- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 19-09-2014

Most stock indices traded higher, supported by the results of the Scotland's independence referendum. 55% of voters said "no" to independence.

Eurozone's adjusted current account surplus climbed to 18.7 billion euros in July from a surplus of 18.6 billion euros in June, beating expectations for a decline to a surplus of 14.3 billion euros. June's figure was revised up from a surplus of 13.1 billion euros.

German producer price index fell 0.1% in August, in line with expectations, after a 0.1% decrease in July.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,837.92 +18.63 +0.27%

DAX 9,799.26 +1.13 +0.01%

CAC 40 4,461.22 -3.48 -0.08%

West Texas Intermediate crude fell for a third day on rising U.S. supplies and as a stronger dollar weighed on commodity prices.

Stockpiles increased last week for the first time since Aug. 8, according to the Energy Information Administration. The Bloomberg Dollar Index headed for a fifth weekly gain as the Federal Reserve moves closer to raising interest rates. Brent widened its premium to WTI on signs of lower OPEC output.

"Oil continues to come under pressure from the idea that we have ample supplies," said Gene McGillian, an analyst and broker at Tradition Energy in Stamford, Connecticut. "The dollar is throwing pressure on oil."

WTI for October delivery dropped 98 cents, or 1.1 percent, to $92.09 at 10:28 a.m. on the New York Mercantile Exchange. The volume of all futures traded was about 3.3 percent above the 100-day average. Prices are poised for a third straight weekly loss. The October contract expires on Sept. 22.

Brent for November settlement fell 2 cents to $97.68 a barrel on the London-based ICE Futures Europe exchange, headed for a weekly gain of 0.6 percent. Volume was 28 percent below the 100-day average. WTI for November was at a discount of $6.37 to Brent for the same month, compared with $5.72 yesterday.

The U.S. dollar traded mixed to higher against the most major currencies despite yesterday's mixed U.S. economic data. The U.S. dollar remained supported by the results of the Fed's monetary policy meeting on Wednesday. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed raised its estimates for interest rate. The U.S. central bank said interest rate will be 3.75% at the end of 2017.

The U.S. dollar was also supported by the results of the Scotland's independence referendum. 55% of voters said "no" to independence.

The U.S. leading indicators rose 0.2% in August, missing expectations for a 0.4% gain, after a 1.1% rise in July. July's figure was revised up from 0.9% increase.

The euro traded near 14-month low against the U.S. dollar. Eurozone's adjusted current account surplus climbed to 18.7 billion euros in July from a surplus of 18.6 billion euros in June, beating expectations for a decline to a surplus of 14.3 billion euros. June's figure was revised up from a surplus of 13.1 billion euros.

German producer price index fell 0.1% in August, in line with expectations, after a 0.1% decrease in July.

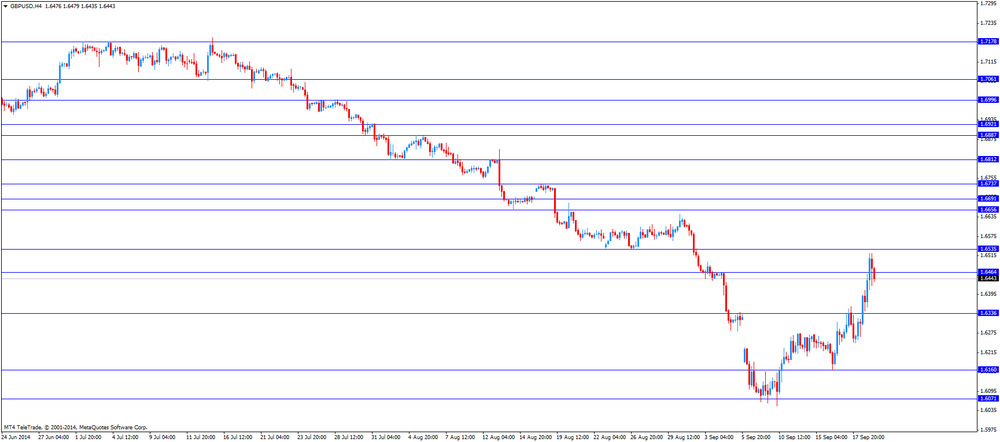

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar jumped against the U.S. dollar after the better-than-expected Canadian consumer price index, but later lost almost all gains. Consumer price index in Canada was flat in August, beating forecast of a 0.1% decline, after a -0.2% drop in July.

