- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-03-2022

- The British pound trimmed some of the last week’s losses, finished up 1.07%.

- Russia – Ukraine peace talks slowed amid failure to reach an agreement.

- US President Biden and China’s Xi talked about Russia – Ukraine.

- Fed’s Bullard, Waller, and Kashkari crossed the wires.

- GBP/USD Price Forecast: The bias is downwards unless GBP bulls reclaim 1.3300.

GBP/USD erased some of earlier weekly losses after the Bank of England (BoE’s) decided to increase borrowing costs for the third time, in the same number of monetary policy meetings, since December of 2021. At the time of writing, the GBP/USD is trading at 1.3176.

Wall Street’s closed the week with gains, reflecting the sudden improvement in risk appetite. Peace talks between Russia and Ukraine would continue; however, there have been mixed signals from both sides of the conflict that do not allow to reach an agreement that could trigger a truce or ceasefire.

Late in the New York session, US President Biden and Chinese President Xi Jinping held a videoconference reunion. China expressed its posture on the Russia-Ukraine conflict to the US. Chinese President Xi said that the invasion “is not something we want to see” and that “the events again indicate that countries should not come to the point of meeting on the battlefield.”

Elsewhere, once the Federal Reserve hiked rates on Wednesday, 0.25% for the first time in three years, the Fed speakers parade began.

The first official to cross the wires was St. Louis Fed President Bullard, who dissented in the meeting because he wanted the Fed to follow a balance sheet reduction plan, alongside a 50 bps increase. In the same tone, Fed’s Waller commented that the US central bank should consider a 50 bps rate hike at a certain point, while added that he expects to begin QT by July.

Late in the day, Minnesota Fed’s President Neil Kashkari said that the central bank should begin lowering its balance sheet as soon as the next meeting.

GBP/USD Price Forecast: Technical outlook

Overnight, the GBP/USD seesawed in a mid-size range, between the 1.3110s-1.3200 area, though as the New York session ends, cable stabilized around 1.3176.

The GBP/USD bias is down, as the daily moving averages (DMAs) reside above the exchange rate. Even though cable has reclaimed to trade within the lower boundaries of the descending channel, it remains vulnerable unless the GBP/USD pair achieves to reclaim the 1.3300 mark. If that scenario plays out, then a GBP/USD upward move to the 1.3415-40 area, where the 50 and the 100-DMA’s sit, is on the cards. However, the path of least resistance is downwards.

The GBP/USD first support would be December 8, 2021, at 1.3160. Breach of the latter would expose November 13, 2020, at 1.3105. Once cleared, the GBP/USD’s next support would be the bottom-trendline of the descending channel around 1.3040 ahead of the 1.3000 mark.

- The New Zealand dollar posted gains of 3% vs. the Japanese yen amid a risk-on market mood.

- The euro and the Japanese yen suffered losses against most G8 currencies.

- NZD/JPY Price Forecast: The bias is upward, but the steepness of the rally might spur a correction before resuming up.

The NZD/JPY extends its gains in the week, surging in tandem with global equities courtesy of a positive market mood, despite ongoing fighting between Russia – Ukraine. At the time of writing, the NZD/JPY is trading at 82.25

The market mood is positive, as Wall Street closed the trading session with gains. In the FX space, safe-haven peers, except for the Swiss franc, dropped whilst risk-sensitive currencies advanced.

Overnight, the NZD/JPY was subdued around the 81.64 area but jumped once European traders got to their desks, reaching 82.10, a daily high at the time. Late in the day, the market mood improved, lifting the NZD/JPY towards new YTD highs around 82.36.

NZD/JPY Price Forecast: Technical outlook

NZD/JPY uptrend remains intact, despite that the 200-day moving average (DMA) is trapped between the 100 and the 50-DMAs. However, due to the steepness of the move, the cross-currency might aim for a correction before resuming upwards.

If the scenario plays out, the NZD/JPY first demand area would be 82.00. Once cleared, the next support would be 81.00, followed by March 14 daily high at 80.26. On the flip side, on the way north, the NZD/JPY’s first resistance would be September 2017, highs around 82.75, followed by the 83.00 mark, and the July 2017 high at 83.91.

- AUD/JPY’s stratospheric rise showed no sign of easing on Friday, with the pair surging to four-year highs above 88.00.

- That marks a fourth successive day of gains during which time AUD/JPY has rallied over 4.0%.

- The RSI suggests the pair has become overbought, so some consolidation or even technical pullback might be in order.

AUD/JPY’s stratospheric rise showed no sign of easing on the final trading of the week, with the pair surging a further near 1.0% to hit its highest level since the beginning of 2018 around 88.30. That marks a fourth successive day of gains during which time the pair has rallied more than 4.0% from underneath 85.00 and easily taken out 2021 highs in the low 86.00s.

Risk appetite was firmly on the front foot again on Friday, with global equities rallying, as has broadly been the case since Tuesday, lifting risk-sensitive yen crosses like AUD/JPY. But other important factors are also working in the AUD/JPY bull’s favour. Friday saw the BoJ release its latest monetary policy decision, with the bank sticking as expected to its ultra-dovish stance, thus maintaining its status as the most dovish G10 central bank alongside the SNB.

In a week where there was a lot of focus on central banks with the Fed and BoE also deciding on rates (and both lifting them 25bps), the BoJ’s dovish stance hurt the yen across the board. Separately, AUD continues to perform very well, as do other commodity-sensitive G10 currencies as traders and investors re-position themselves towards the currencies of nations that will benefit from recent geopolitics induced rallies in commodity prices.

Whilst most energy and other Russia-sensitive commodity prices continue to trade well above pro-Russia's invasion of Ukraine levels, many (like crude oil) have pulled back from last week’s highs and stabilised at slightly lower levels. AUD’s outperformance this week has confused some analysts, but others pointed out that Australia (and the likes of New Zealand and Canada) stand to benefit not just from higher general commodity prices, but also as major commodity buyers turn away from Russia and look to other major resource-producing economies for supply.

Looking ahead, some technicians might be getting concerned that the recent rally has become overstretched. Indeed, AUD/JPY’s 14-Day Relative Strength Index is blinking over-bought, having hit 78 on Friday, well above the 70 level most define as being in over-bought territory, and at its highest since October last year. If a pullback is in order, the bulls will be eyeing a retest of support in the 86.00 area to reload longs for a longer-lasting push higher.

- Silver prices sold off on Friday as risk appetite elsewhere continued to improve, with XAG/USD falling back under $25.00.

- But silver continues to trade well within recent ranges as traders monitor geopolitical developments.

A strong finish to a strong week for US (and global) equities has seen safe-haven silver come back under selling pressure on the final day of the week, despite the fact that long-term US yields are lower and the shape of the curve flashing recession warnings. Spot silver (XAG/USD) was last down nearly 2.0%, having dropped all the way back from the $25.40s to current levels around $24.90, meaning the precious metal is now back to the south of its 21-Day Moving Average.

Whilst geopolitics remains the major driving force in the market right now, as traders/market participants assess the prospect of a potential Russo-Ukraine peace deal, the Fed has also been a big talking point this week. Fed policymakers were out in force on Friday, with James Bullard and Christopher Waller throwing their support behind an aggressive hiking cycle that would see rates going well above so-called “neutral” by the end of the year, while other Fed speakers were a bit more measures.

The hawkish remarks from Bullard and Waller seemed to boost the market’s implied probability of a 50bps hike at the Fed’s next meeting, which might arguably have weighed on interest rate-sensitive precious metals like silver. It certainly did seem to push up short-end US yields, with the 2-year rallying 4bps to back above 1.95% and eyeing a test of earlier weekly multi-year highs at 2.0%. Higher yields can hurt demand for non-yielding precious metals by lifting the perceived opportunity cost of holding them.

But, as noted, the US curve is now flashing recession warning signals. 10-year yields fell 5bps no Friday taking the 2s10s spread to under 20bps. When the 2s10s spread turns negative, this has historically been a reliable indicator of an incoming recession with the next year or two, and fears about this might encourage some safe-haven demand, which could ultimately benefit silver.

Ultimately, from a technical perspective, the price action in spot silver on Friday hasn’t been very consequential. At current levels near $24.90, XAG/USD sits near the midpoint of the range $24.50-$25.50ish range that has prevailed over the past few days. A bearish break next week, perhaps if broad risk appetite continues to improve, would open the door to a run towards the 50 and 200DMAs, both of which reside close to $24.00.

According to a US administration official, talks between Chinese President Xi Jinping and US President Joe Biden on Friday, which lasted for nearly two hours, were direct, substantive and detailed, reported Reuters. Biden reportedly stressed to Xi that China providing material support to Russia would have consequences not just from the US but also from the wider world. Xi raised the issue of Taiwan and Biden reiterated the US position.

