- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-09-2014

(raw materials / closing price /% change)

Light Crude 92.96 -0.12%

Gold 1,226.10 -0.07%

(index / closing price / change items /% change)

Nikkei 225 16,067.57 +178.90 +1.13%

Hang Seng 24,168.72 -207.69 -0.85%

Shanghai Composite 2,315.93 +8.03 +0.35%

FTSE 100 6,819.29 +38.39 +0.57%

CAC 40 4,464.7 +33.29 +0.75%

Xetra DAX 9,798.13 +136.63 +1.41%

S&P 500 2,011.36 +9.79 +0.49%

NASDAQ Composite 4,593.43 +31.24 +0.68%

Dow Jones 17,265.99 +109.14 +0.64%

(pare/closed(GMT +2)/change, %)

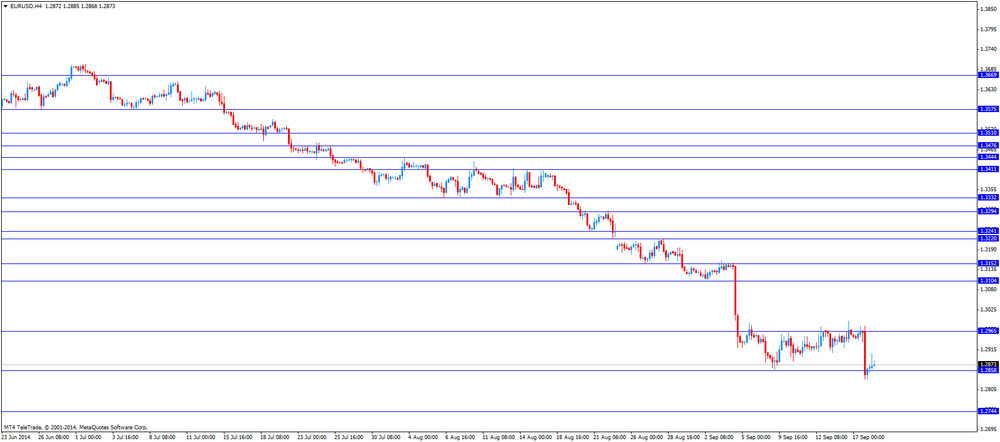

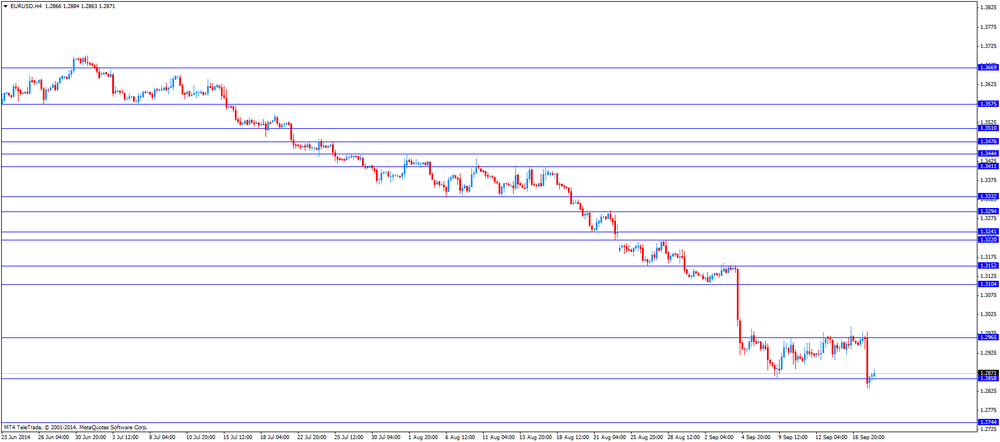

EUR/USD $1,2915 +0,53%

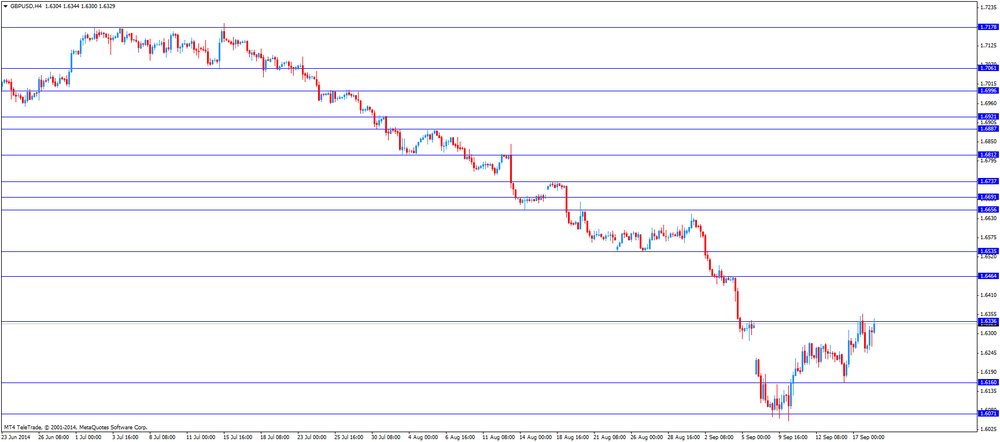

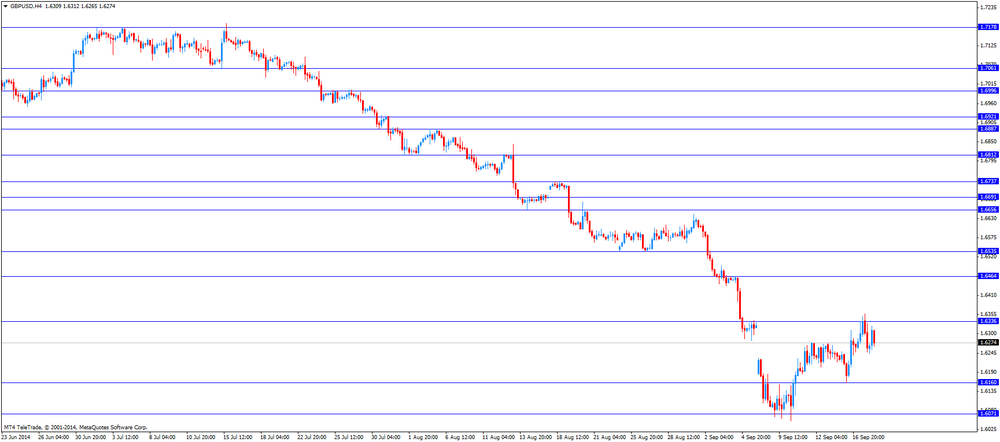

GBP/USD $1,6438 +1,09%

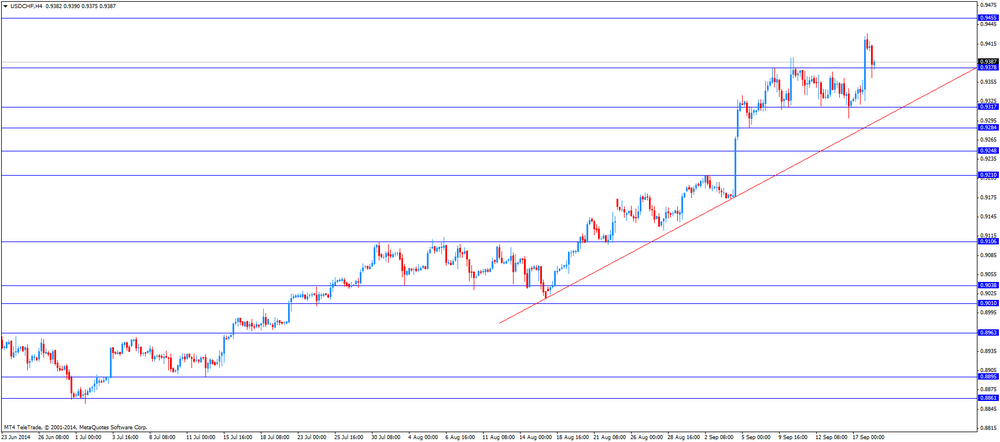

USD/CHF Chf0,9340 -0,87%

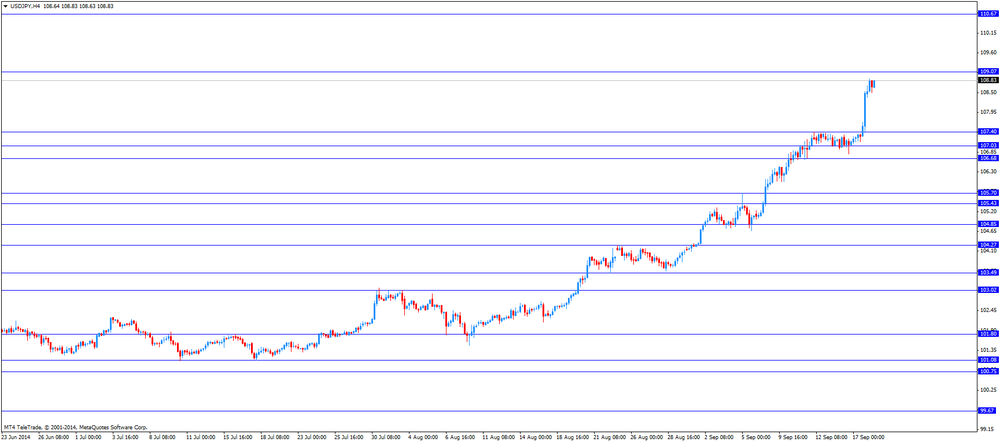

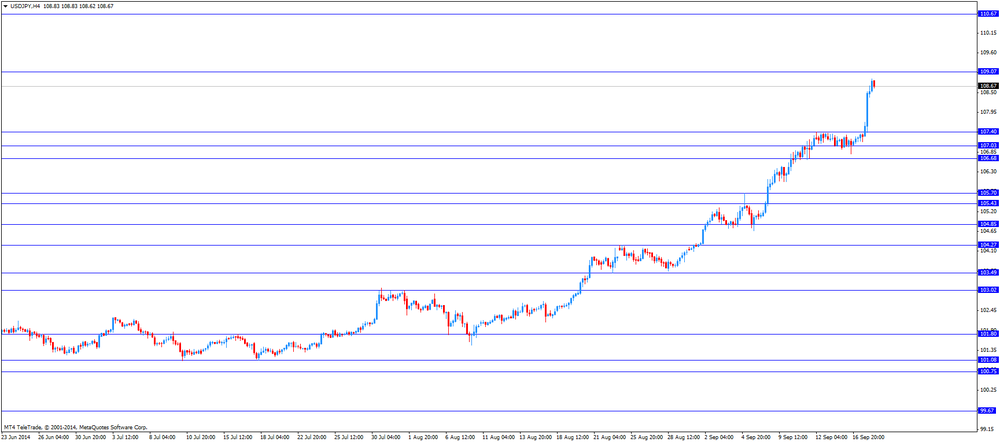

USD/JPY Y108,76 +0,27%

EUR/JPY Y140,47 +0,82%

GBP/JPY Y178,81 +1,38%

AUD/USD $0,8983 +0,32%

NZD/USD $0,8161 +0,83%

USD/CAD C$1,0938 -0,70%

(time / country / index / period / previous value / forecast)