On a yearly basis, Canada's consumer price index rose 2.1% in August, after a 2.1% increase in July.

Canadian core consumer price index, which excludes some volatile goods, jumped 0.5% in August, exceeding expectations for a 0.2%, after a 0.1% fall in July.

On a yearly basis, core consumer price index in Canada climbed 2.1% in August, after a 1.7% gain in July. That was highest level since April 2012.

Wholesale sales in Canada fell 0.3% in July, missing expectations for a 0.8% rise, after a 0.8% increase in June. June's figure was revised up a 0.6% increase.

The New Zealand dollar declined against the U.S dollar. Market participants are awaiting the general election on Saturday. The ruling centre-right National party is expected to win.

Credit card spending in New Zealand rose 4.2% in August, after a 4.5% in July.

The Australian dollar fell against the U.S. dollar in the absence of any major economic reports from Australia.

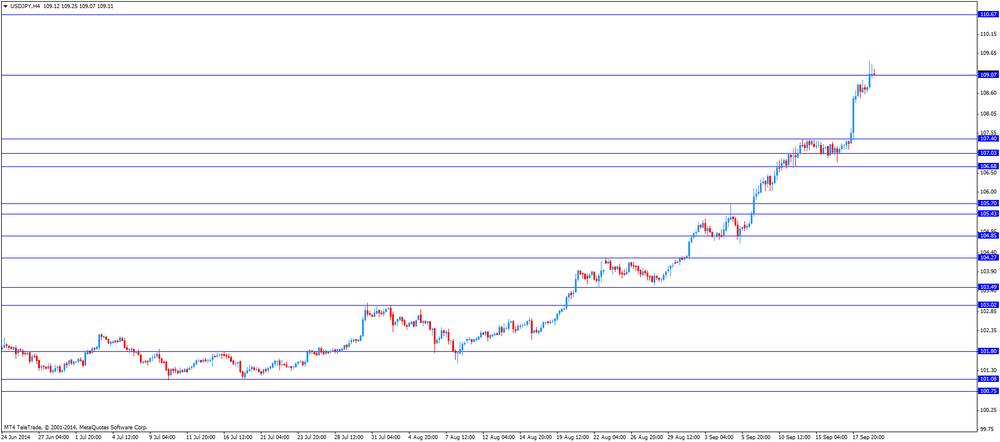

The Japanese yen traded mixed against the U.S. dollar. The all industry activity index in Japan declined 0.2% in July, missing expectations for a 0.4% gain, after a 0.3% fall in June. June's figure was revised up from a 0.4% drop.

The price of gold decreases the third consecutive week, and today was no exception.

Sustained economic growth in the United States support the dollar on the world market and reduces the interest in safe assets.

This week, investors showed some hesitation on the eve of the Fed meeting and referendum in Scotland, but in both cases the fears were unfounded. Experts believe that the gold in these conditions may go down to $ 1,200.

Of statistics published today, the index of leading economic indicators in the United States rose in August 2014 by 0.2%, according to a research organization Conference Board, which calculates. Such a growth rate of this indicator became minimal since January. Analysts had expected a more significant growth rate - 0.4%. In July, the index increased by 1.1%, previously reported growth of 0.9%. Increase was the highest since July last year.

Unlike futures physical gold demand. In China, which is the biggest market for the precious metal, low price has attracted new buyers. Extra charges sellers for the week increased by an average of 1.5 dollars.

The cost of the October gold futures on the COMEX today dropped to 1214.0 dollars per ounce.

EUR/USD: $1.2850(E1.1bn), $1.2900(E598mn), $1.2950(E1.08bn), $1.3000(E1.27bn)

USD/JPY: Y107.00($350mn), Y110.00($366mn)

GBP/USD: $1.6240(stg144mn), $1.6300(stg499mn), $1.6400(stg268mn)

EUR/GBP: stg0.7800(E380mn), stg0.7825(E280mn), stg0.7900(E290mn), stg0.8000(E175mn)

USD/CHF: Chf0.9200($435mn), Chf0.9400(E375mn)

EUR/CHF: Chf1.2150(E398mn)

AUD/USD: $0.9000(A$1.29bn)

NZD/USD: $0.8190(NZ$100mn), $0.8195(NZ$100mn), $0.8200(NZ$746mn)

USD/CAD: C$1.0925($312mn), C$1.0950($550mn), C$1.1050($657mn)

U.S. stock futures rose amid continued investor optimism that interest rates will remain low even as the world's biggest economy is strengthening.

