- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 19-01-2022

December month employment statistics from the Australian Bureau of Statistics, up for publishing at 00:30 GMT on Thursday, will be the immediate catalyst for the AUD/USD pair traders.

The jobs figures become less important considering the Omicron impact to be seen in January. However, the Reserve Bank of Australia’s (RBA) hawkish bias and the recently in-trend inflation fears keep the employment data on the first-tier catalysts’ list of AUD/USD traders.

Market consensus favors Employment Change to ease to 30K from +366.1K previous on a seasonally adjusted basis whereas the Unemployment Rate is likely to drop to 4.5% from 4.6%. Further, the Participation Rate may also rise from 66.2% to 66.1%.

Ahead of the event, analysts at Westpac said,

The ABS’s unadjusted payrolls data points towards solid gains in employment for the month (Westpac f/c 30k, market 60k), with any negative impact from Omicron to be seen in the January data instead. Westpac looks for the rising participation rate to slow the fall in the unemployment rate, keeping it at 4.6% versus a consensus of 4.5%.

How could the data affect AUD/USD?

AUD/USD remains on the back foot around 0.7220, consolidating the week’s first daily gains, ahead of the key event. The pair’s latest losses could be linked to the risk-off mood triggered by US President Joe Biden’s comments, as well as cautious sentiment ahead of the key data.

Given the December jobs report likely preceding the Omicron spread in Australia, today’s jobs report may have a little impact on the AUD/USD, unless being a total disappointment. However, a strong reading may help the Aussie pair to recover some of the latest losses.

Technically, AUD/USD drops towards the 200-SMA and the stated support line, respectively near 0.7190 and 0.7180, amid sluggish MACD and RSI retreat. It’s worth noting, however, that a clear downside break of the 0.7180 will drag AUD/USD towards the monthly low of 0.7129 and August 2021 trough surrounding 0.7105.

Meanwhile, the monthly horizontal resistance near 0.7180 acts as an extra hurdle to the north even if the AUD/USD prices manage to cross the immediate 100-SMA resistance surrounding 0.7225.

Key Notes

AUD/USD retreats towards 0.7200 ahead of Aussie employment, PBOC

Australian Employment Preview: Aussie unlikely to benefit from a strong jobs report

About the Employment Change

The Employment Change released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

About the Unemployment Rate

The Unemployment Rate released by the Australian Bureau of Statistics is the number of unemployed workers divided by the total civilian labor force. If the rate hikes, indicates a lack of expansion within the Australian labor market. As a result, a rise leads to weaken the Australian economy. A decrease of the figure is seen as positive (or bullish) for the AUD, while an increase is seen as negative (or bearish).

- NZD/USD fades bounce off monthly support line, consolidates the week’s first daily gains.

- Biden hints at tighter monetary policy, warns Russia while signaling China’s lack of meeting purchase commitments.

- Wider US-NZ rate differentials helped Kiwi gain the previous day.

- PBOC rate action, Aussie jobs report will be important for the day.

NZD/USD returns to the seller’s desks, declining to 0.6780 during the initial Asian session on Thursday.

The Kiwi pair rose for the first time in a week the previous day after the US Treasury yields eased from the multi-day top. However, challenges to the risk appetite and cautious sentiment ahead of today’s key events recalled the sellers.

US President Joe Biden’s press conference was the latest blow to the market’s mood as he touched various risk-sensitive issues ranging from Russia to China, not forget Fed. US President Biden said, “China is not meeting its purchase commitments,” but also mentioned Chief Trade negotiator Katherine Tai’s efforts to placate Sino-American trade tussles.

Biden also praised Fed Chair Jerome Powell’s push to recalibrate the support also raised concerns over faster rate hikes and balance sheet normalization, which in turn exerted additional downside pressure on the NZD/USD prices.

Read: US President Biden: Inflation has everything to do with supply chain

In addition to the aforementioned catalysts, indecision over the People’s Bank of China (PBOC) Interest Rate Decision also weigh on NZD/USD prices. The PBOC is up for conveying its Interest Rate Decision at 01:30 AM GMT with market players equally divided amid the Chinese central bank’s early signals of a rate cut and the latest comments from PBOC Deputy Governor Liu Guoqiang. The PBOC official mentioned that the central bank “will keep yuan exchange rate basically stable.”

It’s worth noting that New Zealand’s plan to review phased border reopening next month and an easing in the US Treasury yields from two-year, coupled with the firmer equities and commodities, favored the NZD/USD buyers the previous day.

Amid these plays, ANZ said, “We changed our call yesterday and now expect the RBNZ to keep hiking till the OCR reaches 3%. Local rates were already itching to go higher, and they capitulated yesterday afternoon, with the 2-yr swap almost back to November’s post-COVID high, which mildly benefitted the NZD.”

Moving on, Australia's employment data and inflation expectations may also direct short-term NZD/USD move ahead of the PBOC. Should the Chinese central bank announce a rate cut, the kiwi pair may have a reason to pare recent losses.

Technical analysis

Despite crossing the weekly resistance line, now support line 0.6775, NZD/USD reversed from the 100-SMA level of 0.6805, which in turn joins sluggish MACD and RSI line to favor sellers. That said, an upward sloping support line from December 20, near 0.6755 by the press time, becomes crucial for the bears.

Alternatively, a sustained break of the 100-SMA level of 0.6805 will aim for the late December 2021 peak near 0.6860 but a two-month-old horizontal area surrounding 0.6890-95 will challenge the NZD/USD buyers afterward.

Overall, failures to cross the short-term SMA join sluggish Momentum indicators to favor bears.

- EUR/USD consolidates the week’s first daily gains, takes offers to refresh intraday low of late.

- Pullback from 100-SMA, bearish MACD signals hints at further weakness.

- 200-SMA, two-month-old support line challenge short-term bears.

- Seven-week-old horizontal area adds to the upside filters.

EUR/USD reverses from 100-SMA to pare the previous day’s gains around 1.1340 amid early Thursday morning in Asia.

The major currency pair flashed the week’s first positive daily closing while bouncing off the 200-SMA by the end of Wednesday. However, the rebound couldn’t cross the 100-SMA and was backed by the bearish MACD signals to trigger the latest pullback.

That said, the quote is on the way to retest the 200-SMA level of 1.1325 but an upward sloping support line from late November, around 1.1300, will challenge the EUR/USD pair’s further downside.

In a case where EUR/USD drops below 1.1300, multiple supports around 1.1230 should gain the market’s attention.

On the contrary, a clear upside break of the 100-SMA level near 1.1355 isn’t a green card for the EUR/USD bulls are a horizontal area from November 30, near 1.1380-85, will challenge the pair’s further advances.

Should the quote rises past 1.1385, the 1.1400 and the monthly peak of 1.1482 should lure the pair buyers.

EUR/USD: Four-hour chart

Trend: Further weakness expected

- AUD/USD consolidates the heaviest daily gains in a week, fades bounce off six-week-old support.

- Pullback in US Treasury yields initially favored buyers but US President Biden’s comments renewed risk-off mood.

- Biden signaled various concerns ranging from Fed to Russia to China suggesting challenges for risk appetite.

- Australia Inflation Expectations, jobs reports and PBOC interest rate will be the key to watch.

AUD/USD takes a U-turn from the weekly top towards 0.7200 during the initial Asian session on Thursday, having cheered softer US Treasury yields the previous day.

The Aussie pair’s latest pullback could be linked to US President Joe Biden’s press conference as the US Leader signals Fed rate hike, Sino-American tussles and geopolitical hardships. Also exerting downside pressure on the AUD/USD prices is the cautious sentiment ahead of the key Australia employment data for December, as well as Inflation Expectations for January, not to forget the interest rate announcement by the People’s Bank of China (PBOC).

Although US President Biden highlights Chief Trade negotiator Katherine Tai’s efforts to placate Sino-American trade tussles, he also mentioned that the US is “'not there yet' on possible easing of tariffs on Chinese goods”. Biden also said, “China is not meeting its purchase commitments.”

Further, comments favoring Federal Reserve (Fed) Chairman Jerome Powell’s push to recalibrate the support also raised concerns over faster rate hikes and balance sheet normalization, which in turn exerted additional downside pressure on the AUD/USD prices.

Additionally, US President Biden directly warned Russia not to invade Ukraine and if they do they’ll lose access to the US dollar.

Read: US President Biden: Inflation has everything to do with supply chain

With the aforementioned headlines suggesting challenges to the market sentiment, the risk barometer AUD/USD couldn’t be saved and pared the previous day’s gains, the first in the week.

Before that, the easing in the US Treasury yields and Australia PM Scott Morrison’s hope of overcoming the grave virus conditions, with the record death toll, seemed to have favored the AUD/USD prices. Also favoring the quote were the strong gold prices that rallied the most since early November to post a three-month high.

It should be noted that firmer US housing numbers helped equities to consolidate earlier losses but couldn’t save the US bond yields that initially refreshed the two-year top.

That said, AUD/USD pair’s further weakness hinges upon the monthly inflation expectations and jobs report, not to forget the PBOC rate actions.

Forecasts suggest, Australia's Employment Change may ease to 30K versus 366.1K prior while the Unemployment Rate is likely to ease to 4.5% versus 4.6%. The same suggests that the labor market is strong enough to help RBA keep the hawkish bias. However, the Consumer Inflation Expectations should overcome the 4.8% prior to favor the bulls. Also, the PBOC is widely expected to act in regards to the 3.8% benchmark rate, which if happens may help the AUD/USD to recover some of the latest losses.

Read: Australian Employment Preview: Aussie unlikely to benefit from a strong jobs report

Technical analysis

Despite bouncing off a seven-week-old support line, AUD/USD fails to cross the 100-SMA on the four-hour chart.

The pullback move gains support from RSI retreat and sluggish MACD, which in turn hints at further drop towards the 200-SMA and the stated support line, respectively near 0.7190 and 0.7180. It’s worth noting, however, that a clear downside break of the 0.7180 will drag AUD/USD towards the monthly low of 0.7129 and August 2021 trough surrounding 0.7105.

Meanwhile, the monthly horizontal resistance near 0.7180 acts as an extra hurdle to the north even if the AUD/USD prices manage to cross the immediate SMA resistance surrounding 0.7225.

US President Joe Biden crossed wires, via Reuters, during a press conference on Wednesday night while speaking on various matters starting from Russia-Ukraine to China, oil and then to inflation.

The US leader initially warned Russia not to invade Ukraine and if they do, “Russia's banks won't be able to deal in dollars,” said US President Biden.

Additional comments

We're not returning to lockdowns. We are moving towards time when covid won't disrupt daily life.

It is appropriate for fed to recalibrate support for the economy now that it's necessary.

The best thing to tackle high prices is a more productive economy. We must fix the supply chain.

Wherever possible, we will continue to enforce competition laws.

Inflation must be brought under control.

We are confident that we will be able to get parts of the build back better bill signed into law.

Putin has never seen sanctions like the ones I'm promising.

