- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-10-2021

In an article recently published by Bloomberg, the IK's PM Boris Johnson has been quoted saying "we'll fix" Brexit’s Northern Ireland Protocol, in a sign that a compromise will be reached with the E.

''UK Prime Minister Boris Johnson promised to find a solution to Brexit’s Northern Ireland Protocol, a sign that a compromise will be reached with the European Union in a dispute that had threatened to spiral into a trade war,'' the article read, quoting further comments as follows:

“Is there a problem with the Northern Irish protocol? Yes there is -- but we’ll fix that,” Johnson said in an interview with Bloomberg News’s editor-in-chief, John Micklethwait, on Monday. “I don’t think that’s going to be the end of the world.”

Market implications

GBP price action is far more centred around the Bank of England at the moment.

GBP steadied near a 20-month high versus the euro on Monday after Bank of England Governor Andrew Bailey sent a fresh signal that the central bank is gearing up to raise interest rates as inflation risks mount.

GBP/AUD has added around 5.5% this year as traders price in the BoE and the prospects that the Old lady will be one of the first central banks to raise rates as a major factor supporting the pound.

However, there are concerns that the BoE will be cutting off the nose despite the face as the British economy has struggled with a shortage of labour, an energy crisis and rising COVID-19 cases of late. Some of these factors have been leading to inflation but the concern is for stagflation. With that being said, it's a dilemma for global central banks in general as supply chain disruptions sweeping major economies have reawakened an old nemesis for them.

- USD/CAD trades cautiously on Tuesday in the early Asian session.

- Bulls remain hopeful to catch a bid around 1.2400 for more gains.

- Momentum oscillator holds onto oversold zone, warns caution against aggressive bids.

USD/CAD remains muted on Tuesday in the early Asian trading hours. The pair trades in a very narrow price band of 1.2340 and 1.2400 for the past two sessions with no meaningful traction. At the time of writing, USD/CAD is trading at 1.2380, up 0.01% for the day.

USD/CAD daily chart

-637701962244299181.png)

On the daily chart, after testing the high of 1.2896 on September 20, the USD/CAD pair came under selling pressure. The pair then took solace at 50-day Simple Moving Average (SMA) at 1.2616 and moved back to the high made on September 29, at 1.2774. Once again a break of the mentioned SMA resulted in a downside movement for the pair toward the multi-month support near 1.2330.

If the price sustains the intraday high it could easily test the 1.2450 horizontal resistance level followed by the psychological 1.2500 mark. The Moving Average Convergence Divergence (MACD) trades in the oversold zone. Any uptick in the MACD would trigger a fresh round of buying opportunities for the pair. USD/CAD bulls would look out for October 8 high at 1.2562.

Alternatively, a break of multi-month support will bring more pain to the pair with the first downside target at a low of July 6 at 1.2303 followed by the 1.2270 horizontal support level. Next, the market participant will test the low made on June 16 at 1.2157.

USD/CAD additional levels

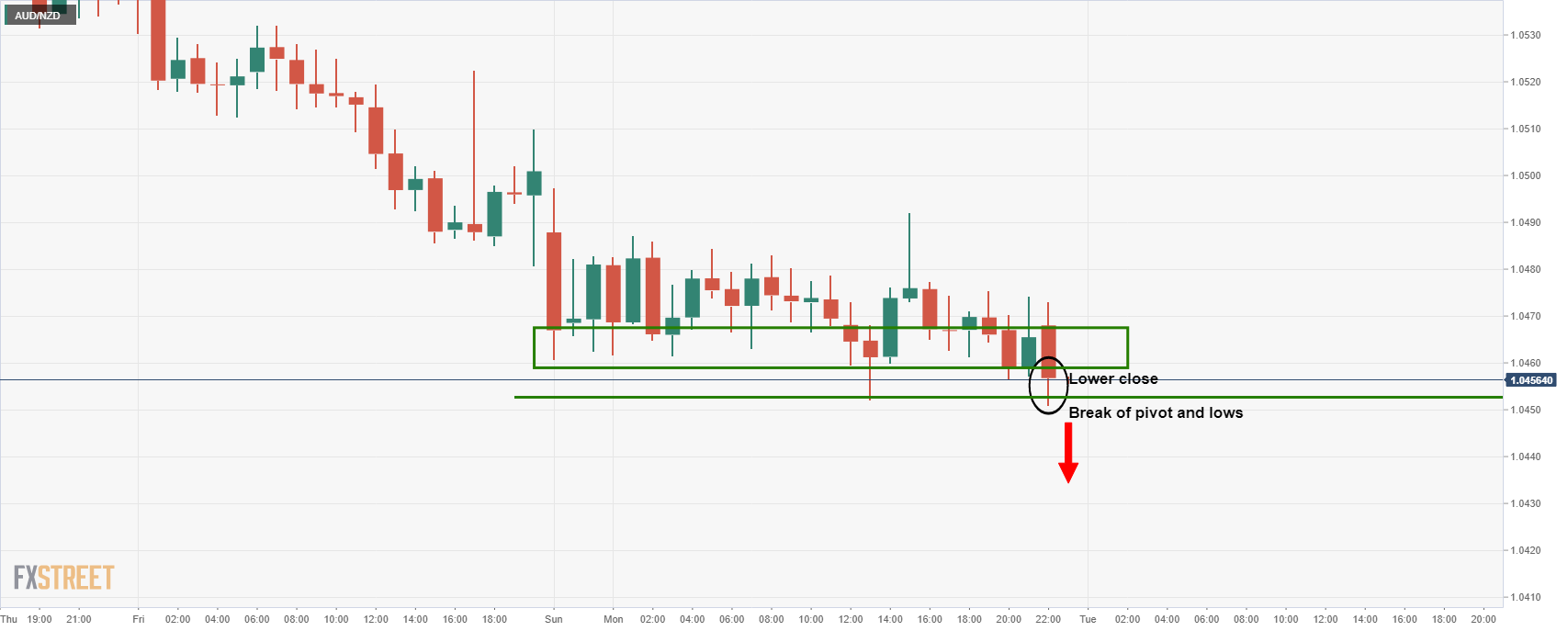

- AUD/NZD is making a fresh low in the Asian session, expended the bearish trend.

- Bears should be aware and take precautions against a significant bullish correction, however.

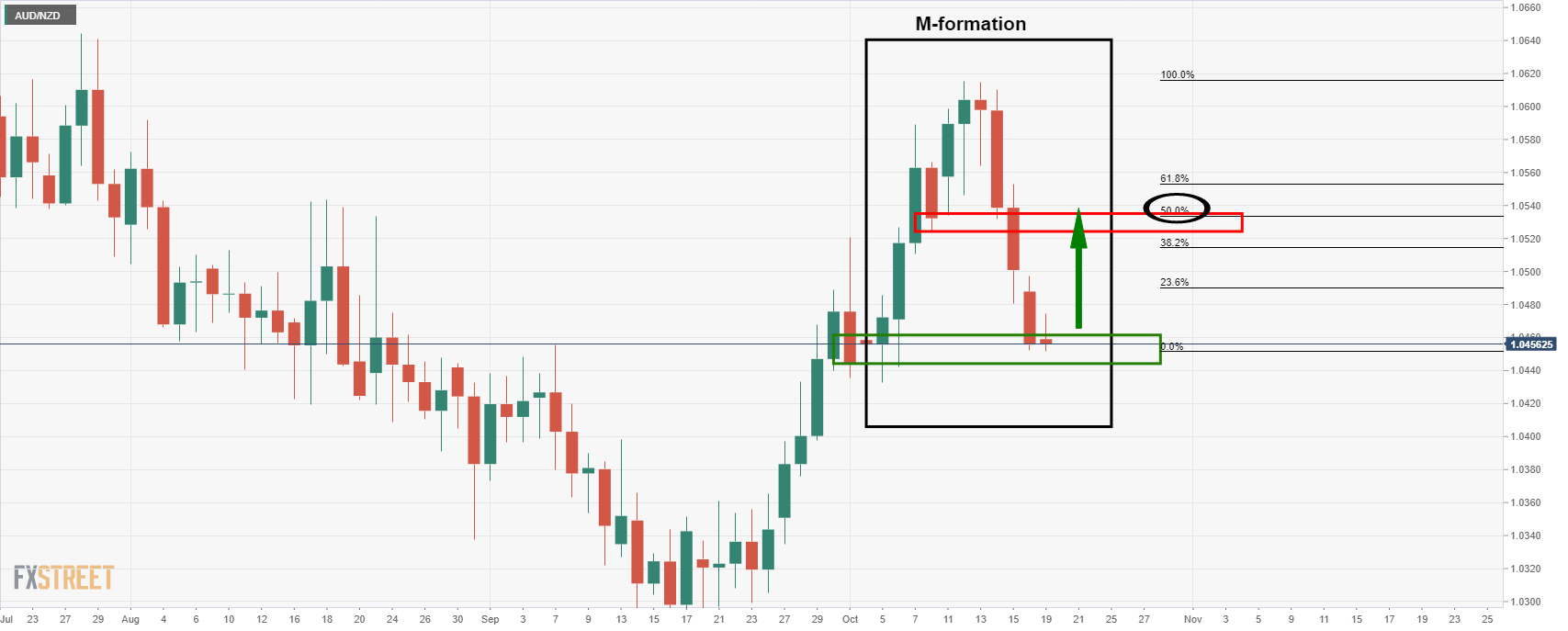

AUD/NZD is on the verge of a downside breakout below the recent phase of accumitlaiton. However, there is a caveat to such a forecast —The daily M-formation.

