- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-09-2014

(raw materials / closing price /% change)

Light Crude 94.71 -0.18%

Gold 1,235.60 -0.09%

(index / closing price / change items /% change)

Nikkei 225 15,911.53 -36.76 -0.23%

Hang Seng 24,136.01 -220.98 -0.91%

Shanghai Composite 2,296.56 -42.58 -1.82%

FTSE 100 6,792.24 -11.97 -0.18%

CAC 40 4,409.15 -19.48 -0.44%

Xetra DAX 9,632.93 -26.70 -0.28%

S&P 500 1,998.98 +14.85 +0.75%

NASDAQ Composite 4,552.76 +33.86 +0.75%

Dow Jones 17,131.97 +100.83 +0.59%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2959 +0,15%

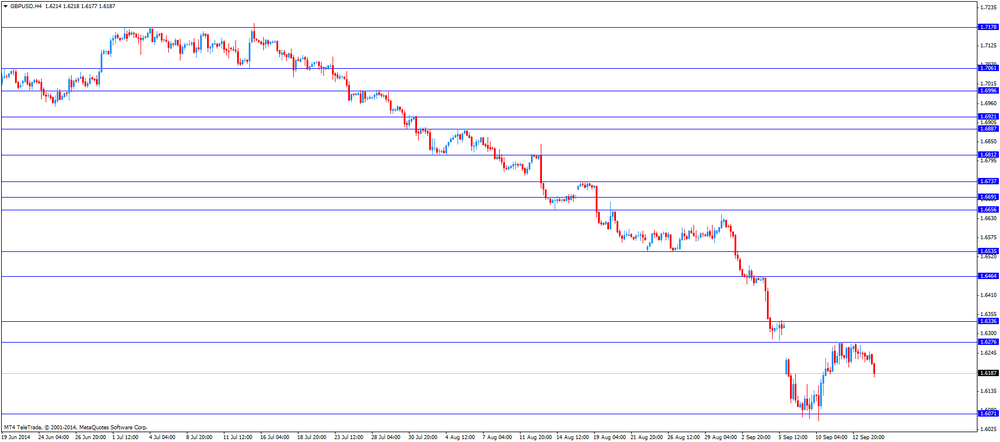

GBP/USD $1,6271 +0,28%

USD/CHF Chf0,9324 -0,31%

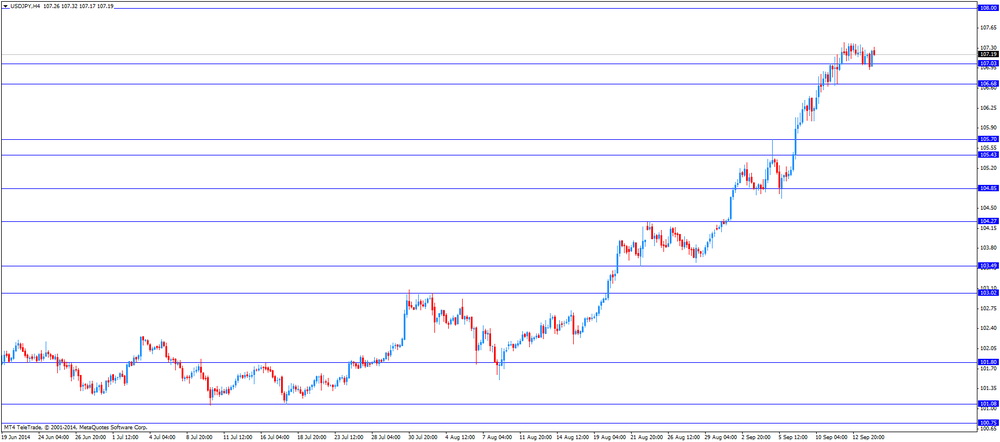

USD/JPY Y107,11 -0,07%

EUR/JPY Y138,81 +0,08%

GBP/JPY Y174,29 +0,22%

AUD/USD $0,9084 +0,56%

NZD/USD $0,8192 +0,20%

USD/CAD C$1,0969 -0,77%

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Average Earnings, 3m/y July -0.2% +0.5%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y July +0.6%

