- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-02-2023

- GBP/JPY is aiming to deliver a breakout above 161.70 after multiple failed attempts.

- BoJ Amamiya believes that the current situation is not ripe for an exit from easy policy.

- The BoE could consider a pause in further policy tightening to avoid slowdown fears.

The GBP/JPY pair is looking to surpass the immediate resistance of 161.70 in the early Tokyo session. The cross has tried multiple times to deliver an upside break of 161.70, however, the Pound Sterling was not getting the required strength.

Mixed views from Bank of Japan (BoJ) officials are triggering volatility for the Japanese Yen. BoJ Deputy Governor Masayoshi Amamiya said on Monday, “The BoJ has already shifted to a sustainable monetary easing framework, so it is appropriate to maintain current policy given underlying price moves.” He further added, “What is more difficult is to decide whether conditions have been met to exit easy policy, and how to communicate BoJ’s intentions.”

The official sounds dovish despite the Japanese administration looking for a quick transition from the decade-long expansionary policy to make the Japanese Yen a strong contender against rival currencies.

Meanwhile, escalating signs of a slowdown in the United Kingdom economy due to higher interest rates by the Bank of England (BoE) has strengthened the case of pausing further hikes. The UK economy has been a laggard in demonstrating inflation softening. Despite a string of interest rate hikes, the BoE has failed in easing inflation from the double-digit figure led by higher food inflation and strong labor demand.

For further guidance, investors' focus will be on the fresh talks between UK Foreign Secretary James Cleverly and Conservative rebels for a post-Brexit deal on Northern Ireland. Earlier, UK Prime Minister Rishi Sunak was forced to pause the deal after a backlash from Senior Tories.

- WTI grinds within immediate bullish channel after snapping five-day downtrend.

- Key moving averages, monthly resistance line challenge buyers.

- Bears need to conquer $72.70 to retake control, $76.70 acts as immediate support.

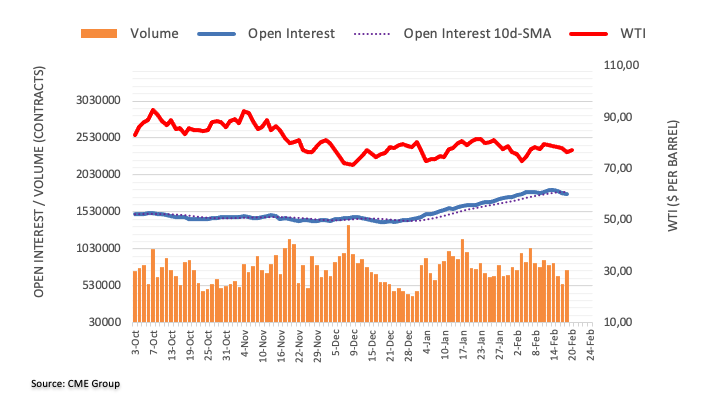

WTI pares the week-start gains as it prints mild losses around $77.30 during Tuesday’s Asian session. In doing so, the black gold trades inside a two-day-old ascending trend channel.

Adding strength to the recovery moves could be the looming bull cross on the MACD, as well as a clear bounce off the six-week-old horizontal support zone, near $72.50-70.

It’s worth noting, however, that the quote’s upside break of the stated channel’s top, around $78.10 at the latest, could find it difficult to lure the Oil buyers as a convergence of the 50-SMA and the 200-SMA might restrict the black gold’s further upside near $78.40.

Even if the quote rises past $78.40, a downward-sloping resistance line from January 27 and the multiple tops marked since late January, respectively near $79.15 and $82.60-65 by the press time, will be crucial to watch for WTI traders past $78.40.

Meanwhile, pullback moves remain elusive unless staying inside the stated bullish channel, currently between $76.65 and $78.10.

Following that, $75.10 and $74.30 may entertain WTI crude oil bears before directing them to the “doubt bottom” marked around $72.50-65.

Overall, WTI is likely to remain firmer inside the $72.50 and $82.65 trading range.

WTI: Four-hour chart

Trend: Limited upside expected

- USD/CHF is struggling to find direction as volatility has squeezed amid a long weekend in the United States.

- Fed minutes will provide a detailed explanation behind an interest rate hike of 25bps.

- The Swiss Franc asset is testing the breakout of the downward-sloping trendline plotted from 0.9600.

The USD/CHF pair is oscillating in a narrow range around 0.9230 in the early Asian session. The Swiss Franc asset has turned sideways following the footprints of the US Dollar Index (DXY). The USD Index failed to gauge a decisive movement amid less trading activity due to an elongated weekend in the United States amid a holiday on Monday due to Presidents’ Day.

Investors are shifting their focus towards the release of the preliminary S&P PMI (Feb) figures and the Federal Reserve (Fed) minutes. The minutes from the Fed will provide a detailed explanation of hiking interest rates by 25 basis points (bps) in the February monetary policy meeting.

Meanwhile, the commentary from Swiss National Bank (SNB) Vice Chairman Martin Schlegel failed to provide strength to the Swiss franc. SNB Schlegel cited the central bank is "still willing" to be active in the foreign currency markets in pursuing its goal of price stability.

USD/CHF is testing the breakout of the downward-sloping trendline placed from November 21 high around 0.9600 on a four-hour scale. Usually, a test of a trendline breakout with an absence of solid downside pressure indicates the strength of bulls and prepares a platform for a confident upside move ahead.

The Swiss Franc asset is employing efforts to shift its auction above the 200-period Exponential Moving Average (EMA) at 0.9245.

Meanwhile, the Relative Strength Index (RSI) (14) has failed to sustain in the bullish range of 60.00-80.00. A bullish momentum will be triggered if the momentum oscillator manages to reclaim the 60.00-80.00 range.

For a fresh upside, the Swiss Franc asset needs to deliver a confident break above February 6 high around 0.9290, which will drive the asset towards January 12 high at 0.9363 followed by January 6 high at 0.9410.

In an alternate scenario, a breakdown below February 9 low at 0.9161 will drag the asset towards the round-level support at 0.9100. A slippage below the latter will drag the asset towards February low at 0.9059.

USD/CHF four-hour chart

-638125313959687125.png)

- EUR/USD picks up bids to pare week-start losses, remains range-bound though.

- ECB’s Rehn signals rate hikes beyond March, EU Consumer Confidence improved in February.

- US holiday, mixed comments from the latest Fed talks and pullback in US Treasury bond yields weigh on US Dollar.

- Preliminary readings of EU, German and US PMIs for February will be eyed for clear directions.

EUR/USD struggles to overcome the week-start losses as it rises to 1.0690 during the early hours of Tuesday’s sluggish Asian session. Even so, the major currency pair remains tight-lipped within a small trading range ahead of the key Purchasing Managers Indexes (PMIs) for February.

The quote’s latest pick-up could be linked to the hawkish comments from the European Central Bank (ECB) official. That said, ECB governing council member and Finnish central bank Chief Olli Rehn recently said, per Reuters, “ECB should keep raising interest rates beyond March and the rate peak, which should be stuck to for some time, could be reached over the summer.” "With inflation so high, further rate hikes beyond March seem likely, logical and appropriate," Rehn told Germany’s Börsen-Zeitung newspaper.

Also underpinning the recovery moves could be the upbeat prints of Eurozone Consumer Confidence. That said, the first readings of the bloc’s Consumer Confidence for February matched market forecasts of -19 versus -20.9 prior.

Earlier on Monday, Germany's Bundesbank released its monthly report and noted that the economic outlook was somewhat brighter with the short-term outlook turning more favorable than seen just a few months ago. The report also mentioned, “High inflationary pressures remain in place as the second round impact of quick wage growth is expected to keep Eurozone inflation above its target for an extended period of time.” On the same line were comments from France’s Finance Minister Bruno Le Maire who expected positive economic growth in 2023 and also believed that inflation should ease off from the middle of this year.

On the other hand, the latest comments from the Federal Reserve (Fed) officials, published on Friday, failed to reiterate the hawkish bias and hence joined a retreat in the US Treasury bond yields to weigh on the US Dollar.

Alternatively, challenges to the sentiment, especially emanating from geopolitical fears surrounding China, Russia and North Korea, seemed to have put a floor under the prices. On the same line could be the last round of the US data showing higher inflation and the Fed’s readiness for further rate lifts.

Against this backdrop, Wall Street was closed and US Treasury yields eased, which in turn weighed on the US Dollar Index (DXY) and allowed the EUR/USD to remain firmer, defending Friday’s rebound from the six-week low.

Moving on, the return of full markets may highlight the geopolitical fears surrounding the US-China tussles over Taiwan and balloon shooting, not to forget the North Korean missile firing, to weigh on the sentiment and the EUR/USD prices.

Additionally, flash readings of German, Eurozone and the US S&P Global PMIs for February will be important to watch for the pair traders. Should the activity data suggest further improvement in the respective economies, the latest hawkish comments from the ECB could gain validation and might help the quote to remain firmer, unless the Fed policymakers sound hawkish too.

Technical analysis

EUR/USD remains on the bear’s radar unless crossing a three-month-old previous support line, close to 1.0725 by the press time.

- Silver spot price climbed on Monday, though the 200-DMA capped its uptrend.

- XAG/USD Price Analysis: The most likely scenario is downwards, with solid resistance from $21.90 and beyond.

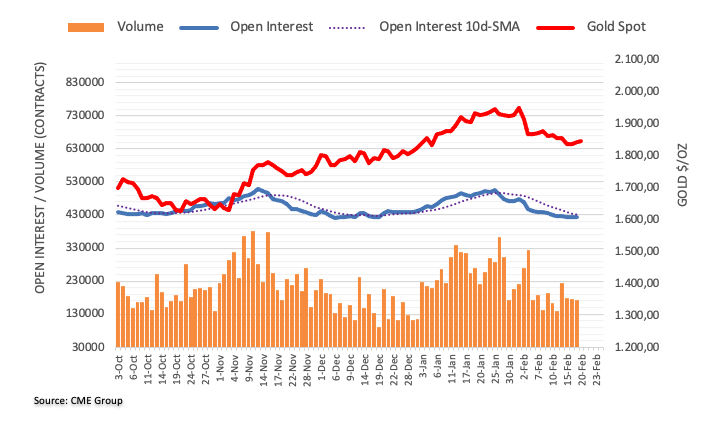

Silver price registered gains on Monday amidst thin liquidity conditions due to a US holiday. However, its rally was capped at a technical juncture, with the important 200-day Exponential Moving Average (EMA) rejecting higher prices for the white metal. Consequently, the XAG/USD retreated and settled at around $21.79 a troy ounce at the time of typing.

The XAG/USD daily chart portrays a large area of resistance resting above Silver’s spot price, led by the 200-day EMA at $21.93, followed by the 100, 20, and 50-day EMAs, each at $22.21, $22.36, and $22.64, respectively. Hence, the XAG/USD path of least resistance is downward biased. Still, the Relative Strength Index (RSI) turning flat at bearish territory, and the Rate of Change (RoC) almost neutral, suggests that bears are taking a respite before attacking the year’s lows.

Therefore, the XAG/USD first support would be the YTD low at $21.18. Once the white metal crosses the latter, it will expose the $21.00 figure, followed by the November 22 swing low at $20.87, and then the November 21 low at $20.59, ahead of the psychological $20.00 figure.

