- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 17-03-2022

- CAD/JPY struggles to extend seven-day uptrend near the highest levels since 2015.

- Oil price recovery, cautious optimism previously favored bulls.

- Sluggish markets, wait for BOJ tests further upside of late.

- Canada Retail Sales, geopolitical headlines will also be important for fresh impulse.

CAD/JPY bulls keep eyes on the Bank of Japan (BOJ) monetary policy decision while flirting with the seven-year high around 94.00 during Friday’s Asian session. In doing so, the cross-currency pair pauses after consecutive seven days of an uptrend.

In addition to the pre-BOJ anxiety, mixed concerns over the Ukraine-Russia peace talks and China’s step back from the previous readiness to an easy regulatory crackdown on the property and IT companies also challenge CAD/JPY.

Furthermore, easing in prices of Canada’s main export, WTI crude oil also negatively affects the pair’s moves. The black gold rose the most in two weeks the previous day before recently easing to $103.30. Sour sentiment and IEA comments may have tested the commodity bulls of late.

Read: WTI surpasses $100.00 as IEA renews supply shortage worries

Elsewhere, the Bank of Japan (BOJ) has already signaled its readiness to keep the easy money flow continue and part ways from the global central banks, which in turn allows traders to prepare for a positive surprise and hence propel the pair before the event.

Read: USD/JPY Weekly Forecast: Federal Reserve and the Bank of Japan head for different exits

Looking forward, BOJ and the geopolitical headlines won’t be enough to predict CAD/JPY as Canada’s Retail Sales release for January is also on the calendar for publication. Should the key data match upbeat expectations of 2.4% MoM, versus -1.8% prior, the pair may have an additional reason to refresh the multi-day high.

Technical analysis

A fresh buying in the CAD/JPY pair can wait for a clear run-up beyond the 94.00 threshold. Following that the bulls can aim for an upward sloping trend line from May 2021, near 94.70.

On the contrary, the year 2021 peak near 93.00 restricts the short-term downside of the pair.

- GBP/USD struggles for clear directions after a volatile day, sidelined of late.

- Doji signals reversal from previous rebound but MACD teases bull cross.

- Previous support from late January holds gate for buyers, 10-DMA challenges downside.

GBP/USD makes rounds to 1.3150 amid Friday’s initial Asian session, following a BOE-led volatile day that ended near the opening levels.

In doing so, the cable pair portrayed a Doji candlestick below a support-turned-resistance line from January 27, suggesting consolidation of the latest gains.

However, the MACD line is likely crossing the signal line from below, which in turn suggests a bull cross and may keep the buyers hopeful to conquer the 1.3205 resistance.

Following that, 21-DMA and January’s low, respectively around 1.3280 and 1.3360, will lure the GBP/USD buyers.

On the contrary, the 10-DMA level surrounding 1.3100 restricts the immediate downside of the pair ahead of a three-week-old previous resistance line near 1.3030.

During the quote’s weakness past 1.3030, the latest multi-month low of 1.3000 may act as an intermediate halt before direct GBP/USD bears towards November 2020 low around 1.2855.

GBP/USD: Daily chart

Trend: Sideways

- The NZD/JPY is barely unchanged as the Asian session begins, though up 2.29% in the week.

- NZD/JPY Price Forecast: The pair is upwards, though RSI at overbought levels suggesting a correction is on the cards.

NZD/JPY is subdued around 81.60 early in the Asian Pacific session on Friday, after rising for three consecutive days, so far in the week, reaching a YTD high around 81.73, the highest level since November 2021.

Overnight, the NZD/JPY pair braced to the 81.00 area, though later it reached a daily high near 81.44, subsequently followed by a drop around 81.00, a solid demand area, which pushed the pair towards 81.73 year-to-date high.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY remains upward biased, despite being a barometer for risk sentiment trades. Daily moving averages (DMAs), although almost horizontal, begin to aim higher, led by the 50-DMA at 77.66, which is about to cross over the 200-DMA at 77.92, forming a golden cross a signal of bullish strength.

However, the Relative Strenght Index (RSI), a momentum oscillator, sits near the 80 reading in the overbought zone, meaning a reversion move is on the cards, so the pair might correct lower before resuming the ongoing uptrend.

If that scenario plays out, the NZD/JPY first support level would be the 81.00 mark, followed by the March 14 daily high previous resistance-now-support at 80.26.

Upwards, the NZD/JPY first resistance would be 82.00. Breach of the latter would expose the 2021 yearly high at 82.50, followed by the 83.00 mark.

- Silver snaps two-day rebound, eyes first weekly loss in seven.

- Ukraine-Russia peaces talks remain sluggish, fears of Moscow’s nuclear use challenge sentiment.

- Hopes of Putin, Zelenskyy meeting join softer yields, USD to keep buyers hopeful.

- Risk catalysts remain in the driver’s seat, light calendar may offer easy day.

Silver (XAG/USD) prices consolidate recent gains around $25.30 during a sluggish Asian session on Friday, adding strength to the first weekly downside since late January.

The bright metal’s latest weakness could be linked to the market’s cautious sentiment concerning the Ukraine-Russia crisis, as well as mixed messages from China. However, hopes of overcoming the grim situation in Kyiv and softer USD keep the XAG/USD buyers hopeful.

Ukraine brokers a top-tier gathering of Russian President Putin and his Ukrainian counterpart Volodymyr Zelenskyy to discuss the 15-point peace plan in detail, which in turn keeps the markets hopeful of overcoming the stand-off between Moscow and Kyiv. However, the Western warning that Moscow may contemplate the use of nuclear weapons dims the optimism. Also challenging the market’s mood are the fears over Russia’s default, as cited by the global rating agency S&P, even if some on the floor confirm receiving coupon payment due this week in the USD.

Elsewhere, China’s step back from previously hawkish comments to ease regulatory crackdown on the property and IT companies joined downbeat comments from the Organisation for Economic Cooperation and Development (OECD) to add to weigh on the market sentiment. “The global economic growth will be more than 1% lower this year due to the Ukraine crisis,” said the OECD.

Amid these plays, the US 10-year Treasury yields closed Thursday with a mildly downbeat performance around 2.16% while Wall Street remained firmer for the third consecutive day.

Considering the light calendar and a lack of major events scheduled on Friday, silver prices may witness fewer moves and can end the week by snapping the six-week winning streak. However, headlines from China and Ukraine remain important to follow for fresh impulse.

Technical analysis

Despite the recent pullback from 10-DMA, around $25.55 by the press time, silver prices keep the upside break of a downward sloping trend line from March 08, which in turn suggests the quote’s strength until it drops back below $24.90.

- NZD/USD has advanced near 0.6900 on the announcement of helicopter money from China.

- The DXY has weakened amid risk-on impulse in the market.

- Kiwi bulls got stronger on upbeat GDP numbers.

The NZD/USD pair has advanced sharply near 0.6900 on multiple positive triggers in the market. The recent resurgence of Covid-19 in China has renewed the fears of a pandemic in the world. In response to the rising cases of Covid-19, the China administration has imposed severe lockdown measures to corner the spread of the Omicron variant, detected in the Covid-19 patients. Apart from that China’s Vice Premier Liu He has signaled more stimulus to support Chinese markets.

The announcement of stimulus has brought optimism for the antipodean as New Zealand is one of the leading exporters to China.

Meanwhile, the underperformance of the US dollar index (DXY) has also underpinned the kiwi against the greenback. The DXY has plunged near 97.60 after the announcement of the interest rate decision by the Federal Reserve (Fed). Fed Chair Jerome Powell increased the interest rates by 25 basis points (bps). The announcement expanded the demand for risk-perceived assets significantly. Also, the antipodeans were trading strong when risk-sensitive assets were going through the carnage. Therefore, underperformance from the DXY firmed bids for the kiwi further.

Apart from that, the outperformance from the yearly Gross Domestic Product (GDP) numbers, which were reported on Thursday, strengthened the kiwi further. The yearly kiwi GDP landed at 3.1%, much higher than the previous print of -0.2%.

- EUR/USD retreats from a two-week top, pauses four-day winning streak.

- Bullish MACD, firmer RSI keep buyers hopeful to overcome immediate resistance.

- 50-DMA adds to the upside filters, short-term support line restricts bear’s entry.

EUR/USD dribbles around 1.1090-95 during a sluggish early Asian session on Friday, after rising for the last four days to poke the highest levels since March 02.

The major currency pair’s latest moves are challenged by the 21-DMA level of 1.1100. However, major attention is given to the horizontal line comprising multiple levels marked since late January and a five-week-old descending resistance line, around 1.1120.

Given the firmer MACD and ascending RSI line, not overbought, EUR/USD prices are likely to cross the aforementioned key hurdles.

Following that, the pair buyers may aim for the 50-DMA level of 1.1241 before the mid-February lows near 1.1280 challenge the further upside.

On the flip side, the EUR/USD pair’s fresh downside may initially aim for the 1.1000 threshold before challenging an upward sloping support line from March 07, close to 1.0985 at the latest.

It should be noted, however, that a daily closing below 1.0985 will allow EUR/USD prices to revisit the 1.0900 round figure ahead of directing the bears towards the multi-month low marked earlier March near 1.0800.

