- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 19-08-2014

(raw materials / closing price /% change)

Light Crude 94.57 +0.10%

Gold 1,296.20 -0.04%

(index / closing price / change items /% change)

Nikkei 225 15,449.79 +127.19 +0.83%

Hang Seng 25,122.95 +167.49 +0.67%

Shanghai Composite 2,245.33 +5.86 +0.26%

FTSE 100 6,779.31 +38.06 +0.56%

CAC 40 4,254.45 +23.80 +0.56%

Xetra DAX 9,334.28 +88.95 +0.96%

S&P 500 1,981.6 +9.86 +0.50%

NASDAQ 4,527.51 +19.20 +0.43%

Dow Jones 16,919.59 +80.85 +0.48%

(pare/closed(GMT +2)/change, %)

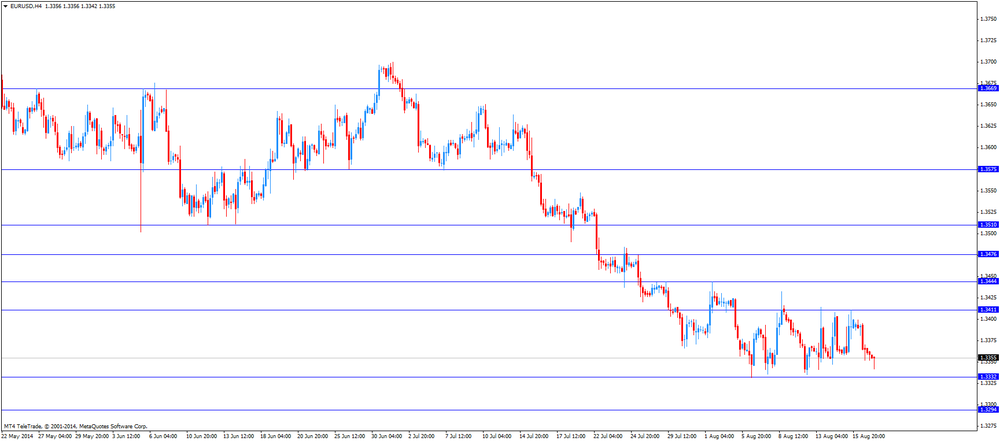

EUR/USD $1,3317 -0,33%

GBP/USD $1,6614 -0,67%

USD/CHF Chf0,9092 +0,31%

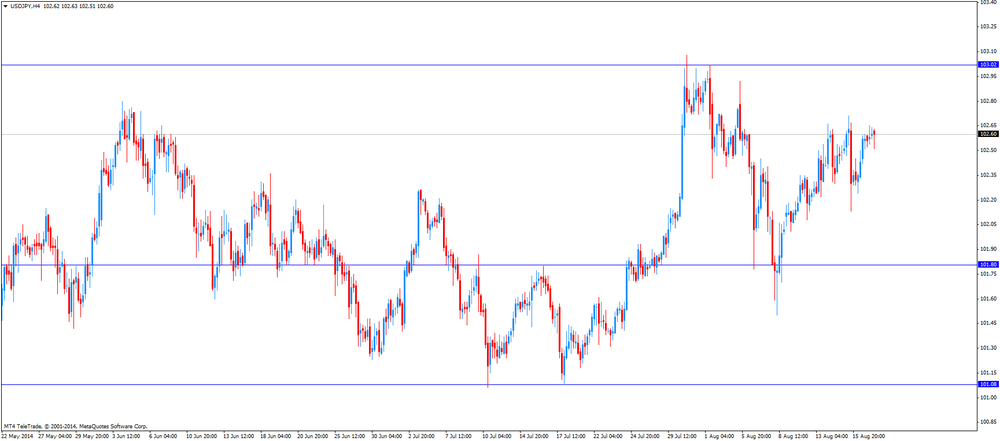

USD/JPY Y102,92 +0,35%

EUR/JPY Y137,06 +0,02%

GBP/JPY Y170,98 -0,32%

AUD/USD $0,9296 -0,28%

NZD/USD $0,8421 -0,67%

USD/CAD C$1,0940 +0,49%

(time / country / index / period / previous value / forecast)

