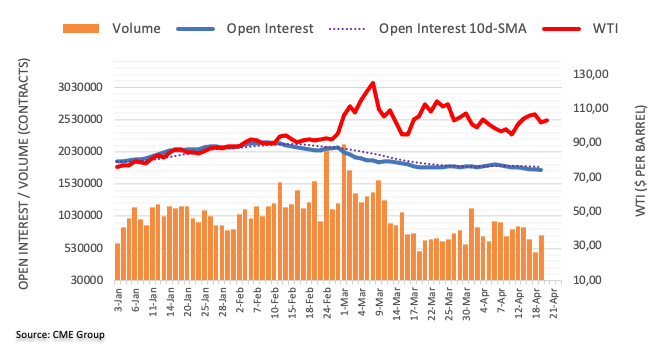

- WTI spot pressured on Wednesday while futures rose marginally.

- Political standoff in Libya has highlighted the fragility of oil supply.

West Texas Intermediate (WTI) crude oil is down in late North American trade by some 1.28% and has fallen from a high of $103.92 to a low of $99.93 into the close. It posted a small gain on Wednesday in the figures markets, however, after day-prior losses following a report showing US inventories unexpectedly dropped last week. WTI crude for May delivery closed up US$0.14 to US$102.19 per barrel, Marketwatch reported.

The Energy Information Administration reported an unexpected 8-million barrel drop in US oil inventories last week, the largest since January 2021. nevertheless, it is far from recovering from Tuesday's collapse of more than 5%. Chinese demand-side weakens pertaining to the Covid-19 lockdowns partly forced the International Monetary Fund to cut its global growth forecast to 3.6% from 4.4% when also weighing the disruption of Russia's war on Ukraine and higher inflation.

Meanwhile, the political standoff in Libya has highlighted the fragility of oil supply, as analysts at TD Securities explained. The analysts particularly noted how the global inventories are depleted and offer little buffer.

''The latest hiccup on the supply side also comes at a time when demand for energy products is firming once more, driving a tightening in crude oil timespreads and cracks, and informing our decision to re-engage upside in far-dated Brent,'' the analysts said.

''Indeed, our tracking of traffic conditions for the 15 largest cities by vehicle registrations suggests that the impact of China's "dynamic" Zero-Covid strategy may already be easing, after catalyzing a sharp drop in energy demand. We also expect that Chinese demand headwinds will soon morph into tailwinds as officials call for additional economic support.''

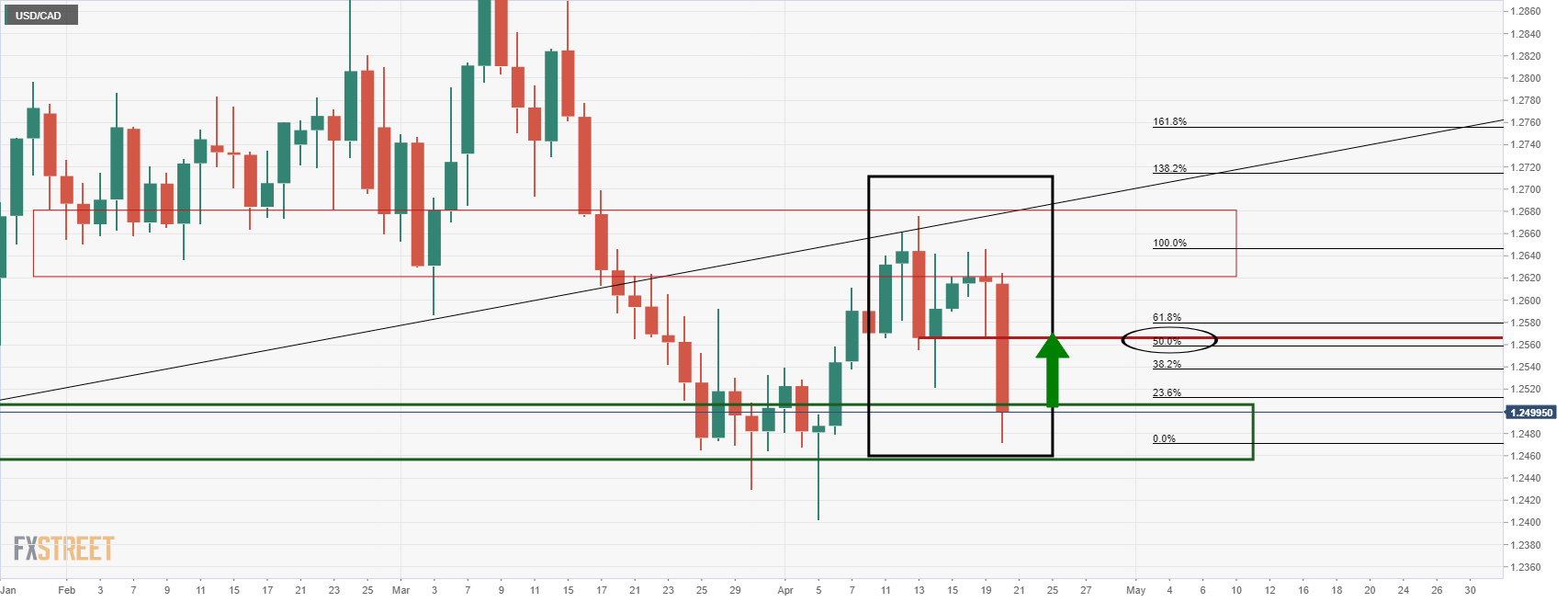

- USD/CAD bulls are moving in at a discount to target a correction.

- The Daily M-formation is compelling in this regard.

The price has fallen below the trendline support, met horizontal support, rallied into a test of the old lows and has left behind an M-formation in the subsequent drop into the demand area again.

USD/CAD daily chart

The M-formation is a reversion pattern so the price would now be expected to revert back to at least the neckline of the pattern:

USD/CAD H1 chart

From an hourly perspective, the bulls will be on the lookout for a correction higher to the neckline and for a bullish structure from which to engage. The price is starting to carve out a bullish structure in the form of accumulation. The 61.8% ratio has a confluence of an area of liquidity that would be expected to draw in the price in order to mitigate the imbalance of the price drop. This could serve as an area of resistance on the way to the neckline target.

- The USD/CHF fell on the back of US dollar weakness, losing 0.34% on Wednesday.

- Most G8 currencies printed gains against the greenback in the FX complex, as the DXY dropped 0.65%.

- USD/CHF Price Forecast: The dip towards 0.9460 found some buying pressure as bulls prepare for a renewed 0.9500 test.

The Swiss franc recovered some ground against the greenback, as the latter suffered losses dragged down by US Treasury yields, which also fell some nine basis points to 2.840%. At 0.9485, the USD/CHF portrays the aforementioned, down some 0.33%, back below the 0.9500 figure.

The market sentiment improved in the North American session. US equities rose, except for the Nasdaq Composite, which fell 1.22% on the drop of Netflix. In the FX complex, risk-sensitive currencies rose while safe-haven peers, like the CHF and the JPY, trimmed losses.

In the meantime, the US Dollar Index, a gauge of the greenback’s value against a basket of six currencies, edged down 0.65% and was last seen at 100.337.

During the day in the Asian session, the USD/CHF opened near 0.9530s yearly highs but dropped on what appears to be a profit-taking move by USD bulls, which triggered losses of the greenback against most G8 currencies across the board. In the case of the USD/CHF, it reached support some pips near the S1 daily pivot at 0.9460, then pushed towards the daily pivot around 0.9490.

USD/CHF Price Forecast: Technical outlook

The USD/CHF daily chart depicts the pair as upward biased. Given that the USD/CHF broke above the YTD high at 0.9460 and April’s 1, 2021 cycle high at 0.9472, it opened the door for a move towards 0.9500 and beyond. Furthermore, it’s worth noting that Wednesday’s dip found some buying pressure near the 0.9460 area, which lifted the pairs towards 0.9490, opening the door for further USD/CHF upside.

With that said, the USD/CHF first resistance would be the figure at 0.9500. A break above would pave the way towards June 30, 2020, a cycle high at 0.9533. A breach of the latter would expose the 0.9600 mark, followed by June 5, 2020, a daily high at 0.9650.

Key Technical Levels

- NZD/USD bulls come up for air and US dollar sinks.

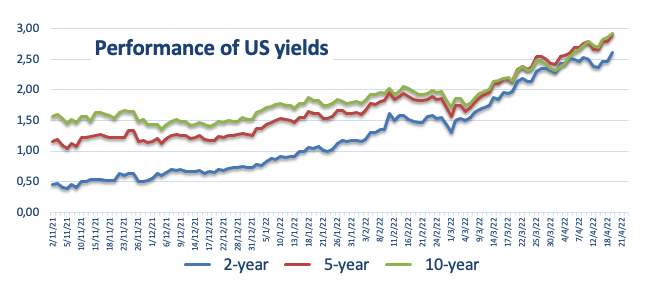

- US yields have corrected and the market gives a sigh of relief.

