- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-04-2022

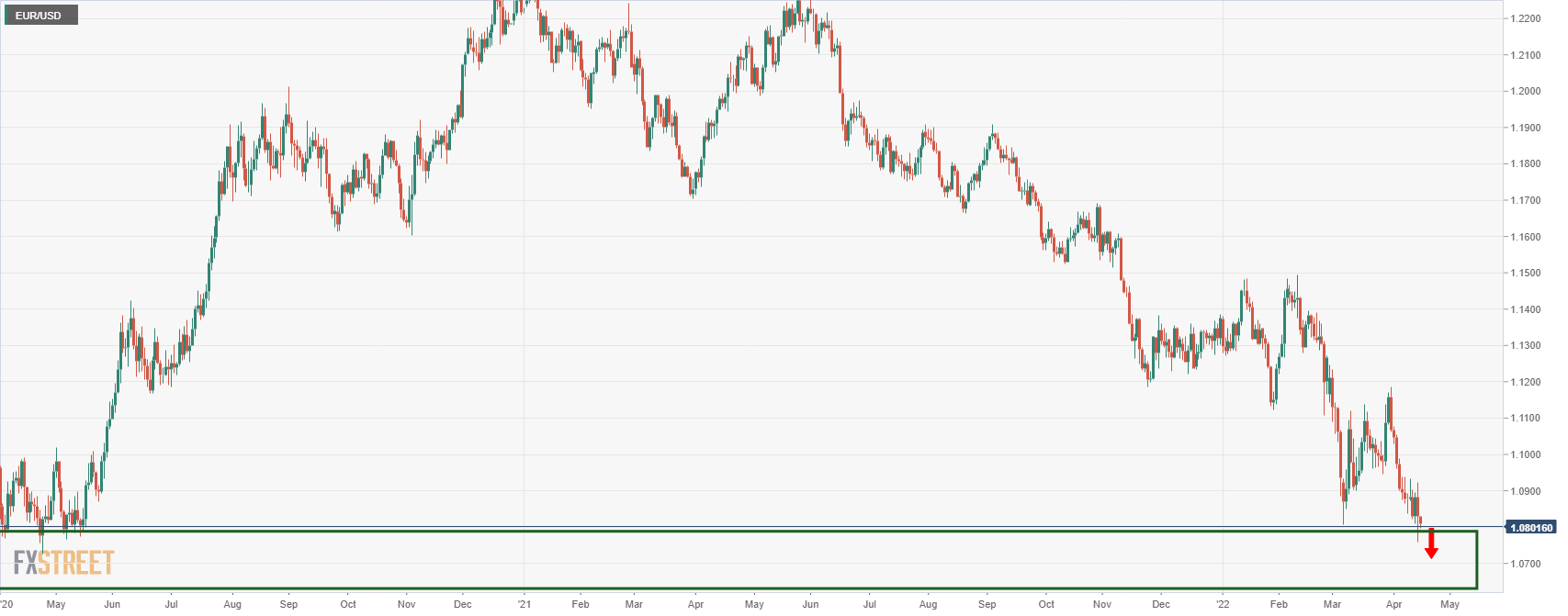

- EUR/USD sees more weakness below 1.0770 on a firmer DXY.

- The ECB will shift to rate hike measure after the conclusion of the ‘Asset Purchase Program’.

- This week Fed Powell’s speech and the release of the EURO’s core CPI will remain in focus.

The EUR/USD pair is hovering around the yearly lows at 1.0769 as investors await the final speech from Federal Reserve (Fed) Chair Jerome Powell before the mega event of monetary policy announcement in May.

The pair has remained vulnerable in the past few trading sessions after the European Central Bank (ECB) maintained its status quo by keeping the policy rates unchanged. After recognizing the elevated inflation levels and stagnant growth rate in the eurozone due to the Ukraine crisis, the ECB preferred to take the bullet itself and went for an unchanged interest rate decision along with neutral guidance.

The ECB dictated that a rate hike decision will get exposed only after the central bank would conclude the ‘Asset Purchase Program’ (APP), which is expected to happen in the third quarter. Currently, higher energy bills are dampening the confidence of the households and corporate.

Meanwhile, the US dollar index (DXY) is inching closer to the 101.00 amid elevated bets on a tight monetary policy by the Fed. St. Louis Fed President James Bullard in his speech on Monday has stated that a 3.5% interest rate is the minimum needed to be achieved this fiscal year. In order to achieve the 3.5% interest rate, the Fed needs to bank upon 50 basis points (bps) rate hike each time in the remaining six interest rate decisions in 2022.

Going forward, the speech from Fed Chair Jerome Powell will hold more importance. However, investors will also focus on the core Consumer Price Index (CPI) to be released by Eurostat on Thursday. The yearly Euro’s core CPI is expected to land at 3%, similar to the prior figure.

- The AUD/JPY begins the Asian Pacific session up 0.23%.

- A dismal market mood weighed on the AUD, but a soaring USD/JPY capped the AUD/JPY Monday’s losses.

- AUD/JPY Price Forecast: In consolidation, waiting for a fresh catalyst.

The Australian dollar clings to gains as the Asian Pacific session begins, though it remains in choppy trading in the 93.00-70 range for the last five days. At the time of writing, the AUD/JPY is trading at 93.51, up some 0.23% at the time of writing.

Risk sentiment, despite a weaker JPY, weighs on the AUD

US equities finished Monday’s session mixed, reflecting the market mood. In the FX complex, the greenback was the gainer in the session, while the antipodeans and safe-haven peers were the laggards. It’s worth noting that the USD/JPY reached a 20-year high above the 127.00 mark, capping the AUD/JPY losses.

- Also read: USD/JPY reaches a 20-year high and breaks 127.00 on high US yields

On Monday, during the Asian session, the AUD/JPY opened around 93.40s before surging towards the daily high at 93.71, followed by a 60-pip fall towards 93.07, a level unsuccessfully broken for the last three days.

AUD/JPY Price Forecast: Technical outlook.

The AUD/JPY daily chart depicts choppy trading in the pair, consolidating in the 93.00-75-0/80 range for the last five trading days. It also shows a negative divergence between price action and the Relative Strength Index (RSI), with the AUD/JPY printing successive series of higher highs, contrarily to the RSI, recording lower highs.

In the meantime, the AUD/JPY 1-hour chart depicts the pair as upward biased and aims to retest the 93.71 Monday’s highs, which, once broken, would open the door for a 94.00 test. However, it would find some hurdles on its way up.

The AUD/JPY first resistance would be the confluence of the R1 daily pivot and a five-day downslope trendline around 93.65. A breach would expose April 13 daily high at 93.86, followed by the R2 daily pivot at 94.00.

Downwards, the AUD/JPY first support would be the confluence of the 50 and 100-simple moving averages (SMAs) around the 93.42-43 area. A decisive break would expose the daily pivot at 93.37, followed by April 18 daily low at 93.07, close to the S1 daily pivot at 93.01.

- A bull flag formation is signaling a continuation of a rally after a time correction.

- The RSI (14) needs to overstep 60.00 for a fresh upside.

- The 20- and 100-EMAs are scaling higher, which signals for gains ahead.

The EUR/JPY pair is oscillating in a narrow range of 136.48-137.08 since Friday. The cross has been facing headwinds while crossing March’s high at 137.58. The asset has remained in a positive trajectory amid broader weakness in the Japanese yen.

The formation of a bullish flag chart pattern over a four-hour time frame is presenting a bull-case scenario for the market participants. The chart pattern signals a directionless move after a strong run towards the north and leads to a further upside if consolidation breaks out decisively. A consolidation phase in a bull flag formation reflects a shakeout for the retail participants.

The 20- and 100-period Exponential Moving Averages (EMAs) at 136.62 and 135.68 respectively are advancing firmly, which adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has trimmed its range to 40.00-60.00, which signals a consolidation ahead. For a fresh impulsive wave, the RSI (14) needs to violate 60.00 decisively.

A cross of March’s high at 137.58 will activate the bull flag breakout, which will send the asset towards the round level resistance of 138.00, followed by the 13 August 2015 high at 138.85.

On the flip side, euro bulls may lose momentum if the asset drop below April’s low at 134.34, which will drag the asset towards the March 25 low at 133.73. A breach of the latter will send the asset to its ultimate target of February 10 high at 133.15.

EUR/JPY four-hour chart

-637859203477714167.png)

- The DXY is experiencing a time correction as bulls are gearing up for further upside

- Fed’s Bullard has dictated a target of 3.5% interest rates this year.

- Also, the FOMC member has opened doors for a 75 bps rate hike by the Fed.

The US dollar index (DXY) went into a time correction in the late New York session after hitting a high of 100.86. The hawkish stances of the Federal Reserve (Fed) policymakers are keeping the asset ascending as investors are pouring their funds into the safe-haven assets amid inflation concerns. As quickly as we are approaching the announcement of the interest rate decision by the Fed, which is due in May, bets over an aggressive interest rate hike are increasing firmly.

