- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 19-09-2024

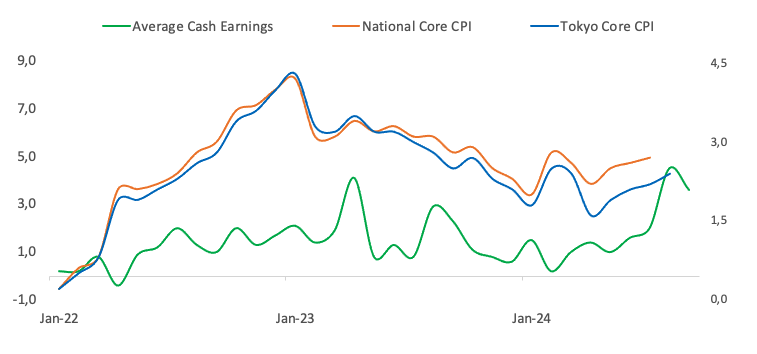

Japan’s National Consumer Price Index (CPI) climbed 3.0% YoY in August, compared to the previous reading of 2.8%, according to the latest data released by the Japan Statistics Bureau on Friday,

Further details unveil that the National CPI ex Fresh food arrived at 2.8% YoY in August versus 2.7% prior. The figure was in line with the market consensus of 2.8%.

CPI ex Fresh Food, Energy increased 2.0% YoY in August, compared to the previous reading of 1.9% rise.

Market reaction to Japan’s National CPI data

Following the Japan’s CPI inflation data, the USD/JPY pair is up 0.08% on the day at 142.72.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

- EUR/USD wrapped itself around the 1.1150 level on Thursday.

- Broad-market Greenback selling has thrown USD-based pairs into a bullish tilt.

- Euro data remains light, markets focused on Fed cut splurge.

EUR/USD found the high end on Thursday, holding fast to the 1.1150 level, though most of the pair’s bullish momentum comes from a broad-market selloff in the Greenback rather than any particular bullish fix in the Euro.

The economic data docket has been particularly light on the European side of things this week. All that remains of moderate note to EUR traders is a scheduled appearance from European Central Bank (ECB) President Christine Lagarde on Friday. Still, even that will be happening during US market hours. ECB President Lagarde will be speaking at the Michel Camdessus Central Banking Lecture in Washington DC.

Forex Today: Will the BoJ surprise markets?

On the US side of things, Initial Jobless Claims eased back to 219K for the week ended September 13, down from the previous week’s revised 231K and under the median market forecast of 230K. The Philadelphia Fed Manufacturing Survey for September also printed well above expectations, with the spread index of manufacturing conditions improving to 1.7 from the previous seven-month low of -7.0 and handily beating the expected print of -1.0.

Fed Chair Jerome Powell convinced markets that the Fed’s outsized jumbo cut of 50 bps this week wasn’t a snap response to deteriorating economic conditions but rather an attempt to get ahead of the curve and bolster the US labor market. Powell successfully floated a rebranding of an entire half-percentage-point cut as a “recalibration,” and investors rewarded the Fed’s latest narrative pivot by pulling out of the Greenback across the board and plowing cash into higher-yielding assets.

EUR/USD price forecast

Despite this week’s Fed-fueled rally, EUR/USD continues to churn just north of the 1.1100 handle. The post-Fed rally has kept Fiber even-keeled in the midweek, but meaningful momentum has yet to materialize and the pair could be poised for an exhaustion play. However, EUR/USD is still cycling chart paper on the high end of recent momentum, and short pressure will have a difficult time staging a full pullback to the 50-day Exponential Moving Average (EMA) near 1.1000.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

US Treasury Secretary Janet Yellen said on Friday that the US Federal Reserve (Fed) rate cut is very positive sign for the US economy.

Key quotes

It reflects confidence on the part of the Fed that inflation has come way down and is on the path back to the two percent target, and that the risks with respect to inflation have really meaningfully diminished.

At the same time, we have a job market that remains strong.

Market reaction

The US Dollar Index showed no reaction to these comments and was last seen gaining 0.03% on the day at 100.67.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

- GBP/USD continues to test fresh 30-month highs.

- Fed rate cut sparks broadbase Greenback selloff.

- BoE held rates despite early summer cut, UK Retail Sales in the pipe.

GBP/USD found a fresh 30-month high bid on Thursday, with a broad-market selloff in the US Dollar sparking a risk bid in Cable and bolstering the Pound Sterling. The Federal Reserve’s (Fed) 50 bps cut this week helped galvanized global markets into a risk-on stance, while the Bank of England’s (BoE) fearful rate hold did little to spark further strength under the GBP.

The only datapoint of note on Friday will be UK Retail Sales for August, though not much momentum is likely to come of it with investors exhausted after a double-header of central banks between the Fed and the BoE. UK MoM Retail Sales in August are expected to tick down to 0.4% from the previous 0.5%, while the annualized figure is expected to hold steady at 1.4%.

The BoE held interest rates steady at 5.0% early Thursday, with the Monetary Policy Committee (MPC) voting seven-to-one for another rate hold. The BoE initially opened the gates to rate cuts earlier in the summer with a quarter-point cut at the last meeting, but the move may have proved to be premature. BoE policymakers are waiting to see how the UK economy unfolds before making further rate adjustments.

On the US data side, Initial Jobless Claims eased back to 219K for the week ended September 13, down from the previous week’s revised 231K and under the median market forecast of 230K. The Philadelphia Fed Manufacturing Survey for September also printed well above expectations, with the spread index of manufacturing conditions improving to 1.7 from the previous seven-month low of -7.0 and handily beating the expected print of -1.0.

Fed Chair Jerome Powell convinced markets that the Fed’s outsized jumbo cut of 50 bps this week wasn’t a snap response to deteriorating economic conditions but rather an attempt to get ahead of the curve and bolster the US labor market. Powell successfully floated a rebranding of an entire half-percentage-point cut as a “recalibration,” and investors rewarded the Fed’s latest narrative pivot by plowing cash into risk assets across the board and yanking the rug out from beneath the safe-haven US Dollar.