Russia will be held accountable if it invades, it will be disaster for Russia if they further invade Ukraine.

Costs to Russia will be heavy and consequential.

The situation on Russia energy supply not a one-way street.

I don't think Putin wants any full-blown war.

Ukraine joining NATO in the new term is unlikely.

The US and Ukraine might work out a deal on whether the west should place strategic weapons in Ukraine.

It's clear we will probably have to break up the build-back better bill into individual portions.

I believe Russia will move in on Ukraine.

We have made progress on speeding up access to materials.

Passing USICA chips bill will ease long-term inflation.

We will continue to work on trying to increase oil supplies.

My trade representatives working on China tariffs, uncertain whether its time to lift tariffs on Chinese imports.

We are not yet in a position to lift some of china's tariffs.

China is not meeting its purchase commitments and be able to lift some tariffs, but we're not there yet.

Russia sanctions will also affect US and Europe economies.

It is not time to give up on Iran talks. Some progress being made on Iran nuclear talks.

I am pleased with how this government has handled COVID-19.

Given the strength of our economy and pace of recent price increases, it’s appropriate — as Fed Chairman Powell has indicated — to recalibrate the support that is now necessary.

FX implications

Market sentiment turned sour and the Antipodeans adhered to the consolidation of recent gains as US President Joe Biden signals Fed rate hike, Sino-American tussles and geopolitical hardships.

Read: S&P 500 dips again after failing to reclaim 4600 level, now down more than 4.0% on the year

- AUD/JPY spent Wednesday ranging in the mid-82.00s as focus switched to Thursday’s Aussie labour market report.

- Higher base metal prices and resilient January Consumer Sentiment figures from Westpac helped the Aussie outperform on the session.

In the run-up to key Aussie labour market data, AUD/JPY spent Wednesday’s session ranging in the mid-82.00s, bouncing at last Friday’s 82.10 lows but then subsequently failing to sustain an attempted push above the 200-day moving average at 82.62. At current levels just under 82.50, the pair trades with modest gains of about 0.1% on the session. Strength in base metals, as well as resilient January Consumer Sentiment figures from Westpac, helped the Aussie to claim the top spot in the G10 performance table on the day.

Markets expect the Australian economy to have added slightly more than 40K jobs in December, taking the unemployment rate down to 4.5% from 4.6% and lifting the participation rate to 66.2% from 66.1%. Strong labour market figures would likely further stoke already very hawkish RBA rate expectations. On Wednesday, money market futures implied a 77% chance that the RBA lifts rates to 0.25% in May and then follow that up with a further four rate hikes before the end of the year, taking rates to 1.25%. That despite the fact that the RBA has up until now maintained there will be no rate hikes before 2023.

Analysts suspect that the final straw for the RBA that could make them capitulate to market expectations and signal 2022 rate hikes could be if next week’s Q4 Consumer Price Inflation figures surprise to the upside. If so, the central bank may opt to axe its QE programme immediately in February and signal rate hikes this year. One might expect that could send AUD/JPY back towards recent highs in the 84.00 area, but risk appetite (in global equities, anyway) remains ropey amid Fed tightening fears. The S&P 500 dropped another 1.0% on Friday and is nearly 6.0% below record highs printed at the start of the year. This makes it difficult for the risk-sensitive AUD to rally versus the safe-haven JPY. Analysts have warned that stock market sentiment may remain rocky in the run-up to next week’s Fed meeting and this may cap potential AUD/JPY gains.

- US equities dipped again on Wednesday, with the S&P 500 failing to reclaim 4600 and down over 4.0% in 2022.

- The Nasdaq 100 dipped 0.2% and the Dow fell 0.3%.

US equity markets have been under modest selling pressure on Wednesday, with market commentators citing continued fears about Fed tightening and higher interest rates, but also describing the day as one of consolidation. The S&P 500 dropped about 0.1% to trade close to 4570, after hitting fresh weekly and annual lows in the 4560s, with traders eyeing a test of the 4530ish lows printed back on December 20. The index attempted but failed to recover back above 4600. On the week, the index is now down about 2.0%, taking on the year losses to about 4.3%. The sectoral performance was mixed but indicative of a defensive bias, given outperformance in the S&P 500 GICS Consumer Staples (+1.2%) and Utilities (+0.9%) sectors.

The S&P 500 GICS Financials sector was the underperformer, shedding about 1.1% as US yields pull back from recent highs (the 10-year was down about 4bps to 1.83%) and following recent downbeat earnings. In fairness, Q4 results from Morgan Stanley (+2.2%) and Bank of America (+0.8%) were better received, but not enough to turn the tide for the sector. Meanwhile, the easing in yields gave the recently battered tech sector some respite. Despite the recent upside in crude oil prices, the energy sector was broadly flat.

Looking at the other major US indices, the Dow was down just over 0.3% while the Nasdaq 100 was flat, with the latter recovering back to 15.2K after printing fresh 2022 lows under 15.15K. The indices are down just under 3.0% and nearly 7.0% respectively on the year. In a sign of further choppiness ahead, the S&P 500 CBOE volatility index or VIX hit fresh highs for the year just under 24.0, substantially up from this year’s starting levels in the 16.0s. The VIX remains well below its post-Omicron peaks near 36.0.

- After briefly moving back above 156.00, GBP/JPY fell back to the 155.60s in recent trade, tracking equity market downside.

- If risk appetite remains ropey ahead of next week's Fed meeting, GBP/JPY may remain under pressure.

GBP/JPY spent most of Wednesday’s session going sideways within 155.50 to 156.20ish parameters, with the 21-day moving average and last Friday’s lows around 155.50 offering substantive support. Hotter than expected UK December consumer inflation numbers out early during European trade combined with comments from BoE Governor Andrew Bailey at the US open were unable to support the pair above 156.00. Despite the governor sounding very concerned about inflation and not saying anything that would diminish expectations for a 25bps rate hike next month, GBP/JPY has ebbed back lower to the 155.60s and is eyeing a test of session lows.

The move lower in the pair likely reflects further losses in the US equity space, with the major indices currently down between 0.1-0.5%. Investors continue to fret about the prospect of rapid monetary policy tightening from the Fed which is expected to kick off in March. Equity market downside since the start of the year (the S&P 500 is down over 4.0%) has weighed on risk-sensitive currency/JPY crosses like GBP/JPY. The pair is now flat on the year and about 1.3% below recent near-158.00 highs. Risk appetite may remain ropey ahead of next week’s anticipated to be very hawkish leaning Fed meeting.

That suggests it makes sense for GBP/JPY to remain in its recent bearish trend-channel for now, suggesting a break below the 21DMA and test of support at 155.00 this week seems likely. Risk appetite is going to need to see broader stabilisation for GBP/JPY to revert to trading as a function of central bank divergence, which would decisively favour the pair moving higher. Japan December CPI and UK December Retail Sales figures out on Friday are unlikely to have too much of an impact.

What you need to know on Thursday, January 20:

Demand for the American dollar eased on Wednesday, with the currency edging lower against most major rivals. Losses were limited across the FX board, with gold outstanding amid rallying beyond $1,840 a troy ounce, its highest since last November.

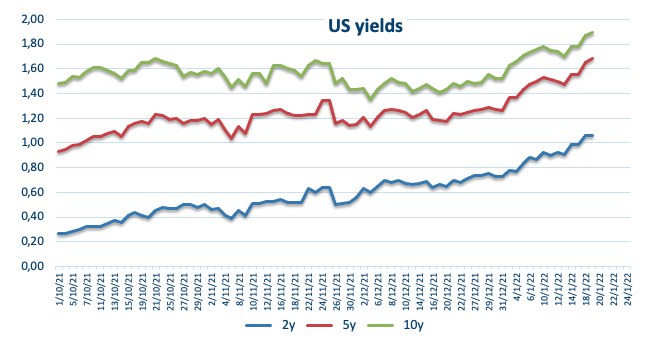

US Treasury yields inched higher at the beginning of the day to reach fresh 2-year highs but ended the day lower. The yield on the 10-year US Treasury note peaked at 1.902% and currently stands at 1.83%. Fears that inflation will force central banks into tighter monetary policies regardless of economic growth led the way.

Meanwhile, stocks traded with a sour tone in Asia but were up during London trading hours, pushing Wall Street’s futures up. US indexes lost momentum through the session, ending the day mixed and not far from their opening levels.

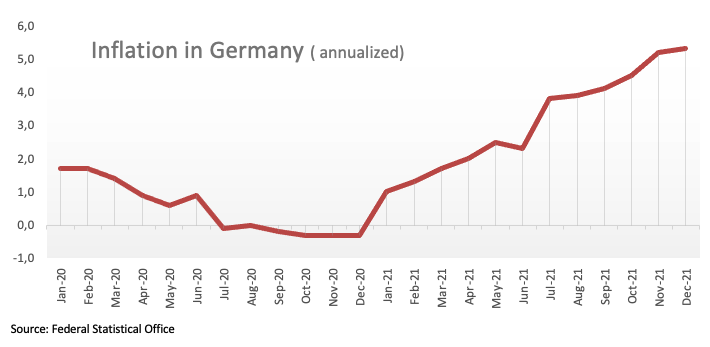

The EUR/USD pair recovered towards the current 1.1340/50 price zone after Germany confirmed inflation at a multi-decade high of 5.3% in December. GBP/USD trades around 1.3620 after UK inflation posted a whopping 5.4% YoY by the end of 2021.

The aussie advanced vs the greenback, ending the day around 0.7230, while the USD/CAD ended the day little changed in the 1.249’ price zone.

Safe-haven currencies were little changed vs their American rival, with USD/JPY trading marginally lower around 114.25.

Risk-off persists heading into the US Federal Reserve’s monetary policy announcement next week, with investors turning cautious ahead of the event. Volatility may decrease while the dollar may remain under mild pressure.

Crude oil prices kept rallying. The black gold reached levels that were last seen in September 2014, with WTI currently trading at $85.90 a barrel.

Australia will publish inflation and employment-related figures early on Thursday, while later into the day, the Turkey Central Bank will announce its monetary policy decision.