08:30 United Kingdom Claimant count August -33.6 -29.7

08:30 United Kingdom Claimant Count Rate August 3.0%

08:30 United Kingdom ILO Unemployment Rate July 6.4% 6.3%

08:30 United Kingdom Bank of England Minutes

09:00 Eurozone Harmonized CPI August -0.7%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y August +0.8%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) August +0.3% +0.3%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) September 2.5

12:30 U.S. Current account, bln Quarter II -111 -114

12:30 U.S. CPI, m/m August +0.1% +0.1%

12:30 U.S. CPI, Y/Y August +2.0%

12:30 U.S. CPI excluding food and energy, m/m August +0.1% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y August +1.9%

14:00 U.S. NAHB Housing Market Index September 55 56

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC QE Decision 25 15

18:30 U.S. Federal Reserve Press Conference

22:45 New Zealand GDP q/q Quarter II +1.0% +0.6%

22:45 New Zealand GDP y/y Quarter II +3.8%

23:50 Japan Adjusted Merchandise Trade Balance, bln August -1023.8 -990.0

Stock indices traded lower as concerns about the Eurozone's economy and the Scotland's independence referendum on Thursday weighed on markets

Market participants are awaiting the results of the Fed's policy meeting. They expect the Fed will cut its asset purchase program by another $10 billion.

Market participants also speculate the Fed will start to hike its interest rate sooner than expected.

The ZEW economic sentiment index for Germany declined to 6.9 in September from 8.6 in August, beating expectations for a drop to 5.2.

Eurozone's ZEW economic sentiment index dropped to 14.2 in September from 23.7 in August, missing forecast of a decrease to 21.3.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,792.24 -11.97 -0.18%

DAX 9,632.93 -26.70 -0.28%

CAC 40 4,409.15 -19.48 -0.44%

West Texas Intermediate and Brent crudes climbed after OPEC's Secretary General said the group may cut output targets next year.

Abdalla El-Badri said today that the Organization of Petroleum Exporting Countries' production quota could fall 500,000 barrels a day to 29.5 million barrels a day next year. El-Badri was speaking at OPEC's secretariat in Vienna after talks with Russian Energy Minister Alexander Novak today. WTI has tumbled 13 percent since touching $107.73 a barrel on June 20 as Asian and European economies have showed signs of slowing while crude output gained.

"After the significant decline in prices, investors were looking for a reason to get into the market and El-Badri's comments gave them that," Michael Lynch, president of Strategic Energy & Economic Research in Winchester, Massachusetts, said by phone. "El-Badri said this was an outlook not a decision, but the market is still taking it as a positive sign."

WTI for October delivery rose 73 cents, or 0.8 percent, to $93.65 a barrel at 10:39 a.m. on the New York Mercantile Exchange. The volume of all futures traded was 11 percent above the 100-day average for the time of day. Prices have decreased 4.8 percent this year.

Brent for November settlement increased 93 cents, or 1 percent, to $98.81 a barrel on the London-based ICE Futures Europe exchange. Volumes were 6.1 percent lower than the 100-day average. The October contract expired yesterday, falling 46 cents to $96.65 a barrel.

The U.S. dollar traded mixed against the most major currencies after the U.S. economic data. The U.S. producer price index (PPI) was flat in August, missing expectations for a 0.1% rise, after a 0.1% gain in July.

The U.S. PPI excluding food and energy increased 0.1% in August, in line with expectations, after a 0.2% gain in July.

The euro traded mixed against the U.S. dollar. The ZEW economic sentiment index for Germany declined to 6.9 in September from 8.6 in August, beating expectations for a drop to 5.2.

Eurozone's ZEW economic sentiment index dropped to 14.2 in September from 23.7 in August, missing forecast of a decrease to 21.3.