EUR/USD: Daily chart

Trend: Further recovery expected

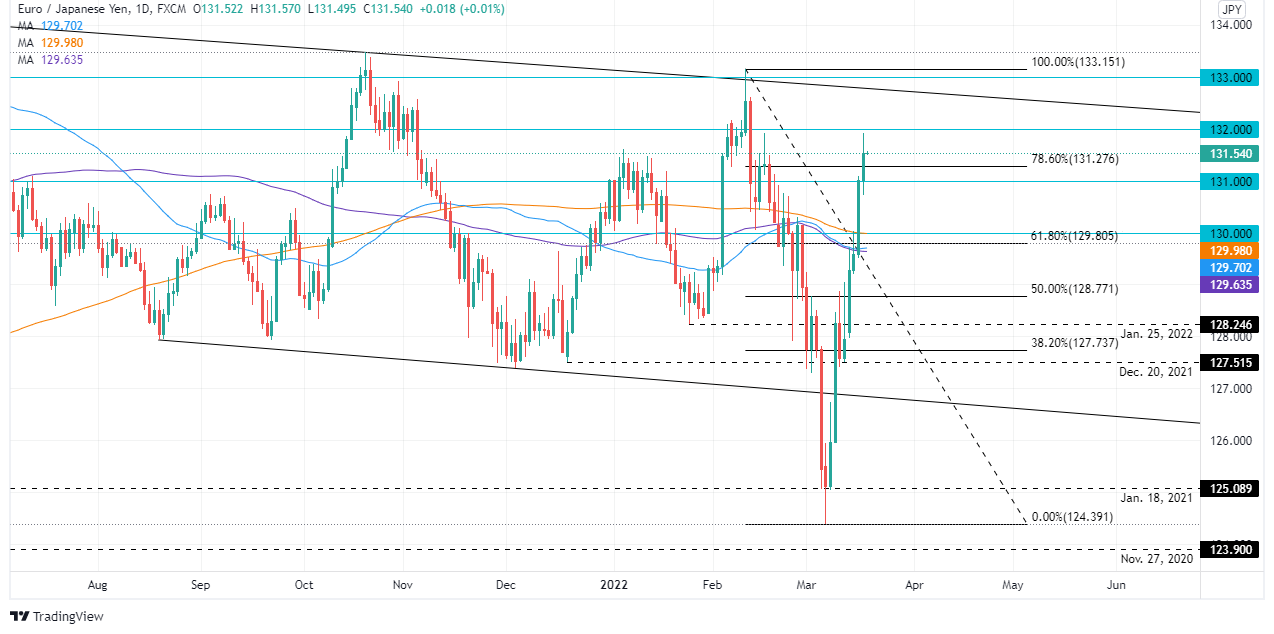

- The EUR/JPY has rallied for four consecutive days in the week, eyeing for a fifth one.

- A positive market mood kept safe-haven peers under pressure.

- EUR/JPY Price Forecast: The path of least resistance is upward, though would need a decisive break above 132.00.

The EUR/JPY weekly rally persists for the fourth consecutive day, up 2.83% as the Asian session is about to begin. The financial market mood reflects an upbeat market mood, though of late, news citing a US intelligence official saying that “Putin is likely to make nuclear threats if the war drags” caused some nervousness on market players, though not enough to spur a sell-off on equities. At the time of writing, the EUR/JPY is trading at 131.54.

Overnight, the EUR/JPY seesawed around the 131.00 mark, though break upwards once North American traders got to their desks, and reached a new YTD high at 131.90, retreating afterward towards 131.50s.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY achieved to break above the 78.6% Fibonacci retracement, which sat at 131.27 and left the Japanese yen vulnerable to further weakness, which indeed happened. The EUR/JPY rallied short the 132.00 figure, though retreated and is trading above 131.52 Thursday’s close.

The EUR/JPY path of least resistance is upwards, and the first resistance would be 132.00. Breach of the latter would expose the downslope trendline around the 132.70-80 area, followed by the February 10 at 133.15.

- AUD/USD pauses after a three-day uptrend near the fortnight high.

- Market’s initial risk-on mood fades amid fears of likely chemical weapon use by Russia, OECD forecasts also weigh on sentiment.

- Aussie jobs report, firmer gold prices and softer USD all favored bulls previously.

- The absence of major data highlights risk catalysts for fresh impulse.

AUD/USD is all set to reverse the previous week’s losses, despite the latest pullback from a two-week high to 0.7380 during early Friday morning in Asia.

The risk-barometer pair rose in the last three consecutive days amid rising hopes of the Ukraine-Russia peace and the US dollar’s failure to cheer Fed’s rate-hike, as well as upbeat Aussie jobs report. Also adding to the pair’s upside momentum was the news suggesting some traders’ receipt of bond coupon payment due this week in USD. However, another credit rating downgrade of Moscow and fears that Vladimir Putin’s forces may use chemical weapons recently probed bulls amid a light calendar.

No clear progress on the 15-point peace plan negotiations between Russia and Ukraine signals an upcoming top-tier gathering of Russian President Putin and his Ukrainian counterpart Volodymyr Zelenskyy, adding to the market's hopes of a solution. However, the recent fears raised by the Western experts that Moscow may contemplate the use of nuclear weapons dim the optimism. Ukraine is brokering a deal for the key meeting, for which an official confirmation is left pending, which if confirmed can help the risk appetite and AUD/USD prices.

Elsewhere market sentiment improved as the US Treasury yields and the US dollar remained on the back foot, following the Fed’s widely anticipated rate hike and Fed Chairman Jerome Powell’s hopes of easy inflation. The same favored gold prices to rise for the second consecutive day and underpin the AUD/USD run-up.

Also, upbeat prints of Australia’s February month jobs report and mixed US data, as well as upbeat Wall Street performance, offered additional help to the Aussie.

It’s worth noting that China’s step back from previously hawkish comments to ease regulatory crackdown on the property and IT companies joined Ukraine-Russia fears to challenge the bulls. On the same line were comments from the Organisation for Economic Cooperation and Development (OECD) that the global economic growth will be more than 1% lower this year due to the Ukraine crisis.

Looking forward, Friday’s economic calendar doesn’t carry any major data/events, which in turn may allow AUD/USD prices to end the week on easy flow. However, the geopolitical and covid updates remain important for the pair traders to watch.

Technical analysis

Although the 200-DMA puts a floor under the AUD/USD prices around 0.7300, upside momentum remains capped below an ascending trend line from January 13, close to the 0.7400 threshold by the press time.

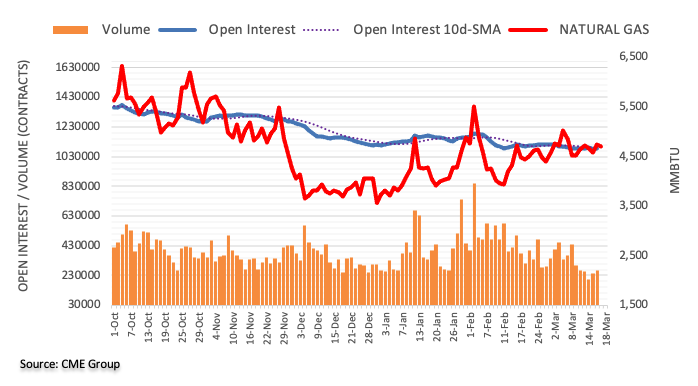

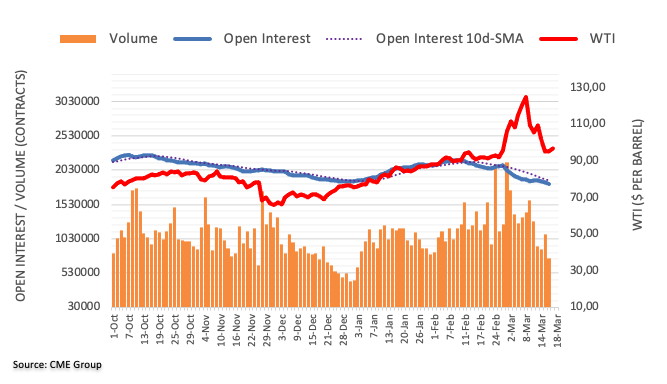

- WTI has climbed near $102.00 as IEA renewed fears of supply shortage.

- The expectation of supply shortage from Russia has already been discounted by investors.

- The OPEC’s positive response to the urge of US President Joe Biden will fix the demand-supply gap.

West Texas Intermediate (WTI), futures on NYMEX, has rebounded sharply after hitting a low of $92.37 on Tuesday. The oil prices have increased around 9% overnight on renewed fears of supply worries due to sanctions on Russia by the Western leaders. Investors should be informed that the Russian economy attracted sanctions from the West on its invasion of Ukraine, three weeks back.

The International Energy Agency (IEA) said three million barrels per day (bpd) of Russian oil and products could be shut in from next month. That loss would be far greater than an expected drop in demand of one million bpd from higher fuel prices. The headline faded the promise of the OPEC cartel, which responded positively to the urge of US President Joe Biden to pump more oil to fill the demand-supply gap.

The statement from the IEA has impacted positively for the oil prices but investors must keep in mind that the previous rally in the oil prices was banked upon the expected shortage of supply from Russia. Therefore, the impact is known to the market and the rebound in oil prices is mere a pullback and not a reversal.

EIA oil inventories

The Energy Information Administration (EIA) reported higher oil stockpiles on Wednesday. The oil stockpiles figure landed at 4.345M outperformed the preliminary estimate of -1.375M and the previous print of -1.863M.

Global rating agency S&P cut Russia rating to ‘CC’ from CCC- while citing difficulties meeting debt payments due on its dollar-denominated 2023 and 2043 Eurobonds on Thursday, per Reuters.

“Russia's payment difficulties stem from international sanctions that reduced its available foreign exchange reserves and restricted its access to the global financial system, markets and infrastructure,” adds S&P per the news.

Key quotes

Although public statements by the Russian Ministry of Finance suggest to us that the government currently still attempts to transfer the payment to the bondholders, we think that debt service payments on Russia's Eurobonds due in the next few weeks may face similar technical difficulties

Russian bonds are hovering at deeply distressed levels in very illiquid trading, with most issues trading less than a handful of times a day, according to Refinitiv data.

FX implications

Although the news adds to the market sentiment, chatters that some on the floor did get coupon payment in dollar eased the risk-off mood. Even so, the Antipodeans witnessed a pullback during early Friday morning in Asia.

Read: Forex Today: Dollar fights back amid talks about chemical weapons

- USD/CHF has detected a pullback from 0.9340 on rising bets over a prolonged war between Moscow and Kyiv.

- Russia claimed that headlines that were aiming for a ceasefire were ‘wrong’.

- The DXY has plunged after activation of 'buy on rumor and sell on news' indicator.

The USD/CHF pair has witnessed a pullback near 0.9340 after a decisive selling pressure from 0.9460 amid renewed fears of ceasefire delay between Russia and Ukraine. The Kremlin reportedly said that news pointing to progress in Ukraine-Russia peace talks was “wrong,” as per Reuters.

