- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-08-2014

(raw materials / closing price /% change)

Light Crude 96.64 +0.24%

Gold 1,298.20 -0.08%

(index / closing price / change items /% change)

Nikkei 225 15,322.6+4.26 0.0%

Hang Seng 24,955.46 +0.52 0.0%

Shanghai Composite 2,239.47 +12.73 +0.6 %

FTSE 100 6,741.25 +52.17 +0.8 %

CAC 40 4,230.65 +56.29 +1.3 %

Xetra DAX 9,245.33 +152.73 +1.7 %

S&P 500 1,971.74 +16.68 +0.9 %

NASDAQ 4,508.31 +43.39 +1.0 %

Dow Jones 16,838.74 +175.83 +1.1 %

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3361 -0,28%

GBP/USD $1,6725 +0,22%

USD/CHF Chf0,9064 +0,46%

USD/JPY Y102,56 +0,21%

EUR/JPY Y137,03 -0,12%

GBP/JPY Y171,53 +0,41%

AUD/USD $0,9322 +0,03%

NZD/USD $0,8477 -0,08%

USD/CAD C$1,0886 -0,09%

(time / country / index / period / previous value / forecast)

01:30 Australia RBA Meeting's Minutes

03:00 New Zealand Expected Annual Inflation 2y from now Quarter III +2.4%

08:00 Eurozone Current account, adjusted, bln June 19.5 21.3

08:30 United Kingdom Retail Price Index, m/m July +0.2%

08:30 United Kingdom Retail prices, Y/Y July +2.6% +2.6%

08:30 United Kingdom RPI-X, Y/Y July +2.7%

08:30 United Kingdom Producer Price Index - Input (MoM) July -0.8% -0.8%

08:30 United Kingdom Producer Price Index - Input (YoY) July -4.4%

08:30 United Kingdom Producer Price Index - Output (MoM) July -0.2% +0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) July +0.2%

08:30 United Kingdom HICP, m/m July +0.2%

08:30 United Kingdom HICP, Y/Y July +1.9% +1.8%

08:30 United Kingdom HICP ex EFAT, Y/Y July +2.0% +1.9%

12:30 U.S. Building Permits, mln July 0.963 1.000

12:30 U.S. Housing Starts, mln July 0.893 0.970

12:30 U.S. CPI, m/m July +0.3% +0.1%

12:30 U.S. CPI, Y/Y July +2.1%

12:30 U.S. CPI excluding food and energy, m/m July +0.1% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y July +1.9%

20:30 U.S. API Crude Oil Inventories August +2.0

23:30 Australia RBA's Governor Glenn Stevens Speech

23:50 Japan Adjusted Merchandise Trade Balance, bln July -1080.8 -770.0

Stock indices traded higher as tensions over Ukraine eased. The Russian and Ukrainian foreign ministers met in Berlin on Sunday. Russian Foreign Minister Sergei Lavrov said no progress had been made towards a ceasefire, but all issues related to Russian humanitarian convoy had been resolved. Germany's Foreign Minister Frank-Walter Steinmeier said there was some progress made.

Eurozone's trade surplus dropped to 13.8 billion euros in June from a surplus of 15.2 billion euros in May, missing expectations for a decline to 14.9 billion euros. May's figure was revised down from a surplus of 15.3 billion euros.

United Internet AG shares increased 3.7% after buying a 10.7% stake in Rocket Internet AG.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,741.25 +52.17 +0.78%

DAX 9,245.33 +152.73 +1.68%

CAC 40 4,230.65 +56.29 +1.35%

Brent crude fell to the lowest in almost 14 months after Kurdish and Iraqi forces seized control of Iraq's largest dam from Islamic State militants. West Texas Intermediate declined.

Brent slid as much as 2 percent. Kurdish forces and government anti-terrorism units took over the Mosul Dam after receiving air support from the U.S., reversing gains made by the Sunni-Muslim insurgents in the north, according to Iraqi military spokesman Qassim Ata. Futures rose the most in a month on Aug. 15 after Ukraine said its forces attacked and partially destroyed a military convoy entering the country from Russia.

"The anti-ISIS forces are gathering strength and making progress," said Michael Lynch, president of Strategic Energy & Economic Research in Winchester, Massachusetts. "The threat has peaked, and the risk premium is declining. We are selling off from Friday's Ukraine-inspired bump."