Biden reportedly laid out in detail to Xi the unified response from governments and the private sector around the world being taken against Russia for its invasion. Biden did not make any specific requests of China, but laid out his view of the situation. Biden was candid and direct with Xi in discussing his assessment of the situation in Ukraine, the US official said, and expressed rock-solid support for Taiwan and the intention to continue providing this rock-solid support.

- Pound's rebound from 1.6540 is capped at 1.6650.

- The sterling remains weak against the commodity-linked CAD.

- GBP/CAD seen appreciating towards 1.6950 – Scotiabank.

Sterling’s recovery attempt from multi-year lows at 1.6540 seen earlier today has been capped about 110 pips higher, at 1.6650, before pulling back to the 1.6620 area.

Higher oil prices are supporting the CAD

The pound has been unable to post a significant recovery as the Canadian dollar remains fairly strong with oil prices picking up from weekly lows.

The lack of progress in the talks between Russia and Ukraine and the warning from the International Energy Agency (IEA) that the decline in global demand caused by higher prices will not offset the shut-in of Russian supplies have renewed concerns about a crude shortage, which has boosted the commodity-linked CAD against its most majors.

Earlier today, the pound has been showing weakness, weighed by Thursday’s dovish statement by the Bank of England. The bank hiked interest rates as widely expected, although the tone of its monetary policy statement was considered tilted to the dovish side, which triggered a broad-based GBP weakness.

GBP/CAD expected to appreciate towards 1.6950 – Scotiabank

From a technical perspective, FX analysts at Scotiabank see the pair rallying towards 1.6950 over the coming months: “We remain of the view that GBP/CAD looks relatively ‘cheap’ here, near the base of the sideways range that has persisted since 2020, and we look for GBP gains through 1.6950 to trigger additional strength back to the low 1.70s.”

Technical levels to watch

- The British pound is climbing 0.75% as the New York session progresses on Friday.

- Investors’ market sentiment is upbeat, as reflected by Wall Street, trading with gains.

- GBP/JPY Price Forecast: Upwards but begins to face solid resistance around the 157.00-158.00 area.

During the New York session, the British pound is recording an outstanding rally in the week, so far up almost 3%. At the time of writing, the GBP/JPY is trading at 157.07.

Risk sentiment is positive in the markets. European equities recorded gains, while US stocks are set to finish the week in the green. In the FX space, risk-sensitive currencies are up, while the laggards are the EUR and the JPY, down 0.40% and 0.50%, respectively.

Factors causing sentiment shifts are the Russia – Ukraine conflict, alongside developments surrounding the conflict, meaning Russia requested China for military and financial aid, while the US is threatening to impose sanctions on the Asian dragon.

On Friday, US President Joe Biden and Chinese leader Xi Jinping held a videoconference in which Chinese President Xi assured that China did not want a war in Ukraine. Despite that, Xi criticized the sanctions imposed on Russia, saying that “the ordinary people are the ones who suffer.”

Overnight, the GBP/JPY opened around the 156.00 mark, though pushed through the Asian session highs, stalling later around the 156.50 area. Nevertheless, once the North American session began, the cross-currency pair extended its rally towards 157.00.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY is upward biased and reached a daily high near 157.22. Of late, it retreated under the 157.00 mark, but the presence of the daily moving averages (DMAs) in a bullish orderly way, well below the spot price, confirms the direction of the trend, which is upwards.

That said, the GBP/JPY first resistance would be 157.00. Breach of the latter would expose the confluence of a six-month-old downslope trendline and February 18 daily high at 157.29, followed by 158.00-06 area, which confluences with the YTD high.

- The euro appreciates for the sixth consecutive day to rest 131.90.

- The dovish BoJ is sending the yen lower across the board.

- EUR/JPY approaching year-to-date high at 133.15.

The euro has gone through a sharp rally against the Japanese yen this week. The pair extended its recovery from early March lows at 124.40 to test 131.90 resistance level, with the year-to-date high, at 133.15, on sight.

A dovish BoJ sends the yen plummeting

The common currency is on track to a nearly 3% weekly rally, favored by broad-based yen weakness as the Bank of Japan’s dovish policy stance has helped the euro to retrace most of the ground lost in February.

The Bank of Japan has confirmed its ultra-expansive monetary policy at its latest monetary policy meeting on Friday. The bank pledged to maintain its huge stimulus program in spite of the increasing inflation trends. With most of the world’s major central banks shifting towards monetary tightening, the BoJ's stance is crushing yen demand.

Yen's weakness has been boosting the EUR/JPY to extend its rally for the sixth consecutive day, despite the sourer market mood on the back of the lack of progress on the Russia – Ukraine peace talks, which has increased negative pressure on the euro.

EUR/JPY: Above 131.90, next significant target is YTD high is 133.15

The pair seems to have found some resistance at 131.90 (February 16 high). If that level gives way, the next potential target would be 132.60 (February 11 high) ahead of a retest to the year-to-date high at 133.15.

On the contrary, a bearish reversal below the intra-day low at 131.15 and March 17 low at 130.70 might seek support at the 200=day SMA, at the 130.00 area.

Technical levels to watch

- US equities are higher for a fourth session, with the S&P 500 breaking to its highest levels since Russia invaded Ukraine.

- The index is trading in the 4430s, up 0.6% on the day and over 5.5% on the week.

- That would mark the best week of gains since November 2020.

US equities are on the front foot for a fourth successive session, with the S&P 500 breaking out to its highest levels since the day Russia initiated its invasion of Ukraine (on February 24) in the 4430s. The main US index is higher by about 0.6% on the day taking its weekly gain to more than 5.5% after a brief dip below 4200 was viewed as a buying opportunity for a second week running. That means the index is on course for its best weekly gains since November 2020. Crucially, the S&P 500 is no longer trading in “correction” territory as it was at the start of the week and is now only about 7.5% lower versus record highs printed at the start of the year.

The Nasdaq 100 index is up about 1.4% and on course to post weekly gains of about 7.5%, though remains about 15% below November’s record levels. The Dow was last up 0.25% and on course for weekly gains of just shy of 5.0%, taking it to within 6.5% of record levels printed at the start of the year. Strength in the equity space this week seemed initially to have been driven by optimism about alleged progress towards a Russo-Ukraine peace deal. Though the reporting in recent days on this has been much more mixed and conflicting, hope for a ceasefire remains and seems to be driving some optimism in the market.

Meanwhile, some traders might have been surprised by the way equities rallied in wake of a much more hawkish than expected Fed policy announcement on Wednesday, but, on reflection, investors seemed to take the view that a more aggressive stance regarding lifting rates is appropriate against the backdrop of high inflation and a tight labour market. So long as future hawkish Fed policy shifts are deemed as the appropriate policy to maximise long-term US growth prospects by investors, equities may continue to greet such announcements positively.

Moving on to Friday’s gains; traders attributed the strength to news that Russia had averted a historic default on a foreign bond payment. Other traders said the call between US President Joe Biden and Chinese President Xi Jinping was a positive for sentiment given both sides framed the discussion as constructive. The US is trying to persuade China not to provide military aid to the Russians, who have requested it.

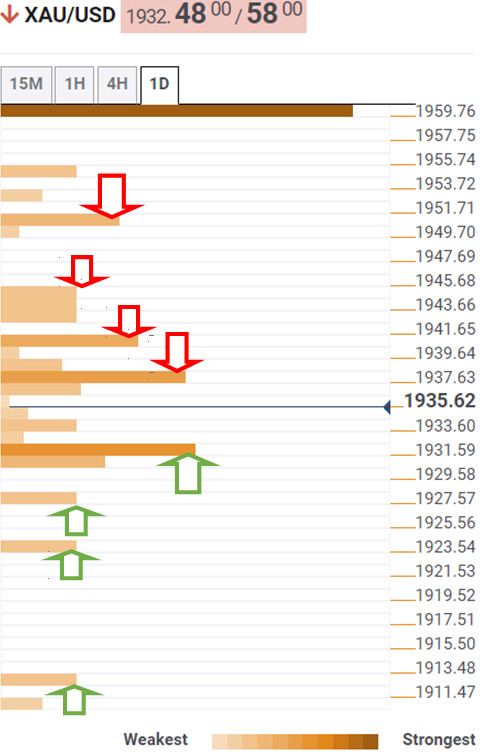

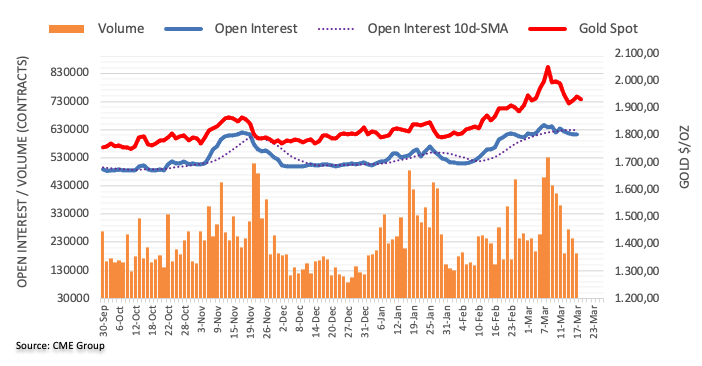

- The yellow metal is set to finish the week with losses is down almost 3%.

