- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-02-2022

- Gold aims for a 2.06% gain on the week, courtesy of geopolitical jitters amid Fed speaking ignored by market players.

- The conflict in Eastern Europe gives signs of no de-escalation as Russian President Putin decided to oversee nuclear drills in the weekend.

- XAU/USD Technical Outlook: Despite finishing the week on the wrong foot, still upward biased, as XAU bulls prepare to probe $1900.

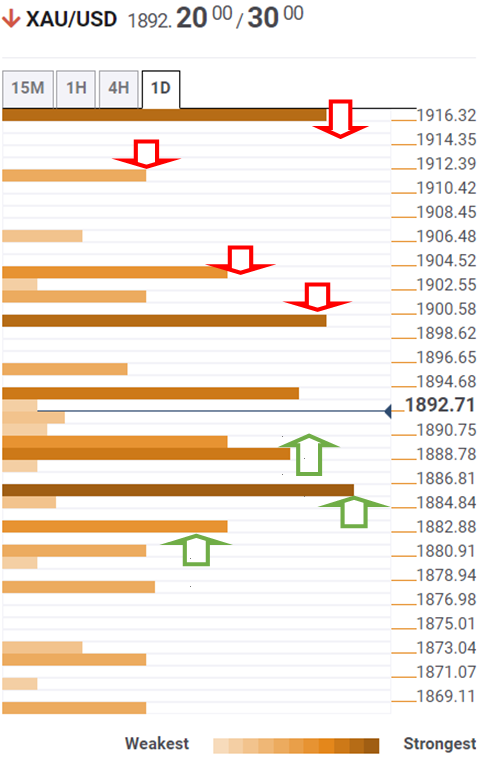

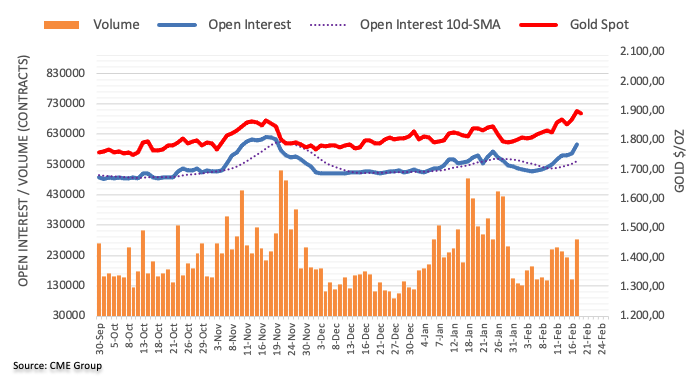

Gold (XAU/USD) slides as the New York session winds down and fails to cling to the $1,900 mark pierced on Thursday, so far in the week up 2.02%. At the time of writing, XAU/USD is trading at $1,897. A risk-off market mood kept the safe-haven gold bid through the majority of the week, with four days of gains and one day in the red.

Russia/Ukraine update

In the meantime, the Russia Ukraine narrative keeps grabbing the headlines. In the last couple of hours, tensions have remained unchanged. Ukraine’s intelligence reported that Russian special forces placed numerous explosive devices around local infrastructure in separatist-held territories in Donetsk. Meanwhile, the Russian Communist leader Zyuganov said that Russian President Vladimir Putin would announce a decision on Donbas on February 20.

Furthermore, late in the day, a Senior US admin official said that Russian President Putin’s decision to oversee nuclear drills on Saturday is “escalatory.” In contrast, other US officials privately urged Ukraine President Zelensky to stay put, as concerns of a possible incursion rise, as reported by CNN’s reporter.

That said, what happened to gold? During Friday’s session, the yellow metal consolidated around the $1,886-$1,900 area, amongst exchanges of statements in news media between Russia, Ukraine, and NATO countries, keeping uncertainty around the current situation in Ukraine.

The US 10-year Treasury yield fell five basis points sits at 1.925% in the bond market. At the same time, the US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, edges up 0.31%, at 96.10, reflecting the increased demand for the US dollar amid geopolitical concerns.

XAU/USD Price Forecast: Technical outlook

On Thursday, the non-yielding metal pierced the $1,900 mark for the first time since last June. However, XAU bulls’ failure to record a daily close left the yellow metal subject of a mean reversion move.

On Friday, XAU/USD consolidated in a $14.00 range. Should gold close within the range, a move towards February 15 daily high, resistance/support at $1,879 is on the cards, as XAU bulls prepare for an assault of $1,900. If that scenario plays out, XAU/USD first resistance is $1,900. The breach of it opens the door towards $1,916, which, once cleared, will expose January 2021 highs at $1,959.

- AUD/USD failed to hold above 0.7200 for a third successive session, as geopolitical angst underpinned US dollar demand.

- Geopolitics will be the highlight for the pair next week, though Aussie Q4 wage data will also be key.

AUD/USD failed to hold to the north of the 0.7200 level for a third successive session, despite solid jobs data earlier in the week keeping calls for RBA monetary tightening in H2 this year alive. At current levels in the 0.7170s, AUD/USD is trading a touch lower on the day, though still looks on course to gain about 0.7% on the week, which would mark the pair’s third successive week. Resilience in copper and gold prices has been largely negative, as far as the commodity-sensitive Aussie is concerned, by slightly lower oil and iron ore prices on the week.

Geopolitical tensions between Russia, Ukraine and NATO remain elevated as Russia continues to amass troops on Ukraine’s border and violence in Eastern Ukraine between government and separatist forces escalates, underpinning the US dollar on the final trading day of the week. That is likely the main reason why AUD/USD hasn’t been able to hold above the 0.7200 handle on Friday, or mount an attempt at testing last week’s high at 0.7250.

AUD’s resilience to the escalating geopolitical situation in Eastern Europe will be put to the test once more next week with a key face-to-face meeting between US Secretary of State Anthony Blinken and Russian Foreign Minister Sergey Lavrov in focus. Any signs the two sides come to some sort of agreement to de-escalate things could help propel the pair back above monthly highs and back towards 2022 highs in the 0.7300 area.

Otherwise, the highlight of next week’s economic calendar will be Australian Q4 Wage Price Index data out on Wednesday. An upside surprise could be the final piece in the puzzle for the RBA to formally signal rate hikes in 2022, as money markets continue to bet they will get started hiking sometime around the middle of the year. Elsewhere on the economic calendar, flash Aussie and US PMI survey results for February and the US January Core PCE inflation report could be market moving, while Fed speak will as ever be worth monitoring.

- The GBP/JPY is down in the week, 0.02% amongst a risk aversion environment.

- Russia/Ukraine news headlines dominate the trading session, safe-haven peers advance.

- GBP/JPY Weekly Outlook: From a weekly chart, it faces a wall of resistance around 158.00.

- GBP/JPY Daily Outlook: Neutral-upwards above 155.30, otherwise neutral.

The GBP/JPY eyes to end the week flat in the North American session. As the weekend approaches, the GBP/JPY trades at 156.40 at press time.

Friday’s session keeps the week’s narrative unchanged. Geopolitical headlines courtesy of the Russia/Ukraine crisis dominate newswires, while central bank speaking and macroeconomic data took the backseat as tensions in eastern Europe arose. That affected the market sentiment, staying sour ahead of the weekend. In the FX space, safe-haven peers like the Japanese yen, the US dollar, and the Swiss franc, benefitted from those factors.

GBP/JPY Price Forecast: Technical outlook

Weekly chart

The GBP/JPY is neutral biased, as this week’s failure to record a new weekly high formed a “bearish-harami” candlestick chart pattern, also known as an inside bar, suggesting that the GBP/JPY aims downwards.

Also, a triple-top formation looms, as the GBP/JPY unsuccessfully tested the 158.00, which opened the door for two retracements. In the first one, the GBP/JPY fell to 148.97, and the second one to 152.90.

A weekly close under 155.00 would accelerate the downward move. Once achieved, the GBP/JPY first support would be 152.90. Breach of the latter would expose 148.97, followed by the 100-week moving average (WMA) at 145.31.

Daily chart

The GBP/JPY depicts the pair as neutral, tilted upwards despite failing to break the five-month-old downslope trendline, drawn from October tops that pass around 157.50, followed by a pullback towards 156.00. Nevertheless, the GBP/JPY printed a fresh weekly high on Friday, keeping the bias unchanged.

That said, the GBP/JPY first resistance would be 157.00. A decisive break would expose 157.50, followed by a January 5 daily high at 157.76, and the October 2021, a cycle high at 158.21.

-637808095391587441.png)

- GBP/USD tried but failed to break above its 1.3500-1.3650ish range that has prevailed for most of February.

- The pair fell back under 1.3600 in the US session as geopolitical angst remains elevated.

- That kept USD in demand and negated pushback against a 50bps March rate hike from Fed’s Williams.

GBP/USD tried but eventually failed to break out of the top of its 1.3500-1.3650ish range that has prevailed for most of February so far, with the pair eventually falling back below the 1.3600 level during US trade. Violence in Eastern Ukraine escalated further on Thursday, weighing on macro sentiment as Russia continues to mass troops close to Ukraine’s border despite pledges earlier in the week to partially withdraw. That means that the safe-haven US dollar gained against most of its G10 counterparts, including sterling.

