- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 17-07-2014

Stock indices due to new sanctions against Russia. The European Union and the United States imposed new sanctions against Russia. New sanctions target OAO Rosneft, OAO Novatek, OAO Gazprombank, and eight defence firms.

Eurozone's consumer inflation rose 0.5% in June, in line with expectations, after a 0.5% gain in May. The consumer inflation remained below the European Central Bank's 2% target. Inflation in the Eurozone has been below 1% since October 2013.

On a monthly basis, consumer price index climbed 0.1% in June, after a 0.1% decline in May.

Consumer price index excluding food, energy, alcohol, and tobacco costs climbed 0.8% in June, in line with expectations, after a 0.8% rise in May.

Banco Espirito Santo SA shares dropped 7.9% as S&P lowered the lender's rating to B- from B.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,738.32 -46.35 -0.68%

DAX 9,753.88 -105.39 -1.07%

CAC 40 4,316.12 -52.94 -1.21%

Cost of oil futures rose today that due to a drop in U.S. oil inventories and extended introduction of sanctions against Russia Washington and Brussels. Experts do not rule out that the U.S. and EU sanctions will create an additional risk premium in world oil and gas markets, but do not predict a significant increase in prices.

"The sharp decline in growth stocks explains WTI, - the analyst said Jefferies Bache Ltd. Christopher Bellew. - Russian sanctions so far, do not seem too worried about the market. "Recall that oil inventories in the U.S. fell last week to 7.53 million barrels to 375.04 million barrels, while experts expected a decline of only 2.75 million barrels. Meanwhile, gasoline inventories increased by 171 thousand barrels to predict when a jump at 610 thousand barrels.

On the dynamics of trade also affects the political situation in Libya and Iraq. Experts point out that in the next few weeks the direction of movement of oil prices will primarily determine the situation of oil supplies from Libya. It will take time before oil terminals reach full operating capacity, so that shipments from Libya in the short term is unlikely to grow significantly, analysts say. According to Libya's National Oil Corporation, now produced 550 thousand barrels per day.

Support prices also continue to yesterday's data on China, who reported a stronger-than-expected GDP growth in the second quarter - by 7.5 percent.

Market participants also drew attention to today's U.S. data. As the report showed Philadelphia Fed in July PMI rose, reaching at this level of 23.9 points compared to 17.8 points in June. It is worth noting that many economists had expected a fall of the index to the level of 15.6.

Cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 102.16 per barrel on the New York Mercantile Exchange (NYMEX).

August futures price for North Sea Brent crude oil mixture fell $ 1.78 to $ 107.67 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded mixed to higher against the most major currencies after the U.S. economic data. The number of initial jobless claims declined by 3,000 to 302,000 last week, missing expectations for a rise to 310,000.

The Federal Reserve Bank of Philadelphia manufacturing index rose to 23.9 July from 17.8 in June. Analysts had expected the index to decline to 15.6.

Housing starts dropped 9.3% in June, to an annual rate of 893,000 units, missing expectations of 1,020,000 units, after 985,000 units in May. That was the lowest level since September 2013. May's figure was revised down from 1,001,000 units.

Building permits declined 4.3% in June, o a rate of 963,000 units, missing forecasts of 1,040,000 units, after 1,005,000 units in May. May's figure was revised up from 991,000 units.

The euro traded mixed against the U.S. dollar after Eurozone's consumer inflation. Eurozone's consumer inflation rose 0.5% in June, in line with expectations, after a 0.5% gain in May. The consumer inflation remained below the European Central Bank's 2% target. Inflation in the Eurozone has been below 1% since October 2013.

On a monthly basis, consumer price index climbed 0.1% in June, after a 0.1% decline in May.

Consumer price index excluding food, energy, alcohol, and tobacco costs climbed 0.8% in June, in line with expectations, after a 0.8% rise in May.

The British pound traded lower against the U.S. dollar in the absence of any major market reports in the UK.

The Canadian dollar traded higher against the U.S. after foreign investment data from Canada. Foreign investment in Canada climbed by C$21.43 billion in May, exceeding expectations of C$14.23 billion.