03:00 New Zealand Credit Card Spending August +4.5%

04:30 Japan All Industry Activity Index, m/m July -0.4% +0.4%

06:00 Germany Producer Price Index (MoM) August -0.1% -0.1%

06:00 Germany Producer Price Index (YoY) August -0.8%

08:00 Eurozone Current account, adjusted, bln July 13.1 14.3

12:30 Canada Wholesale Sales, m/m July +0.6% +0.8%

12:30 Canada Consumer Price Index m / m August -0.2% -0.1%

12:30 Canada Consumer price index, y/y August +2.1%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m August -0.1% +0.2%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y August +1.7%

14:00 U.S. Leading Indicators August +0.9% +0.4%

Stock indices traded higher. The Fed released the results of its monetary policy meeting. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month. This decision was expected by market participants.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed noted "there remains significant underutilization of labor resources".

The Fed raised its estimates for interest rate. The U.S. central bank said interest rate will be 3.75% at the end of 2017.

The European Central Bank said today it allotted €82.6 billion in its new Targeted Long Term Refinancing Operation (TLTRO). Analysts had expected €174 billion.

Market participants are awaiting the results of the Scotland's independence referendum today.

Bayer AG shares jumped 6% after releasing plans to spin off its plastics unit.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,819.29 +38.39 +0.57%

DAX 9,798.13 +136.63 +1.41%

CAC 40 4,464.7 +33.29 +0.75%

West Texas Intermediate and Brent crudes dropped as a stronger dollar curbed the appeal of commodities to investors looking for a store of value.

Futures dropped as much as 0.9 percent in New York and 1 percent in London. The dollar reached a six-year high against the yen after the Federal Reserve increased its outlook for interest rates. Libya's Sharara field, the country's biggest-producing asset, was shuttered while a strike by oil workers in Nigeria entered a third day.

"The focus has been on interest rates and that's pushed the dollar higher, which is hurting demand for commodities," Phil Flynn, senior market analyst at the Price Futures Group in Chicago, said by phone. "Oil would be much lower if not for the trouble in both Libya and Nigeria."