Trading at 0.6804, NZD/USD is firmly bid just over 1% higher on the day as Wall Street draws to a close. The US dollar was sliding as US yields corrected which gave a boost to risk apatite and the commodity complex.

''But moves in US bond markets have been swift and brutal, and while markets typically do correct, such moves often turn out to be just that – corrections, rather than direction changes,'' analysts at ANZ bank said.

''Commodity currencies also rode the coattails of the CAD, which got a boost from significantly stronger CPI data there. We also have CPI data here today, and ANZ is top-of-market, expecting a +2.2% QoQ print that would see annual inflation rise to 7.4% YoY.''

''If it is strong, the knee-jerk reaction in NZD is likely to be higher, but amid a potentially extended period of USD strength as Ukraine weighs on EUR, BoJ policy weighs on JPY, and still rising Fed policy (and QT) expectations give the USD a tailwind, markets might fade the move quickly. Other central banks have a lot of catching up to do and QT still a big threat to US long bonds.''

Meanwhile, as for data on the day, the latest data point on the Federal Reserve's monetary policy tightening plans, its "Beige Book", showed its economy expanded at a moderate pace from February through early April and there was little respite for businesses from high inflation and worker shortages.

Looking ahead, Fed chair Powell takes part in an IMF panel tomorrow with ECB President Lagarde on the global economy. This will be the last we hear from the chairman until his post-decision press conference on the afternoon of May 4. It is worth noting also that at midnight Friday, the media blackout ahead of the FOMC meeting takes effect and there will be no Fed speakers the rate decision has been announced.

- The Australian dollar stages a recovery and rallies more than 1%.

- Falling US Treasury yields and a weaker US dollar are a tailwind for the AUD/USD.

- Hawkish RBA minutes lifted the AUD/USD, despite an incumbent 50-bps increase by the Fed.

- AUD/USD Price Forecast: To probe the 0.7500 figure and beyond.

The Australian dollar is soaring in the North American session and reclaims the 0.7400 figure, courtesy of a weaker US dollar and a risk-on market mood, as portrayed by US equities recording gains. At the time of writing, the AUD/USD is trading at 0.7449, up 0.96% though shy of the March 7 swing high.

The market sentiment is upbeat, and in the FX space, that triggered an appetite for commodity-linked currencies. The AUD, the CAD, and the NZD rose, while the greenback remains on the back foot, down some 0.62%, sitting at 100.362, undermined by falling US Treasury yields. The 10-year benchmark note drops to 2.849%, losing nine basis points.

Meanwhile, the AUD/USD finally reflected the “hawkish” tone of the Reserve Bank of Australia (RBA) last meeting minutes. The RBA’s Board reported that it is more focused on global events, meaning higher inflation and actions of other central banks. The RBA recognized that the timing of the first-rate hike had moved forward, citing extraordinary evidence on inflation and wages.

Of late, Fed officials continue to cross wires ahead of the blackout period on April 23. Monday’s words of St. Louis Fed President James Bullard continue resounding in the financial markets, as he opened the door for a 75 bps rate hike and emphasized that Fed officials want to get to neutral (rates) expeditiously.

On Wednesday, the San Francisco Fed President Mary Daly said that the case for a 50bps rate hike in May is now complete so that the Fed can announce a reduction of its balance sheet as soon as May. Daly added that increasing rates up t0 2.5% is not abrupt or surprising and added that the consensus view about it is appropriate.

Earlier in the week, Chicago Fed President Charles Evan crossed the wires. Evans said that the US economy “will do very well even as rates rise.” He noted that he supports a “couple” of 50 bps increases, which could lift rates to the 1.25%-2.50% neutral rate.

In the geopolitics backdrop, the Ukraine-Russia conflict continues on different fronts. Once a port of 400,000, Mariupol will be seized by Russian troops, while the Kremlin said Kyiv was delaying peace talks. At the same time, Ukraine accuses Moscow of blocking discussions by refusing humanitarian cease-fires.

AUD/USD Price Forecast: Technical outlook

With the AUD/USD reclaiming the 0.7400 figure, it could exacerbate the rally towards 0.7500 and beyond. Now that the Relative Strength Index (RSI) is back in the bullish territory (53.61), the prospects of higher AUD/USD prices increased.

That said, the AUD/USD first resistance would be the mid-parallel Pitchfork’s line between the central and top-parallel lines near 0.7500. A breach of the latter would expose the confluence of October 2021 and March 28 cycle high around the 0.7430-60 area, followed by a test of 0.7600.

Key technical levels

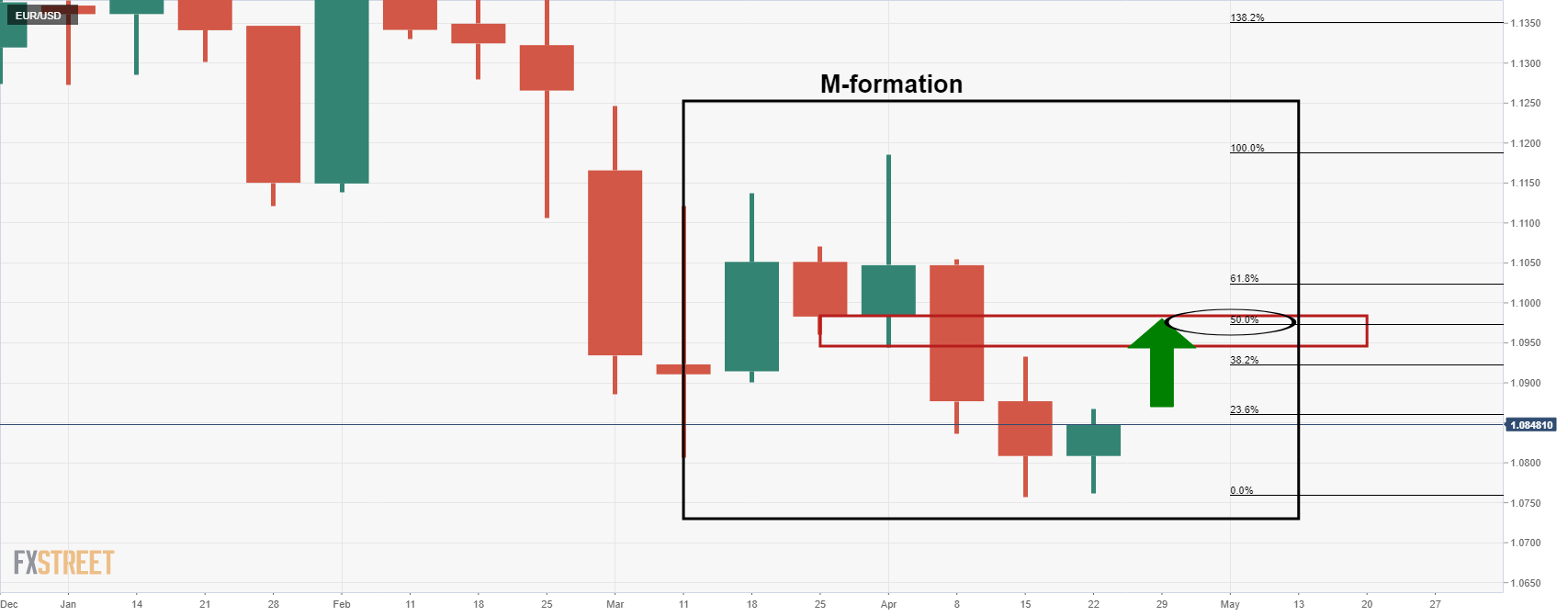

- EUR/USD is higher by some 0.6% in a corrective phase.

- The bulls are noting the weekly M-formation.

EUR/USD has been in a downward spiral since the end of May 2021, moving below the 200 DMA late to mid-June of last year. The price has fallen to as low as 1.07573, or around the 2020 April supporting area. This is an important area of demand as it led to the May 2020-Jan 2021 rally:

EUR/USD daily chart

Given this level of support, a correction would be expected and we are starting to see that in today's price action.

EUR/USD's Doji candle followed by a bullish engulfing candle is a bullish candlestick formation that has taken out the prior support on a closing basis.

Meanwhile, from a weekly perspective, the M-formation is another bullish feature on the charts.

This is a reversion pattern and the price would be expected to revert back to test the old lows, (the neckline). In this scenario, the neckline is the 50% mean reversion level.