00:30 Australia Leading Index June +0.1%

04:30 Japan All Industry Activity Index, m/m June +0.6% -0.2%

06:00 Germany Producer Price Index (MoM) July 0.0% +0.1%

06:00 Germany Producer Price Index (YoY) July -0.7%

08:30 United Kingdom Bank of England Minutes

10:00 United Kingdom CBI industrial order books balance August 2 4

12:30 Canada Wholesale Sales, m/m June +2.2% +1.3%

14:30 U.S. Crude Oil Inventories August 1.4

18:00 U.S. FOMC meeting minutes

22:45 New Zealand Visitor Arrivals July -0.3%

Stock indices closed higher due to the better-than-forecasted corporate earnings and as tensions over Ukraine eased. A.P. Moeller-Maersk A/S shares increased 4.9% after the company upgraded its full-year profit forecast.

Eurozone's current account surplus dropped to 13.1 billion euros in June from a surplus of 19.8 billion euros in May, missing expectations for an increase to 21.3 billion euros. May's figure was revised up from a surplus of 19.5 billion euros.

Consumer price index in the UK decreased 0.3% in July, a 0.2% rise in June.

On a yearly basis, consumer price inflation the UK rose 1.6% in July, missing expectations for a 1.8% gain, after a 1.9% increase in June.

CPI, excluding food, energy, alcohol, and tobacco costs, jumped 1.8% in July, missing expectations for a 1.9% rise, after a 2.0% gain in June.

BHP Billiton Ltd. shares slid 4.9% after reporting the weaker-than-forecasted annual profit.

Sixt SE shares rose 3.2% after reporting the better-than-forecasted second-quarter earnings.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,779.31 +38.06 +0.56%

DAX 9,334.28 +88.95 +0.96%

CAC 40 4,254.45 +23.80 +0.56%

The U.S. dollar traded higher against the most major currencies after the better-than-expected U.S. housing market data. Housing starts in the U.S. jumped 15.7% to 1.093 million units in July from 945,000 units in June. That was the strongest rate since November. June's figure was revised up from 893,000 units. Analysts had expected a rise to 970,000 units.

The number of building permits rose by 8.1% to 1.052 million units in July from 973,000 in June. June's figure was revised up from 963,000 units. Analysts had expected 1.0 million units.

The U.S. consumer price index increased 0.1% in July, in line with expectations, after a 0.3% rise in June.

On a yearly basis, consumer prices in the U.S. rose 2.0% in July, after a 2.1% gain in June.

Consumer prices, excluding food and energy, climbed 0.1% in July, missing expectations for a 0.2% increase, after a 0.1% rise in June.

On a yearly basis, consumer prices, excluding food and energy, increased 1.9% in July, after a 1.9% rise in June.

The euro fell against the U.S. the better-than-expected U.S. housing market data.

Eurozone's current account surplus dropped to 13.1 billion euros in June from a surplus of 19.8 billion euros in May, missing expectations for an increase to 21.3 billion euros. May's figure was revised up from a surplus of 19.5 billion euros.

The British pound declined against the U.S. dollar after the weaker-than-expected economic data from the UK and the better-than-expected U.S. housing market data.

Consumer price index in the UK decreased 0.3% in July, a 0.2% rise in June.

On a yearly basis, consumer price inflation the UK rose 1.6% in July, missing expectations for a 1.8% gain, after a 1.9% increase in June.

CPI, excluding food, energy, alcohol, and tobacco costs, jumped 1.8% in July, missing expectations for a 1.9% rise, after a 2.0% gain in June.

Producer price index input in the UK fell 1.6% in July, missing forecasts of a 0.8% decline, after a 0.9% decrease in June. June's figure was revised down from a 0.8% drop.

Producer price index output in the UK decreased 0.1% in July, missing forecasts of a 0.1% increase, after a 0.1% fall in June. June's figure was revised up from a 0.2% decline.

The New Zealand dollar traded mixed against the U.S dollar. In the overnight trading session, the New Zealand dollar dropped against the U.S dollar after the weaker-than-expected economic data from New Zealand. Producer price index input in New Zealand fell by 1.0% in the second quarter, missing expectations for a 0.7% rise, after a 1.0% gain in the first quarter.

Producer price index output in New Zealand declined by 0.5% in the second quarter, missing expectations for a 0.8% increase, after a 0.9% rise in the first quarter.

New Zealand's annual inflation expectations for the next two years decreased to 2.2% in the second quarter from 2.4% in the first quarter.