Brent for October settlement slid $1.95, or 1.9 percent, to $101.58 a barrel at 9:39 a.m. New York time on the London-based ICE Futures Europe exchange. It fell as far as $101.43, the lowest since June 26, 2013. The contract rose $1.46 on Aug. 15, the most since July 17. The volume of all futures traded was about 5.9 percent below the 100-day average for the time of day.

WTI for September delivery decreased $1.18, or 1.2 percent, to $96.17 a barrel on the New York Mercantile Exchange. Volume was 2.2 percent below the 100-day average. The October contract of the U.S. benchmark crude was at a discount of $7.70 to Brent for the same month on ICE. The spread closed at $8.21 on Aug. 15, the widest since June 24.

The U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected NAHB housing market index. The NAHB housing market index climbed to 55.0 in August from 53.0 in July. Analysts had expected the index to remain unchanged at 53.0.

Market participants continued to monitor closely geopolitical tensions.

The euro declined against the U.S. dollar due to speculation that the European Central Bank will add new stimulus measures.

Eurozone's trade surplus dropped to 13.8 billion euros in June from a surplus of 15.2 billion euros in May, missing expectations for a decline to 14.9 billion euros. May's figure was revised down from a surplus of 15.3 billion euros.

The British pound traded mixed against the U.S. dollar. The UK currency was supported by the BoE governor's comments. The Bank of England Governor Mark Carney told the Sunday Times on Sunday that the Bank of England don't need to wait for wage growth to rise its interest rate.

The Canadian dollar traded slightly lower against the U.S. dollar after the foreign securities purchases in Canada. Canada's foreign securities purchases dropped by C$1.07 billion in June, missing expectations for a C$14.68 billion rise, after an increase of C$21.42 billion in May. May's figure was revised down from a rise of C$21.43 billion.

The New Zealand dollar traded lower against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded mixed against the U.S. dollar after weaker new motor vehicle sales in Australia. New motor vehicle sales in Australia declined 1.3% in July, after a 1.7% rise in June.

On a yearly basis, new motor vehicle sales in Australia fell 0.4% in July, after a 2.2% drop in June.

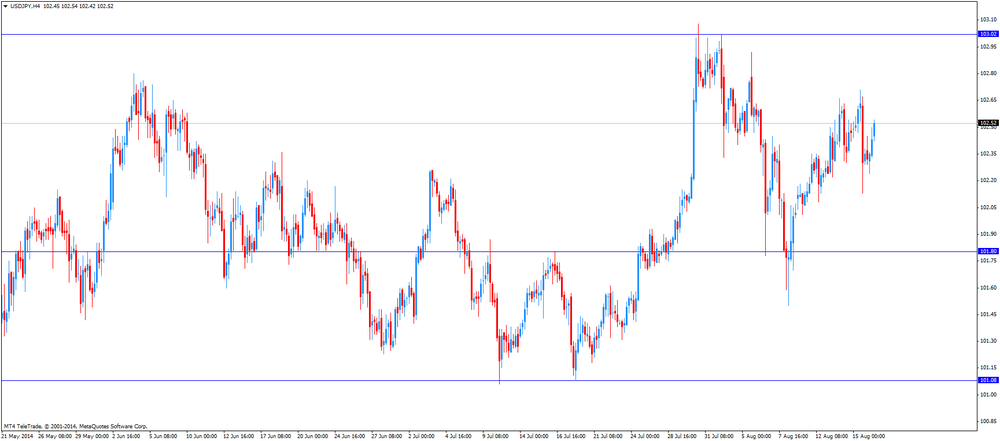

The Japanese yen decreased against the U.S. dollar in the absence of any major economic reports in Japan.

Gold depreciates against the background of easing tensions in Ukraine, but a stable dollar limited the losses, and the price of the metal is kept in the $ 1,300 per ounce.

Russia's Foreign Ministry said on Monday that the negotiations between Russia, Germany, France and Ukraine in Berlin on Sunday about ways to end the armed conflict in eastern Ukraine has been made "some progress".

European stock markets rose after reducing the threat of further escalation of the conflict in Ukraine, although the situation remains difficult.

