- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 19-04-2022

- A rising channel formation is advocating for the greenback bulls to dictate the prices.

- The 20- and 50-EMAs are scaling higher, adding to the upside filters.

- The RSI (14) is not displaying any sign of divergence and an overbought situation.

The USD/CHF pair is advancing higher sharply after violating March’s high at 0.9460. The asset has continued its six-day winning streak on Wednesday and is expected to extend gains after sustaining above Tuesday’s high at 0.9524.

The formation of a rising channel chart pattern on the daily scale is claiming a restricted movement with an upside bias. The lower boundary of the rising channel is plotted from the fiscal year 2021’s low 0.8758 while the upper boundary is placed from July 2021 high at 0.9272.

The 50- and 200-period Exponential Moving Averages (EMAs) at 0.9315 and 0.9237 respectively are advancing, which signals more gains ahead. Meanwhile, the Relative Strength Index (RSI) (14) has registered a fresh high at 76.30, which indicates a firmer upside move. The momentum oscillator RSI (14) is not displaying any sign of divergence and the overbought situation.

Violation of Wednesday’s high at 0.9523 will send the asset towards the rising channel high at 0.9570, followed by the round level resistance at 0.9600.

However, a slippage below Friday’s low at 0.9411 will drag the asset towards April 1 high at 0.9374. A breach of the latter will send the asset towards the 50-EMA at 0.9315.

USD/CHF daily chart

-637860090798101266.png)

- The AUD/JPY reached a seven-year-old new high at 95.66, but it retraced some as the Asian Pacific session began.

- Despite verbal intervention by the Japanese Minister of Finance, most crosses rose against the battered Japanese yen.

- AUD/JPY Price Forecast: Upward biased, but oscillators approach overbought conditions.

The Australian dollar extends its rally against the Japanese yen, taking advantage of a dovish Bank of Japan (BoJ), despite comments from the Japanese Finance Minister Suzuki. At the time of writing, the AUD/JPY is trading at 95.48.

On Tuesday, the Minister of Finance Suzuki said that a weaker yen brought more demerit than merit and emphasized that they would continue monitoring the FX market with a sense of vigilance. Nevertheless, market participants widely ignored his comments, as the USD/JPY rose 1.49%, the EUR/JPY gained 1.55%, and the AUD/JPY rallied 1.83%.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY monthly chart depicts the pair as upward biased, further confirmed by the break of a nine-year-old downslope trendline in March. Nevertheless, the steepness of the rally is beginning to show on oscillators indicators, like the Relative Strength Index (RSI), which illustrates an almost vertical move towards overbought conditions, though still short at 68.87.

To the upside, the AUD/JPY’s first resistance would be May 2015 highs around 97.30. Once cleared, the next resistance would be the 100.00 mark, and then the November 2014 highs near 102.84. On the flip side, the AUD/JPY first support would be the abovementioned downslope trendline around the 90.50-70 area. A breach of the latter would pave the way for further losses. The following support would be the October 2021 highs around 86.25 and then the 200-month simple moving average (SMA) at 84.84.

Key technical levels

- USD/JPY is likely to reclaim a two-decade high at 130.67 as higher US yields battered yen.

- The 10-year US Treasury yields are on the verge of kissing the psychological resistance of 3%.

- A battered yen is not a serious problem for the BOJ but higher commodity prices are.

The USD/JPY pair is marching towards its two-decade high at 130.67 as rising US Treasury yields are punishing the already battered Japanese yen. The asset is continued with its five-day winning streak on Wednesday and is not displaying any signs of exhaustion despite the extreme overbought situation from the momentum oscillators.

The immense hawkish comments from the St. Louis Federal Reserve (Fed) President James Bullard on Monday have sent the US Treasury yields on fire. The 10-year US Treasury yields are near 3% for the very first time in the last three years. Federal Open Market Committee (FOMC) member James Bullard dictated that investors can brace for a 75 basis point (bps) interest rate hike by the Fed. All-time-high inflation is demanding tight screws to get handled by the Fed policymakers. Also, the Fed’s Bullard dictated a herculean target of pushing interest rates to 3.5% by the end of this year.

Meanwhile, the determination by the Bank of Japan (BOJ) to keep an ultra-loose monetary policy till the achievement of pre-pandemic growth levels has frail the Japanese yen. A sluggish yen is likely to fetch political intervention however, the BOJ is not worried about the falling yen as it will improve their exporting business. The BOJ is facing the headwinds of higher commodity prices that are reducing the households’ real income due to higher energy bills. Also, investors are keeping an eye on Japan’s yearly National Consumer Price Index (CPI), which is expected to land at 1.3% on Friday.

- EUR/GBP is oscillating in a 21-pip range ahead of speeches from BOE’s Bailey and ECB’s Lagarde.

- The BOE is preparing to announce one more rate hike to corner the galloping inflation.

- The ECB may announce a rate hike for the first time in the last quarter of 2022.

The EUR/GBP pair has attracted a few bids to near 0.8288 but still balancing in a narrow range of 0.8279-0.8300 from Tuesday. The cross seems unable to fetch attention from the market participants as investors are awaiting the speeches from Bank of England (BOE) Governor Andrew Bailey and European Central Bank (ECB) President Christine Lagarde.

Earlier, the asset bounces sharply from April’s low at 0.8250 after the European Central Bank (ECB) chose a neutral status in its monetary policy announcement. After scrutinizing a tepid growth rate, ECB’s Lagarde preferred to keep the policy rates unchanged. Also, the ECB policymakers dictated neutral guidance till the conclusion of the Asset Purchase Program (APP), which is expected to conclude in the third quarter of the fiscal year 2022.

Meanwhile, BOE’s Bailey and his colleagues are planning one more rate hike to contain the inflation mess. A print of 7% by the UK’s Consumer Price Index (CPI) is indicative for a fourth consecutive interest rate hike by the BOE. Currently, the interest rate has increased to 0.75% and is expected to elevate further amid soaring inflation. The speech from BOE’s Bailey will provide cues for the likely monetary policy action by the BOE in May

This week, investors will also focus on Euro’s Consumer Confidence, which will release on Thursday. A preliminary estimate shows the landing of Consumer Confidence at -20 against the previous print of -18.7.