Economic Indicator

Retail Sales (MoM)

The Retail Sales data, released by the Office for National Statistics on a monthly basis, measures the volume of sales of goods by retailers in Great Britain directly to end customers. Changes in Retail Sales are widely followed as an indicator of consumer spending. Percent changes reflect the rate of changes in such sales, with the MoM reading comparing sales volumes in the reference month with the previous month. Generally, a high reading is seen as bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Next release: Fri Sep 20, 2024 06:00

Frequency: Monthly

Consensus: 0.4%

Previous: 0.5%

Source: Office for National Statistics

GBP/USD price forecast

Despite clipping into a fresh 30-month high on Thursday and crossing the 1.3300 handle, Cable bidders have struggled to push price action deep into bull country, and markets will enter the Friday wrapup with prices hovering near the key psychological level. A firm bullish trend is still baked into daily candlesticks with the pair climbing above the 50–day Exponential Moving Average (EMA) near 1.3000.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- USD/CAD trades on a weaker note around 1.3560 in Friday’s early Asian session.

- The speculation of additional rate cuts by the Fed this year continues to undermine the USD.

- Higher crude oil prices support the commodity-linked Loonie.

The USD/CAD pair attracts some sellers near 1.3560, snapping the two-day winning streak during the early Asian session on Friday. The Greenback edges lower as investors assessed the prospects of further rate cuts by the US Federal Reserve (Fed) in the months to come. The Bank of Canada (BoC) Governor Tiff Macklem will deliver a speech later on Friday.

The Fed surprised the financial markets with a 50 basis points (bps) rate cut on Wednesday, bringing its target range to 4.75% to 5.00%. Fed Chair Jerome Powell said the move was "strong" but that it was needed as price rises ease and job market concerns grow. The dovish stance of the US Fed and the expectation of additional rate cuts this year could further weigh on the US dollar (USD) in the near term.

Data released by the US Department of Labor (DoL) on Thursday showed that the US weekly Initial Jobless Claims slid to the lowest since May, signaling the labor market remains healthy despite a slowdown in hiring. US citizens that newly applied for unemployment insurance benefits came in at 219K for the week ending September 14. This figure was below the market consensus of 230K and lower than the previous week of 231K (revised from 230K).

On the other hand, the rise in crude oil prices provides some support to the commodity-linked Canadian Dollar (CAD). It's worth noting that Canada is the largest oil exporter to the United States (US), and higher crude oil prices tend to have a positive impact on the CAD value.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- The Bank of Japan is anticipated to maintain its policy rate unchanged.

- Investors’ focus should remain on the bank’s rate path for the next few months.

- BoJ Governor Kazuo Ueda is seen sticking to the recent hawkish narrative.

The Bank of Japan (BoJ) is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review.

The decision is set to be announced during the early Asian session. Notably, in March, the BoJ raised interest rates for the first time in 17 years, ending the negative interest rate policy that had been in place since 2016. On July 31, the central bank further surprised markets by hiking its policy rate by 15 basis points to 0.25%.

What can we expect from the BoJ interest rate decision?

As the meeting approaches, most expect a steady policy stance, but market participants will be closely watching for any shifts in the policy statement that might offer clues about when the bank plans to raise rates next.

Currently, money markets are anticipating an increase of about 25 basis points by the end of the year, which would bring the bank's policy rate to a maximum of 0.50% at the December 19 meeting.

On the consumer front, real wage growth saw a positive turn in June (1.1% YoY) and July (0.4% YoY), which could encourage more spending and potentially push inflation higher. For now, inflation remains above the 2% target.

These factors make it tricky for the central bank to decide when to raise interest rates. If rising prices driven by cost pressures start to weigh on consumer spending, it could hinder the demand-driven inflation the Bank of Japan aims for before it can consider scaling back its stimulus measures.

Sanae Takaichi, a potential successor to Japanese Prime Minister Fumio Kishida, has suggested that the BoJ should avoid raising interest rates further, as it could dampen consumer sentiment and hinder capital expenditure.

From the BoJ, policymaker Naoki Tamura believed that the central bank must increase interest rates to at least 1% by the second half of the next fiscal year, highlighting the bank's commitment to steady monetary tightening. In addition, board member Junko Nakagawa argued that the BoJ would continue raising interest rates if inflation aligns with its forecast, but emphasized the need to consider market movements' effects on the broader economic and price outlook before deciding to increase rates. Furthermore, his colleague Hajime Takata cautioned that interest rate hikes should be cautious to avoid significant harm to businesses.

In the meantime, it is worth recalling that BoJ Governor Kazuo Ueda spoke before the Japanese Parliament in late August. In his testimony, he reaffirmed his commitment to raising interest rates if inflation continues to move toward the 2% target, indicating that recent market volatility would not disrupt the BoJ’s long-term plan for rate hikes. However, Ueda cautioned that markets remain unstable, which could influence the central bank’s inflation forecasts.

Ueda’s comments suggested that the central bank might take longer than initially anticipated to decide on its next rate hike, but remained on track to gradually raise borrowing costs from the current ultra-low levels.

According to a Reuters poll published last week, economists unanimously agreed that the BoJ will not raise interest rates at its September policy meeting, though a majority still anticipated an increase at some point by year-end.

As we get closer to the interest rate decision, analysts at Standard Chartered Global Research noted: “We now expect the Bank of Japan (BoJ) to hike the base rate by 25 bps in December (from 15 bps in Q2 and 10 bps in Q3-2025 prior) to 0.50% by end-2024 (0.25% prior) on stronger-than-expected inflation that has stayed above its 2% target for the past 21 months. Wages grew in real terms in June for the first time since March 2022, adding to concerns over demand-side inflation. The BoJ may hike earlier to avoid losing an opportunity to normalise policy before dovish pressures kick in from possible Fed rate cuts of 75 bps by end-2024, risk of a global recession, and China’s slowdown.”