Earlier, Ukraine officials reported that the negotiators from Russia and Ukraine are progressing towards a ceasefire as both nations are preparing a 15-point peace plan, which inculcates the clause of ceasefire and withdrawal of Russian military activities in Ukraine. This had brought a steep reversal in the demand for risk-perceived assets. The expansion of risk appetite had weighed pressure on the greenback. However, rising bets over a prolonged war between Russia and Ukraine has renewed fears of dragging sentiment at the backfoot.

Meanwhile, the US dollar index (DXY) has addressed some bids near 97.70, which seems a minor pullback after a steep fall on elevation in Federal Reserve (Fed)’s interest rates by 25 basis points (bps). Fed Chair Jerome Powell and his colleagues have dictated a solution of seven rate hikes for 2022 to corner the galloping inflation. This had activated the ‘buy on rumor and sell on news’ indicator and the DXY eased swiftly.

Going forward, the market participants are likely to dictate their positions on the headlines from the Russia-Ukraine war. But, the US Existing Home Sales data from the National Association of Realtors and speech from Federal Reserve Bank Governor Michelle Bowman will hold significant importance, which are due on Friday.

- The Japanese yen recover some ground vs. the greenback but stays vulnerable above 118.00.

- US equities ended with gains, while the greenback edges lower on an upbeat market mood.

- USD/JPY Price Forecast: The uptrend remains intact but a correction towards the 116.35-117.00 area is on the cards.

USD/JPY pares Wednesday’s gains as it is headed down as the greenback remains soft as New York’s session is about to end amid a positive market mood, which witnessed US equities rallying. At 118.63, the yen strengthens vs. the buck.

Positive market sentiment benefits US equities finishing with gains

US equities finished on the right foot, confirming the upbeat mood, while investors assessed the first rate hike of the US central bank in three years. Alongside that, Russia and Ukraine’s “peace talks” continue, though they failed to deliver what the market players hope, a ceasefire and an agreement that could keep the world in peace. Meanwhile, US Secretary Blinken claimed that Russia could be preparing chemical weapons in a false-flag operation that could justify Russia’s escalation of its attacks on Ukraine.

The headline impact was barely-noticed in the financial markets, though the USD/JPY retreated from highs 118.60s to 118.50.

The US Dollar Index, a gauge of the greenback’s value against a basket of six rivals, grinds lower 0.60%, sitting at 98.02, while the 10-year benchmark note drops two basis points, down at 2.167%, a headwind for the USD/JPY.

Macroeconomic-wise, the US docket featured Initial Jobless Claims for the week ending on March 12, which came at 214K, lower than the 220K expected, while Industrial Production for February showed some strength, rose by 7.5%y/y higher than the 3.6% previous reading.

On the Japanese front, on Friday, the Bank of Japan would reveal its monetary policy decision, widely expected at -0.10%, and would keep supporting the Japanese economy.

Read more: BoJ Preview: Forecasts from seven major banks, a dovish hold

USD/JPY Price Forecast: Technical outlook

The USD/JPY daily chart shows that the pair remains uptrend. Thursday’s retracement is seesawing around January 17, 2017 resistance/support at 118.61, and in the event of recording a daily close above it, would leave the JPY vulnerable for further upside.

If that scenario plays out, the USD/JPY first resistance would be 118.61. Breach of the latter would expose the 119.00 mark, followed by 120.00, and January 25, 2017, high at 121.68.

In the case of a correction, the USD/JPY first support would be 118.00. Once cleared, the next demand zone would be the top-side of the 24-year-old downslope trendline around 117.00, followed by 116.35.

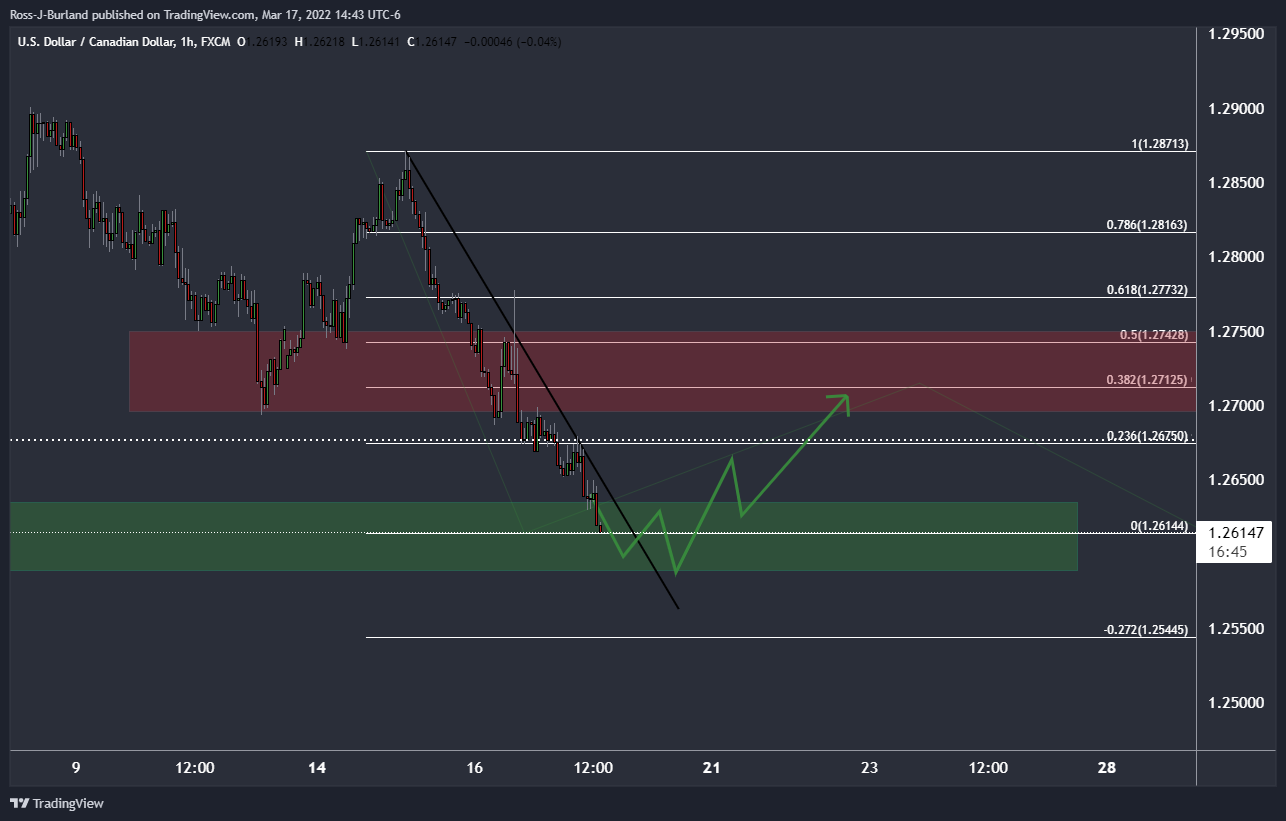

- USD/CAD is moving in on a daily support area.

- The bulls will be looking out for a bullish structure from the lower time frames.

USD/CAD's M-formation is a compelling feature on the daily chart as the price moves in on a key area of what could be a demand area.

USD/CAD daily chart

Should this turn out to be the case, then there will be a strong bias towards the 1.27 area and the Fibonacci scales, starting with the 38.2% ratio and then the 50% mean reversion point near the neckline of the M-pattern and 1.2750.

USD/CAD H1 chart

The hourly chart offers a compelling outlook as well. There are still prospects of lower levels at this juncture for the momentum remains with the bears so far. However, the moment this slows and the trajectory decelerates, traders can be on the lookout for a kindred schematic in the price action as illustrated above.

This illustration forecasts a break of the trendline resistance and retest of the breakout structure prior to a continuation to the upside. This would ultimately equate to a correction of the daily bearish impulse and a reversion towards the M-formation's neckline.

- Despite the broadly risk-on market mood on Thursday, the dovish BoE rate hike prevented GBP/JPY from holding above 156.00.

- Amid rumblings of a Russo-Ukraine peace deal that could hit FX haven like the yen, this may not be enough to prevent GBP/JPY’s rally.

- The BoJ will be deciding on monetary policy during Friday’s Asia Pacific session.

Markets were in a risk-on mood on Thursday with global equities higher across the board, but this wasn’t enough for GBP/JPY. Indeed, the pair was last trading ever so slightly in the red just to the south of the 156.00 level, with sterling struggling to take advantage of risk-on flows in wake of Thursday’s more dovish thank expected BoE rate decision.

The central bank raised interest rates by 25bps as expected, but one of the nine rate-setters unexpectedly voted not to raise interest rates and the bank’s guidance on the prospect for future rate hikes was less hawkish than at its last meeting. Analysts interpreted the dovish hike as a negative for GBP, which, the reasoning goes, can no longer count on the tailwind of being backed by one of the more hawkish G10 central banks. Indeed, the Fed, though a few hikes behind the BoE in this hiking cycle, is looking much more hawkish right now.

Whether that will ultimately be enough to prevent GBP/JPY from advancing is another thing entirely. The BoJ, who decides on monetary policy in the coming hours, is nowhere near moving towards monetary tightening and G10/JPY currency pairs remain highly sensitive to G10/Japan rate differentials. That means if UK rates can maintain recent upside momentum, even if driven by rising inflation expectations, GBP/JPY stands a good chance at continuing to rally.