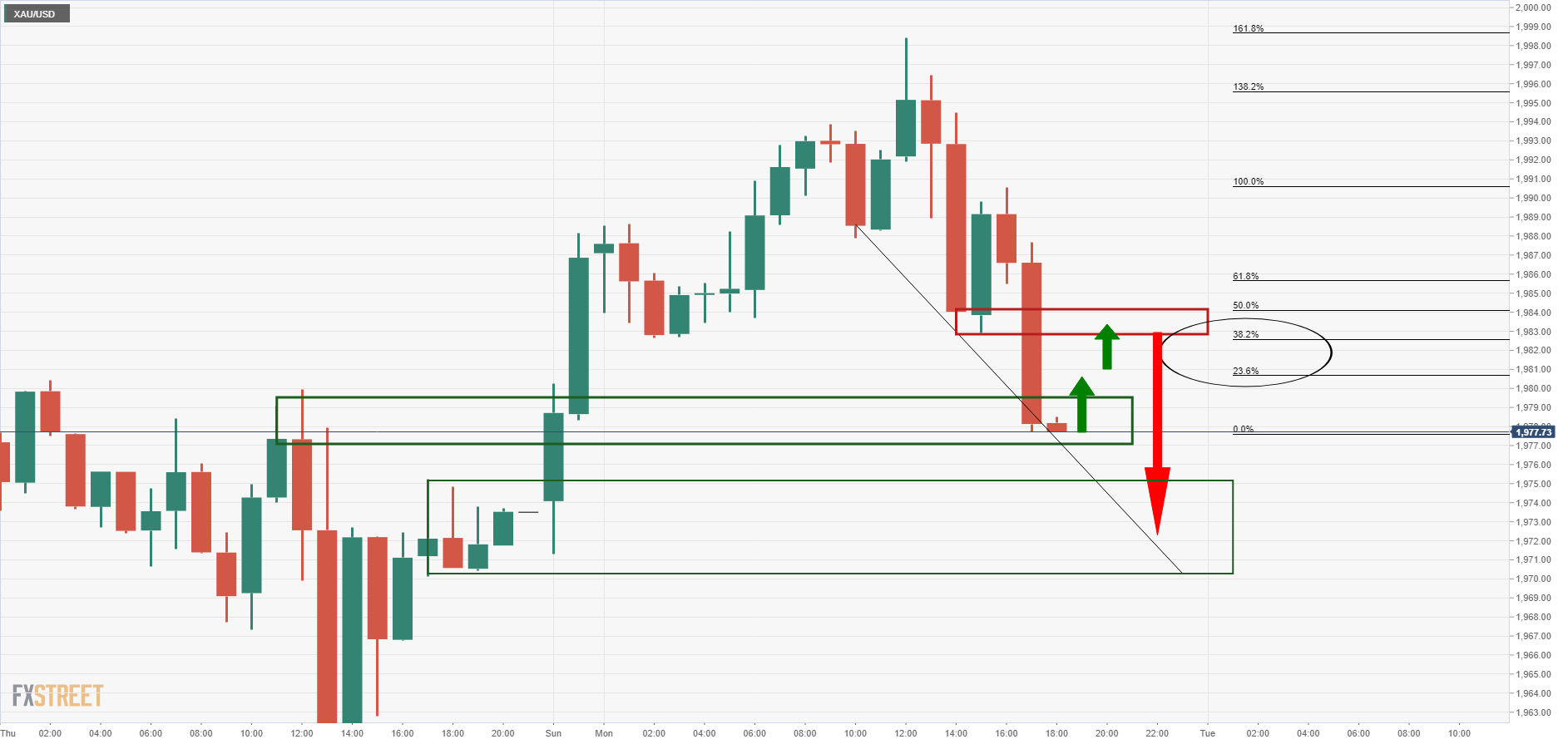

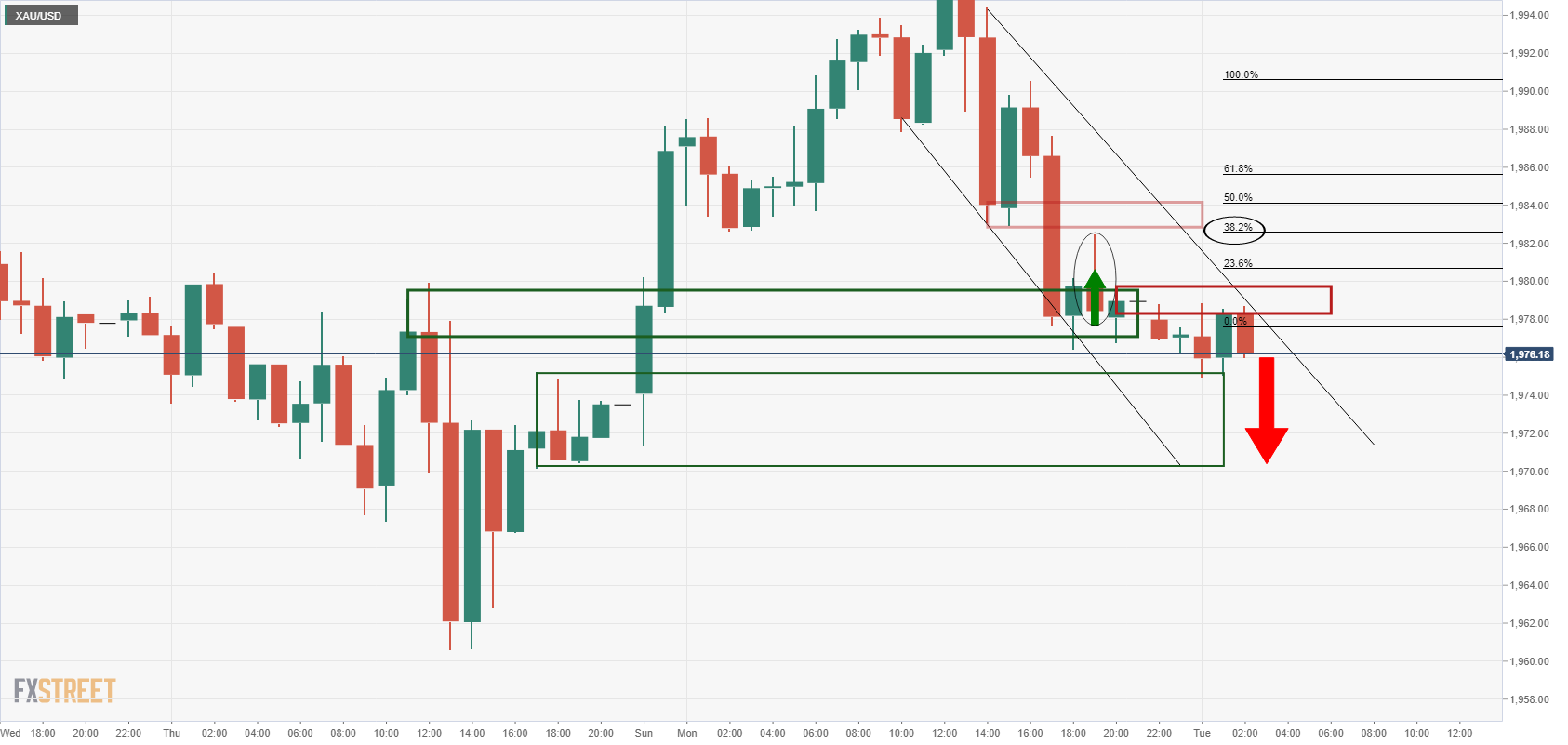

- Silver Price plummeted more than 2.5% as the US 10-year yield closed to the 2.95% threshold.

- US Real Yields turned positive for the first time since March 2020, a headwind for silver.

- Silver Price Forecast (XAG/USD): Further correction lies below $25.81.

Silver (XAG/USD) records its most significant daily loss since March 29, plunging 2.68% during the day, amidst surging US Treasury yields led by the short-end and a firm US dollar. At the time of writing, XAG/USD is trading at $25.17

Fed speaking and an upbeat sentiment weighed on precious metals

As reflected by US equities ending the day with gains, a risk-on market mood kept investors turning towards riskier assets. Consequently, the precious metals complex suffered, on the back of Fed speaking, which triggered a jump in US Treasury yields.

On Monday, St. Louis Federal Reserve President James Bullard reiterated his case for increasing interest rates to 3.5% by the end of 22 to slow 40-year-high inflation readings, as he said that US inflation is “far too high.”

Additionally to St. Louis Fed Bullard, on Tuesday, Chicago’s Fed President Charles Evans said that the US economy “will do very well even as rates rise.” Evans added that he supports a “couple” of 50 bps increases, which could lift rates to the 1.25%-2.50% neutral rate.

In the meantime, money market futures expect the Federal Funds Rates to rise to 1.31% in June and 2.76% next February, from 0.33% now.

It is worth noting that the 10-year TIPS broke above negative territory during the day, up to 0.005%, for the first time since March 2020, a headwind for the white metal. The Treasury Inflation-Protected Securities (TIPS) are also called real yields because they subtract projected inflation from the nominal yield on Treasury securities.

Silver Price Forecast (XAG/USD): Technical outlook

Silver (XAG/USD) is still upward biased, despite Tuesday’s fall. However, failure at the 78.60% Fibonacci level at $26.31 opened the door that exacerbated the break to the downside of the 61.80% and 50% Fibonacci retracement, but the 38.20% Fibonacci level at $25.10, capped XAG/USD’s nosedive.

In the scenario of XAG/USD extending its correction, the first support would be $25.10, the 38.20% Fibonacci retracement. A breach of the latter would expose the $25.00 figure, followed by the 50-day moving average (DMA) at $24.83 and then April’s six cycle low at $24.12.

On the flip side, if XAG/USD’s are to regain control, they need a break above $25.81, the 61.80% Fibonacci level. That said, the XAG/USD first resistance would be $26.00, followed by the 78.60% Fibonacci retracement at $26.31.

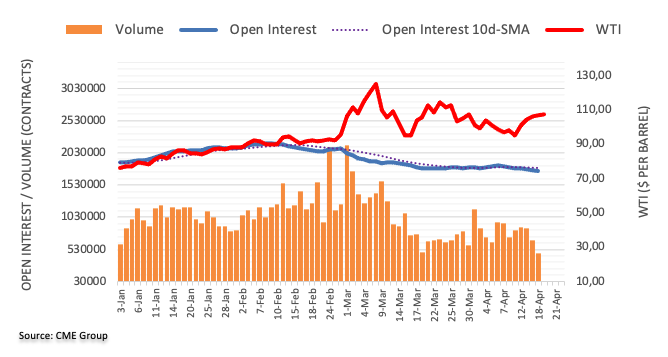

- The 200-EMA is providing a cushion to the asset.

- A re-test of the descending triangle chart pattern will put forward a bargain buy for investors.

- The RSI (14) seems to tumble near the oversold trajectory.

West Texas Intermediate (WTI), futures on NYMEX, has witnessed a steep fall since Monday after failing to sustain above the barricade of $108.00 on Monday. The asset has experienced a sheer downside and is balancing near the 200-period Exponential Moving Average (EMA), which is at $101.48.

On a four-hour scale, the oil prices are facing selling pressure after a strong rally post the breakout of the descending triangle formation. The horizontal support of the chart pattern is placed from March 15 low at $92.37 while the descending trendline is plotted from March 8 high at $126.51. The asset has slipped below the 20-EMA at $104.20, which signals a short-lived downside move.

The Relative Strength Index (RSI) (14) has slipped back to near 40.00 after oscillating in a bullish range of 60.00-80.00. This reflects a best-case scenario of entering into a bullish asset at oversold levels. The momentum oscillator is more likely to find support near the 30.00-40.00 range.

A pullback towards the psychological support of $100.00 will be a bargain buy for the market participants, which will send the asset towards April 13 high at $104.02, followed by Monday’s high at $109.13.

On the flip side, the asset may lose strength if it drops below April 8 high at $98.26. This will drag oil prices to March 15 low and February 25 low at $92.37 and $89.59 respectively.

WTI four-hour chart

-637860018925869146.png)

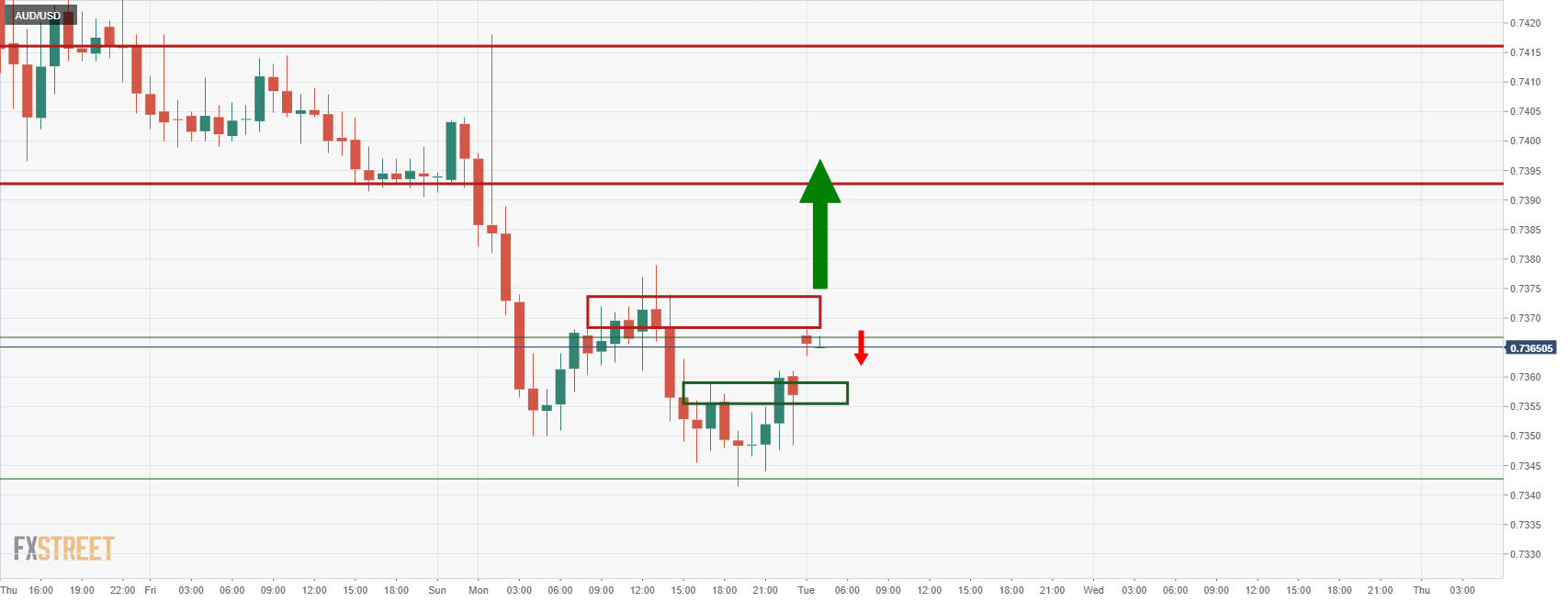

- On Tuesday, the AUD/USD gained 0.32% but recorded a daily close below March’s 21 low, which opened the door for further losses.

- Geopolitics and Fed speaking capped the AUD/USD upside

- St. Louis Fed President Bullard opens the door for 75 bps rate hikes.