The New Zealand dollar traded lower against the U.S dollar. The U.S. dollar still supported by Tuesday's comments by the Fed Chair Janet Yellen. Yesterday's weaker-than-expected consumer inflation in New Zealand dollar also weighed on the kiwi. New Zealand's consumer price index increased 0.3% in the second quarter, missing expectations for a 0.5% rise, after a 0.3% gain in the previous quarter. Market participants speculate if the Reserve Bank of New Zealand will hike its interest rate this year.

No major economic reports were released in New Zealand.

The Australian dollar traded mixed against the U.S. dollar after the release of economic data in Australia. The National Australia Bank business confidence index declined to 6 in the second quarter from 7 in the first quarter. The first quarter's figure was revised up from 6.

The Conference Board leading index for Australia increased by 0.2% in May, after a 0.2% decrease in April. April's figure was revised down from a 0.1% fall.

The Japanese yen traded higher against the U.S. dollar due to increasing demand for safe-haven currency as the United States announced new sanctions against Russia. No major economic reports were released in Japan.

Gold prices rose slightly today, retreating further from the four-week low, as investors took advantage of lower prices to buy. Growth of quotations is also linked to the downturn in most Asian stock markets.

"After a significant decline this week someone buys a depreciating gold, but the general mood is pessimistic," - said a trader at precious metals.

Meanwhile, markets were cautious, since Wednesday, the U.S. and the European Union announced a new package of sanctions against Russia after the annexation of the Crimea in April and continuing tension in the rest of Ukraine. U.S. sanctions have become the biggest at the moment. In response to the sanctions, Russian President Vladimir Putin said that relations with the U.S. are at risk to go to the "dead end" and could harm the business interests of the country in Russia.

The dynamics also influenced today published U.S. data, which showed that the construction of homes fell 9.3% in June, becoming the surprising sign of weakness for the sector, which is struggling to keep up the momentum in the last year. Housing starts fell last month to a seasonally adjusted annual rate of 893,000, the weakest level since September 2013, said the Ministry of Commerce. It was the second consecutive month of falling, and it was due to a decline in the south by almost 30%. Other parts of the country have noted an increase. Despite today's report, several recent signs indicate that the housing market is regaining its footing.

Pressure on prices continue to word Fed chief Janet Yellen, who said that the central bank may raise interest rates sooner or faster than expected, if continued growth of employment and wages in the United States. Growth rates will cause an outflow of investors from the gold market that is profitable percent.

Also today it was announced that the world's largest reserves secured gold exchange-traded fund SPDR Gold Trust on Wednesday fell by 2.7 tons to 806.03 tons, indicating the weakening of investment demand.

From a technical point of view, immediate resistance is at $ 1310. In the case of falling prices, and overcome the mark of $ 1,300, $ level support will in 1285.

The cost of the August gold futures on the COMEX today rose to $ 1303.10 per ounce.

The U.S. Commerce Department released housing market data on Thursday. Housing starts dropped 9.3% in June, to an annual rate of 893,000 units, missing expectations of 1,020,000 units, after 985,000 units in May. That was the lowest level since September 2013. May's figure was revised down from 1,001,000 units.

The second-straight monthly decrease was driven by a 29.6% fall in the South. Other regions posted increases.

Building permits declined 4.3% in June, o a rate of 963,000 units, missing forecasts of 1,040,000 units, after 1,005,000 units in May. May's figure was revised up from 991,000 units.

EUR/USD $1.3500, $1.3550, $1.3570-75, $1.3590, $1.3600, $1.3605

USD/JPY Y101.50-60, Y101.90, Y102.10, Y102.25

EUR/GBP Stg0.7910, stg0.7955

EUR/CHF Chf1.2160

AUD/USD $0.9325-35, $0.9340-50

NZD/USD NZ$0.8625

USD/CAD C$1.0770, C$1.0780, C$1.0800, C$1.0850

U.S. stock futures declined as housing starts unexpectedly fell and European markets slumped on further sanctions against Russia.