FOMC Member James Bullard's speech

St. Louis Fed President James Bullard in his speech on Monday has stated that 3.5% is the minimum Fed policy rate need to be achieved this year. To consider the achievement of a 3.5% interest rate, the Fed would require raising its rate by 50 basis points (bps) each time in its six monetary policies. The Federal Open Market Committee (FOMC) member has cleared that inflation is far too high from the comfort and a 75 bps rate hike cannot be ruled out, however, the base case is not for more than 50 bps at any monetary policy committee (MPC) meet.

Key events this week: Building Permits, Housing Starts, Initial Jobless Claims, and S&P Global PMI.

Eminent issues on the back boiler: Russia-Ukraine Peace Talks, International Monetary Fund (IMF) meeting, People’s Bank of China (PBOC) interest rate decision Fed Chair Jerome Powell speech, and Bank of England (BOE) Governor Andrew Bailey speech.

- NZD/USD is on its knees in the face of a hawkish Fed.

- The bears are lurking as the bulls try to correct.

NZD/USD has been correcting to the upside in the latter part of the New York session and is now meeting a resistance area that was carved out during US dollar strength. The price is currently trading at 0.6730 and towards the bottom of the recent weekly bearish run.

A solid rise in US bond yields underpinned the US dollar and send the kiwi lower at the start of the week. ''The USD usually does well into rate hikes but starts to fade early on, but this time it’s maintaining its strength thanks to peculiarities including global geopolitics,'' analysts at ANZ Bank said.

All eyes on the Fed

With a focus on the Federal Reserve, Fed member James Bullard spoke on Monday and offered further insight on the outlook for Fed policy. Bullard is one of the bank's most hawkish and has called for interest rates to reach 3.0% this year.

US inflation is "far too high," he said on Monday, repeating his case for increasing interest rates to 3.5% by the end of the year to rein in inflation expectations and slow what are now 40-year-high inflation readings.

"What we need to do right now is get expeditiously to neutral and then go from there," Bullard said at a virtual event held by the Council on Foreign Relations, adding that he doesn't expect to need to raise rates by more than half a percentage point at any meeting.

He said that the Unemployment Rate can continue to fall even with aggressive rate hikes, repeating his view that unemployment, now at 3.6%, will go below 3% this year.

Looking forward, a speech from Fed Chair Jerome Powell later this week, where he is expected to solidify expectations for a 50 bps rate hike at the coming Fed policy meeting.

Meanwhile, ''technically, the NZD is now at a key level (0.6723 being the 61.8% Fibo of the January-April rally). A sustained break below could see a deeper trough, but equally, if it holds, that’d likely form a short term base. Complicated,'' the analysts at ANZ Bank said.

- The USD/JPY begins the week in a positive tone, up some 1.67%.

- Geopolitical issues and surging energy prices weighed on the JPY.

- St. Louis Fed President James Bullard said inflation is “far too high.”

- USD/JPY Price Forecast: The speed of the rise keeps the USD/JPY subject to a mean reversion move.

USD/JPY prolonged its gains to four consecutive trading days and printed a 20-year high above the 127.00 mark, amidst the escalation of the Ukraine-Russia war and the lack of cease talks, which paints a picture of no truce in the near-term. At the time of writing, the USD/JPY is trading at 127.07, reaching a 20-year high.

Ukraine-Russia jitters and high energy prices weigh on the Japanese yen

The headlines remain dominated by the Ukraine-Russia conflict. Deterioration in Eastern Europe elevates the prospects of high global inflation, as reflected by oil prices, as WTI’s rose 0.60%, above the $107.20. Analysts at banks note that increasing oil and natural gas prices hurt Japan’s reliance on foreign energy. The mix of soaring energy prices and a weaker Yen triggered reactions of the Japanese Finance Minister and the Bank of Japan (BoJ). On Monday, BoJ Governor Kuroda said he was keeping an eye on the impact of excessive FX movements on the economy and added that the JPY weakening has been quite sharp.

In the meantime, the US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, is up 0.31%, sitting at 100.80, supported by expectations that the Federal Reserve would hike 50 bps at the May meeting.

In the meantime, Fed speaking continued ahead of April 23, when the Fed will enter its blackout period for the May 4-5 meeting. On Monday, St. Louis Fed President James Bullard said that inflation is “far too high” while repeating its case of hiking rates to 3.5% by the end 0f 2022. Bullard added that the Unemployment Rate can continue to fall even with aggressive rate hikes, repeating his view that now at 3.6%, unemployment will go below 3% this year.

Last week, the New York Fed President John C. Williams (voter, neutral) stated that a 50 bps rate increase is a reasonable option, but the rate hikes will depend on the economy’s path. Williams added that the Fed needs to move “expeditiously” to normal policy levels and a more neutral.

- Also read: Fed’s Bullard: Inflation expectations could get out of control if we don’t act quickly

USD/JPY Price Forecast: Technical outlook

The speed of the rise of the USD/JPY from 114.00 to 126.99 would keep the pair susceptible to a mean reversion move. However, the US 10-year Treasury yield surge maintains the USD/JPY under buying pressure. The Relative Strength Index (RSI) at 83.68 reflects the aforementioned, and a negative divergence between the price action and the RSI in the daily chart has formed. However, the slope of the RSI is nearly horizontal and appears to confirm a consolidation in the USD/JPY.

If the USD/JPY resumes upwards, the first resistance would be the 127.00 mark. A breach of the latter would expose the February 2002 cycle high at 135.02, but it would find some hurdles on the way north. The next resistance would be May 2002 highs at 129.09, followed by the 130.00 mark.

On the flip side, the USD/JPY first support would be the March 28 cycle high-turned-support at 125.85. Once cleared, the following line of defense would be March 24 daily high at 122.40 and then the March 31 cycle low at 121.27.

Fed member James Bullard spoke on Monday and offered further insight on the outlook for Fed policy. Bullard is one of the bank's most hawkish and has called for interest rates to reach 3.0% this year.

US inflation is "far too high," he said on Monday, repeating his case for increasing interest rates to 3.5% by the end of the year to rein in inflation expectations and slow what are now 40-year-high inflation readings.

"What we need to do right now is get expeditiously to neutral and then go from there," Bullard said at a virtual event held by the Council on Foreign Relations, adding that he doesn't expect to need to raise rates by more than half a percentage point at any meeting.

He said that the Unemployment Rate can continue to fall even with aggressive rate hikes, repeating his view that unemployment, now at 3.6%, will go below 3% this year.

Additional comments are coming through as follows:

- Would be open to a 'reverse twist' although for now happy to go ahead with passive runoff plan for Fed's balance sheet.

- If inflation doesn't go down as hope, could reduce the balance sheet faster as a 'plan b'.

- If war in Ukraine took a turn for the worse it could affect u.s. monetary policy, but that's not my base case.

- Fed's credibility is being tested.

- Inflation expectations could get out of control if we don't act quickly.

- If we act quickly, we'll get inflation expectations under control, and inflation will go back to down.

Market implications

Meanwhile, the US dollar is firm on the day and hit a fresh two-year high on Monday in thin and choppy trading, in line with higher US Treasury yields, as investors braced for multiple half a percentage-point rate hikes from the Federal Reserve.

Here is what you need to know on Tuesday, April 19:

Major European markets were closed on Monday, making for generally quite subdued trading conditions for most of the day, albeit with flows picking up somewhat during US trade. Nonetheless, the US dollar traded firmly across the board against its major G10 counterparts and the Dollar Index (DXY) hit its highest level since April 2020 in the 100.80s.

Traders cited expectations for an increasingly aggressive Fed tightening cycle, as also reflected by upside in US yields across the curve, as boosting the buck on Monday. Aside from tier two data in the form of various housing market reports and the release of the April Philly Fed Manufacturing Index, the main input to the Fed tightening/US economic outlook stories will come when Fed Chair Jerome Powell speaks on Thursday at the IMF/World Bank meetings.

He is expected to solidify expectations that the Fed will be raising interest rates by 50 bps at the upcoming meeting and likely a few more meetings thereafter, as well as kickstarting balance sheet runoff soon. Analysts think this may mean even more upside for US yields and the US dollar ahead.

The Fed’s position as one of the more hawkish G10 central banks was not the only factor supporting the buck on Monday. Market commentators also cited pessemism about the Russo-Ukraine war, with peace talks seemingly at a dead-end (as per remarks from Ukrainian President Zelenskyy over the weekend) and with Russia kicking off its offensive in the east.

This week’s IMF/World Bank meetings will be used as a platform by NATO/Western nations to push for tougher sanctions on Russia, thus underlying the stagflationary risks the conflict and associated sanction response poses to the global economy.

Elsewhere in currency markets, the worst performer of the major G10 currencies was the Aussie dollar, with AUD/USD falling 0.6% to one-month lows underneath the 0.7350 mark, perhaps weighed amid more confusion/pessimism about the lockdown situation in China. Better than expected Chinese GDP growth figures for Q1 2022 did little to ease concerns about the outlook for the Chinese economy for Q2.

The yen also faired poorly mid upside in US yields, with USD/JPY hitting its highest levels since 2002 near 127.00. Recent jawboning about the negative impact of yen weakness in Japan has not bolstered expectations for some kind of currency market intervention to reverse recent yen weakness.

Indeed, analysts suspect that as long as the BoJ continues with its ultra-dovish flagship policies of negative interest rates and yield curve control, the yen is likely to remain under selling pressure. BoJ Governor Haruhiko Kuroda on Monday reiterated that it remains too early to discuss departing from these policies.