Here is what you need to know on Thursday, April 21:

The US dollar succumbed to profit-taking on Wednesday as US yields pared back from multi-year highs, burnishing the buck’s investment appeal somewhat. The US Dollar Index (DXY) slid back 0.6% to the low 100.00s having hit its highest levels since March 2020 above 101.00 on Tuesday, weighed primarily by downside in USD/JPY as the yen received some overdue respite.

USD/JPY dropped just over 0.8% on the day to back under the 128.00 level, more than 1.2% below intra-day multi-decade highs at 129.40 hit earlier in the session. But at current levels near 127.75, the pair still trades over 1.0% higher on the week and over 5.0% higher on the month, with little sign of a more meaningful yen rebound least the BoJ signals some sort of policy stance shift.

The non-US dollars were notable outperformers on Wednesday. AUD/USD jumped about 1.0% to near 0.7450, NZD/USD gained about 1.0% to reclaim 0.6800 and test its 50-Day Moving Average at 0.6813 and USD/CAD dropped to two-week lows under 1.2500.

The hawkish tone to the RBA minutes released earlier in the week plus spicey Canadian Consumer Price Inflation (CPI) figures released on Wednesday likely helped lift the Aussie and loonie. Meanwhile, kiwi traders are bracing for the release of Q1 2022 CPI figures in the upcoming Asia Pacific session.

Elsewhere, the euro and sterling also gained some ground against the US dollar counterpart, with decent Eurozone Industrial Production figures and hawkish ECB chatter about a potential July hike potentially helping the euro. But in truth, the main driver of EUR/USD’s 0.6% recovery to the 1.0850 area and GBP/USD 0.5% rebound to above 1.3050 came from the dollar side of the equation.

FX strategists noted that while some more profit-taking in the US dollar was certainly possible, with the Fed now very much on autopilot to taking rates to neutral by the end of the year, recent weakness likely won’t be long-lasting. That suggests, at the very least, the recent drop in USD/JPY and rallies in EUR/USD and GBP/USD might not have much further room to run.

Fed Chair Jerome Powell’s remarks on Thursday will be closely scrutinised and are being flagged as having the potential to reignite the buck’s recent bull run. ECB President Christine Lagarde and BoE Governor Andrew Bailey will both also be speaking, so central bank policy divergence will be an important FX market theme for the rest of the week.

- US equities were mixed on Wednesday, with the Nasdaq 100 weighed by over 35% drop in Netflix shares post-earnings.

- The S&P 500 was flat above 4,450 and the Dow advanced back above 35,000 amid strong earnings elsewhere.

- The weaker US dollar and lower long-term yields also made for a more favourable backdrop for equities.

US equity markets were mixed on Wednesday, with a steep more than 35% drop in Netflix shares weighing on the Nasdaq 100 index and tech stocks more broadly after the company reported a surprise drop in subscribers. The company blamed its first decline in subscribers in decades on the Russo-Ukraine war and competition from rivals such as Disney+, though analysts also noted the global post-pandemic “reopening” effect also taking its toll.

The Nasdaq 100 index was last trading lower by about 1.4% and flirting with the 14,000 level, with the 50-Day Moving Average at 14,250 having acted as a ceiling to the price action throughout this week. In terms of the other major US indices; the S&P 500 was last trading flat just above the 4,450 level, having failed an earlier attempt to test its 21DMA in the 4,490s, while the Dow was last up about 0.6%, and trading above its 200DMA just above 35,000.

Decent earnings from consumer staples giant Procter & Gamble and IT giant IBM helped lift cyclical and value equity market sectors which are disproportionately represented in the Dow. The S&P 500 GICS Consumer Staples sector was last up 1.4%, Real Estate was last up 1.8% and Health Care was last up 1.2%.

Profit-taking induced weakness in the US dollar and a retracement back from recent highs in US yields, particularly at the long end of the curve, made for a positive backdrop for equity markets. Fed speak on Wednesday was hawkish, but this is what markets have come to expect at this point. The latest Fed’s Beige Book also pointed to still very elevated inflationary pressures, but this didn’t unnerve investors.

Looking ahead, the main focus for investors on Thursday will be on remarks from Fed Chair Jerome Powell, who is expected to signal 50 bps rates hikes at the next few Fed meetings (as other policymakers have given the nod to in recent days). There will also be some tier two economic data releases, including weekly jobless claims and the April Philly Fed Manufacturing survey.

Most immediately, however, Tesla is scheduled to post earnings after the bell on Wednesday and investors will be praying that there isn't a repeat of what happened to Netflix’s share price.

San Francisco Fed President and FOMC member Mary Daly on Wednesday said that the case for a 50 bps rate hike in May is now "complete" and that the Fed can also make an announcement on the reduction of its balance sheet at the next meeting, reported Reuters.

Daly said that since the March meeting, she had seen new evidence that the economic expansion in the US is self-sustaining. Raising interest rates to 2.5% this year is not abrupt or surprising, she noted, and there is broad understanding that it is appropriate.

The Fed expects US economic growth to slow below trend, but not tip into recession, and even if it did, it would be mild and short, she noted. Moreover, Daly said that its premature to decide on how restrictive policy may need to get and the Fed will need to evaluate inflation and supply chains.

Finally, Daly called the US labour market "frothy".

- USD/CAD slid to two-week lows on Wednesday, falling roughly 1.0% from near its 200DMA above 1.2600 to under 1.2500.

- The USD underperformed, driving much of the move, though spicey Canadian CPI figures also helped weigh on the pair.

USD/CAD slid to two-week lows on Wednesday, falling roughly 1.0% on the day from near its 200-Day Moving Average just above 1.2600 to just under the 1.2500 level, with bears now eyeing a test of this month’s annual lows near 1.2400. The pair was weighed primarily as a result of USD underperformance, with the Aussie and kiwi both also gaining more than 1.0% on the day versus the buck.

Another catalyst for USD/CAD downside on Wednesday was hotter than expected Canadian Consumer Price Inflation figures for March, which saw the YoY rate of headline price growth accelerate to 6.7% from 5.7% in February. Core measures all also saw larger than expected MoM and YoY jumps. The spicey numbers helped fuel expectations that the BoC will follow up last week’s 50 bps rate hike with more hikes of a similar margin at upcoming meetings.

Indeed, the BoC is expected to maintain its lead regarding monetary tightening over the Fed this year, making the loonie less vulnerable than some of its other G10 counterparts to buck strength as a result of hawkish Fed expectations. Should global commodity prices remain elevated in the coming weeks and months as a result of the ongoing Russo-Ukraine war, this should strengthen the case for an eventual break below 1.2400.

In the more immediate future, USD/CAD focus now switches to remarks from Fed Chair Jerome Powell on Thursday, who is expected to solidify expectations for 50 bps rate hikes at the upcoming Fed meetings, which could support the buck. Attention then turns to Canadian Retail Sales figures for March and US flash April PMI survey results on Friday.

- The British pound is gaining in the New York session, up some 0.54%.

- GBP/USD gains were attributed to falling US Treasury yields which undermined the greenback.

- Scotiabank and BBBH expect further downside on the GBP/USD.

- GBP/USD Price Forecast: The pair remains downward biased unless GBP bulls lift the price above 1.3160.

The British pound recovers from weekly lows near the 1.3000 figure amidst a weaker US dollar, spurred by falling US Treasury yields and upbeat market sentiment around the financial markets. At 1.3067, the GBP/USD portrays the aforementioned, poised for a re-test of the 1.3100 mark.

US equities remain trading in the green, except for the tech-heavy Nasdaq, which is losing 0.79%, blamed on a worse than expected Netflix earnings report. In the FX complex, risk-sensitive currencies remain in the driver’s seat, led by the high beta currencies and the GBP, contrarily to the greenback, which is losing 0.63%, as portrayed by the US Dollar Index, at 100.352, down from YTD high at 101.035.

Scotiabank and Brown Brothers Harriman (BBH) expect the pound to fall further

Meanwhile, the GBP/USD took advantage of a weaker greenback, pushing towards April’s 18 daily highs at 1.3064, in which case, the pair would resume its upward trajectory towards 1.3100 in what appears to be a corrective rally. Analysts at Scotiabank wrote on a note that they expect GBP/USD to fall over the coming months, as the Bank of England is set not to deliver rate hike expectations.

Furthermore, they added that “the IMF noted yesterday in its outlook review that the UK will see the highest rate of inflation this year among G7 countries, and it revised its GDP growth projections for the UK by roughly 1ppt in each of 2022 and 2023 amid the cost-of-living crisis.”