Crypto.com hits two-month lows as selling pressure accelerates

Like this article? Help us with some feedback by answering this survey:

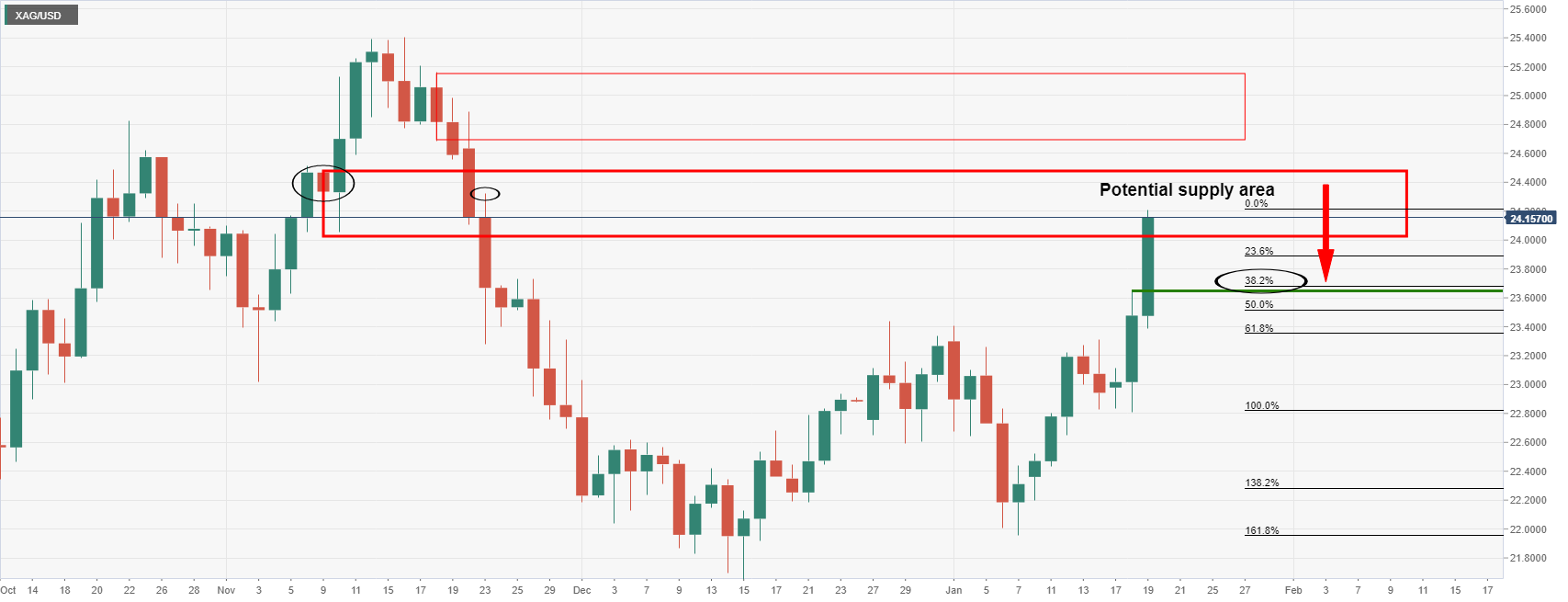

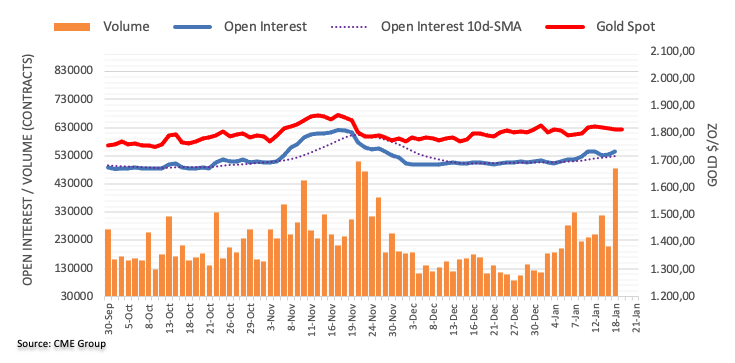

- Silver is performing into a critical supply area on the daily chart.

- Bulls look to 24.00 while the bears eye a correction back to test the 38.2% fibo.

The price of silver has tracked gold higher of a sudden, yet not fully explained, at least as far as fundamentals gold rush for gold. US Treasury yields have retreated from near two-year highs on 2-year and 10-year notes.

Consequently, the greenback is pulling back which can explain some of the moves in precious metals, but the speed and distance for which gold and silver have moved are outside of the average ranges we have seen of late. Nevertheless, silver has spiked into what might be expected to be an area of supply as follows:

XAG/USD daily chart

The 24 area is where price has reacted a number of times in the past, so it would be anticipated to offer the bulls a hard time in conquering it. As it stands, the 38.2% Fibonacci retracement level aligns with the prior day's high, so this could be a compelling level of support for the sessions ahead.

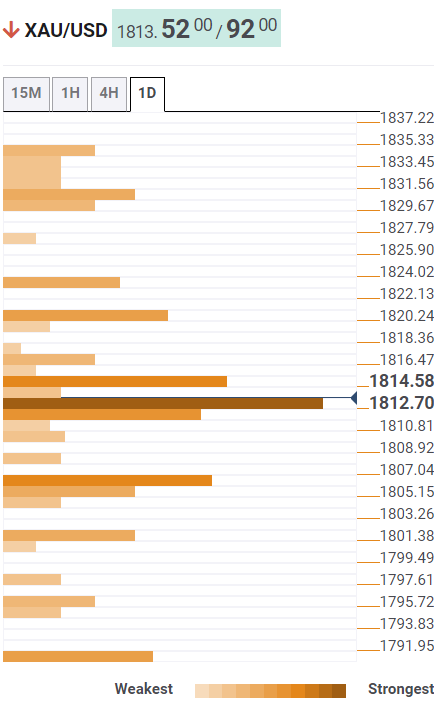

- Gold momentum has waned in recent trade, with the precious metal consolidating at session highs just above $1840.

- XAU/USD burst above resistance in the low-$1830s earlier in the session amid what appeared to be a stop run.

Spot gold (XAU/USD)’s upside momentum has waned in recent trade, with prices trading in more of a subdued manner near $1842 after bursting above resistance in the low $1830s and then subsequently $1840 for the first time in over two months. The speed of spot gold’s latest advances, especially between the $1830 to $1840 area, is suggestive of a stop run. With market participants amping up hawkish Fed bets in recent weeks, a theme that has weighed heavily on certain parts of the US equity market and sent real and nominal yields surging to multi-month/year highs, many were likely betting on weaker gold prices. Many traders short gold may have had their stop loss sat somewhere in the $1830s.

It is unlikely that spot gold can resist the advances of the US dollar and US real yields forever, and expectations for a very hawkish Fed in 2022 suggest continued upside risks for both. But gold is for now garnering safe-haven demand as geopolitical tensions surrounding Ukraine amp up, market commentators said. US Secretary of State Antony Blinken warned earlier in the day that Russia could attack Ukraine at very short and there are fears this could have a highly inflationary impact on the global economy via higher energy prices. Russia is a key gas supplier to Europe and a key global exporter of crude oil. With WTI at multi-year highs in the upper $80s and further energy price gains likely, investors may be buying gold as an inflation hedge.

- USD/JPY bulls are defending the daily trendline support.

- H1 bulls look to a restest of 114.50 before 115.00. Swing trading bears eye 113 the figure.

USD/JPY is under pressure below the 115.00 psychological level on Wednesday as US Treasury yields retreat from near two-year highs on 2-year and 10-year notes. Consequently, the greenback is pulling back and the yen bulls are taking advantage.

The following illustrates prospects of a near term test of the mid-point of the 114 area that guards a run back to test the bearish commitments below the hourly trendline resistance as well as daily bearish prospects to 113 the figure:

USD/JPY H1 chart

The M-formation is a reversion pattern for which the price would be expected to move higher to retest the old support, aka, the neckline of the M-formation. This coincides with a trendline taking into account the opens and closes while guarding a run to the trendline based on the highs.

USD/JPY M5 chart

Traders can look for a scalping opportunity and optimal entry point to target the short term target and the midpoint of the 114 area.114.35 is the current resistance that the price will need to overcome.

USD/JPY daily chart

Meanwhile, the daily outlook is also showing an M-formation, for which the neckline has already been tested:

The price was heavily rejected on a retest near115 the figure, or, the neckline of the formation. The bears are now battling with the bullish commitments at the rising dynamic support which could give way at some point over the course of this week, potentially following one last effort from the bulls. If the trendline breaks, then the focus will be on the downside towards 113 the figure.

- AUD/USD pushed back above 0.7200 on Wednesday to trade in the 0.7220s, with the Aussie outperforming in the G10 space.

- China monetary easing hopes helped base metals higher across the board.

- AUD likely derived support from upside in base metals and “remarkably resilient” Consumer Sentiment data.

AUD/USD recovered back above its 50-day moving average near the 0.7200 level to test an uptrend that it broke below earlier in the week in the 0.7220s on Wednesday. The pair’s 0.6% rally from the 0.7180s makes the Australian dollar the best performer within the G10 on the day, with the antipodean currency having shrugged off a deterioration in Westpac’s Consumer Sentiment survey which was released during Asia Pacific hours. The headline sentiment index fell 2.0% MoM to 102.2, showing that optimism still outweighed pessimism by a small margin (a score above 100 shows more consumers are optimistic than pessimism). Westpac called the data a “remarkably resilient result” given the recent spread of Omicron, contrasting it with previous much larger deteriorations during “Covid-19 events” (prior outbreaks). This could well be supporting the Aussie.

Upside in base metals was a key driver of the Aussie’s outperformance on Wednesday. US copper futures are up over 2.0% on the day, whilst the Bloomberg Industrial Metals subindex, which tracks a basket of copper, zinc, aluminum and nickel prices, is about 1.8% higher. Iron ore futures also saw substantial gains in Chinese markets during Wednesday’s Asia Pacific session, with the complex deriving a boost not only from a weaker US dollar but also hopes for more monetary easing from the PBoC. The central bank’s vice governor Liu Guoqiang said on Tuesday that more policy measures would be rolled out to stabilise the economy, after surprising markets with a 10bps Medium-term Lending Facility rate cut on Monday.

Looking ahead this week, Australia's December jobs data will be released during the upcoming Thursday Asia Pacific session. If strong, it may encourage markets to bring forward already very hawkish RBA rate hike expectations. For reference, during Wednesday’s session, money market futures implied a 77% chance that the RBA lifts rates to 0.25% in May and then follow that up with a further four rate hikes before the end of the year, taking rates to 1.25%. But analysts think that the straw that could break the camels back (regarding a potential RBA capitulation to hawkish market pricing) could be if next week’s Q4 2021 Consumer Price Inflation data comes in hotter than expected. If AUD/USD can break above the recent short-term uptrend, that could open the door to a move back above 0.7250.