As traders continue to assess the fast-moving Ukraine situation and the prospect that it triggers a further downturn in risk appetite next week, the range play for GBP/USD likely makes sense for now. Strong January UK Retail Sales data released early in Friday’s European session, though a sign that the UK consumer started 2022 with good momentum, was not able to spur lasting upside in sterling. That’s because economists continue to fret about an upcoming rise in tax and energy costs in April that will eat into consumer budgets and likely act as a break on growth.

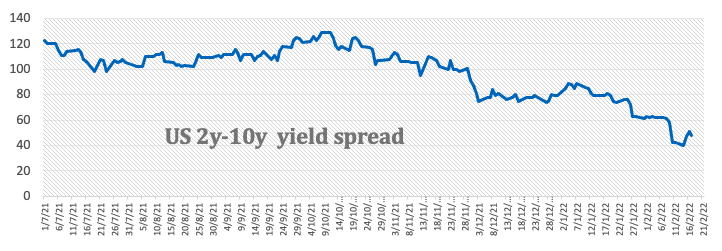

Various Fed members hit the wires on Friday and the most notable moment was NY Fed President John Williams’ remark that there isn’t a compelling reason for taking a “big step” (read: 50bps rate hike) at the start of lift-off. As a result, the money market-implied probability that the Fed hikes rates by 50bps at the coming March meeting fell sharply to just 21%, down from around 50% just one week ago. That “should” have weighed on the dollar, but Fed speak and US data this week has had less influence on markets than usual with so much focus on geopolitics.

That’s likely to remain the case next week, with a key face-to-face meeting between US Secretary of State Anthony Blinken and Russian Foreign Minister Sergey Lavrov meeting at some point in the hope of de-escalating tensions. Otherwise, flash UK and US February PMI surveys, more central bank speak and US Core PCE inflation data for January make up the highlights on the data calendar.

- The NZD/USD slides 0.04% in the North American session on Friday.

- Russia/Ukraine headlines dominate market participants' mood as uncertainty clouds investors.

- New York Fed Williams favors a gradual increase of hiking rates, pushing back the chance of a 50bps in March.

The NZD/USD appears to finish the week on a higher note, as the kiwi climbs 0.72%, ahead of the Reserve Bank of New Zealand (RBNZ) monetary policy meeting the following week. At the time of writing, the NZD/USD is trading at 0.6691.

Geopolitical headlines loom the financial markets. Market players’ mood is a rollercoaster, between risk-on/off, as Ukraine/Russia headlines cross the wires. Major US equity indices remain in the red, while in the FX space, the NZD is the strongest, while the EUR and the CAD are the laggards.

Russia/Ukraine update

In the last couple of hours, wires reported that Ukrainian forces shell Shanzharovka village in LPR using 122 mm caliber artillery, increasing the tension in the zone. Meanwhile, the US State Department, cited by Fox, says that evacuation announcements of 700K in Donbas and reports of an explosion in Donetsk are “false flags” from Russia. Further, US officials cited by the WSJ expect a Russian attack on Ukraine in the next few days and would involve tanks, jets, ballistic missiles, and cyberattacks.

New York Fed Williams crosses news wires

The NZD/USD reacted to the downside and broke under the 0.6700 figure, as the market sentiment turned sour. Moreover, to add a mix to the news, New York’s Fed President John Williams said that he does not see a compelling argument for taking a big step at the start of the interest rate liftoff cycle. Williams added that the US central bank could steadily increase rates and reassess by adjusting the pace of rate hikes if required.

IThe US economic docket featured the Existing Home Sales for January increasing by 6.5M more than the 6.1M foreseen. At the same time, the Consumer Board Leading Index contracted to 0.3%, worse than the 0.2% increase estimated by analysts, trailing December’s reading.

- US equities tumbled for a second successive session on Friday ahead of the long weekend, on course for a negative weekly close.

- The S&P 500 was last down just under 1.0% on Friday and trading below the 4350 level.

- The Ukraine crisis remains the major driving force in the market right now as violence in Eastern Ukraine escalates.

US equity markets tumbled for a second successive session on Friday ahead of the long weekend and now look on course to post a second successive negative weekly close for the first time since November 2021. US equity investors said on Friday that they didn’t want to be caught “exposed” ahead of the long weekend (US markets are shut on Monday for President’s Day) and were taking profit just in case the Ukraine crisis further escalates. The S&P 500 was last down just under 1.0% on Friday and trading below the 4350 level, putting it on course to post a 1.8% weekly loss, taking its losses since earlier monthly highs near 4600 to more than 5.0%.

S&P 500 bears will be hoping that, given the index pushed to fresh weekly lows on Friday, the next stop at some point next week will be a test of the annual lows in the 4220s, a further more than 2.5% down from current levels. As hostilities between pro-Russia separatists and the Ukrainian military in Eastern Ukraine escalate and Russia continues to amass troops near the Ukrainian border, jitters about the breakout of a broader Russo-Ukrainian war will keep equity investors skittish. One key event on the radar next week is a face-to-face meeting between US Secretary of State Anthony Blinken and Russian Foreign Minister Sergey Lavrov next week which might de-escalate tensions somewhat. Reportedly the US agreed to the meeting on the conditions that Russia doesn’t invade Ukraine.

With geopolitics remaining at the forefront of investor attention given fears that an outbreak of war might lead to massive Western sanctions versus Russia with inflationary implications for the global economy, Fed speak and US data has been ignored this week. In truth, there hasn’t been any tier one data to impact Fed tightening expectations too much, nor have Fed members said anything new or particularly interesting. This is likely to remain the case next week, with the only data of note flash February PMIs, January Core PCE inflation and the second estimate of Q4 GDP growth.

Returning back to US equities, the Nasdaq 100 index dropped 1.0% on Friday to test the 14K level, taking its losses on the week to around 1.6%. At current levels, the index is trading more than 16% below last November’s record highs in the 16.75K region. The bears will now be looking for the index to fall back towards the 13.5K area, which would mark a 20% drop from recent highs and thus confirm a “bear market”.

The Dow, meanwhile, dropped 0.6% towards a test of the 34K level, also putting the index on course to post a second successive week of losses. The index has now reversed nearly 5.0% lower versus last week’s highs in the 35.8K area. The S&P 500 CBOE Volatility Index or VIX, often referred to as Wall Street’s “fear gauge”, was slightly higher in the 28.00s, a more than four point rebound from earlier weekly lows around 24.00.

NY Fed President, influential FOMC member John Williams said on Friday that inflation is way too high right now, but there are some reasons for optimism that it will come down, according to Reuters.

Additional Remarks:

- "Businesses that rely on people commuting to work in the office are seeing a slower recovery."

- "The Fed has to stick to a transparent and predictable as possible approach."

- "The labor market is strong and job openings are high."

- "The Fed can manage the soft landing of keeping the economy in a strong place while restoring balance between demand and supply."

- "There's a lot of uncertainty around supply chain issues and inflation."

- Williams' baseline outlook is that supply chain issues will gradually recede.

- "Raising interest rates from near-zero levels in March makes sense under various scenarios."

Data released on Friday showed retail sales dropped in Canada during December by 1.8%, a decline smaller than market forecast of 2.1%. Analysts at CIBC, point out price increases contribute more to the headline number than they typically do and the data don't look quite as impressive in volume terms. They added the rebound in January may have reflected households once again spending more on goods due to many services being temporarily closed to stem the Omicron wave.

Key Quotes:

“Canadian retail sales see-sawed into the New Year, with December's fairly sharp decline followed by a strong estimated rebound in January. However, with price increases contributing more to these headline sales figures than they typically do, the data don't look quite as impressive in volume terms, and the rebound in January may have reflected households once again spending more on goods due to many services being temporarily closed to stem the Omicron wave.”

“There was good news from the advance data for January, which pointed to a rebound of 2.4% in overall retail sales. In nominal terms that would more than offset the decline in December, but after accounting for price increases the volume of sales in January was likely still well short of where it stood in November. Still, much like the US figures earlier this week, the pop higher in January is probably better than anticipated given at least some reduction in foot-traffic due to the Omicron wave.”

“The rebound in sales estimated for January, while likely much more modest in price-adjusted terms, was somewhat better than we had anticipated. That will provide at least a partial offset within monthly GDP to the declines other services industries would have seen as restrictions tightened during the Omicron wave, and could signal upside risk to our current Q1 GDP forecast. However, with so much uncertainty still regarding the scale of the decline seen within other service industries during January, and whether recent transportation disruptions will negatively impact the overall rebound in growth during February, we won't be revising our forecast at this stage.”

- Spot silver failed to hold above resistance at $24.00 on Friday but continues to trade with an upside bias.

- Geopolitical tensions as violence in Eastern Ukraine picks up are keeping precious metals in demand.

Though they had a decent go at it, its looks as though spot silver (XAG/USD) prices are not going to be able to end the week above resistance in the form of the $24.00 per troy ounce level. Having reached as high as $24.09 (multi-week highs) earlier in the session, prices have since dipped back to around $23.90, where they continue to trade with on-the-day gains of about 0.3%. Levels of geopolitical angst remain high as violence escalates between pro-Russia separatist forces and Ukraine’s military in the country’s Eastern Donbas region and Russia continues to amass troops near the Ukrainian border. Evacuations of civilians in separatist-held areas of Donbas into Russia further added to the nerves, as evacuations could be seen as part of separatist force preparations for a greater escalation of violence.

