- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 17-02-2022

- USD/JPY hit as investors raise bets on the Japanese yen over the greenback amid the risk-aversion theme.

- The DXY struggles to find any direction after the US Initial Jobless Claims surge

- Japan’s National Consumer Price Index will be under the radar for further guidance.

The USD/JPY pair has sensed selling pressure from 115.00 in the early Asian session. It seems that the pair is continuing the negative cues of Thursday. USD/JPY has been beaten hard by the bears on Thursday, as the market participants underpin the Japanese yen over the greenback after the geopolitical tensions escalate.

The rising geopolitical fears over the Russia-Ukraine tussle have raised the demand for safe-haven assets to coincide with the risk-aversion theme. Investors are nervous over the obscurity of the Russia-Ukraine fears and are banking upon defensives to combat the uncertainty.

Meanwhile, the US dollar index (DXY) is trading in a limited dimension within 95.70-95.88 on weak performance from the US Initial Jobless Claims (IJC) data by the Department of Labor. The US IJC remains at 248k, well above the market estimates and the previous print has modestly diminished the highly likely hawkish stance from the Federal Reserve (Fed) in the March’s Monetary Policy Committee (MPC) meeting.

The headlines from the ongoing geopolitical tensions between Russia and Ukraine will keep USD/JPY active as investors will continue to adjust their positions as per the developments. Adding to that, the Statistics Bureau of Japan will report yearly National Consumer Price Index (CPI) data, which is likely to grind lower at 0.6% against the previous print of 0.8%.

USD/JPY Technical Analysis

On a four-hour scale, USD/JPY had slipped below Monday’s low at 115.01, which was also tested last week. This would act as a resistance for the next trading sessions and more likely the pair would establish lower. The Relative Strength Index (RSI) (14) has tumbled below 40.00, showing no signs of divergence and oversold.

USD/JPY four-hour chart

-637807363967224341.png)

- The AUD/JPY advances so far in the week, some 0.30%.

- Risk-aversion in the financial markets caused the AUD/JPY retracement from 83.00, as tensions in Ukraine/Russia increased.

- AUD/JPY is neutral biased, but failure at 83.00 seems to form a double-top that would target 80.00.

The AUD/JPY retreats from weekly tops in the North American session, down some 0.59%. At press time, the AUD/JPY is trading at 82.57. Risk-aversion looms the financial markets. Russia/Ukraine tensions remain “high” as diplomats have been unable to reach an agreement in their negotiations.

The AUD/JPY rallied 150 pips in the week, despite a risk-off market mood in the financial markets, led by global equities. However, on Thursday, a headline of the Russia/Ukraine conflict caused a 90-pip drop in the pair in one hour.

AUD/JPY Price Forecast: Technical outlook

Timeframe: Daily chart

The AUD/JPY is neutral biased, though slightly tilted to the upside, by the location of the daily moving averages (DMAs) below the exchange rate, except for the 100-day moving average (DMA) at 82.72. However, the failure of AUD/JPY bulls at 83.00 exposed the pair to downward pressure.

Also, the confluence of the last two cycle highs around 83.00 depicts the formation of a possible “double-top” that will target 80.00, but it would find some hurdles on the way south.

The AUD/JPY first support would be the confluence of the 50 and the 200-DMA at 82.33-36 area. Breach of the latter would expose 82.00, followed by February 14 daily low at 81.55, and the January 28 daily low at 80.36.

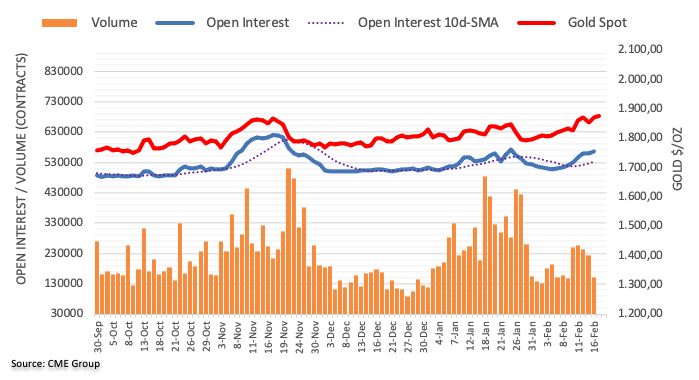

- Gold holds near the fresh cycle highs of $1,900, driven higher by the Russian and Ukraine crisis.

- US dollar pinned to the floor as markets reassess Fed's tightening path.

The price of gold rallied on Thursday and was coming to a close near the highs of the day of $1,901 at $1,898, ending up over 1.54%. The uncertainty surrounding the Russian NATO crisis over Ukraine appears to be generating solid demand for gold as a haven, despite the risks to the yellow metal of substantially higher real rates amid a hawkish central bank regime.

The US dollar index was little changed on Thursday though as investors weighed comments made by NATO allies and officials that sent the message to the market that war appeared imminent after shelling on the Ukraine front line. Against a basket of its rivals (DXY), the US dollar was ranging between 95.71 and 96.10. However, stocks on Wall Street were battered with the S&P 500 losing 2.1% to 4,380.26, the Nasdaq Composite sliding 2.9% to 13,716.72 and the Dow Jones Industrial Average was falling 1.8% to 34,312.03, its biggest loss in 2022.

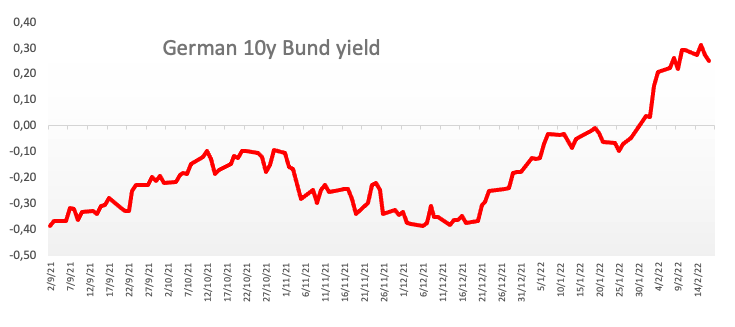

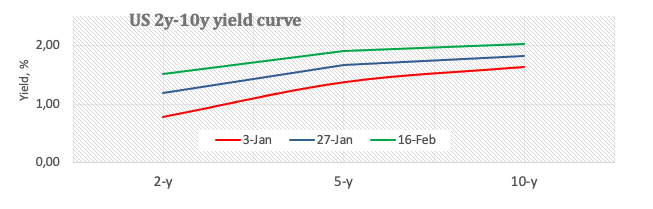

Investors continue to see a high probability of a 50 basis point hike at the Federal Reserve's March meeting. However, money markets were pricing in a 72% likelihood of a 50 bps rate hike next month compared to 80% at the start of the week which likely weighed on the greenback. The 10-year US Treasury yield also sank 8 basis points to 1.96%.

Are trend followers accumulating at the top?

This was the title given to a piece written by analysts at TD securities who, at the core, are bearish on gold.''Precious metals funds are finally seeing an increase in fund flows year-to-date, as participants accumulate positions since early February to hedge against geopolitical risk. How sustainable is this demand if this geopolitical risk event subsides?'' the analysts wrote. ''This question is key to our view for gold prices to consolidate under the weight of a hawkish Fed.''

''Traders should recall that geopolitical risk also carries a heavy time decay, suggesting as the Russia risk premium could be wiped clean as soon as next week if troops head home. Ultimately, we still don't find evidence of sustained buying behaviour, suggesting that gold could simply have been buoyed by a large one-off purchase, followed by a safe-haven bid amid these tensions, which has catalyzed a CTA buying program.''

Gold technical analysis

The price is attempting to break into the longer-term resistance on the daily chart. If the price fails to move through the May 2021 highs, then the focus will be back towards the $1,880's and lower with the 61.8% golden ratio in mind.

- GBP/USD tumbles to 1.3614 after investors prefer defensives over risk-sensitive forex.

- The rising geopolitical tensions between Russia and Ukraine have kept the market on its toes.

- The DXY has been capped after a poor show from the US Initial Jobless Claims.

The GBP/USD pair has attracted some offers in the US session around 1.3630, as the geopolitical tensions between Russia and Ukraine renew after the shelling between Ukraine armed forces and pro-Moscow rebels across a ceasefire line in eastern Ukraine.

After the ceasefire, US President Joe Biden mentioned that there were some signifiers that Vladimir Putin’s area was conspiring of invasion to Ukraine in the next few days along with a pretext for the same.

Russia accused Biden of stoking tensions and released a strongly worded letter saying Washington was ignoring its security demands and threatening unspecified "military-technical measures", as per Reuters.

This has renewed the risk-aversion theme in the market as investors are cautious over escalating geopolitical tensions, which has raised the appeal for safe-haven assets.

Meanwhile, the US dollar index (DXY) is juggling in a narrow range of 95.70-95.88 since the start of the New York session. It would be justified to state that rising Initial Jobless Claims in the US has capped the DXY. The US Department of Labor has reported that the Initial Jobless Claims land at 248k, higher than the previous print of 225k and market estimates of 219k, which could dictate a less hawkish stance from the Federal Reserve (Fed) in the March’s Monetary Policy Committee (MPC) meeting.

For further guidance, speech from the Cleveland Fed’s Mester on Thursday and British Retail Sales data from the Office for National Statistics on Friday will remain in focus while the headlines from the Russia-Ukraine tussle will remain the major driver.

- The NZD/JPY advances so far in the week 0.27% amongst a risk-off market mood.

- Risk-sensitive currencies depreciate as investors scramble towards safe-haven assets but the US dollar.

- NZD/JPY is neutral-downwards after printing a daily close below 77.00.

The NZD/JPY, one of the barometers of market mood in the FX space, drops 0.25% in the North American session among increasing tensions between Russia and Ukraine. At the time of writing, the NZD/JPY is trading at 76.90.

The financial market mood is downbeat, portrayed by US equities remaining in the red. In the FX complex, risk-sensitive currencies like the NZD, the AUD, and CAD fall, while safe-haven peers rise.