WTI for October delivery fell 65 cents, or 0.7 percent, to $93.77 a barrel at 10:14 a.m. on the New York Mercantile Exchange after earlier sliding to $93.62. The volume of all futures traded was 4.7 percent above the 100-day average for this time of day. Prices have decreased 4.7 percent this year.

Brent for November settlement fell 82 cents, or 0.8 percent, to $98.15 a barrel on the London-based ICE Futures Europe exchange. Volumes were 14 percent lower than the 100-day average. The European benchmark crude was at $5.51 premium to WTI for the same month.

The U.S. dollar traded mixed to lower against the most major currencies after the mixed U.S. economic data. The U.S. housing starts in August dropped by 14.4% to a seasonally adjusted annual rate of 956,000 units from 1.117 million units in July, missing expectations for a decline to 1.040 million. July's figure was revised up from 1.093 million units.

The number of building permits in August fell by 5.6% to 998,000 units from 1.057 million units in July. July's figure was revised up from 1.052 million units. Analysts expected building permits to decrease to 1.040 million units.

Philadelphia Fed manufacturing index declined to 22.5 in September from 28.0 in August, missing forecasts of the fall to 22.8.

The number of initial jobless claims in the U.S. in the week ending September 13 dropped by 36,000 to 280,000. The previous week's figure was revised to 316,000 from 315.000.

Yesterday's results of the Fed's monetary policy meeting weighed on the greenback. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed noted "there remains significant underutilization of labor resources".

The euro traded higher against the U.S. dollar. The European Central Bank said today it allotted €82.6 billion in its new Targeted Long Term Refinancing Operation (TLTRO). Analysts had expected €174 billion.

The British pound traded higher against the U.S. dollar. The Scotland's independence referendum weighed on the pound.

The U.K. retail sales increased 0.4% in August, in line with expectations, after a flat reading in July. July's figure was revised down from a 0.1% rise.

On a yearly basis, retail sales in the U.K. climbed 3.9% in August, after a 2.5% gain in July. July's figure was revised down from a 2.6% increase.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance dropped to -4% in September from +11% in August, missing expectations for a decrease to +9%.

The Swiss franc rose against the U.S. dollar after the Swiss National Bank's (SNB) interest rate decision. The SNB kept its interest rate unchanged at 0.00 - 0.25% and also kept the exchange rate floor unchanged at 1.20 francs per euro.

Switzerland's central bank said "will continue to enforce the minimum exchange rate with the utmost determination".

The Canadian dollar traded higher against the U.S. dollar after the better-than-forecasted foreign securities purchases from Canada. Foreign securities purchases in Canada climbed by C$5.30 billion in July, exceeding expectations for a rise of C$2.47 billion, after a C$1.08 billion rise in June. June's figure was revised down from - C$1.07 billion.

The New Zealand dollar traded higher against the U.S dollar. The better-than-expected gross domestic product (GDP) from New Zealand supported the kiwi. New Zealand's GDP rose 0.7% in the second quarter, exceeding expectations for a 0.6% increase, after a 1.0% gain in the first quarter.

On a yearly basis, New Zealand's GDP climbed by 3.9% in the second quarter, after a 3.8% rise in the first quarter.

The Australian dollar traded higher against the U.S. dollar. The Fed's interest rate decision weighed on the Aussie.

The Reserve Bank of Australia (RBA) released its bulletin today. The RBA said spare capacity in the Australian labour market has risen over the past few years.

The Japanese yen traded mixed against the U.S. dollar. Japan' trade deficit declined to ¥948.5 billion in August from ¥1,023.8 billion, beating expectations for a decline to a deficit of ¥990.0 billion.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda on Thursday reiterated the central bank will adjust its monetary policy if needed to reach the 2% inflation target. He believes that Japan can reach a 2% inflation target at around fiscal 2015 to March 2016.

Mr. Kuroda also said that he is optimistic on a recovery of Japan's exports.

Gold prices on Thursday fell to a minimum of 8.5 months at the expense of strengthening the dollar after the Fed meeting. Later in the session, the precious metal was able to regain lost ground after the release of statistical data the United States.

Federal Reserve continues to believe that the near-zero interest rates will be needed for a "substantial period of time", and is still concerned about the weakness of the labor market. In this case, the central bank made it clear that when interest rates start to rise, this process can be faster than analysts suggest.

"Improving the prediction rates of the Fed at the end of 2015 and 2016 may be an obstacle to the rise in gold prices in the future," - wrote in the report, analysts HSBC.

Dollar exchange rate on Thursday rose to a six-year high against the yen and a maximum of four years to a basket of major currencies.