The upshot is that precious metals like silver remain very much in demand. This is likely to remain the case as focus shifts to a face-to-face meeting between US Secretary of State Anthony Blinken and Russian Foreign Minister Sergey Lavrov next week that may defuse tensions somewhat. For now, XAG/USD bulls will be hoping for a more convincing push above resistance around $24.00 which would open the door a run towards resistance in the $24.50 area. For now, Fed speak and US data isn’t having as much of an impact with markets instead focused on the geopolitics. But traders should continue to assess how upcoming Fed speak/data impacts Fed tightening expectations as this could impact silver.

- The USD/CHF is recording losses during the week, so far down 0.30%.

- The break of the 0.9220-60 range exacerbated a move under 0.9200, reclaimed late on risk-off market mood due to headlines of Ukraine/Russia.

- USD/CHF is neutral downward biased, as long as it stays under the 100 and the 50-DMAs.

The USD/CHF extends its losses during the week, and on Friday, it is barely down some 0.02%. At the time of writing, the USD/CHF is trading at 0.9216, reclaiming 0.9200 after printing a daily low at 0.9191.

On Wednesday, the USD/CHF finally broke the 0.9220-60 range, to the downside, on appetite for safe-haven peers but the US dollar. Furthermore, on its way towards highs 0.9190s, it reclaimed the 100 and the 50-daily moving averages (DMAs), exacerbating a move towards lower prices.

USD/CHF Price Forecast: Technical outlook

Therefore, the USD/CHF is neutral-downward biased. The USD/CHF first support would be the 200-DMA at 0.9173, near the February 4 daily low of 0.9176. Breach of the latter would expose the January 21 daily low at 0.9107.

On the flip side, the USD/CHF first resistance would be February 9 daily low at 0.9221, previous support now resistance, followed by 0.9260, and then the February 10 daily high at 0.9296.

NY Fed President, influential FOMC member John Williams said on Friday that he expects it will be appropriate to raise the Federal Funds target range in March, according to Reuters. Williams added that he then expects the Fed to begin the process of steadily and predictably reducing its holdings of treasury and mortgage-backed securities later in the year.

Williams said that his forecast for real US GDP growth in 2022 is 3.0% and for the unemployment rate to end the year around 3.0%. He continued that he expects Core PCE inflation to drop back to around 3.0% this year and then fall further in 2023 as supply issues continue to recede. Finally, Williams said that he is confident that the Fed will achieve a sustained strong economy whilst keeping inflation at its 2.0% longer-run goal.

Market Reaction

Markets are much more focused on geopolitics right now, so Williams' comments did not spur a reaction. They were very run-of-the-mill comments anyway, not really adding anything new to the Fed policy debate.

A large explosion has taken place in the pro-Russia separatist-held city of Donetsk in the Eastern Ukraine Donbas region, Russia's RIA news agency reported on Friday.

Market Reaction

The headline saw risk assets come under immediate selling pressure, with the S&P 500 dropping to fresh session lows around 4350 where it now trades with losses of around 0.6% on the day. NATO, and investors, fear that Russia is building up a case for a military incursion into Ukraine that it can sell domestically, which could be based around claims that Ukraine is committing war crimes and "genocide" against Russian speakers in Eastern Ukraine. A large explosion in Donestk will likely be used to further this narrative to pump domestic support for military action against Ukraine, so NATO (and investors) fear.

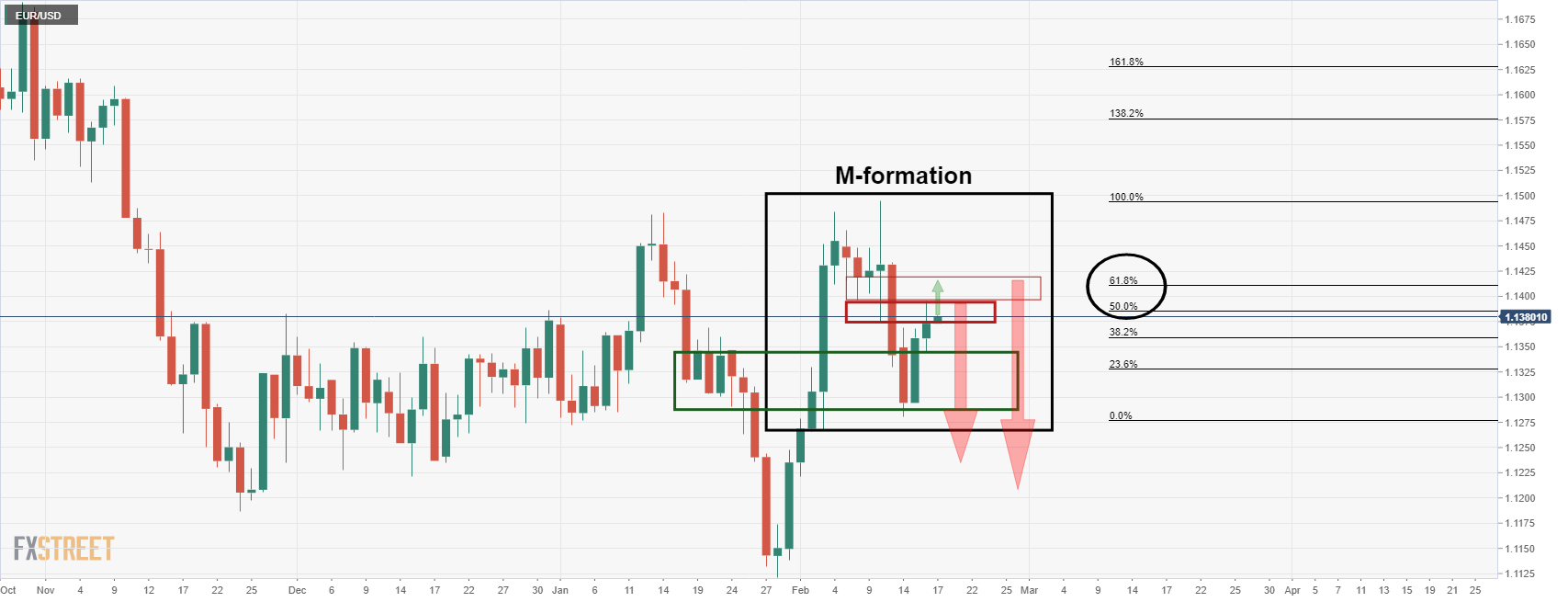

- EUR/USD flat for the week, bearish on Friday.

- Dollar strengthens amid risk aversion.

- Euro finds support after a report shows ECB edging toward 2022 rate hike.

The EUR/USD extended the decline during the American session and printed a fresh low around the London fix at 1.1325. The pair remains under pressure as the US dollar gains momentum across the board. The euro trimmed losses after a report mentioned European Central Bank officials are leaning toward rising rates in 2022 and have begun discussing the end of QE.

Fear ahead of the weekend

Caution prevails across financial markets ahead of the weekend. After the worst day since November, the Dow Jones is falling on Friday by 0.15%. The risk aversion sentiment is pushing the dollar higher across the board.

The EUR/USD is about to end the week flat around 1.1330, after being capped to the upside by 1.1400 while at the same time being rejected from under 1.1300. The short term bias looks neutral. The euro needs to break and hold 1.1400 to gain strength, while a firm slide under 1.1270 should point to more losses.

Next week, attention will remain on the Ukrainian border. On the data front, the February Flash PMIs for the Eurozone and US are due. The other key report in the US will be the PCE. The inflation numbers could have a significant impact on Fed rate hike expectations.

Technical levels

Gold capitalized on safe-haven flows throughout this week. A daily close above $1,910 could open the door for additional gains toward $1,925, FXStreet’s Eren Sengezer reports.

XAU/USD's losses to remain limited unless a resolution of the Russia-Ukraine conflict

“Geopolitics is likely to remain the primary market driver next week. A de-escalation of tensions could trigger a risk rally and cause gold to come under heavy selling pressure. On the other hand, a prolonged threat of a Russian invasion could provide another boost to XAU/USD.”

“The Personal Consumption Expenditures (PCE) Price Index will be featured in the US economic docket on Friday. On a yearly basis, the Core PCE Price Index is expected to edge lower to 4.8% in January. A stronger-than-forecast print could help the greenback find demand and weigh on XAU/USD but the market reaction is likely to remain short-lived as long as geopolitical uncertainties persist.”

“Gold needs to rise above $1,900 (static level, psychological level) and start using that level as support in order to extend its rally. On the upside, $1,910 (static level) aligns as the next bullish target ahead of $1,925 (static level).”

“Support are located at $1,870 (former resistance, static level), $1,850 (static level) and $1,838 (20-day SMA).”

See – Gold Price Forecast: Rate hikes no concern for XAU/USD – ANZ

European Central Bank policymakers are edging towards a rate hike before the end of 2022 to stem more persistent than expected inflationary pressures and a stronger inflation outlook, Bloomberg reported on Friday citing ECB sources. A consensus is emerging ahead of the March meeting that would set September as the end date for asset purchases, the sources continued.