The following is a top-down analysis between the daily and hourly chart and goes as a reminder that when trading lower time frames, it is always prudent to zoom out to the higher time frames for the bigger picture.

AUD/NZD hourly chart

Despite the fresh low, lower close and bearish tendency of the trend, the price could be faking out here according to the daily chart's analysis below.

AUD/NZD daily chart

The M-formation is a bullish reversion pattern that would be expected to draw in the price for a test of the formation's neckline. In this case, that level is the 8 Oct low at 1.0524.

AUD/NZD hourly chart

So, instead of looking for an immediate downside extension, the bulls could be accumulating here and on a break of near term resistance, the bulls can target the M-formation's neckline near 1.0520.

With all this being said, there is still every chance that the price will melt to fresh lows from here. But how far can it go before meeting an old demand area and expected support?

- USD/JPY accumulates minor losses on Tuesday in the initial Asia session.

- US dollar remains steady near 94.00 on firmer US T-bonds yields.

- US debt limit, inflationary pressure, higher Wall Street Index contains the movement in the greenback.

USD/JPY extends the previous session’s declines on Tuesday in the early Asian trading session. The pair stays in a relatively narrow price band, after hovering near the daily highs in the US session. At the time of writing, USD/JPY is trading at 114.27, down 0.02% for the day.

The US benchmark 10-year Treasury bond yields trade at 1.59% after rising trading near 1.61% on Monday, levels are last seen in early June. As the recent, Retail Sales and Initial Jobless Claims suggest ongoing economic recovery despite persistent pricing pressure. The greenback remains steady around 94.00.

The US Treasury Secretary Janet Yellen said that Congress needs to act to protect US credit. In addition to that, US President Joe Biden will speak to US Senator Joe Manchin, the centrist Democrat from coal-rich West Virginia whose vote is critical to the passage of the budget reconciliation bill pending in Congress.

On the other hand, the Japanese yen gained on its safe-haven appeal amid higher pricing pressure due to soaring energy prices. It is worth noting that, S&P 500 Future is trading at 4,473.50, down 0.09% for the day.

As for now, traders are waiting for the US Housing Starts, and Building Permits data to gauge the market sentiment.

USD/JPY additional levels

- Despite a strong upside move in US stocks, the market mood is a mixed bag, as Asian equity futures are mixed.

- AUD/JPY: The prevailing trend still tilted to the upside on the back of the interest rate differentials.

- AUD/JPY: Doji on Monday’s price action and RSI in overbought levels could spur a corrective leg-down.

- AUD/JPY: An upside break opens the door to 2018 highs around 89.00.

The AUD/JPY pair is down 0.02% as the Asian session begins, trading at 84.69 at the time of writing. On Monday, the pair traded within the 84.27-90 range.

The market sentiment is upbeat, even though China’s third-quarter GDP and Industrial production have grown below expectations. Also, heightened inflationary pressures and central banks’ monetary policy tightening weighed on investors’ mood at one time on Monday.

At press time, Asian equity futures are mixed. The Hang-Seng and the Nikkei 225 print gains between 0.01% and 0.32%, while the Australian S&P/ASX 200, the Japanese Topix, and the Chinese China A50 record losses of 0.36%, 0.44%, and 1.83%, respectively.

AUD/JPY Price Forecast: Technical outlook

In the last couple of weeks, the AUD/JPY rallied from 81.00 to 85.00, on the back of risk appetite in the financial markets and the interest rate differential between both countries. From a technical perspective, the daily chart portrays an overextended upside move, which shows that Monday’s price action formed a doji, meaning that indecision surrounds the pair, so it could consolidate before resuming the prevailing upward trend. Furthermore, the Relative Strength Index (RSI), close to 79, in overbought levels, confirms the abovementioned.

A daily break below the 84.27 prices could lead to a downward move towards the before resistance-now support area around 83.80. A breach of the latter would expose the 200-day moving average (DMA) at 82.47.

On the flip side, a clear break above the 84.90 level might see the pair rally towards the May 10 high at 85.80. If buyers could break that supply zone, a test to the 2018’s highs around 89.00 is on the books.

Treasury Secretary Janet Yellen in a letter to Congress said that the Treasury must use extraordinary measures before Dec. 3 to meet all its obligations. She urges a long term debt ceiling increase.

Reuters reported that Yellen said the extended “debt issuance suspension period” would mean that Treasury would continue its suspensions of investments in the Civil Service Retirement and Disability Fund and the Postal Service Retiree Health Benefits Fund. It will also extend a suspension of the sale of State and Local Government Series (SLGS) securities.

"It is imperative that Congress act to increase or suspend the debt limit in a way that provides longer-term certainty that the government will satisfy all of its obligations," Yellen wrote in a letter to House Speaker Nancy Pelosi and other congressional leaders.

- The shared currency stages a recovery reclaims 1.1600.

- China’s weaker than expected GDP dented the market sentiment.

- At press, the market sentiment is upbeat, despite US dollar strength.

- ECB Christine Lagarde insists that “inflation is largely transitory.”

- EUR/USD: Range-bound within the 1.1560 – 1.1620 area, RSI is at 44 flat.

The EUR/USD advances during the New York session, up 0.07%, trading at 1.1610 at the time of writing. During the session, market sentiment conditions improved despite a weaker than expected third-quarter GDP print out of China, rising inflationary pressures, and central bank tightening monetary conditions expectations.

In the Asian session, China’s GDP for the third quarter rose by 4.9% (YoY), lower than the 5.0% expected, which trailed the 7.9% increase of the second quarter. The ongoing energy crisis that hit the Asian dragon forced factories to curb output. Furthermore, Industrial Production for September also came short of expectations with a 3.1% (YoY) increase versus 3.8% (YoY) estimated.

That said, investors flew through safe-haven assets, mainly towards the US dollar, but as the market improved, the EUR/USD pair reclaimed the 1.1600.

Meanwhile, the US Dollar Index that tracks the buck’s performance against a basket of six currencies is gaining 0.02%, sits at 93.97, whereas the US T-bond 10-year yield is up to one a half basis points currently at 1.591%.

On Saturday, October 16, ECB’s President Christine Lagarde said that the ECB is paying “very close attention” to wage negotiations and other effects that could permanently drive prices higher after delivering 2021 Per Jacobsson Lecture at the IMF. She added that “inflation is largely transitory.”

The European economic docket is absent. Across the pond, the US Industrial Production for September on a monthly reading shrank 1.3%, versus an expansion of 0.2% estimated by investors, while Capacity Utilization expanded 75.2% worse than the 76.5% expected.

EUR/USD Price Forecast: Technical outlook

The EUR/USD daily chart shows the pair is range-bound within the 1.1560 – 1.1620 area. The Relative Strength Index at 44, trendless, depicts the pair is in consolidation. However, recent price action illustrates that an inverse head-and-shoulders pattern is forming, but a daily close above the neckline around 1.1625 is needed to confirm its validity. In that outcome, a move towards the 1.1700 figure is on the cards.

On the other hand, failure at 1.1625 would resume the downward trend of the EUR/USD pair. The first support would be the September 30 low at 1.1562, immediately followed by the October 12 low at 1.1524

What you need to know on Tuesday, October 19:

The greenback shed some ground on Monday, although it ended the day mixed across the FX board and within familiar levels. A light macroeconomic calendar keeps investors depending on the sentiment for direction, the latter following US government bond yields. Speaking of which, the yield on the 10-year US Treasury note peaked at 1.627% but finished the day at around 1.58%.

Asian indexes edged lower after softer-than-anticipated Chinese macroeconomic figures. European indexes followed the negative lead, while US traders fought back, with Wall Street ended the day around its opening levels.

The dollar edged lower against most of its major rivals. The EUR/USD pair trades around 1.1610, while GBP/USD stands at 1.3730. The AUD/USD pair and USD/JPY finished the day unchanged while USD/CAD ticked lower, despite weakening crude oil prices.

Crude oil prices hit fresh multi-year highs before retreating. WTI settled at $81.50 a barrel. Gold ended the day with modest losses at around $1,764.60 a troy ounce.

Attention shifts now to the UK inflation data, as the Bank of England has hinted at a possible rate hike as the first move in the case inflation keeps rising above the desired levels.

Cardano price weakens as ADA targets $1.8

Like this article? Help us with some feedback by answering this survey:

- Gold is consolidating above critical dynamic daily support.

- Markets are weighing the prospects of stagflation in surging energy costs.

- Gold is renowned as the perfect hedge for stagflation risks.

The price of gold is currently trading at $1,765.25 into the Wall Street close and is down some 0.12% after falling from a high of $1,772.10 to a low of $1,760.37. While the US dollar fell out of the wrong side of the bed in New York morning, it has moved slightly higher overnight. Treasury yields rose on expectations the Federal Reserve will need to hike interest rates sooner than previously expected to quell rising price pressures.

Trades are looking ahead to next month's Fed meeting where they expect the US central bank to act as inflation looks to be stubbornly persistent and unlikely to fade anytime soon. However, the Fed is not the only central bank on course to start raising rates which potentially strips the greenback of some of the demand that it has enjoyed more recently in 2021. For instance, New Zealand faced its highest inflation pressures in a decade in data revealed on Tuesday and the Bank of England Governor Andrew Bailey has also been wires with hawkish rhetoric.

Gold is the stagflation hedge

The price of oil on Tuesday gave back some gains following a move into seven-year highs, as seen in the following chart of WTI:

However, the correction to the daily support might entice more demand from strong bullish hands in the energy complex, which leads to the risk of stagflation.