As an alternate scenario, if XAG’s bulls reclaim the 200-day EMA and the $22.00 mark, that would pave the way to retest the 100-day EMA.

XAG/USD Daily chart

XAG/USD Key technical levels

- USD/CAD is displaying a rangebound auction ahead of Canada’s CPI and Retail Sales data.

- The market mood is extremely quiet despite escalating geopolitical tensions.

- Higher consumer spending could force the BoC ahead to reassess the monetary policy.

The USD/CAD pair is demonstrating a rangebound performance around 1.3450 in the early Tokyo session. The Loonie asset has turned sideways as investors are awaiting the release of Canada’s Consumer Price Index (CPI) and the Retail Sales data for fresh cues.

The sideways auction in the Loonie asset is also backed by the lackluster US Dollar Index (DXY). The USD Index remained topsy-turvy as United States markets were closed on Monday due to Presidents’ Day. An elongated weekend pushed investors to the sidelines before making a significant move. The market mood was extremely quiet despite escalating geopolitical tensions. S&P500 futures displayed sheer volatility as US-China tensions escalated after the US ambassador warned China for providing lethal support to Russia in the invasion of Ukraine.

Going forward, the release of Canada’s Inflation and Retail Sales data will keep the Canadian Dollar in action. As per the consensus, Canada’s core CPI that excludes oil and food prices is seen higher at 5.5% vs. the former release of 5.4% on an annual basis. While the annual headline inflation is seen lower at 6.1% against 6.3% released earlier.

It is worth noting that the Bank of Canada (BoC) has announced a pause in the continuation of policy tightening after pushing interest rates to 4.5%. BoC Governor Tiff Macklem believes that the monetary policy is restrictive enough to tame the stubborn inflation for now.

Apart from the inflation figures, monthly Retail Sales will remain in focus, which is seen at 0.2% against a contraction of 0.1% released in the prior period. This indicates that consumer spending is coming back despite higher interest rates by the BoC. It could force the BoC ahead to reassess the monetary policy as higher consumer spending could propel wholesale inflation ahead.

Meanwhile, oil prices are aiming to reclaim the $78.00 resistance after Saudi Arabian Energy Minister Prince Abdulaziz bin Salman said on Monday, “OPEC+ is flexible enough to change decisions whenever required.” It is worth noting that Canada is a leading exporter of oil to the United States and higher oil prices would support the Canadian Dollar ahead.

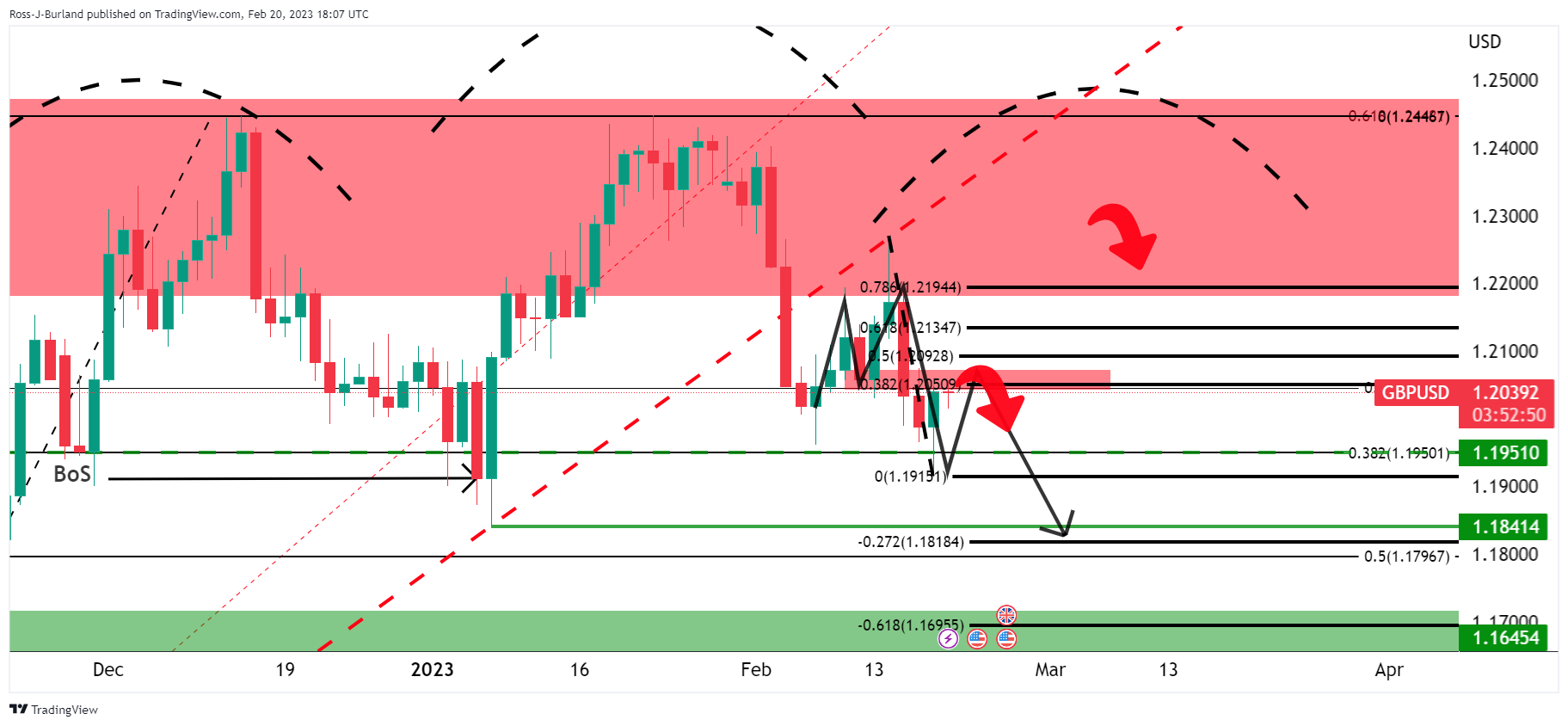

- GBP/USD struggles for clear directions after tepid week-start, fails to extend Friday’s bounce off multi-day low.

- Sluggish oscillators, key HMAs challenge bulls ahead of 13-day-old resistance line.

- Bears need sustained trading below 1.1920-15 to retake control.

GBP/USD remains sidelined near 1.2040 during the early hours of Tuesday’s Asian session, extending Monday’s inaction.

In doing so, the Cable pair seesaws around the 100-Hour Moving Average (HMA) amid the trader’s cautious mood ahead of the first readings of the UK Purchasing Managers Indexes (PMI) for February.

Not only the 100-HMA level surrounding 1.2040 but the 200-HMA level surrounding 1.2075 also challenges the GBP/USD pair buyers.

Following that, a downward-sloping resistance line from February 02, close to 1.2125 at the latest, will be important to watch as a break of which could convince GBP/USD buyers to challenge the monthly high surrounding the 1.2400 threshold. During the run-up, the previous weekly high near 1.2270 may act as an intermediate halt.

Meanwhile, the 1.2000 psychological maget precedes the 1.1960 support to restrict short-term GBP/USD downside.

However, the recent low near 1.1920-15 joins an upward-sloping support line from mid-November 2022 to act as a tough nut to crack for the GBP/USD bears to conquer.

To sum up, GBP/USD remains tight-lipped ahead of the key UK data. However, the sluggish oscillators and multiple hurdles to the north keep sellers hopeful.

GBP/USD: Hourly chart

Trend: Further downside expected

“Cyclone reconstruction will boost economic activity,” said New Zealand (NZ) Treasury on late Monday, early Tuesday in Asia.

More to come

- AUD/JPY clears a downslope resistance trendline around 92.50, with bulls eyeing 93.00.

- Consolidation within the 92.00-93.40 area would keep AUD/JPY traders entertained, nearby last week’s highs.

- AUD/JPY Analysis: Once it clears 93.50, a rally toward 95.00 is on the cards.

The Australian dollar (AUD) is recovering against the Japanese Yen (JPY) despite market sentiment shifting sour as US equity futures turned red, except for the Dow Jones. As the North American session fades, the AUD/JPY is advancing 0.63%, trading at 92.82.

From a daily chart perspective, the AUD/JPY is still neutral-biased, though trading within the 92.00-93.40 range, nearby the highs of the last week. AUD/JPY price action distanced from the daily Exponential Moving Averages (EMAs), suggesting that the uptrend is accelerating. Also, the Relative Strength Index (RSI) shifted upward in bullish territory. Therefore, the AUD/JPY could be testing the 93.00 figure in the near term, followed by the November 30 daily high at 93.84 and the psychological 94.00 figure.

As an alternate scenario, it is less likely that the AUD/JPY shifts gears and turns bearish, though it would face a solid support area below 92.00. Firstly, the 100-day EMA at 91.91, followed by the 91.50-60 area, a confluence of the 20/200/50-day EMAs, and then the 91.00 figure.

AUD/JPY Daily chart

AUD/JPY Key technical levels

- Gold price is looking to recapture the $1,850.00 resistance despite quiet market mood.

- The USD Index failed to capitalize on escalating geopolitical tensions.

- Gold price is gathering strength to deliver a breakout of the Falling Channel.

Gold price (XAU/USD) has displayed a back-and-forth action in a narrow range above $1,840.00 on Monday’s session. The precious metal is expected to hit the critical resistance of $1,850.00 as investors have digested the fact that the United States inflation could display a surprise rebound after declining consecutively for the past six months.

Last week, the release of the higher-than-anticipated Producer Price Index (PPI) indicated that firms believe that consumer spending is still solid and that wholesale inflation should not be declined extensively. Robust demand from households due to the upbeat labor market is going to keep the expectations of a rebound in the Consumer Price Index (CPI) alive ahead.

Meanwhile, the US Dollar Index (DXY) managed to safeguard the critical support of 103.50. The USD Index didn’t pick strength despite rising geopolitical tensions. The market mood was quiet as the US markets were closed on account of Presidents’ Day. S&P500 futures displayed a volatile session amid uncertainty inspired by an elongated weekend.

For further guidance, investors will focus on the preliminary S&P PMI (Feb) data, which will release on Tuesday. The preliminary Manufacturing PMI (Feb) is seen lower at 46.8 vs. the prior release of 46.9. And the Services PMI is seen at 46.6 against the former release of 46.8.

Gold technical analysis

Gold price is oscillating near the upper end of the Falling Channel chart pattern on an hourly scale. The precious metal is gathering strength to deliver a breakout for a fresh upside. A breakout of the aforementioned chart pattern indicates a bullish reversal. The 50-period Exponential Moving Average (EMA) at $1,840.00 is acting as major support for the Gold bulls.

Meanwhile, the Relative Strength Index (RSI) (14) has demonstrated a range shift structure. The RSI (14) has shifted its structure from the bearish segment of 20.00-60.00 to the bullish arena of 40.00-60.00, in which the 40.00 will act as a support for the US Dollar bulls.

Gold hourly chart

- AUD/USD struggles to hold recovery from multi-day low after Australia activity data.

- Preliminary readings of S&P Global PMIs for Australia improved in February.

- US holidays, sluggish markets allowed buyers to keep the reins despite geopolitical challenges.

- RBA Minutes should justify hawkish bias to keep the buyers in the driver’s seat, US PMIs will be eyed too.