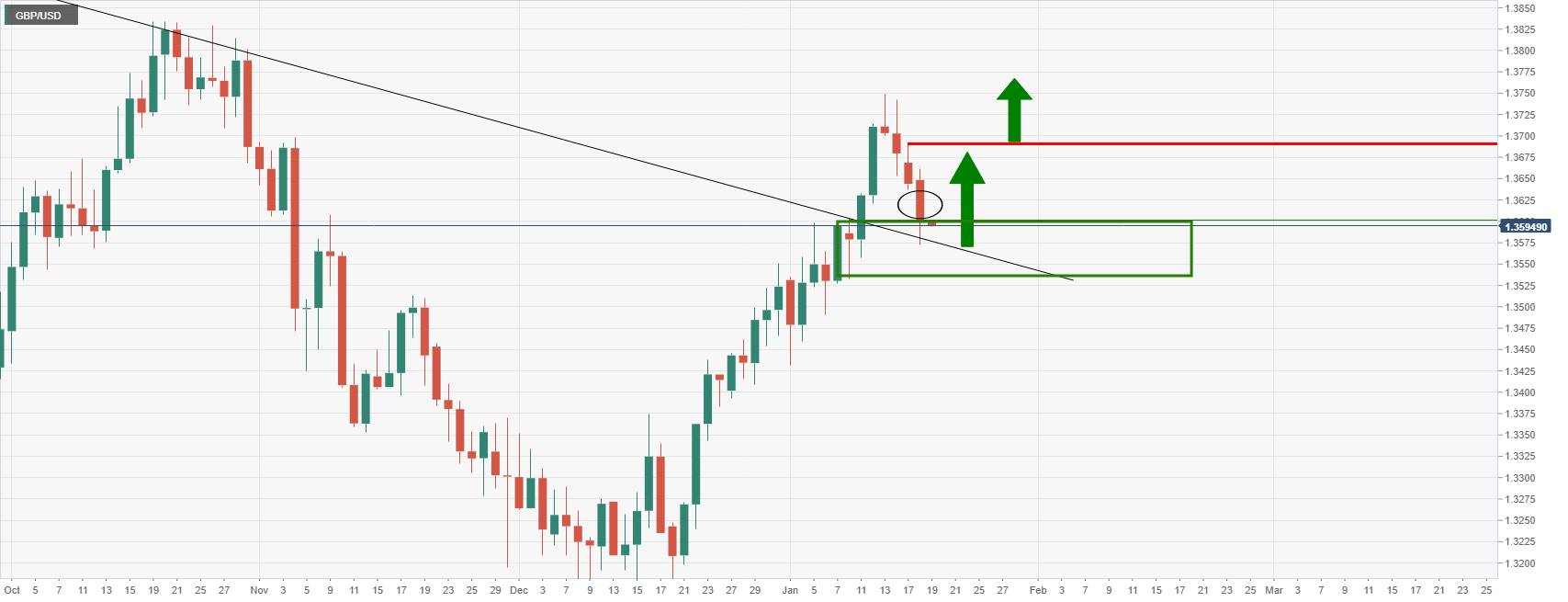

- GBP/USD holds in bullish territory as the US dollar and yields pullback.

- UK politics, the BoE and the Fed are the main focus.

GBP/USD is trading at 1.3627 and higher by some 0.24% after rising from a low of 1.3585 to a high of 1.3648. Besides domestic drivers, the pound has benefitted from a pullback in UIS yields and the greenback. US Treasury yields are retreating from near two-year highs on 2-year and 10-year notes.

The focus this week, in the absence of many data drivers, has been the surge in US yields and a recovery in the UIS dollar. Investors are prepared for a widely expected interest rate increase in March. Sterling, meanwhile, edged higher after UK data on Wednesday showed British inflation rose 5.4% in December, to its highest level in 30 years.

The Bank of England is a major focus in this regard and it had expected CPI inflation to be 4.5% in December, so today’s print represents another material upside miss relative to the central bank’s view, analysts at Nomura explained.

''While that’s not enough by itself to dictate further interest rate increases (after all, the BoE is focused on keeping inflation at target over the medium term and can do little about the current ‘baked-in-the-cake’ elevated inflation rates), we continue to see rates rising throughout 2022 to a terminal rate of 1.50% by H2 2023 as the Bank attempts to dampen the impact of rising current inflation on second-round effects – namely inflation expectations and crucially wages. We continue to see the next hike of 25bp on 3 February.''

The Bank of England governor, Andrew Bailey, confirmed the central bank's view on the economy at the Treasury Select Committee, although he stressed that his comments today were not intended to indicate a view on interest rates. He did say that the labour market was tight and he said the BoE is seeing some evidence of second-round inflation effects.

''For God's sake, go!''

Elsewhere, UK politics is keeping traders on their toes with an ear to the ground surrounding the ''Partygate'' scandal. Talks of a leadership challenge to Prime Minister Boris Johnson is likely keeping the pound hamstrung. Conservative MP David Davis, from the same party as Prime Minister Boris Johnson, called on the British leader to step down from office as Johnson faces a torrent of criticism from lawmakers and citizens over his alleged participation in a party held at 10 Downing Street in breach of Covid-19 rules. ''In the name of God, go,'' MP David Davis exclaimed.

Johnson, in response, evaded the issue in Parliament today and has requested everyone waits for the results of the investigation into the scandal. If he has misled Parliament, he will have to resign if he is not toppled by his own MPs in a no-confidence vote. However, the markets are not seeing an obvious alternative that may go in Johnson's favour and see him through a no-confidence vote.

In additional politics, in what is positive for UK business, confidence and the outlook for growth, Boris Johnson announced the easing of Covid Plan B measures today.

Current measures in England, including guidance to work from home and the widespread use of face coverings, were brought in to halt the spread of Omicron last month and will be reviewed again on January 26. he said the pandemic is not over and Omricon is not a mild disease, especially if you are not vaccinated or boosted.

Focus turns to the Fed

Across the pond, markets are getting set for next week's Fed that will meet. Traders and investors will be looking for further clarity and details on the end of quantitative easing, which will likely be in March. The US central bank could also signal it will raise interest rates in March as well right after ending QE. Fed funds futures have fully priced in a rate hike in March and four in all for 2022.

At this week meeting, the Central Bank of the Republic of Turkey (CBRT) is expected to maintain the key interest rate at 14.00% following a 500bp cut since September 2021. Analysts at MUFG Bank, expect the CBRT to reluctantly reverse course and hike rates by 600bp in 2022.

Key Quotes:

“The Central Bank of Turkey (CBRT) is expected to maintain rates at 14.00% (MUFG and consensus expectations are aligned) this week. A clear distinction is warranted between what the CBRT should and will do. With a policy rate at 14% and an inflation rate of 36.1%, a significantly tighter stance is necessary to anchor expectations and strengthen price stability. That is what we and broader markets believe the CBRT should do. However, the authorities resoluteness in keeping policy rates lows with their willingness to introduce heterodox measures in an effort to limit TRY volatility arising from exceptionally loose monetary policy, is what the CBRT will likely continue doing.”

“From a monetary policy perspective, our base case is that the CBRT will change course and tighten policy this year, but do so reluctantly by raising rates from a trough of 14% to 20% by end-2022. This will be akin to 2018 (sharp recessions) and late 2020/early 2021 (soft landing) when the CBRT reacted to stymie Lira volatility by raising rates sharply.”

“Our conviction behind our narrative is that with real policy rates that are acutely negative (-22%), the current monetary policy stance is unambiguously unsustainable and the pressure on the TRY is likely to continue in the absence of a policy U-turn. Whilst our core scenario is that the policy adjustment will be in an orthodox fashion, we acknowledge that unorthodox measures could materialise.”

“We view that a U-turn on monetary policy is necessary to bring stability to the currency (even though we forecast that such a 600bp hike in base case will still not be suffice to reduce inflation towards signal digits this year).”

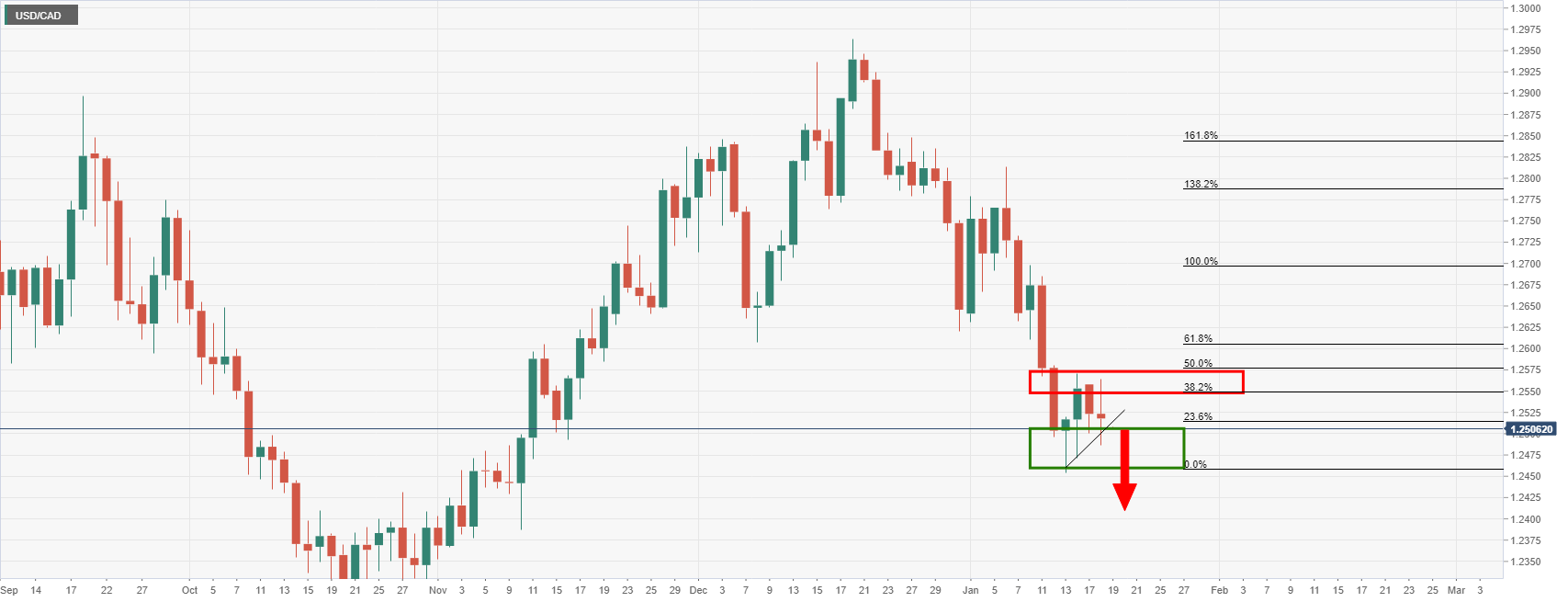

According to analysts at Wells Fargo, there is no imminent rate hike from the Bank of Canada, taking into account Wednesday’s higher than expected inflation numbers. They see weakness ahead for the Canadian dollar versus the greenback.

Key Quotes:

“Even as inflation continues to move higher, with the December CPI edging up to 4.7% year-over-year and the average of the core inflation measures firming to 2.9%, we do not expect an imminent rate increase at the Bank of Canada January monetary policy announcement.”

“Our outlook for a 25 bps rate hike by April is more conservative than current market pricing, which anticipates 52 bps of rate increase during the next three months.”

“More broadly we forecast 75 bps of rate increase from the Bank of Canada over the next 12 months, compared to the 152 bps of rate increase anticipated by market participants. Thus even though there are some positive factors for the Canadian dollar, including a recent rise in oil prices, considering the aggressive market expectations for Bank of Canada policy, and the prospect of relatively rapid tightening (at least by international standards) from the Federal Reserve in 2022, we still expect the Canadian dollar to show renewed weakness versus the greenback as the year progresses.”