''The prospect of a prolonged period of higher inflation is spooking global central banks, and the fears of central bank tightening is weighing on precious metals,'' analysts at TD Securities explained. ''But market pricing for Fed hikes fails to consider that inflation due to a potential energy shock would be unlikely to elicit a Fed response, considering that it is growth-negative,'' the analysts added.

''In turn, market pricing for Fed hikes is too hawkish relative to TD Securities' expectations, notwithstanding the potential for the global energy crisis to intensify. This suggests gold is an ideal hedge against rising stagflationary winds, and reasons to own the yellow metal are growing more compelling.''

The analysts warned further that ''a cold winter could send energy prices astronomically higher, potentially pricing-out industries and fueling price asymmetries in markets — which translates into a fat right tail for gold prices...In the near-term, gold's failure to hold onto positive momentum has prompted yet another whipsaw for CTA trend followers, with marginal selling underway.''

Gold technical analysis

For the latest in-depth technical analysis of gold, see here: Gold Chart of the Week: XAU hit the $1,800 target, now what?

However, at a snapshot, we are likely to see some consolidation to continue to play out:

''As illustrated above, the price is testing not only dynamic support but horizontal also. This would be expected to hold initial tests and potentially lead to a restest of the prior day's lows of the Doji candle which has a confluence with the 61.8% Fibonacci retracement level near 1,786.''

''If gold does manage to break the dynamic trendline support, there is still going to be room into the 1,750s where price could find itself stuck in a range, aka, the ''barroom brawl''.

If, on the other hand, the price holds and moves up beyond 1,770 again, that would be bullish.''

- The euro is steady at four-month highs above 132.15.

- Higher US T-bonds is crushing demand for the yen.

- EUR/JPY: Seen appreciating towards 137.50 – Commerzbank.

The euro has ticked up against the Japanese yen, for the eighth consecutive session, although it has failed to advance beyond the four-month high at 132.75 hit on Friday. The pair, however, maintains its positive bias intact, with bearish attempts contained above 132.15.

The euro remains strong against an ailing yen

The common currency has remained bid against the Japanese yen, in spite of the sour market mood observed during the Asian and the European morning sessions. The weaker than expected Chinese GDP and industrial production figures have revived concerns about a slowdown in the world’s second economy that could reverberate in the whole globe.

Furthermore, crude prices jumped to fresh multi-year highs earlier today, with the US benchmark WTI reaching prices past $83, bringing back inflation pressures to the spotlight and crushing appetite for risk. This has reflected on negative equity markets in Asia and Europe until a moderate pullback on oil prices brightened the mood somewhat and allowed US stocks to post a moderate recovery.

The safe-haven yen, however, has failed to take advantage of the risk-averse sentiment. The JPY remains close to four-year lows against the US dollar weighed by a solid rally on US T-Bond yields amid a widening the monetary policy differential between the Fed and the Bank of Japan, with the investors positioning QE tapering and starting to speculate about interest rate hikes in 2022

EUR/JPY: Likely to extend rally to 137.51 – Commerzbank

From a technical perspective, Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, sees scope on the pair to reach levels beyond 137.00: “EUR/JPY has maintained its gains. We look for a move to 132.69/80, the 23rd June high, and 78.6% retracement. This is regarded as the last defense for the 134.12 June peak (…) Longer-term, a break above here is favored and will introduce scope to 137.51.”

Technical levels to watch

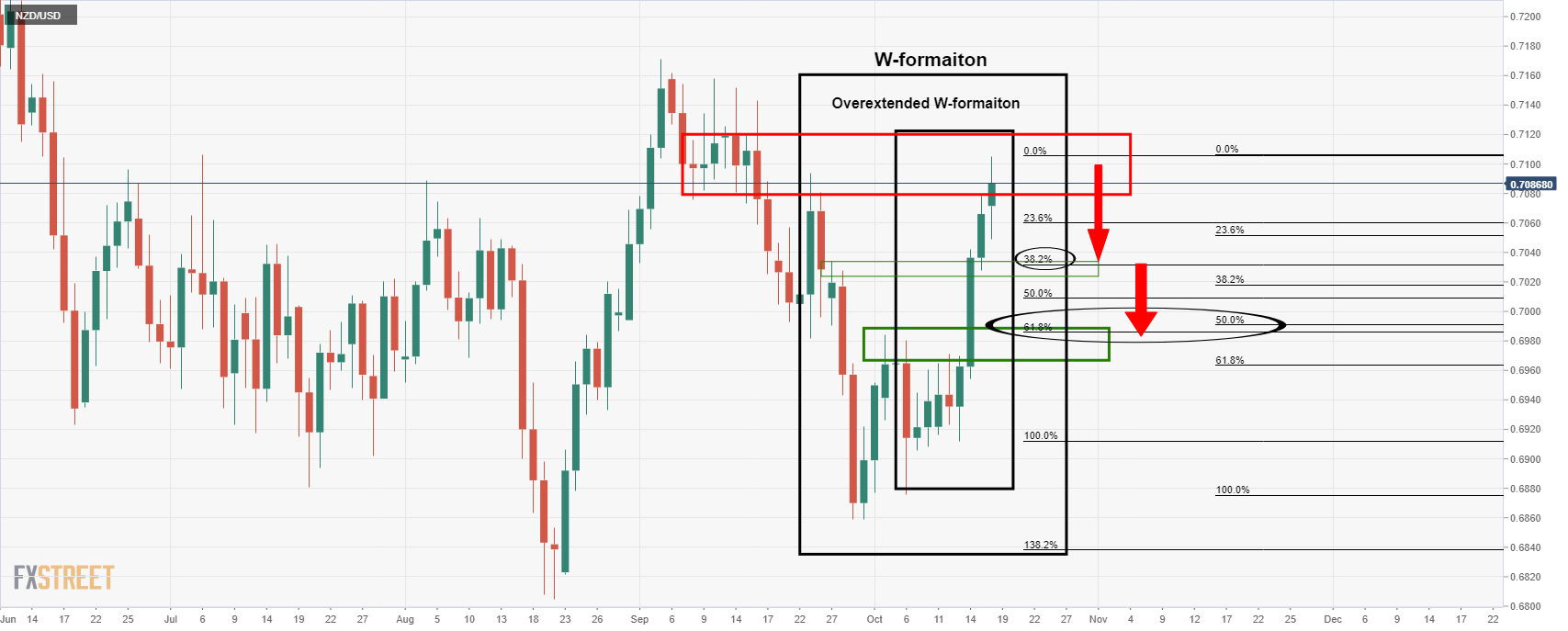

- NZD/USD bears are lurking from the daily resistance.

- Weekly bulls are backing a test of the weekly resistance line.

NZD/USD has enjoyed a burst of life from the bulls since the New Zealand inflation readings from the Asian session. This has seen the price rally parabolically but at some point, there needs to be a pullback. The following illustrates where that might come from in a daily perspective. However, there are bullish tendencies on the weekly chart that is conflicting, to some extent.

NZD/USD daily chart

We have not one but two W-formations on the daily chart. The w-formations are a reversion pattern that has a high completion rate of the price reverting back to test the neckline of the formation. The smallest of the W-formations is highly overextended, so the price is more likely to correct only some of the recent rallies and fall short of the neckline. However, the confluence of the 50% and 61.8% Fibos is compelling as a firm area of technical demand of the price were to correct all the way to the neckline of the larger of the two W-formations (the W that is not over extended, containing the overextended within its ranges).

NZD/USD weekly chart

Meanwhile, from a weekly perspective, the price has corrected deeply to a 78.6% Fibonacci from trendline resistance. It then shot higher in a three-line strike as pe the bodies of the candles. In any case, the bullish engulfing rally has penetrated the resistance line so there are prospects of a breakout, in contrast to the daily chart's W-formations.

- USD/JPY steady around 114.20, waits for a fresh catalyst.

- USD/JPY clings to gains, despite the greenback’s weakness across the board.

- From a technical perspective, the USD/JPY is consolidating before printing a leg-up towards 115.00.

- USD/JPY to push above the 115.00 level amid the energy crisis – ING

The USD/JPY barely advances during the New York session, up some 0.02%, trading at 114.22 at the time of writing. Despite slower than expected economic growth in China, expectations of higher inflation, and central banks reducing the COVID-19 stimulus plan, the market mood is in risk-on mode.

Despite a weaker US dollar, the USD/JPY holds above the 114.00 threshold

The US 10-yeat Treasury yield is flat at press time, clings to 1.581%, whereas the US Dollar Index, which tracks the greenback’s performance against a basket of rivals, slides 0.02%, sits at 93.943. The Japanese yen is close to four-year lows versus the greenback, as higher US T-bond yields, which have been rising lately, have a strong positive correlation with the pair, spurred a rally from 110.00 to 114.46.

The US economic docket featured September Industrial Production data, which contracted 1.3% versus a 0.2% expansion foreseen by analysts. Invertors could largely ignore it, as market sentiment and US T-bond yields remain the main drivers for the pair.

USD/JPY Price Forecast: Technical outlook

The daily chart shows that the USD/JPY pair could consolidate. The Relative Strength Index, a momentum indicator at 75, is in oversold levels and has been there since October 10. Despite the abovementioned, the pair rallied 150 pips towards the 2021 year high at 114.46, but at press time, retraced the move 30 pips, waiting for a fresh catalyst.

The USD/JPY is range-bound within the 114.00 – 114.46 area. A break above the top could pave the way for further gains, with 115.00 as the first supply zone.

USD/JPY: To push above the 115.00 level amid the energy crisis – ING

According to ING analysts: “the USD/JPY pair will also find support from US yields, where our rates team still expect a further rise as market tightening expectations move towards those of the Fed.”