AUD/USD fades the week-start optimism even as Australian activity data for February came in firmer during early Tuesday. Adding strength to the pullback moves could be the return of the full markets, as well as the geopolitical fears. Furthermore, the cautious mood ahead of the Reserve Bank of Australia’s (RBA) Monetary Policy Meeting Minutes also weakens the risk-barometer pair. That said, the Aussie pair retreats to 0.6910 at the latest, following the previous day’s run-up to 0.6920.

Australia’s preliminary readings of the S&P Global PMIs for February came in firmer as Manufacturing PMI rose to 50.1, versus 49.9 expected and 50.0 prior while the Services PMI increased to 49.2 from 48.6 previous readings and 48.4 market forecasts. Further, the S&P Global Composite PMI also improved to 49.2 from 48.5.

Even so, the AUD/USD pair failed to cheer the upbeat data and retreated to 0.6910 following the release.

The Aussie pair’s latest pullback could be linked to the return of the full markets as well as the latest challenges to the sentiment, especially emanating from geopolitical fears surrounding China, Russia and North Korea. On the same line could be the hopes of witnessing dovish remarks of the RBA policymakers from today’s RBA Monetary Policy Meeting Minutes.

On Monday, AUD/USD managed to remain firmer amid hopes of more stimulus from China, after the People’s Bank of China (PBOC) left its monetary policy unchanged. Also seemed to have helped the pair buyers could be the last round of Federal Reserve (Fed) talks that came in slightly offbeat, not to forget the President’s Day holiday in the US.

Amid these plays, Wall Street was closed and US Treasury yields eased, which in turn weighed on the US Dollar Index (DXY) and allowed the AUD/USD to remain firmer, extending Friday’s rebound from the six-week low.

Moving on, the return of full markets may highlight the geopolitical fears surrounding the US-China tussles over Taiwan and balloon shooting, not to forget the North Korean missile firing, to weigh on the sentiment and the AUD/USD prices.

However, major attention will be given to the RBA Minutes and the US S&P Global PMIs for clear directions. Should the RBA fails to defend its hawkish bias, as well as the US PMIs appear firmer, the AUD/USD could reverse the recent gains.

Technical analysis

A clear rebound from the 200-DMA, around 0.6800 by the press time, directs AUD/USD towards a 13-day-old resistance line, close to 0.6950 at the latest.

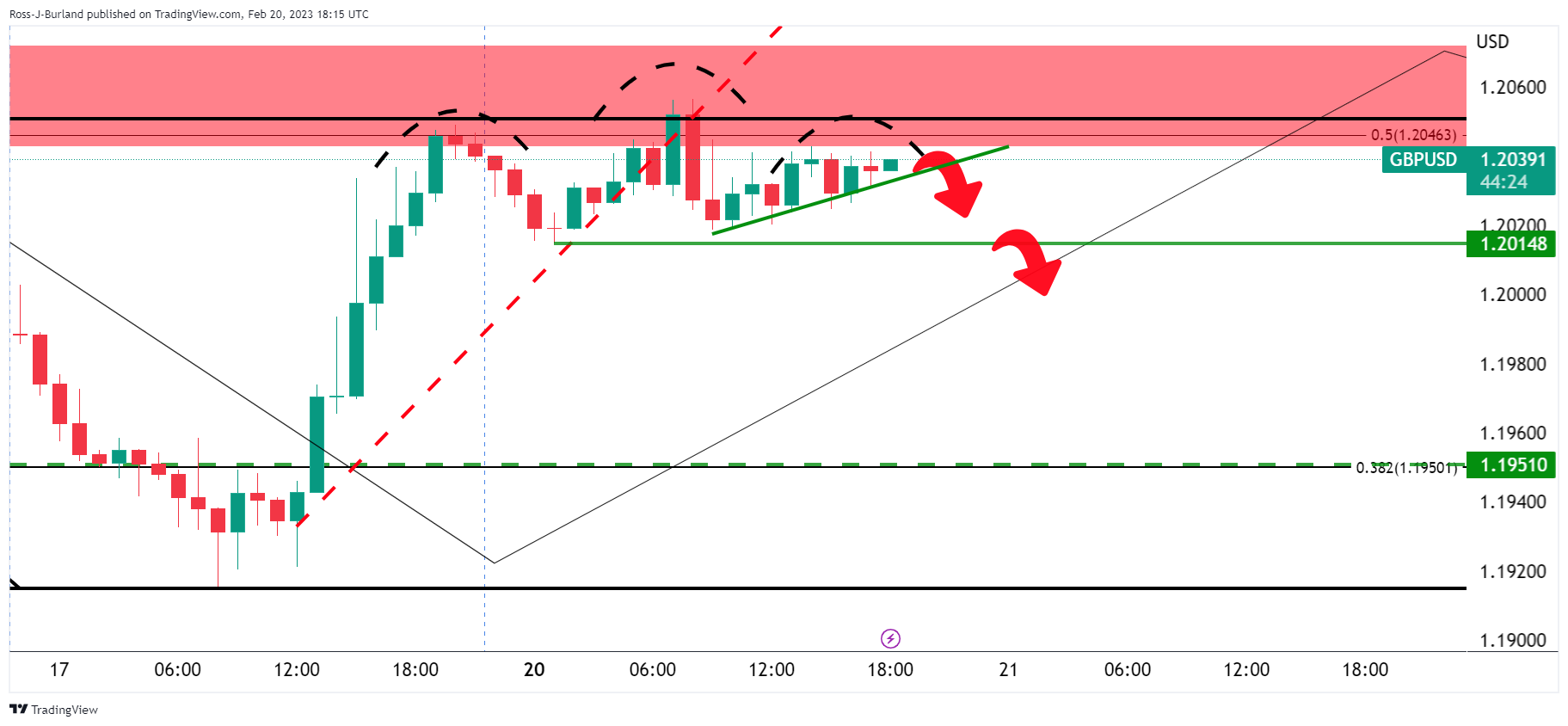

- US Dollar on the backfoot ahead of key data and Fed minutes.

- The bears have pressured the greenback into bearish territories.

The US Dollar continues to take its cues from US Treasuries that are pressured in a more hawkish environment. Recent Fed speakers have been advocating for higher for longer. this has encouraged the Fed Funds futures market to start pricing in a 50bp rate hike in March.

Last week, comments from Loretta Mester and James Bullard (both currently non-voting Fed officials) separately indicated that they saw a case for a 50-bps rate hike earlier this month. However, the Federal Reserve opted for a 25 bps move at the February 1 FOMC meeting.

But with markets expecting the Fed funds rate to peak just under 5.3% by July, the move in the greenback may have run its course and it is sinking at the start of the week.

As measured by the DXY index, it fell in light trade on Monday, losing territory to a low of 103.76. However, it is still up almost 1.8% for the month, on track for its first monthly gain since September. It hit a six-week high of 104.67 on Friday and while below there, the pressures are on.

There will be crucial events, however, from, the US economic calendar. The Federal Reserve's preferred measure of inflation in the Personal Consumption Expenditure deflator will be key. The market is expecting the January headline data to remain at 5.0% YoY, in line with the previous month, in stark contrast to the presumption that a downtrend in inflationary indicators would continue.

''Data in line with market expectations would thus add further weight to the view that the Fed will have to work harder to push inflation back to its target level,'' analysts at Rabobank explained. ''Currently implied market rates are pointing to a peak in Fed funds close to 5.33%.''

On February 22, the release of the minutes of this meeting will come out and may well indicate if a 50-bps move was seriously considered, and if so, the US Dollar could attract further demand, potentially enough to keep it above 104.50 for the foreseeable future in DXY.

US Dollar H4 chart

A move lower, in the meantime, would appear to be the bias with the price on the back side of the prior bullish trend. A move to test 103.50 and a break thereof opens the risk to below 102.00.

- USD/JPY is still underpinned by the US 10-year Treasury bond yield and the market mood.

- The latest US inflation data triggered the last week’s USD/JPY rally from 131.50 to 135.00.

- USD/JPY Technical analysis: To remain consolidated, slightly tilted upwards.

The USD/JPY fluctuated in Monday’s session as US financial markets remained closed during President’s Day. US equity futures are negative, except for the Dow Jones Industrial Average. The US Dollar continued to trend lower, while US Treasury bond yields capped the USD/JPY fall. The USD/JPY is trading at 134.23, above its opening price by 0.07%.

After reclaiming the 50-day Exponential Moving Average (EMA) at 132.73, the USD/JPY enjoyed a rally that peaked at around 135.11. Bull’s failure to hold gains above the latter exacerbated a fall to the 134.20s area, mainly driven by the fall in the US 10-year benchmark note rate, which finished last Friday’s session on a lower note.

Last week’s US inflation data in the consumer segment showed some slowing down. Prices paid by producers, also known as PPI, rose above estimates and the previous month’s reading on a monthly basis. Therefore, traders shifted from a risk-on to a risk-off environment, as traders expect a more hawkish than estimated US Federal Reserve (Fed).

In the meantime, changes in the Bank of Japan (BoJ) are increasing volatility in the pair. Given that Kazuo Ueda remains the leader to become the new BoJ Governor, investors are positioning toward a more hawkish BoJ stance. On early Monday in the Asian session, the current BoJ Deputy Governor Amamiya said that the BoJ has the necessary tools to exit from ultra-loose monetary conditions.

What to watch?

USD/JPY Technical analysis

The USD/JPY uptrend lost steam as it formed an inverted hammer near the peak at around 135.00. Buyers’ failure to hold to the latter exacerbated a retracement below the 100-day EMA at 134.72, opening the door to consolidate within the important 200-day EMA at 133.77 and 134.70, a 100 pip range. The Relative Strength Index (RSI) shifted falt though at bullish territory, signals that buyers are taking a respite, while the Rate of Change (RoC), is almost unchanged. Break above the 100-day EMA, and the USD/JPY might re-test 135.00. On the downside, a break below 134.00 would challenge the 200-day EMA.