Market Reaction

The euro has not reacted to the latest ECB sources reported by Bloomberg. The hawkish drift in opinions held by ECB policymakers has been on full display since the early February meeting, where Lagarde at the time opened the door for a 2022 rate hike by refusing to rule it out as she had done in the past. In more recent days/weeks, prominent ECB policymakers have hinted towards a faster pace of tightening in 2022, with some explicitly outlining timelines that would see QE ended in Q3 and rate hikes in Q4.

Federal Reserve Bank of Chicago President and FOMC member Charles Evans on Friday said the current Fed policy had been "wrong-footed" in the face of high inflation, but may not need to become restrictive. A "substantial repositioning" of policy could be done with a low risk to jobs, he continued, adding that he still feels much of the current wave of inflation is due to supply and other pandemic-related shocks will ease. Underlying inflation, he added, still remains well anchored at a level consistent with the Fed's 2.0% objective, Evans said.

Market Reaction

Volatility ahead of the 4pm London Fix, signs of escalating fighting in Easter Ukraine and Evan's comments that the Fed could do "substantial repositioning" of its policy with a low risk to jobs all seem to have given US dollar some impetus in recent trade. The DXY recently popped back to the north of the 96.00 level and is back at session highs, now up 0.2% on the day.

According to the flash estimate of the European Commission's Eurozone Consumer Confidence survey, the headline index fell to -8.8 in February versus forecasts for a slight rise to -8.0 from -8.5 the month prior (January).

Market Reaction

The euro did not see any reaction to the slightly weaker than expected Eurozone Consumer Confidence data, with FX markets much more focused for now on geopolitical tensions between Russia, Ukraine and NATO as fighting in Ukraine's Eastern Donbas region enters a second day.

- Existing home sales rose sharply by 6.7% in January.

- The data did not result in an FX market reaction.

US Existing Home sales rose sharply by 6.7% in January, according to data published by the National Association of Realtors on Friday. That took the 12-month rolling number of sales higher to 6.50M from 6.09M in December, above the expected 6.10M. The median price of homes sold was $350.3K, up 15.4% YoY.

Market Reaction

FX markets did not react to the latest housing market data.

- The USD/JPY is losing 0.23% amid a mixed-market mood in the week.

- The DXY approaches the 96.00 figure despite increasing tensions in Ukraine.

- Fed’s Bullard and Mester favor hiking rates at a faster pace.

- USD/JPY Technical Outlook: Upward biased, but a daily close under the 50-DMA, would open the door towards 114.00.

The USD/JPY reversed the curse as the weekend approached amid a mixed market sentiment, driven by Russia/Ukraine headlines crossing the wires, down 0.23% in the week. At the time of writing, the USD/JPY is trading at 115.00.

The market sentiment is downbeat. Europan indices record losses, while the US equity futures point that Wall Street would open negatively. Meanwhile, the US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, grinds up 0.13%, sits as 95.920. Contrarily, the US 10-year T-note yield drops three basis points, eyeing to close the week under the 2% threshold, at 1.939%, putting a lid on the USD/JPY.

Russia/Ukraine update

Developments in the Russia/Ukraine conflict fluctuate between de-escalation/escalation mode in the last couple of hours. First, US Secretary Blinken proposed a meeting with Russian Foreign Minister Lavrov late in the week. However, it is conditioned to Russia not invading Ukraine, as reported by the US State Department. Meanwhile, clashes in East Ukraine continued on Friday, as the OSCE has recorded 80 ceasefire violations, while Russian President Putin will oversee strategic drills on Saturday.

Fed speaking, Bullard and Mester crossed the wires

On Thursday, St . Louis Fed President James Bullard reiterated its intentions to “convince” the board that 100 bps are needed by July 1, while noting that it could be necessary that the US central bank has to go beyond neutral rates. Later on the day, Cleveland’s Fed Loretta Mester said that she favors a March hike and would be “appropriate” to hike the Federal Funds Rate (FFR) faster than in the 2008 financial crisis.

A light US economic docket will feature Existing Home Sales, Consumer Board Leading Index, and Fed speaking as Evans, Williams, and Brainard will cross the wires.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is retreating from daily highs, but the 50-day moving average (DMA) at 114.77 stopped the fall. Nevertheless, the pair is upward biased, but downside risks remain. The outcome of a daily close under the 50-DMA could send the USD/JPY tumbling towards February 2 low at 114.14.

Otherwise, the path of least resistance is upwards. The USD/JPY first resistance would be February 16 daily low at 115.35, previous support-turned-resistance. Breach of the latter would expose February 15 daily high at 115.86, followed by a challenge of the YTD high at 116.35.

Economist at UOB Group Barnabas Gan evaluates the latest figures from the exports sector in Singapore.

Key Takeaways

“Singapore’s NODX recorded an 17.6% y/y expansion in Jan 2022, beating market expectations for a milder growth of 12.4% y/y. On a month-on-month seasonally adjusted basis, NODX gained 5.0% in the same month.”

“For the whole of 2022, Enterprise Singapore has kept its forecast unchanged for both total trade and NODX to expand by between 0% and 2.0%. As cited in Enterprise Singapore’s (ESG) press release ‘Review of 2021 Trade Performance’, ‘the pace of growth (in 2022) is expected to moderate from the high base in 2021’. Note that total trade and NODX rose 15.9% and 12.1% respectively in 2021.”

“Singapore is well-positioned to ride the endemic-COVID-19 recovery into 2022. For the year ahead, Singapore would have to contend with new waves of COVID-19 infections, as well as a high growth base in the previous year. As such, we keep our NODX outlook to expand by a modest 2.0% with upside risks.”

- USD/TRY extends the side-lined theme around 13.60.

- Turkey’s Consumer Confidence eased a tad to 71.2 in February.

- Focus remains on the Russia-Ukraine standoff.

The Turkish lira gives away part of recent gains and lifts USD/TRY to the area above the 13.6000 level on Friday.

USD/TRY remains largely side-lined

USD/TRY trades with decent gains following two consecutive daily pullbacks, as market participants seem to have fully digested Thursday’s monetary policy meeting by the Turkish central bank (CBRT).

The daily uptick in the pair comes in response to the recovery in the greenback amidst persistent concerns around the Russia-Ukraine conflict.

It is worth recalling that there were no surprises at the CBRT event on Thursday, where the central bank left the One-Week Repo Rate unchanged at 14.00% for the second consecutive month and despite inflation rose to nearly 50% in the year to January. The CBRT, however, defended its efforts to support the “liraization” strategy.

In the domestic calendar, Turkey’s Consumer Confidence deflated a bit to 71.2 in February (from 73.2).

What to look for around TRY

The pair keeps its multi-week consolidative theme well in place around the mid-13.00s. While skepticism keeps running high over the effectiveness of the ongoing scheme to promote the de-dollarization of the economy, the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are expected to maintain the lira under scrutiny for the time being.

Key events in Turkey this week: Consumer Confidence (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is advancing 0.48% at 13.6385 and a drop below 13.4317 (weekly low Feb.11) would expose 13.2327 (monthly low Feb.1) and finally 12.7523 (2022 low Jan.3). On the other hand, the next up barrier lines up at 13.6767 (weekly high Feb.15) seconded by 13.9319 (2022 high Jan.10) and then 18.2582 (all-time high Dec.20).

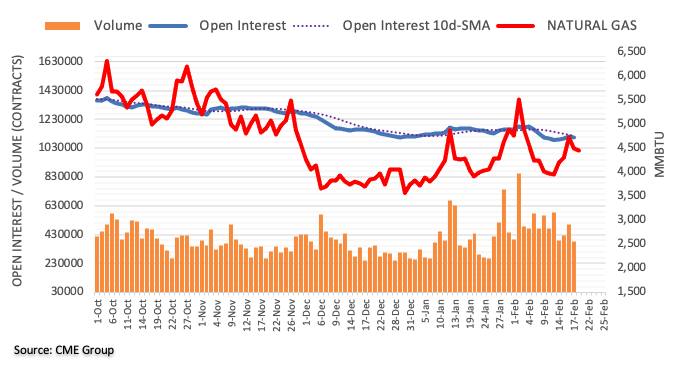

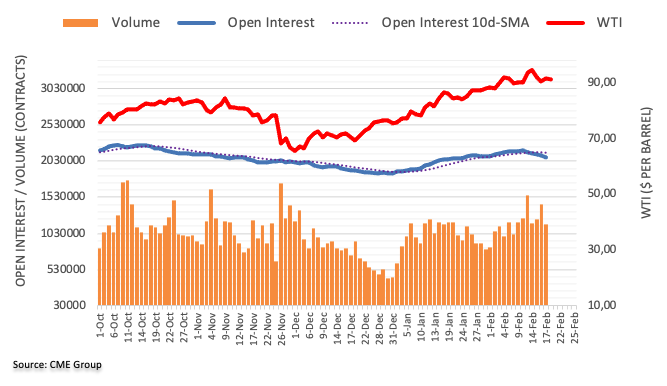

- WTI fell into the $89.00s on Friday and current trades about $2.0 down on the day.