Also read: GBP/USD to tumble under the 1.30 level over the next few months – Scotiabank

In tone with what Scotiabank analysts expressed, analysts at Brown Brothers Harriman (BBH) wrote on a note that “Sterling is seeing a bounce after support near 1.30 held. Here too, we remain negative and look for an eventual test last week’s new cycle low 1.2975. Break below would set up a test of the November 2020 low near 1.2855 and then possibly the September 2020 low near 1.2675.”

GBP/USD Price Forecast: Technical outlook

The GBP/USD remains in a downtrend. If the GBP/USD is about to shift neutral, it would need to reclaim December’s 31 cycle high at 1.3160. Unless GBP bulls push prices through the latter, Wednesday’s rally would be seen as an opportunity for GBP/USD bears to open fresh bets at a better level.

With that said, the GBP/USD first support would be the 1.3000 figure. A breach of the latter would expose April 19 daily low at 1.2980. Once cleared, it would open the door for further tests downwards. First, the YTD low at 1.2971, followed by November 2020 low near 1.2855.

Inflationary pressures in the US remained strong since mid-February, with firms continuing to pass swiftly rising input costs through to consumers, the latest Fed's Beige Book released by the Minneapolis Fed on Wednesday said, according to Reuters. The latest Beige Book is based on information collected before 11 April.

Additional Takeaways:

Inflation...

In multiple districts, contacts reported spikes in prices for energy, metals, and agricultural commodities.

Strong demand allowed firms to pass through input costs to customers.

Contacts in a few districts noted negative sales from rising prices.

Agricultural conditions were mixed across regions. Farmers were supported by surging crop prices, but drought conditions were a challenge in some districts and increasing input costs were squeezing producer margins across the nation.

Firms in most districts expected inflationary pressures to continue over the coming months.

Labour market...

Several districts reported moderate employment gains despite hiring and retention challenges in the labor market.

Some contacts reported early signs that the strong pace of wage growth had begun to slow.

Firms reported inflationary pressures were contributing to higher wages.

Hiring was held back by a lack of available workers, though several districts reported a modest improvement.

Labor demand continued to fuel strong wage growth, particularly for 'footloose' workers.

Economic activity/conditions...

Economic activity expanded at a moderate pace since mid-February.

The outlook for future growth was clouded by the uncertainty created by recent geopolitical developments and rising prices.

Consumer spending accelerated among retail and non-financial service firms, as Covid-19 cases tapered across the country.

Manufacturing activity was solid overall across most districts, but supply chain backlogs, labor market tightness, and elevated input costs continued to pose challenges to firms' abilities to meet demand.

Several districts noted China's covid-19 lockdowns had worsened supply chain disruptions.

Vehicle sales remained largely constrained by low inventories.

Commercial real estate activity accelerated modestly as office occupancy and retail activity increased.

Districts' contacts reported continued strong demand for residential real estate but limited supply.

- The USD/JPY trimmed Tuesday’s gains, down some 0.88%.

- An upbeat market mood, Japanese Government intervention, and falling US T-bond yields weighed the USD/JPY.

- USD/JPY Price Forecast: Negative divergence in the daily chart to trigger a fall towards the 125.00 area.

The USD/JPY retreats from 20-year highs reached around 129.40, in what appears to be a profit-taking move by investors, as Japanese government officials expressed concerns about the value of the Japanese yen. Furthermore, the fall of US Treasury yields caused a drop of 170-pips. At the time of writing, the USD/JPY is trading at 127.75.

A positive market mood keeps US Treasury yields under pressure, as the appetite for riskier assets has US equities rising. Meanwhile, the greenback is down 0.68%, as shown by the US Dollar Index, which was last at 100.294.

Japanese Government officials expressed concerns about a “weaker” yen, US Treasury yields dropped

Meanwhile, Japanese officials’ efforts of verbal intervention finally came to fruition. On Tuesday, the Japanese Finance Minister Shunichi Suzuki made the most explicit warning yet that the damage to the economy from a weakening yen at present is greater than the benefits from it. Additionally, the Bank of Japan (BoJ) Governor Haruhiko Kuroda also commented that the speed of the yen’s decline could hurt the economy, though he kept its dovish stance.

The market’s reaction triggered an almost 200-pip reversal, which was also spurred by the US 10-year Treasury yield, falling from three-year highs to 2.863%, down eight basis points, a headwind for the USD/JPY. Nevertheless, despite the negative factors, the dip appears to be a corrective move due to central bank policy divergence between the Federal Reserve and the BoJ, which committed to buying 10-year Japanese Government Bonds (JGBs) at 0.25% as it advances its yield curve control (YCC).

On the US front, the US central bank is determined to keep a lid on soaring inflation and tighten its monetary policy faster. The markets have been pricing in multiple 50 bps rate hikes, as expressed by influential FOMC members - St. Louis President James Bullard, Chicago Fed President Charles Evans, and Minneapolis Fed President Neel Kashkari.

USD/JPY Price Forecast: Technical outlook

The USD/JPY illustrates the formation of a negative divergence between the price action and the Relative Strength Index (RSI) at 76.52. As the USD/JPY edged higher, the RSI peaks failed to push above the previous ones, meaning that the bullish momentum is waning.

With that said, the USD/JPY first support would be the 127.00 mark. Once cleared, it would expose April 2001 cycle high at 126.85, followed by 126.00, and then the June 2015 cycle high at 125.85.

Data released on Wednesday showed a larger than expected increase in inflation during March in Canada. According to analysts at CIBC, the upside surprise in inflation will likely be followed by another 50 bp rate hike from the Bank of Canada at the next monetary policy meeting.

Key Quotes:

“Inflation surged beyond everyone's expectations in March, including crucially the Bank of Canada's recent Monetary Policy Report (MPR) estimates. The 1.4% increase on the month, and annual rate of 6.7%, were well in advance of the consensus forecast (1.0% m/m, 6.1% y/y), and meant the average for Q1 was two ticks higher than the Bank's MPR projections. That will likely mean interest rates rise by another 50bp at the next policy meeting.”

“Inflation continues to run well ahead of expectations from earlier in the year, linked not just to commodity price spikes but also to stronger underlying price pressures as well. The upside surprise is likely to bring another non-standard 50bp hike from the Bank of Canada at it's next meeting. While March should represent the peak in inflation due to the slight pullback in energy prices from their highest point, any easing in the next few months will likely be fairly gradual due to continued supply disruptions emanating from the war in Ukraine and lockdown measures in China. A more meaningful deceleration in inflationary pressure will likely wait until the second half of this year and into 2023.”

Analysts at MUFG Bank dropped their bullish bias for USD/JPY and turn neutral expecting greater two-way flows at these elevated levels and taking account of the extent of monetary tightening now priced in the US rates market. They see the pair trading in the 121.00/131.00 range.

Key Quotes:

“We still believe there is a reluctance to intervene directly in the FX market. But if the speed of the move continues and we see levels over 130.00 quickly, action is possible especially if around the time of a shift in policy from the BoJ. Rising energy prices in Japan has political implications too, just like elsewhere, and the government will not want to be seen as indifferent to this energy price squeeze being exacerbated by yen weakness ahead of the Upper House elections in July.”

“Given we have turned neutral on the outlook for USD/JPY, there are risks in both directions to consider. A more dovish outcome to the BoJ meeting on 28th April and further move higher in US yields could see USD/JPY breach the upside range we assume from here. Equally, the risks of BoJ action and intervention is no longer a negligible risk and that could result in a more abrupt decline in USD/JPY than we are assuming. We have widened the range in USD/JPY given the scale of the move in recent months.”

San Francisco Fed President and FOMC member Mary Daly on Wednesday said that she is busy thinking about "inflation, inflation, inflation" and that it is unlikely to get inflation back to 2.0% this year, reported Reuters. "I think inflation will start coming down this year," Daly added, noting that she sees inflation at 2.0% in five years. Consumers rebalancing spending from goods to services should help on inflation, she said.

Earlier, Daly said it would be "prudent" for the Fed to raise the federal funds rate to 2.5% by the end of the year.

- US dollar corrects to the downside across the board on Wednesday.

- Euro gains amid comments from ECB officials and data.

- EUR/USD is up for the second day in a row, alleviating bearish pressure.

The EUR/USD is holding onto gains and is testing daily highs around 1.0860 on American hours, supported by a correction of the US dollar across the board.

Dollar finally drops

Comments from European Central Bank officials on Wednesday mentioned the possibility of a rate hike during the fourth quarter, undermining partially Lagarde’s message of last week. German inflation data for March came in above expectations and Industrial Production increased in the Eurozone in February. The comments and the numbers helped the euro.

A new poll suggests a victory for French President Macron against Marie Le Pen, but it warned about voters unwilling to admit their preference for Le Pen. A debate between both candidates is today.