Dollar unchanged against a basket of currencies after the sixth consecutive week of falling, while the yield on 10-year Treasuries was close to a 12-month low reached at the previous week.

In addition to geopolitics, from 21 to 23 August, investors will be focused on the meeting of leading officials from central banks and economists in Jackson Hole, Wyoming.

Investors will be watching the speech from Fed Chairman Janet Yellen, who will perform for the first time on Friday in Jackson Hole at the head of the Central Bank of the USA.

On Wednesday, the Fed will publish the minutes of its July policy meeting, while the gold traders are waiting for any signs of a future increase in interest rates by the bank.

The Central Bank of the United States, is expected to raise interest rates in the middle of next year, depending on the strength of the economy. Higher interest rates will encourage investors to withdraw money from assets such as gold.

Standard Bank analyst Walter de Wet said the market does not expect the Fed's policy changes this week. "Range $ 1.284- $ 1,300 provides very good support ... the pricing in the market for the most part depends on the level of political tension," - he said.

The cost of the October gold futures on the COMEX today dropped to $ 1295.80 per ounce.

USD/JPY Y101.75-80, Y102.15, Y102.65, Y102.80, Y103.00

EUR/GBP stg0.7965, stg0.8000, stg0.8010

EUR/CHF Chf1.2000, Chf1.2150

AUD/USD $0.9310

USD/CAD C$1.0925-30

U.S. stock futures advanced as diplomats from Ukraine and Russia discussed a possible truce and Kurdish forces made progress against militants in Iraq.

Global markets:

Nikkei 15,322.6 +4.26 +0.03%

Hang Seng 24,955.46 +0.52 0.00%

Shanghai Composite 2,239.47 +12.73 +0.57%

FTSE 6,737.73 +48.65 +0.73%

CAC 4,224.88 +50.52 +1.21%

DAX 9,220.27 +127.67 +1.40%

Crude oil $96.58 (-0.89%)

Gold $1297.40 (-1.32%)

(company / ticker / price / change, % / volume)

| 3M Co | MMM | 142.00 | +0.06% | 1.2K |

| Chevron Corp | CVX | 126.40 | +0.24% | 0.5K |

| International Business Machines Co... | IBM | 187.86 | +0.26% | 0.6K |

| Cisco Systems Inc | CSCO | 24.51 | +0.33% | 32.1K |

| Home Depot Inc | HD | 84.00 | +0.37% | 3.5K |

| Boeing Co | BA | 123.66 | +0.41% | 0.9K |

| McDonald's Corp | MCD | 94.17 | +0.41% | 0.4K |

| Verizon Communications Inc | VZ | 49.00 | +0.41% | 7.7K |

| AT&T Inc | T | 34.89 | +0.43% | 3.8K |

| Intel Corp | INTC | 34.33 | +0.47% | 3.7K |

| Microsoft Corp | MSFT | 45.00 | +0.47% | 6.8K |

| Goldman Sachs | GS | 172.76 | +0.50% | 1.2K |

| Wal-Mart Stores Inc | WMT | 74.27 | +0.50% | 0.9K |

| Exxon Mobil Corp | XOM | 99.54 | +0.51% | 0.6K |

| American Express Co | AXP | 87.05 | +0.52% | 2.9K |

| Walt Disney Co | DIS | 89.75 | +0.53% | 5.7K |

| Caterpillar Inc | CAT | 106.31 | +0.54% | 0.1K |

| JPMorgan Chase and Co | JPM | 57.07 | +0.56% | 3.6K |

| Pfizer Inc | PFE | 28.83 | +0.66% | 1.5K |

| General Electric Co | GE | 25.85 | +0.82% | 15.4K |

| Johnson & Johnson | JNJ | 102.00 | +0.82% | 0.7K |

| United Technologies Corp | UTX | 106.90 | +1.20% | 0.6K |

| The Coca-Cola Co | KO | 40.87 | -0.02% | 273.5K |

| E. I. du Pont de Nemours and Co | DD | 63.95 | -1.99% | 0.1K |

Upgrades:

Hewlett-Packard (HPQ) upgraded to Buy at Monness Crespi & Hardt

Downgrades:

Other:

General Electric (GE) reinstated with an Outperform at Credit Suisse, target $30

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia New Motor Vehicle Sales (MoM) July +1.7% -1.3%

01:30 Australia New Motor Vehicle Sales (YoY) July -2.2% -0.4%

09:00 Eurozone Trade Balance s.a. June 15.2 Revised From 15.3 14.9 13.8

10:00 Germany Bundesbank Monthly Report August

The U.S. dollar traded mixed against the most major currencies ahead of the NAHB housing market index. The NAHB housing market index is expected to remain unchanged at 53 in August.