- AUD/USD Price Forecast: It is upward biased, but failure at 0.7400 paved the way for a downward move

The Australian dollar advances in the day but struggles around 0.7400 as the New York session winds down amidst a buoyant US dollar and a risk-on market mood. At 0.7375, the AUD/USD reflects the appetite for risk-sensitive currencies in the FX complex, though capped by a firm US dollar.

Tuesday’s session witnessed a mixed market mood throughout the day. However, the sentiment improved late in the US session, as reflected by US equities recording gains between 1.45% and 2.15%, and the greenback rose. The 10-year benchmark note rose to 2.940%, gaining eight basis points.

Geopolitics and Fed speaking capped the AUD/USD upside

Geopolitics dominates news headlines. The Russian offensive in Eastern Ukraine and the lack of peace talks at the ministry level keep investors hopeless of a cease-fire. So investors have shifted towards Fed speaking led by the Fed “hawk” James Bullard, St. Louis Fed President. On Monday, he said that inflation is “far too high for comfort,” Fed officials want to get to neutral rates expeditiously and opened the door for 75 bps increases to the Federal Funds Rate (FFR).

On Tuesday, the Chicago Fed President Charles Evan crossed the wires. Evans said that the US economy “will do very well even as rates rise.” He noted that he supports a “couple” of 50 bps increases, which could lift rates to the 1.25%-2.50% neutral rate.

In the meantime, the US Dollar Index, a gauge of the greenback’s value against a basket of six peers, is rising 0.17%, sitting at 100.989, a headwind for the AUD/USD.

Data-wise, the US economic docket featured Building Starts and Permits, which came more robust than expected. Meanwhile, the Australian economic docket would feature the Westpac-MI Leading Index. According to Westpac analysts, it is expected to “pop higher as last year’s delta disruptions cycle out of the six-month measure; other positive updates around equities, commodities, and dwelling approvals will also be included.”

AUD/USD Price Forecast: Technical outlook

AUD/USD failure at 0.7400 has left the AUD/USD adrift to some selling pressure, despite recording gains on Tuesday. Also, the pair is shy of breaking below March’s 21 daily low at 0.7373. If the AUD/USD records a daily close under the latter, it will give way for further selling pressure on the AUD/USD.

The Relative Strength Index (RSI), an oscillator sitting at 45.47 in bearish territory, gives an additional selling signal to the abovementioned.

That said, the AUD/USD first support would be the 50-day moving average (DMA) at 0..7346. A breach of the latter would expose the confluence of the mid-parallel Pitchfork’s line between the central and bottom lines and the 200-DMA around the 0.7293-0.7305 range, followed by the 100-DMA at 0.7255.

- NZD/USD bears are moving in during the latter part of Tuesday.

- the US dollar remains in the driver's seat as the US yields rally again.

NZD/USD was pressured into the final stages of Wall Street trade on Tuesday. At 0.6730, the bird is losing flight from a high of 0.6763 and trades close to the lows of the day, 0.6720. The US dollar was on fire this week and DXY index is up for the fourth straight day, marking a fresh cycle high near 101.023.

''The Kiwi tried to rally yesterday as local rates moved up and markets digested Governor Orr’s frank and on balance, hawkish speech yesterday morning,'' analysts at ANZ Bank said.

''Having held key support (with 0.6723 being the 61.8% Fibo of the January-April rally), it looked like the Kiwi’s four-day losing streak might end. However, it is now back at that key level amid a surge in US bond yields (10yr yields are at a new cycle high) and a fall in milk prices at last night’s GDT auction. But the big threat seems to simply be that the local market is fully priced, but that’s not the case elsewhere.''

All eyes on the Fed and USD

Meanwhile, US rates have made a further push higher on Monday-Tuesday as the Fed's Jim Bullard didn't rule out a 75bps hike by the Fed. The US benchmark 10-year Treasury yields hit 2.928% on Tuesday, the highest since December 2018 and are on track to test the October 2018 high near 3.26%. This is supporting flows into the greenback ahead of next month's Fed meeting.

''With inflation expectations remaining fairly steady, the real 10-year yield traded near -0.04% today, the highest since March 2020 and poised to move into positive territory for the first time since the pandemic began,'' analysts at Brown Brothers Harriman explained. ''The 2-year is still lagging a bit but traded at 2.47% today, not yet matching the 2.60% cycle high from earlier this month but still on track to test the November 2018 high near 2.97%.''

Bullard reiterated that he wants to get rates up to 3.5% quickly, noting “You can’t do it all at once, but I think it behoves us to get to that level by the end of the year.”

Also, Charles Evans, Chicago Fed President spoke on Tuesday and said that there is good reason to think the US economy will do very well even as rates rise. He added that the Fed needs to be mindful of a possible wage-price spiral when noting that Fed needs to monitor this.

- GBP/USD is on the verge of a bearish breakout, but support could be firm.

- The bulls will monitor for accumulation at this juncture.

GBP/USD is stalling at a critical level of daily support and the following is an analysis of the markets structure and potential hypothetical outcomes from both a bearish and bullish point of view.

GBP/USD daily chart

GBP/USD daily chart prospects

From a bullish perspective, following a phase of accumulation, the price would ideally break the prior highs and on a retest of that old resistance, the bulls would be expected to engage at a discount protected by a support structure.

Meanwhile, from a bearish perspective, the price could break the current support structure and bears could well be inclined to engage on a restest of the old support that would be expected to act as resistance.

The above scenario presumes a downside continuation and a correction of that impulse, to say, a 38.2% Fibonacci retracement from where the confluence of the old support will act as a firm resistance. Thus a continuation could be traded from within the next bearish impulse and downside continuation.

What you need to know on Wednesday 19 April:

The Japanese yen was battered on Tuesday as further upside in global bond yields exerted further upwards pressure on G10/Japan interest rate differentials, dampening the low-yielding safe-haven currency’s investment appeal. Needless to say, the yen was the worst-performing major G10 currency, with USD/JPY surging nearly 1.4% to the upper 128.00s, its highest levels since early 2002.

EUR/JPY, GBP/JPY and other major G10/JPY pairs also unsurprisingly saw sharp upside, with the former two rallying 1.5% and 1.3% respectively to multi-year highs in the upper-138.00s and mid-167.00s. Japanese politicians have been jawboning more and more in recent days about the negative impact of yen weakness, but until the BoJ budges from its ultra-dovish policy stance, the yen remains vulnerable to further losses. Remarks from BoJ Governor Haruhiko Kuroda earlier in the week suggested that the bank won’t be looking to change its policy stance any time soon.

Strength in USD/JPY helped lift the US Dollar Index above 101.00 for the first time since March 2020. Fed speak remained in the spotlight, with traders digesting the latest commentary from hawkish Fed’s James Bullard and more neutral Fed’s Charles Evans ahead of pivotal remarks from Fed Chair Jerome Powell later in the week.

EUR/USD and GBP/USD both traded broadly flat just under the 1.0800 level and near 1.3000 respectively, despite the return of normal European flows on the reopen of markets there after Monday’s closures for Easter holidays. Relevant fundamental updates, as well as updates relating to the Russo-Ukraine war, were few and far between on Tuesday, making for slow trading conditions.

Decent US housing data and in line with expected Canadian Housing Starts figures didn’t give the buck or loonie much to go off of. USD/CAD was modestly supported, however, by a sharp pullback in crude oil prices, reversing an earlier dip under 1.2600 to end the day closer to 1.2620. Ahead, loonie traders are bracing for the release of March Canadian Consumer Price Inflation figures on Wednesday.

Finally, the antipodes didn’t see too much excitement. The Aussie is a modest G10 outperformer in wake of Tuesday’s slightly hawkish RBA minutes release - the bank noted high expected inflationary pressures and said recent developments suggest an earlier rate lift-off. AUD/USD rebounded about 0.4% to the 0.7375 area, having bounced at its 50-Day Moving Average in the 0.7340s. NZD/USD, meanwhile, traded flat in the 0.6730 area and remained close to the more than one-month lows it struck on Monday just above 0.6700.

Focus during the upcoming Asia Pacific session will centre on the ongoing Covid-19 outbreak and lockdowns in China, as well as the Chinese fiscal and monetary response to the new disruptions to its economy.

Atlanta Fed President and FOMC member Raphael Bostic on Tuesday reiterated the important of getting rates to neutral territory "expeditiously", though cautioned that a 75 bps rate hike is "not on the radar", reported Reuters. Bostic said he estimates the neutral rate to be around 2.5% and feels the US economy is strong enough to stand on its own.

Some improvements on inflation will come from non-monetary developments, he noted. However, Bostic cautioned that cuts to global growth forecasts (a reference to Tuesday's IMF World Economic Outlook release) are a sign that the Fed needs to be cautious and is a reason not to rush beyond neutral regarding rate hikes.

Additional Takeaways:

Bostic estimates GDP growth of around 3% for the US economy this year and said "there is momentum" to avoid recession.

There are some signs that inflation has "capped off" though fertilizer and other input costs may continue adding pressure.

As long as markets continue to function well, the Fed should continue to reduce its balance sheet.

- NZD/JPY rode a wave of yen weakness on Tuesday, surging roughly 1.5% to the upper 86.00s.

- The pair came close to printing fresh highs for the year, as rising global yields kept the yen under pressure.

- Another catalyst for further NZD/JPY upside could be this Thursday’s NZ CPI data release.

NZD/JPY rode a wave of yen weakness on Tuesday, surging roughly 1.5% to come within a few pips of testing annual highs printed last month in the 86.90s. For now, the pair is struggling to hold above last week’s 86.66 highs and is currently trading in the 86.60s. A further rise in global yields amid further bets on global central bank tightening was the major driver of the latest rally in NZD/JPY.

Japanese politicians have been jawboning more and more in recent days about the negative impact of yen weakness, but until the BoJ budges from its ultra-dovish policy stance, the yen remains vulnerable to further losses. Remarks from BoJ Governor Haruhiko Kuroda earlier in the week suggested that the bank won’t be looking to change its policy stance any time soon.

That suggests risks remain tilted to the upside and a bullish breakout into the 87.00s and further push towards the 2014 highs in the 94.00s remains on the cards. Further adding to these upside risks is New Zealand Consumer Price Inflation data for Q1 2022 scheduled for release on Thursday. The YoY rate of inflation is seen jumping to 7.1% and the QoQ rate of price gain is seen hitting 2.0%.

After the RBNZ lifted interest rates by 50 bps to 1.50% last week, a few more 50 bps rate hikes might well be in store, maintaining NZD’s massive rate advantage over the yen. If profit-taking on yen shorts does see the pair drop back again, traders should not support in the form of recent lows and the 21-Day Moving Average in the low 85.00s.

- The shared currency prints a 200 plus pip gains vs. the Japanese yen.