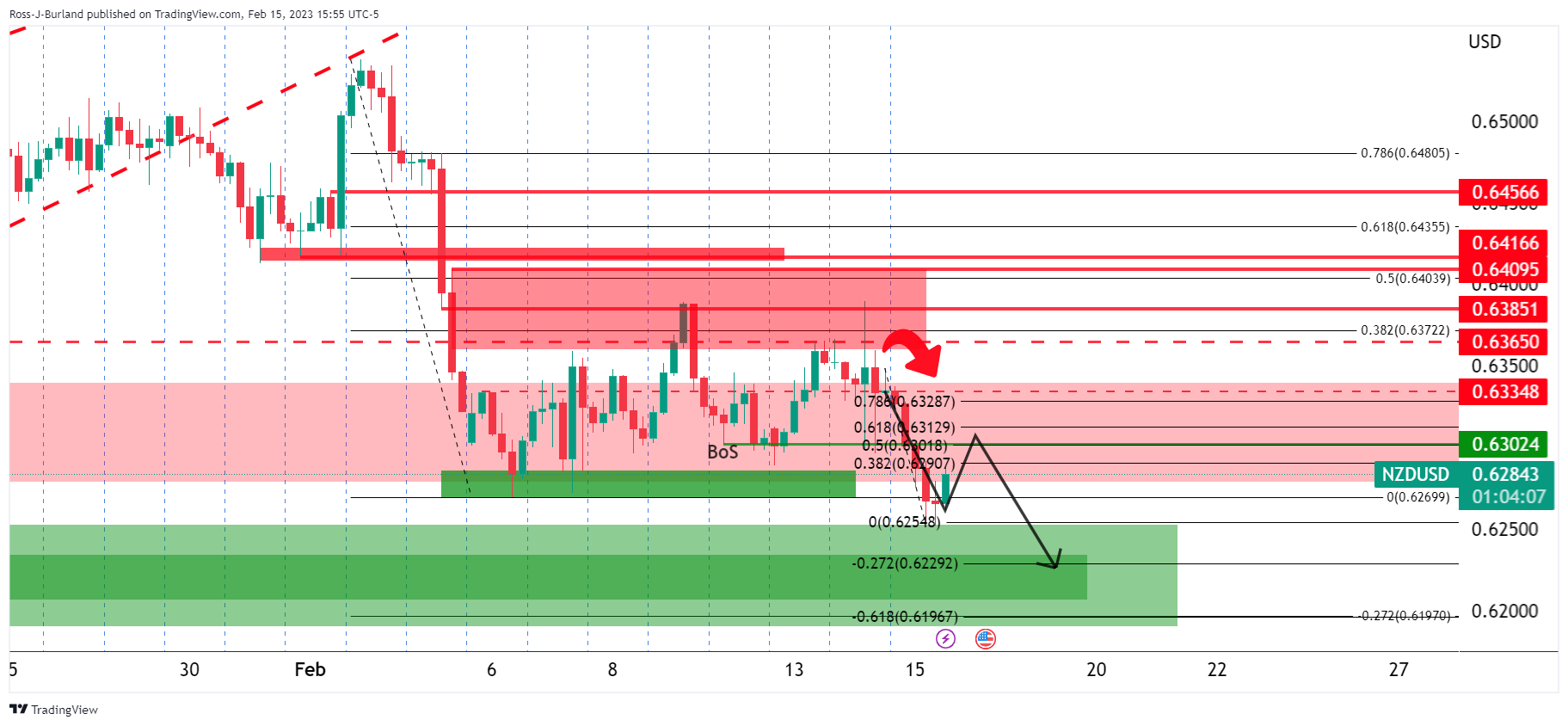

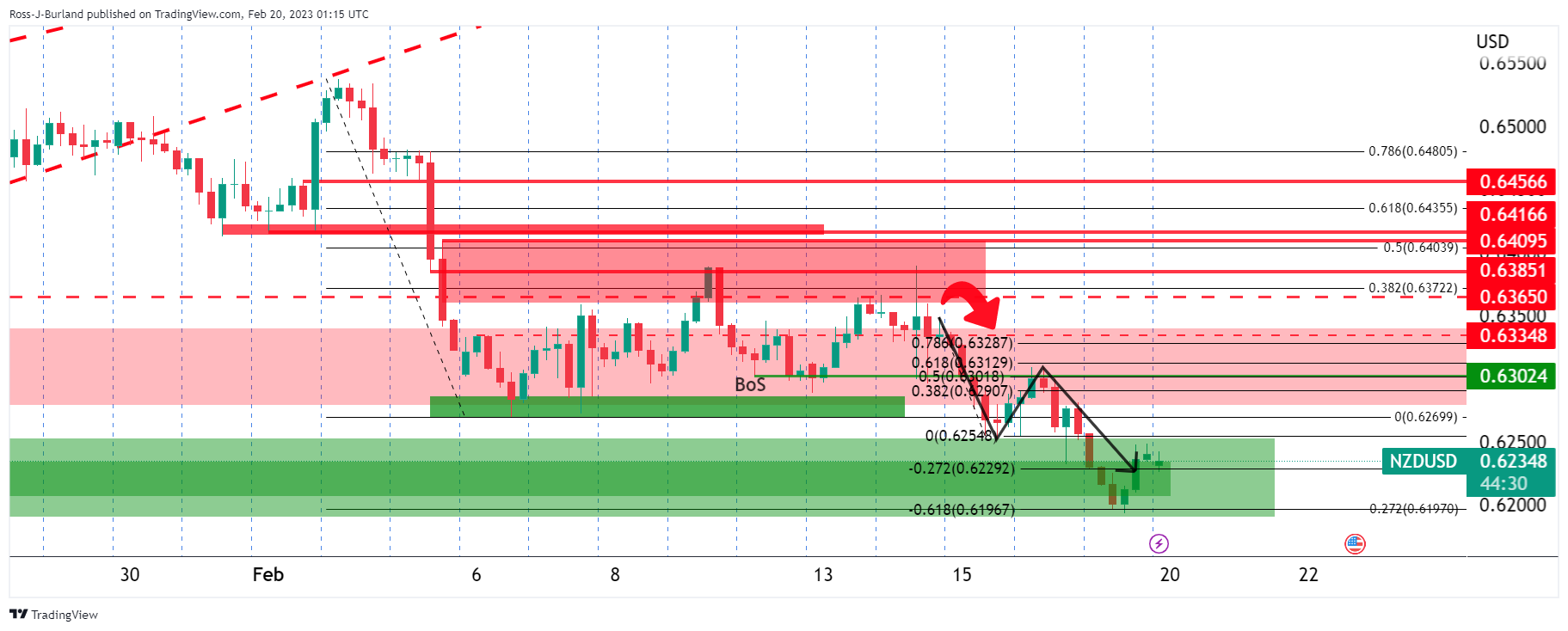

- NZD/USD has been perking up from the failed breakout on Friday with eyes on RBNZ.

- NZD/USD longs are in the market with the 0.6270s eyed that safeguard a move to test 0.63 territories.

NZD/USD is getting set for the Reserve Bank of New Zealand tomorrow and has been tucked up in a tight range due to a slow start this week with the United States out on holiday for Presidents’ Day.

''The Kiwi’s immediate future will depend on what the RBNZ do, but as markets contemplate the cost of rebuilding and the impact that’s likely to have on inflation, insurance flows and infrastructure spending, it’s quickly becoming a potential driver of sustained NZD strength – more than we thought just a few days ago,'' analysts at ANZ Bank wrote in a note on Tuesday, adding, ''market expectations seem to have swung slightly away from arguments to go easy post-cyclone and back toward the economic arguments to press ahead with hikes.''

The US Dollar dynamic

Meanwhile, the US Dollar is being guided by US Treasuries that are pressured in a more hawkish environment. However, further significant US Dollar strength might need the Fed Funds futures market to start pricing in a 50bp rate hike in March. But with markets expecting the Fed funds rate to peak just under 5.3% by July, the move in the greenback may have run its course.

As measured by the DXY index, it fell in light trade on Monday, losing territory to a low of 103.76. However, it is still up almost 1.8% for the month, on track for its first monthly gain since September. It hit a six-week high of 104.67 on Friday and while below there, the pressures are on.

NZD/USD technical analysis

NZD/USD has been perking up from the failed breakout on Friday and longs are in the market with the 0.6270s eyed that safeguard a move to test 0.63 territories.

- EUR/USD stuck in a range and awaits major data this week.

- Traders will have both Eurozone and US economic data to potentially kickstart some major moves in EUR/USD.

EUR/USD is moving sideways during a US holiday parked inside of Friday's range at the upper end of it. The Euro has travelled a small distance between 1.0670 and 1.0704 vs. the US Dollar so far on the day.

Liquidity is expected to remain thin for the remainder of the day with US markets closed for Presidents' Day. However, there is plenty at stake this week and from a technical standpoint, big moves are on the horizon.

A flurry of recent data from the United States reinforced market expectations of tighter monetary policy from the Federal Reserve over the last several days, fuelling a firm recovery in the US Dollar last week. The DXY index, which measures the greenback vs. six other major currencies, rallied from a double-bottom low in the 102.50s last week and reached a high of 104.67, a six-week high. However, the squaring of that run has left the US dollar vulnerable while below 104.00 as it is today which is offering the Euro bulls some relief, albeit possibly only temporary.

The US Dollar is still up almost 1.8% for the month, on track for its first monthly gain since September and the fundamentals will continue to flow this week with the minutes of the February FOMC meeting released on February 22. ''Strong inflation and labour market data since then have turned Fed speak more hawkish,'' analysts at TD Securities said. ''Overall, the minutes are likely to be too outdated to impact markets meaningfully.''

We will also have the Core Personal Consumption Expenditure data that is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behaviour. It is the Federal Reserve's preferred measure for inflation which makes this week a crucial one for the US Dollar and market sentiment surrounding the central bank.

''We expect core PCE prices to accelerate in January to its strongest m/m pace in five months, also outpacing the core CPI's 0.4% MoM gain,'' analysts at TD Securities said.

''The YoY rate likely stayed unchanged at 4.5%, suggesting price gains remain elevated. The report is also expected to confirm that the consumer remains alive and kicking, posting an increase that is likely to more than makeup for recent weakness.''

This data will come out on February 24, but on February 23, the Eurozone will release the Final HICP Inflation reading for January year over year that could be revised up, cementing the inevitably of a 50 basis point rate hike by the Europen Central Bank next month. However, it will also potentially play into the sentiment that the ECB will not be done in March and will need to do more. The governor of the ECB, Christine Lagarde signalled at the prior meeting that March will not mark the final hike.

All in all, there could be something for both the EUR/SD bears and the bulls this week in terms of the data, but the technicals are so far aligning bullish following the failed breakout on Friday:

EUR/USD technical analysis

At the start of the week's analysis, EUR/USD Price Analysis: US Dollar's failures above 104.20 DXY opens risk to 1.0720s, it was noted that the price was entering correction territory and we have seen a test already to the prior week's lows that have acted as support on Monday:

That is not to say that we cannot see more downside. After all, there is money below 1.0670 from Friday's long positions towards 1.0650. However, with the Euro being on the back side of the trend and there being untapped territory above 1.0720, the focus is bullish until a break below Friday's lows near 1.0612.

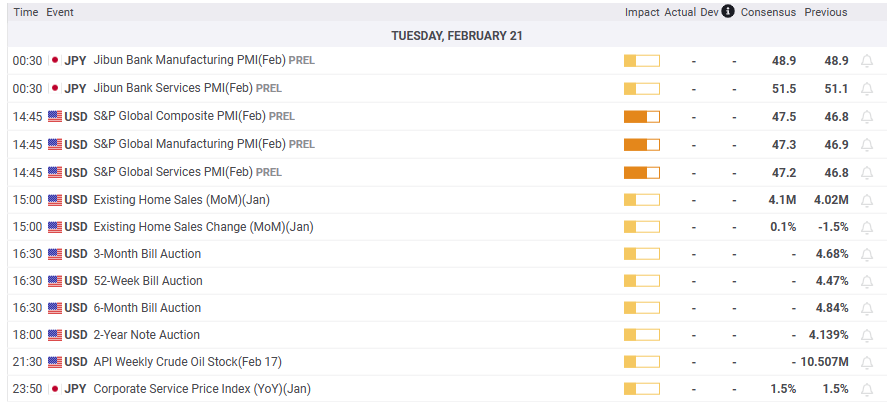

What you need to take care of on Tuesday, February 21:

The week started in slow motion amid the United States celebrating President’s Day. The absence of relevant macroeconomic releases helped majors to trade within tight intraday ranges.

