- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 17-09-2014

(raw materials / closing price /% change)

Light Crude 93.94 -0.51%

Gold 1,218.70 -1.39%

(index / closing price / change items /% change)

Nikkei 225 15,888.67 -22.86 -0.14%

Hang Seng 24,376.41 +240.40 +1.00%

S&P/ASX 200 5,407.25 -38.11 -0.70%

Shanghai Composite 2,307.89 +11.34 +0.49%

FTSE 100 6,780.9 -11.34 -0.17%

CAC 40 4,431.41 +22.26 +0.50%

Xetra DAX 9,661.5 +28.57 +0.30%

S&P 500 2,001.57 +2.59 +0.13%

NASDAQ Composite 4,562.19 +9.43 +0.21%

Dow Jones 17,156.85 +24.88 +0.15%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2846 -0,88%

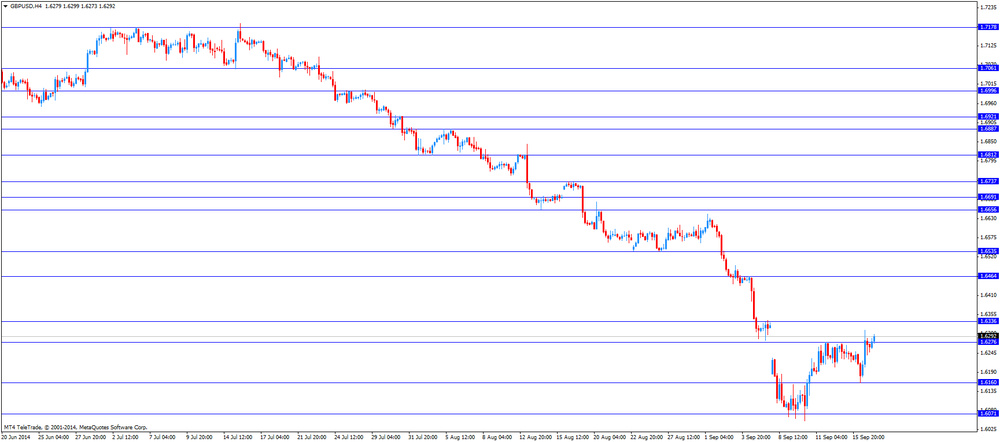

GBP/USD $1,6259 -0,07%

USD/CHF Chf0,9421 +1,03%

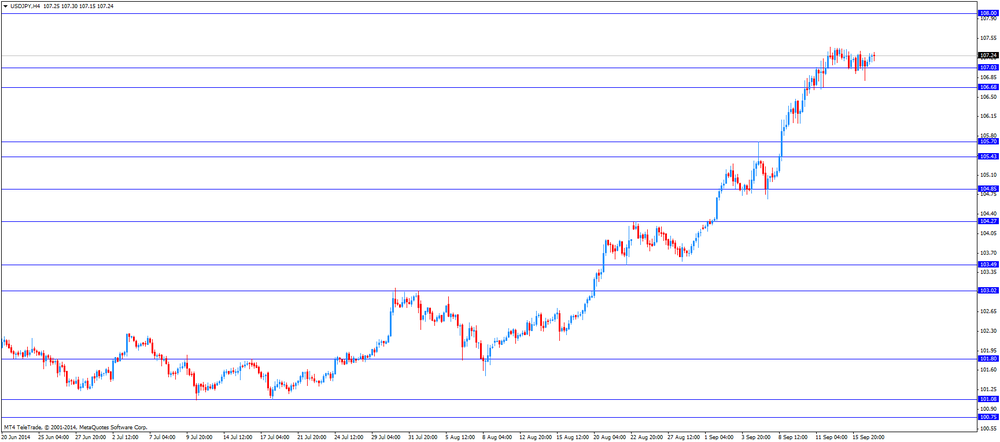

USD/JPY Y108,47 +1,25%

EUR/JPY Y139,32 +0,37%

GBP/JPY Y176,35 +1,17%

AUD/USD $0,8954 -1,45%

NZD/USD $0,8093 -1,22%

USD/CAD C$1,1015 +0,42%

(time / country / index / period / previous value / forecast)