- The verbal “intervention” by the Japanese Minister of Finance Suzuki and BoJ Governor Kuroda was ignored by market players.

- EUR/JPY Price Forecast: The break above 137.50 opened the door towards 141.05.

The EUR/JPY skyrockets more than 200-pips on Tuesday, amidst broad Japanese yen weakness and a risk-on market mood, which keeps US equities trading in the green. At the time of writing, the EUR/JPY is trading at 138.95, some pips below fresh seven-year highs.

The day’s main story is the Japanese yen, weakening against most G8 currencies throughout the day. Minimal efforts of verbal intervention in the FX market by the Japanese Minister of Finance Suzuki and BoJ Governor Kuroda were mainly ignored by market players, as the EUR/JPY soars more than 200-pips.

On Tuesday, the Japanese Government Bond (JGB) of 10-years reached a daily high of 0.276%, two basis points above the yield curve control (YCC) imposed by the BoJ. Nevertheless, it sits at 0.239% at the time of writing, just below the 0.25% BoJ target.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY monthly chart depicts the pair as upward biased. The Relative Strength Index (RSI), a momentum oscillator at 66.95, has enough room to spare if the EUR/JPY aims toward higher prices.

Now that the EUR/JPY left February’s 2018 swing highs at 137.50 behind, the EUR/JPY following target would be the June 2015 swing highs at 141.05. Once cleared, the next resistance would be the December 2014 cycle high at 149.78.

However, if the EUR/JPY fails to record a daily close above 137.50, it might open the door for further downside pressure. The first support would be the 137.00 mark, followed by June 2021 cycle highs at 134.12, followed by a seven-year-old downslope trendline turned resistance around 132.00.

Technical levels to watch

Chicago Fed President and FOMC member Charles Evans on Tuesday pushed back against the idea of larger than 50 bps rate hikes at upcoming Fed meetings, saying that he doesn't see the need for them, reported Reuters. Moreover, Evans said he is comfortable with a rate hike path this year that would see two 50 bps rate rises and get rates to 2.25-2.50% by the end of the year.

The Fed won't be able to make a judgment on whether or not inflationary pressures are easing until the end of the year, he continued. Earlier in the day, Evans had said that there is good reason to think the US economy will do very well even as rates rise.

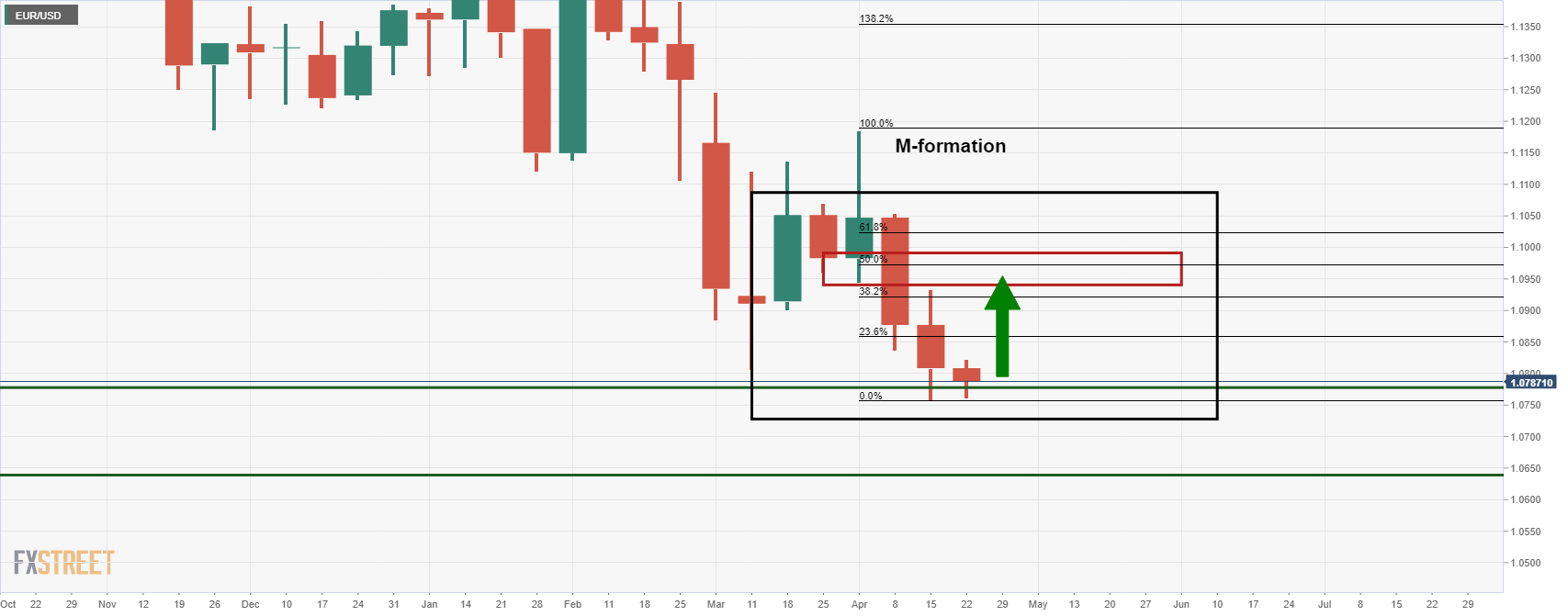

- EUR/USD bears are in charge and are taking on the monthly support.

- The weekly chart, however, has left a reversion pattern, so some mitigation could be in order.

The US dollar rose this week to a fresh 20-year high against a basket of currencies but the euro has still managed to come up for air on Tuesday, trading around flat for the day at the time of writing. The high came in at 1.0814 but the price is sticking to a narrow range with the low at 1.0761.

Nevertheless, there are bullish prospects for the longer-term charts, so long as the bulls can commit at monthly support, at least for the meanwhile. The following illustrates the weekly and monthly structures that lean with a bullish bias.

EUR/USD weekly chart

The M-formation on the weekly chart is compelling as it is a reversion pattern. The price would be expected to move in towards the neckline ner a 38.2% Fibonacci retracement level in the weeks to come.

EUR/USD monthly chart

The monthly chart, on the other hand, shows that the price is meeting a demand area. There is scope for further downside to testing deeper into this area, but some meanwhile mitigation of the bearish impulse's imbalance in price could be in order first.

- GBP/JPY lept more than 200 pips on Tuesday from the low 165.00s to the mid-167.00s as the yen battering continued.

- The yen remains highly vulnerable to rising global yields so long as the BoJ maintains its ultra-dovish stance.

GBP/JPY lept more than 200 pips on Tuesday from the low 165.00s to the mid-167.00s, as a broad sell-off in the yen as a result of rising global bond yields (excluding in Japan) deepened. At current levels in the 167.30s, the pair is trading with on-the-day gains of about 1.3% and is trading at its highest since February 2016.

Commentary from BoJ officials this week suggests a shift away from the bank’s flagship negative interest rate and yield curve control (YCC) policies remain premature to think about, hence the relentless yen sell-off. Given that the Japanese 10-year yield is capped in the 0.25% area (where it currently trades), the yen is vulnerable from a rate-differential perspective to rising yields in the US, UK, Eurozone and in other developed markets.

Given that politicians in Japan do seem to be getting increasingly nervous about the impact of yen weakness, the BoJ’s tolerance for a weaker yen is not without limit. Some have speculated that if the current sell-off continues, they might tweak either their rate guidance or YCC. At current levels, yen weakness has not gone far enough to trigger such a shift.

That suggests that, for now, the yen bears have a green light to continue shorting. At 168.00 is a low from late 2014 that could provide some resistance. The next key area of support turned resistance is at 175.00 (the 2015 low and a February 2016 high). That’s a further nearly 5.0% rally from current levels – such a move might be enough to spur some policy movement from the BoJ.

The greenback will rise versus the Canadian dollar in the coming months according to analysts at Danske Bank. They forecast USD/CAD at 1.30 in three months and at 1.32 in six months and 1.32 in twelve months.

Key Quotes:

“We believe that CAD on a longer-term strategic basis will face support from elevated commodity prices and rising demand for buying inflation protection – which Canadian markets deliver. Meanwhile, short-term we are still worried that global recession risks could lead to a setback to risk and by extension also deliver a hit to risk sensitive assets incl. CAD. Given CAD’s close connection to the USD and the US economy, the Canadian currency is better protected than most other growth-sensitive currencies – yet we still see topside to USD/CAD in our base case.”

“Bank of Canada continuing its tightening cycle will in isolation act as a supportive factor for CAD vs most other currencies but not vs the USD as we expect the Fed to deliver more tightening. We now forecast USD/CAD at 1.26 in 1M (from 1.28), 1.30 in 3M (from 1.31), 1.32 in 6M (1.35) and 1.32 in 12M (1.35).”

- The Swiss franc extends its weekly losses in the week, as the USD/CHF is up by 0.87%.

- Russo-Ukraine jitters and Fed speaking dominate the headlines.

- USD/CHF Price Forecast: The break of 0.9500 might open the door towards 0.9600.

The USD/CHF is soaring and recorded a fresh 22-month-high around 0.9506 during the North American session, courtesy of a firm US dollar, amidst a mixed market mood. At the time of writing, the USD/CHF is trading at 0.9503.

As portrayed by US equities trading in the green, the market sentiment is positive. The Russia-Ukraine conflict continues to dominate the headlines, as the White House said there could be new sanctions on Russia this week. Meanwhile, the US dollar remains buoyant in the session, propelled by St. Louis Fed’s Bullard, who said that inflation is “far too high” and reiterated that the Fed needs to go above neutral, around 3.50%.

On Tuesday, Chicago’s Fed President Charles Evans said that the US economy “will do very well even as rates rise.” Evans added that he supports a “couple” of 50 bps increases, which could lift rates to the 1.25%-2.50% neutral rate.

Later in the day, the Swiss National Bank (SNB) Chairman Thomas Jordan said that inflation expectations are well anchored, but there could be some risk to price stability in Switzerland. He commented that energy prices and supply chain disruptions would significantly impact Switzerland’s price stability.

Aside from this, the USD/CHF remained upwards, opening near the 0.9440 area and is pushing towards the 0.9500 mark, as the safe-haven peer’s Swiss franc and Japanese yen remain battered in the day.

USD/CHF Price Forecast: Technical outlook

The USD/CHF daily chart depicts the pair as upward biased. Given that the USD/CHF broke above the YTD high at 0.9460 and April’s 1, 2021 cycle high at 0.9472, it opened the door for a move towards 0.9500 and beyond.

That said, the USD/CHF first resistance would be June 30, 2020, cycle high at 0.9533. A breach of the latter would expose the 0.9600 mark, followed by June 5, 2020, a daily high at 0.9650.