The British pound traded higher against the U.S. dollar, recovering its early morning losses. The U.K. consumer price index (CPI) increased 0.4% in August, in line with expectations, after a 0.3% decrease in July.

On a yearly basis, the U.K. CPI fell to 1.5% in August from 1.6% in July, in line with expectations.

The U.K. core CPI excluding food, energy, alcohol and tobacco increased to 1.9% in August from 1.8% in July, beating forecasts of a 1.8% rise.

Scotland's independence referendum on Thursday continued to weigh on the pound.

The Canadian dollar traded higher against the U.S. dollar after the better-than-expected Canadian manufacturing shipments. The Canadian manufacturing shipments climbed 2.5% in July, exceeding expectations for a 1.1% rise, after a 0.9% gain in June. June's figure was revised up from a 0.6% increase.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports from New Zealand. Market participants are awaiting Wednesday morning's dairy auction on Fonterra's online platform, GlobalDairyTrade.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie declined against the greenback after the release of the Reserve Bank of Australia's meeting minutes. The Reserve Bank of Australia reiterated it will keep interest rates unchanged for an extended period of time. The central bank added the Aussie is "above most estimates of its fundamental value".

The RBA also said "housing prices were continuing to increase in the larger cities".

The RBA assistant governor Christopher Kent said at the Bloomberg Economic Summit in Sydney on Tuesday that the weaker Aussie provides would support local business.

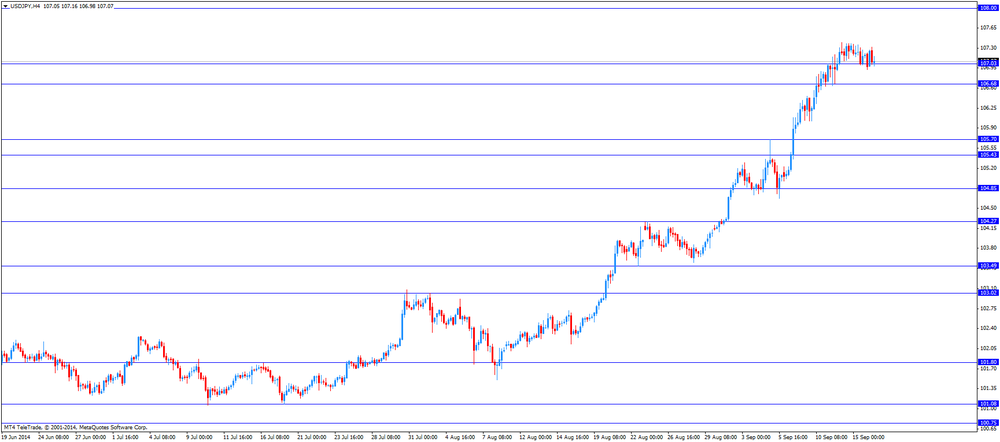

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a meeting of business leaders in the Kansai region today that the BoJ will add fresh easing measures if needed to achieve its 2% inflation target. Mr. Kuroda added Japan's economy will continue to recover moderately and the inflation target of 2% will be achieved as expected.

Gold prices have risen, but are still trading in a limited range, as investors took a wait and see attitude on the eve of the two-day meeting of the Federal Reserve's definition of monetary policy, which is due to start today.

Investors switched their attention to the upcoming meeting of the Fed's monetary policy amid speculation that the central bank of the USA can come to a more aggressive formulation.

The dollar was high demand, as the central bank is expected to reduce the amount of the asset purchase program by another $ 10 billion on its way to full completion in October and higher interest rates in mid-2015.

Fed officials will release updated projections for economic growth and rising interest rates during the two-day meeting, extending the forecast horizon to 2017.

Market participants also focused attention at a press conference led by Fed Chairman Janet Yellen, expected on Wednesday, with the aim of finding clues to the timing of the first increase in interest rates in the United States since 2006.

Investors are also awaiting a vote on Scottish independence on Thursday, as the outcome of the referendum is difficult to predict, as polls show mixed results. Support the campaign for full independence could lead to the disintegration of the United Kingdom.