"From a technical point of view, there is a real possibility that the market is closer to the psychological level of $ 1,200 and $ 1,180 a critical level in the coming days or weeks," - said a dealer MKS Group Jason Cherizola.

Support prices may have increased demand in the physical market of Asia as it approaches quotations to $ 1,200. Surcharges in China on Thursday rose to $ 05.06 per ounce to the price in London from $ 4 on Wednesday.

In addition, according to statistics released Thursday, the number of initial claims in the United States last week fell to the lowest in two months, and the number of new buildings in the country in August decreased by 14.4% in monthly terms, against the expected decline of 5.2%. However, in July, according to revised data, the number of new homes totaled 1.117 million on an annualized basis, the highest since November 2007.

The cost of the October gold futures on the COMEX today dropped to 1215.7 and then rose to 1227.3 dollars per ounce.

The Federal Reserve Chair Janet Yellen said today lower-income families in America are "extraordinarily vulnerable". She added Yellen that the Fed must help Americans build assets.

Yellen said nothing about the Fed's monetary policy.

The U.S. Commerce Department released the housing market data today. The U.S. housing starts in August dropped by 14.4% to a seasonally adjusted annual rate of 956,000 units from 1.117 million units in July, missing expectations for a decline to 1.040 million. July's figure was revised up from 1.093 million units.

The fall was driven mostly by a 31.7% decline in construction of multifamily units. Construction of multifamily units is a volatile segment.

The number of building permits in August fell by 5.6% to 998,000 units from 1.057 million units in July. July's figure was revised up from 1.052 million units. Analysts expected building permits to decrease to 1.040 million units.

EUR/USD: $1.2800(E230mn), $1.2850(E1.87bn), $1.2900(E967mn), $1.2950(E369mn), $1.3000(E1.1bn), $1.3025-30(E618mn), $1.3050(E767mn)

USD/JPY Y107.00($1.1bn), Y107.50($320mn), Y108.00($490mn)

GBP/USD: $1.6200(stg181mn), $1.6300(stg110mn), $1.6350(stg150mn), $1.6400(stg624mn)

EUR/GBP: stg0.7875(E150mn), stg0.7940(E120mn), stg0.7975(E150mn), stg0.8000(E200mn)

USD/CHF: Chf0.9150($515mn), Chf0.9350(E420mn)

EUR/CHF: Chf1.2090(E191mn), Chf1.2150(E128mn)

AUD/USD: $0.8900(A$748mn), $0.8950(A$249mn), $0.9000(A$587mn), $0.9050(A$401mn), $0.9100(A$1.0bn), $0.9200(A$1.1bn)

NZD/USD: $0.8200(NZ$145mn), $0.8300(NZ$208mn)

USD/CAD: C$1.0900($492mn), C$1.0940($200mn), C$1.1000($456mn), C$1.1050($320mn)

U.S. stock futures rose, signaling equities will advance for a third day, as investors assessed mixed data on housing and employment amid optimism that the world's largest economy will be able to cope with higher interest rates from next year.

Global markets:

Nikkei 16,067.57 +178.90 +1.13%

Hang Seng 24,168.72 -207.69 -0.85%

Shanghai Composite 2,315.93 +8.03 +0.35%

FTSE 6,808.79 +27.89 +0.41%

CAC 4,463.67 +32.26 +0.73%

DAX 9,758.53 +97.03 +1.00%

Crude oil $94.38 (-0.04%)

Gold $1220.20 (-1.27%)

(company / ticker / price / change, % / volume)