A weaker US dollar also contributes to boosting EUR/USD. A recovery in Treasuries weighed on the dollar. The US 10-year yield dropped to 2.87%, moving away from multi-year highs. Data from the US showed home prices in the US reached a record high in March, although, Existing Home Sales dropped again, showing signs of a slowdown in the sector. Later on Wednesday, the Federal Reserve will release the Beige Book.

The EUR/USD peaked on Wednesday at 1.0866, the highest level in almost a week. It then pulled back, finding support above 1.0820. It remains near the top, with a bullish intraday bias.

Technical outlook

San Fransisco Fed President and FOMC member Mary Daly on Wednesday noted that it would be "prudent" for the Fed to raise the Federal funds rate to 2.5% by the end of the year, reported Reuters.

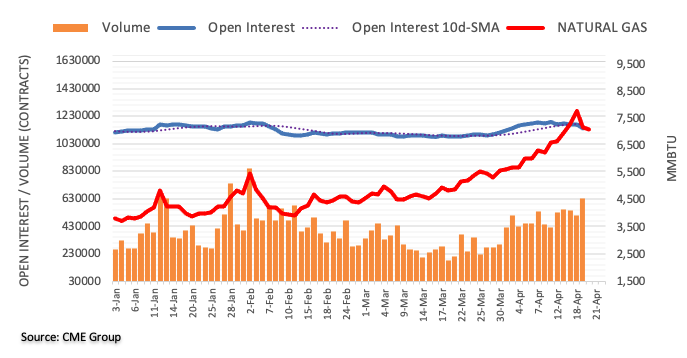

- Oil prices are back to trading near session lows in the upper $101.00s despite a bullish EIA inventory release.

- Growth concerns have been in focus this week and have weighed on crude oil.

- But geopolitics and OPEC+ supply concerns continue to act as a source of support.

A much larger than expected draw in US crude oil inventories of over 8M barrels, according to the latest weekly US EIA report which also showed US Strategic Petroleum Reserve stockpiles falling to their lowest since February 2002, helped crude oil prices momentarily recover earlier session lows, though most of these gains have now faded. Front-month WTI futures are back to trading in the upper $101.00s per barrel and eyeing earlier session lows at $101.50, having been as high as $103.00 in the immediate aftermath of the inventory data release.

WTI prices were unable to break back above the 21-Day Moving Average in the mid-$103.00s and trade over $7.50 below earlier weekly peaks near $110. The majority of this week’s pullback took place on Tuesday after the release of a downbeat International Monetary Fund (IMF) World Economic Outlook report, which warned of prolonged inflation and forecasted weaker global growth.

As traders digest a worsening outlook for global growth and, thus, crude oil demand growth, a move back above $110 and a push towards late March highs in the $116 area seems to be off the cards in the short-term. But equally, against the backdrop of stil very elevated geopolitical tensions as the Russo-Ukraine war rumbles on and as the US/NATO accelerate arms deliveries into Ukraine and look to further tighten sanctions on Russia, strategists argue that WTI above/around $100 continues to make sense.

Indeed, Russian oil output is expected to decline by as much as 3M barrels per day (BPD) by May (roughly 3.0% of global supply), with this shortfall coming at a time when OPEC+ was already struggling to meet its output quotas. A March survey released by Reuters earlier in the week showed the group undershot its output target by nearly 1.5M BPD last month, primarily as a result of the struggles of smaller African producers to keep up with output hikes.

April will show a further large drop as Russian output declines, but Libya is also a concern, with its National Oil Corporation saying 550K BPD in output has been shuttered this week amid a wave of blockades of its major oilfields. OPEC+ output struggles suggest global oil markets will remain tight for the foreseeable future, with only the massive release of crude oil reserves by IEA nations (240M barrels in the next few months) and lockdowns in China keeping the market in balance for now.

European Council President Charles Michel on Wednesday said during his visit to Kyiv that the EU will give a further EUR 1.5B in military aid to Ukraine, reported Reuters, as the country attempts to fend of a more focused Russian assault in its eastern Donbas oblast.

His remarks come after German Chancellor Olaf Scholz said in a video call with Western leaders on Tuesday that Germany will continue to finance Ukraine militarily and financially.

A senior US defense official on Tuesday said that Russia is carrying out the "prelude" to a larger expected offensive operations in eastern Ukraine.

EUR/GBP has moved back down to 0.83 after a short spell up at 0.85 back in late March. As economists at Nordea expect the Bank of England (BoE) to lift its key rate to 1.75% by end-2022, EUR/GBP should plunge to 0.81.

Rate hikes from the BoE to support sterling

“We expect the BoE to move its key rate to 1.75% by the end of the year (currently at 0.75%) and that should support the sterling going forward.”

“We expect EUR/GBP at 0.81 at the end of the year – a level not seen since before the Brexit vote in June 2016.”

Chicago Fed President Charles Evans on Wednesday said that its not the case that inflation will fall back to 2.0% next year, reported Reuters. However, there is good reason to think that special factors that are causing high inflation will stop going up, he noted. The timing for monetary policy can be sensible in dealing with inflation, he added before reiterating that the Fed will lift interest rates to neutral by the end of the year and will probably thereafter end up with a restrictive stance.

His comments on Wednesday come after he pushed back against the idea of a 75 bps rate hike on Tuesday.

USD/JPY has moved from 115 to 129 within less than two months. Economists at Nordea expect the pair to rise above 130, however, USD/JPY should shift back lower in the second half of 2022.

USD/JPY to turn and move lower during H2

“Entering a period of FX intervention is a possibility but the impact on the yen is unlikely to leave a lasting impact on the yen if the Bank of Japan (BoJ) continues to purchase JGBs at the same time.”

“Back in 2002, USD/JPY topped at 135 and we expect USD/JPY to move above 130 during the next couple of months. But we expect USD/JPY to turn and move lower during the second half of the year.”

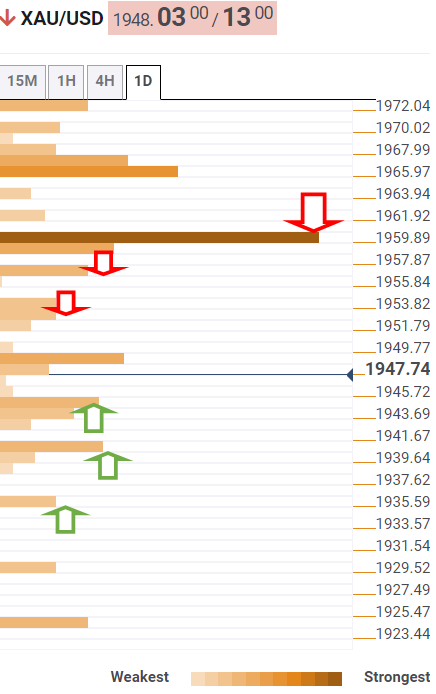

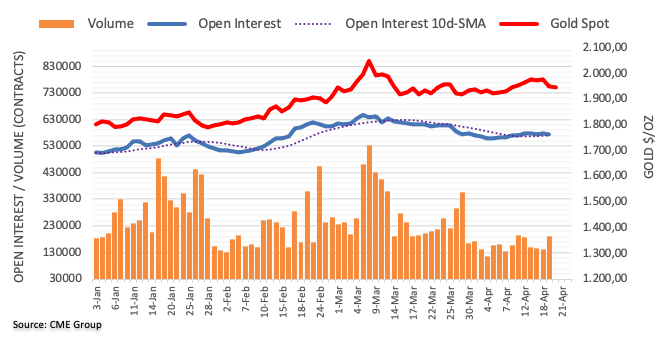

Gold remains extremely resilient in the face of hawkish Federal Reserve rhetoric. Strategists at TD Securities expect the yellow metal to remain in demand as a safe-haven asset.

Fed speak may remain a focus in the near-term

“Fed speak may remain a focus in the near-term, with the rates market proving sensitive to hawkish signals recently, but safe-haven flows continue to provide an impressive offset.”

“Precious metal investors still see compelling reasons to hold on to the shiny metal. The potential for a protracted war in Ukraine simultaneously raises both geopolitical uncertainty and inflation risks, fueling demand for the yellow metal as a safe haven. This trend has also likely been exacerbated by the concurrent decline in global equity and bond prices, which is consistent with fears that Treasuries may be less potent havens in a higher-inflation regime.”

GBP/USD bounces off 1.30. Economists at Scotiabank expect the cable to drop substantially below 1.30 over the coming months as the Bank of England (BoE) is set to not meet rate hike expectations.

IMF cut the 2023 UK growth outlook

“The rates, economic, and political picture point to losses firming under the figure in the near-term.