The cost of the October gold futures on the COMEX today rose to 1242.20 dollars per ounce.

EUR/USD: $1.2840(E565mn), $1.2890-900(E585mn), $1.2995-00(E546mn)

USD/JPY Y106.50($215mn), Y107.00($536mn)

EUR/JPY: Y138.00-10(E200mn), Y139.00(E235mn), Y140.40(E200mn), Y140.70(E195mn)

EUR/GBP: stg0.7935(E250mn), stg0.7970(E612mn), stg0.7975(E2.1bn), stg8015-20(E750mn)

USD/CHF: Chf0.9300($1.2bn)

AUD/USD: $0.9000(A$345mn), $0.9100(A$895mn), $0.9150(A$261mn)

USD/CAD: C$1.0950($323mn), C$1.1125($174mn), C$1.1150($506mn)

USD/MXN: Mxn13.21($260mn), Mxn13.30($790mn)

U.S. stock-index futures fell as investors assessed producer-price data before the Federal Reserve starts a two-day policy meeting.

Global markets:

Nikkei 15,911.53 -36.76 -0.23%

Hang Seng 24,136.01 -220.98 -0.91%

Shanghai Composite 2,296.56 -42.58 -1.82%

FTSE 6,772.99 -31.22 -0.46%

CAC 4,402.88 -25.75 -0.58%

DAX 9,616.34 -43.29 -0.45%

Crude oil $92.77 (-0.18%)

Gold $1236.70 (+0.15%)

(company / ticker / price / change, % / volume)

| Boeing Co | BA | 126.49 | +0.14% | 0.2K |

| Microsoft Corp | MSFT | 46.38 | +0.30% | 12.2K |

| Visa | V | 215.48 | +0.39% | 1.3K |

| Exxon Mobil Corp | XOM | 96.29 | 0.00% | 0.5K |

| International Business Machines Co... | IBM | 191.63 | -0.09% | 0.3K |

| General Electric Co | GE | 25.89 | -0.12% | 4.1K |

| Nike | NKE | 81.47 | -0.17% | 0.7K |

| Pfizer Inc | PFE | 29.87 | -0.17% | 5.2K |

| AT&T Inc | T | 34.62 | -0.20% | 2.0K |

| Intel Corp | INTC | 34.47 | -0.20% | 0.8K |

| Walt Disney Co | DIS | 89.90 | -0.20% | 1.0K |

| Johnson & Johnson | JNJ | 104.50 | -0.21% | 0.8K |

| American Express Co | AXP | 87.16 | -0.25% | 14.2K |

| Wal-Mart Stores Inc | WMT | 75.61 | -0.26% | 0.1K |

| Home Depot Inc | HD | 89.14 | -0.27% | 1.2K |

| JPMorgan Chase and Co | JPM | 59.77 | -0.28% | 40.5K |

| McDonald's Corp | MCD | 93.21 | -0.28% | 0.1K |

| Caterpillar Inc | CAT | 104.51 | -0.33% | 0.3K |

| Goldman Sachs | GS | 183.30 | -0.37% | 0.2K |

| Procter & Gamble Co | PG | 83.55 | -0.38% | 1.1K |

| The Coca-Cola Co | KO | 41.34 | -0.39% | 2.3K |

Upgrades:

Downgrades:

Other:

Microsoft (MSFT) target raised from $47 to $54 at RBC Capital Mkts

Visa (V) initiated with a Outperform at Bernstein, target $262

Tesla Motors (TSLA) initiated with Buy and $320 target at ISI

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia RBA Assist Gov Kent Speaks

