- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-12-2024

South Korean Finance Minister, Choi Sang-mok, said on Thursday that the officials will prepare foreign exchange (FX) stability and liquidity measures in the 2025 policy plan.

Key quotes

Will take market-stabilising measures if volatility is excessive.

Will prepare FX stability and liquidity measures in the 2025 policy plan.

Market reaction

At the press time, the USD/KRW pair was down 0.44% on the day to trade at 1452.88.

- NZD/USD tumbles to near 0.5630 in Thursday’s early Asian session, down 0.43% on the day.

- Weaker-than-expected New Zealand’s GDP data weighs on the Kiwi.

- The Fed announced a quarter-point cut to its key interest rate at its December meeting on Wednesday.

The NZD/USD pair attracts some sellers to around 0.5630 during the early Asian session on Thursday. The weaker-than-expected New Zealand’s Gross Domestic Product (GDP) data and hawkish rate cut by the US Federal Reserve (Fed) exert some selling pressure on the pair.

The downbeat GDP data puts New Zealand into the deepest recession since the initial Covid-related slump in 2020. Data released by Statistics New Zealand on Thursday showed that the country’s GDP shrank by 1.0% QoQ in the third quarter (Q3) compared with a 1.1% contraction (revised from -0.2%) in Q2. This reading was below the market consensus of -0.4%. On an annual basis, Q3 GDP contracted by 1.5% versus -0.5% prior, weaker than the -0.4% expected. In response to the data, the Kiwi falls to the lowest level since October 2022 against the US Dollar (USD).

”It supports the Reserve Bank getting on with official cash rate cuts and getting the OCR back to a more neutral level more quickly than they were anticipating in the November monetary policy statement,” said Harbour Asset Management fixed income and currency strategist Hamish Pepper.

On the other hand, a more hawkish-than-expected message from the Fed provides some support to the Greenback and acts as a headwind for NZD/USD. The US central bank decided to lower its key interest rate by a quarter percentage point on Wednesday, the third consecutive rate reduction. The Fed officials indicated that it probably would only lower twice more in 2025. During the Press Conference, Fed Chair Jerome Powell said, “We can therefore be more cautious as we consider further adjustments to our policy rate.”

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- The Bank of Japan will likely hold interest rates at 0.25% on Thursday.

- The language in the policy statement and Governor Kazuo Ueda’s press conference will hold the key.

- The BoJ policy announcements could ramp up volatility in the Japanese Yen.

After concluding its two-day monetary policy review on Thursday, the Bank of Japan (BoJ) is expected to hold the short-term interest rate at 0.25%.

The BoJ policy announcements will likely provide fresh cues on the central bank’s rate hike outlook, injecting intense volatility in the Japanese Yen (JPY)

What to expect from the BoJ interest rate decision?

As widely expected, the BoJ is set to pause its rate-hiking cycle for the third consecutive meeting in December. Therefore, the tone of the policy statement and Governor Kazuo Ueda’s post-policy meeting press conference, due at 06:30 GMT, will hold the key for gauging the timing of the next rate hike by the BoJ.

Markets have almost priced out a potential rate hike this week after Reuters and Bloomberg News cited people familiar with the BoJ thinking, noting that the Japanese central bank was considering keeping interest rates steady at its December meeting.

One of the sources quoted by Reuters said that “policymakers prefer to spend more time scrutinising overseas risks and clues on next year's wage outlook.”

Wages in Japan have been rising at an annual pace of around 2.5% to 3%, causing inflation to remain above the central bank's 2% target for well over two years.

The BoJ’s closely watched broader price trend indicator, the “core-core" Consumer Price Index (CPI) –excluding both fresh food and energy costs–, rose 2.3% in October from a year earlier, accelerating from a 2.1% gain in September. Further, revised third-quarter Gross Domestic Product (GDP) data showed Japan's economy expanded an annualised 1.2%, at a faster pace than initially reported.

However, falling household spending and a downward revision to the private consumption data hinted at a dwindling Japanese economic recovery. Additionally, BoJ policymakers would prefer to wait for the November CPI report and the start of United States (US) President-elect Donald Trump’s administration before the next rate lift-off.

Analysts at BBH said: “The two-day Bank of Japan meeting ends Thursday with a widely expected hold. The market sees only 15% odds of a hike after several reports emerged that a pause was being considered. The risk is the BoJ paves the way for a January rate hike. The odds of a hike rise to 70% at the January 23-24 meeting, when updated macro forecasts will be released.”

How could the Bank of Japan's interest rate decision affect USD/JPY?

BoJ Governor Kazuo Ueda said in his recent public appearance that the next interest rate hikes are "nearing in the sense that economic data are on track.” "I would like to see what kind of momentum the fiscal 2025 Shunto (spring wage negotiation) creates,” Ueda added.

In case the BoJ fails to provide a clear indication of the next interest rate hike by sticking to its rhetoric that monetary policy will be decided on a meeting-by-meeting basis depending on available data, the Japanese Yen is likely to extend its bearish momentum against the US Dollar (USD).

The JPY, however, could see a sharp corrective upside if the BoJ explicitly indicates that a rate hike is coming in January while acknowledging the encouraging economic prospects.

Any knee-jerk reaction to the BoJ policy announcements could be short-lived heading into Governor Ueda’s presser and as markets digest Wednesday’s policy decision by the US Federal Reserve (Fed).

From a technical perspective, Dhwani Mehta, Asian Session Lead Analyst at FXStreet, notes: “USD/JPY faces two-way risks heading into the BoJ rate call, with a 21-day Simple Moving Average (SMA) and 50-day Bear Cross in play. Meanwhile, the 14-day Relative Strength Index (RSI) holds well above the 50 level.”