Global markets:

Nikkei 16,321.17 +253.60 +1.58%

Hang Seng 24,306.16 +137.44 +0.57%

Shanghai Composite 2,329.45 +13.52 +0.58%

FTSE 6,864.24 +44.95 +0.66%

CAC 4,459.24 -5.46 -0.12%

DAX 9,826.56 +28.43 +0.29%

Crude oil $92.92 (-0.11%)

Gold $1223.90 (-0.25%)

Statistics Canada released consumer price data today. Consumer price index was flat in August, beating forecast of a 0.1% decline, after a -0.2% drop in July.

On a yearly basis, consumer price index rose 2.1% in August, after a 2.1% increase in July.

The rise of consumer price inflation was driven by higher shelter costs and higher natural gas prices.

Core consumer price index, which excludes some volatile goods, jumped 0.5% in August, exceeding expectations for a 0.2%, after a 0.1% fall in July.

On a yearly basis, core consumer price index climbed 2.1% in August, after a 1.7% gain in July. That was highest level since April 2012.

The increase of core consumer inflation was driven by higher prices for passenger vehicles and telephone services.

(company / ticker / price / change, % / volume)

| Cisco Systems Inc | CSCO | 25.25 | +0.12% | 0.2K |

| Visa | V | 217.00 | +0.26% | 1.2K |

| The Coca-Cola Co | KO | 41.90 | +0.26% | 0.2K |

| International Business Machines Co... | IBM | 194.27 | +0.27% | 1.1K |

| 3M Co | MMM | 147.25 | +0.28% | 0.6K |

| Caterpillar Inc | CAT | 104.64 | +0.29% | 0.1K |

| Boeing Co | BA | 128.98 | +0.31% | 0.6K |

| Walt Disney Co | DIS | 90.64 | +0.33% | 1.3K |

| McDonald's Corp | MCD | 93.80 | +0.34% | 3.3K |

| Wal-Mart Stores Inc | WMT | 76.49 | +0.35% | 0.1K |

| Johnson & Johnson | JNJ | 107.75 | +0.37% | 1.4K |

| Procter & Gamble Co | PG | 84.50 | +0.37% | 0.1K |

| AT&T Inc | T | 35.30 | +0.40% | 14.5K |

| Exxon Mobil Corp | XOM | 97.00 | +0.40% | 5.5K |

| United Technologies Corp | UTX | 109.00 | +0.44% | 0.2K |

| American Express Co | AXP | 90.53 | +0.48% | 2.2K |

| Pfizer Inc | PFE | 30.73 | +0.49% | 0.7K |

| Goldman Sachs | GS | 188.83 | +0.50% | 5.0K |

| General Electric Co | GE | 26.34 | +0.50% | 4.6K |

| Merck & Co Inc | MRK | 60.61 | +0.50% | 2.1K |

| Verizon Communications Inc | VZ | 49.96 | +0.54% | 11.4K |

| E. I. du Pont de Nemours and Co | DD | 71.61 | +0.58% | 1.4K |

| JPMorgan Chase and Co | JPM | 61.73 | +0.67% | 4.9K |

| Travelers Companies Inc | TRV | 95.47 | +0.73% | 0.6K |

| Nike | NKE | 82.60 | +0.77% | 3.3K |

| Microsoft Corp | MSFT | 46.67 | -0.02% | 8.6K |

| Intel Corp | INTC | 35.14 | -0.09% | 11.4K |

| Home Depot Inc | HD | 92.00 | -0.10% | 6.5K |

Upgrades:

DuPont (DD) upgraded to Buy from Hold at BGC Financial

Downgrades:

Other:

Amazon.com (AMZN) target raised to $435 at RBC Capital Mkts

Yahoo! (YHOO) target raised to $48 from $44 at Piper Jaffray

Yahoo! (YHOO) target raised to $43 from $39 at Cantor Fitzgerald

Apple (AAPL) target raised to $110 from $106 at Cowen

EUR/USD

Offers $1.3070, $1.3050, $1.3000, $1.2925

Bids $1.2835, $1.2800, $1.2755

GBP/USD

Offers $1.6645, $1.6600, $1.6535

Bids 1.6360, 1.6300, 1.6290, 1.6235, $1.6200

AUD/USD

Offers $0.9250/60, $0.9220, $0.9110/00, $0.9050, $0.9000

Bids 0.8920, $0.8900, $$0.8800

EUR/JPY

Offers Y142.00, Y141.60, Y141.20

Bids Y140.00, Y139.20, Y139.00, Y138.45, Y138.15

USD/JPY

Offers Y111.00, Y110.00

Bids Y108,00, Y107,80, Y107,40, Y106.70/65, Y106.50

EUR/GBP

Offers stg0.8100, stg0.8000/10, stg0.7950, stg0.7900

Bidsstg0.7800, stg0.7700

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:00 New Zealand Credit Card Spending August +4.5% +4.2%