“Japan’s monthly trade balance is expected to widen towards the JPY500 B area. Any wider deficit could provide USD/JPY with the nudge through 115.00 as the market sinks its teeth into the energy dependence story.”

- Silver futures, trading flat near one-month highs at $23.55.

- Precious metals remain weighed amid higher US T-Bond yields.

- XAG/USD: Positive while above $23.00.

Silver futures have been trading without a clear direction on Monday, steady above $23.00, and a short distance to one-month highs at $23.55. Upside attempts, however, have been capped below $23.45, as the US dollar remains firm amid higher US T-Bond yields.

Fed tapering expectations weigh on metal prices

Silver and other precious metals have opened the week on a slightly negative tone, with the US dollar supported by higher US Treasury bond yields. Investors’ expectations of an upcoming announcement of QE tapering, and rising speculation about higher interest rates in 2022 are pushing US bond yields higher, making the US dollar a more attractive hedge from inflation than precious metals.

The US 10-year yield has ticked up to 1.57% from 1.55% on Friday, while shorter-term notes, such as the 5-year yield surging to 20-month highs at 1.19% after having rallied for the last two weeks.

XAG/USD: remains positive while above $23.00

From a technical perspective, the pair remains positive above previous highs, at $23.00, with the focus on the September 14 and 15 highs, at $23.55 September 16 high at $24.00.

On the downside, a reversal below $23.00 (September 22, October 8 highs) might ease bullish pressure, and open the path towards 22.20/35 (October 6 and 12 lows) ahead of year-to-date lows at $21.40.

Technical levels to watch

- WTI falls on supposed profit-taking as it reaches towards the psychological $85 figure.

- Bears are trying to keep control but have run into daily support which is now critical.

- Supply vs demand plays out but the right tail remains the fattest.

The price of the West Texas Intermediate crude spot has morphed into a bearish trend on the lower time frames in New York following a sell-off from higher highs that were made just ahead of the North American open today. At the time of writing, WTI is trading at $81.93 and has fallen from a cycle higher of $83.85 to print a low of $81.90.

A seven-year high was made in London trade which likely encouraged weaker hands to take profits in what has been a parabolic rally since Sep 30 and then Oct 7 following a retest of the 10 day-MAs. More on that below. There have been concerns that demand is outstripping supply as the global economic recovery from the pandemic continues. This has fuelled the demand and taken speculative positions longer while investors at the same time reduced shorts according to the latest weekly COT report.

Global oil inventories falling

Meanwhile, the fresh highs same on the back of the International Energy Agency last week saying that global oil inventories were falling by 0.7-million barrels per day. There has been a shortage of natural gas and coal in Europe and Asia which has encouraged fuel switching amid a higher call on supply from economies recovering from the pandemic. The price of oil was even climbing despite the weak economic data from China at the start of the week. China's Gross Domestic Product rose 4.9% in the third quarter, down from 7.9% in the prior period.

However, as analysts at TD Securities note, ''two-way risks remain elevated, but the right tail remains the fattest suggesting speculators will be happy to hold on to length in the short-term.''

The analysts also explained that the ''oil markets are also benefiting as delta-variant risks have proved benign while growing departure levels suggest air traffic will continue to support jet fuel demand across both APAC and the US. This supports a tight supply-demand outlook that is particularly fueling upside momentum in Brent crude and heating oil, which can be exacerbated by up to 1 million bpd of incremental winter demand due to natural gas switching for crude and fuel oils. This informs our long-short heating oil-gasoline trade.''

WTI technical analysis

From a technical perspective, the price has been bid ever since the test of the 10-day moving averages:

As illustrated, there has been a series of restest of support and this could well just be another one of those. If that is the case, then there are still blue skies for the price to come with the $85 psychological figure in close range.

- The pound consolidates gains near multi-year highs at 157.40.

- Sterling remains strong against an ailing yen.

- GBP/USD steady above 156.60; upside bias, intact.

The British pound is taking a breather on Monday, consolidating gains at five-year highs after having rallied nearly 5% over the last two weeks. The pair remains supported right above the February 2018 peak, at 156.60 with five-year highs at 157.40 on sight.

The pound remains strong against a weaker yen

The sterling remains firm across the board, supported by increasing expectations of interest rate hikes by the Bank of England next year. With energy prices surging and consumer inflation at levels almost twice the BoE’s target for price stability, some Bank officials are openly suggesting the possibility of accelerating the monetary policy normalization plan.

The BoE President, Andrew Bailey, has confirmed those speculations earlier today. Bailey has warned that the Bank of England "will have to act" over rising inflation, although he gave no hint about the bank’s calendar to increase interest rates.

On the other end, the Japanese yen is on the defensive, unable to take advantage of the risk-averse sentiment, triggered by poor Chinese data and revived concerns about inflation. The yen remains close to four-year lows against the US dollar, crushed by higher US T-bond yields, amid a widening monetary policy differential, with the market positioning for the tapering of the Federal Reserve’s monetary stimulus measures.

GBP/JPY: Immediate support lies at 156.60

From a technical point of view, the support level at 1.5660 (intra-day level) maintains the pair’s bullish bias intact. Below here, 156.05 (May 27 and 28 highs) and 154.00 (Jul 7 high) might be the next targets.

On the upside further rally above October 15 high at 157.40, the path seems clear until 159.95 (50% Fibonacci retracement of the 2015-16 decline) and April 2016 high at 162.80.

Technical levels to watch

- The single currency trims two consecutive days’ losses, despite BoE’s prospects of a hike rate.

- ECB Christine Lagarde reinforces that “inflation is largely transitory.”

- ECB and BoE divergence could benefit the British pound versus the single currency.

- EUR/GBP: To extend its slump towards the 0.8385 mark – SocGen.

The EUR/GBP recovers from two days in a row loss, climb 0.27%, trading at 0.8457 during the New York session at the time of writing. Despite rising inflationary pressures, downbeat macroeconomic data from China, and tightening central banks’ monetary policy, the market sentiment is upbeat. The most significant US stock indexes record gains between 0.16% and 0.76%, except for the Dow Jones Industrial, down 0.15%.

European Central Bank and Bank of England divergence boosts the GBP versus the EUR

On Saturday, October 16, the President of the ECB, Christine Lagarde, said that “inflation is largely transitory” after delivering the 2021 Per Jacobsson Lecture at the IMF. Lagarde added that the ECB pays “very close attention” to wage negotiations and other effects that could permanently drive prices.

Meanwhile, over the weekend, the Bank of England Governor Andrew Bailey reiterated that the Bank of England “Will have to act” to curb inflationary pressures.

The UK economic docket featured the Rightmove House Price Index for October, which expanded 1.8% and 6.5% monthly and annual, respectively, higher than the previous reading.

That said, the central bank policy divergence seems to favor the British pound. Portrayed by the move from the October 10 high at 0.8517 towards the October 15 low at 0.8422, it suggests that downward pressures are mounting on the pair, on the expectations of a Bank of England interest rate hike, that could boost the GBP against the shared currency.

EUR/GBP: To extend its slump towards the 0.8385 mark – SocGen

According to analysts at Société Générale, a close below 0.8450 on Friday suggests that downward momentum persists at the EUR/GBP pair: “Holding below 0.8550, EUR/GBP could head lower towards projections of 0.8385.”

“Lower band of the consolidation zone since 2016 at 0.8300/0.8270 and 0.8200 are next significant support levels.”

- Gold treads water below $1,770.

- Bullion remains weak, weighed by higher US bond yields.

- XAU/USD: Dangerously close to $1,725 support area.

Gold futures remain on the defensive on Monday, unable to regain the $1,770 level after a $30 sell-off seen on Monday. The XAU/USD bounced at $1,760 lows earlier today although the ensuing recovery attempt has lacked follow-through, leaving the pair practically flat on the day.

Gold, on the defensive amid higher US T-Bond yields

Bullion has opened the week on a soft note, in spite of the negative market mood seen during the Asian and the European sessions. Weak Chinese data and fresh highs on oil prices, which have revived concerns about inflationary pressures, have hammered risk appetite, triggering losses in equity markets.

The increase on US Treasury bonds, however, fuelled by increasing expectations that Fed tapering is around the corner, has made the US dollar a more attractive refuge for inflation than gold. The US 10-year yield has ticked up to 1.57% from 1.55% on Friday, while shorter-term notes, like the 5-year yield, surging to 20-month highs at 1.19% as investors start speculating about the possibility of higher interest rates for 2022.

XAU/USD remains close to $1,745 and $1,725 support levels

From a technical perspective, XAU/USD remains steady above $1.760 area, consolidating after Friday’s 1.8% decline. If that level is broken, the focus might shift towards t $1,745 (October 6 low) and then a key support area at $1,725 (September 29, 30 low).

On the upside, immediate resistance lies at intra-day highs $1,770, which should be breached to aim toward $1,807 (Sept. 15 high) ahead of $1.830, July and September’s peak.

Technical levels to watch

- The market mood is upbeat as the US stocks indexes are in the green.

- Falling crude oil prices boost the US dollar prospects versus the Loonie.

- BoC’s Tim Macklem: Global supply chain bottlenecks are not easing, which means inflation might not be temporary as expected.

The USD/CAD is flat during the New York session is trading at 1.2362 at the time of writing. Earlier the market sentiment was downbeat due to higher inflationary pressures and central banks reducing the pandemic-era stimulus programs. However, the market mood has improved, witnessed by US stock indexes, recording gains of 0.24% and 52%, except for the Dow Jones Industrial, which is flat at press time.