01:30 Australia RBA Meeting's Minutes

05:30 Japan BOJ Governor Haruhiko Kuroda Speaks

08:30 United Kingdom Retail Price Index, m/m August -0.1% +0.5% +0.4%

08:30 United Kingdom Retail prices, Y/Y August +2.5% +2.5% +2.4%

08:30 United Kingdom RPI-X, Y/Y August +2.6% +2.5%

08:30 United Kingdom Producer Price Index - Input (MoM) August -1.6% -0.2% -0.6%

08:30 United Kingdom Producer Price Index - Input (YoY) August -7.3% -6.6% -7.2%

08:30 United Kingdom Producer Price Index - Output (MoM) August -0.1% -0.1% +0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) August +0.9% +0.9% +0.9%

08:30 United Kingdom HICP, m/m August -0.3% +0.4% +0.4%

08:30 United Kingdom HICP, Y/Y August +1.6% +1.5% +1.5%

08:30 United Kingdom HICP ex EFAT, Y/Y August +1.8% +1.8% +1.9%

09:00 Eurozone ZEW Economic Sentiment September 23.7 21.3 14.2

09:00 Germany ZEW Survey - Economic Sentiment September 8.6 5.2 6.9

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The U.S. producer price index (PPI) is expected to rise 0.1% in August, after a 0.1% gain in July.

The U.S. PPI excluding food and energy is expected to increase 0.1% in August, after a 0.2% increase in July.

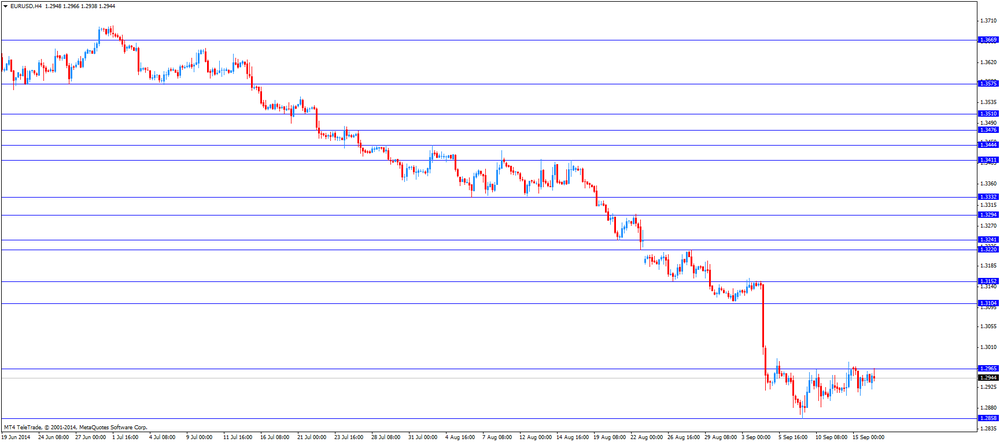

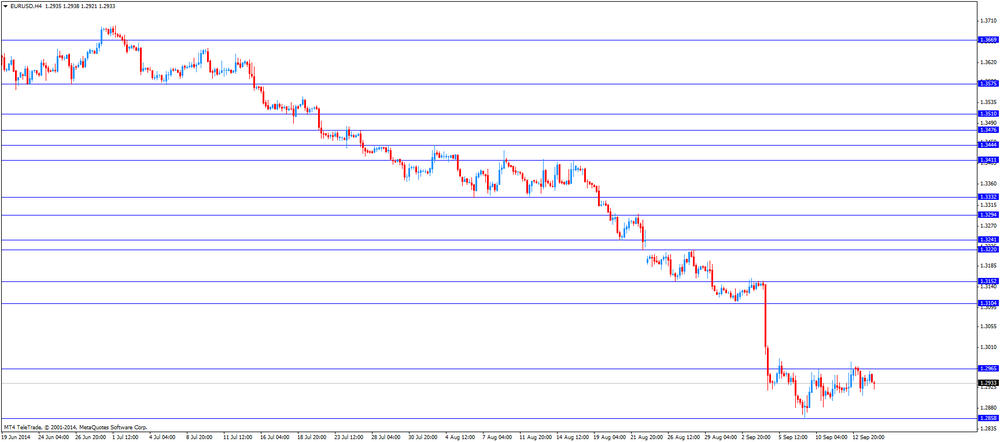

The euro traded lower against the U.S. dollar. The ZEW economic sentiment index for Germany declined to 6.9 in September from 8.6 in August, beating expectations for a drop to 5.2.