| International Business Machines Co... | IBM | 192.82 | +0.01% | 0.9K |

| Walt Disney Co | DIS | 90.36 | +0.03% | 1.0K |

| Wal-Mart Stores Inc | WMT | 76.27 | +0.04% | 53.7K |

| Pfizer Inc | PFE | 30.37 | +0.07% | 1.8M |

| Intel Corp | INTC | 35.01 | +0.09% | 0.8K |

| The Coca-Cola Co | KO | 41.66 | +0.12% | 174.2K |

| AT&T Inc | T | 35.07 | +0.14% | 3.4K |

| Cisco Systems Inc | CSCO | 25.24 | +0.14% | 1.5K |

| Merck & Co Inc | MRK | 60.00 | +0.20% | 0.1K |

| Exxon Mobil Corp | XOM | 97.28 | +0.21% | 0.4K |

| McDonald's Corp | MCD | 93.75 | +0.24% | 29.3K |

| 3M Co | MMM | 145.75 | +0.26% | 0.3K |

| Boeing Co | BA | 128.10 | +0.27% | 3.8K |

| General Electric Co | GE | 26.дек | +0.27% | 18.6K |

| JPMorgan Chase and Co | JPM | 60.47 | +0.27% | 290.0K |

| Nike | NKE | 81.74 | +0.28% | 2.0K |

| Verizon Communications Inc | VZ | 49.36 | +0.30% | 5.8K |

| Goldman Sachs | GS | 185.45 | +0.34% | 0.1K |

| Microsoft Corp | MSFT | 46.69 | +0.37% | 894.00 |

| Home Depot Inc | HD | 91.57 | +0.38% | 0.6K |

| American Express Co | AXP | 89.47 | +0.45% | 2.2K |

| E. I. du Pont de Nemours and Co | DD | 69.68 | +0.62% | 21.9K |

Upgrades:

DuPont (DD) upgraded to Overweight from Neutral at JP Morgan, target raised to $75 from $67

Downgrades:

Other:

FedEx (FDX) target raised to $183 from $170 at Robert W. Baird

FedEx (FDX) target raised to $180 from $170 at Citigroup

The Federal Reserve released the results of its monetary policy meeting yesterday. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed noted "there remains significant underutilization of labor resources".

The Fed raised its estimates for interest rate. The U.S. central bank said interest rate will be 3.75% at the end of 2017.

The Fed Chair Janet Yellen said at the press conference yesterday that the labour market has not recovered fully and inflation has been below the Fed's 2% target.

The Swiss National Bank's (SNB) released its interest rate decision today. The SNB kept its interest rate unchanged at 0.00 - 0.25% and also kept the exchange rate floor unchanged at 1.20 francs per euro.

Switzerland's central bank said "will continue to enforce the minimum exchange rate with the utmost determination".

"It is prepared to purchase foreign currency in unlimited quantities, and if necessary, it will take further measures immediately", the SNB.

The central bank kept its 2014 outlook for inflation unchanged at 0.1%. The projection for 2015 inflation was cut to 0.2% from 0.3%. Inflation in 2016 is expected to be 0.5%.

"The risk of deflation has increased again," the central bank said.

The SNB lowered its GDP forecast for 2014 to 1.5% from 2% in June.

The Swiss National Bank Chairman Thomas Jordan said that the central bank has not ruled out the introduction of negative interest rates.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Bulletin

06:00 Switzerland Trade Balance August 3.98 2.56 1.39

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

07:30 Switzerland SNB Interest Rate Decision 0.25% 0.25% 0.25%

07:30 Switzerland SNB Monetary Policy Assessment

08:00 United Kingdom Scottish Independence Vote

08:30 United Kingdom Retail Sales (MoM) August +0.1% +0.4% +0.4%

08:30 United Kingdom Retail Sales (YoY) August +2.5% Revised From +2.6% +3.9%

09:15 Eurozone Targeted LTRO 174 82.6

10:00 United Kingdom CBI industrial order books balance September 11 9 -4

The U.S. dollar traded mixed to lower against the most major currencies ahead of the speech of the Fed Chair Janet Yellen and the U.S. economic data.

Housing starts in the U.S. are expected to decline to 1.040 million units in August from 1.090 million units in July.

The number of building permits is expected to decline to 1.040 million units in August from 1.060 million in July.

The number of initial jobless claims in the U.S. is expected to decline by 3,000 to 312,000.

Yesterday's results of the Fed's monetary policy meeting weighed on the greenback. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed noted "there remains significant underutilization of labor resources".

The euro traded mixed against the U.S. dollar. The European Central Bank said today it allotted €82.6 billion in its new Targeted Long Term Refinancing Operation (TLTRO). Analysts had expected €174 billion.

The British pound traded higher against the U.S. dollar. The Scotland's independence referendum weighed on the pound.

The U.K. retail sales increased 0.4% in August, in line with expectations, after a flat reading in July. July's figure was revised down from a 0.1% rise.

On a yearly basis, retail sales in the U.K. climbed 3.9% in August, after a 2.5% gain in July. July's figure was revised down from a 2.6% increase.

The Confederation of British Industry released its industrial order books balance. The CBI industrial order books balance dropped to -4% in September from +11% in August, missing expectations for a decrease to +9%.

The Swiss franc rose against the U.S. dollar after the Swiss National Bank's (SNB) interest rate decision. The SNB kept its interest rate unchanged at 0.00 - 0.25% and also kept the exchange rate floor unchanged at 1.20 francs per euro.

Switzerland's central bank said "will continue to enforce the minimum exchange rate with the utmost determination".