The loonie was the second best G10 performer, aided by higher oil prices and with Canadian Consumer Price Inflation data later this week in focus. USD/CAD remained subdued just above 1.2600 and below its 200 and 50-Day Moving Averages.

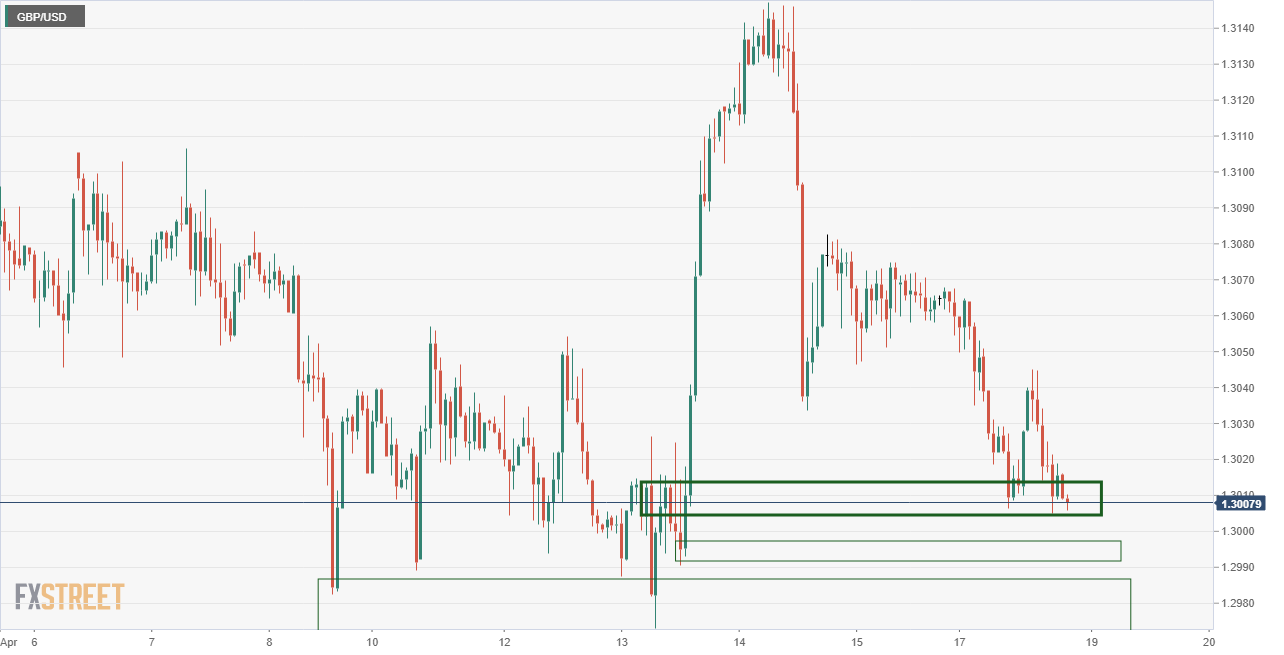

EUR/USD dropped about 0.25% to back under 1.0800 and is once again eyeing last week’s lows around 1.0750. GBP/USD dropped about 0.4% to just above 1.3000 and is also eyeing annual lows, which in this instance are just under the 1.3000 level. NZD/USD fell about 0.3%, dipping below a key level of support in the form of the March low at 0.6728, thus hitting its lowest point since late February. All three pairs were weighed as a result of buck strength.

In the immediate upcoming Asia Pacific session, the only notable economic event is the release of the minutes from the RBA’s last meeting, where the bank dropped its reference to being “patient” regarding rate hikes. Traders will thus be looking for any more clues about the potential timing of interest rates hikes and whether market bets for lift-off in June are overly aggressive.

- GBP/JPY bull is in charge and eye the 4-hour double top.

- The hourly chart is bullish and the bias is with the bulls.

GBP/JPY has broken the neckline of the M-formation and could be on the verge of either a triple top or an upside continuation. The following illustrates the market structure on the four-hour chart and the hourly chart to illustrate the possibilities.

GBP/JPY H4 chart

From a 4-hour perspective, the price is moving in on the double top and pulling away from the dynamic trendline support. However, the price would be expected to move in on the trendline like a magnet. This could result in a triple top. However, if he doubles top resistance breaks, then a meanwhile continuation would be on the cards for the sessions ahead.

GBP/JPY H1 chart

From a 1-hour perspective, the bulls are moving up from a 38.2% Fibonacci retracement that meets prior support. This gives conviction to the meanwhile upside trajectory to test the double top resistance.

- EUR/GBP saw a modest rebound in thin trading conditions on Monday but remained capped under 0.8300.

- The negative tone to recent Russo-Ukraine news/commentary suggests a lasting euro rebound remains unlikely at this time.

- Central bank speak and flash PMIs will be in focus later this week.

EUR/GBP saw a modest rebound in thin trading conditions on Monday, with European markets closed for the Easter holidays. Though at current levels in the 0.8280s, the pair is currently trading with on the day gains of about 0.2%, it was unsurprisingly unable to push back to the north of the 0.8300 level, around which key resistance in the form of late March/early April lows reside.

The negative tone to Russo-Ukraine news/commentary over the weekend and on Monday and further upside in global energy prices suggest that any rebound above 0.8300 would have been short-lived. In recent weeks, the euro has been an underperformer amid fears that a more protected conflict in Ukraine means a greater risk of stagflation in the Eurozone.

The hangover from last week’s not as hawkish as expected ECB meeting is also likely still weighing on EUR/GBP and has seen some betting on a return to annual lows in the 0.8200 area. ECB President Christine Lagarde and BoE Governor Andrew Bailey are both speaking at high-profile IMF/World Bank events this week, and their remarks will be closely scrutinised by EUR/GBP traders.

Friday’s release of flash Eurozone and UK PMI survey data will also provide a timely indicator as to the performance of their respective economies this month as businesses adjust to recent geopolitical events and the subsequent impact on global supply chains and commodity markets. Proper FX flows will be back on Tuesday with the return of European market participants to the fray. For now, it's probably a good bet for EUR/GBP to remain under 0.8300.

- The Australian dollar began the week on the wrong foot, down 0.64%.

- Geopolitics, a firm US dollar, and China’s mixed economic data weighed on the AUD.

- AUD/USD Price Forecast: Failure to reclaim 0.7500, to keep the pair downward pressured.

The Australian dollar extends its losses below the 0.7400 mark, battered by a dampened market mood courtesy of increased attacks of Russia on Ukraine, amid the failure of peace talks, as the Ukrainian Foreign Minister Kuleba expressed that discussions at the Ministry level had not happened in weeks. The AUD/USD is trading at 0.7346 at the time of writing.

Ukraine-Russia tussles, China’s economic data, and a firm US dollar keep the AUD pressured

Geopolitics keeps weighing on risk-sensitive currencies, like the Aussie. Also, mixed data from China, the second-largest worldwide economy and one of Australia’s biggest trading partners, reported that its economy grew for the Q1 by 4.8% y/y, higher than expected, but witnessed a contraction in consumption, as Retails Sales shrank 3.5% y/y, worse than the 1.6% decrease, a headwind for the AUD.

In the meantime, the US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, is up 0.31%, sitting at 100.80, supported by expectations that the Federal Reserve would hike 50 bps at the May meeting.

In the meantime, Fed speaking propelled the prospects of the greenback. Last week, the New York Fed President John C. Williams (voter, neutral) stated that a 50 bps rate increase is a reasonable option, but the rate hikes will depend on the economy’s path. Williams added that the Fed needs to move “expeditiously” to normal policy levels and a more neutral.

- Also read: AUD/USD Weekly Forecast: Pressure mounts, but bulls are not giving up

Aside from this, the Australian economic docket would feature the release of the Reserve Bank of Australia (RBA) meeting minutes at 01:30 GMT, which would shed some light on raising interest rates. On the US front, Fed speaking led by St. Louis Fed President James Bullard will be crossing wires near the end of the New York session, and Chicago’s Fed President Charles Evans, on Tuesday.

AUD/USD Price Forecast: Technical outlook

AUD/USD broke below Pitchfork’s central-parallel line around 0.7400, opening the door for further selling pressure, as the AUD/USD’s fall further extended towards the middle of the 0.73-0.74 range. At the same time, the Relative Strength Index (RSI) remains within the bearish territory at 42.54, aiming lower and with enough room before reaching oversold conditions. However, an upslope trendline that confluences with the 50-day moving average (DMA) lies around the 0.7330-40 area and would be complex support to overcome.

If that scenario plays out, the AUD/USD first support would be 0.7300. A brach of the latter would expose the 200-DMA at 0.7298 that intersects with the mid-line between the central/bottom. Pitchfork’s parallel lines, which once broken, would expose the 100-DMA at 0.7250.

- GBP/USD is sliding into hourly support on the back of a strong US dollar in holiday thin trading.

- Traders will focus on the Fed and BoE speakers this week.

GBP/USD is on the back foot, falling from a high of 1.3064 to a low of 1.3004, down some 0.37% at the time of writing. There were no UK data releases scheduled for Monday and markets have been closed for the Easter Monday Bank holidays.