Growth forecast cut by New Zealand's government also weighed on the kiwi. The government lowered growth forecast in the year to next March to 3.8% from 4% earlier.

The Australian dollar declined against the U.S. dollar after the better-than-expected U.S. housing market data.

The Reserve Bank of Australia released its policy meeting minutes. The RBA said that its interest rate will remain on hold for some time. There were no comments on the currency.

The Japanese yen traded lower against the U.S. dollar the better-than-expected U.S. housing market data. No major economic reports were released in Japan.

The U.S. Commerce Department released the U.S. housing data today. Housing starts in the U.S. jumped 15.7% to 1.093 million units in July from 945,000 units in June. That was the strongest rate since November. June's figure was revised up from 893,000 units. Analysts had expected a rise to 970,000 units.

The number of building permits rose by 8.1% to 1.052 million units in July from 973,000 in June. June's figure was revised up from 963,000 units. Analysts had expected 1.0 million units.

EUR/USD $1.3350(E886mn), $1.3365-75(E204mn), $1.3390(E324mn)

USD/JPY Y102.50($220mn), Y102.60($375mn), Y103.00($250mn)

GBP/USD $1.6600(stg260mn), $1.6685(stg396mn), $1.6795(stg201mn)

EUR/CHF Chf1.2100(E100mn)

AUD/USD $0.9290(A$163mn), $0.9340(A$100mn)

NZD/USD $0.8425(NZ$140mn), $0.8450(NZ$104mn)

USD/CAD C$1.0850-55($170mn), C$1.0950($242mn)

The Labor Department in the U.S. released consumer price index. The U.S. consumer price index increased 0.1% in July, in line with expectations, after a 0.3% rise in June.

On a yearly basis, consumer prices in the U.S. rose 2.0% in July, after a 2.1% gain in June.

Gasoline prices declined 0.3% in July, while food prices rose 0.4% in July.

Consumer prices, excluding food and energy, climbed 0.1% in July, missing expectations for a 0.2% increase, after a 0.1% rise in June.

On a yearly basis, consumer prices, excluding food and energy, increased 1.9% in July, after a 1.9% rise in June.

The figures could mean that the Fed will keep its interest rate low for a while.

The Fed's inflation target is 2% at annual rate. The Fed prefers to use the index for personal consumption. The index for personal consumption was 1.6% at annual rate in June.

U.S. stock futures advanced as housing starts jumped to the highest level in eight months and an inflation gauge showed price pressures remain limited.

Shares of Home Depot Inc. (HD) gained more than 4% after earnings topped analysts' estimates and the company raised its forecast.

Global markets:

Nikkei 15,449.79 +127.19 +0.83%

Hang Seng 25,122.95 +167.49 +0.67%

Shanghai Composite 2,245.33 +5.86 +0.26%

FTSE 6,774.18 +32.93 +0.49%

CAC 4,248.44 +17.79 +0.42%

DAX 9,340.58 +95.25 +1.03%

Crude oil $96.85 (-0.51%)

Gold $1301.30 (-1.00%)

(company / ticker / price / change, % / volume)