How could the Bank of Japan interest rate decision affect USD/JPY?

The BoJ is largely expected to refrain from acting on the policy rate. However, Governor Ueda is seen sticking to his hawkish narrative, leaving the door open to the continuation of the “normalization” of the monetary policy in the next few months.

A glimpse at the broader picture shows that Fed-BoJ policy divergence remains at center stage. Following the recent 50 basis points rate cut by the Federal Reserve (Fed) in September and prospects of an additional 50 basis points of easing in the latter part of the year, a further downside in USD/JPY does appear as the most favourable scenario for the time being.

Looking at the techs surrounding USD/JPY, Senior Analyst at FXStreet Pablo Piovano suggests that “the resumption of the bid bias in the Japanese yen carries the potential to drag the pair to its 2024 bottom of 139.57 (September 16). A deeper retracement could see the spot revisit the July 2023 low of 137.23 (July 14) ahead of the March 2023 low of 129.63 (March 24)”.

On the upside, “there are initial barriers at the September peak of 147.20 (September 3), and the weekly high of 149.39 (August 15)”, Pablo adds.

Economic Indicator

BoJ Interest Rate Decision

The Bank of Japan (BoJ) announces its interest rate decision after each of the Bank’s eight scheduled annual meetings. Generally, if the BoJ is hawkish about the inflationary outlook of the economy and raises interest rates it is bullish for the Japanese Yen (JPY). Likewise, if the BoJ has a dovish view on the Japanese economy and keeps interest rates unchanged, or cuts them, it is usually bearish for JPY.

Read more.Last release: Wed Jul 31, 2024 03:55

Frequency: Irregular

Actual: 0.15%

Consensus: 0%

Previous: 0%

Source: Bank of Japan

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan has embarked in an ultra-loose monetary policy since 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds.

The Bank’s massive stimulus has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy of holding down rates has led to a widening differential with other currencies, dragging down the value of the Yen.

A weaker Yen and the spike in global energy prices have led to an increase in Japanese inflation, which has exceeded the BoJ’s 2% target. With wage inflation becoming a cause of concern, the BoJ looks to move away from ultra loose policy, while trying to avoid slowing the activity too much.

- Silver price breaks above a key resistance trendline, with a move toward $31.00 in sight after strong gains.

- Next resistance levels include the July 11 high at $31.75 and the May 29 peak at $32.29, with YTD high at $32.51 on the horizon.

- A bearish reversal would require a break below the September 18 low of $29.71, with further support at the 100-DMA of $29.43.

Silver climbed sharply during Thursday’s North American session, printing solid gains of over 2%, and closed at around $30.77. Investors, seeking risk and ditching the US Dollar, cheered the Federal Reserve's rate cut.

Market sentiment remains upbeat, with Wall Street's main index, the S&P 500, climbing to a record high. Meanwhile, the precious metals segment, led by Gold and Silver, surged sharply while the Greenback dropped over 0.30%, according to the US Dollar Index (DXY) at 100.63.

XAG/USD Price Forecast: Technical outlook

Silver price is threatening to decisively clear a downslope resistance trendline drawn from May 20 highs passing through $30.67. If this trendline is broken decisively, it will open the way to challenging $31.00.

In that outcome, XAG/USD next resistance will be the July 11 swing high at $31.75, followed by the May 29 peak at $32.29. On further strength, the year-to-date (YTD) high at $32.51 will be up for grabs.

Conversely, bears would need to push the grey’s metal price below the September 18 swing low of $29.71, ahead of testing the 100-day moving average (DMA) at $29.43

XAG/USD Price Action – Daily Chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

- The NZD/USD pair has been choppy between 0.6159-0.6260 in the past sessions.

- The RSI shows rising buying pressure, whereas the MACD suggests a potential reversal in the bearish momentum.

On Thursday, the NZD/USD pair rose to 0.6239, above the 20-day Simple Moving Average (SMA) which served as a strong resistance in the last sessions. Indicators meanwhile look promising.

The Relative Strength Index (RSI) is at 59, in positive territory with a rising slope, signaling rising buying pressure. Conversely, the Moving Average Convergence Divergence (MACD) histogram is red and falling, suggesting that selling pressure may be declining. This presents a mixed outlook for the pair.

NZD/USD daily chart

Key support levels include 0.6150, 0.6120, and 0.6100, while resistance levels are 0.6190, 0.6200, and 0.6230. A close above the 20-day SMA, currently at 0.6200, could signal further upward movement with the next target being at early September highs near 0.6300.

- AUD/USD rises due to a weaker US Dollar following a 50-basis-point rate cut by the Federal Reserve.

- Fed anticipates slower GDP growth and higher unemployment, while inflation is expected to decline.

- RBA hawkish stance also favors the Aussie.

The AUD/USD rose by 0.70% to 0.6815 in Thursday's session. This marks the fourth consecutive session of gains for the AUD/USD, as the Greenback continues to weaken in the wake of the Federal Reserve's (Fed) 50-basis-point rate cut. The Fed's decision to cut rates was driven by concerns about slowing global economic growth and rising unemployment.

Economic projections for Australia remain uncertain. Despite mixed indicators, the Reserve Bank of Australia (RBA) remains cautious due to elevated inflation. As a result, financial markets currently anticipate a modest 25-basis-point reduction in interest rates in 2024, reflecting the RBA's intention to maintain a hawkish monetary stance to combat inflationary pressures.

Daily digest market movers: Australian Dollar rising while markets punish the USD after Fed, Australian labor data

- The US dollar (USD) weakened on Thursday due to increased selling interest after the Federal Reserve's decision to lower interest rates more than expected.

- Gains in copper and iron ore prices also supported the AUD, although concerns about China's housing and industrial sectors may limit upside potential.