Though the reporting on the topic has been mixed and conflicting, there seems to be some momentum towards a Russo-Ukraine peace deal. If reached, that would hit JPY and likely give GBP/JPY, which has already rallied more than 3.0% versus earlier weekly lows, further tailwinds. Whether that would be enough to help the pair muster a break above annual highs in the 158.00 area is another thing entirely.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 03:00 (GMT) | Japan | BoJ Interest Rate Decision | -0.1% | -0.1% | |

| 04:30 (GMT) | Japan | Tertiary Industry Index | January | 0.4% | |

| 10:00 (GMT) | Eurozone | Trade balance unadjusted | January | -4.6 | |

| 12:30 (GMT) | Canada | Foreign Securities Purchases | January | 37.56 | |

| 12:30 (GMT) | Canada | Retail Sales YoY | January | 8.6% | |

| 12:30 (GMT) | Canada | Retail Sales, m/m | January | -1.8% | 2.4% |

| 12:30 (GMT) | Canada | New Housing Price Index, MoM | February | 0.9% | |

| 12:30 (GMT) | Canada | New Housing Price Index, YoY | February | 11.8% | |

| 12:30 (GMT) | Canada | Retail Sales ex Autos, m/m | January | -2.5% | 2.4% |

| 14:00 (GMT) | U.S. | Leading Indicators | February | -0.3% | 0.3% |

| 14:00 (GMT) | U.S. | Existing Home Sales | February | 6.5 | 6.1 |

| 17:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | March | 527 |

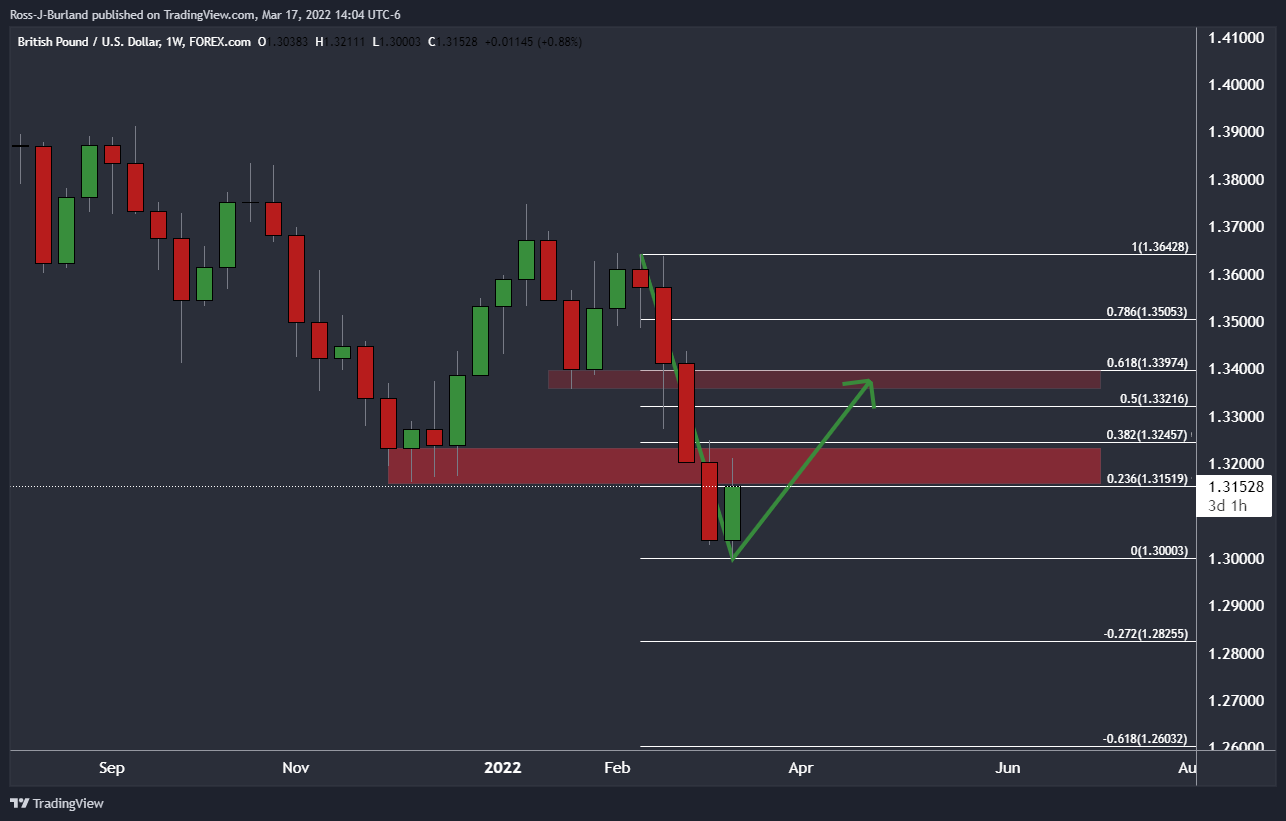

- Bulls hit a 1.3210 high into the BoE meeting in anticipation of a hawkish tilt to the likely 25bps rise in rates.

- The weekly 38.2% Fibonacci retracement level near 1.3245 was a stone's throw away.

GBP/USD is back to trading around flat the day as the US dollar firms within a bearish phase. GBP/USD has travelled with a 1.3087 and 1.3210 range and at 1.3150 currently, the price is 0.03% in the green. The drivers in markets are central banks and the Ukraine crisis.

Markets have been momentarily distracted from the calamity of the Russian invasion by the Federal Reserve and Bank of England central bank meetings. The US dollar has been unwound and the pound has been thrown around by mixed sentiment on the outcomes of both meetings and subsequent reactions in global financial markets.

On Wednesday, there were no tougher surprises from the Fed that might have added to the greenback's weeks-long momentum. Instead, the bar for a hawkish surprise at the Fed was high and given how much was priced in, the US dollar has unwound.

The dollar index (DXY), which measures the US dollar vs. a basket of currencies, fell as much as 0.6% following the Fed. The follow-through Today took the index down 0.8% as traders parse the Fed's chairman's less hawkish statements from the press conference:

- “We do anticipate inflation will move back down. It may take longer than we’d like.”

- “I guess I would say the expectation still is that inflation will come down in the second half of this year, but we still expect inflation to be high this year.”

- We expect inflation to remain high through the middle of the year, begin to come down, then begin to come down more sharply next year.”

The Fed was undeniably hawkish, with the Fed's dot plot suggesting that the committee is looking to overshoot the neutral rate by the end of 2023. However, the convergence of central banks is what has driven the greenback lower which had gained 3% since the start of the Russia-Ukraine war on Feb. 24 and 10% since May 2021.

There had been signs that the pond was on the verge of a comeback earlier in the week when it shot higher against the dollar on strong jobs data. This had supported the prospect of a Bank of England rate hike, while optimism around talks between Russia and Ukraine weighed on the US dollar safe-haven demand. Britain's unemployment rate fell more than expected to 3.9% in the three months to January, official figures showed, while vacancies hit a record high in the three months to February.

However, despite the BoE raising Bank Rate to 0.75% from 0.5%, its third consecutive hike since the COVID-19 pandemic, it softened its language on the need for more increases. This led to a significant drop in the pound on Thursday on the knee-jerk in response to the dovish dissent and cautious tone of the minutes. A deteriorating growth outlook is becoming more of a concern to the MPC which has formed the Policymakers to push back against investors' bets that the Bank Rate will rise sharply to around 2% by the end of this year.

GBP/USD technical analysis

From a weekly perspective, the M-formation is a compelling feature on the charts. The price is currently moving in on the winter 2021 lows near a 23.6% Fibonacci retracement around 1.3150. However, they reached as high as 1.3210 into the BoE meeting in anticipation of a hawkish tilt to the likely 25bps rise in rates. This was close to a 38.2% Fibonacci retracement level near 1.3245. However, the neckline of the M-formation could be appealing which aligns with a golden ratio of the 61.8% target neat 1.34 the figure.

- EUR/USD has been waning from earlier session highs in recent trade and is now back below the 1.1100 level.

- Since Wednesday’s Fed hawkish policy announcement, EUR/USD has gained about 1.0%, flummoxing some analysts.

- Markets seem to currently be being driven by “hopes” for a Russo-Ukraine peace deal, meaning geopolitics remains a key theme.

EUR/USD has been waning in recent trade and recently fell back under the 1.1100 level, meaning that the pair has, for now, failed to break above its 21-Day Moving Average at 1.1108. Nonetheless, the pair is still trading with gains of about 0.6% on the day, as the dollar succumbs to broad weakness despite strong US weekly jobless claims numbers and a better-than-expected Philly Fed Manufacturing Survey released earlier in the session.

Since Wednesday’s Fed policy announcement EUR/USD has gained about 1.0%, despite the fact that the Fed signaled its intention to hike interest rates at all of its remaining rate decisions this year, which was more hawkish than market participants had been expecting. Fed Chair Jerome Powell even warned that the pace of rate increases might be accelerated if deemed necessary and that the Fed could decide to take interest rates well beyond the so-called “neutral” level (in the 2.0-2.5% area) if inflation fails to abate as expected.

Despite all this hawkishness, the buck has failed to benefit, flummoxing some analysts. Clearly, markets are more focused right now on geopolitics and the apparent hope that Russia and Ukraine might reach some sort of peace deal in the near future. Reporting on this front over the last few days has been mixed and conflicting, making it difficult to assign a probability to a peace deal being reached.

But traders have nonetheless used “hope” as an excuse to pair US dollar longs, just as they have used this as an excuse to bid up equities in recent sessions. Whether this momentum can last is the big question and markets are very much expected to remain choppy and headline-driven with a focus on geopolitical headlines in the coming weeks.

Ultimately, while a peace deal might offer EUR/USD some near-term respite, the theme of West/Russia economic decoupling is not going anywhere. A ceasefire in Ukraine doesn’t mean the massive hit to the Eurozone economy as a result of Western sanctions on Russia for its invasion will be magically and immediately negated. 1.1100 is actually a key level of support turned resistance for EUR/USD, and its failure on Thursday to hold above this level might herald some near-term profit taking that could see the pair move back towards 1.10.

What you need to take care of on Friday, March 18:

The American Dollar remained under selling pressure throughout the day, accelerating its slump ahead of the London fix. The greenback was affected by persistent weakness in government bond yields following the hawkish Federal Reserve's announcement on Wednesday.

By the end of the American session, US Secretary of State Antony Blinken said that Russia might be contemplating a chemical-weapons attack, helping the greenback to recover some ground.

The Russian invasion of Ukraine keeps going without progress in peace talks. Financial markets enjoyed some temporal relief on headlines indicating that international bondholders received Russian bond coupon payments due March 16th in dollars. Nevertheless, there's an increased risk to global growth, while the war will only fuel inflationary pressures.

Ukraine and Turkey are working on setting up a meeting between Volodymyr Zelenskyy and Vladimir Putin. US President Joe Biden will talk to his Chinese counterpart Xi-Jinping on Friday to discuss the matter.