Global markets:

Nikkei 15,370.26 -9.04 -0.06%

Hang Seng 23,520.87 -2.41 -0.01%

Shanghai Composite 2,055.59 -11.68 -0.57%

FTSE 6,748.63 -36.04 -0.53%

CAC 4,334.06 -35.00 -0.80%

DAX 9,785.23 -74.04 -0.75%

Crude oil $102.78 (+1.57%)

Gold $1304.90 (+0.39%)

(company / ticker / price / change, % / volume)

| Chevron Corp | CVX | 130.90 | +0.01% | 0.4K |

| E. I. du Pont de Nemours and Co | DD | 65.33 | +0.46% | 0.1K |

| UnitedHealth Group Inc | UNH | 84.30 | +0.64% | 6.5K |

| Microsoft Corp | MSFT | 45.30 | +2.77% | 388.1K |

| AT&T Inc | T | 36.38 | -0.19% | 2.0K |

| Johnson & Johnson | JNJ | 102.02 | -0.20% | 1.2K |

| Walt Disney Co | DIS | 85.16 | -0.22% | 0.7K |

| Visa | V | 222.16 | -0.23% | 0.9K |

| Goldman Sachs | GS | 170.05 | -0.25% | 15.0K |

| Verizon Communications Inc | VZ | 50.82 | -0.27% | 4.7K |

| International Business Machines Co... | IBM | 191.83 | -0.28% | 0.6K |

| Wal-Mart Stores Inc | WMT | 76.63 | -0.30% | 1.4K |

| Cisco Systems Inc | CSCO | 25.90 | -0.31% | 7.7K |

| Boeing Co | BA | 127.00 | -0.33% | 5.2K |

| Caterpillar Inc | CAT | 110.30 | -0.36% | 6.3K |

| McDonald's Corp | MCD | 98.88 | -0.39% | 1.2K |

| General Electric Co | GE | 26.91 | -0.41% | 16.7K |

| Procter & Gamble Co | PG | 80.61 | -0.41% | 0.3K |

| Exxon Mobil Corp | XOM | 103.33 | -0.42% | 1.5K |

| Nike | NKE | 76.60 | -0.42% | 5.2K |

| Pfizer Inc | PFE | 30.83 | -0.42% | 0.5K |

| JPMorgan Chase and Co | JPM | 58.45 | -0.44% | 1.4K |

| Intel Corp | INTC | 34.46 | -0.55% | 119.7K |

| The Coca-Cola Co | KO | 41.88 | -0.57% | 5.0K |

| Home Depot Inc | HD | 79.10 | -0.70% | 2.7K |

| 3M Co | MMM | 145.00 | -0.80% | 1.7K |

| Merck & Co Inc | MRK | 57.54 | -1.05% | 0.7K |

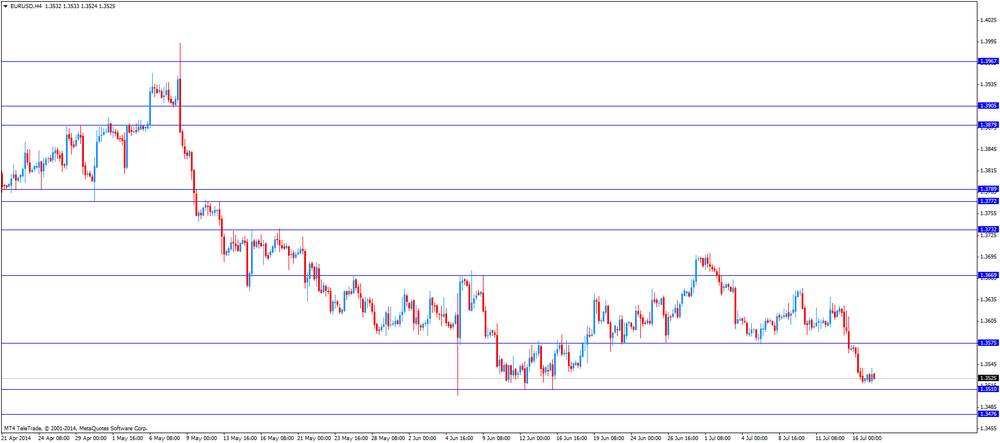

EUR/USD

Offers $1.3640, $1.3590/600

Bids $1.3521-18, $1.3500, $1.3485/80

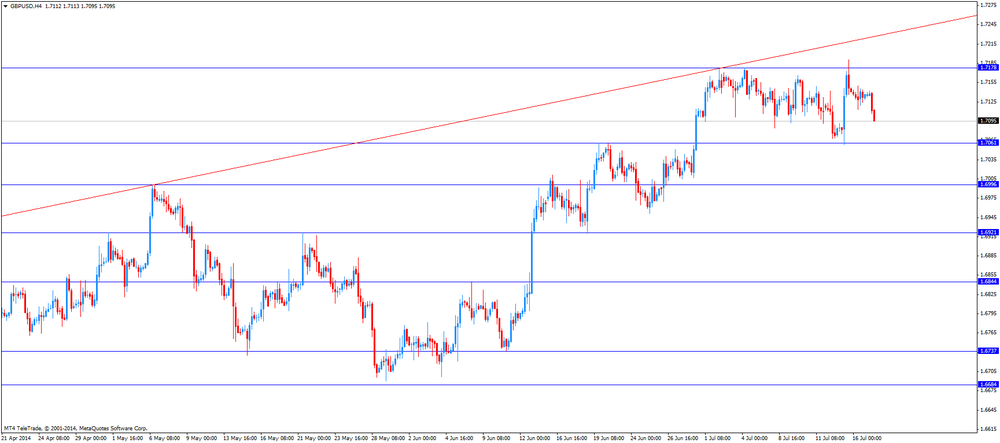

GBP/USD

Offers $1.7200

Bids $1.7055, $1.7045/40

AUD/USD

Offers $0.9450, $0.9420, $0.9400

Bids $0.9350, $0.9300

EUR/JPY

Offers Y138.50, Y138.20, Y138.00, Y137.75/80

Bids Y137.20, Y137.00, Y136.50, Y136.00

USD/JPY

Offers Y102.20, Y102.00, Y101.80

Bids Y101.20, Y101.00, Y100.80, Y100.50

EUR/GBP

Offers stg0.7980/85, stg0.7910-15

Bids stg0.7850, stg0.7800

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index May -0.1% +0.2%