01:30 Australia RBA Bulletin

06:00 Switzerland Trade Balance August 3.98 2.56

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

07:30 Switzerland SNB Interest Rate Decision 0.25% 0.25%

07:30 Switzerland SNB Monetary Policy Assessment

08:00 United Kingdom Scottish Independence Vote

08:30 United Kingdom Retail Sales (MoM) August +0.1% +0.4%

08:30 United Kingdom Retail Sales (YoY) August +2.6%

10:00 United Kingdom CBI industrial order books balance September 11 9

12:30 Canada Foreign Securities Purchases June -1.07 2.47

12:30 U.S. Building Permits, mln August 1.06 Revised From 1.05 1.04

12:30 U.S. Housing Starts, mln August 1.09 1.04

12:30 U.S. Initial Jobless Claims September 315 312

12:45 U.S. Fed Chairman Janet Yellen Speaks

14:00 U.S. Philadelphia Fed Manufacturing Survey September 28.0 22.8

Most stock indices closed higher, waiting for the results of the Fed's monetary policy meeting. Market participants expect the Fed will cut its asset purchase program by another $10 billion. Market participants also speculate the Fed will start to hike its interest rate sooner than expected.

Eurostat said today consumer price inflation was revised up to an annual rate of 0.4% in August from a preliminary reading of 0.3%.

Eurozone's consumer price index excluding food, energy, alcohol, and tobacco costs increased 0.9% in August.

The unemployment rate in the U.K. fell to 6.2% in July from 6.4% in June, beating expectations for a decline to 6.3%. That was the lowest level since late 2008.

The average earnings index including bonuses increased 0.6% in the three months to July, beating forecast of a 0.5% rise, after a 0.1% decline in the three months to June. June's figure was revised up from a 0.2% drop.

The average earnings index excluding bonuses climbed 0.7% in the three months to July, after a 0.7% gain in the three months to June. June's figure was revised up from a 0.6% increase.

Two members of Bank of England's Monetary Policy Committee, Ian McCafferty and Martin Weale, voted for the second consecutive month to raise interest rates to 0.75% from 0.5%.

Investors are awaiting the results of the Scotland's independence referendum on Thursday.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,780.9 -11.34 -0.17%

DAX 9,661.5 +28.57 +0.30%

CAC 40 4,431.41 +22.26 +0.50%

West Texas Intermediate crude fell from a two-week high after an Energy Information Administration report showed U.S. inventories unexpectedly rose last week.

WTI slid for the first time in three days. U.S. supplies gained 3.67 million barrels in the week ended Sept. 12, the EIA, the Energy Department's statistical arm, said. Analysts surveyed by Bloomberg had expected a drop of 1.5 million. Brent reversed earlier gains.

WTI for October delivery slipped 80 cents to $94.08 a barrel at 10:35 a.m. on the New York Mercantile Exchange. The volume of all futures traded was about 1.5 percent below the 100-day average for the time of day.

Brent for November settlement fell 29 cents to $98.76 a barrel on the ICE Futures Europe exchange after earlier rising as much as 0.6 percent. Volume was 8.9 percent below the 100-day average. The European benchmark crude was at a premium of $5.75 to WTI on ICE for the same month. It closed at $5.24 yesterday.

The EIA also reported stockpiles at Cushing, Oklahoma, the delivery point for WTI futures, fell 357,000 barrels to 20 million. Gasoline supply declined 1.64 million barrels to 210.7 million and distillate fuel, including diesel and heating oil, rose 279,000 barrels to 127.8 million.

The American Petroleum Institute said yesterday that crude supplies rose 3.3 million, according to Bain Energy. The API collects information on a voluntary basis from operators of refineries, bulk terminals and pipelines, while the government requires that reports be filed with the EIA.

The U.S. dollar traded higher against the most major currencies ahead of the Fed's interest rate decision. Market participants expect the Fed will cut its asset purchase program by another $10 billion. Market participants also speculate the Fed will start to hike its interest rate sooner than expected.