| Nike | NKE | 78.57 | +0.03% | 0.4K |

| Chevron Corp | CVX | 126.40 | +0.08% | 0.1K |

| Intel Corp | INTC | 34.44 | +0.09% | 1.7K |

| The Coca-Cola Co | KO | 41.39 | +0.10% | 0.1K |

| Caterpillar Inc | CAT | 107.10 | +0.11% | 3.2K |

| Exxon Mobil Corp | XOM | 99.63 | +0.11% | 0.5K |

| Cisco Systems Inc | CSCO | 24.66 | +0.12% | 0.8K |

| AT&T Inc | T | 34.70 | +0.14% | 3.1K |

| Johnson & Johnson | JNJ | 102.85 | +0.15% | 2.6K |

| Microsoft Corp | MSFT | 44.90 | +0.16% | 1.4K |

| Procter & Gamble Co | PG | 82.57 | +0.16% | 0.1K |

| E. I. du Pont de Nemours and Co | DD | 66.00 | +0.20% | 0.1K |

| Verizon Communications Inc | VZ | 48.88 | +0.21% | 17.7K |

| General Electric Co | GE | 26.13 | +0.23% | 2.3K |

| Goldman Sachs | GS | 175.00 | +0.26% | 2.0K |

| Wal-Mart Stores Inc | WMT | 74.70 | +0.28% | 3.4K |

| JPMorgan Chase and Co | JPM | 57.40 | +0.30% | 3.2K |

| McDonald's Corp | MCD | 94.55 | +0.32% | 0.1K |

| Pfizer Inc | PFE | 28.95 | +0.38% | 0.4K |

| American Express Co | AXP | 87.75 | +0.68% | 2.9K |

| International Business Machines Co... | IBM | 189.36 | 0.00% | 0.2K |

| Walt Disney Co | DIS | 89.75 | -0.24% | 5.7K |

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Meeting's Minutes

03:00 New Zealand Expected Annual Inflation 2y from now Quarter III +2.4% +2.2%

08:00 Eurozone Current account, adjusted, bln June 19.8 Revised From 19.5 21.3 13.1

08:30 United Kingdom Retail Price Index, m/m July +0.2% -0.1%

08:30 United Kingdom Retail prices, Y/Y July +2.6% +2.6% +2.5%

08:30 United Kingdom RPI-X, Y/Y July +2.7% +2.3%

08:30 United Kingdom Producer Price Index - Input (MoM) July -0.9% -0.8% -1.6%

08:30 United Kingdom Producer Price Index - Input (YoY) July -4.5% -7.3%

08:30 United Kingdom Producer Price Index - Output (MoM) July -0.1% +0.1% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) July +0.3% -0.1%

08:30 United Kingdom HICP, m/m July +0.2% -0.3%

08:30 United Kingdom HICP, Y/Y July +1.9% +1.8% +1.6%

08:30 United Kingdom HICP ex EFAT, Y/Y July +2.0% +1.9% +1.8%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. housing data and consumer price index. The consumer price index is expected to increase 0.1% in July, after a 0.3% rise in June.

The consumer price index, excluding food and energy, is expected to rise 0.2% in July, after a 0.1% gain in June.

The euro traded mixed against the U.S. dollar after the weaker-than-expected current account data from the Eurozone. Eurozone's current account surplus dropped to 13.1 billion euros in June from a surplus of 19.8 billion euros in May, missing expectations for an increase to 21.3 billion euros. May's figure was revised up from a surplus of 19.5 billion euros.

The British pound dropped against the U.S. dollar after the weaker-than-expected economic data from the UK. Consumer price index in the UK decreased 0.3% in July, a 0.2% rise in June.

On a yearly basis, consumer price inflation the UK rose 1.6% in July, missing expectations for a 1.8% gain, after a 1.9% increase in June.

CPI, excluding food, energy, alcohol, and tobacco costs, jumped 1.8% in July, missing expectations for a 1.9% rise, after a 2.0% gain in June.

Producer price index input in the UK fell 1.6% in July, missing forecasts of a 0.8% decline, after a 0.9% decrease in June. June's figure was revised down from a 0.8% drop.

Producer price index output in the UK decreased 0.1% in July, missing forecasts of a 0.1% increase, after a 0.1% fall in June. June's figure was revised up from a 0.2% decline.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.6632

USD/JPY: the currency pair rose to Y102.69

The most important news that are expected (GMT0):

12:30 U.S. Building Permits, mln July 0.963 1.000

12:30 U.S. Housing Starts, mln July 0.893 0.970

12:30 U.S. CPI, m/m July +0.3% +0.1%

12:30 U.S. CPI, Y/Y July +2.1%

12:30 U.S. CPI excluding food and energy, m/m July +0.1% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y July +1.9%

23:30 Australia RBA's Governor Glenn Stevens Speech

23:50 Japan Adjusted Merchandise Trade Balance, bln July -1080.8 -770.0

EUR/USD

Offers $1.3485, $1.3445, $1.3415, $1.3400, $1.3375/80

Bids $1.3330, $1.3300-3295, $1.3230

GBP/USD

Offers $1.6845, $1.6800/10, $1.6750

Bids $1.6620, $1.6600, $1.6550

AUD/USD

Offers $0.9400, $0.9370, $0.9350

Bids $0.9285/80, $0.9240, $0.9220/00

EUR/JPY

Offers Y138.20, Y138.00, Y137.60

Bids Y136.75, Y136.50, Y136.25/20

USD/JPY

Offers Y103.50, Y103.00, Y102.80/85, Y102.70

Bids Y102.30, Y102.15, Y102.00, Y101.80, Y101.50

EUR/GBP

Offers stg0.8100, stg0.8035, stg0.8000

Bids stg0.7980, stg0.7950/40, stg0.7900

The Office for National Statistics (ONS) released consumer price inflation today. Consumer price index in the UK decreased 0.3% in July, a 0.2% rise in June.