“The IMF noted yesterday in its outlook review that the UK will see the highest rate of inflation this year among G7 countries and it revised its GDP growth projections for the UK by roughly 1ppt in each of 2022 and 2023 amid the cost-of-living crisis.”

“Weak growth and the cost-of-living crisis are likely to keep the BoE from hiking by as much as markets expect this year, which risks GBP losses extending well beyond 1.30 over the next few months.”

- Silver has been unable to take advantage of Wednesday’s weaker USD and lower US yields.

- XAG/USD is currently trading just above $25.00 and eyeing a break below it as more Fed speak looms.

A pullback in the US dollar and retracement lower from fresh multi-year highs in yields across the US curve has offered spot silver (XAG/USD) prices little by way of respite on Wednesday. XAG/USD continues to trade with small on-the-day losses just above the $25.00 per troy ounce mark, having admittedly fended off earlier session pressure that saw the metal dip as low as the $24.89 and eye a test of its 50-Day Moving Average at $24.83.

Trade is understandably cautious ahead of more rhetoric from Fed policymakers later this session, and ahead of remarks from Fed Chair Jerome Powell on Thursday. Policymakers have for the most part conveyed a consistently hawkish message that rates will be lifted “expeditiously” to at least the neutral area in the coming quarters, including in 50 bps intervals at the next few policy meetings.

Meanwhile, Fed policymakers are sounding increasingly open to the prospect of taking interest rates above neutral in order to tackle rampant inflation. If Powell’s remarks on Thursday strike a hawkish tone, recent upside in the US dollar and US yields could be reignited, presenting further downside risks for silver. A stronger US dollar makes USD-denominated commodities more expensive for foreign buyers, while higher yields represent a rise in the “opportunity cost” of holding non-yielding assets (like silver).

A dip back below $25.00 is certainly on the cards for the second half of this week. However, with geopolitical tensions still very high as the US/NATO ups weapons shipments to Ukraine as Russia escalates its assault in the eastern Donbas oblast and sanctions only likely to be tightened from here, stagflationary risks to the global economy remain elevated. This should mean good demand for silver it slips back towards the low $24.00s.

EUR/USD gains to mid-1.08s. Nonetheless, economists at Scotiabank expect the pair to move below he 1.08 level.

Downward pressure remains in place

“The EUR’s solid rebound off sub 1.08 levels, to trade as low as 1.0761 yesterday, to the mid-figure zone is giving the impression that the EUR’s decline may have neared an end. Still, though the EUR broke the trendline from its late-March high, downward pressure remains in place that points to firmer losses under 1.08 – with the close under the figure yesterday augmenting the bearish outlook.”

“Support is ~1.0820 followed by the figure zone, ~1.0780, and ~1.0760.”

“Resistance is ~1.0865 followed by the 1.09 zone.”

The US Existing Homes Sales unit rate fell by 2.7% MoM in March, the latest data release by the National Association of Realtors revealed on Wednesday. That meant the 12-month rolling number of sales (the unit rate) fell to 5.77M in March, below the economist consensus for 5.8M, marking a decline from February's unit rate of 5.93M.

The median house price continued to rise and came in at $375.3K in March. The number of units available rose a little to 0.95M in March from 0.85M a month earlier.

Market Reaction

FX markets did not react to the latest broadly as expected US home price data.

- A combination of factors assisted AUD/USD to gain strong positive traction on Wednesday.

- Hawkish RBA minutes extended support to the aussie amid a sharp USD corrective pullback.

- Bets for aggressive Fed rate hikes should limit the USD losses and cap the upside for the pair.

The AUD/USD pair maintained its bid tone through the early North American session and was last seen trading around the 0.7430 region, just a few pips below the weekly high.

The Reserve Bank of Australia (RBA), through its minutes from the April Board meeting, sent a hawkish message and provided a strong hint that a rate hike is coming sooner than expected. The RBA said that quicker inflation and a pickup in wages growth have moved up the likely timing of the first interest-rate increase since 2010. This, in turn, acted as a tailwind for the Australian dollar, which, along with broad-based US dollar weakness, assisted the AUD/USD pair to gain strong positive traction on Wednesday.

A sharp corrective slide in the USD/JPY pair and a softer tone surrounding the US Treasury bond yields prompted some USD profit-taking following the recent runup to the highest level since March 2020. Apart from this, the risk-on impulse - as depicted by the strong opening in the US equity markets - further underpinned demand for the safe-haven greenback and benefitted the perceived riskier aussie. The combination of factors pushed the AUD/USD pair beyond the 0.7400 mark, further away from the one-month low touched on Tuesday.

It, however, remains to be seen if bulls are able to capitalize on the move amid expectations for a more aggressive policy tightening by the Fed. In fact, the markets seem convinced that the Fed would raise interest rates at a faster pace to curb soaring inflation and have been pricing in multiple 50 bps hikes. This should act as a tailwind for the US bond yields, which supports prospects for the emergence of some USD dip-buying. Hence, it will be prudent to wait for strong follow-through buying before positioning for a further appreciating move for the AUD/USD pair and confirming that the recent corrective slide from the YTD peak has run its course.

Technical levels to watch

- USD profit-taking and localised strength in the antipodean currencies has helped NZD/USD recovery into the upper 0.6700s on Wednesday.

- Traders eye upcoming key risk events on Thursday, including Q1 NZ CPI and Fed Chair Powell’s speech.

Profit-taking on increasingly stretched USD long positioning, plus localised strength in the two antipodean currencies has seen NZD/USD post an impressive recovery on Wednesday. The pair was last trading higher by about 0.8% in the 0.6780s, up from earlier weekly lows in the 0.6720s and eyeing a test of its 50-Day Moving Average which currently resides just above 0.6810.

Key New Zealand Q1 2022 Consumer Price Inflation figures are scheduled for release at the start of Thursday’s Asia Pacific session and, if they come in as spicey as the just-released Canadian numbers, could ignite a further recovery in the pair. Short-term NZD/USD bulls will be eyeing a potential push back into the 0.6800s and a recovery back towards key resistance at 0.6900, where the 200DMA resides.

However, whilst the USD bears are in control on Wednesday, this goes against the recent trend towards a stronger buck as traders price in a more aggressive Fed tightening cycle, and could thus prove short-lived. Fed Chair Jerome Powell, if he comes across as sufficiently hawkish in his speech on Thursday, could reignite US dollar upside. NZD/USD traders should be prepared for the pair to fall back to test March/April lows in the low 0.6700s one again.

- EUR/USD adds to Tuesday’s advance beyond the 1.0800 mark.

- Another visit to the YTD low at 1.0757 should not be ruled out.

EUR/USD extends the upside momentum to the vicinity of 1.0870 on Wednesday.

If the recovery picks up extra pace, the pair might attempt a move to the weekly high at 1.0933 (April 11). Once cleared, there are no resistance levels of importance until the 55-day SMA, today at 1.1087.

While below the 200-day SMA, today at 1.1419, the outlook for the pair is expected to remain negative.

EUR/USD daily chart

- USD/JPY stalled its intraday corrective pullback from the 20-year peak near the 23.6% Fibo. level.

- The Fed-BoJ policy divergence favours bullish traders and supports prospects for additional gains.

- A convincing break below the 126.35 confluence support is needed to confirm a near-term top.

The USD/JPY pair trimmed a part of its heavy intraday losses and was seen trading near the 128.00 mark during the early North American session, still down around 0.70% for the day.

The sharp intraday corrective pullback from a fresh 20-year high touched earlier this Wednesday found some support near the 23.6% Fibonacci retracement level of the 121.28-129.41 parabolic rise. The mentioned support, around the 127.50-127.45 region should now act as a pivotal point for short-term traders.

A convincing break below should pave the way for further losses and drag the USD/JPY pair towards the 127.00 mark. This is closely followed by support near the 126.80 region, or an ascending trend-line extending from the monthly low, below which spot prices could accelerate the slide towards the 126.35 confluence.

The latter comprises the 38.2% Fibo. level and the 50-period SMA on the 4-hour chart. Against the backdrop of a big divergence in the monetary policy stance adopted by the Fed and the Bank of Japan, the fall towards the said support could be seen as a buying opportunity. This should help limit losses for the USD/JPY pair.

On the flip side, the 128.45-128.50 region now seems to act as an immediate resistance ahead of the 1.2880 zone. A subsequent move beyond the 129.00 mark will suggest that the corrective pullback has run its course and lift the USD/JPY pair back towards retesting the two-decade peak, around the 129.40 region.

USD/JPY 4-hour chart

-637860575497482919.png)

Key levels to watch

- DXY corrects lower and revisits the 100.30 region on Wednesday.

- Occasional bearish moves should be deemed as buying chances.

DXY sheds some ground following fresh cycle peaks past the 101.00 hurdle on Wednesday.