The U.S. consumer price index (CPI) declined 0.2% in August, missing expectations for a 0.1% rise, after a 0.1% increase in July.

On a yearly basis, the U.S. CPI decreased to 1.7% in August from 2.0% in July.

The U.S. consumer price index excluding food and energy was flat in August, missing expectations for a 0.2% increase, after a 0.1% gain in July.

On a yearly basis, the U.S. CPI excluding food and energy fell to 1.7% in August from 1.9% in July.

The NAHB housing market index jumped to 59 in September from 55 in August, exceeding expectations for a rise to 56.

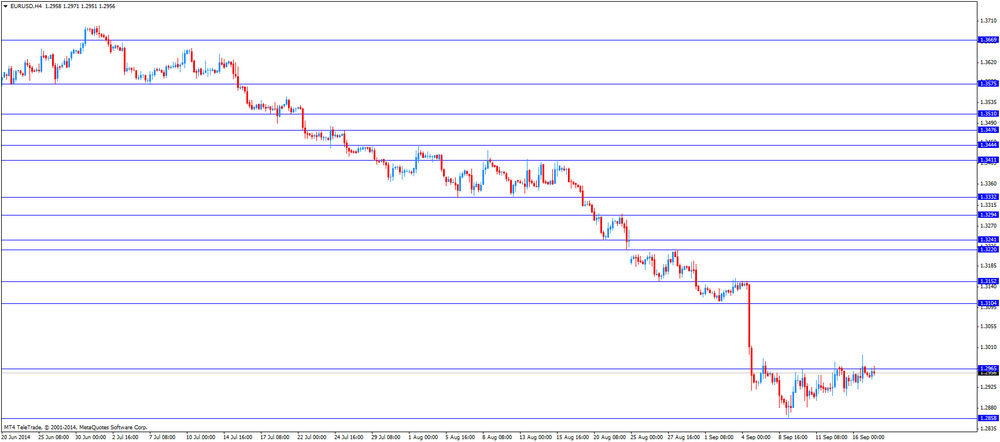

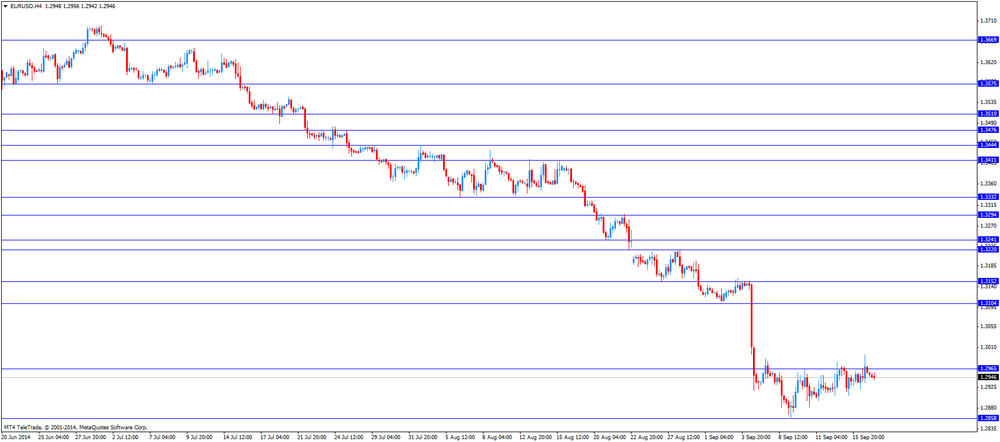

The euro declined against the U.S. dollar. Eurostat said today consumer price inflation was revised up to an annual rate of 0.4% in August from a preliminary reading of 0.3%.

Eurozone's consumer price index excluding food, energy, alcohol, and tobacco costs increased 0.9% in August.