- So far, 0.74 the figure is blocking progress following the RBA minutes.

- The Aussie has succumbed to higher US yields and a strong US dollar.

At 0.7378, AUD/USD is up 0.43% on the day and has travelled between a high of 0.7399, (peaking here following the Reserve Bank of Australia minutes), and a low of 0.7343.

The Aussie, however, has succumbed to the mighty US dollar that remains firm as US rates continue to rise. The DXY index is up for the fourth straight day and made a new cycle high near 101.023. The March 2020 high near 103 is the next big target. This index measures the greenback against six other currencies and is being supported by the divergence in monetary policy between a Federal Reserve determined to keep a lid on soaring inflation and major counterpart central banks such as the Bank of Japan and the European Central Bank.

US yields are lit

Meanwhile, the US benchmark 10-year Treasury yields hit 2.928% on Tuesday, the highest since December 2018 and are on track to test the October 2018 high near 3.26%. ''With inflation expectations remaining fairly steady, the real 10-year yield traded near -0.04% today, the highest since March 2020 and poised to move into positive territory for the first time since the pandemic began,'' analysts at Brown Brothers Harriman explained. ''The 2-year is still lagging a bit but traded at 2.47% today, not yet matching the 2.60% cycle high from earlier this month but still on track to test the November 2018 high near 2.97%.''

US rates have made a further push higher on Monday-Tuesday as the Fed's Jim Bullard didn't rule out a 75bps hike by the Fed. He reiterated that he wants to get rates up to 3.5% quickly, noting “You can’t do it all at once, but I think it behoves us to get to that level by the end of the year.”

He added that “more than 50 bp is not my base case at this point. I wouldn’t rule it out, but it is not my base case here.” Additionally, he said, “we want to get to neutral expeditiously, I guess is the word of the day. I’ve even said we want to get above neutral as early as the third quarter and try to put further downward pressure on inflation at that point.”

''While it’s easy to dismiss Bullard as excessively hawkish, we should all remember that he was the first to push for aggressive tightening and the rest of the Fed eventually came around to his view,'' analysts at BBh said.

Meanwhile, Charles Evans, Chicago Fed President spoke on Tuesday and said that there is good reason to think the US economy will do very well even as rates rise. He added that the Fed needs to be mindful of a possible wage-price spiral when noting that Fed needs to monitor this.

RBA minutes fail to send AUD through the 0.74 barrier

While the RBA minutes confirmed the bank’s hawkish pivot, AUD peaked a pip away from 0.74 the figure after the currency succumbed to broad-based USD gains

Two things stand out from the April RBA Minutes, analysts at ANZ Bank said as being the following:

-

the case for a cash rate move in June rather than May was strengthened; and

-

the prospect of changes in the gap between the cash rate target and the interest rate on exchange settlement balances was flagged.

On this second point, however, the wording in the minutes has prompted us to reconsider our view on how the interest rate on exchange settlement balances will evolve as the cash rate target lifts.

Meanwhile, analysts at BBH argued that the ''odds of liftoff at the May 3 meeting are less than 20% but liftoff at the June 7 meeting is fully priced in.''

AUD/USD technical analysis

AUD/USD was meeting a dynamic trendline support line and the bulls were eyeing a 38.2% Fibonacci retracement and a higher 50% mean reversion towards 0.7420. So far, 0.74 the figure is blocking that progress. In any case, the downside is eyed if there are continued failures between here and 0.7420 and a break of the trendline and horizontal support could be on the cards for the days ahead.

The Bank of Japan (BoJ) will face increasing political pressure if the Japanese yen slides further, say analysts from Danske Bank. They forecast the USD/JPY pair at 126 in one month, 125 in three months, 123 in six months and 119 in a year.

Key Quotes:

“Bank of Japan (BoJ) has fiercely defended its yield curve control as the global pressure for higher yields has also reached Japan. Within a short period of time, the BoJ has twice deemed it necessary to step in and buy JGBs to keep the 25bp ceiling on the 10- year yield. The additional supply of JPY to the market adds to JPY headwinds. The BoJ has continuously communicated it does not see a weak JPY as a problem. On the contrary, it boosts exporting businesses’ profits. The BoJ blames rising living costs on high energy prices and not FX. That said, JPY at its weakest since the early 1970’s could become a political issue with upper house elections this summer. BoJ will face increasing political pressure, if JPY slides further.”

“Higher long US yields have been the most important driver of USD/JPY for a while now. The increasing divergence between US treasury yields and JGBs has kept increasing as the BoJ has defended its yield curve control. As one of the world’s biggest energy importers, high energy prices add to the pressure. In the short run, the global pressure for higher yields and the global energy crunch will keep weighing on JPY. Looking further ahead, we do expect the pressure on JPY will wear off as the US curve inverts. We forecast the cross at 126 in 1M, 125 in 3M, 123 in 6M and 119 in 12M.”

“Upside risks to USD/JPY comes from a continued high pressure on commodities driving inflation and global yields higher. USD/JPY close to 130 will trigger more speculation on Tokyo interference, though. With the short speculative positions in JPY in mind, indications of a global inflation peak can on the other hand quickly trigger a drop in USD/JPY.”

- The Loonie gives back some Monday gains, as the USD/CAD gains 0.13%.

- Eastern Europe conflict weighs on global energy prices, capping the USD/CAD upside.

- USD/CAD Price Forecast: A break above the 200-DMA opens the door towards 1.2676.

The USD/CAD trims Monday’s losses and stages a comeback, soaring in the North American session above the 1.2600 mark, approaching the 50-day moving average (DMA) at 1.2651. The USD/CAD is trading at 1.2625 at the time of writing.

Market sentiment and hawkish Fed lifted the USD/CAD above 1.2600

The market sentiment remains mixed. European equities are about to end in the red, while US stocks record gains between 1.29% and 2.33%. The greenback remains firmly bid, underpinned by US Treasury yields, while oil prices fell, so all those factors dragged the Loonie towards negative territory.

Factors like the Ukraine – Russia conflict, the lack of advancement in peace talks, and Russia’s offensive in Eastern Ukraine maintain global inflationary pressures high, including energy. That capped the greenback’s upside action, supported by a hawkish St. Louis Fed’s Bullard, who said that inflation is “far too high” and reiterated that the Fed needs to go above neutral, around 3.50%.

In the meantime, the US docket featured Chicago’s Fed President Charles Evans, who said that the US economy “will do very well even as rates rise.” Evans added that he supports a “couple” of 50 bps increases, which could lift rates to the 1.25%-2.50% neutral rate.

Aside from this, the US economic docket featured Home Sales statistics, which analysts mainly ignored. Regarding the Canadian economic docket, inflation figures on Wednesday would shed some light after the Bank’s of Canada first 50-bps rate increase, which pushed rates to the 1% threshold.

TD Analysts wrote on a note that “We look for CPI to firm to 6.1% y/y in March, with prices up 0.9% m/m. Energy will provide the main driver, led by an 11% increase in gasoline, alongside another significant contribution from food. Motor vehicles, clothing, and shelter should help drive strength in the ex. food/energy aggregate, while the BoC’s core inflation measures should firm to 3.6% y/y on average.”

USD/CAD Price Forecast: Technical outlook

The USD/CAD is trading above the 200-DMA, the first sign that the pair could be turning bullish and is preparing to jump towards the 50-DMA at 1.2651. Furthermore, oscillators support a bullish scenario and have enough room before reaching overbought conditions, opening the door for further USD/CAD upside.

With that said, the USD/CAD first resistance would be the 50-DMA at 1.2651. A breach of the latter would expose April’s high at 1.2676, followed by the 100-DMA at 1.2680 and then the 1.2700 figure.

The EUR/GBP will likely continue to trade around 0.84 over the next months according to analysts at Danske Bank. They see the cross moving higher if the European Central Bank turns more hawkish.

Key Quotes:

“The Bank of England (BoE) hiked the Bank Rate by another 25bp at the March meeting and we expect BoE to hike further over the course of the year. Relative rates have supported GBP vis-àvis EUR over the past six months but we do not expect the channel will support GBP much further. Markets have already priced in a lot of rate hikes and relative rates may start support EUR/GBP if ECB turns even more hawkish.”

“EUR/GBP is once again trading with a 0.83 handle but remains overall range-bound as expected. Looking forward, on one hand, the positive USD environment is usually benefitting GBP relative to EUR. On the other hand, relative rates now seem supportive for EUR relative to GBP. Overall, we keep our 12M target unchanged at 0.84, while we are looking for new trends in EUR/GBP.”

“A hit to global risk sentiment usually weakens GBP but if the war turns worse and/or the West imposes tougher sanctions on Russia, we are likely to see EUR/GBP moving somewhat lower again. EUR/GBP will move higher if ECB turns more hawkish. EU-UK tensions remain a risk.”

German Chancellor Olaf Scholz said in a video call with Western leaders on Tuesday that Germany will continue to finance Ukraine militarily and financially, reported Reuters.

Additional Remarks:

"Western leaders agreed we will give the maximum support to Ukraine but not get involved in the war."

"Our strength is in our unity... (Russian President Vladimir) Putin did not expect it."

"The impact of sanctions is a disaster for Russia."

"We reached the limit of what we can deliver from the German armed force's own stocks."

"We have asked the German armaments industry to tell us what they can deliver quickly."

"They include antitank and air defence weapons that Ukraine has asked for."

"An imposed peace as Putin envisages is unacceptable."

"With our partners, we agree that Russia must not win this war."

Asked if Germany is sending leopard tanks, Scholz said "our partners all agree it's best to send old East European stocks which Ukraine is familiar with."

"We, with our partners, will help provide long-range artillery to Ukraine."

Chicago Fed President Charles Evans on Tuesday said that there is good reason to think the US economy will do very well even as rates rise, reported Reuters. The Fed needs to be mindful of a possible wage-price spiral, he added, noting that Fed needs to monitor for this.

Additional Takeaways:

- Looking at the composition of inflation, the Fed can take note of some "positive" developments if they continue.

- It's still too early to think the inflation challenges we are facing now are changing, but they could be.

- If the Fed were to do a couple of 50 bps increases, it could get interest rates to the 2.25%-2.5% neutral rate by end of the year.

- If the Fed doesn't see inflation coming down, it is going to raise rates above neutral.

- If the Fed does see inflation coming down, then neutral rates could be about right.

- If inflation reaccelerated, that would be a cause of great concern.

- "My expectation is that we'll need to raise rates above neutral."

Evan's remarks come after St Louis Fed President James Bullard reiterated calls for interest rates to hit 3.5% by the year's end and called inflation "far too high". Bullard also hinted he was open to a 75 bps rate move. His remarks have been attributed as adding fresh impetus to the ongoing global bond sell-off that saw US 30-year yields hit 3.0% for the first time since April 2019 on Tuesday.