On Thursday, the NZD/JPY was headed for a third consecutive day of gains, but headlines from Eastern Europe sent the pair on a free-fall from 77.38 to 76.69, a 70 plus pip fall. Since then, the NZD/JPY seesawed between the daily pivot and the February 16 daily high at 76.96-77.20 before printing five consecutive 1-hour candlesticks below 77.00.

NZD/JPY Price Forecast: Technical outlook

Timeframe: Daily chart

The NZD/JPY is neutral biased but tilted downwards, now that the exchange rate is under the 50-DMA, leaving all the DMAs above the spot price. Furthermore, a seven-month-old upslope trendline, broken upwards, turned resistance, as the NZD bulls could not reclaim 77.00, reinforcing the bias.

Therefore, the NZD/JPY first support level would be the 76.60 psychological figure. Breach of the latter would expose the February 14 daily low at 75.87, followed by February 3 75.59.

- US equity markets were under pressure on Thursday, with all major US indices dropping more than 1.0%.

- Markets fell as Russia/Ukraine/NATO tensions continue to escalate against the backdrop of uncertainty about the timeline of Fed tightening.

- The S&P 500 fell 2.0% to back below 4400.

US equity markets were under pressure on Thursday, with all major US indices dropping more than 1.5% on the day as Russia/Ukraine/NATO tensions continue to escalate against the backdrop of uncertainty about the timeline of Fed tightening. The S&P 500 shed 2.0% to drop under the 4400 level once more, with the bears now eyeing a test of Monday’s lows in the 4360s, while the Nasdaq 100 dropped 2.9% and the Dow dropped 1.8% to hit fresh lows for the week in the 34,300s. The S&P 500 CBOE Volatility Index rose over three points to the mid-27.00s but was still substantially lower than Monday’s highs at 32.00.

Renewed fighting broke out on Thursday between Russia-backed separatist forces and the Ukraine military in the Eastern Ukraine Donbas region as NATO leaders continued to sound about a potential Russian invasion as the country continued to amass troops. Meanwhile, Russia released its response to US security proposals, criticising the country for not taking its concerns seriously and expelled the US Deputy Ambassador from Moscow. NATO leaders warned that Russia is looking to find a pretext/excuse to take military action against Ukraine and investors are fearful of how any subsequent NATO sanctions against Russia might impact the global economy.

Against the backdrop of already high inflation and further warnings from hawkish Fed policymaker James Bullard on Thursday that the Fed should prepare for the possibility of longer-lasting inflation, the risk that Russian commodity export bans trigger a fresh round of global inflation is a worrying prospect. Further Fed speakers will orate on Friday, including influential policymakers including Fed Vice Chairwoman Lael Brainard and NY Fed President John Williams. Traders will be on the lookout for anything that might suggest the Fed is willing to go big with a 50bps rate hike in March, after the minutes of the latest Fed meeting (released on Wednesday) contained no such bombshells.

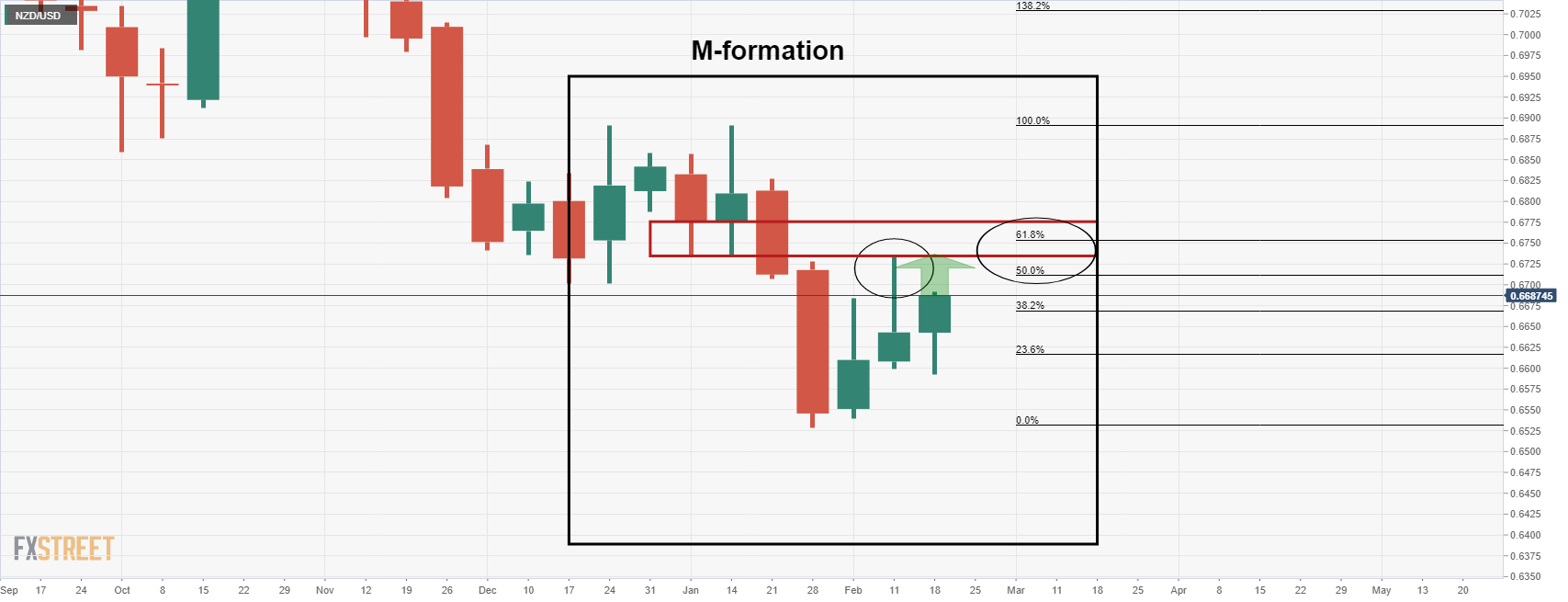

- Bulls moving in at a 4-hour 50% mean reversion mark.

- The is a risk of a significant move to the downside if 0.6680 is broken.

As per the prior analysis, NZD/USD flying towards 0.67 the figure despite Russia angst, the bird crept higher for a deeper test of the M-formation's neckline.

NZD/USD prior analysis

As can be seen in the chart above, the price was moving higher with a bullish conviction for the week. Despite the ebbs and flows of risk sentiment supporting Russia, the bird has managed to hold onto the bulls and keeps rising:

NZD/USD H4 chart

The bulls may start to look to jump in again at a discount from the 50% mean reversion mark for the sessions ahead. If not, then there is a considerable risk of a significant move to the downside if 0.6680 is broken.

- The Australian dollar is up 0.69% in the week, despite the Russia/Ukraine conflict.

- The AUD/USD needs to break above the 0.7200-0.7240 to shift the bias to neutral-upwards.

- The AUD/USD is neutral-downwards, but upside risks remain.

On Thursday, during the New York session, the AUD/USD reached a daily high at 0.7217, followed by a drop below a four-month-old downslope trendline, sparked in part by geopolitical headlines, alongside the former, retracing under 0.7200. The AUD/USD is flat at press time, trading at 0.7193.

During the week, the AUD/USD began on the wrong foot but recovered on Tuesday, when the three-day rally commenced. On Wednesday, the upward break of the 50-DMA at 0.7169 ignited a move towards 0.7200, but AUD bulls fell short of it, stalling at the four-month-old aforementioned trendline around 0.7204.

On Thursday, AUD/USD bulls launched an attack but retreated 80-pips on a Russia/Ukraine headline and could not reclaim the 0.7200 mark.

AUD/USD Price Forecast: Technical outlook

Timeframe: Daily chart.

The AUD/USD is neutral biased, slightly tilted to the downside, facing a wall of solid resistance levels in the 0.7200-40 area. Breach of the latter would expose the January 20 daily high at 0.7257, followed by the January 13 at 0.7313.

However, the AUD/USD path of least resistance is downwards. The first support would be the 50-DMA at 0.7170. A clear break would send the pair tumbling to February 14 daily low at 0.7085, followed by the February 4 daily low at 0.7051.

What you need to know on Friday, February 18:

Ukraine-Russia conflict continued to dominate the headlines and fueled demand for safe-haven assets, although speculative interest stood away from the greenback. Major pairs remained stable within familiar levels after both countries blamed each other for some shelling that took place early on Thursday in the Donbass territory.

The situation escalated as the day went by, resulting in broken diplomatic talks. Western nations believe that not only Russia is not retreating but preparing for an invasion. Russia ejected US officials from their embassy and accused Washington of ignoring its security demands, while US President Joe Biden accused Moscow of creating drama to justify an invasion.

Also, the US Secretary of Defense reported that Russian forces are moving closer to the Ukrainian border wh le. US Ambassador to the UN noted the"t: "the evidence on the ground is that Russia is moving toward an imminent invasion. This is a crucial moment."

Gold benefited the most from the risk-averse environment, trading at its highest since June 2021 at around $1,900.00 a troy ou e. The GBP/USD pair managed to extend gains beyond the 1.3600 level, but EUR/USD remains stuck at around 1.1350.

The CHF and the JPY reached fresh weekly highs against their American rival amid demand for safety, while commodity-linked currencies remained around their opening levels.

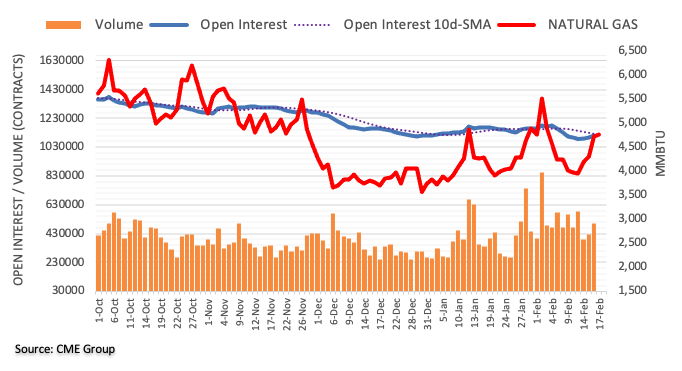

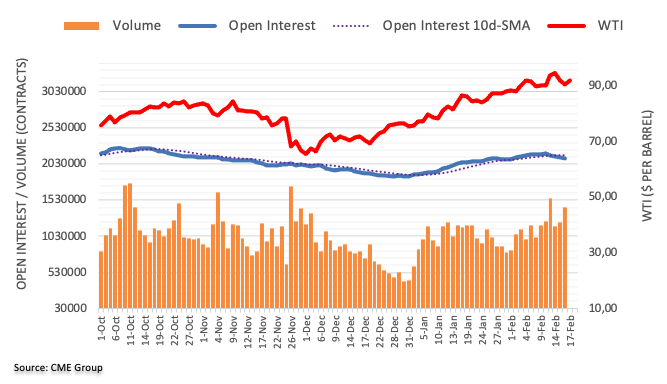

Crude oil prices ticked lower, dragged by the sour tone of equities, and WTI trades at around $91.40 a barrel.