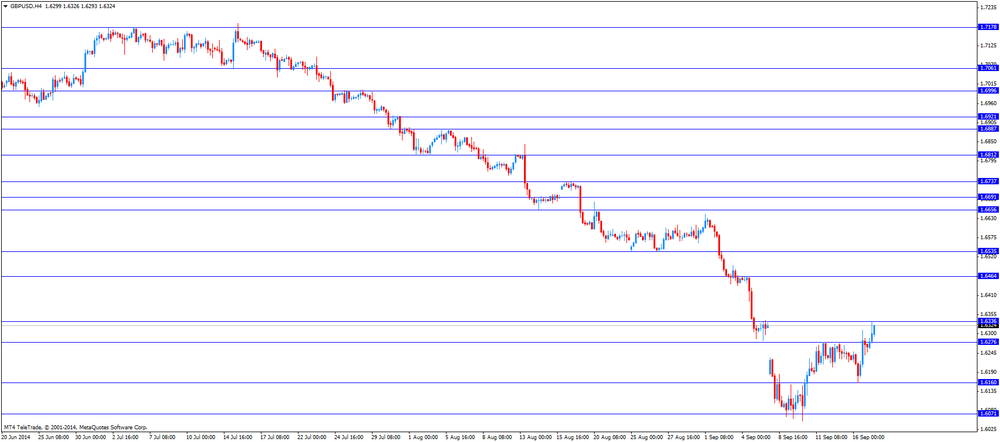

The British pound traded lower against the U.S. dollar. In the morning trading session, the pound increased against the greenback after the better-than-expected unemployment rate from the U.K. The unemployment rate in the U.K. fell to 6.2% in July from 6.4% in June, beating expectations for a decline to 6.3%. That was the lowest level since late 2008.

The average earnings index including bonuses increased 0.6% in the three months to July, beating forecast of a 0.5% rise, after a 0.1% decline in the three months to June. June's figure was revised up from a 0.2% drop.

The average earnings index excluding bonuses climbed 0.7% in the three months to July, after a 0.7% gain in the three months to June. June's figure was revised up from a 0.6% increase.

Two members of Bank of England's Monetary Policy Committee, Ian McCafferty and Martin Weale, voted for the second consecutive month to raise interest rates to 0.75% from 0.5%.

Scotland's independence referendum on Thursday continued to weigh on the pound.

The Swiss franc traded lower against the U.S. dollar. Swiss ZEW Economic Sentiment Index declined to -7.7 in September from 2.5 in August. That was the first negative reading since January 2013.

The New Zealand dollar traded lower against the U.S dollar after the current account data from New Zealand. New Zealand's current account deficit was NZ$1.06 billion in the second quarter, down from a surplus of NZ$1.41 billion in the first quarter. Analysts had expected the current account deficit of NZ$1.04 billion.

The auction on Fonterra's GlobalDairyTrade platform showed dairy prices rose from a two-year low.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia.

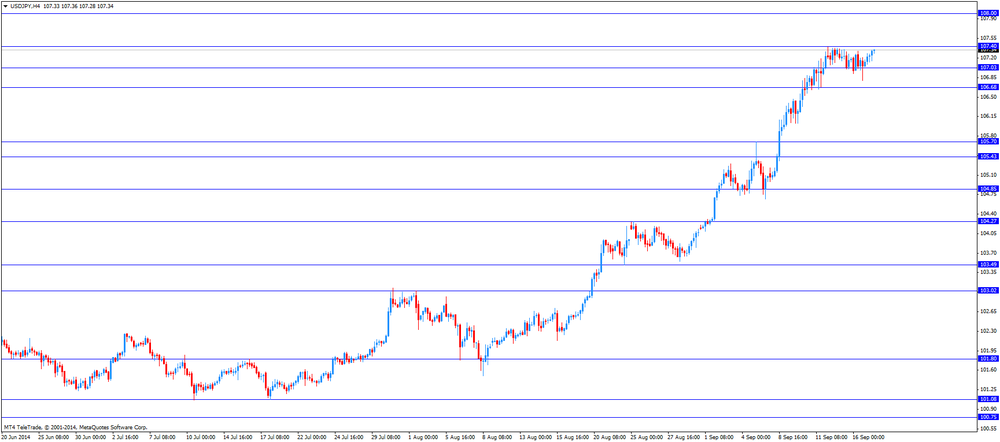

The Japanese yen dropped against the U.S. dollar in the absence of any major economic reports from Japan.