- Russia-Ukraine talks stuck as postures of both sides stand unchanged.

- Fed’s Bullard and Waller favor 50-basis points increases at the bank’s benchmark rate.

- Fed’s Kashkari expects neutral rates at 2%, while the balance-sheet reduction would have to be at double of previously QT.

Gold (XAU/USD) drops for the third time in the week amid a mixed market mood courtesy of continuing talks between Russia-Ukraine, inflation woes, and central bank tightening, keeping investors leaning towards safety assets. At the time of writing, XAU/USD is trading at $1929 a troy ounce.

Market mood is fluctuating, though of late improved. European equities closed the session in the green, while its North American counterparts are recording gains. The greenback holds its reins, with the US Dollar Index above 98.19 up in the day 0.22%, a headwind for the non-yielding metal, despite that US Treasury yields are falling.

Russia-Ukraine peace talks continue, though hostilities remain. Given mixed signals from both sides, discussions appear to be stuck on a mid-point with no advancement. Although reports from Russia said that Russia – Ukraine’s posture regarding neutrality and not joining NATO are closely aligned, reports from Ukraine said that are intended to provoke tension in media, as Ukraine’s stance of a ceasefire, withdrawal of troops, and strong security guarantees are not negotiable.

Elsewhere, in the middle of the week, the Federal Reserve hiked rates 25 basis points with an 8-1 vote, with St. Louis Fed President Bullard being the dissenter. On Friday, Bullard said that he wanted the US central bank to implement a balance-sheet reduction plan while recommending the FOMC to “try to achieve a level of policy rate above 3% this year.” Later, Fed Governor Chris Waller said he favors 50 bps increases in the “near future” while emphasizing that current data “is screaming” for 50 basis points hikes.

Continuing the Fed speaking parade, Minnesota Fed’s Kashkari commented that he sees a neutral rate at 2%. If inflation persists, the US central bank would have to raise rates above neutral. Regarding the Quantitative Tightening (QT) he expected the Fed to tighten at double of the pace of previously reduction.

Meanwhile, the US economic docket featured Existing Home Sales for February came at 6.02M lower than the 6.1M foreseen, while the Consumer Board (CB) Leading Index rose by 0.3%, higher than the 0.2% estimated.

Technical levels to watch

- US dollar's recovery attempt fails at 1.2645.

- The Canadian dollar appreciates amid higher oil prices and retreating US yields.

- USD/CAD expected to move lower in the coming weeks – Rabobank.

US dollar’s recovery from two-week lows at 1.2595 has been short-lived on Friday, as the pair was capped at 1.2645, before pulling back to the 1.2615 area.

Four-day sell-off for the US dollar

The USD is trading lower for the fourth day in a row against its Canadian counterpart, on track to its weakest weekly performance so far this year.

The lack of progress in the peace talks between Russia and Ukraine has triggered a pick-up on crude oil prices. Beyond that, the International Energy Agency (IEA) has warned earlier this week that the decline in global demand caused by higher prices will not offset the shut-in of Russian supplies, which has increased support to the commodity-linked CAD.

Beyond that, the lower US Treasury bonds yields, which have been retreating from multi-year highs after Wednesday’s Fed rate hike, have increased bearish pressure on the USD, which has lost ground against its main rivals this week.

USD/CAD to move lower for the coming weeks– Scotiabank

FX analysts at Scotia Bank see the pair retreating below 1.2600 and point out to a key support area at 1.2575: “Seasonal trends reflect a typically soft Q1 performance for the CAD which turns more positive as we move into Q2/Q3. We expect limited scope for USD gains in the short run and look for more CAD improvement in the coming weeks (…) “We spot resistance at 1.2650 intraday and look for firm resistance to cap USD gains today. Key USD support remains 1.2575/85.”

Technical levels to watch

Richmond Fed President and FOMC member Thomas Barkin said on Friday that the interest rate path laid out by the Fed this week is a balancing act between fighting inflation and managing uncertainty around the post-pandemic economic recovery, reported Reuters. The Fed could move faster with half-point rate hikes if inflation expectations become unanchored, Barkin continued, though he noted that, so far, that does not seem to be the case. Barkin said that the rate path laid out this week should not lead to "economic decline", but instead represents a return to more normal conditions. US inflation and employment are still both being "heavily influenced" by pandemic effects, Barkin said, and it will take time to understand the new post-pandemic economy.

- The pound bounces up to 1.3185, erases previous losses.

- Cable rushes higher ahead of the London closing time.

- GBP/USD, unlikely to rally significantly above 1.32/33 – ING.

The pound has erased previous losses during Friday’s American session. The pair has bounced up strongly from 1.3110 to reach intra-day highs at 1.3185 so far.

Cable turns positive on daily charts

The GBP/USD has rallied more than 0.5% in the last few hours, to erase the European trading session’s decline. In absence of significant macroeconomic releases, positions squaring moves ahead of the London closing bell might be behind the pound’s recovery.

The pound had been hitherto trading lower, weighed by the Bank of England’s dovish statement, after releasing its monetary policy decision on Thursday, while the sourer market mood, as hopes of progress in the Russia – Ukraine peace talks start to fade have favored the safe-haven USD, thus increasing negative pressure on the GBP.

Beyond that, investors have remained remain cautious, reluctant to take excessive risks ahead of the conference between Biden and Chinese President Xi Jinping, after the US warned China about important consequences if they decide to send military aid to Russia.

GBP/USD: levels near 1.32/33, the best case for some time – ING

From a longer-term perspective, currency analysts at ING are skeptical about a significant GBP rally over the coming months: “Unlike the Fed, the BoE delivered a cautious 25bp rate hike, with one dissenter voting for unchanged rates. The market removed roughly one 25bp hike from its expectations this year (Bank Rate now priced at 1.90% in December) (…) Given we strongly favor the dollar this summer, levels near 1.32/33 in the cable may be the best for some time.”

Technical levels to watch

- After a strong week, the euro is suffering from some profit-taking and EUR/USD has fallen back to the mid-1.10s.

- EUR/USD’s failure to press higher beyond the 1.1100 level was likely also due to hawkish Fed commentary.

Though not the worst-performing currency in the G10 on the day, the euro currently sits near the bottom of the relative performance table having dropped about 0.3% versus the US dollar amid profit-taking at the end of what has otherwise been a good week for the single currency. Indeed, while it was unable to hold above its 21-Day Moving Average (currently at 1.1093) for a second successive day, EUR/USD looks to end the week about 1.4% higher just to the north of 1.1050, having rallied from the low 1.0900s. That marks a first weekly gain for the pair in seven.

EUR/USD’s failure to press higher beyond the 1.1100 level likely has something to do with very hawkish commentary from the likes of Fed’s Christopher Waller and James Bullard, who both threw their support behind a faster pace of interest rate hikes (i.e. in 50bps intervals) this year. Both want to see rates moving above so-called “neutral” by the end of the year given high inflation and the tight labour market. Their commentary saw traders upping bets on a 50bps rate hike at the Fed’s next meeting and comes after the Fed announced earlier in the week that it is likely to lift interest rates at every remaining policy decision this year (in 25bps intervals), followed by a further four hikes in 2023.

Of course, the ECB has also been tilting in a more hawkish direction in recent weeks, as emphasised in last week’s policy meeting where the bank laid out plans to completely end its QE programme by the end of Summer to pave the way for a rate hike in Q4. This, alongside optimism/speculation about progress towards a Russo-Ukrainian peace deal, has likely been supporting the euro this week. Whether this can continue next week is the big question – if there were to be more positive news flow on Russo-Ukraine talks, a continued push higher would seem likely.

From a technical perspective, EUR/USD continues to find support at an uptrend from the earlier monthly lows and if the pair can push above resistance in the 1.1100-1.1130 zone, that could open the door to a run back towards pre-Russia invasion levels at 1.1300. But that’s a big if and markets are very likely to remain highly choppy/headline-driven for the foreseeable future.