- GBP/USD has spent Tuesday flirting with the 1.3000 level and remained just above last week’s annual lows.

- With the BoE increasingly at risk of disappointing hawkish market tightening expectations, a break below 1.3000 soon remains a risk.

GBP/USD flirted with the 1.3000 level on Tuesday, with the bears eyeing but not quite getting a test of last week’s multi-month lows in the 1.2970 area. Despite the return of European flows after market closures for Easter Monday, price action in G10 FX markets has for the most part been quite subdued on Monday, with the notable exception of significant yen weakness as a result of a sharp rise in US and European bond yields.

Traders are looking ahead to remarks from Fed and BoE heads Jerome Powell and Andrew Bailey at this week’s IMF/World Bank meetings on Thursday. The former is expected to solidify expectations for 50 bps rate hikes at the next few Fed meetings as the Fed looks to get US inflation under wraps. Bailey, meanwhile, may strike a more cautious tone on the prospect for further rate hikes, reflecting the recent hawkish shift in BoE language at its last policy announcement.

The IMF released its quarterly World Economic Outlook report on Tuesday and downgraded global growth forecasts for this and next year, as expected. Notably, the UK was forecasted to have the weakest growth prospects over the next two years, chiming with the BoE’s increasing concern about the UK outlook with the country currently in the throes of a historic squeeze on living standards.

Many FX strategists have labelled money market-priced expectations for a further nearly 150 bps in tightening this year from the BoE as overly excessive. Should markets start paring back on this pricing amid dovish BoE speak in the coming weeks, GBP/USD remains at risk of tumbling under 1.3000.

Technicians have noted that the pair has formed a descending triangle (with the 1.3000 level the key support) over the last month or so, another ominous sign that a bearish break is in the offing.

Data released on Tuesday showed better-than-expected numbers on housing starts and building permits for March, also February’s numbers were revised higher. Analysts at Wells Fargo point out that the data puts home building on firmer footing ahead of the recent spike in mortgage rates.

Key Quotes:

“Single-family construction appears to be losing a little momentum, with starts declining 1.7% in March and permits falling 4.8%. Permits over the past three months are now running slightly below the three-month trend in starts. By contrast, the three-month average of multifamily permits is running 23.8% ahead of starts, suggesting there are still plenty of projects in the pipeline.”

“The strength in housing starts at the start of 2022 likely reflects some easing in supply constraints that have plagued home builders during the pandemic. While shortages still exist, many builders have found workarounds and many firms have stockpiled key materials. Labor is also more plentiful, as evidenced by the recent strength in construction employment. The reopening of economies in the Northeast and West Coast has likely brought out more workers, which has allowed more projects to move forward.”

“In an unusual quirk, the number of single-family homes currently under construction is also 811,000 units on a seasonally-adjusted annual rate basis. The number of single-family homes under construction is the highest it has been since November 2006. While high, the pace of single-family construction appears to be demand-driven, with much of the current pipeline of homes under construction already sold. Inventories of completed single-family homes remain near all-time lows.”

Russia is carrying out the "prelude" to a larger expected offensive operations in eastern Ukraine, a senior US defense official said on Monday according to Reuters. About seven flights of weapons are heading to Europe in the next 24 hours carrying weaponry for Ukraine, the official added. Russian has about 75% of its pre-invasion combat power currently available, the senior official added.

On Monday, Russian forces tried to break through Ukrainian defenses all along the Donetsk, Luhansk and Kharkiv fronts said the Ukraine Security Council Secretary at the time. The official stated that they think Ukrainian forces in Donetsk and Luhansk can withstand the new Russian assault, but warned that the threat to cities from long-range rocket attacks has become much higher.

- US Dollar jumps against emerging market currencies amid a decline in commodity prices.

- Higher equity prices not helping the Mexican peso.

- USD/MXN reverses sharply and soars from 19.75, above the 20-day SMA.

The USD/MXN rose sharply during the American session, climbing from 19.75 to 20.07, the highest level in a week on the back of a stronger US dollar.

The greenback gained momentum against emerging market currencies as commodity prices declined. Gold tumbled from $1980 toward $1950, Silver from $25.75 to $25.10 and crude oil prices lost more than 3% during the last four hours.

Higher US yields are also helping the US dollar. The 10-year yield peaked at 2.92% and the 30-year reached levels above 3.00% for the first time since 2019. The DXY is up 0.10%, and climbed above 101.00.

In Mexico, President Andres Manuel Lopez Obrador’s project to restore state control of the electricity sector failed. Regarding economic data, on Friday mid-month inflation data is due. “Headline inflation is expected at 7.51% y/y vs. 7.29% in mid-March. If so, inflation would continue to move above the 2-4% target range. Banco de Mexico delivered the expected 50 bp hike to 6.5% in March. Minutes showed a range of views on further tightening but suggested there is a consensus to continue hiking rates at the current 50 bp pace. Next policy meeting is May 12 and another 50 bp hike to 7.0% seems likely”, wrote analysts at BBH.

Technical outlook

The reversal in USD/MXN from the strong support area of 19.75 deteriorated the outlook for the Mexican peso. If the pair manages to hold above 20.00 (static resistance and 20-day Simple Moving Average), more gains seem likely, targeting 20.20.

A slide back under 20.00 during the next hours, should keep USD/MXN in the range between 19.75 and 20.00, favoring an extension of the consolidation bias.

USD/MXN daily chart

-637859797456493784.png)

Technical levels

- In the last two months, the greenback has appreciated 12% vs. the Japanese yen.

- Geopolitics, Fed speaking, and Fed-BoJ divergence, a tailwind for the USD/JPY.

- USD/JPY Price Forecast: Upward biased, and a move towards 130.00 is on the cards.

The USD/JPY extends to 20-year highs and eyes to reach the 130.00 mark, during the North American session, amidst a mixed session, with global equities fluctuating, bond yields rising, and commodities down. At the time of writing, the USD/JPY is trading at 128.71.

Mixed market sentiment and BoJ’s dovish stance weaken the JPY

Geopolitical issues like Ukraine-Russo tussles keep weighing on market mood. Peace talks between both parties are on hold as the Russian Foreign Minister Lavrov said that another stage of the operation is beginning. Meanwhile, Fed speaking maintains the US dollar buoyant. On Monday, St. Louis Fed President Bullard noted that inflation is “far too high for comfort” and added that Fed officials want to get to neutral rates expeditiously.

The market reacted to the headlines, pushing the US 10-year Treasury yield upwards. The 10-year benchmark note sits at 2.917%, up six basis points at the time of writing, while the US Dollar Index, a gauge of the greenback value, trades with gains, up 0.12%, at 100.947.

It’s worth noting that the 10-year Real yield reached -0.04% during the day, its highest level since pre-pandemic levels, and is poised to move into positive territory.

Aside from this, the USD/JPY is underpinned by US Treasury yields. Also, the central bank divergence between the ultra-loose accommodative policy of the Bank of Japan (BoJ), contrarily to the Fed, weakens the JPY. Efforts of verbal intervention by the Minister of Finance Suzuki and BoJ Governor Kuroda were mainly ignored by market players, as the USD/JPY rose almost 200-pips throughout the trading session.

Data-wise, the Japanese docket revealed Industrial Production data, which came better than expected, though it failed to give a fresh impetus to the yen. Meanwhile, housing economic data print was positive in the US, but it remains in the backseat as the Fed is focused on inflation.

USD/JPY Price Forecast: Technical outlook

The USD/JPY monthly chart depicts the pair as upward biased. The break of a 20-year-old downslope resistance trendline opened the door towards February 2002 cycle highs at 135.02, but there would be some hurdles to overcome on its way up.

The USD/JPY’s first resistance would be May 2002 highs at 129.09. A breach of the latter would expose the widely mentioned 130.00 mark by the former top currency diplomat Eisuke Sakakibara, known as "Mr. Yen" who said that “Japan should intervene in the currency market or raise interest rates to defend the yen if it weakens beyond 130.”

- Silver turned lower on Tuesday, dropping to the low $25.00s as rising US yields amid hawkish Fed speak finally weighing.

- XAG/USD has been resilient to rising yields in recent days amid elevated demand for inflation/stagflation protection.

Though the tone of geopolitical updates regarding the Russo-Ukraine war remain downbeat, and despite global growth concerns coming into focus in wake of the IMF releasing its latest World Economic Outlook, precious metals markets finally appear to have succumbed to rising global yields. Spot silver (XAG/USD) was last trading nearly 2.5% lower on the day in the low $25.00s as long-term US bond yields hit fresh multi-year highs, with the 30-year eclipsing 3.0% for the first time since April 2019.

Hawkish comments from Fed policymaker James Bullard, who reiterated a call for rates to hit 3.5% by the year’s end and even suggested his openness towards a 75 bps rate rise have underpinned the latest yield rally. Higher yields raise the opportunity cost of holding non-yielding assets like silver. Looking ahead, a key event this week will be a speech from Fed Chair Jerome Powell on Thursday at the IMF/World Bank meetings.

Powell will likely solidify expectations for a 50 bps rate hikes at next month’s Fed meeting and likely a few more meetings thereafter, suggesting further upside risks for yields and downside risks for silver. XAG/USD bears will be eyeing a test of support in the form of the 21 and 50-Day Moving Averages on either side of the $25.00 per troy ounce level.

Global energy prices turned sharply lower on Tuesday amid profit-taking, with this also weighing on precious metals amid a lessened demand for inflation protection. Whether this is a short-term move that is reversed by dip-buying or the start of a more lasting push lower could be make or break for silver’s near-term prospects.

Up until Tuesday, silver (like other precious metals) had been resilient to upside in US bond yields in recent weeks due to hawkish shifts in Fed tightening expectations and this has largely been as a result of elevated demand for inflation/stagflation protection given the impact of the Russo-Ukraine war and associated sanctions on Russian exports.

Statistics Canada will release March Consumer Price Index (CPI) data on Wednesday, April 20 at 12:30 and as we get closer to the release time, here are the forecasts by the economists and researchers of five major banks regarding the upcoming Canadian inflation data.

The March Canada inflation rate is expected to rise by +0.9% MoM from +1% MoM, clocking in at +6.1% YoY from +5.7% YoY.

TDS

“We look for CPI to firm to 6.1% YoY in March, with prices up 0.9% MoM. Energy will provide the main driver, led by an 11% increase in gasoline, alongside another significant contribution from food. Motor vehicles, clothing, and shelter should help drive strength in the ex. food/energy aggregate, while the BoC's core inflation measures should firm to 3.6% YoY on average.”

RBC Economics

“Canadian CPI report is expected to show a further acceleration to 6% in March. That would top the 5.7% February reading that was already the highest since 1991. The BoC’s newly-minted forecast shows inflation averaging 5.3% in 2022. With labour markets also looking exceptionally strong, there’s no reason for interest rates to still be at emergency low levels. The BoC already hiked the overnight rate by 75 basis points over the last month and a half. We look for another 100 bps worth of increases to bring the rate to 2.0% by October.”