Instead, the focus has been on the US dollar which has been firmer against its major trading partners ahead of a light data schedule. The week's data highlights include home construction on Tuesday, Existing Home Sales on Wednesday, and Weekly Initial Jobless Claims on Thursday. The Federal Reserve will release its Beige Book summary of economic conditions on Wednesday. Before then, St. Louis Fed President James Bullard speaks at 4:00 pm ET today on the economic and policy outlook.

Meanwhile, the minutes of the March 15-16 Federal Open Market Committee meeting released last week point to a more hawkish Fed. The greenback is supported by firm rates in the US in expectation of a 50 bps rate hike at next month's meeting, May 3-4 meeting. Therefore, the comments from Bullard today will be important before the observed quiet period begins on Saturday.

Similarly, traders will be on the lookout for commentary from the Bank of England's Governor Andrew Bailey who speaks twice on the economy this week. This will offer a strong platform to discuss his dovish views on the BoE's policy stance. ''Thursday's discussion at PIIE is likely to be the most important, but he'll address inflation on an IMF panel on Friday as well. External MPC member Mann speaks on decision-making under uncertainty earlier Thursday as well,'' analysts at TD Securities explained.

GBP/USD technical analysis

The price is reaching hourly support but a break here opens the risk of mitigation of the price imbalance between here and 1.2990/80.

- Silver has pulled back into the $25.80s from earlier more than one-month highs in $26.20s as US yields/USD rose.

- But XAG/USD hold onto gains for the day amid elevated geopolitical/inflation concerns.

After hitting its highest levels in more than one month in the $26.20s per troy ounce, profit-taking has seen spot silver (XAG/USD) prices pull back into the $25.80s, eroding the day’s gains to only about 20 cents or about 0.8%. That compares the gains of as much as 60 cents or over 2.0% at earlier highs. Bouyant US yields that saw major benchmarks hitting fresh multi-year highs, and a strong US dollar that saw the DXY hit its highest point since April 2020 are probably the main reasons why silver bulls decided to book profits.

Higher US yields raise the “opportunity cost” of holding non-yielding assets like silver, hence the typically negative correlation. Meanwhile, a strong US dollar makes USD-denominated commodities more expensive to the holders of international currency, hence the typically negative correlation between XAG/USD and the buck. But in recent weeks, this correlation has been notably weaker than usual given elevated geopolitical/inflation concerns.

And those concerns were key factors driving the market’s mood on Monday. Even though trading volumes were low due to market closures in Europe and some Asia Pacific countries, precious metals markets saw decent gains as the fighting in Ukraine intensified and prospects for a peace deal further receded. This has helped ignite further upside in global energy markets and given the expectation that strict Western sanctions on Russia aren’t going away any time soon, demand for inflation protection remains strong.

This will remain a key theme this week in precious metals markets. Even if Fed Chair Jerome Powell is hawkish in his remarks on Thursday and this does ignite further upside in the US dollar and US yields, many silver bulls will be confident that XAG/USD will soon take the $26.00 level and march on towards recent highs near $27.00.

- In a subdued, holiday-thinned start to the trading week, USD/CAD has traded in thin ranges just above the 1.2600 level.

- Higher oil prices have prevented the pair from being lifted above its 200 and 50DMAs by the buoyant buck.

- Focus this week will be on Fed Chair Powell’s Thursday speech and on Wednesday Canadian CPI figures.

In a subdued start to the trading week with many market participants still away for Easter holiday celebrations and key market closures in Europe and some Asia Pacific regions, USD/CAD has traded in thin ranges just above the 1.2600 level. The pair has been supported by broad strength in the US dollar amid buoyancy in US yields as traders price in a more aggressive Fed tightening cycle and, at current levels in the 1.2610s, trades a modest 0.1% higher.

A sharp rise in global oil prices as a result of pessimism regarding a potential Russo-Ukraine peace deal as fighting intensifies as well as OPEC supply concerns amid new outages in Libya has prevented the pair from breaking above its 200 and 50-Day Moving Averages at the 1.2623 and 1.2653 levels. For now, these technical levels look likely to prevent the pair from testing last week’s peaks in the 1.2675 area.

A key focus for USD/CAD traders this week will be on whether key trends established on Monday continue through the week; i.e. can oil and the US dollar continue recent upside momentum. Regarding the latter, Fed Chair Jerome Powell will be speaking at this week’s IMF/World Bank meetings on Thursday and is expected to solidify expectations for 50 bps rate hikes at upcoming Fed meetings.

Whilst this does present an upside risk to USD/CAD, Canadian March Consumer Price Inflation figures are due on Wednesday. If they show a 0.9% MoM rise in the headline price index, as expected, this should solidify expectations that the BoC will follow up last week’s 50 bps rate hike (which took rates to 1.0%) at its next meeting in June. The BoC’s relatively hawkish stance should thus be enough to shield the loonie from the buck’s advances, for now.

- The USD/CHF begins the week in positive territory, up 0.25%.

- USD/CHF Price Forecast: Tilted to the upside, and if it reclaims 0.9500, a move towards 0.9800 is on the cards.

The Swiss franc extends its losses as depicted by the USD/CHF rising in the North American session, amidst a downbeat sentiment, courtesy of geopolitics, a strong US dollar, and rising US Treasury yields, a tailwind for the USD/CHF. At the time of writing, the USD/CHF is trading at 0.9444.

The market sentiment remains dampened on geopolitics surrounding the conflict between Russia and Ukraine. Ukraine President Volodymyr Zelenskyy said that peace talks are at a dead end and would end if Russia destroyed the Ukrainian troops in Mariupol. At the same time, the Ukrainian Foreign Minister Kuleba said that talks at the Foreign Ministry level have not happened in weeks, so a truce appears unexpected to occur in the near term.

Also read: USD/CHF sticks to modest gains near one-month high, just below mid-0.9400s

In the Asian session, the USD/CHF opened near the day’s lows, seesawing around the daily pivot at 0.9420s, and traded in a 30-pip range upwards, around the 0.9420-55 area.

USD/CHF Price Forecast: Technical outlook

From a technical perspective, the USD/CHF is tilted to the upside and would exacerbate a move towards 0.9800 if USD/CHF bulls reclaim 0.9500. Oscillators remain in the bullish area, with the Relative Strength Index (RSI) at 67.71, though short of reaching overbought conditions.

Upwards, the USD/CHF first resistance would be the YTD high at 0.9460. A breach of the latter would expose 0.9500, followed by June’s 2020 cycle highs at 0.9533 and then the 0.9600 mark.

Technical levels to watch

- The shared currency begins the week on the wrong foot, down some 0.28%.

- The Ukraine-Russia conflict escalates amid the lack of talks at the Foreign Ministry level.

- EUR/USD Price Forecast: Remains downward pressured, and a daily close below 1.0806 would exacerbate a move towards 1.0636.

The EUR/USD extends its losses in the North American session following the Easter Friday holiday, down some 0.33%, trading below the March 7 cycle low at 1.0806, opening the door for further losses amidst a risk-off market mood. At the time of writing, the EUR/USD is trading at 1.0775.

Geopolitics and ECB-Fed divergence a headwind for the EUR/USD

Geopolitics and Fed speaking continue spooking investors. Ukraine’s President Zelenskyy said that talks with Russia are at a “dead end” and emphasized that Ukraine will not trade its territory and people. He added that if Russian forces continued and destroyed the remaining troops in Mariupol, it would “put an end” to talks. The Ukrainian Foreign Minister Kuleva said that there had not been any recent contact at the Foreign ministry level in recent weeks.

Aside from this, the ECB last week’s decision of keeping rates unchanged and failing to deliver a “hawkish hold” highly expected by investors weighed on the shared currency, which finally broke below the 1.0806 mark, reaching a YTD low at 1.0757. Contrarily, Short Term-Interest Rates (STIRs), show that the odds of a 50 bps rate hike by the Fed lie in a 98% chance, further confirmed by Fed speakers late in the last week.

On April 14, the New York Fed President John C. Williams (voter, neutral) noted that a 50 bps rate increase is a reasonable option, but the pace of rate hikes will depend on the economy’s path. Williams added that the Fed needs to move “expeditiously” to normal policy levels, and a more neutral.

An absent EU and US economic docket would leave traders leaning on Fed speaking, with St. Louis Fed President James Bullard crossing wires near the end of the New York session.

Also read: EUR/USD trades flat near 1.0800 in quiet start to week, though bearish themes remain in focus

EUR/USD Price Forecast: Technical outlook

The technical perspective of the EUR/USD remains unchanged, tilted to the downside, though downward pressured, once it cleared the March 7 cycle low at 1.0806. The daily moving averages (DMAs) are still above the spot price, with the 50-DMA at 1.1522 about to cross under the 200-DMA, which would form a death cross, indicating further selling pressure.

That said, the EUR/USD first support would be the YTD low at 1.0757. A decisive break would expose April 2020 swing low at 1.0727, followed by March 2020 cycle low at 1.0636.

- Oil prices are on the front foot on Monday amid heightened geopolitical tensions and OPEC supply concerns.