On a yearly basis, consumer price inflation the UK rose 1.6% in July, missing expectations for a 1.8% gain, after a 1.9% increase in June.

Food prices declined by 0.6% in July, while clothing prices fell 0.2% in July.

CPI, excluding food, energy, alcohol, and tobacco costs, jumped 1.8% in July, missing expectations for a 1.9% rise, after a 2.0% gain in June.

Retail price index increased at an annual rate of 2.5% in July, missing expectations for a 2.6% gain, after a 2.6% rise in June.

Stock indices traded higher due to the better-than-forecasted corporate earnings. A.P. Moeller-Maersk A/S shares increased 4% after the company upgraded its full-year profit forecast.

Eurozone's current account surplus dropped to 13.1 billion euros in June from a surplus of 19.8 billion euros in May, missing expectations for an increase to 21.3 billion euros. May's figure was revised up from a surplus of 19.5 billion euros.

Consumer price index in the UK decreased 0.3% in July, a 0.2% rise in June.

On a yearly basis, consumer price inflation the UK rose 1.6% in July, missing expectations for a 1.8% gain, after a 1.9% increase in June.

CPI, excluding food, energy, alcohol, and tobacco costs, jumped 1.8% in July, missing expectations for a 1.9% rise, after a 2.0% gain in June.

Sixt SE shares rose 4.5% after reporting the better-than-forecasted second-quarter earnings.

Current figures:

Name Price Change Change %

FTSE 100 6,767.93 +26.68 +0.40%

DAX 9,318.01 +72.68 +0.79%

CAC 40 4,244.38 +13.73 +0.32%

Asian stock indices closed higher, following gains on U.S. markets as geopolitical tensions eased and due to yesterday's better-than-expected U.S. housing data.

Foreign ministers from Russia, Ukraine, Germany, and France met in Berlin over the weekend. Investors have seen signs of progress in the talks to bring about a ceasefire in Ukraine.

The Red Cross is close to working out details of a safe-passage plan for a Russian humanitarian convoy.

The NAHB housing market index climbed to 55.0 in August from 53.0 in July. Analysts had expected the index to remain unchanged at 53.0.

Indexes on the close:

Nikkei 225 15,449.79 +127.19 +0.83%

Hang Seng 25,122.95 +167.49 +0.67%

Shanghai Composite 2,245.33 +5.86 +0.26%

EUR/USD $1.3350(E886mn), $1.3365-75(E204mn), $1.3390(E324mn)

USD/JPY Y102.50($220mn), Y102.60($375mn), Y103.00($250mn)

GBP/USD $1.6600(stg260mn), $1.6685(stg396mn), $1.6795(stg201mn)

EUR/CHF Chf1.2100(E100mn)

AUD/USD $0.9290(A$163mn), $0.9340(A$100mn)

NZD/USD $0.8425(NZ$140mn), $0.8450(NZ$104mn)

USD/CAD C$1.0850-55($170mn), C$1.0950($242mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Meeting's Minutes

03:00 New Zealand Expected Annual Inflation 2y from now Quarter III +2.4% +2.2%

08:00 Eurozone Current account, adjusted, bln June 19.8 Revised From 19.5 21.3 13.1

08:30 United Kingdom Retail Price Index, m/m July +0.2% -0.1%

08:30 United Kingdom Retail prices, Y/Y July +2.6% +2.6% +2.5%

08:30 United Kingdom RPI-X, Y/Y July +2.7% +2.3%

08:30 United Kingdom Producer Price Index - Input (MoM) July -0.8% -0.8% -1.6%

08:30 United Kingdom Producer Price Index - Input (YoY) July -4.4% -7.3%

08:30 United Kingdom Producer Price Index - Output (MoM) July -0.2% +0.1% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) July +0.2% -0.1%

08:30 United Kingdom HICP, m/m July +0.2% -0.3%

08:30 United Kingdom HICP, Y/Y July +1.9% +1.8% +1.6%

08:30 United Kingdom HICP ex EFAT, Y/Y July +2.0% +1.9% +1.8%

The U.S. dollar traded mixed to higher against the most major currencies. The greenback was supported by yesterday's NAHB housing market index. The NAHB housing market index climbed to 55.0 in August from 53.0 in July. Analysts had expected the index to remain unchanged at 53.0.