NBF

“While we expect strong print for CPI ex-food and energy given labor shortages and supply chain issues, the headline number could also have been upwardly impacted by surging gasoline prices. Elsewhere, food inflation should have remained strong, driven by the upward rise in commodity prices. All in all, we expect the headline index to have increased 0.9% MoM before adjustments for seasonality, a result which would allow the annual inflation rate to increase four ticks to 6.1%. The annual rate of the common CPI, meanwhile, could move up from 2.6% to 2.7%.”

CIBC

“March should hopefully be the peak for Canadian inflation, with the price of oil having moved off its highs in recent weeks. However, what a peak it will be, with the 6.3% reading we forecast more than triple the 2% target and the highest since early 1991. Energy, food and housing costs will continue to be the key drivers but look for further signs of a broadening in inflationary pressure, including an upward move in the average of the BoC’s three inflation measures. While goods price inflation decelerated somewhat in the US CPI figures released earlier, that was largely due to a decline in used car prices that aren’t tracked in the Canadian inflation basket.”

Citibank

“Canada CPI NSA MoM (Mar) – Citi: 1.0%, prior: 1.0%, CPI YoY – Citi: 6.2%, prior: 5.7%. We expect headline CPI to rise 1.0% MoM and climb to 6.2% YoY in March, which would be more or less consistent with ~6%YoY inflation in H1’2022 forecast by the BoC in the April MPR.”

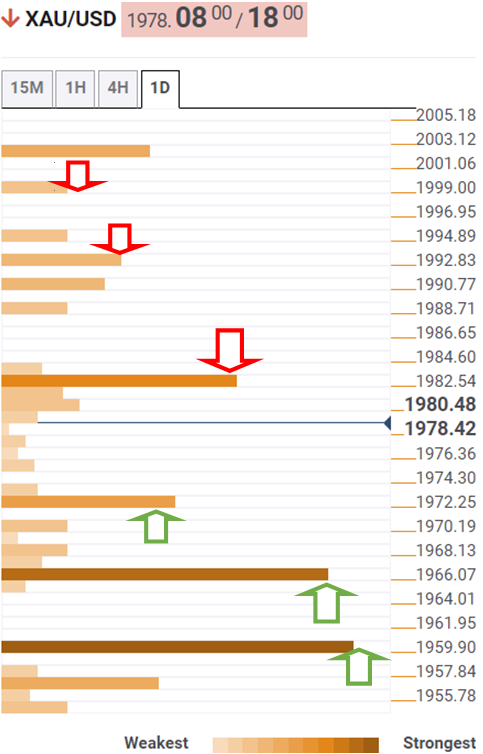

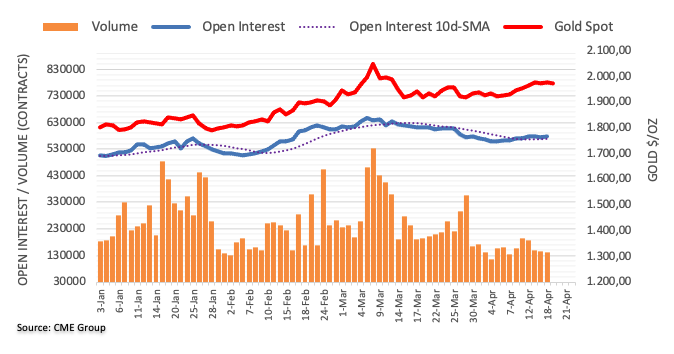

Market fears of the war in Ukraine and continued perception of the US central bank as being behind the curve are supporting Gold markets, economists at TD Securities report.

Protracted war in Ukraine raises both geopolitical uncertainty and inflation risks

“The potential for a protracted war in Ukraine simultaneously raises both geopolitical uncertainty and inflation risks, fueling demand for the yellow metal as a safe haven. This trend has also likely been exacerbated by the concurrent decline in global equity and bond prices, which is consistent with fears that Treasuries may be less potent havens in a higher-inflation regime.”

“While the Fed is signaling its intent to combat inflation by reaching policy neutrality by year-end, and starting an aggressive QT regime, outflows from gold markets have been scarce as participants are happy to retain some optionality against the Fed's stated plan amid growth concerns.”

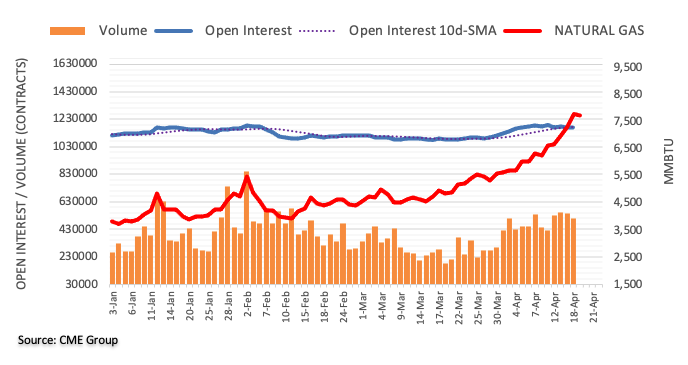

- WTI has slumped from near-$110 on Monday to the $102s on Tuesday with growth concerns in focus.

- But further losses are likely to invite dip-buying amid ongoing concerns about the Russo-Ukraine war and OPEC+ supply difficulties.

Oil prices have turned lower again this Tuesday, with front-month WTI futures dropping back from Monday’s highs near $110 per barrel to the low $100s with global growth concerns in focus. At current levels in the $102.00s, WTI is now trading with on-the-day losses of a little over $4.0, with losses exaccerbated in recent trade in wake of the release of the latest International Monetary Fund (IMF) World Economic Outlook report that saw global growth forecasts for 2022 and 2023 downgraded due to rampant inflation and the Russo Ukraine war.

With WTI having slipped back below its 21-Day Moving Average in the $103.40 area, bears are now eyeing a test of the 50DMA just above the $100 level. But commodity strategists have warned that any further dips back to/below $100 may be subject to being bought into. After all, recent developments in the Russo-Ukraine war suggest a rising risk of a protracted conflict with Russia amping up its assault in Ukraine’s east, meaning the outlook for Russian energy exports remains cloudy. French Finance Minister Bruno Le Maire said on Tuesday that an EU-wide embargo on Russian oil imports is being worked on.

Meanwhile, broader OPEC+ supply concerns also remain a key market focus. A Reuters survey released on Tuesday showed that the group missed its oil output target by 1.45M barrels per day (BPD) in March. Granted, 300K BPD of that miss was due to falling Russian output due to sanctions. But the latest survey highlights the ongoing struggles of smaller OPEC+ producers (namely in Africa) to raise output.

These challenges are likely to have worsened in April. As a reminder, Libya’s National Oil Corporation on Monday announced a force majeure at its largest oil field (Al Sharara) and warned of “a painful wave of closures” amid internal political machinations. With Russian output losses expected to have risen to 1.5M BPD in April and 3M BPD in May, and as the group continues to increase output quotas at a very steady pace of about 400K BPD each month, the outlook for a near-term rebound in OPEC+ supply is remote.

Economist at UOB Group Ho Woei Chen, CFA, reviews the latest PBoC meeting.

Key Takeaways

“The People’s Bank of China (PBoC) announced on Fri (15 Apr) that it will lower banks’ reserve requirement ratio (RRR) by 25 bps, effective from 25 Apr.”

“The quantum of RRR cut is much smaller than previous rounds which would typically be 50 to 100 bps. Furthermore, the PBoC left its 1-year medium-term lending facility (MLF) rate unchanged at 2.85% on Fri (15 Apr), against market’s and our expectation of a 10 bps cut to 2.75%.”

“First, this could imply that the PBoC is running into constraint to use the RRR as a monetary policy tool after successive reductions over the years.”

“Second, the overall impression is that the central bank has little appetite for aggressive monetary policy easing. While the PBoC wanted to boost market confidence, it is also aware that the impact of its policy easing may be limited by weak credit demand. As such, policymakers may find it more useful to use measures to address demand side weakness by easing COVID-19 curbs and boost consumption demand.”

“Third, as the RRR is reduced by a smaller than expected quantum and will only take effect from 25 Apr, the immediate impact on lowering banks’ funding cost will be limited. Thus, the 1Y LPR and 5Y LPR are likely to be unchanged at 3.70% and 4.60% respectively at the fixing this month on 20 Apr.”

“We see more pressure for the PBoC to ease its monetary policy further in the upcoming months, likely by direct cuts to the 1Y MLF rate to bring down the LPR and via its relending tool. We maintain our forecast for the benchmark 1Y LPR to fall to 3.55% but see a longer time frame for the easing by the end of 3Q22 instead of 2Q22.”

- DXY alternates gains with losses near 101.00.

- US yields advances to new highs on Tuesday.

- US housing data surprised to the upside in March.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main competitors, extends the rally to the area just beyond the 101.00 mark on turnaround Tuesday.

US Dollar Index looks to Fed, inflation, Ukraine

The index remains bid for yet another session, this time managing to briefly surpass the key 101.00 barrier to reach levels last seen more than two years ago.

Another good day in US yields also lends extra wings to the buck in a context where the deterioration of the geopolitical scenario also favours inflows into the US dollar via safe haven demand.

In the US docket, Housing Starts expanded 0.3% MoM, or by 1.793M units, in March while Building Permits also expanded 0.4% inter-month, or 1.873M units.

What to look for around USD

The dollar’s rally surpassed albeit ephemerally the 101.00 mark in the first half of the week. So far, the greenback’s price action continues to be dictated by the likeliness of a tighter rate path by the Fed and geopolitics. In addition, the case for a stronger dollar also remains well propped up by high US yields and the solid performance of the US economy.

Key events in the US this week: Housing Starts, Building Permits, IMF World/Bank Spring Meetings (Tuesday) – IMF World/Bank Spring Meetings, Existing Home Sales, Fed Beige Book (Wednesday) - IMF World/Bank Spring Meetings, Initial Claims, Philly Fed Index, Fed Powell (Thursday) - IMF World/Bank Spring Meetings, Flash Services/Manufacturing PMIs (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is advancing 0.06% at 100.87 and the breakout of 101.02 (2022 high April 19) would open the door to 101.91 (high March 25 2020) and finally 102.99 (2020 high March 20). On the downside, the initial support comes at 99.57 (weekly low April 14) followed by 97.68 (weekly low March 30) and then 97.10 (100-day SMA).

- EUR/USD is trading flat on Tuesday as Eurozone yields play catch-up to recent upside in their US counterparts.

- But the pair remains unable to reclaim the 1.0800 level and bears continue to eye a retest of recent lows.