Asian and European equities closed mixed, but US indexes remain in the red heading into the close. Government bond yields, on the other hand, edged lower amid increased bonds demand.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Investors spooked by renewed geopolitical tensions

Like this article? Help us with some feedback by answering this survey:

- EUR/JPY dipped back to the 130.50s on Thursday as the yen outperformed on rising Russia/Ukraine geopolitical concerns.

- Shelling in Ukraine’s Eastern Donbas region has reportedly restarted as NATO warns Russia continues to amass troops on Ukraine’s border.

- If geopolitical tensions continue to rise, traders will eye a test of weekly lows in the 130.00 area.

Having nearly hit 132.00 on Wednesday on hopes that Russia would follow through with pledges to withdraw troops from the Ukrainian border, EUR/JPY has reversed sharply lower on Thursday and now trades in the 130.50 region. That means the pair is back to trading within about 0.4% of Monday’s lows just to the north of the key 130.00 level and is down more than 1.0% from Wednesday’s weekly highs. Shelling between the armed forces of Ukraine and pro-Russia separatist forces in Ukraine’s Eastern Donbas region has reportedly resumed against the backdrop of Russia continuing to amass troops near Ukraine’s border.

Indeed, on Thursday various top NATO member nation leaders further amplified their warnings that a Russian invasion of Ukraine could be imminent. NATO leaders have also been warning that the country may be looking to stage some sort of false flag event to use as a pretext to invade and fighting in Ukraine’s East could provide such an opportunity. Amid fears of war and worsening NATO/Russia ties, risk assets have by and large been on the back foot, with the S&P 500 dropping 1.8%. This has meant that in FX markets, the yen has been an outperformer.

That partly explains why EUR/JPY has dipped on Thursday, though when NATO tensions with Russia rise, that has led to euro underperformance recently, which is another important factor. Traders fret that the Eurozone economy is vulnerable to a Russian retaliation if NATO puts sanctions on Russia for invading Ukraine, including potential disruptions to gas imports. For the most part, ECB speak from the likes of Spain’s Pablo de Cos (who was dovish) and Ireland’s Philip Lane (who was neutral) has not shifted the dial for EUR/JPY on Thursday. Traders might expect the pair to test weekly lows near 130.00 if geopolitical tensions continue to escalate, with a break below opening the door to a potential run towards annual lows in the 128.00s.

- Weekly inverse H&S is in the making for a bullish continuation.

- GBP/JPY bulls looking for a close above 157.00 for conviction.

GBP/JPY is pressing up against the weekly neckline of the inverse head and shoulders, although the Russian risk is preventing bulls from breaking higher on lower time frame advances. Nonetheless, a weekly bullish candle close on Friday will leave the bulls in good stead for the foreseeable future:

GBP/JPY weekly chart

The inverse head and shoulders is a bullish chart pattern, although arguably, the formation is not as symmetrical as investors might wish to see. With that being said, the principal objective is for there to be demand on the way up to carry the price over the line which is seen in the build-up from December's rally.

The correction was met with strong demand in the first instance. However last week was a weaker close. Bulls will be prudent to wait to see how the next days play out and a close above 157.00 would be encouraging.

- USD/CAD saw choppy trading conditions on Thursday and is back to flat around 1.2680 having been as high as 1.2734.

- Geopolitics remains the main talking point in the market, with investors jittery as NATO/Russia relations sour, shelling resumes in Ukraine.

USD/CAD saw choppy, indecisive trading conditions on Thursday, at one point rallying as high as the 1.2730s where it was, at the time, trading higher by about 0.4%, before pulling back to trade flat in the 1.2680s in recent trade. Geopolitics remains the main talking point in the market right now, with investors jittery at the prospect that shelling between Ukraine armed forces and pro-Russia separatists across a ceasefire line in Eastern Ukraine escalates into a broader Russia/Ukraine conflict. NATO leaders further amplified their warnings that Russia looks to be on the verge of military action against Ukraine and warned that the country is looking to fabricate a pretext for invasion.

These fears are currently weighing heavily on the global equity space, but FX markets have been mostly able to resist the risk-off flows seen in other asset classes on Thursday. That could be because Wednesday’s Fed meeting minutes, as well as Thursday’s weaker than expected weekly jobless claims and February Philadelphia Fed manufacturing, have dampened the US dollar’s safe-haven appeal for now. But following recent upside inflation surprises and further hawkish commentary from Fed’s James Bullard, traders will be closely watching what other Fed policymakers have to say in the coming days.

Any indications for support for a 50bps hike in March, combined with ongoing geopolitical risk-off could help push USD/CAD back above 1.2700 again before the week is out. Note, however, that the loonie’s high correlation to crude oil prices, which would be expected to rally on a Russian invasion of Ukraine, means that in a flight to FX havens, it wouldn’t perform as poorly as some risk-sensitive peers. A retest of this year’s triple-top in near 1.2800 seems unlikely if, say, a Russia/Ukraine conflict was to send WTI above $100.

According to Fox News, shelling in the contested Donbas region of Eastern Ukraine between the armed forces of Ukraine and pro-Russia separatists has resumed. The report cited how Russia is building a bridge close to the Ukrainian border and building up blood supplies, presumably as it prepares for battle.

Market Reaction

The latest reports of shelling haven't had a market impact, but US equities continue to trade with a strongly risk-off bias amid continued concerns about escalating geopolitical tensions, with the S&P 500 trading near lows of the day just above 4400, down about 1.4% on the day.

- On Wednesday, the UK’s Office of National Statistics (ONS) revealed higher than expected inflation figures.

- The conflict between Russia and Ukraine weighed on the single currency.

- The EUR/GBP breach of 0.8345 would exacerbate a fall towards 0.8300.

On Thursday, as the American session progresses, the EUR/GBP drops for the second consecutive day in the week, trading at 0.8338 at the time of writing. The financial market mood remains sour, with no de-escalation of the conflict between Russia and Ukraine in eastern Europe, a headwind for the EUR.

Also, UK’s inflation revealed on Wednesday increased at the fastest annual pace in 30 years, increasing the odds of another rate hike of the Bank of England on its next meeting. The UK Consumer Price Index (CPI) increased to 5.5% in January, the highest since March 1992. Money market futures expect the BoE’s interest rates to rise to 2% by the end of 2022.

An EU absent economic docket left adrift EUR/GBP traders to ECB speakers, led by Chief Economist Philip Lane. He said tightening conditions would be met if inflation remained above the 2% target over the medium term while ensuring to “not over-react” to high near-term inflation, which could induce excessive monetary tightening, pushing inflation persistently below the 2% target over the medium term.

Those factors were a headwind for the EUR/GBP, as more ECB policymakers pushed back higher rates, without expressing it directly. Meanwhile, the Bank of England would keep tightening monetary policy conditions, favoring the GBP vs. the EUR in the near term.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP stalled its rally two days ago at the 50-day moving average (DMA) at 0.8400. Since then, EUR/GBP sellers entered the market, pushing the pair to fresh weekly lows at 0.08333, leaving the 0.8345 weekly support behind.

Therefore, the EUR/GBP is downward biased, and its first support level would be the January 20, daily low at 0.8304, near the 0.8300 psychological figure. Breach of the latter would expose the YTD low at 0.8283.

Spot gold (XAU/USD) prices hit $1900 per troy ounce for the first time since June 2021 on Thursday, taking its on-the-day gains to more than 1.5% as geopolitical tensions between Russia, Ukraine and NATO simmer, stimulating demand for safe-haven assets. Gold now trades more than 2.0% higher on the week, taking its two-week run of gains to nearly 5.0%.

Fears of an imminent Russian military incursion into Ukraine have escalated in recent days, with reports of shelling in the war-torn Donbas region of Eastern Ukraine on Thursday sparking fears that Russia is looking to create a pretext for military action, as the country continues to amass troops near the Ukrainian border.

A positive technical backdrop has coincided with the increased safe-haven demand for gold; XAU/USD broke above a key long-term pennant structure at the end of last week. This week it fell back to the $1850 area to test the old long-term pennant and, promisingly for the bulls, found strong support. The bulls will now likely target a move above $1900 and towards the mid-2021 highs in the $1915 area.