“A hawkish BoJ hold could add extra legs to the ongoing USD/JPY correction, drowning the pair toward the 152.20 area, the confluence of the 21-day SMA, 50-day SMA and the 200-day SMA. The next relevant support aligns near 151.00, at the December 10 and 11 lows. Additional declines could challenge the 150.00 psychological support. Conversely, buyers must reclaim the three-week high of 154.48 to negate the near-term bearish bias. The July 24 high of 155.99 will be next on their radars en route to the 156.50 barrier,” Dhwani adds.

Economic Indicator

BoJ Interest Rate Decision

The Bank of Japan (BoJ) announces its interest rate decision after each of the Bank’s eight scheduled annual meetings. Generally, if the BoJ is hawkish about the inflationary outlook of the economy and raises interest rates it is bullish for the Japanese Yen (JPY). Likewise, if the BoJ has a dovish view on the Japanese economy and keeps interest rates unchanged, or cuts them, it is usually bearish for JPY.

Read more.Next release: Thu Dec 19, 2024 03:00

Frequency: Irregular

Consensus: 0.25%

Previous: 0.25%

Source: Bank of Japan

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan embarked in an ultra-loose monetary policy in 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds. In March 2024, the BoJ lifted interest rates, effectively retreating from the ultra-loose monetary policy stance.

The Bank’s massive stimulus caused the Yen to depreciate against its main currency peers. This process exacerbated in 2022 and 2023 due to an increasing policy divergence between the Bank of Japan and other main central banks, which opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy led to a widening differential with other currencies, dragging down the value of the Yen. This trend partly reversed in 2024, when the BoJ decided to abandon its ultra-loose policy stance.

A weaker Yen and the spike in global energy prices led to an increase in Japanese inflation, which exceeded the BoJ’s 2% target. The prospect of rising salaries in the country – a key element fuelling inflation – also contributed to the move.

New Zealand's Gross Domestic Product (GDP) shrank by 1.0% QoQ in the third quarter (Q3) compared with a 1.1% contraction (revised from -0.2%) in the second quarter, the Australian Bureau of Statistics (ABS) showed on Thursday. This reading came in weaker than expectations of -0.4%.

The annual third-quarter GDP contracted by 1.5%, compared with a decline of 0.5% in Q2, while below the consensus of a 0.4% decrease.

Market reaction to New Zealand’s GDP data

The New Zealand Dollar attracts some sellers in an immediate reaction to the GDP report. The NZD/USD pair is trading at 0.5622, losing 0.63% on the day.

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

What you need to take care of on Thursday, December 19:

Financial markets spent most of the day in wait-and-see mode ahead of the Federal Reserve’s (Fed) monetary policy announcement.

The Fed delivered, as expected, a hawkish cut, resulting in the US Dollar soaring amid a risk-averse environment. Early in Asia, the Greenback pressures fresh weekly highs across the board, maintaining the strong positive momentum.

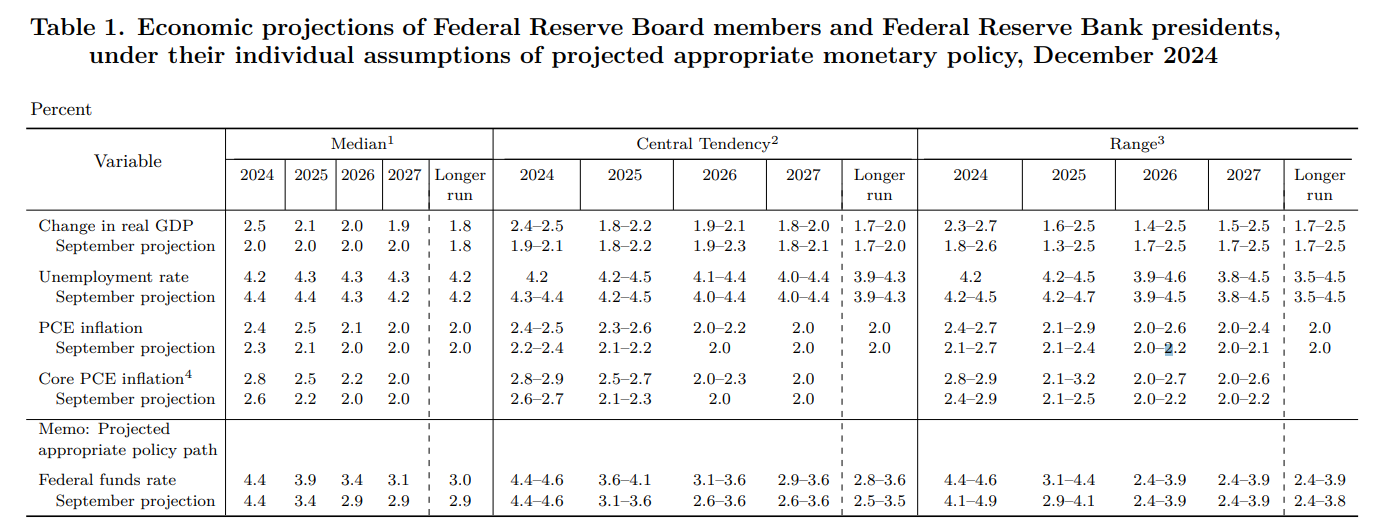

Following the anticipated 25 basis points (bps) rate cut, investors were surprised by a dot plot showing just two potential rate cuts in 2025, quite a hawkish shift. Later, Chair Jerome Powell sounded even more hawkish, saying the economy remains strong and that they have likely avoided a recession.

Earlier in the day, the United Kingdom (UK) published its monthly inflation report, which showed the Consumer Price Index (CPI) rose 2.6% on a yearly basis in November after advancing by 2.3% in October. Core annual inflation rose 3.5%, higher than the 3.3% previous and below the expected 3.6%.