Gold traded steady as investors took a wait before the application of the Federal Reserve later in the session.

Market participants are prepared for the results of the meeting of the Federal Reserve monetary policy, by definition, later on Wednesday amid speculation that the central bank of the USA can use more aggressive rhetoric.

The Fed is expected to reduce the amount of the asset purchase program by another $ 10 billion on its way to full completion in October and higher interest rates in mid-2015.

Investors are also focused attention at a press conference led by Fed Chairman Janet Yellen, which may give further hints on the timing of the first since 2006, rising interest rates in the United States.

Gold prices slightly responded to a report showing that the consumer price index in the United States fell in August for the first time in 16 months.

United States Department of Labor announced that consumer prices fell by 0.2% last month, compared with estimates of growth at 0.1%. The annual calculation of consumer prices in July rose 1.7% in August, below expectations of 1.9% and 2% lower than July.

The consumer price index excluding food and energy remained unchanged in August compared with the previous month, confounding expectations for a gain of 0.2%. Core CPI in July rose during the year by 1.7% in August compared with the projected 1.9%.

Investors are also awaiting a vote on Scottish independence on Thursday, as the outcome of the referendum is difficult to predict, as polls show mixed results. Support the campaign for full independence could lead to the disintegration of the United Kingdom.

The cost of the October gold futures on the COMEX today kept in the range of 1233.20 - 1239.1 dollars per ounce.

EUR/USD: $1.2900(E400mn), $1.2950(E329mn), $1.3000(E331mn), $1.3030(E227mn), $1.3050(E426mn)

USD/JPY Y106.75($300mn), Y107.00($100mn), Y107.25($200mn)

EUR/GBP: stg0.7940(E100mn), stg0.8020(E150mn)

EUR/CHF: Chf1.2090(E336mn), Chf1.2140(E568mn)

AUD/USD: $0.9000(A$833mn), $0.9100(A$1.7bn)

USD/CAD: C$1.0880($240mn), C$1.0980($535mn), C$1.1000($315mn), C$1.1030($350mn), C$1.1090-1.1100($660mn)

U.S. stock futures were little changed as investors assessed whether data showing a drop in consumer prices will give the Federal Reserve room to keep rates lower for longer.

Global markets:

Nikkei 15,888.67 -22.86 -0.14%

Hang Seng 24,376.41 +240.40 +1.00%

Shanghai Composite 2,307.89 +11.34 +0.49%

FTSE 6,786.99 -5.25 -0.08%

CAC 4,434.2 +25.05 +0.57%

DAX 9,666.78 +33.85 +0.35%

Crude oil $94.50 (-0.41%)

Gold $1237.50 (+0.06%)

(company / ticker / price / change, % / volume)

| International Business Machines Co... | IBM | 192.97 | +0.01% | 1.6K |

| Johnson & Johnson | JNJ | 105.92 | +0.04% | 53.9K |

| Verizon Communications Inc | VZ | 48.98 | +0.04% | 0.8K |

| The Coca-Cola Co | KO | 41.66 | +0.05% | 1.0K |

| Exxon Mobil Corp | XOM | 97.50 | +0.07% | 0.5K |

| Cisco Systems Inc | CSCO | 25.25 | +0.12% | 0.8K |

| JPMorgan Chase and Co | JPM | 60.06 | +0.12% | 13.8K |

| Intel Corp | INTC | 34.99 | +0.17% | 0.8K |

| Walt Disney Co | DIS | 90.45 | +0.20% | 1.9K |

| AT&T Inc | T | 35.04 | +0.26% | 7.1K |

| General Electric Co | GE | 26.28 | +0.27% | 15.4K |

| Boeing Co | BA | 128.30 | +0.77% | 2.2K |

| E. I. du Pont de Nemours and Co | DD | 68.18 | +3.57% | 246.4K |

| Caterpillar Inc | CAT | 104.86 | 0.00% | 2.6K |

| Pfizer Inc | PFE | 30.05 | 0.00% | 0.2K |

| Procter & Gamble Co | PG | 84.00 | -0.10% | 0.6K |

| UnitedHealth Group Inc | UNH | 87.00 | -0.18% | 0.1K |

| Microsoft Corp | MSFT | 46.30 | -0.98% | 172.9K |

Upgrades:

Downgrades:

Other:

General Electric (GE) initiated with a Buy at Stifel, target $30

Apple (AAPL) target raised to $114 from $110 at RBC Capital Mkts

3M (МММ) initiated with a Hold at Stifel, target $158

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:45 New Zealand Current Account Quarter II 1.41 -1.04 -1.06

10:30 United Kingdom Average Earnings, 3m/y July -0.2% +0.5% +0.6%

10:30 United Kingdom Average earnings ex bonuses, 3 m/y July +0.6% +0.7%

10:30 United Kingdom Claimant count August -37.4 Revised From -33.6 -29.7 -37.2

10:30 United Kingdom Claimant Count Rate August 3.0% 2.9%

10:30 United Kingdom ILO Unemployment Rate July 6.4% 6.3% 6.2%

10:30 United Kingdom Bank of England Minutes

11:00 Eurozone Harmonized CPI August -0.7% +0.1%

11:00 Eurozone Harmonized CPI ex EFAT, Y/Y August +0.8% +0.9%

11:00 Eurozone Harmonized CPI, Y/Y (Finally) August +0.3% +0.3% +0.4%

11:00 Switzerland Credit Suisse ZEW Survey (Expectations) September 2.5 -7.7

The U.S. dollar traded mixed against the most major currencies ahead of the Fed's interest rate decision. Market participants expect the Fed will cut its asset purchase program by another $10 billion. Market participants also speculate the Fed will start to hike its interest rate sooner than expected.

The U.S. consumer price index is expected to rise 0.1% in August, after a 0.1% increase in July.

The U.S. consumer price index excluding food and energy is expected to climb 0.2% in August, after a 0.1% gain in July.

The NAHB housing market index is expected to increase to 56 in September from 55 in August.

The euro traded mixed against the U.S. dollar after the consumer inflation data from the Eurozone. Eurostat said today consumer price inflation was revised up to an annual rate of 0.4% in August from a preliminary reading of 0.3%.

Eurozone's consumer price index excluding food, energy, alcohol, and tobacco costs increased 0.9% in August.

The British pound traded higher against the U.S. dollar after the better-than-expected unemployment rate from the U.K. The unemployment rate in the U.K. fell to 6.2% in July from 6.4% in June, beating expectations for a decline to 6.3%. That was the lowest level since late 2008.

The average earnings index including bonuses increased 0.6% in the three months to July, beating forecast of a 0.5% rise, after a 0.1% decline in the three months to June. June's figure was revised up from a 0.2% drop.

The average earnings index excluding bonuses climbed 0.7% in the three months to July, after a 0.7% gain in the three months to June. June's figure was revised up from a 0.6% increase.

Two members of Bank of England's Monetary Policy Committee, Ian McCafferty and Martin Weale, voted for the second consecutive month to raise interest rates to 0.75% from 0.5%.

Scotland's independence referendum on Thursday continued to weigh on the pound.

The Swiss franc traded mixed against the U.S. dollar. Swiss ZEW Economic Sentiment Index declined to -7.7 in September from 2.5 in August. That was the first negative reading since January 2013.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.6335

USD/JPY: the currency pair increased to Y107.36

The most important news that are expected (GMT0):