The New Zealand dollar dropped against the U.S dollar after the weaker-than-expected economic data from New Zealand. Producer price index input in New Zealand fell by 1.0% in the second quarter, missing expectations for a 0.7% rise, after a 1.0% gain in the first quarter.

Producer price index output in New Zealand declined by 0.5% in the second quarter, missing expectations for a 0.8% increase, after a 0.9% rise in the first quarter.

New Zealand's annual inflation expectations for the next two years decreased to 2.2% in the second quarter from 2.4% in the first quarter.

Growth forecast cut by New Zealand's government also weighed on the kiwi. The government lowered growth forecast in the year to next March to 3.8% from 4% earlier.

The Australian dollar traded higher against the U.S. dollar after the Reserve Bank of Australia's policy meeting minutes. The RBA said that its interest rate will remain on hold for some time. There were no comments on the currency.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports in Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Building Permits, mln July 0.963 1.000

12:30 U.S. Housing Starts, mln July 0.893 0.970

12:30 U.S. CPI, m/m July +0.3% +0.1%

12:30 U.S. CPI, Y/Y July +2.1%

12:30 U.S. CPI excluding food and energy, m/m July +0.1% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y July +1.9%

23:30 Australia RBA's Governor Glenn Stevens Speech

23:50 Japan Adjusted Merchandise Trade Balance, bln July -1080.8 -770.0

Asian stocks rose after confidence in the U.S. housing industry climbed to the highest level in seven months and tensions eased over global political conflicts. Hong Kong shares climbed to a six-year high.

The MSCI Asia Pacific Index gained 0.7 percent to 148.99 as of 4:03 p.m. in Hong Kong, with all 10 of its industry groups rising. The gauge jumped 2.7 percent last week, the most in four months, as concern eased over global conflicts from Ukraine to Gaza and Iraq. A measure of U.S. homebuilder sentiment yesterday showed confidence rose in August, indicating the industry is making more headway as the Federal Reserve watches economic data to help gauge adjustments to monetary stimulus.

Amcor advanced 4.6 percent to A$10.75 in Sydney after reporting net income of A$564.8 million ($527.4 million), topping the A$560 million average forecast of analysts.

Terumo climbed 3.5 percent to 2,596 yen in Tokyo. Credit Suisse upgraded the shares to outperform from neutral, citing an expected improvement in profit margins at its hospital business as costs are cut.

Don Quijote slipped 3.7 percent to 5,510 yen after projecting operating profit of 34.8 billion yen for the current fiscal year. That's less than than the 37.7 billion estimate of 10 analysts surveyed by Bloomberg.

Nikkei 225 15,449.79 +127.19 +0.83%

Hang Seng 25,122.95 +167.49 +0.67%

S&P/ASX 200 5,623.78 +36.68 +0.66%

Shanghai Composite 2,245.33 +5.86 +0.26%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3441 (6169)

$1.3415 (1234)

$1.3396 (677)

Price at time of writing this review: $ 1.3357

Support levels (open interest**, contracts):

$1.3339 (1789)

$1.3322 (5110)

$1.3298 (4507)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 54616 contracts, with the maximum number of contracts with strike price $1,3400 (6169);

- Overall open interest on the PUT options with the expiration date September, 5 is 59930 contracts, with the maximum number of contracts with strike price $1,3100 (6603);

- The ratio of PUT/CALL was 1.10 versus 1.09 from the previous trading day according to data from August, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.7000 (2650)

$1.6901 (2433)

$1.6804 (1695)

Price at time of writing this review: $1.6718

Support levels (open interest**, contracts):

$1.6694 (3098)

$1.6597 (1990)

$1.6499 (1848)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 27506 contracts, with the maximum number of contracts with strike price $1,7000 (2650);

- Overall open interest on the PUT options with the expiration date September, 5 is 29531 contracts, with the maximum number of contracts with strike price $1,6800 (4032);

- The ratio of PUT/CALL was 1.07 versus 1.09 from the previous trading day according to data from August, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.