As Asian trades reach their desks, the EUR/USD pair trades near 1.0332, the 2024 low, while GBP/USD hovers around 1.2580. Commodity-linked currencies were among the worst performers amid Wall Street collapsing. The AUD/USD hovers around 0.6220 while the USD/CAD trades at 1.4429, and both the CAD and the AUD trading at fresh year lows vs the US Dollar.

Safe-haven assets also shed ground against the USD. The USD/JPY pair trades around 154.60, near a fresh December high, while Gold fell through the $2,600 mark for the first time in a month.

Coming up next is the Bank of Japan (BoJ). The central bank is expected to keep rates on hold this time, albeit a rate hike can not be ruled out. Governor Kazuo Ueda will offer a press conference afterwards.

Later in the day, the Bank of England (BoE) will announce its decision on monetary policy early on Thursday. The BoE is expected to keep the main interest rate on hold, as Governor Andrew Bailey remarked on the need for a gradual approach. At the same time, Bailey recently SAID that four rate cuts are possible in 2025 if inflation continues its downward trajectory.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 1.17% | 1.04% | 0.73% | 0.84% | 1.74% | 1.64% | 0.85% | |

| EUR | -1.17% | -0.12% | -0.42% | -0.32% | 0.56% | 0.47% | -0.31% | |

| GBP | -1.04% | 0.12% | -0.31% | -0.20% | 0.69% | 0.60% | -0.18% | |

| JPY | -0.73% | 0.42% | 0.31% | 0.10% | 1.00% | 0.93% | 0.13% | |

| CAD | -0.84% | 0.32% | 0.20% | -0.10% | 0.89% | 0.79% | 0.02% | |

| AUD | -1.74% | -0.56% | -0.69% | -1.00% | -0.89% | -0.09% | -0.86% | |

| NZD | -1.64% | -0.47% | -0.60% | -0.93% | -0.79% | 0.09% | -0.77% | |

| CHF | -0.85% | 0.31% | 0.18% | -0.13% | -0.02% | 0.86% | 0.77% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Federal Reserve Chairman Jerome Powell explains the decision to cut the policy rate, federal funds rate, by 25 basis points to the range of 4.25%-4.5% after the December meeting and responds to questions in the post-meeting press conference.

Key quotes

"Geopolitical turmoil remains a risk."

"There's high uncertainty projecting the economy 3 years ahead."

"It's been frustrating, progress on inflation is slower than hoped."

"Still, feeling good about where we are headed."

"We won't settle for above 2% inflation."

"We have every intention of getting inflation to 2%, I am confident we will achieve."

"We have made a great deal of progress."

"We don't rule things in or out."

"Rate hike does not appear to be a likely outcome next year."

Federal Reserve Chairman Jerome Powell explains the decision to cut the policy rate, federal funds rate, by 25 basis points to the range of 4.25%-4.5% after the December meeting and responds to questions in the post-meeting press conference.

Key quotes

"Lower hiring rate is a signal of softening in labor market."

"Wages are at a healthy, evermore sustainable level."

"Labor market is cooling in an orderly way."

"People are feeling the effect of high prices, not high inflation."

"Best we can do is to get inflation back to target and keep it there, so wage growth is faster than inflation."

"I expect another very good year next year."

"From here it's a new phase, we are going to be cautious about further cuts."

"It's appropriate to proceed cautiously."

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- EUR/USD experiences sharp decline in response to the Federal Reserve's 25 basis point rate cut paired with a cautious outlook on future policy adjustments.

- Fed Chair Jerome Powell emphasizes a careful approach to further rate changes, noting persistent inflation risks, stable labor market.

- Fed's updated economic projections indicate only modest rate reductions in the coming years, setting the federal funds rate target at 3.4% by 2026.

The EUR/USD sank sharply after the Fed cut interest rates but also adopted a slightly hawkish stance, as the central bank estimates 100 basis points of easing toward the next two years. At the time of writing, the pair trades below 1.0400, volatile.

EUR/USD pair tumbles below 1.0400 as Fed Chair Jerome Powell speaks

In his press conference, Powell said that the central bank could be more cautious about considering additional adjustments, acknowledging that the policy is less restrictive. He added that risks and uncertainty around inflation are skewed to the upside and added that higher inflation is one of the reasons for the adjustment to the dot plot.

Jerome Powell added that it could take a year or two for inflation to get to the 2% goal, adding that the labor market is not cooling in a way that raises concerns.

The Federal Reserve cut rates by 25 basis points to the 4.25%-4.50% range, yet the decision was not unanimous, as Cleveland Fed President Beth Hammack voted to keep rates unchanged.

The statement changed little from the last meeting, though traders were focused on the Summary of Economic Projections (SEP).

The central bank's monetary policy statement revealed that economic activity continued to expand solidly and acknowledged the labor market conditions had eased. Despite the improvement in employment, Fed policymakers decided to keep the language of “The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance.”

Meanwhile, the SEP showed that officials penciled just two rate cuts in 2025 and 2026, driving the fed funds rate to 3.4% in 24 months.

EUR/USD Reaction to Fed's Chair Powell press conference

The EUR/USD has plunged sharply, clearing the 1.0450 psychological level, extending its losses toward the day's lows at 1.0410. The pair would remain trading volatile, as Fed Chair Powell takes the stand. Immediate resistance is seen at the December 13 low of 1.0452, and support at 1.0400. If cleared, the next support would be the YTD low of 1.0331.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Federal Reserve Chairman Jerome Powell explains the decision to cut the policy rate, federal funds rate, by 25 basis points to the range of 4.25%-4.5% after the December meeting and responds to questions in the post-meeting press conference.

Key quotes

"We do think labor market is still cooling, watching it closely."

"Labor market is not cooling in a way that raises concerns."

"We are in a new phase in the process."

"We are still meaningfully restrictive, closer to neutral, appropriate to move cautiously."

"We've done a lot to support economic activity."

"From now we are in a place where we need to see progress on inflation."

"We moved quickly to get to here, going forward we will move slower."