Eurozone's ZEW economic sentiment index dropped to 14.2 in September from 23.7 in August, missing forecast of a decrease to 21.3.

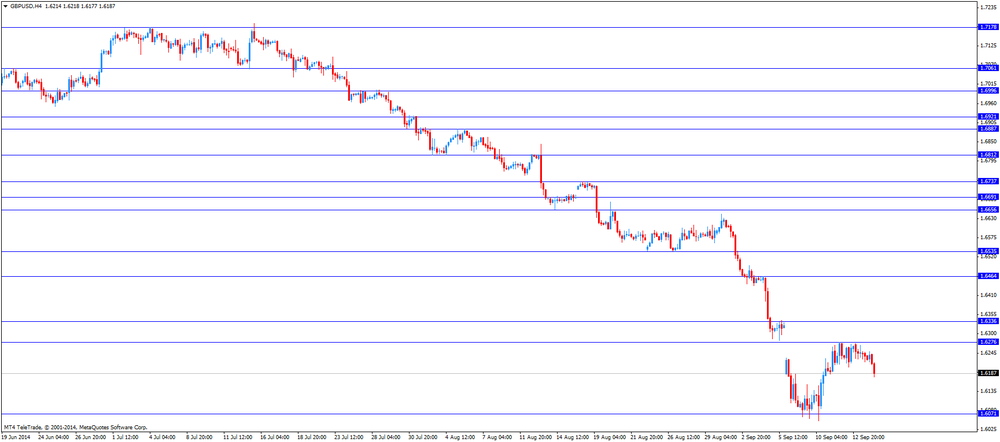

The British pound traded mixed against the U.S. dollar after the economic data from the U.K. The U.K. consumer price index (CPI) increased 0.4% in August, in line with expectations, after a 0.3% decrease in July.

On a yearly basis, the U.K. CPI fell to 1.5% in August from 1.6% in July, in line with expectations.

The U.K. core CPI excluding food, energy, alcohol and tobacco increased to 1.9% in August from 1.8% in July, beating forecasts of a 1.8% rise.

Scotland's independence referendum on Thursday continued to weigh on the pound.

The Canadian dollar traded higher against the U.S. dollar ahead of the Canadian manufacturing shipments. The Canadian manufacturing shipments are expected to rise 1.1% in July, after a 0.6% gain in June.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.6160

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) July +0.6% +1.1%

12:30 U.S. PPI, m/m August +0.1% +0.1%

12:30 U.S. PPI, y/y August +1.7% +1.8%

12:30 U.S. PPI excluding food and energy, m/m August +0.2% +0.1%

12:30 U.S. PPI excluding food and energy, Y/Y August +1.6% +1.7%

13:00 U.S. Net Long-term TIC Flows July -18.7 24.3

13:00 U.S. Total Net TIC Flows July -153.5

16:45 Canada BOC Gov Stephen Poloz Speaks

22:45 New Zealand Current Account Quarter II 1.41 -1.04

EUR/USD

Offers $1.3070, $1.3050, $1.3000/10

Bids $1.2880/74, $1.2860/50, $1.2800

GBP/USD

Offers $1.6350, $1.6290-300

Bids 1.6185, $1.6125/20, $1.6100, $1.6050

AUD/USD

Offers $0.9250/60, $0.9220, $0.9110, $0.9100

Bids $0.8900, $0.8800

EUR/JPY

Offers Y140.00, Y139.50, Y139.20

Bids Y138.30, Y138.00, Y138.50

USD/JPY

Offers Y108.00, Y107.40-50

Bids Y106.70/65, Y106.50, Y106.05/95, Y105.50, Y105.20

EUR/GBP

Offers stg0.8100, stg0.8000

Bids stg0.7940, stg0.7920, stg0.7900

The RBA assistant governor Christopher Kent said at the Bloomberg Economic Summit in Sydney on Tuesday that the weaker Aussie provides would support local business. But he added that it is hard to know where the exchange rate of the Australian dollar should be.