- The Reserve Bank of Australia (RBA) kept its Official Cash Rate (OCR) steady at 4.35% last month, indicating a cautious approach amid ongoing inflationary pressures.

- RBA Governor Michelle Bullock reiterated a cautious outlook, suggesting that rate cuts are unlikely in the near future.

- Despite the RBA's hawkish stance, the market anticipates rate cuts in late 2024, with a 70% probability of a 25-basis-point cut by December.

- A mixed labour market report in Australia for August showed an unchanged Unemployment Rate of 4.2%, while Employment Change increased by 47.5K individuals.

AUD/USD technical outlook: Pair embraces bullish bias indicators positive

Indicators continue to gain ground with the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicating rising buying traction. In addition, with the pair at its highest level since January, the outlook is positive. Buyers now must retain the 0.6800 area.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- USD/JPY's ‘shooting star’ candlestick hints at a possible bearish continuation despite current buyer momentum.

- Key supports: September 19 low at 141.88, 140.44, and YTD low at 139.58.

- Buyers need to surpass 143.94 resistance, with next target at Kijun-Sen at 144.48 for bullish control.

The USD/JPY held on to gains following Wednesday’s Federal Reserve decision but traded well below its daily peak of 143.94 as the Greenback registered losses.

Data-wise, the US docker featured initial jobless Claims for the last week, which fared better than expected but failed to boost the US Dollar. Meanwhile, traders eye the release of Japanese inflation data and the Bank of Japan's monetary policy decision.

USD/JPY Price Forecast: Technical outlook

The downtrend is set to continue despite recovering some ground. As Thursday’s session finishes, the USD/JPY retreated from the weekly high, forming a ‘shooting star’ candlestick. This means that bears are stepping into the market, paving the way for a re-test of the year-to-date (YTD) low of 139.58.

In the short term, momentum favors buyers, as depicted by the Relative Strength Index (RSI), though in the long term, the RSI is bearish.

For a bearish continuation, the USD/JPY must clear the September 19 low of 141.88, immediately followed by the Tenkan-Sen at 141.76. Those levels cleared, and the next demand zone would be the September 18 daily low of 140.44, followed by the YTD low of 139.58

Conversely, buyers must clear the September 19 high of 143.94 before testing the Kijun-Sen at 144.48.

USD/JPY Price Action – Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.40% | -0.51% | 0.20% | -0.34% | -0.71% | -0.53% | 0.10% | |

| EUR | 0.40% | -0.11% | 0.62% | 0.07% | -0.29% | -0.12% | 0.51% | |

| GBP | 0.51% | 0.11% | 0.72% | 0.17% | -0.20% | -0.01% | 0.60% | |

| JPY | -0.20% | -0.62% | -0.72% | -0.51% | -0.90% | -0.74% | -0.11% | |

| CAD | 0.34% | -0.07% | -0.17% | 0.51% | -0.37% | -0.19% | 0.43% | |

| AUD | 0.71% | 0.29% | 0.20% | 0.90% | 0.37% | 0.18% | 0.80% | |

| NZD | 0.53% | 0.12% | 0.01% | 0.74% | 0.19% | -0.18% | 0.63% | |

| CHF | -0.10% | -0.51% | -0.60% | 0.11% | -0.43% | -0.80% | -0.63% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

- The Canadian Dollar was given a boost from Fed-weakened Greenback.

- Canada remains under-represented on the economic calendar.

- Broader markets remain more interested in other avenues following Fed cut.

The Canadian Dollar (CAD) remains overall weaker on Thursday, though the CAD was able to eke out a stronger stance against the Greenback, with the USD getting pummeled after the Federal Reserve (Fed) cut interest rates for the first time in four years by an outsized 50 bps.

Canada is in a lull between key data releases after having printed the latest Consumer Price Index (CPI) figures earlier in the week. All that remains on the economic data docket for the CAD this week is Friday’s mid-tier Retail Sales figures from July, far too late for anybody to do anything about it. Bank of Canada (BoC) Governor Tiff Macklem is also slated to make an appearance on Friday, but the limited scope of the speech is unlikely to draw much bluster.

Daily digest market movers

- The Canadian Dollar is overall weaker on an under-performing Thursday, but still managed to eke out roughly one-third of one percent against the US Dollar.

- The Fed’s 50 bps jumbo cut this week was sold as a “recalibration” by Fed Chair Jerome Powell, who spun it as an advance move to shore up the US labor market, rather than a snap reaction to deteriorating economic indicators in the US.

- The BoC’s Governor Macklem will be giving a speech early Friday at the National Bureau of Economic Research Economics of Artificial Intelligence Conference, in Toronto. It is unlikely that much discussion of monetary policy will come out of it.

- Canadian Retail Sales from July are expected to hold steady on an annual basis of around 0.3% YoY.

- Canadian CPI figures released earlier this week did little to galvanize market confidence in the state of the Canadian economy after headline inflation sunk to 2.0% YoY from the previous 2.5%.

Canadian Dollar price forecast

The Canadian Dollar found a little bit of juice to gain ground against the Greenback on Thursday, gaining around 0.35%, but any CAD strength is purely a result of USD selling and hasn’t bled over to any other major currencies. USD/CAD has eased lower on broad-market risk appetite, pulling the pair down from recent congestion just south of the 200-day Exponential Moving Average (EMA) near 1.3600.

However, extended short pressure remains a risky play with the pair trading so close to August’s swing low into 1.3450, and the high side looks equally over-populated as technical resistance remains stiff above 1.3600.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

The Greenback could not sustain the optimism seen during the Asian trading hours, eventually surrendering that advance and ending the day with marked losses as investors assessed the prospects of further easing by the Fed in the months to come.

Here is what you need to know on Friday, September 20:

The US Dollar Index (DXY) maintained its bearish mood post-FOMC and revisited the 100.50 zone. The Fed’s Harker is only due to speak at the end of the week.