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.6344

USD/JPY: the currency pair traded mixed

USD/CHF: the currency pair declined to CHF0.9362

The most important news that are expected (GMT0):

12:30 Canada Foreign Securities Purchases June -1.07 2.47

12:30 U.S. Building Permits, mln August 1.06 Revised From 1.05 1.04

12:30 U.S. Housing Starts, mln August 1.09 1.04

12:30 U.S. Initial Jobless Claims September 315 312

12:45 U.S. Fed Chairman Janet Yellen Speaks

14:00 U.S. Philadelphia Fed Manufacturing Survey September 28.0 22.8

EUR/USD

Offers $1.3070, $1.3050, $1.3000, $1.3230/25

Bids $1.2835, $1.2800, $1.2755

GBP/USD

Offers $1.6500, $1.6465, $1.6400, $1.6360

Bids 1.6200, 1.6160, $1.6125/20, $1.6100, $1.6050

AUD/USD

Offers $0.9250/60, $0.9220, $0.9110/00, $0.9050

Bids 0.8920, $0.8900, $$0.8800

EUR/JPY

Offers Y141.60, Y141.00, Y140.40

Bids Y139.20, Y139.00, Y138.45, Y138.15

USD/JPY

Offers Y110.00, Y109.00

BidsY107,40, Y106.70/65, Y106.50, Y106.05/95, Y105.50, Y105.20

EUR/GBP

Offers stg0.8100, stg0.8000/10, stg0.7950

Bids stg0.7880, stg0.7800

Stock indices traded higher. The Fed released the results of its monetary policy meeting. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month. This decision was expected by market participants.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed noted "there remains significant underutilization of labor resources".

The European Central Bank said today it allotted €82.6 billion in its new Targeted Long Term Refinancing Operation (TLTRO). Analysts had expected €174 billion.

Market participants are awaiting the results of the Scotland's independence referendum today.

Current figures:

Name Price Change Change %

FTSE 6,812.66 +31.76 +0.47%

DAX 9,756.69 +95.19 +0.99%

CAC 40 4,460.36 +28.95 +0.65%

The Bank of Japan (BoJ) Governor Haruhiko Kuroda on Thursday reiterated the central bank will adjust its monetary policy if needed to reach the 2% inflation target. He believes that Japan can reach a 2% inflation target at around fiscal 2015 to March 2016.

Mr. Kuroda also said that he is optimistic on a recovery of Japan's exports.

The BoJ governor repeated the country's economy is expected to recover moderately and private consumption has remained resilient as a trend.

Most Asian stock closed higher. The Fed's interest rate decision weighed on markets. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed noted "there remains significant underutilization of labor resources".

The Fed raised its estimates for interest rate. The U.S. central bank said interest rate will be 3.75% at the end of 2017.

Japanese stocks were supported by the weaker yen. The yen declined after the Fed's interest rate decision.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda on Thursday reiterated the central bank will adjust its monetary policy if needed to reach the 2% inflation target. He believes that Japan can reach a 2% inflation target at around fiscal 2015 to March 2016.

Mr. Kuroda also said that he is optimistic on a recovery of Japan's exports.

Japan's public pension funds increased local stock holdings by 393 billion yen in the second quarter.

The People's Bank of China took another step to ease potential cash crunch and old 10 billion yuan ($1.6 billion) of 14-day contracts at 3.5% today.

Hyundai Motor Co. shares dropped 9.2% after bidding for real estate.

Sony Corp. shares plunged 8.6% after widening its net loss forecast and suspending its annual dividend.

Indexes on the close:

Nikkei 225 16,067.57 +178.90 +1.13%

Hang Seng 24,168.72 -207.69 -0.85%

Shanghai Composite 2,315.93 +8.03 +0.35%

EUR/USD: $1.2800(E230mn), $1.2850(E1.87bn), $1.2900(E967mn), $1.2950(E369mn), $1.3000(E1.1bn), $1.3025-30(E618mn), $1.3050(E767mn)

USD/JPY Y107.00($1.1bn), Y107.50($320mn), Y108.00($490mn)

GBP/USD: $1.6200(stg181mn), $1.6300(stg110mn), $1.6350(stg150mn), $1.6400(stg624mn)

EUR/GBP: stg0.7875(E150mn), stg0.7940(E120mn), stg0.7975(E150mn), stg0.8000(E200mn)

USD/CHF: Chf0.9150($515mn), Chf0.9350(E420mn)

EUR/CHF: Chf1.2090(E191mn), Chf1.2150(E128mn)