14:30 U.S. Current account, bln Quarter II -111 -114

14:30 U.S. CPI, m/m August +0.1% +0.1%

14:30 U.S. CPI, Y/Y August +2.0%

14:30 U.S. CPI excluding food and energy, m/m August +0.1% +0.2%

14:30 U.S. CPI excluding food and energy, Y/Y August +1.9%

16:00 U.S. NAHB Housing Market Index September 55 56

20:00 U.S. FOMC Economic Projections

20:00 U.S. FOMC Statement

20:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

20:00 U.S. FOMC QE Decision 25 15

20:30 U.S. Federal Reserve Press Conference

EUR/USD

Offers $1.3070, $1.3050, $1.3000

Bids $1.2900, $1.2880, $1.2860/50, $1.2800

GBP/USD

Offers $1.6500, $1.6465, $1.6400, $1.6340/50,

Bids 1.6160, $1.6125/20, $1.6100, $1.6050

AUD/USD

Offers $0.9250/60, $0.9220, $0.9110

Bids 0.8980, $0.8900, $$0.8800

EUR/JPY

Offers Y140.00, Y139.50, Y139.20

Bids Y138.30, Y138.00, Y138.50

USD/JPY

Offers Y108.00, Y107.40-50

Bids Y106.70/65, Y106.50, Y106.05/95, Y105.50, Y105.20

EUR/GBP

Offers stg0.8100, stg0.8000/10, stg0.7970

Bids stg0.7920, stg0.7900, stg0.7890

Stock indices traded higher ahead of the Fed's policy meeting. Market participants expect the Fed will cut its asset purchase program by another $10 billion. Market participants also speculate the Fed will start to hike its interest rate sooner than expected.

Eurostat said today consumer price inflation was revised up to an annual rate of 0.4% in August from a preliminary reading of 0.3%.

Eurozone's consumer price index excluding food, energy, alcohol, and tobacco costs increased 0.9% in August.

The unemployment rate in the U.K. fell to 6.2% in July from 6.4% in June, beating expectations for a decline to 6.3%. That was the lowest level since late 2008.

The average earnings index including bonuses increased 0.6% in the three months to July, beating forecast of a 0.5% rise, after a 0.1% decline in the three months to June. June's figure was revised up from a 0.2% drop.

The average earnings index excluding bonuses climbed 0.7% in the three months to July, after a 0.7% gain in the three months to June. June's figure was revised up from a 0.6% increase.

Two members of Bank of England's Monetary Policy Committee, Ian McCafferty and Martin Weale, voted for the second consecutive month to raise interest rates to 0.75% from 0.5%.

Current figures:

Name Price Change Change %

FTSE 6,807.37 +15.13 +0.22%

DAX 9,683.82 +50.89 +0.53%

CAC 40 4,441.75 +32.60 +0.74%

Eurostat said today consumer price inflation was revised up to an annual rate of 0.4% in August from a preliminary reading of 0.3%. But consumer price inflation remains at the lowest level since Oct 2009.

Eurozone's consumer price index excluding food, energy, alcohol, and tobacco costs increased 0.9% in August.

The Bank of England's Monetary Policy Committee (MPC) released its latest minutes today. Two members, Ian McCafferty and Martin Weale, voted for the second consecutive month to raise interest rates to 0.75% from 0.5%.

Seven of the nine MPC members voted to keep interest rate at 0.5%.

The U.K. Office for National Statistics released its labour market data. The unemployment rate in the U.K. fell to 6.2% in July from 6.4% in June, beating expectations for a decline to 6.3%. That was the lowest level since late 2008.

The claimant count declined by 37,200 people in August, exceeding expectations for a drop of 29,700 people, after a decrease of 37,400 people in July. July's figure was revised up from a fall of 33,600 people.

The average earnings index including bonuses increased 0.6% in the three months to July, beating forecast of a 0.5% rise, after a 0.1% decline in the three months to June. June's figure was revised up from a 0.2% drop.

The average earnings index excluding bonuses climbed 0.7% in the three months to July, after a 0.7% gain in the three months to June. June's figure was revised up from a 0.6% increase.

Most Asian stock closed higher as China's central bank started to boost liquidity. The People's Bank of China yesterday started to inject 500 billion yuan ($81.4 billion) into the country's five biggest lenders (100 billion yuan each).

Market participants are awaiting the results of the Fed' policy meeting. They expect the Fed will cut its asset purchase program by another $10 billion.

Market participants also speculate the Fed will start to hike its interest rate sooner than expected.