EUR/USD added to Wednesday’s uptick and revisited the 1.1180 region following increasing selling pressure in the US Dollar. The ECB’s Lagarde speaks on Friday, along with the release of the flash Consumer Confidence in the broader Euroland. In addition, Germany will release August’s Producer Prices.

GBP/USD surpassed the 1.3300 barrier for the first time since March 2022 on the back of the cautious hold by the BoE and further USD-selling. Retail Sales will be at the centre of the debate, seconded by Public Sector Net Borrowing and the GfK’s Consumer Confidence gauge.

The prevailing appetite for the risk-linked galaxy kept the Japanese Yen on the back foot and sponsored a move to around 144.00 in USD/JPY. An interesting docket in “The Land of the Rising Sun” will feature the BoJ meeting, followed by the Inflation Rate and weekly Foreign Bond Investment figures.

AUD/USD advanced for the fourth session in a row and finally managed to trespass the 0.6800 barrier to print new YTD highs on Thursday. The next relevant release Down Under will be the preliminary Judo Bank Manufacturing and Services PMIs on September 23.

Prices of the American reference WTI rose to two-week tops past the $71.00 mark per barrel following the widespread upbeat tone in the risk complex post-Fed’s rate cut.

Gold prices remained close to the all-time highs around the $2,600 mark per ounce troy, advancing markedly after two consecutive days of losses. Silver prices followed suit and climbed to new two-month highs past the $31.00 mark per ounce.

- Gold prices surge following the Fed's 50 bps rate cut, with officials citing inflation moving toward the 2% target.

- Fed Chair Powell signals labor market strength and cautious policy adjustments, stating no rush to normalize rates.

- US jobs data shows resilience, while rising US Treasury yields fail to support the Greenback, as the DXY drops 0.31% to 100.62.

Gold prices advanced on Thursday after the Federal Reserve (Fed) embarked on an easing cycle with a 50-basis-point (bps) rate cut. Traders ignored the rise of US Treasury yields, which correlate inversely to the non-yielding metal, which remains on its way toward reclaiming $2,600. At the time of writing, XAU/USD trades at $2,589, up over 1%.

Following the Fed's decision, bullion prices extended their gains after registering losses on Wednesday. Officials side with the larger of two cuts expected by Wall Street, justifying their decision by pointing to inflation moving sustainably toward the Fed’s 2% goal. Fed Chair Jerome Powell stressed that the Fed could maintain labor strength with policy adjustments.

Powell commented that risks of inflation diminished, while the labor market had risen. Still he added that if inflation persists, “We can dial back policy more slowly,” while adding that according to the bank’s projections, it’s “not in a rush” to normalize policy.

In the meantime, the US jobs data is taking the spotlight after Powell’s speech at Jackson Hole, in which he shifted toward attaining the maximum employment mandate. On Thursday, the US Labor Department revealed that the number of people filing for unemployment benefits was below expectations, indicating strength in the labor market.

Meanwhile, US Treasury yields follow Gold’s footsteps, with the 10-year T-note yielding 3.74%, rising three and a half basis points. However, this has failed to underpin the Greenback, which, according to the US Dollar Index (DXY), dropped 0.31% to 100.62.

Ahead this week, Philadelphia Fed President Patrick Harker will cross the wires amid a scarce docket in the US.

Daily digest market movers: Gold price recovers amid betterstrong US jobs market data

- Fed Governor Michelle Bowman voted to lower rates by a quarter of a percentage point at the September FOMC meeting.

- The Summary of Economic Projections indicates the Fed projects interest rates to end at 4.4% in 2024 and 3.4% in 2025. Inflation, as measured by the Core Personal Consumption Expenditures Price Index, is estimated to reach its 2% target by 2026, with forecasts of 2.6% in 2024 and 2.2% in 2025.

- US economy will likely grow at a 2% pace in 2024, with the Unemployment Rate rising to 4.4% by the end of the year.

- US Initial Jobless Claims for the week ending September 14 dipped from 231K to 219K, below estimates of 230K.

- US Existing Home Sales plunged 2.5% MoM in August after dipping from 3.96 million to 3.86 million, declining for the fourth time in the year.

- December 2024 fed funds rate futures contracting suggests that the Fed might lower rates by at least 69 basis points, implying that in the following two meetings this year the market expects one 50 bps and one 25 bps rate.

XAU/USD technical outlook: Gold price buyers target $2,600 after Fed’s decision

Gold price uptrend remains intact, but after Wednesday’s Shooting Star candlestick pattern, buyers must challenge the year-to-date peak of $2,599 if they would like to stay hopeful of conquering the $2,600 mark.

Momentum favors buyers. The Relative Strength Index (RSI) aims upwards in bullish territory and not in overbought territory. Therefore, the path of least resistance is tilted to the upside.

XAU/USD's first resistance would be $2,599, followed by $2,600. On further strength, buyers can challenge the psychological levels of $2,650 and $2,700.

If XAU/USD drops below the September 13 low of $2,556, the next support would be $2,550. Once cleared, the next stop would be the August 20 high, which turned into support at $2,531, before aiming toward the September 6 low of $2,485.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- FOMC meeting ended with 50 bps interest rate cut to the 4.75%-5.00% range.

- The Dot Plot suggests a gradual easing cycle that hints at three cuts in 2024.

- Chair Powell stressed during his presser that the Fed is not in a rush.

The US Dollar Index (DXY), which measures the value of the USD against a basket of currencies, is trading flat near 100.70 on Thursday as the market digests the Federal Reserve's (Fed) 50-basis-point (bps) cut. The market overreacted to the news, intensifying expectations of further easing despite the Fed's efforts to indicate a gradual easing cycle. On Thursday, the US released strong Initial Jobless Claims figures, which stopped the USD’s bleeding.