Federal Reserve Bank of Minneapolis President Neel Kashkari said on Friday that inflation is way higher than any of us want it to be and, as a result, we have to normalise monetary policy to bring supply and demand back into balance, reported Reuters. Kashkari said that he is in favour of beginning to shrink the Fed's balance sheet as soon as the next meeting and that we should shrink the balance sheet at a much faster pace this time versus last. I would shrink the balance sheet at double the pace versus last time, he said. Every one of us is committed to the Fed's inflation goal, Kashkari noted, saying that we will keep inflation expectations anchored.

- The Mexican peso posts its biggest weekly gain, 2.39%.

- Market sentiment is mixed; the greenback rallies but falls vs. risk-sensitive currencies.

- USD/MXN Price Forecast: Neutral, but a daily close under the 200-DMA would expose the pair under downward pressure.

The Mexican peso extends its weekly rally gains 2.39% vs. the US Dollar, despite a mixed market mood, on Friday’s New York session. At the time of writing, the USD/MXN is trading at 20.4218.

European and US equity markets fluctuate between gainers and losers. At the same time, the greenback remains bid, with the US Dollar Index, a gauge of the greenback’s value against a basket of peers, is up 0.34%, sitting at 98.31, faltering of weighing on the USD/MXN pair.

Overnight, the USD/MXN pair was subdued in the 20.50 area, without much movement, though as the North American session began, the pair drooped through European session lows around 20.4646, towards lows 20.40s area.

USD/MXN Price Forecast: Technical outlook

The USD/MXN is neutral biased and is probing the 200-day moving average (DMA), sitting at 20.4125. The Relative Strength Index (RSI) is at 41.50, beneath the 50-midline, aiming lower, suggesting the USD/MXN might be moving towards the February 23 YTD low at 20.1558, but it would find some hurdles on the way south.

If that scenario plays out, the USD/MXN’s first support would be the 200-DMA. Breach of the latter would expose 20.3117, which once cleared would pave the way towards February 23 daily low at 20.1558.

Upwards, the USD/MXX first resistance would be the 20.50 mark. A decisive break would expose the 50-DMA at 20.5667, followed by January 28 daily high at 20.9130 and then 21.00.

- The euro drops below 0.8400 after another rejection from 0.8455.

- The regains lost ground following the Post-BoE reversal.

- EUR/GBP seen at 0.8100 by year-end – Nordea.

The strong euro rally witnessed on Thursday, following BoE’s dovish hike, has been rejected at 0.8455 for the second time this week. The euro is losing ground on Friday returning to levels below 0.8400.

Euro bulls fade on renewed concerns about Ukraine

The common currency is trading lower across the board on Friday, with risk sentiment waning as hopes of a peace agreement between Russia and Ukraine start to whither in absence of any substantial progress.

The pair however is clinging to weekly gains and remains on track for the second positive week in a row, after bouncing from six-year lows at 0.8200 in early March.

The euro appreciated sharply on Thursday, with the GBP depreciating across the board following the Bank of England's monetary policy decision. The BoE met expectations with a 25 basis points hike although the dovish tone of the banks’ statement hammered demand for the cable.

EUR/GBP to plummet to 0.81 by year-end – Nordea

In the mid-term, FX analysts at Nordea Bank see the euro retreating further over the next months, to reach 0.81 by year-end: “The BoE did hike for a third meeting in a row and more hikes will come later this year. Hence, we favor sterling to restrengthen versus the euro and probably already during Q2 if or when we get a pause or a lasting solution between Ukraine and Russia (…) “We expect EUR/GBP to move towards 0.81 by the end of the year.”

Technical levels to watch

Gold is set to register its largest one-week loss since November. As FXStreet’s Eren Sengezer notes, technicals turn bearish after the weekly decline.

Bearish shift in the technical outlook

“In case next week’s developments point to a further escalation of the conflict, gold should gather strength and start erasing this week’s losses. On the other hand, the precious metal could come under renewed selling pressure if markets remain hopeful of a ceasefire.”

“$1,920 (Fibonacci 50% retracement of the latest uptrend) aligns as the first support. With a daily close below that level, gold is likely to test the $1,890/$1,900 area (Fibonacci 61.8% retracement, psychological level) before extending the decline to $1,880 (50-day SMA).”

“In case buyers manage to lift gold back above $1,950 (Fibonacci 38.2% retracement), next resistances could be seen at $1,975 (February 24 high) and $1,990 (Fibonacci 23.6% retracement).”

According to Russia's Chief Negotiator Vladimir Medinsky, Russia and Ukraine's views are most aligned on the latter's status as a "neutral" country and offer not to join NATO, reported Russia's state-run Interfax news outlet. Russia and Ukraine are currently discussing nuances linked to security guarantees for Ukraine should it refuse to joining NATO, Interfax reported. Moscow and Kyiv are "halfway there" on the issue of Ukraine's demilitarisation, the report added.

Market Reaction

Reporting on the state of peace negotiations and alleged progress this week has thus far been mixed and conflicting, so traders are likely taking the latest commentary from Medinsky with a grain of salt. Markets have not reacted to the latest reports.

- The dollar is attempting to set a bottom at 0.9330 on retreat from 0.9460.

- The sourer market sentiment is offering some support to the USD.

- USD/CHF is testing an important support level at 0.9330.

The US dollar is heading lower against the Swiss Franc for the third consecutive day, after peaking at 0.9460 earlier this week, although the pair seems to have found some support at 0.9330/45 area.

The USD attempts to bounce up as market sentiment deteriorates

The sourer market mood on Friday, as the peace talks between Russia and Ukraine fail to deliver any substantial progress, has undermined the market optimism observed in previous days which had weighed significantly on US dollar bets.

Beyond that, investors are adopting a cautious approach to risk, wary of the outcome of the US-China conference over Russia, after President Joe Biden warned Xi Jinping of serious consequences if China decides to offer military aid to Russia.

USD/CHF testing an important support at 0.9330

From a technical perspective, after breaking below the last two week’s upside trendline support, the pair is now testing support at 0.9330/40, where the 38.2% support of the March 4 – 16 rally meets the 200-hour SMA.

Below here, the next potential targets are likely to be the 50% Fibonacci retracement, at 0.9310, and March 11 low at 0.9290.

On the upside, immediate resistance lies at 0.9380/90 (intra-day high and the 100-hour SMA. Once above here, the pair might find resistance at the previous trendline support, now at 0.9430 before attempting another test to March highs at 0.9460.

USD/CHF hourly chart

Technical levels to watch

Federal Reserve Bank of Minneapolis President Neel Kashkari said on Friday that he sees the Federal Funds target range rising to 1.75-2.0% by the year's end and that he sees the neutral rate of interest at 2.0%, reported Reuters. If inflation is enduring, the Fed will need to get modestly above neutral while inflationary dynamics unwind, he continued, adding that the Fed will need to act more aggressively if the economy turns out to be in a high-pressure, high inflation equilibrium. Kashkari said that over the course of the year as the Fed moves rates to neutral, we will get more information to determine how much further rates need to rise.

- NZD/USD looks set to end the week firmly on the front foot and on course for a fourth successive session of gains.

- The pair is currently flirting with the 0.6900 level but remains capped by solid resistance (200DMA, annual high).

- A bullish breakout could open the door to a push towards 0.7000.

NZD/USD looks set to end the week firmly on the front foot and on course for a fourth successive session of gains. The pair has spent Friday’s session flirting with the 0.6900 level, but is for now being prevented from breaking higher by formidable resistance in the form of earlier monthly/annual highs in the 0.6925 area and the 200DMA at 0.6912. But NZD/USD still trades about 0.25% higher on the day and is up more than 2.5% versus earlier weekly lows in the 0.6730 area.

Earlier in the week, fears about lockdowns in China as the Omicron Covid-19 variant began spreading in various cities, challenging the country’s zero Covid policy, weighed on the NZD/USD and these fears appear to have ebbed somewhat, facilitating the rebound. Adding to that, the ongoing Russo-Ukraine war and subsequent harsh Western sanctions on Russian exports mean that other commodity-linked currencies like the kiwi remain in high demand. Meanwhile, the Fed’s hawkish policy announcement and subsequent hawkish commentary from two of the bank’s policymakers has failed to translate into US dollar upside, thus failing to prevent the recover over the last four session.

The kiwi also has the backing of a very hawkish central bank, with the RBNZ arguably the most hawkish G10 central bank right now (though the Fed is catching up). The suggestion is that NZD/USD can most certainly continue its recent rally. If it can muster a clean break above 0.6900 and above its 200DMA and earlier monthly highs, a rally back to 0.7000 is very much on the cards.

- Silver is set to finish the week with losses of almost 3%.

- The market sentiment dampened as peace talks between Russia and Ukraine remained stuck.