The Bank of England hiked the benchmark UK interest rate by 25bps to 0.75% from 0.50%, as had been widely expected, noting that "some further modest tightening might be appropriate in the coming months," a dovish twist that sent GBP/USD to an intraday low of 1.3087. The pair managed to recover some ground and settled at 1.3150.

The EUR/USD pair retreated from an intraday high of 1.1137 and finished the day in the 1.1090 price zone, while USD/CAD plunged to 1.2630 as oil recovered the upside, with WTI ending the day at $103.75 a barrel.

Gold flirted with $1,950 a troy ounce, ending the day at around 1,939. The AUD/USD pair retained most of its intraday gains and trades in the 0.7370 price zone.

The USD/JPY pair consolidated its latest gains, ending the day unchanged at around 118.60.

Bitcoin price maintains uptrend in response to the Federal Reserve's rate hike

Like this article? Help us with some feedback by answering this survey:

- DXY accelerates its reversal from the 99.30 area to test two-week lows at 97.80.

- The USD drops across the board after Fed's monetary policy decision.

- Upbeat employment and construction data have failed to cheer USD buyers.

The greenback is losing ground across the board on Thursday. The US Dollar Index, which measures the value of the USD against a basket of the six most-traded currencies has lost about 0.7% so far today to test two-week lows below 97.80.

The dollar loses ground after the Fed’s rate hike

The USD accelerated its reversal from levels right below 21-month highs at 99.35 following the Federal Reserve’s monetary policy decision. The Bank confirmed investors' expectations raising interest rates by 25 basis points and signaled six more hikes in 2022.

In a clear illustration of the “buy the rumor, sell the fact” adage, the US dollar is giving away gains, pulling back from pre-Fed highs, and going through a steady downtrend, despite the release of a string of upbeat macroeconomic figures.

US Housing starts increased by 1.769 M. in February, beating expectations of a 1.69 M. advance, while Building Permits posted an increment of 1.859 M, beyond the 1.85 M. forecasted by market analysts.

Furthermore, US Initial Jobless Claims have dropped to 214K in the week of March 11 from 229K in the previous week, and the Philadelphia Fed Manufacturing Index has improved to 27.4 in March from 16 in the previous month.

Technical levels to watch

- AUD/USD has rallied as the RBA is expected to move towards policy tightening.

- US dollar is on the backfoot following the Fed.

AUD/USD is stalling in the last hour of recent trade following a strong rally to the upside. The price has jumped from a low of 0.7282 to a high of 0.7393 on the day so far and is printing 1.21% higher at the time of writing.

Firstly, the Federal Open Market Committee's two-day meeting drew to a close on Wednesday and failed to surprise markets with anything more hawkish than what was anticipated. The bar for a hawkish surprise at the Fed was high and given how much was priced in, the US dollar has failed to hold up.

The dollar index (DXY), which measures the US dollar vs. a basket of currencies, fell as much as 0.6% on Wednesday. Today, the index has fallen by almost 0.8% as traders parse the Fed's chairman's less hawkish statements from the press conference:

- “We do anticipate inflation will move back down. It may take longer than we’d like.”

- “I guess I would say the expectation still is that inflation will come down in the second half of this year, but we still expect inflation to be high this year.”

- We expect inflation to remain high through the middle of the year, begin to come down, then begin to come down more sharply next year.”

Meanwhile, the release of stronger than expected February Australian labour data has drawn in further speculation that the Reserve Bank of Australia will be moving towards tighter monetary policy. ''At 4.0%, the February unemployment rate sank to a near 14 year low, while the employment change was double market expectations at 77.4K. The labour report did not contain fresh numbers for wage inflation. However, the tightness of conditions clearly suggests scope for upward pressure on this front,'' analysts at Rabobank explained.

The analysts noted that, last week. the RBA governor Phillip Lowe opened the door a little further towards the possibility of a rate rise this year with his comments that it was ‘plausible’ that rates will rise this year and that it would be prudent to prepare for a move.

''Lowe also expressed concerns about a potential change in the psychologically of inflation. He remarked that in recent years domestic firms have been reluctant to put up prices which in turn made it difficult to raise wages. In the current environment, however, is may be easier to raise both''

- The Australian dollar extends its gains vs. the Japanese yen, up some 2.21%.

- An upbeat market mood keeps risk-sensitive currencies up while safe-haven peers fall.

- AUD/JPY Price Forecast: Upwards, though might be headed to a correction before resuming upwards.

The AUD/JPY risk barometer in the FX space rallies for the second straight day in the week and reached a four-year-high at 87.58 before retreating under 87.50 amid an upbeat market mood. At 87.49, the AUD/JPY reflects the abovementioned, after the US central bank paved the way for higher borrowing costs.

On Wednesday, the Federal Reserve hiked rates for the first time in three years, increasing the benchmark rate by 25 bps, and trimmed its economic growth projections for the remainder of the year, 2023 and 2024. Furthermore, policymakers expect inflation to peak around 4.1%, to decrease near the bank’s target at 2.3% by the end of 2024.

Equities reacted negatively, selling-off. However, it erased those losses and remained trading with gains, while in the FX space, the greenback was buoyant vs. safe-haven peers, while risk-sensitive currencies like the AUD and the NZD rose.

Australia’s strong jobs report boosts the AUD

Earlier In the Asian session, the Australian economic docket featured a strong jobs report for February. The economy added 77.4K jobs, smashing the 37K foreseen by analysts, while the unemployment rate fell to 4%.

Analysts at Rabo bank expressed that “the release of stronger than expected February Australian labour data would appear to tick another box on the country’s journey towards tighter monetary policy. At 4.0%, the February unemployment rate sank to a near 14 year low.”

On the Japanese front, on Thursday, the Bank of Japan would reveal its monetary policy decision, widely expected at -0.10%, and would keep supporting the Japanese economy.

Read more: BoJ Preview: Forecasts from seven major banks, a dovish hold

Worth noting that Citi said that “The focus will be on Governor Kuroda’s view about the recent depreciation of the yen, given media reports that the Kishida administration is increasingly concerned about yen weakness.”

AUD/JPY Price Forecast: Technical outlook

The AUD/[JPY is upward biased and with nothing on its way towards the 88.00 mark. However, due to the steepness of the rally, it could be subject to a mean reversion move or consolidation, as AUD bulls prepare an assault towards 88.00.

Upwards, the AUD/JPY first resistance would be the YTD high at 87.58. Breach of the latter would expose the 88.00 mark, followed by 89.00. On the flip side, in the event of a correction, the AUD/JPY first support would be 87.00, followed by October 21, 2021, high at 86.25, and then the 86.00 mark.

US Secretary of State Antony Blinken on Thursday said he agrees with President Joe Biden that war crimes have been committed in Ukraine, adding that US experts are in the process of documenting and evaluating potential war crimes in Ukraine.

"Intentionally targeting civilians is a war crime," Blinken told reporters, adding that he finds it "difficult to conclude that the Russians are doing otherwise" after the destruction over the past few weeks.

''Russia may be contemplating a chemical-weapons attack,'' he added.

Key comments

''Concerned China is considering directly assisting Russia with military equipment.''

Says he ''hasn’t seen any meaningful efforts by Russia to bring the war to a conclusion through diplomacy.''

''Biden will make clear to Xi, China bears responsibility for any actions it takes to support Russia's aggression.''

''The US will not hesitate to impose costs on China.''

''China is refusing to condemn Ukraine's aggression, seeking to ‘portray itself as a neutral arbiter’.''

''China has the responsibility to use its influence on president Putin to defend international rules and principles.''

''We will not hesitate to impose costs on China.''

''Concerned that China is considering directly assisting Russia with military equipment.''

''I have not seen any meaningful efforts by Russia to bring the war to a conclusion through diplomacy.''

''Putin's remarks yesterday suggest he is moving in the opposite direction from diplomacy.''

''Can confirm death of US citizen in Ukraine.''

- The New Zealand dollar reaches 0.6900 in a three-day rally.

- The kiwi extends gains amid a moderate risk appetite and USD weakness.

- NZD/USD aiming towards 0.6925 this week – Westpac.

The New Zealand dollar has surged about 1% against the USD so far on Thursday, to extend its three-day rally from 0.6730 lows to session highs right at 0.6900.

The kiwi appreciates on post-Fed dollar weakness

The US dollar is losing ground across the board, weighed by a pull-back on US bond yields. The Federal Reserve‘s first interest rate hike in more than three years and its plan to gradually normalize monetary policy has failed to provide support to the USD and the US Dollar Index is nearly 0.7% down on the day, testing two-week lows around 97.80.

The NZD has taken advantage of the US dollar's weakness to appreciate further amid a mixed market mood. Investors remain fairly optimistic about the possibility of seeing some progress in the Russia – Ukraine talks and the US equity markets are posting moderate gains after a mixed session in Europe.

Furthermore, the Chinese Government’s pledge to roll out a new economic stimulus program triggered a fresh impulse to the NZD, as China is one of New Zealand’s main trading partners.

NZD/USD aiming towards 0.6925 this week – Westpac

According to FX Analysts at Westpac, the pair might extend towards 0.6925 this week: “NZD/USD retains upward momentum and is poised to test 0.6875 and then 0.6925 during the week ahead (…) While geopolitical risks will restrain the NZD during the weeks ahead, by year-end we target 0.7100+.”

Technical levels to watch

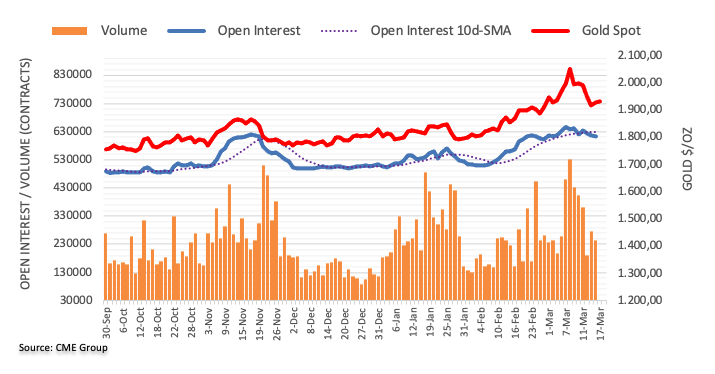

- Gold is moving in on a critical area of resistance on the daily charts.