- Technical selling, hope for a diplomatic solution to Ukraine crisis and talk of an Iran/US deal nearing soon weigh on oil.

Technical selling, hopes that a high-level US/Russia meeting next week might solve the Ukraine stand-off and bets that US sanctions on Iranian oil exports will soon end amid momentum towards reviving the 2015 nuclear pact weighed on oil on Friday. Front-month WTI futures broke below a key upwards trendline that had been supporting the price action since the start of the year and slumped to the mid-$89.00s per barrel, where they now trade lower by more than $2.0 on the day. Bears will be eyeing an imminent test of the next key area of support in the $88.50 region in the form of last week’s lows.

Despite news that pro-Russia separatist leaders in the self-proclaimed Donetsk and Luhansk People’s Republics in Ukraine’s Eastern Donbas region ordered an immediate evacuation of local civilians into Russia as fighting in the region escalates, traders hoped diplomacy could yet prevail. As Russia continue to amass troops on Ukraine’s doorstep, the US Secretary of State Anthony Blinken and Russian Foreign Minister Sergey Lavrov will meet face-to-face next week, reportedly under the condition that there will not be a Russian invasion.

Separately, OPEC+ sources on Friday said the group thinks a US/Iran deal to revive the 2015 nuclear pact, thus removing US restrictions on Iranian oil exports and allowing for the return of 1.3M barrels per day to global markets, is near. Despite the Iran news and near-term bearish technical picture following the break below key 2022 uptrend support, traders said markets should remain reasonably well support near highs amid continued expectations for tight global oil market conditions.

The S&P 500 has gapped lower for its expected retest of 4365. Analysts at Credit Suisse maintain a core negative outlook for a break below here for a retest of the 4223/4199 key support cluster.

S&P 500 to mark important and large “head & shoulders” top below 4199

“We continue to view the recent rebound as corrective only and we look for a clear break below the recent low and the 61.8% retracement of the January/February rally at 4365 in due course with support seen next at 4292 and eventually the major support cluster at 4223/4199 – including the 23.6% retracement of the entire 2020/2021 bull trend and January low.”

“Although a fresh hold at 4223/4199 should be looked for, the completion of what we see as major tops in Credit markets is seen to increase the risk for a major top here also. Below 4199 would mark the completion of a large ‘head & shoulders’ top to signal an important change of trend lower with the next meaningful support then seen at 3855/15.”

“Resistance is seen at 4430 initially, with 4456//90 now ideally capping.”

GBP/USD has settled in an upward trend after relatively long, and choppy, consolidation following its early February test of 1.36. Economists at Scotiabank expect the pair to challange the 1.37 level.

Cable gains some technical momentum

“Technical trends over the past four days suggest further gains ahead to a test of 1.37 once it firmly breaks past the mid-1.36s.”

“Trendline resistance from the decline since June also stands at 1.3669.”

“Support after 1.3600/10 is 1.3580 and 1.3550/60.”

- EUR/GBP held below key short-term resistance in the 0.8350 area on Friday, weighed by strong UK Retail Sales data.

- The pair for now maintains the negative bias that has been in play since last week.

EUR/GBP, though trading slightly higher on the session, held below a key area of short-term resistance at 0.8350 on Friday, keeping the pair’s downside bias of the last week alive. Weighing on the pair was stronger than expected UK January Retail Sales figures that showed sales were up 1.9% MoM, better than the expected 1.0% MoM gain, showing a substantial portion of December’s 4.0% MoM drop had been recovered. Recall that the rapid spread of the Omicron variant in the UK in December and an associated tightening of Covid-19 curbs had weighed on spending at the time.

With Omicron infection rates falling off sharply since mid-January and the government removing virtually all restrictions (in England, at least), the recovery is expected to continue in February and March. But economists continue to fret about the impact that incoming tax and energy price hikes in April will have on the economy. "The key issue… will be whether this apparent bounce back in consumption will be able to withstand the forthcoming increase in taxation and energy bills… which will take a significant chunk out of worker pay,” said analysts at Equiti Capital.

That probably explains why EUR/GBP wasn’t able to push substantially below Thursday’s lows in the 0.8330s on Friday, though the pair did squeeze out a fresh weekly low at 0.8331. Another factor lending some support was hawkish commentary ECB policymaker and Slovak central bank governor Peter Kazimir, who threw his support behind an axing of QE in August and immediate rate hike thereafter. The hawkish drift at the ECB towards accelerated tightening in H2 this year is evident, though continued expectations for more near-term BoE tightening likely shield EUR/GBP from ECB-related upside risk for now.

- USD/CAD attracted some dip-buying on Friday, though lacked any follow-through.

- Retreating oil prices undermined the loonie and extended support to the major.

- Subdued USD demand held back bulls from placing fresh bets and capped gains.

The USD/CAD pair reversed modest intraday losses and was seen trading in the neutral territory, around the 1.2700 mark during the early North American session.

The pair attracted some dip-buying near the 1.2675-1.2670 region on Friday, though a combination of factors kept a lid on any meaningful gains. Hopes for a diplomatic solution to the Ukraine crisis, along with expectations for the return of Iranian oil in the markets weighed on crude oil prices and undermined the commodity-linked loonie. This, in turn, was seen as a key factor that extended some support to the USD/CAD pair.

The intraday uptick, however, lacked any bullish conviction amid subdued US dollar demand, weighed down by a positive risk tone and uncertainty about the pace of the Fed's policy tightening cycle. The minutes of the January 25-26 FOMC minutes failed to reinforce expectations for a 50 bps rate hike in March. Moreover, the latest political developments could force the Fed to adopt a less aggressive policy stance to combat high inflation.

This, along with a softer tone around the US Treasury bond yields, capped the upside for the greenback and failed to impress bullish traders. The USD/CAD pair had a rather muted reaction to mixed Canadian macro data, which showed that the headline Retail Sales contracted less-than-expected, by 1.8% in December. This was offset by a larger-than-anticipated, 2.5% fall in the core sales (excluding autos) during the reported month.

Next on tap will be the release of Existing Home Sales data from the US. This, along with the broader market risk sentiment and the US bond yields, will influence the greenback. Apart from this, traders will take cues from oil price dynamics to grab some short-term opportunities around the USD/CAD pair.

Technical levels to watch

- Canadian Retail Sales fell 1.8% MoM in December, above the 2.1% expected drop.

- StatsCan's flash estimate for January showed a 2.4% MoM rise.

According to a report released by Statistics Canada on Friday, Canadian Retail Sales fell 1.8% MoM in December, less than the expected 2.1% decline and a sharp deceleration from November's 0.7% MoM gain. Statistics Canada's flash estimate for January showed that Retail Sales most likely rose by 2.4% MoM, suggesting a sharp rebound in January as Omicron infection rates eased and states eased lockdown rules. The Core measure of Canadian Retail Sales fell 2.5% MoM in December, larger the expected 2.0% decline.

Market Reaction

The loonie has not reacted to the latest mixed Canadian Retail Sales figures, with focus right now much more on the Russia/Ukraine/NATO situation.

In a sign that hostilities between pro-Russia separatist forces and the Ukrainian military in Ukraine's Eastern Donbas region may remain elevated for some time, a separatist leader just announced an evacuation of local residents to Russia, reported Reuters. The separatist leader said that the evacuation should begin today and that Russia had agreed Russia had agreed to provide accommodation for the evacuees.

Market Reaction

S&P 500 futures have tumbled from near the 4400 level to near 4380 in recent trade, whilst USD/RUB has lept higher from around the 75.80s to the 76.20s, suggestive that markets fear that the evacuation could signal an escalation of military conflict.

- GBP/USD inched back closer to the monthly high, albeit lacked follow-through buying.

- Bulls, so far, have been struggling to make it through a descending trend-line hurdle.

- The technical set-up supports prospects for an eventual breakout to the upside.

The GBP/USD pair struggled to capitalize on a modest intraday uptick back closer to the monthly high and was last seen trading in the neutral territory, just above the 1.3600 mark.

Hopes for a diplomatic solution to the Ukraine crisis underpinned the US dollar's safe-haven status. Apart from this, rising bets for additional rate hikes by the Bank of England acted as a tailwind for the British pound and provided a modest lift to the GBP/USD pair. That said, the lack of progress in talks to resolve the problems with the Northern Ireland protocol of the Brexit agreement held back bulls from placing aggressive bets.

From a technical perspective, the GBP/USD pair, so far, has struggled to make it through a resistance marked by a downward sloping trend-line extending from July 2021. This is closely followed by the very important 200-day SMA, around the 1.3685 region and the 1.3700 mark, which if cleared will set the stage for additional gains. The outlook is reinforced by the fact that oscillators on the daily chart have just started gaining positive traction.

That said, it will still be prudent to wait for sustained strength beyond the aforementioned hurdles before positioning for any further appreciating move. The GBP/USD pair might then aim to retest the YTD low, around mid-1.3700s before extending the momentum further towards reclaiming the 1.3800 mark for the first time since October 2021.

On the flip side, any meaningful slide below the 1.3600 mark is likely to find decent support and bought into near mid-1.3500s. Some follow-through selling could make the GBP/USD pair vulnerable to drop back to challenge the key 1.3500 psychological mark en-route the weekly low, around the 1.3485 region touched on Monday.

