- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-07-2014

Stock indices closed higher, concerns over tensions in Ukraine weighed on markets. A Malaysian Airlines passenger jet crashed in eastern Ukraine. All 298 people on board died.

Eurozone's current account surplus declined to €19.5 billion in May from €21.6 billion in April, missing expectations for a rise to €24.3 billion. April's figure was revised up from a surplus of €21.5 billion.

Volvo AB shares declined 5.4% after the weaker-than-expected second-quarter profit.

Ericsson AB shares jumped 8.2% after the better-than-expected second-quarter profit.

Electrolux AB increased 5.3%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,749.45 +11.13 +0.17%

DAX 9,720.02 -33.86 -0.35%

CAC 40 4,335.31 +19.19 +0.44%

Cost of oil futures fell slightly after much growth in the previous session amid growing geopolitical concerns after the collapse of the liner in Ukraine and another round of U.S. sanctions against Russia.

Crash Malaysian Airlines passenger plane is the main theme of the day, and market participants are wondering whether it will contribute to increased tensions in Ukraine, which in a few months raging pro-Russian riots

Recall last night in eastern Ukraine crashed airliner Malaysian airlines. Killing all 298 people on board, resulting in a conflict between Kiev and pro-Moscow insurgents, in which Russia and the West are at opposite sides has increased sharply. The crash happened on the next day after the United States and the European Union announced a new package of sanctions against Russia after the annexation of the Crimea in April and continuing tension in the rest of Ukraine. U.S. sanctions have become the biggest at the moment.

Markets also continue to monitor developments in the Middle East after Israel on Thursday night announced the start of the ground campaign in Gaza after 10 days of air and naval bombardment failed to stop Palestinian rocket fire. We also add that Libya has raised oil production to 555,000 barrels per day, but the port of Brega is still not working because of the strike guards. Libya asked the UN Security Council to help her in the protection of oilfield facilities, oil ports and civil airports.

"Oil prices are expected to continue their upward trend due to the increasing volatility in the oil market after the uncertainty in the Middle East and rising tensions between Ukraine, Russia and the West," said analyst Myrto Juice from Sucden Financial Research Sucden in London.

Cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 103.21 a barrel on the New York Mercantile Exchange (NYMEX).

August futures price for North Sea Brent crude oil mixture fell $ 0.45 to $ 108.00 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded mixed to higher against the most major currencies after of the Reuters/Michigan consumer sentiment index. The index declined to 81.3 in July from 82.5 in June, missing expectations for an increase to 83.5.

The CB leading indicators for the U.S. rose 0.3% in June, missing expectations for a 0.6% gain, after a 0.5% increase.

Concerns over tensions in Ukraine and Israel's ground campaign in Gaza weighed on markets. Demand for safe-haven currency supported the U.S. currency.

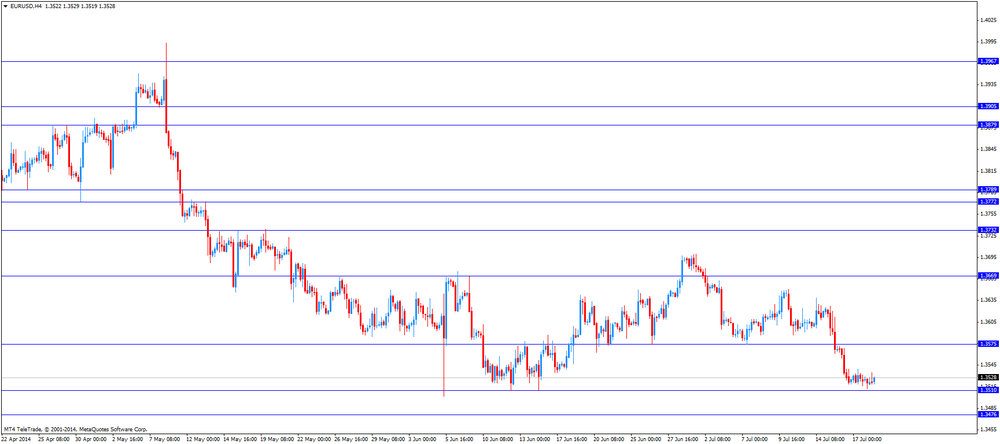

The euro traded lower against the U.S. dollar. The current account surplus in the Eurozone declined to €19.5 billion in May from €21.6 billion in April, missing expectations for a rise to €24.3 billion. April's figure was revised up from a surplus of €21.5 billion.