Price action around the index continues to suggest further upside in the near/medium terms. That said, if the YTD high at 101.03 is surpassed, then there are no resistance levels of significance until the 2020 peak at 102.99 recorded on March 20.

The current bullish stance in the index remains supported by the 7-month line near 96.50, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 95.37.

DXY daily chart

Bundesbank President and ECB governing council member Joachim Nagel said on Wednesday that he expects the ECB's first rate hike to come in Q3 of this year, though he also said he is against hasty rate hikes, reported Reuters. Nagel warned that getting inflation back to the ECB's 2.0% target is looking ever less likely, and that the IMF's forecast for global economic growth could be cut further in the quarters ahead.

His remarks chime with commentary from ECB's Martin Kazaks earlier in the day, who also said an ECB rate hike in Q3 of this year was a possibility.

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting comment on the latest Exports data in Malaysia.

Key Takeaways

“Gross export growth strengthened to 25.4% y/y in Mar (from +16.8% in Feb), higher than our estimate (9.0%) and Bloomberg consensus (10.4%). Gross import growth also accelerated to 29.9% y/y (from +18.3% in Feb). This brought the trade surplus to MYR26.7bn (from +MYR19.8bn in Feb).”

“Exports were lifted by robust growth for electrical & electronics and commodity-based products in particular palm oil, palm-oil based products, petroleum products, LNG, and crude petroleum. In 1Q22, exports gained 22.2% (4Q21: +29.0%) while imports advanced 25.2% (4Q21: +29.6%). Higher imports over exports led to a narrower trade surplus of MYR65.1bn (4Q21: +MYR76.2bn) which we expect to translate into a current account surplus of MYR16.0bn in 1Q22 (4Q21: +MYR15.2bn).”

“Given the export strength to date, we have raised our full-year export growth forecast to 8.0% (from 2.0% previously; BNM est: +10.9%; 2021: +26.0%) albeit mindful of prevailing risks from geopolitical risks, China’s zero-COVID policy, ongoing supply chain disruptions, and tighter global financial conditions. The risk of second order impact on Malaysia from the Russia-Ukraine conflict has emerged following the expansion of sanctions on Russia and potential escalation of Ukraine conflict.”

A key market guage of long-term Eurozone inflation expectations rose to its highest level since 2012 at over 2.42% on Wednesday, reported Reuters citing the Eurozone 5-year 5-year forward inflation swap. This swap is a gauge for the market's inflation expectation for a period that starts five years from now and ends ten years from now.

As long-term Eurozone inflation expectations depart further from the ECB's 2.0% target to the upside, this could be a key determinant that pushes the central bank to bring forward the timeline of its monetary tightening plans. Indeed, ECB policymaker Martins Kazaks said on Wednesday that “a rate hike is possible as soon as July”.

- A combination of factors prompted aggressive selling around USD/CAD on Wednesday.

- An uptick in crude oil prices, stronger Canadian inflation figures underpinned the loonie.

- Modest USD pullback from the two-year peak also contributed to the intraday selling bias.

The USD/CAD pair continued losing ground through the early North American session and dropped to a two-week low in reaction to a stronger Canadian CPI report, though recovered a few pips thereafter. The pair was last seen trading just a few pips above the 1.2525-1.2530 region, still down over 0.70% for the day.

Having failed to find acceptance above the very important 200-day SMA, the USD/CAD pair witnessed aggressive selling on Wednesday and finally broke down below a three-day-old consolidation phase. An uptick in crude oil prices underpinned the commodity-linked loonie and exerted downward pressure on spot prices amid modest US dollar corrective pullback from the two-year peak.

Concerns about tight global supply and a potential European Union (EU) embargo on Russian gas, assisted crude oil prices to recover a part of the previous day's heavy losses. Apart from this, hotter-than-expected Canadian consumer inflation figures provided an additional boost to the domestic currency and further contributed to the heavily offered tone surrounding the USD/CAD pair.

Statistics Canada reported that the headline CPI jumped to the highest level since January 1991 and rose 6.7% YoY in May, surpassing expectations for a reading of 6.1% and 5.7% previous. Adding to this, the Bank of Canada's core CPI, which excludes the eight most volatile items, rose by 1% MoM in March and accelerated to 5.5% on yearly basis, both beating consensus estimates.

On the other hand, the USD witnessed some profit-taking amid a sharp decline in the USD/JPY pair and retreating US Treasury bond yields. That said, the prospects for a more aggressive policy tightening by the Fed should act as a tailwind for the buck. This makes it prudent to wait for a break below the 1.2500 psychological mark before placing fresh bearish bets around the USD/CAD pair.

Technical levels to watch

- The YoY rate of headline CPI jumped to 6.7% in March from 5.7%, well above expected.

- Core measures were also spicey and the loonie saw some initial knee-jerk strength on the data.

- The figures will solidify expectations for aggressive tightening from the BoC.

Annual headline inflation in Canada jumped to 6.7% in March, according to the latest Consumer Price Index (CPI) figures released by Statistics Canada on Wednesday. That was well above the median economist forecast for a rise to 6.1% from 5.7% YoY in February. The larger than expected jump in the YoY rate was powered by a larger than expected 1.4% rise in prices, as per the CPI, on a MoM basis. Expectations were for a 1.0% MoM rise in prices, following a 1.0% rise in February.

The Core inflation numbers were also spicey. The YoY rate of inflation as per the Core CPI came in at 5.5%, a surprise jump from February's 4.8% reading. Median expectations had been for a fall to 4.2%. That was powered by a surprise rise in the MoM rate of Core inflation to 1.0%, versus an expected fall to 0.5% from 0.8% in February.

The BoC's Median CPI measure came in at 3.8%, up from 3.5% in February, the BoC's Trimmed measure came in at 4.7%, up from 4.3% in February and the BoC's Common measure came in at 2.8%, up from 2.6%. That meant the mean of the BoC's measures of Core Canadian inflation rose to 3.77% from 3.47% in February.

Market Reaction

With the latest spicey Canadian inflation figures bolstering the case for continued aggressive BoC monetary tightening (the central bank lifted interest rate by 50 bps last week), the loonie was initially stronger in wake of the data release. USD/CAD dipped briefly below 1.2520, but has since recovered back to pre-data release levels in the 1.2530s.

The current sentiment in the FX markets remains very positive for the US dollar. Economists at Nordea see EUR/USD falling further before rebounding later this year to end 2022 around 1.10.

Dollar maintains the upper hand

“The euro will remain vulnerable as long as there is no change for the better in the war in Ukraine. The tension between Europe and Russia is leaving high uncertainty for the economic outlook in the Euro area and for the euro.”

“We see EUR/USD move down to 1.05 within the next three months. But the tide will turn for the dollar later this year. Sharply lower purchasing power among US households will slow the economic growth in the US and the Fed’s aggressive monetary tightening will bite as well. At the same time, we’ll have the ECB beginning its tightening cycle and hopefully, there will be better news from the war in Ukraine. Hence, the outlook for the European economy and the euro should improve. We expect EUR/USD to end 2022 around 1.10.”

“In 2023 the Fed will be approaching the peak of its hiking cycle and the focus will shift towards the timing of the first potential cut from the American central bank. At the same time the ECB will continue its tightening cycle, although, at a slower pace, but it should continue supporting the euro, and we’re looking for EUR/USD moving towards 1.16 during 2023.”

- EUR/GBP is trading just under 0.8300, after pulling back from earlier highs near the 21 and 50DMAs at 0.8350.

- ING and MUFG warn against betting on further downside with the BoE likely to underwhelm tightening expectations this year.

EUR/GBP is trading flat just beneath the 0.8300 level, having erased earlier gains that saw it rally as high as the 0.8330s and eye a test of the 21 and 50-Day Moving Averages in the 0.8350 area. The themes of BoE/ECB policy divergence are being monitored by traders ahead of remarks from the respective central bank heads Christine Lagarde and Andrew Bailey at the IMF meetings on Thursday, after some hawkish chatter from ECB’s Martin Kazaks on Wednesday, who talked about a rate hike as soon as July.

In a note to clients on Tuesday, ING points out that money markets are only pricing in 30 bps worth of BoE tightening at its upcoming meeting. “The fact that expectations have not shifted towards the 50bp area despite higher inflation is probably down to the same concerns expressed by the IMF yesterday when it cut the 2023 UK growth outlook to 1.2% from 2.3%,” the bank notes.

ING continues to argue that market expectations for BoE tightening this year are excessive. “Money markets continue to price in 150bp of BoE rate hikes by year-end, while our economics team thinks that it will be closer to 50bp,” the bank explains. “Any dips in EUR/GBP to the 0.8250 area could be the low point of the year” they warn.