- WTI is heading towards $110 again, up over $16 versus last week’s lows, and eyeing recent highs around $116.

Oil prices put in a strong rally on Monday as concerns regarding an escalation of fighting in the Russo-Ukraine war and Libyan supply spurred bullish market moves. Front-month WTI futures were last trading higher by nearly $3.0 on the day in the $108.00s and eyeing a break back above $110 and push towards recent highs in the $116 area. WTI has rallied despite lower than usual market trading volumes given many major European market closures for Easter holidays.

The US benchmark for sweet light crude oil now trades an impressive more than $16 per barrel higher than last week’s lows in the $92.00s. The gains have been driven most recently by pessimism on the Russo-Ukraine front. Rhetoric from Ukrainian President Volodymyr Zelenskyy over the weekend suggests peace talks are on the brink of collapse based on what happens in Mariupol, while updates from Ukrainian officials suggest the new Russian offensive in the east has begun.

Member nations of the IMF and World Bank will be meeting this week and a major theme will be toughening sanctions on Russia given the insistence of Western/NATO countries who dominate these global institutions. Sanctions on Russia’s economy seem only likely to be toughened, including perhaps on energy and the impact on Russian output is already evident. Interfax reported last Friday that the country’s output has dropped 7.5% already in April since the end of March.

OPEC+ supply struggles were also in the limelight with Libya’s National Oil Corporation issuing a warning of a “painful wave of closures” and declaring a force majeure at its largest Al-Sharara oilfield, as well as at other sites. The state-owned corporation said that an unidentified group “put pressure on workers in Al-Sharara which forced them to gradually shut down production and made it impossible for NOC to implement its contractual obligations”.

Russian forces tried to break through Ukrainian defenses all along the Donetsk, Luhansk and Kharkiv fronts on Monday, the Ukraine Security Council Secretary said, according to Reuters. Russia appears to have attempted to start the active phase of its new eastern offensive this morning, the Security Council official added.

The official stated that they think Ukrainian forces in Donetsk and Luhansk can withstand the new Russian assault, but warned that the threat to cities from long-range rocket attacks has become much higher.

Additional Updates on Monday

These comments come after Ukrainian's Armed Forces Command said on Monday that they see signs that Russia is beginning its new offensive in eastern Ukraine. Russia's main military target is focused on taking full control of the Donetsk and Luhansk regions, Armed Forces Command added.

Ukraine's Defense Ministry also stated on Monday that Russian aircraft bombing runs in Ukraine have increased by 50%.

The recent escalation of the fighting in Ukraine comes after Ukrainian President Volodymyr Zelenskyy said over the weekend that talks with Russia are at a "dead-end", given that Ukraine will not trade away its territory or people.

Moreover, if Russian forces follow through on threats to destroy the remaining Ukrainian troops in Mariupol, this would "put an end" to peace talks, Zelenskyy warned.

US Treasury Secretary Janet Yellen will urge the International Monetary Fund and World Bank member states to increase economic pressure on Russia whilst also mitigating spillover effects, the US Treasury said in a statement on Monday, reported Reuters.

Additional Remarks:

Yellen will underscore US resolve to hold Russia accountable for its war in Ukraine at this week's IMF and World Bank meetings.

A significant focus of the IMF/World Bank meetings will be on Russia's war against Ukraine and what more can be done to support Ukraine.

Yellen will make clear that the benefits and privileges of the world's leading economic institutions are for countries respecting core principles of peace and security.

The Russian finance minister may virtually attend some sessions at the IMF/World Bank meetings this week, but the US has made clear it cannot be business as usual.

Yellen will not attend some sessions of the G20 finance ministers' meeting but will attend portions supporting ukraine.

Yellen is "deeply concerned" about how Russia's "reckless war" impacts the global economy, including rising food insecurity in emerging markets and developing countries.

Yellen is to hold bilateral meetings with Ukraine's Prime Minister Shmyhal and Finance Minister Marchenko this week.

The US Treasury views estimates of a 35% contraction in Ukrainian economy as daunting and there is no escaping that Ukraine's needs are very large and urgent.

Yellen will convene an April 19 high-level panel with IMF, World Bank, G7 and G20 ministers and others to discuss the issue of food security.

Yellen is to host a news conference on April 21 at 1100ET.

The US Treasury has no specific aid target in mind for addressing global food security panel as it is still analyzing the extent of the problem.

The US Treasury will also continue to impose sanctions that further restrict the Russian economy.

Yellen is concerned about energy insecurity and will discuss ways to restrict Russia's use of energy revenues while providing allies time to find alternate energy sources.

The US Treasury will focus in the coming days and weeks on going after those who attempt to evade sanctions on Russia or facilitate evasion.

The US Treasury is working with Congress for the approval to contribute $21B to IMF trust funds, including a new RST.

The Treasury office of foreign assets control this week will reiterate its commitment to allow the free flow of agricultural exports.

The US Treasury is working with allies to prevent sanction evaders from exploiting financial loopholes to hide their wealth.

- NZD/USD heads for the lowest daily close since late February.

- Technicals point to further losses over the short term.

- US dollar remains strong amid higher US yields and cautions markets.

The NZD/USD is falling for the fifth consecutive day on Monday and technical indicators point to oversold readings in the short term. Still, no signs of correction are seen. The break under 0.6750 left the pair vulnerable to more losses.

Vulnerable while under 0.6750

The NZ/USD is trading at 0.6719, the lowest level in seven weeks. The kiwi failed to recover the 0.6750 area and weakened again during the American session as US yields turn again to the upside.

The US 10-year yield stands at 2.85% and the 30-year at 2.96%, the highest level since April 2019. The DXY is up 0.25%, at 100.75, testing the 2022 top. The stronger US dollar weighs on NZD/USD, unable to benefit from higher commodity prices.

The current week is light in terms of economic data, attention will likely continue on Ukraine and Federal Reserve and RBNZ expectations.

The key day in New Zealand will be on Thursday with Q1 CPI. “Headline inflation is expected at 7.1% y/y vs. 5.9% in Q4. If so, it would be the highest since Q2 90 and further above the 1-3% target range. Last week, the RBNZ delivered the expected 50 bp hike and said it was comfortable with its expected rate path from the February meeting, which sees the policy rate at 2.5% by early 2023 before peaking near 3.5% in 2024”, mentioned analysts at BBH.

In the US, the most relevant day will likely be Friday with service sector surveys. On Wednesday, the Fed will release the Beige Book.

Technical levels

- The S&P 500, the Dow Jones, and the Nasdaq Composite recorded losses in a risk-off market mood as fighting increased in Eastern Europe.

- Ukraine’s President Zelenskyy said that peace talks are dead-end, and if Russia destroys the remaining troops in Mariupol, it will end talks.

- Gold, the greenback, and US Treasuries are rising amidst a hawkish Fed.

After a longer than usual weekend, US equities opened on Monday with losses, reflecting the market mood amid concerns that the Fed would hike rates aggressively and high US Treasury yields. The S&P 500, the Dow Jones Industrial, and the tech-heavy Nasdaq Composite are falling between 0.19% and 0.24%, each sitting at 4382.60, 34,368.09, and 13,866.27, respectively.

The market sentiment is downbeat, amid the escalation of the Ukraine-Russia conflict. Ukrainian President Zelenskiy said peace talks with Russia are at a “dead end” because Ukraine will not trade its territory and people. Furthermore, he warned that if Russian forces followed through on a threat to destroy the remaining Ukrainian troops fighting in Mariupol, it would “put an end” to talks and said they could fight with Russia for ten years.

Regarding stock specifics, highlights came from Twitter (TWTR), which is rising by 0.2%, and shareholders adopted a “poison pill” to protect themselves from a hostile takeover by Elon Musk. In the meantime, the greenback remains in the driver’s seat, as depicted by the US Dollar Index, rising 0.17%, sitting at 100.672, while US Treasury yields, led by the 10-year benchmark note, edge up two and a half basis points, up to 2.851%.

In terms of sector specifics, the main gainers are Energy, up 1.2%, propelled by high oil prices, followed by Financials and Materials, each recording gains of 0.26% and 0.24%, respectively. Contrarily, Health, Industrials, and Consumer Staples are down 0.92%, 0.556% and 0.51%, each.

In the commodities complex, the US crude oil benchmark, WTI, is gaining 0.68%, trading at $107.13 BPD, while precious metals like gold (XAU/USD) are rising 0.75%, exchanging hands at $1987.90 a troy ounce, boosted as a hedge against inflation and slower growth.

Technical levels to watch

Ukrainian's Armed Forces Command said on Monday that they see signs that Russia is beginning its new offensive in eastern Ukraine, reported Reuters. Russia's main military target is focused on taking full control of the Donetsk and Luhansk regions, Armed Forces Command added.

The remarks come after a spokesperson for Ukraine's Defense Ministry said that Russian aircraft bombing runs in Ukraine have increased by 50%.

The recent escalation of the fighting in Ukraine comes after Ukrainian President Volodymyr Zelenskyy said over the weekend that talks with Russia are at a "dead-end", given that Ukraine will not trade away its territory or people.

Moreover, if Russian forces follow through on threats to destroy the remaining Ukrainian troops in Mariupol, this would "put an end" to peace talks, Zelenskyy warned.