Federal Reserve Chairman Jerome Powell explains the decision to cut the policy rate, federal funds rate, by 25 basis points to the range of 4.25%-4.5% after the December meeting and responds to questions in the post-meeting press conference.

Key quotes

"The US economy is performing very, very well."

"No reason to think a downturn is any more likely than usual."

"We have to continue to have restrictive policy to get inflation to 2%."

"I'm confident in the story of why inflation has come down, why that portends well."

"Housing inflation has come down steadily."

"Goods inflation has returned to pre-pandemic range overall."

"Story of why inflation should be coming down is still intact."

"Job market is cooler by so many measures now."

"Inflation is still unwinding from large shocks in 2021 and 2022."

"It might take another year or two from here to get to 2%."

- USD/CAD spikes after the Federal Reserve reduces interest rates by 25 basis points to a range of 4.25%-4.50%.

- Federal Reserve’s decision was nearly unanimous, with Cleveland Fed President Beth Hammack casting the sole dissenting vote.

- The Summary of Economic Projections (SEP) reveals only two anticipated rate cuts through 2025 and 2026, aiming for a federal funds rate of 3.4%.

The USD/CAD soared to fresh yearly highs after the Federal Reserve slashed interest rates at the December meeting while opting to adopt a gradual approach to monetary policy next year. At the time of writing, the pair trades volatile at around 1.4400.

USD/CAD rallies following a Federal Reserve rate cut and projections of four rate cuts in two years

The Federal Reserve lowered interest rates by 25 basis points, setting the target range to 4.25%-4.50%. The decision was not unanimous, with an 11 to 1 vote, as Cleveland Fed President Beth Hammack voted to hold rates. While the accompanying policy statement saw only minor adjustments from the previous meeting, traders' attention shifted to the newly released Summary of Economic Projections (SEP).

The Fed's statement highlighted solid economic growth and a gradual easing of labor market conditions. Despite this, the committee reiterated, "The risks to achieving its employment and inflation goals are roughly in balance."

According to the SEP, officials expect only two rate cuts across 2025 and 2026, which would bring the federal funds rate down to 3.4% over the next two years.

Other projections indicate that the Fed’s preferred inflation measure, the Core PCE, is expected to decline gradually, ending at 2.8% in 2024, 2.5% in 2025, and 2.2% in 2026. On the growth front, the economy is projected to expand by 2.5% in 2024, 2.1% in 2025, and 2.0% in 2026.

The Unemployment Rate is expected to end the current year at 4.4% and remain unchanged at 4.3% in 2025 and 2026.

USD/CAD Reaction to Fed’s decision

The USD/CAD refreshed four-year highs, climbing past the March 2020 peak of 1.4349, which opened the door to test the 1.4400 figure. The pair has climbed past the latter and is eyeing a 2020 peak of 1.4560, but first, buyers must clear the 1.4500 psychological figure. In the event of a pullback, the pair's first support would be 1.4400, followed by the 1.4350 figure.

Federal Reserve Chairman Jerome Powell explains the decision to cut the policy rate, federal funds rate, by 25 basis points to the range of 4.25%-4.5% after the December meeting and responds to questions in the post-meeting press conference.

Key quotes

"Committee is discussing ways in which tariffs can drive inflation, we've done a good bit of work on that."

"That puts us in place to make a careful assessment of appropriate policy response to tariffs."

"There are many factors for how much tariffs will even go into consumer inflation."

"Premature to make any conclusion on impact of tariffs, don't know what countries, what size, how long."

"Don't know that 2018 is much of a guide to what will happen this time."

"We are at the stage of thinking through questions, not getting to definitive answers for some time."

"Core inflation coming down to 2.5% next year, as in projections, would be significant progress."

"We also have to think about the labor market, mindful it is gradually cooling."

"We expect significant policy changes, we need to see what they are and the effects to get a clearer picture."

"We will be looking for further progress on inflation to make those cuts."

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Federal Reserve Chairman Jerome Powell explains the decision to cut the policy rate, federal funds rate, by 25 basis points to the range of 4.25%-4.5% after the December meeting and responds to questions in the post-meeting press conference.

Key quotes

"We are significantly closer to neutral, still restrictive."

"As long as the labor market, economy is solid, can be cautious as we consider further cuts."

"We think the economy in a real good place and policy too."

"What's driving the slower rate-cut path is stronger economic growth and lower unemployment."

"Also driving the slower rate-cutting path is higher inflation this year and next year."

"Also closer to neutral rate, another reason to be cautious."

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Federal Reserve Chairman Jerome Powell explains the decision to cut the policy rate, federal funds rate, by 25 basis points to the range of 4.25%-4.5% after the December meeting and responds to questions in the post-meeting press conference.

Key quotes

"Can dial back policy restraint more slowly if inflation not moving sustainably toward 2%."

"Policy is well-positioned to deal with risks."

"Can ease more quickly if labor market weakens unexpectedly or inflation falls more quickly."

"Today was a closer call but the right call."

"Decided it was the right call as best decision to foster achievement of goals."

"Risks are two-sided."

"Trying to steer between those 2 risks."

"Downside risks to labor market have diminished, but still cooling."

"Don't think we need further cooling to get inflation down to 2%

"Job creation is below the level that would hold jobless rate constant."

"Labor market quite gradually cooling."

"Inflation story broadly on track, housing services steadily coming down."

"Extent and timing language shows we are at or near point of slowing rate cuts."

"Slower pace of rate cuts reflects expectation of higher inflation."

"Risks and uncertainty around inflation we see as higher."

"Cuts we make next year will react to data."

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Federal Reserve Chairman Jerome Powell explains the decision to cut the policy rate, federal funds rate, by 25 basis points to the range of 4.25%-4.5% after the December meeting and responds to questions in the post-meeting press conference.

Key quotes

"Squarely focused on two goals."