Crude oil prices falls for the first time in eight days

In the meantime, crude oil prices are falling. The US benchmark crude oil Western Texas Intermediate (WTI) is losing half percent, trades at $81.55 per barrel, exerting additional pressure on the commodity-oil-linked Canadian dollar.

The US Dollar Index, a basket that measures the performance of the US dollar against six peers, declines 0.04%, sits at 93.94, whereas the US T-bond yields rise, with the 10-year note up two and a half basis points, at 1.60%.

On October 14, the Bank of Canada Governor, Tim Macklem, said that global supply chain bottlenecks “are not easing as quickly as expected,” meaning that inflation in Canada and IMF members will probably take longer than foreseen to come down.

On the macroeconomic front, the Bank of Canada’s (BoC) Business Outlook Survey (BoS) for the Q3 unveiled on Monday that the business sentiment continued to improve, with the BoS indicator hitting a record high of 4.73, compared to 3.96 in the second quarter.

According to the report, “Many businesses face supply constraints that will limit their sales and put upward pressure on their costs.” Furthermore, 45% of the companies interviewed on the survey expect the Consumer Price Index to rise above 3% over the next two years. However, half of those firms say that “drivers of higher inflation are temporary.”

In the US economic docket, the Industrial Production shrank 1.3%, worse than the 0.2% increment expected by analysts. Moreover, Capacity Utilization fell from 76.2% in August to 75.2% in September.

- Australian dollar bounces at 0.7380 lows to regain the 0.7400 level.

- Risk aversion eases with energy prices pulling back from highs.

- AUD/USD: Consolidation before further appreciation towards 0.7450 – UOB.

The Australian dollar is shrugging off the weakness observed during Monday’s Asian and European sessions. The pair has bounced at 0.7380 lows to reach 0.715 area at the time of writing, turning positive on the day.

The AUD picks up as risk appetite improves

The risk-sensitive Aussie has regained lost ground, favored by a somewhat improved market sentiment during the American trading session. The main Wall Street indexes have turned positive after having opened in the red, as the decline in oil prices has eased concerns about the consequences of surging inflation.

Crude prices are pulling back from another multi-year high hit earlier today, which has revived fears about inflationary pressures thwarting the global economic recovery. WTI prices have retreated to $82.11 after having hit $83.85 earlier today, with Brent prices trading at $84.40 at the time of writing, down from fresh three-year highs above $86.00 earlier today.

Furthermore, disappointing figures from China, one of Australia’s major trading partners, have increased doubts about the world’s second economy, adding bearish pressure on the AUD. According to the Chinese GDP, the country’s economy grew at a 4.9% pace in the third quarter, missing expectations of a 5.2% increment, while Industrial production increased 3.1%, against market expectations of a 4.5% reading.

AUD/USD: Consolidation before heading towards 0.7450 – UOB

According to the FX analysis team at UOB, technical indicators suggest that the pair could consolidate before resuming the uptrend: “We detected the build-up in upward momentum last Friday (08 Oct, spot 0.7310) and has held a positive view in AUD since then. As AUD rose strongly, we highlighted yesterday (14 Oct, spot at 0.7380) that ‘0.7405 appears to be within reach and a break of this level would open up the way for further AUD gains towards 0.7450’.

Technical levels to watch

- The euro remains capped below 1.1600, close to long-term lows at 1.1525.

- The sour market sentiment has weighed on the euro's recovery attempt.

- EUR/USD seen extending decline to 1.1400 – Scotiabank.

The common currency has attempted to pick up from the 1.1575 low hit earlier on Monday, before failing at 1.1610 and returning to levels below 1.1600. On a broader picture, the EUR/USD remains unable to return above1.1600 and put some distance from the year-to-date- ows at 1.1525 hit last week.

Risk aversion weighs on the euro

The risk-off market mood seen on Monday, with the major European stock indexes in the red and Wall Street mixed, has weighed on the Eurodollar’s upside attempts. Inflation fears, which have returned to the spotlight, combined with downbeat macroeconomic data from China have curbed appetite for risky currencies.

The third quarter's Chinese GDP has disappointed earlier today, showing a 4.9% growth and missing expectations of a 5.2% increment. Beyond that, industrial production increased 3.1%, against market expectations of a 4.5% reading. These figures have increased concerns about a slowdown on the Chinese economy, hit by high inflation and supply chain disruptions, that could send shockwaves through the whole world.

Furthermore, the global increase in inflation keeps adding negative pressure in the euro which has been one of the worst G10 performances over the last weeks. The surging energy prices have pushed consumer inflation to 13-year highs in the Euro Area and are threatening to derail the post-pandemic recovery.

EUR/USD: Expected to extend losses towards 1.1400 – Scotiabank

According to the FX Analysis team at Scotiabank, the technical EUR/USD picture suggests a further decline towards 1.1400: “Spot’s drift back to the 1.1575/85 zone today leaves it vulnerable to renewed pressure on the low 1.15 area (…) We think broader technical pointers continue to indicate scope for EUR/USD losses to extend to the low 1.14s in the near-term (2-4 weeks) while medium-term pointers suggest losses to the 1.11 area.”

Technical levels to watch

- The British pound declines despite BoE’s Governor Bailey hawkish comments.

- The market sentiment is downbeat, as European stocks print losses, like US stocks, except for the Nasdaq.

- BoE’s Andrew Bailey said that central banks need to prevent higher inflation expectations from becoming permanent.

The British pound is sliding during the New York session, down some 0.23%, is trading at 1.3712 at the 2time of writing. Surging energy prices, higher inflationary pressures witnessed on the last CPI readings in developed country’s economies, and central banks tightening monetary policy dented the market sentiment.

Significant European equity indexes record losses between 0.45% and 0.85%, while in the US, most of the indexes, except for the heavy-tech Nasdaq, edge lower between 0.02% and 0.22%.

In the meantime, the US Dollar Index, a basket that measures the performance of the US dollar against six peers, advances 0.04%, sits at 93.99, underpinned by US T-bond yields rising, with the 10-year note up one basis point, at 1.586%.

Bank of England Governor Andrew Bailey reinforces that the central bank will take measures to tackle inflation

Over the weekend on a panel organized by the Group of 30, Bank of England (BoE) Governor Andrew Bailey said that while the central banks don’t have the tools to counter supply disruptions, officials need to prevent higher inflations expectations from becoming permanent.

Furthermore, Bailey added that rising energy prices mean inflation will be last longer than expected. Additionally said that “we, at the Bank of England, have signaled, and this is another signal, that we will have to act. But of course, that action comes in our monetary policy meetings.”

That said, since October 9, when BoE’s members Michael Saunders and Andrew Bailey expressed concerns about inflation and the central bank reaction, the British pound rallied from 1.3567 to 1.3772, on investors’ expectations, that an interest rate hike is on the cards.

Putting this aside for a moment, in the UK, the economic docket featured the Rightmove House Price Index for October, which expanded 1.8% and 6.5% on a monthly and annual basis, respectively, higher than the previous reading. On the US front, Industrial Production (IP) contracted 1.3%, worse than the 0.2% expansion estimated by economists. Further, Capacity Utilization followed the IP footsteps, falling from 76.2% in August to 75.2% in September.

The Bank of Canada's (BoC) Business Outlook Survey (BoS) for the third quarter revealed on Monday that the business sentiment continued to improve with the BoS indicator hitting a record high of 4.73, compared to 3.96 in the second quarter.

Key takeaways as summarized by Reuters

"Most firms continue to anticipate healthy growth in both domestic and foreign demand, especially from the US."

"Many businesses face supply constraints that will limit their sales and put upward pressure on their costs."

"Demand pressures and supply challenges are driving widespread plans to invest, hire staff and increase prices."

"Labor shortages are frequent and have intensified from last year; employment intentions remain at record-high levels."

"Supply chain disruptions are more prevalent and have worsened since Q2; many businesses anticipate they will persist until H2-2022."

Growing number of respondents plan to increase wages to attract and retain labor; firms intend to continue passing increased input costs on to their customers."

"Compared to Q1 and Q2, greater share of firms plan to invest more in machinery and equipment; this is especially true among large companies."

"45% of firms expect total CPI to be above 3% over next two years; half of those firms say drivers of higher inflation are temporary."

"Expectations for 1-year ahead inflation increase to a record high 3.72%; spike seen as temporary."

"Most respondents plan to increase their spending significantly but remain cautious because of the delta variant."

Market reaction

The USD/CAD pair edged slightly higher from the session lows after this publication and was last seen trading flat on the day near 1.2370.

- Wall Street's main indexes are pushing lower on Monday.

- Rising crude oil prices continue to boost energy stocks.

- Industrial shares start the new week on the back foot.

Following last week's upsurge, major equity indexes in the US opened in the negative territory on Monday as the safe-haven flows dominate the financial markets. Reflecting the souring market mood, the CBOE Volatility Index is rising more than 8% on a daily basis at 17.72.

As of writing, the S&P 500 Index was down 0.5% on the day at 4,448, the Dow Jones Industrial Average was losing 0.7% at 35,035 and the Nasdaq Composite was falling 0.33% at 14,848.

Among the 11 major S&P 500 sectors, the Energy Index is up nearly 1% supported by rising crude oil prices. On the other hand, the Industrials Index is down 0.9%.

Earlier in the day, the data released by the US Federal Reserve showed that Industrial Production in the US contracted by 1.3% on a monthly basis in September. "The production of motor vehicles and parts fell 7.2%, as shortages of semiconductors continued to hobble operations," the Fed noted in its publication.