-637807120528075281.png)

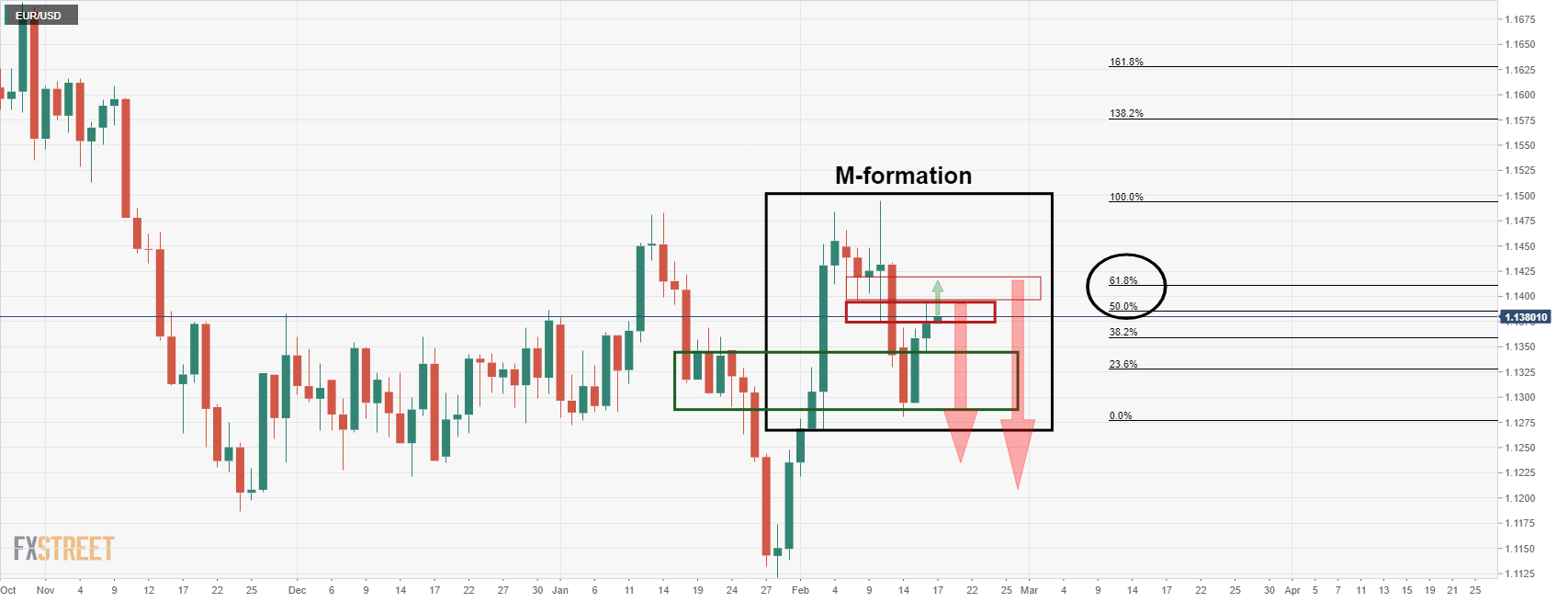

- The EUR/USD fluctuated during Thursday’s session but remained up 0.14% in the week.

- Risk-aversion in the financial markets remains unless tensions between Ukraine and Russia ease.

- EUR/USD is neutral biased, but downward risks remain as long as the pair stays under 1.1400.

On Thursday, amid mounting tensions in the Russia – Ukraine crisis, the shared currency falls 0.04% during the North American session. At the time of writing, the EUR/USD is trading at 1.1367. The financial market mood remains negative. In the Asian session, the EUR/USD witnessed a drop of 58-pips on “reports” that Ukraine forces fired grenades, which officials later denied. Following that headline, the pair stabilized and aimed higher until stalling around the 200-hour simple moving average (SMA) at 1.1363.

Headlines controlled by Russia/Ukraine conflict

In an update of the eastern Europe conflict, Russia stated that Ukraine committed war crimes in Donbas, as stated by a letter to the UN. In the meantime, the US raises the possibility of Russia’s “false-flag” operation as a “pre-text” to invade Ukraine. In the last hour, the White House reiterated its commitment to diplomacy, per remarks of US Secretary of State Blinken at the UN.

ECB and Fed speaking crossing the wires

Earlier in the North American session, ECB’s Chief Economist Philip Lane crossed the wires. He said that “the key message of the February meeting was that risks to inflation are tilted to the upside in the near-term,” according to Reuters. Lane added that “if there is a threat that inflation will settle above two percent in the medium term, while also making sure not to over-react to the extent that there is a risk that high near-term inflation might induce an excessive monetary tightening that pushes inflation persistently below the two percent target over the medium term.”

In the meantime, St. Louis Fed President James Bullard reiterated that he would like 100 bps of rate hikes by July 1 while adding that he is “losing faith” that inflation may abate. Bullard emphasized that an aggressive rate hike would signal that the US central bank is “serious” regarding inflation control. Furthermore, he added that the Fed “may have to go beyond the neutral rate to control prices.”

The US macroeconomic featured Initial Jobless Claims, increasing 248K higher than the 219K for the week ending February 19. At the same time, Building Permits rose to 1.899M better than the 1.76M foreseen, while the Philadelphia Fed Manufacturing Index decreased from 16 to 20, estimated.

EUR/USD Price Forecast: Technical outlook

The EUR/USD is neutral biased and faces strong resistance with the 100-day moving average (DMA) at 1.1400, alongside Pitchfork’s top-trendline around the 1.1400 figure. A clear break would expose February 11 daily high at 1.1430, followed by February 10 cycle high at 1.1494.

On the flip side, the EUR/USD first support would be the 50-DMA at 1.1329. Breach of the latter would expose 1.1300, followed by February 14 daily low at 1.1279. Once cleared, the next EUR/USD floor would be January 28 pivot low at 1.1120.

- WTI rebounded sharply on Thursday after Wednesday’s US/Iran negotiation progress headlines triggered a sharp drop.

- Having been as low as $90.00 on Wednesday, WTI is now trading near $92.00 again thanks to escalating Russia/Ukraine/NATO tensions.

- A long-term trendline continues to offer WTI support.

Oil prices have been choppy on Thursday, caught between the conflicting forces of progress towards a return to the 2015 Iran nuclear deal which could pave the way to a return of Iranian exports to global markets and geopolitical tensions. After Wednesday’s sharp pullback late in US trade on the US/Iran progress headlines that saw front-month WTI futures dip as low as a test of the $90.00 level, prices have seen a sharp recovery on Thursday. Reports of shelling in Eastern Ukraine between pro-Russia separatist forces and the Ukrainian military was the trigger for the rebound and, at current levels near the $92.00 mark, WTI is about $1.50 higher on the session.

For now, WTI is finding support at a long-term uptrend that has been in play all of 2022 thus far. If it wasn’t for Russia/Ukraine/NATO tensions, this support would probably have already been broken to the downside and, if there is de-escalation, may yet be broken. This would likely trigger technical selling and a quick slide under $90.00 and towards recent support in the $88.00s. But that’s a big if, and if Russia does invade Ukraine in some way in the coming days, as NATO leaders see as a very likely possibility, WTI prices would likely be propelled higher towards $100 per barrel.

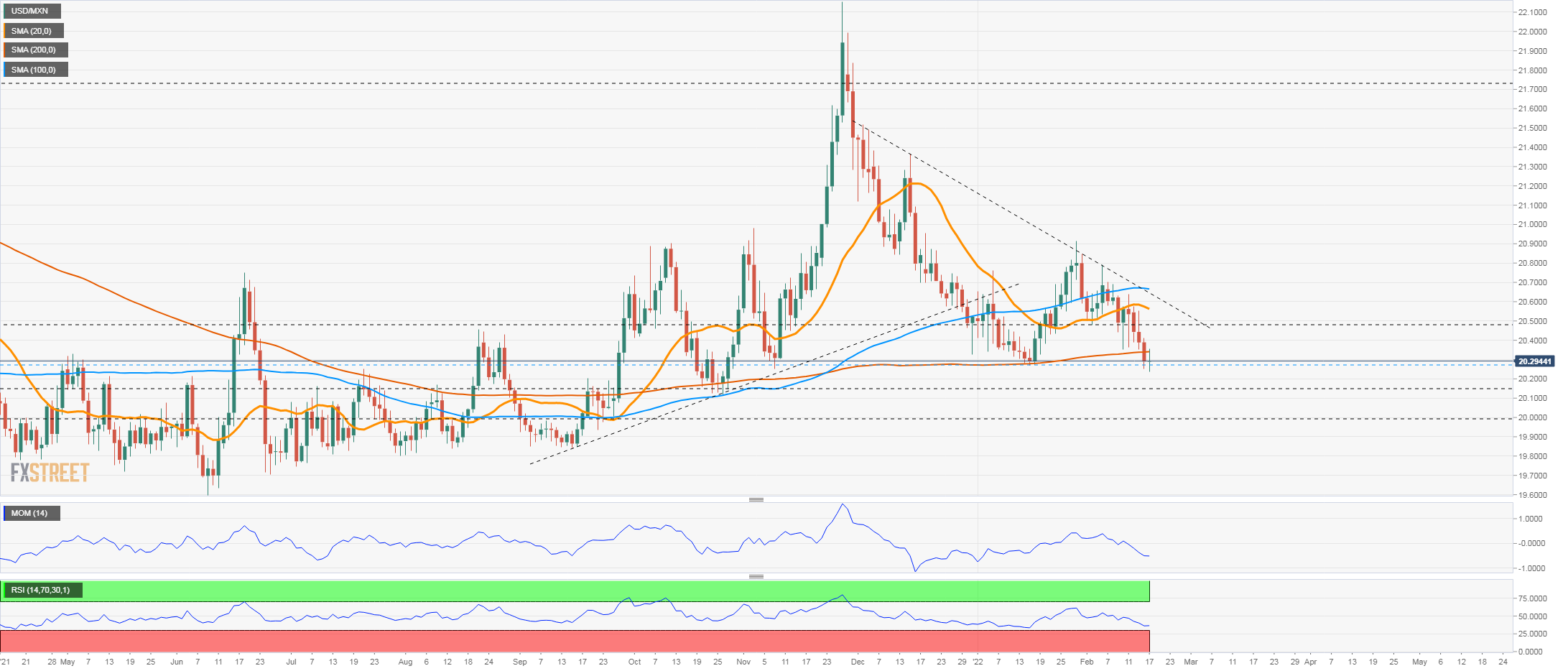

- USD/MXN drops below the 200-day SMA.

- Outlook favor the downside, price to face strong support at 20.30 and 20.05.

- Any recovery of the dollar under 20.70, likely to be unstable.

The USD/MXN posted on Wednesday the first daily close in months below the 200-day moving average and slightly under the 20.30 level. The 20.35/30 area was a strong barrier and while the cross remains below, more losses are on the table.

The next support stands at 20.15 and below a more relevant emerges at 20.00/05. A recovery of USD/MXN could take the price quickly to 20.45 but it should be seen as a correction. The critical resistance at the moment is seen around 20.70, the confluence of horizontal support, key MA and a downtrend line. A break higher would change the short-term bias from bearish to neutral/bullish.

Technical indicators look bearish. The RSI is approaching 70 and flattening, a potential sign of exhaustion, not necessarily followed by a sharp correction. A consolidation is also possible particularly if USD/MXN rises back above 20.30.