- Fed’s Bullard: Wants to implement a balance-sheet reduction and would like rates above 3% in 2022.

- Fed’s Waller: Current data “is basically screaming at us to go for 50 basis points.”

Silver (XAG/USD) slides as the weekend looms in the New York session, down 1.19% amid a risk-off mood that strikes the market, with European and US equities trading with losses, courtesy of mixed signals from peace talks between Russia and Ukraine. At $25.11, XAG/USD does not reflect the safe-haven status of the white metal.

The greenback is advancing in the day, as the US Dollar Index reflects it, sitting at 98.45, up 0.46%, a headwind for silver prices. Contrarily, US Treasury yields are falling, leading by the curve’s long-end, while 2s are rising, sitting at 1.950%.

Discussions in Eastern Europe stuck, Fed speaking grabs market attention

The Russia – Ukraine conflict extends for the third consecutive week as hostilities continue. Peace talks between both sides have reached a point of advance, though not at the speed hoped by market participants, meaning that going towards the weekend, a flight to safe-haven assets might be on the cards.

In the US, the Fed hiked rates on Wednesday 25 basis points. Now that the blackout period ended, the only dissenter which pushed for a 50 bps hike, St. Louis President Bullard, said that he wanted the Fed to implement a balance-sheet reduction and recommended the committee to achieve a level of rates above 3% in this year.

Late in the same tone, Fed Governor Christopher Waller said that he prefers greater rate hikes and would favor “50 basis points at one or multiple meetings in the near future.” Furthermore, he noted that current data “is basically screaming at us to go for 50 basis points,” though the Russia-Ukraine conflict calls for caution.

Meanwhile, the US economic docket featured Existing Home Sales for February came at 6.02M lower than the 6.1M foreseen, while the Consumer Board (CB) Leading Index rose by 0.3%, higher than the 0.2% estimated.

XAG/USD Price Forecast: Technical outlook

Silver is still upward biased as shown by the daily chart and the moving averages, with the 50-DMA about to cross over the 200-DMA, forming a golden cross with bullish implications. However, the RSI at 54.08, aiming low, suggests that XAG/USD might print another leg down before resuming the uptrend.

XAG/USD’s first resistance is the 50% Fibonacci level at $25.39. Breach of the latter would expose the 38.2% Fibonacci at $25.76, followed by the August 4, 2021 high at $26.00 and the YTD high at $26.94.

China has plans to invade Taiwan as soon as next fall, reported Al Jazeera in a tweet citing Newsweek on a Russian intelligence document. Traders are treating the report with skepticism. Many geopolitical analysts had viewed recent geopolitical events regarding Russia's invasion of Ukraine as likely to dissuade China from mounting an assault on Taiwan in the near term (i.e. the strong Western response, Russia's difficulties in achieving its military goals amid unexpectedly spirited resistance).

- USD/TRY keeps the bid bias and adds to Thursday’s gains.

- The stronger note in the greenback lifts the pair to the 14.80 area.

- Renewed geopolitical concerns favour the demand for safer assets.

The Turkish lira loses ground vs. the greenback for the second session in a row and lifts USD/TRY to fresh peaks near 14.80 on Friday.

USD/TRY up on geopolitics, USD demand

USD/TRY adds to Thursday’s gains in response to the strong rebound in the US dollar, mainly following the deterioration of the Russia-Ukraine scenario after peace talks failed to yield some serious progress on Thursday.

In addition, the recent inaction by the Turkish central bank (CBRT) seems to be hurting the lira after it left the policy rate unchanged and announced no measures to tackle the current elevated inflation on Thursday’s event.

Against the ongoing backdrop of soaring energy prices and being Turkey a major energy-importer country, this could only exacerbate the upside pressure in consumer prices going forward, which can also be a prelude to a currency crisis.

What to look for around TRY

The lira eases some ground and trades closer to the area of YTD lows vs. the US dollar. In the very near term, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the Russia-Ukraine peace talks. Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of easing, real interest rates remain negative and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is gaining 0.77% at 14.7886 and a drop below 14.5217 (weekly low Mar.15) would expose 13.7063 (low Feb.28) and finally 13.5091 (low Feb.18). On the other hand, the next up barrier lines up at 14.9889 (2022 high Mar.11) seconded by 18.2582 (all-time high Dec.20) and then 19.00 (round level).

- Australian dollar's recovery from 0.7160 lows loses steam at 0.7400.

- The Aussie remains moderately positive in a mixed market mood.

- AUD/USD above 0.7400, year-to-date highs lie at 0.7440.

The Australian dollar seems unable to confirm above 0.7400 on Friday, although it remains moderately positive on the day, with downside attempts supported above 0.7380.

Aussie’s recovery losses steam as risk appetite falters

The pair remains 1.5% up on weekly charts after having retraced the previous week’s decline, yet the bullish momentum observed in the previous two days seems to have faded.

Market sentiment has deteriorated somewhat. The lack of substantial progress on the peace talks between Moscow and Kyiv while Russian artillery continues shelling Ukrainian cities is starting to weigh on market sentiment. Beyond that, investors seem to have taken a cautious stance awaiting the outcome of the US-China conference over Russia.

European stock markets are trading right below opening levels, with the German DAX Index and the French CAC both about 0.4% down. The US. Markets are mixed, with the S&P 500 and the Nasdaq Tech Index about 0.7% up and the Dow Jones down by 0.2% minutes after the opening bell.

The Aussie appreciated sharply earlier this week, buoyed by strong employment data in Australia, which boosted market hopes that the RBA might consider accelerating its monetary normalization plans and was supported further by the Chinese Government's pledge to roll out a new economic stimulus.

AUD/USD consolidating right below 0.7400

The pair is now consolidating gains above 0.7380 following a 3% rally over the last three days. On the upside, immediate resistance lies at 0.7400 area (Intraday highs) which is defending 0.7440 (March 7 high). A successful break of that level would clear the path towards October 2021 highs at 0.7555.

On the downside, now 0.7380 previous resistance (March 10, 11 highs) is working as immediate support. The next bearish targets below here would be the 200-day SMA, now around 0.7300, and 0.7240 (March 8 low).

Technical levels to watch

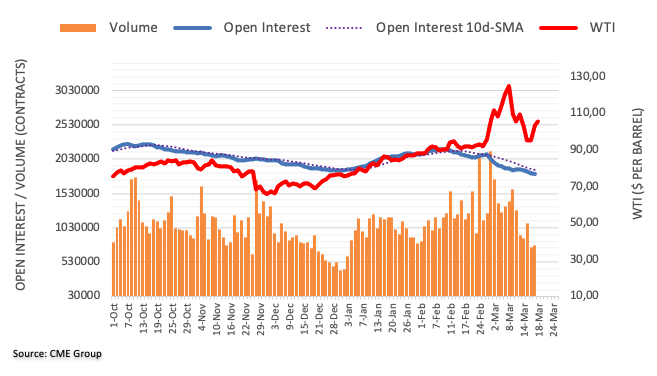

- WTI has stabilised in a thin $102-$106ish range and at current levels in the $103.00s trades broadly flat.

- WTI has found a decent floor above $100 again after a rollercoaster week as traders mull Russia supply risk.

- More evidence of OPEC+ undershooting its output quotas (in February) are contributing to fears of a near-term shortage.

Front-month WTI futures have stabilised in a $102-$106ish per barrel range on Friday amid a comparatively quiet end to what has been a rollercoaster week. Prices were sent crashing as low as the $93.00s from near $110 amid China lockdown fears as the country’s zero-Covid approach struggles to contain Omicron, but has since regained a solid footing back above $100 amid continued worries about crude oil shortages as a result of Western sanctions on the Russian economy. Momentum towards a new nuclear deal between major Western powers and Iran also seems to have waned somewhat.

At current levels in the $103.00s, WTI is trading flat on the day but remains on course to post an on-the-week drop of more than $5.0, which would mark a second successive weekly loss. While prices do remain substantially lower versus last week’s highs in the $130 area, WTI currently still trades with a gain of more than $11.00 since Russia’s invasion of Ukraine. In the absence of an announcement of a Russo-Ukrainian peace deal, which still appears to be some way off, analysts suspect risks remain tilted to the upside for oil.

According to a Reuters report on Friday, OPEC+ continued to undershoot its output quota in February and by an even larger margin than in January. Meanwhile, the major OPEC nations with space capacity (Saudi Arabia and the UAE) haven’t shown signs this week of caving to pressure from major oil importers (like the US) to increase output at a faster rate, despite the fact that, according to the International Energy Agency, oil markets could lose as much as 3M barrels per day in supply from Russia from April. All signs point to WTI continuing to trade at elevated levels for the foreseeable future as supply adjusts higher from non-Russian sources, which will take time.