S&P 500 chart (daily)

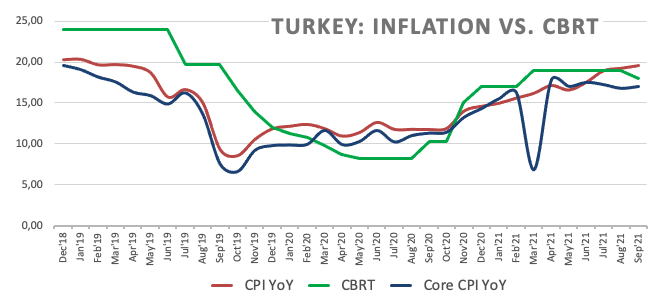

- USD/TRY extends the upside above 9.3000 on Monday.

- Turkey 10-year bond yields surpass 19.00%, highest since May 2019.

- The dollar remains bid and pushes the pair higher.

The lira remains well on the defensive and now helps USD/TRY recording a new all-time high just above the 9.3000 yardstick at the beginning of the week.

USD/TRY looks fragile ahead of CBRT event

USD/TRY entered its third consecutive week of gains on Monday on the back of extra depreciation in the Turkish currency and the moderate recovery in the greenback. Indeed, the pair advanced in six out of the last seven weeks since the beginning of September and was (once again) the worst performer EM currency during last week.

The depreciation of the Turkish currency intensified in past sessions after President Erdogan dismissed three CBRT officials who were against the latest decision by the Turkish central bank (CBRT) to reduce the One-Week Repo Rate by 100 bps at the September event.

Still in Turkey, it is worth recalling that the IMF revised up its GDP forecast for the country and now expects the economy to expand 9% this year and 3.3% in 2022.

Later in the week, Turkey’s Consumer Confidence is due on Thursday ahead of the key CBRT monetary policy meeting. Consensus among investors now expect the central bank to reduce further the policy rate by another 100 bps to 17%.

USD/TRY key levels

So far, the pair is gaining 0.33% at 9.2864 and a drop below 9.0379 (10-day SMA) would aim for 8.9221 (20-day SMA) and finally 8.8317 (monthly low Oct.4). On the other hand, the next up barrier lines up at 9.3060 (all-time high Oct.18) followed by 10.0000 (round level).

The EUR/USD’s gains through the low 1.16s last week have faded. From a technical point of view, the pair points to a slump to the low 1.14s, economists at Scotiabank report.

See: ECB to leave the euro sluggish as its policy has sequence limitations – TDS

Yield differentials to pressure the euro

“With ECB officials remaining generally dovish in their policy outlook, we think yield differentials will continue to weigh on the EUR in the short-to-medium term.”

“Spot’s drift back to the 1.1575/85 zone today leaves it vulnerable to renewed pressure on the low 1.15 area.”

“We think broader technical pointers continue to indicate scope for EUR/USD losses to extend to the low 1.14s in the near-term (2-4 weeks) while medium-term pointers suggest losses to the 1.11 area.”

- Industrial Production in US fell sharply in September.

- US Dollar Index continues to fluctuate near 94.00.

Industrial Production in the United States declined by 1.3% on a monthly basis in September, the data published by the US Federal Reserve revealed on Monday. This reading followed August's expansion of 0.4% and came in worse than the market expectation for an increase of 0.2%.

"The production of motor vehicles and parts fell 7.2%, as shortages of semiconductors continued to hobble operations, while factory output elsewhere declined 0.3%," the publication further read. "Capacity utilization for the industrial sector fell 1.0 percentage point in September to 75.2%, a rate that is 4.4 percentage points below its long-run (1972–2020) average."

Market reaction

This report doesn't seem to be having a significant impact on the dollar's performance against its rivals. As of writing, the US Dollar Index was up 0.06% on the day at 94.02.

- XAU/USD struggles to stage a convincing rebound on Monday.

- US 10-year US T-bond yield is closing in on multi-month highs.

- XAU/USD eyes $1756 and $1750 as the next bearish targets.

Gold lost its traction after testing $1,800 on Thursday and ended up closing the week with small gains at $1,767. With the US Treasury bond yields continuing to push higher on Monday, XAU/USD is having a difficult time recovering its losses in a convincing way. As of writing, the pair was down 0.15% on the day at $1,765.

The benchmark 10-year US Treasury bond yield, which gained 4% and caused XAU/USD to fall sharply on Friday, is currently rising 2.85% on a daily basis at 1.619%. On October 11, the 10-year yield reached its strongest level since June at 1.636% and staged a deep correction in the first half of the previous week. With a daily close above that level, another leg higher could be witnessed and gold could come under renewed bearish pressure.

Meanwhile, the US Dollar Index, which tracks the greenback's performance against a basket of six major currencies, is moving sideways around 94.00 and limiting XAU/USD's downside for the time being.

Moreover, the negative shift witnessed in risk sentiment following the disappointing third-quarter growth data from China earlier in the day seems to be allowing the precious metal to find some demand as a safe haven.

Nevertheless, investors are likely to continue to react to fluctuations in the US T-bond yields as the US economic docket will not be offering any high-tier data releases in the remainder of the day.

Gold near-term technical outlook

"The sellers eye the next support at $1760, where the SMA100 four-hour merges with the Bollinger Band one-day Middle," notes FXStreet Senior Analyst Dhwani Mehta. "If the bearish momentum accelerates, then the pivot point one-day S1 at $1756 will get challenged."

According to Mehta, $1765 is critical for gold buyers to initiate a meaningful recovery towards $1768, where the one-week Fibonacci 61.8% retracement is located.

Additional levels to watch for

There are some regions where earlier tightening is more plausible than others. In the view of strategists at TD Securities, the Bank of England (BoE) is certainly one of them. The Bank of Canada (BoC) also has some risk of earlier tightening. Then there are some central banks where the hawkish repricing in curves looks more unreasonable. This includes the European Central Bank (ECB).

BoE and BoC in the first place to tighten

“We think there are some central banks that are more at risk of acting ‘early’ than expected. The BoE is certainly one of them.”

“CAD outperformance has been broadly based and even stretched in some places. That could create some pullback risk at next week's BoC meeting if the meeting is not hawkish enough.”

“Then there are some regions where there have been holdouts within the central bank community and hence, make it ripe for the market to call out their bluff. The RBA is the standout, since the central bank has been rather steadfast in keeping policy rates unchanged for the foreseeable future.”

“Then there are some central banks that are not quite there in terms of delivering on market expectations. Here, the ECB comes to mind. The reality is that in a reasonably hawkish scenario, the ECB won't be in a position to end QE until late next year, which puts 2023 (likely the latter half) as the risk scenario for tightening. Ultimately, this central bank backdrop leaves EUR rather sluggish overall.”

S&P 500 has seen a clear break and close above key resistance from its 63-day average at 4448/28. With daily momentum turning higher again this suggests the correction lower is over, with resistance seen at 4486/89 next and eventually back at the high at 4546, analysts at Credit Suisse report.

Support at 4448/28 holding to keep the immediate risk higher

“The S&P 500 maintains the strong tone after closing above key resistance from its 63-day average and price gap from late September at 4423/43 and with daily RSI momentum holding a base and with daily MACD momentum having crossed higher this suggests the worst of the corrective setback may already be over.”

“Resistance is seen next at the 78.6% retracement of the September/October fall and price resistance at 4486/87. An initial pause/pullback from here should be allowed for, but with a break in due course expected for a move to 4520/30 next and eventually a retest of the 4546 record high.”

“Support from the price gap from Friday morning and 63-day average at 4448/28 holding can keep the immediate risk higher. A closing break can see a deeper setback to the 13-day exponential average at 4395, but with fresh buyers expected here.”

EUR/GBP has broken below the lower end of the gentle seven-month downtrend channel and prior low for the year at 0.8449/37. This suggests the downtrend is accelerating for a test of the key lows of 2019 and 2020 at 0.8281/39, the Credit Suisse analyst team reports.

Resistance is seen at 0.8515/20

“We are now seeing an acceleration in the downtrend and we look for the risk to stay directly lower. Support is seen next at 0.8417 ahead of 0.8355 and then 0.8332 and then eventually and more importantly the key lows of 2019 and 2020 at 0.8281/39.”

“Whilst we would look for an attempt to hold at the key lows of 2019 and 2020 at 0.8281/39, a sustained break below would mark the completion of a large and important top.”

“Resistance moves to 0.8446/54 initially, with the immediate risk seen lower whilst below 0.8489. Above can see a recovery back 0.8500/02, potentially 0.8515/20, but with this now ideally capping further strength.”

- USD/JPY is fluctuating in a tight range above 114.00 on Monday.

- 10-year US T-bond yield is up more than 1%.

- Wall Street's main indexes look to open in the negative territory.

Following last week's impressive rally, the USD/JPY pair stays relatively quiet on Monday and stays in a consolidation phase below the multi-year high it set at 114.47 on Friday. As of writing, the pair was up 0.1% on the day at 114.32.

Rising US Treasury bond yields continue to fuel USD/JPY's upside. The benchmark 10-year US T-bond yield, which gained nearly 4% on Friday, is currently up 1.8% on a daily basis at 1.602%.

However, the cautious market mood is helping the safe-haven JPY stay resilient against its rivals and limiting USD/JPY's downside. Reflecting the souring sentiment, Wall Street's main indexes remain on track to open in the negative territory with US stock index futures losing between 0.2% and 0.3%.

The only data featured in the US economic docket will be September Industrial Production data. Nevertheless, investors are likely to ignore this report and remain focused on the US T-bond yields. Currently, the US Dollar Index is posting modest daily gains at 94.05.

USD/JPY near-term outlook

UOB Group analysts think that the pair could target 114.55 as long as it stays above the strong support level that is located at 113.00.