- The focus is on Ukraine and Russian peace talks after the Fed failed to deliver any hawkish surprises.

The Gold price is firming despite the undeniably hawkish Federal Open Market Committee, with the Fed's dot plot suggesting that the committee is looking to overshoot the neutral rate by the end of 2023. Nevertheless, the US dollar fell on Wednesday considering that there were no tougher surprises that might have added to the greenback's weeks-long momentum.

The dollar index (DXY), which had gained 3% since the start of the Russia-Ukraine war on Feb. 24 and 10% since May, fell as much as 0.6% on Wednesday. On Thursday, the price has fallen by almost 0.8% as traders parse the Fed's chairman's less hawkish statements from the press conference:

- “We do anticipate inflation will move back down. It may take longer than we’d like.”

- “I guess I would say the expectation still is that inflation will come down in the second half of this year, but we still expect inflation to be high this year.”

- We expect inflation to remain high through the middle of the year, begin to come down, then begin to come down more sharply next year.”

The bar for a hawkish surprise at the Fed was high and given how much was priced in, the US dollar has failed to hold up vs the cautious optimism in peace talks.

Ukraine and Russian peace talk optimism, albeit arguably somewhat misplaced, has been playing into the moves which are set to remain the primary driver. Consequently, the euro has benefitted from this also which is a primary driver in the forex space currently, offering a lifeline to the gold bugs that have managed to bust through $1,927 on Thursday as Wednesday's closing price.

Ukraine / Russian peace talk progress, or lack thereof

The hopes of a possible peace deal are faint but are alive. The Financial Times published a ‘15-point plan’ that was allegedly close to being agreed upon that included Ukraine being a neutral state like Switzerland or Austria and having security guarantees from the US, UK, and Turkey.

However, as analysts at Rabobank said, ''this was then almost immediately rejected by Ukraine. Indeed, a spokesperson said that plan reflected only the Russian position.'' Moreover, the analysts highlighted troubling tones and rhetoric from Russia's president, Vladimir Putin, who gave a national speech.

''He claimed Russia was ‘being cancelled’ and spoke of “fifth columns” and “national traitors” who “cannot do without oysters, foie gras, and gender freedoms,” who “by their very nature are located exactly there, not here, not with our people, not with Russia. This is, in their opinion, a sign of belonging to a higher caste, a higher race. Such people are ready to sell their own mother… The collective West is trying to split our society, speculating on the combat losses, on the socio-economic sanctions… and there is only one goal… the destruction of Russia. But I am convinced that… the Russian people will be able to distinguish true patriots from scum and traitors and simply spit them out like a midge that accidentally flew into their mouths. Spit them out on the pavement. I am convinced that such a natural and necessary self-purification of society will only strengthen our country, our solidarity, cohesion, and readiness to respond to any challenges.”''

''Does this sound like a man looking to deescalate, or one who is going to double down to get better terms?,'' Rabobank questioned, pointing to darker days to come for both the ruble, financial markets and world peace in general.

In trade today, a western official said there's a very big gap between the two nation's positions. The official also said those who have seen Putin's remarks would be forgiven for thinking he is not in a mood for compromise.

''Although both sides have pointed to limited progress in peace talks this week, Putin showed little sign of relenting during a televised speech in which he inveighed against "traitors and scum" at home who helped the West, and said the Russian people would spit them out like gnats,'' Reuters reported.

Gold technical analysis

In the pre-Fed analysis on Wednesday, Gold Price Forecast: XAU/USD stalls just ahead of $1,900, driven by Ukraine crisis ahead of the Fed, it was explained that Gold was meeting a support area on the daily chart and was due for a correction from within.

It stated, ''there is room for a continuation to 24 Feb. lows $1,878, but as it stands, a 50% mean reversion from here could be on the cards, targeting the neckline of the M-formation at around $1,960/70.''

Gold live market, daily chart

As illustrated, the price has indeed moved in toward the aforementioned resistance area and according to the prior analysis, there is from for further mitigation of the imbalance of price where the counter trendline meets the prior lows near a 50% mean reversion around $1,960. Should this area of resistance hold, then bears could be attracted by the discount which could equate to a test of $1,880 which is the last defence for a downside continuation.

- The euro breaches Fibonacci retracement resistance to confirm its bullish momentum.

- The next upside targets are 1.0420 and 1.0465.

The euro has rallied further against the Swiss franc on Thursday, extending its uptrend from early March lows right below parity, to the 1.0400 area so far.

The pair has reaffirmed its uptrend earlier today after the confirmation above the 61.8% Fibonacci retracement level of the February-March decline, at 1.0365, which has acted as support to attack the 1.0400 area at the time of writing.

With the euro strengthening across the board amid a moderate optimism about the possibilities of some progress in the peace talks between Ukraine and Russia and the EUR/CHF standing comfortably above the 50-day SMA, the next upside targets are the 100-day SMA at 1.0420 and February 21, 22 and 23 highs at 1.0465.

Once above here, the pair might take some time before attempting an attack to February 16 high at 1.0555.

On the downside, a bearish reversal below the mentioned Fibonacci retracement level, at 1.0365 might extend towards 1.0290/00 (March 10 high, 50% Fib. Retracement) before testing March 11 lows at 1.0195.

EUR/CHF daily chart

Technical levels to watch

- GBP/USD has recovered from post-BoE lows in the 1.3100s and is back in the green above 1.3150.

- The pair hasn’t yet been able to get back to pre-BoE levels at 1.3200 as traders mull the dovish meeting.

- BoE dovishness coupled with headwinds to the global economy as a result of the Russo-Ukraine conflict will continue to weigh.

Whilst the pair has regained a modicum of poise in recent trade after rebounding from support in the 1.3100 level since the start of US trade to back above 1.3150 amid a weakening US dollar, GBP/USD has been unable to recover back to pre-dovish BoE hike levels in the 1.3200 area. Nonetheless, at current levels in the 1.3160 region, cable is back to trade higher by 0.1% on the day and is no longer the worst-performing G10 currency of the day, as it was in the immediate BoE aftermath. The US dollar has taken that crown in recent trade, despite strong US weekly jobless claims report and an inflationary March Philly Fed survey results which reaffirmed the economic themes that motivated the Fed to turn more hawkish on Wednesday.

Despite recent USD weakness, analysts have cooled on GBP in wake of the latest BoE policy announcement and this may impact cable’s ability to get back above 1.3200 this side of the weekend. “In contrast to both the Fed and the ECB, the BoE delivered a relatively dovish message to investors today,” said a senior analyst at Aviva Investors, adding that “there was more of a focus on slower growth and its impact on households going forward”. Investors also interpreted the vote of one BoE rate-setters voted to leave rates on hold and the newly worded guidance on further rate hikes as more dovish than expected.

Money markets have pared back on BoE tightening bets for 2022, and now see the bank hiking rates another four times in 2022 rather than another five as was expected before the policy announcement. Many analysts see these tightening expectations as overly hawkish and out of sync with the BoE’s new statement that “some further modest tightening might be appropriate in the coming months”. Going forward it thus seems likely that dovish BoE vibes will act more as a headwind to GBP, particularly versus the USD amid the more hawkish Fed. With the pair failing to get back above a key area of resistance in the upper 1.3100s now for a second successive weak, traders might now be upping bets on a move back to annual lows in the 1.3000 area.

Of course, geopolitics will be a key driver of short-term sentiment as has been the case over the last few weeks. Reports regarding the possibility of a Russo-Ukraine peace agreement have been mixed/conflicting. Whilst a peace deal (not most analysts base case) would be a positive surprise that could boost GBP/USD in the short-term (via USD weakness/GBP strength amid risk appetite), it’s unclear whether this would lead to a lasting rebound. Certainly, the West is going to continue with efforts to economically decouple with Russia (via sanctions, etc.) meaning that severe disruption to the global economy (to which the UK is more exposed versus the US) isn’t going to be cured with a peace deal.

GBP/USD

| OVERVIEW | |

|---|---|

| Today last price | 1.3166 |

| Today Daily Change | 0.0017 |

| Today Daily Change % | 0.13 |

| Today daily open | 1.3149 |

| TRENDS | |

|---|---|

| Daily SMA20 | 1.3309 |

| Daily SMA50 | 1.3458 |

| Daily SMA100 | 1.3432 |

| Daily SMA200 | 1.361 |

| LEVELS | |

|---|---|

| Previous Daily High | 1.3156 |

| Previous Daily Low | 1.3034 |

| Previous Weekly High | 1.3246 |

| Previous Weekly Low | 1.3028 |

| Previous Monthly High | 1.3644 |

| Previous Monthly Low | 1.3273 |

| Daily Fibonacci 38.2% | 1.311 |

| Daily Fibonacci 61.8% | 1.3081 |

| Daily Pivot Point S1 | 1.307 |

| Daily Pivot Point S2 | 1.2992 |

| Daily Pivot Point S3 | 1.2949 |

| Daily Pivot Point R1 | 1.3192 |

| Daily Pivot Point R2 | 1.3235 |

| Daily Pivot Point R3 | 1.3314 |

- The Mexican peso keeps the greenback under pressure gains the week 2.24%.

- Risk appetite increases in the session, as portrayed by global equities rising.

- USD/MXN Price Forecast: Neutral, but the path of least resistance is downwards, though facing solid support around 20.50.

The Mexican peso rallies versus the greenback during the North American session, after the first rate hike in three years by the US central bank, which appears to be ignored by USD/MXN traders, which pushed the pair from around 21.00 towards the 20.50s area. At 20.5229, the USD/MXN reflects a risk-on sentiment.

An upbeat market sentiment portrayed by global equities keeps risk-sensitive currencies bid. In the FX space, the AUD, NZD, and the CAD extend gains, followed by the high-interest rate Mexican peso, which appreciated on ebbs and flows, benefitted by the rising Mexican 10-year bond, thirty-three basis points, up at 8.861%.

Meanwhile, the US Dollar Index, a gauge of the greenback’s value against a basket of six rivals, continues its free-fall, down 0.68%, sitting at 97.728, a tailwind for the USD/MXN.