The RBA assistant governor said non-mining business investment is expected to grow at a modest pace in 2014-15.

Mr. Kent noted that the strong Aussie had been a positive factor for investment in some sectors.

Stock indices traded lower. Market participants expect the Fed will cut its asset purchase program by another $10 billion. Market participants also speculate the Fed will start to hike its interest rate sooner than expected.

Investors remained cautious due to the continued geopolitical concerns and the Scotland's independence referendum on Thursday.

The ZEW economic sentiment index for Germany declined to 6.9 in September from 8.6 in August, beating expectations for a drop to 5.2.

Eurozone's ZEW economic sentiment index dropped to 14.2 in September from 23.7 in August, missing forecast of a decrease to 21.3.

Current figures:

Name Price Change Change %

FTSE 6,760.88 -43.33 -0.64%

DAX 9,625.83 -33.80 -0.35%

CAC 40 4,408.2 -20.43 -0.46%

The Reserve Bank of Australia (RBA) released its latest meeting minutes today. The RBA reiterated it will keep interest rates unchanged for an extended period of time. The central bank added the Aussie is "above most estimates of its fundamental value, particularly given the declines in key commodity prices".

The RBA also said "housing prices were continuing to increase in the larger cities".

The central bank noted that "accommodative monetary policy was supporting demand in some sectors of the economy".

The RBA expects the economic growth will be "a little above average in both 2014 and 2015".

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a meeting of business leaders in the Kansai region today that the BoJ will add fresh easing measures if needed to achieve its 2% inflation target.

Mr. Kuroda added Japan's economy will continue to recover moderately and the inflation target of 2% will be achieved as expected.

The BoJ governor also said the BoJ will continue its qualitative and quantitative easing programme.

Mr. Kuroda agreed "stability in currency rates is extremely important to businesses". The central bank will do its "best to ensure currency stability", so Kuroda.

Asian stock closed lower ahead of the Fed' policy meeting. Market participants expect the Fed will cut its asset purchase program by another $10 billion.

Market participants also speculate the Fed will start to hike its interest rate sooner than expected.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a meeting of business leaders in the Kansai region today that the BoJ will add fresh easing measures if needed to achieve its 2% inflation target. Mr. Kuroda added Japan's economy will continue to recover moderately and the inflation target of 2% will be achieved as expected.

Indexes on the close:

Nikkei 225 15,911.53 -36.76 -0.23%

Hang Seng 24,136.01 -220.98 -0.91%

Shanghai Composite 2,296.56 -42.58 -1.82%

EUR/USD: $1.2840(E565mn), $1.2890-900(E585mn), $1.2995-00(E546mn)

USD/JPY Y106.50($215mn), Y107.00($536mn)

EUR/JPY: Y138.00-10(E200mn), Y139.00(E235mn), Y140.40(E200mn), Y140.70(E195mn)

EUR/GBP: stg0.7935(E250mn), stg0.7970(E612mn), stg0.7975(E2.1bn), stg8015-20(E750mn)

USD/CHF: Chf0.9300($1.2bn)

AUD/USD: $0.9000(A$345mn), $0.9100(A$895mn), $0.9150(A$261mn)

USD/CAD: C$1.0950($323mn), C$1.1125($174mn), C$1.1150($506mn)

USD/MXN: Mxn13.21($260mn), Mxn13.30($790mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia RBA Assist Gov Kent Speaks