USD/MXN daily chart

St Louis Fed President and 2022 voting FOMC member James Bullard said on Thursday that recent inflation misses are "not comforting" for policymakers who need to manage the risk that it will continue, according to Reuters. Moreover, Bullard continued, markets may be losing faith that inflation will abate and, thus, front-loading rate increases would send the right signal that the Fed is serious about controlling inflation. Bullard criticised that there is too much "mind share" devoted to the idea that inflation will ease and the risk now is that it will not. Bullard added that there is not much risk of a recession coming from Fed policy.

Market Reaction

Typically hawkish remarks from Fed's Bullard have not had that much impact on FX markets, with the DXY continuing to trade flat in the 95.70s area.

- Despite a risk-off market mood in the week, the NZD/USD is up 0.80%.

- Geopolitical headlines put aside macroeconomic and fundamental data, dominating the headlines.

- US Jobless Claims unexpectedly jumped, while Philadelphia Fed Index decreased.

- NZD/USD Technical Outlook: A daily close under 0.6700 would exacerbate a move towards 0.6500.

The New Zealand dollar slides amid a risk-off market mood, courtesy of the Russia/Ukraine conflict escalation. At the time of writing, the NZD/USD is trading at 0.6698.

Geopolitical jitters dominate the market mood

Since Friday of last week, developments of the Russia/Ukraine conflict have been blamed for the swings in the financial markets. European and US equity indices remain in the red, while in the FX space, safe-haven peers like the USD, the JPY, and the CHF are sought by investors.

In an update of the eastern Europe conflict, Russia stated that Ukraine committed war crimes in Donbas, as stated by a letter to the UN. Meanwhile, the US raises the possibility of Russia’s “false-flag” operation as a “pre-text” to invade Ukraine. In the last hour, the White House reiterated its commitment to diplomacy, per remarks of US Secretary of State Blinken at the UN.

US Initial Jobless Claims increase while Building Permits increase

Before Wall Street opened, US macroeconomic data crossed the wires. Initial Jobless Claims rose 248K higher than the 219K for the week ending on February 19. At the same time, Building Permits rose to 1.899M better than the 1.76M foreseen, while the Philadelphia Fed Manufacturing Index decreased from 16 to 20, estimated.

During the Asian session, ex-RBNZ member Arthur Grims said that he believes the central bank should hike the benchmark rate by 75 basis points (bps) at next week’s meeting. Furthermore, Grimes noted that “to think of unemployment at 3.2%, with 6 % inflation, and if they increase rates by 25 basis points then the Official Cash Rate will be at 1%, it just doesn’t make sense.”

NZD/USD Price Forecast: Technical outlook

The NZD/USD daily chart depicts the pair as neutral-downward biased, regardless of RBNZ’s commencing its tightening cycle in 2021. The daily moving averages (DMAs) above the spot price adds another signal to the aforementioned.

That said, the NZD/USD first support would be February 10 daily low at 0.6652. Breach of the latter would expose February 14 0.6592 daily low, followed by January 28 cycle low at 0.6528.

US Secretary of State Anthony Blinken said to the UN Security Council on Thursday that this is "a moment of peril" for the lives and safety of millions of people in Ukraine regarding the risk of a possible Russian invasion.

Additional Remarks:

- Blinken tells UN "we do not see Russia drawing down its forces."

- Blinken tells the UN security council that Russian forces are preparing to launch an attack against Ukraine "in the coming days".

- Russia plans to manufacture a pretext for its attack on Ukraine.

- A Russian pretext could include a fake or real attack using chemical weapons.

- Russian media has already begun spreading some of these false alarms.

- Blinken outlines a potential Russian disinformation campaign to UN security council.

- The Russian government may 'theatrically' convene emergency meetings.

- "I am here today not to start a war but to prevent one.”

- Russia's targets include Ukraine's capital Kyiv.

- We have information Russia will target specific groups of Ukrainians.

- The information presented here is validated by what we've seen unfolding in plain sight for months.

- Cable heads for highest daily close in a month.

- The pound continues to benefit from BoE expectations.

- Mixed US data: initial jobless claims rise unexpectedly.

The GBP/USD pair rose to 1.3637, after the beginning of the American session reaching the highest level in a week. Later the pair pulled back toward 1.3600 but still was holding onto gains, for the third consecutive day and about to post the highest close in a month.

The pound remains strong and is also up versus the euro as EUR/GBP trades under 0.8350, at the lowest in two weeks after higher-than-expected UK inflation data and also amid concerns regarding the Ukrainian border.

The dollar is mixed on Thursday, with the DXY up 0.04%. Economic data from the US came in mixed. Initial Jobless claims rose unexpectedly to the highest level in three weeks, while housing starts dropped more than forecast. Market participants mostly ignored the numbers. Their attention is set on headlines about Russia, Ukraine and the US.

US President Biden and other American authorities warned about an imminent attack. The situation triggered a decline in equity markets and sent Treasuries higher. The decline in bond yields weakened the greenback.

Levels to watch

A daily close above 1.3600 would be a positive development for the pound. In terms of levels, the next resistance stands at the 1.3645 area (last week high) followed by 1.3662.

On the downside, below 1.3600, the next support stands at 1.3560. A break lower would turn the very short-term bias to bearish/neutral.

Technical levels

- XAG/USD is trading on the front foot in the $23.70s as geopolitical tensions bubble and Russia/Ukraine war risk remains elevated.

- Spot silver traders will be eyeing a test of resistance in the $24.00 area should the situation further escalate.

Spot silver (XAG/USD) prices have been trading on the front foot on Thursday and a challenge of earlier weekly highs at the $24.00 per troy ounce level seems likely if geopolitical tensions continue to rise. There has been limited fighting in Eastern Ukraine on Thursday between pro-Russia separatists and the Ukrainian forces and NATO/US officials continue to sound the alarm about the ongoing Russian troop build-up on Ukraine’s border and the possibility of an attack. Meanwhile, direct relations between NATO and Russia also continue to deteriorate, with Russia recently expelling the US Deputy Ambassador, eroding the seemingly now slim prospect of a diplomatic solution.

All of these fears have been weighing on risk assets (global equities are sharply lower) and boosting demand for safe-havens such as bonds and precious metals. The US 10-year bond yield was last down about 7.5bps on Thursday and back below 2.0% again, which itself helps spur demand for non-yielding assets like silver given the lower opportunity cost. XAG/USD currently trades in the $23.70s, up about 0.7% on the day, underperforming its gold counterpart for now, which for reference is about 1.4% higher on the day. If XAG/USD is able to get above resistance at $24.00, there is scope for some catch-up, as the door would be opened to a run towards the next resistance area around $24.50.

In a letter to the UN Secretary-General on the Ukraine crisis, Russia restated a previous claim that Ukrainian military forces have committed war crimes in Eastern Ukraine. Geopolitical analysts think that Russian claims of Ukrainian war crimes against ethnic Russian's in Ukraine's East, as well as claims of genocide against these people, could form part of the pretext for military intervention in the region.

The White House reiterated on Thursday that we are in a window where we believe a Russian assault on Ukraine could happen at any time. A false pretext for invasion could take many forms, the White House warned, and the US is bracing for more false reporting from Russian state media in the coming days. The White House said that, in his remarks at the UN, Secretary of State Anthony Blinken will signal an intense commitment to diplomacy. The White House reiterated that it has serious concerns about the movement of Russian troops at Ukraine's borders, and the US has been very clear and transparent about how action the US and its allies will take to deter a Russian invasion.

US Secretary of State Antony Blinken will be delivering his remarks on the Russia-Ukraine conflict at a UN Security Council Meeting, from UN Headquarters in New York City, on February 17, 2022.

Markets remain risk-averse on Thursday on reports pointing to a heightened risk of a Russian invasion. The benchmark 10-year US Treasury bond yield is down more than 3% on the day and the S&P 500 Index is losing 1.25%.

Meanwhile, the US Dollar Index, which tracks the dollar's performance against a basket of six major currencies, stays relatively quiet below 96.00.

Ukraine's Foreign Minister: Fire from a tank recorded in Eastern Ukraine.

Russia says US security proposals not constructive, ignore key Russia security concerns.

- The USD/JPY extends its fall in the week, down 0.38%.

- US Jobless Claims rose more than expected, while the Philadelphia Fed decreased more than foreseen.

- Increasing tensions of the Russia/Ukraine conflict increased the appeal of the JPY safe-haven status.

- USD/JPY Technical Outlook: The break of 115.00 exposed the 114.14 level.

On Thursday, increasing tensions between Russia and Ukraine dampen the market mood, boosting the safe-haven appeal of the Japanese yen vs. the greenback, as depicted by the 60+ pip fall in the USD/JPY. At the time of writing, the USD/JPY is trading at 114.92.

In the last two hours, a “packed” US economic docket reported Building Permits, Housing Starts, for January. The former came at 1.899M vs. 1.76M, higher than expected, while the latter rose to 1.638M lower than the 1.7M. At the same time, Initial Jobless Claims for the week ending on February 12 showed an increase of 248K higher than the 219K. Further, February’s Philadelphia Fed Manufacturing Index decreased to 16 vs. 20 foreseen.

Russia/Ukraine tensions increase during the overnight session

Putting US economic data aside, the Russia/Ukraine front developments have dominated the financial market mood.

In the last hour, NATO Chief Stoltenberg said that NATO is “concerned” about the increased ceasefire violations in Ukraine. Meanwhile, in the US, President Joe Biden said that the threat of Russia’s invasion of Ukraine is very high. He reiterated that he believed Putin would invade Ukraine in a matter of days. Furthermore, reports from Ukraine, the Defense Ministry said that “shelling from pro-Russian forces ceased as of 10:00 GMT.”

Therefore, tension escalation boosted the appeal of the Japanese yen, as the USD/JPY heads towards the high 114.90s, a level last reached on February 2.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is neutral biased, but the breach of the February 14 daily low at 115.00 opened the door for a February 2 daily low test at 114.14, but first, JPY bulls would need to reclaim the 50-day moving average at 114.73.