In their yields outlook analysis, economists at Danske Bank point out that while a European Central Bank rate hike in 2022 is not their baseline scenario, they expect markets to increase price rate hikes in 2023 and 2024. They expect the 10Y US Treasury yields to hit 2.25% in 2022 and they see potential for the 10Y Bund yields to increase to 0.3% in 2022.

Key Quotes:

“As a consequence of our new forecast predicting four rate hikes from the Federal Reserve in 2022 and with QT likely to be launched in Q3 22, we have decided to raise our forecast for the 10Y US Treasury yield to 2.25% from 2.0% previously”.”

“Our overall expectation remains that the ECB will keep policy rates unchanged in 2022, though a rate hike late in the year is no longer unlikely. However, in the past month, the ECB has become much more likely to begin raising interest rates in 2023. Our assumption is that the market will continue to price rate hikes into the curve in 2023 and 2024, putting continued upward pressure on monetary policy-sensitive yields in the 3Y-5Y segment. We now expect the 10Y German government bond yield to increase to 0.3% in 2022 compared to 0.2% earlier.”

Economic numbers released on Wednesday surpassed expectations in the US with Housing starts rising 1.4% in December to 1.70 million (annual). Analysts at Wells Fargo point out a milder than usual weather allowed more construction to take place in what is normally a seasonally slow month.

Key Quotes:

“Home building finished 2021 on a high note and appears to have strong momentum headed into the new year. Overall housing starts rose 1.4% to a 1.702 million-unit pace. Multifamily starts surged 13.7% during the month and accounted all of December's increase. Single-family starts fell 2.3% but remains at a high level at a 1.172 million-unit pace. Milder than usual weather allowed work to begin on more projects than usual during December, which explains the stronger-than-consensus print in overall starts. The consensus estimate had called for a modest drop to a 1.65 million-unit pace.”

“With the December data, we now have preliminary data for 2021. Home builders began construction on 1,595,100 homes in 2021, with single-family starts totaling 1,123,100 units. That marks the best year for single-family starts since 2006.”

“Housing permits, which tend to lead starts by 30 to 90 days, rose even more this past year. Overall permits jumped 17.2% in 2021 to 1.725 million. Single-family permits rose 13.4% to 1.111 million, while multifamily permits surged 24.9% to 614,000 units. The strength in permits suggests homebuilding is set for another strong year, even with rising mortgage rates. We expect overall starts to rise 4% to 1.660 million units. Inventories of new and existing homes remain near historic lows, while apartment vacancy rates recently fell to an all-time low.”

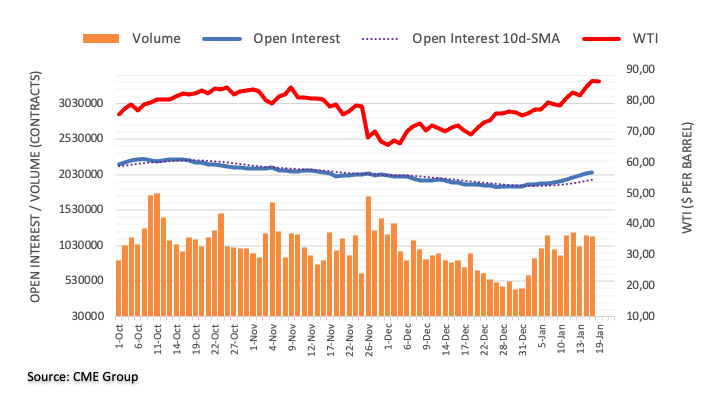

- WTI hit $87.00 for the first time since September 2014 on Wednesday.

- A momentary outage of an Iraqi-Turkish pipeline was attributed as driving the most recent gains.

- But the broader themes of tighter than expected market conditions and rising geopolitical concerns are also keeping oil underpinned.

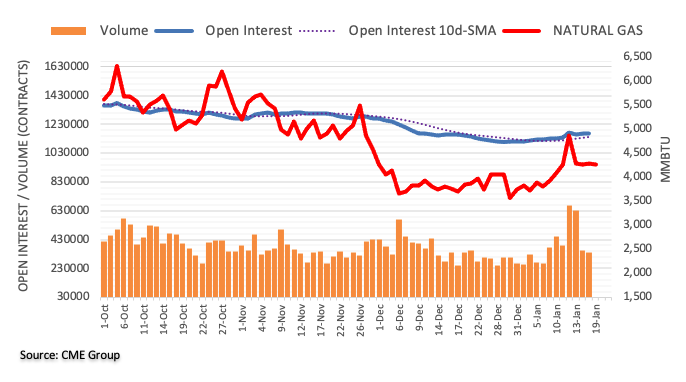

Oil prices scaled fresh multi-year highs on Wednesday with front-month WTI futures hitting the $87.00 per barrel level for the first time since September 2014. Market commentators have cited news of disruption in oil flows along a pipeline carrying crude from Northern Iraq to Turkish port Ceyhan as behind the latest run of gains. Oil flows along the Kirkuk-Ceyhan pipeline (estimated at about 150K barrels per day) have since resumed on Wednesday, with the disruption as a result of a falling power pylon, not an attack as some had feared.

So all in all, the one-day disruption amounts to little more than a drop in the ocean in terms of global oil supply. But the news was enough to add further momentum to the idea that global oil markets at the start of 2022 are significantly tighter than expected just a few months ago, whilst demand remains resilient. Recall that smaller OPEC+ nations have struggled to keep up with rising output quotas in recent months, leading to excessively and involuntarily high levels of compliance to the group’s output cut pact (about 127% at the end of 2021).

Meanwhile, geopolitical concerns about supply security have amped up this week amid fears that Russia (the world’s third-largest supplier of roughly 11M barrels per day) might be on the brink of invading Ukraine. Meanwhile, tensions in the Middle East and around the Gulf Strait between the Saudi-led Sunni coalition and Iran-backed Shia militias based in Yemen rose earlier in the week after the former launched a surprise attack on the latter’s oil infrastructure.

Though the IEA, in its monthly report released on Wednesday, said that oil markets would return to surplus after Q1 2022, the agency raised its global demand growth forecast for the year. The agency also warned that commercial oil and fuel stocks in developed countries had fallen to their lowest levels in seven years and, as a result, any potential dents to supply this year could result in higher than usual levels of oil market volatility. Analysts continue to call for tighter than expected oil market conditions in 2022 to result in (Brent) hitting $100 per barrel.

Ahead, attention now turns to the release of weekly US private API inventory figures which will be released at 2130GMT and are likely to show crude oil stocks being drawn on for an eighth consecutive week.

Data released on Wednesday showed the Canadian CPI rose in December to 4.8% (annual), the highest level since 1991. According to analysts at the National Bank of Canada core inflation will likely continue to run around 2.3% and 3%. They see the Bank of Canada raising rates five times during 2022.

Key Quotes:

“The Canadian CPI print for December was in line with consensus expectations. As a result, annual inflation rose one tick to 4.8%, its highest level in just over 30 years. The food component remained vigorous this month and resultingly year on year growth reached 5.2%, its strongest gain since 2009. Excluding food and energy, month over month price increases were slightly stronger than the headline (+0.37%).”

“On a month-over-month basis, our in-house replication shows an acceleration for CPI-Trim (+0.30%) and CPI-Median (+0.24%), as seen for CPI ex-food & energy. On a three-month annualized basis, those two measures are running respectively at 3.0% and 2.3%. This is essentially the pace we are expecting for core inflation over the next few months given current supply chain disruptions and labor shortages.”

“The BoC Business Outlook Survey released earlier this week suggests the persistence of high inflation. Indeed, nearly all firms polled expected inflation above the 2% mark for the next two years with two-thirds expecting above 3% inflation over that same period. What does this mean for the Central Bank and the upcoming normalization of monetary policy? Given this backdrop, the central bank appears to be late in its normalization of monetary policy. We expect five rate hikes this year with the kick-off occurring in March.”

- Pound among top performers supported by UK CPI numbers.

- EUR/GBP extends slide, start looking at 0.8300.

EUR/GBP extends slide and approaches 0The EUR/GBP broke to the downside and fell to 0.8312, reaching the lowest level since February 2020. It remains near the low, under pressure, looking at the 0.8300 area on the back of a stronger pound.

Data from UK boost GBP

Earlier on Wednesday, CPI data from the United Kingdom came in above expectations, with the annual rate reaching 5.4%, above the 5.1% of the previous month and also surpassing the 5.2% expected. The numbers helped anchor expectations about another rate hike from the Bank of England.

“WIRP now suggests that another hike February 3 is fully priced in, followed by hikes at every other meeting that would take the policy rate to 1.25% by year-end. Furthermore, the market now sees 40% odds of a fifth hike this year to 1.50”, said analysts at Brown Brothers Harriman.

Another week, another slide?

The cross is falling for the sevenths consecutive week. The following key level stands at 0.8300, and below attention would turn to 0.8270/75 (2019 and 2020 lows). On the upside, the key resistance is seen at 0.8380. If the euro recovers above it would alleviate the bearish pressure.

Technical levels

- Technical buying has seen XAU/USD break out to fresh multi-month highs above $1835 as the dollar and US yields ease.

- There was likely a run on stops of bears betting on Fed tightening related gold weakness in the low $1830s.

With the dollar taking a breather from its earlier weekly gains and US yields either flat or seeing some modest retracement of recent gains, spot gold (XAU/USD) prices have taken the opportunity to rally to fresh multi-month highs in the $1830s. Technical buying as XAU/USD broke to the north of a negative trendline that has been capping the price action since last Friday has been the main driver of the move. At current levels around $1836, spot gold trades with gains of about 1.3% on the day. Now that the $1830 resistance area has been cleared, gold bulls will likely target a return to Q4 2021 highs near $1880.

Some macro strategists will be surprised at the extent of gold’s gains on Wednesday, which takes the precious metal's weekly gains to more than 1.0%. That’s because, on the week, the US Dollar Index is up about 0.4% and 10-year TIPS (real) yields are up more about 6bps. The moves in FX and bond markets reflect a further pricing of hawkish Fed policy expectations for 2022 and beyond and would typically weigh on gold. A stronger dollar makes USD-denominated gold more expensive for holders of foreign currency, thus reducing its demand, while higher real yields increase the opportunity cost of holding non-yielding precious metals, also reducing demand.

The latest move higher might well represent a stop-run, with gold bears having placed stops just above resistance somewhere in the low-$1830s. These traders would have been caught off guard by the recent move, but that doesn’t mean the threat of higher real yields and a stronger dollar can’t still deliver spot gold prices some damage. If gold markets continue to move higher in a way that is out-of-sync with bond and FX markets, the precious metal is at risk of becoming relatively “expensive” and vulnerable to a retracement lower.