"The economy is strong, labor market remains solid."

"Inflation much closer to the 2% goal."

"Consumer spending resilient, investment in equipment has strengthened."

"Housing activity has been weak."

"Improving supply has supported strong us economic performance."

"Wage growth has eased."

"Labor market not a source of inflation pressures."

"Total PCE probably rose 2.5% in 12 months ending in November."

"Core PCE prices probably rose 2.8% in November."

"Inflation expectations remain well-anchored."

"Risks to achieving goals roughly in balance."

"Attentive to risks on both sides."

"We can be more cautious going forward, can be more cautious in reducing rates."

"Reducing policy restraint too slowly could unduly weaken economy, employment."

"Policymaker projections for policy rate are higher for next year, consistent with higher inflation."

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- EUR/USD sees a sharp decline after the Federal Reserve cuts rates by 25 basis points but indicates a slower pace for future reductions.

- Cleveland Fed President Beth Hammack cast a dissenting vote, preferring to keep rates steady.

- The Fed's Summary of Economic Projections (SEP) suggests only two rate cuts in 2025 and 2026.

The EUR/USD fell sharply, from around 1.0500, after the Federal Reserve lowered borrowing costs but adopted a cautious stance on the interest rates path in 2025. At the time of writing, the pair trades volatile at around the 1.0400 – 1.0500 range, below its opening price.

EUR/USD pair tumbles into the 1.0400 – 1.0500 range following a Federal Reserve rate cut accompanied by a guarded outlook for 2025

The Federal Reserve cut rates by 25 basis points to the 4.25%-4.50% range, yet the decision was not unanimous, as Cleveland Fed President Beth Hammack voted to keep rates unchanged. T

There was little change in the statement compared to the last meeting, though traders were focused on the Summary of Economic Projections (SEP).

The central bank's monetary policy statement revealed that economic activity continued to expand solidly and acknowledged the labor market conditions had eased. Despite the improvement in employment, Fed policymakers decided to keep the language of “The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance.”

Meanwhile, the SEP showed that officials penciled just two rate cuts in 2025 and 2026, driving the fed funds rate to 3.4% in 24 months.

SEP

Source: Federal Reserve

Next is the Fed Chair Jerome Powell's press conference, which would be scrutinized for traders to look for cues regarding the monetary policy for the upcoming year.

EUR/USD Reaction to Fed’s decision

The EUR/USD has plunged sharply, clearing the 1.0450 psychological level, extending its losses toward the day's lows at 1.0410. The pair would remain trading volatile, as Fed Chair Powell takes the stand. Immediate resistance is seen at the December 13 low of 1.0452, and support at 1.0400. If cleared, the next support would be the YTD low of 1.0331.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.64% | 0.53% | 0.54% | 0.50% | 1.00% | 1.08% | 0.54% | |

| EUR | -0.64% | -0.11% | -0.10% | -0.14% | 0.35% | 0.43% | -0.10% | |

| GBP | -0.53% | 0.11% | 0.00% | -0.03% | 0.46% | 0.54% | 0.00% | |

| JPY | -0.54% | 0.10% | 0.00% | -0.05% | 0.44% | 0.54% | -0.02% | |

| CAD | -0.50% | 0.14% | 0.03% | 0.05% | 0.49% | 0.57% | 0.04% | |

| AUD | -1.00% | -0.35% | -0.46% | -0.44% | -0.49% | 0.07% | -0.47% | |

| NZD | -1.08% | -0.43% | -0.54% | -0.54% | -0.57% | -0.07% | -0.53% | |

| CHF | -0.54% | 0.10% | -0.01% | 0.02% | -0.04% | 0.47% | 0.53% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

- The Federal Reserve delivered as expected, foresees two rate cuts in 2025.

- The Bank of England will announce its decision on monetary policy early on Thursday.

- GBP/USD approaches the 1.2600 mark after gaining near-term bearish traction.

The British Pound found near-term support earlier in the day, leading to GBP/USD reaching an intraday high of 1.2725. The trigger was the United Kingdom (UK) Consumer Price Index (CPI), which rose 2.6% on a yearly basis in November after printing at 2.3% growth in October, according to the data released by the Office for National Statistics (ONS) on Wednesday.

Core CPI (excluding volatile food and energy items) rose by 3.5% YoY in November, compared to a 3.3% increase in October while below the market consensus of 3.6%. Services inflation stayed unchanged at 5.0% YoY in November.

The pair held above 1.2700 afterwards, then collapsed after the United States (US) Federal Reserve (Fed) announced that it lowered the policy rate, federal funds rate, by 25 basis points to the range of 4.25%-4.5%.

The Fed made minor changes to its policy statement from the November meeting. Still, the dot-plot shows policymakers foresee now just two rate cuts in 2025, resulting in a hawkish cut that boosted demand for the US Dollar in a risk-averse environment.

Economic Indicator

BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Read more.Next release: Thu Dec 19, 2024 12:00

Frequency: Irregular

Consensus: 4.75%

Previous: 4.75%

Source: Bank of England

- USD/JPY rises as the Federal Reserve cut its benchmark interest rate by 25 basis points (bps) to a target range of 4.25% - 4.50%.

- The Federal Reserve lowered the policy rate by 25 basis points (bps) to a range of 4.25% - 4.50%.

- Fed officials forecast that the economy will continue to expand at a solid pace, even though labor market conditions have softened.

- The FOMC will consider incoming data, the evolving outlook, and the balance of risks when making future interest rate decisions.

On Wednesday, the USD/JPY currency pair rose after the Federal Reserve cut interest rates by 25 basis points. The Federal Reserve lowered its benchmark interest rate by 25 basis points to a range of 4.25% to 4.50% and Fed officials indicated that the economy would continue to expand despite softer labor market conditions.