USD/MXN Price Forecast: Technical outlook

Overnight, the USD/MXN seesawed in the 20.60-70 area until the North American open, when the pair pierced under March 2 daily low at 20.5783, reaching a daily low at 20.5060.

That said, the USD/MXN bias is neutral. However, in the last two days, the pair broke below the 50 and 100-day moving averages (DMAs), shifting the bias from neutral-upwards as the spot price approaches the 200-DMA at 20.4100. The USD/MXN path of least resistance is downwards, and the Mexican peso's first support would be 20.5000. Breach of the latter would expos ethe 200-DMA at 20.4100, followed by the February 23 YTD low at 20.1558.

Upwards, the USD/MXN first resistance would be the 100-DMA at 20.5660. Once cleared, the next resistance would be the 50-DMA at 20.7019, and the 21.00 mark.

- The euro bounces up strongly to retest six-week highs at 0.8455.

- BoE's dovish hike sends the pound lower.

- EUR/GBP seen around 0.8300 for the coming months – ING.

The euro has bounced up strongly against the British pound on Thursday to resume the near-term uptrend from the 0.8200 area, aiming for a fresh test to the six-week high at 0.8455.

BoE’s dovish hike hurts the pound

The sterling is losing momentum against its main rivals after the Bank of England’s monetary policy decision. The BoE has hiked rates by 25 basis points, to 0.75, for the third consecutive time, but it has struck a more cautious tone, which has undermined the pound.

The bank said that consumer inflation, now at 30-year highs, might reach levels beyond 8% this year and warned that the Russia - Ukraine conflict is likely to disrupt the global supply chain, increasing significantly the uncertainty around the economic outlook.

On the other end, the euro is showing strength, fuelled by the optimism about some progress in the peace talks in Ukraine that might lead to a cease-fire over the coming days.

EUR/GBP seen around 0.8300 over the coming months – ING

Looking forward, FX Analysis Team at ING does not see the euro appreciating significantly in the first half of the year: “Should the BoE continue to prefer a strong GBP to insulate against higher natural gas prices and the run-up in CPI to 8% this April, it could choose to delay a rate protest until later in the year(…) Our preference is for GBP holding gains through the first half of this year – and EUR/GBP continuing to trade near 0.83. If we are wrong and the rate protest comes today, EUR/GBP could spike to the 0.8480/8500 area.”

Technical levels to watch

- EUR/JPY is pushing higher for a fifth successive session and is eyeing a test of 132.00.

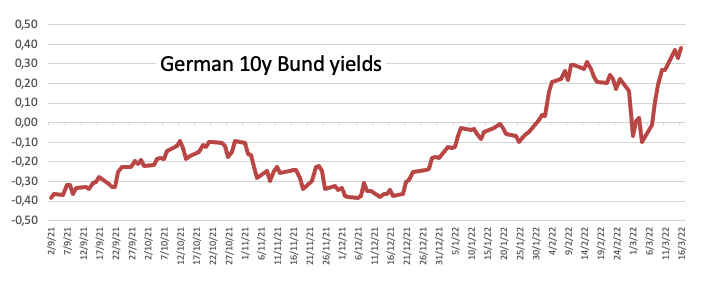

- The pair’s more than 3.0% rally in the last five days comes as Eurozone bond yields push to multi-year highs.

- As long as geopolitical developments don’t deter the ECB from tightening in Q4, EUR/JPY has a shot at 2021 highs.

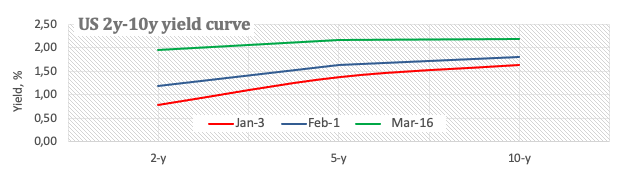

As Eurozone bond yields maintain their recent upwards trajectory to reflect recent more hawkish than expected policy announcements from both the ECB (last week) and Fed (this week), as well as an apparent realisation that the current inflationary environment will require higher longer-term interest rates, an ongoing widening of Eurozone/Japanese yield differentials continues to favour EUR/JPY. The pair is currently on course to post its fifth successive gain during which time it has rallied more than 3.0% from around 127.50 to current levels above 131.50. EUR/JPY bulls will be eyeing a test of the 132.00 level and a break above here could see the pair challenge earlier yearly highs above 133.00.

After EUR/JPY broke back above an important long-term trendline which has provided both support and resistance in recent weeks in the 129.00 area on Monday, technicians will likely not have been overly surprised to see the pair extend to the upside. Technicians have noted an important downtrend that links the Q2 2021, Q4 2021 and Q1 2022 highs as a key level to keep an eye on. It will likely offer substantial resistance in the upper 132.00s. Given that Eurozone bond yields are at multi-year highs (meaning EZ/Japan rate differentials are also at multi-year highs) some might interpret that as suggesting that there is plenty of room for further EUR/JPY upside in the near term.

A break above this long-term downtrend, as well as above the previous annual high just above 133.00 could open the door to a run towards 2021 highs above 134.00. As long as developments in the Russo-Ukraine war don’t deter the ECB from its current policy path of ending QE in Q3 and starting rate hikes in Q4, EUR/JPY may well maintain a medium-term upwards trajectory. That makes watching geopolitical developments of paramount importance for traders. The reporting on this topic has been mixed and conflicting, but there appears to be some momentum towards a peace deal being reached – if peace can be reached, that would only be bullish for EUR/JPY.

- The dollar pulls back from six-year highs at 119.00.

- The Japanese yen has lost about 3.5% over the last eight days.

- USD/JPY might rally as high as 125.00 – ING

The US dollar seems set to put an end to an eight-day rally on Thursday, as the pair turned down from multi-year highs at 119.00 retreating to session lows near 118.40 so far.

The US dollar treads water after Fed’s rate hike

The dollar is losing ground across the board as the market digests the rate hike and Federal Reserve’s plan to gradually increment borrowing released on Wednesday. The US Dollar Index has dropped about 0.5% so far today, to week lows right below 98.00.

The Japanese yen is taking some breather after having plummeted nearly 3.5% in less than two weeks. The monetary policy divergence between the Federal Reserve and the Bank of Japan boosted the gap between the US and Japanese yields ahead of Fed’s meeting boosting a steady USD appreciation.

From a wider perspective, however, the pair remains steady near Wednesday’s peak, with the investors awaiting the Bank of Japan’s monetary policy decision, due on Friday. The BoJ is widely expected to maintain its ultra-expansive policy which, in a context of generalized monetary tightening in most of the major central banks, might provide a fresh impulse to the US dollar.

USD/JPY might rally as high as 125.00 – ING

FX Analysts at ING expect the pair to resume its uptrend aiming to levels well past the 120.00 mark: “The clearest trend will be a higher USD/JPY, where a dovish Bank of Japan and Japan's large negative income shock from the fossil fuel rally will send USD/JPY to 120 and possibly 125 later this year. We also think the dollar can hold/build on gains against European FX too.”

Technical levels to watch

- The New Zealand dollar keeps the rally intact, up 1.29% in the week.

- A mixed market mood keeps the greenback under pressure, with the US Dollar Index down 0.74%.

- Russia-Ukraine fighting endures, while discussions fail to provide a ceasefire or truce.

- NZD/USD Price Forecast: Neutral upward biased, but faces a wall of resistance around 0.6900-25.

The NZD/USD rallies for the third straight day, erasing most of last week’s losses amid a mixed market sentiment, courtesy of geopolitical concerns, which adds upward inflation pressure, despite efforts of central banks increasing borrowing costs to tame it. At press time, the NZD/USD is trading at 0.6895.

European and US stock indexes whipsaw in the North American session, reflecting investor sentiment. In the FX space, the greenback aims lower, down 0.74%, below the 98 mark at 97.89, while US Treasury yields slide, led by the 10-year benchmark note, down two and a half basis points, sitting at 2.160%, a tailwind for the NZD/USD.

Russia-Ukraine faltering to reach an agreement

Elsewhere, Russia-Ukraine tussles keep grabbing headlines as discussions continue between Kyiv and Moscow. However, they have failed to deliver a “fast-track” solution to the conflict, with Ukraine’s President Zelensky saying that talks are challenging. At the same time, Ukraine’s Defense Minister stated that there is nothing to satisfy Ukraine’s posture. On the Russian front, the Kremlin said that their delegation is putting “colossal energy” into those discussions.

Putting this aside, New Zealand reported 2021’s Q4 GDP, which rose by 3%, short of the 3.2% estimated. On the US front, the US central bank hiked borrowing costs 0.25% and expected to increase the bank’s benchmark rates on at least six occasions by the end of the year. All of the Fed’s monetary policy meetings would be subject to hiking rates, at least 25 bps each.

In the same meeting, Fed board members updated their forecasts. Policymakers expect core PCE to peak around 4.1% before falling to 2.3% in 2024. Regarding growth, the board expects the GDP at 2.8% by year’s end, lower than the 3.8% estimated in December, while the balance sheet reduction would be discussed at “coming meetings.”

Earlier in the North American session, the US docket featured Initial Jobless Claims for the week ending on March 12, which came at 214K, lower than the 220K expected, while Industrial Production for February showed some strength, rose by 7.5%y/y higher than the 3.6% previous reading.

NZD/USD Price Forecast: Technical outlook

Overnight, the NZD/USD traded on top of the 200-hour simple moving average (SMA), seesawed around the 0.6820-50 range, surging higher near the London Fix, though falling short of breaking above the 0.6900 mark.

The NZD/USD bias is neutral-upwards and is approaching solid resistance around the 0.6900-13 area, which lies the psychological zero resistance and the 200-day moving average(DMA).

Upwards, the NZD/USD first resistance would be 0.6900-13. Breach of that region would sponsor amove towards the YTD high around 0.6925, followed by the 0.7000 figure.

- The euro has accelerated its recovery to reach levels right above 1.1100.

- Hopes of a cease-fire in Ukraine and USD weakness are boosting the euro.

- EUR/USD is likely to meet strong resistance at 1.1100/20 – ING.

The euro has accelerated its recovery from week lows at 1.0900, to reach session highs right above 1.1100 with the US dollar losing ground across the board.