USD/JPY: Further strength remains in the pipeline – UOB.

Technical levels to watch for

GBP/USD has broken above its 55-day average (DMA) at 1.3731. Analysts at Credit Suisse see scope for a test of the downtrend from June at 1.3808.

Initial support is seen at 1.3690

“We see scope for the recovery to extend further yet with resistance above 1.3774 seen next at the downtrend from the June peak, now seen at 1.3808/16. With the key 200-day average seen not far above at 1.3847, we look for a better cap here.”

“A close above 1.3845 though would reassert a broader sideways range, with resistance then seen next at 1.3914.”

“Support is seen at 1.3690 initially, with a break below 1.3667 needed to ease the immediate upside bias for a fall back to 1.3589, then 1.3544. Beneath this latter level though is needed to clear the way for a retest of the 1.3411 recent low.”

Refined metal prices have continued higher amid continuing production shortages and power outages. At the same time, final demand outlook from the largest metal consumer China has faded. Longer-term outlook supports moderating metal prices, but in the near-term, low metal supply could continue to contribute to global inflationary pressures, economists at Danske Bank report.

Power crunch supports metal prices despite fading demand outlook

“We do expect metal prices to moderate over the longer term on the back of both fading Chinese demand outlook as well as recovering supply.”

“In the near-term, the looming energy crisis is unlikely to fade quickly ahead of the winter’s heating season in developed economies and China.”

“Both the limited supply and elevated prices of metals are likely to continue to contribute to global supply chain challenges and inflationary pressure over the coming months even if the longer-term outlook is for lower prices.”

NZD/USD spiked higher on the back of today’s strong CPI inflation release to test the 200 day-average at 0.7102 before pulling back. Accordingly, economists at Rabobank have upgraded their NZD/USD one-month forecast to 0.70 from 0.69.

NZ CPI inflation a lot higher than predicted

“This morning’s release of New Zealand Q3 CPI inflation data at a much faster than expected 4.9% YoY has been the trigger for the latest spate of fears around RBNZ policy. The market is assuming that a 25 bps rate hike at the November 24 policy meeting is a done deal. This implies that the key element for markets in the coming weeks surrounds the risk of a larger move.”

“On the assumption that the RBA maintains more dovish credentials we expect AUD/NZD to continue moving back towards its recent lows around the 1.03 area.”

“We have raised our one-month NZD/USD forecast to 0.70 from 0.69.”

- EUR/USD stays on the defensive and adds to Friday’s losses.

- Immediately to the upside emerges the weekly top at 1.1624.

EUR/USD extends the leg lower and recedes to the 1.1570 region at the beginning of the week.

While the weekly top at 1.1624 (October 14) caps the upside, then the door remains open to another visit to the YTD low at 1.1524 (October 12). If the pair manages to surpass 1.1624 and the monthly peak at 1.1640 (October 4), then the selling pressure is expected to mitigate somewhat.

In the meantime, the near-term outlook for EUR/USD is seen on the negative side below the key 200-day SMA, today at 1.1926.

EUR/USD daily chart

- EUR/GBP staged a modest bounce from 18-month lows touched earlier this Monday.

- The attempted recovery lacked any obvious fundament catalyst and follow-through.

- Positive Brexit development, hawkish BoE might underpin the GBP and cap gains.

The EUR/GBP cross extended its sideways consolidative price action and remained confined in a range below mid-0.8400s through the first half of the European session.

The cross stalled its recent downward trajectory to the lowest level since February 2020 and staged a modest bounce from the 0.8425-20 region on the first day of a new trading week. The uptick lacked any obvious fundamental catalyst and was solely led by some profit-taking by bearish traders amid slightly oversold conditions.

However, a combination of factors, so far, have failed to assist the EUR/GBP cross to register any meaningful recovery. Resurgent US dollar demand acted as a headwind for the shared currency. Apart from this, positive Brexit development and hawkish signals by the Bank of England collaborated to cap the upside for the cross.

After days of rising tensions, the European Union agreed to scrap most checks on goods and medicines arriving into Northern Ireland from the rest of the UK. Adding to this, the BoE Governor Andrew Bailey warned that rising energy prices means inflation will last longer and that monetary policy cannot solve supply-side problems.

Bailey further added that the BoE will have to act and must do so if we see a risk, particularly to medium-term inflation expectations. This, in turn, acted as a tailwind for the British pound and kept a lid on any meaningful recovery for the EUR/GBP cross amid absent market-moving economic data, either from the UK or the Eurozone.

From a technical perspective, the lack of any strong follow-through buying and the range-bound price action might still be categorized as a consolidation phase. This, in turn, suggests that the recent bearish trend might still be far from being over and warrants some caution before positioning for any meaningful appreciating move.

Technical levels to watch

- USD/CAD gained positive traction on Monday and snapped four days of the losing streak.

- A strong pickup in the USD demand was seen as a key factor that provided a modest lift.

- Bullish crude oil prices underpinned the loonie and kept a lid on any meaningful upside.

The USD/CAD pair held on to its modest intraday gains through the first half of the European session, albeit seemed struggling to capitalize on the move beyond the 1.2400 mark.

A strong pickup in the US dollar demand assisted the USD/CAD pair to attracted some dip-buying near the 1.2350 region on Monday and snap four successive days of the losing streak. The uptick assisted the major to move away from over three-month lows touched on Friday, though lacked any bullish conviction.

The prospects for an early policy tightening by the Fed pushed the yield on the benchmark 10-year US government bond shot back above the 1.60% threshold. This, along with a softer risk tone – as depicted a generally negative trading sentiment around the equity markets – acted as a tailwind for the safe-haven greenback.

The supporting factor, to some extent, was offset by bullish crude oil prices, which continued underpinning the commodity-linked loonie and capped any meaningful recovery for the USD/CAD pair. Hence, it will be prudent to wait for a strong follow-through buying before confirming that the pair has bottomed out in the near term.

Market participants now look forward to the release of US Industrial Production data for some impetus. This, along with the US bond yields and the broader market risk sentiment, will influence the USD. Traders will further take cues from the BoC's Business Outlook Survey report and oil price dynamics for some short-term opportunities.

Technical levels to watch

- DXY reverses the recent weakness and retakes the 94.20 area.

- Further upside is expected to re-visit the YTD peak at 94.56.

DXY so far posts gains for the first time after three consecutive daily pullbacks, including new weekly lows around 93.75 (October 14).

The corrective downside appears so far contained near 93.70. If the incipient recovery gathers traction, then there are no significant hurdles until the 2021 high at 94.56 recorded on October 12 ahead of the round level at the 95.00 barrier.

Looking at the broader picture, the constructive stance on the index is seen unchanged above the 200-day SMA at 91.80.

DXY daily chart

The Russian rouble still appreciates. As Axel Rudolph, Senior FICC Technical Analyst, notes, USD/RUB is within reach of the September 2018 high at 70.64 around which its descent may pause.

USD/RUB to slip back towards the September 2018 high at 70.64

“USD/RUB continues its descent towards the September 2018 high at 70.64 around which it may short-term pause. Slightly further down lies the December 2018 high at 69.78. Still further down the 2014-2021 uptrend line can be spotted at 69.52.”

“Minor resistance above the 72.13 mid-October high and the 72.22 September low sits between the August and early September lows as well as the three month resistance line at 72.55/73. Further resistance comes in along the seven month resistance line at 73.18.”

“For any kind of (unexpected) bullish reversal to gain traction, a rise and daily chart close above the September 20 high at 73.62 would need to be seen. This scenario is highly unlikely, though, and instead further weakness is probably on the cards.”

- EUR/JPY keeps the intense rally well and sound on Monday.

- Further upside could see the Fibo level at 132.79 retested.

EUR/JPY navigates quite a volatile session so far and alternates gains with losses in the mid-132.00s on Monday.

The intense move higher in the cross remains well and sound and points to extra gains in the very near term at least. That said, there is an interim hurdle at the Fibo level at 132.79 ahead of the round level at 133.00 the figure and early-June peaks around 133.70/75.

In the broader scenario, while above the 200-day SMA at 129.91, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

- AUD/USD witnessed a modest pullback on Monday from the vicinity of multi-week tops.

- Resurgent USD demand, a softer risk tone exerted pressure on the perceived riskier aussie.

- A mixed technical setup warrants some caution before placing aggressive directional bets.

The AUD/USD pair struggled to capitalize on its early modest gains to the 0.7435 region and witnessed an intraday turnaround from the vicinity of five-week tops touched on Friday. The corrective pullback extended through the early part of the European session and dragged the pair further below the 0.7400 round-figure mark.

The downfall was sponsored by a goodish pickup in the US dollar demand, bolstered by a fresh leg up in the US Treasury bond yields. This, along with a softer risk tone and disappointing Chinese GDP print, further benefitted the greenback's relative safe-haven status and contributed to driving flows away from the perceived riskier aussie.

Looking at the technical picture, the AUD/USD pair struggled to find acceptance or build on the momentum beyond 100-day SMA. This comes on the back of the formation of an indecisive Doji candlestick on Friday and suggests that the recent strong positive move from September monthly swing lows might have run out of steam.

The outlook is reinforced by the fact that technical indicators on the 1-hour chart have been gaining positive traction. That said, oscillators on daily/4-hour charts – though have lost some traction – are still holding in the bullish territory. This, in turn, warrants some caution for aggressive bearish traders.

Hence, it will be prudent to wait for a strong follow-through selling before confirming that the AUD/USD pair has topped out in the near term and positioning for any meaningful depreciating move. Hence, any subsequent downfall is more likely to find decent support near the lower boundary of a short-term ascending channel.