04:30 Japan All Industry Activity Index, m/m July -0.4% +0.4% -0.2%

06:00 Germany Producer Price Index (MoM) August -0.1% -0.1% -0.1%

06:00 Germany Producer Price Index (YoY) August -0.8% -0.8%

08:00 Eurozone Current account, adjusted, bln July 18.6 Revised From 13.1 14.3 18.7

The U.S. dollar traded mixed to higher against the most major currencies despite yesterday's mixed U.S. economic data. The U.S. dollar remained supported by the results of the Fed's monetary policy meeting on Wednesday. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed raised its estimates for interest rate. The U.S. central bank said interest rate will be 3.75% at the end of 2017.

The U.S. dollar was also supported by the results of the Scotland's independence referendum. 55% of voters said "no" to independence.

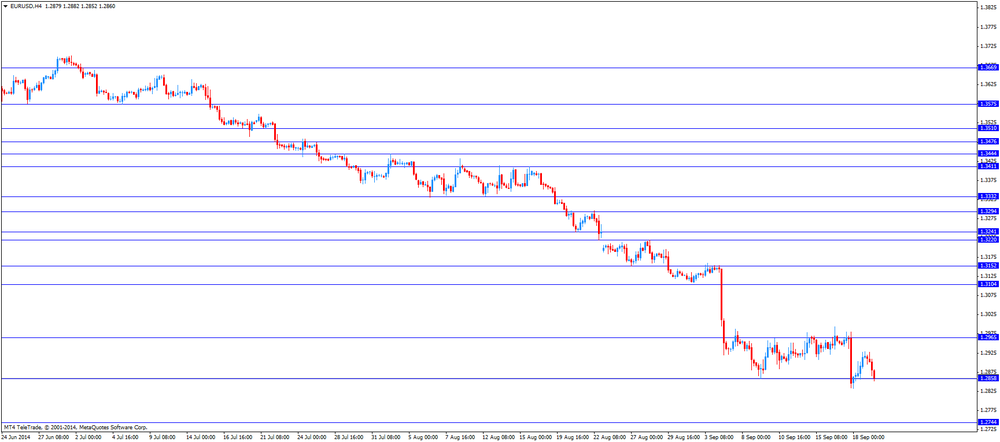

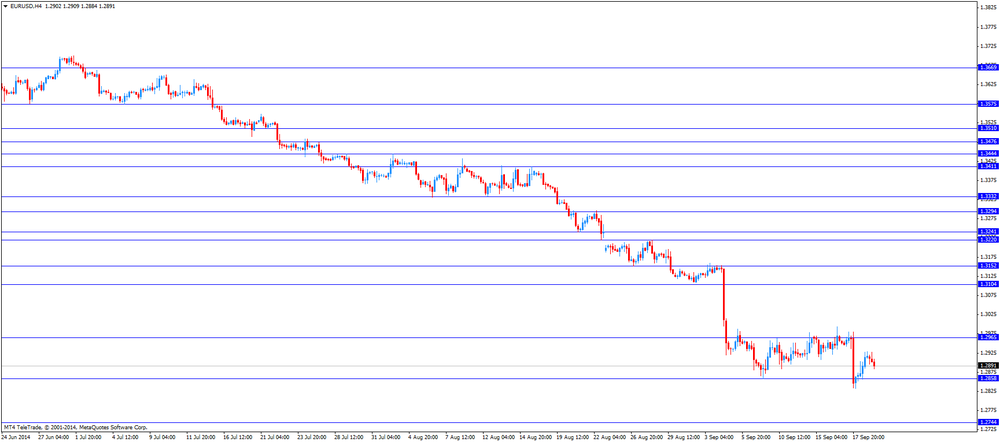

The euro declined against the U.S. dollar. Eurozone's adjusted current account surplus climbed to 18.7 billion euros in July from a surplus of 18.6 billion euros in June, beating expectations for a decline to a surplus of 14.3 billion euros. June's figure was revised up from a surplus of 13.1 billion euros.