However, a shift in the market mood could pave the way for a mean reversion move. The USD/JPY first resistance would be 115.00. A clear break would expose the January 28 daily high at 115.68, followed by 116.00 and the YTD high at 116.35.

European Central Bank Chief Economist Philip Lane said on Thursday that the key message of the February meeting was that risks to inflation are tilted to the upside in the near term, according to Reuters. Lane said that most of the current inflation was an imported inflation shock, given there has not been a boom in domestic demand. Gradualism thus makes sense in this scenario, he added, saying that if inflation is to settle around 2.0% in the medium-term, the policy path is different from open-ended, but won't require a significant tightening cycle. The size and frequency of rate moves will depend on the inflation regime, he added, noting that other increments are possible beyond 25bps moves.

Market Reaction

The euro has not reacted to the latest Lane comments, with FX markets more focused on the escalating geopolitical atmosphere in Eastern Europe at the moment.

According to the Kyiv Independent, as of 1500 local time, over 40 artillery incidents have been recorded in the Donbas region of Eastern Ukraine and two Ukrainian soldiers have now been injured.

Market Reaction

The latest run of Russia/Ukraine/NATO headlines, which suggest more violence in Eastern Ukraine and worsening tensions, are weighing on sentiment, with the S&P 500 now trading more than 1.0% lower on the day.

Ukraine's Foreign Minister Kubela Dmytro said on Thursday that fire from a tank had been recorded in Eastern Ukraine. This follows mortar fire and shelling throughout Thursday morning that was only reported to have stopped at 1300 local time.

Market Reaction

The latest run of Russia/Ukraine/NATO headlines, which suggest more violence in Eastern Ukraine and worsening tensions, are weighing on sentiment, with the S&P 500 now trading more than 1.0% lower on the day.

US President Joe Biden said on Thursday that every indication they have is that Russia is prepared to invade Ukraine. “My sense is it will happen within the next several days”.

In a small talk with journalists outside the White House, Biden said he has no plan to talk with Vladimir Putin.

Stocks are falling on Thursday as uncertainty around the Ukraine border grows. The Dow Jones is likely to open with a 0.75% decline and the Nasdaq falling by almost 1%.

Market Reaction

The latest run of Russia/Ukraine/NATO headlines, which suggest more violence in Eastern Ukraine and worsening tensions, are weighing on sentiment, with the S&P 500 now trading more than 1.0% lower on the day.

In a written response to US security proposals, Russia told the US that their proposals were not constructive and ignored Moscow's key concerns, according to Reuters. Russia's original security proposals were intended as a complete package and not for the US to pick and choose from. US proposals raise doubts that Washington is committed to fixing the security situation in Europe, Russia continued. Russia added that growing US and NATO military activity is alarming and Russia's red lines are still being ignored.

Moreover, US ultimatums for Russia to remove troops from parts of Russia's own territory accompanied by sanction threats are unacceptable and undermine the chances of reaching an agreement. Finally, Russia warned that it would be forced to respond, including by implementing military tactical measures in the absence of negotiating any new, legally binding security guarantees.

Market Reaction

The latest run of Russia/Ukraine/NATO headlines, which suggest more violence in Eastern Ukraine and worsening tensions, are weighing on sentiment, with the S&P 500 now trading more than 1.0% lower on the day.

- EUR/USD comes under pressure after two sessions with gains.

- The weekly high near 1.1400 emerges as the next hurdle for bulls.

EUR/USD trades on the defensive following the moderate rebound in the sentiment surrounding the greenback.

A move higher should revisit the weekly high at 1.1395 (February 14) in the near term. The surpass of this level should pave the way for a potential test of the 200-week SMA at 1.1491 soon followed by the 2022 peak at 1.1494 (February 10).

In the longer run, EUR/USD is expected to keep the negative outlook as long as it trades below the key 200-day SMA, today at 1.1645.

EUR/USD daily chart

A spokesperson for the US State Department said on Thursday that Russia's actions against the US Deputy Ambassador (who was expelled on Thursday) was "unprovoked" and marked an "escalatory step". The US is considering a response, the spokesperson added.

Market Reaction

Markets remain in a defensive mood as they assess the growing likelihood of further military escalation between pro-Russia/Ukrainian forces in Eastern Ukraine and the prospect for further deterioration in Russia/NATO relations. The S&P 500 opened Thursday trade sharply in the red and are back below 4450, down about 0.8% on the day.

St Louis Fed President and 2022 voting FOMC member James Bullard on Thursday reiterated his calls for 100bps of hikes to the Federal Funds target range by July 1, again citing high inflation. We want to pursue the best policy we can and let the market adjust appropriately, he said in an interview on CNN, adding that this is the moment where we need to share less accommodation.

Markets have already done a lot of pricing, Bullard noted, adding that he didn't think raising rates would be risking a recession. Rather, this is about the Fed's first moves away from accommodative policy, he continued, noting that the labour markets will continue getting tighter and inflation is eating into wages.

GBP/USD maintains a slight upward bias in its broader range. Analysts at Credit Suisse look for a retest of key resistance seen starting at the recent spike high at 1.3644, ahead of 1.3662/63 and then the key 200-day average (DMA), now at 1.3692.

Support at 1.3466/56 set to hold

“Resistance moves to 1.3610 initially, above which should clear the way for strength back tougher resistance seen starting at the recent spike high at 1.3644 ahead of 1.3662/63 and then the key 200-DMA, now at 1.3692.”

“A close above 1.3700 remains needed to suggest we are seeing a more sustained turn higher, with resistance then seen next at 1.3830/38.”

“Near-term support moves to 1.3556, then 1.3529, below which can see a retreat back to the 1.3487 recent low. With the 55-DMA and potential uptrend from late not far below at 1.3466/56 we continue to look for a fresh floor here. Should weakness directly extend this can see a retest of the late January low and ‘neckline’ to the December base at 1.3376/59.”

The EUR/USD pair is unchanged on the session trading the 1.1370 area. Economists at Scotiabank highlight the key technical level to watch.

Initial support located around 1.1350

“Support after the mid-1.13s and ~1.1320/25 is the big figure followed by 1.1280.”

“Resistance after 1.1385/00 is limited until the mid-1.14s.”

According to Interfax citing Russia's response to US security guarantees, Russia has no plans to invade Ukraine. However, Russia has not seen full intention from the US to stick to the indivisibility principle of security, Interfax reported.

Separately, RIA reported that Russia said that de-escalation would require that Ukraine comply with the Minsk agreements and that no more weapons should be delivered to Ukraine. RIA added that Russia is insisting on the withdrawal of all US forces from Central and Eastern Europe and expects further specific proposals from the US and NATO regarding no further Easterward enlargement. Moreover, RIA reported that Russia said that arms control issues can't be considered separately from other topics.

Market Reaction

Risk appetite remains uneasy, with S&P 500 futures down about 05% in pre-market trade as headlines suggest ongoing tensions between Russia/Ukraine/NATO.

GBP/USD has broken above 1.36. Economists at Scotiabank expect cable to enjoy further gains towards the 1.3750 region on a path over 1.3650.

1.36 turns into support

“Cable is on a decent upward trajectory since its short-lived break under 1.35 on Tuesday, and today’s climb above 1.36 points to a test of the GBP’s two-week channel’s ceiling of ~1.3650 – after some intermediate resistance at ~1.3625.

“A break past the mid-1.36s zone would point to an extension of its week-long rally in late-Jan/early-Feb toward a test of the mid-Jan high in the mid-1.37s. The 1.3665/70 area also stands as trendline resistance from its losses since mid-2021.”

“Support is the figure zone followed by ~1.3570 and the mid-1.35s”

- DXY regains the smile amidst renewed risk aversion.

- The weekly high around 96.40 emerges as the next up barrier.

DXY reverses two consecutive daily pullbacks and looks to reclaim the area above the 96.00 barrier on Thursday.

If the recovery gathers steam, then the index is expected to challenge the weekly tops at 96.43 (February 14), which is considered the last defence before an assault to the YTD high near 97.50 (January 28).

In the meantime, further gains in DXY looks likely as long as the 5-month line near 95.30 holds the downside.

In the longer run, the outlook for the dollar is seen as positive above the 200-day SMA at 93.70.

DXY daily chart

European Central Bank Chief Economist Philip Lane said on Thursday that if medium-term inflation is expected to stabilise around the bank's 2.0% target, this would permit a gradual normalisation of monetary policy settings. If inflation threatens to persist significantly above the 2.0% target over the medium-term, tightening of monetary policy will be required, Lane added. On the other hand, if inflation is expected to fall significantly below the 2.0% target over the medium term, setting a more accommodative monetary policy will be necessary. Finally, Lane said that there are several factors that suggest that the excessively low inflation environment that prevailed from 2014 to 2019 might not re-emerge even after the pandemic cycle is over.

Market Reaction

Lane's comments do not add anything new to the near-term ECB policy debate and have thus not provoked any notable market reaction.

The S&P 500 strength stays seen as a corrective bounce only. Analysts at Credit Suisse continue to look for resistance from the 13-day exponential average at 4483 to ideally cap on a closing basis for a fall back to 4365 and eventually 4223/4199.

Strength is corrective only

“We continue to view the rebound of the past few days as corrective and we look for the risk to turn lower again from 13-day exponential average, now seen at 4483.”

“Support stays seen initially at the 200-day average at 4456, with a break below the price gap from earlier this week at 4429/02 needed to clear the way for a retest of 4365. Below here in due course can see support seen next at 4292 and eventually the major support cluster at 4223/4199.”

“A close above 4483 can see strength extend further to 4526 next, potentially 4555. We shall though maintain a negative tactical bias whilst below key resistance at 4491/4608.”

Russia has expelled Deputy US Ambassador Bart Gorman, Sputnik reported on Thursday.

Kit Juckes, Chief Global FX Strategist at Société Générale, was asked for a 20 to 30-year view of the GBP/USD exchange rate. He believes that cable could trade as high as 1.50.

Central Bank independence changes everything

“With the Bank of England and Federal Reserve both operating as independent, inflation-targeting central banks, that much-maligned measure of currency ‘fair value, Purchasing Power Parity (PPP) provides the most credible framework for thinking about the GBP/USD outlook.”