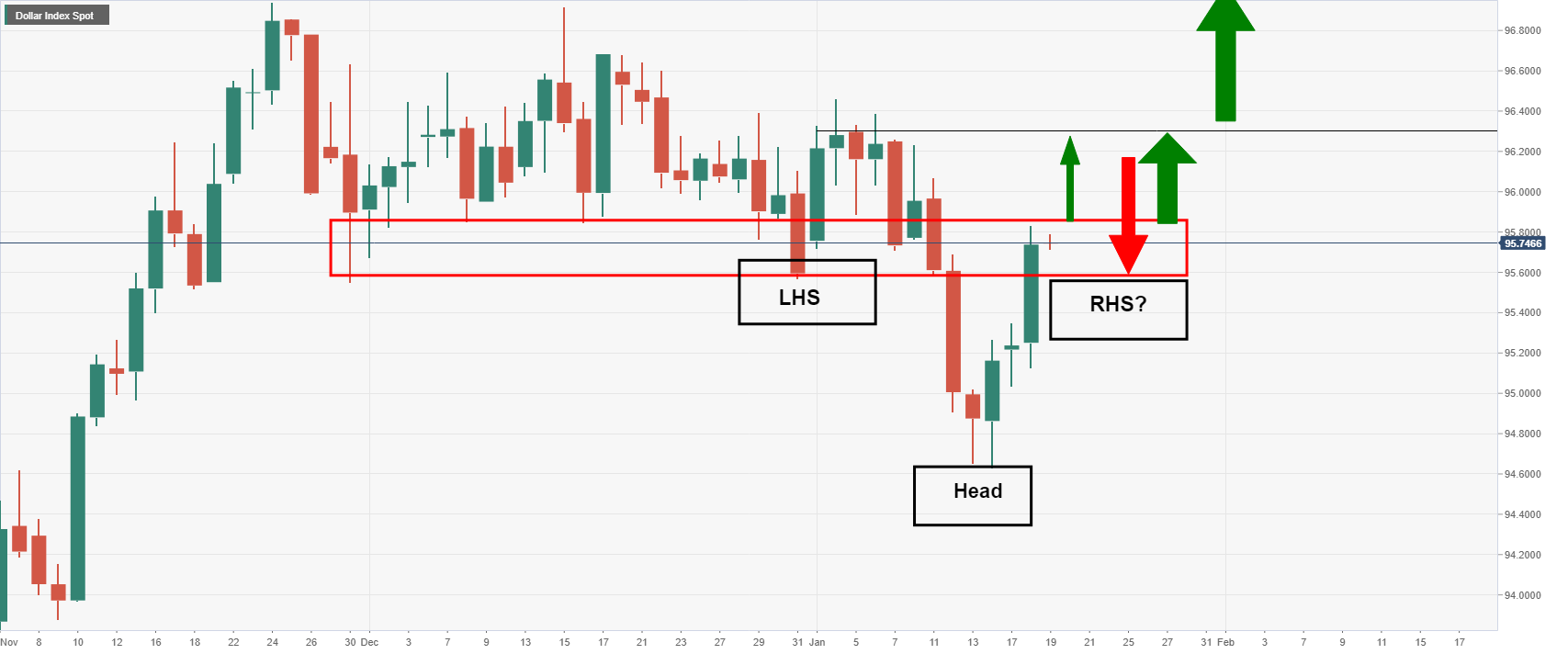

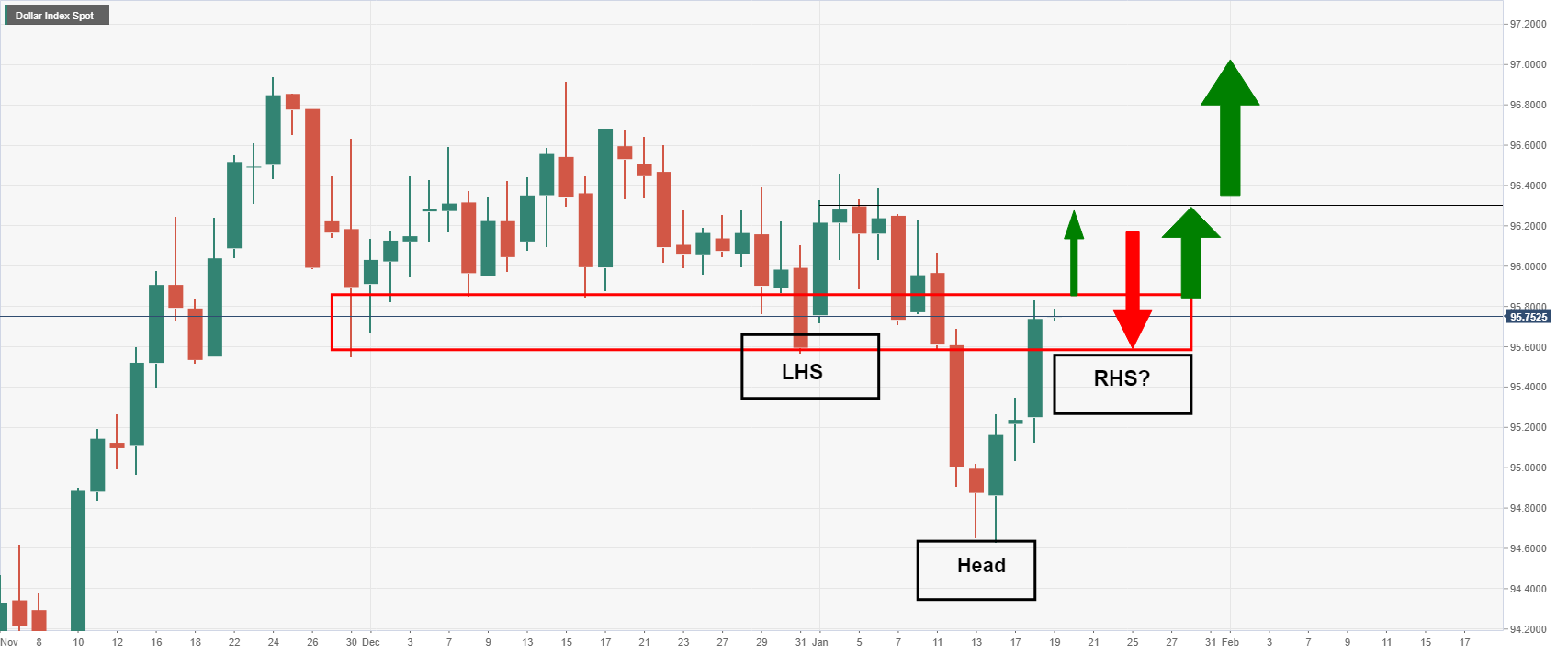

- DXY comes under pressure and flirts with 95.50.

- US yields correct lower and collaborate with the weak dollar.

- US Housing Starts, Building Permits surprised to the upside.

The US Dollar Index (DXY), which gauges the buck vs. a bundle of its main rival currencies, keeps trading in the negative territory around the mid-95.00s in the wake of the opening bell in Wall St on Wednesday.

US Dollar Index weaker on lower yields

The index comes under pressure after climbing as high as the 95.80/85 band earlier in the week, all against the backdrop of the strong rebound in US yields, which saw yields across the curve renew the uptrend and record fresh tops.

Other than higher yields, the constructive view on the greenback also finds support on the prospects of the start of the Fed’s tightening cycle as soon as at the March meeting coupled with the perception that the balance sheet runouff could also begin sooner than many anticipates.

Wednesday’s US calendar saw results in the housing sector coming above expectations in December after Building Permits rose by 1.873M units, or 9%, and Housing Starts rose by 1.702M units, or 1.4%. Earlier in the session, MBA Mortgage Applications rose 2.3% in the week to January 14.

US Dollar Index relevant levels

Now, the index is losing 0.19% at 95.54 and a break above 95.83 (weekly high Jan.18) would open the door to 96.46 (2022 high Jan.4) and finally 96.93 (2021 high Nov.24). On the flip side, the next down barrier emerges at 94.75 (100-day SMA) followed by 94.62 (2022 low Jan.14) and then 93.27 (monthly low Oct.28 2021).

Bank of England Governor Andrew Bailey, who is currently testifying before the UK Parliament's Treasury Select Committee, said on Wednesday that regional agents are seeing some evidence of second-round inflation effects.

Further Remarks:

"Since November, financial markets have pushed back when they expect energy prices to fall."

"Tension on the Ukrainian border with Russia has elevated since November and is a concern for inflation."

"There is a concern that there could be second-round effects on wages."

"BoE regional agents are seeing some evidence of second-round inflation effects."

"There is an argument that higher inflation could restrain demand in the economy and bring inflation back down."

"I would not want to suggest that the Bank of England will not take action on interest rates if necessary."

"Please do not think the BoE does not view inflation pressures as serious."

"We do not see changes in the world economy that would bring interest rates back to levels seen before the global financial crisis."

"Quantitative tightening probably won't have that big an impact on yields if undertaken at a normal time."

"We can and will do everything we can to control inflation."

The EUR is following the dollar-negative tone with a modest 0.2% gain, which has recovered only about a quarter of Tuesday’s decline. As long as EUR/USD trades below 1.1350, economists at Scotiabank expect the pair to eventually break under 1.13.

Euro remains at risk of losses on Russia and Ukraine tensions

“Further to a weak outlook on the basis of monetary policy divergences, the EUR remains at risk of losses on Russia and Ukraine tensions, with the former not letting up in its military pressure.”

“We target a break under 1.13 in the coming weeks to an eventual test of 1.10 as the Fed’s tightening cycle kicks off.”

“EUR/USD will have to break past the mid-1.13 zone and then 1.1375/85 to indicate a possible rebound into the 1.14s.”

“For now, the pair is holding above/around its 50-day MA at 1.1322 that may keep it supported. The big figure and ~1.1280/85 follow as support.”

GBP/USD closed just under 1.36 on Tuesday after three consecutive daily declines that have been met with a decent bounce off the figure during Wednesday’s session. Economists at Scotiabank expect cable to extend its bullish trend.

Cable may continue to be bought on dips below the 1.36 mark

“After weakening from overbought above 1.37, the GBP’s trend remains relatively bullish, particularly as it manages to hold above the 1.36 level and may continue to be bought on dips below this mark.”

“Support after the 1.3590/00 area stands at yesterday’s low of ~1.3575 followed by the mid-figure zone where the 100-day MA at also stands.”

“Above 1.3650/60, resistance is 1.3690/700 and 1.3740/50.”

- USD/CAD has rebounded after briefly dipping below 1.2450 to near 1.2500 despite hotter than expected inflation and higher oil prices.

- Technical support and fading momentum after good recent performance likely explain CAD’s struggles to keep pace with AUD and NZD.

Despite an upside inflation surprise that will likely trigger further speculation about a surprise BoC rate hike next week and further crude oil price upside on Wednesday, USD/CAD was not able to sustainably break below 1.2450. Indeed, the Canadian dollar lags its antipodean counterparts in terms of on-the-day performance and is currently up just 0.1% on the day against the buck versus gains of over 0.5% for the kiwi and Aussie.