German producer price index fell 0.1% in August, in line with expectations, after a 0.1% decrease in July.

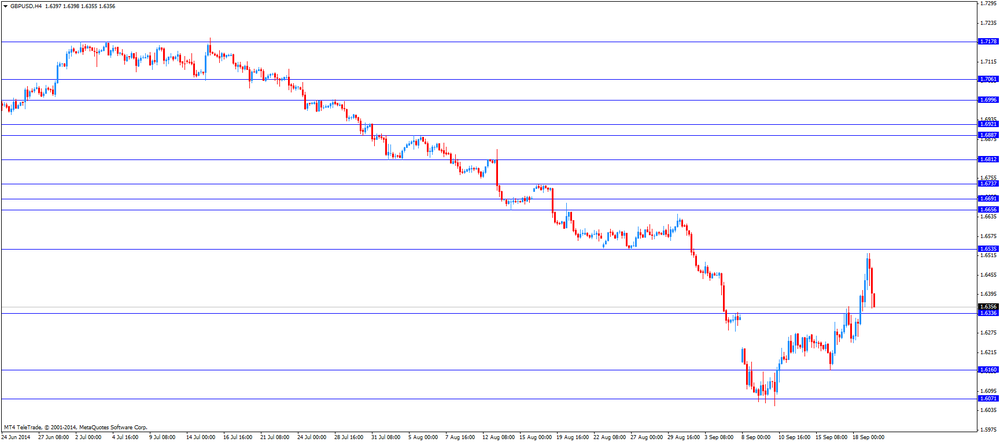

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian consumer price index.

The consumer price index in Canada is expected to decline 0.1% in August, after a 0.2% drop in July.

The core consumer price index in Canada is expected to rise 0.2% in August, after a 0.1% decrease in July.

EUR/USD: the currency pair declined to $1.2852

GBP/USD: the currency pair fell to $1.6353

USD/JPY: the currency pair decreased to Y108.77

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m July +0.6% +0.8%

12:30 Canada Consumer Price Index m / m August -0.2% -0.1%

12:30 Canada Consumer price index, y/y August +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m August -0.1% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y August +1.7%

Stock indices traded higher, driven by the results of the Scotland's independence referendum. 55% of voters said "no" to independence.

Eurozone's adjusted current account surplus climbed to 18.7 billion euros in July from a surplus of 18.6 billion euros in June, beating expectations for a decline to a surplus of 14.3 billion euros. June's figure was revised up from a surplus of 13.1 billion euros.

German producer price index fell 0.1% in August, in line with expectations, after a 0.1% decrease in July.

Current figures:

Name Price Change Change %

FTSE 6,866.58 +47.29 +0.69%

DAX 9,864.1 +65.97 +0.67%

CAC 40 4,470.3 +5.60 +0.13%

Asian stock closed higher as the results of the Scotland's independence referendum and U.S. initial jobless claims supported markets. 55% of Scottish voters said "no" to independence.

The number of initial jobless claims in the U.S. in the week ending September 13 dropped by 36,000 to 280,000.

Japanese stocks were driven by the weaker yen. The Japanese yen hits 6-year low against the U.S. dollar after the results of the Scotland's independence referendum.

The all industry activity index in Japan declined 0.2% in July, missing expectations for a 0.4% gain, after a 0.3% fall in June. June's figure was revised up from a 0.4% drop.

Indexes on the close:

Nikkei 225 16,321.17 +253.60 +1.58%

Hang Seng 24,306.16 +137.44 +0.57%

Shanghai Composite 2,329.45 +13.52 +0.58%

EUR/USD: $1.2850(E1.1bn), $1.2900(E598mn), $1.2950(E1.08bn), $1.3000(E1.27bn)

USD/JPY: Y107.00($350mn), Y110.00($366mn)

GBP/USD: $1.6240(stg144mn), $1.6300(stg499mn), $1.6400(stg268mn)

EUR/GBP: stg0.7800(E380mn), stg0.7825(E280mn), stg0.7900(E290mn), stg0.8000(E175mn)

USD/CHF: Chf0.9200($435mn), Chf0.9400(E375mn)

EUR/CHF: Chf1.2150(E398mn)

AUD/USD: $0.9000(A$1.29bn)

NZD/USD: $0.8190(NZ$100mn), $0.8195(NZ$100mn), $0.8200(NZ$746mn)