01:30 Australia NAB Quarterly Business Confidence Quarter II 6 6

01:55 Australia RBA Assist Gov Edey Speaks

09:00 Eurozone Construction Output, m/m May +0.8% +0.8%

09:00 Eurozone Construction Output, y/y May +8.0% +3.5%

09:00 Eurozone Harmonized CPI June -0.1% +0.1%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) June +0.5% +0.5% +0.5%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y June +0.8% +0.8% +0.8%

The U.S. dollar traded mixed to higher against the most major currencies. The U.S. currency remained supported by Tuesday's comments by the Fed Chair Janet Yellen. The Fed Chair said the economy in the U.S. is continuing to improve but the recovery is not yet complete. She added that if the labour market continues to improve more quickly, the Fed will hike its interest rate sooner than expected, but weaker conditions will mean a longer period of low interest rate.

The U.S. currency was also supported by new sanctions against Russia.

The euro traded mixed against the U.S. dollar after Eurozone's consumer inflation. Eurozone's consumer inflation rose 0.5% in June, in line with expectations, after a 0.5% gain in May. The consumer inflation remained below the European Central Bank's 2% target. Inflation in the Eurozone has been below 1% since October 2013.

On a monthly basis, consumer price index climbed 0.1% in June, after a 0.1% decline in May.

Consumer price index excluding food, energy, alcohol, and tobacco costs climbed 0.8% in June, in line with expectations, after a 0.8% rise in May.

The British pound declined against the U.S. dollar in the absence of any major market reports in the UK.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair decreased to $1.7095

USD/JPY: the currency pair declined to Y101.39

The most important news that are expected (GMT0):

12:30 Canada Foreign Securities Purchases May 10.13 14.23

12:30 U.S. Initial Jobless Claims July 304 310

12:30 U.S. Building Permits, mln June 0.99 1.04

12:30 U.S. Housing Starts, mln June 1.00 1.02

14:00 U.S. Philadelphia Fed Manufacturing Survey July 17.8 15.6

23:50 Japan Monetary Policy Meeting Minutes

Stock indices declined as the European Union and the United States imposed new sanctions against Russia. New sanctions target OAO Rosneft, OAO Novatek, OAO Gazprombank, and eight defence firms.