The United States economy is experiencing mixed signals with signs of both deceleration and resilience. While some economic indicators suggest a slowdown, others indicate that activity remains robust. The Fed has indicated that the pace of future interest rate adjustments will be guided by incoming economic data, so the DXY index will be sensitive to incoming reports.

Daily digest market movers: US Dollar declining, market pricing in more easing

- FOMC cut rates by 50 bps on Wednesday, although the Dot Plot suggests a more gradual easing cycle going forward.

- Despite the Fed's efforts to push back against market easing expectations, they have intensified.

- After initially lowering its expectations following the decision, the market is now factoring in an additional 75 basis points of rate cuts by the end of the year.

- The market anticipates close to 250 basis points of further cuts over the next year, which would bring the fed funds rate significantly below the neutral level.

- Fed released updated macro forecasts, which show that growth remains robust in Q3.

- On the data front, US citizens who newly applied for unemployment insurance benefits reached 219K in the week ending September 14, below expectations and the previous weekly figure.

- Advance seasonally-adjusted insured unemployment rate was 1.2%, and the 4-week moving average was 227.

DXY technical outlook: DXY under bearish momentum, must recover 101.00

The DXY index indicators remain bearish, having lost the 20-day Simple Moving Average (SMA). Selling traction is mounting with the Relative Strength Index (RSI) trending downward below 50. The Moving Average Convergence Divergence (MACD) is printing lower green bars, indicating a shift to bearishness.

Supports are located at 100.50, 100.30 and 100.00, while resistance levels are at 101.00, 101.30 and 101.60.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- The Dow Jones broke above 42,000 to set a third straight all-time high on Thursday.

- Equities are firmly bullish after the Fed’s long-awaited rate cut this week.

- The Fed’s jumbo 50 bps on Wednesday has paved the way for further cuts this year.

The Dow Jones Industrial Average (DJIA) pierced the 42,000 psychological level on Thursday as equities drove higher in a broad-market bull run after the Federal Reserve (Fed) finally delivered its first rate cut in over four years. Equities have gone full-tilt into a risk-on stance, and the Dow Jones is on pace to close up nearly 600 points in record territory.

On the data side, US Initial Jobless Claims eased back to 219K for the week ended September 13, down from the previous week’s revised 231K and under the median market forecast of 230K. The Philadelphia Fed Manufacturing Survey for September also printed well above expectations, with the spread index of manufacturing conditions improving to 1.7 from the previous seven-month low of -7.0 and handily beating the expected print of -1.0.

Fed Chair Jerome Powell convinced markets that the Fed’s outsized jumbo cut of 50 bps this week wasn’t a snap response to deteriorating economic conditions but rather an attempt to get ahead of the curve and bolster the US labor market. Powell successfully floated a rebranding of an entire half-percentage-point cut as a “recalibration,” and investors rewarded the Fed’s latest narrative pivot by plowing cash into equities across the board.

Dow Jones news

Despite some securities stuck stubbornly in the red, most of the Dow Jones board is deep in the green on Thursday. Salesforce (CRM) and Caterpillar (CAT) have climbed over 5% from the morning’s open, tapping $266 and $373 per share, respectively. Salesforce is on the rise despite an announcement that Disney (DIS) would be ceasing their use of Salesforce-owned Slack as a company communication product after a security exploit allowed a hacking entity to capture and leak a terabyte of company information.

Dow Jones price forecast

With Dow Jones climbing around 600 points at its highest on Thursday, the major equity index is on pace to capture yet another record close as price action digs in north of 42,000. The Dow Jones’ stellar 2024 performance is continuing unabated, with the stock board set to close in the green for a fifth straight month.

Buyer exhaustion continues to threaten intraday positions built up from the midweek pullback into 41,500. However, any real threat would first require enough short pressure to get baked into the chart, a difficult proposition with current prices facing no technical resistance and the Dow Jones trading a blistering 8% above the long-term 200-day Exponential Moving Average (EMA) at 38,656.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Mexican Peso holds firm despite Fed's 50 bps rate cut.

- Fed projects federal funds rate at 4.4% for 2024, balancing price stability and employment goals.

- Investors await Banxico's upcoming decision with a 0.25% rate cut expected on September 26.