USD/CAD has tested the 1.26 area. Fundamental case for CAD strength is clear, therefore, economists at Scotiabank expect the USD/CAD to edge lower in the coming weeks.

Seasonals on the cusp of improvement

“Seasonal trends reflect a typically soft Q1 performance for the CAD which turns more positive as we move into Q2/Q3. We expect limited scope for USD gains in the short run and look for more CAD improvement in the coming weeks.”

“The economy has started the year with a bang; our Scotia Economics colleagues’ GDPNowcast is tracking growth well above 5% for Q1 so far.”

“We spot resistance at 1.2650 intraday and look for firm resistance to cap USD gains today.”

“Key USD support remains 1.2575/85.”

After failing to close above 1.11 on Thursday, EUR/USD has broken a four-day positive streak with losses breaching the 1.1050 support zone. Next bearish target aligns at the 1.10 level, economists at Scotiabank report.

Failure to close the week above 1.11 to signal loss of momentum

“The currency maintains a broad upward trend from last week’s lows near 1.08 but a failure to close the week above 1.11 may signal a clearer loss of momentum.”

“Intraday price action has been clearly bearish for the EUR and a break under 1.1050 leaves the 1.10 mark as the next support marker.”

“Resistance after the figure is ~1.1120 and ~1.1135.”

US Existing Home Sales fell to 6.02M in February from 6.49M in January, larger than the expected drop to 6.10M, according to data released by the National Association of Realtors. That marked a 7.2% MoM drop versus January. The total inventory of homes for sale was 870K, which equates to roughly 1.7 months worth of homes, the data showed. The median price of homes sold was $357,300, 15% higher versus February 2021.

As economists at Commerzbank note, USD/RUB and EUR/RUB exchange rates do not exist in the normal sense when the Russian Central bank itself cannot transact in USD or EUR. Their forecasts are ‘symbolic’ to reflect that the effect of sanctions will unfold over multiple years and is unlikely to be adequately priced-in already.

RUB is no longer a freely convertible currency

“USD/RUB and EUR/RUB exchange rates no longer exist in the normal sense, when Russia's central bank, itself, cannot transact in USD or EUR.”

“The ruble is no longer a freely convertible currency, hence exchange rate numbers which we observe on our screens are a moot point. Granted, CBR still tries to produce a fix which attempts to better guide towards a balance between demand and supply of FX, but this is not really a market-driven exchange rate.”

“Our symbolic forecasts for the ruble are significantly weaker than today’s levels in order to portray that we see the impact of sanctions playing out over a much longer period of time, which is unlikely to be adequately priced in today (we do not think it will resemble a one-off shock pattern, where the maximum impact occurs immediately, followed by recovery over the medium-term).”

Chinese President Xi Jinping on Friday said US President Joe Biden that state-to-state relations cannot advance to the stage of confrontation, reported Chinese state media. Xi told Biden that conflicts and confrontations are not in the interests of anyone and that peace and security are the most cherished treasures of the international community.

China's Xi said that the Ukraine crisis is not something that China wanted to see and said that China and the US should guide bilateral relations along the right track. China and the US must shoulder due international responsibilities and make efforts for world peace, Xi told Biden.

- USD/CAD reversed an intraday dip to sub-1.2600 levels, or over a two-week low.

- Resurgent USD demand turned out to be a key factor that extended some support.

- Steady oil prices, upbeat Canadian data underpinned the loonie and capped gains.

The USD/CAD pair built on its steady intraday recovery move from over a two-week low and climbed to a fresh daily top, around the 1.2635-1.2640 region during the early North American session.

A combination of factors assisted the USD/CAD pair to attract some buying on the last day of the week and reverse the early dip to sub-1.2600 levels. A goodish pickup in demand for the US dollar acted as a tailwind for spot prices. Apart from this, an intraday pullback in crude oil prices undermined the commodity-linked loonie and provided modest lift to the major.

Investors turned caution amid the lack of progress in the Russia-Ukraine peace negotiations. In fact, Ukrainian Presidential aide Ihor Zhovkva said that talks with Russia are progressing very slowly. Russia accused Ukraine of slowing down peace talks and said that it wants to go at a faster pace, though the Ukraine delegation has not shown readiness to speed talks.

This, in turn, tempered investors' appetite for perceived riskier assets ahead of a meeting between US President Joe Biden and his Chinese counterpart Xi Jinping. The market nervousness was evident from a softer tone around the equity markets, which drove some haven flows towards the greenback. Apart from this, the Fed's hawkish outlook further underpinned the buck.

Apart from the anti-risk flow, concerns about reduced fuel demand - amid the resurgent of COVID-19 cases in China, Europe and New Zealand - weighed on crude oil prices. That said, the intraday downtick in the black liquid remained limited. This, along with better-than-expected Canadian macro data, benefitted the domestic currency and capped the USD/CAD pair.

According to the data released by Statistics Canada, the headline Retail Sales rose at a pace of 3.2% MoM in January as against the consensus estimate for a growth of 2.4%. This comes on the back of hotter-than-expected Canadian consumer inflation figures, which should further add pressure on the Bank of Canada to accelerate rate hikes.

The fundamental backdrop warrants some caution before confirming that the USD/CAD pair has bottomed out or positioning for any meaningful appreciating move. That said, bearish traders are likely to wait for sustained break below the 200-day SMA. Some follow-through selling below the monthly low, around the 1.2585 region, will set the stage for additional losses.

Technical levels to watch

- Gold prices remain capped under $1950 despite weaker equities as traders mull Russo-Ukraine peace talks, recent Fed developments.

- Some think the bank’s hawkish shift this week may be weighing on gold’s appeal and preventing a rebound.

- Gold is currently on course for its worst one-week performance in nearly four months.

Despite a modest end-of-week pullback in the global equity space as investors mull the Russo-Ukraine war, inflation and central bank tightening risks, spot gold (XAU/USD) prices are struggling to build on Thursday’s gains. Indeed, the $1950 mark continues to act as a ceiling for XAU/USD which, at current levels near $1940, trades with modest on the day losses of around 0.1%. As traders continue to assess the state of Russia/Ukraine peace negotiations (no signs of any breakthrough just yet), attention now turns to a call between the US and Chinese Presidents. US President Joe Biden will reportedly use as an opportunity to urge China President Xi Jinping not to offer military aid to Russia.

Though gold prices did find solid support in the $1900 around the middle of the week, prices remain on course for their worst week in nearly four months. At current levels, spot prices are down just under 2.5% on the week, with traders citing this week’s surprisingly hawkish Fed policy announcement as adding to reluctance on Friday to add to longs at or above $1950. To recap, the central bank hiked interest rates by 25bps for the first time in three years and signalled intentions to lift interest rates a further six times this year, followed by a further four in 2023, with Fed Chair Jerome Powell flagging rising inflation risks and the need to act.

Higher interest rates increase the opportunity cost of holding non-yielding precious metals and can therefore weigh on demand for gold. Meanwhile, though the current inflationary environment, which has been exacerbated in recent weeks by geopolitical developments between Ukraine and Russia, is keeping gold underpinned amid demand for inflation protection, it may continue to push the Fed in a more hawkish direction. Two of the Fed’s most hawkish policymakers James Bullard and Christopher Waller were both on the wires on Friday calling for an accelerated pace of tightening this year.

They have been ahead of the curve regarding Fed policy over the last year and there is a risk that if they can persuade the rest of the central bank’s policymakers to turn even more hawkish, rates could be moving up by more than the 150bps currently expected this year. That could be a headwind for gold. In the more immediate future, geopolitics remains the key factor to monitor amid hopes for Russo-Ukraine peace. More Fed speakers will be on the wires later with Michelle Bowman, Charles Evans and Thomas Barkin all slated to speak.

- GBP/USD witnessed some intraday selling on Friday amid strong pickup in the USD demand.

- A softer risk tone, hawkish Fed outlook turned out to be key factors underpinning the buck.

- The lack of follow-through selling warrants caution before placing aggressive bearish bets.

The GBP/USD pair remained on the defensive heading into the North American session and was last seen trading near the daily low, around the 1.3120 region.

The pair struggled to capitalize on its early modest uptick on Friday, instead met with a fresh supply near the 1.3180-1.3185 region and was pressured by a combination of factors. A dovish assessment of the Bank of England monetary policy decision on Thursday was seen as a key factor that acted as a headwind for the British pound. Apart from this, a goodish pickup in the US dollar demand prompted some intraday selling around the GBP/USD pair.