- GBP/JPY has spent most of Monday’s quiet, holiday-thinned trading session close to six-year highs around the 165.00 level.

- The pair trades over 9.0% higher versus March lows, with the gains driven by BoE/BoJ policy divergence.

- The next key area of support isn't until the 175.00 area, a further 6.0% higher versus current levels.

GBP/JPY has spent the majority of Monday’s quiet, holiday-thinned trading session close to more than six-year highs around the 165.00 level, with commentary from Japan’s Finance Minister and the BoJ Governor during Asia Pacific hours failing to support the yen. Neither gave the market much to go on regarding potential policymaker intervention to strengthen the yen, suggesting that GBP/JPY’s recent more than 9.0% rally from March lows may yet have legs to run.

Indeed, while the BoE is getting increasingly worried about weak UK growth as a result of the cost-of-living squeeze, they still intend to lift interest rates higher in the coming months. Meanwhile, BoJ Governor Haruhiko Kuroda on Monday said it was premature to discuss an exit from the BoJ’s flagship negative interest rate and yield curve control policies. This widening of the policy differential, which is primarily driven by much higher inflation in the UK versus Japan, has been a key driver of recent yen weakness alongside a sharp rise in global government bond yields (excluding in Japan).

When proper sterling flows return to the market on Tuesday, GBP/JPY bulls will be looking to extend recent gains and for a proper push into the 165.00s. Alarming for the yen bulls, the next key area of GBP/JPY resistance isn’t until around the 175.00 area, a further more than 6.0% rally from current levels. In terms of this week’s main calendar events, eyes will be on the IMF meetings taking place all week, commentary from BoE Governor Andrew Bailey on Thursday and Friday and UK flash April PMI survey results on Friday.

- EUR/JPY is consolidating close to recent highs above the 136.50 mark on Monday in quiet, holiday-thinned trade.

- “Until the BOJ changes its ultra-dovish stance… monetary policy divergence argues for continued yen weakness,” one analyst said.

- Technicians are eyeing a possible bullish breakout above the 137.00 level and a push towards 140.00.

EUR/JPY is consolidating close to recent highs above the 136.50 mark on Monday in quiet, holiday-thinned trade (European markets are shut for Easter), with 137.00 still acting as a ceiling, as has been the case of the last few sessions. Japanese policymaker rhetoric regarding recent yen weakness was in focus during Monday’s Asia Pacific session and continues to offer little hope for the EUR/JPY bears.

Analysts have said that a key reason for recent yen weakness is the BoJ’s relatively dovish stance versus its increasingly hawkish G10 peers. Though the bank will acknowledge rising inflation pressures at its policy meeting later this month, no changes are expected to its flagship negative interest rate and yield curve control policies. BoJ Governor Haruhiko Kuroda on Monday acknowledged that a weaker yen could hit profits, but that it remained premature to debate an exit from its ultra-accommodative policies.

Meanwhile, Japan’s Finance Minister Shunichi Suzuki emphasised that the BoJ’s aim is achieving its inflation target, not manipulate currency rates. “We see low risk of FX intervention,” said analysts at BBH Global Currency Strategy. “Until the BOJ changes its ultra-dovish stance, the monetary policy divergence argues for continued yen weakness and intervention would likely have little lasting impact,” they added.

Technicians have argued that over the past few weeks, EUR/JPY has formed an ascending triangle, a pattern often associated with a bullish breakout. For now, the ceiling of this pattern is the 137.00 level. A break above here would open the door to a swift test of the 2018 highs in the 137.60s and then a push towards 140, a level the pair last traded at in 2015.

- AUD/USD continued losing ground on Monday and dropped to over a one-month low.

- Sustained USD buying and the risk-off mood weighed on the perceived riskier aussie.

- The technical setup favours bearish traders and supports prospects for further losses.

The AUD/USD pair extended its recent sharp pullback from the 0.7660 area, or the highest level since June 2021 and witnessed some follow-through selling on Monday. This marked the fourth successive day of a negative move - also the eighth in the previous nine - and dragged spot prices to a one-month low, around mid-0.7300s.

The US dollar stood tall near its highest level since April 2020 and continued drawing support from expectations for a faster policy tightening by the Fed. Apart from this, a generally weaker tone around the equity markets further benefitted the greenback's safe-haven status and weighed on the perceived riskier aussie.

From a technical perspective, Friday's sustained break below the 0.7400-0.7390 support zone, or the 50% Fibonacci retracement level of the 0.7165-0.7662 rally was seen as a fresh trigger for bearish trades. The subsequent slide, however, stalled near an ascending trend-line extending from sub-0.7000 levels, or the YTD low touched in January.

The aforementioned support coincides with the 61.8% Fibo. level and the 50-day SMA, which, in turn, should now act as a pivotal point for short-term traders. Given that technical indicators on the daily chart have just started drifting into negative territory, a convincing break below will set the stage for additional losses.

The AUD/USD pair might then accelerate the downward trajectory towards the 0.7300 round-figure mark before eventually dropping to the next relevant support near the 0.7255-0.7250 region.

On the flip side, attempted recovery might now confront resistance near the 50% Fibo., around the 0.7400 mark. Sustained strength beyond could trigger a short-covering move and push the pair towards the 38.2% Fibo., around the 0.7470 region. Any further move up, however, is more likely to remain capped near the 0.7500 psychological mark.

AUD/USD daily chart

-637858862857906336.png)

Key levels to watch

World Bank President David Malpass said on Monday that the institution is reducing its forecast for global growth in 2022 to 3.2% from 4.1$ previously, reported Reuters.

Malpass noted that the bank has committed $11B for the purchase and deployment of vaccines in the current fiscal year, with total Covid-19 pandemic spending set to reach $157B in the fiscal year ending in June 2021.

Meanwhile, Malpass said the bank is preparing a new 15-month crisis response financing target of $170B, with $50B committed for use in the next three months. The new crisis envelope, he continued, would help address food insecurity, the refugee crisis and economic stress related to the war in Ukraine.

On central banks, Malpass said that they can help address inflation by using regulatory policies and shortening the duration of their bond portfolios. Long-term bonds tend to benefit countries that already have access to capital markets, he commented. Malpass added that central banks need more tools to address inflation, given that interest rate hikes alone will exacerbate rising inequality.

- GBP/USD is trading a tad weaker amid holiday-thinned trade and is eyeing a test of last week’s sub-1.3000 lows.

- Rhetoric from BoE’s Bailey and Fed’s Powell is likely to highlight a growing BoE/Fed policy divergence.

- Analysts continue to call for GBP/USD falling into the upper 1.20s.

Despite the absence of UK and mainland European market participants given public holidays due to ongoing Easter holiday celebrations in the region, GBP/USD has been trading with a downside bias on Monday amid ongoing USD strength. The pair currently trades just over 0.1% lower in the 1.3030s. Traders are citing continued upside in US yields in premarket trade as markets continue to price in a more aggressive Fed response to tackle rampant US inflation as supporting the buck on Monday.

FX market flows should pick continue to pick up in the coming hours as US market participants enter the fray. Intra-day traders will be eyeing whether USD profit-taking allows GBP/USD to retest its 21-Day Moving Average in the 1.3100 area, or whether the pair extends on modest morning losses to test recent lows.

UK political headlines pertaining to UK PM Boris Johnson’s “partygate” scandal are heating up given his recent fines from the police for breaking lockdown rules and pressure is mounting on the PM to resign. Given the worsening cost-of-living crisis in the UK, Chancellor of the Exchequer Rishi Sunak, the man who used to be the favourite to replace Johnson as PM, has seen his approval rating tank in recent weeks.

If Johnson does resign, there is thus less clarity about a potential successor PM. As a result, there could be some short-lived GBP volatility, and it is a theme worth monitoring. Otherwise, the broader themes of the Russo-Ukraine war and central bank tightening will drive the price action in GBP/USD this week.

BoE Governor Andrew Bailey and Fed Chair Jerome Powell will both be orating later in the week. Their rhetoric is likely to highlight a growing divergence between the two banks, with the BoE likely to slow the pace of rate hikes on the coming quarters amid concerns about economic weakness, while the Fed is likely to accelerate them. Strategists continue to call for GBP/USD to fall into the upper 1.20s.

- USD/JPY oscillated in a range just below the two-decade high touched earlier this Monday.

- BoJ Governor Kuroda’s remarks, the risk-off mood benefitted the JPY and capped the upside.

- Sustained USD buying, the Fed-BoJ policy divergence continued lending support to the pair.

The USD/JPY pair consolidated its recent strong gains to a nearly two-decade high and remained confined in a narrow trading band through the early North American session. the pair was last seen trading around the mid-126.00s, nearly unchanged for the day.

A combination of diverging forces failed to provide any meaningful impetus to the USD/JPY pair and led to subdued/range-bound price move on the first day of a new week. Bank Of Japan Governor Haruhiko Kuroda said that sharp moves in the Japanese yen could have negative impacts on the domestic economy. This, along with a generally weaker tone around the equity markets, benefitted the safe-haven JPY and acted as a headwind for spot prices.