The euro appreciates with the US dollar losing ground

The common currency keeps building up on Thursday, favored by a moderate optimism about an agreement between Ukraine and Russia that might lead to a cease-fire in the battered eastern European country.

Beyond that, ECB President Lagarde has assured earlier today that inflation will stabilize at 2% in the medium-term while ECB's chief economist, Philip Lane, confirmed that the current inflationary pressures are temporary. These comments seem to have eased concerns after the release of higher-than-expected consumer prices figures released earlier today.

Furthermore, the US dollar remains on the back foot on Thursday as the market seems little impressed by the Federal Reserve’s interest rate and the monetary policy normalization plan disclosed on Wednesday.

US Treasury bond yields, which had reached multi-year highs right before the Fed’s meeting, have pulled back, weighing on the US dollar’s demand. The US Dollar Index, which measures USD’s value against a basket of the most traded currencies, has retreated about 0.5% so far today to hit weekly lows below 98.00.

EUR/USD faces tough resistance at 1.1100/20 – ING

According to the FX Analysis team at ING the pair might find strong resistance right above 1.1100 area: “After the Fed's success with a hawkish message and some suggestion from sourced reports that the ECB was unhappy with EUR/USD sub 1.10, ECB speakers may be happy to support expectations that the deposit rate is raised 35-50bp by the end of the year (…) EUR/USD could nudge a little firmer on a risk-on day, but we favor gains to stall ahead of the 1.1100/1120 area.”

Technical levels to watch

- US equities have traded in mixed fashion thus far on Thursday, having been buffeted by mixed Russo-Ukraine negotiations headlines.

- The S&P 500 is a tad higher on the day in the 4360s and eyeing a test of 4400.

- With the Fed meeting and US data out of the way, investor focus will switch back to geopolitics and China.

US equities have traded in mixed fashion thus far on Thursday, having been buffeted in recent hours amid conflicting reporting regarding the state of Russo-Ukraine peace talks. The major US indices are currently trading in mixed fashion, with the S&P 500 very slightly in the green in the 4360s after an earlier dip below 4350 was bought into. The Nasdaq 100 index is modestly lower with the 14,000-level capping the price action for now and the Dow is flat just above 34,000. That comes after the three indices posted respective 2.2%, 3.7% and 1.6% rallies on Wednesday as equity investors took the first 25bps rate hike from the Fed in three years and hawkish guidance in their stride.

Analysts said that the positive reaction to the hawkish Fed meeting likely reflects the fact that investors deem such a policy shift from the Fed (to signaling six more 25bps hikes in 2022 and four in 2023) as appropriate given the economic backdrop of hot inflation and a tight labour market. Thursday’s US data in the form of a robust weekly jobless claims report and stronger than expected Philly Fed March survey reinforced these economic themes and thus didn’t impact market sentiment.

With the Fed meeting out of the way and no more important US data releases for the rest of the week, investor focus will switch back onto geopolitics, which suggests markets will remain choppy and headline-driven. Asia markets are also worth watching with indices having seen considerable volatility as a result of initial fears about a widespread Covid-19 outbreak but also optimism related to new pledges for economic support from Chinese officials. So long as news regarding Russo-Ukraine peace talks and the Chinese Covid-19 outbreak doesn’t take a substantial turn for the worse, the S&P 500 probably has a good shot at hitting 4400 again and testing earlier monthly highs around 4415.

- The Australian dollar rallies for the third consecutive day to levels past 0.7350.

- The aussie appreciates on the back of bright employment data and USD weakness.

- The AUD/USD is about to test resistance at 0.7365.

The Australian dollar has extended its recovery from Tuesday’s lows at 0.7165 to reach fresh one-week highs right above 0.7350 favored by broad-based US dollar weakness. The pair has appreciated nearly 2.5% in a three-day rally to erase the reversal witnessed in the previous two days.

Upbeat employment data and USD weakness boost the AUD

The AUD/USD has managed to continue rallying on Thursday in a somewhat sourer market mood as the positive employment data has spurred fresh hopes of monetary tightening by the Reserve Bank of Australia.

The number of employed workers increased by 77K in February, according to the Australian Bureau of Statistics, well beyond the 37K increase expected by the market, while the unemployment rate dropped to 4%. These figures have boosted hopes that the Australian Central Bank might consider accelerating its monetary normalization plans, ultimately increasing demand for the AUD.

On the other hand, the US dollar has been trading moderately lower across the board, with US bond yields retreating from highs as the markets digest Fed’s rate hike. Investors are showing little enthusiasm for the Central Banks’ plans to gradually increase borrowing costs expressed after Wednesday's monetary policy meeting.

AUD/USD is approaching resistance at 0.7365

The pair is now heading toward the 0.7365 area where it might find some resistance at the March 10, 11 highs, following a three-day rally.

Once above 0.7365, the next potential target would be 0.7440 (March 7 high) before aiming for October 2021 highs at 0.7555.

On the downside, a bearish reaction from current levels might seek support at the 200-day SMA, now around 0.7300 and below there, 0.7240 (March 8 low) and 0.7165 (March 15 low).

Technical levels to watch

- Oil prices have seen a strong rebound on Thursday, with front-month WTI futures surging nearly $8.0 to the $102s.

- While prices are still $27 below last week’s highs, Thursday’s rally may signal an end to the recent bear run.

Oil prices have seen a strong rebound on Thursday, with front-month WTI futures surging nearly $8.0 (or over 8.0%) from under $95.00 per barrel to current levels in the $102.00s. That means WTI has now been able to erase more than 50% of this week’s losses that at one point saw it trading more than $15.0 lower in the $93.00s and is now down under $7.0 on the week. That still leaves prices about $27 below last week’s highs, but Thursday’s rally may signal an end to the near-non-stop selling pressure of the past six sessions.

As for the catalysts behind Thursday’s rally, there hasn’t been one clear headline or factor driving the rebound, but analysts have put forth a number of explanations. Firstly, uncertainty regarding whether or not Russo-Ukrainian peace talks can actually come up with a ceasefire to end the increasingly brutal war remains highly elevated. Conflicting reports with various news outlets citing different sources make it difficult for investors to unpack what’s actually going on.

That is helping to keep a high degree of geopolitical risk premia priced into energy markets amid uncertainty about what will happen to Russia’s vast exports. On this topic, the International Energy Agency on Wednesday warned that while higher oil prices will probably destroy about 1M barrels per day in demand, the loss in Russian supply would be far greater. Morgan Stanley came to a similar conclusion in a note out on Thursday, with analysts at the bank predicting a 1M barrel per day drop in Russian oil output from April which would more than offset a 600K barrel per day downward revision to global demand.

Separately, concerns about lockdowns in China eroding oil demand there have eased a touch as Covid-19 cases start to fall back again and sentiment in Asia markets has been given a massive boost by recent announcement from Chinese officials of new policy support. “China fears” were a big reason why WTI fell back under $100 per barrel earlier in the week and so as they fade, it makes sense to see oil rebounding.

As for what lies ahead for oil markets, geopolitics remains the main big risk. If a peace deal does suddenly look highly likely and is on the cusp of being announced, this is a big downside risk for prices, which could be easily sent tumbling back below earlier weekly lows in the $93.00s. Meanwhile, Covid-19 risk in China remains worth monitoring to see whether authorities there can get things back under control.

- DXY remains depressed and closer to 98.00.

- The Philly Fed Index surprised to the upside in March.

- Weekly Claims rose by 214K in the week to March 12.

The greenback remains unable to ignite even the smallest of the rebounds and drops to daily/weekly lows in the boundaries of the 98.00 mark when gauged by the US Dollar Index (DXY).

US Dollar Index under pressure on risk-on mood

The index extends the leg lower to 5-session lows on Thursday and pokes with the 98.00 mark in a context still favourable to the riskier assets, which are in turn propped up by hopes of an end to the Russian invasion of Ukraine.

Further selling pressure in the buck also comes from the corrective downside in US yields along the curve following post-FOMC highs recorded on Wednesday.

Auspicious results from the US data space did not help the dollar either after Initial Claims rose by 214K in the week to March 12 and the Philly Fed Index improved to 27.4 in March. Further data saw Housing Starts expand 6.8% MoM in February, or 1.769M units, and Building Permits contract 1.9% MoM, or 1.859M units. Additionally, Industrial Production expanded 0.5% MoM in February and 7.5% from a year earlier and Capacity Utilization eased a tad to 77.6%.

What to look for around USD

The index corrects further south following the start of the tightening cycle by the Federal Reserve at its meeting on Wednesday. Hopeful news from the geopolitical landscape could be weighing on the buck along with the better tone in the risk-associated complex, all putting DXY under extra pressure. Looking at the broader picture, bouts of risk aversion – exclusively emanating from Ukraine - should prop up inflows into the safe havens and lent legs to the dollar at a time when its constructive outlook remains propped up by the current elevated inflation narrative, the Fed’s lift-off and the solid performance of the US economy.

Key events in the US this week: Building Permits, Housing Starts, Philly Fed Index, Initial Claims, Industrial Production (Thursday) – CB Leading Index, Existing Home Sales (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Futures of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is losing 0.28% at 98.12 and a break above 99.29 (high Mar.14) would open the door to 99.41 (2022 high Mar.7) and finally 99.97 (high May 25 2020). On the flip side, the next down barrier emerges at 98.06 (weekly low Mar.17) followed by 97.71 (weekly low Mar.10) and then 97.44 (monthly high Jan.28).

The Bank of Japan (BoJ) will hold its policy meeting on Friday, March 18 at 03:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of seven major banks.

The BoJ is set to maintain its current accommodative policy stance while the assessment of growth and inflation is in focus.

Standard Chartered

“We expect the BoJ to keep the policy rate on hold. Japan is not currently under inflationary pressure, and considering the external risk, it is likely to normalise monetary policy only gradually.”

ING

“The BoJ is expected to keep its policy rate unchanged. Inflation has gone up rapidly over the past few months, but still remains below the BoJ’s target and lags the global upward trend.”

TDS

“The BoJ meeting is likely to be a non-event though there is a strong likelihood that the Bank downgrades its economic assessment. BoJ stance on increased inflationary pressure in focus.”

BBH