Indexes on the close:

Nikkei 225 15,888.67 -22.86 -0.14%

Hang Seng 24,376.41 +240.40 +1.00%

Shanghai Composite 2,307.89 +11.34 +0.49%

EUR/USD: $1.2900(E400mn), $1.2950(E329mn), $1.3000(E331mn), $1.3030(E227mn), $1.3050(E426mn)

USD/JPY Y106.75($300mn), Y107.00($100mn), Y107.25($200mn)

EUR/GBP: stg0.7940(E100mn), stg0.8020(E150mn)

EUR/CHF: Chf1.2090(E336mn), Chf1.2140(E568mn)

AUD/USD: $0.9000(A$833mn), $0.9100(A$1.7bn)

USD/CAD: C$1.0880($240mn), C$1.0980($535mn), C$1.1000($315mn), C$1.1030($350mn), C$1.1090-1.1100($660mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:45 New Zealand Current Account Quarter II 1.41 -1.04 -1.06

10:30 United Kingdom Average Earnings, 3m/y July -0.2% +0.5% +0.6%

10:30 United Kingdom Average earnings ex bonuses, 3 m/y July +0.6% +0.7%

10:30 United Kingdom Claimant count August -37.4 Revised From -33.6 -29.7 -37.2

10:30 United Kingdom Claimant Count Rate August 3.0% 2.9%

10:30 United Kingdom ILO Unemployment Rate July 6.4% 6.3% 6.2%

10:30 United Kingdom Bank of England Minutes

The U.S. dollar traded mixed against the most major currencies on speculation the Fed will start to hike its interest rate sooner than expected. Market participants are awaiting the Fed's interest rate decision today.

Market participants expect the Fed will cut its asset purchase program by another $10 billion.

The New Zealand dollar traded lower against the U.S dollar after the current account data from New Zealand. New Zealand's current account deficit was NZ$1.06 billion in the second quarter, down from a surplus of NZ$1.41 billion in the first quarter. Analysts had expected the current account deficit of NZ$1.04 billion.

The auction on Fonterra's GlobalDairyTrade platform showed dairy prices rose from a two-year low.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

11:00 Eurozone Harmonized CPI, Y/Y (Finally) August +0.3% +0.3%

14:30 U.S. Current account, bln Quarter II -111 -114

14:30 U.S. CPI, m/m August +0.1% +0.1%

14:30 U.S. CPI, Y/Y August +2.0%

14:30 U.S. CPI excluding food and energy, m/m August +0.1% +0.2%

14:30 U.S. CPI excluding food and energy, Y/Y August +1.9%

16:00 U.S. NAHB Housing Market Index September 55 56

20:00 U.S. FOMC Economic Projections

20:00 U.S. FOMC Statement

20:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

20:00 U.S. FOMC QE Decision 25 15

20:30 U.S. Federal Reserve Press Conference

EUR / USD

Resistance levels (open interest**, contracts)

$1.3069 (4612)

$1.3020 (434)

$1.2987 (160)

Price at time of writing this review: $ 1.2950

Support levels (open interest**, contracts):

$1.2898 (4787)

$1.2876 (7027)

$1.2853 (3902)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 49070 contracts, with the maximum number of contracts with strike price $1,3000 (4612);

- Overall open interest on the PUT options with the expiration date October, 3 is 55185 contracts, with the maximum number of contracts with strike price $1,3000 (7027);

- The ratio of PUT/CALL was 1.13 versus 1.17 from the previous trading day according to data from September, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.6504 (2184)

$1.6407 (1295)

$1.6312 (1485)

Price at time of writing this review: $1.6280

Support levels (open interest**, contracts):

$1.6184 (1381)

$1.6087 (3005)

$1.5990 (1896)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 26553 contracts, with the maximum number of contracts with strike price $1,6500 (2184);

- Overall open interest on the PUT options with the expiration date October, 3 is 36257 contracts, with the maximum number of contracts with strike price $1,6300 (4559);

- The ratio of PUT/CALL was 1.37 versus 1.38 from the previous trading day according to data from September, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.