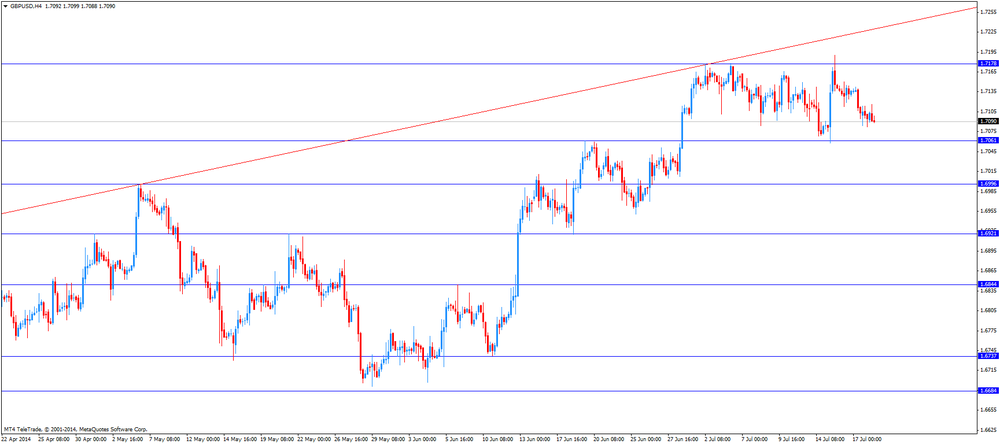

The British pound traded lower against the U.S. dollar in the absence of any major market reports in the UK.

The Canadian dollar traded higher against the U.S. dollar after consumer inflation data from Canada. Annual inflation rose 2.4% in June, after an increase of 2.3% in May. June's inflation reached the highest level since February 2012.

The Bank of Canada's inflation target is 2%. The Bank of Canada Governor Stephen Poloz said this week that the current increase in inflation is temporary.

On a monthly basis, consumer inflation increased 0.1% in June, missing expectations for a 0.4% rise, after a 0.5% gain in May.

Canadian core consumer inflation (excluding eight volatile products) gained 1.8% in June, after a 1.7% rise in May.

On a monthly basis, Canadian core consumer inflation fell 0.1% in June, missing expectations for a 0.4% increase, after a 0.5% rise in May.

Wholesale sales in Canada gained 2.2% in May, exceeding expectations for a 0.7% rise, after a 1.4% increase in April. April's figure was revised up from a 1.2% gain.

The New Zealand dollar traded mixed against the U.S dollar. Decreasing demand for risk assets as the crash of a Malaysian passenger jet in eastern Ukraine and a ground offensive in Gaza weighed on markets. Market participants are awaiting the next Reserve Bank of New Zealand's interest decision. Recently released weak economic data from New Zealand could mean that the RBNZ will keep unchanged its interest rate.

No major economic reports were released in New Zealand.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen traded lower against the U.S. dollar after Bank of Japan's minutes. Members of BoJ's board agreed that the economic recovery will remain on track. The BoJ added that consumer inflation were expected to continue rising moderately and will slow only temporarily.

Gold prices fell sharply today, losing 1 percent, due to profit-taking after yesterday's 1.5 percent growth, but the reluctance to invest in risky assets after the crash in Ukraine support the market.

It should be noted that since the beginning of the week quotes fell nearly 2 percent after a six-week recovery by reducing concerns about Portugal's largest bank and the possibility of an early increase in interest rates the Fed. Prices rose sharply yesterday after reports of falling passenger airliner in the east of Ukraine, which was probably shot down by pro-Russian separatists. The crash happened on the next day after the United States and the European Union announced a new package of sanctions against Russia after the annexation of the Crimea in April and continuing tension in the rest of Ukraine. U.S. sanctions have become the biggest at the moment.

"Geopolitical risks are now elevated. This justifies the rise in gold prices, and in the near future, this growth is sure to continue, "- said an analyst at ANZ Victor Tyanpiriya.

Falling prices is constrained by the news from Israel, which yesterday announced the start of the ground campaign in Gaza after 10 days of air and naval bombardment failed to stop Palestinian rocket fire.

Negative dynamics of gold futures today additionally due to the weakening of investment demand for gold bullion. The assets of the world's largest holder of gold investment institutions ETFs SPDR Gold Trust declined yesterday by 2.69 m - up to 803.34 m (the lowest since July 11, 2014).

The cost of the August gold futures on the COMEX today dropped to $ 1307.20 per ounce.