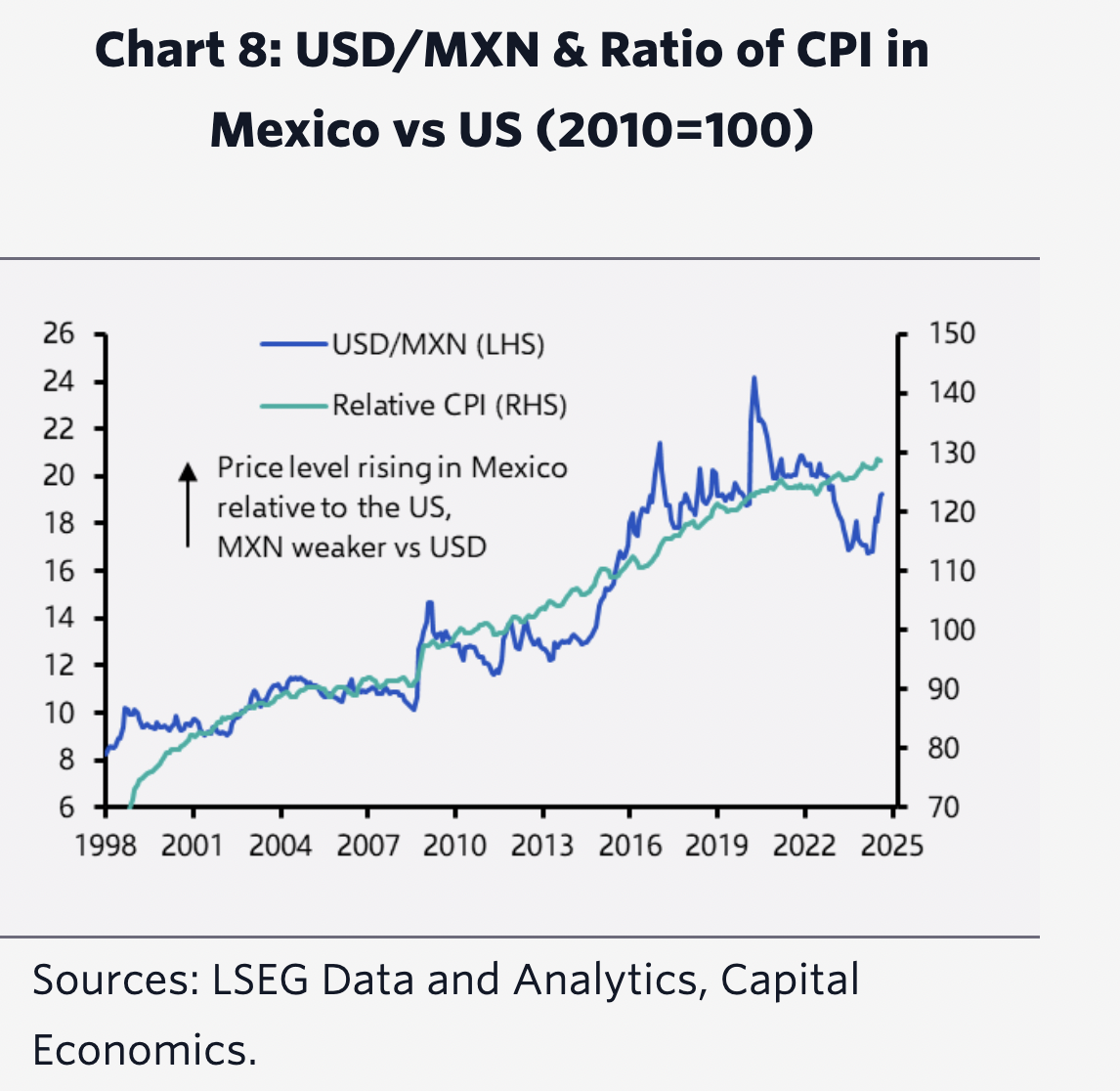

The Mexican Peso remained unchanged against the US Dollar during the North American session on Thursday after the Federal Reserve (Fed) lowered interest rates for the first time in four years. Data from the United States (US) failed to spark a movement on the exotic pair as the USD/MXN trades at 19.26, virtually unchanged.

A scarce Mexican economic docket leaves the emerging market currency leaning into the dynamics of the US economy. On Wednesday, the Fed cut rates by 50 basis points (bps) as it grew confident that inflation will “sustainably” attain its 2% goal and the labor market won’t soften further. In its monetary policy statement, Fed Chair Jerome Powell acknowledged that the dual mandate of price stability and maximum employment is now roughly balanced while noting that the economic outlook remains uncertain.

In the same meeting, Fed officials updated the Summary of Economic Projections (SEP) or Dot Plot, in which they foresee the federal funds rate finishing 2024 at 4.4%.

Recently, the US Department of Labor revealed that the number of Americans filing for unemployment benefits for the week ending September 14 was lower than expected but improved compared to the last reading.

The USD/MXN exotic pair rose toward a daily high of 19.40 after the data as this could dent the US central bank from easing policy aggressively, instead sticking to quarter percentage point reductions.

Meanwhile, investor eyes are on the Bank of Mexico (Banxico), which is expected to lower rates by 0.25% at the September 26 monetary policy meeting decision.

Daily digest market movers: Mexican Peso firm after Fed decision

- The widening of the interest rate differential between Mexico and the US could warrant further downside in the USD/MXN. Nevertheless, fears of the judicial reform capped the Mexican Peso from rallying.

- According to different banks and rating agencies, the impact of overhauling the judicial system remains far from being felt. The lack of a state of law and transparency could be factors in adjusting Mexico’s creditworthiness over the longer term.

- US Initial Jobless Claims for the week ending September 14 dipped from 231K to 219K, below estimates of 230K.

- US Existing Home Sales plunged 2.5% MoM in August, after dipping from 3.96 million to 3.86 million, declining for the fourth time in the year.

- During his press conference, Fed Chair Powell said the risks of inflation diminished and underscored that the economy remained strong. He kept the Fed’s options open, meaning that if inflation persists they can adjust the pace of easing.

- Powell added that SEP data shows the Committee is not in a rush to normalize policy.

- Fed expects inflation to condense to 2.6% in 2024, 2.2% in 2025 and 2% by 2026, according to the Core Personal Consumption Expenditures Price Index.

- Fed officials estimate the US economy will grow at a 2% pace in 2024, with the Unemployment Rate rising to 4.4% by the end of the year.

- December 2024 fed funds rate futures contracting suggests that the Fed might lower rates by at least 69 basis points, implying that in the following two meetings, the market expects one 50 bps and one 25 bps rate cut left in 2024.

USD/MXN technical outlook: Mexican Peso falls as USD/MXN holds gains above 19.30

The USD/MXN uptrend remains in place, though the pair has failed to rally following the Fed’s decision. Next week, Banxico’s policy meeting could push the exchange rate out of the 19.00 – 19.50 range.

Momentum remains mixed but in the short-term it favors sellers as depicted by the Relative Strength Index (RSI).

That said, if the USD/MXN drops below the September 18 low of 19.06, it will expose the psychological 19.00 figure. Further losses lie underneath with the next support being the 50-day Simple Moving Average (SMA) at 18.99, followed by the last cycle low of 18.59, the August 19 daily low.

Conversely, If the USD/MXN climbs above 19.50, the next resistance would be the 20.00 psychological level. Further upside emerges at the yearly peak at 20.22, followed by the 20.50 mark.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- EUR/GBP weakens further, and buying pressure continues to retreat.

- The latest price action and technical indicators suggest that further downside is on the table.