USD/CAD: C$1.0925($312mn), C$1.0950($550mn), C$1.1050($657mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:00 New Zealand Credit Card Spending August +4.5% +4.2%

04:30 Japan All Industry Activity Index, m/m July -0.4% +0.4% -0.2%

06:00 Germany Producer Price Index (MoM) August -0.1% -0.1% -0.1%

06:00 Germany Producer Price Index (YoY) August -0.8% -0.8%

08:00 Eurozone Current account, adjusted, bln July 18.6 Revised From 13.1 14.3 18.7

The U.S. dollar traded higher against the most major currencies despite yesterday's mixed U.S. economic data. The U.S. dollar remained supported by the results of the Fed's monetary policy meeting on Wednesday. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed raised its estimates for interest rate. The U.S. central bank said interest rate will be 3.75% at the end of 2017.

The U.S. dollar was also supported by the results of the Scotland's independence referendum. 55% of voters said "no" to independence.

The New Zealand dollar traded slightly lower against the U.S dollar. Market participants are awaiting the general election on Saturday. The ruling centre-right National party is expected to win.

Credit card spending in New Zealand rose 4.2% in August, after a 4.5% in July.

The Australian dollar traded slightly lower against the U.S. dollar in the absence of any major economic reports from Australia.

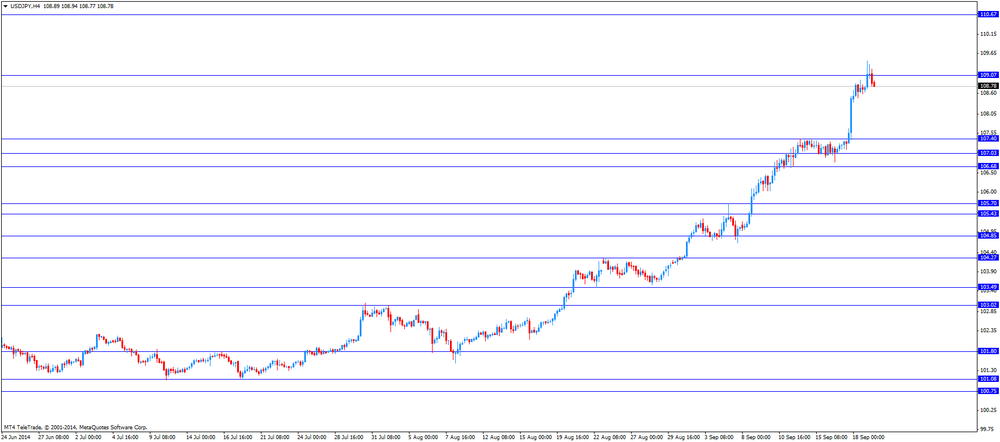

The Japanese yen hits 6-year low against the U.S. dollar as 55% of Scottish voters said "no" to independence.

The all industry activity index in Japan declined 0.2% in July, missing expectations for a 0.4% gain, after a 0.3% fall in June. June's figure was revised up from a 0.4% drop.

EUR/USD: the currency pair fell to $1.2896

GBP/USD: the currency pair decreased to $1.6422

USD/JPY: the currency pair climbed to Y109.45

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m July +0.6% +0.8%

12:30 Canada Consumer Price Index m / m August -0.2% -0.1%

12:30 Canada Consumer price index, y/y August +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m August -0.1% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y August +1.7%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3046 (5152)

$1.2992 (703)

$1.2958 (166)

Price at time of writing this review: $ 1.2912

Support levels (open interest**, contracts):

$1.2878 (6395)

$1.2832 (3445)

$1.2801 (2896)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 52058 contracts, with the maximum number of contracts with strike price $1,3000 (5152);

- Overall open interest on the PUT options with the expiration date October, 3 is 55853 contracts, with the maximum number of contracts with strike price $1,3000 (6395);

- The ratio of PUT/CALL was 1.07 versus 1.10 from the previous trading day according to data from September, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.6702 (4478)

$1.6604 (1551)

$1.6508 (2973)

Price at time of writing this review: $1.6246

Support levels (open interest**, contracts):

$1.6383 (1094)

$1.6287 (4548)

$1.6190 (1988)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 34061 contracts, with the maximum number of contracts with strike price $1,6700 (4478);

- Overall open interest on the PUT options with the expiration date October, 3 is 43292 contracts, with the maximum number of contracts with strike price $1,6300 (4548);

- The ratio of PUT/CALL was 1.27 versus 1.32 from the previous trading day according to data from September, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.