In the meantime, the market sentiment is sour. Tensions between the United States and China over the balloons shots earlier this month continue as US top diplomat Anthony Blinken said Beijing's actions were irresponsible, while Chinese officials responded US reaction was "hysterical." Meanwhile, North Korea fired an intercontinental ballistic missile on Saturday that landed in the Sea of Japan. Finally, US President Joe Biden unexpectedly visited Kyiv to announce additional weapons supplies.

EUR/USD trades around 1.0680, limited by softer-than-anticipated EU data. GBP/USD hovers around 1.2040, unchanged for the day.

Commodity-linked currencies advanced vs their American rival. AUD/USD trades around 0.6910, while USD/CAD is down to 1.3450. The USD/JPY pair is ending the day unchanged at 134.20.

Crude oil prices posted a modest intraday advance, with WTI currently trading at $77.70 a barrel. Gold peaked at $1,847.45, but finished the day around $1,841.

On Tuesday, the focus will be on the preliminary estimates of the February S&P Global PMIs for major economies.

FTT explodes by nearly 28% following FTX Japan's announcement of crypto withdrawal resumption

Like this article? Help us with some feedback by answering this survey:

The Swiss National Bank is "still willing" to be active on the foreign currency markets in pursuing its goal of price stability, Vice Chairman Martin Schlegel said on Monday.

"If the Swiss franc depreciates we are ready to sell foreign exchange, if the Swiss franc appreciates strongly we are willing to buy foreign exchange," Schlegel told an event in Warsaw.

Key notes from SNB Vice Chairman

''We are still willing to be active on the forex markets.''

''If the swiss franc depreciates, we are ready to sell forex. if it appreciates strongly we are willing to buy forex.''

USD/CHF technical analysis

There has been a break in the structure, BoS, below 0.9250 and should the bears commit, a move to test 0.9200 could be in order for the coming sessions.

- USD/CHF retraced some of the last week’s gains after struggling at the 50-day EMA.

- USD/CHF Price Analysis: It is still neutral-to-downward biased, but it could increase once 0.9300 is reclaimed.

The USD/CHF is subdued amidst a thin liquidity trading session sponsored by a holiday in the United States (US), with traders enjoying a long weekend in the observation of President’s Day. At the time of writing, the USD/CHF is trading at 0.9230, below its opening price by 0.12%.

From a daily chart perspective, the USD/CHF remains neutral to downward biased. On Friday, the USD/CHF reached a new multi-week high but reversed its course and finished with losses of 0.12%. The bearish continuation extended today, though it was capped by the 20-day Exponential Moving Average (EMA) at 0.9223.

For a bearish resumption, the USD/CHF must clear the 20-day EMA, followed by the psychological 0.9200 mark. A breach of the latter will expose the February 9 swing low at 0.9160, followed by the February 14 daily low of 0.9135, ahead of the 0.9100 psychological level.

Conversely, the USD/CHF first resistance would be the 50-day EMA At 0.9279, followed by the 0.9300 figure. A decisive break and the buyers could send the USD/CHF aiming towards the 100-day EMA At 0.9388, ahead of the 0.9400 mark.

USD/CHF Daily chart

USD/CHF Key technical levels

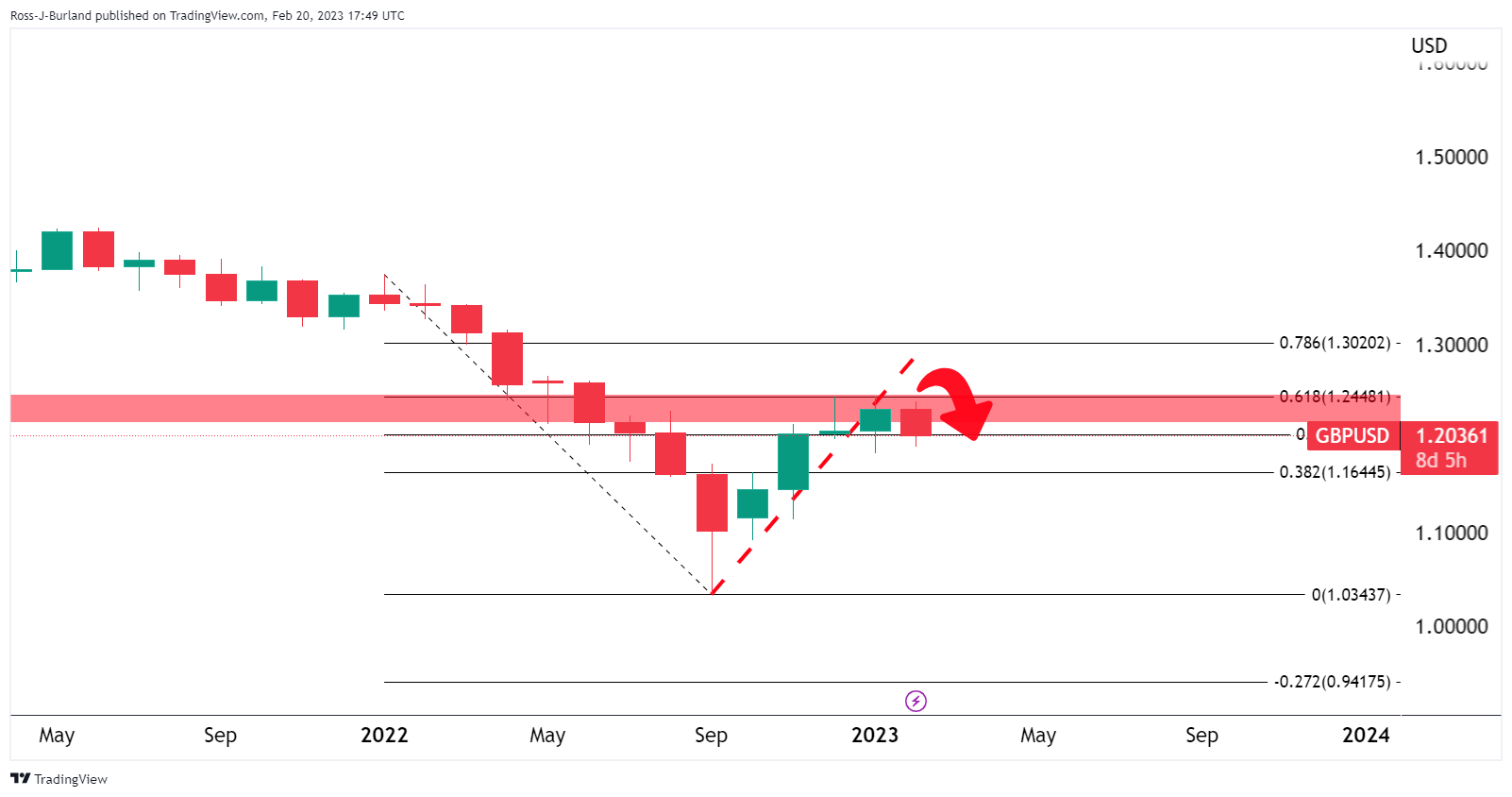

- GBP/USD bears could be about to make a move.

- The multi-time frame structures are dominating the technicals and make for a bias to the downside.

GBP/USD corrected from the low 1.19s on Friday, denting the bear's dominance ahead of a US holiday on Monday as traders squared up into the long weekend. At the time of writing, GBP/USD is trading near 1.2050 and remains in consolidation between the day's low of 1.2014 and 1.2056.

For some background, the pair has been capped where equal highs were put in near 1.2450 between mid-December and late January whereby the price corrected a strong monthly bearish impulse to a 61.8% Fibonacci of the range:

GBP/USD monthly chart

Given the steepness of the correction, while the downside bias is coming to the fore, a gradual decline could be in order and the bears have already made their first move, breaking the old monthly support:

GBP/USD weekly chart

From a weekly perspective, a bearish head and shoulders could be forming:

While on the backside of the prior bullish trend's support line, the bears will be looking for a solid structure to lean against for a move to target the prior resistance in the bullish leg that has the confluence with the 61.8% Fibonacci retracement near 1.1650.

GBP/USD daily chart

For structure, the bears can look to the lower time frames:

While it is too early in the right-hand shoulder's formation phase, a move lower could still be in order for the meantime as the price discovery plays out.

Currently, within the right-hand shoulder's formation, there is an M-pattern on the daily chart that is formed above where there was a break of structure, BoS, at the start of the year. The price has corrected the bearish leg of the pattern to a 38.2% Fibonacci level near 1.2050 and should this hold as resistance, at the neckline of the pattern, then a downside extension would be in order for a run to test 1.1850 territory for the days ahead.

GBP/USD H1 chart

From a 1-hour perspective, the bears could be active on a break of the 1.2015 level and prior support which is a neckline of the current hourly head and shoulders:

- AUD/USD climbs and hovers above the 50-day EMA, eyeing the 20-day EMA on the upside.

- US last week’s inflation data failed to bolster the USD, as the AUD/USD snapped three days of losses.

- AUD/USD traders are eyeing the RBA and the FOMC minutes, each revealed Tuesday and Wednesday.

AUD/USD has managed to stage a recovery after dropping to a new YTD low at 0.6811, which, consequently, cracked the 50, 100, and 200-day Exponential Moving Averages (EMAs). However, the AUD/USD pair reclaimed the 0.6900 figure and is trading at 0.6912, above its opening price by 0.53%.

A soft US Dollar, a tailwind for the AUD/USD amidst a lack of data

The New York trading session remains quiet in observance of US President Day. US equity futures reflect risk aversion, though the AUD/USD pair portrayed the opposite, with renewed demand for the Aussie Dollar (AUD).

Even though last week’s data from the United States (US) showed that inflationary pressures remain tilted to the upside, the greenback has not found its floor on Monday, undermined by falling US Treasury bond yields. The US Dollar Index (DXY), a gauge of the buck’s value vs. a basket of six currencies, is pairing some of its earlier losses but remains down by 0.02%, at 103.864

Speculations that the People’s Bank of China (PboC) would continue to propel the economy increased flows toward the second-largest economy in the world. According to Bloomberg, Goldman Sachs raised its bet on Chinese equities, as its reopening would underpin global growth. Therefore, flows to the AUD/USD boosted the Aussie Dollar (AUD), despite the Federal Reserve’s (Fed) resolution to tackle high inflation in the US.

Another reason that has underpinned the AUD/USD is that the Reserve Bank of New Zealand (RBNZ) will raise rates on Wednesday, a headwind for the US Dollar (USD). Even though the Reserve Bank of Australia (RBA) raised rates during the last week, a dismal employment report triggered a reversal, which weighed on the AUD/USD.

What to watch?

The Australian economic docket will feature Tuesday’s S&P Global PMI figures alongside the RBA’s last meeting minutes. On the US side, S&P Global PMIs find reading numbers would be released, and also the FOMC minutes.

AUD/USD Key technical levels

- USD/MXN jumps from YTD lows around $18.33 and climbs to 18.40.

- USD/MXN Price Analysis: Positive divergence remains, which could pave the way for a recovery.

The USD/MXN bounces after hitting multi-year lows around 18.3301, snapping three days of consecutive losses. Nevertheless, the USD/MXN would remain pressured after a strong downtrend dragged prices from the last year's $21.05 peak toward the above-mentioned $18.33 area. At the time of writing, the USD/MXN exchanges hand at 18.4076, above its opening price by 0.25%.