Eurozone's consumer inflation rose 0.5% in June, in line with expectations, after a 0.5% gain in May. The consumer inflation remained below the European Central Bank's 2% target. Inflation in the Eurozone has been below 1% since October 2013.

On a monthly basis, consumer price index climbed 0.1% in June, after a 0.1% decline in May.

Consumer price index excluding food, energy, alcohol, and tobacco costs climbed 0.8% in June, in line with expectations, after a 0.8% rise in May.

Banco Espirito Santo SA shares dropped 7.9% as S&P lowered the lender's rating to B- from B.

Current figures:

Name Price Change Change %

FTSE 100 6,740.3 -44.37 -0.65%

DAX 9,779.7 -79.57 -0.81%

CAC 40 4,327.04 -42.02 -0.96%

Eurostat released consumer price index for the Eurozone today. Eurozone's consumer inflation rose 0.5% in June, in line with expectations, after a 0.5% gain in May. The consumer inflation remained below the European Central Bank's 2% target. Inflation in the Eurozone has been below 1% since October 2013.

On a monthly basis, consumer price index climbed 0.1% in June, after a 0.1% decline in May.

Consumer price index excluding food, energy, alcohol, and tobacco costs climbed 0.8% in June, in line with expectations, after a 0.8% rise in May.

Consumer prices decreased in Greece, Portugal and Slovakia in June. Only Germany, Slovenia, Finland, Luxembourg and Austria had inflation at or above 1% in June.

Asian stock indices traded lower as markets reacted on corporate earnings reports. There has been no positive impact of yesterday's better-than-expected China's growth. China's gross domestic product rose 7.5% in the second quarter, exceeding expectations for a 7.4% increase, after a 7.4% in the previous quarter.

The Japanese shares traded lower due to stronger yen. The yen strengthened due to increasing demand for safe-haven currency as the United States announced new sanctions against Russia.

Indexes on the close:

Nikkei 225 15,370.26 -9.04 -0.06%

Hang Seng 23,520.87 -2.41 -0.01%

Shanghai Composite 2,055.59 -11.68 -0.57%

EUR/USD $1.3500, $1.3550, $1.3570-75, $1.3590, $1.3600, $1.3605

USD/JPY Y101.50-60, Y101.90, Y102.10, Y102.25

EUR/GBP Stg0.7910, stg0.7955

EUR/CHF Chf1.2160

AUD/USD $0.9325-35, $0.9340-50

NZD/USD NZ$0.8625

USD/CAD C$1.0770, C$1.0780, C$1.0800, C$1.0850

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index May -0.1% +0.2%

01:30 Australia NAB Quarterly Business Confidence Quarter II 6 6

01:55 Australia RBA Assist Gov Edey Speaks

The U.S. dollar traded mixed against the most major currencies. The U.S. dollar remained supported by Tuesday's comments by the Fed Chair Janet Yellen. The Fed Chair said the economy in the U.S. is continuing to improve but the recovery is not yet complete. She added that if the labour market continues to improve more quickly, the Fed will hike its interest rate sooner than expected, but weaker conditions will mean a longer period of low interest rate.

The New Zealand dollar traded lower against the U.S dollar. The U.S. dollar still supported by Tuesday's comments by the Fed Chair Janet Yellen. Yesterday's weaker-than-expected consumer inflation in New Zealand dollar also weighed on the kiwi. New Zealand's consumer price index increased 0.3% in the second quarter, missing expectations for a 0.5% rise, after a 0.3% gain in the previous quarter. Market participants speculate if the Reserve Bank of New Zealand will hike its interest rate this year.

No major economic reports were released in New Zealand.

The Australian dollar traded mixed against the U.S. dollar after the release of economic data in Australia. The National Australia Bank business confidence index declined to 6 in the second quarter from 7 in the first quarter. The first quarter's figure was revised up from 6.

The Conference Board leading index for Australia increased by 0.2% in May, after a 0.2% decrease in April. April's figure was revised down from a 0.1% fall.