The euro traded mixed against the U.S. dollar after the weaker-than-expected trade data from the Eurozone. Eurozone's trade surplus dropped to 13.8 billion euros in June from a surplus of 15.2 billion euros in May, missing expectations for a decline to 14.9 billion euros. May's figure was revised down from a surplus of 15.3 billion euros.

The British pound traded mixed against the U.S. dollar. The UK currency was supported by the BoE governor's comments. The Bank of England Governor Mark Carney told the Sunday Times on Sunday that the Bank of England don't need to wait for wage growth to rise its interest rate.

The Canadian dollar traded mixed against the U.S. dollar ahead of the foreign securities purchases in Canada. Foreign investment in Canada is expected to climb by C$14.68 billion in June.

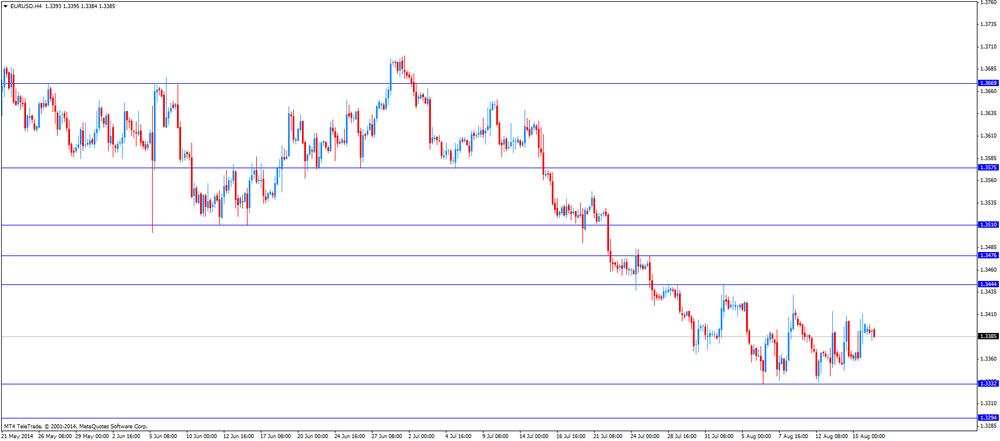

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y102.54

The most important news that are expected (GMT0):

12:30 Canada Foreign Securities Purchases June 21.43 14.68

14:00 U.S. NAHB Housing Market Index August 53 53

22:45 New Zealand PPI Input (QoQ) Quarter II +1.0% +0.7%

22:45 New Zealand PPI Output (QoQ) Quarter II +0.9% +0.8%

EUR/USD

Offers $1.3500, $1.3485, $1.3445, $1.3415

Bids $1.3335-30, $1.3300-3295, $1.3230

GBP/USD

Offers $1.6845, $1.6800/10, $1.6770

Bids $1.6650, $1.6620, $1.6600

AUD/USD

Offers $0.9400, $0.9370, $0.9350, $0.9330

Bids $0.9285/80, $0.9240, $0.9220/00

EUR/JPY

Offers Y138.20, Y138.00, Y137.60

Bids Y136.80/75, Y136.50, Y136.25/20

USD/JPY

Offers Y103.50, Y103.00, Y102.80/85, Y102.65/70

Bids Y102.15, Y102.00, Y101.80, Y101.50

EUR/GBP

Offers stg0.8100, stg0.8035

Bids stg0.7980, stg0.7950/40, stg0.7900

The Bank of England Governor Mark Carney told the Sunday Times on Sunday that the Bank of England don't need to wait for wage growth to rise its interest rate.

The average earnings index, including bonuses, dropped by 0.2% in the three months to June, missing expectations for a 0.1% decrease, after a 0.4% rise in the three months to May. The last month's figure was revised up from a 0.3% gain. That was first negative average earnings index since March-May 2009.