01:30 Australia RBA Meeting's Minutes

05:30 Japan BOJ Governor Haruhiko Kuroda Speaks

08:30 United Kingdom Retail Price Index, m/m August -0.1% +0.5% +0.4%

08:30 United Kingdom Retail prices, Y/Y August +2.5% +2.5% +2.4%

08:30 United Kingdom RPI-X, Y/Y August +2.6% +2.5%

08:30 United Kingdom Producer Price Index - Input (MoM) August -1.6% -0.2% -0.6%

08:30 United Kingdom Producer Price Index - Input (YoY) August -7.3% -6.6% -7.2%

08:30 United Kingdom Producer Price Index - Output (MoM) August -0.1% -0.1% +0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) August +0.9% +0.9% +0.9%

08:30 United Kingdom HICP, m/m August -0.3% +0.4% +0.4%

08:30 United Kingdom HICP, Y/Y August +1.6% +1.5% +1.5%

08:30 United Kingdom HICP ex EFAT, Y/Y August +1.8% +1.8% +1.9%

The U.S. dollar traded mixed to higher against the most major currencies on speculation the Fed will start to hike its interest rate sooner than expected. Market participants are awaiting the Fed's interest rate decision on Wednesday.

Market participants expect the Fed will cut its asset purchase program by another $10 billion.

The New Zealand dollar traded lower against the U.S dollar in the absence of any major economic reports from New Zealand. Market participants are awaiting Wednesday morning's dairy auction on Fonterra's online platform, GlobalDairyTrade.

The Australian dollar dropped against the U.S. dollar after the release of the Reserve Bank of Australia's meeting minutes. The Reserve Bank of Australia reiterated it will keep interest rates unchanged for an extended period of time. The central bank added the Aussie is "above most estimates of its fundamental value".

The RBA also said "housing prices were continuing to increase in the larger cities".

The RBA assistant governor Christopher Kent said at the Bloomberg Economic Summit in Sydney on Tuesday that the weaker Aussie provides would support local business.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a meeting of business leaders in the Kansai region today that the BoJ will add fresh easing measures if needed to achieve its 2% inflation target. Mr. Kuroda added Japan's economy will continue to recover moderately and the inflation target of 2% will be achieved as expected.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.6212

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

09:00 Eurozone ZEW Economic Sentiment September 23.7 21.3 14.2

09:00 Germany ZEW Survey - Economic Sentiment September 8.6 5.2

12:30 Canada Manufacturing Shipments (MoM) July +0.6% +1.1%

12:30 U.S. PPI, m/m August +0.1% +0.1%

12:30 U.S. PPI, y/y August +1.7% +1.8%

12:30 U.S. PPI excluding food and energy, m/m August +0.2% +0.1%

12:30 U.S. PPI excluding food and energy, Y/Y August +1.6% +1.7%

13:00 U.S. Net Long-term TIC Flows July -18.7 24.3

13:00 U.S. Total Net TIC Flows July -153.5

16:45 Canada BOC Gov Stephen Poloz Speaks

22:45 New Zealand Current Account Quarter II 1.41 -1.04

EUR / USD

Resistance levels (open interest**, contracts)

$1.3069 (4612)

$1.3020 (434)

$1.2987 (160)

Price at time of writing this review: $ 1.2940

Support levels (open interest**, contracts):

$1.2898 (4787)

$1.2876 (7027)

$1.2853 (3902)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 49070 contracts, with the maximum number of contracts with strike price $1,3000 (4612);

- Overall open interest on the PUT options with the expiration date October, 3 is 55185 contracts, with the maximum number of contracts with strike price $1,3000 (7027);

- The ratio of PUT/CALL was 1.13 versus 1.17 from the previous trading day according to data from September, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.6504 (2184)

$1.6407 (1295)

$1.6312 (1485)

Price at time of writing this review: $1.6214

Support levels (open interest**, contracts):

$1.6184 (1381)

$1.6087 (3005)

$1.5990 (1896)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 26553 contracts, with the maximum number of contracts with strike price $1,6500 (2184);

- Overall open interest on the PUT options with the expiration date October, 3 is 36257 contracts, with the maximum number of contracts with strike price $1,6300 (4559);

- The ratio of PUT/CALL was 1.37 versus 1.38 from the previous trading day according to data from September, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.