The Japanese yen traded higher against the U.S. dollar due to increasing demand for safe-haven currency as the United States announced new sanctions against Russia. No major economic reports were released in Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair

USD/JPY: the currency pair declined to Y101.45

The most important news that are expected (GMT0):

09:00 Eurozone Harmonized CPI June -0.1%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) June +0.5% +0.5%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y June +0.8% +0.8%

12:30 Canada Foreign Securities Purchases May 10.13 14.23

12:30 U.S. Initial Jobless Claims July 304 310

12:30 U.S. Building Permits, mln June 0.99 1.04

12:30 U.S. Housing Starts, mln June 1.00 1.02

14:00 U.S. Philadelphia Fed Manufacturing Survey July 17.8 15.6

23:50 Japan Monetary Policy Meeting Minutes

EUR / USD

Resistance levels (open interest**, contracts)

$1.3633 (3110)

$1.3604 (692)

$1.3564 (76)

Price at time of writing this review: $ 1.3523

Support levels (open interest**, contracts):

$1.3507 (1916)

$1.3493 (4182)

$1.3472 (2596)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 25553 contracts, with the maximum number of contracts with strike price $1,3650 (3672);

- Overall open interest on the PUT options with the expiration date August, 8 is 34183 contracts, with the maximum number of contracts with strike price $1,3500 (7611);

- The ratio of PUT/CALL was 1.34 versus 1.36 from the previous trading day according to data from July, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.7401 (1025)

$1.7302 (1277)

$1.7205 (1470)

Price at time of writing this review: $1.7138

Support levels (open interest**, contracts):

$1.7093 (2170)

$1.6996 (2450)

$1.6898 (2003)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 15913 contracts, with the maximum number of contracts with strike price $1,7250 (2196);

- Overall open interest on the PUT options with the expiration date August, 8 is 22399 contracts, with the maximum number of contracts with strike price $1,7000 (2450);

- The ratio of PUT/CALL was 1.41 versus 1.36 from the previous trading day according to data from Jule, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(raw materials / closing price /% change)

Light Crude 101.41 +0.21%

Gold 1,298.50 -0.10%

(index / closing price / change items /% change)

Nikkei 225 15,379.3 -15.86 -0.10%

Hang Seng 23,523.28 +63.32 +0.27%

Shanghai Composite 2,067.28 -3.08 -0.15%

FTSE 100 6,784.67 +74.22 +1.11%

CAC 40 4,369.06 +63.75 +1.48%

Xetra DAX 9,859.27 +139.86 +1.44%

S&P 500 1,981.57 +8.29 +0.42%

NASDAQ 4,425.97 +9.58 +0.22%

Dow Jones 17,138.2 +77.52 +0.45%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3525 -0,31%

GBP/USD $1,7136 -0,03%

USD/CHF Chf0,8981 +0,28%

USD/JPY Y101,65 -0,03%

EUR/JPY Y137,49 -0,33%

GBP/JPY Y174,19 -0,05%

AUD/USD $0,9361 -0,06%

NZD/USD $0,8711 -0,57%

USD/CAD C$1,0743 -0,11%

(time / country / index / period / previous value / forecast)

03:00 Australia Conference Board Australia Leading Index May -0.1%

04:30 Australia NAB Quarterly Business Confidence Quarter II 6

04:55 Australia RBA Assist Gov Edey Speaks

12:00 Eurozone Construction Output, m/m May +0.8%

12:00 Eurozone Construction Output, y/y May +8.0%

12:00 Eurozone Harmonized CPI June -0.1%

12:00 Eurozone Harmonized CPI, Y/Y June +0.5% +0.5%

12:00 Eurozone Harmonized CPI ex EFAT, Y/Y June +0.8% +0.8%

15:30 Canada Foreign Securities Purchases May 10.13 14.23

15:30 U.S. Initial Jobless Claims July 304 310

15:30 U.S. Building Permits, mln June 0.99 1.04

15:30 U.S. Housing Starts, mln June 1.00 1.02

17:00 U.S. Philadelphia Fed Manufacturing Survey July 17.8 15.6

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.