The loonie difficulties to keep pace with its non-US dollar peers seem to be driven by technical buying in USD/CAD after the pair bounced at last week’s 1.2450 low, combined with a reluctance to break convincingly below the 200DMA, which resides at bang on 1.2500. At present, the pair trades just under 1.2500.

Waning momentum/difficulties to keep the bearish drive in USD/CAD alive shouldn’t be to surprising given the fact that, on the month, CAD is amongst the best performing G10 currencies and has already come a long way. USD/CAD is already lower by about 1.2% on the month and is over 2.0% below this month’s highs above 1.2800.

Technical support aside, however, with crude oil prices substantially above last week’s levels (when USD/CAD last tested 1.2450) and following further strong domestic data, the case for a lower USD/CAD remains strong. Traders well may see rallies as an opportunity to sell and even if the buck does continue to broadly strengthen this week, are unlikely to express bullish USD views against the loonie so long as the threat of a surprise BoC hike is on the table.

Bank of England Governor Andrew Bailey, who is currently testifying before the UK Parliament's Treasury Select Committee, said on Wednesday that the very tight UK labour market is a concern and has the potential to put upwards pressure on wage negotiations.

Further Remarks:

"Some aspects of current inflation ought to be transitory, such as energy and supply chains."

"Need to keep in mind inflation pressure from the labour market, this influenced my thinking on December rate rise."

"The UK labour market is very tight in terms of supply."

"This week's labour market data shows unemployment broadly back at pre-covid levels, inactivity higher."

"We don't know if people will come back to the labour market or retire early."

"Public sector expansion has created more competition for labour."

"The total labour force is probably smaller than we anticipated, cannot separate out covid and Brexit effects."

"The very tight labour market is a concern."

"The tight labour market has the potential to put upward pressure on wage negotiations."

- USD/TRY remains cautious in the mid-13.00s so far.

- Investors and the lira remain vigilant on the CBRT event.

- The decision on interest rates by the CBRT remains a close call.

The Turkish lira extends the range bound theme and motivates USD/TRY to keep business around the 13.50/60 band so far on Wednesday.

USD/TRY focused on the CBRT

Price action around USD/TRY remains muted for yet another session midweek, always in the mid-13.00s and against the backdrop of increasing cautiousness ahead of the monetary policy meeting by the Turkish central bank (CBRT) on Thursday.

Consensus ahead of the key CBRT event remains well divided, although it seems to prevail, albeit by a scarce margin, the call for an “on hold” decision. In such scenario, it will be the first meeting the CBRT would refrain from acting on rates following the 500 bps rate cuts since the September meeting.

Still around the CBRT, the central bank announced it clinched a 3-year swap deal with the central bank of the United Arab Emirates (CBUAE) worth TL64B and AED18B.

What to look for around TRY

The pair keeps the multi-session consolidative theme well in place, always within the 13.00-14.00 range at least until the CBRT meeting on Thursday. Higher-than-expected inflation figures released earlier in the year put the lira under extra pressure in combination with some cracks in the confidence among Turks regarding the government’s recently announced plan to promote the de-dollarization of the economy. In the meantime, the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are forecast to keep the domestic currency under intense pressure for the time being.

Key events in Turkey this week: CBRT Meeting (Thursday) – Consumer Confidence (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Potential assistance from the IMF in case another currency crisis re-emerges. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is gaining 0.11% at 13.5397 and a drop below 12.7523 (2022 low Jan.3) would pave the way for a test of 12.5482 (55-day SMA) and finally 10.2027 (monthly low Dec.23). On the other hand, the next up barrier lines up at 13.9319 (2022 high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

Bank of France head and ECB governing council member François Villeroy de Galhau said on Wednesday that the ECB will gradually adjust its monetary policy to firmly ensure that inflation recedes soon and stabilises around 2.0% in the medium-term. Villeroy added that this gradual and sequential approach to monetary stimulus withdrawal, starting with tapering, then rate lift-off, then eventually downsizing, is appropriate. We keep full optionality about the speed of this sequence, he added, saying that the ECB will be data-driven.

Market Reaction

The euro has not reacted to Villeroy's latest remarks, which did not reveal anything new on ECB policy.

- Building Permits rose 9.1% and Housing Starts rose 1.4% in December.

- The DXY did not react to the strong housing numbers.

Building Permits shot higher by 9.1% MoM in December to 1.873M over the last 12-months, whilst Housing Starts rose 1.4% MoM to 1.702M over the last 12-months, according to the latest data published jointly by the US Census Bureau and the US Department of Housing and Urban Development on Wednesday. Median economist forecasts had been expecting the December data to show that there had been 1.701M Building Permits in the past 12-months and 1.65M Housing Starts, so the latest numbers were significantly better than expected.

Market Reaction

The DXY did not react to the latest strong housing numbers.

- Headline CPI was in line with expectations at 4.8% YoY.

- But Core CPI was hotter than expected, rising unexpectedly to 4.0% YoY from 3.6% last month.

- The data will likely boost speculation that the BoC hikes rates next week.

Headline Consumer Price Inflation (CPI) in Canada rose to 4.8% YoY in December from 4.7% in November according to the latest release from Statistics Canada on Wednesday. That was in line with consensus economist forecasts. The MoM rate came in at -0.1%, also in line with consensus forecasts for a slight decline from 0.2% in November.

Core CPI, meanwhile, was up 4.0% YoY, a surprise rise from 3.6% in November. The median forecast had been for a slight decline to 3.5% on the month. The BoC's core measures all also rose, with Common coming in at 2.1% YoY, Median at 3.0% (versus 2.8% last month) and Trim at 3.7% (versus 3.4% last month).

Market Reaction

USD/CAD has seen a choppy reaction to the latest data, initially dropping under 1.2450 before retracing to the 1.2460s again, with the hotter than expected inflation data likely to boost speculation that the BoC hike rates next week.

EUR/CAD’s weak tone is extending towards the late November low (lowest since 2017) at 1.4165. A break below here would open up the 1.37/38 region, economists at Scotiabank report.

Key resistance aligns at 1.4615

“We note that technical trend (DMI) oscillators are aligned bearishly for the EUR at this point across the intraday, daily and weekly signals, suggesting limited scope for counter-trend EUR corrections (higher) and ongoing pressure on the downside for the cross.”

“A retest of 1.4165 seems just a matter of time and we continue to see downside risks extending towards 1.37/1.38 (at least) on a break below this point.”

“EUR/CAD resistance is 1.4375/80, with 1.4615 still the level the EUR needs to beat in order to stabilize from a longer run, technical point of view.”

- With the US dollar taking a breather on Wednesday after Tuesday’s gains, GBP/USD has recovered back above 1.3600.

- Sterling remains unfazed by political uncertainty, though did derive some support from hot inflation figures which boosted BoE tightening calls.

Despite growing political uncertainty as momentum builds towards a vote of no-confidence within the UK Conservative Party that has the potential to oust UK PM Boris Johnson from the top spot, sterling has been a beneficiary of recent USD weakness. The buck is taking a breather on Wednesday after hitting one-week highs on Tuesday on hawkish Fed bets and widening rate differentials irrespective of weak NY Fed manufacturing survey data, enabling GBP/USD to recover back above 1.3600. At current levels near 1.3640, the pair trades about 0.6% above Asia Pacific session lows and nearly 0.4% higher on the day and is eyeing a test of resistance at 1.3650.

Sterling has been getting independent bullish impetus from another inflation surprise on Wednesday plus confirmation from PM Johnson that “Plan B” Covid-19 restrictions will end next week, as expected. In terms GBP’s reluctance to reflect the risk that Johnson is unseated from the top spot, traders seem to be reasoning that even if the UK PM does go, his likely replacement wouldn’t herald a major economic policy shift.

Turning to Wednesday’s inflation data; headline Consumer Price Inflation hit 5.4% YoY in December, above the expected 5.2%, while core inflation surprisingly rose to 4.2% YoY versus expectations for a drop to 3.9% from 4.0% in November. Traders said the data boosted the likelihood that the BoE hikes rates at its February 3 meeting and UK money markets on Wednesday are impling a 90% likelihood of a 25bps rate hike to 0.5% the week after next. Its also likely that PM Johnson’s as expected confirmation on Wednesday that “Plan B” Covid-19 restrictions will be eased as planned next week will strengthen the BoE’s conviction that the economic impact of the variant will be short-lived.

“The Bank of England was already feeling uncomfortable about its monetary policy stance” one analyst at JP Morgan told Reuters. “Today's upside surprises to both the headline and core inflation readings will certainly not have helped,” the analyst. “The strength of the labour market will give the Bank of England the confidence to continue to remove support for the economy as it looks to get a better handle on inflation” they continued.

AUD/USD continues to edge lower. A close below the well-defined channel uptrend at 0.7174/69 would rule out further corrective strength, economists at Credit Suisse report.

Aussie to turn bearish again on a closing break below 0.7174/69

“A break below the short-term channel bottom at 0.7174/69 would now be sufficient to end the corrective recovery potential and turn the risks directly lower.

“Our medium-term bearish view is based on the major top completed last year and the clearly negative trend following setup. With this in mind, next supports are seen at 0.7129, then 0.7089/82, below which would trigger a retest of next support at 0.6992/91. Below here would then open up an eventual move to 0.6758, which remains our core medium-term objective.”

“Short-term resistance moves to 0.7229/31, above which would reassert the potential for a test of the back of the broken channel and retracement resistance at 0.7349/60, which we look to cap if reached.”

“Only a weekly close above 0.7349/60 would negate the very large topping structure that we have been highlighting recently, which is not our base case.”

UK Prime Minister Boris Johnson on Wednesday confirmed that, as expected, "Plan B" Covid-19 restrictions in England will expire next week and the country will return to "Plan A". That means the recommendation for people to work from home will be dropped and that face mask requirements will be eased. The PM said the data vindicated the government's decision not to go with even tougher restrictions back in December, with the spread of Omicron looking to have peaked nationally and hospital admissions having stabilised.

Market Reaction

GBP has been advancing in recent trade, boosted by hot Consumer Price Inflation data and perhaps also be Johnson's latest announcement. The pair currently trades in the 1.3640 area, up nearly 0.4% on the day.

The Mexican peso has recovered well after the double-whammy of the Omicron news in late November and the surprise announcement of Victoria Rodriguez Soja as the new Banxico Governor. Looking ahead, economists at ING expect the USD/MXN to trade around the 21.00 level.

Will the new Banxico governor back a big hike?

“The December Banxico meeting saw a surprise 50bp adjustment to 5.50%, helping the Peso, but 10 February is the first meeting with Rodriguez in charge. Will she back another 50bp hike?”

“Our core view on the MXN this year is that as long as Banxico keeps a 550-600bp spread over the Fed, then USD/MXN should be comfortable trading near 21.00.”

“2022 growth is expected at 2.8% (much better than Brazil) and the Mexico remittance story should remain strong.”