GBP/USD daily chart

-637807857542724784.png)

Technical levels to watch

- Spot gold prices have come off the boil having failed to push above $1900 on Thursday/early Friday.

- XAU/USD has suffered from profit-taking amid hopes that talks between Russia and Ukraine next week might avert war in Ukraine.

Having failed to break convincingly above the $1900 level late on Thursday/during the early hours of Friday’s session, which incidentally was the precious metal’s highest levels since June 2021, spot gold (XAU/USD) prices have come off the boil on Friday. Spot prices have ebbed lower to trade near the $1890 mark, down slightly less than $10 or just under 0.5% on the day. News of another face-to-face meeting next week between US Secretary of State Anthony Blinken and Russian Foreign Minister Sergey Lavrov has spurred hope that a diplomatic solution might yet be found between NATO and Russia regarding the Ukraine stand-off.

US press reported that Lavrov agreed to attend talks on the condition that there would not be an invasion of Ukraine, easing fears of an imminent assault. Russian press also reported that there will be a call between the Russian Defense Minister and his US counterpart this Friday. Hopes that diplomacy might yet win through have undermined appetite for safe-havens like gold. If an invasion is really off the table until next week’s US/Russia talks (the timing of which remains uncertain), that could set the stage for some near-term profit-taking, with bulls perhaps looking to reload on long-positions upon the retest of support in the $1880 area.

But tensions between Ukraine armed forces and pro-Russia separatists in the country’s East remain elevated after the worst day of ceasefire violations since 2015 (so the press claimed) on Thursday. Moreover, Russia will be conducting military drills on Saturday that are to be personally overseen by Russian President Vladimir Putin. The scope for a significant pullback in gold thus remains slim for now, with strategists expecting, at the very least, the precious metal will remain supported in the upper $1800s whilst geopolitical uncertainty remains high.

Gold traders will also be keeping an eye on Fed speak on Friday from some influential policymakers including board of governors member Christopher Waller, Vice President Lael Brainard and NY Fed President John Williams. Markets will be looking to assess the degree to which there is a preference for a 25 or 50bps rate hike in March, as the views of these policymakers would likely reflect that of the mainstream at the Fed. For now, Fed tightening fears (which tend to be gold negative) look likely to continue to be outweighed by geopolitics.

Senior Economist at UOB Group Alvin Liew comments on the recent publication of the FOMC Minutes of the January event.

Key Takeaways

“The Jan FOMC minutes noted that most participants thought it was warranted the Federal Reserve should hike the Fed Funds Target Rate (FFTR) at a faster pace this time compared to 2015 due to the current conditions of stronger economic growth outlook, much higher inflation and tighter employment market.”

“But the minutes also showed that the Fed is not committed yet to any policy path/trajectory. Instead, the Fed ‘will be updating their assessments of the appropriate setting for the policy stance at each meeting’, implying every meeting will be ‘live’ and data dependent but it did not talk about a potentially bigger opening rate hike in Mar or that it will hike in every meeting this year. Even though the minutes highlighted the balance of inflation risks is on the upside, markets still viewed this latest minutes as less hawkish compared to the comments by FOMC Chair Powell during the press conference of the Jan FOMC two weeks ago.”

“However, it should be noted the FOMC minutes predated the elevated Jan CPI inflation spike and the recent Jan wage surge, and these data had heightened the risk of more aggressive and frequent Fed rate actions. As such, we still keep our expectations for the Fed to start the rate hike cycle with a 50bps rate hike in Mar FOMC, followed by clips of 25bps rate hikes for another 4 meetings in May, Jun, Sep and Dec FOMC bringing the FFTR to 1.50%-1.75% by end-2022.”

- EUR/USD flirts with the 5-month line near 1.1370.

- The next up barrier comes at the weekly high at 1.1395.

EUR/USD trades on a choppy fashion below the 1.1400 mark in the second half of the week.

Further upside in the pair needs to clear the 5-month line near 1.1370 to mitigate downside pressure and allow for another test of the weekly high at 1.1395 (February 14). Further up is seen the 200-week SMA at 1.1491 closely followed by the 2022 peak at 1.1494 (February 10).

In the longer run, EUR/USD is expected to keep the negative outlook as long as it trades below the key 200-day SMA, today at 1.1641.

EUR/USD daily chart

- DXY alternates gains with losses in the sub-96.00 area.

- The near-term positive bias looks intact above 95.30.

DXY trades within a narrow range in the 95.80 region at the end of the week.

The index navigates in the lower end of the weekly range south of the 96.00 mark, although further upside should not be ruled out as long as the 5-month line near 95.30 holds the downside. That said, the next up barrier comes at the weekly high at 96.43 (February).

In the longer run, the outlook for the dollar is seen as positive above the 200-day SMA at 93.73.

DXY daily chart

- EUR/JPY keeps the range bound theme unchanged on Friday.

- The 200-day SMA at 130.43 holds the downside so far.

EUR/JPY partially fades Thursday’s pullback and regains some composure on the back of mixed risk appetite trends.

So far, price action around the cross looks consolidative, with the 200-day SMA, today at 130.43, acting as a decent contention area. The resumption of the upside pressure immediately targets the weekly high at 131.90 (February 16) ahead of the 2022 peak at 133.15 (February 10).

While above the 2-month support line, today near 128.80, further upside in the cross should remain on the table. On the longer term, the outlook for the cross is seen as constructive as long as it trades above the 200-day SMA.

EUR/JPY daily chart

- Silver faced rejection near the $24.00 mark snapped two successive days of the winning streak.

- The technical setup favour bulls, though Friday’s failure warrants caution for aggressive traders.

- A convincing break below the $23.00 round figure is needed to negate the near-term positive bias.

Silver struggled to capitalize on its gains recorded over the past two trading sessions and once again started retreating from the vicinity of the $24.00 round-figure mark on Friday. The XAG/USD remained on the defensive through the first half of the European session and was last seen trading near the daily low, around the $23.75 region.

Technical indicators on the daily chart are holding in the positive territory and still far from being in the overbought zone. This set-up seems tilted in favour of bullish traders and supports prospects for a further near-term appreciating move, though repeated failures near the aforementioned handle warrant some caution.

Hence, it will be prudent to wait for sustained strength beyond the $24.00 mark before positioning for a move towards testing the very important 200-day SMA hurdle, near the $24.25 region. This coincides with a downward sloping trend-line resistance, extending from July 2021 swing high, and should act as a pivotal point for the XAG/USD.

Some follow-through buying, leading to a subdued move beyond the YTD high, around the $24.70 region, will be seen as a fresh trigger for bulls. The XAG/USD might then accelerate the move and aim to reclaim the key $25.00 psychological mark. The momentum could get extended towards November 2021 high, around the $25.35-$24.40 region.

On the flip side, any meaningful pullback is likely to find decent support near the $23.30 region. This is followed by the weekly low, around the $23.10-$23.05 area. Failure to defend the said support levels will shift the bias in favour of bearish traders and make the XAG/USD vulnerable to extend the downward trajectory.

The next relevant support is pegged near the $22.75 region. Some follow-through selling should pave the way for a further near-term depreciating move towards the mid-$22.00 mark. The XAG/USD could eventually drop to challenge the double-bottom support, around the $21.40 region.

Silver daily chart

-637807792433251044.png)

Technical levels to watch

Lee Sue Ann, Economist at UOB Group, assesses the latest release of the Australian labour market report.

Key Takeaways

“Hours worked declined in Jan, falling 8.8% m/m, driven by large declines in states amid the Omicron outbreak. Still, the unemployment rate remained unchanged at 4.2%, with solid employment growth offset by a rise in labor force participation.”

“In all, the latest job report underscores the resilience of Australia’s labour market. Going forward, the pace of the rebound in hours worked and the level of employment will be crucial indicators, given the large shifts in labour force participation over recent months.”

“Further tightening in the labour market should see wage growth continue to rise from low levels, albeit at a gradual pace. We thus flag the potential risk for rate hikes by the Reserve Bank of Australia (RBA) to occur earlier, though we are still looking for that to occur in 2023.”

- AUD/USD regained some positive traction on Friday and climbed to the fresh weekly high.

- Easing Russia-Ukraine tensions lifted risk sentiment and undermined the safe-haven greenback.

- RBA rate hike bets further inspired the aussie bulls and remained supportive of the move up.

The AUD/USD pair retreated a few pips from the weekly high touched earlier this Friday and was last seen trading just above the 0.7200 mark, still up over 0.35% for the day.

Following the previous day's modest losses, the AUD/USD pair attracted fresh buying on the last day of the week and build on the recent bounce from the 0.7085 region, or the weekly low touched on Monday. The US Secretary of State Antony Blinken accepted an invitation to meet Russian Foreign Minister Sergei Lavrov late next week and raised hopes for a diplomatic solution to the Ukraine crisis. This led to a modest recovery in the global risk sentiment, which undermined the safe-haven US dollar and benefitted the perceived riskier aussie.