EUR/USD $1.3500, $1.3525, $1.3530, $1.3550, $1.3575/80

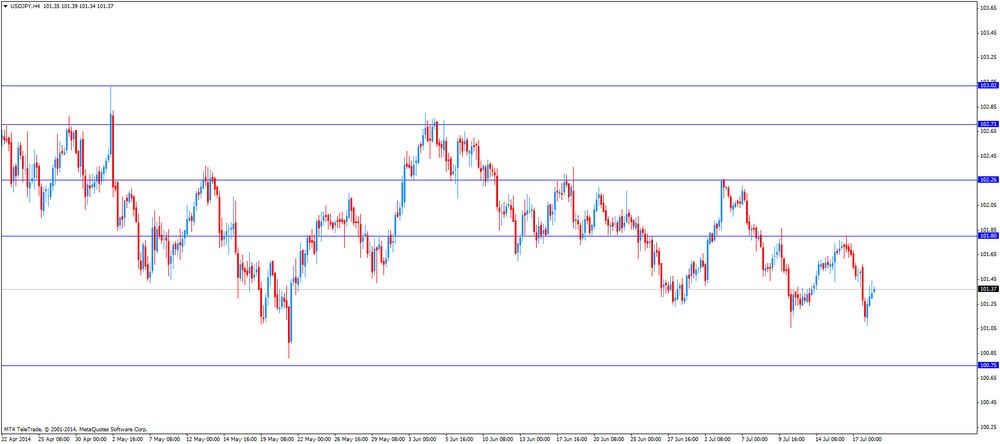

USD/JPY Y101.30

AUD/USD $0.9300, $0.9450

GBP/USD $1.7090/00

EUR/GBP Stg0.7900, stg0.7950, stg0.8050

USD/CAD C$1.0700, C$1.0725, C$1.0740/45, C$1.0750, C$1.0770/75, C$1.0780/90

Statistics Canada released consumer inflation data on Friday. Annual inflation rose 2.4% in June, after an increase of 2.3% in May. June's inflation reached the highest level since February 2012.

The Bank of Canada's inflation target is 2%. The Bank of Canada Governor Stephen Poloz said this week that the current increase in inflation is temporary.

Inflation was driven by food, shelter and transportation costs. Food prices rose 2.9% on an annual basis. Shelter costs jumped 2.9% on an annual basis. Electricity prices increased by 4.2%. Gasoline prices gained by 5.4%.

On a monthly basis, consumer inflation increased 0.1% in June, missing expectations for a 0.4% rise, after a 0.5% gain in May.

Canadian core consumer inflation (excluding eight volatile products) gained 1.8% in June, after a 1.7% rise in May.

On a monthly basis, Canadian core consumer inflation fell 0.1% in June, missing expectations for a 0.4% increase, after a 0.5% rise in May.

(company / ticker / price / change, % / volume)

| Visa | V | 217.97 | +0.04% | 0.6K |

| McDonald's Corp | MCD | 98.46 | +0.09% | 1.3K |

| Microsoft Corp | MSFT | 44.60 | +0.16% | 9.4K |

| Nike | NKE | 76.66 | +0.17% | 0.3K |

| The Coca-Cola Co | KO | 42.10 | +0.19% | 0.3K |

| Intel Corp | INTC | 33.78 | +0.24% | 32.8K |

| Pfizer Inc | PFE | 30.63 | +0.26% | 3.6K |

| Goldman Sachs | GS | 170.63 | +0.29% | 0.4K |

| Merck & Co Inc | MRK | 57.77 | +0.30% | 769.2K |

| AT&T Inc | T | 36.14 | +0.31% | 3.0K |

| Wal-Mart Stores Inc | WMT | 76.88 | +0.35% | 3.2K |

| Verizon Communications Inc | VZ | 50.50 | +0.36% | 9.3K |

| Chevron Corp | CVX | 130.56 | +0.37% | 0.8K |

| Exxon Mobil Corp | XOM | 102.70 | +0.38% | 0.3K |

| Johnson & Johnson | JNJ | 100.75 | +0.38% | 2.5K |

| JPMorgan Chase and Co | JPM | 58.10 | +0.41% | 1.1K |

| UnitedHealth Group Inc | UNH | 85.50 | +0.46% | 1.6K |

| Cisco Systems Inc | CSCO | 25.75 | +0.47% | 1.2K |

| Boeing Co | BA | 126.52 | +0.51% | 1.3K |

| Walt Disney Co | DIS | 85.47 | +0.52% | 0.4K |

| General Electric Co | GE | 26.78 | +0.64% | 0.5K |

| American Express Co | AXP | 94.09 | +1.18% | 0.3K |

| Caterpillar Inc | CAT | 109.07 | 0.00% | 0.5K |

| E. I. du Pont de Nemours and Co | DD | 64.30 | -0.91% | 1.9K |

| International Business Machines Co... | IBM | 190.53 | -1.02% | 10.9K |

| 3M Co | MMM | 141.11 | -1.69% | 0.5K |

Upgrades:

Downgrades:

Other:

Google (GOOG) target raised to $715 from $700 at Canaccord Genuity

Google (GOOG) target raised to $656 from $610 at Oppenheimer

UnitedHealth (UNH) target raised to $94 from $84 at Oppenheimer

EUR/USD

Offers $1.3640, $1.3590/600, $1.3580

Bids $1.3500

GBP/USD

Offers $1.7200

Bids $1.7080, $1.7055, $1.7045/40

AUD/USD

Offers $0.9450, $0.9420, $0.9400

Bids $0.9360, $0.9320, $0.9300

EUR/JPY

Offers Y138.20, Y138.00, Y137.75/80

Bids Y136.50, Y136.00, Y135.75, Y135.50

USD/JPY

Offers Y102.00, Y101.80, Y101.50

Bids Y101.00, Y100.80, Y100.50

EUR/GBP

Offers stg0.7980/85, stg0.7915

Bids stg0.7884-80, stg0.7850, stg0.7800

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:00 Eurozone Current account, adjusted, bln May 21.6 (Revised from 21.5) 24.3 19.5

The U.S. dollar traded mixed to higher against the most major currencies ahead of the Reuters/Michigan consumer sentiment index. Analysts expect the index to increase to 83.5 in July from 82.5 in June.

Concerns over tensions in Ukraine and Israel's ground campaign in Gaza weighed on markets.

The euro traded mixed against the U.S. dollar after Eurozone's current account surplus. The current account surplus in the Eurozone declined to €19.5 billion in May from €21.6 billion in April, missing expectations for a rise to €24.3 billion. April's figure was revised up from a surplus of €21.5 billion.

The British pound traded mixed against the U.S. dollar in the absence of any major market reports in the UK.

The Canadian dollar traded mixed against the U.S. dollar ahead consumer inflation data from Canada. Analysts expected the consumer price index to climb 0.4% in June.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair increased to Y101.4

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m May +1.2% +0.7%

12:30 Canada Consumer Price Index m / m June +0.5% +0.4%

12:30 Canada Consumer price index, y/y June +2.3%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m June +0.5% +0.4%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y June +1.7%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) July 82.5 83.5

14:00 U.S. Leading Indicators June +0.5% +0.6%

Stock indices decreased due to concerns over tensions in Ukraine. A Malaysian Airlines passenger jet crashed in eastern Ukraine. All 298 people on board died.

Eurozone's current account surplus declined to €19.5 billion in May from €21.6 billion in April, missing expectations for a rise to €24.3 billion. April's figure was revised up from a surplus of €21.5 billion.

Volvo AB shares declined 4.8% after the weaker-than-expected second-quarter profit.

Ericsson AB shares jumped 7.8% after the better-than-expected second-quarter profit.

Electrolux AB increased 4.6%.

Current figures:

Name Price Change Change %

FTSE 100 6,706.71 -31.61 -0.47%

DAX 9,693.55 -60.33 -0.62%

CAC 40 4,308.5 -7.62 -0.18%

Most Asian stock indices traded lower concerns over tensions in Ukraine and Israel's invasion into Gaza. A Malaysian Airlines passenger jet crashed in eastern Ukraine. All 298 people on board died.

Israel' troops and tanks moved into Hamas-controlled Gaza. That is Israel's first ground operation in the area since 2009.

Bank of Japan released its monetary policy minutes. Members of BoJ's board agreed that the economic recovery will remain on track. The BoJ added that consumer inflation were expected to continue rising moderately and will slow only temporarily.

Indexes on the close:

Nikkei 225 15,215.71 -154.55 -1.01%

Hang Seng 23,454.79 -66.08 -0.28%

Shanghai Composite 2,059.07 +3.48 +0.17%

EUR/USD $1.3500, $1.3525, $1.3530, $1.3550, $1.3575/80

USD/JPY Y101.30

AUD/USD $0.9300, $0.9450

GBP/USD $1.7090/00

EUR/GBP Stg0.7900, stg0.7950, stg0.8050

USD/CAD C$1.0700, C$1.0725, C$1.0740/45, C$1.0750, C$1.0770/75, C$1.0780/90

EUR/JPY Y138.00

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:00 Eurozone Current account, adjusted, bln May 21.6 (Revised from 21.5) 24.3 19.5

The U.S. dollar traded mixed against the most major currencies. The U.S. dollar was supported by concerns over tensions in Ukraine and a ground campaign in Gaza.