Technically speaking, the USD/MXN daily chart portrays a bearish continuation as the most likely scenario. However, the divergence between the USD/MXN price action and the Relative Strength Index (RSI) remains intact, which would spur a reversal that might open the door for the USD/MXN buyers to reclaim the $19.00 psychological level. This means as price action registered lower lows, the RSI has not. Therefore, risks for a reversal remain, which would open the door for further USD/MXN upside.

For that scenario to play out, the USD/MXN needs to crack the confluence of a downslope-resistance trendline and the 20-day Exponential Moving Average (EMA) at 18.6951, followed by the February 15 daily high at 18.7479, followed by the 50-day EMA At 18.9669, ahead of the 19.0000 psychological price level.

The USD/MXN must conquer the 18.4000 mark for a bearish continuation. Once cleared, that will expose the YTD low at 18.3301, followed by the psychological $18.00.

USD/MXN Daily chart

USD/MXN Key technical levels

The Forint rallied strongly over the past month. Economists at Commerzbank see the HUF staying strong during 2023 but once again in 2024, they forecast a weaker Forint when the Euro resumes depreciating.

HUF underperformance will likely resume during 2024

“HUF’s rally might extend modestly further in the near-term as inflation begins to moderate – in this window, we see EUR/HUF in the 380 range.”

“We forecast a weaker Forint subsequently in 2024 when inflation proves stubborn globally, and the Euro resumes depreciating.”

Source: Commerzbank Research

In the opinion of Kit Juckes, Chief Global FX Strategist at Société Générale, the Dollar’s bounce is fading, unless the Fed starts talking tough.

EUR/USD is stuck

“Presidents’ Day has delivered a slow morning for markets, albeit one with a slight positive bias to Asian and European equities, that helps risk sentiment more broadly and in so doing, has prevented the Dollar from rising any further today.”

“In terms of EUR/USD, there are two reasons why the dollar’s bounce is getting stuck. The first is that 2023 growth forecasts are still converging on the back of European optimism. The second is that the move in relative EU-US rates that triggered the Dollar’s bounce at the start of this month, has petered out.”

“I suspect that further significant Dollar strength will require the Fed Funds futures market to start pricing in a 50 bps rate hike in March. After all, the market currently prices a very high probability of a 50 bps hike by the ECB in March.”

It would be appropriate for the European Central Bank to raise rates beyond March and reach the terminal rate this summer, European Central Bank (ECB) Governing Council member Olli Rehn told Börsen-Zeitung on Monday, per Reuters.

Additional takeaways

"Rates need to stay in restrictive level for some time, should not rush to discuss cuts."

"Rate hikes should not stop while core inflation is rising and is so high."

"Eurozone recession likely avoided, 2023 growth could be around 1%."

Market reaction

These comments don't seem to be having a significant impact on the Euro's performance against its rivals. As of writing, EUR/USD was flat on the day at 1.0690.

GBP/USD recovered from below 200-Day Moving Average at 1.1938. However, economists at Société Générale believe that the pair is unlikely to stage a sustainable rise.

Modes UK PMI improvement may not be enough to lift GBP/USD

“The Pound fought back from below 1.20/USD and the 200-DMA (1.1938) on Friday but conviction for a return to 1.2450 is low based on the outlook for a widening in US/UK rate differentials. Based on implied market rates, the Fed/BoE spread could widen to almost 100 bps in 2Q, keeping GBP/USD in check.”

“The PMI for February is the pick of the UK data calendar tomorrow. We forecast a modest improvement to 49.2. This may not be enough to lift GBP/USD with investors instead bracing for the FOMC minutes and US PCE inflation.”

- Gold price stages a recovery, reclaiming the $1840 area as it aims north.

- Last week’s US economic data and hawkish commentary continue to dampen market sentiment.

- Gold Price Forecast: It will face the 50-DMA as resistance, followed by the 20-DMA; otherwise, it could fall to $1800.

Gold price advances after hitting a six-week low at around $1819 and aims toward the 50-day Exponential Moving Average (EMA), above its opening price by 0.30%. At the time of writing, the XAU/USD is at $1845.82, bolstered by a soft US Dollar (USD) undermined by falling US Treasury bond yields.

Gold climbs to the $1840 mark on a US holiday

As the North American session begins, US equity futures are trading in the red, except for the Dow Jones. Monday’s trading session would be dull due to thin liquidity conditions, as the US remains a holiday in observance of President’s Day.

Last week’s economic data revealed in the United States (US) keeps traders nervous, as they had begun to price in a more aggressive Fed. Uncertainty of where the Federal Funds Rate (FFR) will peak triggered the second consecutive week in which US equities finished with losses. In addition, Fed Governor Bowman and Christopher Waller were the latest policymakers to emphasize the need to raise higher rates for longer as the US central bank battles to tame inflation.

Last Tuesday, the US economic calendar revealed that the Consumer Price Index (CPI) slowed faster than estimated. However, two days later, prices paid by producers, also known as PPI, came above estimates and the prior’s month data in the month-over-month figure, reigniting speculations that the Fed would continue to tighten monetary policy as rate cuts speculations begin to fade.

Reflection of this was the jump in US Treasury bond yields, which closed the last week at 3.822%, eight basis points (bps) above the previous week and underpinned the greenback. The US Dollar Index (DXY), a gauge of the buck’s value vs. a basket of six currencies, climbed above the 104.000 mark. Nevertheless, in the session, the DXY it’s sliding 0.03%, at 103.849.

What to watch?

The US economic docket will feature in the week Existing Home Sales, S&P Global PMIs on its final readings, the Fed’s preferred gauge for inflation, the core PCE and the University of Michigan (UoM) Consumer Sentiment.

Gold technical analysis

From a technical perspective, the XAU/USD jumped from the 100-day EMA at $1820 and climbed above the $1840 area as buyers prepared to assault the 50-day EMA at $1854.08. On the upside, the XAU/USD first resistance would be the 50-day EMA, followed by the 20-day EMA at $1868.83, ahead of the February 9 daily high at $1890.21. Downwards, the XAU/USD first support would be the 100-day EMA, followed by the 200-day EMA at $1802.46, ahead of $1800.

- Eurozone Consumer Confidence Index edged slightly higher in February's flash estimate.

- EUR/USD continues to trade in a tight range at around 1.0700.

Consumer sentiment in the Euro area improved modestly in February with the European Commission's Consumer Confidence Indicator rising to -19 (flash estimate) from -20.9 in January.

For the EU, the Consumer Confidence Indicator rose by 1.5 points to -20.6.

"Despite this fourth consecutive monthly improvement, at -20.6 (EU) and ‑19.0 (EA) pps., consumer confidence remains well below its long-term average," the European Commission noted in its publication.

Market reaction

This data failed to trigger a noticeable reaction in EUR/USD. As of writing, the pair was virtually unchanged on a daily basis at 1.0692.

Value outperformance should resume amid rates uncertainty, in the opinion of economists at UBS.

Price pressures remain, despite an easing of headline inflation

“Based on data going back to the 1970s, value stocks have outpaced growth when inflation is over 3%. The latest US consumer price index release for January has reinforced our view that inflation is only likely to fall below this level later this year.”

Fed officials have stressed that further rate hikes are essential, a greater potential drag for growth sectors

“Growth sectors tend to suffer more from higher rates since this reduces the current value of more distant profits. So, the recent hawkish tone of comments from top Fed officials could also tilt the balance between growth and value sectors.”

Tech, the largest growth sector, faces additional headwinds beyond rate worries

“The MSCI World IT sector trades on a 12-month forward price-to-earnings multiple of 22 times, 20% above the sector’s 10-year average, as of 13 February. By contrast, value sectors are generally more moderately priced. In addition, we expect global tech sector earnings growth to slow further due to a weaker enterprise outlook and lukewarm consumer demand.”

Economist Enrico Tanuwidjaja at UOB Group reviews the latest GDP figures in Thailand.

Key Takeaways

“The Thai economy’s pace of growth decelerated to 1.4% y/y in 4Q22 following a strong, upwardly revised growth of 4.6% y/y in 3Q22. Still, 2H22 accelerated to 3.0% from an average of 2.4% in 1H22. On a sequential basis, the economy contracted by 1.5% q/q sa in 4Q22 (3Q22: +1.1%).”

“Growth in the last quarter was primarily driven by higher private consumption expenditures, investment, and most notably the export of services (tourism revenue). However, export of goods slowed down, while government expenditure, including its public investment decreased.”

“Based on today’s 4Q22 GDP data, the Thai economy grew well below expectation at just 2.6% in 2022 (Bank of Thailand – BOT, consensus, and UOB forecast all were projecting 3.2% for 2022), though it is still much higher than 2021’s tepid 1.6% growth. Given the downside surprise, we revise our 2023 growth forecast lower to 3.1% as the strength of domestic economic recovery appears to be more modest than expected. Nevertheless, we continue to expect higher and steadier tourism income amidst China’s reopening to bode well for services exports performance. Less robust growth recovery will also render BOT less room to embark on an even tighter monetary policy in 2023.”

- EUR/USD keeps the current side-lined trade unchanged.

- Immediately to the downside appears the monthly low near 1.0610.

EUR/USD trades without direction in the sub-1.0700 region at the beginning of the week.

If sellers regain the upper hand, pair could slip back to the February low at 1.0612 (February 17) in the near term. The breach of this level could see a potential test of the 2023 low at 1.0481 (January 6) emerge on the horizon.

So far, the bearish sentiment is expected to persist as long as the 3-month resistance line, today near 1.0890, caps the upside.

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0328.

EUR/USD daily chart

EUR/USD currently stands only slightly above the levels traded at the start of the year. Economists at Rabobank expect the 1.06 level to offer psychological support

Scope for the USD to remain well supported into the middle of the year

“In terms of USD sentiment, February has clearly offered something of a sea-change relative to last month. It is our expectation that this has further to run.”

“Given our expectation that the FOMC is likely to take the top of the target range for the Fed Funds to 5.5%, we see scope for the USD to remain well supported into the middle of the year.”

“1.06 can be expected to offer psychological support. Below this the year’s low at 1.0484 is likely to offer strong support.”

Extra gains in USD/IDR look likely, although a sustained advance beyond 15,245 seems off the table suggests UOB Group’s Market Strategist Quek Ser Leang.

Key Quotes

“Our expectations for USD/IDR to ‘advance further’ last week did not materialize as it traded in a relatively narrow range of 15,139/15,225. The underlying tone still appears to be a tad firm and USD/IDR is likely to edge higher to 15,245.”

“Barring a sudden surge in momentum, a sustained rise above 15,245 is unlikely (next resistance is at 15,270). Support is at 15,130, followed by 15,000.”

- The index treads water around the 104.00 region on Monday.

- Further advance could revisit the 2023 high near 105.60.

DXY trades within a tight range near Friday’s closing levels in the sub-104.00 zone.

The ongoing price action favours the continuation of the uptrend for the time being. Further bouts of strength are now expected to put a potential test of the 2023 top at 105.63 (January 6) back on the investors’ radar in the not-so-distant future.

In the longer run, while below the 200-day SMA at 106.44, the outlook for the index remains negative.

DXY daily chart

Recently released US activity data was stronger than expected. But HSBC’s conviction remains the same, the broader USD is seen weakening in the longer run.