Stock indices traded higher as tensions over Ukraine eased. The Russian and Ukrainian foreign ministers met in Berlin on Sunday. Russian Foreign Minister Sergei Lavrov said no progress had been made towards a ceasefire. Germany's Foreign Minister Frank-Walter Steinmeier said there was some progress made.

Eurozone's trade surplus dropped to 13.8 billion euros in June from a surplus of 15.2 billion euros in May, missing expectations for a decline to 14.9 billion euros. May's figure was revised down from a surplus of 15.3 billion euros.

United Internet AG shares increased 4% after buying a 10.7% stake in Rocket Internet AG.

Current figures:

Name Price Change Change %

FTSE 100 6,736.22 +47.14 +0.70%

DAX 9,218.71 +126.11 +1.39%

CAC 40 4,217.64 +43.28 +1.04%

Asian stock indices closed slightly higher. Tensions over the crisis in Ukraine weighed on markets. The Ukrainian government said on Friday its troops attacked a military convoy that entered the country from Russia.

Investors were also focused on corporate earnings and China's new home prices.

New home prices in China declined in 64 of the 70 cities last month from June.

Nintendo Co. shares rose 4%.

Lenovo Group Ltd. shares climbed 1%.

Indexes on the close:

Nikkei 225 15,322.6 +4.26 +0.03%

Hang Seng 24,955.46 +0.52 0.00%

Shanghai Composite 2,239.47 +12.73 +0.57%

USD/JPY Y101.75-80, Y102.15, Y102.65, Y102.80, Y103.00

EUR/GBP stg0.7965, stg0.8000, stg0.8010

EUR/CHF Chf1.2000, Chf1.2150

AUD/USD $0.9310

USD/CAD C$1.0925-30

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia New Motor Vehicle Sales (MoM) July +1.7% -1.3%

01:30 Australia New Motor Vehicle Sales (YoY) July -2.2% -0.4%

The U.S. dollar traded mixed to lower against the most major currencies. Tensions over the crisis in Ukraine weighed on markets. The Ukrainian government said on Friday its troops attacked a military convoy that entered the country from Russia.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded mixed against the U.S. dollar after weaker new motor vehicle sales in Australia. New motor vehicle sales in Australia declined 1.3% in July, after a 1.7% rise in June.

On a yearly basis, new motor vehicle sales in Australia fell 0.4% in July, after a 2.2% drop in June.

The Japanese yen traded slightly higher against the U.S. dollar due to demand for safe-haven currency as tensions between Russia and Ukraine rose. No major economic reports were released in Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.6763

USD/JPY: the currency pair declined to Y102.24

The most important news that are expected (GMT0):

09:00 Eurozone Trade Balance s.a. June 15.3 14.9

10:00 Germany Bundesbank Monthly Report August

12:30 Canada Foreign Securities Purchases June 21.43 14.68

14:00 U.S. NAHB Housing Market Index August 53 53

22:45 New Zealand PPI Input (QoQ) Quarter II +1.0% +0.7%

22:45 New Zealand PPI Output (QoQ) Quarter II +0.9% +0.8%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3464 (5846)

$1.3443 (1262)

$1.3428 (1262)

Price at time of writing this review: $ 1.3393

Support levels (open interest**, contracts):

$1.3374 (4529)

$1.3358 (1786)

$1.3336 (5160)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 54699 contracts, with the maximum number of contracts with strike price $1,3400 (5846);

- Overall open interest on the PUT options with the expiration date September, 5 is 59628 contracts, with the maximum number of contracts with strike price $1,3100 (6682);

- The ratio of PUT/CALL was 1.09 versus 1.05 from the previous trading day according to data from August, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.7000 (2688)

$1.6901 (2200)

$1.6803 (1661)

Price at time of writing this review: $1.6728

Support levels (open interest**, contracts):

$1.6596 (1947)

$1.6498 (1845)

$1.6399 (752)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 27064 contracts, with the maximum number of contracts with strike price $1,7000 (2688);

- Overall open interest on the PUT options with the expiration date September, 5 is 29380 contracts, with the maximum number of contracts with strike price $1,6800 (4033);

- The ratio of PUT/CALL was 1.09 versus 1.07 from the previous trading day according to data from August, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.