However, they noted that inflation remained elevated and the economic outlook was uncertain. The Fed will consider incoming data, the evolving outlook, and the balance of risks when making future interest rate decisions. Policymakers emphasized that they were committed to achieving their dual mandate of price stability and maximum employment.

For 2025, the Fed is forecasting a rate of 3.9%, up from the earlier projection of 3.4%, and a further increase is expected for 2026, with a target rate of 3.4%. These projections suggest a slightly more hawkish stance, maintaining a focus on balancing inflation control with economic growth. However, the Fed will continue to monitor incoming data and adjust its policies accordingly, keeping a close eye on economic trends and risks.

USD/JPY technical analysis

The technical analysis for USD/JPY shows that the pair is currently experiencing increasing buying pressure, with the Relative Strength Index (RSI) rising sharply. The Moving Average Convergence Divergence (MACD)is also in a bullish phase, as indicated by a rising histogram. Resistance levels are found at 154.50, 155.00, and 156.00, suggesting that the pair may continue to test this levels if demands for the USD continues rising

- Aussie nears 0.6300 as risk-off mood dominates.

- Fed decision looms, fueling US Dollar strength.

- China’s woes and Trump tariffs curb Aussie’s appeal.

The Australian Dollar approaches 0.6300, weighed by broad risk aversion ahead of the Federal Reserve’s (Fed) policy announcement and lingering China-related concerns. The US Dollar remains robust as investors brace for a “hawkish cut,” with the Fed expected to reduce rates but signal fewer 2025 cuts. Weak Chinese data and potential US tariffs further limit the Aussie’s upside.

Daily digest market movers: Aussie stands around 0.6300 ahead of Fed

- Investors nearly fully price a 25-basis-point Fed cut to 4.25%-4.50%, but fear a “hawkish cut” limiting future easing.

- The Federal Reserve’s revised Summary of Economic Projections may alter interest rate, inflation and growth forecasts, influencing the pair’s direction.

- The US Dollar Index benefits from risk aversion, as global equities struggle with geopolitical tensions and tighter policy prospects.

AUD/USD technical outlook: Aussie tests oversold limits as downtrend persists

The AUD/USD pair declined by 0.6% to 0.6300 on Wednesday, reaching its lowest level since October 2023. The Relative Strength Index (RSI) sits at 30, nearing oversold territory and falling sharply. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram displays rising red bars, underscoring sustained bearish momentum. Although oversold signals hint at a possible corrective bounce, ongoing Fed uncertainty and China’s frail recovery cast a shadow over any lasting rebound.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- Mexican Peso improves slightly against the US Dollar, supported by expectations of a Fed rate cut and strong Mexican data.

- Traders await the Fed's decision and dot plot for indications of future rate adjustments, with expectations of three cuts in 2025.

- The upcoming Banxico decision is likely to influence the USD/MXN pair.

The Mexican Peso recovered some ground against the US Dollar on Wednesday as market participants await the Federal Reserve’s (Fed) monetary policy decision. Mexican economic data also lent a lifeline to the emerging market currency, which remained pressured during the last two days. The USD/MXN exchanged hands at 20.14, down 0.18%.

The market remains sideways ahead of the Fed’s decision. According to fed funds rates futures contracts, traders had priced in a 25-basis-point rate cut (bps), bringing rates to a target range of 4.25%—4.50%. However, traders are focused on the release of the Fed’s dot plot, which policymakers use to reveal where they see rates throughout the year.

According to a Bloomberg survey of economists, Fed officials are projected to confirm three rate cuts for 2025 in the December dot plot. In September, policymakers estimated that the fed funds rate would end near 3.4% in 2025.

After that, Fed Chair Jerome Powell will host its latest post-monetary policy press conference of the year.

In addition, Mexico’s economic docket revealed that private spending increased in the third quarter, as revealed by the Instituto Nacional de Estadistica Geografia e Informatica (INEGI).

On December 19, the Banco de Mexico (Banxico) is expected to cut interest rates by a quarter of a percentage point to 10.00%

Ahead this week, Mexico’s docket will feature Banxico's monetary policy. in the US, investors will also focus on Thursday's US GDP data and the Fed’s favorite inflation gauge, the core Personal Consumption Expenditures (PCE) Price Index, which could impact Bullion demand.

Daily digest market movers: Mexican Peso hovers around 20.20

- Mexico Private Spending in Q3 rose by 1.1% QoQ, above Q2 0.6% expansion. Yearly, dipped from 3.3% to 2.9% for the same period.

- Mexican Retail Sales for October disappointed investors, missing estimates on monthly and annual figures, which indicates that the economy continues to slow down.

- Banxico's December private sector survey forecasts Mexico's inflation to close 2024 at 4.37%, with core inflation easing to 3.60%, down from November’s 3.69%. Economic growth is expected at 1.60%, up from the previous 1.53%, while the USD/MXN exchange rate is projected at 20.25.

- For 2025, inflation is expected to decline to 3.80%, while core inflation is projected to rise slightly to 3.72%. GDP growth is forecast at 1.12%, lower than November’s 1.20% estimate, and the USD/MXN exchange rate is anticipated to reach 20.53.T

- Analysts at JPMorgan hinted that Banxico could lower rates by 50 basis points as inflation data shows that prices are edging lower faster than expected.

USD/MXN technical outlook: Mexican Peso remains steady at round 50-day SMA

The USD/MXN remains upward biased, with the pair bottoming near the 50-day Simple Moving Average (SMA) at 20.11. Momentum is sideways, as depicted by the Relative Strength Index (RSI) almost flat at its neutral line. Hence, the exotic pair has found acceptance at around the 20.00-20.20 range, ahead of the end of 2025.

For a bullish continuation, buyers must clear 20.20 before challenging the psychological 20.50. On further strength, the next resistance would be the December 2 daily high of 20.59, followed by the year-to-date peak of 20.82 and the 21.00 mark.