Markets continue to debate how best to respond to US data

“Markets are currently debating what the recent run of better-than-expected US data means for risk sentiment: The ‘risk off’ and USD bullish angle is that a strong US labour market is supporting consumption, keeping inflation levels elevated , which will force the Fed to act more aggressively than what the rate market has priced in. The ‘risk on’ and USD bearish angle is that both inflation and wages growth are decelerating in the US, ensuring the Fed’s tightening is nearly done without needing to induce a US recession. This also helps to allay concerns of a weaker global growth backdrop and subsequent hard landing.”

“We believe this debate will continue over the near term, meaning that the USD is likely to remain choppy. We also expect further deceleration in inflation and measured increases in the unemployment rate to decisively favour the ‘risk on’ narrative and USD weakness, as the year progresses.”

- USD/JPY remains on the defensive on Monday, though the downside remains cushioned.

- Hawkish Fed expectations continue to underpin the USD and lend support to the major.

- The technical setup favours bulls and supports prospects for the emergence of dip-buying.

The USD/JPY pair edges lower on the first day of a new week and remains on the defensive through the early North American session. The pair is currently placed around the 134.00 mark, though the setup warrants some caution before positioning for an extension of Friday's pullback from a nearly two-month high.

The cautious market mood, amid looming recession risks and geopolitical tensions, underpins the safe-haven Japanese Yen (JPY) and acts as a headwind for the USD/JPY pair. That said, the underlying bullish sentiment surrounding the US Dollar, bolstered by expectations that the Fed will stick to its hawkish stance to tame inflation, should continue to lend support to the major.

From a technical perspective, last week's sustained break through the 50-day SMA, for the first time since September 2022, and a subsequent move beyond the 132.90-133.00 supply zone was seen as a key trigger for bulls. The latter also marks the 38.2% Fibonacci retracement level of the pullback from over a three-decade high touched in October and should act as a pivotal point.

Moreover, oscillators on the daily chart have just started gaining traction and support prospects for the emergence of some dip-buying. Hence, any further pullback is more likely to find decent support and remain limited near the aforementioned 133.00 strong resistance breakpoint. A convincing break below, however, will negate the positive outlook and prompt some technical selling.

On the flip side, the 134.45-134.50 area now seems to act as an immediate barrier ahead of the 135.00 psychological mark. Some follow-through buying beyond the monthly peak, around the 135.10 zone touched on Friday, should allow the USD/JPY pair to climb further towards the 135.55-135.60 horizontal zone and eventually aim to reclaim the 136.00 round-figure mark.

The momentum could get extended further towards the 136.75-136.85 confluence resistance, comprising the 38.2% Fibo. level and a technically significant 200-day SMA. A sustained strength beyond will suggest that spot prices have bottomed out and pave the way for an extension of the recent recovery move from the 127.20 area, or the lowest level since May 2022.

USD/JPY daily chart

Key levels to watch

According to UOB Group’s Market Strategist Quek Ser Leang, further upside could motivate USD/MYR to revisit the 4.4550 level in the near term.

Key Quotes

“Last Monday (13 Feb, spot at 4.3510), we held a bullish USD/MYR view. We indicated that ‘the risk for USD/MYR is still on the upside’. We added, ‘a break of the strong resistance at 4.3660 could potentially trigger a rapid rise to 4.4000’. Our bullish view was correct even though the anticipated ‘rapid rise’ exceeded our expectations as USD/MYR surged to a high of 4.4320 before closing higher by a whopping 2.23% (Friday’s close of 4.4300), its largest 1-week advance since Mar 2020.”

“While deeply overbought, the advance has room to extend to 4.4550. The next major resistance level at 4.5000 is unlikely to be tested this week. Support is at 4.4000, but only a breach of 4.3750 would indicate that the current strong upward pressure has eased.”

- EUR/JPY gives away part of Friday’s move to YTD highs.

- Extra gains should retarget the December 2022 peak near 146.70.

EUR/JPY faces some downside pressure following Friday’s yearly highs in the 143.65/70 band.

While the cross looks somewhat side-lined for the time being, a convincing breakout of the 2023 high at 143.67 (February 17) could trigger a move higher to, initially, the December 2022 top at 146.72 (December 15).

In the meantime, while above the 200-day SMA, today at 141.25, the outlook for the cross is expected to remain positive.

EUR/JPY daily chart

- NZD/USD gains some positive traction on Monday, albeit lacks any follow-through buying.

- A combination of factors continues to underpin the USD and acts as a headwind for the pair.

- Traders seem reluctant ahead of the RBNZ decision and the FOMC minutes on Wednesday.

The NZD/USD pair attracts some buyers near the 0.6220 area on Monday and snaps a four-day losing streak to its lowest level since January 6. The pair sticks to its modest gains around the mid-0.6200s through the mid-European session, though seems to struggle to build on Friday's bounce from the very important 200-day SMA.

A combination of supporting factors assists the US Dollar to hold steady just below a six-week high set on Friday, which, in turn, caps the upside for the NZD/USD pair. The prospects for further policy tightening by the Fed continue to act as a tailwind for the US Dollar. Apart from this, a generally weaker tone around the equity markets further benefits the Greenback's relative safe-haven status and keeps a lid on the risk-sensitive Kiwi.

In fact, the markets seem convinced that the US central bank will stick to its hawkish stance and have been pricing in at least a 25 bps lift-off at the next two FOMC meetings in March and May. The bets were reaffirmed by the US CPI and PPI data last week, which showed that inflation isn't coming down quite as fast as hoped. Moreover, several FOMC officials recently stressed the need to keep lifting rates gradually to fully gain control of inflation.

Meanwhile, worries about economic headwinds stemming from rapidly rising borrowing costs, along with geopolitical tensions, take a toll on the global risk sentiment. In fact, North Korea launched two more ballistic missiles off its east coast on Monday after firing an intercontinental ballistic missile (ICBM) into the sea off Japan's west coast over the weekend. Adding to this, talks of Russia ramping up attacks in Ukraine weigh on investors' sentiment.

Traders also seem reluctant to place aggressive bets amid relatively thin volumes on the back of the President Day's holiday in the US and ahead of this week's key event risks. The Reserve Bank of New Zealand (RBNZ) is scheduled to announce its monetary policy decision ahead of the release of the FOMC meeting minutes on Wednesday. This will play a key role in influencing the NZD/USD pair and help investors determine the next leg of a directional move.

Technical levels to watch

The Canadian Dollar is poised to retain a soft undertone, in the opinion of economists at Scotiabank.

The Loonie has little chance of strengthening

“Seasonal pressures which are typically adverse for the Canadian Dollar through Q1.”

“We look for the USD to retain a firm undertone in the short run.”

“Trend signals are aligning bullishly across short, medium and long-term DMI oscillators.”

“The USD/CAD pair is poised to remain firm in the upper 1.34s between a potential range base of 1.3320 and a ceiling of 1.3630.”

- Silver struggles to capitalize on its modest intraday gains to the $22.00 neighbourhood.

- The recent breakdown through key technical levels supports prospects for further losses.

- A sustained move above the $22.55-$22.60 area is needed to negate the bearish outlook.

Silver builds on Friday's modest bounce from the $21.20-$21.15 area, or its lowest level since November 29 and attracts some buyers on the first day of a new week. The intraday uptick, however, lacks bullish conviction and fails just ahead of the $22.00 round-figure mark.

From a technical perspective, the said handle represents the 100-day Simple Moving Average (SMA) support breakpoint. This is followed by the 38.2% Fibonacci retracement level of the recent rally from October 2022, around the $22.15 region. Any subsequent move up is more likely to meet with a fresh supply and remain capped near the $22.55-$22.60 resistance zone.

The latter should act as a pivotal point, which if cleared decisively will negate any near-term bearish bias. The subsequent move up has the potential to lift the XAG/USD towards the $24.00 round-figure mark

en route to the $24.50 supply zone. Some follow-through buying will shift the bias back in favour of bullish traders and pave the way for additional gains.

On the flip side, the 50% Fibo. level, around the $21.35 area, seems to protect the immediate downside. This is followed by Friday's swing low, around the $21.20-$20.15 region, nearing the 50% Fibo. level. A convincing break below the latter will be seen as a fresh trigger for bearish traders and make the XAG/USD vulnerable to weaken further below the $21.00 mark.

Given that technical indicators on the daily chart are holding deep in the negative territory, the white metal could eventually drop to 61.8% Fibo., around the $20.60 region. The downward trajectory could get extended further towards challenging the $20.00 psychological mark en route to the next relevant support near the $19.75-$19.70 horizontal zone.

Silver daily chart

Key levels to watch

In its monthly report published on Monday, Germany's Bundesbank noted that the economic outlook was somewhat brighter with the short-term outlook turning more favorable than seen just a few months ago.

"At the turn of the year, sentiment among entrepreneurs and consumers worldwide brightened slightly, with recessionary fears receding somewhat," the publication read.

Bundesbank further noted that high inflationary pressures remain in place as the second round impact of quick wage growth is expected to keep Eurozone inflation above its target for an extended period of time.

Market reaction

EUR/USD continues to fluctuate in a very narrow range at around 1.0700 following this publication.

A USD rebound is now underway as it reverses losses from the start of the year. Economists at MUFG Bank see room for the USD rebound to run further in near-term.

Break above 105.00 for the DXY to open up the 200-DMA at just below 106.50

“The upcoming releases of the latest FOMC minutes and PCE deflator report are unlikely to derail the USD’s rebound in the week ahead.”

“We believe the USD’s recent rebound has room to run further in the near-term.”

“A break above the 105.00 level for the DXY would open up a retest of the year to date high at 105.63 and then the 200-Day Moving Average at just below 106.50.”

UOB Group’s Market Strategist Quek Ser Leang suggests USD/THB could now navigate within the 33.90-34.65 range in the short-term horizon.

Key Quotes

“We highlighted that last Monday (13 Feb, spot at 33.75) that ‘short-term upward momentum is beginning to build and the bias for USD/THB this week is tilted to the upside’. We added, ‘Looking ahead, the next resistance above 34.00 is at 34.20’.”

“The anticipated USD/THB exceeded our expectations as it took out both 34.00 and 34.20 and surged to a high of 34.64. The sharp and rapid rise in a short time suggests the advance is likely overdone. In other words, USD/THB is unlikely to strengthen much. This week, USD/THB is more likely to consolidate between 33.90 and 34.65.”

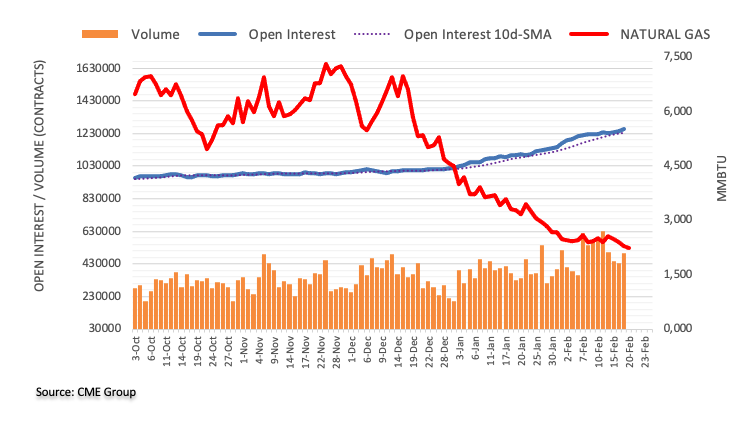

Considering advanced prints from CME Group for natural gas futures markets, open interest rose for the third session in a row on Friday, this time by around 12.5K contracts. Volume followed suit and went up by around 60.2K contracts after three consecutive daily drops.