The greenback was further pressured by the uncertainty about the pace of the Fed's policy tightening cycle, especially after the release of less hawkish FOMC minutes on Wednesday. In fact, policymakers failed to reinforce bets for a 50 bps rate hike in March, though agreed that it would be appropriate to remove policy accommodation at a faster pace. Moreover, the geopolitical developments could force the Fed to adopt a less aggressive policy stance. Apart from this, rising bets for an eventual RBA rate hike in 2022 extended support to the AUD/USD pair.

Investors, however, remain concerned about the possibility of an imminent Russian invasion of Ukraine. British Foreign Secretary Liz Truss dismissed Russia's claims that it is withdrawing troops and said that the buildup around Ukraine has shown no signs of slowing down. Adding to this, US President Joe Biden accused Russia of fabricating a pretext to invade Ukraine. This might keep a lid on the market optimism. Nevertheless, the AUD/USD pair remains on track to end on a positive note and record gains for the third successive week.

Market participants now look forward to the US Existing Home Sales data, due for release later during the early North American session. This, along with fresh geopolitical developments and the broader market risk sentiment, will influence the USD and produce some trading opportunities around the AUD/USD pair.

Technical levels to watch

- A combination of supporting factors pushed GBP/JPY to a fresh weekly high on Friday.

- A positive risk tone undermined the safe-haven JPY and extended support to the cross.

- Rising bets for additional BoE rate hikes benefitted the GBP and remained supportive.

The GBP/JPY cross retreated a few pips from the weekly high touched during the first half of the European and was last seen trading just below the 157.00 mark.

Following the overnight decline, the GBP/JPY cross caught fresh bids on the last day of the week and is now looking to build on this week's goodish rebound from the 155.30 region. Hopes for a diplomatic solution to the Ukraine crisis led to a recovery in the global risk sentiment and undermined the safe-haven Japanese yen. On the other hand, upbeat UK macro data acted as a tailwind for the British pound and provide an additional boost to the cross.

The UK Office for National Statistics reported this Friday that domestic Retail Sales recorded a strong 1.9% MoM growth in January. This marked a solid rebound from the 0.4% fall in the previous month and was also better than expectations for the 1.0% increase. Adding to this, the core sales (excluding fuel) surpassed estimates and rose 1.7% during the reported month.

Against the backdrop of this week's stronger UK wage growth data and hotter UK inflation figures, the data lifted expectations for additional rate increases by the Bank of England. In fact, the markets have been pricing in the possibility of a 50 bps rate hike in the March MPC meeting. This, in turn, inspired the GBP bulls and pushed the GBP/JPY cross to the 157.25-157.30 area.

That said, the lack of progress in talks to resolve the problems with the Northern Ireland protocol of the Brexit agreement held back traders from placing aggressive bullish bets around the GBP/JPY cross. Hence, it will be prudent to wait for some follow-through buying before positioning for a further appreciating move towards the 158.00 mark, or YTD high touched earlier this month.

Technical levels to watch

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the latest monetary policy meeting by the BSP.

Key Takeaways

“Bangko Sentral ng Pilipinas (BSP), as expected, maintained all policy rates unchanged today (17 Feb), with the overnight reverse repurchase (RRP) rate at 2.00%, overnight deposit rate at 1.50% and overnight lending rate at 2.50%.”

“There was a slightly more hawkish tilt in today’s monetary policy statement (MPS) as compared to the Dec 2021’s statement, with changes made for the Monetary Board’s (MB) concerns about near-term inflation, positive growth outlook on the local front, and forward guidance. BSP tweaked its inflation forecasts higher to 3.7% for 2022 (from 3.4% previously: UOB est: 3.5%) and 3.3% for 2023 (from 3.2% previously; UOB est: 3.5%).”

“We see the changes in today’s MPS as a signal that the BSP is preparing markets for an earlier rate hike should conditions warrant and inflation surpasses its target range in the near term. Hence, we revise our BSP outlook to three rate hikes this year with a 25bps increase in each quarter starting from 2Q22 (vs previous est: two 25bps hike in 2H22). It is premised on an expected more aggressive Fed tightening, solid upturn in domestic growth, and rising demand price pressures in tandem with improving economic activities towards year-end. The Monetary Board will next meet on 24 Mar.”

- EUR/USD leaves behind Thursday’s downtick and retakes 1.1380.

- The resumption of the risk-on sentiment weighs on the dollar.

- Markets’ attention remains on the Russia-Ukraine conflict.

EUR/USD reclaims ground lost and advances to the 1.1380 region amidst the improvement in the risk-associated space on Friday.

EUR/USD bid on geopolitics, dollar weakness

EUR/USD extends its consolidative theme in the upper end of the weekly range, although still below the key barrier at 1.1400 the figure.

The better mood surrounding the riskier assets remains supported by hopes of a diplomatic solution to the Russia-Ukraine dispute following news of a Blinken-Lavrov meeting at some point next week.

In the US cash markets, yields show some mild recovery after the recent weakness, while yields of the German 10y Bund extends the corrective downside to the sub-0.25% area.

In the euro docket, EMU’s Current Account and Construction Output are due. In the NA session, the Conference Board will release the Leading Index ahead of Existing Home Sales and speeches by Evans, Waller and Brainard.

What to look for around EUR

EUR/USD continues to look to the geopolitical scenario and the risk appetite trends for near-term direction. Further out, the improvement in the pair’s outlook appears underpinned by fresh speculation of a potential interest rate hike by the ECB at some point by year end, higher German yields, persevering elevated inflation and a decent pace of the economic activity and other key fundamentals in the region

Key events in the euro area this week: EMU Current Account, Consumer Confidence (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is gaining 0.09% at 1.1368 and faces the next up barrier at 1.1395 (weekly high Feb.16) followed by 1.1491 (200-week SMA) and finally 1.1494 (2022 high Feb.10). On the other hand, a drop below 1.1323 (low Feb.17) would target 1.1279 (weekly low Feb.14) en route to 1.1186 (monthly low Nov.24 2021).

GBP/USD has managed to edge higher early Friday after having closed the previous three days in the positive territory. As FXStreet’s Eren Sengezer notes, cable approaches resistance that holds the key for further gains.

Investors might want to book their profits ahead of the weekend

“Profit-taking could limit GBP/USD's upside in the second half of the day but the pair's near-term outlook remains bullish barring a technical correction.”

“In case GBP/USD rises above 1.3640 and starts using it as support, 1.3660 (static level, January 20 high) aligns as the next hurdle ahead of 1.3700 (psychological level).”

“On the downside, 1.3600 (static level, psychological level) could be tested with a technical correction. If that support fails, additional losses toward 1.3560 (200-period SMA) and 1.3530 (100-period SMA) could be witnessed.”

See – GBP/USD: Break above 1.3700/15 to clear the path towards 1.42 – BofA

- NZD/USD gained traction for the fourth straight day and climbed back closer to monthly high.

- A positive risk tone undermined the safe-haven USD and benefitted the perceived riskier kiwi.

- Acceptance above the 0.6700 might have already set the stage for a further appreciating move.

The NZD/USD pair added to its intraday gains and shot to the 0.6730 area, back closer to the monthly high during the first half of the European session.

The pair built on this week's goodish rebound from sub-0.6600 levels and gained follow-through traction for the fourth successive day on Friday. A recovery in the risk sentiment undermined the US dollar's relative safe-haven status and turned out to be a key factor that benefitted perceived riskier currencies, including the kiwi.

The US Secretary of State Antony Blinken accepted an invitation to meet Russian Foreign Minister Sergei Lavrov late next week and raised hopes for a diplomatic solution to the Ukraine crisis. This, in turn, boosted investors' appetite for riskier assets, which was evident from a generally positive tone around the global equity markets.

The greenback was further pressured by the uncertainty about the pace of the Fed's tightening cycle. In fact, the minutes of the January FOMC meeting released on Wednesday failed to reinforce expectations for a 50 bps rate hike in March. Adding to this, the geopolitical developments could force the Fed to adopt a less aggressive policy stance.

Meanwhile, the NZD/USD pair now seems to have found acceptance above the 0.6700 round-figure mark. Some follow-through buying will be seen as a fresh trigger for bullish traders and set the stage for a further near-term appreciating move. The next relevant hurdle is pegged near mid-0.6700s, above which bulls might aim to reclaim the 0.6800 mark.

Market participants now look forward to the US Existing Home Sales data, due for release later during the early North American session. This, along with fresh geopolitical developments and the broader market risk sentiment, will influence the USD price dynamics and produce some meaningful trading opportunities around the NZD/USD pair.

Technical levels to watch

UOB Group’s FX Strategists remain of the view that USD/CNH has embarked on a potential move to the 6.3230 level in the next weeks.

Key Quotes

24-hour view: “We highlighted yesterday that ‘downward momentum has not improved by much but there is room for USD to drop to 6.3270’. We added, ‘the Jan’s low near 6.3230 still appears to be unlikely to come under threat’. USD subsequently dropped to 6.3284 before rebounding to close little changed at 6.3342 (+0.02%). USD is likely in a consolidation for now and is expected to trade between 6.3290 and 6.3420 for today.”

Next 1-3 weeks: “There is no change in our view from Wednesday (16 Feb, spot at 6.3390). As highlighted, the recent consolidation phase is over and USD is likely to head lower towards 6.3230. Only a break of the ‘strong resistance’ at 6.3490 (level previously at 6.3585) would indicate that our view for USD to head to lower towards 6.3230 is wrong.”