Conversely, if USD/MXN falls beneath the 50-day Simple Moving Average (SMA) at 20.11, the next support would be 20.00. Further downside is seen at the 100-day SMA at 19.74, ahead of exposing 19.50.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- DXY trades in neutral fashion near 107.00 on Wednesday.

- Market focused on incoming Fed dot plot and 2025 rate forecasts.

- A 25 bps cut is already priced in.

The US Dollar Index, which measures the value of the USD against a basket of currencies, trades neutrally near the 107.00 mark on Wednesday as it consolidates ahead of the Federal Reserve (Fed) interest rate decision. Traders are keenly awaiting the dot plot to gauge the number of rate cuts envisioned in 2025. Despite a recent easing in the USD following profit-taking on Friday and new Chinese economic data, the Greenback holds steady, looking for direction as the Fed policy announcement nears.

Daily digest market movers: US Dollar stands flat as Fed decision takes center stage

- The US Dollar stands flat as markets await the Federal Reserve’s rate decision, focusing on potential changes in the "dots" that project future interest rates.

- Evolving economic conditions have inflation measured by the Consumer Price Index (CPI) rising from 2.4% in September to 2.8% in November, while growth remains solid and labor markets firm.

- Markets expect a 25-basis-point rate cut, along with forecasts for three cuts in 2025, viewed as a neutral outcome. A hawkish surprise, with fewer cuts, could dampen risk sentiment, though a complete pause on cuts is unlikely.

- Updated macro forecasts and dot plots are likely to tilt hawkish with stronger growth and stubborn inflation prompting fewer projected cuts.

DXY technical outlook: Indicators firm, but gains capped below resistance

Indicators recovered significant ground last week, yet they appear insufficient to push the index beyond the 107.00–108.00 area. At the start of the week, the Index retreated slightly, signaling momentum fatigue.

Still, the broader picture remains constructive if the DXY can hold above its 20-day Simple Moving Average. As traders await the Fed’s guidance, technical signals suggest a cautious but potentially supportive environment for the Greenback, barring any hawkish surprises that might fuel a breakout.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the 'de facto' currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

- Gold falls 0.33% as markets anticipate Fed rate cut.

- Markets have nearly fully priced in a 25-basis-point rate cut; focus shifts to the Fed's dot plot for 2025 rate path insights.

- Investors remain attentive to US data, including GDP data and core PCE.

Gold price extended its downtrend for the second consecutive day as traders brace for the Federal Reserve (Fed) monetary policy decision. Even though market participants widely expect a rate cut, they are eyeing cues about the interest rate path in 2025. At the time of writing, XAU/USD trades at $2,636, down 0.33%.

Traders have priced in a 95.4% chance of a 25-basis-point (bps) Fed rate cut, yet they are mainly focused on the Summary of Economic Projections (SEP), known as the dot plot, which Fed officials use to express their views about monetary policy.

At the September meeting, the dot plot hinted that policymakers project the fed funds rate to end 2025 near 3.4%, down from June’s 4.1%.

Nevertheless, robust US economic data, a stalled disinflationary process, and expansionary fiscal policies by the upcoming administration might forestall Fed Chair Jerome Powell and company from easing policy aggressively.

Some analysts said that if the dot plot is adjusted to two rate cuts instead of four, it would be seen as hawkish and support the US Dollar.

The US economic docket features solid US housing data with upbeat Building Permits for November, while Housing Starts dipped for the fourth consecutive month.

This week, investors will also focus on Thursday's US GDP data and the Fed’s favorite inflation gauge, the core Personal Consumption Expenditures (PCE) Price Index, which could impact Bullion demand.

Daily digest market movers: Gold price retraces as US yields climbed

- Gold prices dropped as US real yields recovered, up by one basis point to 2.085%, a headwind for the precious metal.

- The US 10-year Treasury bond yield stays firm at 4.395%, unchanged.

- The US Dollar Index, which tracks the performance of the American currency against six others, surges 0.20%% to 107.15.

- Building Permits in November rose by 6.1% MoM from 1.419 million to 1.505 million.

- Housing Starts for the same period fell -1.8% MoM from 1.312 million to 1.289 million.

- Recently released US Retail Sales data and Flash PMIs hint that the economy remains solid amid interest rates set above 4%. Although inflation edged lower, core prices stalling at 3% and headline inflation printing higher readings for three straight months suggest that inflation risks are skewed to the upside.

- The CME FedWatch Tool suggests that traders had priced in a 95% chance of a quarter-point rate cut on Wednesday.

- For 2025, investors are betting that the Fed will lower rates by 100 basis points.

Technical outlook: Gold price retreats, sellers eye 100-day SMA

Gold price remains upwardly biased, though it has remained trading sideways during the last three days, with no definitive direction. The golden metal trades within the $2,602-$2,670 area, capped by the 100 and 50-day Simple Moving Averages (SMAs), respectively.

For a bullish resumption, the XAU/USD must clear $2,650, followed by the 50-day SMA at $2,670. If surpassed, the next stop would be $2,700. Conversely, if XAU/USD drops below the 100-day SMA, the next support would be $2,600. If the price slips, the next support would be the November 14 swing low of $2,536, before challenging the August 20 peak at $2,531.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

The latest U.S. data suggest that the economy will end the year on a high note. As has been the case for some time, the current strength reflects solid growth in consumer spending, due not only to the resilience of the labour market, but also to the steady increase in household net worth, NBC’s economist Jocelyn Paquet reports.

GDP set to grow by 1.7% in 2026

“As the drivers of recent performance are likely to remain the same in 2025, the U.S. economy should continue to outperform that of other rich countries, provided the new Trump administration sticks to the most pro-growth part of its agenda and keeps its protectionist instincts to a minimum.”