The New Zealand dollar traded lower against the U.S dollar due to decreasing demand for risk assets as the crash of a Malaysian passenger jet in eastern Ukraine and a ground offensive in Gaza weighed on markets. Market participants are awaiting the next Reserve Bank of New Zealand's interest decision. Recently released weak economic data from New Zealand could mean that the RBNZ will keep unchanged its interest rate.

No major economic reports were released in New Zealand.

The Australian dollar climbed against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen traded lower against the U.S. dollar after Bank of Japan's minutes. Members of BoJ's board agreed that the economic recovery will remain on track. The BoJ added that consumer inflation were expected to continue rising moderately and will slow only temporarily.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair was up to Y101.40

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m May +1.2% +0.7%

12:30 Canada Consumer Price Index m / m June +0.5% +0.4%

12:30 Canada Consumer price index, y/y June +2.3%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m June +0.5% +0.4%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y June +1.7%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) July 82.5 83.5

14:00 U.S. Leading Indicators June +0.5% +0.6%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3603 (733)

$1.3581 (355)

$1.3553 (79)

Price at time of writing this review: $ 1.3521

Support levels (open interest**, contracts):

$1.3497 (4181)

$1.3476 (2605)

$1.3448 (7663)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 25553 contracts, with the maximum number of contracts with strike price $1,3650 (3704);

- Overall open interest on the PUT options with the expiration date August, 8 is 34336 contracts, with the maximum number of contracts with strike price $1,3500 (7663);

- The ratio of PUT/CALL was 1.34 versus 1.34 from the previous trading day according to data from July, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.7401 (1015)

$1.7302 (1264)

$1.7204 (1479)

Price at time of writing this review: $1.7100

Support levels (open interest**, contracts):

$1.6996 (2594)

$1.6898 (2058)

$1.6799 (1288)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 15949 contracts, with the maximum number of contracts with strike price $1,7250 (2195);

- Overall open interest on the PUT options with the expiration date August, 8 is 22899 contracts, with the maximum number of contracts with strike price $1,7000 (2594);

- The ratio of PUT/CALL was 1.44 versus 1.41 from the previous trading day according to data from Jule, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(raw materials / closing price /% change)

Light Crude 103.82 +0.61%

Gold 1,322.70 +0.44%

(index / closing price / change items /% change)

S&P/ASX 200 5,522.43 +3.57 +0.06%

TOPIX 1,273.38 -0.21 -0.02%

SHANGHAI COMP 2,055.59 -11.68 -0.57%

HANG SENG 23,520.87 -2.41 -0.01%

FTSE 100 6,738.32 -46.35 -0.68%

CAC 40 4,316.12 -52.94 -1.21%

Xetra DAX 9,753.88 -105.39 -1.07%

S&P 500 1,958.12 -23.45 -1.18%

NASDAQ 4,363.45 -62.52 -1.41%

Dow Jones 16,976.81 -161.39 -0.94%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3526 +0,01%

GBP/USD $1,7100 -0,21%

USD/CHF Chf0,8973 -0,09%

USD/JPY Y101,15 -0,49%

EUR/JPY Y136,81 -0,50%

GBP/JPY Y172,96 -0,71%

AUD/USD $0,9346 -0,16%

NZD/USD $0,8663 -0,55%

USD/CAD C$1,0759 +0,15%

(time / country / index / period / previous value / forecast)

02:50 Japan Monetary Policy Meeting Minutes

11:00 Eurozone Current account, adjusted, bln May 21.5 24.3

15:30 Canada Wholesale Sales, m/m May +1.2% +0.7%

15:30 Canada Consumer Price Index m / m June +0.5% +0.4%

15:30 Canada Consumer price index, y/y June +2.3%

15:30 Canada Bank of Canada Consumer Price Index Core, m/m June +0.5% +0.4%

15:30 Canada Bank of Canada Consumer Price Index Core, y/y June +1.7%

16:55 U.S. Reuters/Michigan Consumer Sentiment Index July 82.5 83.5

17:00 U.S. Leading Indicators June +0.5% +0.6%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.