“Brexit will continue to throw spanners into the wheels of the UK economy. But the MPC will go on targeting inflation and that probably matters more for sterling.”

“GBP/USD PPP is a whisker below 1.50. That’s as good a guess of where GBP/USD will be in 20-30 years’ time as any, and a lot more reasonable than some.”

- A combination of factors dragged USD/CHF lower for the second successive day on Thursday.

- Retreating US bond yields, less hawkish FOMC minutes acted as a heading for the greenback.

- Russia-Ukraine jitters benefitted the safe-haven CHF and also contributed to the selling bias.

The USD/CHF pair dropped to a nearly two-week low during the early North American session, with bears looking to extend the downward trajectory further below the 0.92000 round-figure mark.

The pair added to the overnight losses and remained under bearish pressure for the second successive day on Thursday amid the emergence of fresh selling around the US dollar. Against the backdrop of less hawkish FOMC minutes released on Wednesday, retreating US Treasury bond yields turned out to be a key factor that failed to assist the buck to preserve its modest intraday gains.

Fed officials agreed that it would be appropriate to remove policy accommodation at a faster pace than anticipated if inflation does not move down as they expect. The minutes, however, failed to reinforce expectations for a 50 bps rate hike in March. Apart from this, the global flight to safety – amid intensifying Russia-Ukraine conflict – dragged the US bond yields lower.

In the latest geopolitical developments, Russian media reported that the Ukrainian military forces fired mortars and grenades in four Luhansk People's Republic (LPR) localities. Adding to this, the Organization for Security and Co-operation (OSCE) in Europe recorded multiple shelling incidents along the line of contact in the East Ukraine in the early hours of Thursday.

Meanwhile, the Russian Ministry of Defense released a video this Thursday, showing a logistics unit coming back to its home base after the completion of drills. The US Defense Secretary Lloyd Austin, however, dismissed Russia's claims that it is withdrawing troops and said that the US is seeing some Russian forces inching closer to the Ukrainian border.

The contradicting headlines kept investors' on the edge, which was evident from a generally weaker tone around the equity markets. This, in turn, benefitted the Swiss franc's relative safe-haven status and dragged the USD/CHF pair to the 0.9200 mark. A convincing break below will be seen as a fresh trigger for bearish traders and set the stage for further losses.

On the economic data front, the US Weekly Initial Jobless Claims unexpectedly rose to 248K during the week ended February 11 and the previous reading was also revised slightly higher to 225K. Separately, the Philly Fed Manufacturing Index fell more than anticipated to 16 in February, from 23.2 in the previous month, and did little to lend any support to the USD.

Technical levels to watch

- Building Permits were stronger than expected, while Housing Starts were weaker.

- FX markets did not react and are instead focused on geopolitics and upcoming central bank speak.

Building Permits rose by 0.7% MoM in December to 1.899M over the last 12-months, whilst Housing Starts fell 4.1% MoM to 1.628M over the last 12-months, according to the latest data published jointly by the US Census Bureau and the US Department of Housing and Urban Development on Thursday. Median economist forecasts had been expecting the December data to show that there had been 1.760M Building Permits in the past 12-months and 1.7.0M Housing Starts, so the latest numbers were mixed, with Building Permits stronger than expected and Housing Starts weaker.

Market Reaction

FX markets seem far more focused on geopolitics right now and, thus, there has not been a notable reaction to the latest data.

According to a report from the Federal Reserve Bank of Philadelphia released on Thursday, the headline Manufacturing Activity Index of the Manufacturing Business Outlook Survey fell to 16.0 in February from 23.2 in January, bigger than the expected decline to 20.0.

Subindices:

- Employment Index rose to 32.3 from 26.1 in January.

- Prices Paid Index fell to 69.3 from 72.5.

- New Orders Index fell to 14.2 from 17.9.

- 6-month Expectations Index fell to 28.1 from 28.7.

- Capital Expenditures Index fell to 21.5 from 26.2.

Market Reaction

FX markets seem far more focused on geopolitics right now and, thus, there has not been a notable reaction to the latest data.

- Initial claims were higher than expected in the week ending February 12 at 248K.

- But Continued Claims in the week ending February 5 were lower than expected.

There were 248,000 initial claims for unemployment benefits in the US during the week ending February 12, the data published by the US Department of Labor (DOL) revealed on Thursday. This was above the median economist forecast for 219,000 initial claims and was also above last week's 225,000 reading, which had been revised higher from 223,000. That meant the four-week average fell to 243,250 from 253,750 the week prior.

Continued claims fell to 1.593M in the week ending on February 5, below the expected 1.605M and down from last week's 1.619M reading, which had been revised a touch lower from 1.621M. The insured unemployment rate was unchanged at 1.2% on the week ending on February 5.

Market Reaction

FX markets seem far more focused on geopolitics right now and, thus, there has not been a notable reaction to the latest data.

Gold continues to push higher above $1,880 on Thursday. When geopolitical tensions eventually subside, higher US Treasury yields, a resilient USD, and lower safe-haven demand may hit gold but a floor is close at hand, amid inflation and other risks, strategists at HSCB report.

XAU/USD to find a floor this year

“Gold may come under pressure in 2022 amid a shift in monetary and fiscal policies but a floor is close at hand.”

“Real rates will remain negative and a possible rise in trade and geopolitical risks could help gold. Financial market volatility and COVID-19 uncertainties could also trigger safe-haven demand for gold.”

“A longer-term source of gold demand could come from central banks, which are expected to accumulate more gold reserves, amid portfolio diversification and risk management.”

See – Gold Price Forecast: XAU/USD to reach $1,950 by end-2022 in Fed becomes dovish – UBS

- EUR/USD has been choppy on geopolitical headlines but is back to trading flat on the day in the 1.1370 area.

- Ahead, focus remains heavily on geopolitics, though upcoming US data and ECB/Fed speak will also be of note.

EUR/USD has seen choppy, two-way price action on Thursday, with the pair buffeted by geopolitical headlines. News during the Asia Pacific session of shelling in Eastern Ukraine, with pro-Russia separatists claiming that the Ukrainian military had attacked unprovoked, saw EUR/USD shed nearly 60 pips in a matter of minutes, dropping from the 1.1380 area to lows just above 1.1320. However, subsequent denial by Ukraine, who blamed pro-Russia separatist forces for the shelling, aided EUR/USD to recover back to the upper 1.1300s.

At current levels in the 1.1370s, the pair is back to trading flat on the day, though troubling reports of shelling in Eastern Ukraine and continued Russian military build-up on the border will likely keep the pair on the defensive. Indeed, US and NATO leaders, government officials and intelligence community leaders continue to sound the alarm that Russia remains ready to launch an invasion at little to no warning. For now, EUR/USD bulls may have a tough time pushing the pair above weekly highs just under the 1.1400 level. Aside from geopolitics, EUR/USD are also focused on ECB/Fed rhetoric, with policymakers having spoken recently and scheduled to orate on Thursday and Friday.

Wednesday’s Fed minutes, which were seen as somewhat stale by many investors given recent inflation surprises since the last policy meeting, did not contain any hawkish bombshells, market commentators noted, which undermined the US dollar slightly at the time. Attention now turns to commentary from ECB Chief Economist Philip Lane at 1400GMT following what investors interpreted as dovish remarks from ECB’s Pablo de Cos earlier in the session, as well as and Fed’s James Bullard and Loretta Mester at 1600GMT and 2200GMT respectively. Before more central bank rhetoric, investors will be keeping an eye on the release of US weekly jobless claims and Philadelphia Fed manufacturing survey data at 1330GMT.

The US Envoy to the UN said on Thursday that evidence on the ground suggests that Russia is moving towards an "imminent invasion" of Ukraine and that this is a "crucial moment", according to Reuters. Reuters also reported that US Secretary of State Anthony Blinken on Thursday changed his travel plans at the last minute to speak at the UN Security Council meeting on Ukraine on Thursday.

The US Defense Secretary Lloyd Austin on Thursday said that the US is seeing some Russian forces inching closer to the Ukrainian border and stocking up on blood. Austin added that Russia is flying more combat aircraft and dismissed Moscow's claims that it is withdrawing troops. "I was a soldier myself not that long ago" Reuters quoted Austin as saying. "I know firsthand that you don't do these sorts of things for no reason," he continued, "and you certainly don’t do them if you're getting ready to pack up and go home." Austin called the reports of shelling in Ukraine "troubling".

Market Reaction

Amid concerning geopolitical headlines pointing towards the risk of Russia/Ukraine military escalation, markets remain in a defensive mood prior to the start of the US session. S&P 500 futures are currently trading with slight losses in pre-market trade of about 0.2%, though remain within Wednesday's ranges and above the 4450 level.

- A combination of factors failed to assist USD/CAD to capitalize on its modest intraday gains.

- An uptick in oil prices underpinned the loonie and capped the upside amid renewed USD selling.

- A recovery in the risk sentiment, retreating US bond yields weighed on the safe-haven buck.

The USD/CAD pair trimmed a part of its intraday gains and was last seen trading around the 1.2700 mark, up nearly 0.20% heading into the North American session.

The pair attracted some buying on Thursday and built on the overnight bounce from the 1.2665 area, or the weekly low, though a combination of factors capped any meaningful upside. Intensifying the Russia-Ukraine conflict pushed crude oil prices higher and underpinned the commodity-linked loonie. This, along with the emergence of fresh US dollar selling, acted as a headwind for the USD/CAD pair.

Russia's claims of a partial pullback of troops from the Ukraine border earlier this week was countered by Western governments, saying that there were no signs of de-escalation on the ground. Apart from this, reports of shelling in eastern Ukraine boosted oil prices, though expectations for the return of Iranian oil in the markets kept a lid on any meaningful upside, at least for the time being.

On the other hand, the USD struggled to preserve its modest intraday gains and met with a fresh supply amid retreating US Treasury bond yields. Moreover, the risk sentiment recovered a bit after the latest satellite image showed that Russia has pulled back some equipment from the Ukraine border. This, along with less hawkish FOMC minutes released on Wednesday, weighed on the safe-haven greenback.