The latter is currently pegged near the 0.7370 region, which if broken decisively could accelerate the fall towards the 0.7320-15 strong horizontal resistance breakpoint. Some follow-through selling, leading to a subsequent weakness below the 0.7300 mark will set the stage for deeper losses and turn the AUD/USD pair vulnerable.

On the flip side, any meaningful move back above the 0.7400 mark might continue to confront stiff resistance near the 0.7435-40 region. A sustained strength beyond should push the AUD/USD pair back towards September monthly swing highs, around the 0.7475-80 region, before bulls aim to reclaim the key 0.7500 psychological mark.

AUD/USD daily chart

Technical levels to watch

The Chinese authorities are capable of containing the risks that could emerge out of the troubled China Evergrande Group on the country’s financial system, the People’s Bank of China (PBOC) Governor Yi Gang said at a virtual meeting of the Group of 30 on Sunday.

Key quotes

The property developer’s trouble “casts a little bit of concern.”

“Overall, we can contain the Evergrande risk.”

Evergrande’s liabilities were spread across “hundreds” of entities in the financial system so that there is “not much concentration.”

“The rights and interests of creditors and shareholders will be fully respected in strict accordance with the law. And also the law has clearly indicated the seniority of those liabilities.”

“The growth momentum has moderated somewhat.”

“Economic growth has been slowed down a little, but the trajectory of the economic recovery remains unchanged.”

“The Chinese economy is doing well in general, but we still face some challenges.”

“We are keeping a close eye on all these problems.”

Related reads

- China’s GDP grows 4.9% YoY in Q3 2021 vs. 5.2% expected

- PBOC unlikely to alter the RRR this year – Goldman Sachs

Turkish lira trades in new all-time lows. According to Axel Rudolph, Senior FICC Technical Analyst at Commerzbank, the USD/TRY pair may rise all the way to the 10.00 level.

USD/TRY trades in new all-time highs above 9.00

“USD/TRY’s advance has reached our daily 0.1 x 3 vertical Point & Figure upside target at 9.1000 and so far risen to 9.2959. Further up lies the 10.0000 mark.”

“We will stay immediately bullish while the cross remains above the two month support line at 9.0330 below which the early October low can be spotted at 8.8037. While remaining above the latter level, overall upside pressure should retain the upper hand.”

“Key support remains to be seen between the June-to-September lows at 8.2925/2605.”

- Gold price extends Friday’s decline amid firmer yields and the US dollar.

- Hawkish Fed’s expectations and higher inflation continue to weigh on gold.

- Gold: Sellers defend $1,800, all eyes on US T-bond yields.

Gold price is looking to extend Friday’s $30 slide on Monday, as the underlying narrative of sooner than expected Fed’s monetary policy normalization to counter inflationary risks continues to play out. An upside surprise to the US Retail Sales data bolstered the hawkish Fed’s bets, leading to an extended rally in the US Treasury yields across the curve. Meanwhile, the buying resurgence in the US dollar, in the face of firmer yields and China slowdown worries-led risk-aversion, also exerts the additional downside pressure on gold price. Looking ahead, gold traders will continue to closely follow the dynamics in the yields and the greenback amid a lack of top-tier US events this week.

Read: Gold Price Forecast: XAU/USD eyes $1750 after rejection at 200-DMA, focus on yields

Gold Price: Key levels to watch

According to the Technical Confluences Detector, gold has breached the critical support at $1765, which is the convergence of the previous day’s low and Fibonacci 38.2% one-month.

Therefore, the sellers eye the next support at $1760, where the SMA100 four-hour merges with the Bollinger Band one-day Middle.

If the bearish momentum accelerates, then the pivot point one-day S1 at $1756 will get challenged.

The additional downside will then open up towards $1750, the previous week’s low, below which the bears will look out for the Fibonacci 23.6% one-month at $1748.

Alternatively, recapturing the abovementioned support-turned-resistance at $1765 is critical for gold buyers to initiate a meaningful recovery towards $1768, the Fibonacci 61.8% one-week.

Up next, the bulls will aim for the $1770 figure, followed by the intersection of the SMA5 one-day, Fibonacci 23.6% one-day and SMA200 four-hour around $1773.

Further up, the level to beat for gold bulls is seen around $1777, where the SMA50 one-day, Fibonacci 38.2% one-day and SMA10 four-hour coincide.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

- NZD/USD witnessed an intraday pullback from one-month tops touched earlier this Monday.

- Hawkish Fed expectations, rallying US bond yields helped revive demand for the greenback.

- A softer risk tone further benefitted the USD’s safe-haven status and exerted some pressure.

The NZD/USD pair extended its corrective pullback from one-month tops and dropped to fresh daily lows, around mid-0.7000s during the early part of the European session.

The pair gained some positive traction on the first day of a new trading week and shot to the highest level since September 16 in reaction to a hotter-than-expected New Zealand CPI report. Bulls, however, struggled to capitalize on the move, or find acceptance above the 0.7100 mark amid a strong pickup in the US dollar demand.

The prospects for an early policy tightening by the Fed pushed the yield on the benchmark 10-year US government bond back above the 1.60% threshold on Monday. This, along with a generally softer risk tone, benefitted the greenback's relative safe-haven status and acted as a headwind for the perceived riskier kiwi.

The FOMC meeting minutes released last Wednesday reaffirmed that the Fed remains on track to begin rolling back its massive pandemic-era stimulus as soon as November. The markets have also started pricing in the possibility of a rate hike in 2022 amid worries that the recent rally in commodity prices will stoke inflation.

Meanwhile, fears about a faster than expected rise in inflation and a sharp deceleration in the Chinese economic growth fueled concerns about the return of stagflation. In fact, the world's second-largest economy recorded a modest 0.2% growth during the third quarter and the yearly rate fell to 4.9% from 7.9% previous.

From a technical perspective, the early uptick faltered near a confluence resistance comprising of the very important 200-day SMA and a downward sloping trend-line extending from YTD tops. With the latest leg down, the NZD/USD pair has now snapped three consecutive days of the winning streak, though the pullback lacked bearish conviction.

Hence, it will be prudent to wait for a strong follow-through selling before confirming that the NZD/USD pair has topped out in the near term and placing aggressive bearish bets. Market participants now look forward to the release of US Industrial Production data for some impetus later during the early North American session.

Technical levels to watch

2-year British government bold yield surged to its strongest level since May 2019 at 0.74% on Monday as investors continue to price the expectation for a Bank of England (BoE) rate hike amid surging energy prices.

Currently, the yield on the 2-year UK gilt is up nearly 25% on a daily basis at 0.7255. According to Reuters, a 15 basis points rate increase by the end of this year is now fully priced in.

Market reaction

The British pound remains on the back foot during the European trading hours on Monday and the GBP/USD pair was last seen losing 0.2% on a daily basis at 1.3723.

EUR/USD is moving back below 1.16 this morning. Economists at Société Générale expect the 1.1650 level to cap any attempts to rebound.

See: EUR/USD to trade within a 1.1550-1.1650 range this week – ING

1.1530 holds the downside

“So long as the 1.1530 area holds, it’s difficult to envisage the pair having a go below 1.15. It’s a similar story to the upside with 1.1625/65 barring the road to 1.17.”

“Without a re-flattening of the US front-end – FF futures are pricing 68% odds of a rate increase by June next year, it will be tricky for the tactical recovery in EUR/USD to broaden beyond 1.1650.”

The CAD is having a good October as it has posted a solid 2.5% gain on the USD so far. Economists at Scotiabank see USD/CAD downside potential to the low 1.22s.

Rallies to run out of steam around the mid-1.24s

“If the USD manages to steady around 1.2365/70 into this week, a modest correction could develop. We expect USD gains to remain limited to the low/mid 1.24s, however, with daily and weekly trend momentum signals aligned bearishly for the USD.”

“We think USD/CAD can print a 1.22 handle ahead of year end.”

- Silver attracted some dip-buying on the first day of a new trading week.

- Acceptance above the head & shoulders neckline favours bullish traders.

- A sustained move beyond the 61.8% Fibo. will reaffirm the positive bias.

Silver managed to find some support near the $23.00 round-figure mark on Friday and attracted some dip-buying on the first day of a new trading week. The commodity edged higher through the early European session and was last seen hovering near daily highs, around the $23.40-45 region.

Looking at the technical picture, last week's sustained move beyond the $23.15-20 barrier marked a bullish breakout through an inverted head and shoulders neckline. The emergence of fresh buying near the mentioned resistance breakpoint–turned–support, adds credence to the positive bias.

The constructive setup is reinforced by the fact that technical indicators on the daily chart have been gaining positive traction and are still far from being in the overbought territory. A sustained move beyond the 61.8% Fibonacci level of the $24.87-$21.42 downfall will reaffirm the outlook.

The XAG/USD might then aim to reclaim the $24.00 mark en-route the next relevant hurdle near the $24.25-30 region. The momentum could further get extended towards September monthly swing highs, near the $24.75-80 zone, before bulls eventually aim to reclaim the key $25.00 psychological mark.

On the flip side, the $23.20-$23.00 neckline resistance breakpoint should protect the immediate downside. The mentioned region coincides with 200-period SMA on the 4-hour chart and the 50% Fibo. level, which, in turn, should act as a strong near-term base for the XAG/USD.

A convincing break below will negate the bullish outlook and prompt aggressive technical selling. The XAG/USD might then accelerate the fall towards the 38.2% Fibo. level, around the $22.75-70 region before dropping further towards mid-$22.00s and the $22.25 region (23.6% Fibo.).