The lack of progress in the Russia-Ukraine peace negotiations kept a lid on the recent optimism and tempered investors' appetite for perceived riskier assets. Traders also seemed nervous ahead of a meeting between US President Joe Biden and his Chinese counterpart Xi Jinping. This was evident from a generally weaker tone around the equity markets, which, in turn, extended some support to traditional safe-haven assets, including the greenback.

Apart from this, the Fed's hawkish outlook, indicating that it could raise interest rates at all the six remaining meetings in 2022, further underpinned the buck. The combination of supporting factors, to a larger extent, helped offset a softer tone around the equity markets and did little to dent the intraday bullish sentiment surrounding the USD. That said, the lack of follow-through selling around the GBP/USD pair warrants caution for bearish traders.

This, along with the overnight bounce, makes it prudent to wait for a convincing break through the 1.3100 mark before positioning for any further depreciating move. Sustained weakness below will suggest that the recent strong recovery move from the lowest level since November 2020, has run its course. The GBP/USD pair might then turn vulnerable to accelerate the fall to challenge the 1.3000 psychological mark, or the YTD low touched earlier this week.

Market participants now look forward to the US economic docket, featuring the release of Existing Home Sales. The data might do little to influence the USD price dynamics as the focus remains on fresh developments surrounding the Russia-Ukraine saga. Apart from this, the headlines coming out of the Biden-Xi meeting might influence the broader market risk sentiment and produce some short-term trading opportunities around the GBP/USD pair.

Technical levels to watch

Fed Board of Governors member Christopher Waller said on Friday in an interview on CNBC that while the data is calling out for the Fed to move in 50bps increments, geopolitical events call for caution. The data is suggesting that we move in the direction of a 50bps hike at the coming meetings, Waller continued, adding that Europe will feel the impact of higher oil prices more than the US, but it will knock off half a point from US growth this year.

I really want to front-load our hikes, Waller said, saying that would imply 50bps or more at coming meetings. I think we need to get rates up and any policy rule would tell you we need to be higher than we are right now, he said. If we need to continue, we'll keep going, Waller added, noting that we can remove liquidity from the system without doing much damage.

We have the room to go sooner and to go faster the last time with the balance sheet, Waller noted, saying that as long as the Fed is clear in its communications and the market adjusts, there has't been much market turmoil. Getting to neutral or slightly above by the year's end should not be a concern for causing a recession, Waller said, though he did note that getting above neutral by the year's end would put pressure on demand.

- Headline Retail Sales rose 3.2% MoM in January, above the expected 2.4%.

- The loonie didn't react to the backward-looking data, with focus now much more on how the Russo-Ukraine war will impact things going forward.

Headline Canadian Retail Sales rose at a pace of 3.2% MoM in January, much stronger than the expected 2.4% gain, marking a strong rebound from December's Omicron Covid-19 variant induced drop of 1.8% MoM, data released by Statistics Canada showed on Friday. Retail Sales excluding autos also saw stronger than expected growth of 2.5% MoM versus expectations for 2.4% growth. That came after a 2.5% decline in December.

Market Reaction

The loonie has not reacted to the latest data release at all. It's not a surprise that Retail Sales rebounded strongly as Covid-19 infection rates/fears eased in Canada in January and focus is now much more on how the Russo-Ukraine war, which began in late February, will impact the global (and Canadian) economy going forward.

- EUR/USD comes under pressure and retests the low-1.1000s.

- There is an initial support at the 10-day SMA at 1.0975.

EUR/USD faces some selling pressure and retreats from recent peaks past 1.1100 the figure on Friday.

In case sellers push harder, a breakdown of the 1.1000 mark carries the potential to spark a deeper pullback to, initially, the 10-day SMA at 1.0975 prior to the weekly low at 1.0900 (March 14).

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1530.

EUR/USD daily chart

- USD/JPY caught fresh bids on Friday after the BoJ stuck to its accommodative policy stance.

- A goodish pickup in the USD demand provided an additional boost and remained supportive.

- A softer risk tone could benefit the safe-haven JPY and cap gains amid overbought conditions.

The USD/JPY pair extended its steady intraday ascent through the mid-European session and climbed to a fresh multi-year peak, around the 119.10-119.15 region in the last hour.

A combination of supporting factors assisted the USD/JPY pair to regain positive traction on the last day of the week and prolong its recent bullish trajectory witnessed over the past two weeks or so. The Bank of Japan stuck to its dovish stance and left its ultra-easy policy setting unchanged at the end of the March meeting. This, in turn, weighed on the Japanese yen and pushed the pair higher amid a goodish pickup in the US dollar demand.

The greenback made a solid comeback on Friday and reversed the previous day's slide to the one-week low, bolstered by the start of the policy tightening cycle by the Fed. It is worth recalling that the US central bank hike its target fund rate by 25 bps on Wednesday and indicated that it could raise interest rates at all the six remaining meetings in 2022. This, along with elevated US Treasury bond yields, underpinned the greenback.

The latest leg up now seems to have confirmed a near-term bullish breakout and might have already set the stage for a further near-term appreciating move for the USD/JPY pair. The divergence in the BoJ-Fed monetary policy outlook adds credence to the constructive outlook. That said, extremely overbought conditions on the daily chart could hold back traders from placing aggressive bullish bets, at least for the time being.

Moreover, a weaker risk tone, which tends to benefit the safe-haven Japanese yen, might further contribute to capping the USD/JPY pair. The lack of progress in the Russia-Ukraine peace negotiations tempered investors' appetite for riskier assets and led to a fresh leg down in the equity markets. Traders might also prefer to wait on the sidelines ahead of a meeting between US President Joe Biden and his Chinese counterpart Xi Jinping.

Nevertheless, the bias seems tilted firmly in favour of bullish traders, though the technical set-up makes it prudent to wait for some near-term consolidation or a modest pullback before the next leg up. Nevertheless, the USD/JPY pair seems all set to settle near the highest level since February 2016 and record strong gains for the second successive week.

Technical outlook

US President Joe Biden will urge Chinese President Xi Jinping in a call scheduled to begin at 1300GMT on Friday to use his influence over Russian President Vladimir Putin to end the war in Ukraine, reported Bloomberg. Separately, US Deputy Secretary of State Wendy Sherman reiterated that the US is collecting evidence of Russian war crimes in Ukraine.

- DXY finally sees some light at the end of the tunnel.

- Next on the upside comes the 99.00 yardstick.

DXY regains the 98.00 mark and above following the earlier drop to the 97.80 region at the end of the week.

The continuation of the bid tone in the index carries the potential to extend to the next target of note at the 99.00 neighbourhood ahead of the weekly high at 99.29 (March 14) and the 2022 peak at 99.41 (March 7).

The current bullish stance in the index remains supported by the 6-month line, today near 95.90, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 94.51.

DXY daily chart

- EUR/JPY faces some selling pressure around 131.90.

- Extra gains look on the cards with the target at the YTD peak.

EUR/JPY looks offered after hitting fresh monthly highs in the 131.90 region on Friday.

The cross gathered extra upside traction following the recent breakout of the 200-day SMA (129.98). The surpass of the 131.90 area could likely allow EUR/JPY to attempt an assault of the 2022 top at 133.15 (February 10).

In the meantime, while above the 200-day SMA, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

The Bank of Russia announced on Friday that it left the policy rate unchanged at 20% as expected.

Key takeaways from policy statement

"Proinflationary risks have considerably increased and are now prevailing over the entire forecast horizon."

"Over a longer horizon, the Russian economy faces considerable uncertainty."

"Annual inflation will return to 4% in 2024."

"Flash indicators, including the Bank of Russia’s business survey, suggest a deterioration of the situation in the Russian economy."

"GDP will reduce over the coming quarters."

"Monetary policy is set to enable a gradual adaptation of the economy to new conditions and a return of annual inflation to 4% in 2024."

"Will take into account actual and expected inflation movements relative to the target and economic developments over the forecast horizon."

"Will take into account risks posed by domestic and external conditions and the reaction of financial markets."

"Drastic change in external conditions for the Russian economy that occurred at the end of February has created threats to financial stability."

"Capital controls helped support the stable functioning of the Russian financial system."

"Weekly estimates show that inflation has significantly accelerated since early March."

"Economy is entering the phase of a large-scale structural transformation, which will be accompanied by a temporary but inevitable period of increased inflation."

Market reaction

The USD/RUB pair edged higher with the initial reaction and was last seen rising 0.65% on a daily basis at 103.80.

Economist at UOB Group Enrico Tanuwidjaja and Yari Mayaseti assess the latest interest rate decision by the BI.

Key Takeaways

“Bank Indonesia (BI) kept its benchmark rate (7-Day Reverse Repo) unchanged at 3.50% at its March MPC meeting. Consequently, BI maintained the Deposit Facility rate at 2.75% as well as the Lending Facility rate at 4.25%.”