- EUR/USD has stabilised just under 1.1350 on Wednesday after Tuesday’s sharp yield differential widening fuelled drop from above 1.1400.

- With market participants expecting the ECB’s transitory inflation call to prove correct but upping hawkish Fed bets, EUR/USD risks further downside.

After Tuesday’s sharp downside that saw EUR/USD shed as much as 0.7% (its worst day since January 3) and slide from above 1.1400 to as low as the 1.1320s, the pair is stabilising just under 1.1350 on Wednesday. At current levels near-1.1340, EUR/USD is up about 0.1% on the day and for now seems content to range close to the 21 and 50-day moving averages at 1.1343 and 1.1324 respectively. Traders attributed a sharp rise in long-term US/Eurozone bond yield spreads on Tuesday which saw the US 10-year’s rate advantage over the German 10-year hit its highest levels since late-November above 188bps as weighing on the pair. Ahead, it should be a reasonably quiet session with just US Building Permits data at 1330GMT worth noting.

Much attention was made of German 10-year yields surpassing 0.0% for the first time since May 2019 on Wednesday and indeed, the US/German 10-year spread is unchanged in the 188bps region on Wednesday, suggesting that EUR/USD consolidation is appropriate. But heading into next week’s Fed meeting which is unanimously expected to be a hawkish affair, EUR/USD traders will be keeping an eye on whether the US/German 10-year spread can rally further to test November highs above 192bps which could coincide with EUR/USD pushing back towards recent lows in the 1.1200 area.

A Reuters poll released on Wednesday suggested that market participants agree that Eurozone inflation will drop back under 2.0% by the year’s end and do not view the ECB as likely to begin hiking interest rates before 2023. That suggests markets continue to buy heavily into the story that while the exit from extraordinary ECB stimulus is on the horizon, the central bank’s monetary tightening plans are set to lag the Fed by a large margin. Indeed, consensus Fed calls are for as many as eight rate hikes by the end of 2023. It is thus not surprising to see that the US/German 2-year spread continues to surge and is on Wednesday trading at its highest since March 2020 at near 165bps. With some analysts calling for the US 2-year yield to hit 1.5% in the coming months (currently at 1.05%), further widening of US/Eurozone 2-year spreads is another reason to favour a lower EUR/USD.

- EUR/USD regains the smile following recent strong pullback.

- The YTD low at 1.1272 emerges as the next support.

EUR/USD regains some buying interest after bottoming out in the proximity of 1.1310 on Tuesday.

The bias appears tilted to further retracement in the very near term. That said, a deeper decline remains on the cards if spot breaks below the weekly low at 1.1314 (January 18). Such a move should open the door to a test of the so far YTS low at 1.1272 (January 4).

The longer term negative outlook for EUR/USD is seen unchanged while below the key 200-day SMA at 1.1722.

EUR/USD daily chart

- DXY meets some decent resistance in the 95.80 region.

- The upside remains underpinned by the 4-month line near 95.30.

DXY gives away part of the recent strong advance and returns to the 95.50 zone on Wednesday.

The intense upside in the dollar has recently surpassed the 4-month line, today around 95.25, and in doing so it has reinstated the bullish bias in the near term. That said, the next target of note should now come at the YTD high at 96.46 recorded on January 4 ahead of the 2021 high at 96.93 (November 24).

Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.17.

- EUR/JPY extends the leg lower to new 2022 lows near 129.40.

- Next on the downside comes the Fibo level at 128.82.

EUR/JPY struggles for direction around 129.80 after the earlier bullish attempt ran out of steam near the 130.00 barrier on Wednesday.

Price action in the cross now seems to favour extra decline in the short-term horizon, particularly after EUR/JPY remains unable to retest/surpass the YTD peaks in the 131.50/60 region (January 5). Against that, extra losses could retest the Fibo level (of the October-December drop) at 128.82.

While below the 200-day SMA, today at 130.53, the outlook for the cross is expected to remain negative.

EUR/JPY daily chart

- Gold is edging modestly higher during the European trading hours.

- 10-year US Treasury bond yield continues to rise toward 2%.

- XAU/USD could struggle to gather recovery momentum if $1,820 resistance holds.

Gold lost 0.3% on Tuesday and seems to have gone into a consolidation phase during the first half of the day on Wednesday. XAU/USD was last seen rising 0.2% on the day at $1,817 and investors remain focused on US Treasury bond yields.

The benchmark 10-year US T-bond yield reached its highest level in two years at 1.9% on Wednesday with investors reacting to speculations that the Fed could opt for a 50 basis points rate hike in March. Supported by surging yields, the US Dollar Index has already erased the majority of the losses it suffered last week. In case the 10-year yield rises above the key 2% mark, the dollar could continue to find demand and trigger another leg lower in XAU/USD.

Later in the day, December Housing Starts and Building Permits will be featured in the US economic docket but these data are unlikely to cause a noticeable market reaction.

Gold technical analysis

Gold continues to trade above the 100-period SMA on the four-hour chart, which is currently located near $1,810, suggesting that sellers remain on the sidelines for the time being. Supporting that view, the Relative Strength Index (RSI) indicator on the same chart has recovered to 50.

$1,820 (Fibonacci 23.6% retracement of the latest uptrend) aligns as first resistance. In case the pair manages to flip that level into support, it could target $1,824 (static level) and $1,830 (static level). On the downside, supports align at $1,810 (100-period SMA), $1,808 (Fibonacci 50% retracement) and $1,804 (Fibonacci 61.8% retracement).

The krone has started the year on the front-foot. Prospects of Norges Bank tightening should drift the EUR/NOK pair lower towards the 9.80 zone, according to economists at ING.

The case for four hikes may get increasingly strong

“Norges Bank should not be in any rush to hike again in January, and may use the meeting to merely signal a move in March.”

“We think the case for four hikes may get increasingly strong, and we expect NOK to remain supported in the coming months, with EUR/NOK that may approach the 9.80 region already in 1Q.”

FX option expiries for January 19 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.1375 348m

- 1.1400 327m

- GBP/USD: GBP amounts

- 1.3330 363m

- 1.3600 410m

- USD/JPY: USD amounts

- 114.50 663m

- 115.00 512m

- 116.00 1.2b

- AUD/USD: AUD amounts

- 0.7245 440m

EUR/JPY has bounced back into the middle of its long-term 128-134 range. Economists at ING expect the pair to turn back higher by year-nd and reach the 140 level in 2023.

The equity market hedge

“EUR/JPY only seems to hit the headlines when equities start to sell off sharply and the JPY briefly outperforms. What of equity markets? Yes, higher US bond yields may favour value over growth stocks, but we favour 2022 being another year of (more modest) equity gains.”

“EUR/JPY could have a slight wobble around European politics in Italy (late January) or France (late April).”

“By year-end, EUR/JPY should be back on the up as the ECB prepares for a March-23 rate hike. EUR/JPY can hit 140 in 2023.”

- EUR/USD reclaims some ground lost in the mid-1.1300s.

- The knee-jerk in the greenback helps the recovery in the pair.

- German final December CPI rose 0.5% MoM and 5.3% YoY.

Finally, some respite for the single currency now motivates EUR/USD to leave behind the area of recent lows and retake the 1.1350 region on Wednesday.

EUR/USD focused on dollar, yields

EUR/USD sees some light at the end of the tunnel after three consecutive daily pullbacks that dragged spot from YTD highs around 1.1480 to Tuesday’s so far weekly low in the 1.1315/10 band.

Once again, dollar dynamics were the exclusive catalyst for the price action around the pair, always tracking the solid performance of US yields across the pond, which keep navigating in fresh tops. In addition, yields of the key German 10y Bund returned to the positive territory for the first time since May 2019.

Data wise in the region, final December inflation figures in Germany showed the CPI rose 5.3% over the last twelve months and 0.5% vs. the previous month. In addition, the Current Account surplus in Euroland widened to €26B in November and the Construction Output expanded 4.4% in the year to November.

Later in the US calendar MBA Mortgage Applications, Building Permits and Housing Starts will be in the limelight.

What to look for around EUR

EUR/USD came under pressure after hitting new YTD highs in the 1.1480 region earlier in the month, finding some contention in the low-1.1300s so far this week. In the meantime, the Fed-ECB policy divergence and the performance of yields are expected to keep driving the price action around the pair for the time being. ECB officials have been quite vocal lately and now acknowledge that high inflation could last longer in the euro area, sparking at the same time fresh speculation regarding a move on rates by the central bank by end of 2022. On another front, the unabated advance of the coronavirus pandemic remains as the exclusive factor to look at when it comes to economic growth prospects and investors’ morale in the region.

Key events in the euro area this week: Germany Final December CPI (Wednesday) – EMU Final December CPI, ECB Accounts (Thursday) - ECB Lagarde, EC’s Flash Consumer Confidence (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. ECB stance/potential reaction to the persistent elevated inflation in the region. ECB tapering speculation/rate path. Italy elects President of the Republic in late January. Presidential elections in France in April.

EUR/USD levels to watch

So far, spot is gaining 0.16% at 1.1342 and faces the next up barrier at 1.1482 (2022 high Jan.14) followed by 1.1491 (100-day SMA) and finally 1.1510 (200-week SMA). On the other hand, a break below 1.1314 (weekly low Jan.14) would target 1.1272 (2022 low Jan.4) en route to 1.1221 (monthly low Dec.15 2021).

The Swiss franc remains super-strong and the Swiss National Bank (SNB) does not seem to mind too much at all. Economists at ING think the EUR/CHF pair is set to move downward in the first half of the year.

SNB seems to welcome FX strength

“Despite continuing to refer to the CHF as ‘highly valued’ and willing to intervene against it, December’s press conference also saw SNB’s Thomas Jordan welcoming CHF strength as a means to limit import prices!”

“Perhaps like Chinese authorities the SNB is happy to ride out the commodity boom with a stronger currency. This suggests there is no EUR/CHF line in the sand for the SNB – or at least based on real exchange rate levels, the line is nearer 1.00.”

“Italian and French politics and Russian tensions could keep EUR/CHF pressured in 1H22. Pricing of 2023 ECB hikes could help later in 2022.”

EUR/RON continues to struggle to surpass the 4.95 mark. Economists at ING believe that the pair will be able to reach the 5.00 level in the last quarter of the year.

Hitting a wall at 4.95

“The NBR continued with rate hikes ‘at its own pace’, which currently means that Romania has the lowest key rate of the CE4 group. Given the large twin deficits and high inflation, we believe that this situation is sustainable for only the very short term.”

“As expected, 4.95 is a very strong resistance as official offers seem to prop the leu by as much as needed. We expect much of the same for most of 2022.”

“EUR/RON will not depart from the current levels before inflation is safely on a downward trend. This seems to be a matter for the last quarter of 2022 when we expect the pair to hit the 5.00 level.”

- GBP/USD continues to find strong support sub-1.3600 levels.

- Hotter UK inflation and softer US dollar help the rebound in cable.