MUFG agree. “We are not convinced the BoE will be in a position to deliver what is priced into the market with growth likely to be very weak through the remainder of this year,” they remark. “We assume two further 25bp rate hikes by the BoE and then a pause… It’s one reason why we see limited downside for EUR/GBP from current levels just below 0.8300.”

- GBP/USD staged a solid recovery from sub-1.3000 levels amid broad-based USD weakness.

- The fundamental backdrop favours the USD bulls and should cap the upside for the major.

- Sustained strength beyond the 1.3100 is needed to support prospects for any further gains.

The GBP/USD pair gained strong positive traction on Wednesday and snapped a four-day losing streak back closer to the YTD low. The momentum extended through the mid-European session and pushed spot prices to a fresh weekly high, around the 1.3065 region in the last hour.

From a technical perspective, repeated failures to find acceptance below the 1.3000 psychological mark prompted some short-covering around the GBP/USD pair amid broad-based US dollar weakness. That said, any meaningful recovery seems elusive amid hawkish Fed expectations. The markets seem convinced that the US central bank would tighten its monetary policy at a faster pace to curb soaring inflation and have been pricing in multiple 50 bps rate hikes. This supports prospects for the emergence of some USD dip-buying, which should cap the GBP/USD pair.

Hence, any subsequent move up is more likely to confront stiff resistance and faltered near the 1.3100 confluence hurdle, comprising 200-period SMA on the 4-hour chart and a descending trend-line. The said handle should act as a pivotal point and help determine the near-term trajectory. A convincing breakthrough would suggest that the GBP/USD pair has formed strong base just below the 1.3000 mark and pave the way for additional gains. The next relevant hurdle is pegged near the 1.3145-1.3150 area, above which bulls might aim to reclaim the 1.3200 round figure.

On the flip side, the 1.3000-1.2990 area might continue to act as immediate support. Some follow-through selling below the YTD low, around the 1.2975-1.2970 region, would make the GBP/USD pair vulnerable to accelerate the slide towards testing the 1.2910-1.2900 support zone. The downward trajectory could further get extended towards the next relevant support near the mid-1.2800s before the GBP/USD pair eventually drops to the 1.2820 area.

GBP/USD 4-hour chart

-637860536890414278.png)

Key levels to watch

As soon as the COVID-19 pandemic started to recede, as soon as rumors of a diplomatic settlement of the war in Ukraine emerged, equity markets rallied. Analysts at Natixis seek to determine why equity investors react so positively to good news, even if it is only of small significance.

Why do equity markets react so strongly to good news?

“Real interest rates are very negative, in an environment of high inflation. This makes holding cash or bonds very detrimental, and therefore encourages investors to return to equities as quickly as possible.”

“Companies’ financial situation improved rapidly after the COVID-19 crisis and was good at the start of the war in Ukraine: earnings picked up, debt net of cash holdings fell.”

“Investors do not expect a sharp rise in interest rates and expect real interest rates to remain negative, as expected long-term interest rates remain lower than inflation. Investors do not, therefore, expect that bonds will become attractive again and that rising interest rates will cause share prices to fall.”

“As long as real interest rates remain negative, holding shares protect against inflation, since negative real interest rates boost share prices and companies’ earnings normally follow inflation.”

- EUR/JPY sees some downside pressure after hitting new highs.

- The continuation of the uptrend could see 140.00 retested.

EUR/JPY clinched new tops around 139.70 earlier in the session, although it lost some momentum since then.

Further upside thus appears on the cards with the immediate target at the fresh peak at 139.69 (April 20). The surpass of this level is expected to motivate the cross to put the round level at 140.00 back on the radar in the short-term horizon. Further up is seen the June 2015 peak at 141.05 (June 4).

In the meantime, while above the 200-day SMA at 130.43, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

Junior Economist Yari Mayaseti at UOB Group reviews the latest tarde balance results in the Indonesian economy.

Key Takeaways

“Indonesia’s trade surplus widened in March 2022 and reached USD4.5bn vs. USD3.8bn in February 2022.”

“Indonesia's exports in March were valued at USD26.5bn, with the non-oil and gas exports amounting to USD25.1bn (March’s 43.8% y/y vs. February’s 35.2% y/y).”

“Indonesia’s imports in March were valued at USD21.9bn, with the non-oil and gas imports amounting to USD18.5bn (March’s 27.3% y/y vs. February’s 14.8% y/y).”

- USD/JPY retreated sharply from a fresh 20-year peak touched earlier this Wednesday.

- Speculation that officials will intervene to curb the JPY slump prompted long-unwinding.

- The Fed-BoJ policy divergence should act as a tailwind and help limit any further losses.

The USD/JPY pair continued losing ground through the mid-European session and plunged to a fresh daily low, around the 127.60 region in the last hour, albeit recovered a few pips thereafter.

The pair witnessed an intraday turnaround from a fresh 20-year high touched earlier this Wednesday and has now retreated around 180 pips from the 129.40 region. Speculation that officials were uncomfortable and would respond to the Japanese yen's recent slump prompted traders to take some profits off the table following the recent parabolic rise in the USD/JPY pair.

In fact, Japanese Finance Minister Shunichi Suzuki made the most explicit warning yet on Tuesday that the damage to the economy from a weakening yen at present is greater than the benefits from it. Adding to this, Bank of Japan Governor Haruhiko Kuroda, who is usually a firm advocate of a weaker currency, also acknowledged that a sharp yen decline could hurt the economy.

Bearish traders further took cues from modest pullback in the US Treasury bond yields, which trigger a US dollar corrective slide from its highest level since March 2020. Despite the negative factors, the downside seems cushioned amid policy divergence between the Fed and the Bank of Japan, which again intervened in the market to check the rise in Japanese 10-year yields.

The BoJ offered to buy unlimited amounts of Japanese government bonds on Wednesday to defend the 0.25% yield cap. Moreover, the BoJ has repeatedly said that it remains ready to use powerful tools to avoid long-term interest rates from rising too much and sustain the current powerful monetary easing to support economic recovery.

On the other hand, the US central bank is determined to keep a lid on soaring inflation and tighten its monetary policy at a faster pace. The markets have been pricing in multiple 50 bps rate hikes and the bets were reaffirmed by influential FOMC members - St. Louis President James Bullard, Chicago Fed President Charles Evans and Minneapolis Fed President Neel Kashkari.

The fundamental backdrop favours the USD bulls and supports prospects for the emergence of some dip-buying at lower levels. Hence, it will be prudent to wait for strong follow-through selling before confirming that the USD/JPY pair has topped out in the near term and positioning for any meaningful corrective slide.

Technical levels to watch

- Silver added to the previous day’s losses and edged lower for the second straight day.

- The overnight break through an ascending channel supports prospects for further losses.

- Sustained strength beyond the $25.70 region is needed to negate the bearish outlook.

Silver witnessed some follow-through selling for the second successive day on Wednesday and retreated further from the six-week high touched on the first day of the current week.

From a technical perspective, the overnight sustained break through the lower end of an upward sloping channel extending from the monthly low was seen as a fresh trigger for bearish traders. A subsequent slide below the 200-period SMA on the 4-hour chart adds credence to the negative outlook.

That said, technical indicators on the daily chart - though have been losing traction - are yet to confirm the bearish bias. Moreover, RSI on hourly charts is hovering near oversold territory. This makes it prudent to wait for some intraday consolidation before positioning for additional losses.

Nevertheless, the XAG/USD seems vulnerable to weaken further below the $24.70 intermediate support and accelerate the slide towards testing the next relevant support near the $24.25 region. The downward trajectory could get extended towards testing sub-$24.00 levels, or the 200-day SMA.

On the flip side, attempted recovery might now confront resistance near the $25.30-$25.35 region. Any further move up is more likely to attract fresh selling and remain capped near the aforementioned ascending channel support breakpoint, now turned resistance, around the $25.70 region.

The latter should act as a key pivotal point for short-term traders, which if cleared decisively will negate prospects for any further losses. The XAG/USD could then aim to surpass the $26.00 round-figure mark and climb back to the overnight swing high, around the $26.20 region.

Silver 4-hour chart

-637860460755588350.png)

Key levels to watch

Yari Mayaseti, Junior Economist at UOB Group, assesses the latest BI monetary policy meeting.

Key Takeaways

“Bank Indonesia (BI) kept its benchmark rate (7-Day Reverse Repo) unchanged at 3.50% at its April MPC meeting. Consequently, BI maintained the Deposit Facility rate at 2.75% as well as the Lending Facility rate at 4.25%.”

“We keep our view for BI to start hiking in mid-2022 to reach 4.5% by the end of 2022.”

- Gold Price sees a tepid bounce but the downside remains favored.