AUD/USD: $0.8900(A$748mn), $0.8950(A$249mn), $0.9000(A$587mn), $0.9050(A$401mn), $0.9100(A$1.0bn), $0.9200(A$1.1bn)

NZD/USD: $0.8200(NZ$145mn), $0.8300(NZ$208mn)

USD/CAD: C$1.0900($492mn), C$1.0940($200mn), C$1.1000($456mn), C$1.1050($320mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia RBA Bulletin

06:00 Switzerland Trade Balance August 3.98 2.56 1.39

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

07:30 Switzerland SNB Interest Rate Decision 0.25% 0.25% 0.25%

07:30 Switzerland SNB Monetary Policy Assessment

08:00 United Kingdom Scottish Independence Vote

08:30 United Kingdom Retail Sales (MoM) August +0.1% +0.4% +0.4%

08:30 United Kingdom Retail Sales (YoY) August +2.5% Revised From +2.6% +3.9%

The U.S. dollar traded lower against the most major currencies. In the yesterday's evening trading session, the greenback rose significantly against the most major currencies. The U.S. dollar was supported by the results of the Fed's monetary policy meeting. The Fed kept its interest rate unchanged at 0.00-0.25%, but it cut its asset purchase program by another $10 billion to $15 billion. The Fed added it want to close its asset purchase program in the next month.

The Fed also said it will keep its interest rate unchanged for "a considerable time after the asset purchase program ends".

The Fed noted "there remains significant underutilization of labor resources".

The New Zealand dollar traded higher against the U.S dollar after the better-than-expected gross domestic product (GDP) from New Zealand. New Zealand's GDP rose 0.7% in the second quarter, exceeding expectations for a 0.6% increase, after a 1.0% gain in the first quarter.

On a yearly basis, New Zealand's GDP climbed by 3.9% in the second quarter, after a 3.8% rise in the first quarter.

The Australian dollar traded slightly higher against the U.S. dollar. The Fed's interest rate decision weighed on the Aussie.

The Reserve Bank of Australia (RBA) released its bulletin today. The RBA said spare capacity in the Australian labour market has risen over the past few years.

The Japanese yen declined against the U.S. dollar despite the better-than-expected data from Japan. Japan' trade deficit declined to ¥948.5 billion in August from ¥1,023.8 billion, beating expectations for a decline to a deficit of ¥990.0 billion.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda on Thursday reiterated the central bank will adjust its monetary policy if needed to reach the 2% inflation target. He believes that Japan can reach a 2% inflation target at around fiscal 2015 to March 2016.

Mr. Kuroda also said that he is optimistic on a recovery of Japan's exports.

EUR/USD: the currency pair rose to $1.2873

GBP/USD: the currency pair increased to $1.6322

USD/JPY: the currency pair climbed to Y108.87

The most important news that are expected (GMT0):

09:15 Eurozone Targeted LTRO 174

10:00 United Kingdom CBI industrial order books balance September 11 9

12:30 Canada Foreign Securities Purchases June -1.07 2.47

12:30 U.S. Building Permits, mln August 1.06 Revised From 1.05 1.04

12:30 U.S. Housing Starts, mln August 1.09 1.04

12:30 U.S. Initial Jobless Claims September 315 312

12:45 U.S. Fed Chairman Janet Yellen Speaks

14:00 U.S. Philadelphia Fed Manufacturing Survey September 28.0 22.8

EUR / USD

Resistance levels (open interest**, contracts)

$1.2993 (442)

$1.2960 (165)

$1.2935 (34)

Price at time of writing this review: $ 1.2956

Support levels (open interest**, contracts):

$1.2832 (3121)

$1.2801 (2471)

$1.2765 (4530)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 50640 contracts, with the maximum number of contracts with strike price $1,3000 (4958);

- Overall open interest on the PUT options with the expiration date October, 3 is 55553 contracts, with the maximum number of contracts with strike price $1,3000 (6669);

- The ratio of PUT/CALL was 1.10 versus 1.13 from the previous trading day according to data from September, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.6505 (3083)

$1.6409 (1565)

$1.6315 (1576)

Price at time of writing this review: $1.6264

Support levels (open interest**, contracts):

$1.6187 (1493)

$1.6090 (3350)

$1.5992 (2258)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 29898 contracts, with the maximum number of contracts with strike price $1,6500 (3083);

- Overall open interest on the PUT options with the expiration date October, 3 is 39529 contracts, with the maximum number of contracts with strike price $1,6300 (4736);

- The ratio of PUT/CALL was 1.32 versus 1.37 from the previous trading day according to data from September, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.