- The 0.8380 presents a strong barrier against the sellers.

Thursday's session saw the EUR/GBP slightly decline by 0.20% below 0.8400. Looking at the technicals the overall bias remains bearish as selling pressure intensifies, the cross must hold the 0.8380 line to avoid further losses.

The Relative Strength Index (RSI) is currently at 37 and is declining sharply in the negative area, indicating that selling pressure is rising. Moreover, the Moving Average Convergence Divergence (MACD) also suggests that selling pressure is rising, as the histogram is red and rising.

EUR/GBP daily chart

Based on the current technical picture, the EUR/GBP is likely to continue trading lower and support levels can be found at 0.8380, 0.8350, and 0.8330. Resistance levels can be found at 0.8430 (20-day SMA), 0.8450, and 0.8500. The 0.8380 is a strong support which if breached would mark a low since 2022 and would confirm a negative outlook for the cross.

- EUR/JPY gains 0.80% as risk-on sentiment pressures safe-haven currencies like the Yen and Swiss Franc.

- ECB’s Klas Knot suggests room for further rate cuts, while Isabel Schnabel pushes back, citing sticky services inflation in the Eurozone.

- BoJ expected to leave rates unchanged, but Governor Ueda hints at potential future hikes if the economy meets expectations.

The Euro rallied sharply against the Japanese Yen on Thursday amid a scarce economic docket. The aftermath of the Federal Reserve’s decision keeps the FX space seesawing as traders scramble after a 50-basis point “hawkish” rate cut. The EUR/JPY trades at 159.54, a gain of over 0.80%.

EUR/JPY rises on upbeat market mood, as ECB members divided on rate cuts and BoJ expected to hold rates

A risk-on impulse has weighed on safe-haven currencies like the Yen and the Swiss Franc. In addition, the rise of the USD/JPY boosted the EUR/JPY, alongside some European Central Bank (ECB) speakers crossing the wires.

Dutch Central Bank President Klas Knot stated that there’s room for further cuts attuned to market expectations. On the other hand, Isabel Schnabel pushed back against easing, commenting that services inflation remains stickier in large parts of the Euro area (EU) and that signs of transmission of monetary policy tightening are weakening.

On the Japanese front, the Bank of Japan is expected to keep rates unchanged at the upcoming meeting, though it’s expected to adjust its quantitative easing policy. The BoJ’s last policy meeting triggered market volatility, which the Japanese parliament questioned.

BoJ Governor Kazuo Ueda appeared in parliament and justified the bank’s decision, hinting that further hikes are coming if the economy performs as foreseen. Other BoJ members supported his view to continue to tighten monetary policy with the likes of Takata, Nakagawa, and Tamura, signaling that further rates are needed if firms increase capex, wages, and prices.

EUR/JPY Price Forecast: Technical outlook

From a technical standpoint, the EUR/JPY remains bearish, with price action standing below the Ichimoku Cloud (Kumo) and the 200-day moving average (DMA). Although the cross spiked toward 160.00 in a short time, it has failed to remain above the Kijun-Sen at 159.51, which opens the door for a pullback. If EUR/JPY drops decisively below 159.00, the next support would be the Senkou Span A at 158.53, followed by the psychological 158.00 figure ahead of the Tenkan-Sen at 157.55.

On the other hand, if buyers reclaim 160.00, look for a test of the bottom of the Kumo at 161.90-162.00.

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan has embarked in an ultra-loose monetary policy since 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds.

The Bank’s massive stimulus has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy of holding down rates has led to a widening differential with other currencies, dragging down the value of the Yen.

A weaker Yen and the spike in global energy prices have led to an increase in Japanese inflation, which has exceeded the BoJ’s 2% target. With wage inflation becoming a cause of concern, the BoJ looks to move away from ultra loose policy, while trying to avoid slowing the activity too much.

- NZD/USD faces pressure to grip a two-week high of 0.6270 due to a decent recovery in the US Dollar.

- Lower-than-expected US jobless claims data prompted US Dollar’s recovery.

- The NZ economy contracted at a slower-than-expected pace in the second quarter of this year.

The NZD/USD pair gains significantly by more than 0.5% but struggles to seize the two-week high of 0.6270 in Thursday’s North American session. The Kiwi asset faces slight pressure as the US Dollar (USD) has rebounded after the release of the United States (US) Initial Jobless Claims data for the week ending September.

The number of individuals claiming jobless benefits for the first time was 219K, lower than estimates of 230K, and the former release of 231K, upwardly revised from 230K. The impact of the better-than-expected jobless claims data is expected to be short-lived as market speculation for the Federal Reserve (Fed) interest rate cut path will pay a major role in its next move.

On Wednesday, the Fed delivered its first dovish decision in more than four years as policymakers are committed to restoring a higher Unemployment Rate and are confident that inflation is on track to return to the bank’s target of 2%. The Fed cut interest rates by 50 basis points (bps) to 4.75%-5.00%, and policymakers see federal fund rates heading to 4.4% by the year-end. On the contrary, traders expect interest rates to fall by a total of 125 bps this year to 4.00%-4.25%.

Meanwhile, the market sentiment is upbeat as investors expect the Fed to continue the policy-easing cycle aggressively. The S&P 500 has opened on a strong note, exhibiting a higher risk appetite of investors. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, recovers its intraday losses and bounces back above 101.00.

In the Asia-Pacific region, the New Zealand Dollar (NZD) strengthens as the domestic Q2 Gross Domestic Product (GDP) data came in better than expected. The NZ economy contracted by 0.2% after expanding by 0.1% in the previous quarter.

The pace at which the economy declined was slower than expectations of 0.4%. Going forward, investors will focus on the People’s Bank of China (PBoC) interest rate decision, which will be announced on Friday. It is worth noting that the NZ economy is one of the largest trading partners to China and a dovish decision by the PBoC would strengthen the Kiwi dollar.

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.