- DXY comes under mild pressure in the 95.70 region.

- The risk-on sentiment returns to the markets on Friday.

- CB Leading Index, housing data, Fedspeak next on tap.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main competitors, trades slightly into the negative territory around the 95.70 zone on Friday.

US Dollar Index offered on risk-on mood

The index navigates the lower end of the recent range south of the 96.00 mark against the backdrop of the improvement in the risk complex. Indeed, markets appear to have welcomed the news of a meeting between US Secretary of State Blinken and Foreign Minister Lavrov at some point next week.

The appetite for riskier assets now puts the buck under some selling pressure amidst the pick-up in US yields across the curve following a couple of sessions with losses.

In the US calendar, the Conference Board will publish the Leading Index for the month of January, seconded by Existing Home Sales. In addition, Chicago Fed C.Evans (2023 voter, centrist), FOMC C.Waller (permanent voter, centrist), NY Fed J.Williams (permanent voter, centrist) and FOMC L.Brainard (permanent voter, dovish) are all due to speak later in the session.

What to look for around USD

Better news on the Russia-Ukraine-US standoff lends some support to the risk-associated universe and weighs on the dollar at the end of the week. However, the recent corrective downside in the buck was deemed as temporary only, as the positive stance in the dollar remains underpinned by the current elevated inflation narrative as well as the probability of a more aggressive start of the Fed’s normalization of its monetary conditions. Looking at the longer run, and while the constructive outlook for the greenback appears well in place for the time being, recent hawkish messages from the BoE and the ECB carry the potential to undermine the expected move higher in the dollar in the next months.

Key events in the US this week: CB Leading Index, Existing Home Sales (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict under the Biden administration. Debt ceiling issue.

US Dollar Index relevant levels

Now, the index is losing 0.05% at 95.75 and a break above 96.43 (weekly high Feb.14) would open the door to 97.44 (2022 high Jan.28) and finally 97.80 (high Jun.30 2020). On the flip side, the next down barrier emerges at 95.67 (weekly low Feb.16) seconded by 95.17 (weekly low Feb.10) and then 95.13 (weekly low Feb.4).

- Gold price remains underpinned by geopolitics, easing 50bps March fed rate hike bets.

- Blinken-Lavrov meeting next week sparks a ray of hope but tensions still persist.

- Gold Price Forecast: XAU/USD remains a ‘buy the dip’ trade, diplomacy talks eyed.

Gold price remains at the mercy of the geopolitical developments concerning the Russia-Ukraine crisis so far this week. The expectations of an imminent Russian invasion of Ukraine has eased, in anticipation of the planned diplomatic talks between the US and Russian officials, have cheered investors and capped gold’s upside. Bulls are, however, likely to regain poise, as the obscurity on the Ukrainian border still persists, keeping gold’s safe-haven appeal underpinned. Further, dialling down of 50-bps March Fed rate hike bets have also aided the metal’s recent upsurge to eight-month highs above $1,900.

Read: How the coming Fed hiking cycle will differ – And why it matters

Gold Price: Key levels to watch

The Technical Confluences Detector shows that gold price has bounced off crucial support at $1,888, which is the convergence of the Fibonacci 38.2% one-day and the Bollinger Band one-day Upper.

So long as bulls defend the latter, the renewed upside could extend towards the June 2021 highs of $1,916.

Ahead of that target, gold buyers will need to recapture a strong supply zone around $1,900-$1,903 – where the Fibonacci 161.8% one-month, the previous day’s high and pivot point one-week R2 coincide.

The next relevant bullish stop is seen at $1,911, the pivot point one-day R1.

If the abovementioned powerful cushion gives way, then the correction could resume towards the confluence of the SMA10 four-hour and pivot point one-month R2 at $1,885.

Further south, the demand zone around $1,881 will come into play, which is the meeting point of the Fibonacci 61.8% one-day and the pivot point one-week R1.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

GBP/USD registered gains for three straight days before turning calm above 1.3600. A break above 1.3710/1.3750 would open up further gains, economists at Société Générale report.

Recent low at 1.3358 is a solid floor

“A test of the neckline at 1.3710/1.3750 is likely. Overcoming this would denote an extended upmove.”

“Recent low at 1.3358 cushions downside.”

See – GBP/USD: The best guess of where cable will be in 20 years’ time is 1.50 – SocGen

We will likely enter the weekend with more questions than answers on the Russia-Ukraine tensions. Therefore, analysts at ING continue to see the US dollar downside as contained given the still highly volatile geopolitical situation.

Greenback likely to find a floor soon

“There is a very high probability that we’ll get into the weekend with a still very blurry picture on geopolitical tensions. We think lingering uncertainty around current diplomatic developments should help put a floor under the dollar as safe-haven demand is unlikely to dissipate in the very near-term.”

“We’ll hear from Charles Evans, Christopher Waller, John Williams and Lael Brainard today after James Bullard continued to advocate in favour of front-loading rate hikes yesterday. Any sign from today’s speakers that they would also favour faster tightening could see markets go back to speculating on a 50bp March hike, a prospect that has been partially and gradually priced out in the past few days.”

“We continue to see any dollar weakness as being quite short-lived, and struggle to see DXY break decisively below 95.50 for now.”

- USD/CAD came under fresh selling pressure on Friday amid renewed USD weakness.

- A recovery in the global risk sentiment undermined the greenback’s safe-haven status.

- Retreating crude oil prices did little to weigh on the loonie or lend support to the pair.

The USD/CAD pair edged lower through the early European session and dropped to a fresh daily low, around the 1.2675 region in the last hour.

The pair met with a fresh supply on the last day of the week and reversed the overnight modest gains amid a softer tone surrounding the US dollar. Hopes for a diplomatic resolution of the East-West conflict over Ukraine led to a goodish recovery in the risk sentiment and undermined the greenback's safe-haven status.

The recent volatility in the equity markets subsided after the US Secretary of State Antony Blinken accepted an invitation to meet Russian Foreign Minister Sergei Lavrov late next week. This raised hopes for a diplomatic solution to the Ukraine crisis and drove investors away from traditional safe-haven assets, including the USD.

Adding to this, the uncertainty about the pace of the Fed's tightening cycle to combat stubbornly high inflation turned out to be another factor that weighed on the buck. In fact, the minutes of the January 25-26 FOMC meeting, released on Wednesday, failed to reinforce market expectations for a 50 bps rate hike in March.

That said, most Fed officials agreed that it would be appropriate to remove policy accommodation at a faster pace than anticipated if inflation does not move down as they expect. This, along with fears of an imminent Russian invasion of Ukraine, should act as a tailwind for the greenback and lend some support to the USD/CAD pair.

Apart from this, retreating oil prices could undermine the commodity-linked loonie and further warrant some caution before placing aggressive bearish bets around the USD/CAD pair. Hence, any subsequent decline is more likely to find support near the 1.2650 area, which is followed by the monthly low, around the 1.2635 region.

Market participants now look forward to the US Existing Home Sales data, due later during the early North American session. This, along with fresh geopolitical developments and the broader market risk sentiment, will influence the USD. Traders will further take cues from oil price dynamics for some impetus around the USD/CAD pair.

Technical levels to watch

AUD/USD could form a double bottom if the pair climbs above 0.7315. Otherwise, a decline below 0.7000 would reaffirm the bearish trend, according to analysts at Bank of America.

Bearish trend to follow through on another dip below 0.70

"The 0.7000 level has proven hard to decisively break through and now it's possible a double bottom pattern is forming since two attempts to break down have failed.”

“To form a double bottom, the pair must rally above 0.7315 to target 0.76-.7630.”

“Another decline below 0.7000 would mean the medium-term bearish view is following through.”

Analysts at Bank of America Global Research are closely monitoring head and shoulder bottom in the GBP/USD pair. In case cable pierces 1.3700/15, sterling could surge as high as 1.42.

Break below 1.3450 to put 1.32/1.3130 back in focus

“If GBP/USD continues to rally and exceeds resistance at 1.37/1.3715 then a head and shoulders bottom will have formed that targets 1.42.”

“Below 1.3450 would be bearish back to 1.32/1.3130.”

Economists at Westpac expect GBP/AUD to spend considerable time above 1.93. But their baseline forecast for end-2022 is GBP/AUD at 1.88-1.89.

Next few weeks should be unsettling for risk appetite and thus for the aussie

“The next few weeks into the March FOMC meeting should be unsettling for risk appetite and thus for AUD.”

“We see GBP/AUD spending considerable time above 1.93 and probably remaining fairly bid into mid-year. But our baseline forecast for end-2022 is 1.88-1.89, with Australian wages and inflation likely to be justifying RBA tightening into 2023.”

Oil prices have risen by more than 20% since the beginning of the year. Strategists at Commerzbank are revising their oil price forecast for the first half of the year significantly upwards, but still expect prices to decline over the course of the year.

Concern about shrinking spare production capacities

“For the current quarter, we expect a Brent oil price of $90 per barrel (previously $80). The main reason is the sharp rise in the risk premium due to the Russia-Ukraine conflict, which is likely to recede only slowly.”

“We still see the oil price significantly higher in the second quarter at $85 (previously $75).”