Market participants now look forward to the US economic docket, featuring the Philly Fed Manufacturing Index, Weekly Initial Jobless Claims and housing market data. This, along with the US bond yields, will influence the USD and provide some impetus to the USD/CAD pair. Apart from this, traders will further take cues from oil price dynamics to grab some meaningful opportunities around the major.

Ukrainian President Volodymyr Zelenskyy said on Thursday that the shelling of a kindergarten in Eastern Ukraine by pro-Russian separatist forces was a big provocation. Zelenskyy urged foreign diplomats and the OSCE to remain in Ukraine, as their monitoring activities act as a deterrent to further aggression.

Market Reaction

Amid concerning geopolitical headlines pointing towards the risk of Russia/Ukraine military escalation, markets remain in a defensive mood prior to the start of the US session. S&P 500 futures are currently trading with losses of about 0.3% on the day, though remain within Wednesday's ranges and above the 4450 level.

NATO Secretary-General Jens Stoltenberg said on Thursday that the defensive alliance is concerned that Russia is trying to stage a pretext for an invasion of Ukraine, according to Reuters. Stoltenberg continued that NATO has intelligence that Russia is trying to stage a false-flag operation and reiterated that NATO nations remain concerned that they have not yet seen any signs of withdrawal of Russian troops.

Market Reaction

Amid concerning geopolitical headlines pointing towards the risk of Russia/Ukraine military escalation, markets remain in a defensive mood prior to the start of the US session. S&P 500 futures are currently trading with losses of about 0.3% on the day, though remain within Wednesday's ranges and above the 4450 level.

- AUD/USD reversed an intraday dip to mid-0.7100s amid the emergence of fresh USD selling.

- Retreating US bond yields, less hawkish FOMC minutes continued weighing on the greenback.

- Geopolitical tensions, the risk-off impulse might cap the upside for the perceived riskier aussie.

The AUD/USD pair traded with a mild positive bias through the mid-European session and was last seen hovering around the 0.7200 mark, just a few pips below the one-week high.

The pair attracted some dip-buying on Thursday and quickly reversed a knee-jerk slide to an intraday low, around mid-0.7100s touched in reaction to reports of shelling in eastern Ukraine. The emergence of fresh selling around the US dollar turned out to be one of the key factors that assisted the AUD/USD pair to regain some traction. The upside, however, remains capped amid the prevalent risk-off mood, which acted as a headwind for the perceived riskier aussie.

Intensifying the Russia-Ukraine conflict kept investors on the edge, which was evident from a generally weaker tone around the equity markets. In fact, Russian media reported that the Ukrainian military forces fired mortars and grenades in four Luhansk People's Republic (LPR) localities. Moreover, the Organization for Security and Co-operation (OSCE) in Europe recorded multiple shelling incidents along the line of contact in the East Ukraine in the early hours of Thursday.

Ukraine, however, denied the accusations, while the Russian Ministry of Defense released a video showing a logistics unit coming back to its home base after the completion of drills. Adding to this, the latest update from US satellite image company, Maxar Technologies, showed that Russia has pulled back some equipment from the Ukraine border. Hence, the market focus will remain on geopolitical developments, which will continue to play a key role in influencing the risk sentiment.

In the meantime, rising bets for an eventual interest rate hike by the Reserve Bank of Australia in 2022 might continue to lend support to the Australian dollar. On the other hand, retreating US Treasury bond yields, along with less hawkish FOMC minutes released on Wednesday could keep the USD bulls on the defensive. This, in turn, supports prospects for a further near-term appreciating move for the AUD/USD pair, though geopolitical tensions warrant caution.

Market participants now look forward to the US economic docket, featuring the Philly Fed Manufacturing Index, Weekly Initial Jobless Claims and housing market data during the early North American session. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to the AUD/USD pair. Apart from this, the broader market risk sentiment would be looked upon for some meaningful trading opportunities around the major.

Technical levels to watch

Russian and Belarusian troops are to hold live-fire exercises on Thursday and Saturday, Russian defense sources told Interfax on Thursday. According to Interfax, the Russian Defense Ministry said that Russian troops will leave Belarus after military drills are completed and that troops continue to return to bases.

Market Reaction

Amid concerning geopolitical headlines pointing towards the risk of Russia/Ukraine military escalation, markets remain in a defensive mood prior to the start of the US session. S&P 500 futures are currently trading with losses of about 0.3% on the day, though remain within Wednesday's ranges and above the 4450 level.

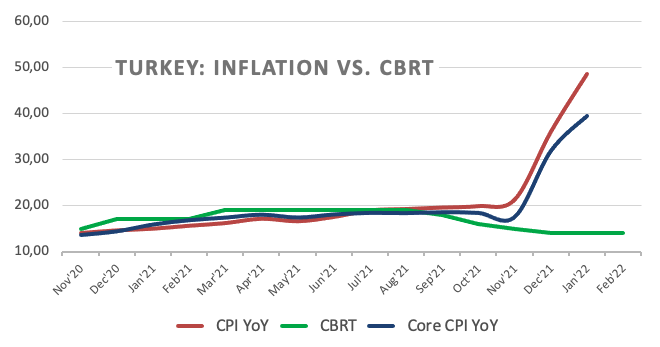

- USD/TRY extends its consolidation theme in the mid-13.00s.

- The CBRT kept the One-Week Repo Rate unchanged at 14.00%.

- The CBRT stands ready to support the “liraization” strategy.

The Turkish lira depreciates marginally and lifts USD/TRY back above the 13.60 level, although always within the broad-based range bound theme prevailing since mid-January.

USD/TRY unfazed by CBRT decision

USD/TRY extends the choppy activity so far this week and it is no exception on Thursday, after the Turkish lira stayed mostly apathetic on the decision by the Turkish central bank (CBRT) to leave the One Week Repo Rate constant at 14.00%.

The central bank deemed as appropriate leaving the policy rate unchanged against the backdrop of the strong economic recovery in Turkey, which was also helped by solid external demand.

The CBRT reiterated that elevated domestic inflation comes in response to “pricing formations that are not supported by economic fundamentals”, higher commodity and energy prices as well as supply disruptions and demand issues.

In addition, the central bank stressed its readiness to keep supporting the “liraization” strategy (whatever that means) in order to achieve the medium-term 5% inflation goal amidst a permanent drop in inflation.

What to look for around TRY

The pair keeps its multi-week consolidative theme well in place around 13.50/60. While skepticism keeps running high over the effectiveness of the ongoing scheme to promote the de-dollarization of the economy, the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are expected to maintain the lira under scrutiny for the time being.

Key events in Turkey this week: CBRT interest rate decision (Thursday) – Consumer Confidence (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is advancing 0.26% at 13.6280 and a drop below 13.4317 (weekly low Feb.11) would expose 13.2327 (monthly low Feb.1) and finally 12.7523 (2022 low Jan.3). On the other hand, the next up barrier lines up at 13.6767 (weekly high Feb.15) seconded by 13.9319 (2022 high Jan.10) and then 18.2582 (all-time high Dec.20).

- EUR/JPY fades the recent strength and drops below 131.00.

- The 200-day SMA near 130.50 supports the downside so far.

EUR/JPY fades Wednesday’s uptick to the vicinity of 132.00 and slips back to the sub-131.00 region on Thursday.

Despite the knee-jerk, further upside in the cross should remain on the table while above the 2-month support line, today near 128.80. That said, the resumption of the upside bias should retarget the weekly high at 131.90 (February 16) ahead of the 2022 peak at 133.15 (February 10). If the buying impulse gathers extra pace, then the focus of attention should gyrate to the October 2021 high at 133.48 (October 20).

On the longer term, the outlook for the cross is seen as constructive as long as it trades above the 200-day SMA at 130.44.

EUR/JPY daily chart

The Central Bank of the Republic of Turkey (CBRT) announced on Thursday that it left its policy (one-week repo) rate unchanged at 14% as expected.

Market reaction

The USD/TRY pair edged slightly lower following this announcement and was last seen posting small daily gains at 13.6200.

Key takeaways from policy statement

"Will continue to use all available instruments decisively within the framework of liraization strategy."

"Strengthening of the improving trend in the current account balance is important for price stability."

"Extending long-term Turkish lira investment credit will play a significant role in achieving this target."

"Comprehensive review of the policy framework is being conducted with the aim of encouraging permanent liraization in all policy tools of the CBRT."

"Cumulative impact of the recent policy decisions is being monitored, to create a foundation for sustainable price stability."

"Expecting disinflation process to start on the back of measures taken."

Japanese Prime Minister Fumio Kishida said on Thursday that they are arranging charter flights in countries near Ukraine in case they need to evacuate Japanese nationals, as reported by Reuters.

Additional takeaways

"Not realistic to ease border controls in one go."

"If changes to the status quo with force were allowed in Ukraine, it would send the wrong message to Asia, international community."

"Making arrangements for talks with Russian President Putin."

"Will analyse rising oil prices to see what steps would be necessary further to ease the pain on people's livelihoods."

Market reaction

The USD/JPY pair stays under modest bearish pressure following these comments and was last seen losing 0.35% on the day at 115.05.

- GBP/USD gained traction for the third successive day and climbed to a fresh weekly high.

- Rising bets for additional BoE rate hikes in 2022 acted as a tailwind for the British pound.

- Retreating US bond yields undermined the USD and remained supportive of the move up.

The GBP/USD pair climbed to a fresh weekly high during the first half of the European session and is now looking to build on the momentum further beyond the 1.3600 mark.

A combination of supporting factors assisted the GBP/USD pair to reverse an intraday dip to the 1.3555 area and move into positive territory for the third successive day on Thursday. As investors digest contradicting geopolitical headlines, the emergence of fresh US dollar selling acted as a tailwind for the pair. Apart from this, rising bets for additional interest rate hikes by the Bank of England underpinned the British pound and provided an additional lift to the major.

Russian media reported earlier today that the Ukrainian military forces fired mortars and grenades in four Luhansk People's Republic (LPR) localities, though Ukraine denied the accusations. Moreover, the Russian Ministry of Defense said that around 10 military convoys have left Crimea and released a video showing a logistics unit coming back to its home base after the completion of drills. This, in turn, capped the upside for the safe-haven USD and extended support to the GBP/USD pair.