- Meanwhile, FX strategists continue to cite Fed/ECB policy divergence and geopolitics as weighing on the pair’s near-term prospects.

A comparatively large jump in Eurozone bond yields versus their US counterparts, which are playing catch up given European market closures on Monday, is supporting EUR/USD on Tuesday. The pair currently trades flat on the day, though has again been unable to hold to the north of the 1.0800 level, likely keeping the bears confident that an eventual retest of last week’s annual lows in the 1.0750 area will eventually be retested.

Indeed, most FX strategists and market commentators continue to favour EUR/USD heading lower as a result of a widening divergence between the Fed and ECB’s response elevated inflationary pressures. Whilst the ECB is expected to do little more than end its QE programme and may implement a few rates hikes by the year’s end, some Fed members (James Bullard on Monday) are even now talking about a potential 75 bps rate hike at next month’s meeting.

The Fed/ECB divergence story will be in focus on Thursday when both ECB President Christine Lagarde and Fed Chair Jerome Powell speak at this week’s IMF/World Bank meetings. The EUR/USD bears are eyeing a test of 2020 lows in the 1.0600s, with the backdrop of recent negative developments in the Russo-Ukraine conflict (Russia ramping up its assault in the east) also being cited as supportive of further downside.

Economist at UOB Group Ho Woei Chen, CFA, assesses the latest set of results in Chinese fundamentals.

Key Takeaways

“China’s 1Q22 GDP expanded by 4.8% y/y (1.3% q/q SA) compared with 4.0% (1.5% q/q SA) in 4Q21. This was above consensus and our forecasts (Bloomberg est: 4.2% y/y, 0.7% q/q SA; UOB est: 4.5% y/y, 0.8% q/q) and the strong q/q growth pointed to a fairly resilient economic momentum despite the pandemic outbreak.”

“The moderation in the economic indicators in Mar came as no surprise but the slowdown was largely more contained than expected and 1Q22 growth was buffered by a strong rebound in the first two months of the year.”

“Reflecting the pandemic outbreak, retail sales reversed sharply to a contraction of 3.5% y/y in Mar as catering sales plunged by 16.4% y/y, of which restaurant sales were down 15.6% y/y. Sales of discretionary consumer goods such as jewellery and clothing also suffered a disproportionately larger hit.”

“The surge in the surveyed jobless rate warrants concern as the labour market is likely to worsen further. The 31 major cities jobless rate was at a record high of 6.0% in Mar from 5.4% in Feb, exceeding previous high of 5.9% in May 2020.”

“The impact of the domestic lockdowns and the Russia-Ukraine conflict is still uncertain at this point while the real estate market outlook has remained weak. As such, we maintain our 2022 GDP growth forecast for China at 4.9%.”

- EUR/USD reverses the earlier drop to 1.0760 and regains 1.0800.

- Another visit to the 2022 low near 1.0750 remains in store.

EUR/USD regains the smile somewhat and reverses three consecutive daily drops on Tuesday.

In light of the ongoing price action, extra losses in the pair remain in the pipeline in the short-term horizon. Against that, a break below the so far 2022 low at 1.0757 (April 14) should open the door to a quick visit to 1.0727 (low April 24 2020) before the 2020 low at 1.0635 (March 23).

While below the 200-day SMA, today at 1.1424, the outlook for the pair is expected to remain negative.

EUR/USD daily chart

- Sustained USD buying dragged GBP/USD lower for the fourth successive day on Tuesday.

- The bias seems tilted in favour of bearish traders and supports prospects for further losses.

- Attempted recovery moves might now be seen as a selling opportunity and remain capped.

The GBP/USD pair struggled to capitalize on its modest intraday recovery and met with a fresh supply near the 1.3040 region on Tuesday amid sustained US dollar buying. The pair turned lower for the fourth successive day and weakened further below the 1.3000 psychological mark during the early North American session.

From a technical perspective, the GBP/USD pair's inability to gain any meaningful traction or register any meaningful recovery suggests that the recent bearish trend might still be far from being over. The negative outlook is reinforced by the fact that oscillators on the daily chart are holding deep in bearish territory.

Some follow-through selling below the YTD low, around the 1.2975-1.2970 region, will reaffirm the bias and pave the way for a slide towards testing the 1.2910-1.2900 support zone. The downward trajectory could further get extended towards the next relevant support near mid-1.2800s en-route the 1.2820 area and the 1.2800 mark.

On the flip side, the daily swing high, around the 1.3040 region, now seem to act as immediate resistance. Any subsequent recovery should attract fresh selling near the 1.3100 round-figure mark and remain capped around the 1.3115-1.3120 area. The latter should act as a pivotal point for short-term traders.

Sustained strength beyond might trigger a short-covering move and lift the GBP/USD pair back towards the 1.3150 area. The recovery momentum could allow bulls to aim back to reclaim the 1.3200 mark with some intermediate hurdle near the 1.3180-1.3185 region.

GBP/USD 4-hour chart

-637859709865844039.png)

Key levels to watch

In its latest quarterly World Economic Outlook released on Tuesday, the International Monetary Fund (IMF) cut its forecasts for global growth in 2022 and 2023 by 0.8% and 0.2% respectively to 3.6%, reported Reuters.

Key takeaways as summarised by Reuters:

- The IMF warned that rising food and fuel prices could "significantly increase" the risk of social unrest in emerging markets/developing economies.

- The IMF said its downgrade reflected the Russo-Ukraine war's direct impact on Russia and Ukraine, as well as global spillovers, and the institution now sees inflation remaining elevated "for much longer".

- Global growth is seen declining to about 3.3% over the medium term.

- The IMF said war-related supply shortages will amplify existing inflationary pressures, raising the price of food, energy and metals. Shortages are seen lasting into 2023.

- The war in Ukraine is adding to supply shocks seen during the Covid-19 pandemic and will trigger more shortages beyond the energy and agricultural sectors.

- The IMF said inflation is projected at 5.7% in advanced economies in 2022, 1.8% higher than in its January forecast, though is seen declining to 2.5% in 2023.

- The IMF said its growth and inflation forecasts are marked by "high uncertainty" and worsening supply-demand imbalances could lead to persistently higher inflation, as well as slower growth.

- The IMF sees inflation at 8.7% in emerging markets/developing countries, 2.8% higher than in its January forecast, and then declining to 6.5% in 2023.

- The IMF lowered its US GDP growth forecast to 3.7% in 2022 and to 2.3% in 2023, a downgrade of 0.3% for both years from its January forecast.

- The IMF sees a rising risk that inflation expectations become de-anchored, which is prompting more aggressive tightening by central banks.

- The IMF said that the latest covid lockdowns in China could cause new bottlenecks in global supply chains.

- The IMF lowered its Euro area growth forecast to 2.8% in 2022 and 2.3% in 2023, down from 3.9% and 2.5% respectively in its January forecast.

- The IMF sees a contraction of 2.9% in emerging and developing Europe in 2022, a drop of 6.4% from its January forecast. Growth is then seen at 1.3% in 2023, versus the previous forecast of 2.9% growth.

- The IMF sees GDP growth in China of 4.4% in 2022 and 5.1% in 2023, down 0.4% and 0.1% from the January forecast.

- The IMF sees the Russian economy contracting by 8.5% in 2022 and by 2.3% in 2023.

- The IMF said that divergence between advanced and emerging market economies is expected to persist, suggesting some 'permanent scarring' from the pandemic.

- The IMF said the medium-term outlook had been revised downwards for all groups except commodity exporters who will likely benefit from the surge in energy and food prices.

- The IMF sees world trade in goods and services expanding by 5% in 2022 and 4.4% in 2023, down 1% and 0.5% from the January forecast.

- DXY pushes higher and clocks new tops past 101.00

- The 2020 high near 103.00 emerges as the next target of note.

DXY navigates levels last seen more than two years ago in the vicinity of the 101.00 yardstick on Tuesday.

Price action around the index continues to suggest further upside in the near term. That said, if 101.02 is surpassed in the near term, then there are no resistance levels of significance until the 2020 peak at 102.99 recorded on March 2020.

The current bullish stance in the index remains supported by the 7-month line near 96.50, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 95.33.

DXY daily chart

According to Quek Ser Leang at UOB Group’s Global Economics & Markets Research, USD/IDR remains poised to keep trading in a side-lined fashion between 14,335 and 14,385 for the time being.

Key Quotes

“USD/IDR traded sideways and within narrow ranges for the past few weeks and indicators are mostly flat.”

“Further sideway-trading would not be surprising, likely within a range of 14,335/14,385.”

- NZD/USD is attempting to snap a four-day losing streak on Tuesday, having found some composure in the mid-0.6700s.

- The pair has performed poorly recently amid the buoyant buck/weak equities.

- Traders are eyeing an upcoming speech from Fed Chair Powell, as well as NZ CPI this week.

NZD/USD is attempting to snap a four-day losing streak on Tuesday, having found some composure in the mid-0.6700s, though failing to hold above the 0.6750 mark. The pair fell to fresh more than one-month lows on Monday, extending on what has so far been a very poor April, with the pair currently trading nearly 3.0% lower versus the end of last month.

Upside the US dollar/US yields as traders price in a more aggressive Fed tightening cycle in wake of recent hawkish rhetoric from the bank’s policymakers and downside in global equity markets, which remain nervous about central bank tightening, inflation, geopolitics and supply chain disruption amid lockdowns in China have been the main factor weighing on the pair so far this month.

And analysts are flagging a risk that the trends of a stronger buck/higher US yields may yet have further room to run, with Fed Chair Jerome Powell expected to solidify expectations that the Fed will hike interest rates by 50 bps at upcoming meetings. This could well tip NZD/USD below 0.6700.

But kiwi traders should also be aware of the release of key Q1 2022 Consumer Price Inflation figures on Thursday. The YoY rate of inflation is seen jumping to 7.1% and the QoQ rate of price gain is seen hitting 2.0%. After the RBNZ lifted interest rates by 50 bps to 1.50% last week, a few more 50 bps rate hikes might well be in store, maintaining NZD’s rate advantage over the US dollar. This could act to cushion further losses.

Housing Starts rose by 0.3% in March, taking the rolling 12-month number of starts to 1.793M, above expectations for a drop to 1.745M from 1.788M in February, data released by the US Census Bureau on Tuesday showed. Meanwhile, Building Permits rose by 0.4%, taking the rolling 12-month number of permits to 1.873M, above expectations for a drop to 1.825M from 1.865M in February.

Market Reaction

FX markets did not react to the latest US housing figures, which are yet to show a substantial slowdown as a result of the recent steep rise in US mortgage rates amid guidance from the Fed towards tighter policy. The DXY for now continues to trade in the upper 100s, supported amid higher US yields and recent hawkish Fed speak.