“While recognizing the high level of uncertainty surrounding these projections, our best guess at this stage is that the spending cuts announced by the Trump administration will be insufficient to prevent tax cuts from widening the deficit further. We therefore expect fiscal policy to have a positive impact on growth over the next two years. On the international trade front, we believe that Washington will refrain from imposing blanket tariffs, opting instead for a more targeted, less disruptive approach.”

“Against this backdrop, we have decided to significantly revise upwards our growth forecast for 2025, to 2.1%. GDP should then grow by 1.7% in 2026.”

- EUR/USD edges slightly higher on Wednesday, settling around 1.0500 but still capped by the 20-day SMA.

- RSI holds at 42 in negative territory, signaling persistent caution and subdued buying interest.

The EUR/USD pair remains in a holding pattern on Wednesday, hovering near the 1.0500 mark. Despite recent attempts to gain traction, the 20-day Simple Moving Average (SMA) near 1.0550 continues to act as a formidable barrier, preventing the pair from establishing a more constructive bias. Market participants are now looking to the upcoming Federal Reserve (Fed) decision for fresh directional cues.

Technical indicators reflect a calm environment. The Relative Strength Index (RSI) is flat at 42, firmly in negative territory and suggesting limited buying interest. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram shows flat green bars, underscoring the pair’s lack of decisive momentum.

In the near term, a clear break above the 20-day SMA would be required to shift the short-term outlook in favor of the bulls. Until then, the bias remains tilted to the downside, with the 1.0500 handle and the 1.0480 support area in focus. The upcoming Fed decision could provide the necessary catalyst for a breakout or further consolidation, shaping the pair’s short-term trajectory.

EUR/USD daily chart

- GBP/USD slides to 1.2695, under pressure from a strengthening US Dollar and a 'death cross' technical formation.

- Key support levels for GBP/USD set at 1.2665 and 1.2605, with further downside risk to the November low of 1.2486.

- Upside resistance seen near 1.2814/16, where the 50-day and 200-day SMAs converge, extending to the 100-day SMA at 1.2893.

The Pound Sterling lost some ground against the US Dollar on Wednesday even though UK inflation data for November was higher than in the previous month. This and expansionary fiscal policy might prevent the Bank of England from cutting rates, although the economy has shown some signs of weakness. The GBP/USD trades at 1.2695, failing to clear the 1.2700 mark decisively.

GBP/USD Price Forecast: Technical outlook

Price action suggests that further US Dollar strength may weigh on the GBP/USD. The 50-day Simple Moving Average (SMA) dropped below the 200-day SMA, confirming the formation of a ‘death cross,’ indicating further downside.

The Relative Strength Index (RSI) shows that sellers are in charge as the RSI aims lower in bearish territory,

That said, GBP/USD's first support would be the December 17 low of 1.2665. If cleared, it will clear the path to test 1.2605, the December 13 law, followed by the November 22 cycle low of 1.2486.

On the other hand, if GBP/USD climbs above 1.2700, buyers must climb above the 1.2814/16 area, the confluence of the 50 and 200-day SMAs. Once surpassed, they could challenge the 100-day SMA at around 1.2893.

GBP/USD Price Chart – Daily

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.06% | 0.07% | 0.18% | -0.03% | 0.17% | 0.31% | 0.09% | |

| EUR | 0.06% | 0.12% | 0.27% | 0.02% | 0.22% | 0.37% | 0.14% | |

| GBP | -0.07% | -0.12% | 0.12% | -0.10% | 0.10% | 0.24% | 0.02% | |

| JPY | -0.18% | -0.27% | -0.12% | -0.24% | -0.03% | 0.10% | -0.11% | |

| CAD | 0.03% | -0.02% | 0.10% | 0.24% | 0.20% | 0.34% | 0.12% | |

| AUD | -0.17% | -0.22% | -0.10% | 0.03% | -0.20% | 0.14% | -0.08% | |

| NZD | -0.31% | -0.37% | -0.24% | -0.10% | -0.34% | -0.14% | -0.22% | |

| CHF | -0.09% | -0.14% | -0.02% | 0.11% | -0.12% | 0.08% | 0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

- Silver price slumps to near $30.30 as investors turn cautious ahead of the Fed’s policy meeting.

- Traders have fully priced in a 25-bps interest rate cut by the Fed.

- Economists see the Fed cutting interest rates three times in 2025.

Silver price (XAG/USD) falls to near $30.30 in the North American session on Wednesday. The white metal drops as investors turn cautious ahead of the Federal Reserve’s (Fed) monetary policy announcement at 20:00 GMT.

According to the CME FedWatch tool, traders have priced in a 25-basis points (bps) interest rate reduction, which will push borrowing rates lower to 4.25%-4.50%. Therefore, investors will pay close attention to the Fed’s dot plot, which shows where policymakers see Federal Fund Rates heading in the medium and long term.

A Bloomberg survey from December 6 to 11 showed that economists see the Fed reducing interest rates three times next year, assuming that progress in the disinflation process has slowed more than anticipated. The survey also indicated that economists have become more worried about upside risks to inflation than downside risks to employment, given incoming President-elect Donald Trump's policies, including mass deportations, higher import tariffs, and tax cuts.

Ahead of the Fed meeting, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, consolidates around 107.00. Meanwhile, 10-year US Treasury yields rise to nearly 4.40%. Higher yields on interest-bearing assets weigh on non-yielding assets, such as Silver, because they increase their opportunity costs.

Silver technical analysis

Silver price slides to a fresh two-week low near $30.20 on Wednesday. The white metal weakens after breaking below the 20-day Exponential Moving Average (EMA), which trades around $30.95.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, suggesting a sideways trend.

Looking down, the upward-sloping trendline around $29.50, which is plotted from the February 29 low of $22.30 on a daily timeframe, would act as key support for the Silver price. On the upside, the horizontal resistance plotted from the May 21 high of $32.50 would be the barrier.

Silver daily chart

Silver FAQs