“We keep our view for BI to start hiking in mid-2022 to reach 4.5% by the end of this year.”

- EUR/USD corrects lower from peaks above 1.1100.

- The dollar gathers some renewed traction on geopolitics.

- EMU trade deficit widened to €27.2B in January.

The single currency gives away some gains and forces EUR/USD to abandon the area of recent tops past 1.1100 and revisits the 1.1030 region on Friday.

EUR/USD weaker on risk aversion

EUR/USD trades on the defensive for the first time this week and comes under some pressure after hitting new 2-week peaks around 1.1140 on Thursday.

The knee-jerk in the pair comes in response to renewed concerns in the geopolitical landscape and after Russia-Ukraine peace talks appear to have stalled in past hours.

The resumption of the risk aversion among traders is also seen in the demand for bonds in money markets on both sides of the Atlantic, with the German 10y bund extending the decline to the 0.35% area and its US peer flirting with the 2.15% region.

In the docket, trade balance figures in the broader Euroland showed the trade deficit clinched a new record at €27.2B during January.

Data across the pond includes the CB Leading Index, Existing Home Sales and speeches by FOMC’s T.Barkin, C.Evans and M.Bowman.

What to look for around EUR

The European currency meets some fresh selling bias at the end of the week and fades the recent uptick to the 1.1140 region, all amidst the fresh bout of risk aversion stemming from the deterioration of the geopolitical arena. Pockets of strength in the euro, in the meantime, should appear reinforced by the speculation of the start of the hiking cycle by the ECB at some point by year end, while higher German yields, elevated inflation, the decent pace of the economic recovery and auspicious results from key fundamentals in the region are also supportive of a firmer currency for the time being.

Key events in the euro area this week: EMU Balance of Trade (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Impact of the geopolitical conflict in Ukraine.

EUR/USD levels to watch

So far, spot is retreating 0.48% at 1.1036 and faces the next up barrier at 1.1137 (weekly high Mar.17) followed by 1.1245 (55-day SMA) and finally 1.1294 (100-day SMA). On the other hand, a drop below 1.0977 (10-day SMA) would target 1.0900 (weekly low Mar.14) en route to 1.0805 (2022 low Mar.7).

- Silver witnessed some selling on Friday and snapped two successive days of the winning streak.

- Bulls struggled to capitalize on this week’s rebound and faced rejection near the 200-hour SMA.

- Sustained weakness below the $24.85 area is needed to support prospects for additional losses.

Silver edged lower on Friday and snapped two days of the winning streak, through the intraday downtick lacked follow-through selling. The XAU/USD remained on the defensive through the first half of the European session and was last seen trading around the $25.25-$25.30 region, down 0.40% for the day.

From a technical perspective, this week's goodish rebound from the $24.45 area faltered near the 200-hour SMA. The mentioned barrier, currently around mid-$25.00s, should act as a pivotal point, which if cleared decisively should set the stage for a further near-term appreciating move for the XAG/USD.

The momentum could then push spot prices beyond the $25.75-$25.80 intermediate hurdle and allow bulls to aim back to reclaim the $26.00 mark. The next relevant resistance is pegged near the $26.40 region, above which the XAG/USD could climb further towards the $27.00 round figure en-route mid-$27.00s.

On the flip side, the key $25.00 psychological mark, closely followed by the $24.85 region now seems to protect the immediate downside ahead of the $24.45 area amid slightly bullish oscillators. Some follow-through selling would make the XAG/USD vulnerable to accelerate the slide to test sub-$24.00 levels.

Silver 1-hour chart

-637831963307865381.png)

Key levels to watch

- GBP/JPY regained positive traction on Friday after the BoJ announced its policy decision.

- A hawkish assessment of the BoE decision undermined sterling and capped the upside.

- Sustained move beyond the 156.70 area is needed to support prospects for further gains.

The GBP/JPY cross retreated a few pips from the daily peak and was last seen trading with modest intraday gains, around the 156.25-156.30 region.

Following the previous day's post-BoE turnaround from a near four-week peak, the GBP/JPY cross caught fresh bids on Friday amid the emergence of fresh selling around the Japanese yen. The Bank of Japan stuck to its accommodative policy stance and downgraded the overall assessment of the economy. In the post-meeting press conference, Governor Haruhiko Kuroda reiterated that the BoJ will ease further without hesitation as needed, which, in turn, undermined the JPY.

That said, the lack of progress in the Russia-Ukraine ceasefire negotiations tempered investors' appetite for perceived riskier assets and acted as a tailwind for the safe-haven JPY. In the latest development, Ukrainian Presidential aide Ihor Zhovkva said that talks with Russia are progressing only slowly. Separately, Russia accused Ukraine of slowing down peace talks and said that it wants to go at a faster pace, though the Ukraine delegation has not shown readiness to speed talks.

Apart from this, a dovish assessment of the Bank of England's decision on Thursday held back bulls from placing aggressive bullish bets around the British pound and capped gains for the GBP/JPY cross. In fact, the BoE raised its key rate for the third successive meeting, though the 25 bps rate hike disappointed some investors anticipated a more aggressive increase. Moreover, the UK central bank also softened its language around the need for future rate hikes.

Nevertheless, the GBP/JPY cross, so far, has managed to hold its neck above the 156.00 round figure and remains on track to post strong weekly gains. Bulls, however, are likely to wait for some follow-through buying beyond the overnight swing high, around the 156.70 region, before placing fresh bets. This will set the stage for an extension of the recent strong appreciating move from sub-151.00 levels, or the YTD low touched earlier this month.

Technical levels to watch

Various Russian media outlets are reporting headlines on a likely call between Russian President Vladimir Putin and Germany’s Chancellor Olaf Scholz.

TASS states that Putin told Scholz that Kyiv was trying to slow down Ukraine peace talks.

Meanwhile, RIA reports that Putin told Scholz Kyiv is making unrealistic proposals.

Related reads

-

Kremlin: Russia has expressed readiness to work much faster but Ukraine not showing similar response

-

Zelenskyy Aide Zhovkva: Ukraine-Russia talks are progressing only slowly

USD/CNH remains side-lined within the 6.3300-6.3900 range for the time being, commented FX Strategists at UOB Group.

Key Quotes

24-hour view: “Our expectations for USD to ‘test 6.3450’ did not materialize as it traded sideways between 6.3555 and 6.3660. Momentum indicators are mostly neutral and further sideway trading seems likely. Expected range for today, 6.3530/6.3730.”

Next 1-3 weeks: “We continue to hold the same view as yesterday (17 Mar, spot at 6.3600). As highlighted, the recent upward pressure has eased and USD is likely to consolidate and trade within a broad range of 6.3300/6.3900 for now.”

- DXY picks up traction and bounces off lows near 97.70.

- US yields extend the corrective downside on Friday.

- Fedspeak, housing data next of note in the docket.

The greenback, in terms of the US Dollar Index (DXY), manages to regain some buying interest and moves beyond the 98.00 hurdle at the end of the week.

US Dollar Index looks to geopolitics, data

The index attempts a mild recovery after four consecutive daily retracements on Friday, as the risk complex gives away part of the recent strong advance and geopolitical concerns appear to have returned to the markets.

The perceived pick up in the risk aversion lends legs to the greenback and favours the demand for bonds, which in turn morph into another negative performance of US yields along the curve.

Later in the session, market participants are expected to closely follow the call between President Biden and China’s Xi Jinping regarding the war in Ukraine.

In the US data space, the CB Leading Index is due seconded by Existing Home Sales and speeches by Richmond Fed T.Barkin (2024 voter, centrist), Chicago Fed C.Evans (2023 voter, centrist) and FOMC Governor M.Bowman (permanent voter, centrist),

What to look for around USD

The index manages to bounce off recent sub-98.00 levels and trims part of the decline following the start of the tightening cycle by the Federal Reserve at its meeting on Wednesday. Concerns surrounding the geopolitical landscape seem to be propping up the demand for the buck along with the offered stance in the risk-associated complex. Looking at the broader picture, bouts of risk aversion – exclusively emanating from Ukraine - should prop up inflows into the safe havens and lent legs to the dollar at a time when its constructive outlook remains propped up by the current elevated inflation narrative, the Fed’s lift-off and the solid performance of the US economy.

Key events in the US this week: CB Leading Index, Existing Home Sales (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Futures of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is up 0.20% at 98.21 and a break above 99.29 (high Mar.14) would open the door to 99.41 (2022 high Mar.7) and finally 99.97 (high May 25 2020). On the flip side, the next down barrier emerges at 97.72 (weekly low Mar.17) followed by 97.71 (weekly low Mar.10) and then 97.44 (monthly high Jan.28).