Natural Gas keeps targeting the $2.00 region

Friday’s decline in prices of the naturas gas was once again amidst rising open interest and volume, opening the door at the same time to the continuation of the current downtrend for the time being. Against that, the next contention of note is expected at the key $2.00 mark per MMBtu.

FX markets start the week on a quiet footing. Is the Dollar rally getting tired? In the view of economists at ING, February's Dollar rally is a correction.

February's hawkish re-pricing of the Fed story might have come far enough

“Friday's price action suggested that February's hawkish re-pricing of the Fed story might have come far enough for the time being. US yields reversed from highs seen in early Europe on Friday and DXY dropped quickly from a high of 104.60. On Friday, we had said that this DXY rally could extend to 105.00 or, with outside risk, to 106.50. Yet Friday's price action suggests those levels could be out of reach.”

“Overall our base case is that February's Dollar rally is a correction – but this week will determine whether it runs out of steam or has a little further to go.”

Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group note USD/CNH keeps targeting the 6.9000/6.9300 region in the next weeks.

Key Quotes

24-hour view: “We expected ‘further USD gains’ last Friday but we held the view that ‘the major resistance at 6.9000 is likely out of reach today’. Our view was correct as USD rose to 6.8966 before staging a sharp and swift pullback (low has been 6.8682). The price movements are likely part of a consolidation and we expect USD to trade sideways between 6.8650 and 6.8880 today.”

Next 1-3 weeks: “Last Friday (17 Feb, spot at 6.8780), we indicated that ‘the outlook for USD remains positive and the focus is at 6.9000’. USD subsequently rose to 6.8966 before pulling back. There is no change in our view but overbought short-term conditions could lead to 1-2 days of consolidation. Overall, only a break of 6.8480 (‘strong support’ level was at 6.8360 last Friday) would indicate that the USD strength that started earlier this month has come to an end.”

The Riksbank delivered a hawkish decision in February. The restrictive monetary policy should cause the Krona to appreciate in the course of the year, according to economists at Commerzbank.

Riksbank the hawk in the far north

“Everything all told the Riksbank has proven itself determined in its fight against inflation. The bank itself puts it very well: It is ‘important for monetary policy to act when inflation is too high’.”

“I stick to my view that the market is trading SEK at excessively low levels and that it should appreciate over the course of the year due to the restrictive monetary policy.”

Source: Commerzbank Research

USD/INR remains below the 83 mark. Economists at Société Générale highlight the key technical levels to watch.

Overcoming resistance zone at 82.95/83.30 essential to affirm an extended uptrend

“USD/INR has evolved within a large sideways consolidation resembling an ascending triangle after facing resistance near 83.30 last October; a clear direction has been lacking.”

“Overcoming the resistance zone at 82.95/83.30 would be essential for affirming an extended uptrend.”

“Recent bullish gap at 82.30 is first layer of support. In case this gets violated, a short-term pullback is likely.”

“Below 82.30, next potential support is located at 81.40, the 76.4% retracement of recent bounce.”

USD/CNY trended higher last week to close almost 550 pips higher at around 6.87. Rising US-China tensions are set to keep the pair well supported for now, economists at Commerzbank report.

Loan prime rates on hold

“The banks’ loan prime rates (LPRs) for February remained unchanged at 3.65% and 4.3%, respectively.”

“We think the PBoC may cut the MLF rate and banks will subsequently reduce the LPRs as early as March following the annual session of the National People’s Congress which is scheduled to begin on 5 March.”

“Macro policy stimulus will likely be announced during the annual session, and it will be a good timing for the PBoC to cut rates and signals that it stands ready to support the economic recovery.”

“Heightened US-China tensions could keep USD/CNY well supported near term.”

- GBP/USD struggles to capitalize on its modest intraday uptick to levels just above mid-1.2000s.

- Hawkish Fed expectations, recession fears underpin the USD and cap the upside for the major.

- Expectations that the BoE’s rate-hiking cycle is nearing the end act as a headwind for the GBP.

The GBP/USD pair attracts some sellers near the 1.2055 area on Monday and stalls its recovery move from the lowest level since January 6 touched on Friday. The pair retreats to the lower end of its daily range during the first half of the European session, though manages to hold above the 1.2000 psychological mark.

A combination of supporting factors assists the US Dollar to regain some positive traction, which, in turn, acts as a headwind for the GBP/USD pair. Against the backdrop of looming recession risks, fresh geopolitical tensions continue to weigh on investors' sentiment and benefit the Greenback's relative safe-haven status. Adding to this, firming expectations that the Fed will stick to its hawkish stance provide a modest lift to the USD.

In fact, the markets are now pricing in at least a 25 bps lift-off at each of the next two FOMC policy meetings in March and May. The bets were reaffirmed by the US CPI and PPI data last week, which showed that inflation isn't coming down quite as fast as hoped. In contrast, the softer-than-expected UK consumer inflation figures fueled speculations that the Bank of England's (BoE) current rate-hiking cycle might be nearing the end.

The divergent Fed-BoE policy expectations also contribute to capping the upside for the GBP/USD pair. The downside, however, seems cushioned, at least for the time being, amid relatively thin trading volumes in the wake of the President Day's holiday in the US. Traders also seem reluctant and might refrain from placing aggressive bets ahead of the latest FOMC monetary policy meeting minutes, scheduled for release on Wednesday.

Several Fed officials, including Chairman Jerome Powell, recently stressed the need to keep raising rates gradually to fully gain control of inflation. Hence, investors will look for fresh cues about the Fed's policy tightening path, which will play a key role in influencing the USD price dynamics and help determine the near-term trajectory for the GBP/USD pair.

Technical levels to watch

Sterling enjoyed a modest recovery on Friday. Nonetheless, economists at ING expect EUR/GBP to remain stuck in a range while GBP/USD will be drive by Dollar’s movements.

Sunak struggles to make progress

“We doubt Sterling strength owes much to PM Rishi Sunak trying to make progress on revisions to the Northern Ireland protocol. It will probably continue to be monetary policy that drives FX trends. We think BoE rates will peak at 4.25% in March – not that far from market pricing of a peak at 4.35%.

“Expect EUR/GBP to stay range-bound and GBP/USD to be bounced around by the Dollar trend.”

USD/JPY could now move into some consolidative phase prior to a potential advance to 135.50, suggest Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “Last Friday, we highlighted that ‘the bias for USD remains on the upside’ but we were of the view that ‘any advance is unlikely to break the major resistance at 135.00 today’. Our view for USD to strengthen was correct even though it rose above 135.00 (high of 135.04) before pulling back sharply. The pullback amid overbought conditions suggests USD has likely moved into a consolidation phase. Today, we expect USD to trade sideways, likely within a range of 133.80/134.80.”

Next 1-3 weeks: “We turned positive USD last Wednesday (15 Feb, spot at 132.90. As USD rose, in our latest narrative from Thursday (16 Feb, spot at 133.85), we indicated that ‘upward momentum has improved further and USD is likely to continue to advance’. We noted, ‘The next level to watch is at 135.00, followed by 135.50’. Our target level of 135.00 was met as USD rose to a high of 135.04 on Friday. From here, overbought short -term conditions could lead to a couple of days of consolidation. As long as 133.10 (‘strong support’ level was at 132.80 last Friday) is not breached, there is still chance for USD to head higher to the next target at 135.50 later on.”

- USD/CAD comes under some selling pressure on Monday and extends Frida’s retracement slide.

- Rebounding oil prices underpins the Loonie and exerts pressure amid subdued USD price action.

- Recession fears, hawkish Fed expectations could limit the USD losses and lend support to the pair.

The USD/CAD pair attracts some sellers in the vicinity of the 1.3500 psychological mark on Monday and extends its steady descent through the first half of the European session. Spot prices retreat further from the highest level since January 6 touched on Friday and drop to the 1.3455 area, or a fresh daily low in the last hour.

Crude oil prices gain some positive traction and for now, seem to have snapped a five-day losing streak to over a one-week low touched on Friday. This, in turn, underpins the commodity-linked Loonie and acts as a headwind for the USD/CAD pair amid subdued US Dollar price action. That said, a combination of factors supports prospects for the emergence of some dip-buying at lower levels and warrants caution before positioning for deeper losses.

Worries that rapidly rising borrowing costs will dampen economic growth and dent fuel demand should keep a lid on any further upside for the black liquid. Apart from this, firming expectations that the Fed will stick to its hawkish stance favours the USD bulls. In fact, the markets are now pricing in at least a 25 bps lift-off at the next two FOMC meetings in March and May. This, in turn, validates the positive outlook for the USD/CAD pair.

Traders also seem reluctant amid relatively thin trading volumes on the back of a holiday in the US and Canada. Furthermore, investors are more likely to wait for the latest FOMC meeting minutes, due for release on Wednesday, before placing fresh directional bets. Hence, strong follow-through selling is needed to confirm that the USD/CAD pair's recent positive move witnessed over the past week or so has run its course.

Technical levels to watch

There is room for the USD rebound to extend further. Therefore, economists at MUFG Bank expect the EUR/USD pair to challenge the 200-Day Moving Average (DMA) at around 1.0330.

Improving cyclical outlook better priced into EUR

“There is room for the reversal lower to extend further in the near-term.”

“We are expecting the EUR/USD pair to fall back towards support from the 200-DMA that comes in at around 1.0330.”

“The price action highlights that the Eurozone rate market and EUR have already moved along way at the start of this year to better reflect the improving cyclical outlook.”

Saudi Arabian Energy Minister Prince Abdulaziz bin Salman said on Monday, “OPEC+ is flexible enough to change decisions whenever required.”

Last week, Saudi Arabian Energy Minister said the current OPEC+ deal on oil output would be locked in until the end of the year, adding the oil group can't increase output based solely on initial signals.

Market reaction

WTI is keeping its upbeat momentum intact on the above comments, rallying 1.08% on the day to trade at $77.35, as of writing.

USD/JPY gained nearly 300 pips last week. On Friday, BoJ Governor nominee Ueda speaks. Hints of change to the BoJ's ultra-dovish monetary policy could pummel the USD/JPY pair, economists at ING r eport.

Hearings for the new BoJ governor

“On Friday, nomination hearings will take place for new Bank of Japan Governor, Kazuo Ueda. He is seen as more of a pragmatic academic than the ultra-dove of his predecessor, Haruhiko Kuroda.”

“Any hints of a change to the BoJ's ultra-dovish monetary policy could see USD/JPY sell off again – dragging the broader Dollar with it.”

Bank of Japan (BoJ) Deputy Governor Masayoshi Amamiya said on Monday, “the BoJ has already shifted to a sustainable monetary easing framework, so it is appropriate to maintain current policy given underlying price moves.”

Additional comments

BoJ has operational tools to achieve exit from ultra-loose monetary policy.

What is more difficult is to decide whether conditions have met to exit easy policy, and how to communicate BoJ’s intentions.