The downside, however, remains cushioned amid a big divergence in the monetary policy stance adopted by the BoJ and the Fed. The markets seem convinced that the US central bank would adopt a more aggressive policy response and hike interest rates at a faster pace to curb soaring inflation. This was reinforced by an extended sell-off in the US fixed-income market, which pushed the US Treasury bond yields to a fresh multi-year peak.

On the other hand, the BoJ has repeatedly said that it remains ready to use powerful tools to avoid long-term interest rates from rising too much. In fact, the Japanese central bank last month offered to buy unlimited 10-year Japanese government bonds to defend the 0.25% yield cap. This has resulted in the widening of the US-Japanese government bond yield differential, supporting prospects for a further appreciating move for the USD/JPY pair.

That said, relatively thin liquidity on the back of a holiday in the European markets held back bullish traders from placing fresh bets. Apart from this, extremely overbought conditions on short-term charts contribute to keeping a lid on any meaningful upside for the USD/JPY pair amid absent relevant market moving economic releases.

Technical levels to watch

Russian President Vladimir Putin said on Monday that "we" must switch to trading in national currencies in new conditions, reported Reuters. Western sanctions have led to a deterioration in the economy in the West, he continued.

On the Russian economy, Putin said that retail demand has normalised, inflation is stabilising and unemployment remains low. Russia was right to manually regulate the market, he continued, adding that the rouble has stabilised and cash forex is flowing back into Russian banks.

Meanwhile, CBR rate cuts will make lending in the economy cheaper, he noted, and the government's budget should support the economy and liquidity.

- USD/CAD gained some positive traction on Monday, though lacked follow-through buying.

- Retreating crude oil prices undermined the loonie and extended support amid a stronger USD.

- The Fed’s hawkish outlook, elevated US bond yields, the risk-off mood all benefitted the buck.

The USD/CAD pair maintained its bid tone heading into the North American session and was last seen trading just a few pips below the daily high, around the 1.2630-1.2625 region.

A combination of factors assisted the USD/CAD pair to build on last week's goodish rebound from the 1.2520 area and gain traction for the third successive day on Monday. A modest pullback in crude oil prices weighed on the commodity-linked loonie and extended support to spot prices amid sustained US dollar buying interest.

Crude oil pulled back from the three-week high after data out of China pointed to economic weakness and fueled worries over slowing demand amid COVID-19 curbs. That said, concerns over tight global supply and a potential European Union (EU) embargo on Russian gas, helped limit the downside for the black liquid, at least for now.

On the other hand, the USD stood tall near the two-year high and continued drawing support from expectations for a more aggressive policy tightening by the Fed. Investors seem convinced that the Fed would hike rates at a faster pace to curb soaring inflation. This, along with elevated US Treasury bond yields, underpinned the buck.

Against the backdrop of the Fed's hawkish outlook, concerns that the worsening Ukraine crisis would put upward pressure on already high inflation pushed the US bond yields to a fresh multi-year peak. Apart from this, the risk-off mood - as depicted by a weaker tone around the equity markets - further benefitted the safe-haven greenback.

That said, relatively thin liquidity conditions on the back of a holiday in Europe held back bulls from placing aggressive bets. The USD/CAD pair, so far, has been struggling to find acceptance above the very important 200-day SMA, which, in turn, warrants some caution before positioning for any further near-term appreciating move.

There isn't any major market-moving economic data due for release on Monday, either from the US or Canada. Hence, the US bond yields, along with the broader market risk sentiment, will play a key role in influencing the USD demand. Traders will further take cues from oil price dynamics to grab some short-term opportunities.

Technical levels to watch

Russian aircraft bombing runs in Ukraine have increased by 50%, a spokesperson for Ukraine's Defense Ministry said on Monday, reported Reuters.

The recent escalation of the fighting in Ukraine comes after Ukrainian President Volodymyr Zelenskyy said over the weekend that talks with Russia are at a "dead-end", given that Ukraine will not trade away its territory or people.

Moreover, if Russian forces follow through on threats to destroy the remaining Ukrainian troops in Mariupol, this would "put an end" to peace talks, Zelenskyy warned.

- EUR/USD is flat at the start of the week near 1.0800 with European markets still shut.

- But recent bearish themes (hawkish Fed, Russo-Ukraine war) remain in play.

- As a result, bears continue to eye a near-term test of 2020 lows in the 1.0600s.

In a quiet start to the week for global markets given the fact that European participants are still away for Eastern holiday celebrations, EUR/USD is little moved in the 1.0800 area. However, with US yields printing fresh multi-year highs in pre-US open trade and European bond markets shut, yield divergence during US trading hours risks sending the pair back towards last week’s lows in the 1.0750s.

Traders continue to cite recent hawkish commentary from Fed policymakers as the main driver of recent upside in US yields and the US dollar. This contrasted to last week’s ECB meeting, where the bank left its policy guidance and tone on the economy unchanged, disappointing some expectations for a hawkish shift, in language at the very least.

This backdrop of increasing policy divergence may continue to weigh on EUR/USD this week, traders have said, adding that the ongoing Russo-Ukraine war continues to further dent the euro’s appeal. Technicians have marked out the 2020 lows at 1.0636 as the next key area of support that EUR/USD is likely headed towards.

Fed and ECB rhetoric will likely be the main fundamentals drivers of the pair this week, with ECB President Christine Lagarde and Fed Chair Jerome Powell scheduled to appear alongside one another on Thursday. Friday sees the release of flash April PMI surveys from the Eurozone and US which should make for interesting reading.

- Silver regained positive traction on Monday and climbed to a fresh multi-week high.

- Acceptance above the 61.8% Fibo. supports prospects for a further appreciating move.

- Sustained weakness below the $25.00 mark is needed to negate the positive outlook.

Silver attracted fresh buying on Monday and built on its recent bounce from the vicinity of the very important 200-day SMA. This marked the seventh day of a positive move in the previous eight and pushed spot prices to a six-week high, around the $25.90-$25.95 region during the first half of the European session.

From a technical perspective, the XAG/USD now seems to have found acceptance above the 61.8% Fibonacci retracement level of the $26.95-$23.97 downfall. Moreover, technical indicators on the daily chart have been gaining positive traction and are still far from being in overbought territory, which, in turn, favours bulls.

That said, traders are likely to wait for some follow-through buying beyond the $26.00 round-figure mark before confirming a bullish breakout and positioning for additional near-term gains. The XAG/USD might aim to test an intermediate resistance near the $26.40 area en-route the YTD peak, closer to the $27.00 mark.

On the flip side, any meaningful slide now seems to find decent support near the 50% Fibo. level, around the $25.50-$25.45 region. This is followed by the previous session's swing low, around the $25.25 area, ahead of the 38.2% Fibo. level, around the $25.00 psychological mark, which should act as a pivotal point.

A convincing break below would prompt some technical selling and drag the XAG/USD back towards the 23.6% Fibo. level, around the $24.65 region. The next relevant support is pegged near the $24.30 region, below which the downfall could get extended towards a technically significant 200-DMA, around the $24.00 mark.

Silver 4-hour chart

-637858741046182415.png)

Key levels to watch

Japanese business lobby Keidanren's head Masakazu Tokura said on Monday, it’s too early for the Bank of Japan (BOJ) to debate altering monetary policy settings, especially in the face of the sharp depreciation in the yen, Reuters reports.

Key quotes

"Sharp currency moves are undesirable.”

“While a weak yen used to be good for Japan's economy, it was "not that simple" nowadays.”

-

USD/JPY recovers from daily lows at 126.30 as DXY strengthens on downbeat market tone

- USD/CHF gained traction for the fifth successive day amid sustained USD buying.

- The Fed’s hawkish outlook, elevated US bond yields underpinned the greenback.

- The risk-off mood extended support to the safe-haven CHF and capped the upside.

The USD/CHF pair maintained its bid tone through the first half of the European session and was last seen trading near a one-month high, just below mid-0.9400s.

The pair built on last week's breakout momentum through the 0.7370-0.7375 horizontal resistance and gained traction for the fifth successive day on Monday. The momentum pushed spot prices back closer to the YTD peak touched in March and was sponsored by sustained US dollar buying interest.

The greenback held steady near its highest level since April 2020 and continued drawing support from expectations for a more aggressive policy tightening by the Fed. The markets seem convinced that the US central bank would hike interest rates at a faster pace to combat stubbornly high inflation.

The bets were reaffirmed by New York Fed President John Williams's hawkish remarks on Thursday, which was seen as a further sign that even more cautious policymakers are on board for bigger rate hikes. This, along with elevated US Treasury bond yields, acted as a tailwind for the greenback.

Investors also seem worried that a protracted Russia-Ukraine war-led rise in commodity prices would put upward pressure on the already high inflation. Apart from this, hawkish Fed expectations pushed the US bond yields to a fresh multi-year peak, which offered additional support to the buck.

That said, the prevalent risk-off mood - as depicted by a generally weaker tone around the equity markets - drove some haven flows towards the Swiss franc and acted as a headwind for the USD/CHF pair. Moreover, holiday-thinned liquidity held back traders from placing aggressive bets.

Nevertheless, the bias remains tilted firmly in favour of bulls and supports prospects for a further near-term appreciating move for the USD/CHF pair. Some follow-through buying beyond the previous swing high, around the 0.9460 region, will add credence to the near-term positive outlook.

Technical levels to watch

The Russian central bank Governor Elvira Nabiullina hinted at a faster rate cut, in her appearance on Monday.

Key quotes

We should be able to lower the key rate faster.

We should create conditions for loans to be more affordable for the economy.

Monetary policy toughening in 2021, diversification of fx reserves helped economy to stay resilient amid sanctions.

Russian banks reduced share of assets denominated in foreign currencies to 19% as of beginning of 2022 vs. 35% in 2016.

Russian economy is entering difficult period of structural changes related to sanctions.

Main problems for economy will be related to restrictions on imports and logistics in trade, export restrictions.

Central bank monetary policy will aim at bringing inflation to 4% target in 2024.

Central bank considering making sale of forex proceeds by exporters more flexible.

Decision to suspend markets was necessary, otherwise exit of foreigners would have caused volatility and triggered mass bankruptcies.

The bank manually managed the markets to limit volatility and cool emotions of market participants.

Market reacted to the new situation much more softly than expected.

Russians withdrew 2.4 trillion roubles from banks in late February - early March.

Central bank plans to launch a programme to stimulate the import of equipment and raw materials which Russia cannot source itself.

The central bank more than doubled its key interest rate to 20% when Russia was hit by the Western sanctions after its military special operation into Ukraine in February but then cut it this month to 17%.

Market reaction

USD/RUB is extending its declines on the above comments. The spot is trading at 81.12, having failed to resist above the $83 mark.

- WTI price is correcting from almost three-week highs of $107.96.

- A stronger US dollar is checking the upside in the black gold.

- A test of the 21-DMA support at $103.58 appears inevitable.

WTI (NYMEX futures) is extending the correction from three-week highs of $107.96 reached earlier in the Asian session on Easter Monday.

The unrelenting strength in the US dollar could be associated with the downtick in the WTI price, as it snaps a three-day uptrend.

Rising concerns over the demand for oil and its products from the world’s second-biggest oil consumer, China, collaborated with the downside. China continues to battle covid outbreaks, with total lockdowns imposed in the nation’s major cities.

Fundamentally, the black gold remains supported amid a protracted war between Russia and Ukraine, with a likely European Union (EU) embargo on the Russian gas and oil sector in the coming days.

From a near-term technical perspective, the corrective pullback in WTI aims for the upward-sloping 21-Daily Moving Average (DMA) at $103.58. Although bulls may find some support at $105.00 and $104.50 beforehand.

The 14-day Relative Strength Index (RSI) is turning south, justifying the renewed weakness in the US oil. The leading indicator, however, holds above the midline, which keeps bulls hopeful.

On the other side, if bulls regain momentum, then the multi-week top near $108.00 could be retested.

The next significant upside target will be then envisioned at the $110.00 round level.

WTI: Daily chart

WTI: Additional levels to watch

- GBP/USD witnessed some follow-through selling for the third successive day on Monday.

- Bets for a more aggressive Fed, the risk-off mood underpinned the safe-haven greenback.

- The fundamental backdrop supports prospects for a further depreciating move for the pair.

The GBP/USD pair extended its steady intraday descent and dropped to a fresh daily low, around the 1.3000 psychological mark during the first half of the European session.

Following an early uptick to the 1.3065 region, the GBP/USD pair met with a fresh supply on Monday and move back closer to the YTD low touched last week. This marked the third successive day of a negative move and was sponsored by sustained US dollar buying, bolstered by expectations for a more aggressive policy tightening by the Fed.

The markets seem convinced that the US central bank will hike interest rates at a faster pace to combat stubbornly high inflation. The bets were reaffirmed by hawkish comments from New York Fed President John Williams on Thursday, which was seen as a further sign that even more cautious policymakers are on board for bigger rate hikes.

This, along with concerns that a protracted Russia-Ukraine war would put upward pressure on commodity prices and the already high inflation, remained supportive of elevated US Treasury bond yields. Apart from this, the prevalent risk-off mood offered additional support to the safe-haven buck and exerted downward pressure on the GBP/USD pair.

That said, relatively thin liquidity conditions on the back of a holiday in Europe could help limit the downside for the GBP/USD pair amid absent relevant market moving economic releases from the US. Nevertheless, the bias seems tilted firmly in favour of bearish traders and supports prospects for a further near-term depreciating move.

Technical levels to watch

- A combination of factors dragged NZD/USD to its lowest level since late February on Monday.

- The USD stood tall near the two-year peak amid Fed rate hike bets/elevated US bond yields.

- The risk-off mood also benefitted the safe-haven buck and weighed on the perceived riskier kiwi.

The NZD/USD pair remained depressed through the early European session and was last seen trading around the 0.6730-0.6725 region, or its lowest level since late February.

Following an early uptick to the 0.6775 area, the NZD/USD pair met with a fresh supply on Monday and turned lower for the fourth successive day. This also marked the eighth day of a negative move in the previous nine and was sponsored by the underlying bullish sentiment surrounding the US dollar.

In fact, the key USD Index stood tall near its highest level since April 2020 and continued drawing support from expectations for a faster policy tightening by the Fed. Apart from this, a fresh leg up in the US Treasury bond yields offered additional support to the already stronger greenback.

Against the backdrop of the Fed's hawkish outlook, worries about the continuous rise in inflationary pressures remained supportive of elevated US Treasury bond yields. Investors seem worried that a protracted Russia-Ukraine war would drive input costs higher and put upward pressure on inflation.

This, in turn, took its toll on the global risk sentiment, which was evident from a generally weaker tone around the equity markets. The risk-off mood was seen as another factor that benefitted the greenback's relative safe-haven status and drove flows away from the perceived riskier kiwi.

With the latest leg down, the NZD/USD pair has now retreated over 300 pips from the YTD peak, around the 0.7035 zone touched earlier this month. The fundamental backdrop seems tilted firmly in favour of bearish traders and supports prospects for an extension of the recent downward trajectory.

In the absence of any major market-moving economic releases from the US, the US bond yields will influence the USD. Traders will further take cues from developments surrounding the Russia-Ukraine saga, which will drive the market risk sentiment and provide some impetus to the NZD/USD pair.

Technical levels to watch

- The US dollar index climbs to retest Thursday’s high of 100.76.

- Firmer yields, inflation and Ukraine risks keep the safe-haven dollar underpinned.

- The DXY has more room to rise, looks to regain 101.00

The US dollar index (DXY) is holding onto the latest advance well above the 100.50 barrier, as bulls keep their sight on the previous week’s high of 100.76.

The buying interest around the dollar gauge remains unabated amid the uncertainty over the Ukraine crisis and China’s covid lockdowns, which are disrupting supply chains and sending inflation through the roof via surging commodities prices.

This, in turn, flags risks of a global recession, directing the risk-off flows into the safe haven buck. Additionally, rallying US Treasury yields on the hawkish Fed’s outlook and commentary add to the upside in the dollar.

Technically, the index has more room to rise and could briefly recapture the 101.00 after the price yielded an upside break from the rectangle pattern on April 5.

The bullish confirmation triggered a fresh uptrend in the DXY, with the pattern target now seen at 101.08. Ahead of that, bulls need to take out Thursday’s high.

The 14-day Relative Strength Index (RSI) looks north well above the midline, backing the bullish case.

On the flip side, the 100.50 level will be the initial demand area, below which sellers will accelerate control towards the April 12 highs of 100.33.

The dollar bears would then look to test the 100 psychological mark.

US Dollar Index: Daily chart

US Dollar Index: Additional levels to watch

Here is what you need to know on Monday, April 18:

Trading conditions remain thin on Easter Monday but the greenback preserves its strength against its rivals. The US Dollar Index, which registered its highest weekly close since March 2020, continues to stretch higher toward 111.00 on the back of rising US Treasury bond yields in the European morning. European stock exchanges will be closed on Monday. US bond and stock markets will operate at regular hours but the economic docket will not be featuring any macroeconomic data releases.

Earlier in the day, the data from China revealed that the Gross Domestic Product (GDP) grew at an annualized pace of 4.8% in the first quarter, beating the market expectation of 4.4%. On a negative note, Retail Sales in China contracted by 3.5% on a yearly basis in Marcy, compared to analysts' estimate for a decrease of 1.6%.

Meanwhile, headlines surrounding the Russia-Ukraine conflict reveal that fighting continues in several parts of Ukraine. According to the latest news, multiple explosions were heard in Ukraine's Lviv and Dnipro regions early Monday. Some intelligence reports suggest that Russia is preparing to ramp up the military aggression in Mariupol.

EUR/USD lost more than 100 pips last week as the euro met heavy selling pressure after European Central Bank left its policy settings unchanged. The pair trades in a relatively tight range near 1.0800 in the early European session.

GBP/USD managed to post small weekly gains but seems to have lost its traction amid broad-based dollar strength. The pair was last seen trading in negative territory near 1.3020.

USD/JPY extended its rally to a fresh 20-year high of 126.79 during the Asian trading hours before going into a consolidation phase near 126.60. Earlier in the day, Bank of Japan (BOJ) Governor Haruhiko Kuroda noted that he has not changed his view that a weak yen is positive for the economy as a whole.